Table of Contents

AAFC portfolio and partner organizations

Agriculture and Agri-Food Canada portfolio and partner organizations

Agriculture and Agri-Food Canada (AAFC) works with partnering organizations and agencies that regulate aspects of the agriculture sector. The Department and its portfolio partners report to Parliament through the Minister of Agriculture and Agri-Food, excluding the Canadian Food Inspection Agency (CFIA), which reports to the Minister of Health. However, the Minister of Agriculture continues to be responsible for CFIA’s non-food safety agricultural activities, including work related to plant health, animal health and trade issues. The Deputy Minister of Agriculture and Agri-Food is responsible for advising the Minister on all matters under the Minister’s responsibility and authority. The organizations within the Agriculture and Agri-Food portfolio are responsible for ensuring that policies and programs are coordinated and work to serve the interests of the sector and Canadians.

Canadian Food Inspection Agency

History: The Canadian Food Inspection Agency (CFIA) was established in 1997 as a regulatory body. It is a science-based regulatory agency focused on mitigating and managing risks related to food safety, animal health and plant protection and prioritizes the health and safety of Canadians. CFIA transitioned from the Agriculture and Agri-Food portfolio to the Health portfolio in October 2013 to better align federal authorities related to food safety.

Mandate: In considering CFIA’s mandate, there are key areas where its activities can impact and influence the competitiveness and economic interests of the sector, particularly:

- Food safety, animal health and plant protection;

- Domestic and international trade and market access; and

- Regulatory modernization.

Activities: The Minister of Health is responsible for the overall direction and budget of CFIA and for issues related to food safety. CFIA continues to report to the Minister of Agriculture and Agri‑Food for non-food safety activities and economic and trade issues (for example, related to animal health, plant protection, market access and agricultural inputs such as feeds, seeds and fertilizer). CFIA collaborates with a variety of departments across all levels of government, stakeholders and interest groups to deliver its mandate.

There are instances where CFIA will be required to brief and seek approval from both the Minister of Agriculture and Agri-Food and the Minister of Health on issues and initiatives that cross areas of responsibility. These include issues such as biotechnology or animal or plant issues that may impact the food supply, such as antimicrobial resistance, as well as market access issues that relate to food safety.

Funding: Total planned spending on core responsibilities and internal services is $838 million in 2022–23 and total planned revenue from all business lines (food safety, animal health and plant health) is $53 million.

(Sources: 2022–23 Estimates – Parts I and II The Government Expenditure Plan and Main Estimates)

FTEs: 6,355 employees

President: Dr. Harpreet S. Kochhar

Appointment: February 27, 2023 to February 26, 2027.

Farm Credit Canada

History: Farm Credit Canada (FCC) is a Crown corporation, created in 1959 through the Farm Credit Act. FCC’s Corporate Office is located in Regina.

Mandate: FCC provides specialized and personalized business and financial services and products to the agriculture and food industry.

Activities: With a portfolio of more than $44.5 billion in loans (March 31, 2022), FCC is Canada’s largest provider of capital to agriculture, agri-business and food producers. FCC has close to 102,000 customers serviced by 102 field offices across Canada. FCC provides financing, software, learning programs and other business services to advance the business of agriculture and food. FCC also makes investments in venture capital funds to address the need for alternative financing in the agriculture and food industry. It also partners with accelerators to provide connections and mentorship to accelerate the growth of start-ups and emerging businesses.

Funding: FCC is self-sustaining and is not dependent on government appropriations. Funds to support its operations are borrowed directly from the Government of Canada under the Consolidated Borrowing Program, which must be approved by the Minister of Finance and Treasury Board.

Budget: Last fiscal year, FCC portfolio increased 7.6%, or $3.1 B to $44.5 B and net income amounted to $931.8 million.

(Source: Annual Report 2021-22)

FTEs: 2,300

Board of Directors:

President & CEO: Ms. Justine Hendricks

Appointment: January 30, 2023 to January 29, 2028

The President and CEO of FCC is responsible for the supervision of the business of the corporation. Working with the Board of Directors, he is responsible for the strategic leadership of the corporation and for providing leadership and advice to the Board on all matters of policy affecting the direction and operation of the corporation.

Board Chair: Ms. Jane Halford

Appointment: April 22, 2020 to April 21, 2024

The Chairperson serves as the FCC’s primary liaison to the Minister of Agriculture and Agri‑Food and is responsible for leading the 12-member FCC Board of Directors while working closely with the CEO.

Director: Rita Achrekar

Appointment: May 21, 2021 to May 20, 2025

Director: Bertha Campbell

Appointment: February 1, 2022 to January 31, 2025 (re-appointed)

Director: Sylvie Chagnon

Appointment: May 21, 2021 to May 20, 2025

Director: Sylvie Cloutier

Appointment: January 27, 2023 to January 26, 2026 (re-appointed)

Director: Laura Donaldson

Appointment: February 1, 2022 to January 31, 2025 (re-appointed)

Director: Michele Hengen

Appointment: May 21, 2021 to May 20, 2024 (re-appointed)

Director: James Laws

Appointment: May 21, 2021 to May 20, 2024 (re-appointed)

Director: Michael Tees

Appointment: May 21, 2021 to May 20, 2025

Director: Govert Verstralen

Appointment: February 1, 2022 to January 31, 2025 (re-appointed)

Director: Vacant

Appointment:

Canada Agricultural Review Tribunal

History: The Canada Agricultural Review Tribunal (CART) is an independent quasi-judicial administrative tribunal created in 1998. Its office is located in downtown Ottawa.

As of November 1, 2014, CART became one of twelve tribunals that are supported by the Administrative Tribunals Support Services of Canada (ATSSC). The ATSSC allocates a budget to CART and provides administrative support, but CART remains part of the Agriculture portfolio. AAFC continues to be responsible for formulating policy in support of the administration of CART, and the Minister continues to have authority for appointments; however, CART remains independent in its review processes.

Mandate: CART’s mandate is to give the public the opportunity to request reviews of certain decisions or penalties imposed under various agriculture and agri-food acts; requests for reviews come from individuals and industry. In this regard, the organization plays a key role in ensuring a fair and efficient administrative monetary penalty system.

Activities: CART’s main focus is to review Notices of Violation issued by Canadian Food Inspection Agency, the Canada Border Services Agency and the Pest Management Regulatory Agency, in order to protect public health, animal welfare and plant life. In 2021–22, CART rendered decisions on 37 cases and carried forward 39 cases to 2022–23.

Funding: In 2021-2022, the ATSSC allocated to CART approximately $1.13 million for all operations.

FTEs:8 employees, 1 full-time member, 3 part-time members

Chairperson: Ms. Emily Crocco

Appointment: January 17, 2023 to January 16, 2028

The Chairperson is a full-time member of CART and its CEO. In this capacity, the Chairperson is accountable for the effectiveness and efficiency of CART’s operations and reports to Parliament through the Minister of Agriculture and Agri-Food. However, because of the size of the Tribunal, it is not an independent entity under the Financial Administration Act (FAA). According to the FAA, CART obtains all of its funds from AAFC and must comply with AAFC and Treasury Board policies and approvals. Therefore, the Minister of Agriculture and Agri-Food must approve CART’s financial expenses.

Part-Time Member: Geneviève Parent

Appointment: August 31, 2021 to August 30, 2024 (re-appointed)

Part-Time Member: Marthanne Robson

Appointment: December 14, 2021 to December 13, 2025 (re-appointed)

Part-Time Member: Patricia Farnese

Appointment: December 13, 2021 to December 12, 2024 (re-appointed)

Canadian Dairy Commission

History: The Canadian Dairy Commission (CDC) is a Crown corporation, created in 1966 by the Canadian Dairy Commission Act. Its office is located in Ottawa on the Central Experimental Farm.

Mandate: To ensure that the supply-managed system in the dairy sector is working to benefit producers through a fair return for their production and that consumers have an adequate supply of high-quality dairy products.

Activities: The CDC chairs the Canadian Milk Supply Management Committee and provides ongoing support to Canada’s dairy industry, in co-operation with stakeholders and governments. The CDC also administers revenue pooling agreements, manages national targets for milk production and the farm gate price of milk and administers programs. It has authority to buy, store, process and sell dairy products on domestic and export markets. In August 2019, the Government announced that the CDC would administer and deliver payments to dairy producers under the Dairy Direct Payment Program.

Funding: The CDC receives funding from Parliament, dairy producers, the marketplace and its commercial operations.

Budget: $14.2 million for the dairy year ending July 31, 2023, including $4.3 million from government appropriations. The remaining $9.9 million is funded by CDC’s commercial operations, from milk producers for programs administered on their behalf and from the marketplace for the storage of butter.

(Source: CDC 2022–23 to 2026–27 Corporate Plan)

FTEs: 73

CEO: Mr. Benoit Basillais

Appointment: July 4, 2022 to July 3, 2026

The CEO is responsible for overall operations and management of the CDC and serves as the primary liaison between the CDC and dairy industry stakeholders and government officials.

Chairperson: Ms. Jennifer Hayes

Appointment: December 23, 2021 to December 22, 2025

The Chairperson serves as the CDC’s primary liaison to the Minister of Agriculture and Agri-Food and is responsible for leading the CDC Board of Directors while working closely with the CEO and Commissioner.

Commissioner: Shikha Jain

Appointment: September 15, 2022 to September 14, 2026

The Commissioner supports both the Chairperson and the CEO in their functions and chairs the CDC Audit Committee.

Canadian Grain Commission

History: The Canadian Grain Commission (CGC) was created in 1912 through the Canada Grain Act (CGA). Its headquarters are located in Winnipeg.

Mandate: In the interests of grain producers, the CGC’s mandate, as set out in the CGA, is to establish and maintain standards of quality for Canadian grain, to regulate grain handling in Canada and to ensure a dependable commodity for domestic and export markets.

Activities: In carrying out its mandate and supporting its vision to be a leader in delivering excellence and innovation for the grain industry, the CGC’s key activities are:

- Quality assurance;

- Quantity assurance;

- Producer protection; and

- Grain quality research.

In Western Canada, the CGC is mandated to license and regulate the entire grain handling system, from the primary elevators, where grain is first received from producers, to the terminal and transfer elevators, where it is exported to foreign buyers.

Funding: The CGC is funded through appropriations from Parliament and fees charged for services delivered.

Budget: $74.6 million (funded by $6.8 million in annual government appropriation and $67.8 million in user fees revenue/use of accumulated surplus). (Source: CGC 2021–22 Departmental Plan)

FTEs: 482

Chief Commissioner: Mr. Doug Chorney

Appointment: December 18, 2020 to December 17, 2023

The Chief Commissioner reports directly to the Minister of Agriculture and Agri-Food, and administers and enforces the CGA. The Chief Commissioner also serves as the CEO and provides overall direction and leadership to the staff of the Commission in administering the Act and regulations and in the provision of services to the grain industry.

Assistant Chief Commissioner: Ms. Patty Rosher

Appointment: February 15, 2021 to February 14, 2025

Commissioner: Mr. Lonny McKague

Appointment: February 13, 2021 to February 12, 2024 (re-appointed)

Farm Products Council of Canada

History: The Farm Products Council of Canada (FPCC) was created in 1972 by the Farm Products Agencies Act (FPAA), which provides for the creation of national marketing agencies for supply managed sectors (excluding dairy) and promotion and research agencies (PRAs). Its office is located in Ottawa on the Central Experimental Farm.

Mandate: The FPCC’s responsibilities, as defined in the FPAA, are to:

- Advise the Minister on all matters relating to the establishment and operations of agencies under the FPAA with a view to maintaining and promoting efficient and competitive industries;

- Approve production quota regulations and levies orders, licensing regulations and certain by-law provisions;

- Work with agencies in promoting more effective marketing of supply managed farm products;

- Investigate and take action, within its powers on any complaints related to national agency decisions; and

- Hold public hearings when necessary, such as when new agencies are proposed.

Activities: FPCC works with and supervises the operations of the following six agencies established under the FPAA to ensure that they are promoting a strong, efficient and competitive production and marketing industry and operate in the interests of producers and consumers.

- Egg Farmers of Canada (1972)

- Turkey Farmers of Canada (1974)

- Chicken Farmers of Canada (1978)

- Canadian Hatching Egg Producers (1986)

- Canadian Beef Check-Off Agency (2002)

- Canadian Pork Promotion and Research Agency (2020)

- A hemp promotion and research agency is currently in development.

FPCC also administers the Agricultural Products Marketing Act (APMA), on behalf of AAFC. The APMA allows the federal government to delegate its authorities over interprovincial and export trade to provincial commodity boards on a wide range of farm products. This enables boards to collect “check off” duties from producers of commodities in order to fund research, marketing and other activities of general benefit to the sector.

Funding: The FPCC is funded entirely through appropriations as part of AAFC’s ongoing votes listed in the Main Estimates.

Budget: The 2022–23 forecasted budget is approximately $3 million

FTEs: 16

Chairperson and Member: Brian Douglas (full-time)

Appointment: June 11, 2022 to June 10, 2026 (re-appointed)

The Chairperson of the FPCC is appointed by the Governor in Council and reports to the Minister, providing advice on the activities, objectives, requirements and policies of the Council and on all matters relating to the establishment, operation and performance of agencies under the FPAA. FPCC is composed of between three and seven members. Currently, the FPCC has five members.

Vice-Chairperson: Vacant (Appointment package submitted to PCO for GIC-approval)

Appointment:

Member: Maryse Dubé

Appointment: April 30, 2021 to April 29, 2025 (re-appointed)

Member: Morgan Moore

Appointment: June 19, 2022 to June 18, 2024 (re-appointed)

Member: Vacant (Appointment package submitted to PCO for GIC-approval)

Appointment:

Mandate letters for portfolio partners

██████

██

███

█

███

███

████

███

█████████████████████████████████████████████

██████████████████████████████████████

█████████████████████████████████████████████████████████████████████████████████████████████████████████████

█████████████████████████████████████████████████████████████████████████████

███████████████ ██████████

███████████████ ███████████████ ████████████

███████████████ ███████████████ ███████████

███████████████ ███████████████ ██████████████████

███████████████ ██████████████████████

███████████████ ███████████

███████████████ ██████████████████████

██████████████████████

███████████████████████

███████████████ ███████████████ ██████████

████████████████████████

█████████████████████████████████████████████████

██████████████████████████████████████

███████████████████████████████

██████████████████████

███████████████████████████

██████████████████████████████████████████████████ ███████████████ ██████████████

███████████████████████████████████████████████

█

██████

Mandate letter for the Canadian Dairy Commission

Quote: 271121

Ms. Jennifer Hayes

Chairperson

Canadian Dairy Commission

960 Carling Avenue, 1st Floor

Ottawa Ontario K1A 0Z2

Dear Ms. Hayes:

From day one, the Government has recognized the importance of a vibrant and sustainable agriculture and agri-food sector to Canada's economy and food security. The Government also recognizes the dairy supply management system as a social contract that contributes significantly to the vitality of many rural communities and family farms across the country.

Despite many recent challenges, including the COVID-19 pandemic, Canadian dairy producers and processors have shown exemplary resilience and continue providing high-quality products in a particularly difficult context. I would like to thank the Canadian Dairy Commission (CDC) for supporting the dairy sector in responding to these challenges and I am pleased that the Government was able to help by quickly increasing your credit limit.

Looking ahead, I expect that the CDC and Agriculture and Agri-Food Canada (AAFC) will continue to work closely with industry partners as they pursue their future vision for an innovative and sustainable sector. Reducing Canada's greenhouse gas emissions and adapting to climate change remain urgent priorities for the Government, and the agriculture sector must be a front line partner. I am grateful that the Dairy Farmers of Canada is aiming for carbon neutrality by 2050, and the CDC should support this endeavour.

In keeping with the ambitious environmental commitments outlined in the Government's climate plan, it is increasingly important for government organizations to collaborate with partners across the dairy value chain in reducing the environmental footprint of the dairy sector. The CDC has a collaborative role to play in supporting broad climate resiliency, as well as supporting industry in making dairy supply chains more efficient through eliminating food waste and finding innovative ways to add value.

Additionally, I am asking you to provide the leadership necessary to ensure that the CDC, in accordance with its mandate, delivers on the following priorities:

Review the approach used by the CDC on milk pricing decisions and ensure clearer and more transparent communication to Canadian consumers and dairy stakeholders;

Help the dairy sector adapt to a changing market and encourage innovation;

Continue to administer the Dairy Direct Payment Program, which provides full and fair compensation to dairy producers following recent trade agreements;

Work closely with AAFC and engage with stakeholders across the value chain to ensure the regulations under the Canadian Dairy Commission Act continue to support the CDC mandate and meet the needs of the dairy industry;

Continue working with AAFC and other federal departments to support Canada in fulfilling its international trade obligations. This includes early stakeholder engagement in industry decision-making processes related to the dairy supply management system;

In accordance with the Budget 2021 corresponding commitment, begin to report on climate-related financial risks. I also encourage the CDC to work with other Crown corporations to share best practices;

Promote an inclusive vision for the future of the dairy sector that fosters opportunities for women, youth, Indigenous Peoples and other underrepresented groups. Take action to improve diversity within the CDC through inclusive recruitment, retention and promotion practices; and

Implement the recommendations outlined in the 2021 Special Examination Report of the Auditor General of Canada to the CDC's board of directors.

As AAFC works to advance sector-specific priorities outlined in my mandate letter, I ask that you continue to support the Deputy Minister in his role as my principal source of public service support and policy advice for the entire Agriculture and Agri-Food portfolio, and in ensuring a coordinated portfolio. I know that I can count on you and the CDC to fulfil these priorities over the course of the Government's mandate and that your organization will commit to tracking and reporting on its progress toward results for Canadians.

I assure you of my full cooperation. Together, we can continue to build an innovative, sustainable and prosperous future for dairy producers and processors and protect the sector's reputation for providing a predictable supply of high-quality dairy products to Canadians.

Sincerely,

The Honourable Marie-Claude Bibeau, PC, MP

Mandate letter for the Canadian Grain Commission

Quote: 272451

Mr. Doug Chorney

Chief Commissioner

Canadian Grain Commission

600–303 Main Street

Winnipeg MB R3C 3G8

Dear Mr. Chorney:

Our government recognizes the importance of a vibrant and sustainable agriculture and agri-food sector to food security as well as Canada's economy. Despite many recent challenges, including the COVID-19 pandemic, Canadian grain producers and the entire value chain have shown resilience and continued to operate in a particularly difficult context in order to provide high-quality products to Canadian and global markets.

Now more than ever, it is critical that Canada maximize its contribution to supplying grain to global markets in order to counteract any impacts to global security caused by the current geopolitical and global market instability. I would like to thank the Canadian Grain Commission (CGC) for supporting the grain sector in responding to these challenges.

Reducing our greenhouse gas emissions and adapting to climate change remain urgent priorities for our government, and the sector must be our front-line partner to achieve our targets. In keeping with the ambitious environmental commitments outlined in our climate plan, it is increasingly important for government organizations to collaborate with partners across the grain value chain in reducing the environmental footprint of the grain sector. The CGC has a collaborative role to play in supporting broad climate resiliency, helping the sector achieve a national fertilizer emissions reduction target of 30 percent below 2020 levels and making grain supply chains more efficient, all this while finding innovative ways to add value.

In addition, in accordance with its mandate, I am asking you to provide the leadership necessary to ensure that the CGC delivers on the following priorities:

Support the Agriculture and Agri-Food Canada (AAFC)-led review of the Canada Grain Act as well as work related to the Agri-Food and Aquaculture Sector Regulatory Review Roadmap to identify what changes are needed to meet the needs of Canada's modern grain sector;

Continue to identify and take action on regulatory changes and operational reforms, within the CGC's existing authority, that deliver benefits to producers and the value chain. This will be accomplished in support of the needs of the changing grain sector and in alignment with the broader AAFC-led review;

Consider updates to the Surplus Investment Framework to ensure that accumulated surplus funds are used effectively and deliver tangible benefits to the Canadian grain value chain. These updates fall within the context of strategic measures already adopted to prevent surplus accumulation and align with the emerging path forward on the Canada Grain Act review;

Collaborate with AAFC officials and sector stakeholders to support Canadian export growth and mitigate international market access risk and technical trade issues through innovative science while leveraging the wealth of evidence collected through grain export monitoring and analytical testing as well as harvest surveys conducted by the CGC; and

Promote an inclusive vision for the future of the grain sector that fosters opportunities for women, youth, Indigenous Peoples and other underrepresented groups. Take action to improve diversity within CGC through inclusive recruitment, retention and promotion practices.

As AAFC works to advance sector-specific priorities outlined in my mandate letter, I ask that you continue to support Chris Forbes, Deputy Minister, in his role as my principal source of public service assistance and policy advice for the entire Agriculture and Agri-Food Portfolio and in ensuring its coordination. I know that I can count on you and the CGC to fulfill these priorities and that you will commit to tracking and reporting on its progress toward results for Canadians.

I assure you of my full cooperation so that together we can continue to build an innovative, sustainable and prosperous future for grain producers and the entire value chain and protect the sector's reputation for providing high-quality grain products to Canada and the world.

Sincerely,

The Honourable Marie-Claude Bibeau, PC, MP

Federal–provincial–territorial relations

Agriculture is an area of shared jurisdiction

- Section 95 of the Constitution Act (1867) establishes that jurisdiction over primary agriculture is concurrent for federal and provincial and territorial (FPT) governments.

- While both orders of government can create their own agricultural programming, some areas of jurisdiction are clear:

- Section 91(2) gives the federal government jurisdiction over international and inter-provincial trade and commerce.

- Provinces have responsibility for intra-provincial trade and commerce under Section 92(13).

- The federal spending power also enables the advancement of national priorities.

- Overall, the FPT relationship in agriculture is strong and characterized by close collaboration in order to maximize benefits and investments for a competitive and sustainable agriculture and agri-food sector.

FPT collaboration occurs on many levels

- Ministers engage multilaterally through the FPT Ministers of Agriculture Table to set overall FPT policy direction in key areas such as the environment, discuss programming enhancements, such as for the Business Risk Management suite, and to address emerging challenges and threats (for example, African Swine Fever; Avian Influenza).

- The bilateral FPT relationships complement multilateral efforts, and address the varied local, unique issues such as PT-tailored AgriRecovery responses to disasters (floods and droughts) and research and science partnerships to address the needs of the jurisdiction.

- Finally, there are areas where separate federal and PT action also occurs – the federal government has the discretion to create federal-only policies/programs (for example, Agricultural Clean Technology), as do the provinces and territories (for example, domestic market development).

The FPT model is strengthened through agricultural policy frameworks

- The FPT relationship is formalized through successive five-year agricultural policy frameworks which define policy priorities and associated programming and funding levels, including how partners will work together.

- The Sustainable Canadian Agricultural Partnership (Sustainable CAP), the fifth in a series of framework agreements dating back to 2003, will be launched on April 1, 2023 (to March 31, 2028) and replaces the existing Canadian Agricultural Partnership (CAP).

- The Sustainable CAP sets out a common vison and priorities for a five-year $3.5 billion investment by FPT governments ($1 billion in federal-only and $2.5 billion for cost-shared) to strengthen and grow Canada's agriculture and agri-food sector. This includes a new cost-shared Resilient Agricultural Landscape Program (RALP) to be administered by PTs which supports ecological goods and services provided by the agriculture sector.

- Through the Partnership:

- Cost-shared program details are defined in bilateral agreements between the federal government and each province/territory at a 60:40 funding ratio.

- PTs deliver the cost-shared programming in their jurisdictions.

- Federal-only programs are delivered by Agriculture and Agri-Food Canada (AAFC).

Strengths of the framework approach

- National outcomes with regional adaptability:

- Common policy priorities and objectives bring greater consistency and clarity for the sector wherever they live in Canada, with flexibility based on commodities, conditions, local delivery and administration.

- Maximizing investments:

- Leveraging FPT resources (60:40 F:PT cost share), while ensuring predictable supports through a common vision and priorities.

- Minimizing trade risks:

- Ensuring that supports given to producers are compliant with our current trade obligations.

- Coordination to overcome barriers and collaboration on cross-cutting issues:

- Arrangements exist between AAFC portfolio agencies and PT governments on issues relating to regulatory matters such as: food, animal health and plant protection, supply management and grain handling.

- AAFC and PTs work together, for example, with their respective departments of labour and skills development to advance efforts in recruitment, skills and training.

Key AAFC roles

- National policy development, such as:

- Working to access and develop new markets for the benefit of the entire sector;

- Ensuring producers and processors have access to the best science and innovation; Achieving national coherence in priority areas, such as addressing environment and climate change.

- Ensuring complementarity of actions and accountability for investments.

- Seeking multilateral action in certain cases while also pursuing federal-only action in others to balance national outcomes with regional flexibilities;

- Support the collection of data and reporting of results achieved through the Sustainable CAP initiatives.

- Facilitating relationships between PTs and other federal departments and agencies on items that intersect with their mandates.

- Labour and Temporary Foreign Workers (Immigration, Refugees and Citizenship Canada and Employment and Social Development Canada), Trade (Global Affairs Canada), Regulations (Canada Food Inspection Agency), Aquaculture (Fisheries and Oceans Canada), Movement of goods (Transport Canada).

Annual conference and FPT tables

- An Annual Conference of FPT Agriculture Ministers occurs in person every July to set policy direction and foster collaboration on common issues.

- The federal minister co-chairs the FPT Table with a provincial or territorial co-chair that rotates on an annual basis. New Brunswick is the co-chair for 2022-2023.

- The PT co-chair hosts the Annual Conference. The next is in Fredericton on July 19 to 21, 2023.

- The Annual Conference also offers opportunities for sector engagement and to showcase regional agriculture in the host location.

- The Ministers’ Table is supported by ongoing meetings of FPT Deputy Ministers (DM) and Assistant Deputy Ministers (ADM).

- Typically, the DM Table meets every six to eight weeks and the ADM Table every four weeks.

- Discussions at the Ministers, DMs and ADMs’ Tables range from the latest emerging issues impacting the agriculture and agri-food sector and ways to mitigate those impacts (for example, African Swine Fever, labour challenges, Avian Influenza), to longer-term priorities that drive the agricultural agenda forward (climate change resiliency, trade opportunities).

- FPT Ministers are expected to hold a virtual three-hour meeting in mid-April 2023 to discuss next steps for African Swine Fever programming and other key files.

Current and ongoing FPT priorities

The FPT table has been seized with a number of topics, which are expected to be discussed at upcoming engagements:

- African Swine Fever (ASF): Industry engagement and agreement on immediate response programming to prepare for ASF

- Business Risk Management (BRM) Programming: Programming improvements and BRM reviews related to environmental considerations

- Grocery Code of Conduct: supplier-retailer relationship and development and implementation of an industry-led Code

- Environment: Discussion on key federal initiatives, fertilizers and other environmental files and issues related to climate change

- Labour: Initiatives to deal with labour shortages

- Trade and market access issues

- Other: Pilots to facilitate interprovincial trade; tackling Avian Influenza; discussions around Foot and Mouth Disease preparedness; Antimicrobial Resistance; mitigating Bee shortages, Animal Health Canada; Science and Technology Opportunities; etc.

Next steps

- Determine timing for the upcoming FPT Ministers’ mid-April virtual meeting and areas of focus in addition to ASF.

- Establish the broader forward path of meetings for FPT DMs and ADMs leading to the Ministers Annual Conference in July.

- Determine key areas of focus to permit strategic discussions and decisions among Ministers for the July 2023 Annual Conference.

- It is recommended that you hold bilateral introductory calls with PTs shortly after joining the department, beginning with your PT co-chair (New Brunswick’s Deputy Minister Cathy LaRochelle).

Annex – PT landscape: British Columbia

- The British Columbia (BC) primary agriculture sector produced $4.4 billion in 2021 farm cash receipts, with agriculture and agri-food representing 2.5% of provincial Gross Domestic Product (GDP).

- Third largest employer of temporary foreign workers (TFWs) and continues to flag ongoing concerns related to labour shortages, notably affecting fruit growers.

- Advocates to improve sector diversity, including increasing specialized Indigenous agriculture programming.

- Has experienced major climate issues over the last couple of years (for example, floods and droughts). Building sector sustainability in face of climate change is a priority.

- Has noted supply chain concerns and the need for a Grocery Code of Conduct.

Key priorities:

Climate change; improving food security and building local markets; diversity and inclusion, including Indigenous; labour; aquaculture; agri-technologies/innovation; and mental health.

Annex - PT landscape: Alberta

- The Alberta (AB) primary agriculture sector produced $18.7 billion in 2021 farm cash receipts, with agriculture and agri-food representing 2.5% of provincial GDP.

- Canada’s largest beef-producing province, with the largest beef processing facilities. Has noted ongoing concerns with labour shortages.

- Has raised concerns over the Government of Canada’s reevaluation decision to phase-out some pesticides, without effective alternatives, and the impacts this has on producers and trade opportunities.

- Advocates for bee imports from the United States (not approved by Canadian Food Inspection Agency) and wants a Canadian foot and mouth disease vaccine bank.

- Supports reducing barriers to interprovincial trade and is part of the Lloydminster pilot with Saskatchewan.

- Opposed to the federal model of carbon pricing and fertilizer targets.

- Wants to expand the Western Livestock Price Insurance Program nationally.

Key priorities:

Interprovincial trade barriers; market growth and value-added production; regulatory competitiveness; labour (particularly attracting domestic workers); farm efficiency; public trust; and science and research.

Annex - PT landscape: Saskatchewan

- Saskatchewan’s (SK) primary agriculture sector produced $19.1 billion in 2021 farm cash receipts, with agriculture and agri-food representing 6.9% of provincial GDP.

- Largest agriculture producing province, it is the top producer of wheat, canola, oats, flax, dry peas, lentils and chickpeas and has large beef and hog sectors.

- Supports reducing barriers to interprovincial trade and is part of the Lloydminster pilot with AB.

- Has noted issues with the federal model of carbon pricing and reducing emissions associated with fertilizer application.

- Has raised concerns over the Government of Canada’s reevaluation decision to phase-out some pesticides, without effective alternatives, and the impacts this has on producers and trade opportunities.

- Wants to expand the Western Livestock Price Insurance Program nationally.

Key priorities:

Economic competitiveness; technological innovation; resiliency and viability of its primary agriculture sector; public trust; labour and mental health.

Annex – PT landscape: Manitoba

- The Manitoba (MB) primary agriculture sector produced $8.5 billion in 2021 farm cash receipts, with agriculture and agri-food representing 7% of provincial GDP.

- MB is the national leader in developing emerging sectors, including plant-based technology (proteins) and value-added processing.

- It is one of the top hog producing PTs and has flagged concerns about the impact of an ASF outbreak, including challenges with appropriately resourcing the depopulation of surplus animals in the case of ASF.

- Supports reducing barriers to interprovincial trade.

- Has raised concerns about federal greenhouse gas (GHG) targets and emissions intensity reduction targets for fertilizer use in particular.

- Wants to expand the Western Livestock Price Insurance Program nationally.

Key priorities:

Innovation, particularly around its protein strategy; local food production; public trust; and mental health.

Annex - PT landscape: Ontario

- Ontario’s (ON) primary agriculture sector produced $18.9 billion in 2021 farm cash receipts, with agriculture and agri-food representing 3.1% of provincial GDP.

- Largest employer of TFWs and is vocal on labour issues, including need for quicker implementation of improved housing standards.

- Second largest hog producing province and has flagged concerns about the impact of an ASF outbreak and its ability to support producers through the crisis.

- Has raised concerns about federal GHG reduction targets and targets for fertilizer.

- Supports its sector through provincial livestock programming, and wants federal support to be provided similar to the Western Livestock Price Insurance.

Key priorities:

Labour; economic development; trade; BRM programming, research/innovation (for example, finding ways to speed up processing); formalized mechanism for data sharing between partners; aquaculture programming for inland fisheries; and domestic marketing.

Annex – PT landscape: Quebec

- The Quebec (QC) primary agriculture sector produced $11.2 billion in 2021 farm cash receipts, with agriculture and agri-food representing 3.4% of provincial GDP.

- Quebec Minister Lamontagne is the Provincial co-chair with Minister Bibeau on the Retail Fees issue, which is working to support industry in developing a Grocery Code of Conduct. QC strongly supports the progress and approach to date.

- Largest hog producing province and wants to ensure a coordinated FPT ASF response plan. Wants strong federal leadership and a national, coordinated role.

- Second largest employer of TFWs, is vocal on the need for improvements to the TFW program.

- Wants its own provincial measures and targets to be the source of reporting on results, notably in relation to the Sustainable CAP.

Key priorities:

As outlined in Quebec’s Politique bioalimentaire du Québec: food self-sufficiency; mental health; alignment of BRM programs with provincial programming; labour; and environment.

Annex – PT landscape: Atlantic Canada

- The Atlantic agriculture sector is small compared to the rest of the country but still accounts for a sizable percentage of provincial GDP.

- New Brunswick (NB): $1 billion in 2021 farm cash receipts, with 4.8% of NB GDP (agriculture and agri-food only).

- Nova Scotia (NS): $673 million in 2021 farm cash receipts, representing 2.7% of NS GDP (agriculture and agri-food only).

- Prince Edward Island (PEI): $568 million in 2021 farm cash receipts, representing 8.6% of PEI GDP agriculture and agri-food only).

- Newfoundland and Labrador (NL): $145 million in 2021 farm cash receipts, representing 1.9% of NL GDP (agriculture and agri-food only).

- The Atlantic provinces are generally aligned and tend to coordinate efforts on key agriculture issues.

- Several Atlantic provinces are still dealing with repercussions from recent events, including major climate issues with hurricane Fiona in NS and PEI, and potato wart in PEI.

Key priorities:

NL: food security/self-sufficiency; environment; animal welfare; greater compensation for supply managed sectors related to trade agreements; supporting agri-food and beverage companies seek new markets.

PEI: labour; mental health; community food security; and environment and climate mitigation.

NS: food security including local processing capacity; climate change; local supply chains; labour; environment; and increased support for export development.

NB: public trust; value added; food security; and investing in aquaculture.

Annex – PT landscape: Territories

- The three territories have a small, but growing agriculture sector. Primary agriculture represents less than 1% of GDP in each of the Territories.

- There is minimal participation of the territories in BRM programming; Yukon (YK) has been the only territory participating in past frameworks, but Northwest Territories (NWT) expected to participate as well for Sustainable CAP.

- Regional flexibility is key in developing programming, in recognition of the unique climate of the North.

- Territories are keen on reducing barriers to interprovincial trade, including restrictions around meat, to help provide greater access.

Key priorities:

Interprovincial movement of goods; food security; climate change; and new opportunities to build its agriculture sector.

Federal–provincial–territorial forward agenda

Federal-Provincial-Territorial Forward Agenda to July 2023

- The next Annual Conference of Federal-Provincial-Territorial (FPT) Ministers of Agriculture will take place on July 19-21 2023 in Fredericton, New Brunswick.

- Ministers held a virtual meeting in January 2023, and will hold more call prior to the July 2023 Annual Conference (mid-April TBC).

- Deputy Ministers’ (DMs) virtual meetings are typically every 6-8 weeks, with additional meetings added to advance files and prepare for the Annual Conference.

- DMs typically meet in person once a year. The last in-person retreat was in late October 2022. You may wish to hold the next DM retreat in fall 2023.

- Assistant Deputy Ministers (ADMs) meet virtually approximately once a month, and on an as-needed basis in the lead up to DM and ministerial meetings and calls. Expanded meetings to include both regulatory and policy ADMs will occur as needed, on issues of common concern.

- The last ADM retreat was in July 2022. ADMs are expected to hold an in-person retreat this spring.

FPT priorities

This list highlights key items expected for discussion at the FPT tables over the coming months, leading to the Annual Conference. Note that it will continue to evolve on a regular basis as needed. Specific topics for the Annual Conference will be defined over the coming months.

- Sustainable Canadian Agricultural Partnership (Sustainable CAP) – Finalizing the Bilateral Agreements towards implementations by April 1, 2023.

- Business Risk Management (BRM) –AgriInsurance pilot review, broader BRM review and BRM program changes for the Sustainable Canadian Agricultural Partnership.

- Internal trade – Update on FPT pilots to address unique internal trade situations.

- African Swine Fever (ASF) – Update on prevention and preparedness activities as well as immediate response programming.

- Animal Health Canada (AHC) – Proposed governance structure and resources.

- Environment – Ongoing discussions on key federal initiatives, fertilizers and other environmental files.

- Trade and market access –Current trade and market access issues / future-oriented discussion on opportunities.

- Grocery Code of Conduct – Updates on implementation, funding, governance.

- Labour – Continued engagement on the federal Agricultural Labour Strategy, and FPT opportunities.

- Others: Antimicrobial resistance, Foot and Mouth Disease (FMD) preparedness, bee shortages, avian influenza, science and technology.

Overview of FPT ADM, DM and Minister meetings leading to July 2023

*More detailed schedule in development (forthcoming)

- March 2: ADMs virtual call (confirmed)

- Potential items: April Ministerial call ; Update on ASF preparedness; Sustainable CAP – federal-only programming; BRM update on AgriStability; Environment update on federal consultations.

- Mid-March - April: 1-2 ADMs virtual calls

- Potential items: Sustainable CAP; Final prep for Ministerial; Digitizing traceability; AAFC’s Strategic Plan for Science; Update from Industry-Government Working Group on bees; Antimicrobial Resistance Pan-Canadian Action Plan; Foot and Mouth Disease preparedness / vaccine bank; Update on Animal Health Canada

- March - April: 1-2 DMs virtual video calls (2-3 hour duration)

- Potential items: Preparations for April Ministerial; ASF; Sustainable CAP; BRM updates; others to be determined

- April (to be confirmed) Virtual meeting of FPT Ministers

- Potential items: ASF; Other topics to be determined

- April - July: 3-5 ADM calls, plus an in-person retreat

- Agenda to be defined based on Annual Conference priorities and opportunities for blue sky discussions on emerging issues (for example, Innovation and Regulatory Barriers, opportunities to inform a scene setter piece for the Annual Conference).

- May - July: 2-3 DMs virtual video calls (2-3 hour duration)

- Review and approval of items leading to the Annual Conference.

- July 19-21 – Annual Conference of FPT Ministers of Agriculture 2023, Fredericton, NB

- Items to be defined over the coming month, and may include ASF, BRM, Internal trade, AHC, Environment, Trade and market access, Grocery Code of Conduct, Labour and others.

Stakeholder engagement

Overview of sector stakeholders

- The agriculture portfolio has one of the most expansive and active networks of stakeholders, representing the diversity of the sector, the interests of their members and the breadth of the food system (see Annex).

They include:- Cross sector associations (for example, Canadian Federation of Agriculture);

- National sector associations (for example, Canadian Cattle Association);

- Regional sector associations (for example, Saskatchewan Pulse Growers);

- Value chain associations (for example, Canola Council of Canada); and

- Others involved in the food system (for example, 4H Canada, Farmers for Climate Solutions, food security organizations, academia, innovation accelerators).

- Stakeholder associations perform a variety of functions for their members such as promotion and marketing, collaborating with other organizations to advance interests and regularly engaging with governments on priorities.

Importance of sector engagement

- Engagement with stakeholders is critical to AAFC’s work and supports many objectives:

- Provides the Department with producer and processor perspectives to inform policy and program development;

- Builds trust and regional intelligence to enable quick responses, particularly in times of emergency (for example, drought and COVID-19 programming);

- Offers a means to communicate with, mobilize and consult a broad membership within the agricultural sector;

- Enables the Department to partner with the sector in the delivery of specialized programming (for example, science and research); and

- Offers specialized knowledge to the Department through organizational reports and data collection (for example, information on labour shortages).

- Certain stakeholders also perform public functions, such as delegation of legislative responsibilities (for example, National Marketing Boards for supply managed products and Promotion and Research Agencies) and setting standards for members (for example, the Dairy Farmers of Canada ProAction Initiative).

How AAFC engages

- Extensive engagement, consultation and collaboration with stakeholders are built into many aspects of the Department’s work in order to ensure policies, programs and activities are designed and delivered effectively.

- AAFC has a number of existing formal and informal mechanisms to engage with the sector. These include:

- National consultations on major policies (for example, the national engagement sessions on the next policy framework);

- Forming government-industry working groups on key issues (for example, supply management compensation);

- The creation of bodies through ministerial appointment to advise on issues

(for example, National Program Advisory Committee, Canadian Agricultural Youth Council, Canadian Food Policy Advisory Council); and - Working with stakeholders bilaterally and at the local level through regional offices on emerging issues (for example, labour disruptions, drought conditions).

Sector Engagement Tables

Sector Engagement Tables (SETs) build upon the success of value chain roundtables to create a more strategic dialogue amongst government and industry in order to collectively advance sector growth and competitiveness. SETs are co-chaired by industry and government representatives.

Thematic Engagement Tables (strategic plans completed)

- Focus on systemic, cross-cutting issues that affect the sector as a whole

- Agile Regulations

- Sustainability

- Consumer Demand and Market Trends

- Skills Development

Sector Advancement Tables

- Five tables that focus on implementing solutions to systemic issues in context of their sub-sectors.

- Animal Protein (launched)

- Field Crops (launch is pending)

- Horticulture (launched)

- Seafood (launch is pending)

- Food Manufacturing Engagement Table (launch is pending)

AAFC also collaborates across the federal government to bring sector perspectives to horizontal initiatives

Environment and clean technology

Environment and Climate Change Canada (ECCC), Natural Resources Canada (NRCan)

Market development and trade

Global Affairs Canada (GAC)

Food security

Crown-Indigenous Relations and Northern Affairs Canada, Health Canada, Employment and Social Development Canada (ESDC) and ECCC

Labour

ESDC, Immigration, Refugees and Citizenship Canada (IRCC)

Policy and financial issues, tax policy

Privy Council Office, Finance and Treasury Board Secretariat

Data development and analysis

Statistics Canada

Supply chains

Transport Canada, Innovation Science and Economic Development (ISED)

Innovation and growth

ISED, Regional Development Agencies

Seafood and aquaculture

Department of Fisheries and Oceans (DFO)

Examples of recent strategic engagement

- Launched in June 2021, consultations with stakeholders on the next policy framework informed priorities and programming for the future. Engagement will continue throughout 2023 and will make special considerations to include the perspectives of women, youth and minority groups.

- During the COVID 19 pandemic, the Department engaged extensively through sector virtual meetings with hundreds of stakeholders and smaller targeted virtual meetings on specific issues of concern. This provided the Department with input on COVID’s impact on the sector and helped in the development of the Government’s response to these issues.

- Challenges associated with the availability of labour, in particular temporary foreign workers (TFW), were heightened during the pandemic. The Department significantly increased its engagement with stakeholders and federal partners responsible for the TFW program (ESDC, IRCC, Service Canada, etc.) to identify issues and find solutions to logistical challenges with the safe arrival of TFWs in Canada.

- On international trade, the Department has an established group of stakeholders that it consults with on an ongoing basis. This engagement intensifies when trade negotiations are active or when a trade irritant is identified.

Annex: Key stakeholders

Cross-sectoral associations

- The Canadian Federation of Agriculture is a national umbrella organization representing producers, composed of provincial general farm organizations and national and interprovincial commodity groups. The Union des producteurs agricoles is the largest and most active of the provincial organizations.

- The Canadian Organic Growers is a national organization representing organic producers with emphasis on extension services for organic and transitioning producers. The Organic Federation of Canada is the national lead on organics standards development.

Animal production

Livestock and poultry

- Canadian Bison Association

- Canadian Cattlemen’s Association

- Canadian Pork Council

- Canadian Mink Breeders Association

- Canadian Sheep Federation

- Livestock Marketing Association of Canada

- National Cattle Feeders’ Association

- National Sheep Network

Supply management groups

- Dairy Farmers of Canada

- Chicken Farmers of Canada

- Turkey Farmers of Canada

- Canadian Hatching Egg Producers

- Egg Farmers of Canada

Fish, seafood, and aquaculture

- Canadian Aquaculture Industry Alliance

- Canadian Organic Seafood Association

- Fisheries Council of Canada

- Lobster Council of Canada

Trade organizations

- Canadian Agri-Food Trade Alliance

- Canada Beef Inc

- Canada Pork International

- Canadian Organic Trade Association

- Agriculture Trade Negotiations Consultations Group

- Other Consultations (for example, Supply Management)

Field crops and horticulture

Field crops

- Barley Council of Canada

- Canada Grains Council

- Canadian Canola Growers Association

- Canadian Hemp Trade Alliance

- Canadian Seed Growers Association

- Canola Council of Canada

- Cereals Canada

- CropLife Canada

- Grain Growers of Canada

- Prairie Oat Growers Association

- Pulse Canada

- Soy Canada

- Seeds Canada

- Western Grain Elevator Association

Horticulture

- Canadian Honey Council

- Fruit and Vegetable Growers of Canada

- Canadian Ornamental Horticulture Alliance

- Canadian Produce Marketing Association

- Mushrooms Canada

Processing and others

Processing

- CanadianMeat Council

- Canadian Oilseed Processors Association

- Canadian National Millers Association

- Canadian Poultry and Egg Processors Council

- Dairy Processors Association of Canada

- Food & Beverage Canada

- Food, Health and Consumer Products of Canada

- Food Processors of Canada

Others

- BIOTECanada

- Canadian Agri-Food Automation and Intelligence Forum

- Canadian Federation of Independent Grocers

- Canadian Food Innovation Network

- Farmers for Climate Solutions

- Fertilizer Canada

- Protein Industries Canada

- Retail Council of Canada

Youth and women

Youth

- 4-H Canada

- Canadian Young Farmers’ Forum

- Young Agrarians

- Canada’s Outstanding Young Farmers

Women

- Ag Women’s Network

- Fédération des Agricultrices du Québec

Food security

Food policy

- Coalition for Healthy School Food

- Breakfast Club of Canada

- Farmto Cafeteria Canada

- Canadian Agri-Food Policy Institute

- Food Banks Canada

- Food Secure Canada

- Foodshare

- Second Harvest

- Food Communities Network

- National Zero Waste Council

- Canadian Centre for Food Integrity

- Provision Coalition

- Community Food Centres Canada

- La Tablée des Chefs

Indigenous rightsholders

- Assembly of First Nations (AFN)

- Inuit Tapiriit Kanatami (ITK)

- Métis National Council (MNC)

- Native Women’s Association of Canada (NWAC)

- Congress of Aboriginal Peoples (CAP)

- Canadian Council for Aboriginal Business (CCAB)

- National Aboriginal Capital Corporations Association (NACCA)

- Council for the Advancement of Native Development Officers (CANDO

International engagement

State of Canada’s agri-food trade

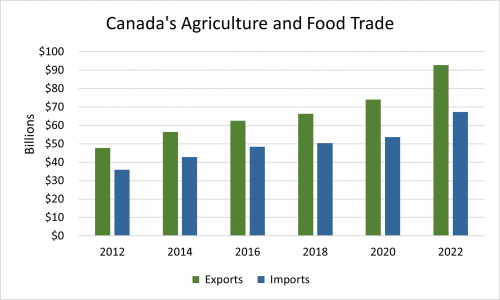

- Despite initial disruptions from COVID-19 on agriculture and food supply chains and the war in Ukraine, trade continued to flow and saw gains – exceeding $92 billion in exports in 2022, a 12.4% increase from 2021.

- A significant portion of this increase in export value can be attributed to price increases, rather than growth in export volumes.

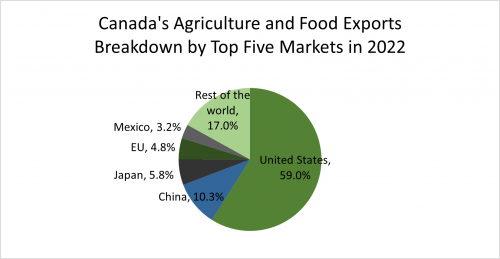

- The bulk of Canada’s agriculture and food exports was shipped to the United States (59.0%).

- Canada and the United States have a strong, interconnected agricultural partnership exceeding $91B in two-way agriculture and food trade in 2022, supporting food security as well as business on both sides of the border. Agricultural exports are often processed (or used as ingredients) and then imported back to Canada.

- China has been Canada’s second leading agriculture and food export market since 2012 – our exports have increased by 75.6% since.

- Since 2020, Canada’s reliance on the United States market has increased, while reliance on other key markets, such as China, Japan and the European Union, continues to decrease.

- Canada’s main export products in 2022 were grains, oilseeds, baked products and red meat.

Description of the above image

Agriculture and food exports and imports in billions of dollars from 2012 to 2022. The chart shows exports and imports have steadily been increasing since 2010, with exports consistently higher than imports.

| Year | Exports ($) | Imports ($) |

|---|---|---|

| 2012 | 47,730,365,774 | 35,878,258,177 |

| 2014 | 56,542,028,298 | 42,853,696,428 |

| 2016 | 62,561,704,622 | 48,372,188,221 |

| 2018 | 66,288,994,148 | 50,327,382,818 |

| 2020 | 74,056,562,212 | 53,665,191,695 |

| 2022 | 92,714,103,937 | 67,270,923,700 |

Data source: Global Trade Tracker, supplied by Statistics Canada

Description of the above image

Canada’s agriculture and food exports, top five markets, 2022

A pie chart showing the percentage of seafood exports going to various countries. United States is the largest at 59%; followed by Other, 17%; China, 10.3%; Japan, 5.8%; European Union (excluding the United Kingdom), 4.8%; and Mexico, 3.2%.

Global trade environment

- Global shift away from science / risk-based decision making

- Trade disputes; proliferation of non-tariff barriers and new wave of protectionist policies threatening the multilateral trading system

- Emergence of digital technologies combined with evolving consumer demands for transparency, traceability and sustainability assurances, including pressure for re-shoring and increased domestic production

- Agri-environmental pressures, incentives and regulations are challenges that Canada will need to navigate to remain competitive

- Canada’s own commitments to environmental sustainability and emissions reductions underscore the importance of helping the sector adopt innovative approaches

- Animal and plant diseases (namely the African Swine Fever (ASF)) and pests)

- Impacts of global supply chain disruptions, inflationary pressures and geopolitical situations (namely Russia’s invasion of Ukraine)

Agriculture and Agri-Food Canada (AAFC) chairs a number of working groups with industry, to advance the resolution of market access and trade challenges.

Canada’s key markets and trade issues

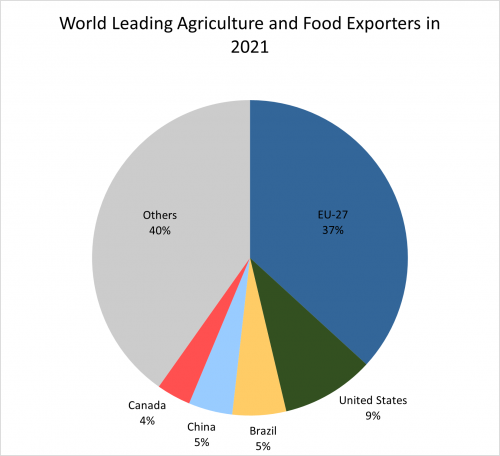

Globally, Canada is the fifth-largest exporter of agriculture and food products in the world and exported to over 200 countries in 2021. With half of the value of Canada’s total production exported, sector growth relies on predictable trade. Yet, we face strong competition from the European Union, the United States, Brazil and others.

With the growth in non-tariff barriers to trade and shifts in trade policy, Canada faces a number of market access issues and trade policy challenges, including in key markets:

- United States – Supply chain, Country of Origin Labelling (COOL), Proposition 12, Dairy Disputes, agri-environment

- China – New food safety regulations (Decrees 248/249), Beef Access, pet food, overall increased volatility & market risk

- European Union – Agri-environment, pesticides/contaminants, deforestation regulation, etc.

Note: The annex contains more information on these three markets

Data source: Global Trade Tracker, supplied by reporting countries

Description of the above image

World leading agriculture and food exporters, 2021

World's leading agri-food and seafood exporters, 2021: European Union, 36.8%; United States, 9.5%; Brazil, 5.5%; China, 4.5%; Canada, 3.5%; Other, 40.2%

Note: For global comparison, data supplied by each country is used. Since many countries, including several European Union member states, have not yet reported 2022 data, 2021 data is used for global comparison.

Agriculture and Agri-Food Canada’s trade toolbox

AAFC uses several tools to advance Canada’s objectives to support the rules-based trading system, gain preferential access, overcome trade barriers and reach buyers in key markets.

Trade agreements and negotiations

- Establishing Canada as a preferred global supplier and establishing regulatory partnerships

- World Trade Organization (WTO) agreements (Sanitary and Phytosanitary Measures (SPS), Technical Barriers to Trade (TBT), Agriculture) and negotiations

- Implementing existing Free Trade Agreements (FTAs) and negotiating new regional/bilateral FTAs

- Dispute settlement

Collaboration with trading partners, international institutions and industry

- Bilateral engagement with long-standing partners (namely United States, Mexico, European Union, Japan) to address trade issues and collaborate in areas of common interests (namely science, environment)

- Engagement in multilateral fora (namely International Standard Setting Bodies (ISSBs); Food and Agriculture Organization (FAO); Organization for Economic Co-operation and Development (OECD))

- Technical cooperation and capacity building functions with partners to contribute to enhanced regulatory systems and long-term and reliable trading relationships

Market access and advocacy

- Policy and technical work to advance and resolve market access issues

- Advocacy to position Canada as a reliable supplier of safe products to positively influence decision-makers

Market development

- Targeted initiatives to support Small-to-Medium-Sized Enterprises (SMEs) seize global opportunities

- Canada Brand tools and resources to promote Canada as a supplier of choice

Supporting the multilateral rules-based trading system

AAFC engages with trading partners to support rules-based trade:

- World Trade Organization (WTO) Agriculture Negotiations

- Ongoing negotiations to continue trade reform in agriculture to reduce distorting subsidies

- WTO and FTA Agreements – Monitoring of implementation

- For example, active engagement in WTO Committees on Agriculture, SPS, TBT

- AAFC chairs bilateral Free Trade Agreement (FTA) Committees on Agriculture

- Trade disputes

- AAFC engages with Global Affairs Canada (GAC) to defend and advance Canada’s agricultural interests in trade disputes

- For example, Canada-United States-Mexico Agreement (CUSMA) Dairy Tariff Rate Quota Administration

AAFC works with Canadian Food Inspection Agency (CFIA) to advocate for science and risk-based measures that enable trade:

- Monitor for trends and market access issues

- Engage multilaterally and bilaterally on the importance of trade for food security, economic growth, environmental sustainability and open, science-based trade (for example, G20, FAO, WTO)

- Leverage FTA implementation mechanisms to advance ambitious commitments that seek to prevent the implementation of unjustified and/or unnecessary measures

- CFIA is engaged in international standard setting bodies (World Organisation for Animal Health (OIE), Codex Alimentarius Commission (CODEX), International Plant Protection Convention (IPPC)) to influence the development of policy and promote the adoption of science-based standards, guidelines and recommendations to facilitate trade.

Critical to success: Canada’s free trade agreements (FTAs) provide preferential access to key growth markets

Canada has 15 bilateral and regional FTAs covering 51 countries, giving Canadian exporters a competitive edge in 2/3 of the global economy.

In 2022, 78.8% of Canada's agri-food and seafood exports were destined to FTA countries.

Leveraging FTAs can be an important part of Canada’s post COVID-19 economic recovery plan. FTAs help Canada preserve and secure:

- Open rules-based trade

- Diversified supply chains; and,

- Preferential market access for Canadian agricultural goods.

Description of the above image

A world map showing where existing free trade agreements are established with Canada as well as where negotiations are ongoing.

Nations with which we have a FTA in force: Australia, Chile, Columbia, Costa Rica, the European Union, Honduras, Iceland, Israel, Japan, Jordan, Liechtenstein, Korea, Malaysia, Mexico, New Zealand, Norway, Panama, Peru, Singapore, Switzerland, United Kingdom, Ukraine, United States, Vietnam.

Nations or trading blocs with which we have ongoing FTA negotiations: United Kingdom, Mercosur (Brazil, Argentina, Uruguay and Paraguay), India, Indonesia and Association of South East Asian Nations (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Vietnam). Canada is currently working with other Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) parties to evaluate the United Kingdom's application for CPTPP accession. Canada is currently exploring the potential modernization FTAs with the Ukraine, as well as the European Free Trade Association (EFTA) and member states (minus Switzerland).

Active FTA negotiations

United Kingdom Bilateral FTA and Comprehensive and Progressive Trans Pacific Partnership (CPTPP) Accession, India, Indonesia, Association of South East Asian Nations (ASEAN), and Mercosur

Market diversification: Leveraging export opportunities and navigating increased risk

Canada’s agriculture, agri-food and seafood exports are concentrated by market and product. Market diversification efforts aim to diversify where Canada exports to, who exports and what is exported.

Increase market share

- Diversify range of exports and increase market share in established markets.

- Target markets: United States, European Union, Japan.

Seek new opportunities

- Pursue high growth, emerging markets.

- Target market: Indo-Pacific.

Defend interests & manage risk

- Defend interests and consider alternative markets for overexposed exports.

- Target market: China.

The Indo-Pacific Strategy spans five key overarching priorities, implicating all sectors

- Promote peace, resilience and security

- Canada as an active and engaged partner to the Indo-Pacific

- Expand trade, investment and supply chain resilience

- Build a sustainable and green future

- Investing in and connecting people

Objectives:

Support sustainable economic development in the region, and build a stronger and more resilient economy at home.

Position Canada for long-term growth and prosperity by enhancing and diversifying our economic relationships with key Indo-Pacific economies.

Intended outcomes:

Expand Canada’s trade network

Enhance rules-based trade

Ensure the resilience of supply chains

Example investments:

Canadian Trade Gateway in Southeast Asia ($20.3M)

Modern Team Canada 3.0 Trade Missions ($45.0M)

CanExport program enhancements ($37.7M)

Indo-Pacific Agriculture and Agri-Food Office (IPAAO) ($31.8M)

The Indo-Pacific Agriculture and Agri-food Office will strengthen Canada’s footprint

In the Indo-Pacific Strategy the Government of Canada has committed to invest $31.8 million to establish Canada’s first agriculture and agri-food office in the region. Intended goals include:

- Deepening partnerships with key partners in the Indo-Pacific

- Advancing technical cooperation and sharing of expertise

- Supporting new opportunities and diversification

- Positioning Canada as a preferred supplier

Market development

With a shared federal, provincial and territorial (FPT) mandate, market development leverages gains from market access and FTA negotiations to support Canadian companies seize global opportunities. It includes the following initiatives:

- Market information and intelligence resources (namely reports on export market opportunities)

- Targeted in-market activities (namely retail and foodservice promotions; virtual and in-person Business-to-Business (B2B) programs, etc.)

- Trade shows and conferences, both in-person through flagship Canada Pavilion trade shows, as well as virtually

- In-market expertise through the Trade Commissioner Service

- Canada Brand promotional tools and resources

- Support exporter preparedness activities and materials

In fiscal year 2021-22 and in coordination with FPT partners, close to 50 market development initiatives were delivered, leveraging roughly $850,000 in shared funding and supporting close to 900 Canadian companies to promote their products.

Implementing the refreshed Canada Brand to bolster the sector’s presence

Canada Brand is an international marketing program which, since its launch in 2006, has brought together the diverse Canadian agriculture, agri-food and seafood sectors under a cohesive umbrella to build recognition and pride of Canadian products in the international marketplace.

Launched the refreshed Canada Brand Program to Canadian Agri-food Industry – February 2023

- The program is open to all export-ready, registered Canadian businesses that have a role in producing, promoting or supporting Canadian agriculture, food or seafood products.

- Program members gain free access to new digitally enhanced marketing tools, including;

- A new logo, modernized graphics and branded taglines;

- And a revamped marketing toolbox for Canada Brand members, with:

- video content;

- animated core graphics,

- branded GIFs and digital stickers;

- refreshed marketing messaging;

- a revitalized photo library; and

- a new client portal system to manage membership access

Launching two digital marketing and e-commerce pilot campaigns in Japan and Vietnam, 2023-24

- Each year-long campaign features a Canada Showcase on a major e-commerce platform, showcasing Canadian products and creating opportunities in a high-traffic digital space.

- The campaigns will be supported by a digital ecosystem of social media, online marketing and a consumer-facing website to promote and educate about Canadian food, including recipes, and information on where to buy Canadian products.

Working with federal partners

Global Affairs Canada (GAC)

AAFC has 40 Full Time Equivalents (FTEs) embedded into GAC’s Trade Commissioner Service, collaborating on:

- Market intelligence and information

- Trade promotion

- Market access and trade policy

- Investment, science and innovation

Canadian Food Inspection Agency (CFIA)

- Competent authority in Canada for food safety, animal and plant health

- Helps advance the export growth agenda by increasing market access abroad

- Negotiates and certifies commodities for export

- AAFC

- CFIA

- GAC

- OGDS

- Department of Fisheries and Oceans

- Department of Finance

- Canadian Grain Commission

- Regional Development Agencies (ACOA, PrairiesCan, etc.)

- Canadian Border Services Agency

- Health Canada

Annex A: Supporting trade - Programs and services

AgriMarketing Program: To increase and diversify exports internationally, seize domestic opportunities and leverage Canada’s reputation for high-quality and safe food

Agri-Food and Trade Commissioner Service: To prepare for international markets, assess target market potential, find contacts and resolve foreign market business problems and deliver promotional initiatives

Agri-Food Market Intelligence Service: To identify market, sector and product trends, obtain trend forecasts and customized analysis and analyze distribution channels

Canada Brand: To leverage Canada’s global image to increase sales of Canadian food and agricultural products and services

Canada Pavilion Program: To facilitate trade show participation for Canadian companies, helping them leverage opportunities arising from market access gains

CanExport Program: Financial support for small and medium-sized enterprises to develop new export opportunities (GAC program)

Agri-Assurance Program: Supports industry in developing and adopting systems, standards and tools to support quality attributes, and health and safety claims

Single Window: This service offers a single point of contact with the goal of helping the Canadian food industry and businesses reach international markets.

Annex B: Active and exploratory free trade agreement negotiations

Canada-United Kingdom Bilateral FTA

The Canada-United Kingdom Trade Continuity Agreement (TCA) entered into force April 1 2021. The TCA is an interim agreement that will apply until a Canada-United Kingdom. Bilateral FTA can be negotiated. Negotiations are expected to be launched in early 2022, and four rounds of negotiations have taken place to-date. The next round is taking place during the week of March 20 in London, United Kingdom.

Canada-Mercosur FTA

*Brazil, Argentina, Uruguay, Paraguay

Canada-Mercosur FTA negotiations were launched on March 9, 2018. Seven rounds of negotiations have been held to date, the most recent in person round occurred in July 2019. While a number of virtual meetings have been held to advance negotiations on non-sensitive areas from 2020-2022, no new in-person rounds have been scheduled as Parties are identifying their respective trade negotiations priorities and assessing next steps.

Canada-India Comprehensive Economic Partnership Agreement (CEPA) Negotiations (including a potential Early Progress Trade Agreement)

In March 2022, Canada and India relaunched negotiations towards a CEPA with a possible interim agreement or Early Progress Trade Agreement (EPTA) that could be concluded early as a transitional step towards the CEPA. An EPTA could include high level commitments in goods, services, rules of origin, sanitary and phytosanitary measures, technical barriers to trade and dispute settlement.

Canada-Indonesia CEPA

Canada and Indonesia launched CEPA negotiations on June 20, 2021. Three negotiation rounds have been held to date, with Round 4 scheduled to take place in-person from February 20th-24th, 2023.

Expansion of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

*Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam

Canada is currently working with other CPTPP Parties to negotiate the terms of the United Kingdom’s accession to the CPTPP. Five other economies have formally requested to join the CPTPP (China, Taiwan, Ecuador, Costa Rica and Uruguay) and Canada will work with the other CPTPP Parties to evaluate their applications and decide, by consensus, whether to commence negotiations with them.

Canada-Association of Southeast Asian Nations (ASEAN) FTA

*Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Vietnam

Canada and ASEAN launched FTA negotiations on November 16, 2021. Two negotiation rounds have been held to date. A third round is tentatively scheduled for March 2023.

Canada-Ecuador Exploratory FTA Discussions

On November 24, 2022, Canada and Ecuador launched exploratory talks toward a potential FTA.

Annex C – Priority markets: United States

- Canada’s agriculture and food exports to the United States exceeded $54.6 billion in 2022, compared to $45.7 billion in 2021 – an increase of 19.6%. The United States accounted for 59.0% of Canada’s total agriculture and food exports in 2022.