Abbreviations

- AAFC

- Agriculture and Agri-Food Canada

- BRM

- Business Risk Management

Executive summary

Purpose

The Office of Audit and Evaluation at Agriculture and Agri-Food Canada (AAFC) conducted an evaluation of the AgriInsurance Program to assess its relevance, design and delivery, efficiency and effectiveness.

Scope and methodology

AgriInsurance activities were evaluated using multiple lines of evidence: a review of program documents, files and literature; analysis of secondary and administrative data; interviews with internal and external stakeholders; and an academic expert panel. Activities out of scope for this evaluation include other programs within the Business Risk Management (BRM) suite. The scope of the evaluation includes fiscal year 2017-18 to 2021-22, but also includes previous years and 2022-23 to provide context and developments in the Program and the agricultural sector.

Background

AgriInsurance is a statutory contribution program within AAFC's BRM suite, which includes AgriStability, AgriInvest and AgriRecovery. The BRM suite includes the tools that provide agricultural producers with protection against income and production losses, helping them manage risks that threaten the viability of their farms and resume production after catastrophic events. AgriInsurance is a cost-shared production insurance program designed to minimize the economic effects of production losses caused by uncontrollable natural hazards (for example, drought, flood, wind, frost, hail or snow) or losses resulting from uncontrollable diseases, insect infestations and wildlife. AAFC is responsible for providing oversight, ensuring that the Program is actuarially sound and making timely payments to provinces. Provinces are responsible for the design and delivery of insurance plans in their respective jurisdictions. From fiscal year 2017-18 to 2021-22, total Program costs were approximately $5.5 billion, including $3.4 billion in federal expenditures and $2.1 billion in provincial expenditures.

Findings

- The Program is relevant as it fills a gap in agriculture insurance in Canada. There are no other insurance mechanisms available that could offer the same coverage as AgriInsurance at an affordable price to producers.

- Innovation and promising practices have addressed design and delivery issues pertaining to program administration in some provinces, however these have not been widely adopted.

- The Program is contributing to producers' income stability and, because of federal investment in AgriInsurance, Canada's agricultural sector is protected from the financial impact of natural hazards.

- The absence of participant-level Program data and standardization in data collection across the various jurisdictions impedes the timely assessment of results.

- The administration of AgriInsurance was found to be efficient in only a few provinces. There were notable variations observed across Canada due to the diversity of crops, sizes of farms and participation rates.

- For some sub-sectors and groups, a limited awareness of AgriInsurance products, and how the BRM suite interacts, resulted in gaps in coverage.

- Climate change poses a threat to the Program's cost as more frequent and severe regional weather events are expected to occur, at a time when provincial reserves are at a historic low. If this trend continues, the risk and likelihood of future reinsurance paymentsEndnote 1 from AAFC to cover Program payments will increase.

Conclusion

AgriInsurance contributes to stabilizing production loses for agricultural producers. Increasing administrative costs, inefficiencies, inadequate performance data, lack of producer awareness of how the Program can be used in tandem with other departmental BRM programs are key areas for improvement. Some provinces have adopted innovative practices, including the streamlining of the participation process, modernizing premium setting using big data, and the remote assessment of losses to facilitate delivery and improve efficiency.

Recommendations

- Recommendation 1

- The Assistant Deputy Minister, Programs Branch should identify and address Program inefficiencies by facilitating collaboration between provinces to share promising design and delivery practices.

- Recommendation 2

- The Assistant Deputy Minister, Programs Branch in consultation with the Information Systems Branch, should work with the provinces to standardize Program performance and administrative data and develop mechanisms to share this data and improve its timeliness.

- Recommendation 3

- The Assistant Deputy Minister, Programs Branch should improve sector awareness and understanding of the BRM suite of programs.

Management response and action plan

Management agrees with the evaluation recommendations and has developed an action plan to address them by December 2026.

1.0 Introduction

The Office of Audit and Evaluation at AAFC conducted an evaluation of AgriInsurance as part of the 2022-23 to 2026-27 Office of Audit and Evaluation Plan. The evaluation complies with the Treasury Board of Canada's Policy on Results and fulfills the requirements of the Financial Administration Act. Findings from this evaluation are intended to inform current and future program and policy decisions.

2.0 Scope and methodology

This evaluation assessed the relevance, design and delivery, efficiency and effectiveness of AgriInsurance activities from fiscal year 2017 18 to 2022 23. Activities out of scope for this evaluation include other programs within the BRM suite.

The evaluation used multiple lines of evidence including: a review of Program documents, files and literature; analysis of administrative and secondary data; interviews with AAFC officials, provincial government officials, representatives of general farm organizations, members of the private crop insurance industry and academics; and an external expert panel review. For the detailed evaluation methodology, see Annex A.

AgriInsurance activities were previously evaluated by the Office of Audit and Evaluation through the Evaluation of AgriInvest, AgriStability, AgriInsurance and the Wildlife Compensation Program (2017) and through the Evaluation of the AgriInsurance, Private Sector Risk Management Partnerships and Wildlife Compensation Programs (2013).

3.0 Program profile

3.1 Overview of AgriInsurance

In Canada, rudimentary forms of government-funded crop insurance programs existed as early as the 1930s. In 1959, the Crop Insurance Act provided federal funding to the provinces to operate a subsidized crop insurance program. This Program evolved into the Production Insurance Program and on April 1, 2007, the AgriInsurance Program was introduced.

AgriInsurance is a production insurance program which intends to minimize the economic effects of production losses caused by uncontrollable natural hazards (for example, drought, flood, wind, frost, excessive rain, heat or snow) or losses resulting from uncontrollable diseases, insect infestations and wildlife. The commodities covered vary by province and continue to expand to cover new agricultural products.

AgriInsurance is one of 4 core programs within AAFC's BRM suite of programs. Under the Canadian Agricultural PartnershipEndnote 2, the BRM suite intended to help farmers protect their income and manage risks beyond their control (for example, drought, flooding, market declines and increased input costs). Canadian farmers can participate in one or more BRM programs to help them adapt to changing markets, stabilize income over the long-term, mitigate financial losses and adopt technological innovations.

3.2 Governance

During the evaluation period, the AgriInsurance Program operated under the Farm Income Protection Act, subsection 4(1) and was guided by the Canada Production Insurance Regulations and the Canadian Agricultural Partnership framework. The Program receives its authority from the Act, which allows the Minister to enter into an agreement with one or more provinces to establish a crop insurance program. A cost-sharing agreement covering up to 60% of Program administrative expenses is in place between AAFC and the provincesEndnote 3. Premiums are shared between governments and producers (36% federal, 24% provincial and 40% producer) to ensure affordable coverage to producers, while administration costs are covered solely by governments (60% federal and 40% provincial). Premiums are funds collected from producers, the provinces and the federal government to cover Program payments (indemnities) in the current period or saved in a reserve for future periods.

Provincial governments are responsible for the development, implementation and administration of insurance plans to producers in their respective provinces, primarily through Crown corporationsEndnote 4 with the exception of British Columbia, which is delivered through the provincial government. The federal government is responsible for providing program oversight to ensure that legislative obligations are maintained and makes payments to the provinces according to the Program's Terms and Conditions.

Federally, AAFC's Production Insurance and Risk Management Division, in Programs Branch, is responsible for managing and coordinating the federal government's participation in the AgriInsurance Program. This division includes 2 separate units:

The Operations Unit is responsible for:

- reviewing proposals for new and changing plans and operational documents

- providing policy and program advice to the division

- administering and enforcing federal legislation, regulations and federal-provincial agreements

- monitoring crop seasons, evolving farming and market conditions and the Program's response to these events

- exploring and evaluating how new technologies can be applied to the development and management of industry insurance products

- acting as the primary contact point with provinces and maintaining a detailed knowledge of provincial insurance programs

- collaborating with the Actuarial Unit to ensure actuarial soundness is considered in all matters

The Actuarial Unit is responsible for:

- ensuring that new and changing provincial production insurance plans are sound, self-sustaining, meet actuarial requirements and comply with applicable federal legislation, regulations and agreements

- reviewing the actuarial components of operational documents

- establishing and auditing the actuarial requirements of certifications

- testing and advising on various actuarial and production insurance issues

- calculating provincial and federal reinsurance ratesEndnote 5 and evaluating yearly provincial risk profiles

- advising provinces and delivery agencies on the interpretation of actuarial guidelines, regulations and agreements that apply to the provincial production insurance plans

The Production Insurance and Risk Management Division is supported by the AAFC's BRM Finance Division for its overall financial management. The Division processes federal contribution payments, verifies and recommends payment of provincial claims for administrative reimbursement, maintains AAFC's financial reporting system and provides internal and external reporting of Program financial data.

The governance structure for the Program includes standards outlined in the Canada Production Insurance Regulations, national actuarial certification guidelines and federal-provincial-territorial committees, including the AgriInsurance Working Group (which reports to the Business Risk Management Policy Working Group).

3.3 Resources

From 2017-18 to 2021-22, AgriInsurance cost federal and provincial governments close to $5.5 billion, including almost $3.4 billion in federal and $2.1 billion in provincial expenditures. AAFC employed an average of 19.6 full-time equivalent employees each year to support the delivery of AgriInsurance (see Table 1).

Table 1: Federal expenditures by fiscal year (2017-18 to 2021-22)

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | Total | |

|---|---|---|---|---|---|---|

| SalaryTable 1 note 1 | 2,277,524 | 2,141,024 | 2,677,314 | 2,199,605 | 2,267,107 | 11,562,574 |

| Non-Pay Operating | 732,237 | 632,751 | 523,609 | 451,741 | 347,256 | 2,687,594 |

| Capital | 90,500 | 204,506 | 266,000 | 291,648 | 299,761 | 1,152,415 |

| ContributionsTable 1 note 2 | 651,704,357 | 664,580,115 | 666,672,139 | 645,912,746 | 719,839,291 | 3,348,708,648 |

| Total | 654,804,618 | 667,558,396 | 670,139,062 | 648,855,740 | 722,753,415 | 3,364,111,231 |

| Full-time Equivalents (AAFC) | 20 | 19 | 23 | 18 | 18 | n/a |

|

Source: Program financial data. |

||||||

3.4 Intended outcomes

The AgriInsurance Program has the following immediate, intermediate and ultimate outcomes:

- Immediate outcome: producers have access to individualized crop protection from natural hazards to reduce the financial impact of production or asset losses.

- Intermediate outcome: producers' income is stabilized by minimizing the economic effects of production losses caused by natural hazards.

- Ultimate outcomes:

- Producers see value in the BRM suite in managing their business risks

- The agricultural sector is financially resilient

- Cost effective programming

- Industry is able to better manage business risks and remain viable in the long-term

4.0 Relevance

This section summarizes evaluation findings on whether there is a gap in insurance offerings to which the federal government needs to respond, and Program alignment with departmental and government roles, responsibilities and priorities.

4.1 Gaps addressed by the AgriInsurance Program

AgriInsurance is relevant as it fills a gap in support for producers to mitigate the financial impact of production losses. There are no other comparable production insurance mechanisms in Canada.

The evaluation found that production insurance supports the viability and stability of farms and contributes to the sustainability of the agriculture sector. Agriculture and agri-food businesses are vulnerable to various risks and can face losses in production because of severe weather events, diseases, pests and unpredictable markets. Governments around the world are increasingly concerned about the effects of severe weather events and variations in climate conditions on the design and sustainability of crop insurance programs.Endnote 6 Major shifts in weather patterns are expected to increase the probability, frequency and severity of severe weather events, impacting crop yields, resulting in larger production losses and a greater need to support producers to mitigate the impact of such losses.

AgriInsurance supports producers by pooling risks across participants in the Program and by subsidizing the provision of multi-peril insurance. Specifically, the Program pools risks by collecting premiums from a large number of producers, across regions and sectors, into a reserve. It then uses this reserve to cover production losses experienced by producers in the form of indemnity payments. AgriInsurance is a cost-shared program whereby provincial governments are responsible for the design, implementation and administration of insurance plans to producers; however, premiums are funded by the federal and provincial governments and from Program participants. As a result, the Program can offer premiums at more affordable prices to producers, compared to insurance programs offered through private insurance firms that fund their programs through premiums alone. The reserve enables the Program to pay out large indemnities in a given year with little immediate fiscal impact on the federal or provincial governments.

AgriInsurance fills a gap in supporting producers by helping to mitigate the financial impact of production losses. The evaluation found a limited number of production insurance options for producers in Canada; private insurance offerings were typically smaller in scope, not as comprehensive as AgriInsurance and typically covered only single perils (for example, hail or snow). Evidence indicates that for production insurance to be viable and affordable for producers, it must include a government subsidy. Without the AgriInsurance Program and its 60% subsidy, the cost of privately offered crop insurance would be prohibitive for most producers, potentially leaving producers un-insured and putting the long-term health and sustainability of their operations at risk. This was evidenced in the evaluation where it was found that only 17.2% of producers had purchased private crop insurance, which subsequently impacts the ability of private insurance to effectively pool risks while offering affordable premiums.

4.2 Alignment with AAFC and government priorities, roles and responsibilities

AgriInsurance is aligned with federal and departmental roles and responsibilities to manage sector risk.

The Program is legislated under the Government of Canada's Farm Income Protection Act. This Act provides authority for a federal-provincial-territorial agreement to establish a crop insurance program to protect producers' income. The evaluation found that BRM programs, including AgriInsurance, are aligned with section 4(1) and respect the principles outlined in section 4(2) the Act.

BRM programs are aligned with AAFC's Canadian Agricultural Partnership policy framework, specifically the 'risk management' priority area, as well as AAFC's core responsibility toward mitigating 'sector risk'. As a part of the BRM suite of programs, AgriInsurance is intended to help producers better manage business risks and remain viable and financially resilient in the long-term.

5.0 Program design and delivery

This section summarizes evaluation findings on the Program's integration with the BRM suite of programs and advantages to public delivery of production insurance.

5.1 Integration of AgriInsurance with the core BRM suite of programs

AgriInsurance is well-integrated in the BRM suite of programs but a limited understanding of the suite and how programs interact may result in gaps in coverage.

The BRM suite is comprised of 4 tools intended to work together to help producers manage risks which are largely beyond their control:

- AgriStability supports producers experiencing a large margin decline

- AgriInvest provides producers with cash flow to offset small income declines

- AgriInsurance provides producers with cost-shared insurance against uncontrollable natural hazards to reduce the financial impact of production or productive asset losses

- AgriRecovery helps producers with the extraordinary costs associated with recovery following natural disaster events

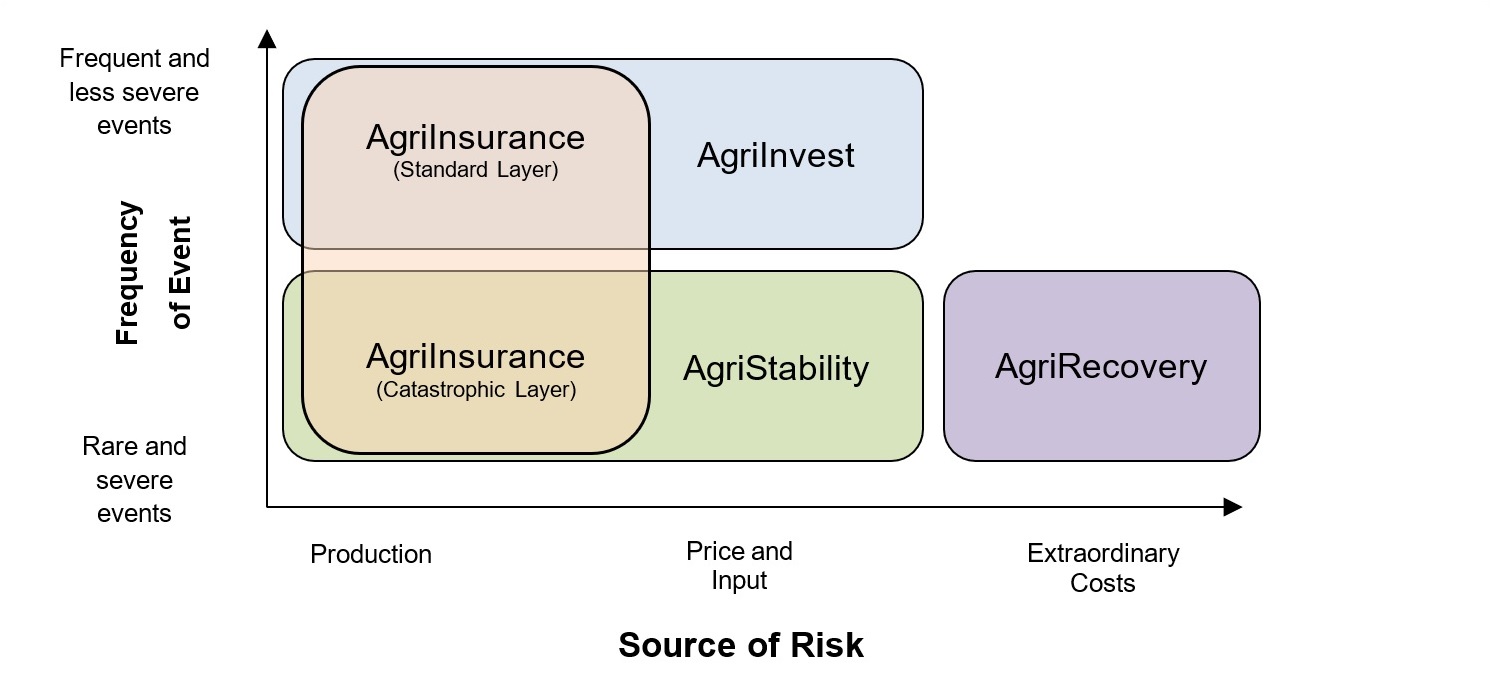

The BRM suite of programs aims to provide protection against a full range of risks that threaten farm viability. For example, when a producer's crops are damaged by natural calamities, AgriInsurance can cover production losses, while AgriInvest and AgriStability can cover additional costs and lost income (Figure 1).

Figure 1: Relationship between the BRM suite with frequency of events and source of risk

Source: Adapted from Antón, J., S. Kimura, & R. Martini's (2011) OECD risk management in agriculture in Canada and Agriculture and Agri-Food Canada's (2012) Evaluation of income stability tools — AgriStability and AgriInvest.

Description of Figure 1

The frequency of events is depicted on the Y axis, ranging from rare and severe events to frequent and less severe events. The source of risk is depicted along the X axis, indicating: production, price and input, and extraordinary costs. AgriInvest addresses production, and price and input risks, that are frequent and less severe. AgriStability addresses production, and price and input risks, that are rare and severe. AgriInsurance addresses production risks that are frequent and less severe through its standard layer, as well as rare and severe events through its catastrophic layer. AgriRecovery addresses extraordinary costs for rare and severe events.

***The source for this information is adapted from Antón, J., S. Kimura, & R. Martini's (2011) OECD risk management in agriculture in Canada and Agriculture and Agri-Food Canada's (2012) Evaluation of income stability tools — AgriStability and AgriInvest.***

BRM programs are intended to provide support in a predictable, timely and comprehensive way. A review of BRM suite program documents found that no one program is designed to meet all these criteria. Therefore, producers are encouraged to take advantage of multiple BRM programs to ensure their operations are protected against production and income losses.

The evaluation found that AgriInsurance is well-integrated into the BRM suite. The Program is designed not to overlap with other BRM programming and aims to fill a gap in the suite by providing timely payments to producers following a loss in production. However, AgriInsurance and AgriStability both cover production risk, reducing the incentive for producers to participate in both programs simultaneously.

Evaluation evidence indicated that the role of AgriInsurance in the BRM suite and the relationship of AgriInsurance to the other BRM programs is not well understood by some producers. As BRM participation rates demonstrate, some producers do not use BRM programs in a complementary way and as a result are unprotected for certain business risks. Analysis of 2021 Farm Financial Survey data showed that only half of AgriInsurance participants also participated in the other 2 BRM programs (see Table 2).Endnote 7

Table 2: AgriInsurance participants participating in other BRM programs

| Participation in BRM programs | Percent of AgriInsurance participants (%) |

|---|---|

| AgriInsurance only | 15.4 |

| AgriInsurance and AgriInvest | 30.7 |

| AgriInsurance and AgriStability | 4.1 |

| All 3 BRM programs | 49.8 |

| Source: 2021 Farm Financial Survey | |

Evidence indicated that there is a lack of understanding of the BRM suite of programs and how they interact, especially among some smaller producers (annual revenues <$250,000) who do not participate in the programs, leaving them exposed to risk. In other cases, a perception that AgriInsurance provides a revenue guarantee, or is sufficient to address all issues relating to production losses, may result in producers concluding that they do not need to participate in other BRM programs. Analysis of the 2021 Farm Financial Survey confirms that some producers lacked information about the Program and were unaware of its benefits. AgriInsurance administrators have implemented several initiatives to increase producer understanding of crop insurance programs. Furthermore, the literature identified how communication tools, such as educational articles outlining how AgriInsurance works and how it relates to other BRM programs, informative videos, mobile-based learning and text messages including information and tips, can improve producers' understanding of programs.

5.2 Public administration

Public administration and provincial delivery of the Program creates efficiencies not attainable by the private sector in Canada and supports the responsiveness of AgriInsurance to local needs. However, the Program lacks a mechanism for administrators to capitalize on promising practices and more efficient program features.

Advantages of public administration and provincial delivery

Delivery of the Program through provincial partners was found to create efficiencies that are not attainable by the private sector. Alternative models of delivery were examined, including the American federal crop insurance program (which is publicly funded but delivered by a third-party private corporations). Private American crop insurance agencies include profit when setting premiums. As Canadian provincial administrators do not engage in the same profit seeking model, they can operate at a lower cost to participants than American private insurers. Due to the lack of subsidies and inclusion of profit in the price of private insurance, it is estimated that transitioning AgriInsurance into a purely private model would represent a cost increase of 300% to producers.

The Program benefits from the relationships that provinces have with local agricultural communities, which lowers transaction costs.Endnote 8 For example, the provincial delivery of AgriInsurance enables administrators to meet a wide range of Canadian farmers' needs and develop plans that are region-specific. Additionally, premium setting is based on the risks connected with the commodities produced within the province and the risks farmers face with production, point of sale, delivery and distribution.

Provincial documentation shows that provinces have introduced design and delivery changes to respond to feedback received from local producers, namely to improve the administration of their programs. Some provinces improved access by providing producers with multiple channels to engage with Program staff, including video calls and live online chat systems. Some provinces addressed the administrative burden associated with the Program by reducing and streamlining paperwork, using remote claims verification through satellite imagery and weather stations, as well as through continuous feedback from participants. Improvements to information technology infrastructure, such as online form portals and claim tracking and payment systems, have also improved producer access to the Program.

Improving design through innovation

While the public administration of the AgriInsurance Program has much merit and advantage, the evaluation found that the adoption of private sector innovations into the publicly-delivered model could support increasing efficiency, improving delivery and reducing Program costs. This could be further supported by integrating promising design and delivery innovations found at the provincial level.

Evidence supports that innovations and tools from the private sector around the use of big data could complement public delivery and help modernize premium setting and aid in ensuring premiums are reflective of risk. Promising innovations include the use of satellite imaging to gather production information, weather station data for yield estimates, regional predictive climate models and field-level data shared by farmers directly with the Program.

Further improvements to Program efficiency come from changes in Program delivery, moving from field-level insurance to crop-level insurance or whole-farm insurance. Whole-farm insurance, or revenue insurance, could simplify AgriInsurance as producers would only require one contract for their operation rather than a contract for each field or commodity. The reduction in the number of contracts would reduce administrative cost of the Program while increasing Program coverage. Movement away from field-level insurance could reduce the likelihood of an operation producing on marginal land that is more likely to trigger payments.

Design and delivery challenges

The following challenges were identified over the course of the evaluation:

- Design decisions impact program costs: The provinces are responsible for the decision of what insurance products to offer and which commodities to insure. This has implications on the cost of delivery in the development of multiple insurance products and the cost share of premiums paid.

- Sector complexity: AgriInsurance, since its inception, has grown beyond what it was initially intended for, expanding into other sectors such as livestock, pastures and fruits and vegetables. This has increased the complexity of the program creating larger information requirements.

- Consistency of insurance products: The difference in insurance product offerings between provinces creates gaps in coverage for some producers in some provinces.

- Application of innovative practices: Provincial promising practices and innovations that reduce Program costs and increase the value of insurance products to producers have not been adopted in all jurisdictions.

- Marginal land: Anecdotal evidence from literature suggests crop insurance may provide an incentive to farm marginal land that would otherwise be uneconomical.

- Economies of scale: The pooling of risk and premiums is limited to the number of participants within a given province. Smaller risk pools require greater premiums which result in greater costs to producers and the Program.

6.0 Performance

This section provides an overview of the performance of AgriInsurance, including its efficiency and achievement of expected outcomes.

6.1 Performance measurement

The absence of participant-level Program data, and standardization in data collection across the various jurisdictions, impedes the ability to assess the success of the Program in meeting its outcomes.

Despite the long-term and significant investment in the AgriInsurance Program ($600 million per year), there remains a lack of standardization in key metrics, no consolidated performance database, and a need to further develop mechanisms to share data between the provinces and AAFC. These issues impact the ability to assess the success of the Program to meet its outcomes and to undertake improvements in Program delivery. Further, modelling and forecasting insurance costs and premiums could be greatly aided by standardized data collection. Key evaluation findings pertaining to data availability, quality and timeliness; Gender-based Analysis Plus (GBA Plus); and measurement of the intermediate outcome are highlighted below:

- Data availability: Participant-level Program data are not available to the federal government. Provinces are custodians of these data and information sharing provisions limit the federal government's access. During the evaluation period, each province maintained its own database, with aggregate data provided periodically to AAFC. As a result, there is limited data available to assess Program outcomes.

- Data quality: Inconsistent data collection across provincial jurisdictions, in part due to differences in definitions associated with insurance data variables, affects overall data quality and utility. For example, the grouping of commodities such as spring wheat differ across provinces as some provinces have only one classification for this commodity (whereas others have over 22 different classifications).

- Timeliness: There is up to a 2-year lag in the receipt of Program data from some provinces and up to a 4-year lag in Program performance metrics, preventing timely analysis of Program results.

- GBA plus: The Program does not collect administrative data on farm size or demographic data identifying Program clients as members of underrepresented populations including Indigenous Peoples, women, persons with disabilities and young farmers. This limits the Program's understanding of the populations it serves and its effects on underrepresented groups.

- Measurement of intermediate outcome: The intermediate outcome, "income stabilization", should be reviewed to confirm its alignment with the Program.

The evaluation was unable to assess the interrelated use of multiple BRM programs because each BRM program assigns its own unique identification number to its users. AAFC is considering moving to the use of a unique identifier across all BRM programs to better track participation and program impact across BRM programming.

6.2 Efficiency

AgriInsurance was efficiently administered in only a few provinces. Recent severe weather events have shrunk premium reserves, placing some provinces at risk of requiring a reinsurance payment from AAFC to cover Program payments to producers.

Planned budget vs. actual spending

AgriInsurance is the largest of the 4 core AAFC BRM programs, with a 5-year federal expenditure of approximately $3.4 billion, representing over 60% of all federal BRM program spending. Budget planning for AgriInsurance is difficult as it is a demand-driven program, where changes in market conditions influence Program participation and the cost of the Program. The Program over-spent its budget in each year of the evaluation period (see Table 3). The primary drivers for this over-spending are tied to premium payments from the increase in insured acres, insuring higher value crops, and the cost of administration due to greater than expected capital investments such as purchasing information technology systems.Endnote 9

Table 3: AgriInsurance planned budget vs. actual spending by fiscal year ($ millions)

| Fiscal year | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | Overall |

|---|---|---|---|---|---|---|

| Actual | 654.8 | 667.6 | 670.1 | 648.9 | 722.8 | 3,364.1 |

| Budgeted | 645.3 | 627.7 | 627.6 | 627.6 | 627.6 | 3,155.8 |

| % budgeted | 101.5% | 106.4% | 106.8% | 103.4% | 115.2% | 106.6% |

| Source: Program financial data.

Note: Actual expenditures represent premiums and administrative costs. |

||||||

Efficiency of administration

The efficiency of AgriInsurance is controlled by provincial administrators who decide how the Program is designed and administered. This underlines the importance of the provinces' choices on what plans are offered and which commodities are insured. Despite having limited control over Program costs, AAFC is required to cover 60% of provincial administration costs. The evaluation undertook an analysis of the combined federal-provincial costs incurred by the Program by comparing administrative expenditures to:Endnote 10

- total Program cost

- premiums paid

- Program coverage

- inflation

Overall, AgriInsurance is administered efficiently with administrative costs making up 7.4% of total Program expenditures.Endnote 11 Within the context of the suite of BRM programs, AgriInsurance is less expensive to administer than AgriStability (16%), but more expensive than AgriInvest (4.1%) and AgriRecovery (1.1%). However, administrative efficiency varied widely across the provinces from 4.5% to 83.7%. This is driven by each province's unique approach to the design and delivery of the Program, as well as the diversity of their agricultural sectors, sizes of farms and participation rates.

AgriInsurance is meeting its target (12%) for administrative costs when compared to premiums paid, costing only 7.9 cents per dollar spent in premiums by producers, provinces and AAFC. In a typical year, the Program provides insurance for nearly 72 million acres or 46.8% of the total farm area in Canada. For each acre, $22.55 is collected in premiums and costs $1.79 in administrative expenses.

Comparison of the administrative costs to Program coverage provides insight into the cost to insure production relative to its value to the Canadian economy. Over the evaluation period, AgriInsurance provided coverage for $109.6 billion in production, costing $642 million in administrative expenses. As a result, the Program met its 2.0% target as administrative costs were only 0.6% of the total value of coverage. Changes in the value of commodities, as seen in recent years, do not affect the cost to administer the Program; thus, changes in values of commodities will cause the Program to appear to be more efficient.

AgriInsurance was delivered efficiently within the context of inflation, with administrative expenses rising by 1.4% and inflation rising by 2.2%. Yet, at the same time, most provinces were found to have Program costs growing faster than the rate of inflation. Overall efficiency was found to be driven by a small number of provinces experiencing declines in the cost to deliver in 2020-21 and 2021-22: these same provinces hold a large proportion of the value of contracts and share of administrative costs.

The majority of provinces encountering challenges administering AgriInsurance efficiently were those with low participation rates, and a small and diverse agricultural sector. Interviews with stakeholders and subject matter experts indicated that there may be opportunities to improve Program efficiencies through collaboration and joint administration of AgriInsurance reducing duplication of effort (for example the sharing of IT infrastructure and Program delivery templates).

Managing the financial risk of severe weather events

In most years, AgriInsurance collects $5 in premiums for every $4 paid out in indemnitiesEndnote 12, with the excess premiums held in a reserve. This reserve helps to stabilize premiums by reducing the need to increase premiums after years of high indemnity payments. As a result of the nearly $6 billion in indemnity payments in 2021-22, the 25-year loss ratio jumped to over 95% (see Table 4)Endnote 13, which led to a 10% increase in premiums.

Table 4: 25-year average loss ratio of AgriInsurance (1997-98 to 2021-22)

| Program year | Premium ($) | Indemnities ($) | Loss ratio (%) |

|---|---|---|---|

| 1997-98 to 2020-21 | 27,810,114,753 | 22,253,119,562 | 80.0 |

| 2021-22 | 1,739,518,296 | 5,961,373,454 | 342.7 |

| Overall | 29,549,633,049 | 28,214,493,016 | 95.5 |

| Source: Program financial data and Program performance data | |||

Reinsurance is available to provinces, either in the form of public reinsurance from AAFC's Federal Crop Reinsurance Program, or from private reinsurance. Overall, public reinsurance is the more accessible for provinces than private reinsurance as it only includes a premium when balances are low.Endnote 14 However, at the same time, public reinsurance can be challenging for provinces to use as it requires the reserve to be drawn down to zero and the province must cover a 2.5% deductible. As a result, to date there have not been any public reinsurance payments. Private reinsurance is more flexible and can be used when indemnity payments threaten provincial reserves. However, provinces pay a premium to enrol in private reinsurance, which is paid from their reserve funds. Five provinces have opted into private reinsurance. These provinces have made claims against private reinsurance in years of large indemnity payments.

Climate changeEndnote 15 poses a threat to the cost of AgriInsurance as reserves have been significantly reduced. It is likely that subsequent similar events would lead provinces to trigger reinsurance payments from AAFC to cover indemnities as their reserves become depleted. Modelling studies demonstrated that warming temperatures due to climate change will have a positive effect on production yield in Canada and will lead to more frequent and severe weather events, increasing the Program's reliance on reserves. Low reserves limit the Program's ability to stabilize premiums, increasing the likelihood that premiums will increase to cover expected indemnities if the level of coverage is not decreased. As the cost of premiums are shared between producers and the federal and provincial governments, rising premiums to cover these agricultural risks will increase the overall cost of the Program.

Premium pricing methodologies need to forecast the impact of climate change and generate sufficient premiums to cover current and future losses without making the Program cost-prohibitive to producers. Climate change reduces the ability of historic information to accurately predict future indemnities. During the evaluation period, the Program used a 20 to 25-year historic average of experienced losses to calculate premiums, which does not consider the frequency and severity of future weather events or use more forward-looking forecasting techniques that could make the premium rate methodology more adaptive in the shorter term.

6.3 Immediate outcome: Access to crop protection

Producers in Canada have access to AgriInsurance; however, some Agricultural sub-sectors remain underserved. Uncertainty remains around the extent of the Program's reach to underrepresented groups.

The evaluation found that AgriInsurance provided access to individualized crop insurance for most crops grown in each province. Multiple lines of evidence confirmed that participation in AgriInsurance varied greatly across provinces, sectors and farm sizes and that not all producers access the Program to the same extent.

Insurance coverage

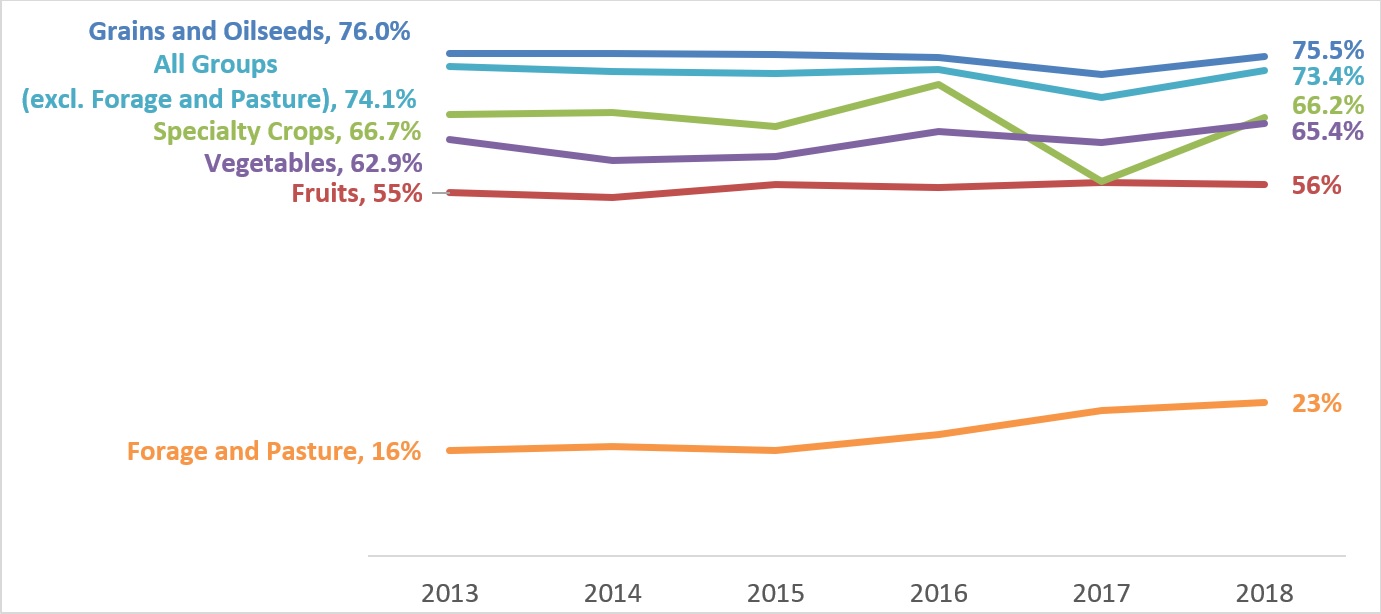

AgriInsurance's coverage of production provides a good indicator for the extent to which the Program aligns with producers' needs. AgriInsurance was found to be available for most crops grown within a province; most provinces offer multi-peril coverage on over 50 different types of crops. However, the Program's coverage falls short of its targets, covering only 73% of the value of production (75% target for non-forage/pasture) (see Figure 2). AgriInsurance's appeal for forage and pasture production was found to be increasing and meeting Program targets (20%), covering 23% of the value of production in 2018-19.

Figure 2: Percent of expected value of crops insured by AgriInsurance by sector (2013-14 to 2018-19)

Source: Program performance data

Description of Figure 2

Figure 2 presents the percent of expected value of production that is insured by AgriInsurance by sector between 2013-14 and 2018-19. The coverage for the majority of sectors varies by a few percentage points from year to year. However, the forage and pasture sector increased in coverage from 16% in 2013-14 to 23% in 2018-19.

| Grains and oilseeds (%) | Fruits (%) | Specialty crops (%) | Vegetables (%) | All groups (excluding, forage and pasture) (%) | Forage and pasture (%) | |

|---|---|---|---|---|---|---|

| 2013 | 76.0 | 54.9 | 66.7 | 62.9 | 74.1 | 16.0 |

| 2014 | 75.9 | 54.1 | 67.1 | 59.7 | 73.3 | 16.6 |

| 2015 | 75.8 | 56.2 | 64.9 | 60.3 | 73.0 | 15.9 |

| 2016 | 75.4 | 55.7 | 71.2 | 64.2 | 73.5 | 18.3 |

| 2017 | 72.8 | 56.5 | 56.7 | 62.5 | 69.3 | 22.0 |

| 2018 | 75.5 | 56.2 | 66.2 | 65.4 | 73.4 | 23.2 |

Coverage of production was found to vary across provinces, even within the same sector. Variations in coverage is attributed to differences in coverage options, the size and structure of farms and approaches to design and delivery. Manitoba's AgriInsurance Program has some of the highest coverage rates in most sectors. Manitoba's grains and oilseeds sector covers over 90% of eligible production, whereas other provinces cover around three-quarters of eligible grains and oilseeds production (69.1% to 80.0%).

In the 2021 Farm Financial Survey, producers in the fruits and vegetable sectors had the lowest coverage rates among non-forage and pasture production. Producers in these sectors cited most frequently that AgriInsurance had inadequate commodity-specific plans (16.6% of non-participants), or that production coverage options were unclear (13.7%). Unclear production coverage was highest among British Columbia's fruit and vegetable sector, with over one-quarter (28.4%) of its producers reporting that their reason for not participating was due to unclear Program requirements. While reasons varied across farm operators, there was a common theme of farm operators being unsure if their production was eligible for insurance. Lack of commodity-specific plans was frequently cited by fruit and vegetable producers in Alberta (30.3%), New Brunswick (24.9%) and Quebec (22.6%).

Cost of premiums

Premiums were found to play a significant role in a producer's decision to participate in AgriInsurance. Premium costs are influenced by a farmer's planting decisions. Higher-valued commodities are more likely to be insured, although this is dependent on insurance being available for that product and a sufficient history for the premium to be accurately priced. The average farm spends $9,364 to participate in the AgriInsurance Program. This is the amount required for the average farm to obtain close to three-and-a-half contracts, covering $1 million worth of agricultural products. The "average farm" is considered to be large, with an expected annual net sales greater than $1 million.

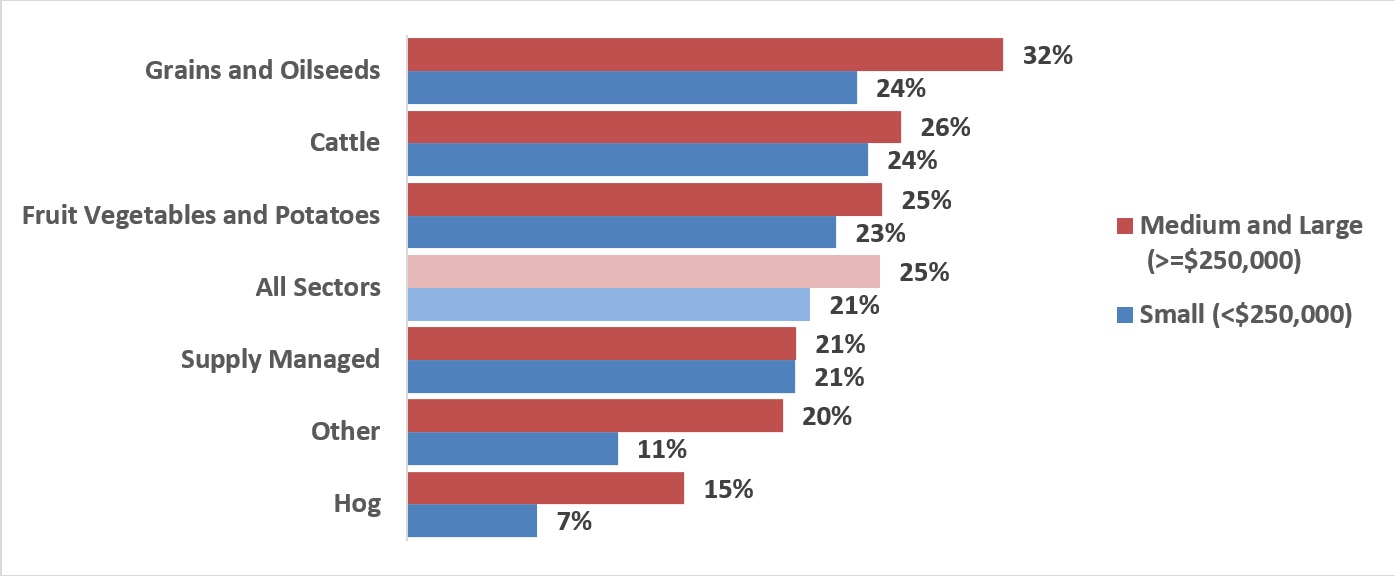

The cost of premiums was the most frequently cited reason for non-participation in AgriInsurance (23% reporting) as reported in the results of the 2021 Farm Financial Survey. Even though larger operations ($250,000 or more in annual revenue) were more likely to participate in AgriInsurance, the cost of premiums was a common reason for non-participation. This was most common for large operations in the grains and oilseeds sector where nearly one-third (32%) cited the cost of premiums as their reason for non-participation (Figure 3).

Figure 3: Percent of AgriInsurance non-participants citing non-participation due to premiums being too high (2021)

Source: Farm Financial Survey 2021

Note: Farm size is determined by the operations annual net sales.

Description of Figure 3

Figure 3 presents the percent of AgriInsurance non-participants by sector and farm size citing that the reason for non-participation is due to premiums being too high. For each sector, non-participants with smaller operations were less likely than larger operations to cite the cost of premiums being too high as the reason for their non-participation. Small operations are defined as those with an annual revenue less than $250,000.

| Small (<$250,000) | Medium and Large (≥$250,000) | |

|---|---|---|

| Grains and Oilseeds | 24% | 32% |

| Cattle | 24% | 26% |

| All Sectors | 21% | 25% |

| Fruit Vegetables and Potatoes | 23% | 25% |

| Supply Managed | 21% | 21% |

| Other | 11% | 20% |

| Hog | 7% | 15% |

Production insurance is actuarially sound when it balances coverage and premium cost. Premiums need to be set low enough to attract producers to the Program, yet high enough so that the Program can cover its indemnities. A lack of production history may result in the use of regional area averages that are not representative of operations, resulting in higher premiums or requirements for higher losses to trigger payments. Program participants across farms of different sizes and sectors indicated during the evaluation that that they found premiums too costly and that, in some cases, this was a deterrent for participation.

Access and awareness

The administrative burden (for example, paperwork) associated with the Program was found to be an impediment for participation among some producers. Interviewees noted that the Program's application process requires time, resources and expertise that may not be available to small operations. It was found that participation requires a time investment to learn about the Program, enrol and submit reports. A producer's level of administrative effort to participate was found to be similar regardless of the size of the operation. Larger operations were found to be more likely to participate in AgriInsurance. Consultants and accountants were cited as key resources that help larger operations understand the Program and how it can contribute to the farm's overall risk management strategy. However, smaller operations were found to be more likely to view the value of insurance coverage as insufficient to offset costs and effort associated with participation.

Access for underrepresented groups

The accessibility of AgriInsurance by groups typically underrepresented in the agriculture could not be assessed by the evaluation due to demographic information either not being collected or collected by provinces but not reported to AAFC. Underrepresented groups include youth, women, Indigenous Peoples, persons with disabilities and other groups underrepresented in agriculture, including smaller producers.

Documentation reviewed, including the Government of Canada's response to recommendations from the Standing Committee on Agriculture and Agri-FoodEndnote 16, along with data on farm size and previous evaluation findings, demonstrates that the BRM suite provides better support for larger farming operations when compared to smaller ones. In relation to farm size, smaller operations that represent 60% of the agricultural sector, were found to be less likely than larger operations to participate in AgriInsurance.Endnote 17 Smaller operations were found to encounter unique challenges in participating in AgriInsurance. The document and literature review showed that smaller farms may be unaware of the Program or reluctant to adopt insurance, believing that AgriRecovery will address losses.

According to Program documents, AAFC's Service Delivery Advisory Centre has explored the inclusion of Gender-Based Analysis Plus questions in data collection tools for BRM programming to better understand the Program's reach and barriers to access for underrepresented groups. It was noted that communications and capacity building activities for women, agricultural college students and Indigenous groups and elders could be tailored to improve participation rates. Furthermore, the literature review confirmed that increasing underrepresented populations' awareness of AgriInsurance and its role in the BRM suite can help improve their access to crop insurance programs.

Access for underserved sectors

Some Agricultural sub-sectors such as livestock, fruit and vegetable, as well as smaller operations, are underserved as a result of the design of AgriInsurance, most notably for commodities not covered by the Program (for example livestock production). As shown earlier in this section, the proportion of production covered by the Program for these sectors is well below the 75% target, which inhibits the program from achieving its performance targets.

6.4 Intermediate outcome: Stabilization of producer income

AgriInsurance responds quickly to producers experiencing a loss and contributes to producers' income stability.

AgriInsurance as part of the overall BRM suite of programs aims to stabilize producers' incomes. AgriInsurance is intended to be a producer's first line of defence when production is impacted due to natural hazards. AgriInsurance contributes to stabilizing an operation's income as it provides payments for losses in production but does not cover risks associated with changes in expenses or commodity prices on an operation's income (which are covered by AgriStability).

Based on reviewed studies from the United States, crop insurance programming is effective at protecting against farm-level income risks and can contribute to stabilizing producers' incomes by minimizing production losses caused by uncontrollable natural hazards or from uncontrollable diseases, insect infestations and wildlife. However, such studies have not been conducted in Canada due to limited data. As a result, the degree to which AgriInsurance contributes to the stabilization of producer's income remains unclear.

AgriInsurance's contribution to stabilize producer income can be seen through its program payments. Between 2017-18 and 2021-22 there were 1.2 million contracts issued, of which over one-quarter (28.0%) resulted in a claim. During this period, $11.4 billion was paid to producers to cover losses. The total loss from the claims is estimated to be $14.9 billion, with AgriInsurance payments covering 76.2% of producers' losses.

Service standards and program administration

AgriInsurance claims are frequent, with over one-quarter (28.0%) of contracts resulting in a claim. AgriInsurance was found to respond quickly, meeting its service standard of processing over 90% of payments within 30 days. However, the process was found to slow down in years where multiple severe weather events covering large areas occurred in short succession. This was the case in 2018-19, when Saskatchewan, Alberta and British Columbia processed only 70% of claims in 30 days. The decrease in claim processing time was associated with the high demand placed on adjusters to inspect claims. Since then, measures have been introduced to utilize existing data to eliminate the need for adjusters to inspect claims.

6.5 Ultimate outcome

Canada's agricultural sector shows signs that it is financially resilient and healthy, which is attributed to both AAFC's core BRM programs and to increased production and favourable market conditions.

There are 4 ultimate outcomes intended to capture the long-term impact of the overall BRM suite of programs:

- The agricultural sector is financially resilient

- Producers see value in the BRM suite in managing their business risks

- Programming is cost effective (see section 6.2)

- Industry is able to better manage business risks and remain viable in the long-term

AgriInsurance is one of 8 business risk management toolsEndnote 18 contributing to the financial resiliency of the agriculture sector. This outcome is also influenced by the overall success of the sector, such as productive years and improved market conditions. Producers also have a shared responsibility for the management of production risks and the financial health of their operation. As a result, the financial resiliency of the sector cannot be solely attributed to AgriInsurance.

Sector's financial resiliency

Regarding the contribution of the BRM suite to financial resiliency, evidence indicates that the combined effect of these programs to stabilize individual producers' incomes and subsequently enable producers to invest in agriculture, can culminate in a more financially resilient agriculture sector. AgriInsurance can provide vulnerable producers with certainty following natural disasters. Evidence suggests that this provides producers with confidence to make investments in their operations, diversify, and adopt environmental best management practices such as cover crops/intercropping, drought/frost resistant varieties and precision agriculture. Experts and stakeholders noted that environmental best management practices can further improve the resiliency of farming operations by mitigating the impact of severe weather events, reducing the incidence of claims.

Financial resiliencyEndnote 19 of the sector can be understood through multiple measures. Farm incomes were found to meet targets, with farm income being at least 91% of its historical average (target of 85%) between 2013-14 and 2018-19. The sector was found not to rely on BRM program payments to sustain their operations, with BRM program payments making up only 12.3% of farm's net operating income (target of 25%). In addition, most farms (92%) were found to be financially healthy (target of 90%). Other factors faced by the agricultural sector, such as increased land values, investments, low interest rates and market-driven price increases during the evaluation period, as well as participation in a number of BRM programs simultaneously, demonstrate financial resiliency.

Unintended impacts on the sector's resilience

The evaluation found that AgriInsurance may have an unintended consequence of reducing an operation's long-term financial health and resilience by its very construct. Some operations that would not be economically viable without AgriInsurance's support are continued through the very set up of the Program. Anecdotal evidence suggested that provincial crop insurance may provide an incentive to farm marginal land that would otherwise be uneconomical. AgriInsurance may discourage smaller producers from diversifying (due to minimum acreage requirements and growing of commodities without insurance coverage) and innovating to ensure the operation's future viability.

Producers see value for program

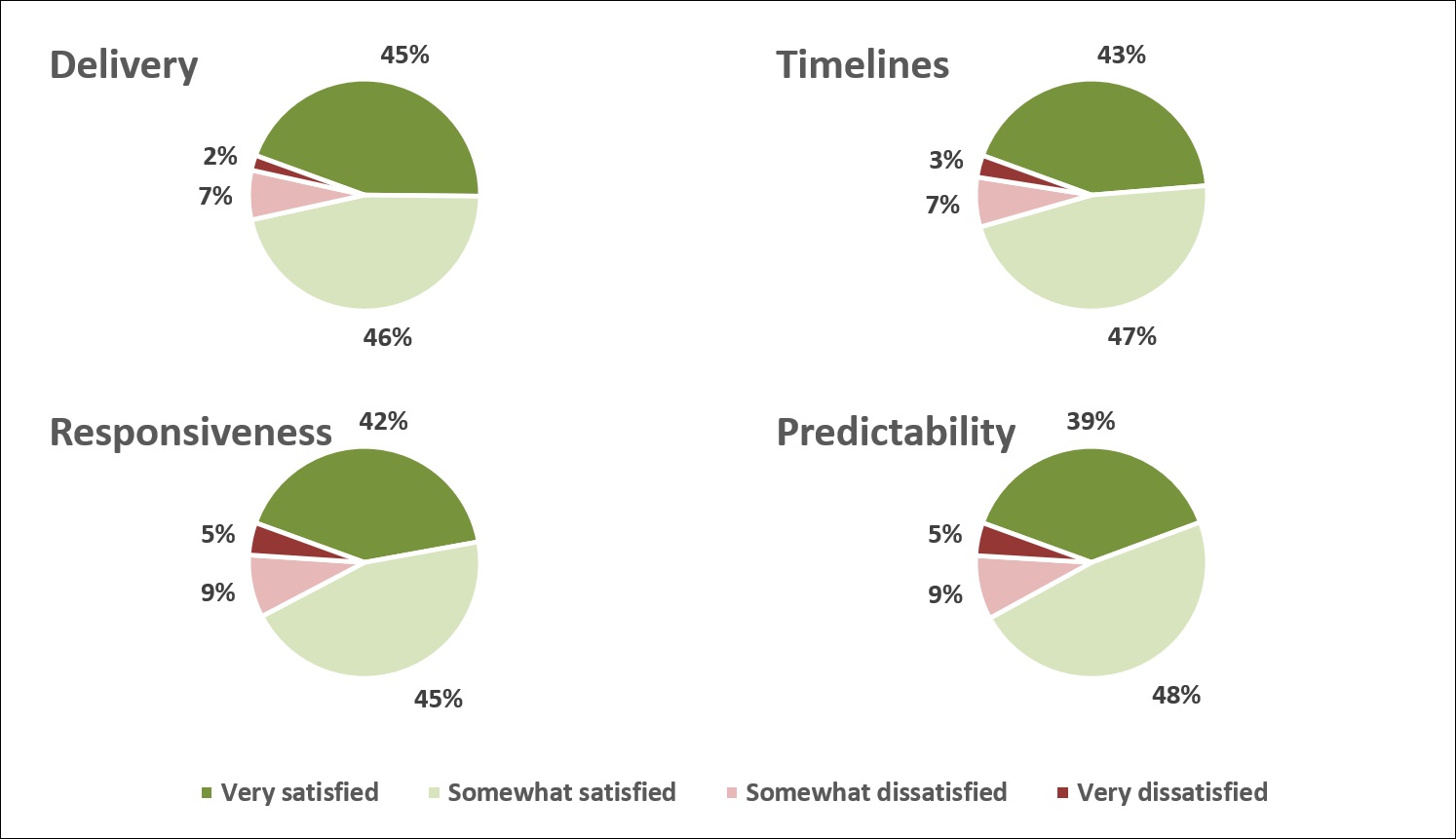

Producers value AgriInsurance and it is the most favourably viewed BRM program due to its timely response, predictability of payments and size of payments. The extent to which producers value AgriInsurance is shown in feedback received directly from producers and in consistent participation. Overall, producers participating in AgriInsurance are very satisfied with its delivery, predictability, timeliness and responsiveness (Figure 4). According to the 2021 Farm Financial Survey, high levels of satisfaction among Program participants are consistent across sectors and farm sizes. The high coverage rates and consistent participation provide further evidence of producers' satisfaction in AgriInsurance.

Although the Program is favourably viewed by Program participants, there is a lack of data to understand the views of non-participants. Low participation rates for forage and pasture producers need data to be better understood.

Figure 4: AgriInsurance participant's satisfaction with the Program (2021)

Source: 2021 Farm Financial Survey

Description of Figure 4

Figure 4 presents the degree of satisfaction with the Program's delivery, timeliness, responsiveness and predictability among AgriInsurance participants. For each metric, around 40% were very satisfied, and over 45% were somewhat satisfied. Very few AgriInsurance participants were very dissatisfied or somewhat dissatisfied (less than 15%).

| Delivery | Timeliness | Responsiveness | Predictability | |

|---|---|---|---|---|

| Very satisfied | 45% | 43% | 42% | 39% |

| Somewhat satisfied | 46% | 47% | 45% | 48% |

| Somewhat dissatisfied | 7% | 7% | 9% | 9% |

| Very dissatisfied | 2% | 3% | 5% | 5% |

Mental health

Business risk management programs, such as AgriInsurance, were found in the peer-reviewed literature to contribute to farmers' mental health. Several studies of farmers' mental health have found that financial challenges and economic uncertainties are major stressors for farmers. Weather is a constant stressor for farmers, and climate change and severe weather events add to farmers' uncertainty. AgriInsurance has the potential to provide vulnerable operations with additional certainty when facing uncontrollable natural disasters, thereby reducing mental health stressors.

7.0 Conclusions and recommendations

AgriInsurance was found to contribute to stabilizing the financial impact of production loses. The Program is well-integrated into the BRM suite of programs, filling the role of addressing production declines. Within the BRM suite of programs, AgriInsurance is the most favourably viewed by producers due to its predictability and quick response to sector losses.

AgriInsurance is administered differently across the provinces, with some provinces being less efficient. Provinces encountering challenges in designing and delivering AgriInsurance in an efficient and effective manner would benefit from adopting promising practices from other provincial administrators, as well as leveraging private sector innovation in crop insurance. These improvements have the potential to improve the accuracy, reliability and overall efficiency of the Program.

The impact of multiple severe weather events on AgriInsurance resulted in record payments in 2021-22, which has placed some provinces at risk of requiring reinsurance payments from AAFC to cover indemnities. Premium rate setting should account for the impact and increase in frequency of severe weather events on indemnity payments, taking into consideration the impact of cost to producers. Given the rising cost of covering agricultural risks and delivering insurance across Canada, attention is required to mitigate financial risks to the Program.

Despite significant investment in the AgriInsurance Program over many years, there remains a lack of a consolidated performance database and a need for standardized data with mechanisms to share data and improve its timeliness. This gap limits the ability to assess the Program's effectiveness and achievement of its results.

Producer awareness and access to AgriInsurance was found to be inconsistent across the sector and provinces. Smaller producers and those in the non-grains and oilseed sectors were found to have lower participation, limiting the Program's ability to support the sector through natural hazards and to reach performance targets. Improved awareness of the BRM suite and improvements in AgriInsurance coverage could improve Program reach in underserved sectors and with underrepresented groups, thereby reducing reliance on ad-hoc supports such as the AgriRecovery framework.

Recommendations

- Recommendation 1

- The Assistant Deputy Minister, Programs Branch should identify and address Program inefficiencies by facilitating collaboration between provinces to share promising design and delivery practices.

- Recommendation 2

- The Assistant Deputy Minister, Programs Branch in consultation with the Information Systems Branch, should work with the provinces to standardize Program performance and administrative data and develop mechanisms to share this data and improve its timeliness.

- Recommendation 3

- The Assistant Deputy Minister, Programs Branch should improve sector awareness and understanding of the BRM suite of programs.

Management response and action plan

Management agrees with the evaluation's recommendations and has developed an action plan to address each recommendation. In support of recommendation one, Programs Branch will work closely with the provinces to identify, and promote, promising practices and innovations. Programs Branch will also explore new insurance products to reduce premiums and assess the impacts of climate risk on the AgriInsurance Program. All components addressing the first recommendation will be completed by December 2026. In support of recommendation 2, Programs Branch and Information Systems Branch will work with the provinces to improve data collection and sharing. Activities addressing the second recommendation will be completed by March 2025. In support of recommendation 3, Programs Branch and Public Affairs Branch will work with the provinces to initiate activities that promote the suite of business risk management programs under Sustainable Canadian Agricultural Partnership framework. Activities addressing the third recommendation will be completed by March 2024.

Annex A: Evaluation methodology

Contextual research

The evaluation team completed research to understand the Program's context and common evaluation methodologies used to evaluate similar insurance programs. This involved reviewing evaluations of crop insurance programming in Canada and other countries; completing a non-systematic review of recent news stories associated with the Program; and informal meetings with AAFC's Programs Branch and other areas of the Department.

Document and file review

A document and file review were conducted to obtain a better understanding of how the Program operates and to inform other lines of evidence. This was done through a synthesis and analysis of 315 internal and external documents.

| Document type | Number of documents |

|---|---|

| Federal-provincial-territorial meeting records | 64 (286 files) |

| Program documents (briefing notes, decks, etc.) | 26 (24 files) |

| Speeches from the Throne | 3 |

| Federal budget speeches and economic updates | 10 |

| Reports from provincial delivery agencies | 26 |

| AAFC policies, mandates and commitments | 13 |

| Reports and decks from Program consultants | 6 |

| Transcripts and reports from House of Commons | 16 |

| Transcripts from provincial legislative assemblies | 110 |

| Media articles | 41 |

| Total | 315 |

To analyze documents, evaluation questions and indicators were used as codes. Documents were analyzed deductively, extracting information relevant to the codes. Synthesis involved a modified version of thematic analysis by grouping, describing and interpreting codes to answer the evaluation questions.

Peer-reviewed literature review

The evaluation team analyzed and synthesized academic literature sourced from database searches (for example, Google Scholar), leading agriculture and insurance journals and the Canadian Agriculture Library. Several search queries were executed between July and August 2022. Key words included: 'AgriInsurance' [in title]; 'Crop Insurance' and 'Canada' [in title]'; and 'Crop insurance' or 'AgriInsurance' and 'Canada'. Exclusion criteria were established to limit review to only those articles that substantively addressed crop insurance in Canada were included. In total, 71 articles were reviewed.

A novel conceptual framework was developed to analyze the literature. The framework acted as a guide to understand Program barriers, enablers and benefits; Program effectiveness and efficiency; and the needs to the sector. Literature was analyzed deductively by using the evaluation questions and indicators as codes. A modified version of thematic analysis was used to identify patterns and themes in the literature in relation to each code.

Analysis of program administrative and secondary data

Program administrative and performance data was extracted from the Production Insurance national Statistical System (PINSS) database and analyzed to provide context to findings from other lines of evidence. It was further supplemented by Program financial data for the calculation of efficiency metrics. Data from the 2021 Census of Agriculture and the 2021 Farm Financial Survey were used to provide context for Program performance. Finally, the Farm Financial Survey was used to provide insight into producers' perception of AgriInsurance and other BRM programs.

Key informant interviews

Semi-structured interviews were conducted through video conferencing with internal and external stakeholders between September and November 2022. Forty-five key informants were invited to participate in an interview. In total, 30 key informants were interviewed.

| Key informant type | Number of invitations | Number interviewed |

|---|---|---|

| AAFC officials | 3 | 3 |

| Provincial government officials | 10Table 2 note 1 | 9 |

| Representatives of provincial general farm organizations | 12Table 2 note 1 | 10 |

| Representatives of private crop insurance companies | 7 | 3 |

| External academics | 13Table 2 note 2 | 5Table 2 note 2 |

| Total | 45 | 30 |

Each interview was recorded with a de-identified summary transcript. Each transcript was reviewed individually. Structural coding and pattern coding was used to analyze the transcripts where evaluation questions and indicators acted as codes to categorize the data corpus. This resulted in summaries of interview results organized by both indicator and question.

External expert panel

A panel of 4 leading external academic experts in crop insurance in Canada was established. The experts were identified following a comprehensive review of peer-reviewed articles. The experts were consulted throughout the duration of the project and provided the Office of Audit and Evaluation with expert feedback regarding key evaluation questions. A facilitated discussion allowed the group to provide in-depth feedback regarding results which supported triangulation.

Triangulation

The evaluation incorporated across-method, within-method and sequential methodological triangulation (for example, qualitative phase first being conducted to inform the subsequent quantitative).

Methodological limitations

| Limitation | Mitigation strategy | Impact on evaluation |

|---|---|---|

| Response bias: Key informants who participated in the evaluation may have a vested interest in the continuation of BRM programming. | Interviews with participants from 5 different stakeholder groups generated a variety of perspectives. Data was synthesized within and across stakeholder groups and triangulated with other lines of evidence where possible to eliminate potential bias. | Low |

| Data limitation 1: Lack of recent Program performance and administrative data, including farm-level data. | Utilized available Program administrative data from 2012 to 2018 and partial information up to 2022 to understand Program need and use. Other lines of evidence were used to offset a lack of complete 2018-2021 program administrative data. | Medium |

| Data limitation 2: The evaluation made use of existing secondary data to address evaluation questions: 2019 and 2021 Farm Financial Survey was not weighted for participation in BRM programs. |

The Farm Financial Survey provided generalizations about those of whom participated the Program. Other lines of evidence were used to substantiate findings. | Low |

Annex B: Logic model

The Logic Model for the AgriInsurance Program is outlined below.

Activities

- Participating in the development/analysis of provincial insurance plans

- Processing provincial financial claims

Outputs

- Agreements for insurance plans

- Payments to provinces (funding for producers to have effective insurance protection)

- Producer claims processed by the province within a turnaround time of 30 calendar days.

Immediate outcomes

- Producers have access to individualized crop protection from natural hazards to reduce the financial impact of production or asset losses.

Intermediate outcomes

- Stabilizes a producer's income by minimizing the economic effects of production losses caused by natural hazards.

Ultimate outcomes

BRM suite ultimate outcomes:

- The agricultural sector is financially resilient

- Producers see value in the BRM suite in managing their business risks

- Cost effective programming

- Industry is able to better manage business risks and remain viable in the long-term

Source: Program Information Profile for the AgriInsurance Program

Annex C: Efficiency and performance metrics summary

Summary of efficiency metrics (overall 2017-18 to 2021-22)

| Efficiency metric | Value | Target | Summary |

|---|---|---|---|

| Administrative Efficiency | 7.4% | n/a | n/a |

| Administrative cost as percent of premiums collected | 7.9% | 12.0% | Met |

| Administrative cost as percent of Coverage | 0.6% | 2.0% | Met |

| Change in administrative cost per contract to change to inflation | 1.4% | 2.2% | Met |

| Source: Program administrative and financial data | |||

Summary of performance metrics

| Efficiency metric | Value | Target | Summary |

|---|---|---|---|

| Percent of the value of non-forage and pasture covered by AgriInsurance | 73.4% (2018-19) |

75.0% | Unmet |

| Percent of the value of forage and pasture covered by AgriInsurance | 23.0% (2018-19) |

20.0% | Met |

| Percent of payments processed in 30 days | 83.0% (2018-19) |

90.0% | Unmet |

| Farm's net operating income compared to previous 5-year average | 91.0% (2018-19) |

85.0% | Met |

| Percent of farm's net operating income coming from BRM program payments | 14.0% (2018-19) |

25.0% | Met |

| Percent of farms that are financially healthy | 92.0% (2021-22) |

90.0% | Met |

| Source: Program administrative and financial data | |||