Contents

- Executive summary

- 1.0 Introduction

- 2.0 Detailed observations, recommendations and management responses

- 3.0 Conclusion

Executive summary

Agriculture and Agri-Food Canada (AAFC) delivers grants and contributions programs to fulfill its strategic objectives related to farm income stabilization, market access improvement, environmental protection, innovation and research, and to address food insecurity.

Payments from AAFC contribution programs to recipients are issued through cash advances and reimbursement of eligible expenditures. To receive a payment, recipients submit a claim request. The Department assesses expenditure eligibility and accuracy in accordance with applicable acts, policies and program terms and conditions to process the claim. Claims processing is critical to the sound stewardship of program funds by demonstrating that only eligible expenditures within program terms and conditions are funded.

The audit was included in the 2022-23 Office of Audit and Evaluation Plan due to high materiality and to assess if efficiencies could be gained by standardizing claims processes across the various contribution programs. The audit objective was to determine whether adequate and effective controls were in place to process recipient claims for AAFC contribution programs in support of achieving program and departmental objectives.

The audit examined whether claims delivery and management at the branch and program levels were adequate, effective and sensitive to risk, and whether claims were paid in compliance with applicable acts, policies and program terms and conditions as well as established processes.

Overall, the audit found that adequate and effective controls were in place to process recipient claims for AAFC contribution programs in support of achieving program and departmental objectives. However, improvements are needed to:

- Align the roles and responsibilities of Program Officers and Claims Officers and claims documentation with Programs Branch’s policies and guidance; and

- Further streamline the claims processes.

1.0 Introduction

1.1 Risk context and objective

Transfer payments are one of the Government of Canada’s key instruments in furthering its broad policy objectives and priorities. Payments can be administered as either grants, which are unconditional transfers of funds to recipients, or as contributions, which are subject to performance conditions specified in a contribution agreement.

Agriculture and Agri-Food Canada (AAFC) delivers transfer payment programs to provide funding to fulfill departmental strategic outcomes related to farm income stabilization, market access improvement, environmental protection, innovation and research and to address food insecurity. AAFC spent almost $2.2 billion (71.3% of total expenses) on transfer payments in fiscal year 2021-22.

Programs at AAFC fall into two categories:

- Statutory programs: Programs are mandatory as they are named in acts of Parliament, such as Business Risk Management (BRM) programs to support agricultural producers with protection against income and production losses, helping to manage risks that threaten the viability of their farm.

- Voted programs: Programs require Cabinet and Treasury Board approval and include provincial/territorial delivered cost-shared programs (funded by AAFC and provinces/territories) and federally delivered programs.

At AAFC, federally delivered contribution programs that are outside the suite of BRM programs are known as non-BRM contributions programs. The Programs Branch within AAFC manages contribution program delivery to the agriculture and agri-food sector. The following three directorates in Programs Branch are responsible to deliver non-BRM contribution programs, including processing claims payments:

- Business Development and Competitiveness Directorate

- Innovation Programs Directorate

- Service and Program Excellence Directorate

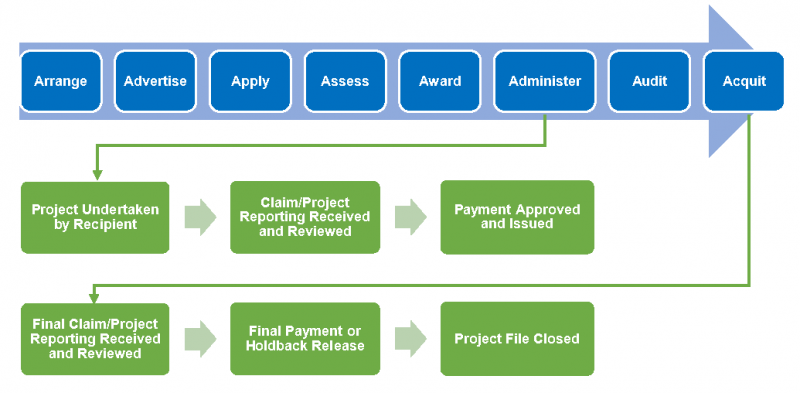

Programs Branch has established an eight stage program and project lifecycle that includes the processing of claims (see Figure 1). Figure 1 also provides a high level overview of the main steps in the claims process.

Figure 1. Program and project lifecycle

[Description of the above image]

Program lifecycle includes eight stages, which are arrange, advertise, apply, assess, award, administer, audit and acquit.

In the administer stage, steps related to claims processing include: project undertaken by recipient, claim/project reporting submitted and reviewed, and payment approved and issued.

In the acquit stage, steps related to claims processing include: final claim and documentation received/reviewed, final payment or holdback release and close project file.

This figure only identifies the steps associated with claims processing. Please note that there are other steps in the administer and acquit stages, for example, project progress and performance monitoring.

Claims processing is important to ensure accountability for program funds in support of achieving program and departmental objectives by demonstrating only eligible expenditures within program terms and conditions are funded.

The audit was included in the 2022-23 Office of Audit and Evaluation Plan and focused on the claims processing portion of the program and project lifecycle due to high materiality and to assess if efficiencies could be gained by standardizing claims processes across the various contribution programs. The audit objective was to determine whether adequate and effective controls were in place to process recipient claims for AAFC contribution programs in support of achieving program and departmental objectives.

The audit assessed the following areas:

- Claims delivery and management: Management activities and controls related to recipient claims processing at the branch and program levels are adequate, effective and sensitive to risk.

- Payment compliance: Claims are paid in compliance with the Financial Administration Act, Treasury Board and AAFC policies and guidelines, program terms and conditions, program applicant guide, contribution agreements and in alignment with established processes.

To provide horizontal insights into claims processing, the audit assessed three non-BRM contribution programs. This provided a mix of program sizes (small, medium and large) and Programs Branch directorates:

Table 1. Programs selected for the audit

| Program directorate | Selected program |

|---|---|

| Business Development and Competitiveness Directorate | AgriAssurance – National Industry Association |

| Innovation Programs Directorate | AgriInnovate |

| Service and Program Excellence Directorate | AgriDiversity |

The audit did not assess the following types of programs as they had unique delivery structures that were not easily comparable:

- statutory programs, including BRM programs

- grant programs

- cost-shared programs

The audit also excluded: Section 33; Recipient audit; Collection of repayable contributions; and IT Controls of departmental and program specific systems.

During the audit, the Department was onboarding the Grants and Contributions Digital Platform, including the claims module, to automate program delivery and management and further streamline processes to improve effectiveness and efficiency. The audit took into consideration the onboarding of the claims module when reviewing the current manual claims processes and developing the audit recommendations.

The audit team gathered evidence through various methods including interviews with AAFC management and employees, analysis of claim processes and documentation and reviews of a sample of claims.

1.2 Overview of claims processing

Contribution programs are governed by the Treasury Board Policy on Transfer Payments and the supporting Directive on Transfer Payments. The Policy requires that transfer payment programs be managed with integrity, transparency and accountability in a manner that is sensitive to risks.

For AAFC’s contribution programs, a contribution agreement is signed between the Department and the recipient once an application has been assessed and approved. The contribution agreement defines the activities that the recipient undertakes and sets out the terms and conditions for the agreement between the recipient and AAFC. Payments are issued through cash advances for recipients with cashflow needs and for reimbursement of eligible expenditures based on the program terms and conditions and an approved contribution agreement.

To receive a payment, recipients submit a claim request. In general at a high-level, Programs Branch conducts the following activities to process the claim:

- Program Officer and the Claims Officer review the request to determine whether expenditures are eligible and accurate based on supporting evidence for the expenses and progress/performance report (if applicable);

- Claims Unit Manager reviews the documentation;

- Program Director approves Section 34; and

- claim transaction is posted to AAFC’s financial system.

Figure 2. High-level claims review process

[Description of the above image]

The main personnel involved in claims reviewing and processing include: Program Officer and Claims Officer, Claims Unit Manager, Program Director (for Section 34) and Financial System Posting Team.

2.0 Detailed observations, recommendations and management responses

The following sections present the audit observations organized by the audit’s two areas of focus:

- Claims delivery and management

- Payment compliance

Recommendations for improvement are provided after the observations. Management responded to each recommendation and provided:

- An action plan

- A lead responsible for implementation of the action plan

- A target date for completion

2.1 Claims delivery and management

Claims processing is critical to the sound stewardship of program funds to ensure that only eligible expenditures within program terms and conditions and contribution agreements are paid. The audit expected that adequate and effective claim management activities such as financial monitoring, policies/guidance and claim processes were in place to ensure accountability for program funds and support consistent, efficient and risk-based claims processing.

Audit criteria: The audit examined whether management activities and controls related to recipient claims processing at the branch and program levels were adequate, effective and sensitive to risk.

2.1.1 Financial monitoring

Financial monitoring is important to ensure that funds are being spent appropriately in accordance with the contribution agreement and to provide information on project and program spending to senior management as a part of their oversight role.

What the audit found: Financial monitoring activities were conducted at the project, program and branch levels to monitor project and program spending with various activities observed:

- Project level: Assessment of expenditure eligibility, verifying a sample of expenditures and monitoring of project spending using claim reports

- Program level: Claims trackers to monitor claims

- Branch level: Monthly discussions on financial reports at the director general level

2.1.2 Policies and guidance

AAFC has developed policies for AAFC grants and contributions (Gs&Cs) expenditures to reflect the complexity and uniqueness of these expenditures and to provide claims processing staff with guidance and interpretation of Treasury Board policy requirements.

What the audit found: Programs Branch’s policies and guidance relating to claims processing were being reviewed and updated.

Programs Branch had policies, directives and guidelines in place relating to processing Gs&Cs claims that were implemented or last updated between 2001 and 2018. During the conduct of the audit, Programs Branch was in the process of reviewing and updating the policies, directives and guidelines.

The audit reviewed the draft revised policies and determined that Programs Branch was appropriately updating Gs&Cs policies to reflect current requirements and to provide more consistent guidance in processing claims across the Branch.

2.1.3 Claims processes

Processes are an integral part of the implementation of policies. The Treasury Board Policy on Transfer Payments requires that:

- Departmental processes and procedures be in place to support the delivery and management of transfer payments with integrity, transparency and accountability while taking account of risk.

- Departments pursue opportunities to standardize processes and to achieve efficiencies in the administration of transfer payment programs to ensure claims are processed consistently and staff use their time efficiently to process more claims.

Each of the three directorates in Programs Branch that deliver non-BRM programs has a claims unit/team; and has established and documented their respective claims processes.

As part of claims processes review, the audit had observations in:

- Risk-based strategies,

- Processes efficiency,

- Roles and responsibilities.

Risk-based strategies

The Treasury Board Policy on Transfer Payments requires transfer payments to be managed in a manner that is sensitive to risks. The audit expected that risk-based claims strategies were established and followed to support efficient claims processing and manage risk.

What the audit found: Risk-based strategies for claims processing were established and mostly followed. Opportunities exist to further align the level of effort put into reviewing claims with project risk and the amount of a claim.

The Project/Recipient Risk Management Framework (2018) and its associated directives established risk management strategies for the delivery of non-BRM programs, including for claims processing. The risk management strategies used when assessing claims are dependent on the results of an annual risk assessment that is conducted for each project.

For claims processing, risk management strategies included payment timing (pay now, sample later versus sample before pay), advance amounts, sampling percentage, sampling frequency and holdback percentage.

The review of sampled claims noted that most of the risk-based processes and strategies were followed with the exception of sampling frequency for low-risk projects.

The Sampling Process and Holdback Directive for Non-BRM Recipient Claims (2018) noted that for low claims risk projects, sampling frequency could be one claim per year or every other year for three-year projects. However, the review of samples noted that for the majority of projects with low claim risk from the three programs, all claims in a fiscal year were sampled.

In addition, the audit noted opportunities to further align the level of effort made by program staff on the review of claims with the value of the claim. The review of the Project/Recipient Risk Management Framework, its associated directives and other Programs Branch’s guidance noted that the documents were silent on adapting claim review based on the value of the claim. The same processes and level of effort were used to review claims that had the same risk rating regardless of whether the claim was $4,500 or $3,700,000.

Sampling more often than needed and applying the same level of review for claims with different risks and dollar values does not take account of the risk and materiality associated with claims. This can create unnecessary work for program staff and recipients, as well as potentially impeding the efficiency of claims processing.

Processes efficiency

The Policy on Transfer Payments requires departments to pursue opportunities to achieve efficiencies in the administration of transfer payment programs.

What the audit found: Opportunities exist to streamline existing claims processes. Between 2014 and 2017, Programs Branch conducted various streamlining reviews, which led to some improvements to the claims processes. However, recommendations from these reviews were inconsistently implemented across directorates.

The audit conducted a process mapping analysis of the claims processes across directorates. The audit noted that the manual processes included many steps, checkpoints, duplicate reviews and non-value-added activities. The audit was unable to use the process mapping analysis to identify the potential impacts on meeting service standards as directorates tracked service standards inconsistently and some did not include sufficient detail for comparison.

Interviews and review of the Grants and Contributions Digital Platform’s claims processes noted that this system will assist in eliminating some non-value-added activities in the current manual processes, including automating the input of financial coding for transaction posting to the departmental financial system and tracking service standards consistently. However, as the system allows flexibilities in processes and roles and responsibilities, redundant checkpoints and reviews will persist if directorates continue with their current processes in this system.

Lengthy processes with multiple checkpoints and duplicate reviews can create unnecessary work for program staff, reducing claims processing efficiencies and may result in service standards not being met.

Roles and responsibilities

The audit expected to find that the roles and responsibilities of claims processing staff aligned with the Programs Branch Gs&Cs Operations Guide and that the existing AAFC Delegation of Authority for Section 34 approval was leveraged to improve efficiency in claims processing.

What the audit found: Claims processing varies across directorates. In some cases, the roles and responsibilities are not aligned with the Programs Branch Gs&Cs Operations Guide or do not leverage AAFC Delegation of Authority to improve efficiency.

The Programs Branch Gs&Cs Operations Guide outlines the roles and responsibilities of Program Officers and Claims Officers to ensure that proper segregation of duties exist in the processing of claims. The roles and responsibilities ensure that Program Officers do not manage a project through its whole lifecycle and that Claims Officers have the main responsibility in processing claims.

The segregation of duties as outlined in the Gs&Cs Operations Guide has been implemented by the Innovation Programs Directorate and the Service and Program Excellence Directorate. However, in the Business Development and Competitiveness Directorate, Program Officers manage projects from start to finish and have the main responsibility in processing claims while Claims Officers have a verifying role, which is not aligned with the Gs&Cs Operations Guide.

The audit observed that existing delegation of authority was not always leveraged across directorates to improve efficiency for claims processing. Prior to fiscal 2023-24, Program Directors signed Section 34 for claims payments in addition to managing program delivery (for example, approving recommendations for funding, contribution agreements and amendments, etc.). This may lead to potential delays in Section 34 approvals.

However, the AAFC Delegation of Authority allows for manager and officer positions to approve claim payments (Section 34). As directorates establish their own processes, the Business Development and Competitiveness Directorate and the Innovation Programs Directorate have implemented the delegation of the Program Manager signing Section 34 as of fiscal 2023-24, however this has not been implemented in the Service Program Excellence Directorate.

Inconsistency in following Programs Branch’s guidance on segregating duties during the project lifecycle could increase the risk of mismanagement of program funds, while not leveraging existing delegation of authority could impede the optimization of efficiency for claims processing.

2.2 Payment compliance

Only eligible expenditures within program terms and conditions and contribution agreement should be reimbursed or advanced.

Audit criteria: The audit examined whether claims were paid and processed in accordance with applicable policies, program terms and conditions, contribution agreement and established processes.

2.2.1 Claims payments

The audit expected that claims payments demonstrated accountability for program funds by making payments for eligible expenditures within program terms and condition.

What the audit found: The audit found that claims were paid appropriately and in alignment with established processes. However, the audit identified minor gaps in claims documentation of progress monitoring and the issuing of advances.

Progress monitoring

While financial information provides some assurance on expenditure eligibility and accuracy of the payments, non-financial information, such as progress reporting, provides the qualitative information to assure deliverables of the contribution agreement are met.

Recipients report on project progress based on the schedule established through the project risk assessment. The audit expected that claims payments were made only when work progressed as scheduled and were supported by appropriate documentation.

What the audit found: Evidence to support progress monitoring was missing in all the AgriInnovate and AgriDiversity claim documentation for the samples reviewed.

The review of samples found that although progress reporting was received from recipients and saved in program/project files, monitoring results (for example, project progressed as scheduled) were not documented in all the AgriInnovate and AgriDiversity claim documentation.

The audit found that there is a lack of communication between Program Officers and Claims Officers regarding progress monitoring results in the Innovation Programs Directorate and the Service and Program Excellence Directorate. Payments can be made by Claims Officers without awareness of project progress and, therefore, do not demonstrate accountability for program funds to support the achievement of program objectives.

A lack of communication on project progress between Program Officers and Claims Officers increases the risk Claims Officers may make full payments without retaining a holdback if work has not progressed as scheduled or may make payments for expenditures not yet incurred.

Advance payments

In addition to reimbursement of eligible expenditures, AAFC also issues advance payments, which can be made only if allowed by the program terms and conditions and the contribution agreement. As per the Treasury Board Policy on Transfer Payments and the Programs Branch Gs&Cs Operations Guide, advances must be limited to the immediate financial needs of the recipient and clearly documented.

What the audit found: Evidence to support the issuing of advances was missing in claim documentation.

In the majority of advances reviewed, across the three selected programs, the required justification to support the immediate financial need of the recipient was not obtained or included in claim documentation.

Without evidence to support cash flow needs, advances may be made to recipients that do not have cash flow difficulties, giving recipients the opportunity to re-invest or earn interest on advances. This may raise concerns of fairness and transparency and potentially damage the Department’s reputation.

Recommendation 1

The Assistant Deputy Minister, Programs Branch should further strengthen the alignment of the claims processes with Programs Branch’s policies and guidance in the areas of roles and responsibilities for Program Officers and Claims Officers and that claims documentation includes the results of progress monitoring and the need for advances.

Management Response and Action Plan: Agreed. Programs Branch has undertaken a comprehensive review of all its claims functions to ensure consistency, efficiency, and alignment with Programs Branch’s policies and guidelines. This work will continue to determine if current model needs to be adjusted for better efficiencies.

Programs Branch will determine if the structure and function of current claims units need to be adjusted, taking into consideration claims units in other departments (including classification and level, and roles and responsibilities). Upon this determination, claims units will be aligned (as needed) for the overall enhancement of Programs Branch operations. As necessary, Programs Branch will engage HR and Classification teams to develop appropriate job descriptions.

Programs Branch will use the information from the review to analyze and update processes, including roles and responsibilities, to ensure consistency (where possible and appropriate) and continued alignment with Branch policies and guidelines, with an emphasis on claims documentation that incorporates the results of monitoring efforts and the need for advances.

The Services and Programs Excellence Directorate’s Centre of Expertise for Grants and Contributions is committed to undertaking, within the next 12 months, a comprehensive review and revision of related policy documentation, directives, guidance resources and training materials.

The inclusion of functionality to facilitate claims processing within the Grants and Contributions Digital Platform (GCDP) will enhance role standardization and streamline processes for claim reviews. The Centre of Expertise for GCDP will review, evaluate and monitor the system’s utilization across program to decrease checkpoints and eliminate redundancy, to improve processing efficiencies.

Lead responsible: Assistant Deputy Minister, Programs Branch

Target date for completion: April 2025

Recommendation 2

The Assistant Deputy Minister, Programs Branch should implement additional streamlining opportunities that are proportionate to risk and administrative costs.

Management Response and Action Plan: Agreed. The Centre of Expertise for Grants and Contributions, in collaboration with BDCD, SPED and IPD, will review opportunities to implement additional streamlining including:

- Expand the application of Section 34 claim delegation approval to managers within all directorates;

- Review and reduce duplicate efforts within processes and policy requirements, such as the “Pay Now, Sample Later” guidance, by removing the requirement to submit two separate claims packages (one at the payment stage, and again when the invoices are sampled and verified);

- Enhance clarity and mutual understanding of sampling directives, by reviewing and refining training to ensure instructions and shared comprehension; and

- Review the Recipient/Project Risk Management Framework Guide and Assessment Tool to identify mitigation strategies that effectively balance risk considerations and minimize administrative costs.

Lead responsible: Assistant Deputy Minister, Programs Branch

Target date for completion: September 2024

3.0 Conclusion

The audit concluded that adequate and effective controls were in place to process recipient claims for AAFC contribution programs in support of achieving program and departmental objectives. However, improvements are needed to:

- Align the roles and responsibilities of Program Officers and Claims Officers and claims documentation with Programs Branch’s policies and guidance; and

- Further streamline the claims processes.

Annex A: About the audit

Statement of conformance

The audit conformed to the Institute of Internal Auditors' International Professional Practices Framework, as supported by the results of AAFC’s 2020 internal audit quality assurance and improvement program. Sufficient and appropriate evidence was gathered in accordance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing to provide a reasonable level of assurance over the findings and conclusion in this report. The findings and conclusion expressed in this report are based on conditions as they existed at the time of the audit and apply only to the areas included in the audit scope.

Audit objective

To determine whether adequate and effective controls were in place to process recipient claims for AAFC contribution programs in support of achieving program and departmental objectives.

Audit scope

This audit was focused on claims processing for the period from April 2021 to March 2023, including assessing expenditure eligibility and approving payments, in the administer and acquit stages of the project lifecycle. The audit also looked at relevant activities beyond this period to gain a more complete understanding of the subject matter of the audit.

Programs selected

Three non-BRM contribution programs were selected for assessment to include a mix of program sizes (small, medium and large) and Programs Branch directorates:

| Program directorate | Selected program |

|---|---|

| Business Development and Competitiveness Directorate | AgriAssurance – National Industry Association |

| Innovation Programs Directorate | AgriInnovate |

| Service and Program Excellence Directorate | AgriDiversity |

Audit criteria

The following criteria were developed to ensure sufficient and appropriate evidence was collected and examined to support the audit conclusion:

- Claims delivery and management: Management activities and controls related to recipient claims processing at the branch and program levels are adequate, effective and sensitive to risk.

- Payment compliance: Claims are paid in compliance with the Financial Administration Act, Treasury Board and AAFC policies and guidelines, program terms and conditions, program applicant guide, contribution agreements and in alignment with established processes.

The audit did not specifically assess the Grants and Contributions Digital Platform as the project planning phase of its development was recently audited. However, the audit took this system into consideration that was being on-boarded for audit observations and recommendations.

The audit also excluded the following areas:

- Section 33: Stand-alone audit would be required due to its complexity.

- IT controls for departmental financial system and program-specific systems: Stand-alone audit would be required due to its complexity.

- Recipient audit: Not part of the claims process.

- Collection of repayable contributions: Not part of the claims process.

Audit approach

The audit approach was risk-based and consistent with the Institute of Internal Auditors' International Professional Practices Framework. These standards require that the audit be planned and performed in such a way as to conclude against the audit objective. The audit was conducted in accordance with an audit program, which defined audit tasks to be performed to obtain and examine sufficient and appropriate evidence to assess each audit criterion.

The audit conducted the following work to complete the engagement:

- Review of documents, such as claims submissions and supporting documentation, claims process checklists, claims packages and processes.

- Interviews with AAFC management and employees involved in the management and implementation of the claims processes.

- Review of a judgmental sample of contribution program claims packages.

- Comparison of claims processes across directorates to identify opportunities to improve efficiency.