Abbreviations

- AAFC

- Agriculture and Agri-Food Canada

- BRM

- Business Risk Management

- FPT

- Federal-Provincial/Territorial

Executive summary

Purpose

The Office of Audit and Evaluation of Agriculture and Agri-Food Canada (AAFC) conducted an evaluation of AgriInvest to assess relevance, design, delivery, efficiency and effectiveness.

Scope and methodology

AgriInvest activities from 2016-17 to 2020-21 were evaluated using multiple lines of evidence: a review of program documents, files, and literature; interviews with internal and external stakeholders; and analysis of secondary and administrative data. Activities out of scope for this evaluation include other programs within the Business Risk Management (BRM) suite and temporary emergency programs implemented during COVID-19.

Background

AgriInvest is one of four core programs within AAFC’s BRM suite of programs. BRM programs are the tools that provide agricultural producers with protection against income and production losses, helping them manage risks that threaten the viability of their farms. As a government-matched savings program for producers, AgriInvest is intended to mitigate small income declines and manage financial risk (for example, through investing in on-farm innovations). Farmers can withdraw from their accounts at any time and can use these funds for any purpose. From 2016-2017 to 2020-21, program costs were approximately $1.5 billion, with $887 million in federal expenditures.

Findings

- AgriInvest provides funds to protect against minor income disruptions, for some but not all producer groups.

- AgriInvest plays a unique role in the BRM suite as it is the only program designed to address minor income declines.

- The Program is efficiently run; however, demand is frequently underestimated.

- Smaller operations (less than $100,000 in annual net sales) were found to have a higher income variability and greater need for BRM programs. However, these and other underrepresented groups (women, Indigenous Peoples and persons with disabilities who are under-represented in agriculture) are underrepresented in the Program and face challenges contributing to their AgriInvest accounts.

- The vast majority of producers participating in AgriInvest make contributions, and make the maximum eligible contribution.

- Balances in AgriInvest accounts varied widely among producers based on size of operation. Smaller operations tended to have larger balances, relative to their annual net sales, suggesting the ability to cover short-term losses, however this group was less likely to make withdrawals.

- There is no tracking of how AgriInvest funds are used, so the extent to which the Program helps producers mitigate small income declines cannot be fully assessed.

Conclusion

AgriInvest provides easily accessible coverage of small income declines and makes on-farm investments to limit risk. However, the Program does not fully meet the needs of all producers, notably for smaller operations. Given the absence of the Program’s tracking on use of funds, there is no mechanism to attribute the Program’s contribution to its intended intermediate and ultimate outcomes, resulting in AgriInvest possibly not always being used as intended, as a first line of defense against small income declines. More needs to be done to include underrepresented groups in the Program.

Recommendations

- Recommendation 1: The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Strategic Policy Branch, should assess whether the AgriInvest program is still relevant and meeting its intended outcomes.

- Recommendation 2: The Assistant Deputy Minister, Programs Branch, should improve data collection on the use of AgriInvest funds towards achieving Program outcomes.

- Recommendation 3: The Assistant Deputy Minister, Programs Branch, should, in consultation with provinces and territories, discuss how to address barriers to participation in AgriInvest.

Management Response and Action Plan

Management agrees with the evaluation recommendations and has outlined an action plan to address them by December 31, 2025.

1.0 Introduction

The Office of Audit and Evaluation conducted an evaluation of AgriInvest as part of the 2021-22 to 2025-26 Integrated Audit and Evaluation Plan. Findings from this evaluation are intended to inform current and future program and policy decisions and the department’s next departmental policy framework.

2.0 Scope and methodology

This evaluation assessed the relevance, design, delivery, efficiency and effectiveness of AgriInvest activities from 2016-17 to 2020-21. Activities out of scope for this evaluation include other programs within the Business Risk Management (BRM) suite and temporary emergency programs implemented during COVID-19.

The evaluation used multiple lines of evidence including: a review of program documents, files and literature; interviews with AAFC officials, provincial government officials, federal–provincial–territorial (FPT) committee members, producer associations and financial institutions; and an analysis of secondary and program administrative data. For the detailed evaluation methodology, see annex A.

AgriInvest activities were previously evaluated through the Evaluation of AgriInvest, AgriStability, AgriInsurance and the Wildlife Compensation Program (2016-17) and the Evaluation of Income Stability Tools – AgriStability and AgriInvest (2011-12).

3.0 Program profile

3.1 Overview of AgriInvest and the Business Risk Management suite

AgriInvest is one of four core programs within AAFC’s BRM suite of programs. Under the current agricultural policy framework, the Canadian Agricultural Partnership (2018-23), the BRM suite is intended to help farmers protect their income and manage risks beyond their control (for example, drought, flooding, market declines and increased input costs). Canadian farmers can participate in one or more BRM programs to help them adapt to changing markets, stabilize income over the long-term, mitigate financial losses, and adopt technological innovations.

AgriInvest is a government-matched savings program for producers intended to mitigate small income declines, and to make investments to manage risk and improve market income (for example, through investing in on-farm innovations). The government will match 1% of a producer’s allowable net sales (that is, total sales of commodities minus total cost of commodities purchased) deposited into an AgriInvest account, to a maximum of $10,000 (or 1% of $1 million in allowable net sales) annually. Farmers can withdraw from their accounts at any time and can use withdrawn funds as they see fit.

3.2 Governance

AgriInvest governance is shared between the BRM Programs Directorate, which manages the federal government’s role in the administration of the program, and the Farm Income Programs Directorate, which delivers AgriInvest in all provinces except Quebec. Costs to administer the program are cost-shared between federal (60%) and provincial (40%) governments. The BRM Programs Directorate undertakes program analysis, program development and performance reporting, as well as liaison activities with provinces and industry associations, including the FPT BRM Policy Working Group. In addition to delivering AgriInvest, the Farm Income Programs Directorate operates a Contact Centre which handles AgriInvest inquiries, plays a leadership role on BRM-related working groups and provides comptrollership support for the BRM suite of programs. The Farm Income Programs Directorate Management Accountability and Control Framework, a compilation of documents with controls to mitigate the risks to meeting BRM objectives and priorities, informs the Farm Income Programs Directorate.

Several committees and working groups support the design and delivery of BRM programming:

- The National Program Advisory Committee (established as outlined in Section 5(3) of the Farm Income Protection Act) is comprised of producer representation from across Canada, federal officials and provincial/territorial officials. The Committee’s responsibility is to regularly review AgriInvest and AgriStability and provide advice on program administration;

- The FPT BRM Policy Working Group is comprised of policy and subject matter experts who represent federal government and each province/territory. This working group evaluates BRM policy and program issues and develops recommendations for resolution for the FPT Policy Associate Deputy Ministers.

- The FPT Administrators Working Group, comprised of provincial and federal employees, develops and maintains program guidelines, evaluates the parameters of AgriInvest and AgriStability, assesses any processing issues, and helps to ensure consistency in national delivery.

3.3 Resources

From 2016-17 to 2020-21, AgriInvest has cost FPTs nearly $1.5 billion, including $887 million in federal expenditures by AAFC. Program administrative costs comprised about 4% of program spending and program payments over 96% (see Table 1). AAFC employed an average of 126 full-time equivalents each year to deliver AgriInvest.

| 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | Total | |

|---|---|---|---|---|---|---|

| Administrative | 11,305,072 | 13,152,628 | 11,275,868 | 11,338,982 | 12,674,588 | 59,747,138 |

| AAFC | 9,358,081 | 11,450,321 | 9,559,212 | 9,516,573 | 10,544,680 | 50,428,867 |

| Provincial | 1,946,991 | 1,702,307 | 1,716,656 | 1,822,409 | 2,129,908 | 9,318,271 |

| Grants and contribution | 295,442,046 | 279,357,816 | 291,890,715 | 262,802,770 | 259,052,181 | 1,388,545,529 |

| AAFC | 177,265,228 | 167,614,690 | 175,134,429 | 157,681,662 | 155,431,309 | 833,127,318 |

| Provincial | 118,176,819 | 111,743,127 | 116,756,286 | 105,121,108 | 103,620,872 | 555,418,212 |

| Capital (AAFC Only) | 586,316 | 660,424 | 1,090,082 | 688,929 | 613,620 | 3,639,371 |

| Total Cost | 307,333,434 | 293,170,868 | 304,256,665 | 274,830,681 | 272,340,389 | 1,451,932,038 |

| Total AAFC | 187,209,625 | 179,725,435 | 185,783,723 | 167,887,164 | 166,589,609 | 887,195,556 |

| Total Provincial | 120,123,809 | 113,445,434 | 118,472,942 | 106,943,517 | 105,750,780 | 564,736,482 |

| Full-time equivalents (AAFC) | 132 | 130 | 127 | 125 | 117 | n/a |

|

Note: Federal expenditures, and full-time equivalents, exclude those associated with internal services. Administrative costs include salary and non-pay operating. Source: Corporate Management Branch reports (April 5) and Program financial data |

||||||

3.4 Intended outcomes

The following immediate, intermediate and ultimate outcomes were examined as part of this evaluation:

- Immediate outcome: Producers set aside funds to cover future losses and/or make investments to mitigate risk

- Intermediate outcome: Account balances help producers manage risk and make on-farm investments in a timely fashion

- Ultimate outcome for the suite of BRM programs:

- The agricultural sector is financially resilient

- Producers see value in the BRM suite in managing their business risks

- Cost effective programming

- Industry is able to better manage business risks and remain viable in the long-term

For the full AgriInvest logic model, see ANNEX B.

4.0 Relevance

This section summarizes evaluation findings on the relevance of AgriInvest; specifically, whether there is a continued need for the Program, the extent to which AgriInvest meets that need, and program alignment with departmental and government roles, responsibilities and priorities.

4.1 Continued need for AgriInvest

AgriInvest was designed to provide quick access to funds to protect against minor income disruptions; it was found to be better suited for medium-sized producers and less so for smaller operations that are considered most at risk.

The agriculture and agri-food industry is regularly exposed to a multitude of risks that can be difficult to predict and manage (for example, extreme weather, pests, and disease, trade disputes, global crises, and labour shortages). These risks can impact the sector’s production and/or demand and can have devastating impacts for agriculture and agri-food producers, including cash flow problems and bankruptcy. As a result, Federal Government risk management strategies have been put in place to support the sector in mitigating these risks; protect the livelihood of Canadian agriculture and agri-food producers; and enable producers to stay competitive in the international marketplace.

AgriInvest is one mechanism of the Federal Government’s BRM programs to protect against risk. AgriInvest is intended to provide producers with government-sponsored savings to ‘self-insure’ against risk. Self-insuring mitigates risk of an adverse event by reducing or relieving the impact of an event. AgriInvest is designed to manage the first layer of risk, which “refers to losses that are part of the normal business environment for an individual farmer. The risks occur frequently but result in relatively limited losses.”Footnote 1

The evaluation found that AgriInvest helps manage the first layer of risk for producers because AgriInvest account balances are quickly accessed to cover minor losses, providing a first-line of financial defense against risk. Additionally, AgriInvest enables producers to save up to 400% of their annual net sales in their accounts incentivising producer long-term savings while providing a potential source of funds for risk management purposes. The program is well received by farmers and has high participation rates. However, AgriInvest is best designed to meet the needs of medium-sized producers; program caps make the program less effective for producers with Allowable Net Sales over $1 million, the AgriInvest minimum payment make the program less useful for the smallest producers, and the value of the program is constrained for sectors who must deduct high feed costs. Despite these limitations, in 2018 an external panel of experts of producers, academics and global experts identified AgriInvest as a synergistic component of BRM programming because it is flexible, predictable and bankable, and helps producers mange their specific risks.

4.2 Alignment with AAFC and government priorities, roles and responsibilities

AgriInvest is partly aligned with federal and departmental priorities, as participants may not be using AgriInvest funds for risk management, as intended.

AgriInvest is legislated under section 4(2) of the Farm Income Protection Act. This act provides authority for FPT agreements to protect the income of agricultural producers.

The management of ‘sector risk’ is one of AAFC’s three core responsibilities and is a key part of it’s mandate. BRM programming is aligned with the Department’s Canadian Agricultural Partnership policy framework; specifically the ‘risk management’ priority area for action. As a part of the BRM suite of programs, AgriInvest is intended to help producers manage or mitigate the impact of risk and has provided producers with timely access to money while they wait for other BRM programming (for example, AgriStability, AgriRecovery) to start providing resources. However, AgriInvest may not fully align with the departmental priorities, as there are no controls on how or when funds are being used, and therefore the evaluation cannot confirm the manner in which the Program is being used for risk mitigation activities.

5.0 Program design and delivery

This section summarizes evaluation findings on the design and delivery of AgriInvest, including the Program’s integration with the BRM suite of programs, design and delivery concerns, and recent changes to program design and delivery.

5.1 Integration of AgriInvest with the core BRM suite of programs

AgriInvest is well-integrated in the BRM suite of programs, but not all producers take full advantage of, or benefit to the same degree from, the suite of programs.

The BRM suite is comprised of four programs that work together to help producers manage risks which are largely beyond their control:

- AgriStability: for producers experiencing a large margin decline;

- AgriInvest: cash flow to offset small income declines;

- AgriInsurance: cost-shared insurance against natural hazards that reduces the financial impact of production or asset losses; and

- AgriRecovery: an FPT disaster relief framework to help producers with the extraordinary costs associated with recovery following natural disaster events.

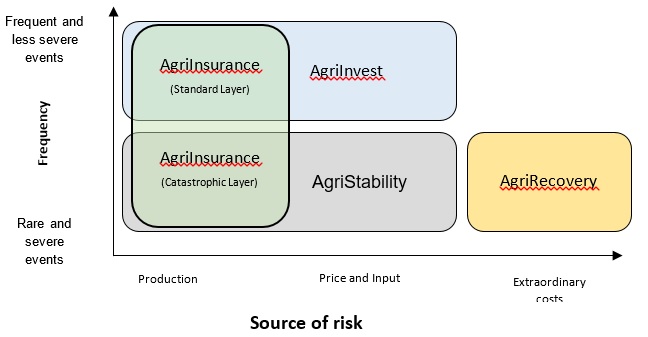

The BRM suite of programs, together, are intended to provide protection against a full range of risks that threatens farm viability. For example, when a producer's crops are damaged by natural calamities, AgriInsurance can cover production losses, while AgriInvest and AgriStability can cover additional costs and lost income (Figure 1).

Figure 1 : Relationship between the BRM programs with frequency of events and source of risk

Description of the above image

Figure 1: Relationship between the BRM programs with frequency of events and source of risk

Frequency of events is depicted on the Y axis, ranging from rare and severe events to frequent and less severe events. The source of risk is depicted along the X axis, indicating: production, price and input, and extraordinary costs. AgriInvest addresses production, and price and input risks, that are frequent and less sever. AgriStability addresses production, and price and input risks, that are rare and sever. AgriInsurance addresses production risks that are frequent and less sever through its standard layer; as well, as rare and sever events through its catastrophic layer. AgriRecovery addresses extraordinary costs for rare and severe events.

Source: Adapted from Antón, J., S. Kimura, & R. Martini’s (2011) OECD risk management in agriculture in Canada and Agriculture and Agri-Food Canada’s (2012) Evaluation of income stability tools – AgriStability and AgriInvest.

BRM programs are intended to provide support in a predictable, timely and comprehensive way. A review of program documents found that no one program is capable of meeting all these criteria. The evaluation found that AgriInvest tends to complement other programs in the BRM suite by protecting against small income declines and providing timely access to savings while producers wait for other BRM programs to activate and provide payments. Alternatively, AgriStability is intended to provide protection against large margin declines resulting from any type of risk (for example, input, market, production), while AgriInsurance and AgriRecovery are intended as coverage following natural hazards or disaster events.

Producers are encouraged (but not required) to take advantage of all BRM programming to ensure their operations are protected against production and income losses. Analysis of 2019 Farm Financial Survey data showed that the vast majority of AgriInvest participants also participated in at least one other BRM program (AgriStability, AgriInsurance, or the Advance Payments Program) (see Table 2).

| Participation in BRM Programs | Percent of AgriInvest Participants (%) |

|---|---|

| AgriInvest only | 8.1 |

| AgriInvest and one other BRM program | 27.8 |

| AgriInvest and two other BRM programs | 39.0 |

| All four BRM programs | 25.1 |

|

Source: 2019 Farm Financial Survey |

|

The evaluation found that producer needs are not uniform across the sector and producers will select different combinations of BRM programming to meet their needs. In addition, users sometimes do not fully understand the synergistic design of the BRM suite and do not use BRM programs in a complementary way which may leave gaps in their protection. Therefore, not all producers take full advantage of, or benefit to the same degree from, the suite of programs.

Apart from AgriInvest and AgriStability which share a common application form and personal identification number, examining the interrelated use of multiple BRM programs is not feasible because each BRM program assigns a unique identification number to its users. Given this limitation, AAFC is considering the use of business numbers in addition to program identification numbers to better track participation and program impact across BRM programming.

5.2 Evolution of AgriInvest

Design and delivery changes during the Canadian Agricultural Partnership framework were intended to make AgriInvest’s delivery more affordable and reduce administrative costs; these changes also made the Program less useful for larger producers and excluded smaller producers (less than $25K in sales) from participating.

The suite of BRM programming has evolved alongside changes to the various AAFC policy frameworks over last twenty years.

According to program documents, AgriInvest operates like its predecessor, the Net Income Stabilization Account program (1991-2002). The Net Income Stabilization Account program involved a producer savings account, which enabled producers to save from 3% to 8% of their annual Eligible Net Sales and receive matching contributions from government. In 2002, the Net Income Stabilization Account program was paused, having its coverage integrated into the Canadian Agricultural Income Stabilization Program (2003-07) until the AgriInvest program emerged in 2007.

5.2.1 Recent changes to AgriInvest

Several significant changes to the design and delivery of AgriInvest were implemented in response to recommendations from past evaluations, to make support more impactful, to lower administrative costs and to ensure more equitable support under other BRM programming. However, these changes also resulted in reduced benefits for certain producer groups.

- The Maximum Allowable Net Sales CAP was reduced from $1.5 million under Growing Forward 2 to $1.0 million under the Canadian Agricultural Partnership

- The Maximum Government Deposit percentage was reduced from one and a half percent of Annual Net Sales under Growing Forward to 1% under Growing Forward 2 and the Canadian Agricultural Partnership

- The Maximum Government Contribution was reduced from $15,000 under Growing Forward 2 to $10,000 under the Canadian Agricultural Partnership

- The Maximum Account Balance was increased from 25% of the participant’s average Allowable Net Sales under Growing Forward to 400% of Allowable Net Sales starting in Growing Forward 2.

- An AgriInvest Minimum Payment was increased from $75 to $250 under the Canadian Agricultural Partnership. This increase meant producers with Allowable Net Sales under $25,000 would not receive a government contribution.

The intent of increasing the AgriInvest miminum payment was to target meaningful support for risk management (rather than payments that are too small to support this goal) and to reduce payments in situations where administrative costs are higher than the value of the support. However, the increase in AgriInvest minimum payment of $250, excluded a large number of smaller producers which is described more in detail in section 6.2 below. Lastly, reduction in the Allowable Net Sales lowered the maximum payment (maximum government contribution) making the program delivery more affordable for federal and provincial partners.

A 2020 review of BRM programming, confirmed by the responses from several interviewees, including five producer associations, stated that AgriInvest has become a less effective part of the BRM suite of programs for larger producers as a result of the changes to the maximum matchable deposit. To remedy this, the Standing Committee on Agriculture and Agri-Food recommended increasing the percentage of Allowable Net Sales, the matching government contributions and the maximum account balance limit to improve AgriInvest’s effectiveness, agility, timeliness and equitability. At the time of writing this report, this recommendation was still under consideration by the Program.

5.3 Program Reach

While AgriInvest is reaching many producers, participation and coverage rates may be over-estimated and its reach is limited for certain producer groups.

The following section summarizes evaluation findings regarding AgriInvest participation and contribution rates by province, sector and farm size (revenue class), as well as the Program’s ability to reach underrepresented groups (for example, women, youth/new farmers, Indigenous Peoples, persons with disabilities).

5.3.1 Participation and coverage rates

The evaluation found AgriInvest reached a significant number of producers, with participation rates increasing from 73% to 78% from 2013-14 to 2017-18. As a result, AgriInvest’s coverage of eligible market revenue increased from 89% to 97% during this timeframe. By the end of 2017-18, participation and coverage exceeded performance targets of 75% and 85%, respectively. However, participation and coverage rates may be over-estimated due to multiple operators from the same farm participating in AgriInvest and each counted as an individual operation. Additionally, an eligible producer may not have made a contribution to their AgriInvest account and not received a government contribution, but are counted as a participant.

Program participation was found to be strongly related to sector and farm size. Farms involved in the Grains and Oilseeds sector saw near full participation in AgriInvest, while Cattle; Hog; and Fruit, Vegetable and Potato sectors saw over three-quarters of the sector participating. However, supply managed operations that also sell eligible commodities, and “other” sector saw significantly lower participation (50% and 29%, respectively). The lower participation rates in these sectors likely related to their supply managed production which is not eligible for matching contributions.

Smaller operations (less than $50,000 in annual revenues) and larger operations (greater than $500,000 in annual revenues) were also found to have lower participation (68%, and 66%, respectively) than mid-sized operations. Smaller operations reported not participating due to having insufficient funds to participate, whereas larger operations reported not participating due to limited perceived benefits (for example, cap on matching federal funds) and the use of other tools or programs to manage risk.

5.3.2 Access for underrepresented groups

Documents as well as interviews with AAFC officials, provincial government officials, FPT committee members, and producer associations highlighted that BRM programming supports underrepresented groups (that is, women, Indigenous Peoples, persons with disabilities and other groups who are under-represented in agriculture). This was said to be accomplished by enabling all farmers, including new farmers who have not reported previous farming income and Indigenous Peoples who may not file income tax returns, to participate in the program, eliminating geographic barriers for accessing the program by using branchless banking and omitting demographic characteristics from program eligibility criteria. However, these groups were found to have lower participation rates in AgriInvest.

A Gender-Based Analysis Plus assessment conducted by the Department for the Canadian Agricultural Partnership policy framework found BRM programming was unlikely to have different impacts for specific demographic groups, nor would it reinforce imbalances based on gender and other characteristics. Documents highlighted the following ways that BRM programming supports underrepresented groups (that is, youth, women, Indigenous Peoples, persons with disabilities and other groups who are under-represented in agriculture):

- enabling all farmers to participate through the use of income tax data; processes are in place to accommodate new farmers (who may not have reported previous farming income) and Indigenous Peoples (who may not file income tax returns);

- omitting demographic characteristics as part of program eligibility criteria; and

- targeting education and awareness activities at women and young farmers.

However, since the Gender-Based Analysis Plus assessment was conducted, documents reviewed indicated more can be done. For example, there is a need for BRM programming to be more accessible to young farmers, women, Indigenous Peoples and persons with disabilities by addressing challenges that can hinder participation of these underrepresented groups. For example:

- For women, the lack of daycare and family-friendly spaces can make attending engagement sessions difficult.

- For young and early career producers, debt/asset ratios and stability of production can impact debt risk, and limit access to capital.

- For Indigenous producers, lack of land ownership can impact access to capital. Distrust of federal government and language barriers may deter applications, and lack of reliable internet services and remote locations may limit access to markets.

An Indigenous producer organization explained that Indigenous producers on reserve face barriers to securing bank loans and are often forced to finance through development corporations, who charge far higher interest than normal bank loans. There is also a perceived gap in communication from AAFC and provincial agricultural bodies on how Indigenous producers can apply for AgriInvest without having filed income tax.

A 2020 Standing Committee on Agriculture and Agri-food heard from witnesses that BRM programming is not equitable, as the suite provides better support for larger farming operations when compared to smaller ones. The report highlighted specific challenges for new and young farmers accessing AgriInvest, and suggested a different allowable net sales percentage or providing a federal contribution without producer contribution to better meet the needs of this population. At the time of writing this report, these suggestions were still under consideration by the Program.

Female operators are under-represented in agriculture, with less than 30% of farm with female operators.Footnote 2 Female-operated farms tend to be smaller than male-operated farms. Although AgriInvest does not collect demographic information about its participants, the 2017 Farm Financial survey, the most recent gender analysis data, found that operations participating in AgriInvest were less likely to have a female operator (oldest or youngest) than operations that did not participate in AgriInvest. Additionally, operations participating in AgriInvest were less likely to be run by operators under the age of 40.

The 2019-20 Departmental Results Report noted that work to enhance access for underrepresented populations is ongoing, including examining participation rates of diverse groups and identifying barriers to access. However, it is difficult to assess how well AgriInvest supports different priority population groups because demographic data is not routinely captured. According to program documents, AAFC’s Service Delivery Advisory Centre has strongly encouraged the inclusion of Gender-Based Analysis Plus questions in data collection tools for BRM programming to better understand reach and barriers to access for underrepresented groups. It was noted that communications and capacity building activities for women, agricultural college students and Indigenous groups/elders could be tailored to improve participation rates.

6.0 Performance

This section provides an overview of the performance of AgriInvest, including its efficiency and achievement of expected outcomes. The evaluation used both Performance Information Profile and program level targets to assess program performance.

6.1 Efficiency

AgriInvest is efficient to run due to the centralized and automated nature of its administration. However, the Program frequently underestimates demand and runs over budget.

The efficiency of AgriInvest was measured by the Program’s ability to remain within budget and meet financial performance metrics, as well as program performance with respect to the administrative costs.

6.1.1 Planned budget vs. actual spending

AgriInvest is a demand-driven program, which means changes in market conditions affect program participation rates as well as the size of eligible contributions. Demand for the Program is expected to fluctuate from year to year, making it difficult to precisely budget program expenditures. However, AAFC works with provinces and territories to forecast BRM expenditures for upcoming years, taking into account market conditions and their expected financial impact on the program. These forecasts also help with performance monitoring and the development of policies and programs.

AgriInvest’s demand-driven nature has resulted in the program’s actual spending to be above budget during the evaluation period (see annex C). The primary driver of over-spending in AgriInvest is the under-estimation of program payments due to high participation rates and favourable market conditions; however, program administrative costs (salary and non-pay operating) have been under budget during the evaluation period.

6.1.2 Efficiency of administration

AgriInvest was found to be one of the least expensive BRM programs to administer per participant, at $90 in salary and non-pay operating expenditure per participant enrolled.Footnote 3 AgriStability had an average cost of $1,239 per participant and AgriInsurance cost approximately $1,430 per farm. Factors affecting the lower cost of AgriInvest include the Program’s simplicity, including a simple application process and no monitoring of how program funds are used (therefore resulting in less need for human resources and information technology for administration purposes). Additionally, interviewees across stakeholder groups attributed the Programs efficiency to its centralized and automated nature.

Program administrative efficiency is also measured by comparing the changes in administrative costs to that of inflation (consumer price index). From 2013 to 2017, program administrative costs decreased by nearly 19%, whereas the consumer price index increased by over 5%. As such, program cost increases have been far below that of inflation and are meeting program targets. The evaluation compared the changes in cost per participant to the changes in inflation to place context around the Programs efficiency in processing AgriInvest applications. Between 2016 and 2020 the cost per participant increased by over 4%, which is lower than that the 6% rate of inflation over this period, thus indicating that the program continues to be run efficiently. Additional efficiencies could be obtained through a move to more online services and less paper-based communication.

Relative to other BRM programs, AgriInvest was found to have the lowest administrative cost with respect to total program costs (those incurred by provincial administrators and AAFC). The administrative cost of AgriInvest was 4% of total program expenditures, compared to 16% for AgriStability (2016-21), 13% for Advance Payments Program (2014-18) and 7% for AgriInsurance (2010-15).

6.1.3 Service standards and program administration

AgriInvest’s simplicity enables the Program to quickly process applications. The average time for processing an AgriInvest application was 11 days, with over 60% of applications processed in under 4 days. AgriInvest exceeded the 80% program target for processing time, with over 96% of applications completed within 45 days from 2013-14 to 2017-18. Applications for operations with an annual revenue greater than $1,000,000 took longer to process at an average of 13 days, and were more likely to take more than 45 days to process.

A review of calls to the AAFC’s Contact Centre, which answers inquires for several programs, showed that 65% of calls received related to AgriInvest. On average, staff met or exceeded the 90% program target for percentage of calls answered within 60 seconds in 2016, 2017, 2018, and 2020. The Contact Centre fell below the target in 2019 (86%) and 2021 (89%). AgriInvest was also found to be timely in it’s processing of applications. Between 2013 and 2017, 60% of application forms were processed within four days, with 90% of applications processed within four weeks. Program performance has exceeded its program targets, expecting 80% of applications to be processed within 45 calendar days of receipt.

6.2 Immediate Outcome: Producers set aside funds to cover future losses and/or make investments to mitigate risk

The vast majority of producers participating in AgriInvest contributed the maximum eligible amount to their AgriInvest accounts. However, Program performance metrics do not provide insight into how producers set aside funds to cover future losses.

AgriInvest is intended to function as a government augmented savings account which enables producers to set aside funds to cover future losses and/or make investments to mitigate risks. From 2013 to 2017, 158,722 producers participated in AgriInvest, making over 512,000 deposits worth nearly $1.4 billion, and receiving nearly $1.4 billion in matched funds from the government. The vast majority of deposits into AgriInvest accounts were small; over one-quarter of participants made contributions under $500 and over four-fifths made contributions under $5,000.

The minimum payment for AgriInvest was increased under the Canadian Agricultural Partnership (2018-23) from $75 to $250. The change excluded those producers with less than $25,000 in annual net sales from participating in AgriInvest; which represented 15% of participants between 2013-14 and 2017-18. This change was intended to lower the administrative cost of the Program; however, it appears to have had a mild effect. The number of government contributions to AgriInvest accounts between 2016-17 (Growing Forward 2), and 2018-19 and 2019-20 (Canadian Agricultural Partnership) decreased by 15% and 20%, respectively; however, program administrative costs remained relatively the same. This suggests the increase to the minimal payment did not have the desired effect on program administrative savings. Small contributions (less than $250) may be unlikely to have a meaningful impact on producers risk management; however, over time, the cumulative deposits may have a meaningful impact on managing small income declines.

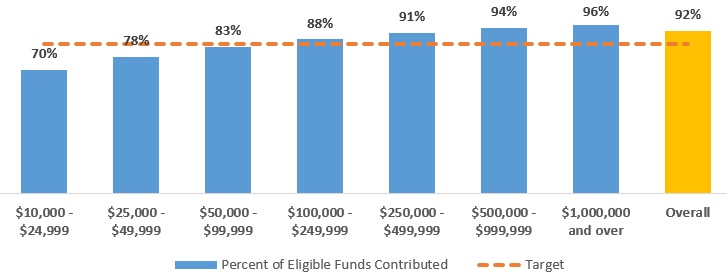

From 2013-17, AgriInvest met its performance target of having at least 85% of eligible contributions being made. However, when examining contributions by revenue size, smaller operations (less than $100,000 in annual revenues) were less likely to meet this target (see Figure 2). The difference in actual contributions and eligible contributions is the direct result of participants not making any contribution, as nearly all participants that contributed to their AgriInvest account contributed the full amount (99.9%).

Figure 2 : Percentage of eligible contributions made to AgriInvest accounts by revenue class overall 2013 to 2017

Description of the above image

| Revenue class ($) | % |

|---|---|

| 10,000 to 24,999 | 70.0 |

| 25,000 to 49,999 | 77.7 |

| 50,000 to 99,999 | 83.0 |

| 100,000 to 249,999 | 87.5 |

| 250,000 to 499,999 | 91.4 |

| 500,000 to 999,999 | 93.9 |

| 1,000,000 and over | 95.6 |

| Overall | 92.3 |

Source: Program administrative data

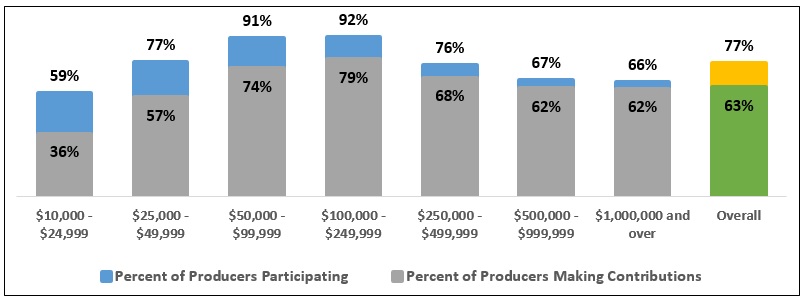

Program performance metrics do not provide insight into how producers set aside funds to cover future losses. Additionally, percentage of contributions being made only examines the percent of eligible dollars contributed to AgriInvest accounts and is heavily influenced by large operations making large contributions. As a result, a contribution rate metric was developed by the Office of Audit and Evaluation to examine whether or not a participant made a contribution to their AgriInvest account. The ability of a producer to make a contribution to their AgriInvest account was closely tied to size, with larger operations more likely to make a contribution than smaller operations. Per the 2019 Farm Financial Survey, smaller operations (less than $250,000 in annual revenue) more frequently reported an inability to meet matching requirements due to a limited cash surplus for investing/saving compared to larger operations (22% versus 15%).

Figure 3 : Participation and contribution rate by revenue class (overall 2013 to 2017)

Description of the above image

| Revenue class ($) | Producers making contributions (%) | Producers participating (%) |

|---|---|---|

| 10,000 to 24,999 | 36 | 59 |

| 25,000 to 49,999 | 57 | 77 |

| 50,000 to 99,999 | 74 | 91 |

| 100,000 to 249,999 | 79 | 92 |

| 250,000 to 499,999 | 68 | 76 |

| 500,000 to 999,999 | 62 | 67 |

| 1,000,000 and over | 62 | 66 |

| Overall | 63 | 77 |

Source: Program administrative data

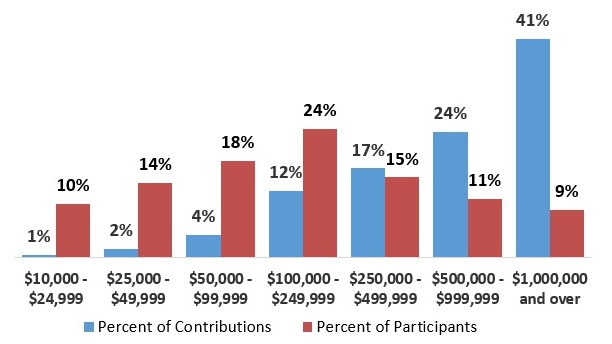

The majority of program payments were found to be made to larger operations with over 81% of program payments provided to operations with an annual revenue greater than $250,000 (see Figure 4). However, over 66% of program participants were smaller operations with an annual revenue less than $250,000. Smaller operations (less than $250,000 in annual revenue) were found to have a higher income variability than larger producers, indicating that they would be more likely to benefit from having funds set aside through AgriInvest.Footnote 4 Per the 2019 Farm Financial Survey, larger operations (greater than or equal to $250,000 in annual revenue) were also more likely to report a lack of need for the program as they use other tools or programs to manage risk (20% versus 13%).

Figure 4: Percent of program participants and government contributions, by revenue class, 2013 to 2017

Description of the above image

| Revenue class ($) | Producers making contributions (%) | Producers participating (%) |

|---|---|---|

| 10,000 to 24,999 | 1 | 10 |

| 25,000 to 49,999 | 2 | 14 |

| 50,000 to 99,999 | 4 | 18 |

| 100,000 to 249,999 | 12 | 24 |

| 250,000 to 499,999 | 17 | 15 |

| 500,000 to 999,999 | 24 | 11 |

| 1,000,000 and over | 41 | 9 |

Source: Program administrative data (2013-2017)

6.3 Intermediate Outcome: Account balances help producers manage risk and make on-farm investments in a timely fashion

Only 44% of survey respondents indicated that they withdrew funds to address a revenue decline or make an on-farm investment. A lack of tracking on fund usage prevents attributing the Program to helping producers manage risk or make on-farm investments.

AgriInvest has been somewhat effective in helping smaller farming operations manage risk from small income declines and to make on-farm investments, with sufficient account balances established within two-to-six years. Smaller operations use their accounts differently, as they were less likely to make deposits and withdrawals and had larger balances relative to their size. In the 2019 Farm Financial Survey, the vast majority of AgriInvest participants (82%) viewed the Program as important in providing effective means of managing business risk and disaster situations. There were challenges identified in that producers had various levels of financial literacy, uneven access to financial advisory services, and there was not always a full understanding of how the Program works.Footnote 5

Interviewees from producer associations were divided as to whether they believe AgriInvest is helping producers manage risk and make on-farm investments, with several noting the scale of funding is too small to have an impact, especially for larger farms. Financial institutions suggested that AgriInvest accounts are often perceived by producers as retirement savings, rather than for risk management. There is difficulty in determining the value and effectiveness of AgriInvest in the absence of tracking how AgriInvest funds were used by producers.

In the 2020 Standing Committee on Agriculture and Agri-Food report AgriInvest was described as a well-used program because it is “eas[y] to use, with strong predictability, bankability, transparency and a low administration burden” for producers. The majority of AgriInvest participants view the program as being timely (77%), responsive (75%) and predictable (80%), which exceeds performance targets (70 percent).Footnote 6

As of November 2021, over 95,000 producers had balances in their AgriInvest accounts totalling $2.6 billion, with an average of $27,000 in each account. This suggests that the average AgriInvest account is capable of addressing a 9% decline of an average participant’s annual net sales. However, the AgriInvest account balances varied widely between different sizes of operations. The highest balances, relative to annual net sales, were found among small (less than $250,000 annual revenue) operations (10%), and the lowest among large (greater than or equal to $250,000 annual revenue) operations (7%). Additionally, the impact of a decline in annual net sales on an operation is dependent upon its margin. Operations, with narrow margins (for example, hog sector) are more likely to be unable to cover expenses with a modest decline in revenues. Smaller operations were found to be less likely to withdraw funds from their AgriInvest accounts than larger operations. While the evaluation cannot confirm, one possible explanation is that their balances may initially not meet their investment needs; and as such, there has been a growth in their balances over the reference period.

The objective of AgriInvest is to have at least 75% of participants use reserved funds to address income declines or to make investments to reduce on-farm risks or increase revenue. The Farm Financial Survey is used to gather information on how the funds are used; however, the survey is not targeted at program participants and can only be used as an indicator of Program use. Only 44% of survey respondents indicated that they withdrew funds to address a revenue decline or make an on-farm investment, while 68% of producers reported they used funds to pay for farm input expenditures. Further, although AgriInvest is intended as a first-line of defense, only 45% of participants made a withdrawal from their AgriInvest account when triggering an AgriStability payment, falling short of the 60% target.

In theory, AgriInvest should be effective in assisting participants to address income declines or make investments to reduce on-farm risks or increase revenues, especially given the high participation rates, the ease and timeliness of withdrawal, flexibility in how funds can be used, and the government matching of savings. However, a 2021 report by the OECD Trade and Agriculture Directorate criticised AgriInvest in that it does not help farmers to mitigate risk because it is not used during periods of shock or income decline. Many interviewees across all stakeholder groups found it difficult to comment on its effectiveness due to a lack of data on how producers use AgriInvest funds. The absence of stipulations on how AgriInvest funds are to be used as a first line of defence, as well absence of tracking of how AgriInvest funds are being used, prevents the assessment and direct attribution of Program funds to manage risk and make on-farm investments.

6.4 Ultimate BRM outcomes

Canada’s agricultural sector shows signs that it is financially resilient and healthy. This cannot be attributed solely to AAFC’s BRM programs.

There are four ultimate outcomes intended to capture the long-term impact of the BRM suite as a whole:

- The agricultural sector is financially resilient;

- Producers see value in the BRM suite in managing their business risks;

- Cost effective programming; and

- Industry is able to better manage business risks and remain viable in the long-term.

AgriInvest is one of multiple factors that contribute to these outcomes. Additionally, these outcomes are influenced by the overall success of the sector, such as productive years and improved market conditions. The following outlines how AgriInvest was found to contribute to these outcomes.

Financial Resiliency

The agriculture sector was found to be showing signs of financial resiliency, having low financial stress and ‘healthy” balance sheets from growing net cash income and net operating income due to improved market conditions. AgriInvest encourages operations to put money aside in savings accounts, and provides an additional stream of revenue through matching government contributions. AgriInvest participants were found to have the same or better revenue growth rates than the broader industry, outperforming it in 2015-16 and 2016-17. However, many provincial representatives and producer associations suggested that AgriInvest is likely not a key driver of financial resiliency, instead crediting higher market prices for commodities and higher net operating incomes as a result. Further, analysis of data from the 2019 Farm Financial Survey found that AgriInvest participation does not impact the borrowing capacity of producers.

Value of BRM Suite

There are mixed views as to the value in the BRM suite. While almost all provincial and Associate Deputy Minister FPT Policy Table representatives agreed that AgriInvest is viewed favorably by producers, producer associations often criticized AgriInvest for not contributing to meaningful change in the industry. There is anecdotal evidence that points to producers using AgriInvest savings for a variety of reasons that may not be related to managing business risks; for example, as retirement savings or non-farm uses.

Cost Effective Programming

As mentioned in 6.1.2, AgriInvest has low administrative costs, with these costs decreasing in recent years, however it has frequently ran over-budget due to under-estimating program payments.

Managing Business Risks

The ability of the agriculture industry to manage business risks and remain viable was primarily attributed to the other factors, and not specifically to AgriInvest. External factors (such as commodity prices) and other methods of risk management (for example, diversifying commodities, adopting technologies, using other BRM programs) likely contributed more to this outcome than AgriInvest.

7.0 Conclusions and recommendations

The evaluation found that AgriInvest provides a timely and flexible program to address small, frequent losses that are a normal part of the business environment. The Program provides producers with control over when program funds will be used and how the funds will be spent. While AgriInvest was meeting most performance targets and immediate outcomes, the evaluation was unable to link AgriInvest as a key driver of ultimate outcomes for the BRM suite, such as financial resilience or improved ability to manage risk. AgriInvest was found to be inexpensive to administer and efficient to run.

The evaluation found several key areas for program improvement. While the Program has met most of its targets, there is a lack of information on how program funds are being used and how the Program contributes to helping producers manage risk or make on-farm investments. This prevents direct attribution of program funding to its intended outcomes and hampers the ability of performance measurement of the program results and its impacts.

AgriInvest was intended to be a first-line of defence against small income declines, however there are no controls on the program requiring this. Given the absence of data of producers drawing down on their AgriInvest account when triggering an AgriStability payment, it is not possible to assess that the Program is being used as intended or that AgriInvest contributes to the ultimate outcomes for the BRM suite, such as financial resiliency or improved ability to manage business risk.

AgriInvest was favorable among producers but did not meet the need of all producers, particularly smaller operations and underrepresented groups. Smaller operations would benefit from AgriInvest due to their larger variability in income and higher likelihood of experiencing a significant decline. However, smaller operations were found to have lower participation and to be less likely to contribute to their AgriInvest accounts. AgriInvest’s participation from underrepresented populations, who are more likely to operate smaller farms, has been limited.

Given the overall findings in the evaluation, and the availability of other programs to manage risk to agricultural producers, the relevance of and need for the AgriInvest program should be assessed.

Recommendations

- Recommendation 1: The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Strategic Policy Branch, should assess whether the AgriInvest program is still relevant and meeting its intended outcomes.

- Recommendation 2: The Assistant Deputy Minister, Programs Branch, should improve data collection on the use of AgriInvest funds towards achieving Program outcomes.

- Recommendation 3: The Assistant Deputy Minister, Programs Branch, should, in consultation with provinces and territories, discuss how to address barriers to participation in AgriInvest.

Management response

Management agrees with the evaluation recommendations and has outlined an action plan to address them by December 31, 2025.

Annex A: Evaluation methodology

Document, file, and literature review

To assess program relevance, design and delivery, efficiency, and effectiveness, the evaluation reviewed internal program documents and files. With support from the Canadian Agriculture Library, the evaluation also examined select literature to support the assessment of relevance.

Key informant interviews

Interviews were conducted with internal and external stakeholders to assess program relevance, design and delivery, efficiency, and effectiveness. The evaluation involved 40 interviews with 43 stakeholders, including AAFC staff (8), national and regional producer associations (17), provincial or territorial officials (11), Assistant Deputy Minister FPT Policy Table representatives (4), and financial institutions/accounting firms (3).

Analysis of secondary and administrative data

The evaluation analysed disaggregated summary data files for program participants between 2013 and 2017. The evaluation supplemented the primary data analysis with data from the Agriculture Taxation Data Program (2013-20), the Farm Financial Survey (2017 and 2019) and the Business Risk Management Survey (2016). Secondary and administrative data was used to assess the program’s relevance, design, delivery, efficiency and effectiveness.

Methodological limitations

The following methodological limitations were considered in interpreting the data:

| Limitation | Mitigation Strategy | Impact on Evaluation |

|---|---|---|

|

Response bias: Key informants who participated in the evaluation may have a vested interest in the continuation of BRM programming. |

Interviews with participants from five different stakeholder groups generated a variety of perspectives. Data was synthesized within and across stakeholder groups, and triangulated with other lines of evidence where possible to eliminate potential bias. |

Low |

| Data limitation 1: Lack of recent program administrative data. | Utilized available program administrative data from 2013 to 2017 to understand program need and use. Results from this period were generalized over the period to eliminate variances from year to year. Other lines of evidence where used to offset a lack of 2018-2021 program administrative data. | Low |

|

Data limitation 2: The evaluation made use of existing secondary data to address evaluation questions:

|

Utilized 2016 Business Risk Management Survey results to cross reference where needed. While certain indicators were not weighted for program participation, they were deemed appropriate for analysis purposes. |

Low-Medium |

Annex B: Agriinvest program logic model

Ultimate Outcome

BRM suite ultimate outcomes:

- The agricultural sector is financially resilient

- Producers see value in the BRM suite in managing their business risks

- Cost effective programming

- Industry is able to better manage business risks and remain viable in the long-term

Intermediate Outcomes

Account balances help producers manage risk and make on-farm investments in a timely fashion

Immediate Outcomes

Producers set aside funds to cover future losses and/or make investment to mitigate risk

Outputs

Efficient support to facilitate producers’ savings and investments

Activities

- Processing Canadian applications, documentation or benefits for government programs

- Conducting policy research and/or analysis

- Processing other transfer payments for different levels of government

Source: Performance Information Profile for the AgriInvest Program

Annex C: AgriInvest budget, dollars, 2016-17 to 2020-21

| 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | Overall | |

|---|---|---|---|---|---|---|

| Salary | ||||||

| Budgeted | 7,125,798 | 7,034,597 | 7,212,305 | 7,218,565 | 7,187,262 | 35,778,527 |

| Actual | 6,275,052 | 8,580,374 | 7,115,780 | 7,073,236 | 7,854,329 | 36,898,771 |

| Variance | -850,746 | 1,545,777 | -96,525 | -145,329 | 667,067 | 1,120,244 |

| Non-pay operating | ||||||

| Budgeted | 4,765,298 | 4,765,298 | 4,671,267 | 4,671,267 | 4,671,267 | 23,544,397 |

| Actual | 3,083,029 | 2,869,947 | 2,443,432 | 2,443,337 | 2,690,351 | 13,530,096 |

| Variance | -1,682,269 | -1,895,351 | -2,227,835 | -2,227,930 | -1,980,916 | -10,014,301 |

| Grants and Contributions | ||||||

| Budgeted | 143,700,000 | 143,700,000 | 156,750,000 | 139,460,000 | 139,460,000 | 723,070,000 |

| Actual | 177,265,228 | 167,614,690 | 175,134,429 | 157,681,662 | 155,431,309 | 833,127,318 |

| Variance | 33,565,228 | 23,914,690 | 18,384,429 | 18,221,662 | 15,971,309 | 110,057,318 |

| Capital | ||||||

| Budgeted | 426,000 | 426,000 | 900,000 | 900,000 | 900,000 | 3,552,000 |

| Actual | 586,316 | 660,424 | 1,090,082 | 688,929 | 613,620 | 3,639,371 |

| Variance | 160,316 | 234,424 | 190,082 | -211,071 | -286,380 | 87,371 |

| Total | ||||||

| Budgeted | 156,017,096 | 155,925,895 | 169,533,572 | 152,249,832 | 152,218,529 | 785,944,924 |

| Actual | 187,209,625 | 179,725,435 | 185,783,723 | 167,887,164 | 166,589,609 | 887,195,556 |

| Variance | 31,192,529 | 23,799,540 | 16,250,151 | 15,637,332 | 14,371,080 | 101,250,632 |

|

Note: Excludes expenses associated with internal services. Source: Corporate Management Branch reports – April 5. |

||||||