Executive summary

Purpose

The Office of Audit and Evaluation of Agriculture and Agri-Food Canada (AAFC) conducted an evaluation of the AgriMarketing Program to assess its relevance and performance.

Scope and methodology

AgriMarketing activities from 2018-19 to 2021-22 were evaluated using multiple lines of evidence including a review of program documents, literature and performance data as well as interviews with internal and external stakeholders.

Background

The AgriMarketing Program is a contributions program under the Canadian Agricultural Partnership delivered through the Business Development and Competitiveness Directorate in the Programs Branch. The Program aims to increase and diversify exports to international markets and seize domestic market opportunities through industry-led promotional activities. Planned federal expenditures are over $106 million between 2018-19 and 2022-23.

Findings

- The AgriMarketing Program supports a strong national approach in export promotion, overcomes complexities within the Canadian agricultural sector and navigates challenges in the international marketplace.

- There is a large number of market development and export promotion programs and services offered across Canada by federal, provincial, non-for-profit and for-profit entities. An absence of Program representation on key collaborating committees in this area increases the risk of duplication of effort.

- The format, quality and timeliness of Program performance data limits its use for evaluation and Program reporting purposes.

- AgriMarketing was administered efficiently. Canada spends less to achieve its export promotion outcomes than other comparable countries.

- Best practices and lessons learned in export promotion are currently not shared between Program recipients or other Canadian agri-businesses.

- The Program supported visibility of the agriculture sector and increased its capacity to seize international and domestic market opportunities for Canadian agriculture and agri-food products. However, projects had limited flexibility to adapt to changing market conditions and the criteria for identifying priority export markets was not clear.

Conclusion

AgriMarketing addresses a gap in federally delivered market development and export promotion support for the Canadian agricultural sector and successfully contributes to Program outcomes. Ongoing federal collaboration and engagement is needed to limit the risk of duplication of programs and services with similar objectives and beneficiaries and to help bolster awareness of these resources. Program performance data improvements are required, and a greater return on investment could be achieved by a broader dissemination of knowledge gained from AgriMarketing projects. Supporting project flexibility in adapting to emergent market challenges and mitigating overexposure to specific markets would better support the Program's export diversification objective.

Recommendations

Recommendation 1: The Assistant Deputy Minister, Programs Branch in consultation with International Affairs Branch, enhance Federal coordination and exporter awareness of market development and promotional supports.

Recommendation 2: The Assistant Deputy Minister, Programs Branch improve the quality and timeliness of performance information and the sharing of best practices and lessons learned.

Recommendation 3: The Assistant Deputy Minister, Programs Branch integrate design changes specifically targeting greater project flexibility to adapt to changing market conditions and diversification of projects to support a more proactive export promotion approach.

Management response and action plan

Management agrees with the evaluation recommendations and has developed an action plan to address the first recommendation by January 31, 2024. Recommendations 2 and 3 will be addressed by November 30, 2023. For further details see Annex E.

1.0 Introduction

The Office of Audit and Evaluation conducted an evaluation of the AgriMarketing Program as part of the 2022-23 to 2026-27 Office of Audit and Evaluation Plan. This evaluation fulfills the requirements of the Treasury Board of Canada's Policy on Results (2016) and the Financial Administration Act. Findings from this evaluation are intended to inform current and future Program and policy decisions.

2.0 Scope and methodology

This evaluation assessed the relevance, efficiency and effectiveness of AgriMarketing activities from 2018-2019 to 2022-23. The evaluation used multiple lines of evidence including a review of program documents, project files and literature; key informant interviews; and analyses of administrative and financial data. For more detailed evaluation methodology, see Annex A.

AgriMarketing Program activities were most recently evaluated through the Evaluation of AgriMarketing Stream C: Market Development in 2017-18.

3.0 Program profile

3.1 Overview of AgriMarketing

AgriMarketing is a $106-million, five-year contribution program established within the Canadian Agricultural Partnership (2018-2023). The objective of the Program is to increase and diversify exports to international markets and seize domestic market opportunities through industry-led promotional activities. Agriculture and agri-food national industry associations are used for Program delivery to promote Canadian products domestically and internationally.Endnote 1 Project activities include:

- industry-wide advertising and promotion, including in-store and food service promotions and product demonstrations for buyers (businesses and consumers)

- incoming, outgoing and exploratory missions

- market research and technical training for buyers about Canadian products and product handling

- trade seminars designed to inform industry representatives of specific attributes of Canadian agriculture, agri-food, fish and seafood products

- industry-to-industry trade advocacy

- participation in, or attendance at, trade shows and multilateral industry meetings and conferences.

National industry associations, if eligible, can receive a maximum AAFC project contribution of $2.5 million per year, up to a maximum of $10 million over 5 years, for one or more projects. Over the reference period, a total of 102 projects were funded amongst 56 national industry associations. On average, projects received $1.1 million, with the smallest project receiving $11,000 and the largest receiving $6.2 million.

3.2 Governance

The AgriMarketing Program is managed by the Business Development and Competitiveness Directorate in the Programs Branch. Applications are assessed by the Director General Competitiveness Committee, which includes members from AAFC's Programs Branch, Strategic Policy Branch, Market and Industry Services Branch, as well as members from the Department of Fisheries and Oceans and Global Affairs Canada as needed. The Director General Competitiveness Committee is responsible for reviewing proposals and approving or rejecting project recommendations for funding on behalf of the Minister of AAFC.Endnote 2 After an application is approved, recipients are required to enter into a contribution agreement with AAFC and meet the obligations listed such as providing documentation for accountability purposes, including annual progress, performance and financial reports.

3.3 Resources

The AgriMarketing Program accounts for over $106 million in planned expenditures over the five-year period from April 1, 2018 to March 31, 2023 (see Table 1). AAFC employed an average of 13 full-time equivalent employees over the reference period to deliver the program.

| 2018-19 actual | 2019-20 actual | 2020-21 actual | 2021-22 actual | 2022-23 Table 1 note [2] planned | Total spending | |

|---|---|---|---|---|---|---|

| Salary – Programs Branch (Vote 1) ($) Table 1 note [1] |

1,227,927 | 1,315,932 | 1,296,681 | 1,034,269 | 1,383,000 | 6,257,809 |

| Non-Pay Operational – Programs Branch (Vote 1) ($) Table 1 note [1]Table 1 note [3]Table 1 note [4] |

35,848 | 63,640 | 86,122 | 21,768 | 42,500 | 249,878 |

| Grant and Contribution (Vote 10) ($) | 22,902,666 | 22,924,441 | 16,029,513 | 16,418,848 | 20,340,000 | 98,615,468 |

| Employee Benefit PlanTable 1 note [1] ($) | 184,192 | 200,635 | 193,153 | 155,140 | 276,600 | 1,009,720 |

| Total ($) | 24,350,634 | 24,504,647 | 17,605,470 | 17,630,024 | 22,042,100 | 106,132,875 |

| FTE | 13.1 | 13.2 | 12.5 | 9.2 | 15.2 | n/a |

|

Source: Corporate Management Branch (as of January 17, 2023)

|

||||||

3.4 Intended outcomes

AgriMarketing is identified under the Trade and Market Expansion Program in AAFC's Departmental Results Framework. The program supports the following trade and market expansion outcomes:

- Immediate outcome: Recipient sectors are supported to maintain the visibility of Canadian sectors/products and/or increase their capacity to identify and seize market development opportunities in targeted markets.

- Intermediate outcome: The Canadian agriculture and agri-food sector is successfully supported in its efforts to take advantage of new domestic and international market opportunities.

- Ultimate outcome: The Canadian agriculture and agri-food sector contributes to growing the Canadian economy. For the full Trade and Market Expansion Program logic model, see Annex B.

4.0 Relevance

4.1 Gaps addressed by the AgriMarketing program

AgriMarketing is relevant through its national approach to export promotion, and its ability to overcome sector complexities and international marketplace challenges.

Canada's position as a global leader in agricultural exports depends on its ability to identify and seize new international and domestic market opportunities. In 2021, the agriculture and agri-food sector was supported primarily by increased international sales in commodities which represent a positive net growth driver for Canada's gross domestic product. Nevertheless, increasing international competition, trade regulation issues and supply chain challenges all point to the need for a strong national export promotion program. While the world's largest economies have experienced extraordinary vulnerability, evaluation evidence supports that the AgriMarketing Program has leveraged new market opportunities by adopting innovative activities that expand and diversify Canadian agricultural exports.

Addressing sector complexity and international marketplace challenges

Canada's agriculture and agri-food sector represents a complex network of 56,988 agri-businesses, each supplying a wide array of products and commodities to domestic and international markets. Regional differences exist in specific commodities such as fruit, grains and seafood products, and the agricultural value chains of certain sectors are highly complex. For example, the beef and pork sectors of livestock include many growers, producers and exporters, each dealing with inter-related market access, development and export promotion concerns.

Adding to this complexity, Canadian agri-businesses face many barriers to accessing and developing international markets including unpredictable trade flows, market disruptions and intense competition to expand or diversity export markets. AgriMarketing's use of national industry associations as a program delivery mechanism addresses these sector complexities and international market barriers in several ways, including:

- leveraging national industry association sector knowledge of the agricultural value chain to maximize export potential for individual Canadian agri-businesses

- building on existing in-market networks and connections of national industry associations to connect buyers and sellers in foreign markets

- navigating market disruptions by resolving or mitigating market barriers and advancing trade positions through government-industry meetings and knowledge exchange

- combatting fierce international competition through industry-led promotional activities which increase Canada's profile in global markets

Federal role in supporting a national presence in export promotion

The literature emphasizes that federal governments play a crucial role in supporting multiple internationalization pathways for agri-businesses to increase and diversify exports. Small and/or non-export experienced businesses benefit from access to market information, technical assistance and sector-specific expertise in market development. Medium-sized firms that are nearer to export readiness benefit from direct participation in trade fairs and trade missions which accelerates their export potential. Larger firms require strategic, network-focused support, trade facilitation and in-market connectivity to establish a foothold in new markets and to maintain pre-existing markets. The evaluation found that national industry associations, acting as the federal delivery agent, are in a unique position to provide sector-wide support to their members, including producers, growers or exporters, at different stages of market development and export promotion.

Evidence supports that a unified national presence is essential for promoting Canadian agricultural products in key international markets. Individual agri-businesses often lack the collective capacity or business interest to engage in market development activities at the sector level, such as sharing market access information with other businesses. Competing interests at the provincial or regional levels also results in sector fragmentation that can impede Canada's ability to present a unified national presence in the international marketplace. The use of national industry associations addresses this critical gap through their understanding of the key factors defining the domestic and international market development space and through facilitating national branding activities.

Small and medium-sized enterprise supports

Prior to 2019, the AgriMarketing program provided a holistic approach to export promotion by offering broad, sector-wide coverage through funding national industry associations, as well as firm-specific funding directly to small and medium enterprises.Endnote 3 This approach to federal trade and market expansion support is similar to comparator countries such as Australia.Endnote 4 Global Affairs Canada currently provides funding for small and medium agricultural firms through the CanExport Program. In relation to AgriMarketing, the evaluation observed:

- Not all small and medium enterprises are members of a given national industry association and, as such, not all Canadian agri-businesses can be supported through a sector-wide approach.

- The reviewed literature establishes that small and medium enterprises often lack the technical, informational and financial resources required for international market development and export promotion.

- AAFC is well-placed to offer agriculture sector-specific expertise in export promotion to assist small and medium Canadian agri-businesses through internal resources such as Global Analysis, Flagship Trade Shows and the In-Market Partnership Fund.

While small and medium enterprises are no longer a component of the AgriMarketing Program, evidence suggests addressing their specific export promotion and market development needs remains an important consideration in the broader sector-wide approach.

4.2 Alignment with AAFC and government priorities, roles and responsibilities

AgriMarketing activities align with Government of Canada and AAFC priorities to support international export growth and market diversification in Canada's agriculture and agri-food sector.

Federal budgets in the last 5 years underscore the importance of the Canadian agriculture and agri-food sector to the overall economy and recognize the need to improve, protect and diversify Canada's agricultural exports. In 2022, the federal government announced plans to support agriculture and agri-food export diversification in the Indo-Pacific region and the Minister's mandate letters for 2021 and 2019 highlight growth and innovation in the agricultural sector. Building the sector's capacity to maintain and expand market access and advancing Canada's agricultural interests internationally remain key components of AAFC's core responsibilities. The AgriMarketing Program is aligned with federal priorities and budgetary commitments in its objective to increase and diversify exports to international and domestic markets.

4.3 Overlap and duplication

Opportunities exist for greater coordination between stakeholders in the market development and export promotion space to limit the risk of duplication between programs and services offered.

The evaluation defines 'overlap' as a degree of similarity between programs and 'duplication' as replicating other programming. Three key areas were used to assess the existence of overlap and duplication among existing programs and services: objectives and outcomes, intended beneficiaries and type of activities funded. Over 400 federal, provincial, private sector services and non-profit services were reviewed to inform the evaluation.

Key distinctions between AgriMarketing and other programs

Overlap between the AgriMarketing Program and other federally offered programs and services was found to be productive with the various programs complementing one another in scope, intended beneficiaries and program delivery models.Endnote 5 Examples of complementary programs are listed in Annex C.

- The AgriMarketing Program funds national industry associations to attend and participate in tradeshows, while the AAFC Canada Pavilion Program supports associations and businesses to take part in flagship tradeshows.

- The CanExport Associations Program offered by Global Affairs Canada funds national industry associations for sector-wide business development and export promotion activities, excluding the agricultural associations who are served by the AAFC's AgriMarketing Program.Endnote 6

- The In-Market Partnership Fund delivered by the International Affairs Branch funds trade commissioners to provide targeted market development branding activities. Trade commissioners are also involved in the AgriMarketing application review process to avoid duplication between funded projects.

The evaluation found that AgriMarketing is the only federal program that provides funding for national industry associations to conduct promotional activities for agricultural, agri-food and seafood products with the intention of benefiting the whole sector, rather than individual agri-businesses. The program takes a national approach to export promotion and limits sector fragmentation that can stem from provincial programs that promote region-specific agricultural products or commodities. Compared to other federal and provincial programs or services, AgriMarketing has the largest funding envelope, enabling the Program to support more costly or complex marketing and export promotion activities.

Risk of duplication

Evidence demonstrates that AgriMarketing's application review process reduces the risk of duplication among federal programming. The technical review process screens out project applicants that receive funding from other programs for the same or similar export promotion activities. However, the risk of duplication remains given the sheer number of similar programs and services offered in Canada. This risk is amplified by AgriMarketing's absence on existing working groups and governance structures such as the Federal Provincial Market Development Council and International Market Engagement Teams, which coordinate market development activities.

A review of provincial cost-share programs also revealed that there is no obligation to report results of market development and export promotion activities to AAFC. Without such a reporting structure, the risk of duplication between provincial and federal programs is high. The evaluation found limited evidence of communication between these entities, beyond the working groups led by the International Affairs Branch. Taken together, evidence points to the need for ongoing leadership from AgriMarketing staff in the market development and export promotion area.

Awareness of federal supports

The evaluation found that there is general lack of awareness amongst exporters about the multitude of federal market development programs and services available. Of the interviewees that could speak to the experience of Canadian exporters, all noted that exporters and national industry associations would benefit from greater communication, coordination and awareness of existing supports. This is a reoccurring finding from recent trade and market expansion program evaluations.Endnote 7 Limited awareness can result in exporters not taking full advantage of federal supports and services that could advance their export promotion capacity.

5.0 Performance

5.1 Performance measurement

The quality and format of AgriMarketing performance data is lacking and does not support the timely assessment of results.

Absence of a performance data repository

Despite the long-standing history of the program in the department, there is currently no performance data repository for Program monitoring and evaluation purposes. As a result, AgriMarketing performance data cannot be retrieved in a timely manner and relies on cyclical evaluations or ad-hoc data reports on a sample of projects to inform decision-making. Program performance data for the current evaluation was extracted by hand from scanned project files, cleaned and organized for analysis. This resource intensive and time consuming process informed insights on how the Program's performance measurement and reporting could be improved through the use of an electronic data repository and improved data quality.

Quality of performance and financial data

The evaluation found that, despite the program's efforts in standardizing key performance indicators, performance and financial information were reported inconsistently across projects. The program required recipients to report on the results of their activities using one or more indicators from a standard list of 10 indicators (for example, number of new leads or value of estimated sales). However, because these indicators were not well-defined, recipient responses varied in the types of activities and outputs as well as level of detail they reported for each indicator. Financial information reported was not sufficiently detailed to enable cost comparisons of different activities, or to summarize results across projects. The validity of the project data was uncertain as results were self-reported (by recipients) and there was no requirement to provide supporting evidence to validate results. For these reasons, the accuracy of reported results could not be verified.

No link to exporter outcome data

Detailed outcome data were not collected on the agriculture and agri-food growers, producers and exporters who collectively are the key drivers for the sector-wide economic outcomes the program intends to achieve. Consequently, the evaluation could not examine the direct effect of national industry associations' sector-wide activities on intended beneficiaries.

Absence of indicators to assess Gender-Based Analysis Plus

The Trade Market Expansion Performance Information Profile does not require the collection of data related to Gender-Based Analysis Plus. In examining program administrative data, 18% of projects claimed to benefit under-represented groups, primarily women, visible minorities and Indigenous people. However, based on a sample review of 40 projects, no supporting evidence was found within the technical review assessments to substantiate these claims. The extent to which such projects supported marginalized groups is unknown.

5.2 Efficiency

The AgriMarketing Program is administered efficiently. However, relevant project outputs, best practices and lessons learned are not shared broadly, limiting the return on investment.

Efficient distribution of planned budget versus actual spending

The AgriMarketing Program distributed 96.2% of $81.3 million in committed funding between 2018-19 and 2021-22. Project spending was underspent in fiscal years 2020-21 and 2021-22, due to the impact of COVID-19 travel restrictions on international trade shows. Any unspent funding was not carried over to subsequent fiscal years, consequently, 30 project recipients underwent amended contract agreements totalling over $2 million.

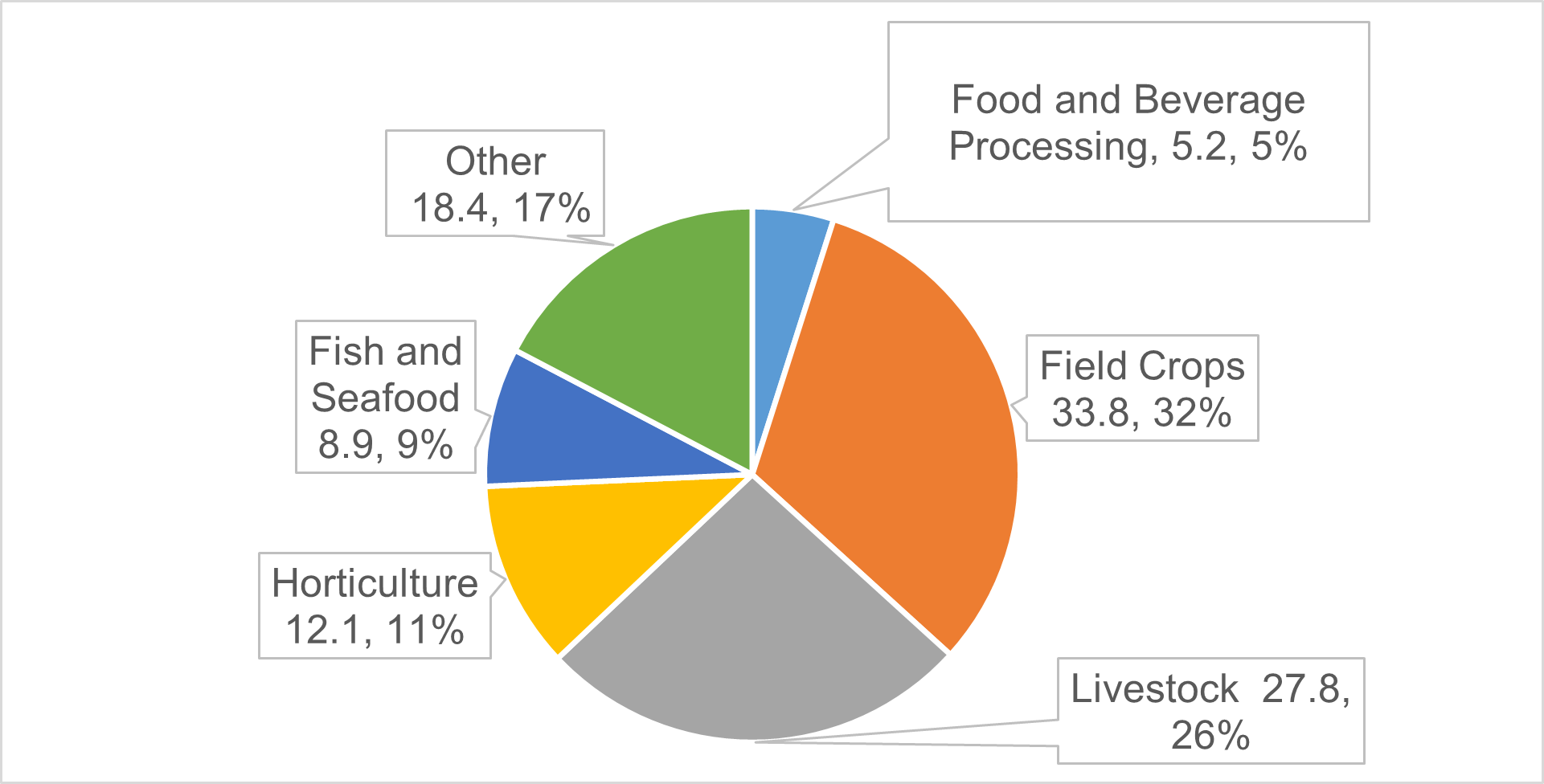

Funds were awarded to national industry associations in 7 provinces with most of the funds awarded to national industry associations in Ontario and Manitoba (42.7% and 28.5%, respectively). Figure 1 shows that nearly one-third of funds were awarded to national industry associations in the field crops sector and just over one-quarter to the livestock sector (32% and 26%, respectively). The amount of program funding distributed by sector corresponds to the relative size of these 2 sectors in terms of total exports and is similar to previous cycles of the program.Endnote 8 Over two-thirds of the funding was allocated to 9 different national industry associations representing a wide range of growers, producers and exporters across the Canadian agriculture and agri-food sector.

Figure 1: Share of AgriMarketing funding, by sector, 2018 to 2022 ($ millions, %)

Source: Policy Analysis and Reporting Division, Business Development and Competitiveness Directorate, Program Performance Data.

Description of the above image

| $ millions | % | |

|---|---|---|

| Field crops | 33.8 | 32 |

| Livestock | 27.8 | 26 |

| Other | 18.4 | 17 |

| Horticulture | 12.1 | 11 |

| Fish and seafood | 8.9 | 9 |

| Food and beverage processing | 5.2 | 5 |

Canada spends less than other countries on international market development and export promotion

The evaluation examined agriculture, agri-food and seafood exports in the context of total expenditures on marketing and export promotion activities by federal governments in Canada, the United States, Australia and Ireland (see Annex D). In 2021, Canada's expenditure on market development activities, including export promotion, was one-third to one-tenth of the expenditures of comparator countries.Endnote 9 For every one dollar Canada expends in market development activities, $2,560 in exports are generated, compared to $790 for the United States, $390 for Australia and $280 for Ireland. The country comparison reveals that Canada generates a higher level of exports for less federal market development expenditures, demonstrating that Canada is receiving a higher return on investment for its export promotion activities in the agriculture and agri-food sector.

AgriMarketing yields positive return on industry investment

AgriMarketing leveraged nearly $94 million in industry investment, representing 46.5% of program expenditures and 48.7% of committed investment funds. The review of performance data and relevant documents suggests that the program realized a positive return on this investment, as well as a positive impact on outcomes relative to expenditures. Nearly one-third (36) of the projects reported estimated sales as a key performance indicator. A conservative estimate of the average sales generated by these projects was between $11.80 (the lowest 25th percentile) and $59.39 (the median) in sales per federal dollar expended on export promotion, with a combined contribution of between $1.3 billion and $6.5 billion in estimated revenue.

The program's median return on investment is higher than similar market development programs offered in the United States. Moreover, a 2022 study examining export market development programs in the United States found that any reduction in federal spending on these programs would decrease export revenues and cause adverse impacts on the overall economy.Endnote 10 These findings support similar evidence from a Canadian study examining the impact of trade promotion services on exporter performance on the overall economy.Endnote 11 Evaluation evidence indicates that, without AgriMarketing support, the Canadian agricultural sector would not participate in export promotion activities in the same way or to the same extent. In such a scenario, Canada would decrease its competitiveness and risk losing visibility as a major exporter in the global marketplace.

Comparison of administration costs

The AgriMarketing Program was administrated efficiently with 8.4% of program costs allocated to staff salary and non-pay operating expenditures. The evaluation found that the administrative costs for the program were similar to, or lower, than other AAFC programs with a grants and contributions component using national industry associations as a delivery mechanism (see Table 2).

| Organization | Program | Years | Program delivery as percentage of total costs |

|---|---|---|---|

| AAFC | AgriMarketing | 2018–19 to 2021–22 | 8.4 |

| AAFC | AgriScience Program | 2018–19 to 2020–21 | 10.9 |

| AAFC | AgriInnovation Program (Stream C: Enabling Commercialization and Adoption) | 2013–14 to 2016–17 | 7.5 |

| AAFC | Agri-Opportunities Program | 2006–07 to 2010–11 | 8.3 |

| AAFC | Agri-based Processing Initiative | 2009–10 to 2013–14 | 8.4 |

| Atlantic Canada Opportunities Agency | Innovation and Commercialization Sub-Program | 2007–08 to 2011–12 | 8.3 |

| AAFC | AgriAssurance – National Industry Association Component | 2016-17 to 2020-21 | 9.0 |

|

Source: Program Administrative Data Note: AgriAssurance program delivery ratio is estimated. The transfer of funds to the Canadian Food inspection Agency through the Program's Memorandum of Understanding was also treated as a non-program delivery cost. |

|||

Sharing best practices and lessons learned to leverage investments

The project file review revealed that a substantial amount of export promotion and market development information and knowledge is generated by individual AgriMarketing projects. For example:

- One project developed a program to measure variability in railway transit times to manage the risk and uncertainty that erodes export and marketing competitiveness. Lessons learned from such a project could be valuable to other stakeholders in the Canadian agricultural sector that are vulnerable to supply chain disruptions.

- Another project aimed to address market access issues by undertaking virtual promotion activities. This industry-led promotional campaign created a new user interface to connect with users through notifications that could be applicable to other national industry associations, or individual growers, producers or exporters seeking to use social media tools to increase visibility in domestic or international markets.

- Best practices in relationship building were also clear in a project focused on trade advocacy which used exploratory missions and expert real-time support to perform market research and industry-to-industry trade advocacy and policy development. Information from such innovative trade advocacy activities could be broadly applicable to other national industry associations engaged in similar activities.

The evaluation found that these innovative and creative tools, lessons learned and best practices in export promotion are not being shared with other national industry associations and their membership, including exporters who could benefit from these resources. This lack of information sharing or broader knowledge dissemination represents a missed opportunity to capitalize on over $81 million in investments made by the Government of Canada.

5.3 Effectiveness

Maintaining visibility and increasing capacity to seize market opportunities

AgriMarketing maintained sector visibility and increased its capacity to identify and seize market development opportunities. Current program parameters limit the flexibility of recipients to respond to market disruptions.

The AgriMarketing Program achieved its immediate outcome through completing over 1,900 activities. Examples include:

- Promoting a unified national presence for Canadian agricultural and agri-food products in domestic and international markets using innovative forms of print and social media

- Attendance at international trade shows and conferences, enabling Canadian agri-businesses to connect and maintain relationships with buyers and sellers

- Virtual and in-person technical training on the multiple uses of Canadian agricultural products and the nutritional and environmental sustainability benefits of Canadian agricultural commodities and products

- Market intelligence and research to provide the sector with access to market information (a key element in export capacity building for small and medium-sized agri-businesses)

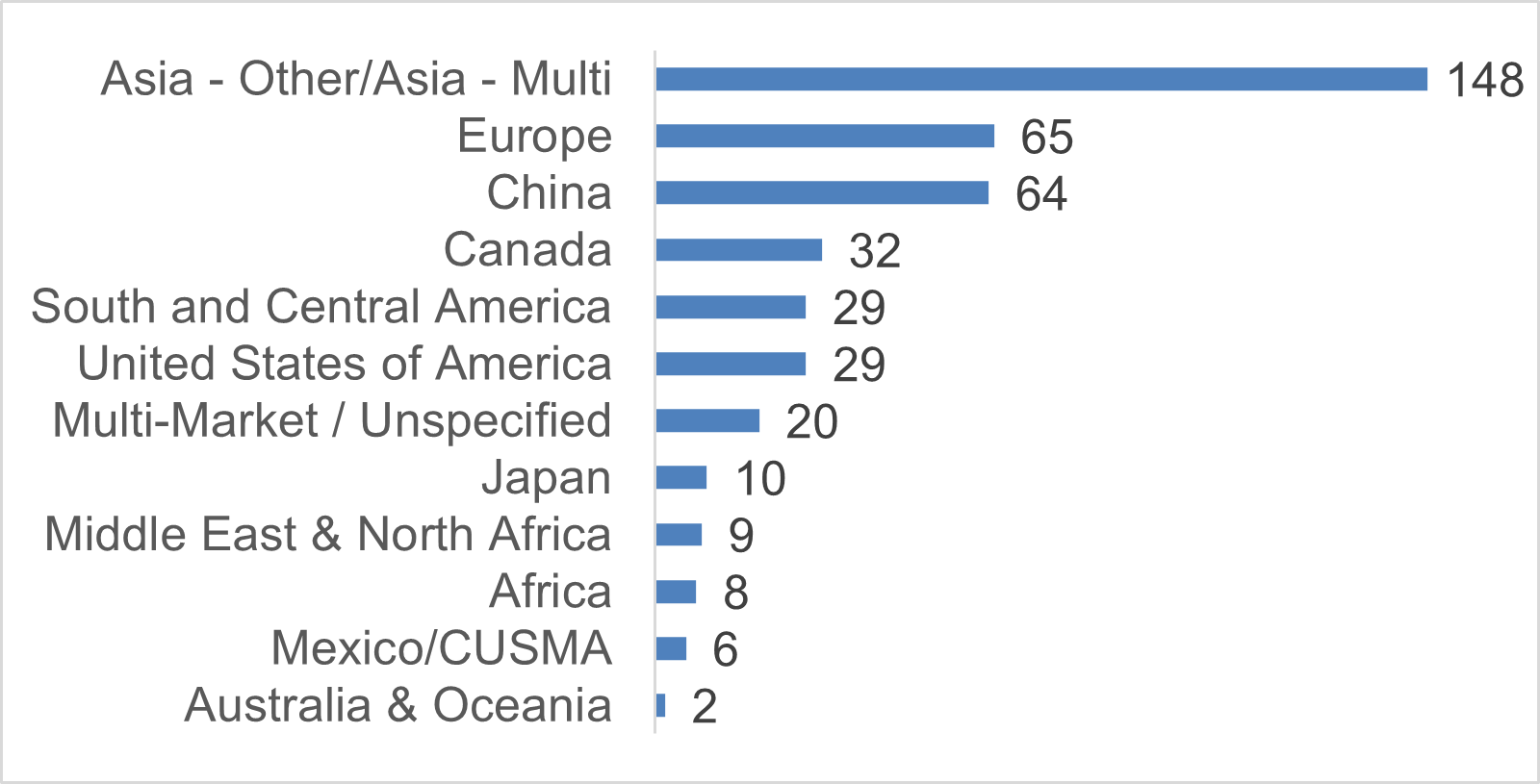

The Program supported the sector to build capacity to identify new markets primarily through technical training and market research activities, such as providing market intelligence to their members on targeted foreign markets. National industry associations enabled their members to access new opportunities in both domestic and international markets. These efforts supported the Program in exceeding its target of 20% of activities per year in new markets, where over 40% of these activities were in Asia, not including China (see Figure 2).Endnote 12 This represents a slight increase in accessing new markets relative to previous cycles of the program.Endnote 13

Figure 2: AgriMarketing activities for new markets, 2018 to 2022

Source: Policy Analysis and Reporting Division, Business Development and Competitiveness Directorate, Program Performance Data

Description of the above image

| Market | Number of activities |

|---|---|

| Asia — Other/Asia — multi | 148 |

| Europe | 65 |

| China | 64 |

| Canada | 32 |

| South and Central America | 29 |

| United States of America | 29 |

| Multi-market/unspecified | 20 |

| Japan | 10 |

| Middle East and North Africa | 9 |

| Africa | 8 |

| Mexico/CUSMA | 6 |

| Australia and Oceania | 2 |

Flexibility in response to changing market conditions

Now more than ever, volatile international market conditions present significant strategic risk for the Canadian agriculture and agri-food sector. The evaluation found that increasing market turmoil, political pressures and other international marketplace challenges, such as the suspension of export certificates, presented an element of unpredictability affecting AgriMarketing's planned export promotion activities.

The vulnerability of the Canadian agriculture sector was exposed during the COVID-19 pandemic by global supply chain disruptions which fundamentally affected access to international export markets.Endnote 14 During this time, the technical review process was streamlined, permitting more timely project adaptation to international travel restrictions, with some recipients responding to this crisis by refocusing their activities on digital communications methods to reach international buyers, or domestic market activities which did not require travel.

Under current program application requirements:

- Applicants must plan specific activities, in specific markets at a specific time, often years in advance of implementation.

- On average, there is a 176-day waiting period between application submission and project approval that further aggravates this situation.

The project file review demonstrated that several projects were required to cancel activities because markets suddenly became unstable or less favourable to develop due to intense competition from other countries or changes in foreign policy. This finding was further corroborated through interviews with national industry associations who noted that:

- Other countries (such as the United States) spend more on marketing and export promotion and are more visible at international tradeshows and events.

- Program requirements to identify particular products or commodities in specific markets do not consider changing market conditions between application and funding approval, which restricts recipients' ability to seize emerging opportunities.

- The program's application procedure limits the scope of activities to individual national industry associations, discouraging collaborative efforts between associations operating in the same international market and with similar market access or development goals.

Under current program parameters, a formal amendment is required to adjust planned activities and to move funds between markets and fiscal years. This process makes it difficult for recipients to adjust their activities if there are significant disruptions in identified markets or a sudden loss of an export opportunity. Consequently, market share and sale of Canadian agricultural commodities or products are lost to competitors during unexpected disruptions to planned program activities.

Taking advantage of domestic and international market opportunities

AgriMarketing supported the sector to take advantage of domestic and international market opportunities. The program's attempt to diversify Canadian export markets via the market diversification pilot was limited by ambiguous qualifying criteria.

The program exceeded targets for new leads, generating 38,065 new leads through industry-led promotional activities, with just under 20% of these leads in domestic markets. National industry associations that were interviewed noted that neglecting domestic markets risks leaving them vulnerable to seizure by non-Canadian businesses, and that a key focus of their activities is to assist Canadian agri-businesses develop market readiness by pursuing domestic opportunities first, before entering foreign markets. Evaluation evidence supports this finding in that many national industry associations successfully shifted their focus to domestic markets during the COVID-19 pandemic helping them to take advantage of key domestic market shares.

Advancing trade issues effectively through network and relationship building

The AgriMarketing Program supports the sector to seize international market opportunities primarily through national industry association network and relationship building activities. Interviewed Program recipients validated this finding, noting they provide their members with sector-specific information to identify new markets as well as advice on next steps toward internationalization. This is particularly true for Canadian agricultural products with specialized markets (such as ginseng), where the agricultural value chain is sensitive to producer and buyer relationships and stakeholders must work closely to ensure smooth business transactions. Project file evidence revealed several successful network and relationship building activities to seize international market opportunities, such as:

- One national industry association reported securing nearly 10,000 leads in international markets with a project aimed at facilitating market entry for Canadian businesses.

- A member of another national industry association reported securing a million-dollar contract for their products as a result of their participation in a trade show.

- One national industry association member attended a trade show in an international market recommended by their association, which resulted in 2 agreements, one with a 500-store retail chain and another to secure a distributor and a retail contact.

The reviewed literature suggests that several trade barriers have created export risks for the Canadian agricultural sector that require action. Interviewed internal staff and national industry associations confirmed these risks stating that unfavourable interpretation of international standards in certain markets (such as China) present significant non-tariff barriers to trade for Canadian agriculture and agri-food products. AAFC supports an entire slate of trade and market expansion initiatives to counter these risks, including AgriMarketing, which work together to resolve international market challenges and optimize export opportunities. The AgriMarketing Program supported AAFC's overall trade and market expansion effort by advancing 794 issues through trade advocacy activities.

Developing clear criteria for identifying priority markets

The development of new markets in the Asia Pacific is a crucial element of Canada's Indo-Pacific Strategy and forms part of the federal government's goal to grow the Canadian economy. The literature and document review supports this approach, emphasizing that increased export diversification for the Canadian agricultural sector can mitigate the risk of overexposure to a limited number of markets or products, reduce vulnerability to commodity price fluctuations and contribute to overall economic growth. Expanding and diversifying market opportunities is a key objective for the AgriMarketing Program.

In 2021, 56.1% of all Canadian agriculture and agri-food products were exported to the United States, followed by China, Japan and Mexico (11.2%, 6.2% and 3.2%, respectively). The challenge of market overexposure for the Canadian agricultural sector is increasing where the value of exports destined to the United States has risen by 122% from $38.2 billion in 2019, to $46.7 billion in 2021 (see Figure 3). There may be a trend toward lack of market and/or product diversity for the Canadian agriculture and agri-food sector.

Figure 3: Value of Canadian exports by country, $ billions

Source: Trade Map

Description of the above image

Figure 3: Value of Canadian exports by country, $ billions

- United States: 46.7

- Other: 19.4

- China: 9.3

- Japan: 5.2

- Mexico: 2.7

The AgriMarketing Program introduced a market diversification pilot in 2021 offering a higher cost-share ratio to encourage activities in new and emerging markets. An analysis of historical funding for previous cycles of the AgriMarketing Program indicate that project funding has supported similar activities in similar markets, across multiple years. The market diversification pilot was an effort to change this situation.

The rationale for the market diversification pilot was to incentivize applicants to explore new and emerging markets by offering a 70:30 cost-share ratio, with AAFC assuming the greater portion of risk. A questionnaire was developed to assess applications and award funding to projects which proposed activities in markets where Canada exported less than 10% of the product on average per year, over the past 3 years.

Evaluation evidence found:

- Only 4 projects met the pilot criteria as most applications were either a continuation of planned activities or did not sufficiently differentiate their market diversification efforts for new or emerging markets.

- The qualifying criteria were not clearly communicated to national industry associations in the diversification questionnaire making it difficult for applicants to target activities for specific products or commodities in targeted markets.

- Administration of the pilot proved challenging for both recipients and AAFC staff and the extra funding did not make a noticeable difference to export promotion activities or to seize new international markets.

Interviewed program staff and national industry associations noted that the criteria for the market diversification pilot were too broad and did not account for differences in targeted markets, such as the differences in markets for the field crops sector. The evaluation found that the Program did not focus the market diversification pilot sufficiently on priority areas so that expansion in specific regions could complement other government efforts that focus on accessing those markets. For example, detailed information about market or commodity priorities was not shared in advance of the Program's second application cycle. Clear criteria for identifying priority markets was not developed that would assist recipients with project planning to target key regions or to identify high priority commodities for export. In the absence of clear criteria up-front, it is difficult to achieve AAFC's broader priority to support market or commodity diversity for the sector.

Supporting growth of the Canadian economy

Although economic growth in Canada's agriculture and agri-food sector cannot be solely attributed to a particular AAFC program, AgriMarketing has contributed to national export and gross domestic product growth targets.

The program's ultimate outcome is shared among 7 other programs within AAFC and is further influenced by external factors. Given that the program has effectively contributed to its immediate and intermediate outcomes, and that export and GDP growth were evident in the sectors targeted by the program, it is reasonable to conclude that AgriMarketing activities have contributed to growing the Canadian economy.

The 3 indicators that inform the ultimate outcome are agriculture and agri-food sector gross domestic product, value of agriculture and agri-food exports and percentage change of export product sold. The evaluation found that most economic growth targets for the agriculture and agri-food sector were met during the evaluation reference period. For example, long-term analysis of gross domestic product data shows that AAFC's growth rate target of 2.5% was achieved from 2017-18 to 2019-20, and a 3.6% growth rate was achieved in 2020-21. Moreover, the agriculture and agri-food sector generated $134.9 billion (6.8%) of Canada's gross domestic product in 2021.

A 3.3% average annual growth rate for agriculture and agri-food sales was maintained throughout the reference period. Although this growth rate fails to meet the departmental target of 4.5%, supply chain disruptions and high labour costs are both factors which have hindered AAFC's ability to meet this target. Nevertheless, the value of Canadian agriculture and agri-food exports increased from $67.6 billion in 2019 to $83.2 billion in 2021, exceeding its target of $75 billion by December 2025. This increase in exports was driven by high international market prices and increased demand for agriculture and agri-food sector products in China and the United States. Canada has maintained its position as the fifth largest exporter of agriculture and agri-food products in the world. Evaluation evidence suggests that at a time of economic recession, Canada's agriculture and agri-food sector is a large contributor to growth of the Canadian economy.

6.0 Conclusions and recommendations

The AgriMarketing Program addresses an important gap in market development and export promotion supports by navigating multiple complexities within the Canadian agricultural sector and international marketplace. The Program supports a strong federal presence in key foreign markets which is essential for promoting Canadian agriculture and agri-food exports. The Program was administered efficiently and contributed to its immediate and intermediate outcomes. To further strengthen the Program, the evaluation found 4 areas for improvement.

First, given the large number of federal, provincial, non-profit and for-profit programs and services being offered in the market development and export promotion space, ongoing federal coordination, collaboration and guidance is needed to limit any risk of duplication in this area, and to bolster awareness of available supports. AgriMarketing's absence on existing working groups and governance structures such as the Federal Provincial Market Development Council and International Market Engagement Teams, which coordinate market development activities, is a key gap.

Second, the Program's performance measurement and reporting tools should be improved to ensure that results can be reported accurately and in a timely manner to support Program monitoring and evaluation. Disseminating more widely industry-led best practices, lessons learned and other key outputs generated by the projects would better leverage the investments made by the Program in export promotion.

Third, the development of a mechanism that offers greater flexibility for projects, for example by permitting contingency plans to be submitted along with the initial application, would enable recipients to adapt to emerging changes in the international marketplace. This would support the sector to be more responsive to changing market conditions without compromising the Program's necessary governance, accountability and oversight structures.

Finally, AgriMarketing is AAFC's market development and export promotion umbrella Program for the agriculture and agri-food sector, and as such, shares a significant responsibility for supporting the government's market diversification efforts. The Program could mitigate strategic risk and overexposure in specific export markets for the Canadian agriculture and agri-food sector by developing and communicating clear market diversification criteria to encourage a more targeted approach in identifying and seizing new domestic and international market opportunities.

Recommendations

- Recommendation 1: The Assistant Deputy Minister, Programs Branch in consultation with International Affairs Branch, enhance federal coordination and exporter awareness of market development and promotional supports.

- Recommendation 2: The Assistant Deputy Minister, Programs Branch improve the quality and timeliness of performance information and increase the sharing of best practices and lessons learned.

- Recommendation 3: The Assistant Deputy Minister, Programs Branch integrate design changes for greater project flexibility to adapt to changing market conditions and diversification of projects to support a more proactive export promotion approach.

Management response and action plan

Management agrees with the evaluation's recommendations and has developed an action plan to address the first recommendation by January 31st, 2024. Recommendations 2 and 3 will be addressed by November 30, 2023. In support of recommendation one, Programs Branch will explore options using existing forums and working groups to enhance federal collaboration in the export promotion space. In support of recommendation 2, Programs Branch will implement a data collection plan for managing and reporting on AgriMarketing performance information and disseminating lessons learned and best practices from project outputs. Regrading recommendation 3, Programs Branch will integrate design and delivery changes specifically targeting project flexibility and identifying priorities for market diversification. For further details see Annex E.

Annex A: Evaluation methodology

Document review

To assess program relevance, performance measurement, efficiency and effectiveness, the evaluation reviewed internal program documents including the Performance Information Profile, Terms and Conditions, Applicant Guide, as well as applications, technical review documents and performance and financial reports submitted by recipients.

Literature review

With support from the Canadian Agriculture Library, the evaluation examined selected academic literature and other primary sources to support the assessment of relevance, efficiency and effectiveness where appropriate.

Data review

To examine the extent to which the Program achieved expected outcomes, the evaluation reviewed performance reports and data was extracted, cleaned and organized into a database for analysis.

Several data sources were used to assess the efficiency of the program. The evaluation reviewed: data on efficiency from evaluations of other AAFC programs, the Grants & Contributions Dataset, TradeMap, AgriMarketing financial reports and financial data from market development programs offered in other countries.

Interviews

Interviews were conducted with internal and external stakeholders to assess program relevance, design and delivery, efficiency and effectiveness. The evaluation involved 36 interviews with stakeholders, including AAFC program staff (7), agriculture and agri-food trade commissioners (1), representatives from Canadian agriculture and agri-food companies that were members of the national industry associations that received funding (11), national industry associations that received support through the AgriMarketing Program (16) and one national industry association that was unsuccessful in receiving funding.

| Limitation | Mitigation strategy | Impact on evaluation |

|---|---|---|

| Response bias: Interviewees who participated in the evaluation may have a vested interest in the continuation of the AgriMarketing Program. | The inclusion of 4 key informant groups, including those with varying degrees of separation from the program helped provide varying perspectives to draw from. Data was triangulated across multiple lines of evidence where possible. | Low |

| Data limitation: Limited data on the ultimate beneficiaries of the Program, including exporters, producers and growers, were not available. | In the absence of data on the ultimate beneficiaries of the program, the evaluation relied on key informant interviews with exporters to inform the program outcomes. | Medium |

| Data limitation: Variability in the performance and financial data reported in recipient performance reports. |

Variability in performance was addressed by summarizing common indicators across projects wherever possible. However, it was not possible to summarize the financial data as the format and level of detail varied significantly. |

Medium/high |

Annex B: Trade and market expansion logic model

Activities

- Trade policy development and market access activities

- Research, analysis and knowledge transfer to stakeholders

- Events, partnerships and collaboration with stakeholders

- Program and project management activities (for example, assessing applications, managing contribution agreements, reporting on results)

- Support industry-led market development initiatives

Outputs

- Strategic advice, representations and consultations

- Market information, analysis and intelligence

- Market access and market development collaboration

- Program and project management products (for example, contribution agreements, financial claims, etc.)

- Targeted communication and consultations

- Free trade agreements

Immediate outcomes

- Priority market access and trade policy interests are advanced (TB-sub)

- Stakeholders are aware of domestic and international market opportunities (TB-sub)

- Recipient sectors are supported to maintain the visibility of Canadian products and/or increase their capacity to identify and seize market development opportunities in targeted markets

Intermediate outcomes

- Access to international markets is increased or maintained by resolving or mitigating market barriers and advancing trade positions (DRF)

- The Canadian agriculture and agri-food sector is successfully supported in their efforts to take advantage of domestic and international market opportunities. (TB-sub)

Ultimate outcomes

The Canadian agriculture and agri-food sector contributes to growing the economy (DRF).

Source: Program Information Profile for Trade Market Expansion Program

Annex C: Abbreviated list of other market development programs and services

Federal departments and agencies

Global Affairs Canada CanExport Associations

Supports industry associations and trade organizations in all industry sectors by funding international business development activities, including participating in trade shows and other in-market activities and accessing market intelligence. To limit overlap, CanExport Associations no longer funds industry associations in the agriculture sector.

Note: CanExport Small Medium Enterprises Program does not overlap and thus is not included.

Export Development Canada

Offers trade knowledge, financial solutions, and international connections to companies of all sizes and sectors through a partnership with the Trade Commissioner Service.

Atlantic Canada Opportunities Agency

Provides research and competitive intelligence, as well as support for participation in trade shows, trade missions, B2B events and other in-market promotional events to Atlantic Canadian businesses in several sectors.

In-Market Partnership Fund

Supports targeted agriculture and agri-food branding and market development activities, including non-flagship trade shows, business meetings and networking and education events.

Global Analysis

Produces and distributes market research and analysis to identify market opportunities and build export capacity within Canadian industry.

Provincial

Provincial ministries of agriculture

All provincial ministries of agriculture have cost-shared programs under the Canadian Agricultural Partnership to help agriculture and agri-food businesses in their province to access market development supports, such as support for participation in trade shows, networking events, promotional activities, trade missions and market intelligence.

CAP-funded programs: Agriculture Business Program (Newfoundland and Labrador), Ag Action Program Market Development (Manitoba), Product2Market Program (Saskatchewan), Market Expansion and Export Readiness (Nova Scotia), Agri-industry Development and Advancement (New Brunswick) and Selling to Export Markets (Ontario).

Other provincial programs: Ontario Food Exports (Ontario), Alberta Export Expansion Program (Alberta).

Private sector/non-profit

Investment Agriculture Foundation

Supports the development of marketing skills and plans, the creation of market research and export-focused market development activities, including reaching new customers through interprovincial/ international tradeshows.

Private companies

Offer prepared or customized market data and analysis.

Annex D: Country comparison

| Program | 2021–22 |

|---|---|

| Canada (Can$) | |

| AgriMarketing | 17,474,885 |

| In-Market Partnership FundTable 2 note [2]Table 2 note [4] | 513,589 |

| Trade commissionersTable 2 note [1] | 7,107,620 |

| Flagship Trade ShowsTable 2 note [2] | 2,396,585 |

| Global AnalysisTable 2 note [2] | 1,221,897 |

| Global Affairs Canada CanExport Small Medium EnterprisesTable 2 note [3] | 3,750,000 |

| Total MD expenditures | 32,464,576 |

| Total agri-food, agriculture, and seafood exports ($ thousands)Table 2 note [5] | 83,234,328 |

| Ratio of total exports to MD expenditures (thousands) | 2.56 : 1 |

| United States (US$) | |

| Market Access ProgramTable 2 note [6] | 175,599,999 |

| Foreign Market Development ProgramTable 2 note [7] | 26,798,341 |

| E. Kika de la Garza Emerging Markets ProgramTable 2 note [8] | 8,000,000 |

| Technical Assistance for Specialty CropsTable 2 note [8] | 9,000,000 |

| Priority Trade FundTable 2 note [8] | 3,500,000 |

| Total MD expenditures | 222,898,340 |

| Total agri-food, agriculture, and seafood exports ($ thousands)Table 2 note [5] | 176,480,098 |

| Ratio of total exports to MD expenditures (thousands) | 0.79 : 1 |

| Australia (A$) | |

| Austrade Export Market Development GrantTable 2 note [9] | 137,900,000 |

| Total MD expenditures | 137,900,000 |

| Total agri-food, agriculture, and seafood exports ($ thousands)Table 2 note [5] | 53,911,987 |

| Ratio of total exports to MD expenditures (thousands) | 0.39 : 1 |

| Ireland (EUR €) | |

| Bord Bia Operating BudgetTable 2 note [10] | 49,919,000 |

| Total MD expenditures | 49,919,000 |

| Total agri-food, agriculture, and seafood exports (€ thousand)Table 2 note [5] | 13,950,294 |

| Ratio of total exports to MD expenditures (thousands) | 0.28 : 1 |

|

|

Annex E: Management response and action plan

Management agrees with the evaluation recommendations and have outlined how each will be addressed to below.

Recommendation 1: The Assistant Deputy Minister, Programs Branch in consultation with International Affairs Branch, enhance federal coordination and exporter awareness of market development and promotional supports.

Response to recommendation 1: Agreed. The Assistant Deputy Minister, Programs Branch, recognizes that enhanced collaboration is needed to limit any risk of duplication and to bolster awareness of available supports in the market development and export promotion area.

Program Branch officials will use existing forums and working groups to share details on the AgriMarketing Program under the Sustainable Canadian Agricultural Partnership, including sharing information on new and emerging markets being targeted. Examples of forums and working groups leveraged early in the implementation of the Sustainable Canadian Agricultural Partnership will be the Federal– Provincial Market Development Council, the International Market Engagement Teams, and various federal, provincial and territorial government tables.

- Target date:Endnote 15 January 31, 2024

- Responsible lead: Assistant Deputy Minister, Programs Branch; Director General, Business Development and Competitiveness Directorate

Recommendation 2: The Assistant Deputy Minister, Programs Branch improve the quality and timeliness of performance information and increase the sharing of best practices and lessons learned.

Response to recommendation 2: Agreed. The Assistant Deputy Minister, Programs Branch, recognizes that a mechanism to track and manage performance data is key to being able to report on Program successes.

A plan to respond to this recommendation is being developed, including: clarifying definitions of performance measures to ensure recipients are accurately and consistently reporting across projects; reducing the number of indicators reported per activity; standardizing performance measures and formatting work plans to allow for the capture of data ultimately through the Grants and Contributions Digital Platform (GCDP); leveraging other data collection systems, such as Knowledge Workspace, to collect data received on projects outside of the formal reporting process; and providing training to Program Officers on the collection of performance information and best practices to use when developing targets and assessing results.

- Target date: November 30, 2023

- Responsible lead: Assistant Deputy Minister, Programs Branch; Director General, Business Development and Competitiveness Directorate

Recommendation 3: The Assistant Deputy Minister, Programs Branch integrate design changes for greater project flexibility to adapt to changing market conditions and diversification of projects to support a more proactive export promotion approach.

Response to recommendation 3: Agreed. The Assistant Deputy Minister, Programs Branch, recognizes the need for the AgriMarketing Program to continue to support long-term strategic projects while allowing for greater project flexibility. This will be done by building in more adaptable approaches ensuring AgriMarketing recipients remain agile, competitive and well supported during ever-changing global market conditions, while still meeting broader policies, directives and priorities.

When establishing contribution agreements under the Sustainable Canadian Agricultural Partnership, Program Branch officials will meet with each AgriMarketing recipient to fully explain their options. Along with the option to amend their contribution agreement, they can include contingency plans with pre-assessed and approved activities. Examples of contingencies would be to include alternative countries within a broader regional market, allowing the applicant to shift activities without a formal amendment required to their contribution agreement.

- Target date: November 30, 2023

- Responsible lead: Assistant Deputy Minister, Programs Branch; Director General, Business Development and Competitiveness Directorate