Standing Committee on Agriculture and Agri-Food

Supplementary Estimates (B) 2019–2020

March 12, 2020, 3:30 pm to 4:30 pm

Some sections of these materials have been redacted based on the Access to Information Act.

Table of Contents

-

Impact of rail blockades on Canadian farmers

Key messages

- The Government recognizes that producers are coming off a very challenging year. Recent rail disruptions resulted in difficulties moving products to market and accessing input supplies. These challenges have negatively impacted the sector's reputation as a consistent, reliable supplier with international buyers.

- While railway recovery efforts are underway, it will take time for the system to return to normal.

- The Government continues to closely monitor the situation, including the movement of grain and vessel line-ups on the West Coast.

- The grain industry is a powerful driver for the Canadian economy, and Canadian farmers are known around the world as efficient and reliable suppliers of high quality products.

- We will continue to seek ways to make the transportation system more resilient. AAFC's Crop Logistics Working Group serves as a valuable forum which brings together industry and government, with a focus on identifying ways to improve the grain handling and transportation system.

Initiatives/examples

- The Crop Logistics Working Group, which was recently renewed, held its most recent meeting in late February where it outlined key areas of work, including performance measurement and the identification of future infrastructure needs.

- AAFC and Transport Canada continue to jointly fund the Grain Monitor Program, which is in place to monitor and assess the performance of the grain handling and transportation system.

- The Government of Canada has committed more than $10 billion to trade and transportation corridors funding, to help get valuable commodities to market, including agricultural and agri-food products. This includes over $350 million in investments for road and rail infrastructure projects in and around west coast ports, as part of the National Trade Corridors Fund (NTCF).

- The Transportation Modernization Act is now delivering a more transparent, fair and efficient freight rail system, and includes a number of new tools and benefits for the grain sector. The Act has led to railway investments in new hopper cars, and additional supply chain transparency with new required railway reporting and planning.

Sector data

- Total grain supply for 2019-2020 is estimated to be 82.8 million metric tonnes. The projected supply is 0.9% more than the previous year.

- Given the challenges to rail services this winter, the current shortfall in grain shipments, as compared to the last crop year, is around 1.286 million metric tonnes, or approximately 14,000 carloads.

- Year-to-date Western Canadian shipments from port terminal elevators as of Grain Week 30 (the week ending February 29, 2020, which represents the most recent data available) are 3% lower than the same period last year and even with the 3-year average. Country elevator space remains tight as the rail system continues to work towards recovery.

- For Week 30 (week ending February 29, 2020), car order fulfillment (the rate at which railways fulfill hopper car orders placed by shippers) has shown an improvement over the previous week, however, at 70%, it is below the previous year and 3-year average.

- Vessel lineups at Vancouver and Prince Rupert are higher than average. As of March 9, 2020, 52 vessels are waiting for grain to arrive. Of those vessels, it is estimated that 32 incur daily demurrage (penalties for delays in loading) and 19 of them face out-of-contract penalties.

- Since March 7, 2020, 3 vessels have departed Vancouver, and 1 has departed from Prince Rupert.

- The National Trade Corridors Fund is providing over $350 million in funding to enhance rail and port facilities in Vancouver and Prince Rupert. A couple of specific examples:

- Expansion of the Zanardi Bridge and Causeway and infrastructure improvements at Ridley Island in Prince Rupert ($110 million)

- North Shore Corridor capacity improvements and the Burrard Inlet Road and Rail improvement in Vancouver ($145 million)

-

Canola seed exports to China

Key messages

- Restoring full market access for canola seed exports to China is a top priority for the Government of Canada.

- The Government is engaging the Government of China on multiple fronts to resolve this important issue, including through technical discussions and senior official dialogue with Chinese officials.

- Following in-person technical meetings held between Canadian and Chinese officials in Beijing in December 2019, there was an agreement by both countries to continue technical discussions in 2020.

- Canada looks forward to continuing technical discussions with China in the coming months to find a long-term suitable solution to facilitate the predictable export of canola seeds to China.

Market diversification

- Following China's restrictions, Canadian canola seeds exports to China accounted for 19% of Canada's total canola seeds exports in 2019, compared with 47% in 2018.

- That said, market diversification efforts have helped the sector increase the export market share to other markets. Between 2018 and 2019, Canada's share of canola seeds exports increased from 3% to 16% to the European Union; 4% to 9% to the UAE; and 5% to 9% to Pakistan.

- We recognize that the domestic production of renewable fuels represents an important opportunity for value-added domestic markets for producers. We are committed to support the growth of renewable fuels within Canada.

Impact of the COVID-19 outbreak

- Our current official Government of Canada advice is to avoid non-essential travel to countries that have had a high incidence by COVID-19.

- While we fully agree that the technical discussions are extremely important, Canada's position is to keep dates for future technical face-to-face meetings open until the COVID-19 situation has become clearer.

WTO consultations

- WTO consultations between Canada and China took place in October 2019 in Geneva. Consultations provided an opportunity for important face-to-face discussions.

- Following consultations between Canada and China in October 2019 in Geneva, Canada continues to explore all options in order to restore full market access for Canadian canola seed.

- Canada is an ardent supporter of the rules-based trading system. Canada's long-standing practice is to use the WTO to seek resolution to trade disputes when necessary, including with our closest trading partners.

Responsive only —Expiring 2016 MOU for canola seeds

- The Government understands that the existing trade conditions that allow for Canadian canola seed exports to China will expire in March 31, 2020.

- Canadian officials are engaging with Chinese officials to determine conditions for exports of Canadian canola seeds to China after March 31, 2020.

- Canada has asked China to maintain the existing trade conditions while both sides continue to work to find a long-term suitable solution to facilitate the predictable export of canola seeds to China.

Responsive – meat exports to China

- June 25, 2019, CFIA at the request of Customs China stopped issuing export certificates for meat (pork and beef) to China.

- November 5, 2019, China informed Canada that pork and beef exports could resume immediately.

- Government of Canada continues to engage with China to restore access for remaining establishments temporarily suspended.

Initiatives/examples

- As a response to China's actions on Canadian canola seed, the Government established the Government-Industry Canola Working Group to develop and coordinate strategies on the market access issue with China, market diversification, and support to the sector. The Working Group continues to meet regularly.

- Minister Bibeau also announced enhanced financial support to producers through the implementation of the new regulations to strengthen the Advance Payments Program (APP). The amendments increase loan limits from $400,000 to $1 million for all producers on a permanent basis and increase the interest-free portion of loans on canola advances from $100,000 to $500,000 in the 2019 program year. Producers of all other commodities can continue to receive up to $100,000 interest-free. The increase in the interest-free limit for 2019 canola advances has allowed close to 6,400 producers to receive more than $1.52 billion in interest free advances, providing them with the added flexibility to manage their farm operations and explore new market opportunities.

- Through the Canadian Agricultural Partnership, programs are supporting the Canola sector. For example, the Canola Council of Canada has a project for $3,643,324 with the AgriMarketing Program, to help the sector reach its market growth goal of 26 million tonnes of sustained market demand and production of canola by 2025. From this funding $1,026,240 is to undertake activities in China to help the sector maintain and grow their sales.

Meat exports to China

- The CFIA identified an issue involving inauthentic export certificates specific to exports of meat products to China. As of June 25, 2019, at the request of the General Administration of Customs China (Customs China), the CFIA stopped issuing export certificates for meat (pork and beef) and meat products to China, effectively ending imports of Canadian pork and beef into China.

- On November 5, 2019, China informed Canada that eligible Canadian establishments could resume pork and beef exports immediately. The CFIA has resumed issuing export certificates for establishments eligible to export to China. The CFIA continues to work with industry to monitor the export certification process for meat and meat products being exported to China. The purpose is to limit preventable non-compliances with Chinese authorities. The Government also continues to engage with China to restore access for the remaining establishments temporarily suspended and the approval of additional establishments.

- One pork establishment in Quebec remains suspended as a result of the inauthentic certificates. Two other pork establishments in Quebec and Alberta remain suspended and ineligible to export due to unrelated labelling violations in April 2019. The suspended establishments are in Customs China's website publically and CFIA list of eligible establishments to China reflects that these establishments are ineligible.

Sector data

- In 2019, canola seed was Canada's largest agricultural export to China and was the second largest canola export market after the United States in that year.

- In 2019, Canadian canola seed exports to China dropped by approximately 70% in value compared to 2018:

2018 2019 Value $2.8 billion $852.9 million Quantity 4,872.9 thousand tonnes 1,602.8 thousand tonnes Source: CATSNET, 2020 -

Engagement with Prairies since March 2019

- Minister Bibeau met with representatives from all Prairie Provinces during the Federal-Provincial-Territorial Annual Ministers' Conference, July 2019 and during a face-to-face meeting on December 17, 2019. Canola was a key item raised during these conferences.

- She has had a bilateral meeting with Minister Dreeshen (Alberta) on July 10, 2019 in Calgary, and held a meeting with a delegation from Alberta on December 9, 2019 in Ottawa. In addition, she will be meeting with Minister Dreeshen on March 18, 2020 (forthcoming) as part of an Alberta outreach. Minister Bibeau has also had phone calls with Minister Dreeshen on May 1, 2019 and August 22, 2019.

- She had a bilateral meeting with Minister Pederson (Manitoba) on February 13, 2020 in Winnipeg and met with Minister Eichler (the former Manitoba Minister) on July 14, 2019.

- She held a meeting with Saskatchewan Minister Marit during Agribition on November 25, 2019 in Regina, and also met with him and Minister Harrison (Saskatchewan Minister of Trade and Export Development) on March 29, 2019 in Saskatoon.

- Minister Bibeau also held individual calls with all Prairie Ministers in November 2019 following her re-appointment to discuss priorities for the sector including issues pertaining to canola exports to China.

- Canola and trade with China were a key part of her bilateral discussions with the Prairie Ministers.

-

Canadian canola production by province, 2019

Province tonnes Canada 18,648,800 Saskatchewan 10,130,500 Alberta 5,320,100 Manitoba 3,056,300 British Columbia 72,000 Ontario 42,200 Quebec 25,700 New Brunswick 1,200 Prince Edward Island 800 Newfoundland and Labrador 0 Nova Scotia 0 Source: Statistics Canada, Table 32-10-359-01 -

Export markets by province, 2019

Saskatchewan Country Value (Can$) Japan 616,603,731 China 488,813,062 Mexico 299,066,558 Pakistan 224,887,687 United Arab Emirates 206,947,428 France 184,775,379 United States 170,709,474 Germany 69,740,664 Belgium 65,285,747 Bangladesh 64,662,971 Portugal 46,727,539 Nepal 16,244,446 Israel 4,860,690 Malaysia 1,862,158 Australia 1,207,301 India 931,999 Algeria 147,822 Chile 75,185 Chad 67,425 Indonesia 51,101 Colombia 35,400 Costa Rica 26,192 Spain 19,492 Guatemala 11,766 Total 2,463,761,217 Alberta Country Value (Can$) Japan 288,774,106 China 228,925,886 Mexico 140,061,880 Pakistan 105,321,683 United Arab Emirates 96,919,715 France 86,535,878 United States 79,948,391 Germany 32,661,654 Belgium 30,575,282 Bangladesh 30,283,617 Portugal 21,883,915 Nepal 7,607,764 Israel 2,276,408 Malaysia 872,104 Australia 565,415 India 436,484 Algeria 69,230 Chile 35,213 Chad 31,577 Indonesia 23,932 Colombia 16,579 Costa Rica 12,266 Spain 9,129 Guatemala 5,510 Total 1,153,853,618 Manitoba Country Value (Can$) Japan 160,095,333 China 126,915,693 Mexico 77,649,805 Pakistan 58,389,962 United Arab Emirates 53,731,945 France 47,975,179 United States 44,323,106 Germany 18,107,503 Belgium 16,950,827 Bangladesh 16,789,130 Portugal 12,132,363 Nepal 4,217,715 Israel 1,262,032 Malaysia 483,493 Australia 313,464 India 241,985 Algeria 38,380 Chile 19,522 Chad 17,506 Indonesia 13,269 Colombia 9,191 Costa Rica 6,800 Spain 5,061 Guatemala 3,055 Total 639,692,319 British Columbia Country Value (Can$) Japan 6,563,046 China 5,202,862 Mexico 3,183,225 Pakistan 2,393,674 United Arab Emirates 2,202,719 France 1,966,722 United States 1,817,010 Germany 742,310 Belgium 694,894 Bangladesh 688,264 Portugal 497,362 Nepal 172,909 Israel 51,737 Malaysia 19,822 Australia 12,850 India 9,921 Algeria 1,574 Chile 800 Chad 718 Indonesia 543 Colombia 377 Costa Rica 279 Spain 208 Guatemala 125 Total 26,223,951 Ontario Country Value (Can$) Japan 2,474,594 China 1,961,735 Mexico 1,200,235 Pakistan 902,532 United Arab Emirates 830,533 France 741,551 United States 685,105 Germany 279,887 Belgium 262,009 Bangladesh 259,510 Portugal 187,530 Nepal 65,191 Israel 19,507 Malaysia 7,475 Australia 4,846 India 3,741 Algeria 593 Chile 301 Chad 271 Indonesia 205 Colombia 142 Costa Rica 106 Spain 78 Guatemala 47 Total 9,887,724 Quebec Country Value (Can$) Japan 1,398,681 China 1,108,807 Mexico 678,393 Pakistan 510,129 United Arab Emirates 469,433 France 419,138 United States 387,243 Germany 158,198 Belgium 148,092 Bangladesh 146,681 Portugal 105,995 Nepal 36,848 Israel 11,025 Malaysia 4,225 Australia 2,739 India 2,114 Algeria 336 Chile 171 Chad 153 Indonesia 116 Colombia 81 Costa Rica 60 Spain 45 Guatemala 27 Total 5,588,730 -

Canada–United States–Mexico Agreement's impact on Canada's agriculture and agri-food sector

Key messages

- CUSMA maintains the existing, mutually beneficial agriculture relationships between Canada, the U.S. and Mexico, and safeguards the already highly integrated North American trade environment.

- The agreement provides continued access to the most important export destination for many of our crop and livestock producers – Canadian agri-food and seafood exports to the U.S. and Mexico totaled $42.0 billion in 2019.

- Implementation of the new Agreement will provide certainty to the businesses of Canadian farmers, producers and food processors who depend on trade.

- Critically, the Agreement preserves Canada's existing duty-free access to the U.S. and Mexico, and provides new access for Canadian exports of refined sugar, sugar-containing products, and certain dairy products.

- CUSMA contains new provisions that recognize and support innovation and facilitate trade in products of agricultural biotechnology.

- The Agreement also reduces trade costs and red tape at the border for our producers and exporters, helping them to trade more efficiently and increasing their competitiveness in the region.

- CUSMA provides limited access into Canada for certain dairy, poultry and egg products, but preserves the supply management system, ensuring that its integrity will be maintained long into the future.

- The Government will continue to work in partnership with all sectors under supply management to address future impacts of the CUSMA, and stands by its commitment to fully and fairly compensate for the CUSMA.

Responsive – if asked about Canada's dairy export thresholds and export charges

- Outcome was unique response to strong U.S. concerns with respect to exports of a limited number of specific products that are produced under Canada’s dairy supply management system.

- Do not in any way consider this a precedent and will continue to pursue an ambitious free trade agreement agenda to open new markets and diversify trade.

Responsive – if asked about grain grading provisions in the CUSMA/Bill C-4

- CUSMA will not change how Canadian grain is delivered in the primary elevator system in Canada, nor will it affect our grain quality assurance system or the quality of Canadian exports.

- U.S. producers who deliver grain in Canada will be subject to the same safety and quality rules and regulations as Canadian producers, including variety registration.

Responsive – if asked Canada's market access gains for agriculture and agri-food products

- The Agreement includes a number of positive outcomes for Canada's export-oriented agriculture and agri-food sector, including maintaining existing duty-free access for Canadian exports of refined sugar, sugar-containing products and certain dairy products including cheese, cream and butter.

- It also eliminates U.S. tariffs on whey products, peanut butter and margarine, and provides a more liberal rule of origin for margarine.

Initiative

- The Canada-United States-Mexico Agreement (CUSMA) was signed by leaders on November 30, 2018. Subsequently, on December 10, 2019, the 3 parties signed a Protocol of Amendment.

- The U.S. completed its ratification process in January 2020. The Mexican Senate passed the Agreement and its amending protocol in 2019, and is expected to complete its process without delay.

- Canada tabled its implementing legislation (Bill C-4) in Parliament on January 29, 2020. The House Standing Committee on International Trade (CIIT) completed its review of Bill C-4 on February 27.

- As part of the overall balanced outcome, Canada provided the U.S. with additional access for certain supply-managed goods; committed to eliminate milk classes 6 and 7; and will monitor global exports of certain dairy products and apply charges above agreed thresholds.

- As part of the CUSMA, Canada agreed to allow U.S. wheat varieties that are registered in Canada to receive an official Canadian grain grade. Canada also agreed to remove requirements for official inspection certificates to indicate that U.S. wheat is of foreign or mixed origin, unless it is in relation to phytosanitary or customs requirements of an importing country.

- The Canada Grain Act will be amended to permit wheat grown in the U.S., but of a variety registered in Canada, to receive a statutory Canadian grain grade. Further, following changes to the Canada Grain Act, the Canadian Grain Commission (CGC) will make consequential amendments to the Canada Grain Regulations.

- This change will have minimal impact on the Canadian grain sector. The quality of Canadian wheat will not be compromised since wheat is required to be of a registered variety in Canada in order to receive an official Canadian grade, whether it is grown in Canada or the U.S.

Sector data

- Canada and the U.S. benefit from highly integrated supply chains with bilateral agriculture and seafood trade totalling C$66.0 billion in 2019, of which Canadian exports totaled $37.3 billion.

- Mexico was Canada's fourth-largest export market for agri-food and seafood products in 2019, with bilateral agricultural trade between Mexico and Canada reaching C$4.7 billion that year. (Please note – Mexico was 5th largest market in 2019 if EU28 counted as one market)

-

Comprehensive review of the allocation and administration of tariff rate quotas for dairy, poultry and egg products

Key messages

- Import controls are one of the pillars of supply management and are important for our farmers and their families. The Government of Canada will defend supply management and our farmers that depend on it.

- The objective of the comprehensive review is to create long-term allocation and administration policies to ensure continued efficiency and effectiveness of Canada’s tariff rate quotas (TRQs) for dairy, poultry and egg products.

- Long-term TRQ allocation and administration policies will be compliant with Canada’s international trade obligations and will support the long-term viability of supply management.

- The comprehensive review is an inclusive process with two phases of consultations involving provincial governments, stakeholders across the entire value chain, including primary processors, distributors, further processors, etc., and international trading partners.

- The Government of Canada will consider all feedback received and take into account the economic realities of today.

- AAFC supports allocation methods that mitigate the impact of market access commitments on the supply management system, while also limiting market disruptions in a manner that is compliant with our international trade obligations.

Responsive – if asked about stakeholder consultations

- The consultative process includes cross-Canada outreach with industry stakeholders in partnership with the provinces, tariff rate quota advisory committees (composed of industry representatives), as well as meetings with key international trading partners.

- Feedback from the first phase of consultations informed the development of a range of policy options.

- The options are for further consultation. Stakeholders are encouraged to provide feedback and also alternative options, if desired.

Responsive – if asked about concerns being raised by stakeholders on draft policy options (e.g., elimination of historical allocations and non-import control list pools)

- The range of policy options is non-exhaustive. Stakeholders are encouraged to make their views known during the second phase of consultations that will continue until April 3, 2020.

- The Minister of Small Business, Export Promotion and International Trade will make a final decision by September 1, 2020.

- It is important that long term allocation policies reflect current market dynamics, encourage fairness and transparency, address market concentration, and improve competitiveness.

Responsive – if asked about next steps

- Officials will review and consider all feedback received throughout the consultative process.

- Final policies and Notices to Importers will be published on September 1, 2020 and be effective for the beginning of the quota year on January 1, 2021.

Initiative

- On May 10, 2019, Global Affairs Canada (GAC) launched the first phase of the comprehensive review of the allocation and administration of Canada’s TRQs for dairy, poultry and egg products.

- This includes Canada’s 16 global TRQs at the World Trade Organization (WTO), 2 cheese TRQs under the Comprehensive Economic and Trade Agreement (CETA), 20 TRQs under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and eventually the 16 new TRQs under the Canada-United States-Mexico Agreement (CUSMA).

- GAC received approximately 200 submissions and held over 60 meetings with stakeholders in the first phase of consultations.

- The second phase of consultations began on February 14, 2020 and will close on April 3, 2020. They will include regional outreach, meetings in Ottawa and the opportunity for stakeholders to provide written submissions on a range of published draft policy options. Allocation options range from status quo to the elimination of historical holders and allocations across the entire value chain. A range of options concerning various administrative elements (e.g., transfer and return policies) has also been published for further consultation.

- The feedback received from this second phase of the consultations will guide the formulation of the final policies and inform the decision of the Minister of Small Business, Export Promotion and International Trade.

- The long-term allocation and administration policies for each TRQ will be published on September 1, 2020 and will be effective for the next quota year starting on January 1, 2021.

Sector data

- In 2019, GAC issued over 25,000 import permits for dairy, poultry and egg products valued at $1.41 billion.

- In the first phase of consultations, the dairy sector garnered the most interest in the comprehensive review process.

- A majority of stakeholders recognize that rapidly changing markets have made it necessary for Canada to adjust TRQ allocation and administration policies in order to remain competitive.

-

Comprehensive Economic and Trade Agreement

Key messages

- CETA opens new agriculture and agri-food market opportunities for Canadian exporters in the EU. CETA strengthens economic relations, which will encourage investment, open markets, create jobs, promote new economic opportunities for Canadian businesses and benefit Canadian consumers.

- With almost 94% of EU agriculture tariffs duty free under CETA, Canadian exporters now have an advantage over competitors in countries that do not have a free trade agreement with the EU. When CETA is fully implemented, over 95% of EU agricultural tariff lines will be duty-free.

- There have been many positive gains for Canadian exports benefiting from tariff reductions under CETA, including cranberries, frozen fruits and nuts, frozen lobsters, sweet potatoes, frozen scallops and beef.

- In 2019, Canadian exports to the EU increased substantially. Agri-food exports were up 31.9%; and fish and seafood exports were up 13.2%, compared to 2018.

Initiatives/examples

- The Government continues to encourage exporters to explore the European Union market and guide them in their efforts to become export ready, in order to capitalize on the opportunities under CETA.

- The Dairy Farm Investment Program ($250 million over 5 years) and the Dairy Processing Investment Fund ($100 million over 4 years) help dairy farmers and processors adjust to EU cheese imports under CETA.

- The Canadian Agricultural Partnership supports the expansion of domestic and international markets and enhances the sector's ability to seize and diversify these markets.

Sector data

- In 2019, Canadian exports of agri-food to the EU increased by 31.9% (from $2.6B to $3.5B) when compared to 2018.

- In 2019, Canadian exports of fish and seafood products to the EU increased by 13.2% (from $453.1M to $513.0M) when compared to 2018.

- Canada's top three exports were

- soybeans — up 179.7% from $241.2M to $674.8M

- canola seeds — up 241.4% from $187.4M to $639.6M

- durum wheat — up 145.2% from $129.3M to $317.2M

- Canadian imports from the EU went up 3.9% (from $6.3B to $6.6B).

- Canada's top three imports from the EU in 2019 were:

- grape wines — up 2.8% from $1.1B to $1.2B

- beer — down 6.0% from $442.9M to $416.4M

- cheese — up 12.3% from $231.9M to $260.5M

-

Pulse trade with India

Key messages

- Maintaining long-term, sustainable market access to India is a priority for Canadian pulse exporters and for the Government.

- Canada continues to express deep concerns with a number of India's trade restrictive measures, which have been neither consistent nor transparent.

- In addition to high tariffs on all pulses and imposed quantitative restrictions on dried peas, India has not finalized an arrangement on pulse fumigation despite a Prime Minister-level commitment.

- Furthermore, India has recently begun delaying and rejecting shipments of lentils citing the presence of weed seeds.

- We are working closely with Canadian pulse industry stakeholders and we will continue to press India to remove unjustified barriers to trade and to finalize an arrangement on pulse fumigation.

Initiatives/examples

- Since 2017, India has applied a number of measures impacting the trade of pulses, including quantitative restrictions, minimum import prices and single port of entry requirements on dry peas. This is primarily in response to domestic politics, farmer concerns, and an oversupply of pulses due to bumper pulse crops in India. Additionally, for the first time in fourteen years, India did not renew Canada's country-specific exemption from India's mandatory fumigation requirements on October 1, 2017.

- █████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████████

Update on World Trade Organization process:

- In light of the lack of progress addressing India's trade restrictive measures, Canada is considering all available alternatives, including WTO options, to re-establish unimpeded access for Canadian pulses to India.

- A recommendation to launch WTO dispute settlement proceedings on India's measures affecting trade on pulses is being considered by the Minister of Small Business, Export Promotion and International Trade (Minister Ng).

- Minister Ng plans to reach out to her Indian counterpart to inform him of increasing domestic pressure in Canada to launch a WTO challenge of India's trade-restricting measures. Minister Ng would like to have this discussion with her Indian counterpart prior to making a decision on whether to proceed with a request for consultations under the WTO dispute settlement process.

Sector data

Canada's total pulse exports to India million $ 2017 929 2018 158 2019 421 -

Trade with Italy

Key messages

- Canadian durum wheat is among the highest quality in the world. Italians have depended on Canadian durum wheat for pasta production for more than a century.

- In 2019, Canada was the top source of imported durum for Italy.

- The Government will continue to consult and cooperate with our industry stakeholders and provincial partners in defending the interests of the Canadian wheat sector abroad.

- Canada continues to raise concerns with Italy and with the European Commission with respect to the Italian country of origin labelling (COOL) measure for pasta.

- We have been assured by the European Commission that once the voluntary EU-wide country-of-origin labelling measure comes into force on April 1, 2020, country specific measures, such as the Italian COOL measure, will cease to exist. Canada will closely monitor all developments.

Initiatives/examples

- Canada is committed to continuing to work with its durum wheat industry and provinces to determine a constructive way forward, which would fight misinformation, restore consumer confidence and increase exports

Sector data

- Between 2013-2017, the average annual value of exports of Canadian durum wheat was $342 million (900,000 tonnes).

- In 2018, Canada's exports of durum wheat were worth $93 million (292,675 tonnes), which was a drop of 57% from 2017 and a drop of 68% from the previous five-year average.

- In 2019, Canada's exports of durum wheat increased by 201% to $274 M (880,628 tonnes), making Canada again the top source of imported durum for Italy in 2019.

- Canada's share of Italian durum imports last year was 31.1% (2019) vs. 4 years ago 46.3% (2015).

- While Canada remains the top supplier to Italy in 2019, the supply fell by 46% based on the compound annual growth rate (CAGR) for the period of 2015-2019.

-

Pollution pricing and grain drying

Key messages

- Carbon pollution pricing remains an important part of Canada's plan to transition to a cleaner and more innovative economy that reduces emissions and protects our environment.

- Farmers and farm families are important drivers of the Canadian economy, and the federal carbon pollution pricing system has been designed to limit its impact on the agriculture sector.

- The Government has committed to return all direct proceeds of carbon pollution pricing collected through direct payments to families and through support to other affected sectors, including small- and medium-sized enterprises in the agriculture sector.

- Currently, the federal carbon pollution pricing system applies in Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nunavut and Yukon.

- The additional cost from carbon pollution pricing to grain drying cost represents less than 1% of total operating expenses for an average farm.

- In Ontario, the energy expenses with carbon pollution pricing as a share of total operating income represents less than ██ for grain and oilseed farms on average, and would represent almost ██ for greenhouses without the partial rebate for propane and natural gas.

Initiatives/examples

- Under the Canadian Agricultural Partnership, the governments of Canada and Alberta recently announced a cost-shared investment of $2 million for the Efficient Grain Dryer Program that will help cover the costs for eligible energy efficient grain drying equipment. Under the Partnership, farmers also have access to a suite of Business Risk Management programs to help manage significant market volatility and risks beyond their control.

- The Government has committed to return all direct proceeds of carbon pollution pricing collected through direct payments to families and through support to other affected sectors. The bulk of the direct proceeds collected through the fuel charge is being returned directly to individuals and families through tax-free Climate Action Incentive payments. There is also the Climate Action Incentive Fund which has a stream for small- and medium-sized enterprises, including agricultural enterprises.

Sector data

- Currently, the federal carbon pollution pricing system applies in Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nunavut and Yukon.

- The data provided shows that the carbon pricing cost on grain drying is an average of ████ in Ontario, ██████ in Manitoba and ████ in Alberta. However, each farm situation is unique and carbon pricing affects them differently.

- The added fuel expenses and the carbon pricing cost have increased the total production cost for farmers in 2019. AAFC recognizes that the data provided by provinces are reasonable estimates of the incurred costs. However, those estimates represent a relatively small share of farmers' total operating expenses.

- The additional cost from carbon pollution pricing to grain drying cost represents less than 1% of total operating expenses for an average farm.

- In Ontario, the energy expenses with carbon pollution pricing as a share of total operating income represents less than ██ for grain and oilseed farms on average, and would represent almost ███ for greenhouses without the partial rebate for propane and natural gas.

Table of data provided for Ontario, Manitoba, Alberta and Saskatchewan for carbon pricing cost on grain drying Average carbon pricing cost per farm ($) Average carbon pricing cost by acre ($) Share of total operating expenses (%) Total cost from carbon pricing (million $) Ontario █████ ███ ████ ███ ██ Manitoba █████ █████ ███████ ███ ███ Alberta ███ ████ ████ ███ Saskatchewan ██████ ██ ████ ██ ██ Canada █████ ███ ██ ████ ██ Drying costs for Ontario grain and oilseed farms vs. heating costs for Ontario greenhouse farms Grain and oilseed farms Greenhouse farms Number of farms ██████ █████ Total operating expense ($ million) █████ █████ Expense of drying / heating fuel ($ million) ██ ███ Expense of drying / heating fuel as a share of total operating expense (%) ████ ████ Implied cost with carbon pricing ($ million) ██ ███ Implied cost with carbon pricing as a share of total operating expense (%) █████ ████ Total net operating income ($ million) ███ ███ Implied cost with carbon pricing as a share of total operating income (%) ████ █████ -

Canadian Agricultural Partnership – Business Risk Management programs

Key messages

- Under the Canadian Agricultural Partnership, producers continue to have access to a robust suite of Business Risk Management (BRM) programs to help manage significant risks that threaten the viability of their farm and are beyond their capacity to manage.

- The suite of BRM programs is cost-shared with provinces and territories and provides roughly $1.5 billion in annual support. The varying individual needs of farmers mean that different combinations of BRM programs will work for different farms:

- AgriInvest for income declines and investments to manage on-farm risk;

- AgriStability for large margin declines;

- AgriInsurance for production losses (commonly known as crop insurance);

- AgriRecovery for extraordinary costs to recover from natural disasters; and,

- AgriRisk Initiatives for developing new tailored risk management tools.

- In December 2019, federal, provincial, and territorial Ministers recognized that the risks facing producers have changed and that current programs may need to evolve to meet producers' needs. Directions included:

- Short term adjustments to the AgriStability program to provide more incentive to use complementary risk management tools, and to reduce application burden;

- FPT officials are assessing programs' alignment with objectives;

- Officials are also developing options to make BRM programs more effective, agile, timely, and equitable.

Initiatives/examples

- Under CAP, provincial and territorial governments are now able (with the agreement of the federal Minister) to trigger a mechanism to allow producers to enter the AgriStability program late in situations where there is a significant income decline and a gap in participation.

- Four late participation applications were approved for 2018 (the first year of CAP), primarily due to severe weather events (for example, frost, drought, wildfires, and flooding) impacting farmers. Provinces approved included: British Columbia; New Brunswick; Nova Scotia; and, Prince Edward Island.

- At their meeting in December 2019, FPT Ministers agreed to make changes to AgriStability for the 2020 Program Year, including:

- Changing how private insurance payments are included in payment calculations in order to incent the use of private risk management tools; and

- Exploring a pilot project where producers who file their taxes on a cash basis could apply for AgriStability on largely the same basis.

- FPT Ministers are planning on meeting in April to review the assessment of BRM programs against the objectives laid out in December 2019, and to receive an update on officials' progress towards options to improve effectiveness, timeliness, agility and equitability of BRM programs

Sector data

Growing Forward 2 - Summary of FPT program payments

Federal/provincial contributions, interest costs, payments, premiums and wildlife costs (in $ millions) Programs Program years Average - GF2 Totals 2013 2014 2015 2016 2017 AgriInvest 265.5 267.5 278.7 287.0 290.0 277.7 1,388.7 AgriStability 311.7 296.8 259.1 503.1 219.3 318.0 1,589.9 AgriInsurance 1,188.6 942.4 924.0 1,102.2 1,014.4 1,034.3 5,171.6 AgriRecovery 1.2 4.0 2.2 8.5 20.9 7.4 37.0 Sub-Totals 1,767.0 1,510.8 1,464.1 1,900.8 1,544.6 1,637.5 8,187.3 AgriStability Interims - Number 39 117 39 39 25 52 259 AgriStability Interims - Value 6.0 12.9 3.7 4.2 3.0 6.0 29.9 Note: Unless otherwise noted, this report contains only program payments. It does not include program expenditures such as administrative costs and other non-payment costs. - Producers representing 93.4% total agricultural market receipts participated in the AgriInvest program in 2016, above the target of 85% and down less than 1% compared to 2015.

- Producers representing 55.8% total agricultural market receipts participated in the AgriStability program in 2016, below the target of 65%, and down 3% compared to 2015.

- Producers representing 88.2% of the total value of agricultural products eligible (excluding livestock) participated in the AgriInsurance program in 2016, above the target of 75%.

- Publicly-reported AgriStability expenditures reflect a fiscal year accrual of expected federal program payments and administrative support. Calculation of these expenses is based on forecasted program expenditures for current year and differences between forecasts and actual/projected expenditures for previous program years

Sector data provided is limited as release of commodity-specific information could put BRM programs at trade risks (in other words, countervail).

2016 is the latest program year for which complete data is available.

Statutory programs - Grant and contribution expenditures (1)

CAP - Business Risk Management (BRM) - Federal share (2) Cost shared- Federal portion Average annual expenditure under GF2 Framework (3) 2018/19 Expenditures - Year 1 of CAP Framework CAP Statutory authorities (5) Agri-Invest 182,369,000 175,134,000 139,500,000 Agri-Stability 190,765,000 215,244,000 424,200,000 Agri-Insurance 663,812,000 664,580,000 623,000,000 Agri-Recovery 4,136,000 894,000 118,513,335 Sub-total CAP BRM 1,041,082,000 1,055,852,000 1,305,213,335 CAP - Business Risk Management (BRM) - FPT costs (4) Federal and provincial approximate expenditures Average annual expenditure under GF2 Framework(3) 2018/19 Expenditures - Year 1 of CAP Framework Agri-Invest 303,948,333 291,890,000 Agri-Stability 317,941,667 358,740,000 Agri-Insurance 1,106,353,333 1,107,633,333 Agri-Recovery 6,893,333 1,490,000 Sub-total CAP BRM 1,735,136,667 1,759,753,333 Notes

- 1: Grants and Contribution Expenditure includes provincial administration costs.

- 2: Cost share agreement is 60% Federal and 40% provincial. The first table is only federal contributions. Verified data.

- 3: The annual average spending is based on the GF2 actuals - Fiscal 2013/14 to 2017/18.

- 4: The second table derives the data from the federal share using a 60/40 split. Unverified data.

- 5: The TB Authorities are based on the 5 year CAP BRM submission - Fiscal 2018/19 to 2022/23. Programs are demand driven. The total amount spent may be higher or lower based on demand. Unused Statutory authorities cannot be carried over from one year to the next.

-

Canadian Agricultural Partnership (CAP)

Key messages

- The Canadian Agricultural Partnership (CAP) is a five-year, $3 billion investment by federal, provincial and territorial governments to strengthen the agriculture and agri-food sector and increase its competitiveness, prosperity and sustainability.

- Extensive consultations with industry and Canadians informed the development of the new agreement, which came into effect on April 1, 2018, and builds on the success of previous FPT agricultural frameworks. Governments will continue to work closely with the sector as Canadian Agricultural Partnershipprograms are implemented, to reflect the diverse needs across Canada, including the North.

- The Partnership features simplified, streamlined, and accessible programs and services as well as key enhancements to programs that help farmers manage significant risks that threaten the viability of their farm and are beyond their capacity to manage.

- The Government will continue to evaluate programming offered under the Partnership to draw lessons as it looks forward to the negotiation of the next policy framework with provincial and territorial partners, which will ultimately be launched in April 2023.

Initiatives/examples

- CAP focuses on six key priority areas:

- Science, Research, and Innovation;

- Markets and Trade;

- Environmental Sustainability and Climate Change;

- Value-added Agriculture and Agri-food Processing;

- Public Trust; and,

- Risk Management.

- Under the Partnership, FPT governments agreed to strengthen the ability to improve the sharing, communicating, and reporting of results.

- Over $450 million was spent in 2018-2019 under the cost-shared and federal strategic initiatives. Of this investment, approximately $345 million was comprised of funding for cost-shared programming, while the remainder ($105 million) was dedicated to funding for federal strategic initiatives.

Sector data

Canadian Agricultural Partnership year 1 expenditures (2018-2019)

Priority areas under the partnership Cost shared initiatives ($) Federal strategic initiatives ($) Total ($) PT portion Federal portion Markets and Trade 28,751,812 35,104,788 30,961,237 94,817,837 Science, Research and Innovation 45,071,779 52,861,556 69,306,313 167,239,648 Environmental Sustainability and Climate Change 69,059,491 39,118,426 * 108,177,917 Value-Added Agriculture and Agri-Food Processing 4,403,987 19,841,038 * 24,245,025 Public Trust 1,954,906 4,378,853 2,468,647 8,802,406 Risk Management 23,636,917 21,531,509 8,175,166 53,343,592 Total 172,878,892 172,836,170 110,911,363 456,626,425 Overall, Federal Strategic Initiatives align financially with the Science, Research, and Innovation Priority Area, but individual projects can focus on components of the Environmental Sustainability and Climate Change and Value Added Agriculture and Agri Food Processing Priority Areas.

Programs under the Canadian agricultural partnership Program name Priority area addressed Funding over 5 years ($) AgriScience Program

Science, Research and Innovation priority areaSupports pre-commercialization activities and invests in cutting edge research to benefit the sector.

- AgriScience – Clusters: supports industry-led and commodity specific science and research projects that address priority themes and horizontal issues, and coordinate research activities across Canada.

- AgriScience – Projects: supports specific shorter-term science projects to help industry overcome challenges and address fiscal barriers experienced by small and emerging sectors.

338 million AgriInnovate Program

Science, Research and Innovation priority areaAims to accelerate the demonstration, commercialization, and/or adoption of innovative agri-based products, technologies, processes or services that increase agri-sector competitiveness and sustainability. 128 million AgriMarketing Program

Markets and Trade priority AreaProvides national industry association's with matching funding to help them address market access issues impacting their sector, and implement market development strategies to develop, maintain, or expand new and existing markets 121 million AgriAssurance Program

Public Trust priority areaFunding is offered through two components:

- National Industry Association component: Funding provided will assist industry associations develop assurance systems, standards or tools such as food safety, animal and plant health surveillance, animal welfare, environmental sustainability, traceability, etc.

- Small and medium-sized enterprises component: Funding provided will assist for-profit organizations obtain third-party certification when it is required to meet an export opportunity.

74 million AgriCompetitiveness Program

Markets and Trade priority areaAssists industry-led efforts to provide producers with information needed to build capacity and support the sector's development as well as activities to raise agricultural awareness. Projects have been funded with organizations such as 4-H Canada, Farm Management Council and the Canadian Agricultural Safety Association. 20.5 million AgriDiversity

Markets and Trade priority areaHelps under-represented groups in Canadian agriculture, including youth, women, Indigenous Peoples, and persons with disabilities, to fully participate in the sector. 5 million FPT Cost-Shared Programs The Partnership's cost-shared funding with provinces and territories focuses on six priority areas:

- Science, Research and Innovation – Helping industry adopt practices to improve resiliency and productivity through research and innovation in key areas.

- Markets and Trade – Opening new markets and helping farmers and food processors improve their competitiveness through skills development, improved export capacity, underpinned by a strong and efficient regulatory system.

- Environmental Sustainability and Climate Change – Building sector capacity to mitigate agricultural greenhouse gas emissions, protect the environment and adapt to climate change by enhancing sustainable growth, while increasing production.

- Value-added Agriculture and Agri-food Processing – Supporting the continued growth of the value-added agriculture and agri-food processing sector.

- Public Trust – Building a firm foundation for public trust in the sector through improved assurance systems in food safety and plant and animal health, stronger traceability and effective regulations.

- Risk Management – Enabling proactive and effective risk management, mitigation and adaptation to facilitate a resilient sector by working to ensure programs are comprehensive, responsive and accessible.

2 billion -

Advance Payments Program: helping with difficult harvest

Key messages

- The Advance Payments Program (APP) is a federal loan guarantee program that provides agricultural producers with access to low-interest cash advances. The advances help provide marketing flexibility, allowing producers to sell their products based on market conditions rather than the need for cash flow.

- The Government made rapid changes in 2019 to the Advance Payments Program to help producers manage cash flow by increasing the loan limit from $400,000 to $1 million. An additional $585 million has been provided to approximately 13,000 grains and oilseeds' producers.

- The Government also provided a stay of default for grain, oilseed and pulse productions, which delayed the reimbursement of the 2018 APP advances by 6 months, from September 30, 2019, to March 31, 2020.

- Producers have the option to repay their 2018 outstanding advances with amounts advanced under the 2019 program year, and these advances are available until March 31, 2020. They will have to be repaid by September 30, 2020 and currently, there is no indications of impending defaults.

- As of April 1, 2020, producers can access up to $1 million in 2020 advances, including the $100,000 interest-free to address cash flow needs. The repayment deadline is September 30, 2021.

- If an APP administrator makes the request, the Government has the authority to implement another stay of default if producers are facing significant challenges repaying their advances.

- To date, no APP administrator has requested a stay of default to further extend the repayment deadline for 2018 advances.

- The APP default rate is low at approximately 4% of advances. If APP administrators are unable to collected defaulted advances, then the Government takes on the responsibility to collect to the debt (approximately 1% of advances).

- Producers facing difficulties repaying their farm debts, including their APP advances, can register with the Farm Debt Mediation Service, which can help develop a plan to repay creditors.

Initiatives/examples

- For the 2019 program year, the APP has issued over $2.9 billion in advances to date to approximately 21,000 producers, an increase of 27% from 2018. Producers have until March 31, 2020, to obtain a 2019 advance and until September 30, 2020, to repay these advances.

- Close to 5,000 grains, oilseeds and pulses producers participated in the 8 month stay of default on 2018 advance, deferring the repayment of $323 million in outstanding advances.

- As it was done with the 2018 advances, a stay of default on 2019 advances could be considered closer to the September 30, 2020, repayment deadline if there is a request from an APP administrator. The Government is working with APP administrators to monitor the situation.

Program data

- For the 2019 APP Program Year to date, $2.9 billion has been advanced to 21,321 producers, for an average advance of $138,000 per producer.

- $2.3 billon is grain and oilseeds (G&O) advances, with almost $1.2 billion being canola advances. The average G&O advance is $169,000.

- Due to the increased interest free limit on 2019 canola advances, the majority of 2019 advances were interest free ($2.4 billion).

APP Advances and participation program year 2018 20191 % change Total advances to date $2,316,823,559 $2,944,605,952 27 Total Interest Free (IF) advances $1,521,807,781 $2,430,050,344 60 Total Interest Bearing (IB) advances $795,015,778 $514,555,608 -35 Grain and oilseed advances issued $1,678,508,951 $2,263,976,642 35 Total producers 21,309 21,321 0 Total G&O producers 12,901 13,358 4 1. 2019 Program year finishes March 31, 2020 and the amounts will change. New limit statistics - 2019 Number Value ($) Producers with advance less than $100,000 14,933 911,816,301 Producers with interest free advances between $100,000 and $500,000 6,388 1,518,234,043 Producers with advances above $400,000 1,688 888,327,893 Advances at $1 million limit 112 112,000,000 - A Stay of Default on APP repayments was announced in August 2019 for outstanding 2018 advances on grain, oilseed and pulse crops. The Stay provided approximately 5,000 crop producers with an additional six months (ending March 31, 2020) to repay their 2018 advances valued just over $323 million. Over the length of the Stay, participating producers continue to benefit from the interest-free benefit.

- Approximately $135 million has been repaid to date with $188 million outstanding.

APP statutory spending, 2017-18 to 2019-19 ($ millions) Type of program expenditure 2017-18 2018-19 Interest paid on interest-free advances ($) 18.83 25.74 Default payments ($) 24.62 23.30 Gross program expenditure ($) 43.45 49.04 Default recoveries ($) −14.42 −12.81 Net statutory G&C costs – Public accounts ($) 29.03 36.23 APP Statutory authorities, 2017-18 to 2019-20 ($ millions) Program authorities 2017-18 2018-19 2019-20 Statutory funding for grants and contributions 65.9 65.9 65.9 Increase 0 0 21.4 Total authorities 65.9 65.9 87.3 - Program spending has been lower then program authorities because of relatively low interest rates and low number of program defaults.

- The increase in program authorities for 2019-20 of $21.4 million is due to the increase to the APP limits in 2019.

-

Intergenerational transfers

Key messages

- The Government remains committed to helping farm families in passing down the results of their hard work; and firmly believes that support for young farmers is critical to the renewal and future of Canada's agricultural sector.

- Intergenerational transfers are an important way to facilitate access for new farmers to farmland, given that increasing land and capital costs are creating a major barrier to sector renewal.

- Canada offers a strong support system for succession planning, including in the areas of taxation, planning and programs.

- Agriculture and Agri-food Canada will continue to work with farmers, and the Department of Finance on tax measures to facilitate intergenerational transfers of farms, to deliver on this mandate commitment.

Initiatives/examples

- The government's main tool for helping family farm businesses in succession planning is the tax system. Several tax measures exist that help to facilitate intergenerational farm transfers:

- Lifetime Capital Gains exemption, which allows an individual selling a qualified property to use their capital gains to reduce their taxable income;

- Rollover provision, which allows an individual to transfer the title of an asset on a tax-deferred basis; and

- Reserve provision, which allows the proceeds from the sale of property to be claimed by the seller over a period of five years.

- Farm Credit Canada (FCC) provides support to the next generation of farmers, with low-interest loan programs for young and beginning farmers, as well as services to guide farm families through the succession planning process. These include:

- Transition Loan: special payment options for both buyers and sellers in a farm transfer, to facilitate intergenerational farm transfers amongst family members.

- Young Farmer Loan: a loan for farmers under 40 to purchase ag-related assets up to $1 million.

- Young Entrepreneur Loan: a loan for young entrepreneurs under 40 to finance new or existing ag-related businesses up to $1 million.

- Starter Loan: For 18 to 25 year-olds to build credit history and gain independence with their own loan to purchase livestock, equipment or shares in a company.

- Women Entrepreneur Loan: a loan for women entrepreneurs to finance ag-related businesses, with no maximum loan amount.

- Agriculture and Agri-Food Canada has been working with Finance Canada who is leading on this issue as part of their broader review of the Income Tax Act. Finance is developing options to facilitate true intergenerational farm transfers, using Canada's tax system. These options will reflect the feedback provided to Finance Canada by the agriculture sector during their stakeholder consultations.

- Under the Canadian Agricultural Loans Act (CALA), the federal government guarantees, to the lender, repayment of 95% of a net loss on an eligible loan issued with a maximum aggregate loan for any one farm of $500,000, and offers special terms to assist young farmers in accessing capital to improve their operations.

Sector data

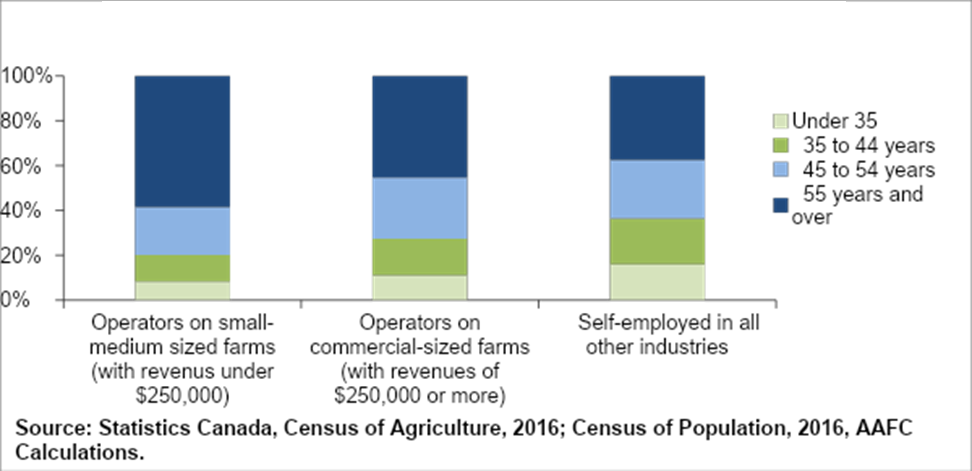

Chart 1. Share of farm operators and self-employed in other industries, by age, 2016

Chart 1 - description

Chart 1 Share of farm operators and self-employed in other industries, by age, 2016 Operators on small- and medium sized farms with revenues under $250,000 (%) Operators on commercial-sized farms with revenues of $250,000 or more (%) Self-employed in all other industries (%) Under 35 8 11 16 35 to 44 years 12 16 20 45 to 54 years 21 27 26 55 years and over 58 45 37 Source: Statistics Canada, Census of Agriculture, 2016; Census of Population, 2016, AAFC calculations

Number of farm operators and self-employed in other industries by age, 2016Number of farm operators and self-employed in other industries by age, 2016 Operators on small-medium sized farms (with revenues under $250,000) Operators on commercial-sized farms (with revenues of $250,000 or more) Self-employed in all other industries Under 35 15,770 9,070 354,710 35 to 44 years 22,620 13,365 449,865 45 to 54 years 40,535 22,340 580,105 55 years and over 111,215 37,035 827,835 Source: Statistics Canada, Census of Agriculture, 2016; Census of Population, 2016, AAFC Calculations. - Farm operators over the age of 55 years make up almost 60% of small and medium sized farms, and almost 50% of commercial sized farms, indicating an aging agriculture population and the need for succession planning.

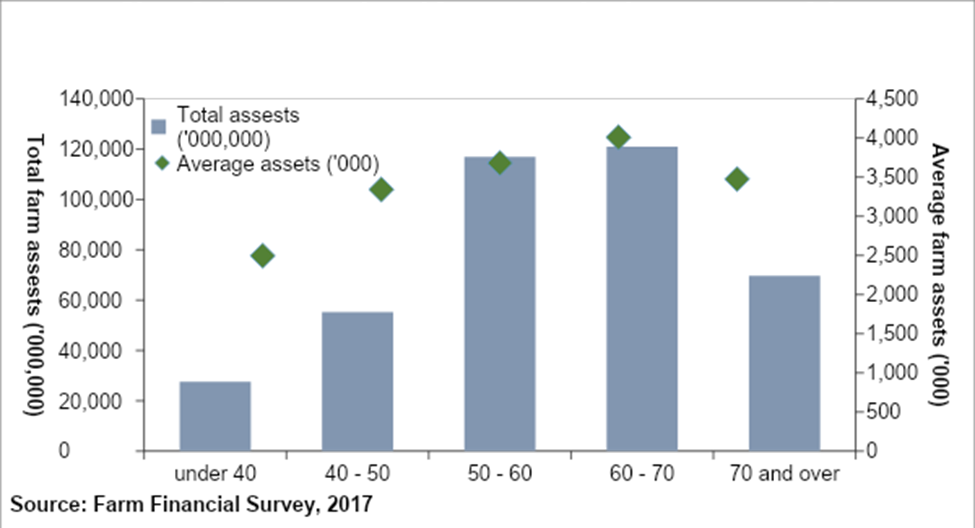

Chart 2. Average and total farm assets, by the age group of the oldest operator on farm, 2017

Chart 2 - description

Chart 2 Average and total farm assets, by the age group of the oldest operator on farm, 2017 Total farm assets

($ million)Average farm assets

($ million)Under 40 27,569.4 2.5 40 to 50 years 55,250.7 3.3 50 to 60 years 116,963.4 3.7 60 to 70 years 120,969.2 4.0 70 years and over 69,627.9 3.5 Source: Statistics Canada, Farm Financial Survey, 2017 - Producers aged 50 and 60 have total farm assets of $117 million, producers aged 60 to 70 have total farm assets of $121 million, while farmers under 40 have a much lower total farm asset value of $28 million indicating that intergenerational farm transfer in the agriculture sector will see substantial assets changing hands.

-

Compensation for supply-managed sectors (poultry, eggs and dairy)

Key messages

- Our government strongly supports Canadian producers and processors, and is committed to protect and preserve supply management for future generations of Canadian farmers. We are delivering on our commitment to provide full and fair compensation in support of supply-managed farmers, as a result of commitments made under CPTPP and CETA.

- In Budget 2019, we announced support for eligible dairy, poultry and egg producers for CETA and CPTPP. In August, we announced a total of $2 billion in compensation for dairy producers, including $345 million in 2019-2020 through the Dairy Direct Payment Program.

- We have delivered full and fair compensation for dairy farmers, and we are working diligently with the poultry and egg farmers, and supply managed processing sector to provide that support. Furthermore, we maintain our commitment to deliver full and fair compensation for the new NAFTA once it has been ratified

Responsive on SM4

- Through the Poultry and Egg Working Group we worked in partnership with the sectors to understand their views on how to respond to the impacts of CETA in the most fair and effective way possible.

- The Government is committed to tailoring its response based on the unique needs of processors and SM4. Our commitment is firm and we are working to ensure that compensation is made available as quickly as possible.

-

Labour shortages and temporary foreign workers

Key messages

- The Government knows that reliable access to labour is vital to the growth and success of agricultural and food processing operations.

- The Government is committed to attracting and retaining the best talent from around the world to help fill labour and skills shortages.

- The Government will continue to engage with employers, workers and other stakeholders to address key issues raised by the sector, such as improving access to skills development opportunities.

Initiatives/examples

- As part of Budget 2019's Youth Employment and Skills Strategy, the Government announced an investment of up to $3.75 million to help bring youth into the agriculture industry.

- AAFC's Youth Employment and Skills Program aims to create opportunities for Canadian youth to explore employment in the agriculture and agri-food sector and to better prepare themselves for the labour market.

- AAFC's Youth Employment and Skills Program will contribute $864,000 annually to projects that employ youth. The program is expected to help create some 60 agricultural internships for youth entering the workforce.

- In 2019, Immigration, Refugee and Citizenship Canada (IRCC) announced two pilots that will help to deal with critical labour shortages in agri-food and rural communities:

- The Rural and Northern Immigration Pilot launched in January 2019, is aimed at spreading the benefits of economic immigration to smaller communities. As of March 9, 2020, the pilot has been launched in 6 of the 11 rural and northern communities selected by IRCC to participate in this pilot. Newcomers are expected to begin to arrive under this pilot in 2020. In total the pilot could accept up to 2,750 principal applicants and their families annually.

- The Agri-Food Immigration Pilot announced in July 2019 will test an industry-specific approach to help address the year-round labour needs of the Canadian agri-food sector. Additional details on how to apply for permanent residence through this pilot will be available in March 2020. This pilot could accept up to 2,750 principal applicants and their families annually.

- The Agri-Food Immigration Pilot was well-received by the agriculture and agri-food sector. There are high expectations for the successful implementation of these initiatives.

- In May 2018, the Government established a Temporary Foreign Worker (TFW) Program Agricultural Service Delivery Working Group to provide an industry/government-led forum to discuss service delivery issues and explore potential solutions. This working group, jointly chaired by Service Canada and the Canadian Federation of Agriculture, has made progress on a number of administrative issues and irritants, including improvements in Labour Market Impact Assessment processing times and TFW arrivals.

Sector data

- The Canadian Agricultural Human Resource Council estimates that 16,500 jobs in primary agriculture went unfilled in 2017, resulting in $2.9 billion in lost revenues.

- Food Processing Skills Canada is reporting that 65,000 new workers will be required if businesses are to achieve the targets set by the Agri-Food Economic Strategy Table.

- In 2018, TFWs accounted for about 19% of the primary agriculture workforce and 1% of the food and beverage manufacturing sector. TFWs are common in horticulture and meat and seafood processing in Ontario, British Columbia and New Brunswick.

-

Value creation

Key messages

- AAFC is committed to Canada's grain growers in moving towards a stronger, more innovative and more competitive sector in the global marketplace.

- AAFC is committed to playing an important role in seed research and development.

- AAFC's economic analysis on the two royalty collection mechanisms that were put forward by the Grains Roundtable shows that increasing investment in breeding can result in improvements to crop yield and net farm incomes over time, consistent with other published studies in this area.

- Given the work currently underway by some producer organizations and the seed industry on value creation, and based on their interest in more time to discuss ideas for a path forward, the Government is not planning further consultations until consensus is reached.

- AAFC is pleased with the leadership and efforts that industry is putting forth and will continue to monitor the outcomes of the pilot project, and participate in sector-led discussions as needed in order to help build consensus around a path forward.

Initiatives/examples

- As requested by the Grains Roundtable, AAFC and the Canadian Food Inspection Agency jointly launched a multi-phase a consultation process on two proposed value creation models for Canada's cereals sector. A series of in-person engagement sessions were held – commencing in November 2018 until May 2019.

- Based on feedback collected, a decision was made to delay the next phase of the consultation process so that the analysis of impacts on wheat growers could be expanded to include other crops such as barley, oats and flax. The results of this economic analysis were finalized in Winter 2020 and presented to Grains Roundtable members in March 2020.

- The Grain Growers of Canada (GGC), the Canadian Federation of Agriculture (CFA) and the Canadian Seed Trade Association (CSTA) have been working together on a common set of guiding principles for Value Creation.

- SeCan, FP Genetics, Seednet and several other seed distributors launched a pilot of the contract-based "Seed Variety Use Agreement" in February 2020.

Sector data

- Wheat contributes $9 billion annually to the Canadian economy and provides a much needed crop in producer rotations for pest and disease control. However, for close to two decades, cereal (for example, wheat, barley, oats, etc.) acreage has been on the decline and has attracted a lower share of private sector investment relative to crops like corn, soybeans and canola.

- Two interrelated issues are responsible for the lack of private investment in cereal variety development. High rates of farm-saved seed, coupled with the lack of strong intellectual property rights (for example, patents) make it difficult for the private sector to achieve a return on investment in cereal breeding.

- Consequently, public sector entities such as AAFC, along with Canadian agriculture universities, have remained the dominant players in cereal breeding. At present, royalties are only collected on the first sale of certified seed into the marketplace, which represents only 20% of cereal production acreage (on average 80% of annual cereal production is derived from royalty free farm-saved seed).

-

Mental health challenges in the agriculture sector

Key messages

- Mental health is an issue that touches all people. The Government is working with provinces, territories and industry partners to support the mental health of farmers, ranchers and producers.

- Agriculture and Agri-Food Canada supports action through the Canadian Agricultural Partnership. Provinces and territories can use federal cost-shared funding to address regional-specific pressures that can pose mental health challenges.

- Farm Credit Canada is actively working to raise awareness of mental health warning signs and available resources through its Rooted in Strength initiative.

- The Government committed $5 billion, over 10 years, directly to provinces and territories to improve mental health initiatives and services as part of Budget 2017.

Initiatives/examples

Farm Credit Canada (FCC) is actively working with the sector to raise awareness of mental health warning signs and available resources, including:

- Partnering with the Do More Agriculture Foundation to fund mental health training sessions in over 20 communities across Canada this year.

- Running public service announcements in various communities across Canada to increase awareness of available resources.

- Updating their mental health booklet, titled Rooted in Strength: Taking Care of Our Families and Ourselves, which was reissued to all farm mailboxes in Canada the week of February 18 and is available online through FCC's website.

- In addition, AAFC is working with Farm Management Canada to explore the link between mental health and the impact on farm business management decisions.

- Agriculture and Agri-Food Canada (AAFC) continues to explore ways that its policies, programs and services can further support initiatives to address the mental health challenges faced by those in the sector.

Sector data

Research from the University of Guelph (submitted to Standing Committee on Agriculture and Agri-Food in 2019) indicates that farmers are vulnerable when it comes to mental health challenges, with rates of stress, anxiety, depression, emotional exhaustion and burnout all being higher than other groups in the population. This data also indicates that farmers and others in the agricultural sector are less likely to seek help for mental health issues due to a lack of resources in rural areas, resources that aren't knowledgeable of the realities of the sector, and the stigma associated with seeking help.

Canada does not gather statistics on deaths by suicide by employment sector. -

Innovation in the agriculture sector

Key messages

- In Canada, federal and provincial governments believe strongly in the power of science and innovation investments to drive improved profitability and sustainability in the sector.

- Under the Canadian Agricultural Partnership, the Government is investing $690 million in federally funded activities and programs in support of innovation. We are using approaches that combine talent and resources from industry, government and universities to find the best solutions for our farmers, processors and Canadians.

- AgriScience Program: $338 million to support leading edge discovery and applied science, and innovation driven by industry research priorities. Up to $240.77 million has been approved for 19 AgriScience cluster and 50 AgriScience projects.

- AgriInnovate Program: $128 million to accelerate the commercialization, adoption, and/or demonstration of innovative products, technologies, processes or services that increase agri-sector competitiveness and sustainability. Up to $56.2 million has been approved in repayable contributions for 16 projects.

- AAFC is working in collaboration with ISED to support initiatives within the Innovation and Skills Plan. The Innovation and Skills Plan recognizes agriculture and agri-food as a key sector for Canada, and is providing support to innovation in the sector through initiatives such as the Strategic Innovation Fund and Innovation Superclusters Initiative.

Initiatives/examples

- Under AAFC's AgriScience Program, the Swine Cluster will carry out research activities such as new ways of feeding piglets that could help provide immunity from diseases, and the effect of long-distance transport on animal health and welfare.

- The Government's $153 million investment in the Protein Industries Canada Supercluster will complement the Canadian Agricultural Partnership and help farmers add value to a wide range of crops, create new jobs in the sector and add billions of dollars to the Canadian economy.

Sector data

AAFC AgriScience clusters

- Under the AgriScience Program's clusters support industry-led and commodity specific science and research projects that address priority themes and horizontal issues, and coordinate research activities across Canada.

- Nineteen clusters were approved for a total of $183.2 million in support. This includes $126.9 million in funding directly to industry, and $56.3 million in support from AAFC research scientists.

- Clusters are generally grouped by commodity or target sector: beef, canola, diverse field crop, pulse, dairy, wheat, soybean, swine, barley, grape and wine, ornamental horticulture, edible horticulture, poultry, organic, automation, food processing, biomass, agronomy and bioproducts.

Distribution of cluster activities Province Activities Funding ($) British Columbia 18 4.7 Alberta 58 24.4 Saskatchewan 66 35.5 Manitoba 48 23.5 Ontario 84 43.6 Quebec 46 22.2 New Brunswick 5 3.5 Nova Scotia 13 5.8 Prince Edward Island 6 3.0 Newfoundland and Labrador 2 0.2 USA 2 0.3 Note: activity funding is lower than overall total as administration costs are not included here. Innovation Superclusters Initiative

- The Innovation Superclusters Initiative will invest up to $950 million by 2023 to accelerate the growth and development of business-led innovation in Canada.

- Five Supercluster proposals were approved by Cabinet and announced by Minister Bains, February 14, 2018:

- SCALE.AI – The Artificial Intelligence Supply Chains Supercluster (Quebec-Windsor corridor) - $230 million;

- Next Generation Manufacturing Supercluster (Ontario) – $230 million;

- Digital Technology Supercluster (B.C.) - $153 million;

- Protein Industries Canada (Prairies) - $153 million; and,

- the Ocean Supercluster (Atlantic, Northern Canada) - $153 million.

-

Investing in agricultural research and resources

- Agriculture and Agri-Food Canada planned spending for science and innovation is $587 million for 2019-2020

- This includes programming under the Canadian Agricultural Partnership: AgriInnovate and AgriScience, supporting the sector

- Funding will maintain the national network of research and development centres and hire the next generation of scientists and professionals

- This will support new emerging areas to advance science and innovation

- Living Laboratories Initiative is a good example of agricultural innovation

Initiatives

- The Accelerated Staffing Initiative: AAFC is hiring the next generation of federal research scientists and science professionals.

- Since 2018, AAFC hired 26 scientific researchers and professionals in new and emerging areas of science.

- By 2021, it is expected that AAFC will staff a total of 75 positions through this initiative.

- Living Laboratories Initiative: An open approach to innovation, bringing scientists, industry and farmers together to co-develop new farming practices in a real-life context.

- Interdepartmental Research Initiative in Agriculture: Funds collaborative federal research projects focused on supporting environmental resiliency, and to advance the use of cutting-edge technologies and artificial intelligence in agricultural science.

- This initiative will continue to support the creation of interdisciplinary science teams across the government.

Infrastructure Investments

These projects are related to maintaining or improving the built infrastructure at these sites to ensure the proper operation of a research facility.

2019/2020 Planned investments for main research centres Main research centres 2019/2020 Planned investments ($,000) Agassiz 507 Brandon 988 Charlottetown 607 Fredericton 378 Guelph 35 Harrow 898 Kentville 992 Lacombe 494 Lethbridge 1,120 London 2,138 Morden 3 Ottawa 2,764 Ste-Foy 344 St-Hyacinthe 5,547 St-Jean-sur-Richelieu 1,073 Saskatoon 1,902 Sherbrooke 2,659 St. John's 736 Summerland 1,295 Swift Current 1,150 AAFC has 20 Research and Development Centres with 30 satellites research locations across Canada that includes

- British Columbia: Agassiz, Summerland

- Alberta: Lacombe, Lethbridge

- Saskatchewan: Saskatoon, Swift Current

- Manitoba: Morden, Brandon

- Ontario: Harrow, London, Guelph, Ottawa

- Quebec: Saint-Jean-sur-Richelieu, Sherbrooke, Saint-Hyacinthe, Quebec city

- Nova Scotia: Kentville

- New Brunswick: Fredericton

- Prince Edward Island: Charlottetown

- Newfoundland and Labrador: St. John's

Since October 2018, AAFC has hired 53 new scientists, including 25 scientific researchers and professionals in new and emerging areas of science through the Accelerated Staffing Initiative (ASI).