About this guide

The Canadian agri-food sector is a major contributor to the Canadian economy, with production and processing of a wide range of food products across all of the Canadian provinces. Canada is the fifth-largest exporter of agriculture and agri-food products in the world with exports valued at approximately $73.9 billion in 2020. The United States is the largest export destination accounting for over 50% of agri-food exports, followed by China (13%), Japan (7%), the European Union (EU) (6%), and Mexico (2%).

The Canada-EU Comprehensive Economic and Trade Agreement (CETA) gives Canadian companies unprecedented access to the European market and its over 500 million consumers - a great many of whom enjoy and appreciate high quality food products. In 2020 Canada exported $4.6 billion in agri-food, fish and seafood products to the EU. CETA has eliminated tariffs on over 94% of Canadian food products giving our exporters a competitive advantage in Europe - it's an opportunity not to be missed!

This guide will provide concrete advice on exporting agri-food products to the EU from choosing the right market and developing a business plan through to distribution, logistics and product launch. It will also help new-to-market exporters navigate EU regulations and take advantage of CETA. A comprehensive summary in the form of a market-readiness checklist is also included to help ensure that exporters are prepared and positioned for success. Exporters of fish and seafood products should consult the Guide to exporting fish and seafood products to the EU for specific guidance on those products.

This guide is specifically targeted to Canadian companies who have an export-ready product and who have conducted preliminary market research to confirm the feasibility of entering the EU market. Exporters are also encouraged to reach out to the Trade Commissioner Service to discuss opportunities and validate their market entry approach.

Canada's agrifood industry and the Government of Canada

The Government of Canada's responsibility for the Agri-food industry falls with two organizations:

- Agriculture and Agri-Food Canada (AAFC) sets policy, regulates, and provides market access , market development, branding and traceability support for agriculture and agri-food products

- The Canadian Food Inspection Agency (CFIA) sets policy, requirements and inspection standards for food, live animals for human consumption and feed production and export.

Contents

- Understanding the EU market

- CETA and Opportunities for Agri-Food Exporters

- Choosing the right EU market

- Choosing the right business model

- Implementing a market entry plan

- Marketing and launching your product

- Administration, logistics, and distribution

- E-Commerce Potential

- Exporting Agri-food products from Canada – what to be aware of

- Assistance for Canadian Exporters

- Checklist of key steps to successful Agrifood exports to the EU

Understanding the EU market

The EU is the world's largest single market and is a key trading partner full of growing opportunities. It is also a Customs Union with its 27 member states forming a single territory for customs purposes, meaning:

- No customs duties are paid on goods moving between EU Member States.

- All Member States apply a common customs tariff for goods imported from outside the EU.

- Goods that have been legally imported can circulate throughout the EU with no further customs checks.

Note: For information on the UK: Brexit: Information for Canadian Companies for more information.

In 2020, the EU agri-food trade was valued at €254 billion ($400 billion) with €184 billion in exports and €122 billion in imports. The strong purchasing power of EU consumers fuel the major food trends such as healthy eating, preserving the environment and sustainable sourcing and packaging of food products.

The EU agri-food market also faces challenges including mislabelling, environmental and ecological issues, and food safety. Consumers seek reassurances from their supermarket, local farmer, fishmonger or online shop that the products they are purchasing are as sustainable, environmentally friendly and healthy as possible.

CETA and Opportunities for Agri-Food Exporters

The Canada-European Union Comprehensive Economic and Trade Agreement (CETA) is a progressive free trade agreement which covers virtually all sectors and is designed to eliminate or reduce barriers to trade. Canadian agrifood exporters benefit from preferential access to the EU with tariffs that have been either reduced or eliminated entirely. This provides exporters with an opportunity to sell products that were previously too cost-prohibitive to sell into the EU, or to increase their market share, especially over competitors from countries that do not have a preferential trade agreement in force with the EU.

Not all agri-food products are covered by CETA, and there are specific rules with respect to origin that must be met in order to qualify. Products excluded from the scope of the CETA agreement include chicken, turkey meat, eggs and their directly derived products. Consult Opportunities and Benefits of CETA for Canada's Agriculture and Agri-Food Exporters for more information:

Tariff elimination

In order to determine the tariff rate applicable to products imported to the EU under CETA, exporters will need to know the 6-digit Harmonised System (HS) code of their product. HS codes must be provided on export declarations to all destinations including the EU, but if you have difficulty identifying the correct HS code, contact a Trade Commissioner for assistance. If there are doubts about which HS code should be applied to a product, exporters can undertake a procedure called a binding tariff information, but it is not necessary in most cases.

Annex 2-A: Tariff elimination and Annex 2-A: Tariff schedule of the EU from the CETA text provide full details of tariff elimination.

Free online tools allow Canadian exporters to check tariffs on their products to the EU, including CETA-related staging and tariff elimination:

- Canada Tariff Finder

- TARIC (EU website detailing the duties and information about tariff phase-outs)

CETA Tariff Rate Quotas

Under CETA, the European Union has established annual duty-free tariff-rate-quotas for several products. Details can be found in Annex 2-A of the CETA Agreement.

| Product / Commodity | Quantity | Timeframe | Comments |

|---|---|---|---|

| Processed shrimp | 23,000 MT |

|

|

| Frozen Cod | 1,000 MT |

|

|

| Low and Medium Quality Common Wheat | 100,000 MT |

|

|

| Sweet Corn | 8,000 MT | As from January 1, 2022 onwards |

|

| Bison | 3,000 MT | As from 2017 and onwards |

|

| Fresh/chilled Beef and Veal | 30,840 MT (carcass weight equivalent) | As from January 1, 2022 onwards |

|

| Frozen/ other Beef and Veal | 15,000 MT (carcass weight equivalent) | As from January 1, 2022 onwards |

|

| High Quality Fresh, Chilled and Frozen Meat of Bovine Animals | 11,500 MT (carcass weight equivalent) | As from 2017 and onwards |

|

| Pork | 75,000 MT (carcass weight equivalent) |

As from 2017 and onwards |

|

CETA rules of origin

To be eligible for CETA preferential tariff treatment, products must meet certain conditions. Please consult the full text of the CETA Protocol for Rules of Origin for more information, but in summary, products fall into two categories:

- Products "wholly obtained" or produced from exclusively originating materials;

- Fruits, vegetables, and grains harvested in Canada (or the EU);

- Fish/Seafood caught, landed and processed within Canadian or EU territorial waters;

- Meats as long as the animals were born and slaughtered in Canada and have stayed in Canada their whole life;

- Processed products – must be processed in Canada with all-Canadian ingredients and must involve "sufficient production" in Canada (cooking is sufficient production, packing is not).

Exporters must include the text of the CETA origin declaration (see Annex 2 of the ETA Protocol for Rules of Origin) on their invoice or other commercial document in order for duty relief to be applied.

Be sure to keep a copy of the origin declaration, as well as supporting documents (purchase receipts, etc.) for three years (see article 26 of the CETA Protocol for Rules of Origin for more information)

- Products whose production involves non-Canadian/EU materials/ingredients

Products that are not ‘wholly obtained' must meet the Product Specific Rules of Origin in order to be eligible for tariff relief under CETA. Processed food products that are partially produced from non-originating inputs (imported from outside the FTA parties) must satisfy the applicable product-specific rules of origin in order to be considered originating.

- Ingredient HS code, origin and percentage in the final product have to be taken into consideration

- Generally requires a Change in tariff classification or Weight or value requirement

- Note that sugar does not qualify as originating if the refining process has taken place outside the FTA parties or has been refined from non originating raw sugar.

Recognizing that some Canadian processed products are produced using relatively high proportions of non-originating inputs or ingredients, CETA also includes Origin Quotas which provide alternative, more liberal rules of origin, for products such as high-sugar containing products; sugar confectionery and chocolate preparations; processed foods; dog and cat food; fish and seafood. Exporters wanting to use an origin quota should determine the tariff code classification of their product in order to determine whether it qualifies for one of these origin quotas. NOTE: These quotas are volume limited and require an export permit (except fish/seafood). More information on how to apply for an export permit can be found here.

If there are uncertainties around the origin of a product, especially a processed product with multiple ingredients from a variety of sources, a procedure called advance ruling relating to origin can be undertaken which provides a ruling on the application of the Product Specific Rule of Origin.

Choosing the right EU market

Now that you have decided to export to the EU and have identified opportunities under CETA, the next step is to identify which market to target. The EU is a patchwork of cultures with different preferences especially when it comes to taste, convenience, product packaging, size, and price point of food products so selecting the appropriate country for your product is critical to your success.

Each member state approaches the agrifood trade differently. Some are more open to international trade, some have higher disposable income and some place a higher value of good quality food. The retail scene varies with the overall size of the market and consumer buying preferences. It is important to conduct a thorough analysis on the markets that interest you in order to determine the best fit for your product and company.

| Retailer | Stores | Presence |

|---|---|---|

| Carrefour | 11,150 | across Europe |

| Rewe | 8,300 | Germany |

| Edeka | 3,600 | Germany |

| Albert Hein | 1,000 | Netherlands / Belgium |

| Mercadona | 1,600 | Spain / Portugal |

| Auchan | 4,000 | France |

| Les Mousquetaires /Intermarché | 3,000 | France |

| E.Leclerc | 1,500 | France |

| Sainsbury's | 2,300 | United Kingdom |

| Tesco | 4,600 | United Kingdom |

Retailers in large countries like Germany, France and Spain operate in select regions of the country, which contributes to a more diversified product offering while in smaller countries like Denmark, Belgium and the Netherlands, there are fewer retailers but they are present across the country. The specialized or independent shops including butchers, fishmongers, wine shops, bakeries, local markets and specialty or organic outlets play an important role in consumer shopping patterns in markets like Italy, France, Spain and Portugal.

Key questions to ask in evaluating your market options

Market size and growth:

- Are there a lot of products already in the market that would compete with yours?

- Are there cultural factors that may affect the marketability of your product?

- Does your product have something new or unique to offer?

- What is your estimated retail price and how does it compare to your competitors?

- How many potential buyers are there likely to be?

- How much is spent annually on products like yours?

- Is the demand for your type of product likely to grow or shrink?

- Is the market or segment growing rapidly? If so, can you develop new products to take advantage of this?

Market accessibility:

- Are there any restrictions on your product in the market you want to export to?

- Are there non-tariff barriers for products such as yours?

- Will shipping your products to the market be expensive and/or logistically complicated?

NOTE: The COVID19 crisis had a significant effect on the European consciousness around the sustainability, security and transportation of food products. As a result, The EU and Member State governments are taking strides to secure the food supply and shorten supply chains, which may have impact on imported food in the future.

Other important considerations include:

- Product shelf life

- Price sensitivity across markets

- Discounter dominance (Germany has a strong presence of discount retailers which leads to lower price points)

- Openness to new / imported products

Large countries like France and Germany have many food processors and suppliers and are less open and reliant on imports than other countries. The north/south/east divide is also important with northern consumers being more open to new products than those in Southern Europe who tend to prefer traditional cuisine and products. Eastern European countries consume a more basic assortment of goods due to lower income levels.

Choosing the right business model

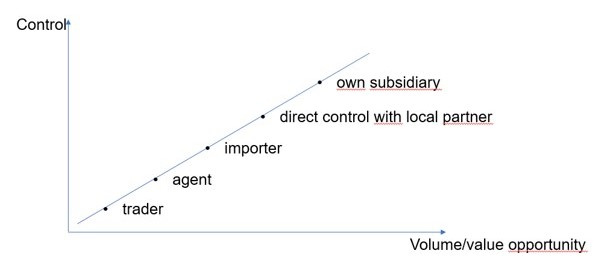

There are several business models and entry methods for exporting to the EU (see graph below). Exporters will need to balance the level of control they wish to have and the volume of products distributed with the market dynamics of each country.

Description of above image

This chart shows the level of control that an exporter can expect to maintain on their product in the market given the different type of importer and the value/volume opportunity. The first step is a Trader where the exporter has the lowest level of control but also the lowest of volume / value. The next steps linearly are then the Agent, the Importer and the Direct Control via a Local Partner. The option with the highest level of control and the highest volumes would be for the exporter to have it’s Own Subsidiary.

Most exporters who are new to the EU market will look at appointing a distributor who will clear the goods through customs, coordinate logistics and arrange local supply chain management for a fee. This model is relatively simple and requires little additional resources and structure from the exporter. It does have some disadvantages in that some of the large EU retailers prefer to deal with suppliers directly rather than through an intermediary, and that although many distributors claim to cover multiple markets, most are only strong in their home markets.

In markets like France and Germany, retailers prefer to work with a local supplier who takes care of importing, warehousing and distribution of the products. In markets like the UK, Belgium, the Netherlands and Denmark, the retailer may want a closer or more direct relationship to the supplier.

This requires a local sales and marketing operation (or sub-contractor) in each market. A regional hub in the EU will also be necessary for administrative functions such as customs clearance, receiving electronic orders, sending invoicing, administration and payment of VAT, central stock keeping and managing of the supply chain structure.

Implementing a market entry plan

Once you have selected your preferred EU market and the business model you want to use, the next step is to implement a market entry plan. This involves looking at a few marketing aspects in detail to define your product offering, target consumer pricing, and retail outlet.

- The right product

It is important that your products and range of selection are relevant and appropriate for the target market. Most major retailers carry a selection of imported products, but the depth of range and local availability differ greatly between markets and depends on the size of the outlet and population (ie: smaller stores in more rural areas do not carry as large a selection). Consider which product, category or concept you want to sell and whether it is right for consumers in your target market. You then need to determine if the current format meets consumer expectations and market requirements (regulatory, supply chain) or whether changes will be required on packaging, labelling or positioning.

- Sold in the right place

To determine where to sell your products, ask some key questions:

- Where do I want my product to be featured (mainstream retail, specialty shops, online)?

- Is my product more suited to retail, foodservice (catering, hotels, restaurants), or as an ingredient?

- Will I offer private label or contract manufacturing?

- Will I offer exclusivity?

- At the right price

Setting the correct pricing from the start is critical. The price of your product needs to be high enough to make a profit while remaining an attractive price for the consumer in the foreign market.

- Correct price = appropriate price for the market + the appropriate price for the exporter.

- Correct price does not necessarily mean lowest price – premium and high quality products deserve a higher price.

- Be aware of having a wide variation in pricing structure within a market and across different markets.

- Cross border sales, especially online, will be sensitive to large price gaps

- A competitive sales price will generate higher consumer appeal and create more margin for the producer/exporter

- Using the most suitable promotion

Promotions help build awareness about your product. Some retailers will offer price support tools (ie: 2 for 1 promotions) to introduce a product and build the brand and suppliers are often expected to participate in the cost of promotions and marketing campaigns. Working together with retailers can increase your future chance of success and would speed up the process of building strong trial amongst the core target group.

- With the right partner

A good partner will give you advice, support and insights into the food trade in your target market. They know the main players including their characteristics and sensitivities and can advise on the best way to approach them. Local Trade Commissioners can also provide excellent insight and local knowledge.

- To the right customer

The next step is to meet your future clients in the EU whether virtually, by organising a visit in-market or participating in a trade show. Be sure to prepare a presentation including your sales pitch and a market entry plan. Mention your sales, marketing and communication strategies as they will help build product awareness during the beginning stages and beyond. This will provide the buyer with a concrete plan and may help them feel more confident in working with your company.

You may have several buyers interested in your products so choosing the right one(s) to work with is important. Ask yourself a few key questions:

- Is the buyer offering the right profile for your brand?

- If using indirect sales: exclusive importer – just for one country or a wider region?

- Does the retailer have the right profile for my target end customer?

- Price setting: If you choose to launch your product at a discount chain first, it will impact your pricing strategy for full service accounts

- Is the buyer offering the right profile for your brand?

- If using indirect sales: exclusive importer – just for one country or a wider region?

Some guidelines for a great sales pitch for European buyers:

- Be aware that in certain EU markets like France, Germany, Spain and Italy your presentation needs to be in the local language. In The Netherlands, Belgium and the Nordic countries presentations can be in English. Your local Trade Commissioner can provide advice on this.

- Tailor your presentation to the customer and personalize the content. This shows respect and demonstrates that you have done your research.

- Build trust by demonstrating your company's credibility. Mentioning credentials from other markets, other accounts or other case studies will help endorse your case.

- Sell your product concept with a clear response to the buyer's needs. Focus on why the customer should buy from you. Selling "product + price" features is not sufficient.

- Identify the buyer's current gaps and convey how your company will fill them. Show that you understand their business, systems, expectations and customers in detail.

- Clearly explain the benefits for your client and show how you differ from competition.

Marketing and launching your product

A successful launch, with emphasis on the product and brand, is vital so use a combination of promotion techniques, innovative mechanics, and creative messages. Promotions close to the point of purchase are the most effective. Leading innovative retailers like Tesco in the UK and Albert Heijn in NL offer highly sophisticated promotional tools enabling the supplier to target the desired customer group in an effective and cost efficient way. In the EU, promotions are often a contractual requirement with your local partner. They do not always guarantee the best ROI, so costs should be kept low and should be seen as an investment in developing the business / distribution.

Administration, logistics, and distribution

Before starting to do business in the EU, exporters should seek advice on administrative procedures, including tax and excise regulations with an accounting firm experienced in international transactions in one or more EU market. Trade Commissioners and Export Development Canada (EDC) can also be helpful in providing advice and contacts.

Logistics and point of entry into the EU are important considerations. The Trade Commissioners' Step-by-Step Guide to Exporting, Step 7: Deliver the goods provides some good information on logistics.

If you are supplying directly to your customers in one or more markets, you may need to establish a storage hub in a strategic geographical area and appoint a Logistic Service Provider (LSP) to provide storage and distribution services to nearby markets. Markets that are often serviced together include the BENELUX countries (Belgium, Netherlands Luxembourg), the Nordic countries (Sweden, Denmark, Norway), the Baltics (Latvia, Lithuania, Estonia), and Spain and Portugal. Poland and Germany are large food processing hubs and distributers in those countries would have good links to smaller adjacent markets like Austria, Slovakia, Romania Hungary and Croatia. For example, an LSP in the Netherlands would provide warehousing and daily supply distribution (even less-than-container loads) to the Dutch market, Belgium, the Nordics, Western Germany and Northern France. A Belgian LSP would typically service Belgium, the Netherlands, Northern France and Luxembourg.

LSPs offer many benefits:

- Provide flexibility and just-in-time delivery (normally able to deliver to depots within 18 hours).

- Consolidation of orders from different suppliers in one truck.

- Lower physical distribution and regional stock holding costs

- Keeping central stock for one or more markets resulting in lower costs and higher flexibility / less stock keeping risk

Select your port of entry carefully. The port of entry that is closest to your LSP or distributor is ideal, but also consider the type of product you are exporting and whether that port is familiar with and has experience clearing the product.

Each major customer will have its own logistical requirements to which you will have to adapt. Pallet format is very important as most European retailers oblige or prefer to receive returnable pallets or crates. These can be rented from companies like CHEP or IPP. Most European retailers would accept both Euro (100 x 80 cm) or block pallet (100 x 120 cm) configurations. However, in certain product categories only one of these sizes may be the required standard. The appointed LSP could advise you on the requirements of the different key accounts in their area and could help you "re-configure" if necessary.

Distribution requirements will vary by account. Some retailers like Leclerc in France, Edeka in Germany and Carrefour in France and Belgium have a decentralized structure and will require regional distribution agreements. Franchised stores and independents will perform purchasing independently which requires the support of a local sales force. In all cases, in order to get products listed, distributors and exporters should collaborate to provide free samples, in-store sampling, information (brochures, QR codes).

E-Commerce Potential

The share of e-commerce in food purchases varies greatly by EU market. However, it is growing steadily and has been accelerated by the COVID-19 crisis. Mainstream food retailers have all started to offer home delivery or ‘click and collect' services as an extension of the standard supermarket sales. In this situation, an online listing would only happen after the in-store listing. There are also independent online-only web shops selling a variety of products. These shops may offer the right platform for your product concept and could be an interesting way to reach potential customers.

Although the UK is no longer an EU-market, a good example of an independent web shop is the UK company OCADO, an online-only mainstream retailer that directly competes with the established Food Retail organizations like Tesco, Sainsbury, Asda etc. Online retailers offering Canadian products to EU consumers include MyEnso (Germany), Kanata (France), and Saveurs du Québec (Belgium).

Exporting Agri-food products from Canada – what to be aware of

The CFIA's website has excellent resources available such as food-specific export requirements, a Step-by-Step guide to exporting food and a checklist for companies who are starting their exporting activities.

Inspection and certification requirements

Animals, animal products, plants and plant parts for export to the EU are subject to sanitary & phytosanitary inspection and certification as required. This includes live animals, products of animal origin, animal products and animal-derived products, feed and pet food, live plants and certain plant parts.

For live animals and products of animal origin, the processing plant must be approved for export to the EU. The EU maintains a website with lists of approved establishments and there are currently 24 lists for Canada. All products are subject to inspection and require certification by the Canadian Food Inspection Agency (CFIA). See here for more information.

Effective January 15, 2022, the EU requires exporters to use updated export certificates for food and animal commodities destined for the EU and for which certification is required. These can be accessed through the Trade Control and Expert System New Technology (TRACES NT). Information on how to prepare for this transition is available on the CFIA website.

Some plant products are not allowed in the EU such as potatoes. However, there is a derogation for the importation of seed potatoes originating in certain provinces of Canada into Greece, Spain, Italy, Cyprus, Malta and Portugal, subject to certain conditions.

Inspection at the entry point of the EU includes an administrative step where documents are scrutinised and verified including health certificates, invoices and bill of lading. Box labels must match other available information, and the plant number must appear on the box. There are a limited number of EU entry points with inspection services. Physical inspections are relatively rare.

Even after inspection, there may be limitations to the movement of the goods in order to protect the environment. Live lobsters, for example, cannot be put into European waters.

Other certification requirements

- Some fishery products require a catch certificate.

- Shipments of wine over 100 liters require a certificate of analysis made by an accredited laboratory (there are some in Ontario and BC).

Additional Food Safety Certifications

Some European countries, retailers or manufacturers may impose additional requirements on suppliers by requiring them to be certified to a specific scheme, normally one affiliated with the GFSI, or Global Food Safety Initiative. These may include BRC (British Retail Consortium), HACCP (Hazard Analysis Critical Control Point), SQF (Safe Quality food) or others. Contact a Trade Commissioner for more information on requirements for your target market.

Organic certification

Canada and the EU have an equivalency agreement that mutually recognizes organic certifications. For your product to be labelled as organic in the EU, your organic certifier must also be listed as an approved certifier for exporting to the EU (most are). This list of recognized certifiers is included in the relevant EU Regulation 1235/2008. Since 2017, organic products must also be registered in an electronic system called "TRACES" so your certifier should familiarize themselves with this system.

Commodities

In general, GMO commodities or products made with GMOs are not allowed in the EU unless they have been approved by the EU. Approved varieties are listed in a database. Different rules apply for food versus feed use, and details can be found in Regulation (EC) No 1829/2003 on genetically modified food and feed. In addition, all commodities must respect the Maximum Residue Limits (MRLs) for various pesticide products of interest. There is a European database with all currently approved pesticide MRLs. For both GMOs and pesticide MRLs, it is important to verify whether additional Member State requirements or restrictions exist.

Ingredients, Additives and Contaminants

Ingredients can face issues especially if they are new to the EU market. If a product has not been imported or traded in the EU before 1997, it may be considered a "Novel Food". There are two sources of information about novel foods: the Union list of [approved] novel foods provided by Regulation 2017/2470, and the Novel Food Catalogue, which is a non-exhaustive list and serves as orientation on whether a product will need an authorisation under the Novel Food Regulation.

Food additives have a broader definition and are more regulated in the EU than in Canada. They can be either approved or prohibited, with or without a maximum level. The relevant regulation is EU Regulation 1333/2008.

There are also constraints around contaminants. Physical contaminants are governed by Regulation 1881/2006, while sanitary contaminants are governed by Regulation 2073/2005. Be sure to use the most recent consolidated version to get the up-to-date data.

Food supplements

Food supplements are not harmonised in the EU so they fall under national requirements and a national approval process applies. Please contact the Trade Commissioner in the relevant market for more information.

Labelling

EU law specifies that all food and drink packaging needs to be "fully understandable" to the end consumer. Nutritional information, use-by date, ingredient lists, etc. must appear in the language of the country in which the product will be sold. In some markets there can be more than one language required for packaging (Belgium requires both Dutch and French on their labels). Commercial information like marketing phrases or slogans can remain in the original language and many companies choose to put these in English. For specific information please see EU Food labelling legislation and Specific rules on organic production, labelling and control.

Exporters looking at multiple markets may want to consider multi-lingual packaging to take advantage of economies of scale when printing. For example, packaging with text in French and Dutch will cover The Netherlands, Belgium and France. Multi-lingual will help reduce logistical complexity in the European warehousing process.

Labelling requirements differ slightly depending if the product is destined for B2B sales or retail. Products destined for B2B sales must have the required information included on box labels as per this extract of Regulation 1169/2011. Foodservice products must be labelled as in Articles 8 and 9 below.

Art. 8:

Food business operators shall ensure that the particulars referred to in points (a), (f), (g) and (h) of Article 9(1) also appear on the external packaging in which the prepacked foods are presented for marketing.

Art.9:

(a) the name of the food;

(…)

(f) the date of minimum durability or the ‘use by' date;

(g) any special storage conditions [already met in my opinion] and/or conditions of use;

(h) the name or business name and address of the food business operator referred to in Article 8(1);

Other regulations require that following information also be provided: weight, batch number, and for animal products: "Canada xxxx" where "xxxx" is the establishment number.

Products destined for retail sales follow the same Regulation 1169/2011, article 9, which requires:

- the name of the food;

- the list of ingredients;

- any ingredient or processing aid listed in Annex II or derived from a substance or product listed in Annex II causing allergies or intolerances used during the manufacture or preparation of a food and still present in the finished product, even if in an altered form;

- the quantity of certain ingredients or categories of ingredients;

- the net quantity of the food;

- the date of minimum durability or the ‘use by' date;

- any special storage conditions and/or conditions of use;

- the name or business name and address of the food business operator referred to in Article 8(1);

- the country of origin or place of provenance where provided for in Article 26;

- instructions for use where it would be difficult to make appropriate use of the food in the absence of such instructions;

- with respect to beverages containing more than 1.2 % by volume of alcohol, the actual alcoholic strength by volume;

- a nutrition declaration.

From other regulations, the following information must also be provided: batch number, and for animal products: "Canada xxxx" where "xxxx" is the establishment number.

Additional considerations include:

- Fishery products must provide additional information as per REGULATION (EU) No 1169/2011 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL. This includes the Latin name, common name, catch area and catch method.

- Nutritional and health claims must be justified and often approved by the EU.

- Organic products must bear additional information, and may eventually display the European organic logo.

- Requirements for labelling of genetically modified organisms and the traceability of food and feed products produced from genetically modified organisms are outlined in Regulation (EC) No 1830/2003

- Some products such as alcoholic beverages are exempted from some labelling requirements such as ingredient list, date, and nutrition declaration.

- Other regulations apply, such as the set of authorized contents for alcoholic beverages established by Directive 2007/45/EC. It prohibits the sale of spirits in bottles of 75 cl. Spirits also have a European definition so exporters should make sure that their products meet the definition.

Canadian labels will need to be altered in order to comply with European requirements. Typical changes include modifications to the ingredient list, and inclusion of a best before date, batch number, nutritional table and the importer’s name and address. Please consult your distributor or a Trade Commissioner if you have any questions.

Private and third party certifications can be additional selling points for your products. Marine Stewardship Council (MSC) for fishery products is an example of a non-mandatory certification that is increasingly in demand with retailers. The same is true for the British Retail Consortium (BRC) and / or International Featured Standards (IFS) for products sold under private labels. Some retailers may have their own sanitary or certification requirements.

Assistance for Canadian Exporters

There are a number of services available to Canadian exporters to help you prepare, support and improve your ability to expand internationally. These include:

- Agri-food Market Intelligence Reports

- The Canada Brand program

- The Agriculture and Food Trade Commissioner Service Additional videos:

- The AgriMarketing program

- CanExport

- The AAFC Single Window export and market access-related information and support

- AAFC Trade Show Service

Checklist of key steps to successful Agrifood exports to the EU

- Define your strategic export objectives

- Make a thorough review of CETA, define the tariff applicable to your product, and identify specific attention points for your product

- Check legal and regulatory compliance

- Research potential markets

- Understand your potential customer(s) and the competitive environment

- Select most suitable market for your product and company

- Decide on a business model

- Develop your market entry plan

- Allocate resources (human and financial) for both short and long-term and ensure support from top management

- Validate and get local advice from the Trade Commissioner Service, 3rd party experts or consultants

- Check packaging

- Handle your foreign accounts as you would handle your Canadian accounts and follow-up systematically

- Be committed and have patience – it will pay off in the long term