December 2, 2014

Report:

Office of Audit and Evaluation

Executive Summary

In 2009, Agriculture and Agri-Food Canada (AAFC) announced a lump sum contribution of $17 million to be used between 2009 and 2013 in support of market development initiatives for Canada's pork industry. As the export market development agency of the Canadian pork industry, Canada Pork International (CPI) was the recipient and delivery agent of the Fund. Objectives of the International Pork Marketing Fund (IPMF) included repositioning the industry for sales of higher valued products, building markets and gaining wider international recognition for Canadian pork products, and increasing international market access for Canadian pork products.

The evaluation was conducted in accordance with the federal government's Policy on Evaluation. As such, it focuses on the relevance of the IPMF and its performance. More specifically, the evaluation explores the need for the program, its alignment with government priorities and federal roles and responsibilities, the extent to which it has achieved its expected outcomes, and the extent to which efficiency and economy have been demonstrated.

Findings Related to Program Relevance

There was a need for the program at the time it was launched. In 2009, the Canadian pork industry was suffering from a variety of negative factors including increased feed and other input costs, price reductions due to oversupply, and negative effects on the market associated with the H1N1 virus ("swine flu"). Internationally, the Canadian industry was facing ever-increasing competition from the United States (US) which had a price and volume advantage.

The ever-present threat of disease outbreaks combined with continued strong competition and constant changes in import restrictions around the world create a continuing need for a national pork marketing program.

The objectives of the IPMF were also closely aligned with federal government priorities and AAFC strategic outcomes at the program's inception and throughout its duration. In 2009, Canada's Speech from the Throne identified as a priority for the government to support Canadian agriculture industries in difficulty. The 2013 Speech from the Throne reinforced the emphasis on trade as an engine of job creation.

AAFC priorities identified in 2009-10 included advancing Canadian agriculture and agri-food; sector competitiveness; trade negotiations and market access; market growth and business development. Growing Forward 2 highlighted innovation, competitiveness and market development initiatives as a framework to help producers meet the rising global demands for food and agri-based products.

The objectives of the IPMF were also closely aligned with federal roles and responsibilities, as stated in the 2013-14 AAFC Report on Plans and Priorities. The Department's roles and responsibilities related to the promotion of Canadian agriculture are mandated under the Department of Agriculture and Agri-Food Act.

Findings Related to Program Performance

The IPMF supported a range of market development activities; the Canada Pork Handbook, translated into French, Spanish, Korean, Chinese, Russian and Japanese, and 6,500 copies printed; technical seminars delivered to audiences such as supermarket chains and other buyers in Japan, China, Russia, and the Philippines; and country specific programs such as the Japan Program that develop technical marketing materials translated into Japanese combined with planning and delivering technical seminars and some 2,500 in-store product demonstration days per year.

Taken from CPI's Strategic Plan, the program's intermediate/long-term outcomes were to develop a marketing approach that would allow the industry to obtain a higher price (or value) for their pork. Export data from 2009 to 2012 showed that the program met its intermediate/long-term outcomes as the volume of pork product exports rose by 10.6 percent, while the value of these exports rose by 22.9 percent. Specific export markets data further showed that Canadian industry capitalized on the value opportunities as export values between 2009 to 2012 showed sharp increases in Japan, the US, Russia, China/Hong Kong, South Korea and Mexico.

Multiple lines of evidence suggest that the IPMF was well administered and produced outputs economically. The funding flexibility inherent in the IPMF "helped to mitigate the impact" that negative external events and contextual issues could have had on the pork industry and their market strategies and activities, allowing industry to react quickly and decisively. Much of the success of the IPMF can be attributed to the co-ordinated and participatory approach from AAFC, CPI, and industry.

Conclusions

The evaluation suggests that the IPMF generated a number of significant outcomes, creating a favourable return on the Government of Canada's $17 million investment in the pork industry. CPI's strategy of focusing on increasing the value obtained for Canadian pork products based on product "differentiation through education" contributed to a 23 percent increase in the value of exports over a three-year period starting in 2009. The qualitative evidence from the evaluation supports the conclusion that the IPMF had a large role to play in this growth.

The evaluation suggests that Canadians can compete and beat its competitors in some markets, despite being outspent on marketing and out-priced on product, developing innovative marketing approaches to allow them to compete on quality.

The Canadian pork industry's success suggests that other Canadian agricultural export industries could also compete on quality/value over price/volume. The potential for market growth is significant as countries such as China, India, Mexico, Brazil and others continue to develop their export industries.

1.0 Introduction

1.1 Purpose of Report

The evaluation of the IPMF was undertaken by AAFC's Office of Audit and Evaluation (OAE) as part of AAFC's five-year Departmental Evaluation Plan (2013-14 to 2017-18) and fulfills the requirements of the Financial Administration Act and the Treasury Board Policy on Evaluation (2009).

The evaluation assessed the relevance and performance of program activities associated with the IPMF between 2009 and July 2013. The evaluation placed a significant focus on the 2010 to 2012 period, given that program activity was at its peak then and due to the availability of related data.

1.2 Evaluation Methodology

The evaluation examined the relevance and performance of the IPMF. Under relevance, the evaluation looked at the need for the program focusing particularly on market conditions at the time of program launch, alignment with federal roles and responsibilities, and alignment with the department's priorities and strategic outcomes. In terms of performance, the evaluation examined effectiveness, efficiency and economy.

The evaluation involved the following data collection methods:

- Document and data review:

- Analysis of performance and secondary data included both quantitative and qualitative sources. Quantitative sources consisted mainly of export and sales data collected and processed by AAFC. Qualitative sources of performance data included market and association member surveys conducted throughout the lifespan of the program. The data review also included an assessment of relevant program documents, including background documentation, plans and strategies, results reports, media releases, and published literature. These included CPI documents (for example, Strategic Plan, interim program evaluation, presentation decks, activity reports, etc.), Government of Canada documents pertaining to the creation and monitoring of the IPMF, media reports and academic literature.

- Key informant interviews:

- Eleven in-depth interviews were conducted as part of the evaluationFootnote 1. Interviewees included CPI officials, AAFC officials and a variety of value chain partners, including producers, packers and processors, as well as representatives of trading companies.

- Case studies:

- Three case studies were conducted. These were based on multiple sources of evidence including the key informant interviews. A great deal of documentation was also reviewed in an effort to gain a thorough understanding of tools and strategies that were developed by CPI through the IPMF. These included The Canadian Pork Handbook and Pork Story, The Canadian Pork Quality Standards, and Competitive Benchmarking. The three cases studied were:

- The Japanese Market;

- Differentiating Canadian Pork Products; and,

- The Canadian Pork Handbook (which features the Canadian Pork Story).

- Three case studies were conducted. These were based on multiple sources of evidence including the key informant interviews. A great deal of documentation was also reviewed in an effort to gain a thorough understanding of tools and strategies that were developed by CPI through the IPMF. These included The Canadian Pork Handbook and Pork Story, The Canadian Pork Quality Standards, and Competitive Benchmarking. The three cases studied were:

- Activity-based analysis:

- The activity-based analysis component of the evaluation attempted to assess the return on the Government of Canada's investment in the IPMF. The analysis compared IPMF expenditures as reported in IPMF annual reports and strategic plan to pork export data globally and in key target markets.

Limitations

The evaluation methodology was limited due to several constraints. The evidence base did not include primary data from recipients of program outputs (for example, processors and retailers in foreign markets) the result of which was that information related to immediate outcomes – for example, changes in buying patterns on the part of target market representatives – was limited. As such, the evaluation was able to report on findings respecting activities and outputs as well as intermediate and longer-term outcomes but was limited in its ability to directly attribute these outcomes to Fund-supported activities.

Program expenditure data was available as were figures related to pork exports. However, as above, it was not possible to directly attribute changes in exports to the market development program. Factors influencing price such as exchange rates, actions of competitors, and/or economic conditions in export markets are important additional variables affecting exports.

1.3 Program Description

In 2009, AAFC announced a lump sum contribution of $17 million to be used between 2009 and 2013 in support of market development initiatives for Canada's pork industry. CPI, the recipient of the fund, is the export market development agency of the Canadian pork industry. Its aim is the diversification and expansion of export markets through market research, promotional activities and coordination of market access issues (for example, removal of trade barriers). CPI's annual reportsFootnote 2 highlight five areas of endeavor:

- Industry Strategy:

- Focused approaches designed to result in a competitive advantage for Canadian pork exports;

- Markets:

- Getting access to chosen markets and understanding individual market requirements;

- Competitive Intelligence:

- Benchmarking competitors in key areas that will make a difference and learning from international marketing successes in other sectors;

- Logistical Barrier Reduction:

- Removing the export impediments and barriers in order to enable effective and efficient (timely) movement of products out of Canada; and,

- Market Development Actions:

- The design and delivery of services in support of the strategy and aligned to market requirements.

As per the funding agreement between CPI and AAFCFootnote 3, the purpose of AAFC's contribution was to support the Canadian pork sector in order to build recognition for Canadian pork products, diversify and expand export markets for the industry, and enhance export capacity. Expected results of the initiative included an increase in the recognition of the safety and quality of Canadian pork products in foreign markets, an increase in pork exports and market share in targeted countries, and a greater participation of stakeholders in export capacity building activities.

CPI was eligible to use funds for the following marketing activities:

- Market research to identify target markets and opportunities, understand target market demands and consumer perceptions and establish benchmark image and reputation indicators in those target markets;

- The development and promotion of generic industry-wide branding with the objective of identifying and building a reputation for the quality and safety of Canadian pork products and the promotion of company specific brands when consistent with this objective;

- The development of systems and standards that can be used to support and build the reputation of Canadian pork products;

- The establishment of strategic partnerships with industry groups in target market countries to resolve trade irritants informally at an early stage and to influence agricultural trade and policy development in cooperation with the Government of Canada;

- The development and implementation of communication strategies that help to:

- open and expand foreign markets to Canadian pork products, including the capacity to respond to misinformation that may lead to trade disputes, and

- change international and domestic consumer perceptions regarding the safety and quality of Canadian pork products when the industry is faced with emerging issues such as those posed by H1N1 influenza; and,

- Provision of training programs and services that contribute to enhancing the export capacity of the Canadian pork sector.

2.0 Relevance of the Program

2.1 Need for the Program

2.1.1 Program Inception

The Canadian pork industry was in a state of crisis in 2009. Government of Canada documents, CPI's Strategic Plan, and media coverage from the period all paint a picture of an industry struggling to regain its profitabilityFootnote 4. Interviewees who participated in this evaluation described the state of hog farming and processing in 2009-2010 in stark terms. The pork industry, particularly hog producers, had been struggling for some time prior to the detection of H1N1 in the Canadian herd. Input costs, such as feed, were increasing while an oversupply of hogs was driving prices down. Many producers went out of business which, in turn, put pressure on processors: "It was far more than H1N1, pork producers were losing money for years and packers were not doing much betterFootnote 5." Thus, the detection of H1N1 caused one crisis to be layered on top of another, while threats of a second wave of disease continued to loom.

In terms of markets, US imports into Canada were increasing. Internationally, the Canadian industry was facing ever-increasing competition from the US which had a price and volume advantage. Emerging exporters, such as Brazil, also presented increased competition. Moreover, Country of Origin Labeling (COOL) was having a negative impact on exports to the USFootnote 6, while access to some important markets, notably Russia, was being threatened by the imposition of import restrictions (for example, the Russian ban on Ractopamine as a feed additive). As one interviewee noted, "before, it was a lot easier to export."

At the time of program inception, the ultimate industry need was to regain profitability. According to interviewees, the Canadian pork industry lobbied the government to create a pork marketing fund. The result was the creation of the $17 million IPMF designed to address the challenges of swine health, market access, and volatility of the economy limiting Canada's pork industryFootnote 7.

2.1.2 Continuing Industry Needs

All interviewees felt that the Canadian pork industry is in much better shape today than in 2008-2009. Notwithstanding this significant improvement, there was also a unanimous view that it was crucial to the health and continued growth of Canada's pork industry that the federal government remains active in providing export development funding. The most compelling need and rationale for continued government involvement was to counter the fact that competitors, particularly the US and Europe, were receiving "massive assistance from their governments: "We have to try to level the playing field."

In addition to the need to counter the assistance that Canada's competitors were receiving from their governments, some of the initial conditions that led to the crisis continuing. The threat of disease within livestock remains a concern. For example, a recent discovery of Canada's first case of porcine epidemic diarrhea (PED) virus on an Ontario farm could have negative effects on production, and ultimately exports.Footnote 8 US COOL requirements generated a trade dispute and disadvantage exporters of Canadian pork to the US. High grain prices, a relatively strong Canadian dollar, and sluggish economic growth around the world also continue to present challenges to selling pork internationally.

While the IPMF's main objective, that is, help industry increase the volume and value of pork exports, remains relevant, and always will according to interviewees, specific industry needs and challenges are evolving. The key challenges identified by key informants are as follows:

- There is an increased need for the industry to focus on growing the value (that is, not just volume) of exports.

- The industry is more mature; the need to promote the generic "Canada Brand" has been reduced. The need lies increasingly in the promotion of corporate brands.

- There is a need to focus on the Philippines and China. As stated by an interviewee, "China will not import less than 2 million tons [per year]. Now we have to move up to higher value-added products – to differentiated areas where you will get a premium."

- There is a major need to focus on market access by securing trade agreements, especially with South Korea and Europe, and to address specific trade barriers (for example, the Russian ban on Ractopamine as a feed additive).

- There is a need to help the industry react quickly and effectively to sudden market changes.

2.1.3 Changing Export Landscape for Canadian Pork

According to interviewees, Canada's pork export landscape has changed markedly in the years since the launch of the IPMF. One person noted: "Most significantly, we find that the industry's focus on increasing the value of exports is bearing fruit. From 2009 to 2012 the volume of pork product exports rose by 10.6 percent, from 1.1 billion kilograms to over 1.2 billion kilograms. The value of exports, however, rose by an even larger margin of 22.9 percent, from $2.6 billion in 2009 to $3.2 billion in 2012."

The overall trade situation has been described as "more complex" compared to five years ago due mainly to the industry's increased need to respond to market access barriers. These often politically-oriented issues include the imposition of non-tariff barriers and the need to secure trade agreements. Some members of the industry who were interviewed as part of the evaluation saw the imposition of barriers to markets as the price they sometimes paid for success: "When local producers see a lot of Canadian pork coming in they put pressure on their government to put up barriers." Additional changes to the export landscape identified by interviewees include the following:

- increasing competition (for example, US, European Union (EU), Brazil, Chile);

- the potential for China to become a primary market for Canada based on an increasing demand and a maturing of the market: "They are almost ready for table meat"; and,

- the evolution of the Russian market from sausage only to include "table meat."

It was expected that the thrust of the IPMF supported industry strategy, which was to focus on increasing the value of Canadian pork exports through product quality and safety differentiation, would continue into the future.

2.2 Alignment of Program with Federal and Departmental Priorities

Multiple lines of evidence suggest that the objectives of the IPMF were closely aligned with federal government priorities and AAFC strategic outcomes at the program's inception and throughout its duration.

2.2.1 Alignment with Federal Government Priorities

The evidence shows that the IPMF, with its focus on expanding export markets for a major Canadian agricultural commodity, was closely aligned with federal government priorities at the time of program inception. In 2009 Canada's Speech from the ThroneFootnote 9 identified as a priority for the government to "support Canadian industries in difficulty – including … agriculture." The Speech from the Throne also made reference to the priority that the government placed on expanding trade. "…trade matters to Canada's prosperity"; "our government is committed to seeking out new opportunities for Canadians." It was also recognized that "better positioning Canada to compete for investment and market opportunities will require action at home."

By the end of the IPMF, the program continued to be closely aligned with federal government priorities. This is evident from the 2013 Speech from the Throne's emphasis on trade as an engine of job creation, and the Government's pledge to "continue to develop new markets around the world for Canadian [farm] products…"

2.2.2 Alignment with Departmental Priorities

A comparison of the priorities contained in AAFC's 2009/2010 Report on Plans and Priorities (RPP) and IPMF-stated prioritiesFootnote 10 reveals a close alignment at program inception between AAFC Strategic Outcome 2 and IPMF priorities, as is illustrated in Table 1 on the following page.

| AAFC's 2009/2010 Strategic Outcome 2 | Associated IPMF Priorities |

|---|---|

|

A competitive agriculture, agri-food and agri-based products sector that proactively manages risk [including...]

|

Industry Strategy: Focused approaches designed to result in a competitive advantage for Canadian pork exports Competitive Intelligence: benchmarking our competitors in the key areas that will make a difference and learning from international marketing successes in other sectors Logistical Barrier Reduction: Removing the export impediments and barriers in order to enable effective and efficient (timely) movement of products out of Canada Markets: Getting access to our chosen markets and understanding individual market requirements Market Development Actions: The design and delivery of services in support of the strategy and aligned to market requirements |

By the end of the IPMF, a new 5-year policy framework, Growing Forward 2Footnote 11, was in place. It highlighted "investments in innovation, competitiveness and market development initiatives [as] central to the framework to help producers meet the rising global demands for food and agri-based products." Thus the IPMF, a market development initiative, continued to align with AAFC's work priorities.

2.3 Alignment of Program with Federal Roles and Responsibilities

Up until the 1980s, the nature of the federal government's involvement in helping the industry to deal with a crisis was to provide technical and scientific assistance at home, while communicating with the governments of the relatively limited number of (mainly European) countries that imported Canadian pork in order to mitigate concerns.

As Canada exported a growing proportion of its pork production to an increasing number of markets, the nature of the federal government's involvement evolved. Markets and relationships became more complex, and the industry was marketing directly in foreign countries. In the 1980s and 1990s the federal government's role in crisis management expanded to include support for export development. By 2009, the federal government's involvement in helping the industry recover from crises had an emphasis on export markets and marketing.

The role of AAFC has evolved to:

"Help ensure the agriculture, agri-food and agri-based products industries can compete in domestic and international markets, deriving economic returns to the sector and the Canadian economy as a whole. Through its work, the Department strives to help the sector maximize its long-term profitability and competitiveness, while respecting the environment and ensuring the safety and security of Canada's food supplyFootnote 12."

AAFC fulfills its role by:

"Provid[ing] information, research and technology, and policies and programs to help Canada's agriculture, agri-food and agri-based products sector compete in markets at home and abroad, manage risk and embrace innovation. The activities of the Department extend from the farmer to the consumer, from the farm to global markets, through all phases of sustainably producing, processing and marketing of agriculture and agri-food products. In this regard, and in recognition that agriculture is a shared jurisdiction, AAFC works closely with provincial and territorial governmentsFootnote 13."

AAFC's roles and responsibilities are mandated through law under the Department of Agriculture and Agri-Food ActFootnote 14. As stated in the Act:

"The powers, duties and functions of the Minister extend to and include all matters over which Parliament has jurisdiction, not by law assigned to any other department, board or agency of the Government of Canada, relating to:

- (a) agriculture;

- (b) products derived from agriculture; and

- (c) research related to agriculture and products derived from agriculture including the operation of experimental farm stations."

The IPMF falls within AAFC's role of helping industries to compete internationally, and derive economic returns. Additionally, the program is within the scope of AAFC's responsibilities, as AAFC provided funding for programming to be used on marketing activities. Considering the IPMF is related to agriculture, products derived from agriculture and research related to agriculture, it is AAFC's responsibility to contribute to Canada's pork industry market development.

3.0 Effectiveness

3.1 Achievement of Expected Outcomes

3.1.1 Overview of International Pork Marketing Fund Strategy and Activities

The review of documents, interview data and case studies paint a clear picture of how program outcomes were to be achieved. The IPMF strategic planFootnote 15, developed by the CPI and outlining how the CPI and the industry would utilize the IPMF, was founded on a strategy of product differentiation based on product quality and safety. This strategy was designed to allow Canadian producers to compete against their US competitors who possessed a price and volume advantage. The same strategy would be employed to compete against other competitors such as Denmark.

The CPI Strategic PlanFootnote 16 identified six "A" markets, defined as: "Marketplaces where we can undertake sustainable market development activities at the end-user (retail or trade) level. This market has room to grow." Japan, China/Hong Kong, Russia, US, South Korea and Mexico were designated "A" Markets. Japan was already Canada's largest export market on a value basis, accounting for almost $857 million in 2008.

Much of what was created by CPI was developed with the Japanese market in mind. According to interviewees, it was reasoned that if the Canadian Pork Story and tools and strategies worked well in the world's best and most sophisticated market, they could be adapted to work well in other target markets, particularly Korea. The development of the Canadian Pork Story provided the substance for differentiating Canadian pork from American and other competitors, but this represented only half of the marketing equation. CPI and its industry partners still had to muster an audience for the Story. What would be variously referred to as the "friendly partner" or "differentiation through education" strategy evolved as a way of attracting an audience for the Story by embedding it into "something that people wanted."

Specific strategies for capitalizing on market opportunities were developed for each target country. According to the key informant interviews and the case studies, the range of country-specific marketing plans, strategies and tools was wide, however, "all of the tools and activities were largely aimed at differentiating Canadian pork based on quality, production attributes, safety, traceability, animal welfare, and OFFSRP [On-Farm Food Safety Recognition Program]." For Russian restaurant retailers, for example, the focus could be on providing assistance in menu optimization. For Chinese buyers it might be how to discern meat quality, and for Japanese consumers it could be a taste of Canadian pork and small gift. "In China if we were to say: ‘Hey can we come down and tell you why our meat is the best for two hours'? They would say no way. But if we say: ‘Can we show you how to get better value out of what you buy, where quality comes from and some new ways of cooking pork?' then they welcome us with open arms. So we are educating them using the Canadian example because that's what we know. The Canada Pork Story and the branding part is there, but it's not in the form of a sales pitch."

3.1.2 Activities

The realization of the strategy was carried out in all target country markets through six main areas of activity. Each involved considerable planning and development and, once ready, was implemented multiple times across a variety of audiences.

The Canadian Pork Story

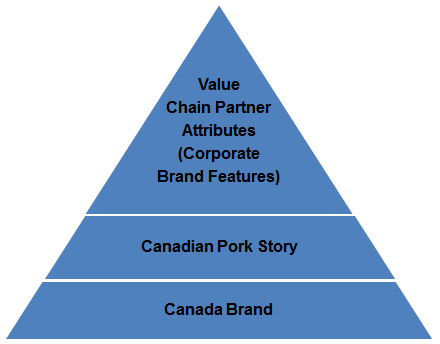

The first area of activity or "product" of the IPMF was the Canadian Pork Story, developed to serve as the basis of Canadian product differentiation. It was crafted by CPI with the input of the industry, and covered every aspect of the Canadian pork delivery system from regulations to feed to slaughter and processing. Much of what became the Story had existed in various corporate brochures, CPI promotional materials, government publications, etc., but CPI brought all of the elements together to form a cohesive and, by all accounts, a highly polished narrative. The Story would form the centrepiece of an industry branding pyramid, which had the Canada brand (for example, clean air, fresh water, open spaces, etc.) at its base and the various corporate brands at the top.

The Canadian Pork Story was used, in whole or in part, by CPI and its stakeholders to enhance and customize a wide range of promotional and marketing strategies and tools. The way in which the Story was used depended on a number of factors, including the overall level of sophistication of a target market, target market preferences and the nature of the audience (for example, at a seminar or trade show). For example, marketing materials using the Canadian Pork Story for Russian audiences reflected the fact that the Russian pork market was less sophisticated than others such as the Japanese or Korean markets; imports of Canadian pork into Russia were used mainly to make sausage.

Differentiating Canadian Pork

Interviewees provided many examples of how the IPMF contributed to the development of customized marketing efforts. For example, industry representatives highlighted their use of the Canadian Pork Story to help them differentiate Canadian pork quality and safety during outbound and inbound trade missions (for example, international trade fairs, as well as market specific missions). "We have been to Japan several times to meet the people who deliver our products to restaurants, hotels and grocery stores. These people have to understand the characteristics, advantages and history of our products, down to the last detail. We provide these individuals with written material, video, stickers etc. We have a Japanese web site to explain our products;" "The technical services group of CPI has been developing market support material which I believe is second to none. I've done retail seminars with supermarket chains in Philippines and the whole basis of my presentation was material developed by CPI. The Fund's role in helping us educate our clients about the uniqueness of the Canadian pork product has been critical."

Competitive Benchmarking

In addition to discussing how elements of the Canadian Pork Story were successfully used to develop customized seminars and presentations, interviewees placed a great deal of emphasis on explaining the value of two tools that were specifically developed using IPMF resources to allow the Canadian industry to differentiate its products: competitive benchmarking and the Canadian Pork Quality Standards. These tools were also the subject of a case study: Differentiating Canadian Pork Products.

Competitive benchmarking was, and continues to be, a service offered by CPI to its members: Member meat samples are cut by a local master cutter (for example, from the Japanese Meat Academy) to target market specifications and then tested against the competition on a number of key dimensions, including product quality and yield. The testing is "very sophisticated" involved a detailed report and a four-hour presentation.

Competitive benchmarking was used by a number of Canadian firms to tailor their products to more closely correspond to the preference and requirements of a specific market, notably Japan and Korea (prior to the impact of the lowering of tariffs on Canada's competitors). As one representative put it: "benchmarking provides excellent marketing intelligence against any competition. It helps to benchmark yield test, quality test, etc. … So when buyers question why they should get Canadian products on the shelf, we can give them a very detailed breakdown. We can show how Canadian products are better value."

Competitive benchmarking is popular. For example, a total of eight projects were completed in 2012, and 450 competitor products have been tested over the course of the program. Benchmarking has taken place in Japan and Korea while in Russia: "We showed them the technology, and they're interested in getting it." From CPI's perspective: "Competitive benchmarking was more successful than expected. Sometimes we're booked six months out."

Canadian Pork Quality Standards

The Canadian Pork Quality Standards is a ruler-like tool which took over two years to develop. It helps packers and other members of the industry rate quality according to meat and fat colour, as well as marbling. The tool allows users to more easily triage their meat according to market/buyer specifications, particularly in Japan, where, for example, customers like their fat to be white, not yellow. According to a representative of CPI, the Quality Standards have "become the meat quality bible in the scientific community."

A representative of the pork industry explained how the tool, which he called "the Score Card," was useful to his company: "What that allows us to do is sell into high value markets like Japan. We now have a yardstick that measures what they value and consistently produce according to the need. These markets will pay a premium if we can consistently deliver against what they want. You can't have a dialogue without a scorecard and CPI has developed that."

In addition to the above promotional strategies and marketing tools developed since program inception, CPI IPMF annual reports highlight continued promotional efforts specifically targeting Japan, South Korea, Mexico, Singapore, the US, and the Philippines.

Technical Seminars

There was broad agreement among the interviewees that the pork industry, with the support of CPI, has been successful in leveraging IPMF resources to differentiate their products. Some reiterated the importance and success of competitive benchmarking in allowing companies to differentiate their products, while others spoke of the relevance of trade missions, trade shows and seminars in educating potential customers about the Canadian Pork Story: "The seminars are really key in terms of getting the message out." Two industry representatives focused on their use of in-store product demonstrations in Asia: "What works very effectively in the Asian market is what we call ‘mannequin support,' or in-store sampling. We used the IPMF to run regular in-store sampling in Asia." This interviewee also went on to explain how IPMF resources allowed his company to participate in a retailer home delivery program; a program he described as "effective."

The Canada Pork Handbook

One of the purposes of the evaluation is to gauge how pervasive the focus on product differentiation was in the many plans, strategies, and activities that were developed and implemented through the IPMF. Competitive benchmarking was very effective at helping Canada tailor their products to the needs and preferences of specific markets. Similarly, the Canada Pork Handbook, Canadian Pork Quality Standards allowed processors and sellers to match their pork to a market, particularly the Japanese market, with a much greater level of precision. The Canadian Pork Handbook contributed to differentiating Canadian pork. About half of the Handbook is devoted to providing technical information, while the other half contains the complete Canadian Pork Story. The handbook spawned a chart of individualized cuts and merchandizing which one industry representative described as a tool that: "helped us drive more value out of pork protein." According to one CPI representative, the Canadian Pork Handbook "is the premier handbook in the world. South African regulators use this as their guide." The handbook is also the basis of the Distributor Education Program (DEP), a full day training session provided by CPI "for people coming into industry or who want to learn." The DEP was lauded by one industry representative as helping sales and marketing people to "really understand the Canadian pork product."

The Handbook, including the Canadian Pork Story, helped achieve a number of significant immediate and intermediate outcomes. According to a number of those who were interviewed, one of the key indicators of the Handbook's success is found in its level of uptake, that is, the prevalence of the tool within the Canadian industry as well as its proliferation among buyers, wholesalers, and retailers in export markets. The Handbook has achieved 100 percent utilization of 6,500 copies. Indeed, a second limited printing of the first edition will be required to meet demand before the second edition is ready. As one interviewee stated: "I think if we are talking about impact, then you have to look at the fact that none of these are lying in a box in some storage. Every single one of them is in use around the world."

The front line of the Canadian pork's marketing approach is the industry's sales and marketing force. It is through their work with buyers, wholesalers, and retailers in target markets that Canadian products are differentiated and successfully positioned and merchandized. Many of those who were interviewed as part of this evaluation highlighted the positive contribution that the DEP has made to the development of the industry's sales and marketing force. This finding was strongly supported by the case studies. The DEP, which is based on the Handbook, allowed sales and marketing representatives to more quickly develop, and to possess a better grasp of technical specifications: "It was really useful for the new sales people. You give them one of these and that's their bible. That's what they use to deal with customers. Within three or four weeks of using it and studying it, they really know what they are talking about." The DEP and Handbook also deepened representative's knowledge of the Canadian pork delivery system and thus enhanced their ability to differentiate Canadian pork based on quality and safety attributes (that is, The Canadian Pork Story). As noted by one interviewee, "they might have known some parts of the story before and emphasized those, but now they can really talk knowledgeably about the quality of Canadian pork and explain what gives it quality, like CQA, animal care, feed, all of that."

Moving from Canada to overseas, there was agreement among interviewees that the Handbook has been extremely well received in Canada's target export markets. It became a key reference tool in some countries and even the primary resource in a few others. Consistent with the "differentiation through education" approach, the specifications in the Handbook drove foreign buyers and processors to obtain it, and, in doing so, they also brought the Canadian Pork Story into their midst.

3.1.3 Outputs

Over the lifespan of the Fund, the following activities and outputs were implemented:

- The Canada Pork Handbook:

- the Canada Pork Handbook was developed, translated into French, Spanish, Korean, Chinese, Russian and Japanese, and printed in 6,500 copies all of which were distributed;

- the Handbook contains a wealth of technical information on pork cuts and merchandising – according to interviewees the Handbook is the premier pork handbook in the world and is used by other countries as their guide;

- the Handbook was used as the basis for 7 separate Distributor Education Program (DEP) modules;

- the Handbook contains the complete Canadian Pork Story which helps marketers differentiate Canadian pork in terms of quality and safety;

- Canadian Pork Quality Standards:

- a ruler like tool was developed for use in rating the quality of meat;

- Competitive Benchmarking:

- the competitive benchmarking program provided to Canadian packers and traders an opportunity to have their products professionally compared to domestic products in Japan, Korea, China and Russia – participating firms received a 100-page report and image catalog accompanied by a four hour presentation by a CPI technical expert covering alignment with local demands and preferences, quality, positioning, packaging, specifications, and workmanship allowing Canadian firms to tailor their products to specific markets – 8 benchmarking studies were conducted, 450 competitor products were tested;

- Technical Seminars:

- 25 technical seminars were delivered to audiences such as supermarket chains and other buyers in Japan, China, Russia, and the Philippines – seminars involved from 7 to 10 representatives from companies that sell Canadian pork and included between 70 and 250 potential customers – the emphasis was on "differentiation through education;"

- Japan Program:

- development of a Japanese website;

- assignment of a full-time Canadian pork representative to coordinate marketing activities in Japan;

- planning and delivering technical seminars and some 2,500 in-store product demonstration days per year;

- national and regional tradeshow participation;

- Japanese DEPs;

- consumer engagement events (for example, recipe contests, cooking seminars);

- point-of-purchase branding and promotion;

- advertising (for example, in trade, retail and consumer publications and flyers);

- technical marketing materials translated into Japanese;

- technical seminars in Tokyo and outside of Tokyo;

- Other Outputs:

- development and maintenance of a CPI website;

- attendance by CPI at 44 trade shows;

- 4 outreach missions;

- 5 incoming buyer missions;

- 27 trade relationship meetings; and,

- additional promotional materials to support in-store product demonstrations as well as other activities, including aprons, table cloths, displays, signage, consumer information, and key chains.

3.1.4 Immediate Outcomes

Limitations with respect to the evaluation methodology, owing to resource constraints, preclude the identification and measurement of distinct elements making up the kind of output chain traditionally associated with program evaluations. Nevertheless, outcomes observed following IPMF funded activities can be roughly divided into two groups. The second group, presented later in the report, relates to actual sales and expanded markets. The first group, presented immediately below, is comprised of outcomes observed to have occurred essentially immediately following, and in some cases during, the implementation of IPMF funded activities.

Recovery from pre-2009 Conditions

In terms of facilitating the pork industry's capacity to recover lost markets due to H1N1, CPI and the IPMF were credited by representatives of the industry as having had a tangible impact on the breadth and pace of the industry's recovery. As one interviewee noted, "the Fund definitely contributed to the recovery of the positive perception of Canadian pork products after H1NI. The Canadian industry recovered much faster than what would otherwise have been the case. The farther the market, the more difficult it is to recover;" "We were lucky to recover our reputation so quickly. The Canadian industry recovered much faster than would have otherwise been the case [without IPMF]."

Industry Cohesion

While it was not identified specifically as an evaluation question, the evidence from interviewees suggests that the Handbook fostered Canadian pork industry cohesion and communication in two significant ways. First, there was major industry participation in the development of the Handbook. The development of the Handbook, including the Canadian Pork Story, was led by CPI's in-house technical expert with significant and iterative input from industry specialists. Consultations took place during the creation of each chapter or major section. CPI relied on its extensive network of contacts to reach out to the top subject-matter experts in Canada: "If I know that this guy is the godfather of pork slaughter, then I'm going to draft that section and sit down with him to go through it." Each section was vetted a number of times. "There were many, many changes made." The second edition of the Handbook will be informed by the feedback received by CPI from industry.

The Canadian Pork Story also contributed to intra-industry cooperation and cohesion in a second way. The success of the Canadian Pork Story hinged on the willingness of members of the industry to accept the notion that the Canadian Pork Story applied to their competitors as much as it applied to them, without exception. The Story forms the middle level of a three-part branding pyramid which separates the "Canada Brand" at the base of the pyramid from the various corporate brand promises at the top of the pyramid (where they could differentiate themselves from their Canadian competition). Industry accepted the proposition that they would benefit in the long run if buyers and consumers in target markets came to understand that there is uniformity in the way hogs are raised, fed, slaughtered and processed in Canada, a uniformity based on science, concern for the environment, expertise and leading-edge safety and security throughout.

Recognition of Canadian Pork Products

The evaluation's case study on the Japanese market provides the best evidence and most illustrative information on how the IPMF was used in Canada's most important export market to increase the recognition and approval of Canadian pork products. According to CPI's Strategic Plan for the IPMF: "The principal strategic objective in Japan will be to increase the visibility of Canadian brands in the retail, and the Hospitality, Restaurant and Institutional (HRI) sectors in order to help Canadian brands increase their share of market segments."Footnote 17

IPMF-sponsored activities were wide ranging and extensive in Japan. Among these were point of purchase branding and promotion, consumer engagement events (for example, recipe contests, cooking seminars, etc.) and many trade shows. Two other activities stood out in the case studies and in the interviews as particularly effective at increasing recognition and approval of Canadian pork products: technical seminars and in-store product demonstration days.

The nature and content of the seminars varied depending on the audience (for example, restaurateurs/chefs, buyers). The seminars covered core issues, such as Canadian pork production and export performance, pork quality and safety systems, and competitive benchmarking. Other aspects of a seminar might have included a cutting and merchandising demonstration or a segment on recipes and cooking. A typical seminar could include 70 to 250 potential customers and seven to ten representatives from companies that sell Canadian pork. A number of interviewees felt that the seminars, which provided tangible benefits to attendees while also highlighting the Canadian Pork Story, were effective at building trust and confidence in Canadian pork providers. All of the seminars organized by CPI included the participation of companies that sell Canadian pork products. This allowed current and potential buyers of Canadian pork to meet suppliers or their agents and to ask questions and build relationships.

The point of the in-store demonstrations is to differentiate and position Canadian pork as the best import choice (that is, over the American alternative). Before IPMF, in-store demonstrations were relatively rare. Since IPMF, thousands have been conducted across Japan. The demonstrations have been very well received by supermarket chains: "They like it for a couple of reasons. They end up selling more pork that weekend, no question about that. They also like to do things for their customers; it creates a nice atmosphere." In-store demonstrations were viewed as crucial to growing the Japanese market, particularly in light of the Japanese consumers' loyalty to Japanese food: "You have to get them to try it, or they won't buy it. The Japanese are very loyal to Japanese food. The idea that a non-Japanese product could taste as good or better is hard to swallow."

According to one interviewee with extensive knowledge of the Japanese market, Canadian pork is sold in at least twice as many stores and supermarkets today as compared to 2009. All of the products are clearly identified as Canadian. The thousands of in-store demonstrations conducted by Canadian firms, as well as the CPI website, advertising, contests, and seminars have all been designed to raise awareness of Canadian pork's quality and safety and to differentiate it from the US alternative. The views of key informants were that, collectively, all of these activities have enabled Canadian pork to be effectively differentiated and positioned in the Japanese market. And, similarly, that there has been a significant increase in the recognition and approval of Canadian pork, particularly chilled products in Japan.

Representatives of CPI and AAFC spoke about the contribution that three logos had played in helping to increase recognition of Canadian pork: The Canadian Quality Association (CQA, the OFFSRP for hog producers), Hazard Analysis Critical Control Points (HACCP), and Canadian pork logo, along with supporting materials, such as a pork quality and safety video available in seven languages. More frequently, however, the IPMF supported seminars and trade missions that were highlighted by interviewees as having contributed to solidly establishing the Canada Brand in key markets, notably Japan, by educating potential customers about the unique quality and safety attributes of their products: "We became pioneers. For the first time, we talked about the colour dynamics of meat and its relationship to quality. We explain all that. In Asian markets they never really thought about those things in the past. We explain how nutritionally, Canadian pork is superior. People are receptive to becoming educated about their passion for pork. These are the positive messages we are able to deliver because of the fund."

3.1.5 Intermediate and Long-Term Outcomes

Value of Canadian Pork Products

The CPI's Strategic Plan focused on developing approaches that would allow the industry to obtain a higher value (or price) for pork. As discussed earlier in the report, this orientation was meant to counter US exporters' emphasis on price and volume, as well as to exploit the superior nature of the pork sold by Canada.

The analysis of export trade data reveals that the value of Canadian pork exports has increased since the program's inception. The qualitative data, including the interviews and, in particular the case study of the Japanese market, strongly suggests that the IPMF-related marketing strategies and activities had a significant role to play achieving success on the export value front.

On a global level, from 2009 to 2012 the volume of pork product exports rose by 10.6 percent, while the value of these exports rose by a margin of 22.9 percent. When the IPMF was initiated in 2009, Japan (33% of total exports) and the United States (32% of total exports) made up almost two thirds of Canada's $2.6 billion export market for pork products. Hong Kong, South Korea, and Australia each accounted for 5 percent of the export market, China and Mexico each accounted for 2 percent, the Russian Federation accounted for 4 percent, and all other markets combined for 12 percent. Data from 2012 shows the US to comprise 31 percent of Canada's $3.2 billion in pork product exports, with Japan allotting for 27 percent, the Russian Federation for 15 percent, Australia for 3 percent, South Korea for 4 percent, Hong Kong for 1 percent, China for 7 percent, Mexico for 3 percent, and all other markets combined for 9 percentFootnote 18.

The overall increase in export value relative to volume is consistent with the rising price of Canadian pork over this same period. At program inception in 2009, Canadian pork was valued at $2.40/kilogram. The price peaked at $2.80/kilogram in 2011, and in 2013 it sat at $2.70/kilogram, demonstrating an increase of 11.5 percent from 2009. In terms of specific markets, the value of Canadian pork per kilogram has increased by 23.5 percent in the US, 10.5 percent in Japan, 62.5 percent in Russia, 10 percent in Mexico, 12.4 percent in China and 21.9 percent in the Philippines. The value of Canadian pork products per kilogram has remained consistent in China and has decreased by 6.6 percent in South Korea, where tariffs on Canadian pork have made high value cuts too expensive to compete.

Members of the industry who were interviewed as part of the case studies noted that there had clearly been an increase in the value of Canadian pork exports, particularly into Japan: "We're exporting more chilled pork that is, fresh, vacuum packed, not frozen, and that's where the highest value is because it's fresh." Representatives of CPI corroborated the view that the value of Canadian pork products has risen. Again, thanks in large part to an increase in the volume of Canadian chilled pork entering Japan: "The numbers are there: In 2010 about one-third of our exports to Japan was chilled, now most of it is chilled." Packer involvement in competitive benchmarking and in-store demonstrations in Japan were seen as having played a key role in increasing chilled pork sales in Japan.

Overall, there was strong agreement among interviewees that the IPMF has contributed to an increase in the international market share for Canadian pork. In some markets, this meant increasing Canada's share, while in other countries, such as Korea and Russia it meant gaining market share and then "fighting to try to keep it." Some interviewees noted the inroads that had been made by Canadian companies in the Philippines, where the market for imported pork has more than tripled from 2009 to 2013, and where Canada's share of the market grew from 23.3 percent in the 2012 to 26 percent in 2013.

The CPI member and key stakeholder surveyFootnote 19 conducted as part of an evaluation to assess the performance of the IPMF between 2009 and 2011, also found that stakeholders and most members felt that the program had made a difference to the industry by helping them enter and/or grow export markets. Improved exports to countries such as Russia, Japan, China, South Korea, former Soviet republics, Colombia, South Africa, the Philippines, and the Caribbean were specifically mentioned.

Expanded Market Opportunities

The evaluation questions of expanded market opportunities and of the Canadian pork industry's success at capitalizing on these opportunities are discussed together below. The export data and the qualitative evidence strongly suggest that the Canadian industry was very effective at capitalizing on expanded market opportunities. The qualitative data also suggests that the industry, with the assistance of CPI and the IPMF, worked to make the most of these opportunities.

The question of expanding market opportunities can be looked at in three ways based on market maturation. First, we have the extent to which Canadian pork has entered completely new markets in the years between 2009 and 2013. These markets would also tend to be the least mature. Second, there is the extent to which opportunities in existing maturing markets have increased with respect to volume and value (for example, The Philippines). And third, we have the opportunities associated with selling higher value pork products in mature markets (for example, US and Japan). This way of assessing market potential was reflected in CPI's Strategic Plan, which categorized markets according to their growth potential, from "A" to "D".

The Strategic Plan identified Japan, the US, China/Hong Kong, South Korea, Russia and Mexico as the markets with the most opportunity (that is, "A" Markets). The overall strategy was to develop a marketing approach that would allow the industry to obtain a higher price (or value) for their pork. Within "A" markets, however, the nature of the opportunity varied based on the sophistication and maturation of the market. China/Hong Kong and Russia presented good volume opportunities and some value opportunities. The opportunities that existed in the very competitive and mature US and Japan markets, conversely revolved around increasing value, not volume. South Korea and Mexico presented both value and volume opportunities. The evolution of the value and volume of exports into each of the "A" market over the life of the IPMF is highlighted below.

- United States:

- The Canadian industry has capitalized on the value opportunities in the US market. From 2009 to 2012 Canadian export volume has decreased slightly by 2.6 percent ($329 million in 2009 to $320 million in 2012), while the value of exports has risen significantly by 17.6 percent ($834 million in 2009 to $981 million in 2012).

- Japan:

- The gains made by the Canadian pork industry in Japan have been in terms of value. From 2009 to 2012, exports volume has shrunk by 6.2 percent (227 million kilograms in 2009 to 213 million kilograms in 2012), while total export value has actually increased by 1.5 percent ($865 million in 2009 to $878 million in 2012). It is important to note that the overall Japanese market for all imported pork products actually shrank by about two per cent over this period, in part due to changes in the regulations that govern the importation of frozen pork. Underneath these aggregate numbers, we can see the great success that the industry has had in moving from exporting frozen to fresh pork. According to CPI's statisticsFootnote 20, Canada's share of the chilled pork market grew from 24 percent in 2010 to 30 percent by the end of 2013. In terms of export value, 60 percent of Canadian pork exports to Japan were made up of the highest value chilled category in 2013, compared to only 30 percent in 2010. There was strong agreement that CPI's marketing activities in Japan had a significant impact on increasing Canadian chilled pork exports into this country: "The results really are there."

- South Korea:

- At program inception in 2009, Canada had $125.5 million in value and 63.6 million kilograms in quantity of exports to South Korea. By the end of 2011, the Canadian industry appeared to have been taking full advantage of the opportunities afforded by this market with the volume of exports increasing by about 50 percent and the value almost doubling ($233 million in 2011). The negative impact of the US-South Korean Free Trade Agreement on the competitiveness of Canadian pork, particularly higher value cuts, was strongly felt in 2012, when both export volume and value fell back to 2009 levels.

- China:

- The Canadian industry has capitalized on both the volume and value opportunities presented by the Chinese market. From 2009 to 2012, there was an overall increase of 527.2 percent in value ($39 million in 2009 to $240 million in 2012) and 425.7 percent in quantity of Canadian pork exports to China (27 million kilograms in 2009 to 139 million kilograms in 2012).

- Hong Kong:

- In the eyes of many in Canada's pork and beef industries, Hong Kong, China and Macao form a single market with various entry points. As imports of Canadian pork directly into mainland China grew rapidly from 2009 to 2012, it is not surprising to find that exports into Hong Kong shrunk significantly over this period, by 81.2 percent in value ($118 million in 2009 to $22 million in 2012) and 80.8 percent in quantity (79 million kilograms in 2009 to 15 million kilograms in 2012).

- Russia:

- At program inception in 2009, Canada had $101.8 million in value and 58.8 million kilograms in quantity of exports to Russia. Exports have followed an increasing trend since 2009, with peak exports in 2012 totaling $492 million in value and 207.1 million kilograms in quantity. This demonstrates an overall increase of 383.3 percent in value and 251.8 percent in quantity from 2009. According to those who were interviewed as part of this evaluation, the Russian market is notoriously volatile and non-tariff trade barriers affecting trade can be put up very quickly.

- Mexico:

- The value and volume of Canadian pork exports to Mexico have increased in lockstep from 2009 to 2012, 40.8 percent in value ($59 million in 2009 to $82 million in 2012) and 40.6 percent in quantity from 2009 (43 million kilograms in 2009 to 61 million kilograms in 2012).

The consensus view among interviewees was that the Canadian pork industry had been very effective in capitalizing on expanded market opportunities. According to industry representatives, Canadian companies were taking market share from the Americans in the Japanese chilled pork market and also beating the Europeans in the Philippines and the Americans in China: "There is no question that all the work that CPI has done in the Japanese market has paid off. Our company's been involved in all of it: the benchmarking, the outbound and the inbound missions. It's increased our sales."

Prior to the trade barrier restrictions imposed by Russia and Korea, Canada was said to have become the top supplier in those markets. It is important to note that these achievements are only a few years removed from what many consider to be the Canadian pork industry's nadir. In terms of success factors, "the good relationship" which CPI enjoys with the industry, was highlighted: "CPI always had good support from their members. Industry will tell CPI if not doing it right. Industry is very supportive of CPI. CPI worked well with their members."

3.2 Efficiency and Economy of the Program

The evaluation included questions concerning the extent to which the IPMF was delivered in an economical and efficient manner. The evidence from the key informant interviews and the case studies strongly suggests that IPMF funds were well-managed overall. More specifically, CPI was successful at producing key inputs in an efficient and cost-effective manner. These findings are consistent with the results of the 2012 Interis evaluation which found a very high level of satisfaction among CPI members with the Fund's management.Footnote 21

The activity-based analysis undertaken as part of this evaluation, suggests a positive return on investment (ROI). This finding is also consistent with the results of the Interis evaluation.

Some of the key lessons learned from the evaluation of the IPMF stem from CPI's attempts at improving the efficiency and economy of their activities and outputs.

3.2.1 Estimated Return on Investment: Activity-based Analysis

The evaluation included an activity-based analysis, aimed at comparing IPMF expenditures to Canadian pork industry exports. This analysis provides a rough indicator of the extent of the IPMF's ROI.

Little research has been conducted to quantify the benefits of increased marketing expenditures to the export of pork products in Canada. The interim evaluation of the IPMF, however, made a qualitative link between the activities of CPI and pork product exports using subjective estimates made during interviews conducted with CPI members. The interim evaluation reported that CPI members estimated that 15 percent to 30 percent of their export revenues are dependent on continued support from CPI.Footnote 22

Table 2 shows that during 2010 to 2013 Canada exported over $12 billion worth of pork products around the world. Using the low end of the CPI member estimate (that is, 15%), the benefits of the IPMF over the life of the program are estimated to be about $1.8 billion (that is, the increased aggregate export revenue associated with the IPMF). This suggests an ROI of roughly 107:1.

| Year | Canada's Global Pork Product Exports | 15% of Exports |

|---|---|---|

| 2010 | $2,768,482,882 | |

| 2011 | $3,205,814,385 | |

| 2012 | $3,199,015,367 | |

| 2013 | $3,193,050,920 | |

| Estimated Total (2010-2013) | $12,366,363,554 | 1,825,996,895 |

There are 3 limitations that should be considered as part of this analysis.

- Reliance on the CPI member estimate attributing 15 percent to 30 percent of the value of pork exports to the program.

- Individual Canadian pork industry companies spent their own (non-IPMF) money on marketing activities in target markets (for example, travel costs are only partially subsidized by IPMF, companies pay competitive benchmarking fees, in-store product demonstrations in Japan are paid for by companies, etc.)

- The analysis does not take into account external factors that could have enhanced or diminished export opportunities for Canadian pork in each target market. The two most significant of these were the negative impact of the US-South Korea Free Trade Agreement and the ban on Ractopamine, particularly where the Russian market is concerned.

3.2.2 Economy of Program Administration

There was a general perception among those who participated in the evaluation that the IPMF was a well administered program that produced outputs economically, and which provided a very good ROI. The program's strong ROI was highlighted by industry representatives, as well as CPI executives. The latter group also felt that they had utilized Fund dollars very efficiently: "We did a lot with very little staff." For their part, AAFC program officials described the program as "very well managed."

In terms of the external factors and risks that could have affected economy and efficiency, interviewees agreed that the international pork trade was subject to many risks and affected by all manner of events, including the outbreak of disease and the sudden imposition of trade restrictions. From CPI's perspective, the funding flexibility inherent in the IPMF "helped to mitigate the impact" that negative external events and contextual issues could have had on the pork industry and their market strategies and activities; it allowed them to react quickly and decisively.

The case studies provided the opportunity to examine in-depth how some of the key outputs of the IPMF were produced, including the weighing of alternative approaches and the decisions that were made in an effort to maximize efficiency and economy. There are a number of findings that allow us to conclude that the Canadian Pork Handbook, including the Story, was designed and developed cost-effectively within the key constraint of having to produce a very high-quality and specialized product. These findings include:

- the extensive use of in-house and pro bono Canadian pork industry expertise;

- use of a competitive bidding process for the awarding of the production contract;

- use of existing meat photographs, where possible as a cost- and time-saving strategy; and,

- the leveraging of Russian and Chinese assistance in the Handbook's translation, leading to both cost savings and an optimally translated product.

The reasons for the creation of the CPI's Japan Marketing Office and the number and quality of outputs the Office has generated, reveal that alternatives were not only considered for using Fund resources, but also implemented. It also strongly suggests that this alternative allowed the Fund to be used more efficiently and effectively in Canada's most important export market for pork.

Prior to opening its Japan office, CPI relied on Japanese firms to develop and implement its marketing activities in Japan. This approach yielded very poor value for money according to CPI executives. The IPMF, which provided CPI with longer-term funding, gave the organization the opportunity to explore another option: to hire someone in Japan to coordinate marketing efforts and to liaise with both the Canadian pork industry and Japanese customers. CPI found this approach to be successful and less expensive.

4.0 Conclusions

This evaluation suggests that the IPMF generated a number of significant outcomes, thereby creating a good return on the Government of Canada's $17 million investment in the pork industry. The program's positive ROI manifests itself in several ways, only one of which can be currently expressed in dollars. The four elements of IPMF's ROI are discussed below.

The International Pork Marketing Fund and the Canadian Pork Industry Crisis

The IPMF was created at a time when the pork industry was experiencing one of the worst crises in its history: an outbreak of H1N1 layered over a financial crisis that was affecting the profitability of producers and processors, and threatening the survival of the industry. Key informants interviewed as part of this evaluation gave a significant amount of credit to the IPMF and CPI for helping the industry recover from crisis.

The International Pork Marketing Fund and Market Expansion

Canadian pork export figures suggest that the industry not only recovered from its crisis, it also returned to profitability, and even experienced growth with respect to both the volume and value of exports as seen by 2013 export data. CPI's strategy of focusing on increasing the value obtained for Canadian pork products based on a strategy of product differentiation contributed to a 23 percent increase in the value of exports over a three-year period from 2009. The qualitative evidence from this evaluation supports the conclusion that the IPMF had a large role to play in this growth. This conclusion is also consistent with the findings of the 2010 Interis evaluation.

The International Pork Marketing Fund and the Industry's International Marketing Capacity

The innovative strategies and tools that were developed by CPI, in concert with the industry through the IPMF, can continue to be used in current target markets, as well as to capitalize on future market opportunities. The Canada Pork Story, the Canadian Pork Handbook, the Canadian Pork Quality Standards, Competitive Benchmarking, etc. are among the key elements of the IPMF's legacy. These and other tools, such as the product differentiation strategy and the "friendly partner approach" were demonstrated to have been highly successful. The IPMF has run its course, but all of its tools and proven strategies can continue be used to take advantage of opportunities in the Philippines, China, Korea (in light of Canada's recent free trade agreement with this country) and other markets. In this sense, calculating the IPMF's ROI will be another few years in the making.

Lessons Learned and Potential Best Practices

The biblical story of David and Goliath was used by a number of those who participated in the evaluation to describe the competition between Canada and the US in the international pork market. The evaluation suggests that this analogy is apt: Canadians can compete and even beat the US in some markets, despite being outspent on marketing and out-priced on product, if they can develop innovative marketing approaches to allow them to compete on quality (or possibly other attributes).

The development of innovative and unique marketing tools can help mitigate marketing resource disparities. The Canadian Pork Handbook, and in particular competitive benchmarking and the Canadian Pork Quality Standards, were leveraged by the industry to increase their share of the Japanese chilled pork market, despite being outspent by competitors. Similarly, the CPI's overall strategic approach, dubbed "the friendly partner" by some, appears to have been effective at helping CPI and the industry to differentiate Canadian pork in key target markets, including Russia and China. The Canadian approach stands in contrast to the US strategy which has been described as the "price and parties" approach. The Canadian pork industry's success suggests that other Canadian agricultural export industries could also compete on quality/value over price/volume. This lesson is highly relevant in the global economic context in which Canadian exporters find themselves competing. The potential for market growth is significant as countries such as China, India, Mexico, Brazil and others continue to develop and expand their middle class. Some of these markets, however, may also be able to provide a lower cost alternative to Canadian agricultural (and other) products, adding to the competition that Canada already faces from the US and the EU.

The pork industry representatives and others who participated in the evaluation pointed to several key lessons learned and potential best practices for future industry market development initiatives. These are identified below.

- The IPMF funding formula promotes more aggressive marketing:

- The 75:25 funding ratio was seen to provide businesses with diminished financial risk (that is, relative to the standard 50-50 formula) and thus, the impetus to adopt more "more aggressive" strategies.

- The effectiveness of in-store demonstrations:

- The case study of the Japanese market suggests that in-store demonstrations are an effective way to introduce products to Japanese consumers. This tactic also helps to build recognition and approval of a product and can contribute directly to sales volume increases and market expansion.

- The cost-effectiveness of having someone on the ground:

- In some foreign markets, such as Japan, it may be more cost-effective in the long-run to hire someone to manage local suppliers than it is to try to manage projects and activities from afar.

- The positive impacts of having longer-term, stable funding:

- Many interviewees spoke about what they saw as the dramatic benefits of having access to stable longer-term funding. It was not simply that they might be able to do more, it was that they could do different things that required long-term planning and development, such as opening the Japan Marketing Office and the development of the Canadian Pork Quality Standards: "It's not something that you are going to do if you don't know if or how much funding you're going to receive from one year to the next." It was also felt that the upfront funding method allowed the industry flexibility to react swiftly to sudden situations and crisis: "The lump sum up-front gave us the flexibility to react to different trade issues immediately." It is probably fair to say that for CPI, this is the key lesson to be learned from the IPMF.