November 28, 2014

Office of Audit and Evaluation

Executive Summary

In 2005, Agriculture and Agri-Food Canada (AAFC) announced the Beef Market Development Fund (Legacy Fund) with a contribution of $50 million over ten years to support long-term market development for the Canadian beef and cattle genetics industry. The Legacy Fund is administered by the Canadian Cattlemen Market Development Council (CCMDC), part of the Canadian Cattlemen's Association (CCA). The Legacy Fund also includes contributions from the Government of Alberta and check-off funds matched by the industry. The mission of the fund is to utilize resources to:

- maintain consumer confidence for all markets;

- build on Canada's comparative advantage to implement innovative market strategies;

- increase sales in existing markets (that is, domestic, United States, and Mexico);

- secure markets for beef from animals over 30 months of age (OTM);

- intensify programs to be ready for re-entry into markets such as Japan and South Korea; and,

- develop new markets such as Russia, the European Union (EU), Philippines, Indonesia and Singapore.

The Canadian Beef Advantage (CBA), an industry-wide branding effort designed to differentiate Canadian beef and genetic products from those of other countries, was one of the main marketing activities associated with the Legacy Fund. The CBA initiative was founded on communicating attributes of Canadian beef products, that is, quality and safety. The CBA licenses retailers in Canada and the United States (US) to sell Canadian beef marketed by Canada Beef Inc. (CBI) with CBA logos and associated messages.

Findings related to program relevance

There was a need for the program at the time it was launched. Canada's beef industry saw a significant decline in exports and cattle prices with the 2003 bovine spongiform encephalopathy (BSE) crisis. Access to the US market was threatened. There were concerns that Canadian consumer confidence might suffer, especially with respect to beef from older animals. The overseas market for over 30 months of age (OTM) products and live cattle was also affected. When Canada was shut out of some overseas markets, competitors, such as Australia, were able to capitalize. The industry and the Government of Canada were concerned market share could be lost permanently if actions were not taken to improve perceptions of safety of Canadian beef.

The objectives of the Legacy Fund were closely aligned with federal government priorities and AAFC strategic outcomes at the program's inception and throughout its duration. Alignment with federal government priorities remains strong as the 2013 Speech from the Throne emphasized trade as an engine of economic growth.

The objectives of the Legacy Fund were also closely aligned with federal roles and responsibilities. As stated in the 2013-14 AAFC Report on Plans and Priorities, the role of AAFC is to "help ensure that agriculture, agri-food and agri-based products industries can compete in domestic and international markets." The Department's roles and responsibilities related to the promotion of Canadian agriculture are mandated under the Department of Agriculture and Agri-Food Act.

Findings related to program performance

The evidence suggests that the loss in confidence in beef products among domestic consumers due to BSE was minimal, and was quickly regained and surpassed during the program period due at least in part to activities supported by the Legacy Fund. International consumer confidence has also been recovered since the 2003 crisis. Consumer surveys from foreign markets showed increased recognition of the quality and safety of Canadian beef since Legacy Fund inception.

The evidence also suggests that the program played a significant role in increasing over thirty month (OTM) sales both domestically and abroad. Over a five year period, more than 200 new OTM products were developed within the Canadian convenience food industry. The US market for OTM products was reopened, success was achieved in increasing exports to Hong Kong, and an additional 44 country markets were opened to Canadian OTM beef products.

Since 2005, substantial advances were made in most of the program's target export markets. Markets were recovered in the US, Mexico and China in terms of both the volume and, to a greater extent, value. Exports of beef and veal products increased in Japan, Russia, the European Union, Philippines, Taiwan, the Middle East and North Africa, and Singapore. Exports of genetic products increased in Russia, Kazakhstan, the United Kingdom, South Korea and China.

While the US remains Canada's largest market for beef and veal product exports, data shows a decreasing dependency on the US since the Legacy Fund's inception in 2005. The US export share decreased by 14 percent, while alternative market shares – most notably China, Japan, EU and Russia – grew.

The program accelerated the beef industry's maturity and sophistication in the realm of international marketing. The Legacy Fund helped to enhance the industry's marketing infrastructure (which contributed to the development of many strategies and tools), as well as their knowledge of each priority market. Program activities helped enable the industry to successfully shift its mind-set from volume to value. For example, by selling parts of the animal in markets offering the best price for the product, greater returns were gained from each animal.

Findings related to efficiency and economy

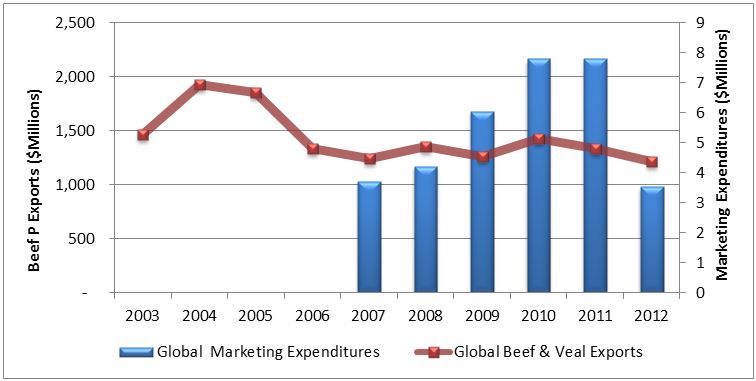

Program expenditures were compared to product exports by value (worth) of Canadian exported beef products around the world. The net financial gain was calculated for each year with the analysis providing a rough estimate of return on investment. The analysis found that during the 2007-2012 period, $34.4 million of Legacy Fund expenditures were used for marketing and promotion in the United States and internationally. Over the same period, Canada exported $7.8 billion worth of beef products around the world. Using a net gain formula, global marketing expenditures yielded a return of 25,390% over the 2007-2012 period. This analysis suggests the return on investment was very positive.

Findings related to design and delivery

Providing funds in a one-time lump sum was seen as having been potentially beneficial to the industry in tackling the immediate market crises more rigorously and effectively.

1.0 Introduction

1.1 Purpose of Report

The evaluation of the Beef Market Development Fund (known as the Legacy Fund) was undertaken by Agriculture and Agri-Food Canada's (AAFC) Office of Audit and Evaluation (OAE) as part of AAFC's five-year Departmental Evaluation Plan (2013-14 to 2017-18) and fulfills the requirements of the Financial Administration Act and the Treasury Board Policy on Evaluation (2009).

1.2 Evaluation scope and methodology

1.2.1 Scope

The operational period of the Legacy Fund is from Fiscal Year 2005-06 through Fiscal Year 2014-15. The evaluation assessed the program activities associated with the Legacy Fund between July 2005 and July 2013. The evaluation was conducted between July 2013 and July 2014.

The evaluation examined the relevance and performance of the Beef Market Development Fund (Legacy Fund). Under relevance, the evaluation looked at the need for the program focusing particularly on market conditions at the time of program launch, alignment with Government priorities and the Department's priorities and strategic outcomes, and alignment with federal roles and responsibilities. Under performance, the evaluation examined outcomes achievement, efficiency and economy.

1.2.2 Data collection methods

The evaluation involved the following data collection methods:

- Document and data review

- Analysis of performance and secondary data included both quantitative and qualitative sources. Quantitative sources consisted mainly of export and sales data collected and processed by AAFC. Qualitative sources of performance data included member and market surveys conducted throughout the duration of the program. The data review also included an assessment of relevant program documents, including: background documentation; plans and strategies; results reports; media releases; and, published literature. These included: Canadian Cattlemen Market Development Council (CCMDC) Market Implementation Plans and Annual Results Reports; independent audit reports; Public opinion surveys; Government of Canada documents pertaining to the creation and monitoring of the Legacy Fund; media reports; and, academic literature.

- Key informant interviews

- Twelve in-depth interviews were conducted as part of the evaluationFootnote 1. Interviewees included officials representing the Canadian Cattlemen's Association (CCA), Canadian Cattlemen Market Development Council (CCMDC), Canada Beef Inc. (CBI), and several provincial associations. Interviewees also included AAFC officials and several value chain partners (private industry representatives).

- Case studies

- Three case studies were conducted. These were based on multiple sources of evidence including the key informant interviews and the document and data review. The three cases studied were:

- The Canadian Beef Advantage;

- Re-entry of Canadian Beef Products to the Japanese Market; and,

- Enhancing the Commercial Beef Market in Canada.

- Activity-based analysis

- The activity-based analysis component of the evaluation examined the return on the Government of Canada's investment in the Legacy Fund. The analysis compared Legacy Fund expenditures to beef export data as tabulated by AAFC.

1.2.3 Limitations of the evaluation

The evaluation methodology was, limited due to several constraints. The evidence base did not include primary data from recipients of program outputs (for example, processors and retailers in foreign markets) resulting in information related to immediate outcomes being limited. While program expenditures and beef export data was available, external factors such as product price, competitors' actions and economic conditions make it difficult to directly attribute all the changes in export levels to the Legacy Fund.

1.3 Program Description

In 2005, the AAFC announced a ten-year contribution totaling $50 million to support long-term market development for the Canadian beef and cattle genetics industry. These funds were administered through the Legacy Fund and included a $30 million contribution from the Government of Alberta and cattle industry check-off funds. The Canadian Cattlemen Market Development Council (CCMDC) was established under the CCA to manage the $80 million fund, including fund allocation and development of annual results reports for programs supported by the Fund. This funding, matched by industry through the national check-off paid by cattle producers, is expected to provide over $170 million for the 10-year period 2005 to 2015.

The vision of the Legacy Fund is: "This fund will be managed to facilitate bold and innovative approaches to recovering and expanding markets for Canadian beef and beef cattle around the world assuring a profitable, sustainable Canadian industry that results in Canadian beef and cattle being recognized as the most outstanding by Canadian and world customers."Footnote 2

The mission of the fund is to utilize resources to:

- maintain consumer confidence for all markets as a high priority;

- build on Canada's comparative advantage to implement innovative market strategies;

- increase sales in existing markets (that is, domestic, US, and Mexico);

- secure markets for beef from animals over 30 months (OTM);

- intensify programs to be ready for re-entry into markets such as Japan and South Korea; and,

- develop new markets such as Russia, EU, Philippines, Indonesia and Singapore.

From the Legacy Fund's inception to June 30, 2011, funding was distributed among three industry marketing organizations: Canadian Beef Breeds Council (CBBC) - representing the Canadian pure-bred beef industry and responsible for genetics market development for live breeding cattle, semen and embryos; Beef Information Centre (BIC) - responsible for Canadian beef market development programs in Canada and the United States for commercial beef (over 30 month products); and, Canada Beef Export Federation (CBEF) - responsible for developing export markets. In 2011, BIC and CBEF merged to become Canada Beef Inc. (CBI). Since July 2011, the Legacy Fund resources have been distributed to CBBC and CBI.

As per the funding agreement between CCA and AAFC, the purpose of AAFC's $50 million contribution to the Legacy Fund was to support international and domestic market development activities for Canadian beef cattle, beef cattle genetics, beef and beef products. AAFC sought to:

- assist the recipient (that is, CCA) to create a ten-year Beef Market Development Legacy Fund which would be the principal source of support for the Canadian beef cattle industry in creating and implementing a comprehensive marketing strategy;

- assist the recipient to develop a Business Plan and Strategic Beef Market Development Plan, and annual updates, that would describe the eligible marketing activities that would be undertaken by the recipient and the marketing groups; and,

- permit the recipient to meet annual cash flow requirements for eligible administrative costs and eligible marketing costs.

Recipients of the Legacy Fund were eligible to use the funds to support the following marketing activities:

- development and implementation of product promotion, advertising, marketing, campaigns, seminars, and training programs;

- support to incoming and outgoing trade missions;

- participation in trade shows;

- support to regulatory authorities of foreign countries for the purpose of official visits to Canada to review the safety and quality of Canadian beef;

- completion of market research;

- activities related to the development and marketing of new products; and,

- product development, research, and marketing measures to assist products and processors to enhance their capability to differentiate beef and beef products to develop customer loyalty in export markets.

- educational campaigns (developing brochures, recipe books, booklets, etc., and hosting cooking lessons);

- maintain websites;

- market research (identifying market opportunities, identifying markets that will provide highest value return for specific products, etc.); and,

- product development (improving use of all products that is Tim Horton's Mushroom Melt was developed).

The Canadian Beef Advantage (CBA), an industry-wide branding effort designed to differentiate Canadian beef and genetic products from those of other countries, was one of the main marketing activities associated with the Legacy Fund. CBA has been referred to as "the legacy of the Legacy Fund." Marketing the CBA was founded on communicating attributes of Canadian beef products, that is, quality and safety. The CBA licenses retailers in Canada and the US to sell Canadian beef marketed by CBI with CBA logos and associated messages.

In communicating the message of the CBA, Legacy Fund resources were used to encourage involvement on the part of key stakeholders. The Beef InfoXchange System (BIXS) was developed to provide to marketing groups access to data related to, and in support of, the CBA, and to encourage information sharing generally between sectors of the value chain. Upon establishing an educated industry with shared values in the CBA, the Legacy Fund supported numerous marketing activities aimed at spreading the CBA message domestically and internationally. To varying degrees, recipients of Legacy Fund took part in marketing activities similar to the ones listed above, in support of the CBA.

2.0 Relevance

2.1 Need for the program

2.1.1 State of the beef industry at program inception

Canada's beef industry saw a significant decline in exports and cattle prices with the 2003 finding of bovine spongiform encephalopathy (BSE) in the domestic herdFootnote 3. Interviewees shared a common view of the devastating impact that BSE had on perceptions of Canadian beef around the world. In many markets, negative perceptions translated into trade restrictions. As a result, Canada's beef exports saw significant decreases in sales, with the market for over thirty months (OTM) and bone-in products and live cattle being most greatly affected. The impact on the Canadian beef industry was both swift and devastating. Interviewees noted:" … before BSE we were shipping animals at $1,200 each and after we had to pay $20 each to have them taken away," and "on May 23, 2003 all of Canada's beef export business ceased; we couldn't sell anything. The plants that made bundles of beef products (different bundles for different markets) were stressed and left with large stranded inventory, especially with respect to Asia. By the end of June, the plants came to a halt in production."

The vacuum was created when Canada was shut out of some overseas markets, allowing competitors, such as Australia, to capitalize on our lost markets. The industry and the Government of Canada were concerned market share could be lost permanently if the stigma of BSE was not removed from people's perception of Canadian beef. The aim of the Legacy Fund was "to reclaim and expand markets for Canadian beef as part of the BSE recovery strategy." More specifically, the Legacy Fund was designed to help the industry to rehabilitate the image of Canadian beef and mend relations in key markets. Additionally, the Legacy Fund would assist the industry to diversify by opening new markets for its products.

Although marketing efforts can contribute to market access efforts through advocacy and the gathering of in-market intelligence, it is important to note that the Legacy Fund was a marketing fund, and was not aimed at directly addressing market access issues (that is, opening of markets through lobbying and negotiation). The Canadian beef industry, through the CCMDC, attempted to meet its needs through the Legacy Fund by focusing on the following broad objectives:

- gaining growth in traditional, existing, new and emerging markets for Canadian beef and genetics products;

- building awareness for a Canadian beef identity brand built on the benefits defined by a strong and clear value proposition; and,

- realizing long-term and sustainable market impact.

There was general agreement among beef industry representatives, as well as others who were interviewed as part of the evaluation, that the Legacy Fund constituted a very timely and significant intervention: "the Fund provided a huge boost at a vulnerable time for the industry."

2.1.2 Evolution of industry needs

Since the creation of the Legacy Fund, and the 2003 crisis, most markets have at least partially reopened. Beef prices have increased in recent years, as has Canada's share of the market in a few countries. While the health of the beef industry has improved, the consensus view among interviewees was that it continues to be in "[BSE] recovery mode" today: "I would not say that the BSE crisis has passed. The immediate effects, yes, but the impacts are not gone yet."

New challenges such as volatile feed and cattle costs highlight the need for continued efforts in Canada's beef industry market development. Challenges related to food safety, access to labour, US 2008 country of origin labeling (COOL) regulations and non-trade barriers, such as, restrictions on the use of growth promotants or various meat processing aids, continue to restrict exports. The views of interviewees paint a similar picture of the industry's shifting needs. Collectively, they identified the following challenges as influencing the industry's need for continued marketing support:

- the impacts of the 2008 recession;

- the continued impact of COOL;

- high concentration in the Canadian processing industry (90% of beef is processed by two companies);

- difficulty accessing credit for producers;

- an aging producer population/producers leaving the business;

- smaller herds and a cautious approach to herd expansion on the part of producers;

- increased competition from key competitors (for example, US, Brazil, Australia);

- the impact of a relatively high Canadian dollar on the price of exports; and,

- high feed prices (for example, exacerbated by the US ethanol production and a drought).

Given the current challenges facing the industry, interviewees expressed the need for the industry to continue to focus on growing the value of exports rather than on trying to increase export volume (for example, high Canadian dollar, smaller herd). The key to increasing value was for Canadian industry to continue to more closely align product offerings to market opportunities. That is, "sending the parts of the cow where they will fetch the highest price" (that is, loins to the US, livers to Egypt, and tongues to Japan, etc.).

Two very large and persistent issues were identified by interviewees when discussing the industry's current and future needs. First, the federal government was seen as having a crucial and unique part to play in helping the industry gain and overcome market issues through negotiation. As one interviewee noted: "I see government working with the industry to ensure that our priority markets allow us competitive access. An example is [South] Korea where, yes, the market was re-opened but then the US encouraged an FDA rule that cut us out of there," and "the collaboration of AAFC, CFIA and DFAIT with the beef industry is unprecedented and creates an unbeatable combination for getting into markets, expanding existing markets, or entering into new markets."

The second large industry need revolved around the fact that Canada's key competitors, notably the US and Australia, continued to receive a large amount of marketing funds from their governments. There was agreement that as long as Canada's main competitors were receiving government assistance to help them market their beef, Canadian governments would have to follow suit or risk the health of the industry. According to interviewees, "it is a world-wide business and we have competitors from other countries that are supported in their marketing by their governments. So, without support we will fall behind. We are Davids compared to their Goliaths and to some degree there would [be a need for government involvement] if just to be competitive with other countries like the US, Australia and Brazil; we need a healthy industry in Canada to compete. It is really a necessity to spend these kinds of funds."

In the face of old and new challenges, such as a reduction in herd size, heightened consumer interest in food safety, persistent trade disputes, high input costs and a fragile world economy, interviewees expressed some concern about what would happen once the Legacy Fund ran its course in 2015. They shared the view that the Legacy Fund's objectives and focus on promoting and marketing Canadian beef in export markets remained highly relevant.

2.1.3 Changing export landscape for Canada's beef industry

Today, the US, Mexico, and Japan remain the key export markets for Canada's beef industry. The US market is still Canada's largest market by far. Perhaps the most significant change in the export landscape identified by interviewees has been the strategic shift in focus away from increasing export volume and towards maximizing the value of Canadian beef. That is, the price that can be obtained by better matching cuts to markets. It was expected that the focus on increasing the value of Canada's beef industry exports through brand differentiation would continue into the future.

Interviewees also identified the following changes in the export landscape:

- an expanding protein-consuming middle class in emerging markets, such as China, Russia, Philippines and Singapore;

- market receptivity to specialty products;

- some markets open to OTM "bone-in" cuts;

- generally more aware and health-conscious consumers in developed markets; and,

- stagnant growth in beef consumption among North Americans, with the exception of the American-Hispanic sub-market, which consumes considerably more per capita than the North American average.

Overall, the trade situation has been described as being increasingly complex and competitive. Exports of beef and veal products have followed a decreasing trend since Legacy Fund inception. According to AAFC export data, exports of live cattle, which were greatly affected by BSE, have followed a general increasing trend since program inception increasing by 66.9 percent in value and 41.7 percent in quantity from 2005 to 2012. Live cattle exports slowly recovered from BSE, seeing peak sales in 2008. Genetic product exports, embryos and semen have been relatively unaffected, while purebred exports, which were greatly affected by BSE, have followed an increasing trend since program inception. While most of Canada's beef and veal products continue to go to the United States, Mexico, and Japan, Canada's markets have diversified, and Canada's domestic market has also increased.

2.2 Alignment of program with government and departmental priorities

2.2.1 Alignment with federal government priorities

The evidence shows that the Legacy Fund has been aligned with federal government priorities since program inception. Canada's 2005 Speech from the ThroneFootnote 4 highlighted support for Legacy Fund work by identifying increasing opportunities for international trade as a priority of the federal government. Language such as, "securing and enhancing markets," "renewed focus on trade arrangements," "advancing Canada's trading interests," and "bolstering international trade" was used throughout the Speech to emphasize the importance the Government placed on trade. The 2005 Speech also made specific mention of the importance of agriculture and farmers to the country.

The 2013 Speech from the ThroneFootnote 5 continues to emphasize trade as an engine of economic growth: "[Canadian's] prosperity hinges on opening new markets for Canadian goods, services and investment." An emphasis on agriculture and agri-food is also expressed in the Speech through the pledge to help "continue to develop new markets around the world for Canadian [farm] products, while supporting supply management," and the statement that "Canada was built on the work of farmers."

Interviewees familiar with federal government priorities expressed confidence that the objectives of the Legacy Fund were, and continue to be, well aligned with the government's strategic focus on economic growth, job creation and export development.

2.2.2 Alignment with Departmental Priorities

In 2005, AAFC's strategic outcomes included "security of the food system," "health of the environment," and "innovation for growth"Footnote 6. Strategic outcome activities were implemented under the Agricultural Policy Framework (APF) within the scope of addressing issues of business risk management, food safety and quality, environment, innovation and renewal, and international affairs.

The Legacy Fund was well aligned with AAFC's strategic outcomes at the time of program inception. AAFC's 2005 three-year strategic plan was greatly driven by the 2003 BSE crisisFootnote 7. AAFC's 2005/2006 Report on Plans and Priorities (RPP) highlighted numerous strategic responses directly related to the activities of the Legacy Fund.

A Comparison of priorities in AAFC's 2005/2006 RPP to Legacy Fund work priorities found AAFC's work priorities were aligned with Legacy Fund work priorities. This included:

- Strengthening Canada/US regulatory cooperation

- Regaining access to world markets for beef and cattle

- Maximize and capture opportunities for Canadian producers in both domestic and international markets

- Address issues and gaps in coverage

- Pressing for a more level playing field where Canadian producers and processors can trade on the basis of their competitive advantage

An examination of AAFC's funding agreement with CCA reveals that the Legacy Fund still aligns with Departmental strategic outcomes. By 2013, a new 5-year policy framework, Growing Forward 2Footnote 8, was in place. It highlighted "investments in innovation, competitiveness and market development initiatives [as] central to the framework to help producers meet the rising global demands for food and agri-based products." The Legacy Fund, a market development initiative, aligns with AAFC's 2013/2014's work priorities.

According to interviewees, the Legacy Fund's objectives were seen as aligning with AAFC work priorities related to the creation and maintenance of a competitive, innovative, and sustainable agricultural sector in Canada. One of the program delivery agents indicated that his organization worked closely with AAFC to ensure that Legacy Fund contributions aligned closely to AAFC priorities: "[Canada Beef Inc.] works much more closely with AAFC and I believe that our work on the Fund aligns very closely with their priorities. We work closely with the Trade Commissioners and the development of the larger Canada Brand."

2.3 Alignment of program with federal roles and responsibilities

The Legacy Fund is relevant to Federal government roles and responsibilities. Since the early 1990s, AAFC has provided market development support in assisting the beef industry to recover from crises. As one interviewee stated, "the export support programs of AAFC were there before the Legacy Fund, so AAFC has always been in the game." Up until the 1980s, the nature of federal government's involvement in a crisis was to provide technical and scientific assistance to the industry, while communicating with governments of Canada's few export markets. As Canada's export market grew, the nature of federal government involvement in a crisis evolved to include supporting industry in marketing to foreign markets.

The role of AAFC has evolved to:

Help ensure the agriculture, agri-food and agri-based products industries can compete in domestic and international markets, deriving economic returns to the sector and the Canadian economy as a whole. Through its work, the Department strives to help the sector maximize its long-term profitability and competitiveness, while respecting the environment and ensuring the safety and security of Canada's food supply.Footnote 9

AAFC fulfills its role by:

Provid[ing] information, research and technology, and policies and programs to help Canada's agriculture, agri-food and agri-based products sector compete in markets at home and abroad, manage risk and embrace innovation. The activities of the Department extend from the farmer to the consumer, from the farm to global markets, through all phases of sustainably producing, processing and marketing of agriculture and agri-food products. In this regard, and in recognition that agriculture is a shared jurisdiction, AAFC works closely with provincial and territorial governmentsFootnote 10."

AAFC's roles and responsibilities are mandated through law under the Department of Agriculture and Agri-Food ActFootnote 11. As stated in the Act:

"The powers, duties and functions of the Minister extend to and include all matters over which Parliament has jurisdiction, not by law assigned to any other department, board or agency of the Government of Canada, relating to:

- (a) agriculture;

- (b) products derived from agriculture; and

- (c) research related to agriculture and products derived from agriculture including the operation of experimental farm stations."

The Legacy Fund falls within AAFC's role of helping industries to compete domestically and internationally, and derive economic returns. Additionally, the program falls within the scope of AAFC's responsibilities, as AAFC provided funding for programming to be used on marketing activities. Considering the Legacy Fund is related to agriculture, products derived from agriculture, and research related to agriculture, it is AAFC's commitment to contribute to Canada's beef industry market development.

Interviewees also agreed that the Legacy Fund was consistent with the role that the federal government should be playing in the realm of agriculture and agri-food. Those with knowledge of federal roles and responsibilities thought that the objectives of the Legacy Fund were aligned, and that the program was designed with an eye to ensuring alignment with federal roles and responsibilities.In terms of implementation, it was noted that marketing tools and strategies developed and used with the Legacy Fund were aligned with AAFC's role in promoting the Canada Brand for all agricultural products.

3.0 Performance

3.1 Achievement of expected outcomes

3.1.1 Consumer confidence in Canada and abroad

An expected immediate outcome of the Legacy Fund was increased consumer confidence in Canadian beef. Consumer confidence was assessed separately between domestic and international consumers. In terms of domestic consumers, there was general agreement among interviewees that consumer confidence in Canadian beef was high, and remained strong in the face of the Bovine Spongiform Encephalopathy (BSE) crisis. As noted by interviewees: "domestic consumers are very confident in the product. Canada was one of the few countries in the world where consumption went up just after the BSE crisis. Consumer confidence never failed in Canada," and "the Canadian public continued unqualified support for industry."

This finding illustrates that the Canadian public provided an alternative market for industry while foreign markets denied Canadian products. An increase in domestic and OTM sales during the BSE crisis would not have been possible without domestic consumer confidence in Canadian beef products. One interviewee attributed this continued support, at least in part, to the tendency of Canadians to "hold high opinions of [the country's] farmers and ranchers."

Despite already high levels of domestic consumer confidence at the time of crisis, an Ipsos survey of Canadian Beef Export Federation (CBEF) clientsFootnote 12 suggests increases in domestic consumer confidence since Legacy Fund inception reached a high of 85% in 2010, up from 78% in 2006.

In terms of international consumer confidence, confidence has been recovered since the 2003 BSE crisis. According to consumer surveysFootnote 13, when comparing data from 2010Footnote 14 to 2006, there has generally been an increase in consumer responses indicating increased confidence in Canadian beef at the time of market closures. When international consumers were asked if CBEF promotional activities increased their confidence in Canadian beef during the time the market is/was closed, 51 percent of consumers in Japan, 70 percent of consumers in South Korea, 86 percent of consumers in Hong Kong, 64 percent of consumers in China, 78 percent of consumers in Mexico, and 80 percent of consumers in Taiwan, responded that activities had indeed increased their confidence in Canadian beef products. Overall, it is evident that Legacy Fund activities were successful at increasing international consumers' confidence in Canadian beef in 2006, and continued to be successful throughout the course of the program.

Interviewees noted that materials developed under the Legacy Fund helped to bolster consumer confidence domestically and abroad. Domestically, the CBA was used to build confidence in the Canada Brand: "With the help of the Legacy Fund we were able to create new beef products for the domestic market and to replace beef imports with Canadian [OTM] beef." According to another interviewee, the CBA was "used extensively" and was "a key tool in marketing domestic OTM." In maintaining domestic consumer confidence during the crisis, interviewees noted that "funds [were used] to maintain support," and that success was attributable to "communication efforts."

In recovering international consumer confidence, one interviewee pointed to incoming missions as "often the most important activity to build confidence in a potential customer [as] they could see first-hand the processes that we had put in place to ensure quality and safety." Another interviewee highlighted the role of the Legacy Fund support in recovering consumer confidence abroad by describing the experience in Japan. One key informant stated: "Once we had re-entry, our challenge was to rebuild the confidence of our partners in those countries. This is where the support of the Legacy Fund for things like the Canadian Beef Advantage, trade events, incoming trade mission, etc. [was important]. Once confidence was established we could build up our promotional activities: So, (1) access, (2) confidence, (3) marketing and promotion. We would target influential people such as celebrity chefs, the food media, trade media, large importers, etc."

3.1.2 Consumer recognition and perceptions of Canadian beef

In addition to increasing consumer confidence, another immediate outcome of the Legacy Fund was to increase consumer recognition and positive perceptions of Canadian beef. Combined sources of evidence suggest the Legacy Fund to have indeed been successful at increasing consumer recognition and improving perceptions of Canadian beef.

In terms of increased consumer recognition, social media account trends provide one source of evidence indicating improvements from Legacy Fund initiatives. Data gathered in 2011/12 on the number of website visits, Facebook fans and activity on the Twitter accountFootnote 15 were used as indicative of the growth in the CBA brand recognition:

- 265,243 website visits by consumers (up 89% from 2011/12).

- Unique visitors to consumer-driven property totaled 222,462, a 98 percent increase from 2011/12 (112,362 visitors).

- Over 8,700 Facebook fans, an increase of 50 percent from 2011/12.

- Six active Twitter accounts, with over 7,000 followers, doubling the number of follows from 2011/12.

- Twitter chats with brand and retail partners reached 1,605,602 consumers, generating 19,957,637 million media impressions.

- The Canadian beef blog logged an average of 1,100 visitors per month, a 25 percent increase from 2011/12.

Industry buy-in of the CBA brand also provides evidence of increased consumer recognition of Canadian beef products since the inception of the Legacy Fund. When the CBA brand and logo were launched by the BIC in 2008/09, the initial number of licensed partners totaled 37 across domestic and US markets. By 2012/13, license holders grew to total 134 (103 domestically, 26 in the US, 5 in Mexico), representing a 262% increase from launchFootnote 16. Canadian Beef brand license holders represent over 75% of retail-sector market-share leaders (for example Loblaw, Costco, Sobeys, Wal-Mart, Safeway, Overwaitea, Federated and Atlantic Co-op, M&M Meat Shops). Recognition of the CBA brand has evidently increased amongst retailers since program inception, alluding to a coinciding increase in recognition amongst consumers.

Consumer recognition has increased over the course of the Legacy Fund and surveys conductedFootnote 17 with foreign consumers over the course of the Legacy Fund indicate that perceptions of Canadian beef have also improved. According to survey findings, foreign consumers' perceptions of Canadian beef in comparison to competitors (US, Australia, New Zealand, and responders' domestic products) were relatively positive in 2007, and improved over the course of the Legacy Fund.

In 2007Footnote 18, when consumers were asked how the quality of Canadian beef compared to competitors, overall, respondents indicated Canadian beef to be "better" than the competitor. Respondents from Japan, Hong Kong, and Taiwan ranked Canadian beef as "better" than the competitor, and respondents from China and Mexico ranked Canadian beef as "substantially better" than the competitor. South Korea presents the only case in which respondents ranked Canadian beef as "falling short" to competitors. Since 2007, findings from 2010 indicate foreign consumers' perceptions of the quality of Canadian beef improved. In 2010, perceptions from Japan, Taiwan, Hong Kong, and Mexico remained unchanged from 2006, while perceptions from South Korea and Hong Kong improved. In 2010, South Korea ranked the quality of Canadian beef as "better" than the competitor, and Hong Kong ranked the quality of Canadian beef as "substantially better" than the competitor. In 2010, Canadian beef was ranked by all cases as "better" than the competitor in terms of quality.

In 2007, when consumers were asked how the safety of Canadian beef compared to competitors, overall respondents indicated Canadian beef to be the "same" as competitors. Respondents from Japan, South Korea, and Hong Kong ranked Canadian beef as the "same" as competitor, respondents from Mexico and Taiwan ranked Canadian beef as "better" than the competitor, and respondents from China ranked Canadian beef as "substantially better" than the competitor. Since 2007, findings from 2010 indicate foreign consumers' perceptions of the safety of Canadian beef to have improved. In 2010, perceptions from Taiwan remained unchanged from 2006, perceptions from Mexico, Hong Kong, and Japan improved, and perceptions in South Korea (to "falling short") and China (to "better") declined. In 2010, South Korea was the only case in which foreign consumers did not perceive Canadian beef as "better" than the competitor.

As illustrated by consumer survey findings, there have been improvements in foreign consumers' perceptions of Canadian beef over the course of the Legacy Fund. Unfortunately, South Korea presents as the only case in which perceptions of safety of Canadian beef did not increase. This finding is not surprising, as trade restrictions imposed by South Korea, and trade incentives developed with the US have impacted Canada's trade relationship with South Korea throughout the course of the Legacy Fund, thereby limiting South Korea's exposure of Canadian Beef making their perception of safety of Canadian beef post BSE, limited.

The work of the industry through the Legacy Fund contributed to these tangible increases in the overall recognition of Canadian beef, as well as improved consumer perceptions of Canadian products; An interviewee said "the Legacy Fund started out as a brand proposition; now in year 8, we can touch it, talk about it, organizations talk about "living the brand"; [there has been] a big tangible shift over last 8 years that Legacy Fund can take credit for."

The industry's strategy to increase consumer recognition and to improve perception was aimed at selling higher value products through differentiating Canadian beef as superior. Differentiation was based on a series of 13 to 15 attributes, constituting the CBA brand promise. The Canadian beef brand sits on the middle rung of a value and quality hierarchy, sitting above grass-fed beef from countries such as, Australia, Brazil and India, and below corporate brands, such as Cargill's "Sterling Silver" and "Certified Angus." Interviewees felt that the differentiating strategy and development of the CBA improved the recognition and perception of Canadian beef products primarily in foreign markets. Within the domestic market, consumer's ability to recognize Canadian beef was limited. For example: "Ontario is the largest market for grocery consumers in Canada and so we are a target for the US shipping products into the big grocery chains in the province. [A grocery chain] can get a big discount shipment from the US and perhaps mix it with a small proportion of Canadian beef and then advertise 'Canada Grade AAA beef or the equivalent' in their flyers and so it looks like Canada beef. So they undercut us on price and then make it look like its Canadian. We could have used some money to help differentiate real Canadian product in the grocery stores."

Within the international market, interviewees felt that in particular, the Japan market had significant success in improving consumer recognition and perception of Canadian beef products. As one interviewee assessed, "there has been a change in the recognition of Canadian beef and beef products [in the market], through seminars and other sessions." The market was very receptive to the CBA, and was noted by interviewees to evoke a number of positive attributes in buyers and consumers (for example, clean air and water, meaning safe, nutritious food). Seminars held in Japan were said to be "well attended and well accepted" by Japanese participants.

Finally, one interviewee cautioned that in weighing the impact of the Legacy Fund - supported activities on the attitudes and perception of foreign consumers, it was important to understand that in some markets, such as Japan, direct outreach and promotion to the general public was limited compared to Canada.

3.1.3 Recovery of markets lost and entry into new markets

The Legacy Fund included an emphasis on re-entry into markets closed as a result of BSE and developing new markets. Tracking export sales was identified as an indicator for measuring these intermediate program outcomes. It should be noted that numerous factors affect exports (such as the strength of the dollar, the global economy, trade restrictions, product costs, etc.). As attributing export sales increases or decreases to the Legacy Fund is difficult, the data illustrates the potential contribution of the Legacy Fund to exports.

Domestic sales

In order to address domestic sales of beef/veal products, a measurement of domestic "disappearance" (disappearance is defined as domestic beef production minus exports plus importsFootnote 19) is used. Disappearance is a measure of beef that stays and is consumed in Canada.

At program inception in 2005, Canada's domestic disappearance per capita was 22.1 kilograms. Disappearance has followed a decreasing trend since 2005, with disappearance totaling 20 kilograms per capita in 2012, demonstrating a decrease of 9.5 percent. However, during the immediate effects of BSE in 2003, disappearance was at a high of 23.7 kilograms per capita, indicating the push for domestic utilization of products during border closures to be successful. As indicated in CCMDC's Strategic Marketing PlanFootnote 20 "without access to export markets, Canadian beef production was able to displace nearly two-thirds of beef imports, growing the Canadian industry's share of the domestic market to approximately 85 to 95 percent (up from 70% in 2002)" (pg.1). Additionally, one interviewee noted that, "Canada was the first country to increase beef consumption rates post-BSE." As Canada began to re-enter markets, a decrease in domestic disappearance should have been expected – that is, with more beef being exported. Findings of a decrease in domestic consumption does not indicate program failure, rather a minimal decrease of 9.5 percent while market opportunities improved may highlight some degree of program success.

International sales

The beef industry has three product groupings of exports: live cattle (excluding pure-bred for breeding)Footnote 21, beef and veal productsFootnote 22, and genetic products (pure-bred for breeding, embryos, & semen)Footnote 23. In discussing Canada's beef industry exports, where appropriate products are explored by the product groupings exported to that country and investigated by country marketFootnote 24.

Throughout Annual Marketing Implementation Plans, the CCMDC identified the following international markets for developing targeted market development strategies to; the US, Mexico, China (including Macau and Hong Kong), Japan, South Korea, Russia, EUFootnote 25, Philippines, Taiwan, and the Middle East and North Africa (MENA)Footnote 26.

US, Mexico, and China markets

Since BSE, significant markets, such as the US, Mexico, and China have been re-entered. Exports of beef and veal products to the United States and Mexico have followed a decreasing trend over the course of the Legacy Fund (2005 – 2012), decreasing by 48 percent in quantity and 45 percent in value, and 51 percent in quantity and 40 percent in value, respectivelyFootnote 27. This may be due, in part, to a decrease in available beef to sell, but a decreasing trend in exports may also be a result of the overall challenges currently facing Canada's beef industry previously discussed, as well as, the COOL trade requirements being imposed by the US market and the weak peso affecting Mexico's ability to import productFootnote 28.

Exports of beef and veal products to China have followed an increasing trend over the course of the Legacy Fund (2005 – 2012), increasing 15 percent in quantity and 29 percent in valueFootnote 29. As mentioned by interviewees, significant market potential, such as capitalizing on an expanding protein consuming middle class exists in China. To capitalize on this market opportunity, it was identified that Canada needs to create a value chain free of growth promotants such as Ractopamine.

Canada's exports of genetic products to the United States, Mexico, and China have remained relatively unaffected over the course of the Legacy Fund (2005 – 2012), while exports of cattle for breeding to the United States has followed an increasing trend over the course of the Fund (2005 – 2012), demonstrating an increase of 86 percent in quantity and 109 percent in valueFootnote 30, again pointing to successful Fund-supported initiatives.

Japan market

Japan, which has long been "a value and volume leader" of Canada's beef exports, re-opened its market to Canadian cattle under 21-months of age in December 2005Footnote 31. Upon the market re-opening, the Legacy Fund supported a number of activities aimed at regaining the confidence of Japanese-based value-chain stakeholders (importers, distributors, retailers, and foodservice) and consumers. However, the trade requirement of under 21-months products presented challenges to achieving desired results in exports. As noted by one interviewee, "Japan insisted on under 21 months but Canada couldn't produce that on a year round basis. The age classification was challenged, but the US was ahead on this."

Despite being faced with challenges, exports of beef and veal products to Japan have followed an increasing trend over the course of the Legacy Fund (2005 – 2012), increasing 405 percent in quantity and 290 percent in value from 2006 when borders effectively re-opened. According to one interviewee, Japan currently represents "the first and best destination for Canadian Beef."

Russia market

In Russia, significant effort was made to improve market access. Access seemed promising until Russia joined with China in declaring a ban on Ractopamine-fed products in 2012. Despite this setback, exports of beef and veal products to Russia have followed an increasing trend over the course of the Legacy Fund (2005 – 2012), increasing by 113 percent in quantity and 185 percent in value from 2008 when trade effectively commenced. Genetic product exports to Russia have increased since 2005 from zero to $10.8 million in value. Given inconsistent data over the years no trend can be identified. Interviewees shared a view that there may be a market in Russia for Canadian genetic products (the Russian government is attempting to improve its cattle through genetics), and that an expanding protein consuming middle class represented an opportunity for Canada's beef industry.

European Union market

Exports of beef and veal products to the European Union (EU) have followed an increasing trend over the course of the Legacy Fund (2005 – 2012), increasing 135 percent in valueFootnote 32. While Canada saw a slight decrease in the quantity of exports to the EU, this contrast between value and quantity indicates that Canada was capitalizing on exporting high value products to the market. This finding is reflective of the EU hormone-free product trade requirement, which yields high value purchases. Interviewees agreed that additional market opportunities for capitalizing on the EU's hormone free market exist. Exports of genetic products to the EUFootnote 33 have also followed an increasing trend over the course of the Legacy Fund (2005 – 2012), rising by 29 percent in value. According to interviewees, the new Canada - EU Comprehensive Economic and Trade Agreement holds a great deal of promise for Canada's beef industry. Value chain partners remain concerned about the potential for existing regulations to negatively impact access (for example, processing plants need to be certified for the EU market and modifications could be extremely expensive).

South Korea market

Canada has seen minimal exports to South Korea despite years of effort and expenditure of Legacy Fund resources. Post BSE, South Korean borders remained closed to Canadian beef and veal products until 2012Footnote 34. Once Canada had finally regained market access for beef and veal products, a free trade agreement between South Korea and the United States quickly followed, pricing Canada out of the market.

Interviewees noted the case in South Korea to be predominantly an issue of market access, and identified the importance of disentangling market access issues (for example, trade agreements, tariff barriers, technical barriers, etc.) from issues that can be addressed through marketing strategies. For some interviewees, South Korea serves as an example where a marketing strategy was inappropriately employed over a much needed trade strategyFootnote 35. Another way of looking at it relates to the importance of maintaining a presence even in high risk markets with no guarantee of success in order to position Canada to succeed when and if access is achieved. In this sense, Fund-supported activities in South Korea may have proven worthwhile.

Philippines market

Exports of beef and veal products to the Philippines have followed an increasing trend over the course of the Legacy Fund (2005 – 2012), increasing 267 percent in quantity and 324 percent in value. Interviewees expressed entry into the market had been good, and identified an expanding protein consuming middle class as an opportunity for Canada's beef industry.

Taiwan market

Exports of beef and veal products to Taiwan have increased since 2005 from zero to 0.4 million kilograms in quantity and $1.4 million in value. No trend presents as exports saw a steady increase from 2007 – 2009 followed by a steady decrease from 2009 – 2012. From 1998 – 2012, Canada has seen no exports of genetic products to Taiwan. Interviewees generally agreed that market opportunities in Taiwan existed and that Canada needed to create a value chain free of feed additives to capitalize on market opportunities. Due to unevenness in market access currently, Taiwan represents a high risk market to Canadian exporters.

Middle East and North Africa market

Exports of beef and veal products to Middle East and North Africa Market (MENA) have increased since 2005 by 11 percent in quantity and 174 percent in value. Exports have seen an increasing trend since 2008. A contrast between the increases in volume versus value indicates that Canada's industry is capitalizing on export high value products to the market. Interviewees noted that entry in markets such as the United Arab Emirates and Saudi Arabia had been particularly good.

Indonesia market

At program inception in 2005, Canada had zero exports to Indonesia until 2007 where exports by quantity peaked at 2.8 million kilograms at $3.1 million in value. Exports by value peaked in 2008 at $4 million at 2.5 million kilograms in quantity. Exports by quantity and value have both since followed a decreasing trend.

Singapore market

At program inception in 2005, Canada had zero exports to Singapore until 2009 when exports were $4,000 in value and 0.37 thousand kilograms in quantity. Interviewees identified an expanding protein consuming middle class as an opportunity for Canada's beef industry.

When interviewees were asked to make comment on the impact of the Legacy Fund, many felt that it was difficult to quantify the impact program outputs have had in terms of dollar amount: Additionally, a number of interviewees spoke to the inherent difficulty of ascribing precise financial impacts to the work that came out of the Legacy Fund. One interviewee stated: "If I bring a VIP mission to Canada, and three years later they start buying. Why? Is it because of Legacy Fund, the Canadian dollar – who knows what triggered the decision to purchase? If sales go up or down – question is why? Normally as income goes up, cuts of protein consumed goes up. With 2008 recession, it lowered demand. Attribution is tough."

Overall, it was found that during the Legacy Fund's duration substantial advances were made in most of the program's target export markets. Markets were recovered in the US, Mexico and China in terms of both the volume and, to a greater extent, value. Exports of beef and veal products increased in Japan, Russia, the European Union, Philippines, Taiwan, the Middle East and North Africa, and Singapore. Exports of genetic products increased in Russia and the European Union.

3.1.4 Securing markets for beef from animals over 30 months of age (OTM Beef)

Securing markets for beef from animals OTM was identified as an expected intermediate outcome for the Legacy Fund. Internationally, strategies used to bolster utilization of Canadian OTM products can be seen as a success. The first CCMDC Results Report published in 2007Footnote 36 highlights Canada's OTM market access shortly after the time of the Legacy Fund inception. When comparing the 2007 Results Report to the most recent Results Report (2013)Footnote 37 significant growth in secured markets for OTM products is highlighted. Since the introduction of the Legacy Fund, the United States has expanded their market by accepting all OTM products. Also, while it cannot be attributed entirely to promotion efforts supported by the Fund, and may also be due to market access initiatives, market access for Canadian OTM products has increased from 33 countries in 2007 to 83 in 2013. An additional 50 markets have been secured for Canadian OTM products; 36 of which have no formal trading protocols, and thus pose a commercial risk. Four additional markets (Indonesia, Russia, Peru, & Kazakhstan) accept Canada's OTM offalFootnote 38 products.

Data available on the quantity of OTM exportsFootnote 39 indicates industry success at securing markets for OTM products. Canada's export of OTM products exhibited a substantial decrease in 2003, with a 75.2 percent drop in value from 54.1 million kilograms to 13.4 million kilograms. Exports hit a low of 1.2 million kilograms in 2005. Exports began to rebound in 2008 and by 2012 exports totaled 23.5 million kilograms, demonstrating a substantial increase from 2005.

According to interviewees, success was most evident in Hong Kong and the United States markets. In Hong Kong, "that's where the CCA, the CMC, and the CFIA were very successful in gaining access to that market for OTM cattle." "The United States accepted over 30 months, then boneless products under 30 months, then all products." Respondents agreed that Legacy Fund resources had been essential to the regaining of market share for OTM products; specifically, through use of the Canadian Beef Advantage.

Despite improved OTM market access, respondents noted that some structural issues affecting markets for Canadian OTM products remained (that is BSE risk mitigation measures costing a producer over $30 per head to overcome). Additionally, some interviewees noted that the international OTM issue was really a question of access and not marketing, and that access had only been fully restored in a few markets.

Prior to BSE, domestic utilization of Canadian OTM products represented 40 percent of all OTM beef products produced. Post BSE (2004 – 2007), 99 percent of OTM products was utilized domestically. Given the challenges faced by Canada's beef industry to export products post BSE, a push for domestic utilization would have been expected.

Several interviewees pointed to the Legacy Fund support of innovative product development as an important initiative for improving domestic OTM utilization. Over a five year period more than 200 new OTM products were developed within the convenience food area with retailers such as McDonald's, Boston Pizza, and Tim Horton's. As one interviewee noted, "we did develop a great working tool, the Handbook of products and how to use OTM beef. Domestically, we helped develop the Tim Horton's Mushroom Melt Sandwich."

As available evidence suggests, both domestic and international efforts to improve OTM product utilization have shown success. Indeed, it may be observed that domestically expectations were exceeded in this regard.

3.1.5 Dependence on the US market

Decreasing Canada's dependency on the US market was an additional objective of the Legacy Fund prior to its initial development, and was identified as a long-term outcome of the program. Addressing the extent to which this had been achieved, generated a significant amount of discussion from interviewees. All interviewees began by identifying the importance of the US market. However, while some felt the objective of lessening dependence on the market was worthy and realistic, others felt it to be unnecessary and unrealistic.

Those who agreed reducing dependence on the US market was a good idea had fairly modest expectations: "Should we diversify? Yes, but it will be slow."Those who saw decreasing dependence on the US market as unnecessary illustrated the accessibility of the market despite common challenges involved in penetrating and sustaining overseas export markets as an essential reason to maintain focus on the market: "They have money, they are close and they speak the same language."A number of practical issues related to transportation, shelf-life, animal welfare, and cost were also identified to be clear reasons to maintain priority in the market. For example, beef trim, a product with an eight day shelf-life, represents half of Canadian exports to the market. Exporting trim overseas would require freezing the product and additional shipping, reducing profits.

Overall, interviewees' opinion on the extent to which dependency on the US market had decreased was divided. Some felt that there had been no appreciable reduction in dependency on the US market. Interviewees stated: "I think that this is a great objective; but, have they done it? No!" and "if we are going to do this we need to see Japan, EU and China grow a lot. The North American Free Trade Agreement (NAFTA) partners are the easiest to deal with; the "industry" has not diversified."

Those who felt that dependence on the US had been reduced were unsure the extent to which this could be attributed to Legacy Fund related activities. Comments included: "The Legacy Fund has helped us to create demand pull in new markets and that has helped reduce the US share of exports from 81 per cent to 72 per cent now. But the access to the new markets was likely more important in this shift than the Legacy Fund itself;" "the result is there but I am not sure it can be tied directly to the tools and strategies [of the Legacy Fund]. It is more about market access and as the markets open up you can send more there;" and, "the Legacy Fund has brought about a shift in dependency on the US market but not the degree hoped for. The US remains the most accessible market, reached efficiently, and best at accepting beef products from Canada. However, there is no question that Canada is better served by having a range of markets, but international markets have been slow to fully open up to Canadian beef. COOL has reduced access to the US – it is hoped that the US Farm bill will provide a solution."

According to sales statistics, in 2005 when the Legacy Fund was initiated, the US comprised 86 percent of Canada's total beef and veal product export sales by valueFootnote 40. More recent data from 2012 shows the US to comprise 72 percent of Canada's total export sales by value. While the US remains Canada's largest market by far for beef and veal product exports, data illustrates a decreasing dependency on the US since Legacy Fund inception in 2005. The US export share has decreased by 14 percent, while alternative market shares – most notably China, Japan, EU and Russia – have grown.

3.2 Economy and Efficiency

3.2.1 Economy in program administration

There was a general perception among those who participated in the evaluation that the Legacy Fund was a well administered program that produced outputs efficiently and economically. The administration of the Legacy Fund was deemed by interviewees to have been conducted "ethically" and with sufficient "transparency" and "accountability:" Overall, there was agreement among interviewees that the Fund was "well spent." One respondent noted that the "CCA took the Fund seriously. For example, they brought in an outside expert to serve as a challenge function."

A recipient audit reportFootnote 41 on the CCA Legacy Fund spending for the period of September 29, 2005 to June 30, 2010, supports interviewee's feelings of the fund being spent judiciously. The audit concluded that the CCA was in compliance with the program funding agreement established with AAFC in 2005.

While funding the CCA to distribute funds to recipients (CBI and CBBC) may have required more administrative work than directly funding CBI and CBBC, it was felt that having the CCA distribute the funds produced an unexpected benefit of "forc[ing] discussion around the synergy across the three [recipient] agencies." This opportunity contributed to the merger of BIC and CBEF into CBI, which was seen by interviewees as an effective adjustment to inefficiencies created by the funds' original administrative structures. As early planning proceeded, inefficiencies in the use of the two delivery agents whose work overlapped were realized. The formation of CBI to consolidate the two entities was seen to improve efficiency and increase success of programming. Interviewees stated: "The most significant external event was the consolidation of the check off and export entities. The created cost efficiencies with reduced staff time and dealing with a single agency CBI was easier" and "we were duplicating efforts and silos had been created. Both [were] doing good work but not benefiting the industry as a whole most efficiently. Each couldn't see the forest for the trees. It had become a little bit of a buddy system for the smaller player; it needed to be fixed and the industry did so." The CCMDC, as a "neutral player" contributed an important challenge function to the work of the marketing agencies.

3.2.2 Economy and efficiency: return on investment

It is not possible to directly attribute export values and gains to the Legacy Fund activities, as it is impossible to rule out competing explanations for gains (or losses) due to market forces and conditions in country markets outside of the control of the Legacy Fund. To mitigate this limitation analysis was undertaken to roughly estimate net financial gains as a measure of return on investment of the fund, despite the limitation of not being able to attribute the results directly to the Legacy Fund.

Using Annual Market Implementation Plans and Results Reports reflecting the direction and priorities of the Canadian Cattlemen Market Development Council were the basis of the review of program expenditures for the Legacy Fund. Annual Market Implementation Plans and Results Reports were available from the 2006/2007 fiscal year up to the 2012/2013 fiscal year on the Canadian Cattlemen's Association website.Footnote 42 Annual Reports provide a breakdown of Legacy Fund expenses for the United States and the international market. Information on annual marketing expenditures from the Legacy Fund for 6 priority and target markets; the United States, Mexico, China (including Mainland China, Hong Kong, and Macau), Japan, Taiwan, and South Korea, were available.

Program expenditures were compared to product exports by value (worth) of Canadian exported beef products around the world. Export data compiled by AAFC. The net financial gain was calculated for each year using the following formula:

Net gain = (exports − expenditures) ÷ expenditures × 100

A number of limitations exist with this analysis including: multiple resources other than the Legacy Fund were expended for market development by relevant Canadian samsstakeholders; it is difficult to identify the multitude of extraneous variables that may have affected exports in a particular country; estimates of production costs was not available and hence the analysis does not provide a representation of total expenditures involved in production.

Nonetheless, the analysis does provide a rough estimate of an export to expenditures ratio. Analysis was done for an overall ratio representing a global net gain and for each international market the Legacy Fund reached during the 2007-2012 period. Below are the calculations for the global net financial gain of global Legacy Fund marketing in tabular and graphic form, followed by summary values for each international market.

Global

During the 2007-2012 period, a total of $34.4 million of Legacy Fund expenditures were used for marketing and promotion in the United States and internationally. Over the same period, Canada exported $7.8 billion worth of beef products around the world. Using the net gain formula, global marketing expenditures yielded a return of 25,390% over the 2007-2012 period. Figure 1 shows that global beef products exports decreased significantly from 2005 to 2006. Between 2006 and 2012, the value of exports fluctuated between $1.2 and $1.4 billion.

Description – Figure 1

| Global marketing expenditures ($ millions) | Global beef and veal exports ($ millions) | |

|---|---|---|

| 2003 | N/A | 1,462,440,057 |

| 2004 | N/A | 1,921,371,421 |

| 2005 | N/A | 1,849,398,547 |

| 2006 | N/A | 1,334,180,286 |

| 2007 | 3,701,109 | 1,243,917,602 |

| 2008 | 4,210,104 | 1,352,830,924 |

| 2009 | 6,044,879 | 1,260,921,782 |

| 2010 | 7,785,175 | 1,422,025,154 |

| 2011 | 7,790,978 | 1,329,405,415 |

| 2012 | 3,531,208 | 1,208,918,621 |

| N/A: Not available | ||

International markets

Similar to the analysis as above for global markets was done for each international market the Legacy Fund contributed to. The analysis is summarized below.Footnote 43 The analysis of export to expenditures ratios across all international markets during the 2007-2012 period, showed that for every Legacy Fund dollar spent, $99 was generated in exports. Each dollar spent in specific markets during the same period, related to the following values of exports:

- US market: $546;

- Mexico market: $196;

- China, Hong Kong and Macau market: $100;

- Japan market: $50; and,

- Taiwan market: $24.

The case of South Korea represents an isolated incident in which export values fell below Legacy Fund expenditures. Between 2007 and 2011, every dollar spent in the Korean market related to $0.11 in exports. When interviewees were asked about the ROI in the market they too saw expenses at a loss, and identified market access being the significant barrier to Canada's beef industry.

In summary, the evidence suggests the Fund coincided with positive return on investment in terms of exports with net gain being highest in the US market and strong in other international markets.

3.2.3 Design and delivery alternatives

While almost all interview respondents felt that the funding application process was clear and easy to follow, interviewees took the opportunity to provide feedback and suggestions for improvement of future similar initiatives. Their consolidated suggestions on programming are as follows:

- Some interviewees felt that the criteria for obtaining funding were too rigid;

- Some felt that the Legacy Fund should not have been predominantly focused on export markets and that more flexibility should have been built into the program's design: "At times I thought that they could have been more liberal in the things that they were permitted to spend money on";

- A few noted that there was too much of a "shotgun approach" to the program; meaning they were trying to do too much with the available funds and were spreading the money too thinly: "We might have been overzealous at first, spreading ourselves too thin" ;

- A few interviewees felt that the ratio for matching funds (25%) could have been lower as producers do not have a lot of extra money available to support their share of the costs; and,

- Some interviewees indicated that the Legacy Fund might have been better designed if long-term activities were supported alongside "one-off" activities.

In terms of funding, interviewees noted that some alternatives could have been used in the design of the Legacy Fund. Providing funds in a one-time lump sum was seen as having been potentially beneficial to the industry in tackling the immediate market crises more rigorously, and thus, effectively. Another approach identified was to provide the funding directly to the industry's marketing organizations rather than to a distributor. As noted by one interviewee: "The approach taken was necessary to accommodate two marketing groups with the same intent but different governance and accountability. Ten years ago the Legacy Fund was the right way to go. It allowed the CCA to have direct control over the funding organizations. Today the marketing organizations could deal directly with AAFC."

4.0 Conclusions

The Legacy Fund addressed critical needs within the Canadian beef industry. The Legacy Fund was aligned with Government and AAFC objectives and fit well with the Federal Government's role in supporting the industry. The Legacy Fund was created at a time when the beef industry was experiencing the worst crises in its history affecting the profitability of producers and processors. Key players in the industry interviewed as part of this evaluation gave credit to the Legacy Fund for helping the industry recover from the crisis. Without the support of the Legacy Fund, recovery would likely have been considerably slower and it is possible that producers who continued to be affected would have been forced to leave the industry, diminishing a critical component of the value chain.

The evidence suggests that the program played a significant role in increasing OTM sales both domestically and abroad. Canadian Beef Advantage marketing and promotional efforts, including effective use of online resources and social media, appear to have boosted consumer recognition and confidence in OTM products. The US market for OTM products was reopened, success was achieved in substantially increasing exports to Hong Kong, and an additional 44 country markets were opened to Canadian OTM beef products.

Other long-term impacts and outcomes are more difficult to attribute to the Legacy Fund with certainty. During the Legacy Fund's duration the program has changed the way beef is exported by selling parts of the carcass in markets offering the best price for the product, greater returns were gained from each animal. Advances were made in most of the program's target export markets. Markets were recovered in the US, Mexico and China in terms of both the volume and, to a greater extent, value. Exports of beef and veal products increased in Japan, Russia, EU, Philippines, Taiwan, MENA(middle East North Africa), and Singapore. Exports of genetic products increased in Russia, Kazakhstan, the United Kingdom, South Korea and China.

While the US remains Canada's largest market for beef and veal product exports, data shows a decreasing dependency on the US since the Legacy Fund's inception in 2005. The US export share decreased by 14 percent, while alternative market shares – most notably China, Japan, EU and Russia – grew.

Despite the limitations of direct attribution of export values and gains to the Legacy Fund activities, estimations of the return on investment using net gains as a proxy, showed high financial gains. In addition to high net gains, further analysis estimated that for each dollar spent from the Legacy Fund resulted in returns in value of exports as high as $546. The case of South Korea represented an isolated incident where for each dollar spent from the Legacy fund, export values were $0.11.

The example of South Korea suggests that while marketing plays an important role in industry success, in some cases addressing market access issues may have helped the industry more.

The program accelerated the beef industry's maturity and sophistication in the realm of international marketing. The Fund helped to enhance the industry's marketing infrastructure and contributed to the development of many strategies and tools, as well as knowledge. Program activities helped enable the industry to successfully shift its mind-set from volume to value.