- Step 1. What this program offers

- Step 2. Who is eligible

- Step 3. Before you apply

- Step 4. How to apply

- Step 5. After you apply

- Applicant guide

- Frequently asked questions

- Contact information

Applicant guide - Phase 2

Intake period: Closed

The application intake period for the Dairy Farm Investment Program is closed.

1.0 Dairy Farm Investment Program Phase 2

1.1 Purpose of the Applicant Guide

The purpose of this document is to provide you with information about the Dairy Farm Investment Program Phase 2. In addition, this Program Applicant Guide ("Applicant Guide") will assist you in applying for funding under the program. It is important to follow the process outlined in this Guide.

1.2 Program Description

The Dairy Farm Investment Program (DFIP) is a six-year (beginning 2017-2018) $250-million program to help Canadian licensed cow's milk producers improve productivity through upgrades to their equipment.

DFIP is one of two programs announced on November 10, 2016 to support the productivity of the dairy sector, as it adapts to the anticipated impacts of the Canada–European Union Comprehensive Economic and Trade Agreement (CETA).

The assessment of projects under Phase 1 of the Program has been completed. Phase 2 of the program provides funding assistance from April 1, 2020 until March 31, 2023. The project activities must be completed by March 31, 2023. Reimbursement to applicants will be made in 2020-21, 2021-22 and 2022-23 as projects are completed and funding remains available. Applicants will be informed in which year they should expect to be reimbursed for their eligible activities.

Based on the demand, the program will strive to support investments in all provinces – approximately in proportion to their share of the total national milk quota.

1.3 Program Duration

DFIP Phase 2 covers projects started on or after August 1, 2017. The program ends on March 31, 2023.

1.4 Dairy Farm Investment Program Phase 2 Process

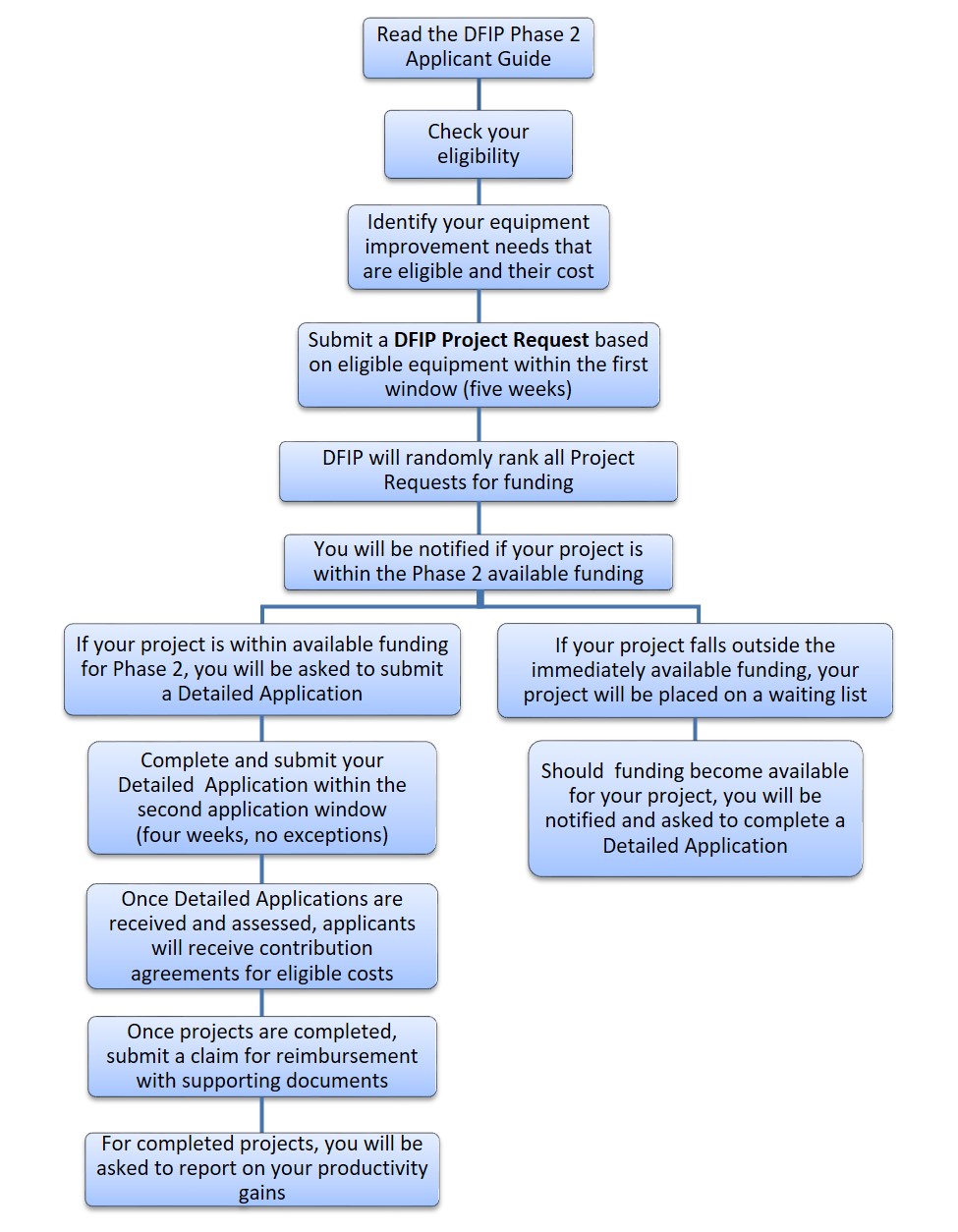

Description of the image above.

- Read the DFIP Phase 2 Applicant Guide

- Check your eligibility

- Identify your equipment improvement needs that are eligible and their cost

- Submit a DFIP Project Request based on eligible equipment within the first window (five weeks)

- DFIP will randomly rank all Project Requests for funding

- You will be notified if your project is within the Phase 2 available funding

- If your project is within available funding for Phase 2, you will be asked to submit a Detailed Application

- Complete and submit your Detailed Application within the second application window (four weeks, no exceptions)

- Once Detailed Applications are received and assessed, applicants will receive contribution agreements for eligible costs

- Once projects are completed, submit a claim for reimbursement with supporting documents

- For completed projects, you will be asked to report on your productivity gains

- If your project falls outside the immediately available funding, your project will be placed on a waiting list

- Should funding become available for your project, you will be notified and asked to complete a Detailed Application

- If your project is within available funding for Phase 2, you will be asked to submit a Detailed Application

2.0 Are you eligible?

Applicants must ensure that they meet all eligibility criteria before applying.

Under DFIP Phase 2, eligible applicants must be legal entities capable of entering into legally binding agreements in Canada. Eligible applicants must be Canadian licensed cow's milk producers. Applicants must own a valid dairy license stating the production quota and be registered with a provincial milk marketing board. To verify eligibility, applicants will be asked to:

- provide information on their dairy license and production quota

- authorize Agriculture and Agri-Food Canada (AAFC) to verify this information with the respective provincial milk marketing board

Applicants not approved under Phase 1 must re-apply if they wish to have their project considered under Phase 2. See section 1.4 for more details on Dairy Farm Investment Program Phase 2 Process.

Any dairy license owned by a cow's milk producer that was assigned funding under Phase 1 will not be eligible for use in an application under Phase 2.

If an applicant owns more than one license, licenses that did not receive funding under Phase 1 can be used to apply under Phase 2. A unique dairy license is normally tied to a specific legal land location/facility. If you have been issued a new dairy license number for the same legal land location/dairy facility and you received funding from the Phase 1 of the program for this legal land location/facility your newly issued dairy license number is not eligible.

An applicant may submit only one application per dairy license for Phase 2. If multiple Project Request forms are received for a single license, only the first Project Request form received will be considered.

Ineligible applicants include:

- other types of dairy producers (for example, goat, sheep, water buffalo)

- any dairy license owned by a cow's milk producer that was assigned funding under Phase 1

- any applicant who does not own a dairy license (that is, any individual or any business renting or leasing a dairy license, or in the process of acquiring a license is ineligible)

- educational institutions

3.0 Identify your productivity needs that are eligible and their cost

3.1 Maximum/Minimum Funding Amount

Phase 2 program contributions are capped at $100,000 for all projects. The minimum funding amount that will be considered for a project is $1,000.

3.2 Cost Sharing

Approved eligible costs may be reimbursed up to a maximum of 50% up to a maximum of $100,000.

When including funds from other government sources to meet the applicant's minimum 50% share of eligible costs, the stacking limit must be respected. The stacking limit refers to the maximum level of total Canadian government funding (federal, provincial/territorial, and municipal) a successful applicant can receive towards the total eligible costs of a project.

The maximum level of total government funding cannot exceed 85% of eligible costs per project.

3.3 Eligible Activities

All activities must relate to improving productivity of milk production from cows in Canada and be within the barn.

Eligible activities are of the following nature and type:

- Hiring of external expertise (consultants) to assess how the dairy farm enterprise can improve efficiencies and productivity

- Purchasing, shipping, and installing eligible equipment (that is, barn equipment, commercial-off-the-shelf software and IT infrastructure, see Annex A of this Applicant Guide for a list of eligible equipment types)

- Training necessary to operate eligible equipment

- Retrofits of current facilities within the existing barn footprint related to the installation and operation of eligible equipment

Note: Purchasing equipment for utilization/installation outside the barn (for example, tractors, self-propelled loaders, silos, office equipment) is an ineligible activity. Also, while applicants may seek funding to retrofit their facilities to accommodate eligible equipment, new buildings or barn expansions are ineligible. Purchase of new equipment is eligible when installed in an existing or new barn. Applicants are strongly encouraged to review sections 3.4 Eligible Costs and 3.5 Ineligible Costs of this Applicant Guide on ineligible costs prior to submitting their application.

3.4 Eligible Costs

Eligible costs are the costs directly related to the project and must respect all conditions and limitations set out in this Applicant Guide, the written decision letter, and the Contribution Agreement, if the project is approved.

An eligible cost may be a planned or actual cost. A planned cost is an estimated amount for a project element supported by a quote from a company but not yet incurredFootnote 1, or incurred but not yet paid. An actual cost is the amount incurred and paid and is supported by an invoice, receipt and proof of payment.

In completing the Project Request form, an applicant need only check off the nature of the project and identify the expected total eligible costs.

Only applicants whose projects are selected at random to have their projects considered for Phase 2 funding will be invited to complete a Detailed Application form and provide supporting documentation for both planned and actual costs included in the Detailed Application form for assessment (see section 7.0 of this Applicant Guide for more details).

Eligible costs must be presented in the budget tables of the Detailed Application form, as planned or actual costs, and using the standard DFIP Cost Categories and Types. The DFIP Cost Categories and Types are listed below, however applicants should refer to Annexes A and B of this Applicant Guide for more detailed guidance or requirements for the DFIP Cost Categories and Types.

DFIP Cost Categories and Types include:

- Equipment

- Costs of new equipment. Please refer to Annex A for a list of eligible equipment types.

- Associated Costs

- Associated costs are those costs related to the purchase of new equipment, such as:

- Consultant fees: as billed to the applicant and including reasonable travel costs for the consultant, to assess how the applicant can improve on-farm efficiencies and productivity

Note: Consultant fees are only eligible if the applicant is applying for DFIP funding for the purchase of equipment stemming from the consultant's report/recommendation

- Installation (Labour): physical labour and associated technical and trade services for the installation of eligible equipment

- Installation (Material costs): material costs, including tool rental and machinery rental, for the installation of eligible equipment

- Retrofits (Labour): physical labour and associated technical and trade services for retrofits of an existing facility (as it relates to the installation and operation of eligible equipment)

- Retrofits (Material Costs): material costs, including tool rental and machinery rental, for retrofits of an existing facility (as it relates to the installation and operation of eligible equipment)

- Salaries and Benefits: limited to incremental costs only, for salaries and benefits pertaining to:

- transportation and installation of eligible equipment

- training

- existing facility retrofits (as it relates to the installation and operation of eligible equipment)

- Shipping: costs related to shipping eligible equipment

- Training: costs, including reasonable travel costs for the trainer, for short term training related to the implementation of eligible equipment

- Travel (Ground Transportation, Per Diem): for required training to properly operate the eligible equipment, accessories and commercial off-the-shelf software

- Other Associated Cost: related to the purchase of eligible equipment

- Consultant fees: as billed to the applicant and including reasonable travel costs for the consultant, to assess how the applicant can improve on-farm efficiencies and productivity

- Associated costs are those costs related to the purchase of new equipment, such as:

Associated costs can be submitted as a total and do not need to be described in the detail they may appear on a quote or invoice.

- Other Costs

- Such as Translation costs for training documents, to support Official Language Minority Communities and promote linguistic duality

- Other costs can be submitted as a total and do not need to be described in the detail they may appear on a quote or invoice.

Note: DFIP's contribution towards the total of associated and other costs combined cannot exceed the program's contribution towards the total costs of eligible equipment (that is, the program will not contribute more towards associated costs than its contribution towards the relevant equipment).

In the Project Request form and the Detailed Application form, applicants will enter equipment and associated costs separately, to ensure this limit is adhered to.

Costs must not include any refundable portion of Goods and Services Tax/Harmonized Sales Tax (GST/ HST), value-added taxes, rebates, refunds, trade-in values or the cost of extended warranties.

3.5 Ineligible Costs

Ineligible project costs are, but not limited to, the following:

- Activities starting or any costs incurred before August 1, 2017, or incurred after March 31, 2023

- An activity that is a commercial expansion as defined by the purchase of additional dairy quota. A project may include an increase in production to meet additional quota granted by a provincial milk marketing board to meet normal market growth, or an increase in the number of dairy cows to fill quota already owned by an applicant at the time of application (the purchase of cows is not an eligible cost). For example, an applicant may purchase a robotic milking system with the goal of filling quota owned at the time of application even if the applicant does not have enough lactating cows to do so at the time of application.

- Tractors, silos, loaders (including skid-steer loaders), and related equipment

- Cooling tanks that do not fall under the following:

- Limited to one new tank when buying a new milking system (must be a change of the milking process, for example, from a pipeline to a robotic milking system not a replacement of like-for-like equipment)

- Funding may be limited to the portion of the tank size required to meet the existing production quota or herd size

- Used or refurbished equipment

- Generators

- Animal purchases (replacing or increasing herd)

- Spare parts

- Cost to replace equipment (cost to upgrade equipment is eligible)

- Goat or sheep or water buffalo milking equipment

- Planning, design and construction of new infrastructure (retrofits for the installation and operation of the eligible equipment are eligible)

- Architectural plans

- Construction permits/licenses

- Compliance with the Canadian Environmental Assessment Act (CEAA), if applicable

- Refundable portion of Goods and Services Tax/Harmonized Sales Tax (GST/ HST), value-added taxes or other items for which a rebate or refund is received

- Supplier rebates, refunds, discounts (only the net cost paid is eligible);

- Share of costs being reimbursed under an existing federal, provincial, territorial or municipal program

- Barn retrofit and other associated expenditures that will not: decrease the required labour to complete an activity pertaining to milk production, increase the efficiency of milk production, or decrease production costs

- Epoxy coating of corridors (may be eligible if combined with a feed pusher in the project)

- Acquisition of land or buildings

- Capital assets not specifically required for the shipping, installation and operating the eligible equipment

- Normal costs of establishing, operating or expanding a commercial operation not incremental to shipping, installation or operating the equipment

- Veterinary equipment

- Quota purchases

- Any costs which cannot be directly tied to the project and which are part of ongoing operations

- Business goodwill

- Legal fees

- Hospitality (for example, alcohol, meals, entertainment, and gifts)

- Clothing

- On-going support costs for items such as software licenses, troubleshooting and upgrades; and machinery maintenance or repair

- Travel costs other than for training and knowledge transfer (external expertise/consultant) activities

- Software customization

- Purchase of extended warranties

- Post-production equipment or vehicles (such as shipping milk off farm)

- Salaries and benefits as it pertains to establishing, operating or expanding a commercial operation not incremental to shipping, installation or operating the equipment

- Planning costs to apply for funding, administration costs to process invoices, and other internal costs

- Marketing costs

- Any portion of any cost that, in Agriculture and Agri-Food Canada's opinion, exceeds the fair market value for that cost item

- Project activities pertaining to supporting industry efforts to lobby or influence governments

- Surcharges or penalties incurred as a result of late payment of an invoice

- Banking/credit card fees and interest charges

- Bartering

- In-kind contributions

- Any other costs incurred by eligible applicants in relation to barn equipment, commercial off-the-shelf software and IT infrastructure that is the subject of the application, and not otherwise listed as eligible, may be ineligible for reimbursement

3.6 Retroactivity

The program allows applicants to apply for projects that have already started, or have even been completed, subject to certain conditions.

Applicants may apply for eligible activities that started on or after August 1, 2017 ("retroactive activities") and costs that were incurred on or after August 1, 2017 ("retroactive costs"). If a deposit has been paid before August 1, 2017, or a contract/purchase order signed before August 1, 2017, the equipment concerned is ineligible.

While the program allows for such retroactive activities and costs to be submitted, the applicant assumes the risk of not being reimbursed should:

- the project not be approved

- some activities or costs not be approved or deemed ineligible

- funding not be available.

Thus, any costs incurred prior to the signature by both the applicant and Agriculture and Agri-Food Canada of the Contribution Agreement are incurred solely at the applicant's risk without obligation of payment by Agriculture and Agri-Food Canada. See section 8.2 for more details on the Contribution Agreement.

Further, in no instance will any cost incurred prior to August 1, 2017 or after the program end date of March 31, 2023 be eligible for reimbursement or considered as part of the applicant's contribution toward the project.

3.7 Project Types

In Phase 2 of the program, there will be a common stream for all projects (that is, there will be no distinction between small and large projects as there was in Phase 1).

A project must improve efficiency and productivity of milk production. It can be a single, integrated system (for example, robotic milking systems, feeding systems, more efficient ventilation or lighting systems) or any other investment in eligible equipment (that is, can be a variety of unrelated pieces of equipment or project elements). Eligible costs can be reimbursed up to 50%, to a maximum of $100,000. All equipment must be installed and/or utilized in the dairy barn.

Examples: Investment projects

Example A – Robotic Milking System

An applicant seeks to invest in 2 robotic milking systems with a per unit price of $190,000 and a total shipping, installation, barn retrofit and training cost of $230,000, for a total investment of $610,000.

| Quantity | Cost Per Unit | Total | |

|---|---|---|---|

| Purchase Price – Robotic milking system | 2 | $190,000 | $380,000 |

| Associated Expenses | - | $230,000 | $230,000 |

| Total Investment | $610,000 | ||

While 50% of eligible costs in this example would be $305,000 (50% of $610,000), the maximum DFIP funding request would be the $100,000 limit for all projects.

Example B – Herd Management

An applicant seeks to invest in 200 units of herd management equipment with a per unit price of $300 and a total shipping, installation and training cost of $1,000, for a total investment of $61,000.

As the project will contribute to improving productivity, project costs are eligible for a reimbursement of up to 50%.

| Quantity | Cost Per Unit | Total | |

|---|---|---|---|

| Purchase Price – Herd management equipment | 200 | $300 | $60,000 |

| Associated Expenses | - | $1,000 | $1,000 |

| Total Investment | $61,000 | ||

In this example, the maximum DFIP funding request would be $30,500 (50% of $61,000).

Example C – Multi-component

An applicant seeks to invest in a variety of herd management, barn operation and feeding equipment (per unit prices ranging from $1,500 to $35,000) with a total purchase price of $250,000 and a total shipping, installation and training cost of $10,000, for a total investment of $260,000.

| Total | |

|---|---|

| Purchase Price – Total for all equipment | $250,000 |

| Associated Expenses | $10,000 |

| Total Investment | $260,000 |

While 50% of eligible costs in this example would be $130,000 (50% of $260,000), this would exceed the maximum reimbursement of $100,000. Therefore, the maximum DFIP funding request for this example would be $100,000.

Example D – Multi-component with a system

An applicant seeks to invest in:

- 1 robotic feeding system with a per unit price of $140,000 and a total shipping, installation and training cost of $10,000, for a total investment of $150,000.

- A variety of milking equipment upgrades (per unit prices ranging from $2,000 to $15,000) with a total purchase price of $120,000 and a total shipping, installation and training cost of $30,000, for a total investment of $150,000.

| Total | |

|---|---|

| Purchase Price – robotic feeding system | $140,000 |

| Purchase Price – total for other equipment | $120,000 |

| Associated Expenses | $40,000 |

| Total Investment | $300,000 |

For this application, there is no distinction between a system and unrelated equipment in Phase 2 of DFIP. The maximum DFIP funding request would be $100,000 as the funding cap per project was exceeded (50% of $300,000=$150,000).

Example E – Project with large associated costs

An applicant seeks to invest in:

- a ventilation system which requires major modifications to an existing barn for installation.

| Total | |

|---|---|

| Purchase Price – ventilation system | $40,000 |

| Associated Expenses (installation) | $100,000 |

| Total Investment | $140,000 |

For this application, the maximum DFIP funding request would be $40,000 as the associated costs cannot exceed the cost of the equipment. The eligible associated costs are $40,000, making the total eligible costs $80,000 × 50% = $40,000 contribution limit.

4.0 Submit a Project Request Form

4.1 What is a Project Request Form?

The Project Request form provides basic details about a project such as applicant information, the type of equipment and expected cost. Ensure the equipment in the Project Request form is included in Annex A and/or Annex B of this guide. If not, it may not be eligible.

The submission of a Project Request form creates no obligation on the part of Agriculture and Agri-Food Canada to provide funding for the proposed project. Funding is only offered through a contribution agreement (see Section 8.2 of this Applicant Guide) once the Applicant has been invited to submit a Detail Application and the project's eligibility assessment has been completed.

In Phase 2, applicants must obtain a project number by submitting a Project Request form (See Section 10 of this Applicant Guide for more information on submitting a Project Request form). There are no supporting documents required with a Project Request form.

Project Request forms will be accepted for a set period (below).

Phase 2 Application Window

Only Project Request forms submitted between 07-01-2019 and 08-02-2019 23:59:59 Eastern Time will be accepted. Late and early submissions will not be accepted.

For the Phase 2 application window, Project Request forms will only be accepted for projects that fall within these dates:

| Investment Project | |

|---|---|

| Start Date | Activities must begin between August 1, 2017 and March 31, 2023. |

| Completion Date | Activities must be completed by March 31, 2023. |

Once an applicant has submitted a Project Request form and it has been entered into the program database, the applicant will receive an acknowledgement notice from Agriculture and Agri-Food Canada. If applicants provide an email address, the acknowledgement notice will be sent by email with a target service standard of 3 business days. Otherwise, it will be sent by regular mail. Applicants should not consider their project submitted to the program until they receive the acknowledgement notice.

Helpful hints

- All equipment must be utilized and/or installed in the barn.

- Use the Dairy Farm Investment Program forms only. Do not use the Dairy Processing Investment Fund forms.

- Do not use the Phase 1 DFIP forms.

- For retroactive projects, ensure the project start date complies with the date limitations outlined in Section 3.6.

- Do not use the Detailed Application form until requested to do so.

DFIP requests that any additional supporting material submitted is limited to documents directly relevant to, and in support of, the project proposal.

Helpful hints

It is important that cost estimates in the Project Request form be accurate as Agriculture and Agri-Food Canada may not be able to accommodate increases in project budgets after Project Request forms have been submitted.

5.0 You will be assigned a Dairy Farm Investment Program project number

All projects submitted within the Phase 2 application window will be assigned a DFIP project number.

6.0 Projects will be randomly ranked for funding

All submitted Project Request forms will be assigned a project number. Once the submission window closes, all Project Request forms received will then be ranked by Agriculture and Agri-Food Canada through a computerized random process for potential funding based on DFIP's available funding. The random selection process will be overseen by an independent third party and use a recognized algorithm to perform the randomization. The program funding allocations over the life of the six-year program will aim to reflect provincial shares of the national dairy production quota.

7.0 Complete and submit your Detailed Application form within the second application window

Helpful hints

This section is only applicable to those applicants invited to submit a Detailed Application form following the random selection process.

7.1 Projects within the available funding for Phase 2

If your project is within available funding for Phase 2, you will be asked to submit a Detailed Application form within a four week period (no exceptions or extensions will be granted). If Detailed Application forms are not received during that period the project will be considered withdrawn. A Detailed Application form with additional supporting documentation (listed in section 7.4 and 7.5 of this Applicant Guide) is required by the program to fully assess the project.

The submission of a Detailed Application form creates no obligation on the part of Agriculture and Agri-Food Canada to provide funding for the proposed project. Funding is only offered through a contribution agreement (see Section 8 of this Applicant Guide) once the project's eligibility assessment has been completed.

The program strongly encourages that Detailed Application form packages, including supporting documentation, be submitted in electronic format. A checklist will be provided to applicants submitting Detailed Application forms to assist them in completing the Detailed Application form.

7.2 Projects outside the available funding for Phase 2

If your project falls outside the funding available following the random selection process, your project will be placed on a waiting list. Should funding become available for your project, you will be notified and asked to complete a Detailed Application form. Any funding that becomes available through the assessment of Detailed Application forms will be re-allocated to other projects based on their rank through the random ordering that was done of all Project Request forms. This procedure will eliminate the burden on applicants to file a Detailed Application form should there be insufficient funding for their project.

7.3 Detailed Application form

The Detailed Application form has the following sections:

- Part 1: Applicant Information provides profile information of the applicant including name, contact information (in the case of an applicant who is not an individual, information establishing that the applicant is a recognized legal entity, and acknowledgement of whether they have previously received funding under the program.

- Part 2: Facility Information describes the dairy facility.

- Part 3: Project Description provides a description of the expected change to the facility including timelines, and the expected benefits/results, including estimated on-farm productivity improvement. Risks of the project and their mitigation measures are to be identified.

- Part 4: Budget describes the cost components of the project.

- Part 5: Budget Summary lists total project costs and the DFIP cost share.

- Part 6: Sources of Funding identifies funding from DFIP, other government sources and the applicant.

- Part 7: Environmental Considerations provides information to identify if further environment assessment is needed.

- Part 8: Results and Benefits provide performance measures to be tracked in the future.

- Part 9: Declarations outlines conditions that must be met by the applicant for funding eligibility. By signing this section, the applicant agrees to these conditions.

Applicants are strongly encouraged to review Annex A: Eligible Equipment Types and Annex B: DFIP Cost Categories and Types prior to completing the budget. In order for costs set out in the budget to be considered eligible costs they must fall within the standard DFIP cost categories and respect all conditions and limitations set out in this Applicant Guide, whether or not the budget is approved by the parties. For greater certainty, these eligible costs must also be reasonable, reflect fair market value and be directly related to the project.

Helpful hints

Once submitted, changes to the project cannot be made to the Project Request form and/or the Detailed Application form. The equipment type should remain the same (that is, brand may change but not the nature of the equipment) and the total estimated costs should remain the same.

7.4 Supporting Documentation for Eligible Costs as part of the Detailed Application Form

A Detailed Application form is to be submitted only upon request by Agriculture and Agri-Food Canada once a project has been selected at random from the pool of applications and the applicant has been notified. Applicants must provide supporting documentation (such as quotes, invoices, receipts, and proof of payment) to substantiate all planned or actual costs included in the Detailed Application formFootnote 2. For actual costs, applicants are also required to provide proof of paymentFootnote 3. Additional guidance on supporting documentation for the standard DFIP Cost Categories and Types under the program can be found in Annexes A and B.

All documentation must be legible. Documents can be submitted in electronic and/or paper format. Legible, scanned images or pictures of paper documents that are maintained in electronic format are acceptable. It is the applicant's responsibility to ensure that documents are scanned properly and are legible and complete. Illegible and/or incomplete documents may result in rejection of a Detailed Application form.

Applicants must retain the originals, in case of an audit. See section 8.2 Contribution Agreement this Applicant Guide for more details.

For each planned costFootnote 4 (cost not yet incurred, or incurred but not yet paid) listed in the budget tables of the Detailed Application form, the applicant must provide:

- Copies of quotes, estimates, contracts, or – in the case of costs incurred but not yet paid – invoices. Note:

- The documentation must show a total amount

- Documentation for equipment costs must detail the per unit purchase price

- Notations must be made on the documentation if funding for only a portion of the total amount is being requested

- The name of the individual/organization providing the estimate/quote/contract/invoice should be clearly noted

- Documentation must indicate that the cost will be incurred (or was incurred) within eligible project start and completion dates (see section 4.1 of this Applicant Guide for current eligible project dates)

- Where a signed contract is being provided as supporting documentation, the date(s) of signature must be within eligible project dates

For each actual costFootnote 5 (cost incurred and paid) listed in the budget, the applicant must provide:

- Copies of the receipts or invoices. Note:

- Date(s) of the receipt/invoice must indicate that the cost was incurred within eligible project start and completion dates (see section 4.1 for current eligible project dates)

- The receipt/invoice must show the total amount of the purchase

- The receipt/invoice should include a clear description of goods and services provided

- The receipt/invoice for equipment costs should detail the per unit purchase price

- Notations must be made on the receipt/invoice if funding for only a portion of the receipt/invoice amount is being requested

- The name of the Biller/Supplier company must be noted

- Invoices should include an invoice number and have a "billed to" name that matches the name of the applicant

- Copies of proof of payment, such as:

- Combination of bank statement and front of cheque

- Cancelled cheque (Copy of both front and back of cheque)

- Credit card statement showing supplier (as per invoice) is paid

- Electronic deposit transfer notice detailing the biller/supplier and amount paid

On all copies, applicants should redact (blackout) account information and details of unrelated transactions (for example, on receipts and bank/credit card statements).

Applicants planning to use paper money payments/cash transactions for payment of eligible costs must ensure they have sufficient documentation and proof of payment (such as printed receipts or signed acknowledgements by the Biller/Supplier of receipt of payment).

Applicants should ensure their lists of equipment are cross-referenced with their supporting documentation (quotes or receipts) to enable faster assessment of their projects. Cross-referencing by listing the number of the quote or receipt is provided for in the Detailed Application form and Claim.

7.5 Additional Requirements for Projects Selected to Submit a Detailed Application

Applicants must submit the following information to support the completed Detailed Application form:

- Supporting documentation for Eligible Costs: See section 7.4 this Applicant Guide for more details on the requirements for supporting documentation.

Where applicable, applicants are required to provide:

- A copy of the applicant organization's Articles of Incorporation: Required when an applicant is not applying as an individual. Articles of Incorporation are issued and filed, respectively, by or with the provincial, territorial or federal government that documents the applicant's status as a legal entity. The Articles of Incorporation should match the records of an Applicant's milk board.

- Scan/Photo of the applicant's dairy license document. Required to facilitate confirmation of the license, ownership of quota and the location of the dairy facility by the licensing authority. The specific documents are listed below.

- Scan/Photo of the applicant's monthly milk pay statement. Required to facilitate confirmation of the license, ownership of quota and the location of the dairy facility by the licensing authority. The specific documents are listed below (most recent less than 2 months old).

| Province | Document Name | Where It Can Be Found |

|---|---|---|

| BC | I.R.M.A Number | Milk Statements, BCMMB dairy license |

| AB | CDC Number | Milk Pay Statement, laminated license that should be hanging in the milk house |

| SK | Producer Number | Laminated Paper License, online on the producer portal. Do not use your barn identifier number. |

| MB | Producer Registration Number or Producer Number | On DFM website, on your monthly statement, laminated card to be displayed in the milk house |

| ON | License Number | Milk Statement, DFO website, license certificate, quota exchange invoice, DFO correspondence |

| QC | Producer Number | Quota Certificate, on milk pay, on the producers' extranet, etc. |

| NB | Producer Number | On your statement or any other document, dairy license document |

| NS | Producer I.D. Number | License certificate, producer reports, producer pay statement |

| PE | Producer Registration Number | Payout and quota statements, monthly production |

| NL | License number | Annual milk license |

- Scan/Photo of the original signature page of the Detailed Application form: Required for e-mail Detailed Application form submissions. Applicants should print, sign and scan the signature page of the Detailed Application form.

- Proof of financing: An optional requirement for Detailed Project applications. Proof of financing includes documents or bank statements detailing an applicant's contribution towards the total project costs, and confirming the applicant has the financial ability to complete the project. If commercial financing of a project is required it should be done through a financial institution and suppliers paid in full. All eligible costs must be incurred within the timelines of the project and must be paid prior to submitting a claim for reimbursement. A loan agreement between a recipient and a supplier is not acceptable proof that the equipment has been paid for.

- Proof of activity: Proof of activity is required when the applicant is applying for activities already completed at the Detailed Application form submission. Proof of activity includes:

- Pictures of all equipment purchased under the project

- Pictures of any installation of the above-noted equipment

- Serial numbers for all above-noted equipment with a per unit cost over $10,000

- Pictures of any completed facility retrofit/fit ups under the project

- Copies of any reports produced by consultants hired under the project

- Proof of travel: Proof of travel is required when the applicant is applying for an actual travel per diem cost, to confirm that each day of the travel took place. Examples of proof of travel include a hotel invoice or transportation ticket stub in the traveler's name.

Project plans, pictures and diagrams displaying what is intended to be done through the project are encouraged and can be included in the Detailed Application form package.

- Confidentiality: It is the applicant's responsibility to clearly identify, on any documentation submitted to Agriculture and Agri-Food Canada, the information that is considered commercially confidential. This information will not be disclosed unless required by law, including the Access to Information Act, or upon the express authorization of the applicant.

7.6 Cost of Production Calculation

If a cost of production calculation is required, applicants will be informed in their Contribution Agreement. Applicants may want to consider components of the National Cost of Production Calculation by the Canadian Dairy Commission in calculating their cash cost and labour cost of production:

- Cash costs

- Purchased feed

- Artificial insemination

- Transportation, fees and promotion

- Machinery, equipment repairs

- Fuel & oil

- Custom work

- Fertilizer & herbicides

- Seeds & plants

- Other (Misc): Professional fees

- Other (Misc) Animal costs

- Other (Misc): Crops costs

- Land & Building repairs

- Property taxes & insurance

- Hydro & telephone

- Hired labour

- Purchase/sale of animals

- Dairy Inventory Value adjustment

- Producer labour

- Direct labour

- Return to management

For more information, see the Canadian Dairy Commission Cost of Production Study.

8.0 Assessment and Approval

8.1 Assessment Criteria

The Detailed Application form will be assessed against the following criteria:

- Completeness of the Detailed Application form (applicant has provided all required information and documentation)

- Applicant has met all eligibility criteria

- Scope and duration of activities

- Proposed activities, including outcomes, support the program objectives and can be measured using the program performance indicators

- Proposed activities and costs are eligible, reasonable and required to meet the project outcomes

- All sources of funding are identified

- Other factors required under the Terms and Conditions of the Program

The technical and financial viability of the project may also be assessed, as well as environmental considerations (such as environmental effects and risks related to the project) and other risks.

Other considerations in the Detailed Application form assessment may include regional distribution of funds, and whether the applicant has previously received funding under the program.

Supplementary information may be requested at various points in the assessment process.

Helpful hints

- For retroactive projects, ensure the project start date complies with the date limitations outlined in Section 3.6.

- In the case of retroactive projects submitted under Phase 2, proof of payment must accompany the Detailed Application (see Sections 7.4 and 7.5 of this Applicant Guide for details).

- Ensure the equipment in the Detailed Application is included in Annex A and/or Annex B of this guide. If not, it may not be eligible.

- If an applicant’s contact information changes (for example, address, phone number, e-mail) during the life of a project and the Dairy Farm Investment Program is not informed of the change, projects may be deemed ineligible at the sole discretion of Agriculture and Agri-Food Canada.

- Ensure GST/HST number is provided.

8.2 Contribution Agreement

Successful applicants will receive a decision package including a written decision letter outlining the level of assistance awarded and any other conditions if applicable, and the clauses for the Contribution Agreement. For projects that include planned (not yet completed) activities, claim instructions and a claim will also be provided in the decision package.

As a condition of reimbursement, applicants are required to enter into a Contribution Agreement that outlines the amount of funding Agriculture and Agri-Food Canada offered toward eligible costs, as well as the applicant's responsibilities and obligations.

Note: Contribution Agreements with Agriculture and Agri-Food Canada contain Information Management, Retention and Access provisions which require that applicants retain records for six (6) years after the date of expiration or early termination of the funding agreement with Agriculture and Agri-Food Canada, whichever comes later.

9.0 Claims for reimbursement

A document providing step-by-step instructions on how to complete a claim will be provided once a countersigned Contribution Agreement for projects with future costs or that are partially retroactive has been returned to Agriculture and Agri-Food Canada. Detailed Application forms for fully retroactive projects are considered to be claims.

Unless otherwise requested by the Minister (as specified in the Contribution Agreement), Agriculture and Agri-Food Canada will make one payment per project, once all project activities are completed and eligible costs are incurred and paid by the recipient.

Where a claim is required for planned (as opposed to retroactive) activities, the claim must be certified by an authorized official of the recipient.

When submitting a claim for eligible costs and where applicable, recipients must attach copies of:

- receipts or invoices

- proof of payment (see Section 7.4 Supporting Documentation for Eligible Costs as part of the Detailed Application Form)

- proof of activity (Pictures of all installed equipment and associated serial numbers with a unit price of $10,000 or more)

- proof of travel.

Recipients must complete a direct deposit form with their claim to enable the electronic transfer of the funds. This is done by completing the form "Guideline on Completing the Recipient Registration and Direct Deposit Request" which will be provided in the Contribution Agreement package sent to applicants whose projects are approved. Once a claim has been approved for payment, the recipient will be notified of a test payment and requested to confirm receipt. Once confirmation of the test payment is received, the balance of the payment will be made within 30 business days.

10.0 How to Submit a Project Request Form, Detailed Application Form or Claim

Phase 2 will use an online system as the primary method to submit Project Request forms, Detailed Application forms and Claims to DFIP.

Project Request forms and Detailed Application forms should not to be transmitted through multiple channels (for example, both mail and e-mail). If Project Request forms or Detailed Application forms are received through multiple channels, the DFIP Online System submissions will be considered the real submissions and the others will be discarded.

Helpful hints

It can take up to 3 business days to receive an acknowledgement from DFIP that your submission has been received and entered into the program database. Do not resubmit the same application more than once. There is no priority given to Project Request forms or Detailed Application forms submitted early in the submission windows. If you do not receive an acknowledgement to your online or emailed submission, you provided an email address, and it has been 3 business days or longer (responses to all submissions without an email address will be sent by mail), please call 1-877-246-4682 so that the DFIP customer support team can investigate the matter and get back to you.

Dairy Farm Investment Program Online System (DFIPOS)

DFIPOS is the primary method to submit Project Request forms, Detailed Application forms and Claims to DFIP. The online system will simplify these processes for applicants, making it faster for information to get to the program. Applicants will not have to submit signature pages separately. This will also expedite processing of applications. The Detailed Application form will not be made available to all applicants. Only those who submitted a Project Request form using DFIPOS and selected at random to fill out Detailed Application forms will be granted access to the Detailed Application forms section in the DFIP Online System.

As a first step in the submission process, you will be asked to sign in using the same credentials you use for online banking. This is made possible by the secure and confidential SecureKey Concierge Online Access system. Neither your bank nor Agriculture and Agri-Food Canada will have any record of the identification information applicants use in this case to sign-on to DFIPOS. To use SecureKey Concierge, follow the steps on the DFIPOS sign-on page.

Alternatively, you may register for GCKey. A GCKey is a confidential access tool to government services that is unique to the applicant. It lets you securely access the Government of Canada's online services. It includes a username and password that applicants choose. You must create security questions. This keeps your data secure and you will be able to recover your accounts. If you already have a GCKey from previous participation in other government services, you can use the same GCKey. Using a GCKey also allows you to skip printing, signing, scanning and separately submitting the signature page of the DFIP Project Request form and the Detailed Application form.

PDF file format Project Request forms and, if an applicant is requested to complete one, Detailed Application forms can be submitted by e-mail to: aafc.dfip-pifl-phase2.aac@agr.gc.ca. The Detailed Application form will not be made available to all applicants. Only those who submitted a Project Request form by e-mail and selected at random to fill out Detailed Application forms will be sent a PDF file format application by e-mail.

Helpful hints

If you established a contact with a program officer during Phase 1 for any reason, do not send Phase 2 Project Request forms or Detailed Application forms directly to them. Any such submissions will be rejected.

The maximum size of e-mail attachments to Agriculture and Agri-Food Canada is 15 MB. If an applicant's electronic submission exceeds the maximum, the applicant may forward their submission in a series of e-mails. For Project Request forms/Detailed Application forms with attachments that exceed 15 MB, each e-mail in a series of e-mails must clearly indicate the total number of e-mails sent as part of the Project Request form/Detailed Application form (for example, 1 of 3, 2 of 3, 3 of 3). Project Request forms/Detailed Application forms with links to attachments in a Database Cloud Service will not be accepted. Attachments must not be password protected.

If Project Request forms/Detailed Application forms are submitted to DFIP by e-mail as attachments, they must be filled out and saved in PDF file format (the way the form is made available to you, not as a Word document or as a scan in Adobe format). The saved PDF file must then be attached to the email you are submitting. If you submit a Project Request form/Detailed Application form saved in PDF format, you must also attach a scanned copy of the signature page of the form to the e-mail.

The complete and correct transmission of a Project Request form/Detailed Application form is the sole responsibility of the applicant. Incomplete Project Request forms/Detailed Application forms may result in significant delays in their processing and may be deemed ineligible at the sole discretion of Agriculture and Agri-Food Canada. Agriculture and Agri-Food Canada is not responsible for the security of the Project Request forms/Detailed Application forms during transmission.

Helpful hints

Do not use your smart phone to submit your application. This can lead to issues such as incompatibility of file format, bad network connection, and small screen typing errors resulting in the application being sent to the wrong address.

Do not take pictures of each page of the application and send it in. This can cause issues if the picture quality is low, whole pages or pieces of pages are missed, or the picture is too dark or too blurry to be legible.

Fax or Mail

For those applicants who do not have internet access, they may make submissions by fax or mail. Refer to the contact information provided in section 13 of this Applicant Guide to obtain a Project Request form/Detailed Application form along with the necessary instructions. Only those who submitted a Project Request form by fax or mail and selected at random to fill out Detailed Application forms will be sent a paper Detailed Application form by fax or email. If submitting your application by mail then all supporting documentation must be submitted in paper format. Electronic submissions by mail will be rejected (that is, mailing a CD, DVD, USB stick or other electronic storage devices will not be accepted).

11.0 Reporting requirements

Recipients will be contacted annually to track progress against project performance measures and will be required to complete a reporting survey which will be sent to Agriculture and Agri-Food Canada.

Other reports may be required at Agriculture and Agri-Food Canada's discretion. If so, they will be specified in the Contribution Agreement.

12.0 Notes

12.1 Risk Framework

Agriculture and Agri-Food Canada conducts a risk assessment for the program. The result may determine monitoring strategies for projects conducted under the program. Any monitoring strategies or requirements stemming from the risk assessment will be outlined in the Contribution Agreement letter sent to recipients.

12.2 Intellectual Property

The Contribution Agreement will contain an intellectual property clause which will confirm that all title to copyright in any materials created or developed by or for the recipient using the contribution funding (including reports, updates, and training manuals, in written and electronic format), shall vest in the recipient or in a third party, as may be negotiated by the recipient. Agriculture and Agri-Food Canada may, at its discretion, include a provision in the Contribution Agreement requiring that the recipient grant or ensure that third parties grant (including ultimate recipients, if applicable) a non-exclusive, worldwide, perpetual, royalty-free license to the Crown to such material, in whole or in part, in any form or medium, for internal government program administration purposes.

12.3 Retention and Disposition of Assets

Before receiving funding under the program, the applicant must agree (in the Contribution Agreement) that, for the length of the program and unless pre-authorized by Agriculture and Agri-Food Canada, they will not return to the vendor, loan, donate, resell or exchange any equipment reimbursed in any part by the program in respect to an approved project.

12.4 Official Languages

12.4.1 Language of Service

Applicants are encouraged to communicate with Agriculture and Agri-Food Canada in the official language of their choice. Agriculture and Agri-Food Canada reviews and assesses Project Request forms /Detailed Application forms and project deliverables in both official languages.

12.4.2 Language Obligations of Recipients

Agriculture and Agri-Food Canada is committed to enhancing the vitality of the official language minority communities (French-speaking people outside Québec or English-speaking people in Québec), supporting and assisting their development, and promoting the full recognition and use of both English and French in Canadian society. When it is determined that projects under the Dairy Farm Investment Program (1) involve activities related to developing training documents required to operate new dairy equipment or software and (2) are susceptible of promoting the use of both official languages, Agriculture and Agri-Food Canada will ensure that translation costs are considered eligible costs for reimbursement.

12.5 Conflict of Interest

Applicants must acknowledge that individuals who are subject to the provisions of the Conflict of Interest Act (S.C. 2006, c. 9, s. 2 as amended), the Conflict of Interest Code for Members of the House of Commons, the Conflict of Interest Code for Senators, the Conflict of Interest and Post-Employment Code for Public Office Holders, the Values and Ethics Code for Agriculture and Agri-Food Canada, the Values and Ethics Code for the Public Sector, or any other legislation or values and ethics codes applicable within provincial or territorial governments or specific organizations, cannot derive any direct benefit resulting from this Agreement unless the provision or receipt of such benefit is in compliance with such legislation and codes.

12.6 M-30 Law (for Quebec organizations only)

The Act Respecting the Ministère du Conseil Exécutif (M-30) may apply to an applicant in the Province of Québec. Applicants may be required to complete an additional information form and, if they are subject to the requirements of the Act, to obtain written authorization and approval from the Government of Québec prior to execution of any contribution funding agreement. Agriculture and Agri-Food Canada will follow-up with the applicant during the application assessment, as required.

12.7 Privacy Notice

Agriculture and Agri-Food Canada is subject to the Privacy Act and is committed to the protection of the personal information under its control. Personal information provided in or with this application package will be used for communication regarding the application, for its assessment and review of eligibility, and program administration. The personal information is being collected under the authority of the Department of Agriculture and Agri-Food Act. Personal information may also be used for survey, statistical analysis, reporting, and audit and evaluation purposes. For more information about Agriculture and Agri-Food Canada's privacy practices, you may refer to the following Personal Information Banks: Public Communications PSU 914; Outreach Activities PSU 938 and Agriculture and Agri-Food Canada-specific Personal Information Bank not yet assigned (please contact the program for details). Please refer to section 12.8 of this Applicant Guide for additional details concerning the use of business information in the delivery of this program.

Individuals have the right of access to their personal information held by Agriculture and Agri-Food Canada and to request changes to incorrect personal information. To exercise these rights, please contact the Agriculture and Agri-Food Canada Access to Information and Privacy Coordinator at aafc.atip-aiprp.aac@agr.gc.ca.

12.8 Collection and use of Applicant's Business Information

Agriculture and Agri-Food Canada may collect, use and share an applicant's information, which includes, but is not limited to, documentation prepared in the administration of the Dairy Farm Investment Program. Agriculture and Agri-Food Canada will use and share this information for the purposes of assessing and reviewing the eligibility of the applicant and the proposed project with:

- Other Agriculture and Agri-Food Canada programs and/or other Agriculture and Agri-Food Canada Branches

- Other departments or agencies of the Government of Canada

- Other levels of government in Canada

- Provincial dairy licensing authorities

The information may be shared with the parties mentioned above, or disclosed to third parties, for purposes that include, but are not limited to:

- The use of the applicant's information in the administration, including audit and evaluation of the program

- Surveying for the applicant's experience with Agriculture and Agri-Food Canada

- Audit, analysis and risk assessment of the applicant and/or the project

- Determining the possible availability of funding for the applicant's project under another program or initiative

- Examining the scope and direction of agricultural programming in Canada

- Ensuring efficiencies and effectiveness in setting up and administering agricultural and other government programs

The Applicant must also consent that the information may be shared with other Agriculture and Agri-Food Canada programs and other federal, provincial and territorial government departments, agencies and third parties to assist the Department in the collection of debts owed to the Government of Canada by the Applicant.

The Government of Canada may publish a list of approved projects on a government website. This list would include the name of the recipient, the project name, and the amount of the DFIP contribution. Agriculture and Agri-Food Canada may also publicize this information, along with a description of the project, in:

- Project funding announcements or other promotions

- In other government documents, including public reports on the progress of government initiatives

12.9 Environmental Considerations

Applicants must provide details on environmental considerations for their project in the Detailed Application form:

- All projects must comply with the Canadian Environmental Assessment Act 2012 (CEAA 2012), the applicability of which will depend on the type of activities being undertaken as part of the project and the project location. Applicants will therefore be asked in the Detailed Application form to indicate whether the project is on federal land. Under CEAA 2012, a federal land means:

- lands that belong to Her Majesty in right of Canada, or that Her Majesty in right of Canada has the power to dispose of, and all waters on and airspace above those lands, other than lands under the administration and control of the Commissioner of Yukon, the Northwest Territories or Nunavut;

- the following lands and areas:

- the internal waters of Canada, in any area of the sea not within a province

- the territorial sea of Canada, in any area of the sea not within a province

- the exclusive economic zone of Canada

- the continental shelf of Canada

- reserves, surrendered lands and any other lands that are set apart for the use and benefit of a band and that are subject to the Indian Act, and all waters on and airspace above those reserves or lands

If a project is on federal land, Agriculture and Agri-Food Canada staff will follow-up with the applicant for further details and/or to clarify, as required. Agriculture and Agri-Food Canada will provide guidance on potential environmental legislation requirements, which may require obtaining permits or authorization before the project begins.

- Applicants will be asked to provide details on whether the project has any negative environmental effects and/or risks, and if relevant any related mitigation measures. Negative environmental effects and risks can include those related to air emissions, soil erosion, noise, effluent, waste water, solid waste, odor, construction, rare species and related habitat, nearby water bodies, and any public concern. Agriculture and Agri-Food Canada reserves the right to request additional information.

- Applicants will also be asked to acknowledge that they are in compliance with any federal, provincial or municipal environmental laws and regulations. Copies of authorizations or permits might be required by Agriculture and Agri-Food Canada during the application assessment.

If any environmental requirements are identified, including further environmental analysis or those related to CEAA 2012, a project may be conditionally approved pending the completion of all requirements (for example, development and agreement to mitigation measures, obtaining environmental authorizations or permits, etc.).

Positive environmental impacts will not be tracked in Phase 2 which should significantly reduce the number of project referrals to the Environmental Services Unit.

12.10 Issuance of an AGR-1

As the funding under the program is taxable, Agriculture and Agri-Food Canada will issue an AGR-1 Supplementary – Statement of Farm Support Payments tax information slip in February for all contributions issued under the program. Individual recipients will be required to provide a Social Insurance Number.

12.11 Acknowledgement of Funding Contribution

In all cases the recipient must publicly acknowledge Agriculture and Agri-Food Canada's support for the project in all project-specific communications products. The department may request that such acknowledgment include text in both official languages.

12.12 Self-Identification

Applicants are encouraged to answer the self-identification question(s) in the Project Request form to help Agriculture and Agri-Food Canada collect information on whether applicants are a member of an official language minority community to tailor future policies, programs and communications activities.

13.0 Contact Information

For further information please contact us toll-free at 1-877-246-4682, by fax toll free at 1-877-949-4885, by TTY at (613) 773-2600, by e-mail at aafc.dfip-pifl-phase2.aac@agr.gc.ca or by mail at:

Agriculture and Agri-Food Canada

c/o Dairy Farm Investment Program (DFIP)

1341 Baseline Road

Tower 7, 7th Floor

Ottawa, ON K1A 0C5

Annex A: Eligible Equipment Types

Important information

- The purchase of used equipment is ineligible. Only barn equipment that is new and commercially available is eligible.

- All equipment must be utilized and/or installed in the barn.

| Category | Equipment type |

|---|---|

| Equipment cost - Barn operation |

|

| Equipment cost – Cow comfort |

|

| Equipment cost – Feeding |

|

| Equipment cost – Herd management |

|

| Equipment cost – Milking |

|

Annex B: Dairy Farm Investment Program Cost Categories and Types

| Cost Category | Cost Type | Additional requirements |

|---|---|---|

| Equipment | See Annex A: Eligible Equipment Types | |

| Associated Costs | Consultant fees |

As billed to the applicant and including reasonable travel costs for the consultant, to assess how the applicant can improve on-farm efficiencies and productivity. Consultant fees are only eligible if the applicant is applying for DFIP funding for the purchase of equipment stemming from the consultant’s report/recommendation. Agents or consultant fees to prepare a DFIP application are not eligible costs. When provided as supporting documentation, the consultant contract must:

Where travel costs are included, they must be broken down separately on quotes and / or invoices and adhere to the guidelines for reasonable travel costs outlined below this table. The consultant’s report should be provided as proof of activity. |

| Installation (Labour) |

Includes physical labour, associated technical and trade services for the installation of eligible equipment. Where travel costs are included, they must be broken down separately on quotes and / or invoices and adhere to the guidelines for reasonable travel costs outlined below this table. |

|

| Installation (Material costs) | Includes material costs, including tool rental and machinery rental, for the installation of eligible equipment. | |

| Retrofits (Labour) |

Includes physical labour, associated technical and trade services for the installation of eligible equipment. Where travel costs are included, they must be broken down separately on quotes and / or invoices and adhere to the guidelines for reasonable travel costs outlined below this table. A retrofit is the improving of existing buildings specifically required for the installation and/or use of eligible equipment. New facility construction is not eligible under the program. |

|

| Retrofits (Material costs) |

Includes material costs, including tool rental and machinery rental, for the installation of eligible equipment. A retrofit is the improving of existing buildings. New facility construction is not eligible under the program. |

|

| Salaries and Benefits |

Limited to incremental costs (costs above regular on-going or recurring costs) only, for salaries and benefits of:

while the following work is undertaken for:

Benefits are defined as employment costs paid by the employer and may include the following:

Applicants may submit a completed Calculation Worksheet - Planned / Actual Salaries and Benefits Cost form (Annex C) in lieu of a quote (for a planned cost) or an invoice (for an actual cost) for a Salaries and Benefits cost. In addition, they are not required to submit proof of payment with their Detailed Application form for actual costs of salaries and benefits. However, applicants are required to keep the records relating to salaries and benefits (e.g., pay stubs, timesheets, and benefit statements used to arrive at the calculations, proof of payment) on file for six years in case of an audit. The applicant may also be asked to provide the records as part of the Detailed Application form or claim assessment. |

|

| Shipping | Reasonable shipping costs include freight, duty, and tariffs. | |

| Training | Includes costs for short term training related to the implementation of eligible equipment. Where travel costs for the trainer are included, they must be broken down separately on quotes and / or invoices and adhere to the guidelines for reasonable travel costs outlined below this table. | |

| Travel (Ground Transportation) | Reasonable ground transportation costs for the applicant, family farm resident(s), and/or employee(s) on the applicant’s payroll to travel for project activities. Costs should adhere to the guidelines on reasonable travel costs noted below this table. | |

| Travel (per diem) |

Per diem to address costs for accommodations, meals (excluding alcohol) and incidentals for the applicant, family farm resident(s), and/or employee(s) on the applicant’s payroll to travel for project activities. DFIP reimburses up to a maximum of 50% of a per diem incurred and paid to the traveller. See limits on per diems in the guidelines on reasonable travel costs noted below this table. Applicants must specify the number of days, the number of travellers, and the per diem rate under Cost Type – Associated Costs [Part 4 of the Detailed Application form]. For this cost type only, quotes or receipts to support the planned or actual per diem costs will not be required with the Detailed Application form. However:

|

|

| Other Associated Costs | Other costs related to the purchase of eligible equipment, except for translation costs. Translation costs should be entered in the Associated Costs & Other Costs table of the Detailed Application form. Then select under “Category –Other Cost – Translation”. | |

| Other Costs | Such as translation costs for training documents, to support Official Language Minority Communities and promote linguistic duality. | |

Guidelines on reasonable travel costs

All travel costs should be based on the following guidelines.

Ground transportation (Costs reimbursed up to a maximum of 50%)

- air, rail and ground transportation costs as follows based on economy rate (not Business or First Class)

- Private vehicle: maximum mileage rate of $0.50 per kilometer; and

- Rental vehicle: the cost for a mid-sized vehicle and gas.

Where applicable, an itinerary should be prepared, to demonstrate planned / actual mileage, that shows addresses of the start and end locations of each trip and total kilometers traveled/ to be traveled.

Per diem (Costs reimbursed up to a maximum of 50%)

Per diem to address costs for accommodations, meals (excluding alcohol) and incidentals of:

- No more than CAD$300 per day for each day that ends with an overnight stay

- No more than CAD$70 per day for each day that ends with no overnight stay

Annex C: Calculation Worksheet – Planned / Actual Salaries and Benefits Costs

Important:

- Applicants are required to keep the records relating to salaries and benefits (for example, pay stubs, timesheets, and benefit statements used to arrive at the calculations, proof of payment, etc.) on file for six years in case of an audit. The applicant may also be asked to provide the records as part of the Detailed Application form or claim assessment

Instructions:

Please complete one worksheet per employee for which you are seeking a contribution. Contributions pertaining to salaries and benefits within an investment project are limited to either:

- Wages* of an employee on the applicant’s payroll for work related to the project that is incremental/in addition to their regular working hours and activities.

- Wages* of temporary personnel for work related to the project

- Wages* of temporary personnel to replace an employee on the applicant’s payroll, while the employee undertakes work related to the project during their regular hours

*Note: if an employee works overtime on the project and is compensated, an overtime rate of up to 1.5 times the regular rate of pay may be charged.

Employee _____ (Identify the employee by A, B, C, et cetera. For privacy reasons, do not identify the employee by name)

Employee type:

- Incremental/additional hours of an employee on the applicant’s payroll that will undertake / has undertaken work related to the project

- How long has the employee been employed by the applicant:_____________________

- Regular hours per week (8 week average):_____________________

- Temporary personnel specifically hired to undertake work on the project

- Temporary personnel that is replacing an employee on the applicant’s payroll that will undertake / has undertaken work related to the project

Employee details:

- The work related to the project undertaken by the employee will occur / occurred between (date)________________ and (date)___________ and consisted of (task description): ______________________________________________________

- Hourly rate is ________________________. (For salaried employees divide annual salary by 52 weeks by number of hours per work week)

- Pro-rated hourly share of benefits (if any) is ______________________________

Benefits – all other regular payroll costs incurred by the organization (for example, CPP/QPP, EI, and Workers’ Compensation Benefit), whether required by statutory or contractual obligation, as well as:

- Eligible time off with pay that may apply to full-time or part-time employees; e.g., statutory holidays (including provincial/territorial holidays), sick days, and vacation.

For further clarification, eligible salary and benefit costs do not include:

- Incentive amounts such as bonuses, stock options, and profit sharing

- Benefits that are considered “perks” such as a gym membership, or parking allowance

- Amounts paid to or on behalf of a consultant or other person with whom the organization does not have an employer-employee relationship, as defined by the Canada Revenue Agency (CRA).

- Severance costs.

- Benefit costs must not normally exceed 30% of the eligible salary costs for each employee who works on the project (although the Program may apply a lower amount). The recipient may charge any percentage up to the maximum of 30% for benefit costs. In some exceptional circumstances, the recipient may claim benefit costs in excess of 30%, provided the costs are pre-approved by Agriculture and Agri-Food Canada. In these cases, a listing of the benefits claimed, plus an explanation from the recipient, must be approved by the Program Director. A listing of benefit costs included in the project expenditures will not be required for the claims process; however, it may be required for audit purposes. Number of hours completed by the employee for work related to the project___________________

Total Planned or Actual Cost Calculation:

- Add the hourly rate (B above) and Pro-rated hourly share of benefits (C above),

- Multiply by the number of hours (D above)

=_______________________

Please report this amount in Part 4 Budget under “Category, Associated Cost – Salaries and Benefits” of the Detailed Application form.

Benefit Percentages and Examples

| Benefit | Percentage |

|---|---|

| Time off with pay | 11.5% (assumes 30 days of paid time off out of 260 weekdays in a year; paid time off includes statutory holidays (10), vacation time (15), sick days (5)) |

| CPP/QPP (for 2018) | 5.0% |

| EI (for 2018) | 2.0% |

| Subtotal | 18.5 |

| Amount remaining for all other benefits | 11.5% |

| Total | 30% |

| A | B | C | D = A ÷ B ÷ C | E | F = D × E | G = F × 30% | H = F + G | |

| Annual Salary | # of Weeks in Year | # of working hours per week | Hourly Rate of Pay | # of Hours Worked on Project | Salary Cost | Benefits @ 30% | Total Salary and Benefits Charged to the Project | Final Rate of Pay |

| $52,000.00 | 52 | 40 | $25.00 | 72 | $1,800.00 | $540.00 | $2,340.00 | $32.50 |

| A | B | C | D = A ÷ B ÷ C | E | F = D × E | G = F × 30% | H = F + G | |

| Annual Salary | # of Weeks in Year | # of working hours per week | Hourly Rate of Pay | # of Hours Worked on Project | Salary Cost | Benefits @ 30% | Total Salary and Benefits Charged to the Project | Final Rate of Pay |

| - | 52 | 40 | $25.00 | 10 | $250.00 | $75.00 | $325.00 | $32.50 |