September 15, 2016

Report:

Office of Audit and Evaluation

Executive summary

Agriculture and Agri-Food Canada (AAFC) administers the AgriInnovation Program - Enabling Commercialization and Adoption stream which provides repayable contribution funding to industry to facilitate the commercial demonstration, commercialization and adoption of innovative agri-based products, technologies, processes or services.

This internal audit was included in the 2015-2018 Risk-Based Audit Plan. The objective of the audit was to provide assurance on the adequacy and effectiveness of the management control framework in place to support the delivery of the program.

The audit concluded that an adequate and effective management control framework is in place to support the delivery of the AgriInnovation Program – Enabling Commercialization and Adoption stream. In particular, the following strong practices were noted:

- A formal application and assessment process that is consistently applied;

- Clear approval process for funding decisions; and

- An established claims review and approval process.

Recognizing that the program is well-managed, opportunities to improve its current risk management practices were identified, namely:

- Incorporating quantitative data into program risk assessments to support the identification of risks and identification of appropriate risk responses; and

- Defining the program's risk tolerance for repayment arrears and default levels to assess their impact on the achievement of program objectives.

The audit also identified opportunities to improve the program's stewardship-related controls by:

- Reviewing the processes in place to ensure that management has access to the breadth of the program's due diligence throughout the assessment phase;

- Incorporating periodic verifications of the financial assessment methodology; and

- Formalizing the policies and procedures for repayment management and monitoring.

1.0 Introduction

1.1 Background on the overall AgriInnovation Program

- 1.1.1 Agriculture and Agri-Food Canada (AAFC) administers the AgriInnovation Program, included in the Growing Forward 2 agricultural policy framework. The program is a five-year (2013-2018) initiative with funding up to $698 million. Of this funding, $468 million is available for projects based on applications from industry. The remaining $230 million was designated for AAFC Research, Development and Knowledge Transfer activities, as well as program administration that complement industry activities.Footnote 1

- 1.1.2 The AgriInnovation Program is designed to accelerate the pace of innovation by supporting research and development activities and facilitating the demonstration, commercialization and/or adoption of innovative products, technologies, processes, practices and services. The aim is to enhance economic growth, productivity, competitiveness, adaptability and sustainability of the Canadian agriculture, agri-food and agri-based products sector and assist in capturing opportunities for the sector in domestic and international markets.

- 1.1.3 The AgriInnovation Program brings together the pre-commercialization and commercialization stages of innovation. It builds on predecessor programs that ended March 31, 2013 and supports the following industry-led streams:

- Industry-led Research and Development stream; and

- Enabling Commercialization and Adoption stream

- 1.1.4 This internal audit focused on the Enabling Commercialization and Adoption stream and was included in the 2015-2018 Risk-Based Audit Plan.

1.2 Enabling commercialization and adoption stream

- 1.2.1 The objective of the Enabling Commercialization and Adoption stream (referred to as "the program" in this audit report) is to facilitate the commercial demonstration, commercialization and adoption of innovative agri-based products, technologies, processes or services. The funding under this stream is designed to support, and reduce the financial risk associated with, late-stage activities of the innovation continuum. The innovation continuum is defined as the movement of innovation from research and development, through bench-scale testing, piloting, pre-commercial demonstration, to full commercialization.

- 1.2.2 Repayable contribution funding of $118.5 million was approved by Treasury Board for the five-year lifecycle of the Enabling Commercialization and Adoption streamFootnote 2. Contributions are provided to approved industry-led commercial demonstration, commercialization or adoption projects. The program accepts applications on a continuous basis.

- 1.2.3 The maximum funding available for any project under the Enabling Commercialization and Adoption stream is $10 million. Eligible costs related to a project are to be shared between AAFC and the successful applicant (and others where relevant, for example, other industry supporters and other governments). Applicants are responsible to cover at least 50% of the total eligible costs related to the project.

1.3 Organization and governance

- 1.3.1 The Innovation Programs Directorate (IPD) within the Programs Branch is responsible for the delivery of the program. IPD includes the following support units:

- Programs Design and Performance Division:

- Coordinates the program's risk assessments and manages program-level reporting and service standard tracking.

- Claims/Repayment Division:

- Finance Claims Unit – Centralized unit that coordinates the review and approval of claims for expenditures incurred under the program.

- Repayment/Financial Business Case Analysis Unit – Performs the financial assessment of applications for the program and manages and monitors the repayment process.

- Programs Design and Performance Division:

- 1.3.2 The work of the Innovation Programs Directorate is supported by:

- Service and Program Excellence Directorate (SPED) – SPED is a centralized directorate within the Programs Branch. It serves as the focal point for the stewardship and coordination of service transformation and grant and contribution programming modernization within the Department. SPED leads the creation of branch-wide tools used in contribution program administration.

- Market and Industry Services Branch (MISB) – Technical experts located in MISB's Sector Development and Analysis Directorate (SDAD) and Departmental Regional Offices (DRO) review applications received by the program to evaluate their technical and market merits.

- Directors General (DG) Innovation Committee – The DG Innovation Committee is co-chaired by the DG, Innovation Programs Directorate (Programs Branch) and the DG, Partnership and Planning Directorate (Science and Technology Branch). The role of the committee is to support the development and implementation of comprehensive innovation programs in support of AAFC's strategic objectives. To that end, the Committee reviews the program's recommendations for project funding and makes recommendations for ministerial decision.

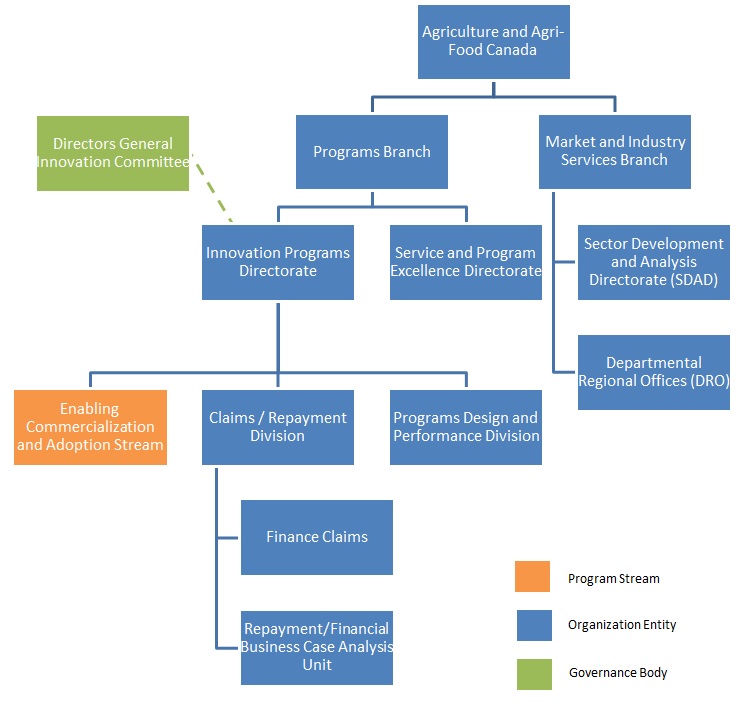

- 1.3.3 An organization structure of units involved in the administration of the program is provided in Figure 1.

Figure 1 – Organization Structure of Units Involved in the Administration of the Enabling Commercialization and Adoption StreamFootnote 3

Description of this image follows:

Agriculture and Agri-Food Canada oversees Programs Branch and Market Industry Services Branch.

Programs Branch oversees Innovation Programs Directorate and Service and Program Excellence Directorate. Innovation Programs Directorate oversees Enabling Commercialization and Adoption Stream, Claims/Repayment Division, and Programs Design and Performance Division. Claims/Repayment Division oversees Finance Claims and Repayment/Financial Business Case Analysis Unit.

Directors General Innovation Committee is a Governance Body governing the Innovation Programs Directorate.

Market and Industry Services Branch oversees the Sector Development and Analysis Directorate (SDAD) and the Departmental Regional Offices (DRO).

1.4 Audit objective

- 1.4.1 The objective of this audit was to provide assurance on the adequacy and effectiveness of the management control framework in place to support the delivery of the AgriInnovation Program – Enabling Commercialization and Adoption stream.

1.5 Audit scope

- 1.5.1 The assessment of the audit focused on the program controls and practices that were in place at the time of the audit in the areas being reviewed (see Annex A for the audit criteria).

- 1.5.2 The audit conduct phase included a review of a judgmental sample of approved, rejected and withdrawn project funding applications received during the period of April 1, 2013 to November 23, 2015.

Project Status Population as at November 23, 2015 Sample Size Approved 23 6* (26%) Rejected 12 2 (17%) Withdrawn 21 2 (10%) * This total includes 1 additional project approved in February 2016. - 1.5.3 Concurrent to this audit, Internal Audit conducted a review of the recipient audit function within the Service and Program Excellence Directorate (SPED) and as such, this audit did not assess the adequacy of guidance and/or templates that have been developed by SPED and used by the program.

1.6 Audit approach

- 1.6.1 The audit approach and methodology were risk-based and consistent with the International Standards for the Professional Practice of Internal Auditing and the Internal Auditing Standards for the Government of Canada, as required under the Treasury Board Policy on Internal Audit. These standards require that the audit be planned and performed so as to conclude against the objective. The audit was conducted in accordance with an audit program that defined audit tasks to be performed in the assessment of each line of enquiry.

- 1.6.2 Audit evidence was gathered through various methods including interviews, observations, process walkthroughs as well as, the review and analysis of documentation and financial data.

1.7 Conclusion

The audit concluded that an adequate and effective management control framework is in place to support the delivery of the AgriInnovation Program – Enabling Commercialization and Adoption stream. The following strong practices were noted:

- A formal application and assessment process that is consistently applied;

- Clear approval process for funding decisions; and

- An established claims review and approval process.

- 1.7.1 Recognizing that the program is well-managed, opportunities to improve its current risk management practices were identified, namely:

- Incorporating quantitative data into program risk assessments to support the identification of risks and identification of appropriate risk responses;

- Defining the program's risk tolerance for repayment arrears and default levels to assess their impact on the achievement of program objectives.

- 1.7.2 The audit also identified opportunities to improve the program's stewardship-related controls by:

- Reviewing the processes in place to ensure that management has access to the breadth of the program's due diligence throughout the assessment;

- Incorporating periodic verifications of the financial assessment methodology;

- Formalizing the policies and procedures for repayment management and monitoring.

1.8 Statement of conformance

- 1.8.1 In the professional judgment of the Chief Audit Executive, sufficient and appropriate audit procedures have been conducted and evidence gathered to support the accuracy of the conclusion provided and contained in this report. The conclusion is based on a comparison of the conditions, as they existed at the time of the audit, against pre-established audit criteria that were agreed on with management. The conclusion is applicable only to the entity examined.

- 1.8.2 This audit was conducted in accordance with the Internal Auditing Standards for the Government of Canada, as supported by the results of the Quality Assurance and Improvement Program.

2.0 Detailed observations, recommendations and management responses

The following sections present the key observations, based on the evidence and analysis associated with the audit, and provide recommendations for improvement. Management responses were provided and include:

- an action plan to address each recommendation;

- a lead responsible for implementation of the action plan; and

- a target date for completion of the implementation of the action plan.

The results of the audit are organized into two themes: Risk Management and Stewardship. (See Figure 2)

Description of this image follows:

Risk Management and Stewardship are the two themes.

Risk Management covers Program-Level Assessments and Arrears and Default Risk Tolerance.

Stewardship covers Project Assessment Due Diligence, Financial Assessment, Claims Processing, and Repayment Policies and Procedures.

Risk management

2.1 Program-level risk assessment and response

- 2.1.1 The objective of the 2012 Treasury Board Policy on Transfer Payments is to ensure that transfer payment programs are managed with integrity, transparency and accountability in a manner that is sensitive to risks; are citizen- and recipient-focused; and are designed and delivered to address government priorities in achieving results for Canadians. To that end, the Directive on Transfer Payments requires that risk-based approaches are adopted to the design of transfer payment programs, the preparation of terms and conditions and funding agreements, and recipient monitoring and auditing.

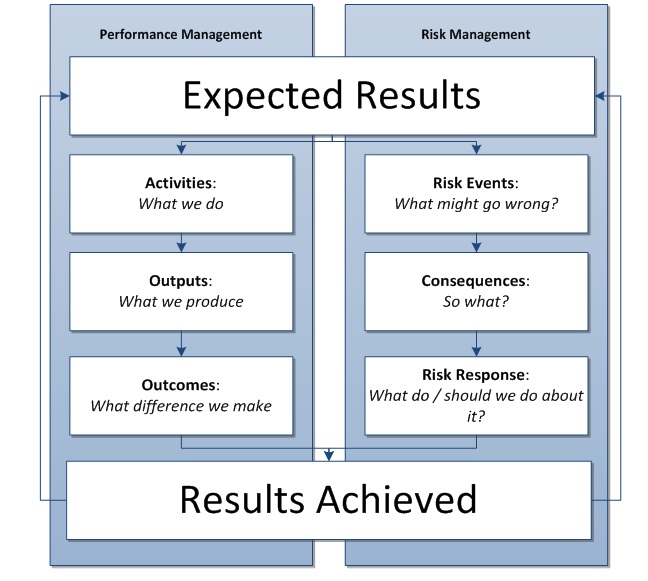

- 2.1.2 Agriculture and Agri-Food Canada (AAFC) has articulated its expectations for program-level risk management in its Integrated Program Risk Management Directive (2012). As per this departmental Directive, "Integrated Program Risk Management supports sound management of AAFC programs. It enables the program manager and employees to identify potential events that may impede the achievement of program objectives before they occur, and to put corrective action in place so as to avoid or lessen the likelihood and/or impact of the risk." This link between program risk management and performance management is illustrated in Figure 3.

Figure 3 – Linkages between Performance and Risk Management in the Program LifecycleFootnote 4

Description of this image follows:

Expected Results of Performance Management are:

- Activities: What we do;

- Outputs: What we produce; and

- Outcomes: What difference we make

Expected Results of Risk Management are:

- Risk Events: What might go wrong?

- Consequences: So what? and

- Risk Response: What do/should we do about it?

Both arms of the Expected Results result in Results Achieved, which lead back to Expected Results

- 2.1.3 Risk assessments: Internal Audit reviewed the program's completed risk assessments from 2014 and 2015 and noted that they reflect a qualitative approach to risk management. Information used in the risk assessments is based on program management's observations about issues in areas such as application processing, approval delays, and limitations on resources, without referencing specific data that confirm these observations or quantifying the impact of these issues.

- 2.1.4 Quantitative data on program management controls would help focus management action on specific areas of weakness in the program and obstacles to achieving the program's objectives. Examples of quantitative program data that could be helpful include: service standard records, number of applications processed, claims processing data, and information on repayment defaults and arrears. The use of this type of data would add context to identified issues and allow for evidence-based decisions on the impact of risks and appropriateness of response strategies.

- 2.1.5 Risk responses: Internal Audit expected to find that program management documented responses to identified risks, implemented mitigation strategies (when required) and that management would monitor their implementation. Interviews confirmed that there were no formally documented action plans or monitoring established for the risks identified in the program-level risk assessment. Internal Audit was also informed that the risk assessment process was used primarily to facilitate discussion, on an annual basis, about the risks relevant to the program.

- 2.1.6 As a result, risks to the achievement of program objectives may not be managed in a manner to avoid or lessen the likelihood of occurrence and/or related impact. As well, risks and effective mitigation strategies that could be considered when developing future programs or policy frameworks may not be captured during the risk assessment process.

Recommendation 1 – Program-level risk assessment and response

To further strengthen current risk management processes, the Assistant Deputy Minister of Programs Branch should ensure that:

- Quantitative program data is incorporated into program-level risk assessments to help inform identification of issues and decision-making; and

- As appropriate, action plans to mitigate identified risks are documented, implemented and monitored.

Management response and action plan:

-

Agreed. Qualitative information currently included in the program's risk assessment can be supplemented by quantitative data to better reflect the potential impact of the issues raised.

IPD's Program Design and Performance Division, in coordination with the Commercialization and Environmental Programming Division, will, using the departmental risk tool:

- Include quantitative data on the program's performance against service standards, including application processing and approval delays, in future program risk assessments.

- Review listed risk factors in future program risk assessments and ensure issues and impacts are quantified in all cases in which data is available.

- Agreed. Mitigating identified risks is an important part of internal risk assessment.

IPD's Program Design and Performance Division will ensure that, when appropriate, information on approaches to control/mitigate risk are identified in the program risk assessment tool.

Lead(s) responsible: Manager – Innovation Programs Directorate (IPD) - Program Design and Performance Division

Target date for completion: November 2016

2.2 Arrears and default tolerance

- 2.2.1 The Treasury Board's Directive on Transfer Payments states that contributions made to for-profit businesses that are intended to allow the businesses to generate profits or increase the value of the businesses are to be repayable.

- 2.2.2 In alignment with the Treasury Board Directive, the Enabling Commercialization and Adoption stream is designed to provide interest-free repayable contribution funding to companies to allow them to leverage other sources of financing and reduce cash flow pressures on the company. The program does not encumber the assets of recipient companies because that can be a significant barrier for recipients to securing other sources of financing necessary to undertake projects. The program assesses the financial viability of applicant companies as part of the evaluation of potential projects.

- 2.2.3 Internal Audit reviewed the program-level risk assessment and observed that it identified the residual risk of recipients not repaying contribution funding in the medium-high range. Interviews with program management noted that the risk of non-repayment is in large part due to the nature of the program and its recipients, given that the program funds innovative projects in the pre-commercialization stage across a wide range of industries and geographic locations within Canada. Many of the recipient organizations are new and have a limited operational history and finances.

- 2.2.4 To mitigate this risk and improve on experiences from similar predecessor programs, Internal Audit observed that program management implemented enhanced practices for the financial assessment of applications received under Growing Forward 2 through the new Repayment/Financial Business Case Analysis Unit and permitted the use of financial guarantors in cases where the recipient organization has poor financial health. Programs Branch also implemented quarterly reporting to senior management on recipients with accounts in repayment default or arrears.

- 2.2.5 Interviewees within the program noted that the application process may lead to the selection of financially stable companies or projects that involve adopting existing technologies, rather than developing new, innovative ones, which are considered higher-risk. Interviews also indicated that although it is not anticipated that all recipients will ultimately repay the contribution funding received, there are no defined levels of defaults or arrears that are deemed tolerable for the program.

- 2.2.6 As at July 15, 2016, the program was in the early stages of managing repayments; there were a total of 28 approved projects, comprised of 19 (68%) in the active project phase or in the one-year grace period before repayments commence and 9 (32%) in the active repayment phase. Of these 9 projects in repayment, 8 had commenced repayments within the past year. The program had disbursed a total of $73,107,683 and had received repayments of $2,044,404 (3% of total disbursements)Footnote 5. Internal Audit noted that arrears and default tolerance was not defined by program management in order to determine the strategic impact of potential future defaults and arrears.

- 2.2.7 In the context of the department's commitment to deliver results for Canadians, defining the arrears and default levels that are tolerable to the program may help reduce the risk of missing opportunities to fund highly innovative projects that could be of benefit to Canada. This will also support the government's focus on supporting business and entrepreneurs become more innovative, competitive and successful.

Recommendation 2 – Arrears and default tolerance

To optimize the achievement of the program's innovation objectives and manage related financial risks, the Assistant Deputy Minister of Programs Branch should define the arrears and default tolerance levels accordingly.

Management response and action plan:

Agreed. It is recognized that defining arrears and default tolerance levels can help in achieving the program's innovation objectives.

IPD, in consultation with Corporate Management Branch – Accounts Receivable and Revenues Management, will define arrears and default tolerance levels for repayments under AgriInnovation Program - Enabling Commercialization and Adoption stream and future programs. To support this IPD will:

- Conduct an evidence based analysis of the arrears and default tolerances to date, as well as model risk-based repayment expectations.

- Conduct a review of the current repayment monitoring processes, including communicating with the recipient when repayments are in arrears, when a notice of default is initiated and when files are transferred to Accounts Receivable and Revenues Management for further action.

- Update the process for timely and appropriately actioning files in arrears, as deemed appropriate.

- Define tolerance levels to support industry-led activities across the innovation continuum in line with the program terms and conditions.

Lead(s) responsible: Manager – IPD - Claims/Repayment Division – Repayment/Financial Business Case Analysis

Target date for completion: January 2017

Stewardship

2.3 Information for management during project assessment

- 2.3.1 The Treasury Board Policy on Transfer Payments and related Directive and Guideline outline the requirements that federal departments must adhere to in managing transfer payment programs. In line with these requirements, the Department established Terms and Conditions for the program that identify the specific criteria to be used in the assessment of funding applications. The program's review of applications provides the foundation for recommendations to fund or reject projects and has a direct impact on the achievement of the program's objectives.

- 2.3.2 As noted in the Treasury Board Policy on Information Management, the Department must ensure that "decisions and decision-making processes are documented to account for and support the continuity of departmental operations, permit the reconstruction of the evolution of policies and programs, and allow for independent evaluation, audit and review." AAFC's Management Control Framework for contribution programs (March 2015)Footnote 6 reinforces the responsibility to ensure the collection of quality information and the use of this information to make decisions. On this basis, the audit team expected that the activities undertaken by the program to assess applications should be documented on the project files.

- 2.3.3 Internal Audit noted that the program has formal application and assessment processes which are described in detail in the program's Applicant Guide.

- 2.3.4 All potential program applicants must first submit a Project Screening Summary. The program officers review the summaries to familiarize themselves with the proposed projects; however they do not make formal determinations related to eligibility. The summary is used as background for a teleconference discussion between the potential applicant and program staff. As at January 7, 2016, the program had received approximately 260 Project Screening Summaries and approximately 80 full applications.Footnote 7 Program management identified that the intention of the screening process was to provide potential applicants with direct access to informal advice from program staff which in turn would help these companies to make informed decisions about whether or not to proceed with full applications.

- 2.3.5 Applicants are required to complete a full application package that includes a detailed business plan, project work plan, budget, and various administrative documents. The program reviews each application and assesses it for completeness. Once the full application is deemed complete, the program officer conducts an analysis on the application, which is also sent to internal AAFC experts who conduct technical, market and detailed financial reviews of the application. The result of this work is compiled in a Due Diligence Summary form which includes a recommendation on whether or not to fund the project, signed by the program officer and program manager. The Due Diligence Form is then summarized into a Project Recommendation Form, signed by the program director, and submitted to the required governance committee: Directors General (DG) Innovation Committee.

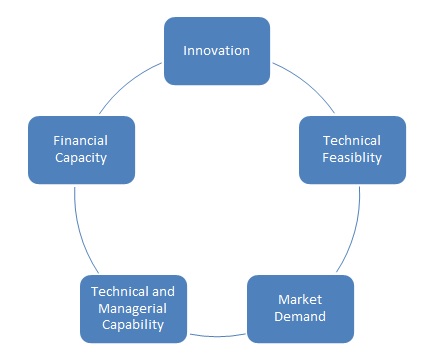

- 2.3.6 Applications are assessed by the program in five categories (See Figure 4):

- The innovative aspect of the proposed product, process, technology or service;

- Technical feasibility and readiness for market of the innovation;

- Sufficient evidence from the market to support the need and demand for the innovation;

- The technical and managerial capability to successfully complete the project; and,

- The financial capacity to complete the project and to repay the contribution.

Figure 4 – Project assessment categories

Description of this image follows:

The Project Assessment Categories are made up of Innovation, Technical Feasibility, Market Demand, Technical and Managerial Capability, and Financial Capacity, each leading to the next in a clockwise direction.

- 2.3.7 As part of the Due Diligence Form, the program provides risk rating for each of the assessment criteria, except for innovation which is assessed to determine if the project supports the program's objectives.

- 2.3.8 Internal Audit reviewed a judgmental sample of six approved and two rejected projects (where a full application was received) to analyze the documentation and assessment of program applications under each of the categories noted above. The final assessment documentation showed that the financial capacity assessment was consistently documented.

- 2.3.9 For the other assessment criteria, there were instances where the breadth of the program's due diligence activities to validate applicant information and the related analysis for each criterion was not fully reflected in the documentation on file. Internal Audit confirmed the breadth of due diligence through interviews with program management and staff. In the context of the policy framework that guides the stewardship of program resources, access by management to the full extent of due diligence information could benefit the decision-making process.

Recommendation 3 – Information for management during project assessment

The Assistant Deputy Minister of Programs Branch should review the processes in place to ensure that management has access to the breadth of the program's due diligence throughout the assessment phase.

Management response and action plan:

Agreed. Programs Branch will review the Program's due diligence process with program officers to ensure that the requirements for validating applicant information and performing related analysis for each criterion are clear and reflected in the documentation on file. Further Programs Branch will inform management through the project approval documentation e.g. Project Recommendation Form, Memo for Decision that additional assessment information is available from the program for their review upon request.

Lead(s) Responsible: Director - IPD - Enabling Commercialization and Adoption Stream

Target Date for Completion: September 2016

2.4 Financial assessment

- 2.4.1 The Repayment/Financial Business Case Analysis Unit was created in October 2012 and since then has developed a financial analysis process and related analytical methodology to assess applications to the program. The financial analysis of applications is highly complex and currently carried out by a small team of one senior officer and one officer in training. Given that all of the program's applications are reviewed by this unit, its work is strategically important to project assessment.

- 2.4.2 The financial viability of applicant companies is one of the factors used by the program to evaluate potential projects. The financial viability of the applicant company is assessed in two levels. At the first level, the analysis looks at the historical financial performance of the applicant company. A financial review report is subsequently generated by the financial analysis officer and signed by the Repayment/Financial Business Case Analysis Unit's management team. The financial analysis officer makes one of three recommendations in the report:

- Do not proceed.

- Proceed with conditions. (e.g. gather more information)

- End financial analysis at Level 1 due to the very strong financial history of the applicant. (i.e. no additional value in proceeding to a Level 2 assessment)

- 2.4.3 If the first level financial review indicates the need to gather more information, then the financial analysis team will proceed to a Level 2 assessment. At this second level, the financial analysis focuses on the future financial outlook of the company and considers the ability of the company to repay the contribution over the long-term repayment period. The financial analysis officer then prepares a Level 2 Financial Summary Report which is signed by the Repayment/Financial Business Case Analysis Unit manager and then submitted to the program officer for inclusion in the due diligence documentation.

- 2.4.4 In addition, Internal Audit noted that although the Repayment/Financial Business Case Analysis Unit management signs off when financial reviews are completed, there is no secondary validation of the details of financial reviews on a project-by-project basis to ensure that there are no errors in data entry and to validate the interpretation of results. Furthermore, there is no periodic external review of the financial analysis methodology to assess whether it reflects current best practices.

- 2.4.5 The financial review of applications is critical to the assessment and approval of projects within the program, providing information to determine whether projects are likely to be completed and if funding is likely to be repaid.

Recommendation 4 – Financial assessment

In order to reduce the risk of errors and confirm the methodology used by the Repayment/Financial Business Case Analysis Unit, the Assistant Deputy Minister of Programs Branch should implement a periodic validation of the results of the financial assessments and methodology.

Management response and action plan:

Agreed. IPD will conduct a validation of the results of the financial assessments and methodology by:

- Engaging with private industry and/or other government departments to become informed on leading financial analysis best practices.

- Conducting a review of completed financial assessments with the objective of assessing their appropriateness.

- As deemed appropriate, update the financial analysis methodology and tools to incorporate best practices and ways to reduce the risk for errors (e.g., promotion of streamlined tools and establishment of clear and consistent analysis and recommendations).

- Determining an appropriate frequency for revalidation.

Lead(s) responsible: Manager – IPD - Claims/Repayment Division – Repayment/Financial Business Case Analysis

Target date for completion: March 2017

2.5 Claims processing

- 2.5.1 After ministerial approval of a project, the recipient and the Department enter into a Contribution Agreement detailing the terms and conditions for the use of the funding and the obligations of both parties.

- 2.5.2 The recipient must submit claims for project-related expenditures to the Department in order to be reimbursed. Claims are processed by both the program and the Finance Claims Unit. Internal Audit reviewed the documentation for the claims process and found that processes and procedures related to claims processing and Section 34 account verification have been established and roles and responsibilities of staff are defined. Internal Audit was informed that this process was also recently reviewed to identify process improvements and efficiencies.

- 2.5.3 The process in place is such that program officers must complete the Recipient/Project Risk Management Framework (RRMF) Assessment Form annually for each recipient. The results of this risk assessment determine the level and nature of monitoring and reporting for each recipient project, including the percent of sampling required to verify the eligibility of expenditures claimed by the recipient.

- 2.5.4 Internal Audit reviewed a sample of seven claims and found that the appropriate Section 34 account verification was carried out on all claims reviewed and the appropriate level of sample verification of the eligibility of expenditures was conducted.

2.6 Repayment policies and procedures

- 2.6.1 The Treasury Board Policy on Transfer Payments requires that departments ensure that cost-effective oversight, internal control, performance measurement and reporting systems are in place to support the management of transfer payments.

- 2.6.2 Program officers manage project files until the final payment has been disbursed and the project file is closed. Ownership of the file is then transferred to the Repayment/ Financial Business Case Analysis Unit that manages the repayment process and monitoring for all repayable programs.

- 2.6.3 Internal Audit was informed that recipients for the program are on monthly repayment schedules with the repayment unit ensuring that billings are invoiced each month, as per the Contribution Agreement (or amended) payment schedule.

- 2.6.4 Internal Audit was advised that the Repayment/Financial Business Case Analysis Unit regularly monitors the status of recipient payments. It maintains an on-going Arrears List to track recipients who are behind in repayments. Interviews with the Repayment/Financial Business Case Analysis Unit identified that they work with recipients in arrears to obtain payments and noted that there are escalation practices for accounts in arrears at set intervals (i.e. 30 days, 60 days, 90 days, etc.)

- 2.6.5 Based on interviews, the Repayment/Financial Business Case Analysis Unit has mature practices in place to carry out repayment processing and monitoring. However, Internal Audit was informed that formal policies and procedures do not exist.

- 2.6.6 As this work is critical and on-going, formally documenting current practices would assist with making process improvements in the future and also acts as a helpful orientation tool to support staff turnover. It would also support consistency in repayment processing, monitoring and the application of remedial strategies for recipients in arrears.

Recommendation 5 – Formal repayment policies and procedures

To support the sound management of repayment processes, the Assistant Deputy Minister of Programs Branch should ensure that formal policies and procedures are developed and applied for the management and monitoring of repayment processing.

Management response and action plan:

Agreed. To address this deficiency the Repayment/Financial Business Case Analysis Unit has been reviewing its current operational practices and consulting with other departments/Corporate Management Branch- Accounts Receivable and Revenues Management. Currently the unit is drafting documents which outline the roles and responsibilities of the repayment unit, provide guidelines for contacting the recipient, monitoring repayments, resolving repayment arrears, escalation to default and transferring to CMB- Accounts Receivable and Revenues Management. A process document for managing repayments in SAP and providing information to clients will also be created.

When finalized, these documents will formalize the main aspects for managing and monitoring the unit's repayments.

Lead(s) responsible: Manager – IPD - Claims/Repayment Division – Repayment/Financial Business Case Analysis

Target date for completion: January 2017

Annex A: Audit Criteria

- Program-level risk management

- Program management develops and monitors the implementation of mitigation measures for risks identified in the annual update to the Program Risk Profile.

- Process for the assessment of project funding applications

- An adequate control process has been documented and is consistently applied for the assessment of project funding applications.

- Administration of funding

- Procedures and guidelines for project monitoring and claims processing are documented and followed.

- Repayments

- Procedures and guidelines are in place for the management of repayment processing and monitoring.

Annex B: Acronyms

- AAFC

- Agriculture and Agri-Food Canada

- DG

- Director General

- DRO

- Departmental Regional Offices

- IPD

- Innovation Programs Directorate

- PCRA

- Project Complexity and Risk Assessment

- PB

- Programs Branch

- RRMF

- Recipient/Project Risk Management Framework

- SPED

- Service and Program Excellence Directorate