Departmental Audit Committee

December 12, 2019

Executive summary

The Audit of the Revenue Control Framework was included in the 2019–20 Integrated Audit and Evaluation Plan due to the risk that decentralization of revenue generation and management in various branches and locations across Canada may hamper the Department's ability to collect and monitor revenues.

The objective of this audit was to provide assurance that Agriculture and Agri-Food Canada's (AAFC) control framework for revenues was adequate and functioning as intended. The audit focused on the revenues generated from the sales of goods and services (in other words, royalties, rentals, and sales of surplus goods) and disposal of capital assets.

The Treasury Board Policy on Financial Management expects that financial resources of the Government of Canada are well managed, through establishing effective controls and oversight over financial management. To this end, the audit examined whether policies in support of revenue management were in place and supported by processes and staff training. The audit also examined whether controls were in place and operating effectively for revenue management to support compliance with applicable acts and policies.

Overall, the audit found that AAFC had an adequate revenue control framework in place, however, there was ineffective implementation of controls in certain areas. Implementation of the revenue control framework could be improved by

- reviewing and improving the Trade Accounts Receivable Process for royalty license and rental agreements to ensure that the information in AAFC's financial and accounting system is complete and accurate and that revenues owed are invoiced and received

- providing ongoing training to Local Financial Officers and their managers to improve their understanding of roles and responsibilities in the trade accounts receivable process;

- ensuring appropriate approval of sales of surplus goods and reviewing and confirming segregation of duties or alternative controls in processing money receipts; and

- exploring options and implementing a solution to provide additional assurance that the department is receiving the royalties it is owed, including considering whether to conduct royalty audits.

Several strong practices were noted:

- AAFC had appropriate documented policies and processes for revenue management with clearly defined roles and responsibilities;

- payments were deposited on a timely basis; and

- the Office of Intellectual Property and Commercialization initiated additional trend analysis to improve monitoring and following up on potentially overdue royalty payments.

1.0 Introduction

1.1 About the audit

- 1.1.1 The Audit of the Revenue Control Framework was included in the Office of Audit and Evaluation's 2019–20 Integrated Audit and Evaluation Plan due to the risk that decentralization of revenue generation and management in various branches and locations across Canada may hamper the department's ability to collect and monitor revenues.

- 1.1.2 Based on the risk context, the objective of this audit was to provide assurance that Agriculture and Agri-Food Canada's (AAFC) control framework for revenues was adequate and functioning as intended.

- 1.1.3 In the planning phase, the audit performed an initial scoping assessment of all AAFC revenue types. The audit determined that the engagement would focus on the revenues generated from:

- sales of goods and services:

- royalties from license agreements;

- rentals; and

- sales of surplus goods (such as grains, cattle and dairy).

- disposal of capital assets

The revenue types and sources included in the audit scope were considered to be higher risk due to the decentralized management of these revenues.

- sales of goods and services:

- 1.1.4 The Treasury Board Policy on Financial Management expects that financial resources of the Government of Canada are well managed, by establishing effective controls and oversight over financial management. To this end, the audit examined the Department's revenues to determine whether policies in support of revenue management were in place and supported by processes and staff training. The audit also examined whether controls were in place and operating effectively for revenue management to support compliance with applicable acts and policies.

- 1.1.5 The audit team gathered evidence through various methods: interviewed 47 key stakeholders from different branches, completed site visits to four research centres, performed analysis of documentation, and reviewed a judgmental sample of 96 revenue transactions (and associated agreements, where applicable).

- 1.1.6 The audit did not assess revenues generated from collaborative research and development agreements, fees charged for providing internal services, interest, the Community Pasture Program, the Canadian Pari-Mutuel Agency, the Crop Reinsurance Fund, and Business Risk Management administration fees. Details about the audit objective, scope, criteria, and approach are in the About the Audit section at the end of the report.

1.2 Overview of revenue management at AAFC

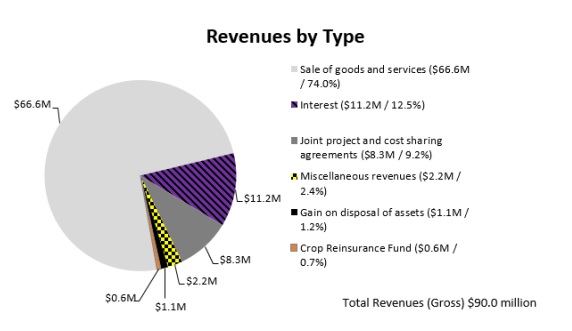

- 1.2.1 The department generates revenues from various activities, such as programs, goods, and services across Canada (see Exhibit 1). AAFC's revenue types and amounts have remained relatively stable over the last several years: revenues ranged from $90- to $104-million per year from 2015-16 to 2018-19. AAFC revenues were approximately $90 million for the year ending March 31, 2019.

Exhibit 1. 2018-19 AAFC Revenues

Source: 2018–19 AAFC Departmental Results Report

Description of above image

AAFC generated total revenues (gross) of $90-million in the fiscal year 2018-19, from the following revenue types:

- Sale of goods and services ($66.6-million / 74.0%)

- Interest ($11.2-million / 12.5%)

- Joint project and cost sharing agreements ($8.3-million / 9.2%)

- Miscellaneous revenues ($2.2-million / 2.4%)

- Gain on disposal of assets ($1.1-million / 1.2%)

- Crop Reinsurance Fund ($0.6-million / 0.7%)

- 1.2.2 AAFC generated revenues primarily from the sale of goods and services, which included revenues earned from license agreements for plant varieties and technology, renting or leasing out spare offices and land, sales of surplus goods, collaborative research and development agreements, fees charged for providing internal services to other government departments, the Community Pasture Program, the Canadian Pari-Mutuel Agency, and Business Risk Management administration fees. Revenues from sale of goods and services and collaborative agreements accounted for 86.5% of total revenues.

- 1.2.3 The Department may receive revenues at any one of its locations across the country, including three service centres and 20 research and development centres across Canada, or at its head office in the National Capital Region. The Corporate Management Branch's Integrated Services Management provides financial, administrative, materiel management, and other facilities-related services to the sites outside of head office. Revenue monitoring is a shared responsibility of the Corporate Management Branch's Accounts Receivable and Revenue Management unit in head office and the Integrated Services Management, with support from the Science and Technology Branch. The revenues in scope were managed by Integrated Services Management's Local Financial Officers.

2.0 Detailed observations, recommendations and management responses

The following sections present the key audit observations. Recommendations for improvement are provided after the detailed observations. Management responded to each recommendation and provided

- an action plan to address each recommendation

- a lead responsible for implementation of the action plan

- a target date for completion of the implementation of the action plan.

2.1 Policies and processes

- 2.1.1 The Treasury Board Policy on Financial Management requires departments to have effective oversight and controls over financial management to ensure that financial resources are well managed. Also, in accordance with the Treasury Board Management Accountability Framework, financial management policies and authorities should be appropriately designed to mitigate financial risks and communicated to help ensure that financial resources are well managed and accountable.

- 2.1.2. Audit criteria: The audit expected to find that Agriculture and Agri-food Canada (AAFC) had established revenue management policies and processes that were consistent with Treasury Board policy requirements.

- 2.1.3 What the audit found: The audit found that AAFC has established policies and processes for revenue management that are consistent with current Treasury Board policy requirements. However, they were not always followed.

- 2.1.4 AAFC has documented policies and processes for revenue management. AAFC's policies provide general guidance on revenue management at the Department. AAFC's processes, in particular the Trade Accounts Receivable Process, outline detailed processes to be followed to invoice, receive, and record revenues. AAFC's Trade Accounts Receivable Process establishes standard processes for revenue management across Canada, including conducting credit evaluation, establishing sales contracts in the financial management and accounting system (in other words, systems, applications, and products: SAP), billing, processing payments, and collection. This process document also defines the roles and responsibilities of Local Financial Officers and the Accounts Receivable and Revenue Management unit. The policies and processes were available to all staff on the Intranet (AgriSource).

- 2.1.5 The Department uses the SAP information system to record financial transactions, including revenues. SAP is the Department's official system of records for financial management and reporting.

Managing revenues

- 2.1.6 AAFC's Trade Accounts Receivable Process requires Local Financial Officers to ensure revenues are invoiced in a timely manner and accurately recorded in SAP. To this end, Local Financial Officers are expected to correctly record contract types, billing plans, action dates, sales orders, and general ledger coding.

- 2.1.7 The audit examined a sample of 96 revenue transactions (and associated agreements, where applicable), 24 from each revenue source included in the scope for the fiscal year 2018-19, to assess whether Local Financial Officers followed AAFC's process. The sampled transactions represented $1,116,174 or 8% of the $13,922,970 revenues in scope for 2018-19. See About the audit for more details. The audit found that Local Financial Officers recorded the payments for royalties, rentals, sales of surplus goods, and the disposal of capital assets in the correct general ledgers in SAP. However, license and rental agreements were not always entered accurately. There were several examples of non-compliance with AAFC's Trade Accounts Receivable Process, as shown in Table 1.

| Sampling result | Background | Impact |

|---|---|---|

|

The contract type was incorrectly recorded to a different contract type for:

|

There are a number of contract types in SAP, and depending on which one is selected, there are different subsequent inputs required, as outlined in AAFC's Trade Accounts Receivable Process. | If a contract type and related inputs are entered incorrectly in SAP, it may result in certain required actions not being taken (see next sampling result sections on billing plans, action dates, and sales orders). |

|

Billing plans were not established in SAP or, if included, the billing dates did not align with agreements for:

|

Billing plans and action dates are to be entered in SAP according to AAFC's Trade Accounts Receivable Process. These help to identify activities that need to be taken over the term of the agreement. A billing plan lists payment due dates, while an action date represents the date on which the next action should be taken based on the agreement provisions (for example, send sales order or invoice to customer). Both serve as reminders for upcoming payments due. |

Without accurate billing plans and action dates input into SAP, Local Financial Officers may not be aware of upcoming payments due, and in turn, may not issue sales orders or invoices to request payments from customers, which could result in late or no payments. It also limits the ability of the Accounts Receivable and Revenue Management unit to determine whether collection actions are required. |

|

Action dates did not align with agreements for:

|

||

|

Sales orders were not issued to customers for

Sales orders were not required for rental agreements. |

In accordance with AAFC's Trade Accounts Receivable Process, sales orders are to be sent to remind customers of upcoming royalty payments due. Royalty payments are based on a percentage of sales. |

Monitoring revenues

- 2.1.8 AAFC's Trade Accounts Receivable Process requires the Accounts Receivable and Revenue Management unit to establish a monitoring mechanism to ensure that processes and procedures are applied consistently and that revenue management controls are effective.

- 2.1.9 The audit confirmed that the Accounts Receivable and Revenue Management unit conducted revenue monitoring activities, including the following:

- Reviewing past due contract action dates on a quarterly basis; and

- Examining open sales orders (more than 150 days) on a quarterly basis.

- 2.1.10 Monitoring relies on the information in SAP. When the information is incomplete or inaccurate (as shown in Table 1), monitoring performed by the Accounts Receivable and Revenue Management unit is impeded. For example,

- While there was monitoring to identify past due action dates, it was not possible to check for incorrect action dates, as the unit did not have access to the sales agreements. In these instances, reminders may not have been actioned for the required dates (for example, to invoice customers); and

- Although there was monitoring to identify sales orders that were open more than 150 days, it was not possible to monitor sales orders when the information was not recorded in SAP, which was the case for 7/24 (29%) of the sampled license agreements. In these cases, the department may not receive the payments it is owed.

- 2.1.11 Without complete and accurate information in the financial system, the Department may not have the information necessary to ensure that it is receiving the revenues it is owed.

Recommendation 1 – Improve the trade accounts receivable process for royalty license and rental agreements

The Assistant Deputy Minister (ADM), Corporate Management Branch (CMB) should review and improve the Trade Accounts Receivable Process for royalty license and rental agreements to ensure that SAP information is complete and accurate and that revenues owed are invoiced and received.

Management response and action plan

Agreed. The Finance and Resource Management Services (FRMS) Directorate will collaborate closely with Integrated Services (IS) Local Financial Officers (LFOs) by implementing the following action plan:

- Provide ongoing monthly (short-term, starting in January, 2020) and quarterly (long-term) training sessions for all LFOs to discuss their questions and educate them on the negative implications of incomplete, inaccurate and untimely SAP agreement information and communicate expectations for input;

- Collaborate with IS's LFOs to ensure front-end controls are in place for complete and accurate SAP agreement information by:

- Ensuring issues identified during the monitoring process are actioned by LFOs within 10 business days and reporting any delays to the Director General – Integrated Services (DG-IS) to take action; and

- Ensuring an appropriate authority conducts quarterly quality control reviews of random agreements and reporting the results to the DG-IS to take any necessary action.

- Investigate the feasibility of centralizing certain revenue generation functions/activities.

Lead(s) responsible: ADM CMB, DG ISM, and DG FRMS

Target date for completion: June 30, 2020

2.2 Training

- 2.2.1 The Treasury Board Policy on Financial Management requires senior departmental managers to ensure individuals responsible for financial management are aware of their financial management responsibilities and have the necessary training to carry them out. Also, at AAFC, all users are required to take mandatory SAP training before obtaining access to specific modules in the system.

- 2.2.2 Audit criteria: The audit expected that Local Financial Officers were provided with training and support to fulfil their roles and responsibilities in revenue management.

- 2.2.3 What the audit found: The audit found that Local Financial Officers received the initial mandatory SAP training but then did not receive ongoing training on the Trade Accounts Receivable Process to support them in carrying out their duties.

- 2.2.4 Local Financial Officers were provided with mandatory SAP training before obtaining access to specific modules of the system. The transactions included in the sample were recorded in SAP accounting module or sales and distribution module. The 33 Local Financial Officers who processed the transactions included in the sample had all completed the mandatory training for specific SAP modules.

- 2.2.5 The Office of Intellectual Property and Commercialization and several Local Financial Officers interviewed indicated that additional training on the Trade Accounts Receivable Process would be beneficial to help them fulfil their roles and responsibilities in revenue management. The audit found a number of examples (see Table 1) where Local Financial Officers had entered information into SAP incorrectly, which indicated a need for additional training.

- 2.2.6 Without ongoing training on the Trade Accounts Receivable Process, Local Financial Officers may not record complete or accurate royalty and rental agreement information in SAP. In turn, this may limit the Department's ability to ensure revenues owed are invoiced and collected on a timely basis as well as the ability of the Accounts Receivable and Revenue Management unit to effectively monitor revenues owed and to determine whether collection actions are required and affect AAFC's financial reporting.

Recommendation 2 – Improve training

- The Assistant Deputy Minister, Corporate Management Branch should ensure that ongoing training on the Trade Accounts Receivable Process is provided to Local Financial Officers and Integrated Services Managers to fulfill their roles and responsibilities.

Management response and action plan

Agreed

Refer to the Management Response and Action Plan for Recommendation #1. Training would be starting in January 2020.

Lead(s) responsible: ADM CMB, DG ISM, and DG FRMS

Target date for completion: January 31, 2020

2.3 Approving sales by appropriate authority

- 2.3.1 Signing authorities must be exercised in accordance with AAFC's delegation of authorities. AAFC's Departmental Application of Delegated Spending and Financial Signing Authorities gives Integrated Services Management the authority to approve the disposal of assets under the Surplus Crown Assets Act, including the sales of research by-products (for example, grains, cattle, and dairy).

- 2.3.2 Audit criteria: The audit expected sale arrangements to be approved by the appropriate authority. The audit assessed whether the sampled sale arrangements were approved in accordance with AAFC's Departmental Application of Delegated Spending and Financial Signing Authorities.

- 2.3.3 What the audit found: Sale arrangements for license agreements, rentals and disposal of capital assets were approved by the appropriate authority. For the sampled sales of surplus goods, a majority were found to be non-compliant with AAFC's delegated signing authority:

- 19/24 (79%) of the sampled sales of surplus goods were not signed off by the appropriate authority (Corporate Management Branch, Integrated Services Management); and

- in these 19 transactions,

- 15/19 (79%) had no record of approval on file; and

- 4/19 (21%) were signed off by officials who did not have the delegated authority.

- 2.3.4 The majority of Integrated Services Managers and Local Financial Officers interviewed indicated that they were not aware of approval requirements for the sales of surplus goods, suggesting a need for improved communication and training.

- 2.3.5 The lack of appropriate approval of sales may increase the risk of goods being sold through a non-arm's length transaction, or at either below market value, or not receiving payments.

2.4 Processing payment

- 2.4.1 The Receipt and Deposit of Public Money Regulations require that public money must be deposited to the Receiver General: without delay for money received electronically; daily for money received by other than electronic means; or if it is not cost effective to do so, then weekly. Both the Treasury Board Directive on Public Money and Receivables and AAFC's Policy on Receipts and Accounts Receivable require segregation of duties to be implemented for employees who have responsibilities for receipts, deposits, and recording of public money. These requirements ensure public money received is safeguarded, promptly deposited, and recorded accurately. The Treasury Board Directive also notes that if the organizational structure, materiality, or cost-effectiveness considerations do not allow for such segregation of duties, alternative control measures should be implemented and documented.

- 2.4.2 Audit criteria: The audit expected to find that revenue payments were processed in a timely manner and with appropriate segregation of duties.

- 2.4.3 What the audit found: Money receipts were deposited in a timely manner, but money receipts were not always processed with appropriate segregation of duties.

- 2.4.4 The audit assessed the processing of money receipts for sales of surplus goods. This assessment focused on: timeliness of deposits of money receipts, in accordance with the Receipt and Deposit of Public Money Regulations;and segregation of duties in receipts, deposits, and recording of public money (in other words, three officers were required to achieve segregation of duties), in accordance with Treasury Board Directive on Public Money and Receivables and AAFC's Policy on Receipts and Accounts Receivable.

- 2.4.5. An electronic transfer option was provided to customers when payments were requested, but this option was seldom used by customers – it was used in 3/24 (13%) of the sampled sales of surplus goods. A review of the electronic transfer option and interviews of Integrated Services Managers and Local Financial Officers indicated that customers did not favour electronic payments for large dollar amounts, or considered the option to provide insufficient payment information, making it challenging to match payments to invoices.

- 2.4.6 Sample testing of the sales of surplus goods found that a majority of payments (21/24; 88%) were deposited on a timely basis, in accordance with the Receipt and Deposit of Public Money Regulations.

- 2.4.7 Sampling results showed that most transactions (18/24; 75%) did not have, or did not show, appropriate segregation of duties:

- In 14/24 (58%), supporting documentation indicated that two officers completed the process of money receipt, depositing, and recording the funds, not three as required; and

- In 4/24 (17%), no supporting documentation was prepared in the region where money was received, as such, there was no supporting documentation on file to demonstrate segregation of duties.

- 2.4.8 The lack of appropriate segregation of duties in the processing of money receipts may increase the inaccurate recording of public money received or risk of loss.

Recommendation 3 – Ensure appropriate authority and segregation of duties

The Assistant Deputy Minister, Corporate Management Branch should establish clear processes and accountabilities for the approval of the sales of surplus goods and review and confirm segregation of duties or alternative controls in the processing of money receipts.

Management response and action plan

Agreed. The Finance and Resource Management Services (FRMS) Directorate will work with Integrated Services (IS) Directorate to provide training and communication to ensure IS managers are aware of their responsibilities and accountabilities to ensure appropriate approval of the sales of surplus goods and segregation of duties (or alternative controls) in the processing of money receipts.

- Lead(s) responsible: ADM CMB, DG ISM, and DG FRMS

- Target date for completion: June 30, 2020

2.5 Royalty payments

- 2.5.1 Scientists at AAFC develop intellectual property (plant varieties and technology). The Department commercializes intellectual property through licensing to industry and receives royalty payments. As at August 23, 2019, the Department had 707 active license agreements. When license agreements are signed, the royalty payment to AAFC is based on a percentage of sales. Along with royalty payments, licensees have a contractual obligation to provide royalty statements, which provide details of the royalty calculation. The Office of Intellectual Property and Commercialization's mandate requires it to manage the lifecycle of intellectual property, including financial stewardship (for example, establishing royalty rates and payments schedules for AAFC's license agreements).

- 2.5.2 Audit criteria: The audit expected that a mechanism was in place to verify royalty payments to ensure that they were consistent with the payment terms of license agreements.

- 2.5.3 What the audit found: The audit found that the Office of Intellectual Property and Commercialization had a partial mechanism in place to verify whether the royalty payments received were consistent with the terms of license agreements.

- 2.5.4 The Office of Intellectual Property and Commercialization verifies the reasonableness and accuracy of royalty payments by conducting monthly spot checks on a sample of payments. This involves reviewing royalty statements by matching rates received with license agreements and assessing reasonableness through industry reports.

- 2.5.5 The Office confirmed that verifying the reasonableness and accuracy of royalty payments was a challenge because it did not receive the reliable financial information necessary to verify payments. For example, licensees were not publically traded so audited financial statements were not required.

- 2.5.6 To improve royalty monitoring, in the summer of 2019, the Office of Intellectual Property and Commercialization initiated additional monitoring using trend analysis to identify license agreements which showed a decline in payments or no payments in recent years. From this analysis, Commercialization Officers would be able to review and follow up on potentially overdue royalties.

- 2.5.7 Nonetheless, several interviewees raised concerns that AAFC may still not be receiving all of its royalty payments because some license agreements were not entered into SAP, or that invoicing or following up on royalty payments due was not being performed.

- 2.5.8 A sample of license agreements showed that an audit clause was included in almost all license agreements (23/24; 96%). The Office of Intellectual Property and Commercialization confirmed that royalty audits have not been conducted to verify royalty payments since 2007.

- 2.5.9 The current royalty verification activities may not provide adequate assurance that the department is collecting the full amount of royalty revenues owed by licensees.

Recommendation 4 – Provide Additional Assurance on Royalty License Revenues

The Assistant Deputy Minister, Science and Technology Branch (STB), in collaboration with the Assistant Deputy Minister, Corporate Management Branch, should explore options and implement a solution to provide additional assurance that the Department is receiving the royalties it is owed, including considering whether to conduct royalty audits.

Management response and action plan

Agreed.

-

A 5 year plan for royalty examination of AAFC's crop licenses will be established using existing documentation and data. Contractually, license agreements will continue to include the possibility for AAFC to audit licensees when royalties are lower than expected.

A study will be conducted to examine the possibility of imposing audit obligations on licensees when royalty payments are expected to be relatively significant.

A report including recommendations on options will be submitted to the Assistant Deputy Minister, Science and Technology Branch and to the Assistant Deputy Minister, Corporate Management Branch for decision.

- Monitoring of licensees' web sites will be implemented for licensed technologies. AAFC license agreements will include the possibility to audit licensees at AAFC's cost when analysis show unreported licensed products for technologies.

Lead(s) responsible: ADM STB and ADM CMB

Target date for completion: September 30, 2020

3.0 Conclusion

- 3.0.1 Overall, the audit found that Agriculture and Agri-Food Canada (AAFC) had an adequate revenue control framework in place, however, there was ineffective implementation of controls in certain areas.

- 3.0.2 Implementation of the revenue control framework could be improved by:

- Reviewing and improving the Trade Accounts Receivable Process for royalty license and rental agreements to ensure that SAP information is complete and accurate and that revenues owed are invoiced and received;

- Providing ongoing training to Local Financial Officers and Integrated Services Managers to improve their understanding of roles and responsibilities in the trade accounts receivable process;

- Ensuring appropriate approval of sales of surplus and reviewing and confirming segregation of duties or alternative controls in processing money receipts; and

- Exploring options and implementing a solution to provide additional assurance that the Department is receiving the royalties it is owed, including considering whether to conduct royalty audits.

- 3.0.3 The following strong practices were noted:

- AAFC had appropriate documented policies and processes for revenue management with clearly defined roles and responsibilities;

- Payments were deposited on a timely basis; and

- The Office of Intellectual Property and Commercialization initiated additional trend analysis to improve monitoring and following up on potentially overdue royalty payments.

Annex: About the audit

Statement of conformance

The audit conforms to the Institute of Internal Auditors'International Professional Practices Framework, as supported by the results of Agriculture and Agri-Food Canada's (AAFC) internal audit quality assurance and improvement program. Sufficient and appropriate evidence was gathered in accordance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing to provide a reasonable level of assurance over the findings and conclusion in this report. The findings and conclusion expressed in this report are based on conditions as they existed at the time of the audit and apply only to the areas included in the audit scope.

Audit objective

To provide assurance that AAFC's control framework for revenues was adequate and functioning as intended.

Audit scope

Based on the work performed in the planning phase, the audit team developed a risk assessment and identified scoping considerations. The areas identified as being of greatest risks were used to confirm the audit objective, scope, and audit criteria.

In the conduct phase, the audit examined revenue transactions that were included in the scope, for the fiscal year 2018-19 and the controls and management practices in place up to October 2019.

The audit focused on the following revenues that were generated from:

- Sales of goods and services:

- Royalties from license agreements;

- Rentals; and

- Sales of surplus goods (for example, grains, cattle, and dairy).

- Disposal of capital assets

The audit team did not assess the following revenue sources:

- Collaborative research and development agreements: These agreements represent a separate, distinct process which may be considered for a future audit engagement;

- Fees charged for providing internal services to other government departments: A review of information system services was completed by an external consulting firm in 2019;

- Interest revenues: Interest is generated from overdue accounts, primarily from three programs: Advance Payment Program, AgriStability, and Hog Industry Loan Loss Reserve Program. The management of accounts receivables and collections may be considered for future audit engagement;

- Community Pasture Program: This Program ended in 2018-19 and was transferred to Environment and Climate Change Canada;

- Canadian Pari-Mutuel Agency: The Agency is separately audited on an annual basis;

- Crop Reinsurance Fund: Revenues from premiums collected are held as a trust fund. Actuarial review of rates and the accumulated funds are periodically performed; and

- Business Risk Management administration fees: Fees represent relatively immaterial amounts and may be considered during periodic evaluations or audits performed on these programs.

Audit criteria

The audit examined the following criteria of an effective revenue control framework during the audit's conduct phase:

- Policies in support of revenue management are in place and supported by processes and staff training; and

- Controls are in place and operating effectively for revenue management to support compliance with applicable acts and policies.

Audit approach

The audit approach and methodology were risk-based and consistent with the International Standards for the Professional Practice of Internal Auditing, as required under the Treasury Board Policy on Internal Audit. These standards require that the audit be planned and performed so as to conclude against the objective. The audit was conducted in accordance with an audit program that defined audit tasks to be performed in the assessment of each audit criterion.

Audit evidence was gathered through various methods. The audit team interviewed 47 key stakeholders from different branches, completed site visits to four research centres, and included analysis of documentation. In addition, the audit reviewed a judgmental sample of revenue transactions (and associated agreements, if applicable), to assess whether sales were approved by appropriate delegation of authority and whether invoicing and payments were processed in accordance with Treasury Board and AAFC requirements. A total of 96 revenue transactions (and associated agreements, where applicable) were sampled, with 24 from each revenue source included in the scope for the fiscal year 2018-19:

| Revenue source | Number of sampled transactions | Sampled revenue ($) | Total revenue ($) | Total revenue sampled (%) |

|---|---|---|---|---|

| Royalties from license agreements | 24 | 412,877 | 5,592,455 | 7 |

| Rentals | 24 | 88,857 | 2,544,222 | 3 |

| Sales of surplus goods | 24 | 453,678 | 4,659,822 | 10 |

| Disposal of capital assets | 24 | 160,762 | 1,126,470 | 14 |

| Total | 96 | 1,116,174 | 13,922,9701 | 8 |

| 1. Numbers may not add up due to rounding. | ||||