Abbreviations

- AAFC

- Agriculture and Agri-Food Canada

- CFIA

- Canadian Food Inspection Agency

- GAC

- Global Affairs Canada

Executive summary

Purpose

The Office of Audit and Evaluation of Agriculture and Agri-Food Canada (AAFC) conducted an evaluation of the AAFC Trade Commissioner Service to assess its relevance, design, delivery, efficiency and effectiveness.

Scope and methodology

The AAFC Trade Commissioner Service is one component of the Trade and Market Expansion Program. This evaluation examined program activities from 2016‑17 to 2020‑21 using multiple lines of evidence including: a review of program documents, literature and administrative data; interviews with internal and external stakeholders; and a case study.

Background

AAFC's Trade Commissioner Service has two main areas of responsibility:

- Market development, such as connecting exporters to clients and supporting trade shows; and

- Market access and trade policy interests, such as working government-to-government to resolve trade challenges and helping exporters meet regulatory requirements.

Trade commissioners support Trade and Market Expansion Program activities related to trade irritants, trade agreements, market access issues, market development, market intelligence, trade leads, missions and flagship trade shows.

Findings

- The evaluation identified a continued need for the AAFC Trade Commissioner Service, which undertakes valuable market development and market access activities for Canadian agriculture and agri-food companies.

- AAFC trade commissioners have successfully worked to advance, maintain and restore market access and contributed to international market development.

- The AAFC Trade Commissioner Service employs both Canada-based and locally-engaged staff. Locally-engaged staff, who comprise the majority of AAFC trade commissioners abroad, would benefit from greater integration with AAFC Headquarters in Canada.

- Valuable performance measurement data is available for the Trade Commissioner Service; however, the evaluation identified concerns about timely access to data, consistency of data entry, and the ability to capture market access activity outputs.

- The Trade Commissioner Service provided value and efficiencies to Canadian agriculture and agri-food exporters.

Conclusion

The evaluation found that the AAFC Trade Commissioner Service is relevant to industry needs and aligned with federal priorities. AAFC trade commissioners effectively supported Trade and Market Expansion program outcomes, including advancing market access and trade policy interests and making industry aware of international market opportunities.

AAFC's locally-engaged staff could be better integrated with AAFC staff in Canada since COVID-19 restrictions have constrained in-person meetings and training normally held in Canada. Consistent practices for capturing performance results and having more timely access to Trade Commissioner Service performance data would aid in departmental performance reporting.

Recommendations

- Recommendation 1: The Assistant Deputy Minister, International Affairs Branch, should implement a strengthened human resource strategy to better integrate locally-engaged staff.

- Recommendation 2: The Assistant Deputy Minister, International Affairs Branch, should develop and implement ways to improve the timely access to existing data platforms and standards for the entry of key performance metrics.

Management response and action plan

Management agrees with the evaluation recommendations and has outlined an action plan to address them by March 31, 2023.

1.0 Introduction

The Office of Audit and Evaluation of Agriculture and Agri-Food Canada (AAFC) conducted an evaluation of the AAFC Trade Commissioner Service as part of the 2020‑21 to 2024‑25 Office of Audit and Evaluation Plan. This evaluation was conducted in accordance with the Treasury Board's Policy on Results and is intended to inform current and future programming and policy decisions.

2.0 Scope and methodology

The Trade and Market Expansion Program was last evaluated in its entirety in 2016. During the preliminary assessment of Trade and Market Expansion, a risk assessment (which included consultations with program staff) determined that of the five Trade and Market Expansion Program components, the following three would be prioritized and evaluated individually to enable a more focused examination of each:

- Market development activities,

- Trade Commissioner Service, and

- AgriMarketing Program.

The AAFC Trade Commissioner Service is the second component to be evaluated during this reporting cycle. Other components of the Trade and Market Expansion Program, including Trade Agreements and Negotiations and the International Collaboration Program, as well as the activities of the Canadian Food Inspection Agency (CFIA), are out of scope for this evaluation.

This evaluation assessed the relevance, design, delivery, efficiency and effectiveness of the AAFC Trade Commissioner Service between 2016-17 and 2020-21. The AAFC Trade Commissioner Service was evaluated using multiple lines of evidence including: a review of program documents, literature and administrative data; interviews with internal and external stakeholders; and a case study. For a detailed description of the methodology, see Annex A .

3.0 Program profile

The AAFC Trade Commissioner Service was created in 1994 to augment Global Affairs Canada's (GAC) Canadian presence abroad with dedicated agriculture and agri-food sector experts. The goal of the AAFC Trade Commissioner Service is to support the Canadian agriculture and agri-food industry's efforts to maintain market access and expand business activities in international markets. AAFC trade commissioners provide direct support to Canadian agriculture and agri-food exporters and work collaboratively with GAC and CFIA to:

- resolve market access issues and contribute to advancements in trade policy;

- influence international technical trade-related discussions, policies and safeguards; and,

- support Canadian agriculture and agri-food exporters to take advantage of opportunities in international markets.

3.1 Areas of responsibility

The AAFC Trade Commissioner Service has two main areas of responsibility:

- International business and market development; for example, supporting: the analysis of international business and export market trends; the planning, development and evaluation of marketing strategies; trade show activities and incoming missions; and the implementation of integrated federal, provincial and industry market development strategies.

- The resolution of market access issues in markets with Free Trade Agreements; for example, supporting negotiations to resolve trade irritants and market access issues by formulating policy options and advocacy activities, and by providing positions, strategies and advice to headquarters and mission management.

3.2 Expenditures

From 2016-17 to 2020-21, expenditures for the AAFC Trade Commissioner Service were over $35 million (see Table 1). The AAFC Trade Commissioner Service employed an average of 42 full-time equivalent staff annually at 22 posts in Canada and in 16 different countries.

| 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | Total | |

|---|---|---|---|---|---|---|

| Salary[1] ($) | 1,528,285 | 1,547,754 | 1,719,825 | 1,524,075 | 1,618,926 | 7,938,864 |

| Non-pay operating[2] ($) | 5,370,679 | 5,368,237 | 5,239,114 | 5,180,948 | 6,280,142 | 27,439,120 |

| Total program cost ($) | 6,898,964 | 6,915,991 | 6,958,939 | 6,705,023 | 7,899,068 | 35,377,984 |

| Full-time equivalents | 38.30 | 36.89 | 39.74 | 45.97 | 47.44 | N/A |

|

Note: 1. Salary includes staff based in Canada and abroad. Market Access Geographic Division estimated allocation is one full-time equivalent per year. 2. Non-Pay Operating includes transfers to GAC to cover the cost of locally-engaged staff and common services abroad. Source: Program Financial Reports and Program Performance Reports |

||||||

3.3 Intended outcomes

Five outcomes in the Trade and Market Expansion logic model are being examined as part of this evaluation:

- Immediate outcome: Priority market access and trade policy interests are advanced;

- Immediate outcome: Stakeholders are aware of international market opportunities;

- Intermediate outcome: The Canadian agriculture and agri-food sector is successfully supported in their efforts to take advantage of international market opportunities;

- Intermediate outcome: Access to international markets is increased or maintained by resolving or mitigating market barriers and advancing trade positions; and

- Ultimate outcome: The Canadian agriculture and agri-food sector contributes to growing the economy.

For the full Trade and Market Expansion logic model, see Annex B.

4.0 Relevance

This section summarizes evaluation findings on the continued need for the AAFC Trade Commissioner Service, the extent to which AAFC trade commissioners meet this need and alignment with federal and departmental priorities.

The AAFC Trade Commissioner Service plays a significant role in facilitating international market development activities and advancing access to international markets, in alignment with federal priorities.

4.1 Continuing need for the AAFC Trade Commissioner Service

The Canadian agriculture and agri-food sector is important to Canada's current economy and future economic growth. In 2020, the agriculture and agri-food sector contributed over $139 billion (around 7.4 percent) to Canada's gross domestic product and one in nine jobs in Canada.Footnote 1 From 2015 to 2019, approximately half of the value of primary agricultural production in Canada (excluding fish and seafood) was exported as either primary commodities or processed food and beverage products. As such, the agriculture and agri-food sector depends on its ability to export. The AAFC Trade Commissioner Service can support companies wanting to export products, as evidenced in a 2015 study; Canadian exporters who accessed Trade Commissioner Services were found to export, on average, 17.9 percent more than comparable exporters who do not access these services.Footnote 2

Program documents noted the United States accounts for approximately half of the value of Canadian agriculture and agri-food exports; therefore, more diversification of export markets could reduce Canada's vulnerability to fluctuations in one market. New free trade agreements, such as the Canada-European Union Comprehensive Economic and Trade Agreement (signed in 2016) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (signed in 2018), open new opportunities for Canadian businesses to access and export to a more diversified international market. The evaluation found that through activities such as providing training to businesses on trade agreements, the AAFC Trade Commissioner Service is well positioned to support exporters in their product and market diversification efforts.

The increased use of non-tariff barriers since the mid-1990s led to a greater number and more complex technical trade and market access issues in international markets. Starting in early 2020, the COVID-19 pandemic further disrupted international supply chains with effects that are likely to continue for years into the future. Such disruptions to these supply chains can change the supply and demand landscape in international markets. For example, a country that can no longer import from its previous source may increase demand for Canadian products, while reduced production capacity in another country may reduce demand for primary agriculture exports. The changing global context highlights a need for trade commissioners, who can support Canadian businesses in identifying and accessing new markets and who can advocate for Canada's interests (for example, the reduction of non-tariff and other barriers).

The evaluation found that AAFC trade commissioners meet the need for market development by:

- establishing relationships and networks with international exporters;

- supplying on-the-ground market intelligence and knowledge of the local and cultural context;

- providing a dedicated focus and specialized knowledge on agriculture; and

- identifying new opportunities, including important events and activities, for Canadian exporters.

In addition to the activities mentioned above, AAFC trade commissioners meet the need for market access by

- responding to market intelligence (for example, identifying what exporters need to do to meet specific buyer requirements or in-country regulations and passing on information about market opportunities to Canadian businesses);

- assisting companies with regulatory and labelling requirements;

- communicating exporter needs to government officials; and

- obtaining translated materials.

Clients surveyed by the Trade Commissioner Service explained that, because of the AAFC Trade Commissioner Service, they gained confidence to explore or expand operations and connected with partners or customers who otherwise would be difficult to identify.

4.2 Responsiveness to changing needs

Evidence showed that AAFC trade commissioners adapted their services to respond to changing needs arising from the COVID-19 pandemic. For example, international trade missions were hosted through online forums, which most interviewees described as an expedient way to connect with key international contacts. However, the shift to a virtual format had mixed success depending on the business culture in a specific market. For example, some virtual platforms cannot be used in specific countries, while the lack of face-to-face interaction can impede the development of interpersonal relationships and trust-building.

Overall, evaluation evidence supported that the AAFC Trade Commissioner Service has been responsive in addressing changing needs because of their understanding of international markets, their flexible approach, their effective networks and leadership and their ability to address emerging issues while located abroad.

4.3 Alignment with government and departmental priorities

Federal Budgets in the last five years have re-confirmed that Canada's agriculture and agri-food industry is vital to the Canadian economy. Speeches from the Throne (2015 and 2019) highlighted the Government's commitment to expanding trade opportunities, pursuing opportunities in emerging markets and removing trade barriers for businesses and farmers.

Since 2016, AAFC's departmental mandate has focused on supporting global export growth and market diversification in Canada's agricultural sector. The 2019 Mandate Letter to the Minister of Agriculture and Agri-Food highlighted “identifying additional tools to help Canada's agricultural and agri-food businesses export their products and diversify info global markets”. The 2021 Mandate Letter to the Minister also points to the goal of seizing new market opportunities.

The AAFC Trade Commissioner Service was found to align with the Government of Canada's objectives for market diversification and export growth, as well as AAFC's priorities to increase opportunities to export internationally. Trade commissioner services support exports by advancing market development and market access.

5.0 Program design and delivery

This section summarizes evaluation findings on the design and delivery of the AAFC Trade Commissioner Service, including governance and human resources.

AAFC's Trade Commissioner Service benefits from the hybrid model of Canada-based staff and locally-engaged staff; however, locally-engaged staff could be better integrated with AAFC's Headquarters.

5.1 Governance

AAFC has the principal federal responsibility for international business development in the agriculture and agri-food sector, mainly through the Trade and Market Expansion Program. The AAFC Trade Commissioner Service is one component of this Program.

The AAFC Trade Commissioner Service's human resource processes and overall budget are managed by Horizontal and Strategic Initiatives within the International Affairs Branch. Horizontal and Strategic Initiatives also undertakes policy coordination activities on behalf of the International Affairs Branch, such as providing advice and guidance on the effective management of the relationship with GAC for AAFC and CFIA. AAFC's Regional Offices (under the Market and Industry Services Branch) share market intelligence from trade commissioners with industry and connect qualified suppliers/exporting agri-food companies to trade commissioners abroad. The Market Access Geographic Division (under the International Affairs Branch) focuses on maintaining, re-opening and expanding market access, advancing regulatory co-operation, and reviewing trade commissioner performance agreements and leave requests.

The Trade Commissioner Service commonly interacts with representatives from AAFC Headquarters, AAFC Regional Offices, provincial governments and Canadian agriculture and agri-food exporter clients. The roles and responsibilities of AAFC, GAC, CFIA, Regional Offices and the International Affairs Branch are clearly outlined in the AAFC-DFATD [now GAC] Memorandum of Understanding on International Commerce for the Agriculture and Agri-food Sector. Other documents, including the Foreign Service Directives, form the suite which governs governmental operations overseas. Although the general roles and responsibilities of AAFC and GAC are outlined within program documents, the evaluation found that clients had difficulty understanding the difference between the three departments at Post (AAFC, GAC and CFIA) and did not always know who they needed to contact. Other stakeholders, such as provincial representatives posted in overseas countries, add to the number of government officers with whom a business client might interact.

AAFC trade commissioners participate in International Market Engagement Teams that include federal and provincial partners, the AAFC Regional Operations Directorate, the AAFC Geographic Division, and industry associations. The evaluation found this involvement contributed to the coordination of market development activities in priority markets.

5.2 Human resources

The AAFC Trade Commissioner Service uses a hybrid model which includes two types of positions abroad: locally-engaged staff (employees hired from the Post country) and Canada-based staff (employees from Canada on assignment and working at the Post). The majority of locally-engaged staff are trade officers who perform similar duties to Canada-based staff, while others are hired in assistant (administrative) positions. The number and location of AAFC-funded employees abroad varied, as positions were added and discontinued over the evaluation reference period (see Table 2). Over half of positions were located in China, with fewer in Europe, the Middle East and the Americas (see Annex C).

There are benefits to having both Canada-based staff and locally-engaged staff involved in the AAFC Trade Commissioner Service, as each brings key skills and knowledge to their roles while contributing to the overall support needed by the agriculture and agri-food sector. Locally-engaged staff comprised the majority of AAFC-funded staff abroad over the evaluation period; in many countries, the locally-engaged trade officer is the only representative of AAFC to undertake trade commissioner work. Locally-engaged staff can speak local languages, understand local contexts, are likely to be in their positions longer-term and are usually less costly for AAFC to hire. Alternatively, Canada-based staff have extensive knowledge of the Canadian context and can represent Canada in government-to-government interactions such as market access negotiations; however, Canada-based staff are limited to two-to-four-year postings with higher associated costs (for example, pre-posting expenses and relocation costs).

| Description | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | Average |

|---|---|---|---|---|---|---|

| Canada-based staff | 11.80 | 10.39 | 13.24 | 13.47 | 12.94 | 12.37 |

| Locally-engaged staff | 23.00 | 23.00 | 23.00 | 30.00 | 30.00 | 25.80 |

| Horizontal and Strategic Initiatives Group | 2.50 | 2.50 | 2.50 | 1.50 | 3.50 | 2.50 |

| Market Access Geographic Division | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Total number of staff by full-time equivalent | 38.30 | 36.89 | 39.74 | 45.97 | 47.44 | 41.67 |

|

Source: Program Performance Reports |

||||||

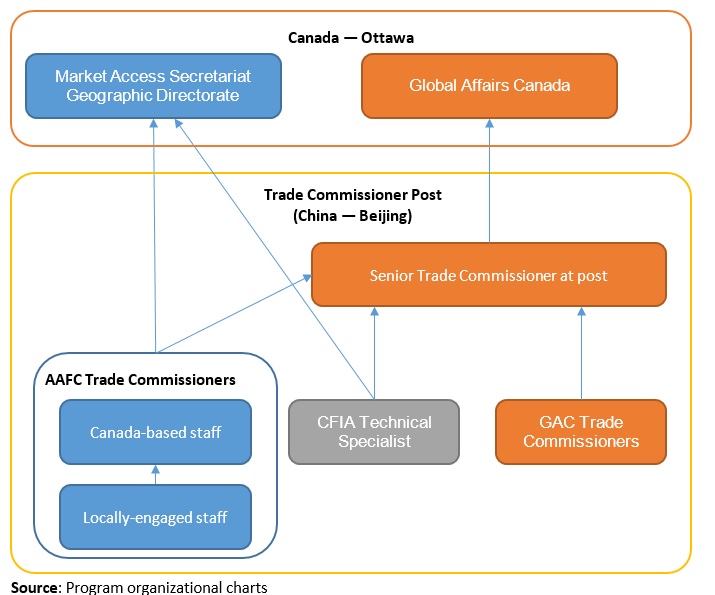

AAFC trade commissioners work as part of a team of trade commissioners at the Post, but AAFC and GAC trade commissioners report to different organizations with different managers and mandates. AAFC trade commissioners report functionally to both the GAC Senior Trade Commissioner at the Post and the Market Access Secretariat Geographic Director in Canada (see Beijing China example in Annex D). The evaluation identified challenges to this approach related to multiple levels of reporting, performance management processes and differing priorities and direction between AAFC and mission management. For example, AAFC trade commissioners report to AAFC Headquarters in Canada for leave approval and performance management, rather than the team they work with every day at the Post. Recently, GAC staff at the Post have been integrated into the performance management process for AAFC trade commissioners, which addresses one aspect of these challenges.

AAFC participates in and approves the hiring of AAFC-funded locally-engaged staff, while human resource management of locally-engaged staff (including position classification and performance management) is the responsibility of GAC. As such, AAFC's Headquarters interacts primarily with Canada-based staff, whereas AAFC's locally-engaged staff trade officers report to GAC at the Post and have more limited interaction with AAFC Headquarters. Locally-engaged staff were brought to Canada in the past for an annual meeting with AAFC staff and agriculture and agri-food stakeholders, for outreach activities across the country and training. With the advent of COVID-19, in-person interactions and travel ceased and there have been no online training or similar activities initiated as a replacement. Interviewees expressed an interest in increasing the integration of locally-engaged staff with AAFC Headquarters, as training and visits to Canada would increase their knowledge of Canadian agriculture and agri-food sector needs, context and issues.

6.0 Performance

This section provides an overview of the performance of AAFC’s Trade Commissioner Service, including performance measurement, efficiency and achievement of expected outcomes.

6.1 Performance measurement

Valuable performance measurement data is available for the Trade Commissioner Service; however, the evaluation identified concerns about timely access to data, consistency of data entry, and the capturing of market access activity outputs.

The Trade and Market Expansion Performance Information Profile and logic model are designed to incorporate the multiple program components of the Trade and Market Expansion Program. As such, some Trade and Market Expansion performance indicators are supported by more than one program, making it difficult to ascertain direct attribution to certain outcomes. Nonetheless, an assessment of Trade Commissioner Service indicators found the indicators to be useful for reporting on program performance. Performance data captured by two performance measurement systems effectively addressed most of these indicators.

6.1.1 Performance measurement systems

There are two key performance measurement systems used by AAFC to collect, monitor and report on Trade Commissioner Service activities:

- TRIO (GAC’s Client Relationship Management system) is the primary tool used by AAFC trade commissioners to capture performance information and collect data on key activities across multiple lines of business, such as the number of services, outcalls, referrals, opportunities and successes.

- Strategia, used by GAC and AAFC for strategic planning purposes, supplements TRIO data by capturing descriptive and financial information on trade commissioner activities, such as trade shows, industry exhibitions and participation in government-industry working groups. Satisfaction surveys are also conducted to capture client feedback on trade commissioner activities.

The evaluation found these systems provided a vast amount of data for performance measurement. This data was useful in demonstrating the Trade Commissioner Service’s capacity to help clients explore and pursue potential business opportunities, and captured the results of business transactions contributing to Canada's economic growth.

6.1.2 Limitations of the performance measurement systems

AAFC Trade Commissioner Service performance results may be underestimated due to reporting gaps and unreported data; for example, successes are not consistently captured due to inconsistencies between data entry requirements and definitions of ‘outputs’ and ‘successes’ at different Posts. In addition, TRIO does not provide results specific to AAFC trade commissioners, separate from GAC trade commissioners at the same Post, though performance results from TRIO can be extracted to provide a breakdown for the agriculture sector. To isolate activities carried out by AAFC trade commissioners, a manual lookup must be done of each AAFC trade commissioner by name. It is mandatory for GAC trade commissioners to use TRIO for performance reporting purposes, and it was clarified during the evaluation period that AAFC trade commissioner at Post should be doing the same, which is now integrated into AAFC trade commissioner mandate letters.

There is evidence to suggest performance measurement systems do not capture the extent of all activity that is occurring; for example, these systems do not effectively capture market access activities which require considerable effort and time (such as advocacy, relationship building and local, on-the-ground activity). The evaluation identified gaps in the current performance measurement system, such as not including the following:

- Qualitative measures that help identify successes;

- Specific quantitative measures (for example, number of introductions made, number of contracts signed, number and type of issues resolved for Canadian companies, number of market information reports developed and the number of events/initiatives/webinars organized and held);

- Information on timeliness to fulfill requests and respond to inquiries; and

- Information on the extent to which trade commissioner involvement generated sales or business for clients.

Access to TRIO trade commissioner performance data is an area needing improvement. International Affairs Branch staff do not have direct access to and training on the use of TRIO. As such, to secure agriculture trade commissioner data, a request is made to GAC to generate data extracts based on the specifications given by AAFC. It may take a few days to multiple weeks to process a request, depending on the number of requests and level of detail required. These data are pertinent for reporting on the performance of the Trade Commissioner Service and are used by other AAFC divisions. Further, AAFC regional offices in Canada use a different Client Relationship Management system than trade commissioners despite interacting with many of the same clients.

6.2 Efficiency

Notwithstanding the cost for in-person resources in international markets, the Trade Commissioner Service provides valuable and efficient services to Canadian agriculture and agri-food exporters.

6.2.1 Cost considerations for AAFC trade commissioners

Expenditures for Canada-based staff and locally-engaged staff differ according to location and the applicable policies for each. In addition to the suite of human resource policies that apply to government employees when in Canada, the National Joint Council’s “Foreign Service Directives” set out policies for Canada-based staff when posted overseas. This governs pre-posting expenses, relocation costs and the cost of education for dependents. These expenses can make it more expensive to post Canada-based staff abroad compared to locally-engaged staff who already live in-country.

The higher cost of hosting Canada-based staff at Post is primarily driven by a difference in common services cost (for example, administration and advisory, property and material, security and transportation services). In 2021-22, the cost of common services for Canada-based staff was $175,996 per year compared to $90,810 for locally-engaged staff with offices, which is nearly double. Having trade commissioners based in international markets is costly, but the AAFC Trade Commissioner Service seeks efficiencies through its Resource Allocation Determination system. This system monitors resource allocation through bi-annual updates, which ensures trade resources are allocated to regions with opportunities and higher client demand.

6.2.2 Value of service for the sector

The AAFC Trade Commissioner Service adds value and efficiencies for the agriculture and agri-food sector by functioning as a centralized body that collects market information and conducts market access and development activities to benefit the broader sector. Without the free and open access to market information provided by the Trade Commissioner Service, activities would need to be undertaken by individual companies at their own cost, isolated for internal use. As such, the Trade Commissioner Service provides good value for money for clients, especially small and medium-sized enterprises that require the critical market navigation function and market information services the Trade Commissioner Service provides.

The vast majority of AAFC Trade Commissioner Service clients from the Canadian agriculture and agri-food sector expressed satisfaction with the assistance they have received. A 2021 GAC client satisfaction survey showed a five-year average client satisfaction rating of almost 91% for AAFC officers. The perceived value of services was generally dependent upon the performance of the individual trade commissioner. Some trade commissioners were described as under-resourced, over-capacity, or lacking the time to provide support, while others were described as proactive in informing industry about demand for products or innovative in their approaches to entering smaller markets.

6.2.3 Efficiency in generating successes

The efficiency of the AAFC Trade Commissioner Service can be measured by its ability to convert services and referrals into successes (as demonstrated by GAC in its 2017 evaluation of trade offices in China) using data from TRIO and the following formula:

Description of above image

Efficiency ratio equals number of services plus referrals divided by number of successes

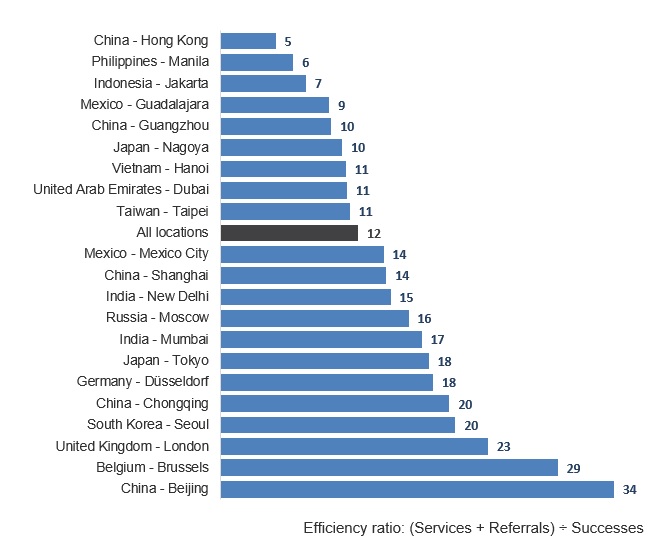

The number of services (the provision of detailed information or intelligence to a client by a trade commissioner) plus referrals (the identification of a specific business lead with a foreign business entity) divided by the number of successes (the achievement of a specific result, such as a pursued opportunity) is referred to as the “efficiency in generating successes” ratio. Efficiency ratios were calculated for the agriculture and agri-food sector by Post from 2017 to 2021, where a ratio less than 100 is considered efficient. Overall, agriculture and agri-food trade commissioners were found to be efficient in converting services and referrals into successes, requiring only 12 services or referrals to produce a success. The evaluation found all posts to be efficient during this period (see Figure 1 ).

Efficiency ratios provide an estimation of the efficiency of different trade commissioner Posts; however, not all Posts are directly comparable due to differences in locations and focus of activities. For a list of caveats, see Annex A.

Description of above image

| Efficiency ratio | |

|---|---|

| China – Hong Kong | 5 |

| Philippines – Manila | 6 |

| Indonesia – Jakarta | 7 |

| Mexico – Guadalajara | 9 |

| China – Guangzhou | 10 |

| Japan – Nagoya | 10 |

| Vietnam – Hanoi | 11 |

| United Arab Emirates – Dubai | 11 |

| Taiwan – Taipei | 11 |

| All locations | 12 |

| Mexico – Mexico City | 14 |

| China – Shanghai | 14 |

| India – New Delhi | 15 |

| Russia – Moscow | 16 |

| India – Mumbai | 17 |

| Japan – Tokyo | 18 |

| Germany – Düsseldorf | 18 |

| China – Chongqing | 20 |

| South Korea– Seoul | 20 |

| United Kingdom– London | 23 |

| Belgium – Brussels | 29 |

| China – Beijing | 34 |

Note: A lower number reflects more successes per service or referral.

Source: Program performance data

On average, trade commissioners achieved one success for every 12 referrals or services provided. Anything less than 100 is considered efficient.

6.3 Effectiveness

The following section describes the extent to which AAFC’s Trade Commissioner Service is contributing to intended immediate, intermediate and long-term outcomes.

6.3.1 Contribution to the advancement of market access and trade policy interests

The AAFC Trade Commissioner Service has contributed to the advancement of market access interests despite not fully meeting performance targets.

The evaluation found the AAFC Trade Commissioner Service engages in activities to support the advancement of market access and trade policy interests. Both locally-engaged staff and Canada-based staff contribute to this outcome, but Canada-based staff are in the best position to address issues related to market access due to their government-to-government role.

There are five types of activities intended to advance market access and trade policy interests:

- building and maintaining a diplomatic presence at events;

- building and maintaining relationships with foreign counterparts;

- advising industry on new or upcoming trade requirements and barriers;

- gathering and providing market intelligence; and

- providing input to inform the market development strategies of International Market Engagement Teams.

The AAFC Trade Commissioner Service targets 45 outreach activities every year to advance market access and trade policy interests. This target was not met target in 2019-20 and 2020‑21, with 35 and 14 activities respectively (prior data was unavailable at time of reporting). However, a review of project documentation showed a number of efforts that trade commissioners are making regarding market access. These included in-person and teleconference meetings with foreign ministers at the deputy minister and assistant deputy minister levels, supporting Canadian exhibitors at tradeshows, participating in conferences, discussing bilateral issues and cooperation to advance market access issues. An inability to meet targets in the last two years may be, in part, a consequence of the COVID-19 pandemic which limited international travel and in-person engagement opportunities.

6.3.2 Contribution to increased stakeholder awareness of international market opportunities

Agriculture-focused trade commissioners contributed to increased stakeholder awareness of international market opportunities by meeting or exceeding most relevant performance targets.

The evaluation found the AAFC Trade Commissioner Service helped increase stakeholder awareness of international market opportunities by

- raising awareness of trade policy issues, particularly those that would affect long-term market access;

- bringing immediate opportunities or information to the attention of industry;

- inviting industry to relevant events and international market activities;

- maintaining communication and supporting the mutual exchange of ideas;

- making industry aware of pertinent market information such as price, reputation, tastes and culture;

- attending industry meetings to prepare stakeholders for new market potential created by trade agreements;

- leading targeted outreach; and

- facilitating contact between key individuals.

Agriculture-focused trade commissioners (including AAFC, GAC and CFIA officials) averaged almost 1,800 active clients every year since 2017, exceeding the performance target of 1,500 active clients annually. The COVID-19 pandemic has not reduced the number of clients; instead, the number of active clients has increased.

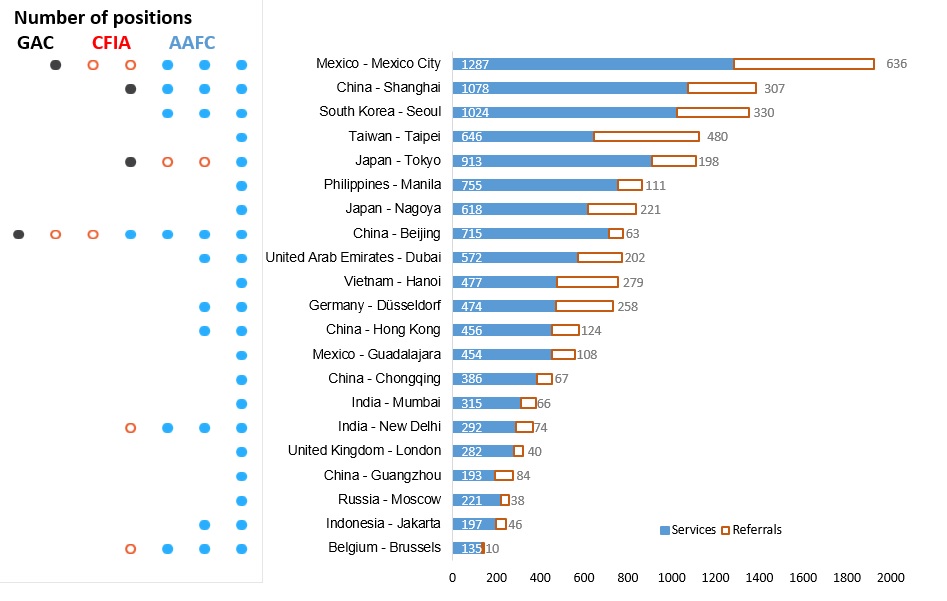

The volume of services delivered by AAFC, GAC and CFIA officials from 2017 to 2021 is shown in Annex E (as well as referrals made). According to TRIO data, an average of almost 2,300 services were delivered to clients each year, exceeding the performance target of 2,060 services delivered annually. TRIO data showed more than 1,000 outcallsFootnote 3 were conducted annually across all Posts included in the dataFootnote 4, for a total of 5,695 outcalls from 2017 to 2021. Strategia data (which reflects outcalls for 21 AAFC trade commissioners) indicated that AAFC trade commissioners exceeded outcall targets during every fiscal year of the evaluation reference period, except for 2020-21 with the onset of the COVID-19 pandemic.

6.3.3 Support for Canadian businesses to take advantage of new international market opportunities

The AAFC Trade Commissioner Service supported Canadian agriculture and agri-food companies in taking advantage of international market opportunities.

The evaluation found AAFC Trade Commissioner Service activities enabled Canadian businesses to take advantage of new international market opportunities. From 2017 to 2021, services and referrals resulted in 1,235 intermediate and final successes. The most common successes achieved by trade commissioners were opportunities pursued (646) and economic outcomes facilitated (476) (see Figure 2). On average, almost 130 opportunities were pursued by Canadian agriculture and agri-food companies each year, which exceeded the performance target of 85 opportunities in every year except 2017 (with 58 opportunities pursued).

The AAFC Trade Commissioner Service supported Canada’s agriculture and agri-food companies to take advantage of international market opportunities by

- promoting Canadian products to distributors;

- making introductions between exporters and potential buyers, distributors and other market contacts;

- identifying opportunities for industry to participate in market development events;

- bringing immediate opportunities to the attention of industry (for example, removing a technical barrier to trade); and

- informing companies of how to make their products ready for international markets (for example, labelling requirements).

International promotion

The AAFC Trade Commissioner Service’s efforts to promote Canadian agricultural goods are supported by the In-Market Partnership Fund (“the Fund”). The Fund was implemented in 2018 and provides $1.75 million over five years to support targeted market development activities, such as non-flagship trade shows, networking events and promotional activities in AAFC’s priority international markets. From 2018-19 to 2020-21, AAFC trade commissioners leveraged the Fund to implement 169 initiatives in collaboration with partners such as GAC, the Atlantic Canada Opportunities Agency, provinces and industry.

While AAFC trade commissioners have contributed to supporting Canadian businesses and other stakeholders to take advantage of international opportunities, the evaluation identified a need for AAFC to continue the coordinated approach to national promotional activities. Acknowledging that there are various federal programs contributing to the promotion of Canadian products, the evaluation confirmed the importance of maintaining awareness of Canadian products in international markets and the ongoing need to compete with the high-quality national branding campaigns of other countries.

Description of above image

| Intermediate Successes | Number of successes achieved | Target |

|---|---|---|

| Opportunity Pursued | 646 | 618 |

| Investor Visit to Canada | 20 | 2 |

| Partnership Pursued (2019-2021 only) | 7 |

| Final Successes | Number of successes achieved | Target |

|---|---|---|

| Economic Outcome Facilitated | 476 | 419 |

| Market Access Advanced | 64 | |

| Foreign Direct Invest Win (2018-2021 only) | 17 | 2 |

| Science, Technology and Innovation Partnership (2019-2021 only) | 5 |

Notes

This data reflects successes in the area of agriculture and agri-food by approximately 38 AAFC-funded employees, eight employees from CFIA and four employees from GAC, across 21 Posts. The number of AAFC-funded positions have varied over the time period.

No targets were set for Partnership Pursued, Market Access Advanced or Science, Technology and Innovation Partnership

Source: Program Performance Data

6.3.4 Increased access to international markets by resolving or mitigating market barriers and advancing trade positions

The AAFC Trade Commissioner Service contributed to advancing, maintaining and restoring access to international markets, although performance data does not adequately capture market access efforts.

The evaluation found that AAFC trade commissioners have increased access to international markets by resolving or mitigating market barriers and advancing trade positions. Examples of trade commissioner market access activities include

- communicating regulations, certifications, labelling and other requirements;

- resolving market access issues and trade disputes;

- market intelligence gathering and providing input to AAFC Headquarters during negotiations;

- pivoting to online international trade missions during the COVID-19 pandemic;

- maintaining entry and relationships in existing markets and expanding as opportunities arise;

- using relationships with authorities to troubleshoot regulatory matters on-the-ground; and

- making the Canadian presence visible (for example, advising on the best platforms for promotion) and maintaining influence.

AAFC’s Market Access Secretariat employs a methodology to assess the extent of efforts to resolve or mitigate market access barriers, trade disputes and trade issues. The division issues a score out of 100, where 100 indicates all possible efforts to advance issues were undertaken. A mean score for all issues (weighted to consider the importance of individual issues) is generated. From 2018 to 2020, the annual performance target of 80% was exceeded, with results ranging from 84.1% to 85.5% (partly attributable to the work of CFIA). This is evidence that nearly all partners and stakeholders have worked to understand issues, provide policy advice and discuss problem-solving.

Of the 1,235 successes by trade commissioners reported in the past five years, 64 were described as advancing market access; however, there are no targets against which to measure this activity. Further, Posts with market access activities as the primary focus (such as Brussels) reported no successes related to advancing market access over the evaluation period. A few federal and industry interviewees with strong knowledge of the Trade Commissioner Service identified challenges in facilitating market access. For example, in certain markets like the European Union, laws pertaining to trade issues are binding for all member states, and market access activities require ongoing and intentional communication. Enabling market access can be a slow process that takes years for success to be realized, and advocacy efforts may not always be successful. This makes market access efforts less visible than trade promotion activities. As such, performance data underestimates efforts by trade commissioners to advance market access.

Support for diverse population groups to access international markets

The Trade and Market Expansion Performance Information Profile does not include indicators or targets for performance related to Gender-Based Analysis Plus. Data from TRIO showed the number of agriculture clients served by GAC, AAFC and CFIA trade commissioners which are women-owned, youth-owned and Indigenous-owned businesses. These clients comprised a very low percentages of overall clients. For example, in 2020-2021, of the 1,123 unique small and medium‑sized enterprise clients, 65 (less than 6%) were women-owned businesses; 23 (2%) youth-owned; and seven (less than one%) Indigenous-owned (see Figure 3 ). The proportion of these types of clients has increased over time.

While some interviewees noted instances where the AAFC Trade Commissioner Service supported specific population groups to access international markets, such as the Women in Trade initiative and opportunities for industry engaging with Indigenous, women and youth exporters, support has not typically focused on targeting underrepresented groups.

Description of above image

| 2016-17 | 2018-18 | 2018-19 | 2019-20 | 2020-21 | |

|---|---|---|---|---|---|

| Women-owned | 4.1 | 4.4 | 4.6 | 5.4 | 5.8 |

| Youth-owned | 0.2 | 0.7 | 1.5 | 2.0 | 2.0 |

| Indigenous-owned | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 |

Source: Program Performance Reports

6.3.5 Contribution to economic growth

Although economic growth in the agriculture and agri-food sector is a result of many external factors, the AAFC Trade Commissioner Service has demonstrated that it contributed to increases in agriculture and agri-food exports.

The ultimate outcome for the Trade and Market Expansion Program is to contribute to growing the economy. Trade and Market Expansion is one of six AAFC program areas contributing to this outcome. Given the multiplicity of factors which contribute to economic growth, it is not possible to fully attribute economic growth to AAFC, nor to its Trade Commissioner Service. However, given that the AAFC Trade Commissioner Service has effectively contributed to its immediate and intermediate outcomes, it is reasonable to conclude the AAFC Trade Commissioner Service has contributed to the increase in agriculture and agri-food exports and supported growing the Canadian economy to some extent.

Most economic growth targets for the agriculture and agri-food sector were met during the evaluation reference period. The agriculture and agri-food sector exceeded AAFC’s departmental target for a 2% average annual economic growth rate; departmental results reports showed an annual economic growth rate of 2.5% from 2017-2018 to 2019-2020. In addition, the value of Canadian agriculture and agri-food exports, at $73.9 billion for 2020, was reported to be on track to meet its target of $75 billion by December 2025. Preliminary analysis suggests the recent growth in exports is due to high international market prices and increased demand for agriculture and agri-food sector products from China and the United States. AAFC also has a target of 4.5% average annual growth rate for sales of agri-food products between 2017 and 2025. The AAFC 2019-20 Department Results noted the sector did not meet this target (3.3% from 2017 to 2020); labour shortages, transportation infrastructure disruptions and regulatory challenges are some examples of what has hindered the Department’s ability to meet this target.

Evaluation evidence showed that the AAFC Trade Commissioner Service is a key factor in enabling the Canadian agriculture and agri-food sector to contribute to growing the economy. The agriculture and agri-food sector requires the specialized expertise of agriculture-dedicated trade commissioners and the Trade Commissioner Service’s contribution to the economy is evident through its ability to maintain trade in established markets, as well as grow into emerging markets and diversify beyond the United States. Industry interviewees stated that the Trade Commissioner Service facilitates company sales by helping them enter markets and resolve challenges. Other aspects of the Trade Commissioner Service that were considered economic enablers were the 'on-the-ground' perspective that trade commissioners offer, as well as the relationships and intelligence established through postings abroad.

7.0 Conclusions and recommendations

The evaluation found the AAFC Trade Commissioner Service is relevant in its ability to meet industry’s continued need for market development and market access activities and its alignment with federal and departmental priorities. Although there is a cost to having trade commissioners out-of-country, the Trade Commissioner Services provides good value and efficiencies for the agriculture and agri-food sector. AAFC trade commissioners contributed to Trade and Market Expansion program outcomes, including the advancement of market access, trade policy interests, and market development. The Trade and Market Expansion Program Information Profile does not include indicators to assess Gender-Based Analysis Plus, yet program data showed some uptake by diverse population groups.

The Trade Commissioner Service makes use of Canada-based staff and locally-engaged staff in international markets. Both groups bring a specialized set of skills and expertise to the Post; however, there are opportunities for further integration of locally-engaged staff with AAFC Headquarters in Canada through virtual or in-Canada meetings and training. This would help increase locally-engaged staff knowledge of the Canadian agriculture and agri-food sector. Further, while valuable performance measurement data was available to support this evaluation, there is a need to maximize the use of existing data systems. The International Affairs Branch would benefit from having direct access to and training on the use of TRIO, as this could provide more timely access to performance data. In addition, efforts to increase the consistency of capturing data would improve the quality of performance measurement data.

Recommendations

- The Assistant Deputy Minister, International Affairs Branch, should implement a strengthened human resource strategy to better integrate locally-engaged staff.

- The Assistant Deputy Minister, International Affairs Branch, should identify opportunities to develop and implement ways to improve the timely access to existing data platforms and implement standards for the entry of key performance metrics.

Management response action plan

Management from the International Affairs Branch are supportive of this evaluation as well as the recommendations and have outlined an action plan to address them by March 31, 2023.

Annex A: Evaluation methodology

Document, data, and literature review

To contribute to the assessment of program relevance, design and delivery, efficiency, and effectiveness, the evaluation reviewed internal program documents and performance data. With support from the Canadian Agriculture Library, the evaluation also examined select literature to support the assessment of relevance.

Key informant interviews

Interviews were conducted with internal and external stakeholders to assess program relevance, design and delivery, efficiency, and effectiveness. The evaluation involved 27 interviews with 29 stakeholders, including AAFC Trade Commissioners (9); senior officials at AAFC, GAC, and other federal government departments (7); industry stakeholders (9); and provincial stakeholders (4).

Case study

A case study was conducted to address evaluation question #4: “Were Trade Commissioner Service activities delivered in an efficient manner?” It involved the calculation of an efficiency ratio and an assessment of other considerations that can be used to inform decision-making on the allocation of Trade Commissioner Service resources. The following caveats should be considered when comparing efficiency ratios between Posts:

- There has been changing representation by AAFC trade commissioners at Posts over the evaluation period. Some Posts were only created partway through the evaluation period in 2018 (for example, Düsseldorf, New Delhi, Guadalajara, Manila, Seoul, Hanoi). One other AAFC posting was discontinued during this period.

- Data on services, referrals and successes has not been consistently captured in TRIO at all Posts over the evaluation period.

- Of the 21 Posts with data, six Posts included trade commissioners from GAC and/or CFIA who also worked on agriculture and agri-food sector files. The data does not separate the results of AAFC trade commissioners from CFIA and GAC trade commissioners who work together on agricultural issues, creating challenges in the attribution of services, referrals and successes to AAFC trade commissioners.

- Data for securing investment and expansion in Canada (foreign direct investment) wins were not tracked prior to 2018, while partnerships pursued and science, technology and innovation partnerships were not tracked prior to 2019.

- Due to the COVID-19 pandemic, some trade commissioners have been limited in their mobility within a region to pursue regular activities.

Methodological limitations

The following methodological limitations were considered in interpreting the data:

| Limitation | Mitigation strategy | Impact on evaluation |

|---|---|---|

| Response Bias: Key informants who participated in the evaluation may have a vested interest in the continuation of the Trade Commissioner Service. | The inclusion of five key informant groups, including those with varying degrees of separation from the program, helped provide varying perspectives. Data was also triangulated across multiple lines of evidence where possible. | Low |

| Data Limitation: Some data was missing or not available. Some data could not be disaggregated to the AAFC trade commissioner level. |

The evaluation worked with the data as available but noted issues limitations and identified areas to improve upon before the next evaluation. For the efficiency analysis the evaluation made use of the data that was quantifiable. |

Medium |

Evaluation questions

- Relevance: To what extent...

- Is there a continued need for Trade Commissioner Service (TCS) activities? How have the needs changed in the past 5 years?

- Design and delivery: To what extent...

- Were governance structures in place to ensure effective management and coordination of TCS activities? To what extent were the governance structures followed?

- Were performance measurement systems effective in collecting, storing, and monitoring TCS activities?

- Efficiency and effectiveness:

- To what extent were TCS activities delivered in an economical and efficient manner?

In what manner and to what extent did Trade Commissioner Service activities contribute to...

- The advancement of priority market access and market development?

- Increased stakeholder awareness of domestic and international market opportunities?

- Successfully supporting the Canadian agriculture and agri-food sector in its efforts to take advantage of new international market opportunities?

- Increase access to international markets by resolving or mitigating market barriers and advancing trade positions?

- Enable the Canadian agriculture and agri-food sector to contribute to growing the economy?

Annex B: Trade and market expansion program logic model

| Ultimate outcome |

The Canadian agriculture and agri-food sector contributes to growing the economy |

|---|---|

| Intermediate outcomes |

|

| Immediate outcomes |

|

| Outputs |

|

| Activities |

|

| Source: Performance Information Profile for the Trade and Market Expansion Program | |

Annex C: Geographic allocation of AAFC-funded employees and areas of responsibility, 2017 to 2021

| Canada-based staff trade commissioners | Locally-engaged staff trade officers | Locally-engaged staff assistants | |

|---|---|---|---|

| Americas | |||

| Mexico - Guadalajara | 0 | 1 MD (created 2019-20) | 0 |

| Mexico - Mexico City | 1 MA, MD | 1 MA, MD | 1 |

| U.S.A. - Washington D.C. | 1 MA | 0 | 0 |

| Europe | |||

| Belgium - Brussels | 1 MA | 2 MA | 0 |

| Germany - Düsseldorf | 0 | 2 MD (1 created 2019-20) | 0 |

| Italy - Rome | 1 MA, MD | 0 | 0 |

| Russia - Moscow | 1 MA, MD (ended 2020-21) | 1 MA, MD | 0 |

| United Kingdom - London | 0 | 1 MD | 0 |

| Middle East | |||

| United Arab Emirates - Dubai | 1 MA, MD | 1 MA, MD | 0 |

| South and Southeast Asia | |||

| India - Mumbai | 0 | 1 MD | 0 |

| India - New Delhi | 1 MA, MD | 1 MA, MD (created 2019-20) | 1 |

| Philippines - Manila | 0 | 1 MA, MD (created 2019-20) | 0 |

| Taiwan - Taipei | 0 | 1 MA, MD | 0 |

| Vietnam - Hanoi | 0 | 1 MD (created 2019-20) | 0 |

| Indonesia - Jakarta | 1 MA, MD | 0 | 1 |

| East Asia | |||

| China - Beijing | 2 MA | 1 MA, MD | 1 |

| China - Chongqing | 0 | 1 MD (created 2016-17) | 0 |

| China - Guangzhou | 0 | 1 MD | 0 |

| China - Hong Kong | 0 | 1 MA, MD | 1 |

| China - Shanghai | 0 | 2 MD | 1 |

| Japan - Nagoya | 0 | 1 MD (created 2019-20) | 0 |

| Japan - Tokyo | 0 | 0 | 1 |

| South Korea - Seoul | 1 MA, MD | 1 MA, MD (created 2019-20) | 1 |

| First year of evaluation period (2016-17): | |||

| Total 34 positions | 11 CBS | 15 LES Trade Officers | 8 LES Assistants |

| Percentage of positions | 32 | 44 | 24 |

| Last year of evaluation period (2020-21): | |||

| Total 40 positions | 10 CBS | 22 LES Trade Officers | 8 LES Assistants |

| Percentage of positions | 25 | 55 | 20 |

|

Notes

Number of “Canada-based staff trade commissioners” represents the number of postings and may not represent the number of budgeted staff in a given year. Source: Program Administrative Data |

|||

Annex D: Organization and reporting structure for the trade commissioner service in Beijing, China

Description of above image

The following is an example of the organization and reporting structure for the trade commissioner service in Beijing, China. The AAFC Trade Commissioners in Beijing China is led by its Canada Based Staff, who have their locally-engaged staff report to them. The AAFC Trade Commissioners work within the Trade Commissioner Post, working along side CFIA Technical Specialists and Global Affairs Canada Trade Commissioners. All three (AAFC Trade Commissioners, CFIA Technical Specialists, and Global Affairs Canada Trade Commissioners) report to the Global Affairs Canada Senior Trade Commissioner at Post. The Global Affairs Canada Senior Trade Commissioner at Post in turn reports to Global Affairs Canada in Ottawa. AAFC Trade Commissioners, and CFIA Technical Specialists, also report to AAFC’s Market Access Secretariat Geographic Directorate in Ottawa.

Annex E: Number of staff positions, as well as services and referrals, by trade commissioner post, 2017 to 2021

Description of above image

| GAC positions | CFIA positions | AAFC positions | Services | Referrals | |

|---|---|---|---|---|---|

| Mexico City, Mexico | 1 | 2 | 3 | 1,287 | 636 |

| Shanghai, China | 1 | 0 | 3 | 1,078 | 307 |

| Seoul, South Korea | 3 | 1,024 | 330 | ||

| Taipei, Taiwan | 1 | 646 | 480 | ||

| Tokyo, Japan | 1 | 2 | 1 | 913 | 198 |

| Manila, Philippines | 1 | 755 | 111 | ||

| Nagoya, Japan | 1 | 618 | 221 | ||

| Beijing, China | 1 | 2 | 4 | 715 | 63 |

| Dubai, United Arab Emirates | 2 | 572 | 202 | ||

| Hanoi, Vietnam | 1 | 477 | 279 | ||

| Düsseldorf, Germany | 2 | 474 | 258 | ||

| Hong Kong, China | 2 | 456 | 124 | ||

| Guadalajara, Mexico | 1 | 454 | 108 | ||

| Chongqing, China | 1 | 386 | 67 | ||

| Mumbai, India | 1 | 315 | 66 | ||

| New Delhi, India | 1 | 3 | 292 | 74 | |

| London, United Kingdom | 1 | 282 | 40 | ||

| Guangzhou, China | 1 | 193 | 84 | ||

| Moscow, Russia | 1 | 221 | 38 | ||

| Jakarta, Indonesia | 2 | 197 | 46 | ||

| Brussels, Belgium | 1 | 3 | 135 | 10 |

Source: Program Performance Data, and Program Administrative Data