March 17, 2017

Report

Office of Audit and Evaluation

List of abbreviations

- AAFC

- Agriculture and Agri-Food Canada

- AgriFlexibility

- Agricultural Flexibility Fund

- API

- Agri-based Processing Initiative

- BIXS

- Beef InfoXchange System

- BSKM

- Building Success in Key Markets

- CBAI

- Canada Brand Advocacy Initiative

- CCC

- Canola Council of Canada

- CFIA

- Canadian Food Inspection Agency

- DFATD

- Department of Foreign Affairs, Trade and Development Canada

- FPT

- Federal-Provincial-Territorial

- GF

- Growing Forward

- GF2

- Growing Forward 2

- Gs&Cs

- Grants and Contributions

- IRI

- Innovation from Research Initiative

- LATI

- Livestock Auction Traceability Initiative

- LLP

- Low-level Presence

- MOU

- Memorandum of Understanding

- MRL

- Maximum Residue Levels

- MT

- Million Tonnes

- PAA

- Program Alignment Architecture

- PSA

- Program Sub-Activity Architecture

- PT's

- Provinces and Territories

- REI

- Renewable Energy Initiative

- S&C

- Salmonella & Campylobacter

- TBS

- Treasury Board of Canada Secretariat

- TFI

- Traceability Foundations Initiative

Executive summary

Agriculture and Agri-Food Canada's (AAFC) Office of Audit and Evaluation evaluated the Agricultural Flexibility Fund (AgriFlexibility) activities undertaken between 2009 and March 31, 2014. The purpose of the evaluation was to examine the relevance and performance of the three AgriFlexibility initiatives [Federal-only, Federal-Provincial-Territorial (FPT) cost-shared and Industry-led].

AgriFlexibility background

Budget 2009, Canada's Economic Action Plan, provided a $500 million Agricultural Flexibility Fund to AAFC to implement new agricultural initiatives from 2009-2010 through 2013-2014. AgriFlexibility was created to help the agriculture and food processing sectors adapt to pressures and improve their competitiveness. It addressed a broad range of needs, including those related to improving environmental sustainability, reducing production costs, fostering value chain innovation or sectoral adaptation, and addressing emerging opportunities and challenges.

The original $500 million budget was divided into $300 million for Federal-only and Industry-led initiatives and $200 million for FPT cost-shared initiatives. Over the five-year AgriFlexibility funding period, the total actual expenditures, as of March 31, 2014, were $227 millionFootnote 1, including $101.7 million for Federal-only initiatives, $30.6 million for Industry-led initiatives and $90.4 million for FPT cost-shared initiatives.

Key findings: relevance

Many AgriFlexibility funded initiatives were developed in response to Canada's 2008 economic recession. The economic crisis brought on immediate pressures in the agriculture sector such as high input prices, low or volatile commodity prices and increasing competition and restrictions from the international marketplace. Budget 2009 provided stimulus funding during a period of high economic uncertainty facing the Canadian agricultural sector. AgriFlexibility initiatives addressed challenges, emerging opportunities and the need for innovation and reduced production costs for the sector to remain competitive nationally and internationally. The evaluation found that AgriFlexibility helped producers and agriculture associations to take proactive measures to address emerging issues and needs, which may prove beneficial to the long-term success of the agricultural sector.

Of AAFC's three strategic outcomes (2009-2010 to 2013-2014), the bulk of AgriFlexibility initiatives aligned with the two outcomes relating to an innovative (43% of program expenditures) and competitive (49% of program expenditures) agriculture, agri-food, and agri-based products sector. Program expenditures focusing on innovation and competitiveness were expected given the challenges facing the Canadian agricultural industry such as a short growing season, extreme weather variation, labour shortages, transportation delays, and strong competition from the international marketplace. Producers, processors, and suppliers needed to make effective management decisions to meet these sectoral challenges. Their ability to innovate and increase efficiency was critical to improving the competitiveness and profitability of the agriculture industry. The evaluation found that many of the initiatives funded through AgriFlexibility fostered innovation and increased competitiveness.

The evaluation found the Federal-only, FPT cost-shared and Industry-led initiatives did not duplicate or counteract other federal programs, rather they complemented other AAFC program activities. The federal government played an appropriate and necessary role in providing a pan-Canadian approach through AgriFlexibility, as there were sector needs that the provinces and industry either would not or could not address on their own.

Performance

While some AgriFlexibility initiatives did not meet their performance targets, many had a positive impact on the agriculture and agri-food industry, and without AgriFlexibility, the industry may not have advanced as quickly or been as well-prepared for the future. The proactive approach towards food safety, traceability, market access and demand, and value chain innovation efforts has helped position the sector to address current and future trade barriers and impending regulations.

The FPT cost-shared initiatives varied widely, as some provinces and territories were better prepared to take advantage of AgriFlexibility funding than others. Some provinces that lacked pre-existing programming or available administrative resources, or those that developed initiatives with too wide a scope, found it difficult to achieve outcomes or measure impacts. While not discounting the positive contributions many of these initiatives made to the agriculture sectors of their respective provinces, most FPT cost-shared initiatives were created quickly and not designed to capture the information needed to determine how they fulfilled program objectives.

The Industry-led initiatives attempted to address areas of importance to the agricultural industry and helped to uncover areas requiring further attention. Many of the Industry-led initiatives evolved and adapted to industry changes and challenges as they materialized during AgriFlexibility. Many Industry-led initiatives made progress towards achieving their respective end outcomes.

The announcement of AgriFlexibility as part of the Government of Canada's Budget 2009, originally allocated $500 million in funding over five years (2009–2010 to 2013–2014). The timing of this announcement came shortly after AAFC and the provinces and territories announced new programs funded under the Growing Forward framework. The provinces and territories found utilizing the funds offered by AgriFlexibility particularly challenging, as they had already committed a large portion of their budgets and resources towards the new Growing Forward programs. Some provinces were unable to match the 60/40 funding cost share requirement or to find worthwhile initiatives that were incremental and did not duplicate, overlap, or displace the new Growing Forward or their own existing provincial programs.

These implementation challenges led to increased diligence to ensure selected initiatives that received AgriFlexibility funding did not duplicate, overlap, or displace existing programs. However, the time required to perform this due diligence, in some cases, resulted in lapsed funding. On the positive side, the requirements for AgriFlexibility funding did result in a streamlined approval process for programs, which AAFC now regularly utilizes.

AgriFlexibility developed an efficient governance structure to ensure funds were dispensed to initiatives that met the funding requirements in a timely manner which included functional risk-management and control frameworks.

Ultimately, while some of the funding was reallocated to other non-AgriFlexibility programming, resulting in $227 million of actual expenditures of the original $500 million budgeted over five years, the flexibility in funding offered through AgriFlexibility assisted a multitude of programs and projects in many sectors of agriculture to respond to market challenges and opportunities, and promote innovation and sectoral adaptation.

Lessons learned

Several lessons learned were identified:

- Consultation with industry to identify gaps, imminent needs, and stakeholder engagement issues prior to full rollout can increase initiative success.

- Initiatives that target a strong existing need within industry and which are efficiently administered are most likely to be effective in their delivery.

- To assess the impact of initiatives with a broad range of activities and recipients, comparable performance measures and data collection strategies are necessary.

- Although some initiatives may not have met all of their objectives, some additional benefits, such as increased food safety, productivity and sales were achieved by participants.

- Refining the request for proposal process and narrowing eligibility criteria can reduce administrative burden.

1.0 Introduction

This evaluation was conducted by the Office of Audit and Evaluation as part of AAFC's Five-year Departmental Evaluation Plan (2013-2014 to 2017-2018). The evaluation fulfills the requirements of the Treasury Board Secretariat Policy on Evaluation (2009), which requires all direct spending programs to be evaluated. This report provides an overall analysis of the findings in relation to the core issues of relevance and performance, and lessons learned.

1.1 Evaluation scope and approach

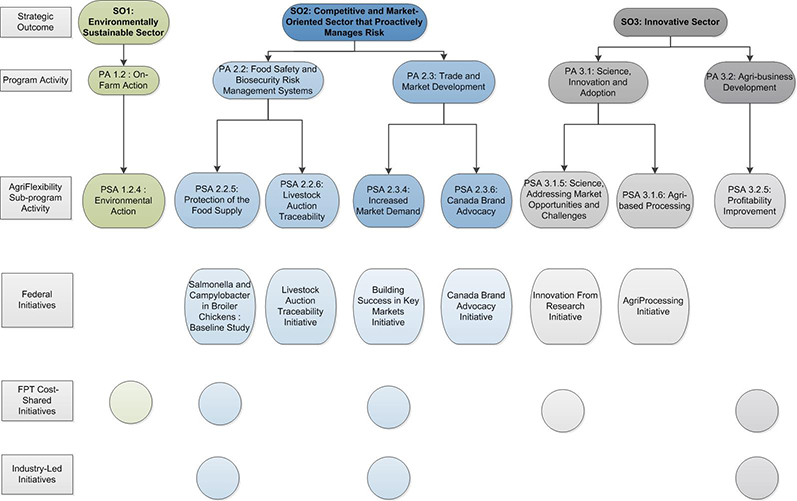

In accordance with the Treasury Board of Canada Secretariat (TBS) Directive on the Evaluation Function (2009), the evaluation examined five core issues related to the relevance and performance (effectiveness, efficiency, and economy) of AgriFlexibility. The evaluation assessed all activities, outputs and outcomes that were funded under AgriFlexibility from April 1, 2009 to March 31, 2014, as per the 2013-2014 Program Alignment Architecture shown in Annex A.

The evaluation used a mixed-methods, non-experimental design, incorporating multiple lines of evidence, both qualitative and quantitative, to assess the program and address evaluation issues and questions. Qualitative data were used to provide context around quantitative data.

1.2 Evaluation issues and questions

The evaluation addressed the following issues:

- Relevance

- What were the needs addressed under AgriFlexibility initiatives?

- To what extent are the objectives of AgriFlexibility aligned with federal government priorities and AAFC's strategic outcomes?

- To what extent does AgriFlexibility support or inhibit other federal government programs?

- Is the federal government's role appropriate or should these initiatives be delivered by other departments or orders of government?

- Performance

- To what extent did each AgriFlexibility initiative achieve its expected outputs and outcomes?

- What return on investment resulted from AgriFlexibility?

- To what extent was AgriFlexibility delivered in an efficient manner?

- What factors supported and/or hindered efficiency?

- What are the lessons learned in managing (implementing and delivering) AgriFlexibility?

1.3 Evaluation methodology

1.3.1 Data collection methods

The evaluation used the following lines of evidence:

- Financial and administrative file data were reviewed including, but not limited to program eligibility and criteria, financial information, AgriFlexibility annual reports, audits/evaluations, bilateral agreements, contribution agreements, and performance reports. The review provided information on expenditures and program delivery that helped to assess efficiency and economy, as well as questions related to the relevance of AgriFlexibility initiatives. Over 1,700 program and project documents were reviewed as part of this evaluation.

- Project file reviews was conducted based on the information gathered through preliminary interviews and document review. Specific project files were selected based on one or more of the following criteria: priority areas, regional representation, materiality, and spread across the Department (such as, Program Alignment Architecture boxes), program management recommendations, results and data availability. Files for a total of 32 projects were reviewed.

For each project, files were reviewed for the following information (where available):

- objectives,

- budgeted/actual expenditures,

- planned/implemented activities,

- outputs produced, and

- outcomes/impacts achieved.

Table 8 located in Annex B lists the specific projects for which a file review was conducted.

- The list of key informant interviews was developed in consultation with representatives from each initiative. Interviews were conducted with 33 key informants who provided their insights on AgriFlexibility, including 22 who were internal to AAFC and 11 who were external to the Department (including five representatives of other federal departments). Overall, 29 key informants participated in interviews in-person or by phone and four key informants provided written comments. Interviewees included senior management, project managers, program officers, federal and provincial collaborators, and funding recipients. Table 9 located in Annex B identifies the number of key informants by initiative and type (internal versus external). This information was used in conjunction with other lines of evidence to provide a qualitative assessment of questions related to relevance and performance. To ensure confidentiality of interviewees, no individual was identified in the evaluation.

- Case studies were conducted for a total of 18 projects. Case studies were selected in consultation with program representatives, taking into consideration the following factors: priority area, region, materiality, spread across the Department (such as, Program Alignment Architecture boxes), and results and data availability. Table 10 in Annex B provides the specific projects for which case studies were conducted. Each case study consisted of a review of project documents and files (proposal and progress reports), key informant interviews with stakeholders and an administrative financial review that provided information on questions related to relevance and performance.

- An online survey of Livestock Auction Traceability Initiative (LATI) recipients provided information on program need and impact. Contact information for recipients was obtained from program representatives. The final sample for the survey contained 324 potential respondents. In total, 124 responses to the survey were received. This information provided data on relevance and performance of LATI.

- A return on investment assessment was conducted for various funded initiatives through AgriFlexibility. The return on investment is a general term for the concept that any outlay of resources is assessed in terms of its return. Where the return and the resource outlay are precisely measureable, it is possible to create various efficiency and effectiveness ratios.

An initiative such as the Agri-based Processing Initiative, where federal funds were used to enhance the sales-economic return of private firms, provided an opportunity to measure a return on investment. Projects under this Initiative offered the most usable data for assessing the impact of AgriFlexibility funding on outcomes, primarily in production outputs and product sales, as information was available to determine the project-by-project effect of federal funding.

1.3.2 Methodological considerations

The evaluation had two significant methodological considerations in assessing the performance of AgriFlexibility initiatives:

- Limited availability of performance data to assess return on investment: To assess the return on investment that can be attributed to AgriFlexibility funding would have required that performance monitoring and measurement strategies be defined and established at the start of each program/initiative. The absence of such performance measures and baseline data in many cases limited the ability to measure the return on investment.

Agri-based Processing Initiative and some Industry-led Initiatives provided usable data to measure return on investment, especially with regards to production outputs and product sales. The majority of AgriFlexibility initiatives did not have agreements with funding recipients to collect data to measure outcomes. Some outcomes are targeted for attainment well after AgriFlexibility funding ends, as the nature of the program extends for many years and will likely be continued with other forms of funding. In some cases, it takes upwards of 10 or more years for scientific research, best management practices or other farming information to translate into economic benefits.

Given these challenges, an overall measure of the return on investment of AgriFlexibility for Canada was not possible. Quantitatively measuring efficiency as defined by the TBS Policy on Evaluation (2009) was not possible, as it was difficult to link spending to outcomes and/or measure the outcomes achieved. As a result, data from interviews and case studies were used to develop a qualitative assessment.

- Attribution of results: Since AgriFlexibility was a one-time five-year funding investment, baseline scenarios were not established and performance data were not fully monitored and collected. Many AAFC programs were underway (such as, Growing Forward programming) and were expected to influence the agriculture and agri-food sector before the beginning and duration of AgriFlexibility. Incremental impacts or attribution of funding of AgriFlexibility programs on the agriculture and agri-food sector could not be fully assessed.

To achieve more robust conclusions, the evaluation focused on those activities and outputs that demonstrated the range of impacts given the diversity of sector needs and that were working towards achieving AgriFlexibility's expected outcomes. Many of the results reported in the report are outputs, not outcomes.

2.0 Overview of AgriFlexibility

Forming part of the Government of Canada's Economic Action Plan, Budget 2009 allocated $500 million in funding over five years (2009–2010 to 2013–2014) to AgriFlexibility. The objectives of AgriFlexibility were to improve competitiveness by helping the sector adapt to pressures through non-business risk management measures that reduce costs of production, improve environmental sustainability, promote innovation and sectoral adaptation, and respond to market challenges and opportunities. Aiming to be responsive to emerging sector needs and regional diversity, AgriFlexibility supported initiatives in the following three priority areas:

- investments to help reduce production costs or improve environmental sustainability for the sector;

- investments in value chain innovation or sectoral adaptation; and,

- investments to address emerging opportunities and challenges for the sector.

2.1 AgriFlexibility initiatives

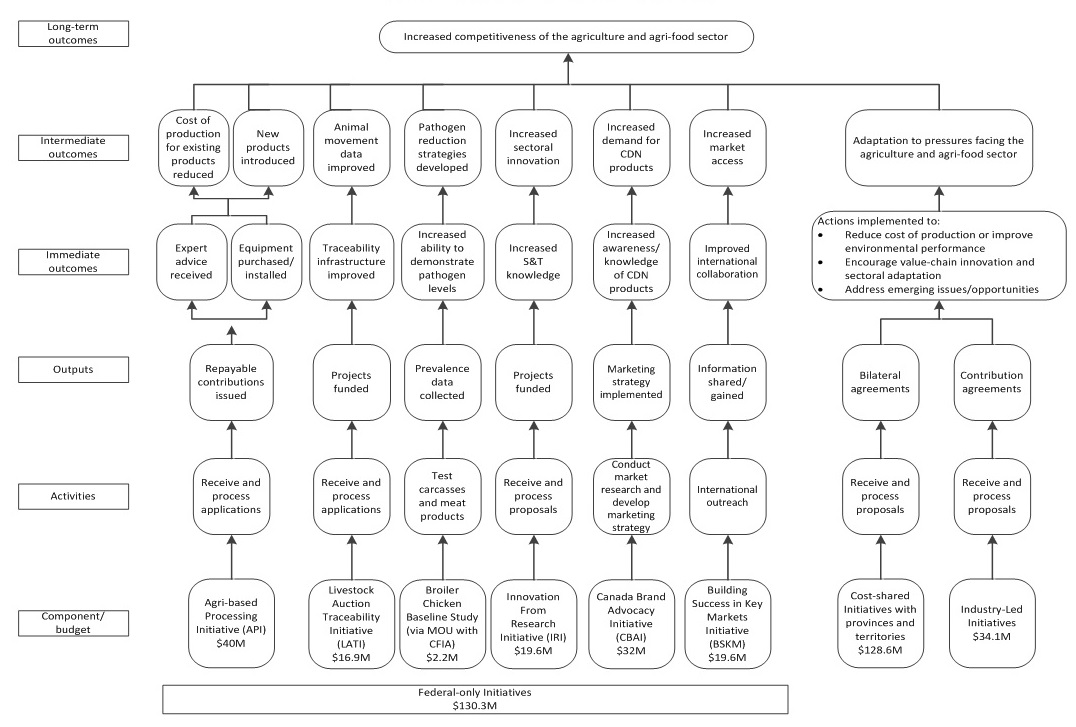

As shown in Table 1 (below), AgriFlexibility was comprised of six Federal-only initiatives, 26 initiatives cost-shared in partnership with the provinces and territories (plus one national project), and nine Industry-led initiatives. Annex A provides more information on AgriFlexibility's placement in AAFC's Program Alignment Architecture and an overall logic model for AgriFlexibility.

| Federal-only initiatives | Cost-shared initiatives with provinces/territories | Industry-led initiatives |

|---|---|---|

|

|

|

2.2 Overview of initiatives

The following is a summary of AgriFlexibility initiatives by objectives and activitiesFootnote 2:

- Federal initiatives

The Salmonella and Campylobacter in Broiler Chicken: Baseline Study focused on gathering baseline data on the prevalence and concentration of salmonella and campylobacter bacteria. Such data were needed to develop a pathogen reduction program. The study was to provide baseline data on these bacteria in broiler chickens from production to retail and compare them to those causing illness in humans.

The Livestock Auction Traceability Initiative focused on ensuring the integrity of a national livestock traceability system by facilitating the recording of the time and place of off-farm animal movements.Theprogram provided non-repayable grants and contributions for capital investments to assist in the alteration of animal handling structures (infrastructure, building modifications, and technology) to improve traceability and implement animal movement recording and reporting.

Building Success in Key Markets (BSKM) aimed to strengthen Canada's ability to seize opportunities in priority markets by providing additional resources to overcome market access challenges and building stronger relationships with key countries. The BSKM provided AAFC with incremental capacity to address significant market access issues in priority markets. A number of targeted activities under the BSKM aimed to strengthen the capacity to negotiate free trade agreements and increase support for work related to international standard setting.

The BSKM supported the development of a low-level presence strategy, as well as to support the research work from the Value Chain Roundtables related to the development of strategies to respond to market access issues. It established three new Canadian trade commissioners positions to deepen relationships with key trading partners and supported the development of specific projects through the use of existing Memorandum of Understanding designed to enhance engagement and facilitate long-term market opportunities.

The Canada Brand Advocacy Initiative aimed to enhance the food and agriculture sector's competitiveness by increasing consumer demand for Canadian products in select markets where the competitive challenges and opportunities for growth were greatest. The Initiative used market research to identify four markets, established customized marketing strategies and then implemented supporting consumer-oriented promotional activities. Although considered a Federal Initiative, the Program made extensive use of industry and in-market partnerships to deliver activities designed to position Canada as the country of choice for imported foods.

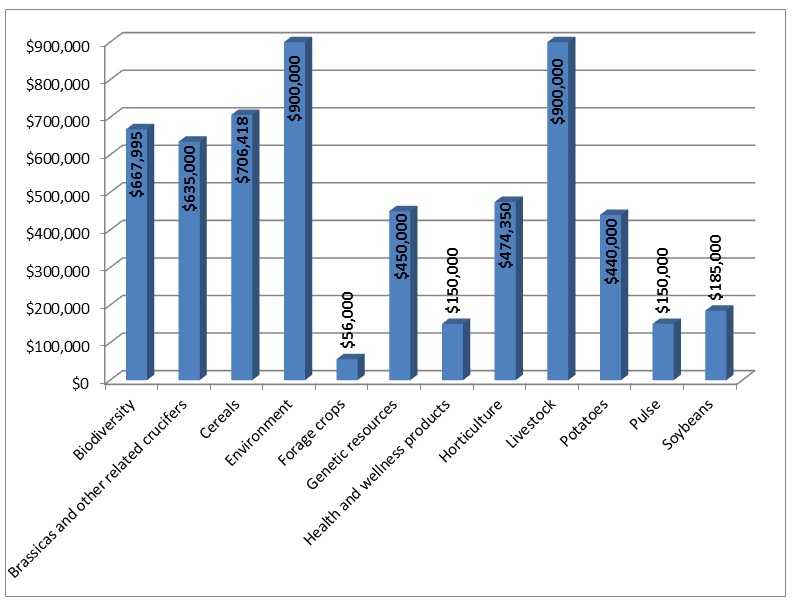

The Innovation from Research Initiative aimed to create new and incremental research leading to new commercial activities that would benefit Canadian farmers to strengthen the growing multidisciplinary nature of agricultural science. The Initiative undertook applied research projects that responded to market threats and/or took advantage of emerging market opportunities. Annex C provides a breakdown of the commodities that received funding for this Initiative.

The Agri-based Processing Initiative aimed to support existing agri-processing companies or co-operatives to adopt new-to-company manufacturing technologies and processes. The program provided repayable contributions to purchase and install machinery and equipment in Canadian facilities, to adopt new technologies and/or processes, to introduce new products and to contract external expertise for services and training. Annex D illustrates the various commodities types that received funding through agri-processors.

- FPT cost-shared initiatives (cost-shared on a 60:40 basis)

Provinces and territories undertook 27 initiatives that were to be aligned with AgriFlexibility's objectives. Of the 27 approved initiatives, four were to reduce production costs or improve environmental sustainability, five were to support value chain innovation or sectoral adaptation, and 18 (including one national initiative) were to address emerging opportunities and challenges.

Under FPT cost-shared initiatives, the allowable maximum was $10 million per initiative per year for any number of projects over the five years. If an initiative generated a profit or an increase in value, the recipient was required to repay the contribution or to share the resulting financial benefits with the federal and provincial governments commensurate with its share of the risk.

The 27 FPT cost-shared initiatives responded to emerging sector needs in regions across the country. Chart 1 illustrates the funding received by the various provinces for FPT cost-shared initiatives. Quebec (almost $34 million), Manitoba ($13.6 million) and Ontario ($10.5 million) received 66% FPT program funding.

Chart 1: FPT cost-shared funding distribution by provinces (2009-2014)Footnote 3

Description of above image

Provinces Sum of Total Alberta $5,317,409 British Columbia $5,027,402 Saskatchewan $3,624,633 Manitoba $13,668,195 Ontario $10,584,764 Quebec $33,910,142 New Brunswick $3,319,109 Nova Scotia $3,249,703 Newfoundland $4,785,281 Prince Edward Island $1,827,679 National (recipients from across Canada) $2,485,523 Grand Total $87,799,840 - Industry-led initiatives

Funding was provided to commodity associations to improve access to markets or the marketability of their commodity, through developing plans to respond to barriers or to improve public perceptions (such as, animal health codes) and strengthening supply and value chains (such as, transportation). Projects varied significantly, but were consistent with at least one of AgriFlexibility's three strategic outcomes.

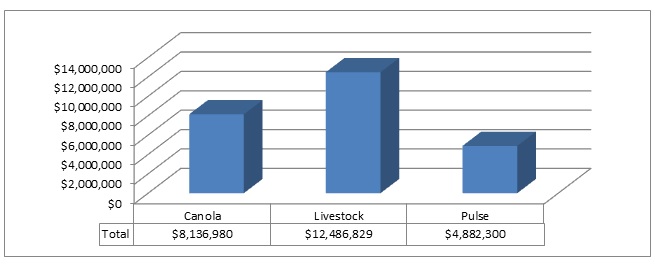

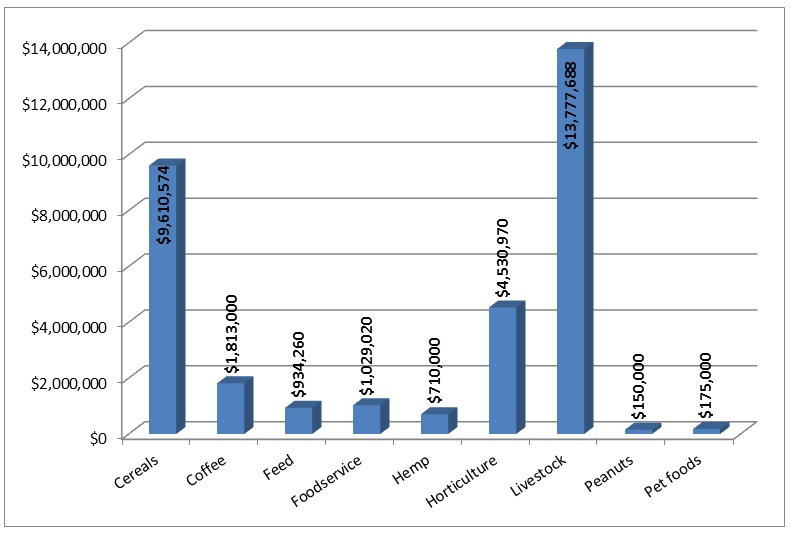

Chart 2 shows the funding distribution of the nine Industry-led programs by commodity.

Chart 2: Industry-led funding distribution by commodity (2009-2014)Footnote 4

Description of above image

Commodities Funding Canola $8,136,980 Livestock $12,486,829 Pulse $4,882,300 Total $25,506,109

2.3 Program resources

As shown in Table 2, the original budget allocation for AgriFlexibility was $500 million, including $300 million for Federal-only and Industry-led initiatives and $200 million for FPT cost-shared initiatives. Financial resources were realigned among other AAFC program activities and the remaining financial resources available for AgriFlexibility initiatives were $322.7 million, including the following:

- $190.4 million for Federal-only and Industry-led initiatives; and

- $132.2 million for FPT cost-shared initiatives.

| Initiatives | Federal-only and Industry-led Initiatives | Federal-Provincial-Territorial Cost-shared Initiatives | Total |

|---|---|---|---|

| Slaughter Improvement Program (Budget 2010) | $10 | - | $10 |

| Abattoir Competitiveness Program / Over Thirty Months Payment Program (Budget 2010) | $25 | - | $25 |

| Slaughter Waste Innovation Program (Budget 2010) | $40 | - | $40 |

| Agricultural Innovation Initiative (Budget 2011) | $30 | $20 | $50 |

| Plum Pox Management Initiative (Budget 2011) | $4.6 | $3.1 | $7.7 |

| Excess Moisture and Flooding Assistance Initiative (Agricultural Disaster Relief Program) | - | $44.6 | $44.6 |

| Realignment of Funding - Subtotal | $109.6 | $67.6 | $177.3 |

| Original Funding | $300 | $200 | $500 |

| Total remaining for AgriFlexibility initiatives | $190.4 | $132.3 | $322.7* |

|

* Totals may not sum due to rounding. ** AgriFlexibility financial overview final June 2014 (realigned from the initial original funding). |

|||

As shown in the following Table 3, over the five-year AgriFlexibility funding period, planned and total expenditures were the following:

- Planned expenditures were $293.1 million, which represents 91% of $322.7 million (Table 2) remaining;

- Actual total expenditures, as of March 31, 2014, were $227 millionFootnote 5, including;

- $101.7 million for Federal-only initiatives;

- $30.6 million for Industry-led initiatives; and

- $90.4 million for FPT cost-shared initiatives; and

- Actual expenditures of $227 million, represented 77% of the planned expenditures of $293.1 million; and

- Actual expenditures of $227 million also represented 70% of the $322.7 million (Table 2) remaining after the budget reallocations.

| Initiative | Planned | Actual* | Variance |

|---|---|---|---|

| Federal-only and Industry-led Initiatives | |||

| Livestock Auction Traceability Initiative | $16.9 | $11.3 | ($5.6) |

| Building Success in Key Markets* | $19.6 | $8.8 | ($10.8) |

| Canada Brand Advocacy Initiative | $32.0 | $21.6 | ($10.4) |

| Innovation from Research Initiative | $19.6 | $18.4 | ($1.2) |

| Agri-based Processing Initiative | $40.0 | $39.5 | ($0.5) |

| Salmonella and Campylobacter Baseline Study | $2.2 | $2.1 | ($0.1) |

| Industry-led Initiatives | $34.1 | $30.6 | ($3.5) |

| FPT Cost-shared Initiatives | $128.6 | $90.4 | ($38.8) |

| Employee Benefit Plan / Accommodations / Internal Services | $4.3 | ||

| Total | $293.1 | $227 | ($66.7)* |

|

* Totals may not sum due to rounding. ** Source: AgriFlexibility overview final June 2014. |

|||

Overall, about half (45%) of the original $500 million funding was realigned for the six Federal-only initiatives, 27 cost-shared initiatives in partnership with provinces and territories (including one national project), and nine Industry-led initiatives.

3.0 Evaluation findings

This section of the report presents key findings related to AgriFlexibility. More specifically, it explores the relevance of the initiative, its effectiveness and the extent to which economy and efficiency have been realized.

3.1 Relevance of AgriFlexibility

In assessing the relevance of AgriFlexibility initiatives, the evaluation assessed: the original need; the alignment with federal priorities and the Departmental strategic outcomes; the extent to which AgriFlexibility supported other AAFC programs; and alignment with AAFC's roles and responsibilities.

3.1.1 Need for AgriFlexibility

The 2008 economic crisis was international and affected all sectors of the Canadian economy. AgriFlexibility was created in anticipation to offset losses in the agriculture and agri-food processing sectors and help the sector to adapt and improve their competitiveness following the 2008 economic recession. AgriFlexibility addressed a broad range of needs, including those needs related to improving environmental sustainability, reducing production costs, fostering value chain innovation or sectoral adaptation, and addressing emerging opportunities and challenges.

The evaluation found that there was a need for original AgriFlexibility funding in these areas and that in some cases further support would have been beneficial, especially in assisting industry to improve value chain innovation or sectoral adaptation, and addressing emerging opportunities and challenges. Funding provided through AgriFlexibility somewhat met essential or critical needs and addressed areas of concern that may become critical needs in the future. Many of the initiatives took a proactive approach in addressing emerging issues and needs, which may prove beneficial to the long-term success of the agricultural industry.

AgriFlexibility involved numerous programs and projects at the federal, provincial and industry level. Each was developed to respond to a specific industry need. The following sections discuss the relevance of the different types of AgriFlexibility initiatives based on AAFC's 2013-2014 Program Alignment Architecture (PAA) (Annex A, Figure 1), which includes:

- Addressing emerging opportunities and challenges:

- food safety, biosecurity and traceability (under PAA 2.2: Food Safety and Biosecurity Risk Management Systems)

- trade and market development (under PAA 2.3)

- Fostering value chain innovation or sectoral adaptation:

- science, innovation and adoption (under PAA 3.1)

- agri-business development (under PAA 3.2)

- Helping reduce production costs or improve environmental sustainability:

- environmental programs (under PAA 1.2: On-Farm Action)

3.1.1.1 Need for food safety, biosecurity and traceability programs

The domestic and international marketplace is demanding assurance systems that allow for quick and easy trace-back of food products in the event of an animal health crisis or a food recall situation. Food safety systems can help to expand access to foreign markets, reduce the risk of health incidents, and minimize the impact of food safety incidents when they occur. As food production becomes more globalized, food chains become longer and food safety risks heighten. Canadian trading partners' expectations of food safety have increased in recent years, with some trading partners requiring importing countries to meet their own mandatory industry/government requirements.

In the future, as trading partners establish more stringent food safety measures as a prerequisite for access to their markets, it is essential that Canada is able to demonstrate its food safety measures in meeting or exceeding international food safety standards and requirements of key trading partners.Footnote 6

The following programs demonstrate how AgriFlexibility responded to industry needs for enhanced food safety and traceability:

- Salmonella and Campylobacter in Broiler Chicken Baseline Study: Canada's future chicken exports were at risk because some importing countries were developing new standards for the prevalence and concentration of these bacteria in broiler chicken. The baseline study was necessary to develop a pathogen reduction program that would demonstrate the effectiveness of Canada's food safety measures and help protect the safety of Canadians, more than to retain export markets because Canada is still developing its exporting capabilities in this area.

- Livestock Auction Traceability Initiative: The Initiative allowed livestock auction facilities to buy and install technology to record individual animal movement and undertake infrastructure changes. Such changes are needed for animal health management, and once regulations are in place, to meet marketplace requirements for quick and easy trace back to source of food products in the event of an animal health crisis or a food recall.

- National Meat Hygiene Pilot Project: The Project was designed to address issues regarding access to slaughter capacity and trade of meat in areas underserved by federally registered establishments. CFIA worked with provincial counterparts to map out challenges preventing small meat businesses from moving from provincial to federal registration, and becoming eligible to move products either inter-provincially or to sell to major retailers who have federal meat registration as a pre-condition for sale.

3.1.1.2 Need for trade and market development programs

Canada is an important player in the international trade of agriculture and agri-food products. With exports sales of $43.6 billion in 2012, Canada accounted for over 3.5% of the total value of world agriculture and agri-food exportsFootnote 7. While Canadian exports to market outside the United States (US) continue to grow, China overtook Canada as the world's fourth largest agricultural exporterFootnote 8. With growth opportunities centered in middle income countries, more sophisticated consumers and trading partners are demanding product attributes and assurances that have increased this tendency in bilateral and regional trade rule setting. This demand changed the global marketplace significantly and led to new challenges and pressures on trade and market development opportunities. For example, technological advancements and the rise in non-tariff barriers to trade have resulted in an increasingly complex and challenging international marketplace.

The following AgriFlexibility funded initiatives were intended to respond to these challenges by strengthening Canada's international approach, allowing it to take advantage of opportunities in priority markets, and increasing foreign consumer receptiveness to Canadian products:

- Building Success in Key Markets Initiative: This Initiative responded to the need to strengthen Canada's international approach and to seize the full extent of possibilities in priority markets.

- Canada Brand Advocacy Initiative: This Initiative introduced a range of targeted retail, foodservice and media-oriented promotions to positively influence both consumer purchase intent and associated supply chain development for Canadian products in four international markets.

- Pulse Canada: Health, Innovation and Commercialization: This industry-led Initiative addressed the need of the Canadian pulse industry to diversify its market base. The industry's heavy reliance on a small number of export markets left it exposed to unexpected changes in those markets.

- Nova Scotia: Collaborate to Compete: This cost-shared Initiative addressed the need for a provincial beef industry strategy that would help it build new niche markets in the face of strong competition from producers in other provinces.

3.1.1.3 Need for science, innovation and adoption programs

AgriFlexibility's Innovation from Research Initiative, Agri-based Processing Initiative and FPT cost-shared initiatives responded to a number of complex and interlinked challenges facing the agriculture and agri-food industry. These challenges include increased global demand for food and high-value foods, and pressures for greater productivity. Market demand and productivity responses are putting pressure on limited resources (arable land, water) and affecting environmental quality (soil, air, water, biodiversity). The potential pace and magnitude of climatic and technological changes, add to the complexity and opportunities for AAFC programs. The following AgriFlexibility funded initiatives responded to the need for science, innovation and adoption programs:

- Innovation from Research Initiative: Research initiatives responded to farmer and processor needs for the applied research to drive productivity improvements and respond to changing environmental conditions.

- Agri-based Processing Initiative: Due to increasing production costs and out-migration of food processors to other countries, the Initiative addressed the need to improve competitiveness of existing food processors by helping them modernize their operations.

- Newfoundland: Agriculture Research Initiative: This Initiative addressed the need to develop applied research capacity in Newfoundland, both public and private, to support the competitiveness of the agricultural industry.

3.1.1.4 Need for agri-business development programs

Agricultural producers and processors require the skills and supports that will enable them to use sound business practices, implement improvements, manage transformation, and respond to change in order to succeed. The following examples demonstrate the need for agri-business development:

- Canola: Grow Canola 2.015: This Initiative responded to canola producers' needs for up-to-date agronomic information, research results, and market information that could assist them in adopting cost-effective and environmentally sustainable practices. The project involved developing a social media platform to deliver this information to producers.

- Alberta: Crop Pest Surveillance System: This Initiative responded to producers' need for a centralized and coordinated approach to pest surveillance and response.

- Quebec: Strategic Sector Development: This Initiative met the need for greater coordination amongst organizations and businesses in specific agricultural sectors to take collective action to increase competitiveness.

3.1.1.5 Need for environmental action programs

The previous AAFC Agricultural Policy Framework (2004-2009) responded to the state of agri-environmental challenges and concluded that there was a need for better scientific understanding of the interactions between agriculture and the environment that could inform industry decision-making and national policy development.

Only a few initiatives addressed the environmental action component of AAFC's PAA. One was the Alberta's Environmental Market Opportunities project which addressed the need to link environmental action with potential new market access opportunities.

In terms of the overall need, AgriFlexibility funded initiatives that responded to industry needs to improve environmental sustainability, reduce production costs, foster value chain innovation or sectoral adaptation, and address emerging opportunities and challenges. The evaluation found that AgriFlexibility helped producers and agriculture associations to take proactive measures to transform their sector, which may prove beneficial to the long-term success of the industry.

3.1.2 Alignment with federal priorities and linkages with other programs

The evaluation assessed the alignment of AgriFlexibility with federal government priorities and AAFC's strategic outcomes and whether AgriFlexibility supported or inhibited other federal government programs. The evaluation found that AgriFlexibility initiatives aligned with federal government priorities and complemented other federal government programming.

As part of Budget 2009: Canada's Economic Action Plan, the Prime Minister committed to "…invest new funds over the next five years to help Canadian farmers to innovate, to increase competitiveness, and to achieve greater environmental sustainability"Footnote 9. Program documents show that AgriFlexibility initiatives were designed to address industry needs in three main areas that aligned with AAFC's strategic outcomes.

| Strategic Outcome (2009-2010 to 2013-2014) | AgriFlexibility investment/program area |

|---|---|

| Strategic Outcome 1: An environmentally-sustainable agriculture, agri-food, and agri-based products sector | Investments to help reduce the cost of production or improve environmental sustainability: Initiatives which aimed to support the adoption of management practices that were intended to reduce the usage of agricultural inputs, lower farm production costs and/or improve agriculture's environmental performance; assist in the sustainable development of water resources for agricultural use; and accelerate the use of agricultural biomass in the emerging bioenergy sector. |

| Strategic Outcome 2: A competitive agriculture, agri-food, and agri-based products sector that proactively manages risk | Investments in value chain innovation or sectoral adaptation: Initiatives which were intended to help industry take advantage of opportunities across the value chain, encourage value chain innovation, and help sectors in transition enter new markets and/or commodity lines. |

| Strategic Outcome 3: An innovative agriculture, agri-food, and agri-based products sector | Investments to address emerging opportunities and challenges: Initiatives which were intended to help position industry to anticipate and address emerging opportunities or challenges and to maintain its competitive advantage. These include the ability of governments and industry to respond to change, whether from new technologies, new food-safety and biosecurity threats, changes in regulations or trade rules, or innovative products and processes reaching the market.** |

| **Program eligibility and criteria for the contribution Program entitled Agricultural Flexibility Fund – Cost Shared Initiatives (Amended). | |

The Federal-only initiatives under AgriFlexibility were directly linked to two AAFC strategic outcomes. Four Federal-only initiatives aligned with Strategic Outcome 2 for competitiveness and addressed government and AAFC priorities:

- The Salmonella and Campylobacter in Broiler Chicken Baseline Study supported the pathogen reduction initiative for meat and poultry, which was part of the federal government's strategy to strengthen the Canadian food safety system.

- The Livestock Auction Traceability Initiative supported the government's traceability and market access priorities.

- Building Success in Key Markets supported the government's international trade priorities, which were reflected in its commitments to strengthen the market access and deepen Canadian trade relations through the trade commissioner service and Market Access Secretariat, AAFC.

- The Canada Brand Advocacy Initiative supported the government's priority to improve sector competitiveness by offering a sector-wide promotion program aimed at specific consumer segments in target markets. This advocacy paved the way for coordinated and complementary industry activities focused on specific product categories to positively influence perceptions of the benefits of the high-quality food that Canada produces.

Two Federal-only initiatives aligned with AAFC's Strategic Outcome 3: An innovative agriculture, agri-food and agri-based products sector:

- The Innovation from Research Initiative addressed priorities for innovation in the sector and aligned with the Department's mandate for innovation: and,

- The Agri-based Processing Initiative aligned with the government's interest to facilitate innovation in the sector.

The FPT cost-shared initiatives under AgriFlexibility were linked to all three Departmental strategic outcomes. The Industry-led initiatives were aligned to AAFC's Strategic Outcomes 2 and 3 (2013-2014).

Overall, AgriFlexibility expended approximately the following per outcome, as of March 31, 2014Footnote 10:

- Strategic Outcome 1: Environment: $16,567,487;

- Strategic Outcome 2: Competitiveness: $105,963,498; and,

- Strategic Outcome 3: Innovation: $93,393,650.

3.1.2.1 Linkages to other programs

AgriFlexibility was designed to complement, but not overlap, duplicate, or counteract other federal programs. AAFC worked with the Treasury Board Secretariat to determine and ultimately approve initiatives that were unique and incremental. AgriFlexibility responded to pressure from other federal departments, some provinces, and industry to supplement Business Risk Management programming.

A list of Federal-only initiatives and their linkages with other programs follows:

- The Salmonella and Campylobacter in Broiler Chicken Baseline Study contributed to the federal government's Pathogen Reduction Initiative.

- The Livestock Auction Traceability Initiative complemented pre-existing traceability programs offered to producer organizations through Growing Forward (GF), and to individual businesses through provincial GF cost-shared programs. Prior to applying to the initiative, applicants were required to first attempt to obtain funding from pre-existing provincial programs (where available) and had to provide proof of their application. These precautions ensured that the initiative did not duplicate any other program.

- The various activities under Building Success in Key Markets were to provide incremental capacity for work in international markets of strategic importance. The sub-initiatives to enhance the Agriculture and Food Trade Commissioner Service and the Value Chain Roundtables were incremental to Growing Forward programming as it placed additional AAFC trade commissioners in key markets and expanded activities on priority issues under the Value Chain Roundtables.

- The Canada Brand Advocacy Initiative complemented work undertaken by federal trade commissioners, who participate in market access and market development activities (including trade promotion). AAFC staff worked closely with the Canadian Tourism Commission to deliver a number of media and trade show events, activities that complemented Growing Forward programming.

- The Innovation from Research Initiative allowed AAFC's network of research facilities and scientific expertise across Canada to support incremental applied research in emerging areas and accelerate the uptake of new technologies at the farm level. The Initiative has been transitioned to ongoing Departmental (A-base) and Growing Forward funding sources.

- Prior to the Agri-based Processing Initiative (API), AAFC had few programs specifically targeting processors and not in the same capacity as API. While the initiative did not counteract or duplicate any other federal programs, key informants interviewed for this evaluation recognized that some businesses could have obtained traditional financing for their projects through other sources (for example, financial institutions). Nonetheless, key informants indicated that API provided businesses with more favourable financing terms. For some companies, the projects represented large investments and without API funding, the projects would not have proceeded.

According to the program eligibility and criteria for the FPT cost-shared initiatives, AgriFlexibility was considered to complement (not duplicate, overlap, or displace) existing PT Growing Forward and non-Growing Forward programming when the following conditions were met:

- It accelerated the pace of activities towards reaching national outcomes;

- Eligible activities for investment were different than those of existing programs;

- It ensured equitable access to funding across the country and equitable treatment for Canadians; and,

- The program details regarding provincial/territorial programming were not available until after the AgriFlexibility initiatives were announced.Footnote 11Footnote 12

The due diligence processes ensured the FPT cost-shared initiatives complemented existing programs. AAFC worked with provinces to refine their proposals, as necessary, to ensure there was no duplication or displacement of federal programs. Table 11 in Annex F shows examples of how various cost-shared programs were linked with other programs.

In summary, the evaluation found the Federal-only, FPT cost-shared and Industry-led initiatives under AgriFlexibility did not duplicate or counteract other federal programs, rather many supplemented other AAFC activities.

3.1.3 Alignment with federal roles and responsibilities

The agricultural sector was facing many challenges as a result of the economic downturn in 2008. High input prices, low or volatile commodity prices and increasing competition from the international marketplace were just a few of the immediate pressures facing the sector. AAFC staff interviewed for this evaluation considered the federal government's role in AgriFlexibility appropriate in helping the agriculture and agri-food sector address challenges of innovation and increase competitiveness during Canada's 2008 economic recession.

For the FPT cost-shared initiatives, AAFC took on the role primarily of overseeing the disbursement of the funds and ensured that the agreed-upon performance reporting was adhered to by provincial departments involved in AgriFlexibility initiatives. In some cases, AAFC worked with provinces to refine their proposals as necessary to ensure there was no duplication or displacement of Federal-only initiatives. Since Industry-led initiatives, by their nature, generally had little or no federal government involvement, the federal government role was primarily to review project proposals, determine eligibility and select proposals during the approval process. Here, the federal government was seen as a funding source to help Industry-led initiatives accomplish their objectives.

AAFC collaborated with other federal departments (for example, the Canadian Food Inspection Agency, Health Canada, and Department of Foreign Affairs, Trade and Development Canada [now Global Affairs Canada]) on some of the initiatives. Many AgriFlexibility initiatives supported cooperation between the federal, provincial/territorial governments and industry.

Based on various lines of evidence, the evaluation found that the federal government played an appropriate and necessary role in providing a pan-Canadian approach through AgriFlexibility during a challenging economic period, as there were sector needs that the provinces, territories, industry or other government departments could not address on their own.

3.2 Program performance

3.2.1 Effectiveness

To assess effectiveness, the evaluation examined the achievement of outputs and outcomes relating to food safety, traceability, market demand, brand advocacy, value chain innovation, agri-based processing, profitability improvement and environmental sustainability. The evaluation assessed the return on investment in terms of the benefits Canada received in agricultural, environmental and economical terms relative to the funding allocated in AgriFlexibility. In terms of efficiency and economy, the evaluation assessed AgriFlexibility's overall resource utilization, implementation and factors that supported or hindered its efficiency.

3.2.1.1 Effectiveness of food safety, biosecurity and traceability programs

The evaluation assessed the contributions AgriFlexibility made to protect the food supply. According to program data, AgriFlexibility initiatives nearly achieved all of their output targets in this area, developing five of six food safety plans and programs to improve food safety, biosecurity, traceability, and risk management measuresFootnote 13. AgriFlexibility funded significant efforts towards bolstering industry awareness and implementation of food safety and traceability systems. This priority was addressed by two of the Federal-only initiatives including the Salmonella and Campylobacter Baseline Study and the Livestock Auction Traceability Initiative, one Industry-led initiative and three FPT cost-shared initiatives. The following two initiatives demonstrate some of the results achieved.

Livestock Auction Traceability Initiative

Launched in January 2011, Livestock Auction Traceability Initiative (LATI) was designed to improve traceability systems at auction marts, assembly yards and feed lots to limit and/or contain animal disease outbreaks, such as foot-and-mouth disease (FMD). LATI covered up to 80% of the costs of implementing traceability systems, including: computers, software, cattle handling equipment, weigh scales, radio-frequency identification (RFID) readers, and training. The evaluation found that LATI contributed to its expected outcomes of improving traceability infrastructure and animal movement data; however, performance results were limited by low participation levels.

In total, 426 projects were completed with $9.9 million paid to recipientsFootnote 14. A large number of these recipients had little to no traceability capabilities prior to applying to LATI. These sites are now able to electronically capture, record, and report animal movement information related to traceability to meet current market demands, and are prepared for mandatory traceability regulations when they are fully implemented.

Two surveys of recipients, one conducted as part of the evaluation, found that 99% of recipients indicated that the Initiative had helped their facility enhance its traceability capabilities and 98% indicated that LATI helped their facility adjust to future traceability requirements. Exit survey results were collected as part of the program recipients' final expense claims. The survey results confirmed that LATI increased the livestock sector's ability to collect and transmit traceability information to the Canadian Cattle Identification Agency and Agri-Traçabilité Quebec.

LATI was intended to reach 900 to 1,000 sites, such as auction marts, assembly yards and feed lots, but less than half that number participated in the Initiative. Low participation, especially by auction marts, limited the Initiative's results. Some key informants indicated that the requirement for applicants to cover at least 20% of the project costs was a barrier for potential participants. Others suggested this Initiative may have been premature, as industry did not need to alter their animal handling structures before federal regulations would come into effect.

Ontario: Traceability Foundations Initiative

The Traceability Foundations Initiative in Ontario appears to have contributed to the AgriFlexibility outcome of encouraging value chain innovation and sectoral adaptation. This Initiative provided up to 75% cost-shared provincial funding to recipients for projects to implement or enhance traceability within a sector or value chain. The Initiative exceeded its target by nearly a third, funding 35 sector and value chain projectsFootnote 15. Projects under this Initiative contributed to improved product traceability. Mock traceability exercises were conducted in 18 value chain and 15 sector projects that demonstrated the industry was able to trace, identify and contain 100% of their products within 24 to 48 hours. Participants also reported that projects increased their competitiveness as they were able to obtain new food safety certifications that allowed them to access new markets, acquire new customers and develop new partnerships. Project participants from the 35 projects also reported job creation and retention results due to their participation in the Traceability Foundations InitiativeFootnote 16.

Ontario worked with industry to promote the results of the Traceability Foundations Initiative and encouraged other businesses and agricultural sectors to participate. For example, Ontario developed brochures to showcase the results of this Initiative and encouraged past participants to presents the results of their projects at conventions and conferences.

3.2.1.2 Effectiveness of trade and market development programs

The evaluation assessed the extent to which AgriFlexibility enabled industry to respond to market threats and/or emerging opportunities. By providing tools, technology and information necessary to industry, AgriFlexibility made significant contributions to addressing market access issues and trade barriers. Two Federal-only initiatives, five Industry-led initiatives and five FPT cost-shared initiatives fell under this area. Several examples are presented below to highlight some of the results achieved by trade and market development programs:

Building Success in Key Markets: Agriculture and Food Trade Commissioner Service

The evaluation found that the trade commissioner service and related activities under this Initiative contributed to its expected outcomes of improved international collaboration and increased market access. Building Success in Key Markets provided AAFC with the financial resources to more actively pursue exports in key markets and likely contributed to record levels of agricultural exports. As a result of the funding, three additional trade commissioners were added to the Agriculture and Food Trade Commissioner Service. These additional trade commissioners were senior executives placed in three priority markets – China (Beijing), India (New Delhi) and Turkey (Ankara) and were responsible for developing, maintaining and nurturing networks and relationship with key foreign decision-makers and decision-influencers in emerging markets. Funding also enabled staff to make more frequent visits to foreign countries (for example, three to four times per year versus once per year) and increase engagement to resolve trade issues.

While it was difficult to directly attribute changes in trade statistics to the activities undertaken through this Initiative, it appears that those activities made some positive contributions. For example, the Agriculture and Food Trade Commissioner Service (China) reported the following resultsFootnote 17:

- Canada has gained market access for beef in China and for pork in Russia, markets to which the US did not have access (as of June 2014);

- Canada has expanded access to Japan for beef and has parity with the US for access to Taiwan;

- AgriFlexibility funding was used to pay for incoming missions for other countries to audit Canadian programs, which helped expand access to beef export markets in Japan and Korea;

- Participation at the China Fisheries and Seafood Expo and Canadian Food Fair, which was supported by this Initiative, resulted in reported sales in excess of $37 million;

- China, where additional trade commission support was funded under the Initiative, is now the top export market for Canadian ice-wine; and,

- Despite China's partial restriction on canola seed exports since November 2009, efforts to keep the market open through intervention, negotiation and advocacy were essential to maintaining canola seed exports to China valued at $2.3 billion (2014).

Overall benefits of trade and market development activities to Canada included improved relationships with trade partners and increased export opportunities. The push towards improving relationships and opening and expanding markets in China, India and Turkey was a focus of AAFC market and trade activities. Based on key informant discussions, it was not possible to isolate the incremental activities conducted using AgriFlexibility funding, especially with the activities funded as part of the Agriculture and Food Trade Commissioner Service. The additional three full-time equivalents were used to work on trade issues that were already being addressed and new issues as they arose (such as, the funding was not used to address a new set of issues and priorities). These federal government full-time equivalents were used to facilitate increased coordination and collaboration among the existing full-time equivalents in China, India and Turkey whether they were from AAFC, DFATD, or the CFIA and engaged in higher-level liaisons. While AgriFlexibility funding helped to increase awareness of Canada's agriculture and agri-food sector globally, it raised expectations that certain market and trade activities may continue after the end of AgriFlexibility funding.

There were insufficient data to support an analysis of incremental benefits or return on investment arising from the AgriFlexibility funding under the Building Success in Key Markets Initiative.

Alberta: New Markets and New Products Initiative

The New Markets and New Products Initiative was designed to assist Alberta agri-food exporters to identify export opportunities and access custom market intelligence and in-market expertise, and business matchmaking. This Initiative funded 26 projects, including incoming buyers' missions, outgoing trade missions, and tradeshows. As a result of this Initiative, 37 products were modified or manufactured to meet consumer demands in priority markets, and 86 new exporters or products entered into new markets with an estimated value of $70.5 millionFootnote 18.

This Initiative addressed various needs of participating businesses and, when necessary, adapted to the needs of individual companies to help them increase their ability to address their exporting challenges such as modifying products to meet new and/or foreign market demands. Additionally, the ability to create forums or customized business networking events allowed industry to transition into new markets and increase sales, leading to market diversification.

Canola Council of Canada: Canola Market Access Plan

The Canola Market Access Plan Initiative, led by the Canola Council of Canada (CCC), developed a joint industry and government plan, the Rapid Response and Market Access Plan which helped the canola industry to address country-specific market access issues, contributed to significant increases in the volume of canola exports, and increased the capacity and knowledge to maintain and improve the industry's market access.

The Initiative facilitated relationships with international stakeholders which enabled dialogue to address specific market access issues leading to a long-term global strategy for canola market access. Case study and interviews indicate that the project contributed to maintaining or expanding the multi-billion dollar canola market, including restoration of the Chinese market after concerns about canola seed testing positive for blackleg fungusFootnote 19 led to an emergency quarantine order in 2009–2010.

According to CCC's final performance reports, the Initiative far exceeded its targets by 169% for canola seed and oil exports in 2012 and 2013 in major markets of China, US, Japan and Mexico. The Initiative, however, fell short of its target for canola seed and oil exports to the European Union by 39%.

While there was limited evidence to demonstrate the direct contribution of this $6.8 million Initiative, the economic impact across the Canadian canola industry (including value chain) increased from $8 billion in 2008-09 to an average of $19.3 billion in 2011-2012Footnote 20, gaining market access played an important role in this growth.

Canada's overall investments in trade and market activities have benefited numerous commodity exports. The Agriculture and Food Trade Commissioner Service (China) reported that the total agri-food and seafood exports to China was $5.3 billion in 2014, almost double the 2009 export salesFootnote 21. Among the other trade benefits with China reported for 2014 were: rapeseed/colza seeds exports at $2.7 billion (56% increase from 2009), animal/vegetable fats and oils exports at $500 million (80% increase from 2009), seafood exports at $496 million (43% increase from 2009), and grains and cereal exports at $408 million (58% increase from 2009)Footnote 22. The return on investment of the increased coordination and collaboration by AAFC's involvement in China trade promotion activities for 2012-2013 contributed to increased sales of value-added exports, which made up less than 1% of export value to China. The value-added exports in 2014 were dominated by beverages ($20 million), tobacco products ($32 million) and prepared vegetables, fruit and nuts ($30 million)Footnote 23.

3.2.1.3 Effectiveness of science, innovation and adoption programs

The evaluation assessed contributions made to accelerating the pace of innovation and maintaining/increasing value chain innovation and adaptation. The agri-based processing sector made substantial progress towards reducing the cost of production and increasing sales revenues, highlighting the impacts of a strategically, well-planned program contributing to positive results for participants. Two Federal-only initiatives and five FPT cost-shared initiatives were funded under this area. Two initiative examples are discussed below.

Agri-based Processing Initiative

The Agri-based Processing Initiative (API) helped businesses physically transform their operations through the purchase and installation of new-to-company equipment. More than $34 million in funding was distributed over the five years of the APIFootnote 24. More than 53 companies participated in the API, although about one-fifth of the projects were relatively small (less than $100,000 in funding) in repayment contributions. The evaluation found the API largely met its expected outcomes even though some companies withdrew. The API encouraged processing companies to establish operations in Canada, and allowed companies to increase sales and market share, access new markets (for example, by helping them meet export standards, develop new types of packaging, extend product shelf-life) and reduce the cost of production. Of the 53 contracted API projects, 45 had started repayments in 2013-2014 and eight projects were due to start in 2014-2015Footnote 25

The evaluation assessed the return on investment for 35 projects funded through the API based on information available in their performance reports, specifically their total sales. The evaluation examined total sales (both domestic and export) the year prior to the API funding, and compared it to the reporting year. It then calculated the difference of sales before and after, as seen in Table 5.

As per Table 5 below, the companies involved in those projects saw a 50% increase in product sales as of March 31, 2014. Based on the funding provided to the examined companies, $22.2 million of AgriFlexibility generated $29.62 in sales for every $1 funded.

| Total Sales ($) | Agri-based Processing Initiative Funding to Sales Ratio | ||

|---|---|---|---|

| Yearly sales prior to Agri-based Processing Initiative funding* | Sales during Agri-based Processing Initiative reporting year | Agri-based Processing Initiative Funding | Sales Ratio |

| $657,274,058 | $1,315,482,011 | $22,222,444 | $1:$29.62 |

|

*Sales reported by 35 companies one year prior to getting API funding. ** Agri-based Processing Initiative documentation and data, March 31, 2014. |

|||

Aside from increased economic activity, the API funding helped create 527 new full-time jobs and 63 part-time jobs between 2009 to 2014 based on 35 of 50 projects, as shown in Table 6 below.

| Description | Number of Jobs |

|---|---|

| Full-Time Jobs | 527 |

| Part-Time Jobs | 61 |

| Total Jobs | 588 |

| ** Agri-based Processing Initiative documentation and data, March 31, 2014. | |

A project review of a meat manufacturing and packaging company in Ontario provided an example of how this Initiative assisted one company.

The meat processing company purchased and installed new packaging equipment for its processed meat products. The company received an interest-free repayable contribution under this Initiative. The new equipment was expected to increase productivity and efficiency as well as enhance food safety and product shelf-life. The company reported the equipment increased production speed by a third, improved the shelf-life of its processed meat products which allowed the company to reach new retailers, allowed for the introduction of new product lines and, most importantly, led to a near doubling of annual domestic sales from $4 million at project outset to $7.7 million in 2013.

Broader benefits from the project included reduced packaging which cut the company's cardboard consumption by 81 metric tonnes in 2012. It also nearly doubled the company's demand for meat inputs from producers and created 10 new full-time jobs.

While it was difficult to attribute, with any certainty, some or all of this change to AgriFlexibility funding, theAPI had the most beneficial impact under science, innovation and adoption programs. Evidence from case studies and interviews showed the API helped some companies improve their competitiveness by modernizing processing facilities to increase productivity and sales and others simply to remain in business. Key informants and program documentation noted other benefits such as increased export sales to US and other markets, reduced transportation cost by buying regionally, increased demand for Canadian primary agricultural commodities (such as, ingredients for production) and improved environmental sustainability.

Innovation from Research Initiative

The Innovation from Research Initiative (IRI) was created to help foster new innovations in the sector, such as new processes, tools and practices and bring applied research closer to commercialization. Using a peer-review process with program management oversight to ensure alignment with AAFC's priorities, a total of 39 research projects were selected during the first year of this Initiative.

The evaluation found that IRI was driven by a need to fill gaps in innovation and to support new scientists hired by AAFC. IRI has contributed to the development of 110 innovations, falling short of meeting its performance target of 133 innovations. IRI helped develop networks with other scientists that will allow much of IRI's research to continue under various AAFC programming with the intent that the results of applied research are provided to farmers and processors as quickly as possible to ensure that they remain competitive.

Saskatchewan: Commercialization of Rapid Wheat DNA Testing

Through this project, a team of experienced technologists, senior scientists, and project leaders with expertise in crop genetics and molecular biology worked together to launch new commercial tests for several wheat varieties and developed more efficient processes for testing of wheat midges. According to documentation, the project led to the commercial sale of three newly-registered midge resistant wheat varieties. This technology was expected to help offset the $40 million annual cost of midge damage to wheat without the application of chemicalsFootnote 26.

3.2.1.4 Effectiveness of agri-business development programs

Agri-business development programs were aimed at helping businesses become more profitable through activities that helped to increase awareness and encourage the use of beneficial business management practices. Many proactive initiatives were undertaken to help agri-businesses address emerging opportunities and regulations and gain operational efficiencies. Three Industry-led initiatives and 10 FPT cost-shared initiatives fell under this area. A few program examples are discussed in further detail below.

National: Meat Hygiene Pilot Program

This Program was undertaken in partnership with CFIA and provinces and intended to help provincially-inspected abattoirs upgrade their facilities to meet federal Meat Inspection Regulations, 1990. CFIA worked with provincial counterparts to map out challenges preventing small meat businesses from moving from provincial to federal registration, and becoming eligible to move product either inter-provincially or to sell to major retailers who have federal meat registration as a pre-condition for sale.

The Pilot Program started in 2011 with the CFIA conducting a gap analysis with 13 participating facilities. The analysis identified facility, structural, equipment, and quality assurance infrastructure areas where changes to satisfy then current federal meat requirements were needed. This provided CFIA with the necessary information to reflect and redesign a number of federal meat inspection requirements in a more flexible way that would achieve food safety outcomes without having to fully upgrade their facilities to meet federal registration requirements. The Program provided supporting evidence to allow amendments to the Meat Hygiene Manual of Procedures in 2012, and numerous amendments to the Meat Inspection Regulations, 1990 that were approved in April 2012, April 2013 and June 2014.Footnote 27

Of the 13 facilities that initially participated in the program in 2011–2012, 11 remained at the end of the ProgramFootnote 28. One of the facilities went out of business and a second withdrew due to the high cost of required upgrades. At the time of the evaluation, most of the 11 facilities remaining in the Program had yet to complete the process of attaining federal registration, although some were considered close to this goal. As of November 2014, there were two facilities that had requested registration and were being reviewed by CFIA to become compliant with federal registration regulations. A number of factors led to delays in federal registration by CFIA including: waiting for amendments to the Meat Inspection Regulations, 1990 to be approved, the availability of funding, structural and physical limitations to the facilities being upgraded, and the amount of time needed to schedule and complete the work, especially in western Canada, due to labour issues and the shortage of tradespeople. In addition, some businesses looked at the work involved and decided to plan more long-term, taking into consideration how these changes would improve their business, not just how they would meet the federal requirements.

Although the participating meat processing facilities have not yet attained federal registration, the evaluation found that those facilities involved in the program have a better understanding of the upgrades that are required. A case study conducted as part of the evaluation showed that the structural and process upgrades completed to one meat processing facility have streamlined the plant's operations, making it more efficient and productive. Further, the information generated by this Program allowed CFIA to better justify changes it made to food safety guidelines, taking into account the challenges faced by businesses in this Pilot Program.

Quebec: Initiative to Support Advisory Services

This Initiative aimed to improve the management capacity of farm businesses and their competitiveness. The evaluation found that the Initiative conducted numerous financial analyses, provided advisory services, and assisted with the development of business and operating plans and produced the following outputs:

- 2,582 financial analysis were conducted and 5,788 advisory services were provided for businesses that were in a precarious financial situation; and,

- Over 2,200 business plans and operating plans were produced over the duration of the Initiative.

Canadian Cattlemen's Association: Facilitating Information Across The Beef Value Chain

This project created and delivered an internet-based database solution, Beef InfoXchange System (BIXS), enabling Canadian beef producers to access and share production information and detailed individual animal carcass data. The platform was designed to help producers determine how to raise an animal so it meets processors' demands for specific product attributes (for example, marbling in beef). Despite considerable consultation and testing of BIXS 1.0, the system was too complex and did not meet the technical expectations of some stakeholders which ultimately hampered uptake.

To enhance sustainability and uptake, BIXS was re-designed and developed to include a revenue model that incorporates technical and visual structure designed to accommodate advertising that was driven and maintained by BIXS staff - the ability to invoice based on metered activities (for example, fees to generate standard reports or export data; fees for random queries, e-mails); billable specialty services (for example, one-off more complex reports) and successfully introduced BIXS 2.0. With the release of BIXS 2.0, many of the challenges were addressed with the expectation that continuous improvements will be sought to meet stakeholder needs.

Pulse Canada: Innovative Solutions to Transportation Challenges in the Canadian Pulse and Special Crops Industry