Abbreviations

- AAFC

- Agriculture and Agri-Food Canada

- AMPA

- Agricultural Marketing Programs Act

- AGA

- Advance Guarantee Agreement

- APP

- Advance Payment Program

- BRM

- Business Risk Management

Executive summary

Purpose

The Office of Audit and Evaluation at Agriculture and Agri-Food Canada (AAFC) undertook an evaluation of the Programs under the Agricultural Marketing Programs Act (AMPA) to assess the relevance, performance, design, and delivery of these programs. This evaluation fulfils a requirement of the Financial Administration Act and the Treasury Board's Policy on Results and is intended to inform current and future program and policy decisions.

Scope and methodology

The evaluation assessed the Programs under the AMPA over the period of April 2014 to March 2019. Given the Price Pooling Program's low risk, and that the Government Purchase Program is only used for catastrophic events, the evaluation focused solely on the Advance Payments Program (APP). Multiple lines of evidence were included: document and literature review, analysis of program data, interviews with stakeholders, surveys of producers and administrators, the Farm Financial Survey, and a data linkage project with Statistics Canada.

Background and context

Under the Agricultural Marketing Programs Act, the APP, the Price Pooling Program, and Government Purchase Program are designed to improve marketing opportunities through short-term cash flow for agricultural producers. These programs are intended to help producers meet their financial obligations and benefit from market opportunities.

Specifically, the APP aims to improve marketing opportunities for producers through cash advances that support producers with their cash flow and short-term financial commitments. The APP is administered by third party administrators and financing is guaranteed by the federal government to enable administrators borrow money from lenders to deliver advances to producers. The Price Pooling Program aims to facilitate the marketing of agricultural products by cooperatives through minimum price guarantees. These guarantees protect unanticipated declines in market prices and enable agencies to secure financing for delivery of products. Finally, the Government Purchase Program provides the Minister of Agriculture and Agri-Food Canada the authority to buy, sell or store agricultural products. This authority is reserved for extreme market situations in the agriculture sector.

Findings

- The APP improves access to affordable short-term credit for Canadian agricultural producers, notably for beginning farmers and those who do not have sufficient farming experience and/or available security (collateral) required for traditional loans.

- The APP aligns with AAFC and Government of Canada priorities to help producers anticipate, mitigate, and respond to sector risk. The APP aligns with federal government roles and responsibilities and complements programs in the BRM suite by providing a proactive risk management tool that differs from stabilization tools.

- The APP delivery model is relatively low cost to deliver funding and provides options to producers. However, inconsistencies among administrators result in disparities in delivery across the Program that ultimately affect producers and AAFC. Benefits that accrued to large administrators, for instance lower bank interest rates, did not fully accrue to producers.

- Overall, the APP produced its intended outputs and enabled producers to manage business risks associated with cash flow and marketing. The advance limits for APP were found to be sufficient for the majority of producers. Most of the estimated benefits for participants came from delayed marketing, with a secondary benefit of favourable interest rates.

Subsequent events – Outside the evaluation scope

In May 2019, the Minister of Agriculture and Agri-Food Canada announced regulatory amendments to increase the APP's loan limit from $400,000 to $1-million for all producers, and the interest-free portion of 2019 canola advances was raised from $100,000 to $500,000. These amendments were in response to a market access dispute with China. Given that these amendments occurred outside of the scope of this evaluation, and in the absence of evidence and/or recipient experience related to these changes, which will take time to manifest, the evaluation could not assess the impact of these changes.

In December 2019, the Mandate Letter to the Minister of Agriculture and Agri-Food Canada outlined a commitment to consolidate existing federal financial and advisory services across several agencies into a new entity called Farm and Food Development Canada "with an expanded and enhanced mandate and additional capital lending capability". The effect of this new entity on AMPA or other AAFC lending programming is unknown at this time.

In the Spring 2020, the COVID-19 pandemic and Government of Canada responses occurred after the completion of this evaluation.

Conclusion

The APP fills a continued need to provide short-term credit to the sector and to improve marketing opportunities, notably for young producers and niche market producers. The Program enables producers to address the short-term credit issues they face. The Program's advance limits are sufficient to meet sector needs. The Program provides producers with financial benefits and its third party delivery model is administratively economical compared to similar programs. However, there are drawbacks to the APP's design and delivery model that could be improved.

Recommendations

- Recommendation 1: The Assistant Deputy Minister, Programs Branch, should assess whether comparable interest rates across APP administrators could be achieved.

- Recommendation 2: The Assistant Deputy Minister, Programs Branch, should address inconsistencies in the APP third party delivery model to maximize producer benefits.

- Recommendation 3: The Assistant Deputy Minister, Programs Branch, should revisit the Program Risk Management Framework to reduce APP liabilities.

Management response and action plan: Management has agreed with the recommendations, and has already taken action to address some aspects. Specifically, the Financial Guarantee Programs Division recently implemented a new annual procedure to conduct interest rate analysis for every Advance Guarantee Agreement (AGA) for APP to ensure that competitive interest rates are being offered. Additionally, financial oversight has been strengthened by requiring large administrators to be transparent and publicly disclose APP financials to ensure APP benefits are focused towards producers. Improvements to the Risk Management Framework are ongoing. All management actions will be completed by December 2020.

1.0 Introduction

The Office of Audit and Evaluation of Agriculture and Agri-Food Canada (AAFC) undertook an evaluation of the Programs under the Agricultural Marketing Programs Act (AMPA) as part of the 2019-20 to 2024-25 Integrated Audit and Evaluation Plan. This evaluation fulfils a requirement of the Financial Administration Act and the Treasury Board's Policy on Results, and is intended to inform current and future program and policy decisions.

2.0 Scope and methodology

The evaluation assessed the relevance, performance, design, and delivery of Program activities from April 2014 to March 2019. This evaluation overlaps with the 2016 Evaluation of the Programs under the Agricultural Marketing Programs Act, where the 2014-15 program year data was not fully available. As well, the previous evaluation did not assess the Program changes resulting from the 2015 legislative review, which came into effect in 2016. To ensure these aspects were assessed, this evaluation extended the scope to include the 2014-15 period, as well as previous years to provide context and analyze specific longer-term trends.

The Agricultural Marketing Programs Act (AMPA) includes three programs: the Advance Payments Program (APP); the Price Pooling Program; and the Government Purchase Program. Given the low risks of the Price Pooling Program and the Government Purchase Program's use limited to catastrophic events, this evaluation focused solely on the APP.

The APP was evaluated using a variety of methods including: a document and literature review; interviews with internal and external stakeholders; analysis of program and financial data; a survey of producers; a survey of producer associations; analysis of the Farm Financial Survey; and a data linkage project with Statistics Canada. For a detailed evaluation methodology, see Annex A.

As per the Treasury Board Directive on Results, the evaluation examined program activities, outputs, and outcomes with Gender-Based Analysis Plus. Gender-Based Analysis Plus is an analytical tool, process, or product used to assess the potential impacts of the policies, programs, services, and other initiatives on diverse groups taking into account identity factors beyond gender including the examination of a range of other intersecting identity factors (such as, sex, age, sexual orientation, disability, race, ethnicity, religion, education, language, geography, culture, and income).

3.0 Program profile

3.1 Program context and objectives

Under the Agricultural Marketing Programs Act, the Advance Payments Program, Price Pooling Program, and the Government Purchase Program are designed to improve marketing opportunities for participants and improve short-term cash flow. These programs are intended to help producers meet their financial obligations and benefit from market opportunities.

Advance Payments Program

The APP aims to improve marketing opportunities for producers of agricultural products (such as, farm operators) through cash advances to enable producers to sell based on market conditions rather than cash flow requirements. These advances are intended to assist producers with their short-term financial commitments by providing preferential interest ratesnote1 as well as an interest-free component for the first $100,000 of the loans. Advances are delivered by third party administrators, often producer associations or commodity groupsnote2, that secure federally guaranteed financing from financial institutions. The federal government guarantee enables administrators to obtain preferential interest rates from lenders that they in turn can pass on to producers. While the Program was initially meant for non-perishable and storable commodities such as grains and oilseeds, it expanded its scope in 2006 to include livestock and perishable commodities such as fruits and vegetables.

The Program enacted the following changes in 2015 and 2016:

- Producers can apply for an APP advance on all their commodities through one application with one administrator;

- Subsidiary companies and producers with off-farm income became eligible;

- Repayments without proof of sale are permitted in certain circumstances;

- The overpayment limit and the limit for cash repayments without proof of sale were increased;

- The definition of livestock and types of agricultural products eligible were expanded, including specific classes of breeding animals intended for market;

- More classes of security (for example, alternate insurance products) can be used to obtain an APP advance;

- Rules on the relatedness, such as, personal relationships between producers such as being married or in a common-law relationship, or owning voting shares or profit entitlements in the same corporation were clarified to ensure that producers who are related do not borrow more than the Program's limits.

Price Pooling Program

The Price Pooling Program aims to facilitate the marketing of agricultural products by cooperativesnote3 by providing minimum price guarantees on the marketed products. The Program protects agencies from unanticipated declines in market prices by guaranteeing a minimum average wholesale price of products sold by marketing agencies. If the actual average wholesale price of the agricultural product is less than the guaranteed price, the federal government pays for the shortfall. These guaranteed prices are designed to enable cooperatives, acting as marketing agencies, to secure financing and issue initial delivery payments to their members. Agriculture and Agri-Food Canada (AAFC) has not been required to honour any claims from participating agencies or make payments since the Agricultural Marketing Programs Act (AMPA) was enacted in 1997.

Government Purchase Program

The Government Purchase Program provides the Minister of Agriculture and Agri-Food Canada with the authority to buy, sell, or store agricultural products, including selling and delivering to a government or government agency of any country. This authority is for extreme market situations where using the Government Purchase Program could lead to greater market stability. Given the specific criteria to use this authority, the Government Purchase Program has not been used since the AMPA was enacted in 1997. Historically, a similar authority – the Agricultural Products Boards Act – was last used in 1994 to stabilize the apple juice concentrate sector.

3.2 APP program governance and delivery

The Program is overseen by the Financial Guarantee Programs Division, housed within the Business Risk Management Programs Directorate in Programs Branch. Program staff are responsible for: drafting Advance Guarantee Agreements (such as, the tripartite agreement between the administrator, AAFC, and the financial institution); conducting annual risk assessments of existing and potential administrators; and serving in an oversight capacity to ensure Program rules are followed by administrators and payments under the guarantee are dispersed in a timely manner.

Departmental management of APP is based on a Risk Management Framework to ensure the proper administration of public funds and Program activities in a third party administrator model. As such, Program staff conduct annual risk assessments of existing and potential administrators to determine the appropriate mitigation measures. Depending on the risk rating of a particular administrator, these measures may include recipient audits, compliance visits, on farm inspections, producer credit checks, or other oversight actions.

The APP is delivered by third party administrators, often producer associations or commodity groups. These administrators are responsible for: establishing financing arrangements with financial institutions; promoting and marketing the available APP advances; and conducting necessary due diligence of applications. The APP permits administrators to recover their costs of administering the Program through application fees, default management fees, and a spread on the interest rate from interest-bearing loansnote4. Administrators vary in size, the fee structure they impose, types of producers they serve, and their capacity to administer the Program.

The administrator enters into a tripartite agreement with their respective financial institution and AAFC. These tripartite agreements, known as Advance Guarantee Agreements, are designed to provide an administrator with the ability to negotiate preferential interest rates that they may otherwise not be able to secure without the Program guarantee. The administrators then use these loans to issue repayable advances, with preferential interest rates, to producers. In addition to the guarantee of the advance, the federal government also pays the interest on the first $100,000 of each producer's annual advance. Eligible producers could access up to $400,000 at any one time.

The Program permits producers to take out advances by using a yet to be harvested commodity, or one they have in storage, as required security. Animals, animal products, and products that are non-storable require security from potential proceeds from relevant business risk management programs (such as, AgriStability, AgriInsurance, or other insurance products). Producers are able to access advances up to 50% of the expected sale value of their commodity each program year, subject to the Program's limit. Expected sale values, known as Advance Rates, are based on average prices for each eligible products and are determined by AAFC staff in the Market Information Program of the Markets and Industry Services Branch. Producers must repay the advance upon sale of the commodity, respecting the terms of the advance, which varies depending on the production period associated with the commodity (18 to 24 months). These repayments must be timely (within 30 days of sale) and require a proof of sale in most circumstances to demonstrate that the advance was used for appropriate purposes (such as, to improve marketing opportunities of that commodity).

3.3 Resources

Program expenditures vary by fiscal year based on Program uptake, and default rate. Table 1 shows that the APP had a total gross program expenditure of $161.2-million from 2014-15 to 2017-18. For the same period, AAFC recovered $58.3-million from default-related payments, resulting in net program costs of $117.5-million.

| Type of program expenditure | 2014-15 | 2015-16 | 2016-17 | 2017-18 | Overall |

|---|---|---|---|---|---|

| Interest Paid on Interest-free Advances | 20.2 | 16.8 | 15.6 | 18.8 | 71.4 |

| Regular APP Default-related Payments | 17.5 | 17.1 | 25.6 | 25.3 | 85.5 |

| 2008-09 Cattle and Hog default-related payments | 2.7 | 2.0 | 0.2 | (0.7) | 4.2 |

| Gross Program Expenditures | 40.4 | 36.0 | 41.4 | 43.4 | 161.2 |

| Default Recoveries | (14.4) | (13.8) | (15.7) | (14.4) | (58.3) |

| Net Statutory G&C Costs | 26.0 | 22.2 | 25.7 | 29.0 | 102.9 |

| Program Administrative Costs | 3.9 | 3.8 | 3.3 | 3.6 | 14.7 |

| Net Program Cost | 29.9 | 26.0 | 29.0 | 32.7 | 117.5 |

|

Source: Program administrative and financial data Note: Default-related payments may be associated with advances from previous years. Financial information for 2018-19 was not available during the evaluation. |

|||||

4.0 Relevance

This section summarizes the evaluation findings related to the relevance of the Advance Payment Program (APP). It does this by exploring the demonstrable need for the Program, its alignment with government priorities, its consistency with federal roles and responsibilities, and how it complements other programs.

4.1 Continued need for the program

The APP improves access to affordable short-term credit for Canadian agricultural producers, notably for beginning farmers and those who do not have sufficient farming experience and/or available security required for traditional loans.

There is a need for programming that assists agricultural producers in securing cash flow – without sufficient cash flow, operations cannot be sustained or improved. Adequate cash flow enables producers to meet short-term financial commitments (for example, interest/debt payments, utility expenses, and paying for inputs for production). Further, given that agriculture is seasonal, producers require a sufficient supply of cash to manage their operation until they are able to sell their products. Producers also face unforeseen risks such as weather and climate, disease and pests, workforce availability, and international trade events. Greater cash flow gives producers more control when responding to seasonal fluctuations in commodity and input prices.

When producers experience a decrease in cash flow, they have a limited number of tools to mitigate its effect on their operations. Aside from obtaining an operating loan, a producer may need to reduce input purchases, sell equipment and land, or sell their commodities at less than optimal timing and diminish their profits. When producers sell their crops when prices are low, they forgo higher revenues that could be used to re-invest and grow their business, hampering the long-term viability of their operations.

Access to credit is a need addressed by the Program. This need is mostly predominant in two groups – new and young producers,note5 and producers in niche commodity sectors.note6 New and young producers face barriers when it comes to accessing traditional credit because they often lack the required assets, equity, or business history. New and young producers may also have more farm debt from the substantial start-up costs required to enter farming. The evaluation's producer survey found that younger producers were more likely to report stress from farm debt than other producers (90% compared to 76%) and difficulty in accessing credit (73% compared to 65%). The evaluation's producer survey found that young producers were somewhat more likely to report taking out an advance (39%) in 2018-19 than older producers (28%). Producers in niche commodity sectors may also face difficulties accessing credit due to uncertainty in the sector and a lack of familiarity from lenders towards their products, which can deem them to a higher risk to the lender. While the sector can access financing, they face barriers to acquiring financing or are subject to less favourable interest rates and terms if they do so. Of note, accessing credit was not a challenge for the majority of the agriculture sector during the evaluation period, due to low interest rates and relatively high commodity prices during the last two decades.

The APP addresses the needs outlined above by providing producers cash flow through low cost financing. This increased cash flow provides producers the ability to delay the sale of their commodities and wait for optimal prices, and the ability to capitalize on opportunities and improve their operations (for example, purchasing inputs when prices are low). In addition, the advance enables producers to have improved cash flow throughout their production cycle, enabling producers to capitalize on opportunities and improve their operations, despite the seasonal nature of farming. The evaluation found that the absence of the APP would affect some producers' ability to acquire short-term financing. Approximately half of surveyed producers (54%) who took out an advance in 2018-19 reported believing they would not qualify for a loan of the same size elsewhere. For those producers who can access loans elsewhere (46%), the majority felt they would have gotten less favourable interest rates or repayment terms at financial institutions. The most common sources of alternate financing for producers are operating loans, lines of credit, and financing from input suppliers.

While the Program does not specifically target new or young producers or niche commodity sectors, the interest-free portion, lower interest rates and use of agricultural products as security are key factors that make the Program relevant for these and other producers who may not be able to easily access traditional loans.

4.2 Alignment with AAFC and government priorities

The APP aligns with Agriculture and Agri-Food Canada (AAFC) and Government of Canada priorities to help producers anticipate, mitigate, and respond to sector risk.

The APP aligns with two of AAFC's priorities in the 2019–20 Departmental Plan. The APP supports the AAFC priority to "support the financial resilience of the agriculture and agri-food sector" by helping agricultural producers improve their cash flow, and their ability to manage price risk in commodity and input markets. The APP contributes to this departmental priority when it is used to respond to market events that disrupt or delay the usual or expected marketing of products. Over the years, the Program responded to significant market events and disruptions such as the cattle and hog sector crisis in 2008–09 and the grain transportation crisis in 2013–14. More recently, the Program responded to the 2019–20 market disruption caused by China's trade restrictions on canola.

The APP aligns with the departmental priority to "Enhance export growth and market diversification, and support the sector to seize market opportunities" as it helps producers proactively manage price volatility by enabling them to buy inputs from, and sell products to, markets when they believe they can get the best price. With the Program, producers can delay their marketing to take advantage of higher expected prices, based on market opportunities resulting in higher revenues and greater margins.

The Program aligns with the broader Government of Canada priority to support and grow the middle class. The APP's low interest rates and interest-free portion supports producers' cash flow of farmers, which can contribute to their viability and enabling them to grow their business.

4.3 Alignment with federal roles and responsibilities

The APP aligns with federal government roles and responsibilities by providing producers with an effective option to access affordable credit.

In addition to the federal roles and responsibilities outlined in the Agricultural Marketing Programs Act, the Program is consistent with federal responsibilities outlined in the Farm Income Protection Act, which state that the federal government or federal programs:

- should encourage adjustments with respect to production or marketing so as to improve the effectiveness of the responses of producers to market opportunities.

- encourage the long-term economic sustainability of farm families and their communities.

- ensure equitable programming that takes into account regional diversity.

The evaluation found that APP provides producers with the flexibility to respond to market opportunities by enabling them to delay marketing by taking a low interest advance as an interim cash flow, and then selling their commodity at a better price. The Program encourages the long-term sustainability of farm families, and their communities, by enabling producers to improve their cash flow, and potential for greater margins, that sustain their profitability. The Program indirectly contributes to the sustainability of farmer-based communities as third party administrators are local associations that are closely connected to farmers. Lastly, the Program aims to ensure equitable programming that takes into account regional and sector diversity by using third party administrators across the country. The Program permits the addition of new administrators to deliver the APP when the Administrator is assessed as having sufficient capacity to deliver the Program.

4.4 Uniqueness

The APP complements programs in the Business Risk Management suite by providing a proactive risk management tool that differs from stabilization tools. The APP provides an accessible and alternative financing option to producers.

The Business Risk Management (BRM) suite is a set of core AAFC programs that are designed to help agricultural producers manage risks to their operations that are generally outside their control. As the APP targets risks associated with market volatility through managing cash flow, it differs from BRM programs such as AgriInsurance or AgriStability that stabilize declines in margins or production from weather or other unforeseen risks. Unlike these programs, the APP aims not only to provide credit to address unforeseen risk but also take advantage of marketing opportunities when they arise. The APP complements the BRM suite of programs by providing a proactive risk management tool that differs from the BRM tools.

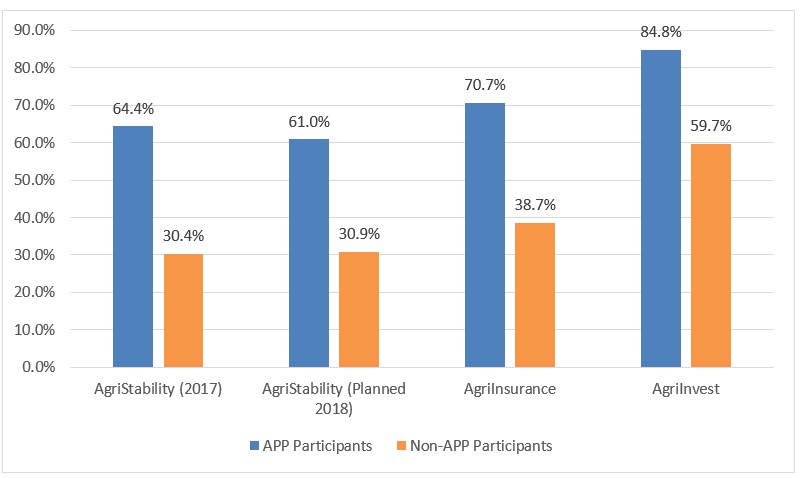

AgriStability is a tool that is triggered when production margins fall below 70% of their reference margin. The APP complements AgriStability because the APP can relieve declining producer margins through delayed marketing, preventing the immediate decline in those margins and the triggering of an AgriStability payment. APP supports broader BRM participation by requiring AgriInsurance or AgriStability as additional security to mitigate the risks associated with advances for non-storable agricultural products or livestock. The evaluation found that APP users are more likely to participate in BRM programs than those who do not use APP, as shown in Figure 1. Participation in AgriStability and AgriInsurance facilitate producers to manage declines in margins and production respectively, reducing the likelihood of an economic downturn.

Description of above image

Figure 1 shows participation rates in of producers who were in the Advance Payment Program versus those not in the Advance Payment Program in these business risk management programs:

- AgriStability in 2017,

- planned participation in AgriStability in 2018

- AgriInsurance in 2017

- AgriInvest in 2017

In all cases, producers in the advance payment program were more likely to take part in the business risk management programs than were producers not in the advance payment program.

| APP participants | Non-APP participants | |

|---|---|---|

| AgriStability (2017) | 64.4% | 30.4% |

| AgriStability (Planned 2018) | 61.0% | 30.9% |

| AgriInsurance | 70.7% | 38.7% |

| AgriInvest | 84.8% | 59.7% |

Source: Farm Financial Survey – 2017

Another cash flow program available from the federal BRM suite is AgriInvest. AgriInvest provides producers with a self-managed savings accounts into which both producers and governments deposit funds. These funds are available to cover small income declines or to make investments to help improve market income. Unlike the APP, AgriInvest is not a loan and does not need to be repaid by the producer. AgriInvest and APP differ in that the former focuses on generating savings for producers to stabilize cash flow or make investments, while APP aims to enable delayed marketing and improve cash flow of a producer.

The APP differs from the AAFC's Canadian Agricultural Loans Act Program and Industry, Science and Economic Development's Canadian Small Business Financing Program. These two programs provide support to farmers to purchase physical capital, land, or real property to either enter or expand in their sectors. These programs do not provide short-term financing to deal with operating requirements. However, similarities in the third party delivery models of APP and other federal financial programs for producers present an opportunity to examine the complementarity of these programs to share best practices.

Aside from the federal government, operational loans and working capital programs from provincial governments and producer associations are available for producers. Benchmarking undertaken for the evaluation of Canadian Agricultural Loans Act Programnote7 shows that Alberta, Manitoba, Ontario, New Brunswick, Quebec, and Nova Scotia each have at least one similar loan or advance program. However, these programs are often commodity or province specific. The federal APP, administered by third party administrators, provides broad access to producers throughout the country. The APP also provides long-term stability in producer decisions as federally legislated programs are generally longer-term compared to provincial or association-run counterparts.

Outside of government programs, there are sources of financing from financial institutions and other lending institutions. The most common alternative source of short-term financing for producers would be a line of credit, revolving loan or short-term loans from banks, credit unions, or Farm Credit Canada. Producers can also access input supplier financing. Short-term financing often resembles more traditional loan products, requiring security in the form of realizable assets such as farm equipment, land, or property, and include more traditional repayment terms. For example, Farm Credit Canada provides financial products that provide cash flow but these products require real and/or personal property as collateral and terms are dependent on the farmer's financial health. These Farm Credit Canada products are designed for general cash flow needs and do not specifically target marketing purposes. In contrast, APP permits producers to use their agricultural products or risk management products as security to delay their marketing to achieve for revenue maximization. This enables producers to use other farm capital as security for other financing products.

The APP's role is not to replace traditional lenders such as banks, credit unions, and Farm Credit Canada. The Program's role is to provide another option for producers who may not be able to access short-term financing at traditional institutions in support their product marketing activities. The evaluation found that there was no significant difference in the amount of current debt owed to banks between APP participants and non-APP applicants.note8

The evaluation found that financial institutions do not necessarily see the APP as competition to the products they offer. In part, this is because financial institutions often prefer providing larger loans and lines of credit to producers as the level of effort required by loan officers is relatively the same regardless of loan size. In contrast to the Program, banks prefer farmland and other tangible capital as security to mitigate the risk of bankruptcies/defaults in their portfolios. The 2017 report "Investigating the Financial Health of Canadian Farms using the Farm Financial Survey" found that banks' agricultural portfolios remained constant at 12% since 2013, and over time, such loans have required more information and management from applicants. The APP enables financial institutions to be invested in this aspect of the agricultural sector with little or no risk through the Advance Guarantee Agreement, which is the program mechanism that specifies the amount of financing they make available to administrators, the associated interest rates, and the Government guarantee.

5.0 Program design and delivery

This section summarizes the evaluation findings related to the Advance Payment Program (APP) design and delivery. It examines the benefits and challenges of the Program's delivery model.

The APP delivery model is relatively low cost for Agriculture and Agri-Food Canada (AAFC) and provides options to producers in a government program. However, inconsistencies among administrators result in disparities in delivery across the Program that ultimately affect producers and AAFC. Benefits that accrued to large administrators, for instance lower bank interest rates, did not fully accrue to producers.

5.1 Benefits of the Program Delivery Model

The third party delivery model employed by the APP enables the Program to quickly deliver advances with relatively lower program delivery costs to the Government of Canada, when compared to other federal loan guarantee program delivery models. Administrators are responsible for the operations and assessments of the loans, requiring little government involvement, resulting in services that are closer to the speed of business.

Administrative costs are categorized as the cost incurred by AAFC to oversee the delivery of the program, and excludes costs associated with the guarantee (interest paid on interest free advances and honoured defaults).note9 The Program's administrative costs for the fiscal period of 2014-15 to 2017-18 was $14.7-million, with an annual average cost of $3.7-million. Delivery costs for different programs can be compared in two ways; the first is by the cost to deliver an advance to producer (borrower) participating in the Program, and the other is by the cost associated with every $1,000 advanced (loaned). The administrative cost to AAFC to deliver advances was $176 per producer, or $1.73 for every $1,000 advanced. The evaluation compared the APP to two other government backed lending programs, the Canadian Agricultural Loans Act Program and the Canadian Small Business Financing Program. The average cost per producer (borrower) is estimated to be $383 for Canadian Agricultural Loans Act Program and $347 per borrower for the Canadian Small Business Financing Program; the costs for every $1,000 advanced (loaned) are estimated to be $5.60 and $2.60, respectively.note10

The APP is less costly for AAFC to deliver because administrators are responsible for their own operational costs associated with delivering the program. The cost to administrators is difficult to estimate, as some deliver the APP with full cost recovery and others offer the program as a service to members. The Agricultural Marketing Programs Act (AMPA) allows administrators to recuperate their operational costs from applicants (producers) through cost recovery as revenue earned from administration fees. Where administration fees are paid by producers, they are estimated to be $23.9-million over the fiscal period of 2014-15 to 2017-18, with an annual average cost of $6.0-million.note 11 When added to the costs incurred by AAFC to deliver the Program, these administrative fees resulted in a total administrative cost (incurred by producers and AAFC) per producer of $471, compared to the Canadian Agricultural Loans Act Program and Canadian Small Business Financing Program which have total administrative costs of $1,136 and $3,283 per producer respectively. When comparing the cost for every $1,000 advanced, the APP was $4.60, compared to the Canadian Agricultural Loans Act Program and Canadian Small Business Financing Program which have total administrative costs of $16.60 and $22.60, respectively.

Unlike the APP, the Canadian Agricultural Loans Act Program and the Canadian Small Business Financing Program charge all borrowers (producers) a service fee to acquire financing. This fee, paid by producers, offsets the administrative delivery costs. As a result, the Canadian Agricultural Loans Act Program and the Canadian Small Business Financing Program become revenue generators, making $199 and $2,336 per producer, respectively. The APP has a higher net cost to the Government of Canada, but the cost to producers (borrowers) is lower than other programs.

| APP | CALA | CSBFP | |

|---|---|---|---|

| Program administrative cost | 176 | 383 | 347 |

| Total paid by program | 176 | 383 | 347 |

| Paid by borrower to third party administrator | 295 | 171 | 0 |

| Paid by borrower to program | 0 | 582 | 2,683 |

| Total paid by borrower | 295 | 753 | 2,683 |

| Total administrative cost | 471 | 1,136 | 3,030 |

| Net program administrative cost (revenue) | 176 | (199) | (2,336) |

|

Source: APP Program Data, CSBFP Evaluation, CALA Evaluation Note: Net Program Administrative Costs is equal to "Program Administrative Costs" less fees "Paid by borrower to Government of Canada". |

|||

The APP's third party delivery model enables competition amongst its delivery agents, to provide producers with a variety of choice related to fee structure, customer service options, administrator familiarity with their sector and/or region, and other aspects. For example, the evaluation found evidence that an incumbent administrator changed their fee structure in response to the increased competition by a new entrant, ultimately leading to lower costs to producers.

Producer associations and commodity groups that participate in the Program as administrators, are well-connected to the local farming community, and are familiar with their local agricultural sectors. This connection and familiarity with the local agriculture sector provides access to stakeholders such as grain elevators, input suppliers, and other firms along the value chain. The connections and familiarity can benefit producers through access to these stakeholders.

Producers reported that they were generally satisfied with their administrator and the current delivery model. When asked what delivery model they prefer, surveyed producers were most likely to cite the current model where producer associations administer the APP, compared to alternative models such as where the federal government or a provincial government would deliver the Program. Almost all producers (90%) who took out an advance in 2018 or 2019 were satisfied with their administrators, and the majority (84%) agreed that the fees charged by their administrators were reasonable.

Changes to the program in 2015 and 2016

The Program enacted changes in 2015 and 2016 that aimed to increase competition and choice for producers by permitting administrators to advance on more types of commodities. The evaluation found that this change coincided with consolidation among administrators, with the number of administrators decreasing from 48 in 2013 to 36 in 2018. The majority who exited the Program were smallnote 12 administrators. Over half of producers surveyed who took out a loan between 2013 and 2019 reported benefitting from at least one of the changes to the Program made in 2015-16, as outlined in Section 3.1. The two changes that were most utilised were the ability to apply for an advance on all commodities through one administrator and being able to repay an advance without proof of sale in certain circumstances. Producers reported that these changes benefited them by making the application and repayment process easier. These changes also reduced costs for producers, as producers were not financially penalized for repayment without proof of sale in certain circumstances and could apply for a single advance on all of their commodities, resulting in just one fee for the year.

5.2 Challenges with the Third Party Administrator Delivery Model

The design of the Program affords flexibility in how administrators function and provide services to producers. However, this administrator flexibility does not always result in optimal benefits for producers. Furthermore, the model has the potential to create real or apparent conflicts of interest that could affect producers.

Administrators' size and mode of service delivery can result in significant variances that affect producers. Among the 36 administrators, the four largest administrators accounted for 83% of all dollars advanced in 2018-19 and 84% of all producers served in 2018-19.

Interest-free interest rates

APP administrators are responsible for negotiating the interest rates with financial institutions, including the interest rate AAFC pays for the interest-free portion of each advance (on the first $100,000). This results in differences in interest-free rates among administrators, which have implications for Program costs. With the larger dollar value of their advances, larger administrators are able to secure lower interest rates, resulting in lower costs to AAFC when it covers the interest on the interest-free portion of advances. The evaluation found that, if all administrators had rates as low as those held by larger administrators, the Program could reduce its program costs to the Department with an estimated annual saving of $1.7-million, which is equal to 10% of interest paid by the Program for all its interest-free advances in a given program year.

Interest-bearing interest rates

In addition to setting a fee structure, administrators can set the interest rates for the interest-bearing portion of their loans and use the spread between the rate they pay and the rate they charge to recuperate the costs associated with running the Program. As a result of this program design, there are variances in the interest rates passed on to producers for the interest-bearing portions of their loans. While larger administrators are able to secure lower interest rates from their financial institutions, they generally charge higher rates for their interest-bearing advances and thus earn a greater spread on interest-bearing advances.

The evaluation found that the interest-bearing spread of large administrators was much larger than for smaller administrators. There are no discernable benefits to producers in incurring these higher costs, nor a reduction in AAFC liabilities. Smaller administrators take less spread on their interest-bearing portions or only provide interest-free advances, resulting in a direct transfer of the benefits of the government guarantee to the producer. The evaluation estimated that the spread on interest-bearing portions of advances resulted in $30.6-million in revenue for select administrators from 2014-15 to 2018-19 (Table 3, Figure 3).note 13

| Program year | Administrator average IB interest rate | Producer IB interest rate (prime −0.25%) | Administrator interest cost for IB advances ($ million) |

Producer interest cost for IB advances (prime −0.25%) ($ million) | Administrator spread - estimated ($ million) |

|---|---|---|---|---|---|

| 2014-15 | 1.73 | 2.71 | 7.8 | 13.3 | 5.4 |

| 2015-16 | 1.52 | 2.49 | 8.5 | 15.1 | 6.6 |

| 2016-17 | 1.54 | 2.45 | 9.5 | 16.6 | 7.1 |

| 2017-18 | 2.04 | 2.85 | 11.9 | 17.9 | 6.0 |

| 2018-19 | 2.50 | 3.51 | 11.1 | 16.6 | 5.5 |

| Total | NA | NA | 48.9 | 79.5 | 30.6 |

| Source: OAE table derived from Program Performance Data, and Statistics Canada (Table 10-10-0122-01 Financial market statistics) data. | |||||

Description of above image

Figure 2 presents the interest cost for administrators and producers for interest-bearing loans. The costs are presented in a cumulative fashion, showing the total amount of interest paid over the period of program years 2014-15 to 2018-19.

| Fiscal year | Producer cost for interest-bearing loans ($ million - cumulative) |

Administrator cost for interest-bearing loans ($ million - cumulative) |

|---|---|---|

| 2014-15 | 13.3 | 7.8 |

| 2015-16 | 28.4 | 16.3 |

| 2016-17 | 45.0 | 25.9 |

| 2017-18 | 62.9 | 37.8 |

| 2018-19 | 79.5 | 48.9 |

Source: OAE table derived from Program Performance Data and Financial Data

Default rates

Default rates of APP advances were found to differ across administrators, appearing to be related to administrator size and to fall outside the Program's target range for default rates of between 3.0% and 4.0%. As shown in Table 5, larger administrators have higher default rates of 4.2% compared to 1.1% among small administrators. Defaulted loans have similar recovery rates across administrator size once they are honoured by AAFC. The Program area would benefit from undertaking work to better understand and address this variance in default rates.

| Program year | Small (fewer than 50 producers) | Medium (50 to fewer than 1,000 producers) | Large (1,000 or more producers) | Overall |

|---|---|---|---|---|

| 2013-14 | 1.2 | 1.3 | 4.5 | 4.1 |

| 2014-15 | 2.2 | 1.3 | 3.7 | 3.4 |

| 2015-16 | 0.7 | 3.4 | 4.3 | 4.0 |

| 2016-17 | 0.2 | 3.5 | 4.3 | 4.1 |

| 2017-18 | 0.8 | 2.8 | 4.1 | 3.9 |

| Overall | 1.1 | 2.5 | 4.2 | 3.9 |

|

Source: OAE table derived from Program Performance and Financial Data |

||||

In addition to fees and interest-bearing spreads, administrators can charge default management fees and default interest rates to recover the costs associated with delinquent payments. Between 2013-14 and 2017-18, an estimated 920 producers default each year. At the time of default, some administrators charge producers a default management fee and interest, typically equal to Prime +1% from the day the advance was obtained to the day of default. The evaluation estimated that the average default penalty payment to be over $5,500, resulting in over $5-million in additional funds paid by producers to administrators each year.note 14 With the higher default rates, larger administrators reap higher default revenues, at a cost to producers. However, the higher default rates is a strategy that large administrators can use to manage the risk they take on to deliver the program.note 15

The third party delivery model can place the administrators in an apparent conflict of interest, where it could be perceived that a public official's private interests could improperly influence the performance of their duties. The administrator's “public role” is to provide APP advances and conduct due diligence on producers on behalf of the federal government, while its private role, as a producer organization, is to represent, lobby, or advocate on behalf of their producers, often challenging the federal government. The dual roles of ally and advocacy can lead to apparent conflicts of interest. Access to the financial records of third party administrators would be needed to determine whether a bona fide conflict of interest has occurred, which is beyond the scope and mandate of this evaluation.

Administrators are responsible for marketing and promoting the APP, often through newsletters, annual general meetings, and word of mouth. Some administrators have created specific names and branding for their APP advances, resulting in scenarios where producers do not know they are receiving a federal government backed advance. Although the majority of producers were familiar with the APP, the evaluation found in its survey of producers that 13% of producers did not know whether they were past or current participants in the Program, despite having received an APP advance within the past 10 years.

5.3 Economy

Between the fiscal years 2014-15 and 2017-18, the APP cost AAFC $161.2-million. Default-related payments to financial institutions totalled $85.5-million in costs to the Department; however, the Program was able to recover over two-thirds of these costs from defaulted producers, reducing the net cost of defaults to $27.2-million or 23% of all costs. The next largest net cost for the Program arose from the interest payments on the first $100,000 paid by AAFC to financial institutions for each producer, which resulted in $71.4‑million or 60.8% of the Program's cost to the Department. These interest payments by the Department accounted for less than the estimated interest paid by producers would have made to financial institutions in the absence of APP advances.

While the APP's delivery model is more efficient in its delivery than other government backed lending programs, APP is less economical than the Canadian Agricultural Loans Act Program and the Canadian Small Business Financing Program because it does not charge a service fee to all producers on top of the fees charged by some third party administrators to recuperate costs, as noted in Section 5.2. During this same period, producers paid administrators an estimated $216.1-million in administration fees, default fees, and default payments, and interest to participate in the Program in this third party delivery model. The cost of APP to the Program and producers is estimated to be $98.2-million to administrators, and $173.0-million to financial institutions, and $69.0-million from producers to the Program in default recoveries.

6.0 Performance

This section presented the outputs produced by Advance Payment Program (APP), the achievement of its expected outcomes and its impact.

Overall, the APP produced all of its intended outputs and enabled producers to manage business risks associated with cash flow and marketing. The advance limits for APP were found to be sufficient for the majority of producers. Most of the estimated benefits for participants came from delayed marketing, with a secondary benefit of favourable interest rates.

6.1 Outputs and immediate outcomes

The Program monitors and manages the APP's performance by tracking indicators such as the number of producers serviced, administrator's borrowing rates, default rates, and the total dollar value advanced. Aside from the number of producers serviced, the Program met all other targets during the period of 2013-14 to 2018-19. From 2013-14 to 2018-19, the average default rate as a percentage of total dollars advanced was 3.9%, meeting the target range between 3.0% and 4.0%. The Program enabled administrators to acquire preferential interest rates below the prime interest rate (see Annex C for detailed Program performance information).

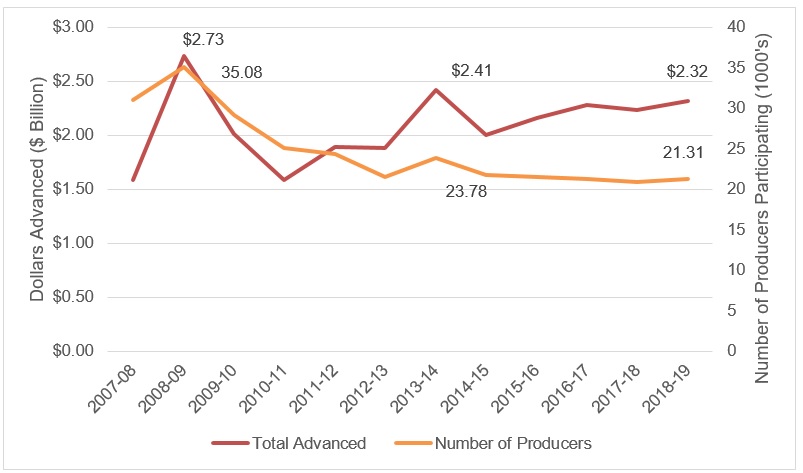

From 2013-14 to 2018-19, the Program dispersed advances to 37,404 unique producers; representing 20% of Canadian producersnote 16. On average each year 21,730 unique producers participated in the Program. While there was a peak in 2013-14, the number of unique producers hovered around 21,700 or 9% below the Program's annual target of 24,000 producers. During the same period (2013-14 to 2018-19), the Program advanced a total of $13.4-billion dollars, averaging $2.2-billion annually and surpassing the target of $2-billion by 10%. The majority of dollars advanced were for grains and oilseeds commodities. As shown in Figure 4, Program uptake peaked during two particular market events from 2007-08 to 2018-19. The first peak in 2008-09 was the result of the Program using its Severe Economic Hardship provision to enable cattle and hog producers to manage major crises in their sector. The second peak in 2013-14 was due to a grain transportation blockage that resulted in producers being unable to get their grain to sale in a large harvest year. During the evaluation period of 2013-14 to 2018-19, there were no identified uptake peaks.

Description of above image

Figure 3 presents the number of producers participating in the program, and the number of dollars advanced by the program by program year.

| Fiscal Year | Number of Producers (Thousands) | Total Advanced ($ Billions) |

|---|---|---|

| 2007-08 | 30.95 | $1.58 |

| 2008-09 | 35.08 | $2.73 |

| 2009-10 | 29.18 | $2.01 |

| 2010-11 | 25.08 | $1.58 |

| 2011-12 | 24.39 | $1.89 |

| 2012-13 | 21.46 | $1.88 |

| 2013-14 | 23.78 | $2.41 |

| 2014-15 | 21.70 | $2.00 |

| 2015-16 | 21.49 | $2.16 |

| 2016-17 | 21.28 | $2.28 |

| 2017-18 | 20.84 | $2.24 |

| 2018-19 | 21.31 | $2.32 |

Source: OAE table derived from Program Performance Data

6.2 Intermediate and long-term outcomes

The evaluation found evidence that the APP was meeting its intermediate outcome of enabling producers to access low cost capital. From 2013-14 to 2018-19, the average size of an advance was approximately $103,000. The average advance size rose at an annual rate of $1,225. While the overall average advance size mirrors the interest-free limit of $100,000, the average advance size for interest-free and interest-bearing loans are $60,000 and $236,000, respectively. This suggests that producers are using the APP when needed in their operations, and not just maximizing the interest-free portion on the $100,000. Approximately 18% of producers obtained advances at the Program's limit of the interest-free portion of $100,000. Similarly, 4% of producers were at the Program's $400,000 overall loan limit.

The Program provides access to producer loans of up to 50% of the expected value of eligible products, mitigating the risk for producers to borrow up to the Program's limit for the interest-free portion when it is not appropriate for their operations. Furthermore, Statistics Canada data suggests that an estimated 89%note 17 of producers in 2018 generated less than the $800,000 in gross farm receipts required to secure a $400,000 advance, reaching the Program limit between 2013-14 and 2018-19.note 18 The distribution of advance sizes and gross farm receipts suggest that the Program's loan limits of the first $100,000 for the interest-free portion, and $400,000 overall, have been sufficient to meet sector needs.

Continuous outstanding advances, defined as advances that are obtained while an advance from the previous program year is outstanding or are within 30 days of repayment of that previous advance, can create unforeseen liabilities. The evaluation found that 41% of the producers involved in APP between 2013-14 and 2017-18 took out an advance in the subsequent program year, within one month of repayment. In terms of liabilities, the average volume of these continuous advances was almost half (45%) of the total dollars advanced or $975-million each year. The majority of advances (70%) being rolled over by producers were interest-free loans ($100,000 or less). From 2014-15 to 2017-18, the evaluation estimated that continuous advances account for approximately 65% of the dollar value of interest paid by the department.

The evaluation found that the APP achieved its intended long-term outcome of enabling producers to manage business risks associated with cash flow. According to the evaluation's producer survey, producers are satisfied with the Program overall, with 85% of producers in the survey reporting they were satisfied with their advance. Surveyed producers believe that their advances were effective in meeting the Program's intended outcomes, with 53% and 69% of producers believing that their advances helped them market their products and meet short-term financial pressures, respectively.

While the APP was originally designed to be a program that provides marketing flexibility to producers, the Program's usage has expanded to include broader cash flow and short-term financial commitments. Nearly 60% of producers took out their advance between April to September where it was likely used to support general cash flow and for short-term requirements, such as purchasing inputs or hiring labour. The producer survey also indicated that those who participated in the Program between 2013 and 2019 used their advance primarily to meet cash flow requirements (33%), purchase inputs (30%), and delay marketing (14%). This expansion in the Program's purpose was facilitated by various changes. First, the inclusion of non-storable commodities, and animal and animal products expanded how the APP could be used as these types of commodities do not lend themselves to delays in marketing in the same manner as storable commodities such as grains and oilseeds. In 2015-16, Program changes relaxed the proof of sale requirements in certain circumstances and broadened the use of the advance, as the linking of the advance with marketing a commodity was relaxed. Lastly, for many producers' operations, it can be difficult to delineate what constitutes delayed marketing and general cash flow management. Almost three-quarters of producers who took out an advance noted that their advance both helped them market their products and deal with short-term financial pressures.

6.3 Impact

The evaluation found that the Program was effective in enabling producers to delay their marketing to obtain better prices on their commodities and products. 72% of producers who took out an advance in 2018 or 2019 reported delaying their marketing, with the average delay in marketing being six months. These producers who delayed marketing reported an average price increase of 6%. The evaluation estimates that the average producer who delayed marketing, saw an increase in revenue ranging from $6,424 to $12,848note 19. For the nearly 15,600 producers who delayed marketing, it is estimated that the Program created a net benefit of $100-million to $200-million each year.note20

Through its interest-free portion, lower interest rates and delay of marketing, the Program provides tangible benefits to producers. From 2013-14 to 2018-19, each year the average APP participant saved $1,150 from the interest paid by the federal government, $1,060 from the preferential rates secured by the government guarantee, and $4,602 to $9,205note21 from the higher prices captured through delayed marketing. Most of the estimated benefits for the average participant come from the delayed marketing, not the interest paid by the government for the first $100,000 nor favourable interest rates. These estimates highlight that the APP's primary impact on producers' operations is through the increased marketing flexibility. Based on analysis completed in collaboration with Statistics Canada on administrative and tax data, the evaluation found that APP participation was associated with higher net incomes over time, suggesting a possible longer-term impact on producers' ability to manage business risks and opportunities over time.

Overleverage

As the Program provides loans to producers, there could be a risk that producers become overleveraged – that is, incur too much debt and become unable to meet their debt commitments. Overleveraged producers create risks to Agriculture and Agri-Food Canada (AAFC) as the Advance Guarantee Agreement assign the Department as the final responsibility to honour producers' defaults, when administrators are unable to recover delinquent advances.

The evaluation found that producers do not appear to be overleveraged: 4% of producers defaulted on their advances, with 80% of every defaulted dollar recovered by AAFC.note22 Producers who use APP in a given year have relatively similar financial health as those who did not.note23 APP participants are slightly higher risk in their debt-to-equity ratios but are still at acceptable levels of risknote24. In the producer survey, the evaluation found that one third of producers who took out an advance in 2018 and 2019 reported a reduction in their line of credit or operating loans from the bank, at an average reduction of $100,000, suggesting that financial institutions mitigate the risk of overleveraging by reducing the total debt of some producers. Producers who use the Program participate more in AgriStability and AgriInsurance and mitigate risks that could trigger a default from margin or income losses.

Mental health

The evaluation found that the Program may have resulted in an unintended outcome, of possibly benefiting the mental health of producers. The 2019 report “Mental Health: A Priority for Our Farmers” by the Standing Committee on Agriculture and Agri-Food found that farmers were particularly vulnerable to mental health challenges, with almost half (45%) of Canadians farmers facing high stress levels and over half (58%) face anxiety. Producers face unique financial stressors such as changes in commodity or input prices and economic uncertainties from international trade. In the producer survey, the evaluation found that producers reported significant stress from their overall farm finances (77%), market volatility (87%), and access to credit (67%). As the APP provides cash flow through a preferential interest rate advance, it may ameliorate the some of the financial stress that affect producers' mental health. The evaluation's producer survey found that producers who reported stress from marketing decisions, increasing farm expenses and overall finances were more likely to take out APP advance in 2018 or 2019.

7.0 Conclusion

Relevance

There is a continued need for the Advance Payment Program (APP) to provide short-term credit to the agricultural sector and to improve marketing. While the agriculture sector was not challenged with accessing credit, certain segments such as young, new, and niche commodity producers may face challenges in accessing credit and are supported by this Program.

The Program aligns with federal and departmental priorities by improving producers' cash flow and their ability to proactively manage risks in input and commodity markets. In addition to federal roles and responsibilities in the Agricultural Marketing Programs Act (AMPA), the Program complements federal responsibilities outlined in the Farm Income Protection Act.

The APP complements programs in the Business Risk Manamgement (BRM) suite by providing a proactive risk management tool that differs from stabilization tools. The APP's provision to permit producers to use AgriInsurance and AgriStability as additional security for certain commodities is associated with an increase in participation rates in these programs. APP is a federally legislated program that provides broad access to producers throughout Canada and does not duplicate programs in other jurisdictions. Rather than replace traditional lending or act as a lender of last resort, the Program provides option to producers who may not be able to access short-term financing at traditional financial institutions.

Design and delivery

The Program's third party delivery model disperses funding to producers at a low administrative cost and provides services that are close to the speed of business. With lower total administrative costs but higher net costs to the Department than similar programs,note25 APP costs an average $33-million each year to generate the aforementioned benefits of $100- to $200-million to producers. Changes enacted in 2015 and 2016 further improved choice, access, and flexibility for producers. Administrators are generally part of the agricultural community and are familiar with their sector/region.

Flexibility in the Program's third party delivery model resulted in variances in costs and services to producers. While the cost to Agriculture and Agri-Food Canada (AAFC) to deliver advances is low, the flexibility in the delivery model has allowed third party administrators to generate revenue from producers through sources other than administrative fees, increasing costs incurred by producers. The four largest administrators accounted for the majority of dollars advanced and producers served in 2018-19, enabling them to negotiate lower interest rates from financial institutions. If all administrators were able to secure similar low interest rates from lenders as larger administrators, the Program could potentially reduce its annual interest costs by 10%, or $1.7-million. Despite securing lower interest rates from lenders, larger administrators earned from revenue from the spread on the interest-bearing portion of their APP advances, rather than passing savings on to producers, and received an estimated $30.6-million in revenue during the last five years. Larger administrators had higher default rates than smaller administrators. The default penalties paid by producers to administrators are estimated to be $25.3-million. Between the spread on interest-bearing loans and the default penalties, administrators earned an estimated $56-million from producers over five years. The delivery model may lead to apparent conflicts of interest for its administrators as they function as both advocacy associations and federal delivery agents. This apparent conflict of interest and the variances noted above suggest that the Program's Risk Management Framework could be improved.

Performance

Overall, the Program met its performance indicator targets. Program uptake remained stable over the evaluation period, with the program serving 37,404 producers and advancing a total of $13.4-billion.

The Program's limits of $100,000 for the interest-free portion and $400,000 overall are sufficient for producers to access low cost capital. Average advance sizes for those who took out only interest-free loans and those who took out interest-bearing loans fell well below their respective advance limits, even in the context of market downturns such as the 2008-09 cattle and hog crisis and the 2013-14 grain transportation blockage. A small percentage (4%) of users took out loans at the overall limit. The vast majority of producers in the sector are not able to generate sufficient gross farm receipts to secure a $400,000 advance.

The Program enables producers to manage business risks associated with cash flow. Changes to requirements and eligibility broadened how producers use the APP from a marketing tool. Through mostly improved marketing flexibility, the APP provided producers an estimated benefit of $100 to $200-million each year.

Recommendations

- Recommendation 1: The Assistant Deputy Minister, Programs Branch, should assess whether comparable interest rates across APP administrators could be achieved.

- Recommendation 2: The Assistant Deputy Minister, Programs Branch, should address inconsistencies in the APP third party delivery model to maximize producer benefits.

- Recommendation 3: The Assistant Deputy Minister, Programs Branch, should revisit the Program Risk Management Framework to reduce APP liabilities.

Management Response and Action Plan: Management has agreed with the recommendations, and has already taken action to address some aspects. Specifically, the Financial Guarantee Programs Division recently implemented a new annual procedure to conduct interest rate analysis for every Advance Guarantee Agreement (AGA) for APP to ensure that competitive interest rates are being offered. Additionally, financial oversight has been strengthened by requiring large administrators to be transparent and publicly disclose APP financials to ensure APP benefits are focused towards producers. Improvements to the Risk Management Framework are ongoing. All management actions will be completed by December 2020.

Subsequent events

In May 2019, the Minister of Agriculture and Agri-Food Canada announced regulatory amendments to increase the APP's loan limit from $400,000 to $1-million for all producers, and the interest-free portion was raised from $100,000 to $500,000 for canola producers only. These amendments were in response to a market access dispute with China. These amendments occurred outside of the scope of this evaluation, and in the absence of evidence and/or recipient experience related to these changes, which will take time to manifest, the evaluation could not assess the impact of these changes.

In December 2019, the Mandate Letter to the Minister of Agriculture and Agri-Food Canada outlined a commitment to consolidate existing federal financial and advisory services into a new entity called Farm and Food Development Canada “with an expanded and enhanced mandate and additional capital lending capability”. The effect of this new entity on AMPA or other AAFC lending programming is unknown at this time.

In spring 2020, the COVID-19 pandemic and the Canadian Government responses occurred after the completion of this evaluation.

Annex A: Evaluation methodology

Literature and document review

To assess the Program's relevance and design, the evaluation reviewed internal documents, academic literature, and reports from other organizations. The evaluation examined Agriculture and Agri-Food Canada (AAFC) policy and program documentation to understand the Program's context, background and design. The evaluation reviewed reports from organizations such as the Canadian Mental Health Association and the House of Commons to assess the Program's relevance. Lastly, the evaluation reviewed reports and documents from similar programs in other jurisdictions for comparison when appropriate.

Program and financial data

The Advance Payment Program Electronic Data System (APPEDS) database was used to assess how the Program was used by administrators and Program Participants. Cognos reports were extracted from the APPEDS database, and used for the analysis.

Farm Financial Survey

The Farm Financial Survey was used to determine differences between producers who participate in Advance Payment Program (APP) and those who do not. The analysis primarily involved checking for relationships between variables and Program participation.

The 2017 Farm Financial Survey was used as a key source to provide a snapshot of farms finances based on a sample of 8,905 individuals scaled to the population of farmers (109,590). The Farm Financial Survey contains 1,030 cases involved in the APP that are used to estimate the finances of 11,690 farms.

An initial analysis was carried out to determine if there are significant difference between the two groups across a variety of demographic characteristics. As such, multiple demographic variables were summarized individually and then cross-tabbed with the others. Simple statistical tests were employed to detect differences between groups (for example, t-tests, ANOVA, chi-square). These tests were used for the majority of the subsequent analysis, where appropriate.

The analysis provided information about the Program's relevance and performance. Depending on the specific area of analysis, the evaluation compared either program participants against non-participants or program participants against matched non-participants.

Key informant interviews

To assess the Program's relevance, performance, and design and delivery, the evaluation conducted interviews with internal and external stakeholders. The evaluation undertook 20 interviews with key informants from AAFC (14) and industry stakeholders from the financial and agricultural sectors (6).

Surveys

To assess the Program's relevance and performance, the evaluation designed, conducted surveys of producers and associations.

For the producer survey, the evaluation developed a list of potential respondents from past participants of the Program. This list included producers who received their first advance in 2018, producers who received advances before 2015 but not after, and returning producers who received an advance in 2018. The producer survey resulted in 1,147 usable responses from a list of 9,359 possible respondents.

For the administrator and association survey, the evaluation worked with AAFC's Public Opinion Research and Consultations Directorate and the Program to develop a list of associations, including APP administrators. The administrator and association survey received 37 usable responses out of 130 possible respondents. Out of these 37 respondents, 23 were former or current administrators.

Statistics Canada data linkage project

The evaluation engaged Statistics Canada to conduct an analysis regarding the Program's impact on producers.

Statistics Canada matched the list of Program participants to their linked file environment. The list included all program participants from 2006 to 2019. Of the 62,094 participants, 82% were matched within the linked file environment. A control group was generated from producers that were not found in the list of Program participants. Factors included in the matching were total net income, debt ratios, and other financial risk tax variables, as well as some basic enterprise characteristics, such as age of the enterprise, North American Industry Classification, and their location (province-level).

The analysis utilized in the evaluation focused on changes in farm net income from the year before participation in APP and the most recent year available on file. Controls were put in place to capture the effect of industry, region, revenue class, and age of the operation.

Methodological limitations

The following limitations were identified during the course of the project. Where possible, mitigation strategies were used to minimize their impact, as presented below.

| Limitation | Mitigation strategy | Impact on evaluation |

|---|---|---|

| The producer survey was conducted in the context of politically sensitive market access events and may comprise of respondents with stronger opinions of the program, government or the sector. Survey respondents in general may skew higher on the intensity of opinions while those who have lukewarm or no opinions on issues may not fill out the survey. | The evaluation weighted the survey responses by demographic factors to minimize the skew as much as possible. | Weighting reduced the demographic and industry specific skews that self-selection could cause. However, there is a possibility that respondents, regardless of commodity, age or province, comprised of those with higher intensity of positions or opinions compared to non-respondents. |

| Cognos reports produced from the APPEDS database were inconsistent across reports in the number of advances, producers, and total dollars advanced. | The evaluation selected Cognos reports where the values closely matched those reported in the BRM one-pagers. Selected reports were then incorporated into an access database for analysis. | The evaluation relied on estimates of program outputs when actual values were unavailable. |

| Statistics Canada's data linkage project encountered challenges in including unincorporated farms in the analysis due to agricultural tax data was unavailable for unincorporated farms. Additionally, important factors (for example, AgriStability participation) were unavailable for inclusion in the analysis. | The evaluation included only data from incorporated farms, and did not report on the magnitude of impact of program participation on unincorporated farms. | The evaluation was unable to provide an estimated impact of program participation on farmers, only the direction of the impact overall. |

Acknowledgements

The Office of Audit and Evaluation would like to thank the Canadian Agricultural Library, Public Opinion Research and Consultations Directorate, and the Research and Analysis Directorate for their contributions to the evaluation. Library staff conducted a literature search and then provided relevant material to assist the evaluation team in its assessment of the Program's relevance and performance. Colleagues from the Public Opinion Research and Consultations Directorate supported the evaluation in designing, scoping, and disseminating the producer and association surveys. Finally, the Research and Analysis Directorate assisted in the drafting, planning and contracting of the Statistics Canada data linkage project as well as access to the Farm Financial Survey.

Annex B: Logic model

The logic model below describes the key activities and outputs of the Programs under the Agricultural Marketing Programs Act.

| Long-term outcome | Advance Payments Program: Producers are able to manage business risks associated with cash flow demands |

|---|---|

| Price Pooling Program: Producers have access to alternative marketing opportunities |

|

| Intermediate outcomes | Advance Payments Program: Producers can access low cost capital |

| Price Pooling Program: Producers have access to timely payments upon delivery to pool |

|

| Immediate outcomes | Advance Payments Program: Administrators have access to low cost capital they can use to make advances to their producers |

| Price Pooling Program: Marketing agencies have access to low cost capital to make initial payments to producers for their products |

|

| Outputs |

Advance Payments Program:

|

|

Price Pooling Program:

|

|

| Activities |

Advance Payments Program:

|

|

Price Pooling Program:

|

|

| Inputs |

|

| Source: Performance Information Profile for Financial Guarantee Programs | |

Annex C: Advance payment program performance indicators

| Outputs and outcomes | Indicator | Target: | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

|---|---|---|---|---|---|---|---|

| Cash advances are available to eligible producers | Number of producers that are eligible for advances | 24,000 | 23,786 | 21,547 | 21,494 | 21,282 | 20,843 |