Purpose

- The purpose of the evaluation was to examine the relevance and performance of AgriStability, AgriInvest, AgriInsurance and Wildlife Compensation Programs.

- These four programs are offered under the Agriculture and Agri-Food Canada's (AAFC) Business Risk Management (BRM) suite of programs as part of Growing Forward 2 (GF2), to help producers manage risk due to severe market volatility and disaster situations. GF2 is five-year (2013/14-2017/18) initiative and developed as part of Federal/Provincial/Territorial (FPT) Multilateral Framework Agreement for Canada's agricultural and agri-food sector.

Evaluation scope and methodology

- The Evaluation of AgriStability, AgriInvest, AgriInsurance, and the Wildlife Compensation Program was included in AAFC's Five-Year Evaluation Plan (2014-15 to 2018-19) and fulfils the requirements of the Financial Administration Act and the Policy on Results (2016).

- The evaluation used multiple lines of evidence (including literature and document review, case studies, secondary data analysis, surveys, and interviews) to assess program activities undertaken and delivered from 2013-14 to 2016-17.

Evaluation findings

Relevance

- While the Canadian agriculture and agri-food sector has performed very well in recent years, there is a continued need for BRM programming, as many risks that threaten farm operations or commodity groups are ongoing or cyclical in nature, and thus beyond producers' controls.

- Private sector and producer-led tools and support mechanisms are insufficient in managing these risks.

- The appropriate role of BRM programming is to provide disaster level support and encourage the development of tools and strategies to manage normal business risk.

- In regard to federal roles and responsibilities, as legislated in the Farm Income Protection Act, AgriInsurance, AgriStability and AgriInvest are aligned. The Wildlife Compensation Program is only partially aligned as weak policy rationale exists for providing compensation for damages caused by non-federally protected species.

- In regard to GF2 priorities, AgriInvest and the Wildlife Compensation Program are less aligned with BRM principles as they primarily cover or compensate for normal business risks. There is also some evidence that AgriInsurance products also partially cover some normal business risk.

Effectiveness

- AgriInsurance is effective in mitigating the financial impact of production losses for producers of eligible commodities.

- The value of insured crop production under AgriInsurance compared to total production value was 76 percent in 2013/14 and 2014/15 (target of 75 percent). However, the value of insured forage production compared to total production value was 16 percent and 76 percent for all other products, compared to their targets of 20 percent and 75 percent respectively.

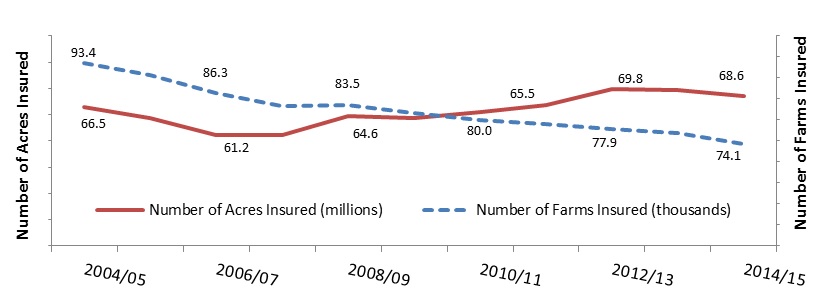

- Participation has remained high and stable. While the number of participants declined 13 percent from 2007/08, the number of acres insured increased 11 percent (see Figure 1).

Figure 1: Number of farms and acres insured through AgriInsurance by year

Description of above image

Figure 1 illustrates the relationship between the number of farms and acres insured by AgriInsurance from 2004/05 to 2014/15.

- In 2004/05, there were 93,400 farmers and 66.5 million acres insured by AgriInsurance.

- In 2006/08, there were 86,300 farmers and 61.2 million acres insured by AgriInsurance.

- In 2008/09, there were 83,500 farmers and 64.56 million acres insured by AgriInsurance.

- In 2010/11, there were 80,000 farmers and 65.5 million acres insured by AgriInsurance.

- In 2012/13, there were 77,900 farmers and 69.8 million acres insured by AgriInsurance.

- In 2014/15, there were 74,100 farmers and 68.6 million acres insured by AgriInsurance.

- Producers are satisfied with AgriInsurance, rating the program's timeliness and predictability at 3.8 and 3.6 respectively on a scale of one to five, with five being very satisfied.

- The Wildlife Compensation Program is effective in providing financial assistance for production losses from wildlife damage to crops and predation of livestock. However, there is insufficient evidence on whether producers who receive compensation make efforts to prevent recurrence of losses.

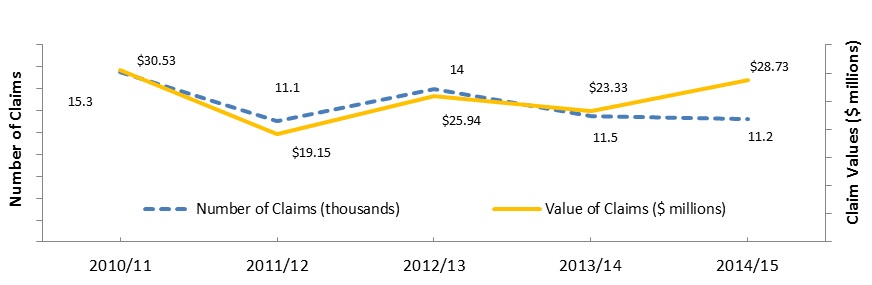

- During 2013/14 and 2014/15, an average of 11,362 claims have resulted in an average of $26 million in compensation. Likewise, 82 percent of total compensation paid was for damages to crops by wildlife and 18 percent was for predation of livestock from 2010/11 to 2014/15 (see Figure 2).

Figure 2: Wildlife Compensation Program claims and claim values by year

Description of above image

Figure 2 illustrates the relationship between program claims and the value of claims for the Wildlife Compensation Program from 2010/11 to 2014/15.

- In 2010/11, the number of claims was 15,300 and the value of claims for the Wildlife Compensation Program was $30.53 million.

- In 2011/12, the number of claims was 11,100 and the value of claims for the Wildlife Compensation Program was $19.15 million.

- In 2012/13, the number of claims was 14,000 and the value of claims for the Wildlife Compensation Program was $25.94 million.

- In 2013/14, the number of claims was 11,500 and the value of claims for the Wildlife Compensation Program was $23.33 million.

- In 2014/15, the number of claims was 11,200 and the value of claims for the Wildlife Compensation Program was $28.73 million.

- The Wildlife Compensation Program has expanded beyond its original policy rationale to compensate for damages caused by federally protected waterfowl species and has no direct linkages to AgriInsurance, aside from Quebec.

- During 2013/14 and 2014/15, an average of 11,362 claims have resulted in an average of $26 million in compensation. Likewise, 82 percent of total compensation paid was for damages to crops by wildlife and 18 percent was for predation of livestock from 2010/11 to 2014/15 (see Figure 2).

- The evaluation found that AgriStability did not meet most of its performance targets and more years of data are required to determine the effectiveness of the program. Based on the BRM survey results, AgriStability payments have been effective in mitigating the financial impacts of large short-term income losses, but declining participation has limited the number of beneficiaries.

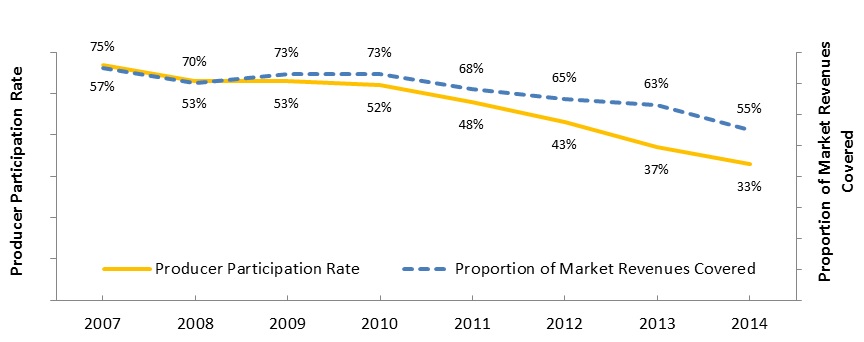

- From 2007 to 2014, the number of participating producers has declined from 57 percent to 33 percent, significantly failing to meet the target of 50 percent. For the same period, the percentage of market revenues covered by the program has not declined as dramatically (from 70% to 55%), also failing to meet the target of 65 percent - due to higher proportion of larger producers participating in the program (see Figure 3).

Figure 3: Proportion of farm market revenues covered by AgriStability compared to producer participation rate by year

Description of above image

Figure 3 compares the relationship between the producer participation rate and the proportion of farm market revenues covered by AgriStability from 2007-2014.

- In 2007, the producer participation rate was 57% and the proportion of revenues covered by AgriStability was 75%

- In 2008, the producer participation rate was 53% and the proportion of revenues covered by AgriStability was 70%

- In 2009, the producer participation rate was 53% and the proportion of revenues covered by AgriStability was 73%

- In 2010, the producer participation rate was 52% and the proportion of revenues covered by AgriStability was 63%

- In 2011, the producer participation rate was 48% and the proportion of revenues covered by AgriStability was 68%

- In 2012, the producer participation rate was 43% and the proportion of revenues covered by AgriStability was 65%

- In 2013, the producer participation rate was 37% and the proportion of revenues covered by AgriStability was 63%

- In 2014, the producer participation rate was 33% and the proportion of revenues covered by AgriStability was 55%

- As of 2013, AgriStability program participation rates were highest among hog (75%), fruit, vegetable and potato (49%) and grains and oilseeds (48%) producers and lowest among producers of supply managed commodities (27%) and cattle (34%).

- Evidence from the key informants attributes declining participation to issues of complexity, transparency, predictability and timeliness of payments. Likewise, producers gave AgriStability an average score of 2.65 on a scale of one to five on these elements, the lowest compared to other BRM programs.

- From 2007 to 2014, the number of participating producers has declined from 57 percent to 33 percent, significantly failing to meet the target of 50 percent. For the same period, the percentage of market revenues covered by the program has not declined as dramatically (from 70% to 55%), also failing to meet the target of 65 percent - due to higher proportion of larger producers participating in the program (see Figure 3).

- AgriInvest is somewhat effective in affording producers greater flexibility in managing financial risks and increasing producers' capacity to deal with income losses.

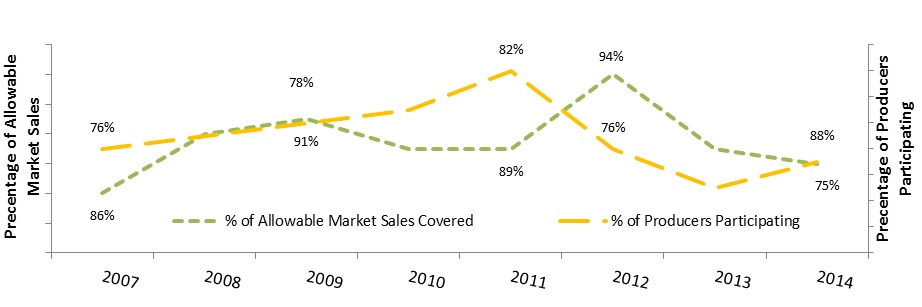

- Participation is high and producers are setting aside funds. From 2007 to 2014, the percentage of participating producers has remained consistent, meeting the target of 75 percent (see Figure 4).

- Coverage of total market sales of producers is also high, with the program covering 88 percent of allowable market sales in 2014, meeting the target of 85 percent.

Figure 4: AgriInvest participation and coverage of market sales by year

Description of above image

Figure 4 illustrates the relationship between the participation rate and coverage of market sales by AgriInvest from 2007-2014

- In 2007, the producer participation rate was 76% and the coverage of market sales by AgriInvest was 86%

- In 2009, the producer participation rate was 78% and the coverage of market sales by AgriInvest was 91%

- In 2011, the producer participation rate was 82% and the coverage of market sales by AgriInvest was 89%

- In 2012, the producer participation rate was 76% and the coverage of market sales by AgriInvest was 94%

- In 2014, the producer participation rate was 75% and the coverage of market sales by AgriInvest was 88%

- Account balances have grown to nearly $2 billion but are beginning to level out due to an increase in withdrawals and reduced contributions as a result of GF2 program changes, such as the reduced government contribution. Approximately 60 percent of the users of AgriInvest are large producers with sales revenues greater than $500,000.

- The program is considered by participants and key informants to be a somewhat effective tool for managing financial risk. With the limit of $15,000, AgriInvest matching contributions were not considered large enough by industry to support a significant risk management investment or address an income loss as intended.

Efficiency and Economy

- Compared to production insurance programs in other countries, AgriInsurance is delivered efficiently and economically. However, there has been a 23 percent increase in the administrative cost per contract from 2010/11 to 2014/15, due to an increase in costs and a decline in the number of contracts.

- As a result of on-farm federally required inspections and the prevalence of small claims, the Wildlife Compensation Program's administrative costs per claim are high, particularly compared to the other programs evaluated. Approximately 38 percent of all claims paid during the past five years were less than $500 and, for most of these claims, the $405 administrative cost was equal to or greater than the claim amount.

- AgriStability is delivered as efficiently and economically as possible, given the administrative complexity of the program. There has been a 16 percent reduction in total administrative costs from 2010 to 2014, due to a 22 percent decline in participation. However, the subsequent loss of economies of scale increased the cost per application by 11 percent to $1,022 in 2014/15.

- As a result of its simple design and streamlined delivery, AgriInvest is delivered efficiently. However, cost-effectiveness is impeded by a high proportion of participants who make very small contributions. These contributions under ($75 - $1000) accounted for 47 percent of all contributions processed in 2014/15 and had an average ratio of costs to contribution at 25 percent.

Recommendations and management response and action plan

All Management Responses and Actions have a deadline of March 31, 2018 and are under the responsibility of the Director General, Business Risk Management Programs Directorate, Programs Branch.

| Recommendation | Management Response and Action Plan |

|---|---|

| 1. AAFC should work with the provinces to examine options to modify products identified as covering normal business risk in order to transfer greater responsibility to producers and better align the coverage levels provided by AgriInsurance with current GF2 objectives and BRM principles. | 1. Agreed. The findings and recommendations will be brought to the attention of provincial and territorial colleagues at the BRM Working Group and Policy Assistant Deputy Minister (ADM) level, and will support a discussion of coverage levels under AgriInsurance. Any proposed changes would be considered under FPT negotiations for the next policy framework. However, as under previous policy frameworks, there is considerable support at the industry and government levels for insurance type approaches to risk management and AgriInsurance in particular. Insurance is seen as respecting the principle of producers to proactively managing risk while providing timely and predictable coverage. Given this, there may be resistance to proposals to change a program that is considered to be working. |

| 2. While some efforts to control costs have been undertaken, AAFC should work with the provinces to identify additional cost-control mechanisms to prevent significant increases in AgriInsurance administrative costs as well as in government premiums should commodity prices and the total value of agricultural production insured continue to increase. | 2. Agreed. AAFC will continue the current cost-control measures and will share the recommendation on the need for further controls with the FPT Business Risk Management Working Group and provincial and territorial (PTs) Policy ADMs. Any changes would be negotiated in the context of the next policy framework and would be included in the next framework agreement. |

| 3. AAFC should work with the provinces to refine the performance measures used to assess the efficiency and economy of the administrative costs to deliver AgriInsurance. | 3. Agreed. AAFC will negotiate with provinces and territories for a commitment to refine performance indicators under the Next Policy Framework. This will include measures to assess the efficiency and administrative costs of the programs. |

| Recommendation | Management Response and Action Plan |

|---|---|

| 4. AAFC should work with the provinces to reduce administrative costs by adopting a minimum claim amount (for example, $1,000) or charging an application processing fee. Additional opportunities to save on administrative costs should be investigated including reducing federal requirements for on-farm inspection and verification of loss, eliminating payments for recurrent losses, and promoting initiatives to enhance producer preventative efforts to reduce or eliminate the need for compensation. | 4. Agreed. AAFC will continue to seek administrative efficiencies in BRM programs. AAFC will present the recommendation to PTs and pursue changes to reduce administrative costs associated with Wildlife Compensation through FPT negotiations. |

| 5. AAFC should work with the provinces to should work with the provinces to continue to investigate the feasibility of including wildlife damages as an insurable peril under AgriInsurance and restricting eligible wildlife to those species protected under federal legislation in order to better align with government mandates and responsibilities. | 5. Agreed. The recommendation will be brought to the attention of the PT colleagues through the Working Group and FPT ADMs and the role of FPT governments in wildlife compensation will be considered during the FPT negotiations. Any proposed changes would be considered for the next policy framework. |

| Recommendation | Management Response and Action Plan |

|---|---|

| 6. AAFC should work with the provinces to examine options to reduce AgriStability complexity and, in turn, decrease administrative costs. This will require a re-design of the program to reflect the transition from an income support program to providing producers assistance under severe situations. This could potentially decrease the frequency and amount of information that must be collected from producers as well as reduce program administrative costs. | 6. Agreed. In July 2016, FPT Ministers of Agriculture outlined in the Calgary Statement that governments should seek ways to improve participation, timeliness, simplicity and predictability to ensure producers have access to support when needed. AAFC, in collaboration with PTs, will consider changes to AgriStability to reduce the administrative burden and associated costs. Any proposed changes would require PT agreement and would be negotiated in the context of the next policy framework. |

| 7. AAFC and the provinces should monitor the participation rate of producers in AgriStability to ensure that the program provides coverage to a sufficient number of producers to avert the need for ad hoc programming and payments. Analysis should be undertaken to determine what participation rate would assure a meaningful coverage for the industry, and strategies to facilitate a sufficient number of producers participating in the program should be developed. |

7. Agreed. In July 2016, FPT Ministers of Agriculture outlined in the Calgary Statement that governments should seek ways to improve participation, timeliness, simplicity and predictability to ensure producers have access to support when needed. However, as described above, the capacity of AgriStability to target the individual farm situation comes at the expense of program simplicity. Developing a much simpler program would require a fundamental redesign that would move away from the highly targeted nature of AgriStability. In consultation with industry, they have stressed the importance of the targeting ability of AgriStability and there may not be support for this level of change. AAFC, in collaboration with PTs, will consider changes to AgriStability to reduce the administrative burden and associated costs. Any proposed changes would require agreement with provinces and territories and would be negotiated in the context of the next policy framework. |

| Recommendation | Management Response and Action Plan |

|---|---|

| 8. AAFC should work with the provinces to clarify AgriInvest objectives and linkages within the context of the BRM suite of programs. The assessment should inform AAFC and the provinces regarding program design options to support flexibility in risk management while strengthening the program's linkages to GF2 priorities and BRM principles. For example, a potential role of AgriInvest could be to offset a decline in coverage by AgriStability. An option to be explored is to clarify and exercise the cross compliance clause in the GF2 FPT Multilateral Framework Agreement in conjunction with the provinces to implement conditions for producer participation in AgriInvest. | 8. Somewhat agree. AgriInvest assists producers in managing income declines and allows for investments that help manage risks. Producers are able to withdraw funds from AgriInvest accounts whenever, and for whatever purpose, they choose. This program approach provides flexibility for producers in managing risk, and in providing timely access to funding during periods of need (for example, income declines). Given that flexibility is a key feature of AgriInvest, information is not collected to confirm the extent to which these funds are used for risk-mitigating investments. To that end, cross compliance has been viewed as potentially impacting program flexibility and administrative simplicity. While indicators do demonstrate that less than 50 percent of producers use their AgriInvest funds when they experience income declines, producers faced with disruptive events (such as, grain transportation, drought, disease outbreaks, etc.) have been encouraged to use their AgriInvest accounts to help manage the immediate impacts. This, along with support from other business risk management programs, contributed to reducing the need for ad-hoc programming. The need to clarify the program intent and the potential expansion of cross compliance will be raised with the BRM working group during discussion on the Next Policy Framework. |

| 9. AAFC should work with the provinces to increase the minimum contribution that will justify the administrative expenses to process the AgriInvest contribution and/or producers share in the program administration costs. | 9. Agreed. The concept of a higher minimum deposit will be discussed with the Business Risk Management Working Group and FPT Policy ADMs in the context of the negotiations for the next policy framework. |