On this page

Executive summary

Agriculture and Agri-Food Canada (AAFC) delivers grants and contribution programs to fulfill its strategic objectives related to farm income stabilization, market access improvement, environmental protection, innovation and research and to address food insecurity. For contribution programs, applications are assessed by the Department to ensure that only eligible recipients and projects are funded, within program terms and conditions, to support the achievement of program objectives and sound stewardship of program funds.

The Audit of Application Assessment for Contribution Programs was included in the 2021-22 Office of Audit and Evaluation Plan due to high materiality and risk of approving recipients that did not align to program Terms and Conditions. The audit objective was to determine whether adequate and effective controls were in place to support application assessment for AAFC contribution programs.

The audit examined whether program oversight and monitoring on program application assessment activities were in compliance with Treasury Board and AAFC policies and guidance. The audit also examined whether funding decisions were made in accordance with program terms and conditions, and whether assessments were appropriately documented.

Overall, the audit found that AAFC had adequate and effective controls in place to support application assessment for contribution programs and that funding decisions were made in accordance with program terms and conditions. However, gaps were noted in contribution programs application assessment activities that should be addressed by:

- Implementing a Management Control Framework for non-Business Risk Management programs to ensure alignment of AAFC's grants and contributions programs with policy requirements.

- Documenting the due diligence work performed for technical review and stacking verification.

1.0 Introduction

1.1 Risk context and audit objective

Agriculture and Agri-Food Canada (AAFC) delivers grants and contribution programs to fulfill its strategic objectives related to farm income stabilization, market access improvement, environmental protection, innovation and research and to address food insecurity. AAFC spent almost $3.2 billion (78.2% of total expenses) in 2020–21 and almost $1.8 billion (67.8% of total expenses) in 2019–20 on these programs.

Programs at AAFC fall into two categories:

- Statutory programs: Programs are mandatory as they are named in acts of Parliament, such as Business Risk Management (BRM) programs. BRM programs provide producers with support to manage infrequent and severe risks beyond their capacity to control that impact the financial viability of their farming operations.

- Voted programs: Programs require Cabinet and Treasury Board approval and include provincial/territorial delivered cost-shared programs (funded by AAFC and provinces/territories) and federally delivered programs.

At AAFC, federally delivered programs that are outside the suite of BRM programs are known as non-BRM contribution programs. The program lifecycle includes eight stages (see Figure 1).

Figure 1 Program Lifecycle

-

Description of the above image

The steps of the program lifecycle are

- Arrange

- Advertise

- Apply

- Assess

- Award

- Administer

- Audit

- Acquit

To support the achievement of program objectives and demonstrate sound stewardship of program funds, the application assessment phase of the program lifecycle should be fair and transparent to ensure that only eligible recipients and projects are funded within program terms and conditions.

The audit was included in the 2021-22 Office of Audit and Evaluation Plan and focused on the application assessment phase of the program lifecycle due to high materiality and risk of approving recipients that did not align to program Terms and Conditions. The audit objective was to determine whether adequate and effective controls were in place to support application assessment for AAFC contribution programs.

The audit assessed the following areas:

- Program oversight and monitoring: Whether management monitored program application assessment activities for compliance with Treasury Board and AAFC policies and guidance.

- Funding decisions: Whether programs made funding decisions in accordance with program terms and conditions and appropriately documented their assessments.

To provide horizontal insights into the application assessment process, multiple contribution programs were selected for assessment during the audit. The following five non-BRM contribution programs were selected to include a mix of program sizes (small, medium and large), Programs Branch directorates and program complexity:

Table 1. Programs Selected for the Audit

| Program directorate | Selected program(s) |

|---|---|

| Business Development and Competitiveness Directorate |

|

| Innovation Program Directorate |

|

| Service and Program Excellence Directorate |

|

The audit did not assess the following program areas as they had unique delivery structures that were not easily comparable, had pre-determined eligibility criteria or were considered lower risk:

- Statutory programs, including BRM programs

- COVID-19 programs

- Cost-shared programs

- Grant programs

The audit team gathered evidence through various methods including interviews with AAFC management and employees, performed analysis of application assessment documentation and data and reviewed a sample of program applications. In addition, the audit team took into consideration the impact of the changes to the work environment and processes as a result of the COVID-19 pandemic.

More details about the audit objective, scope, criteria and approach are in Annex A: About the Audit.

1.2 Overview of application assessment for contribution programs

Contribution programs are governed by the Treasury Board Policy on Transfer Payments and the supporting Directive on Transfer Payments. Under the policy, programs must be designed and delivered to address government priorities in achieving results for Canadians; managed with integrity, transparency and accountability in a manner that is sensitive to risks; and citizen- and recipient-focused.

Within AAFC, Programs Branch's Service and Program Excellence Directorate is the focal point for grants and contributions programming stewardship and modernization and carries out the:

- Day to day program support services,

- Development of program policies, standard tools, forms and processes; and

- Development and delivery of grants and contributions training and communication.

Three directorates within Programs Branch are responsible to deliver non-BRM contribution programs:

- Business Development and Competitiveness Directorate

- Innovation Programs Directorate

- Service and Program Excellence Directorate

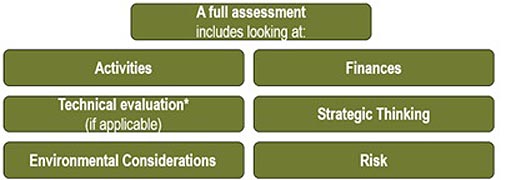

The assessment process for applications is performed by program staff and reviewed and approved by program managers and directors, to determine whether applications submitted are complete, meet eligibility criteria for the program and whether the project is well developed and feasible. The process is detailed in Figure 2 below.

Figure 2 Application assessment process

-

Description of the above image

A full assessment includes assessing the project for the following:

- Project activities

- Financial capacity and viability

- Technical feasibility and capacity

- Strategic alignment with program objectives

- Environmental considerations

- Project risks

Once the assessment is complete, the project goes to a Director General level committee for review and recommendation for approval or rejection to the delegated authority.

2.0 Observations

The following sections present the audit observations organized by the audit's two areas of focus:

- Program oversight and monitoring; and

- Funding decisions

Recommendations for improvement are provided after the observations. Management responded to each recommendation and provided:

- An action plan

- A lead responsible for implementation of the action plan and

- A target date for completion

2.1 . Program oversight and monitoring

The Treasury Board Policy on Transfer Payments requires management to monitor compliance with the policy and its supporting directive to ensure effective implementation and expects that transfer payment programs are supported by cost-effective oversight and control systems.

Effective program oversight and monitoring are essential to oversee and direct a department's implementation and delivery of programs, including whether the application assessment activities support sound stewardship of program funds by ensuring that only eligible recipients and projects are funded, within the terms and conditions of the program, to support the achievement of program objectives.

The audit expected that a framework was in place to ensure program activities were conducted in compliance with Treasury Board and AAFC policies and guidance, with regular communication with senior management to support their oversight role. The framework should outline:

- Management's role in decision-making and oversight of programs,

- A minimum set of controls that are expected to be in place; and

- Monitoring activities for both programs and Programs Branch.

2.1.1 Management control framework

Audit criteria: The audit examined whether management monitored program application assessment activities for compliance with Treasury Board and AAFC policies and guidance.

What the audit found: Gaps were observed at the branch level on the implementation and ongoing monitoring of program controls for application assessment activities to support senior management's oversight role for ensuring program compliance with policy requirements.

Program level

Based on the Programs Branch Grants and Contributions Program Operations Guide, Program management is responsible for establishing program guidance and managing program implementation.

For the five programs included in the audit, the audit observed guidance and tools established to guide application assessment for program staff and approval process. It was further observed that programs conducted monitoring in areas such as application status, service standards and program funding. In addition, program funding, for example, current spending and forecasted lapse / deficit, was regularly provided to the branch level Program Service Excellence Working Group.

For four out of five programs included in the audit,Footnote1 program Director General committees such as Director General Innovation Committee and Director General Project Review Committee were in place to provide project level oversight. Meeting records noted that the committees were focused on reviewing projects and recommending them for approval or rejection to the delegated authority.

While programs had controls in place, there was no program level assessment on compliance with the Treasury Board Policy on Transfer Payments that was reported to the branch level.

Branch level

In 2015, the Programs Branch developed the non-BRM Programs Management Control Framework to manage programs using a risk-based approach, in accordance with legislative requirements from the Federal Accountability Act and Policy on Transfer Payments. The framework was intended to be a corporate governance tool for AAFC to verify whether controls were in place for the eight phases of a grants and contributions program lifecycle to mitigate risks and to respect government-wide policy requirements. The framework was not approved or implemented.

Without an approved and implemented management control framework, Programs Branch had not defined the minimum controls that were expected to be in place for programs. The audit team was advised that the branch was updating the framework and planned to implement it in Fall 2022. A review of the draft framework by the audit team noted gaps in the planned control activities and the roles and responsibilities for monitoring program control implementation to ensure compliance across programs on an ongoing basis and reporting to senior management.

While Programs Branch regularly monitored program financials through updates to the Program Service Excellence Working Group and monitored projects approvals by providing updates to both the Deputy Minister Office and Minister's office, the audit found that oversight had not been established for monitoring the implementation of program controls, ongoing compliance and reporting to senior management throughout the length of a program.

Departmental level

At the departmental level, AAFC has various committees with oversight responsibilities.

The Director General Management Committee and Departmental Management Committee have an oversight role in financial management, including program spending. The audit observed that Financial Status Reports were regularly presented and discussed.

The Director General Policy and Program Management Committee and Policy and Program Management Committee have oversight responsibilities in the design and implementation of AAFC's grants and contributions programs and in ensuring they are consistent with Government of Canada policy requirements and expectations.

Review of the committees' records of discussion noted that the committees did not receive reporting on overall program implementation and policy compliance. The audit team observed that strategic discussions took place for topics such as the direction and priorities for the next policy framework, that is, the 2023-2028 Sustainable Canadian Agricultural Partnership. Occasionally, individual programs presented to the committees when challenges were being experienced and direction was being sought from senior management. In addition, Program Evaluations were presented to the Policy and Program Management Committee on a regular basis.

Without an implemented Management Control Framework, regular monitoring and reporting on program control implementation, potential control gaps in programs may persist and risks may not be mitigated.

Recommendation 1: Management Control Framework

The Assistant Deputy Minster, Programs Branch, should implement a non-BRM Management Control Framework that includes responsibility within Programs Branch for monitoring implementation and communication to senior management on the alignment of AAFC's grants and contributions programs with policy requirements.

Management Response and Action Plan

Agreed. The Assistant Deputy Minister, Programs Branch, recognizes that a non-BRM Management Control Framework is required for the on-going governance of Grants and Contributions (Gs&Cs) programs. PB will finalize and implement a Framework this fall, which will include risk mitigations to ensure:

- Compliance with legislation, regulations, policies and delegated authorities;

- Ownership and accountability, including responsibilities of Programs officials;

- Consistent monitoring and oversight of Gs&Cs programming;

- Effectiveness and efficiency of programs, operations, and resources management; and

- Reliability of financial reporting.

The implementation of the non-BRM Management Control Framework is a branch priority, and each DG will be reminded of their accountability in its implementation and ongoing monitoring.

Lead responsible: Assistant Deputy Minister, Programs Branch

Target date for completion: January 1, 2023

2.2 Funding decisions

A component of the Treasury Board Policy on Transfer Payments (2022) objective is to ensure that transfer payment programs are managed with integrity and transparency. The policy requires that departmental processes and procedures are in place to support the design, delivery and management of transfer payments.

Application assessment processes are essential to ensure that only eligible recipients and projects are funded, within program terms and conditions, to support the achievement of program outcomes. Funding decisions should be fair, transparent and project files should fully document the due diligence work conducted to reach the decision.

To decide to approve or reject an application, Program staff assess the project for the following:

- Activities — linkages and eligibility to program terms and conditions.

- Financial — project reasonableness and financial standing of the applicant.

- Technical- technical feasibility and capacity.

- Strategic — alignment with the program's strategic objectives and outcomes.

- Risks — potential impacts to success and associated mitigation strategies.

- Environmental — potential impacts and effects on federal lands or if it is subject to Impact Assessment Act.

Once the assessment is complete, the program staff prepare a Project Recommendation Form to capture the due diligence results and make the program's recommendation to approve or reject an application. The form is the primary document to be reviewed by funding decision makers for project approval or rejection and goes to the director general level committee for review and recommendation for approval or rejection.

For the four out of five programs included in the audit that use Director General level committee(s) to review projects and recommend them for approval or rejection to the delegated signing authority, the committees are:

- Director General Project Review Committee:

- AgriCompetitiveness

- AgriDiversity

- Director General Innovation Committee:

- Agricultural Clean Technology: Adoption Stream

- Agricultural Clean Technology: Research and Innovation Stream

- Director General Indigenous Initiatives Committee:

- AgriDiversity

2.2.1 Due diligence

Audit criteria: The audit examined whether programs made funding decisions in accordance with program terms and conditions and appropriately documented their assessments.

What the audit found: Funding decisions were made in accordance with program terms and conditions with the due diligence documentation generally well done. However, the full breadth of activities performed for technical reviews and verifying stacking limits was not always documented.

The audit observed that the five programs included in the audit had developed guides and tools to outline the steps for application assessment to support program staff. The guides and tools were aligned with program terms and conditions.

The audit observed that programs had made positive process changes to tailor the assessment of both project and recipient financials. Examples included

- Both streams of Agricultural Clean Technology used the directorate's Financial Analysis Unit to assess whether the applicant had the financial capacity to complete the project as presented and whether the applicant was financially viable.

- AgriCompetitiveness, AgriDiversity and Poultry and Egg On-Farm Program used the simplified funding table tool which helped to clearly identify the eligibility of activities/costs for projects.

Technical review

Programs use technical reviews to assess the project feasibility and the applicant's technical capacity to complete the project, as part of the application assessment.

In most programs, technical review is performed by employees in other branches or from other government departments who have specific expertise. Four out of five programs included in the audit use technical reviews: AgriCompetitiveness, AgriDiversity, Agricultural Clean Technology: Adoption Stream and Agricultural Clean Technology: Research and Innovation Stream.

Depending on the focus of the proposed project, multiple reviews are conducted, and each reviewer provides an assessment of the proposal and a recommendation on whether to approve or reject funding. Program staff review the technical review results and incorporate into the Project Recommendation Forms to be reviewed by those making funding decisions.

Overall, the audit observed improvements had been made under the Canadian Agricultural Partnership as compared to Growing Forward 2 to the technical review process, with technical questions now tailored to the expertise of individual branches conducting the reviews and improved response rates.

The audit team reviewed a sample of approved and/or rejected files from the five programs included in the audit. For the technical review forms reviewed, the majority of program files sufficiently documented how concerns raised in the technical reviews were addressed by the program officer, however other program files did not always summarize concerns into the Project Recommendation Form used for decision-making or otherwise note how concerns were resolve in the file documentation. Improvement is required in appropriately documenting the concerns raised in technical reviews.

Verifying stacking limits

A project's stacking limit is the maximum level of total Canadian government funding authorized by the terms and conditions for a transfer payment program for any one activity, initiative or project. The Treasury Board Directive on Transfer Payments (2022) requires that program management ensures the amount of funding provided to a recipient does not cause the established stacking limit to be exceeded.

The Project Recommendation Form required program staff to calculate and note the percentage of funding of eligible costs from all government sources (stacking). However, Programs Branch and program guidance and process documents for four out five programs, included in the audit, did not include steps on the sources that should be checked to identify other government funding during application assessment or during the award stage.

The Poultry and Egg On-Farm Investment Program had developed a risk-based approach for the verification of an applicant's funding history with AAFC programs and requires verification for projects at or above $500,000. Program guidance outlined the steps to be taken by program staff to conduct the verification.

The audit found that declarations of applicants funding were accepted as provided by applicants and there were no formal checks required to verify the declaration. Any informal checks conducted were not consistently documented.

Both directorates, the Business Development and Competitiveness Directorate and the Innovation Programs Directorate, have unique and distinct databases for their respective programs that include projects completed/closed and being assessed. For the Agricultural Clean Technology: Research and Innovation Stream's sampled files, evidence was on file to demonstrate that the directorate's database was checked for the applicant's history. However, for the remaining programs in these directorates included in the audit, evidence was not on file to demonstrate whether the directorate's database was checked for the sampled files reviewed by the audit.

AAFC's Contribution Agreement Registry and the Open Government Disclosure of Federal Grants and Contributions are sources available to independently verify potential stacking of program funding for projects. For the sampled files reviewed, documentation did not demonstrate whether sources such as these were checked.

During the conduct of the audit, Programs Branch updated their guidance documentation to reflect the stacking verification steps that should be conducted by program staff. The new guidance requires program staff to check easily accessible sources of information such as AAFC's Contribution Agreement Registry and Open Government Disclosure of Federal Grants and Contributions for funding received by the applicant. Programs will need to reflect these changes in their program guidance, tools and future application assessments.

In addition to the gap noted above, both Programs Branch's Internal Risk Management Controls Review (2021) and the Office of Audit and Evaluation's Fraud Risk Assessment (2022) identified control gaps that could lead to programs approving double dipping or over-contributions for projects.

Documentation is necessary to demonstrate sound stewardship. Without consistent and complete documenting of the due diligence conducted, program files may not provide a strong audit trail in the event of questions on the funding decisions.

Recommendation 2: Due diligence

The Assistant Deputy Minster, Programs Branch, should update guidance to ensure that due diligence work performed for technical review and stacking verification is appropriately documented.

Management response and action plan

Agreed. The Assistant Deputy Minister, Programs Branch, recognizes that while project files may not always be clearly documented, project assessments are thorough, ensuring due diligence as part of the review and assessment process of every application.

To ensure that due diligence activities are completed and appropriately documented within the project file, PB will update Guidance, including the Gs&Cs Operations Guide (Chapter 5 — Assess), Training modules (Module 2 — Apply and Assess) and Tools (Assessment Checklist) this fall.

Due diligence and the responsibilities of Program Delivery Staff will be reinforced as a priority by Managers on an ongoing basis through team meetings and communications, and by conducting random project file review.

These activities will ensure that due diligence work performed for technical review and stacking verification is appropriately documented for each file.

Lead responsible: Assistant Deputy Minister, Programs Branch

Target date for completion: November 1, 2022

3.0 Conclusion

The audit concluded that adequate and effective controls were in place to support application assessment for contribution programs and that funding decisions were made in accordance with program terms and conditions.

Gaps were noted in contribution programs application assessment activities that should be addressed by:

- Implementing a non-BRM Management Control Framework that includes responsibility within Programs Branch for monitoring implementation and communication to senior management on the alignment of AAFC's grants and contributions programs with policy requirements.

- Documenting the due diligence work performed for technical review and stacking verification.

Annex A: About the audit

Statement of conformance

The audit conformed to the Institute of Internal Auditors' International Professional Practices Framework, as supported by the results of AAFC's 2020 internal audit quality assurance and improvement program. Sufficient and appropriate evidence was gathered in accordance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing to provide a reasonable level of assurance over the findings and conclusion in this report. The findings and conclusion expressed in this report are based on conditions as they existed at the time of the audit and apply only to the areas included in the audit scope.

Audit objective

To determine whether adequate and effective controls were in place to support application assessment for AAFC contribution programs.

Audit scope

This audit was focused on application assessment activities, which included the assessment of recipient eligibility, capacity, expected results to Canada and approval or rejection of funding, in accordance with each program's terms and conditions.

Programs selected

The following five non-BRM contribution programs were selected for assessment during the audit to include a mix of program sizes (small, medium and large), Programs Branch directorates and program complexity:

| Program directorate | Selected program(s) |

|---|---|

| Business Development and Competitiveness Directorate |

|

| Innovation Program Directorate |

|

| Service and Program Excellence Directorate |

|

Audit criteria

The following criteria were developed to ensure sufficient and appropriate evidence was collected and examined to support the audit conclusion:

- Program oversight and monitoring: Program application assessment activities are monitored to ensure they are conducted in accordance with Treasury Board and AAFC policies and guidance.

- Funding decisions: Funding decisions are made in accordance with program terms and conditions and are appropriately documented.

The audit excluded areas recently assessed or planned to be assessed:

- Grants and Contributions Digital Platform: Audited in the 2019 covering the project planning phase.

- Claims processing: To be audited in 2022–23 as part of the Office of Audit and Evaluation's annual risk-based plan.

Period covered by the audit

To assess current application assessment processes and practices, the audit focused on the period from July 2020 to July 2022 to ensure the most recent application intake periods were covered for the five selected programs. Given this timeframe, the audit took into consideration the impact of the changes to the work environment and processes as a result of the COVID-19 pandemic.

The audit also looked at relevant decisions and activities since the start of each program (for example, April 1, 2018, for the Canadian Agricultural Partnership programs) to gain a more complete understanding of the subject matter of the audit.

Audit approach

The audit approach was risk-based and consistent with the Institute of Internal Auditors' International Professional Practices Framework. These standards require that the audit be planned and performed in such a way as to conclude against the audit objective. The audit was conducted in accordance with an audit program, which defined audit tasks to be performed to obtain and examine sufficient and appropriate evidence to assess each audit criterion.

The audit team conducted the following work to complete the engagement:

- Review of documents, such as application forms and supporting documents, technical reviews, recommendation forms, committee materials and procedures and processes.

- Interviews with AAFC management and employees involved in the management and implementation of the application assessment processes.

- Review of a judgmental sample of contribution program applications.

- Comparison of program processes to identify opportunities to improve efficiency.