Corporate Management Branch

Our organization — Team, key work themes, and vision

Our organization

- Marie-Claude Guérard

ADM, Corporate Management / CFO, AAFC- Finance and Resource Management Services

- Human Resources

- Pay Transformation

- Strategic Management

- Real Property and Asset Management

- Integrated Services

- Canadian Pari-Mutuel Agency

Corporate Management Branch (CMB) delivers innovative and collaborative client services rooted in the sound stewardship of AAFC 's resources. Our client-focused values are respect, excellence, and integrity.

Key work themes

- Our people

Supporting our employees - Our business

Ensuring departmental stewardship - Our future

Implementing client-centric vision

Our people — Statistics

Count of Employees by Region

Map of Canada showing the distribution of CMB employees by region as of January 31, 2023

| Region | Number of Employees |

|---|---|

| Yukon | 0 |

| British Columbia | 21 |

| Alberta | 56 |

| Saskatchewan | 83 |

| Manitoba | 95 |

| Ontario | 50 |

| National Capital Region | 473 |

| Quebec | 79 |

| Atlantic | 121 |

| Total | 978 |

Over half of CMB employees are located in the National Capital Region.

Total population = 978

- Western region

257 FTEs

8 RDCs - Central region

132 FTEs

7 RDCs - National Capital Region (NCR)

486 FTEs

1 RDC - Atlantic region

111 FTEs

4 RDCs

Description of the above image

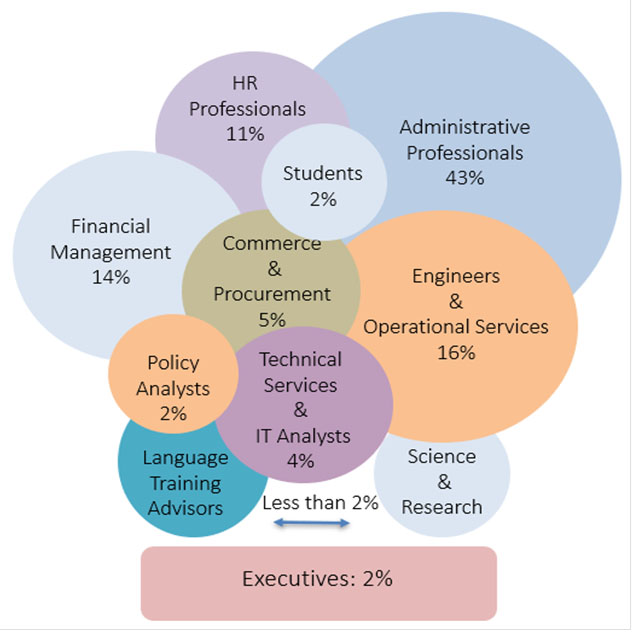

Bubble diagram showing the distribution of CMB employees by profession as of January 31, 2023

| Category | Percentage of Workforce |

|---|---|

| Human Resource Professionals | 11 |

| Financial Management | 14 |

| Policy Analysts | 2 |

| Students | 2 |

| Administrative Professionals | 43 |

| Commerce & Procurement | 5 |

| Engineers & Operational Services | 16 |

| Technical Services & Information Technology Analysts | 4 |

| Language Training Advisors and Science and Research | Less than 2% |

Over 40% of CMB's workforce are administrative professionals. Engineers and operational services, financial management, and human resource professionals each make up over 10% of CMB's workforce.

Our people — Supporting our employees

- Putting employee mental wellbeing first

- Adapting to a hybrid work environment

- Proactively supporting diversity, equity and inclusion

- Meaningful work / freedom to innovate

Diversity, equity & inclusion

- Strengthening our diverse workforce; addressing employment equity gaps; increasing accessibility

- Building a safe space and learning environment where employees feel able to openly discuss sensitive topics

Future of work

- Adapting our real property footprint to support a Flexible-Hybrid work environment

- Supporting clients and employees with targeted change management support

Mental health

- Enhancing employee experience by developing strategies to respond to digital fatigue, reducing burden and promoting positive work habits

Our business — Ensuring departmental stewardship

- Support AAFC's long-term financial and human resource sustainability

- Ensure sound governance of AAFC resources, lands, and infrastructure

- Engage with central agencies, departments and external stakeholders to ensure effective comptrollership and compliance

Oversight

- Sustained engagement and leadership on investment, real property and integrated planning

- Transparency of pari-mutuel betting and delivery equine of the drug control program

- Integrated services in support of Departmental operations at our Research and Development Centres

Partnerships & collaboration

- Trusted partner in the co-delivery of horizontal, Government of Canada-wide initiatives (for example, Greening Strategies, Labs Canada)

- Leverage new technology to strengthen processes and outcomes impacting our people and business, including pay services

Advisory support

- Provide integrated and strategic planning advice in support of departmental mandate and tailored to client business needs

- Support AAFC branches and departmental decision-making in the implementation of Budget and departmental resourcing decisions

Finance and Resource Management Service (FRMS)

2022-2023 Business Profile — Shawn Audette, DG

2022-23 FRMS draft priorities

- Support the preparation for the Next Policy Framework

- Coordinate the Investment Planning function to improve the process and respond to the associated audit findings

- Review branch budgets and spending to establish a Resource Roadmap that aligns with departmental priorities and risks

- Implement the use of new automated tools to streamline processes, find efficiencies and improve financial reporting

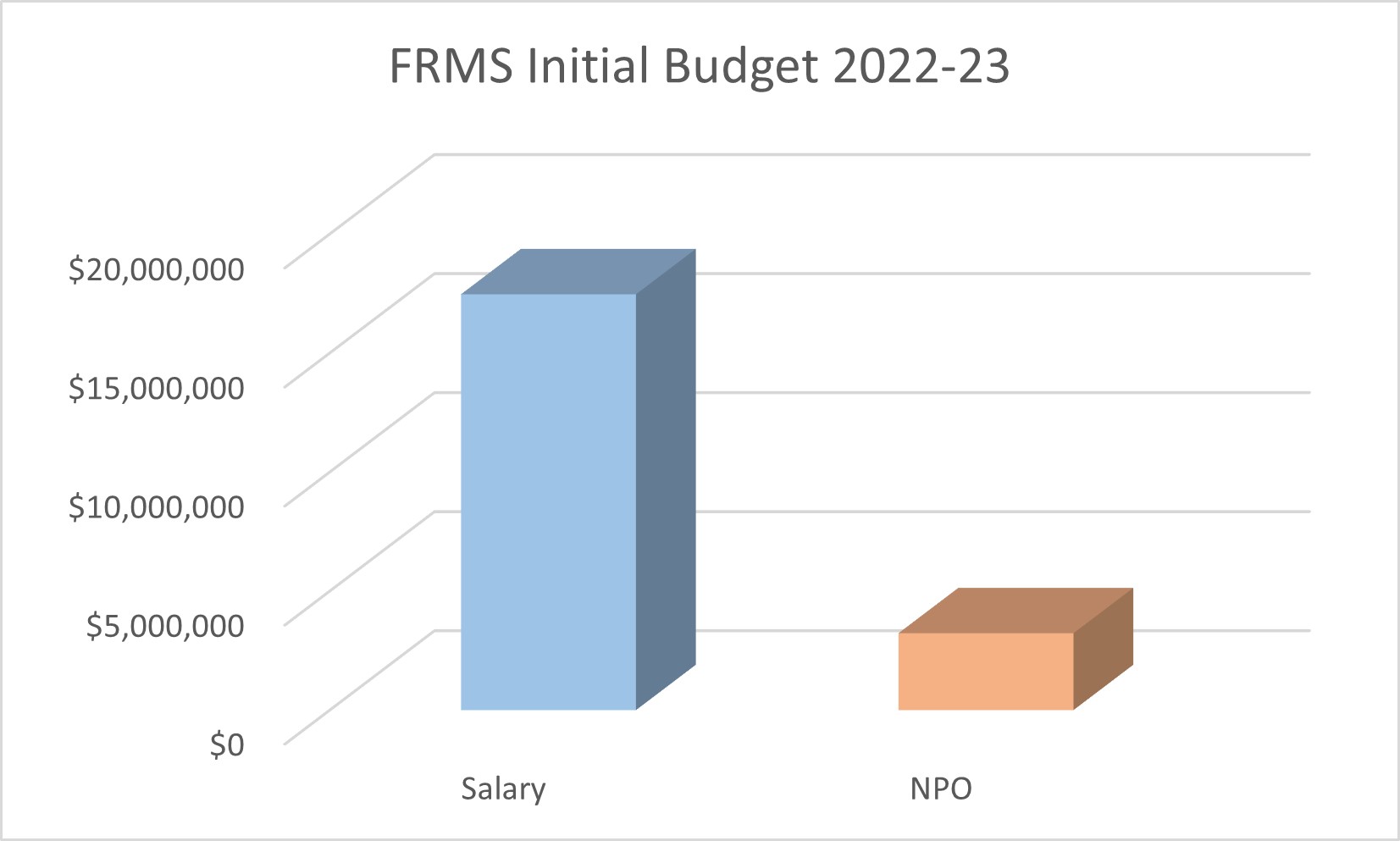

FRMS Initial Budget 2022-23

Description of the above image

FRMS Initial Budget 2022-23

Salary: $17,467,460

NPO: $3,229,710

Capital: $0

Approximately 84% of the directorate's $20.7 million budget is allocated to salary.

Key contributions (internal and external)

- Support the development of Cabinet & Treasury Board documents including providing costing expertise.

- Advise on financial policies and processes.

- Coordinate financial planning and reporting exercises.

- Perform financial monitoring and controls (FAA Section 33), attestation and audits of program recipients.

Operational risk/challenge(s)

- Increase in client expectations and competing work demands impacting staff productivity, recruitment, retention and mental health.

- Resistance to change (staff and clients).

- Reliance on external parties for timely decisions and direction (for example, Central Agencies).

- Access to data and information technology tools (and expertise to use them).

Future readiness/risk mitigation strategies

- Review and prioritization of work activities, strategic staffing and realignment of resources.

- Proactive communications with clients and stakeholders.

- Training and professional development.

- Leveraging other government department best practices.

Human Resources (HR)

2022-2023 Business Profile – Nathalie Leblanc, DG

2022-23 HR draft priorities

- Streamline our staffing practices, supporting and enabling innovation and excellence in hiring to increase the diversity of the workforce and promote a culture of inclusion

- Foster the use of data, systems and tools to support HR planning and informed, evidenced-based decision-making

- Actively contribute to the Future of Work, ensuring that employee mental health, safety and wellbeing are prioritized

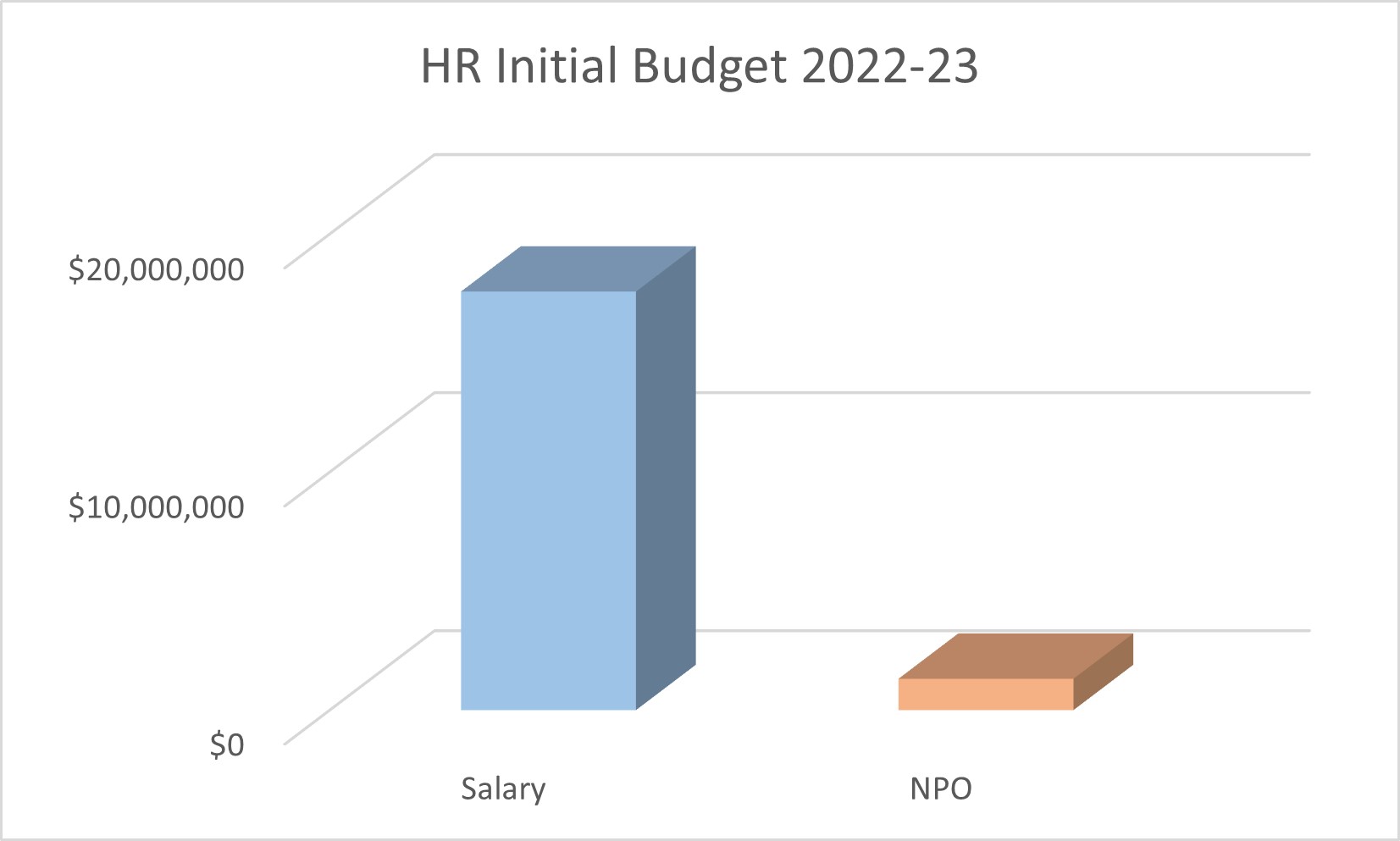

HR Initial Budget 2022-23

Description of the above image

HR Initial Budget 2022-23

Salary: $17,581,299

NPO: $1,317,031

Capital: $0

Approximately 93% of the directorate's $19 million budget is allocated towards salary.

Key contributions (internal and external)

- Implement the 2022-25 Diversity, Equity and Inclusion Strategy and Action Plan.

- Provide advice and guidance to ensure effective people management practices and adapting to the new reality of the flex-hybrid work environment.

- Support the recruitment, development, and retention of employees Indigenous employees and all employees.

- Introduce business process changes and leverage technology to enhance analysis and reporting.

Operational risk/challenge(s)

- Competitiveness between organizations to recruit and retain staff has increase.

- Enhance and promote a culture shift on diversity, equity and inclusion.

- Enhanced HR systems implementation is dependant on central agency timelines and departmental investments.

Future readiness/risk mitigation strategies

- Recruitment efforts will highlight unique aspects that AAFC has to offer, such as developmental programs and diversity and inclusion networks.

- The launch of AAFC's Diversity and Inclusion Index, will help measure progress in diversity and inclusion, as well as inform and focus departmental initiatives and practices.

- Toolkits being developed will provide managers with a one-stop shop to obtain information and resources to support them in carrying out HR-related duties, such as encouraging diversity, equity and inclusion in the department, supporting employee mental health and wellness, embracing accessibility, and experimenting with the flexible hybrid work environment.

Pay Transformation

2022-2023 Business Profile — Scott Aughey, Director

2022-23 Pay Transformation draft priorities

- Implement strategies to help ensure timely and accurate pay for employees

- Continue to actively support enterprise-wide efforts to stabilize the Phoenix pay system

- Work collaboratively with service partners to align with future state HR-to-Pay solutions

- Maintain personalized, direct access to compensation advisors through regional outreach

KEY Contributions (Internal and External)

- Employees and managers supported through direct pay issue resolution and escalation activities.

- Credible and transparent information, training and tools developed and shared with employees and managers.

- Regular reporting and pay analytics shared with senior management and employees.

- Pay validation and self-service expertise related to Phoenix entries.

- Actively contribute to system transformation projects and policy instrument development.

Operational risk/challenge(s)

- Inadequate foresight and integrated planning between policy centres and service delivery partners has adversely impacted pay stabilization efforts.

- Service delivery model changes and delayed HR planning at the Pay Centre.

- Increasing intake volumes as departments grow to fulfill mandate objectives.

- Next Gen readiness planning and HR Transformation agenda are ambitious, significant in scope and draw on same resource pool.

Future readiness/risk mitigation strategies

- Strong working relationships and leadership/collaboration with service delivery partners and within interdepartmental community.

- Consistent presence and authentic voice on interdepartmental working groups and HR-to-Pay governance committees.

- Repatriating targeted pay processing activities within AAFC.

Real Property and Asset Management (RPAM)

2022-2023 Business Profile — Karen Durnford-McIntosh, DG

2022-23 RPAM draft priorities

- Real property (RP) contribution to the updated departmental 5-Year Investment Plan and Governance

- Provision of national procurement and material management services

- Align AAFC policies and processes to new Policy Framework, supporting completion of alignment to science needs with AAFC property footprint / infrastructure

- Align accommodations services and portfolio to the GOC FOW

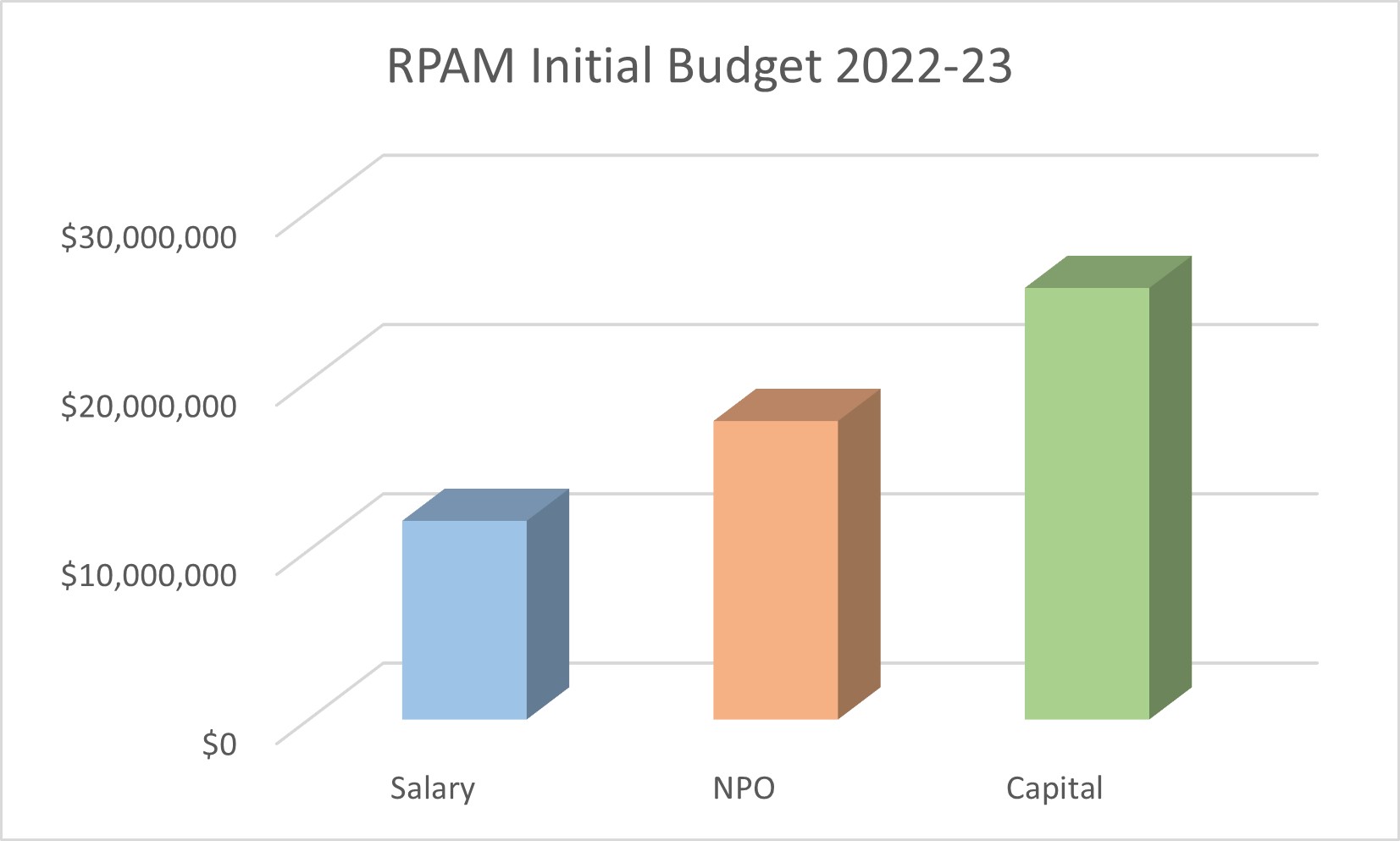

RPAM Initial Budget 2022-23

Description of the above image

RPAM Initial Budget 2022-23

Salary: $11,734,265

NPO: $17,633,227

Capital: $25,493,000

Approximately 46% of the directorate's $55 million budget is allocated towards capital investments.

Key contributions (internal and external)

- Deliver 2022-23 RP investment portfolio.

- Provide key guidance, leadership and stewardship on departmental security policy, program and operational requirements.

- Support and facilitate procurement planning and modernize practices and procedures.

- Coordinate and lead the sound environmental stewardship of AAFC's custodial operations.

- Deliver RP services (occupancy agreements, accommodations, divestiture and acquisition services and policy guidance)

- Lead the Greening Government Strategy commitments to transition to carbon neutrality by 2050.

- Coordinate the procurement strategy for Indigenous businesses.

- Progress on RP disposal and accessibility in built-environment programs.

Operational risk/challenge(s)

- AAFC's aging RP portfolio.

- Impact of global supply chain and labour constraints on project delivery and procurement outcomes.

- Equipment failures in aging RP portfolio resulting in lost research, building closures, stoppage in business delivery and health and safety risks.

Future readiness/risk mitigation strategies

- Prioritization of which AAFC sites to invest in and which to close or divest.

- Develop longer term procurement strategies to secure suppliers.

- Develop departmental procurement and material management framework.

- Work with central agencies and expert departments to communicate challenges and develop broad approaches (such as guidance, tools, stable long-term funding) to achieve desired performance.

Strategic Management Directorate (SMD)

2022-2023 Business Profile — Jean-Pierre Contant, Acting DG

2022-23 SMD draft priorities

- Advance integrated business planning, including a reinvigorated approach to risk management.

- Support the improvement of outcomes and measures of key programs and activities.

- Provide change management advice and support to the planning and implementation of Flexible Hybrid @ AAFC.

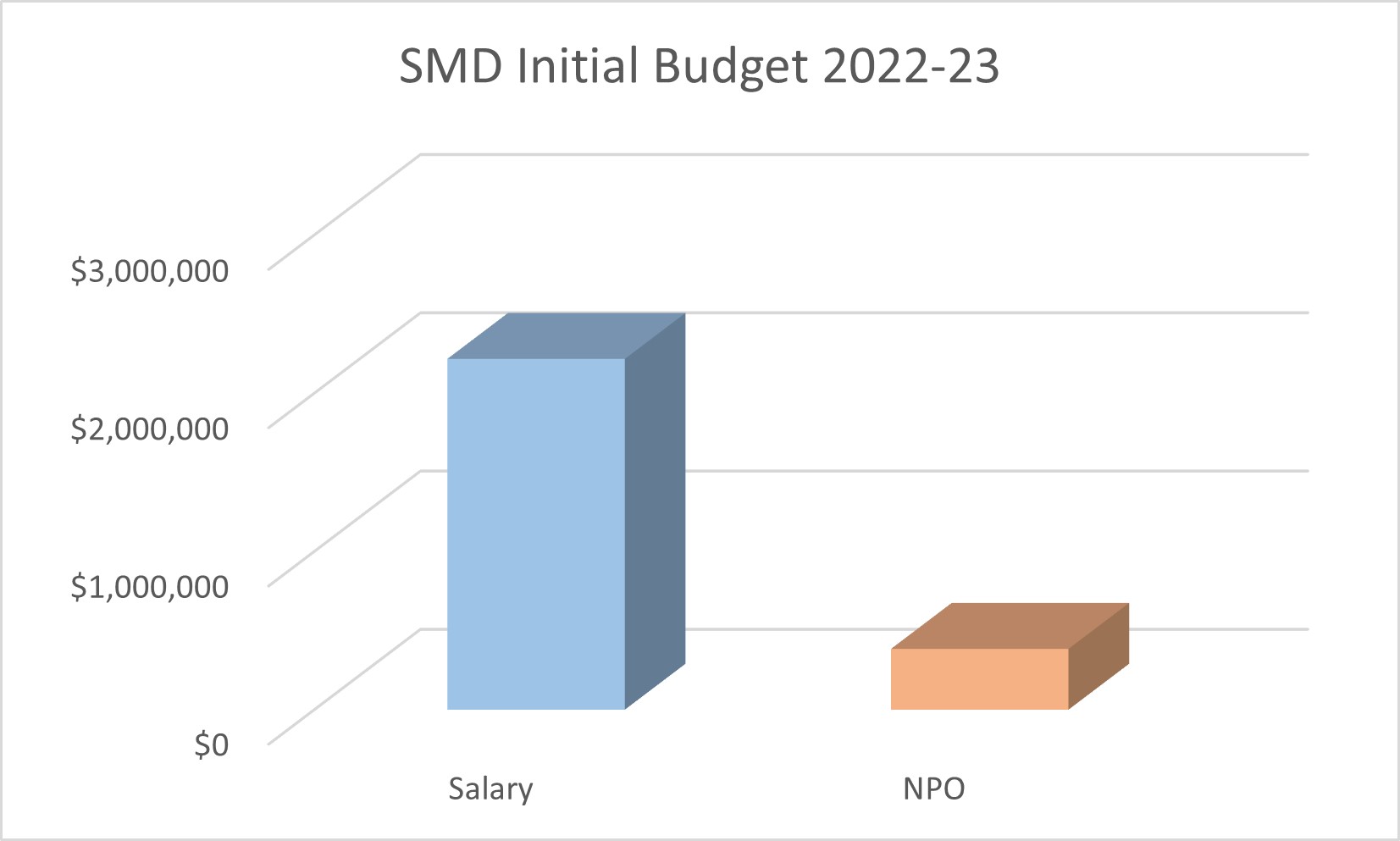

SMD Initial Budget 2022-23

Description of the above image

SMD Initial Budget 2022-23

Salary: $2,217,100

NPO: $384,365

Capital: $0

Approximately 85% of the directorate's $2.6 million budget is allocated towards salary.

Key contributions (Internal and external)

- Communicate departmental plans and results through annual parliamentary reporting.

- Report on mandate letter commitments as well as Federal and Departmental Sustainable Development Strategies.

- Support implementation of Policy on Results.

- Lead integrated business planning efforts, including approach to risk management.

- Support AAFC transformational initiatives through strategic change management advice and planning.

Operational risk/challenge(s)

- Additional burden on organization from increased planning and reporting expectations from both internal and external sources.

- Moving towards impact measurement to facilitate improved results.

Future readiness/risk mitigation strategies

- Continue to pursue an experimental, incremental and collaborative approach in designing integrated planning practices, processes and tools.

- Explore renewing the Departmental Results Framework and Program Inventory, and improving the utility of Performance Information Profiles.

- Including change management as part of strategic planning to help realize planned objectives of internal transformation initiatives.

Integrated Services (IS)

2022-2023 Business Profile — Crista-lynn Ferguson, DG

2022-23 IS draft priorities

- Establish and Deliver Standard Baseline for IS Services

- Plan and Initiate Conversion to Zero Emission Fleet

- Plan and Facilitate SAP Transformation

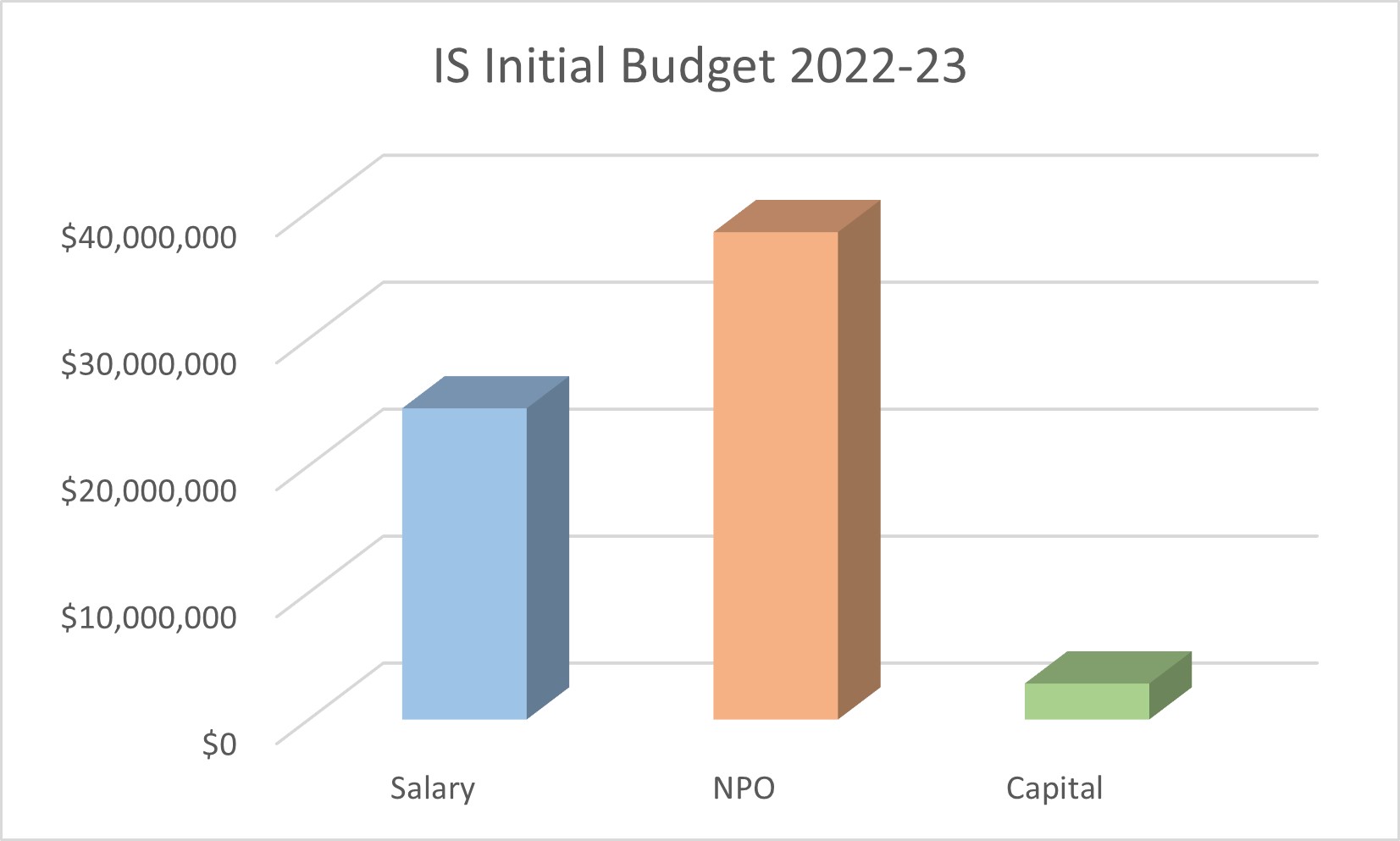

Integrated Services Initial Budget 2022-23

Description of the above image

Integrated Services Initial Budget 2022-23

Salary: $24,510,188

NPO: $38,387,475

Capital: $2,834,000

Approximately 58% of the directorate's $66 million budget is allocated towards NPO, with capital investments making up a small portion of the budget.

Key contributions (Internal and external)

- Distributed / Local provision of CMB services to Research and Development Centres — enables AAFC Research Mandate while ensuring sound resource stewardship by research programs

- Provide regional perspective and input to national strategic planning

- Contribute to Government of Canada initiative to improve Asset Lifecycle Management and Stewardship through implementation of Real Property Solutions

- Contribute to Government of Canada initiative to implement standardized SAP Management Systems

- Contribute to Green Government Strategy and Climate Change Roadmap through transformation to Zero Emission Departmental Fleet

Operational risk/challenge(s)

- Distributed Delivery of Services is more effective and responsive to client but requires more HR and financial resources

- Relatively large budget but high %'age is non-discretionary (utilities, legislated maintenance, etc.) but little contingency for unforeseen pressures (pandemic costs, commodity price increases, heating/cooling during extreme weather, etc.)

- Size and flatness of org makes it difficult to consistently address site issues, support local manager, and contribute to strategic initiatives

Future readiness/risk mitigation strategies

- National Standardization of Services

- Organizational Structure Review

- IS-Specific prioritization and Articulation of Non-Real Property Capital Initiatives

- RPS products as an enabler (funding dependent)

Canadian Pari-Mutuel Agency (CPMA)

2022-2023 Business Profile — Lisa Foss, Executive Director

2022-23 CPMA draft priorities

- Attention to fiscal responsibility and forward planning. Continue IT reform that automates business processes

- Supporting and valuing staff. Building team cohesion and inclusiveness.

- Supporting Justice Canada efforts to modernize the Criminal Code.

- Working with industry partners and the provinces on opportunities associated with the legalization of single event sports betting.

Key contributions (internal and external)

- Providing effective regulatory oversight over pari-mutuel betting in Canada

- Delivering equine drug control program across Canada to help ensure fair play

- Supporting provincial efforts to oversee horse racing including adjudication of offences

- Advancing scientific research on equine doping

- Providing industry elimination guidelines to support equine health and to help ensure a level playing field

Operational risk/challenge(s)

- Revenues are declining steadily

- New science costly and may challenge drug testing regime (for example, gene doping)

- Evolution of broader gaming industry placing greater demands on CPMA's limited capacity

- Reliance on third party contractors for equine sample collection and bulk of testing

- Pressure from industry to legalize other forms of horse racing betting

Future readiness/risk mitigation strategies

- Analyze options for long term financial sustainability

- Work with international science partners to buttress cpma research and look at other ways to manage equine drug control program

- Undertake succession planning from within CPMA

- Work with provincial and international partners to stay abreast of gaming landscape

Our future – Implementing a client-centric vision

- Improving investment and integrated planning decision-making

- Serving as a trusted advisor and partner for AAFC branches and OGDs

- Optimizing governance for strengthened internal collaboration

- Renewing AAFC's corporate financial and HR systems

Align

Continuing to strengthen alignment of corporate functions and services with client needs and timely departmental decision-making

Simplify

Ensuring services are accessible and meet client needs through complementary supports, addressing process gaps and limiting overlap

Enhance

Enable AAFC clients to better achieve objectives by leading renewal of key corporate systems and via innovative and consistent corporate policies, integrated planning and practices

Annex A: CMB organizational chart

- Marie-Claude Guérard

Assistant Deputy Minister/CFO- Shawn Audette

Director General

Finance and Resource Management Services- Responsible for the provision of timely and relevant financial information, services, stewardship and advice through the guidance of the Deputy Chief Financial Officer

- Karen Durnford-McIntosh

Director General

Real Property and Asset Management- Provides services for the management of departmental assets to meet operational requirements and deliver on priorities including, real estate, accommodations, materiel, investment planning, engineering & environmental, departmental security and water infrastructure

- Crista-lynn Ferguson

Director General

Integrated Services- Provides integrated administrative and facilities management services in support of Departmental operations, principally for science and technology research and development center's

- Jean-Pierre Contant

Director General

Strategic Management- Provides department-wide advice and services for key departmental initiatives, including leadership on corporate planning and reporting exercises, performance measurement, change management and branch planning

- Nathalie Leblanc

Director General

Human Resources- Provides HR management policies, programs, advice and services that support the objective of the department's policy framework and business results

- Lisa Foss

Executive Director

Canadian Pari-Mutuel Agency- A special operating agency within AAFC that regulates and supervises pari-mutuel betting in Canada on horse races, thereby ensuring that pari-mutuel betting is conducted in a way that is fair to the public

- Scott Aughey

Director

Pay Transformation- Established to provide surge capacity in addressing backlog of Phoenix requests and to serve as the conduit between AAFC employees and the Public Service Pay Centre

- Shawn Audette

Annex B: More people statistics

Branch official language distribution

Description of the above image

Branch Official Language (OL) Distribution

Lower than BBB: 61.8%

BBB to CBC: 14.4%

CBC or better: 23.8%

Approximately 38% of CMB employees have an official language profile of BBB or better.

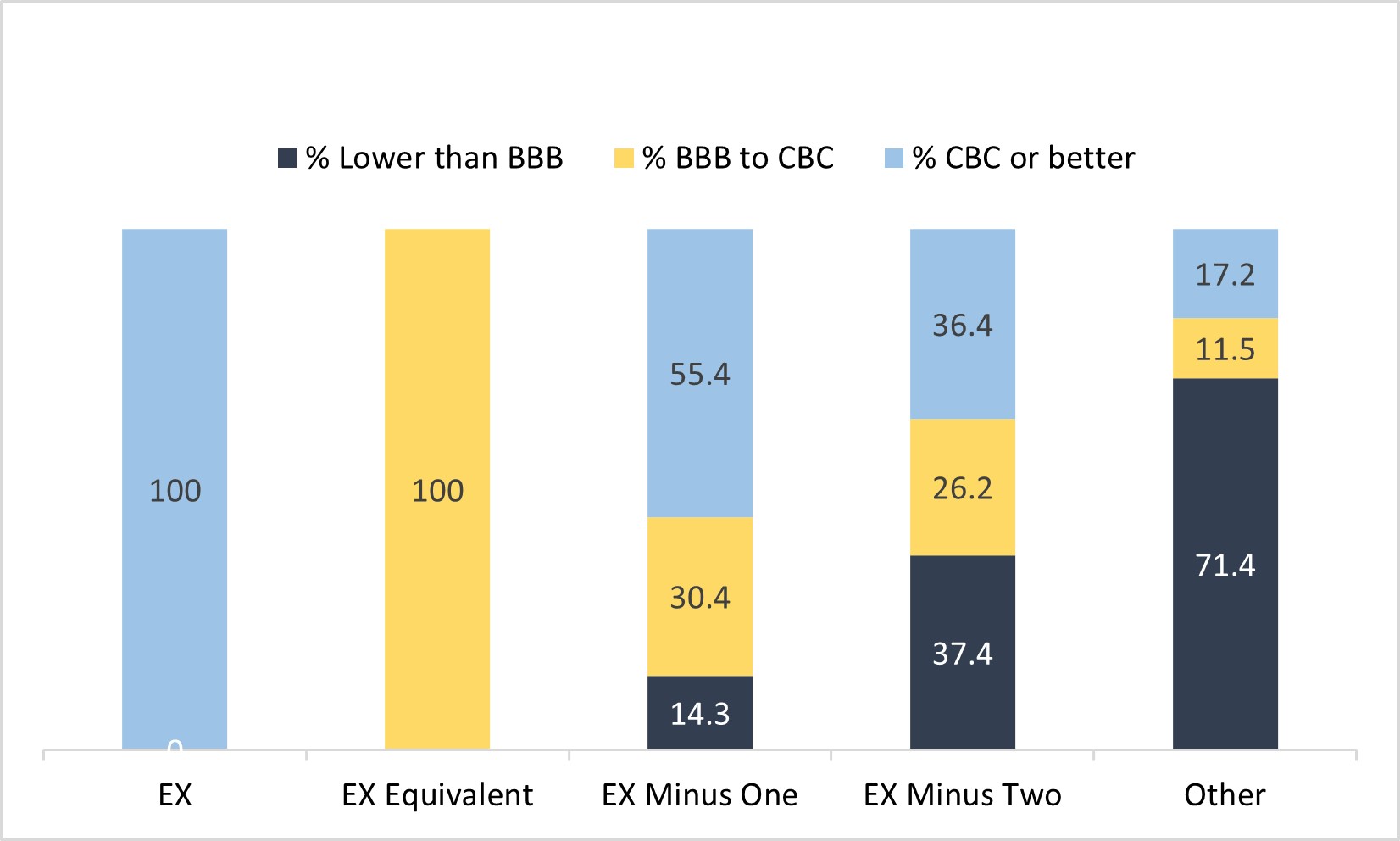

Distribution of OL Capacity by Working Level

Description of the above image

| Working Level | % Lower than BBB | % BBB to CBC | % CBC or better |

|---|---|---|---|

| EX | 0 | 0 | 100 |

| EX Equivalent | 0 | 100 | 0 |

| EX Minus One | 14.3 | 30.4 | 55.4 |

| EX Minus Two | 37.4 | 26.2 | 36.4 |

| Other | 71.4 | 11.5 | 17.2 |

Official language capacity increases with each increase in working level.

Employment Equity (EE) Representation

Employment Equity Representation as of September 30th, 2022

Description of the above image

| Group | Current Representation (in %) | Expected Representation (in %) | Gap between current and expected representation |

|---|---|---|---|

| Indigenous Peoples | 5.0 | 4.8 | 2 more people |

| Persons with disabilities | 7.8 | 9.7 | 19 fewer people |

| Visible minorities | 17.3 | 11.6 | 55 more people |

| Women | 59.0 | 60.1 | 11 fewer people |

The current representation of visible minorities within CMB is markedly greater than the expected representation, and there is little to no disparity in the representation of Indigenous Peoples. The current representation of persons with disabilities and women is less than the expected representation.

Data Source: HR analytics as of January 31,2023, EE data as of Sept 30,2022

Annex C: Real Property footprint details

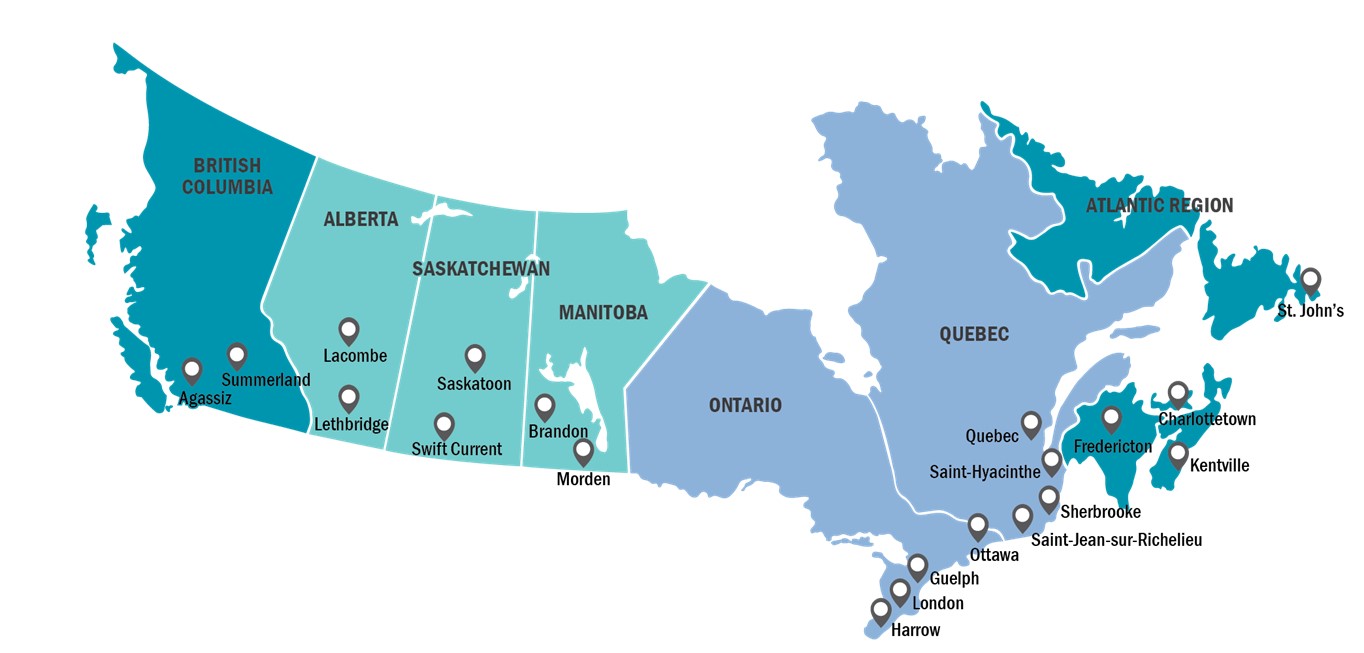

AAFC is comprised of 20 main research facilities or Research and Development Centres (RDC's are located in every province and supported by 26 local satellite offices and research farms).

1,048 buildings, 10,067 hectares of land and 875 fleet vehicles managed

Description of the above image

A map of Canada showing the location of each of AAFC's Research and Development Centres.

Annex D: Financial dashboard

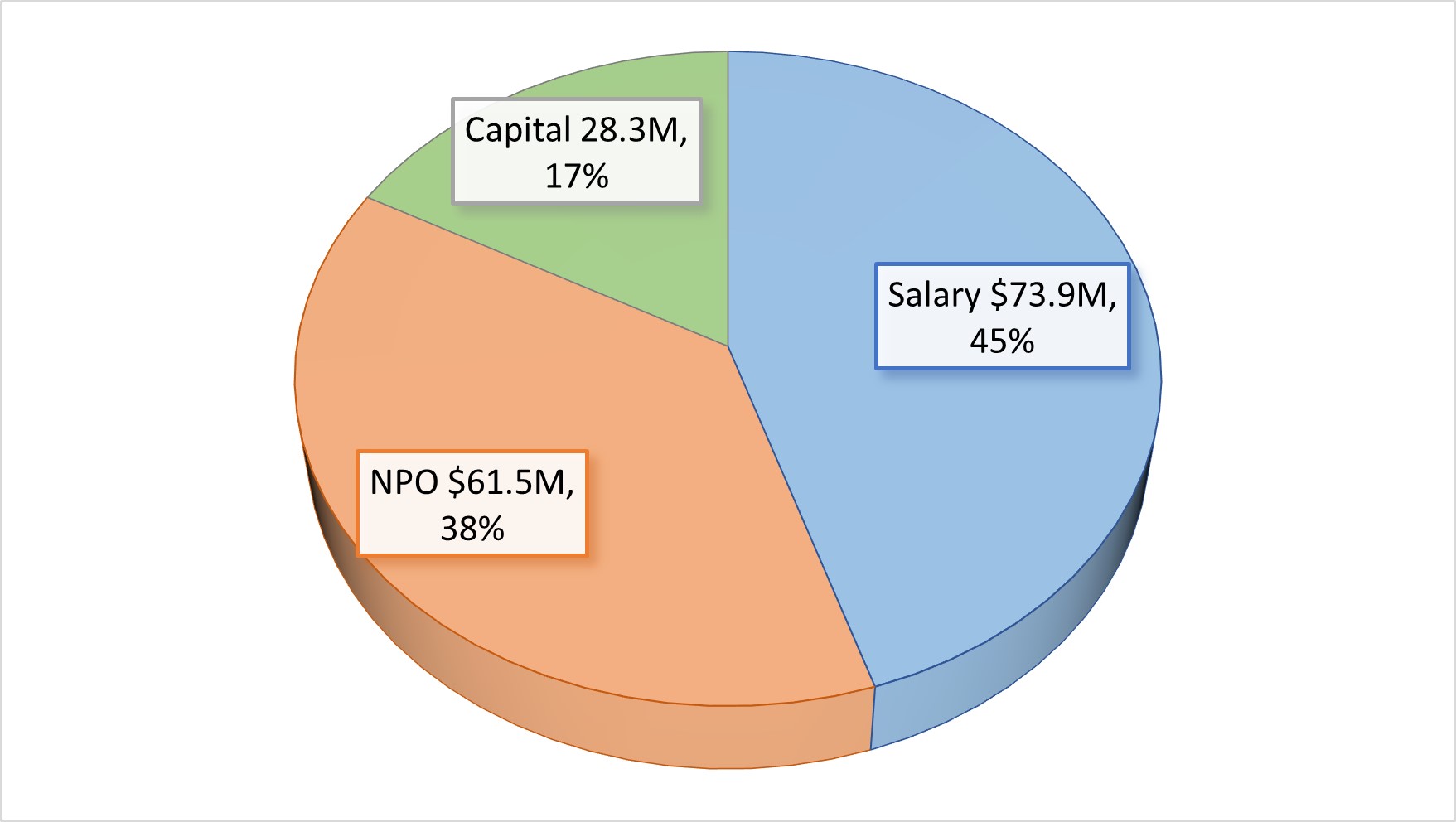

Initial Budget 2022-2023

Description of the above image

Initial Budget 2022-2023

| Salary | NPO | Capital | |

|---|---|---|---|

| Budget ($ million) | 73.9 | 61.5 | 28.3 |

| Percentage of total budget | 45 | 38 | 17 |

Totalling: $135.2M

Almost half of the branch budget is allocated to salary.

- Initial budget does not include funding from Deputy Minister Unallocated Reserve (Pay Transformation and part of HR)

- Canadian Pari-Mutuel Agency funded separately through a revolving fund.

- Budget consists of Initial budget, and currently approved Treasury Board submissions and Supplementary Estimates (A)

- Estimated in-year transfers (Collaborative Research and Development Agreement, Rental revenue and other) totalling $2.6M.

Budget (Vote 1 and Vote 5) by Directorate 2022-2023

Description of the above image

| Funds centre | Salary | NPO | Capital |

|---|---|---|---|

| ADMO | $335,443 | $408,959 | |

| RPAM | $11,734,265 | $17,633,227 | $25,493,000 |

| Integrated Services | $24,510,188 | $38,387,475 | $2,834,000 |

| FRMS | $17,467,460 | $3,229,710 | |

| SMD | $2,217,100 | $384,365 | |

| HR | $17,581,299 | $1,317,031 |

Integrated Services and RPAM have the greatest directorate budgets in the branch.

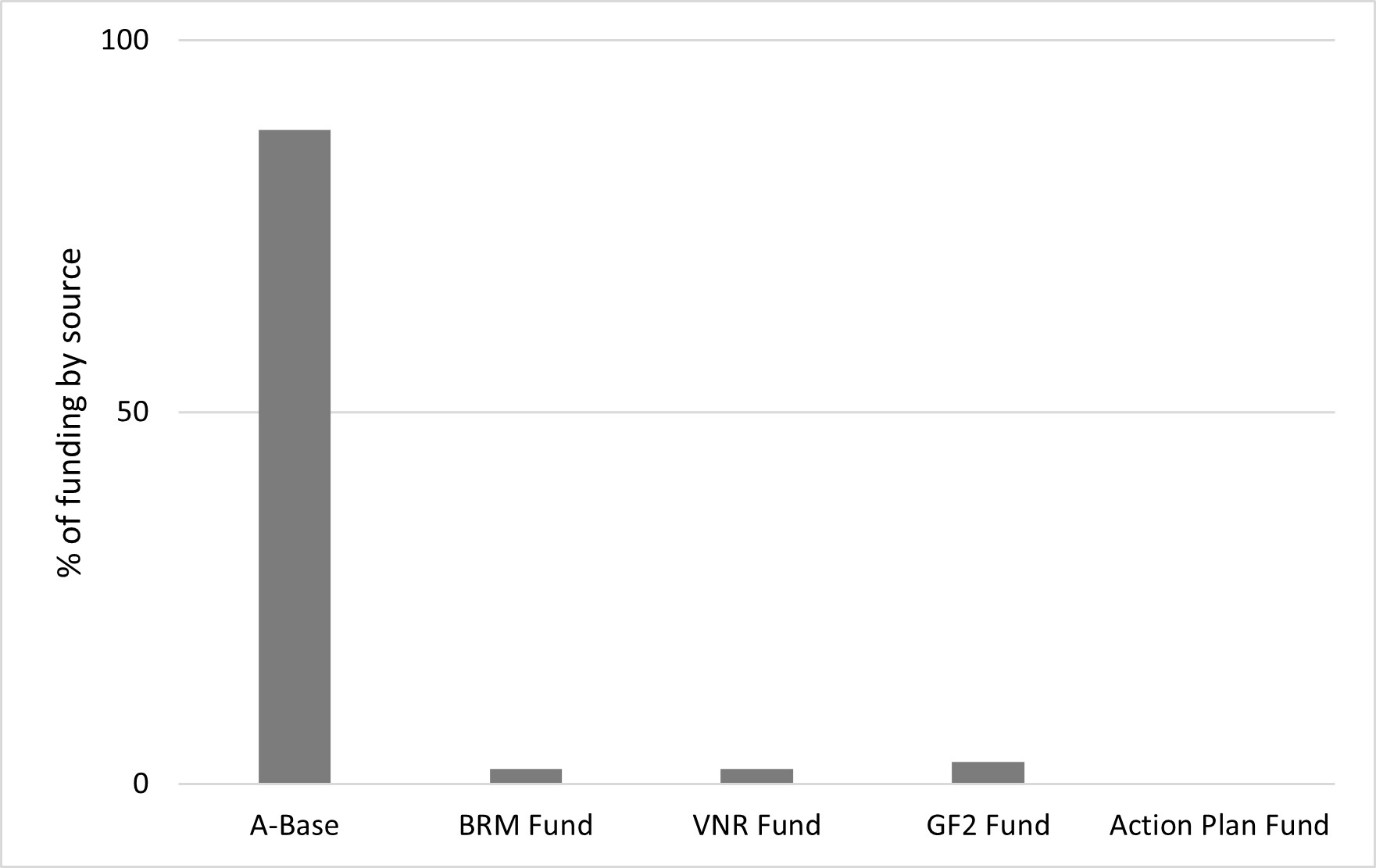

Vote 1 Funding Source

Description of the above image

| Source | Percentage of Vote 1 |

|---|---|

| A-Base | 88 |

| BRM Fund | 2 |

| VNR Fund | 2 |

| GF2 Fund | 3 |

| Action Plan Fund | 0.1 |

A significant majority of Vote 1 funding comes from A-base budgets.

International Affairs Branch

Purpose

Overview the shared Agriculture and Agri-Food Canada (AAFC) and the Canadian Food Inspection Agency (CFIA) role in international trade and how International Affairs Branch (IAB) carries out this mandate

IAB is critical to maintaining and enhancing international trade

IAB advances trade across many fronts, including:

- Implementing an International Regulatory Framework by working with multilateral institutions and standard setting bodies

- Facilitating regulatory co-operation and technical market access activities to mitigate trade barriers

- Aiding in the resolution of market access barriers, such as by negotiating import and export conditions and advocating for science and rules-based trade

- Undertaking technical capacity building and inspection activities to maintain public confidence and facilitate the adoption of systems grounded in science by trading partners

- Collaborating within the Department and Agency, as well as with Federal Provincial Territorial (FPT) and industry partners to advance Canadian trade positions and support predictable trade

- Implementing a shared FPT approach to market development, international branding and export promotion

- Advancing bilateral relations in support of the Agency and Department's mandates

IAB implements and delivers organizational trade and market expansion priorities

- IAB supports departmental priorities related to maintaining and expanding trade and markets, notably the outcomes of:

- The Canadian agriculture and agri-food sector contributes to growing the economy; and

- Access to international markets is increased by resolving or mitigating market barriers and advancing trade positions.

- Trade continues to grow, emphasizing IAB's key role: In 2021, Canada reached a record Canadian $82 billion in sector exports to over 200 destinations, representing a 27.3% increase since 2017.

- IAB continues to meet increasing pressures to support the sector in implementing its international trade aspirations, while offering avenues towards market diversification and risk mitigation.

IAB also plays a key role to advance the whole-of-government approach to sector trade

AAFC and the CFIA both play important and complementary roles to support trade…

- AAFC leads on maintaining and opening markets, advocacy, and industry engagement

- CFIA leads on regulatory and technical expertise, technical negotiations, and import/export certification

… which is part of the coordinated Federal Market Access Team (FMAT) approach with other government departments (OGDs)

- FMAT

- AAFC

- CFIA

- Global Affairs

- OGDs

IAB is the cornerstone of FMAT, facilitating collaboration and a whole-of-government approach to advancing Canada's trade agenda, including bilateral/multilateral engagement.

IAB organizational and management structure

- Kathleen Donohue: Assistant Deputy Minister and Vice President of IAB (AAFC-CFIA)

- Parthi Muthukumarasamy: Executive Director of International Programs Directorate (CFIA)

- Shelley Monlezun: Executive Director of Horizontal and Strategic Initiatives Directorate (AAFC-CFIA)

- Michelle Cooper: Director General of Market Access Secretariat (AAFC-CFIA)

- Lauren Donihee: Executive Director, Market Development (AAFC)

IAB directorates and key functions

International Programs Directorate (CFIA)

- Supports strategic bilateral and multilateral engagement with foreign competent authorities and international organizations

- Mitigates the risks of imported animal, plant and food products to the health and safety of Canadians and Canada's resources

- Facilitates the export of animal, plant and food products to enhance the well-being of Canada's economy

Horizontal and Strategic Initiatives (AAFC-CFIA)

- Leads branch-wide policy and corporate functions for both AAFC and the CFIA, such as governance committees, leading corporate planning and reporting, leading technical assistance activities of the CFIA, and administers IAB's presence abroad.

- Responsible for developing and administering financial and administrative policies, services and reporting systems for IAB

Market Access Secretariat (AAFC-CFIA)

- Works to maintain, re-gain and expand market access, such as by providing regional intelligence that supports positive working relationships with foreign competent authorities

- Leads and contributes to engagement in the World Trade Organization's (WTO) Committee on Sanitary and Phytosanitary (SPS) Measures and International Standard Setting Bodies (ISSBs) and by being involved in the negotiation of Free Trade Agreements

- Manages key bilateral relations for the Department and Agency

Market Development (AAFC)

- Works closely with federal, provincial and industry partners to encourage and facilitate a Pan-Canadian approach to market development

- Plans and organizes flagship trade shows in support of the agriculture, agri-food and seafood industry

- Provides customized market data and economic global analysis

- Manages the Canada Brand

IAB human resources snapshot

CFIA staff

- In-Canada positions: 148 Full Time Employees (FTEs)

- CFIA Technical Specialists Abroad: 11 FTEs

AAFC staff

- In-Canada positions: 102 FTEs

- AAFC Agriculture and Food Trade Commissioner Service: 40 FTEs

Global Affairs Canada

- Dedicated Trade Commissioner Service positions focused on agriculture: 8 FTEs

Reflecting upon four years since IAB's establishment: Benefits and successes

- Since 2018, IAB has facilitated a coordinated and strategic Government approach to agricultural trade:

- Ensuring one voice is taken with international counterparts

- Building linkages between policy and technical levers

- Optimizing organizational strengths to better meet Government and industry growth and diversification objectives

- Streamlining engagement with industry stakeholders

- IAB has effectively addressed a number of high-profile access issues, such as canola, meat and seafood to China, and beef to the European Union (EU)

Looking ahead: Risks and challenges

- Maintaining market access has become increasingly complex, and risk is growing

- IAB's dual organizational structure has been beneficial to integrate international functions, but the corporate functions need to be further integrated to gain efficiencies

- IAB is increasingly called upon to engage bilaterally in new areas: environment, food security

- IAB's funding structure relies heavily on tied funding

Information Systems Branch

Information Systems Branch (ISB) organizational structure

- Vidya ShankarNarayan

Assistant Deputy Minister (ADM) and Chief Information Officer (CIO)- Digital Solutions and Innovation (DSI)

- Transformation and Modernization Services (TMS)

- Strategic Management (SMD)

- Office of the Chief Data Officer (CDO)

Priorities:

- Provide seamless delivery of data and digital solutions that are secure, client driven, inclusive and accessible by accelerating digital transformation and embracing innovation.

- Establish ourselves as a trusted partner to help enhance the competitiveness and sustainability of Canada's agricultural sector by identifying opportunities to collaborate and raise awareness to fully realize the ambitions of the digital economy and meet the challenges of a dynamic trade environment.

By the numbers:

- 514 employees (including 45 casuals and 15 students)

- Approximately 200 contractors

The ISB evolution

- Ongoing mandate to support the department with digital and data infrastructure to enable employees to work (See Annex A and B for more details)

- Primarily led by Digital Solutions and Innovation and Transformation and Modernization Directorates through development and delivery of digital tools and information technology (IT) equipment

- Supported by Strategic Management Directorate (SMD) through policy, process and contract management and Office of the Chief Data Officer (OCDO) through data policy and governance and process automation

- Building capacity to support the sector in collaboration with sector-facing branches

- Primarily led by SMD and OCDO through initiatives to build awareness of digital trends and high priority issues (for example, Cyber security, Supply Chain Visibility) and pilot projects to explore digital solutions

AAFC'S Data and Digital Strategy

- User-centric and secure digital services

- Supporting AgTech

- Digital Office Tools and Processes for Employees

- Renewing our workforce

- Digital and Data Infrastructure

Agriculture and agri-food sector's data and digital future

- Workforce diversity and re-skilling

- Digital trust and cyber security

- Digital and data interfaces between stakeholders and government

- Investment in research and development technologies

- Cross-jurisdictional infrastructure

- Enable technology and knowledge transfer

- Precision agriculture

- Robotics and artificial intelligence

- Digital farmer/entrepreneur

Information Systems Branch

- Assistant Deputy Minister (ADM) and Chief Information Officer (CIO): Vidya ShankarNarayan

- Focused on evolving the branch from an internal service provider to one that can also provide digital expertise in support of sector competitiveness

- Building awareness within the department of digital trends to support sector competitiveness

- Collaborating with departmental partners to facilitate connections and awareness across the sector of digital opportunities to support its competitiveness

- ADM Co-Champion – Diversity, Equity and Inclusion

Digital Solutions and Innovation (DSI)

- Director General: Ling Lee

- Working with clients across the Department to co-develop digital solutions, tools and innovations to support delivery of the Department's mandate

- Key projects:

- Departmental Data and Digital Transformation Strategy

- Client Relationship Management / Canada Brand Portal

- Science Solutions

- Executive Champion for the Visible Minorities Network

- Co-Chair - Directors General Data and Digital Transformation Steering Committee

- Ling Lee

Director General- Digital Platforms and Workload Migration

- Cloud Operations

- Business Solutions and Applications

- Science Solutions and Innovation

- Program and Service Delivery Solutions

Key services:

- Work horizontally across the Department to lead collaboration to enable digital transformation

- Lead the internal review and preparation for implementation of government wide digital initiatives, including designing digital government platforms, workload migration/application modernization and Compute Canada infrastructure projects

- Developing operating and continual modernization of the Department's two cloud environments

- Design, develop, implement and operate all external facing digital interfaces with departmental stakeholders, including supporting international trade initiatives

- Responsible for designing and building digital technologies to enable science research, collaboration and innovation, including horizontal collaboration with other science-based departments and agencies, academia and international partners

- Design, operate and maintain all digital delivery mechanisms for the departmental grants and contributions solutions for AAFC's business risk management programs, including the Department's Grants and Contributions Digital Platform

Transformation and Modernization Services (TMS)

- Director General: Nadine Boudreau-Brown

- Enabling the department's hybrid environment with digital infrastructure as the head of IT client services support

- Key projects:

- Financial and Human Resources (HR) systems modernization

- Management of cyber security risks while supporting digital transformation and innovation

- IT Indigenous Apprenticeship Program

- ISB lead for:

- Indigenous, Black and Racialized employees

- Director General (DG) Future of Work Committee and digital transformation initiatives

- Two interdepartmental-clusters (PeopleSoft and SAP) for more than a dozen Government of Canada departments and agencies

- Nadine Boudreau-Brown

Director General- Financial Management Applications

- IT Client Services

- Digital Transformation and Service Integration

- PeopleSoft

- Cluster

- Cyber Security and Identity Management

Key services:

- Lead delivery and support of IT services to AAFC's workforce of approximately 7,000 clients across Canada, while also providing innovative and tailored IT support solutions to the Minister's Office (MINO), Deputy Minister's Office (DMO), AAFC's 21 Research and Development Centres and 65 corporate and satellite research facilities across the country.

- Shepherd AAFC's digital transformation and flexible hybrid activities by leading initiatives and emerging technologies, such as: Microsoft 365, boardroom modernization, connectivity (that is, bandwidth, Wi-Fi) and digital dexterity (See Annex C for more details).

- Lead two inter-departmental clusters: 1) SAP providing financial operations to 7 departments and more than 30,000 end users; and 2) PeopleSoft as a human resources management solution supporting 8 departments and 33,000 end users.

- Lead cyber-security operations, maintain IT risk management framework. Manages Security Operations Centre (SOC), develops IT security standards, policies and risk assessments, conducts compliance monitoring, manages identity, and incident management in collaboration with departmental and Government of Canada stakeholders.

Strategic Management Directorate (SMD)

- Director General: Katherine MacDonald

- Ensuring digital and data infrastructure is considered in policy and program development within the department and leading the branch's effort to provide a digital lens to sector competitiveness

- Key projects:

- Agriculture sector cyber security awareness

- Development of AAFC's Digital Ambition

- Leverage modern tools for tracking of data and digital investments and producing user-friendly dashboards and reports that are accessible to a broad audience

- Transition from legacy repositories to SharePoint Online as AAFC's official corporate repository

- Executive Champion for the Persons with Disabilities Network

- Katherine MacDonald

Director General- Digital Government

- Digital Integration

- Knowledge Services

- Planning & Portfolio Management

- Branch Management

Key services:

- Support the implementation of AAFC's data and digital vision through the development AAFC's Digital Ambition, by providing enterprise architecture services to AAFC's data and digital projects and by collaborating with AAFC branches in support of key agricultural technology initiatives. (See Annex D).

- Provide knowledge services through the Canadian Agriculture Library and information resources, expert research services, data architecture services and information management support to AAFC employees across Canada.

- Manage the departmental data and digital investment planning process and digital project governance framework.

- Manage the data and digital relationships between ISB, AAFC Branches and external partners including Shared Services Canada (SSC). Provide support services to ISB such as digital procurement, branch human resources, financial planning, costing of Budget proposals, Memoranda to Cabinet and Treasury Board Submissions, and others.

- Collaborate with external partners to increase awareness and find opportunities to improve cybersecurity for the agriculture as part of the critical infrastructure for the country.

Office of the Chief Data Officer (OCDO)

- Chief Data Officer and Director General: Elise Legendre

- Championing the use of data and advanced technologies to drive AAFC's digital transformation, improve decision-making and organizational performance, while also leveraging data through strategic partnerships to help enhance the competitiveness of Canada's agricultural sector.

- Key Projects:

- AAFC Data Strategy Refresh

- Data Management Platform Project

- Automation and Artificial Intelligence

- Digitizing Traceability (see Annex F)

- Member of the Government of Canada Data Community Steering Committee, the CDO Council of Canada and a sponsor in the AAFC Sponsorship program

- The CDO reports to both the ADM of ISB and the ADM of Strategic Policy Branch.

- Elise Legendre

Director General/Chief Data Officer- Data Policy

- Data Management & Infrastructure

- Data Driven Technologies

- Science Data Lead

Key priorities:

- Collaborating for Growth

- Forging strategic partnerships with key federal, provincial and territorial partners (for example, Canadian Food Inspection Agency, Statistics Canada).

- Building strong relationships within the agricultural sector and with international partners, such as the US Department of Agriculture and other countries around the world (for example, exploring potential for seed potato traceability in the Indo-Pacific region).

- Empowering Data-Driven Transformation

- Creating a culture that uses data to make informed decisions and drive continuous improvement and innovation.

- Implementing technologies, promoting data literacy and leveraging insights to optimize operations and enhance people's experiences.

- Building Capacity

- Stabilize the foundations of the Office of the Chief Data Officer to ensure the capacity to leverage data to deliver better services, work more efficiently, and solve complex problems with partners.

Annex A: AAFC Data and Digital 201

Why transform?

Digital service expectations

- Rapid technological, digital and data transformation are part of Canadians' daily lives, revolutionizing the way they access information and services and the way they live, socialize and work. They expect the federal government to keep pace with change and provide consistent leadership.

Transformation accelerated by COVID-19 pandemic

- The COVID‑19 pandemic significantly accelerated the global shift to online services and the trend toward full access to remote work.

- From the onset of the pandemic, the GC and AAFC rose to the occasion, working across traditional divides and innovating to rapidly deliver digitally-enabled essential services, including emergency benefits, and supporting our employees to work remotely with modern and secure digital tools.

Digitally-enabled science key to pandemic recovery

- As our economy recovers from the pandemic, the need for digitally enabled science and research, further investments in growing our sector, and making decisions based on FAIR (Findable, Accessible, Interoperable and Reusable) data is greater than ever.

- To make our commitments a reality in an unpredictable environment, we must modernize our technology and how we manage it to keep AAFC responsive and resilient so that it meets the changing needs and expectations of producers, scientific research, sustainable growth and food security in the agriculture and agri-food sector.

Digital evolution of service delivery

Despite ongoing pandemic challenges, contributions from Canada's agriculture and agri-food sector are key to economic recovery.

AAFC support includes:

- Delivering programming that drives sector resilience, innovation, sustainability and productivity

- Advancing clean growth and climate change actions through the sequestration and reduction of greenhouse gas emissions

- Providing a business risk management suite of programs that help producers manage risk and ensure food security

- Building digital trust through an enhanced focus on cyber security, including adapting and enhancing security tools and surveillance.

What is digital government?

Digital Government means modernizing and adapting the way we work so that we can compete in a fast‑changing world and ensure that AAFC remains responsive, resilient and relevant.

- Our employees need and expect modern, secure, reliable technology and data.

- To meet these needs and expectations, we need a workforce that has the right digital skills and tools, forward-thinking leaders and lean governance models.

- With digital training and tools, our workforce can provide seamless, client-focused programs and services.

- Data is a strategic asset and is the "currency" of digital government and well beyond.

- AAFC's multitude of programs and services collect, generate and hold an ever‑expanding array of data and information.

- Hundreds of software applications are used to run the systems that deliver AAFC programs and services.

- Cybersecurity threats continue to increase, and so must our risk response.

- The integrity and security of AAFC's data is essential to the delivery of science priorities, and services to the agriculture and agri-food sector.

- With the increasing sophistication and frequency of cyberattacks, we must remain vigilant and continue to modernize our infrastructure and processes to meet the latest standards.

AAFC digital transformation pillars

Employee and partner experience

- Secure, reliable and accessible digital tools

- Flexible, smart and connected workplace

- Training and automated 24/7 support (Service Help bots)

- Services designed for partner needs and accessible to partners across rural/remote locations

- Access to real-time, integrated market research & analytics

Data and digital platform

- Cloud-based secure Data and Digital technology platform

- Establish Federal–Provincial–Territorial (FPT) data sharing

- Labs Canada Science Technology requirements – secure IT, data management services and collaboration services

- Digital capabilities to support employee and partner services

- Data Strategy, Governance and Stewardship

- Adoption of GC digital enablers

- Cyber Security controls and Risk Management

Digitally driven business models

- Digital research and development centres

- Data management and interoperability with partners

- Leveraging big data to make agri-food supply chains more sustainable, traceable and resilient

- A seamless, integrated digital stakeholder experience to drive innovation, collaboration and efficiency

Innovation and experimentation

- On-demand high performance computing for science

- AI and Process automation to alleviate high-volume tasks

- Smart Contracts with partners for Agile Programming

- Support Open Science

- Blockchain-based applications for climate change programs and traceability

Annex B: AAFC Data and Digital Foundation

Users

To whom do we offer services?

AAFC Partners

- Producers

- Sector Partners

- Science/Academia

- Other government departments

- Provinces and Territories

- International

AAFC Workforce

- At Home

- On Premises

- In the field/lab

Interfaces

How do they interact with us (BRM, Living Labs, SAP, PeopleSoft, etc.)?

Partner Facing

- Digital Services Portal

- Open Data (open.canada.ca)

- Open APIs (sharing platform)

- Open Source

- Open Collaboration

Internal Facing

- Corporate Systems (SAP, PeopleSoft)

- Business Intelligence

- Employee Experience Tools

Services

What do we offer them?

- Statutory Programs and Gs&Cs

- Science Services

- Market and Industry Services

- Legislation, Regulation and Policy

- Internal Services

Digital Capabilities

What must we be able to do?

- Customer Relationship Management

- Case Management

- Open Science

- Content Management

- Human Capital Management

- Machine Learning and Predictive Analytics

- Robotic Process Automation

- Enterprise Interoperability

- Information Management

- Financial Management

- Identity and Access Management

- Communication and Collaboration

- IT Services Management

- Business Systems Management (App Dev)

- Enterprise Data Management

- Artificial Intelligence

- Big Data Analytics

- Enterprise Architecture

- FPT Data Sharing

- Data Governance and Stewardship

- Cloud Excellence

Technologies

How do we enable these capabilities?

- Email, Personal Storage, and Collaboration (M365)

- Devices

- Team Chat and Video Conferencing

- High Performance Computing

- Storage for Science

- API Gateways and Messaging

- Business Intelligence

- Identity and Access

- Application Development and Hosting

- Internet of Things (IoT)

- Zero Trust Networks

- Data Management and Interoperability

- GC End State Data Centre and Public/Hybrid Cloud (SaaS, IasS, PaaS)

Annex C: Digital Workplace and Digital Roadmap

Digital Workplace — Employees work in a collaborative environment that is not located in any one physical space in a secure and safe way.

- A workplace of mobility, portability – seamless transition between home, office, research centre and everywhere in between.

FY 2021-2022

There were:

- 6,918 licensed users

- 21.8M emails read

- 18.98M Teams chat messages

- 479,300 Teams video meetings

- 20,800 GB of email storage in use

- 49,200 GB of OneDrive storage in use

Home

- Research studies

- Genomics

Lethbridge Research and Development Centre

Plant and Animal Research

- Field work

- Animal management

- Research studies

- Genomics

Morden Research and Development Centre

Plant Research

- Field work

- Lab work

- Research studies

- Genomics

Winnipeg Regional Office

- Collaboration

NHCAP

- Collaboration

GC Workplace Hub

- Engagement with GC partners

St. Hyacinthe Research and Development Centre

Dairy Research

- Lab work

- Research studies

- Industry Engagement

Charlottetown Research and Development Centre

Potato Research

- Field work

- Lab work

- Research studies

Digital Roadmap — Employee Experience and Experimentation – Explore | Experiment | Evolve

April – October 2022

Enhanced collaboration and connectivity

Bandwidth

- Usage reports – leveraged workstation data to build estimation reports

Wi-Fi

- Completed 22-23 site prioritization with CMB and STB

- Burnaby Office

- Saint-Jean-sur-Richelieu RDC

- London RDC

- Harrington

- Vineland Research Farm

- Lacombe RDC

- Regina Office

- St. John's RDC

- Collected site facility drawings to design plans with SSC

Boardrooms

- Installed 11 surface hubs in the following locations:

- NHCAP – T4-3-232

- NHCAP – T5-4-211

- NHCAP – T5-6-247

- NHCAP – T7-2-244

- NHCAP – T7-6-244

- NHCAP – T7-9-223

- NHCAP – T7-9-340

- Confederation Building – Minister's Office

- ORDC – BLDG39 – The Lodge

- ORDC – BLDG34 – Room 109

- Regina RDC – Room 306

- Enabled CVI in over 200 Video conference enabled boardrooms

- Added 11 boardrooms to the booking tool

- Gathered feedback from users through AAFC's hybrid survey

- Provided 12+ training sessions to ADMOs, Governance, (PAB Branch reps, STB Branch Reps, MISB employees and various other groups in AAFC)

- Added instructions in each boardroom on how to use the equipment

M365

- Informed employees on how to use M365 applications (Whiteboard, Harmon.ie, live captions, transcriptions, automated translation, using Teams for effective meetings, external chat)

Digital literacy

Digital Innovation Hub (NHCAP)

- Engagement and planning for Digital Innovation Hub

Learning

- Held 25 M365 training sessions for whiteboard and harmon.ie along with 20+ hands on demos at the various management tables and departmental meetings

- Evaluate Microsoft learning pathways and Viva for ongoing training

- Building the Automation citizen developer network (trial in Harrow)

Wellness and workload management

IT support

- Increased presence of onsite support, including new IT Service Kiosks at NHCAP

Wellness

- Evaluated accessibility tools in M365 through an assessment and engagement of the Persons with Disability Network.

- Enabled wellness tools for M365 (virtual commute, personal analytics, mindfulness exercises, delay email sending features, controls to limit meetings to 25 or 55 min)

- Informed employees about how to use wellness tools through pilot demo sessions

Automation

- Assessed and prioritized automation needs and capacity of tiger team

- Developed an interim booking tools for boardrooms and meeting rooms space

- Investigated desktop support modernization tools and solutions to support employees in a hybrid model

- Launched an AAFC ChatBot to increase timely responses for routine IT questions

November 2022 – May 2023

Enhanced collaboration and connectivity

Bandwidth

- Usage reports – continue to work with SSC to validate and acquire new data

- Identify and request bandwidth upgrades from SSC based on testing and feedback

- Deploy GC Science Network at 3 sites related to clean plant health

- Work with SSC to evaluate regional hub model for impacts to AAFC

- Evaluate SSC shared network model for impacts to AAFC

- Network modernization study and planning for next steps

Wi-Fi

- Complete installation at

- Agassiz RDC

- Guelph RDC

- Sherbrooke RDC

- Charlottetown RDC

- Develop a 23-24 priority list with CMB and STB along with a DM unallocated request

Boardrooms

- Continue prioritization exercise with CMB and STB for this fiscal and 23-24 and develop a DM unallocated request

- Additional procurement and installation in over 25 rooms in various AAFC locations across Canada

- Additional procurement and installation of 75 Polycom Microsoft Teams Room devices within NHCAP and at other regional sites

- Continue to gather user feedback

M365

- Office Suite implementation and training sessions

- Planning for migrating active data from Agridoc, and Knowledge Workspace to SharePoint Online for improved collaboration

- Continued training sessions, demos and info sessions on M365 products

Digital literacy

Digital Innovation Hub (NHCAP)

- Conversion of the space – IT kiosk, digital competency stations and event space

Learning

- Launch Microsoft learning pathways for ongoing training

- Continual outreach on new training provided for M365 tools

- Continue to build and expand the Automation citizen developer network

- Inform and expand access to Power automate

Wellness and workload management

IT support

- Explore self-service options (contactless equipment pickup)

- Review the current service catalogue based on client feedback and data

Wellness

- Improved wellness tools for M365 with the deployment of Office 365

- Inform employees about document accessibility testing tools and provide training as part of the Office 365 deployment

- Continue to inform employees about how to use wellness tools through training sessions

Automation

- Implement prioritization for the automation centre of excellence

- Explore self-service options (booking appointments with desktop support staff)

- Transition from current booking tool to Archibus

Inventory, clean-up and equipping of physical space throughout

Annex D: Digital Transformation in the Food System

Drivers

- Cellular ag

- Transformative technology

- Scale-up

- Trade

- Competitiveness

- Trust

- Social governance

- Data integration

- Transparency

What we heard

- Highlight key messages heard at World Agri-Tech Innovation Summit and Future Food-Tech Innovation and Investment from Farm to Fork, in London, UK from September 20-23, 2022.

- The purpose of the placemat is to act as a catalyst for discussion and identify collective next steps.

Why it matters

- Digital adoption will enable the sector to produce more food, more efficiently – increasing their competitiveness, environmental sustainability and supporting global food security.

- Opportunity to enhance trust and transparency with consumers and trading partners using digital solutions.

- Increasing volume of data supports more effective decision-making in all parts of the supply chain.

Systems approach

- System-wide approach is needed

- Digital adoption has been limited

- Scalability is a challenge

- Partner to find solutions

- Need to accept some methods will fail

- Consumer trust will accelerate change

- Lack of a collective purpose

Food industry

- Food innovation ecosystem needs to be more visible

- Difficulty tackling innovation challenges

- Tech driven solutions at price parity

- Technology must be transparent

Agriculture industry

- Reducing footprint is imperative

- More socially aware businesses

- Accountability for demonstrating sustainability goals

- Transform narrative around primary production

Digital transformation

- Difficult to demonstrate sustainability without digitization

- Greater standardization of data

- Individual entities can leverage their data to inform decision-making

- Demonstrate value to consumers through data

- Youth can drive digital transformation

- Achieving scalability requires interoperability across systems to accelerate adoption

Considerations for AAFC

- What is our collective vision for digital transformation in the sector? Are we on the right track? How can we help accelerate change?

- What is the role of government? How/when does AAFC partner with other departments provincial/territorial governments and the sector?

- Digital and tech adoption and the challenges associated with it varies along the value chain. How do we ensure a systems-wide approach to moving the sector and value chain forward?

- How do we encourage experimentation across the industry and within our programs as innovation rapidly advances around the world (for example, cellular agriculture)?

What is next?

- Engage stakeholders and other partners (that is, provinces, other government departments) to develop collective visions, enable experimentation and build awareness of resources to digital adoption.

- Take a system-wide approach to policy programming, leverage existing programs and collectively address gaps.

- Incorporate concrete and measurable next steps on digital transformation and innovation into forward planning.

Annex E: Government of Canada's evolving context and despite commitments, Canada is falling behind with digital services relative to global peers

Digital content

- 2018 – Report to the Clerk of the Privy Council Data Strategy Roadmap for the Federal Public Service. Canada signs the Digital Nation Charter, joining leading digital nations in a mission to harness digital technology to the benefit of citizens.

- 2020 – Renewal of Canada's Digital Operations Strategic Plan (2021-2024). Supported by other foundational policy pieces such as Digital Standards, the Policy on Service and Digital and Policy on Government Security.

- The 2020 BCG Digital Citizen Survey shows:

- Canada has the lowest usage frequency for digital government services (30%) in a group of 36 countries

- About 2/3 of Canadians (68%) reported one or more problems with use of digital services

Volume, velocity, and variety of data

In 2018, the global datasphere was 33 Zettabyts (ZB), and it is predicted to grow to 175 ZB by 2025. If 175 ZB were saved on DVDs, it would create a stack that could circle the Earth 222 times

- Sector growth is data driven – combining technology and analytics harnesses the power of data to support smart farming decisions to gain efficiency in production cycles.

- Addressing climate change will require faster variety development, innovative mitigation ideas and increased use of technology and data to generate insight.

- AAFC creates and has access to a significant amount of data, internally and from our stakeholders, GoC and FPT partners.

- Implementing partnerships to ensure data assets are FAIR (Findable, Accessible, Interoperable and Usable) allows us to be an effective collaborator, tell our story, streamline service delivery and support sector growth.

Rapid shift to digitally-delivered services and working remotely

Then COVID struck while some pre-pandemic challenges remain

- Rapid technological, digital and data transformation are part of our daily lives.

- Fundamentally changed the way we worked and accelerated the global shift to online services.

- Technical debt, vulnerability of aging systems, gaps in data, interoperability issues, have hindered transformation and required focused collaboration across traditional divides to address.

- Demonstrated high level of adaptability, innovation and collaboration as workforce transitioned to remote work.

- Siloed, fragmented data, aging systems and increasing technical debt at all levels of governments.

- Low data/digital literacy that slows down cultural shift required. Competing for scarce resources – overall 30% vacancy in IT, supply chain issues, procurement challenge.

- Tension between protecting private information remains which impacts effective data usage to streamline/tailor program/service design, delivery and reporting.

- Cumbersome and long processes do not support agile development and implementation of enterprise solutions.

Leveraging data and talent

Overcoming obstacles and equipping our Department to truly leverage data assets

- AAFC's multitude of programs and services, and extensive research generate and hold an ever-expanding array of data and information.

- Increased frequency and sophistication of cyber-attacks stresses the need to protect the integrity and security of our data and digital assets, as well as our partners.

- We can build on pockets of data excellence throughout the department to spur digital transformation aligned with the GC digital ambition:

- Excellence in technology and operations

- Data enabled digital services and programs

- Action-ready digital strategy and policy

- Structural evolution in funding, talent, and culture

Annex F: Traceability and Agriculture and Agri-Food Sector

By the numbers

- By 2050, the world's population will be approximately 9.7 billion – feeding it will require food production to doubleEndnote 1

- Agri-Food chains – from farm to fork – are complex, suffer from inefficiencies and contribute to a number of global problems.

- Paper-based transactions still dominate international trade – costing approx. $500B/yr. or roughly 2.5% the value of global tradeEndnote 1

- Contribute 26% of anthropogenic release of GHG, use 50% of the planet habitable land and 70% of fresh water worldwideEndnote 1

- Food fraud across the global agri-food supply chain results in damages of up to $40B annually – source of problem often hard to identify due to opacityEndnote 1

- Canada is the fifth-largest exporter of agri-food and seafood in the world, exporting to over 200 countries in 2021Endnote 2

- Agriculture and food account for 11% of Canada's goods GDP and almost 10% of Canada's total merchandise tradeEndnote 3

- Highly integrated into global supply chain, particularly with the USAEndnote 2

Traceability is about trust and transparency

- Trade requires trust: confidence in trading partners and truth of claims – paper/electronic documents are subject to fraud and difficult to trace backwards for verification

- To remain competitive internationally, companies may need to evolve to providing verifiable information – secure, tamper-evident, verifiable credentials and transparent chain of custody

- Key trading partners (for example, US and EU) are increasingly advancing traceability use and requirements

- Technology exists – challenges are information asymmetry, governance, digital landscape and regulatory framework

Established, reliable technologies and tools to track data in a fraud-resistant way

- Digital credentials are the electronic equivalent of physical credentials (for example, a driver's licence)

- A verifiable credential is a credential claim that has undergone successful validation and verification using trusted processes (cryptographically secured, machine verifiable, privacy respecting).

- Blockchain is a new kind of database, or ledger. Rather than being stored in a single location, this database is shared across the internet with many people holding a copy of it – a distributed ledger. The addition of data to the database is synchronized between all copies so that there is still a single truth

- Blockchain platforms are being built around the globe, even in developing countries – private, public and joint sector initiatives.

Digitizing traceability opens up opportunities

- Reducing manual updating and processing for all need-to-know parties at the same time and speeds up response time – both in peace time and crisis situation

- Using blockchain, Walmart and IBM demonstrated provenance of mangoes reducing effort from 7 days to 2.2 seconds

- Providing reliable, verifiable evidence demanded by importers and consumers – origin, sustainability, fair-trade, GHG Impacts

- Maintaining and enhancing market access, combatting greenwashing and distrust of product and corporate claims

Proposed actions

- Engage with industry and government stakeholders to raise awareness, explore current traceability initiatives and build partnerships

- Explore opportunities using digital credentials and blockchain initiatives – identify areas for collaboration with industry through proof of concept

- Share results and communicate findings on future opportunities to digitize traceability

Market and Industry Services Branch

Who we are

Market Industry Services Branch (MISB) Employment Equity Snapshot

The Employment Equity data presented below was obtained using the most recent Employment Equity Report for MISB (September 30, 2022). Representation in this report is shown as the percentage of the total Department population who have self-identified in PeopleSoft compared to the expected percentage of the population based on the Workforce Availability Estimates (WAE). The WAE is based on the 2018 Census for Indigenous Peoples, Visible Minorities and Women and in the case of Persons with Disabilities, on the 2017 Canadian Survey on Disabilities.

Employment Equity Representation

Description of the above image

Employment Equity Representation (%)

| Indigenous Peoples | Persons with Disabilities | Visible Minorities | Women | |

|---|---|---|---|---|

| Current representation | 3.90 | 6.20 | 21.80 | 58.40 |

| Expected representation | 2.60 | 8.80 | 18.70 | 50.80 |

MISB is a diverse and inclusive workplace - Overall numbers:

- FTE% by classification group:

- CO 42%

- EC 35%

- AS 12%

- EX 7%

- Other 4%

- FTEs 244 (January 2023)

- FTE% by Employment Type:

- Casual 0.43%

- Determinate 5.60%

- Indeterminate 93.97%

- Salary budget $25.37M

What we do

- MISB supports the economic growth and long-term prosperity of the agriculture and agri-food industry domestically and internationally. MISB supports sector development, advances agricultural interests in bilateral and multilateral trade negotiations and works closely with industry to foster a competitive agriculture sector.

- MISB consists of:

- Policy, Planning and Emergency Management

- Regional Operations Directorate

- Sector Development and Analysis Directorate

- Trade Agreements and Negotiations Directorate

Market and Industry Services Branch – Organization

- Tom Rosser - Assistant Deputy Minister

- Mathieu Boucher - Acting Senior Policy Advisor

- Vanessa Poitevien – Policy Advisor

- Rosie Reaume – Acting Executive Assistant

- Casandra Vrieling – Acting Senior Planning and Coordination Officer

- Sector Development and Analysis Directorate (SDAD)

(Donald Boucher, Director General) - Regional Operations Directorate (ROD)

(Nathalie Gour, Director General) - Trade Agreements and Negotiations Directorate (TAND)

(Marie-Noëlle Desrochers, Acting Director General) - Policy, Planning and Emergency Management (PPEM)

(Patricia Ouellette, Acting Director)

- Sector Development and Analysis Directorate (SDAD)

Assistant Deputy Minister's Office (ADMO), Branch Planning and Resource Management (BPRM) and Policy and Coordination (P&C)

- ADMO, BPRM and P&C

- ADM support, cross-department coordination

- HR staffing support to the Branch classification

- Branch financial management

- Branch Training

- Strategic coordination of horizontal issues and initiatives

Core responsibilities:

- Provide point of contact window for ADMO, triage requests as necessary

- Point of contact for corporate services within the Branch, including business planning, corporate reporting, human resources and administration coordination, finance and information systems to support managers and staff

- Leads MISB's federal-provincial-territorial (FPT) agenda and key interdepartmental committees, such as Senior Officials Committee and Committee on Food Safety.

Regional Operations Directorate (ROD)

- ROD key files

- Atlantic Regional Office

- Quebec Regional Office

- Ontario Regional Office

- Midwestern Regional Office (MB, SK)

- Northwestern Regional Office (AB, BC, YT, NT)

- Events Team

Core responsibilities:

- Provide information and analysis on key regional issues, sectors and supply capacity.

- Maintain strong regional partnerships with industry and FPT partners to provide strategic information and advice on priorities, opportunities and risks.

- Manage FPT agreements through bilateral committees and support the implementation of other agricultural policies and programs.

- Central point for AAFC on the ground when emergencies arise.

Emergency Management (EM)

- EM key files

- Covid-19 EM response

- Preparedness for sectoral-based emergencies

- Public safety engagement

Core responsibilities:

- Supports AAFC's preparedness for sectoral-based emergencies through the development of best practices, tools, and reporting.

- During emergency events, EM provides a critical departmental coordination and information-sharing role with industry and other government departments to ensure a timely, appropriate response.

Sector Development and Analysis Directorate (SDAD)

- SDAD key files

- Market Information and Analysis

- National Sector Expertise and Intelligence

- Innovation and Investment Attraction

- Government –Industry Engagement

Core responsibilities:

- Deliver market information, intelligence and advice to support industry and government information needs and decision making.

- Work with industry stakeholders, portfolio partners, other departments, and other levels of government to address issues impacting the competitiveness of the sector.

Trade Agreements and Negotiations Directorate (TAND)

- TAND key files

- Free trade agreement and World Trade Organization Negotiations

- Multilateral Fora Engagement and Advocacy

- Addressing Technical Trade Barriers

- Addressing Trade Disputes

Core responsibilities:

- To build an open, predictable rules- based trading system through the negotiation and supporting implementation of bilateral and regional free trade agreements (FTAs).

- To advocate for Canada's agricultural trade policy interests within multilateral fora.

- To address tariff and non-tariff barriers to trade and facilitate the growth of sectors that rely on export markets.

- To advocate for science- and risk-based decision-making and transparent, rules-based trade.

Risks and challenges

- (EM) Department's Emergency Management for agriculture sector is being refined.

- Ensuring EM full-time equivalent (FTE) resources are appropriate to deliver on priorities amidst an increasing frequency, complexity and economic cost of emergency events.

- Balancing EM priorities across the EM continuum (prevention & mitigation, preparedness, response & recovery) in order to best support the sector.

- (ROD) Market Intelligence and Stakeholder Relations

- Delivering market information services requires annual investments to maintain current information products and service levels.

- Providing market intelligence services at a status quo level may prevent meeting the evolving and growing information needs of the Department as well as industry and government stakeholders.

- (SDAD) Increasing catastrophic crises, evolving industry needs, reduced financial capacity.

- Crises such as COVID-19, African Swine Fever and potato wart impact the directorate's ability to respond to market disruptions while continuing to support sector growth and competitiveness.

- Maintaining the same level of service to industry is challenged by reduced financial resources coupled with growing sector needs.

- (TAND) Market volatility, trade disruptions and other supply chain issues.

- These issues make maintaining market access increasingly challenging, placing risk on exporters.

- Advancing trade objectives in Free Trade Agreement negotiations is also challenged by protectionist policies and changing trade priorities from trading partners.

Public Affairs Branch

Mandate

To provide support and advice to the Minister, Deputy Ministers (DMs) and all Branches within the Department through a full range of strategic and operational activities for internal and external communications. It is also to serve as the departmental lead for the management and delivery of both translation and Access to Information and Privacy (ATIP) services.

Key areas of support and advice for DMs

Deputy Minister's communications

Provide support to Deputy Minister for communications and engagement with employees:

- Townhalls with employees and executives

- Conversations with employees and Networks

- Outreach across the country

- Twitter/Social media

Support department for internal communications including on Hybrid@AAFC, Diversity, Equity and Inclusion/Networks, Wellness Program/Activities and New Technologies /IT projects

Strategic Planning, Advice and Coordination

- Provide strategic communications advice on key priority files

- Monitor the public environment, manage emerging issues, and develop reactive and proactive communications products

- Proactively align the department and Minister's outreach and communications priorities via a quarterly strategic communications placemat

Public Affairs Branch (PAB) demographics

PAB has a network of over 160 communicators across the country:

- National Capital Region: 115

- Ontario: 14

- Atlantic: 8

- Quebec: 8

- Manitoba: 4

- Saskatchewan: 2

- Alberta: 6

- British Columbia: 6

Management structure

- Mary Dila: Assistant Deputy Minister

- Dominique Richer: Director General

Strategic Planning, Advice and Coordination- Suzanne Kye: Director

Strategic Communications - Kirsten Gartenburg: Director

Media Services and Ministerial Communications

- Suzanne Kye: Director

- Alec Nicholls: Director General

Communications Services- Sonia Forget: Director

Operations - Jean-Pierre Contant: Director

Digital, Science, and Storytelling Communications - Miriam Wood: Director

ATIP Office and Translation Services

- Sonia Forget: Director

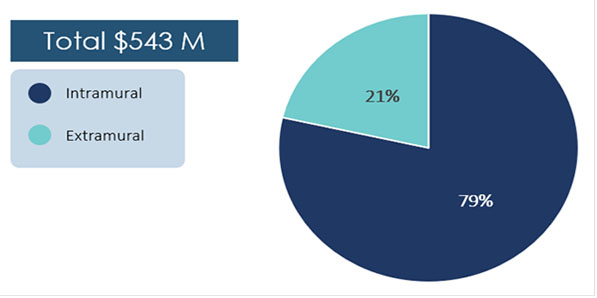

- Penny O'Shaughnessy