December 16, 2016

Acronyms

- AAFC

- Agriculture and Agri-Food Canada

- AMPA

- Agricultural Marketing Programs Act

- APP

- Advance Payments Program

- APPEDS

- Advance Payments Program Electronic Delivery System

- CALA

- Canadian Agricultural Loans Act

- FCC

- Farm Credit Canada

- GPP

- Government Purchase Program

- OAE

- Office of Audit and Evaluation

- PPP

- Price Pooling Program

Executive summary

This report presents the findings of the evaluation of the programs under the Agricultural Marketing Programs Act (AMPA). The evaluation was undertaken by AAFC’s Office of Audit and Evaluation (OAE) as part of AAFC's Five-year Departmental Evaluation Plan (2014-15 to 2019-20). The evaluation assessed the relevance and performance of AMPA related programs from 2008-09 to 2014-15.

Background

The Agricultural Marketing Programs Act (AMPA) is a federal act establishing programs to facilitate and improve market opportunities for producers through the provision of loan and price guarantees. Three programs are governed under the AMPA:

- The Advance Payments Program (APP) is a federal loan guarantee program intended to improve producers' cash flow throughout the year, enabling them to meet their financial obligations and benefit from the best market conditions.

- The Price Pooling Program (PPP) is a federal price guarantee program intended to assist with the cooperative marketing of agricultural products and enhance the cash flow of producers through initial delivery payments.

- The Government Purchase Program (GPP) is a federal program which provides the Minister with the authority to intervene in the purchase or sale of agricultural products.

Key findings

The evaluation found that there continues to be a need for producers to have guaranteed access to low cost, short-term loans to support cash flow and marketing. Producers who are not able to acquire adequate alternative private financing benefit significantly from such support. Through the APP, these producers are able to access short-term loans, whereas they would not be able to otherwise. Producers who are able to acquire adequate alternative loans benefit from the difference in interest rate between the APP and private loans. As interest rates are currently low and commodity prices are high, the benefit to these producers is currently small. However, if and when interest rates rise or commodity prices decline, the benefits would increase.

Interviews with program management noted that the interest-free component of the APP loan is important as it helps to entice producers to participate in the program, increasing the program’s ability to leverage private financing at low rates. As APP loans do not target producers based on the need for increased cash flow, it is likely that the APP provides benefits to some producers who are not experiencing cash flow difficulties. Demand for the APP is significant among Canadian producers, although participation rates over the evaluation period have declined significantly from 31,862 in 2008-09 to 21,547 in 2014-15.

The evaluation found that there is low demand for services offering price guarantees to facilitate delivery payments to members of cooperative marketing agencies (that is, PPP). Some of the PPP agencies have become the APP administrators in order to reduce the risk associated with carrying large amounts of debt. Nonetheless, some interviewees noted that the PPP is important for assisting emerging marketing cooperatives to become established and provide initial payments to their members.

The evaluation found that the AMPA programs align with federal priorities and departmental strategic outcomes. The APP and PPP short-term advances complement other federal, provincial or private sector services that offer longer-term financing intended for capital investment and non-guaranteed working capital financing that require realizable assets for security.

In terms of the achievement of intended results, the AMPA programs have largely achieved their intended outputs and outcomes. Although program participation rates have declined over the evaluation period, the average loan amount per producer has increased from $68,740 in 2009-10 to $101,700 in 2013-14. As a result, the APP has achieved, or was very close to achieving, its performance target of providing at least $2 billion in APP advances in four of the last five years. Some key factors contributing to the decline in the number of producers participating in the APP are high commodity prices and low interest rates.

The evaluation found that the APP is achieving its intended outcomes of providing producers with low cost capital to reduce short-term financial pressures. According to evaluation survey results, in the absence of the APP in 2013, it is estimated that 3,092 producers would not have qualified for alternate financing, leading to a shortfall of approximately $315 millionFootnote 1. Producers, administrators and other interviewees all agreed that the APP helps producers to address short-term financial pressures. The evaluation also found that the increased marketing flexibility achieved as a result of the APP had a significant impact on producers of storable commodities who benefited significantly from the ability to delay marketing their products. It is estimated that the total increase in producer revenues achieved as a result of delayed marketing in 2013-14 was $184.4 million.

The evaluation found that the PPP has achieved its intended outcome of providing a cash flow floor that helps to address the short-term financial pressures of producers. However, the low demand for the PPP has reduced the impact of the program.

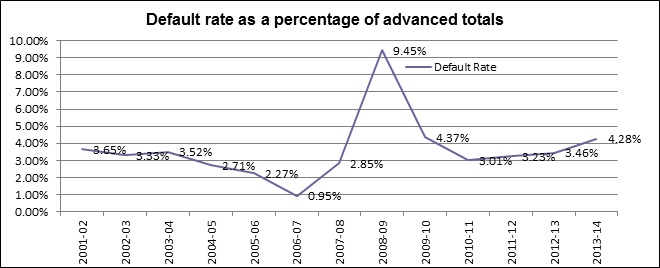

In terms of efficiency and economy, the evaluation found that the administration of the APP and PPP has been efficient. However, a substantial increase in APP loan defaults due to the 2008-09 livestock emergency advances resulted in a short-term increase in program expenditures in 2012-13 and 2013-14. When compared to other loan programs, APP loan administration costs and honour ratesFootnote 2 have been relatively low.

The economic benefits of the APP significantly outweigh the program costs. Producers are generally satisfied with the delivery of the APP and the APP and PPP have met their service standards in most instances. In terms of the PPP, the costs to deliver the program are very low and there has not been a claim made by marketing agencies against the PPP price guarantee since the AMPA was enacted in 1997.

In terms of design and delivery, the evaluation found that it would be useful for the program to develop a framework for assessing whether or not an economic emergency situation could be substantially mitigated by the APP through the Severe Economic Hardship provision. Nonetheless, recent legislative changes have addressed numerous design and delivery issues, which are likely to improve program efficiency.

1.0 Introduction

This report presents the findings of the evaluation of the programs under the Agricultural Marketing Programs Act (AMPA). The evaluation was undertaken by AAFC’s Office of Audit and Evaluation (OAE) as part of AAFC’s Five-year Departmental Evaluation Plan (2014-15 to 2019-20). The evaluation fulfills the requirements of the Financial Administration Act and the Treasury Board Policy on Evaluation (2009) for programs to be evaluated every five years.

The AMPA is a federal act establishing programs to facilitate and improve market opportunities for producers through the provision of loan and price guarantees. Three programs are governed under the AMPA:

- The Advance Payments Program (APP) is a federal loan guarantee program intended to improve producers' cash flow throughout the year, enabling them to meet their financial obligations and benefit from the best market conditions.

- The Price Pooling Program (PPP) is a federal price guarantee program intended to assist with the cooperative marketing of agricultural products and enhance the cash flow of producers through initial delivery payments.

- The Government Purchase Program (GPP) is a federal program that provides the Minister with the authority to intervene in the purchase or sale of agricultural products.

1.1 Evaluation scope

The evaluation included a comprehensive assessment of the relevance and performance of the APP and PPP. As the GPP has not had any activities, outputs or outcomes or direct spending since the enactment of the AMPA, the scope of the evaluation included only a review of the relevance of the GPP and whether there is a continuing need for the program. The evaluation covered the period from 2008-09 to 2014-15. In terms of performance, the evaluation focused on analysing APP's and PPP's achievement of intended outcomes, with particular emphasis on assessing the efficiency of program design and delivery. The evaluation addressed the following core evaluation issues in accordance with the Treasury Board of Canada's Directive on the Evaluation Function (2009).

1.2 Evaluation issues and questions

Relevance

- 1. Assessment of the extent to which the APP, PPP and GPP continue to address a demonstrable need and are responsive to the needs of Canadians.

- 2. Assessment of the linkages between the APP and PPP objectives and (i) federal government priorities and (ii) departmental strategic outcomes.

- 3. Assessment of AAFC's role and responsibilities in delivering the APP and PPP.

- 4. Assessment of the extent to which the APP and PPP complement or overlap with other government programs or financing provided by the private sector.

Performance

- 5. Assessment of progress toward expected outcomes with reference to performance targets, program reach and program design, including the linkage and contribution of outputs to outcomes for the APP and PPP.

- 6. Assessment of resource utilization in relation to the production of outputs and progress toward expected outcomes for the APP and PPP.

2.0 Evaluation methodology

2.1 Data collection methods

The evaluation of the APP, PPP and GPP relied on multiple lines of evidence including a literature review, a comparative analysis of similar programs, a document review, a review of program performance data, surveys of producers, key informant interviews and a cost-benefit analysis. By using multiple lines of evidence and triangulating the findings, the research methodology supported a comprehensive evaluation of the programs.

- Literature review and comparative analysis of similar programs

The literature review and comparative analysis were conducted to obtain information related to the need for the programs and to compare the effectiveness and efficiency of the APP and PPP with similar programs in Canada and in other jurisdictions (that is, Australia and the United States). A total of 81 websites, journal articles and other literature sources were reviewed.

- Document review

The document review addressed the evaluation issues related to relevance and performance. It examined, for example, published data on producers’ risks and need for cash flow, legislation including the Agricultural Marketing Programs Act and the Agricultural Growth Act, Agricultural Marketing Programs Regulations, Speeches from the Throne, Federal budgets, AAFC Reports on Plans and Priorities, Departmental Performance Reports, previous evaluations of the AMPA programs, the APP Advance Guarantee Agreement template, program financial expenditure reports, the APP and PPP service standards reports and the AMPA Program Performance Measurement and Risk Management Strategy. A total of 31 documents were reviewed as part of the evaluation.

- Review of program performance data

A review of program performance data was conducted to obtain information related to the relevance and performance of the APP and PPP.

The APP uses the Advance Payments Program Electronic Delivery System (APPEDS) to manage program administration processes. APPEDS contains information on program administrators, APP advance recipients and APP advances. The APPEDS data analyzed in this evaluation included the following:

- APP advances and pro-rated repayments by province/product for the period from 2008-2015 (as of December 31, 2014);

- APP advances by producer/administrator/province from 2011-2013;

- Summary data of the APP honoured ratesFootnote 3 as a percentage of the total APP advances issued from 2001-2007;

- Interest claims by crop year/production period from 2011-2013;

- Guarantee amount and risk rating by APP administrators from 2011-2013;

- Agreement lender information by administrator/production year and account type, from 2011-2013;

- Producer defaults by administrator/production year from 2011-2013;

- Producer interest rate by account type (interest bearing rate, default rateFootnote 4 and repayment without proof of sale) and administrator in 2013; and

- Product advance rates by province/product group in 2013.

The PPP uses the Program Access Database to manage program administrative processes. The Program Access Database includes information on the number and value of PPP loan guarantees. Data sourced from the Program Access Database and analyzed during this evaluation included data on the contingent liability, initial payment, product delivery volume and average wholesale price by administrator/product from 2010-2013.

- Key Informant Interviews

A total of 54 interviews were conducted with key informants between April and May 2015 to address evaluation questions dealing with the relevance and performance of the APP and PPP. Respondents were included from the following categories of stakeholders:

- AAFC's APP and PPP program staff (6);

- AAFC senior management (2);

- Commercial lenders (3);

- Representatives of agricultural associations (4);

- APP administrators (36); and

- PPP administrators (3).

- Surveys of producers

Three separate surveys were conducted in 2015 to collect feedback from producers regarding the APP. Separate questionnaires were developed for producers who obtained APP advances in 2013; producers who obtained advances in 2009 but not in 2013; and producers who have never participated in the APP.Footnote 5

The purpose of the survey of producers who obtained APP advances in 2013 was to obtain information regarding the uses and benefits of the APP financing, as well as producers' motivation for participating in the APP and their degree of satisfaction with the services received. The purpose of the survey of producers who obtained advances in 2009 but not in 2013 was to obtain insight into why some producers chose not to participate in the APP in 2013, and what alternative methods, if any, they employed to address short-term financial pressures and achieve marketing flexibility. The purpose of the survey of producers who have never participated in the APP was to obtain information on the awareness of the APP among eligible producers, and their rationale for not participating in the APP.

The three survey questionnaires were programmed into the online survey software FluidSurveys. The programmed questionnaires were then tested for functionality and ease of administration prior to contacting respondents.

Respondents for two of the producer surveys (that is, those who received an APP advance in 2013 and those who received an advance in 2009 but not 2013) were randomly selected from the APPEDS database. In order to maximize response rates, and to help promote an "informed" discussion about the APP, all participants were sent pre-survey communication which included a letter of introduction from AAFC and a copy of the survey questionnaire. Following field testing, survey administration began on March 25, 2015 and was completed on May 11, 2015.

To obtain feedback from producers who have never participated in the APP, AAFC solicited 27 producer organizations involved in a wide variety of eligible commodities to email their members, or include a notice in their monthly newsletter, to request that their members complete the online survey regarding the APP. A total of 19 producer organizations agreed to notify their members about the survey. The efforts of these producer organizations resulted in 172 survey questionnaires completed by producers who have never received an APP loan.

Completion targets were established for each cohort to ensure statistical reliability and adequate representation from all types of producers and all regions of the country. As highlighted in Table 2.1, the surveys met the anticipated targets for all groups with the exception of the survey of producers who received APP advances in 2013. However, the number of completions for the survey of producers who received APP advances in 2013 was still very large (531 producers) and able to generate statistically significant results (estimated sample error of ±3.8%).

Table 2.1: Key Survey Metrics by Cohort Group Initial Sample Valid Sample Target Completions Actual Completions % of Target Response Rate Estimated Sample Error[1] 2013 Producers 3,000 2,656 600 531 89% 20.0% ±3.8% 2009 Producers 1,926 1,516 200 202 101% 13.3% ±6.4% Total 4,926 4,172 800 733 92% 17.6% n/a [1] At the 95% confidence interval

n/a = not applicable - Cost-benefit analysis

The purpose of the cost-benefit analysis was to determine the economic benefits of the APP and compare these benefits with the costs of delivering the program. The economic benefits included in the analysis were producer interest savings and increased revenues obtained by delayed marketing of agricultural products. The major costs included in the analysis were the direct program operating costs and fees paid by producers to administrators. Information for the cost-benefit analysis was obtained from a variety of sources including the survey of APP producers, APP administrator interviews and the document, file and database review.

2.2 Methodological considerations

The evaluation had three considerations in assessing the APP and PPP:

- Potential response bias in the findings of the administrator and key informant interviews. Given the respondents’ personal involvement in the APP and PPP, there was potential for a positive response bias because stakeholders want to ensure that the programs are viewed favourably. This limitation was mitigated by clearly communicating the purpose of the evaluation, its design and methodology; by cross-checking the responses with those of other stakeholder groups; and by using multiple lines of evidence and triangulating the evaluation findings.

- Reliance on Producer-Reported Information for the Cost-Benefit Analysis. One of the primary sources of data for the economic analysis was producer-reported information obtained from the survey of 2013 APP advance recipients. For example, the estimated savings in interest costs incurred by producers have been calculated using the average interest rate surveyed producers expect they would have to pay for alternate financing. Similarly, the increased producer revenues achieved through greater marketing flexibility were calculated using producer-reported incremental revenues obtained by delaying the marketing of their agricultural products. The information may be inaccurate as a result of incorrect estimates on the part of survey respondents, or a positive response bias from some producers to ensure they will continue to have access to APP advances in the future. Due to the possibility of bias in the producer-reported information, the economic benefits reported for the APP may be over or understated.

- Limitations in the representativeness of the sample of producers surveyed. The producer survey respondents who received APP advances in 2013 are fairly representative of the overall population by type of commodity, province and APP loan value. Some exceptions are grain and oilseed producers as they are slightly over-represented by 10 percent (65% of survey respondents versus 55% of all recipients). Recipients in Ontario and Prince Edward Island are under-represented by approximately eight per cent, but these two provinces accounted for less than 10 percent of total APP advances in 2013. Finally, vegetable (0.6% versus 8.1%), pulse (1.0% versus 4.7%) and forage/hay (0.4% versus 3.5%) producers are under-represented but these three types of producers combined accounted for less than 15 percent of the total number of APP recipients. To account for differences in the characteristics of the survey sample versus the total population of producers, the producer survey results were weighted.

The reader should use caution when interpreting the results of the survey of producers that have never obtained APP advances due to the low number of responses. The purpose of the survey was not to be representative of all eligible producers who have never obtained APP advances, but to obtain anecdotal evidence on the level of awareness of the program and the motivations for not participating in the APP. The survey results should be used to provide information on the specific opinions of those respondents who participated in the survey.

3.0 Program profile

3.1 Program context

Agricultural cash advance programs were first implemented in Canada in the 1950s to help provide cash flow to grain producers whose crops were marketed by the Canadian Wheat Board. The programs were designed to provide immediate cash flow to the producers while the Canadian Wheat Board marketed their product throughout the year. Over time, the program was expanded to include all different types of agricultural products in every region across the country. The expanded program was intended to ensure that industry has timely and broad access to credit, thereby reducing the risk of producers being forced to make operating and marketing decisions based solely on the need for working capital, and ultimately increasing producers’ incomes. The AMPA was enacted in 1997 by the Government of Canada and combined the following four acts and pieces of legislation into one Act: the Prairie Grain Advance Payments Act, Advance Payments for Crops Act, Cash Flow Enhancement Program, Agricultural Products Cooperative Marketing Act and the Agricultural Products Board Act.

The objective of the AMPA is to establish programs to facilitate the marketing of agricultural products through the provision of loan and price guarantees. It is comprised of three federally delivered programs: the Advance Payments Program, the Price Pooling Program and the Government Purchase Program. Changes were made to the AMPA legislation under the Agricultural Growth Act (Bill C-18)Footnote 6, which received royal assent in February, 2015.

3.2 Overview of the Agricultural Marketing Programs Act Programs

Advance Payments Program

The APP is a federal loan guarantee program designed to improve producers’ access to cash flow by providing producers with a cash advance based on the value of their agricultural product. The cash flow received through the APP enables producers to address immediate financial obligations, including input and other production costs, and costs related to short-term emergencies that affect production and marketing. It also allows producers to market their commodities based on a strategy to obtain the most competitive prices, rather than a need for cash.

The APP’s origins can be traced back to the Prairie Grain Advance Payments Act and the Advance Payments for Crops Act. These programs were initially created to respond to the need to provide producers with cash flow so they could store their harvested crops for sale until prices are the highest. Over time, the APP has placed additional focus on providing overall cash flow support to producers by providing a spring advance in addition to the fall advance. This has allowed the program to expand the types of producers that can benefit from the APP from storable agricultural products such as grain to non-storable crops and livestock.

The APP is managed by the Business Risk Management Programs Directorate, Programs Branch of AAFC. Employees of the Programs Branch perform a variety of roles including program executive, finance, operations, management of administrators, default management and business development. APP cash advances are issued to producers by producer organizations, known as APP administrators, who deliver the APP through Advance Guarantee Agreements (AGAs) with the federal government. The APP is delivered by approximately 45 administrators who are responsible for day-to-day interactions with producers. Each year, AAFC enters into a tripartite agreement with APP administrators and financial institutions, wherein AAFC functions as a guarantor of the loan. This enables APP administrators to secure loans with preferential interest rates and terms, thus providing administrators with the ability to offer lower interest rates to their producers. The APP administrators in turn use the loan to issue repayable advances (loans) to producers up to a maximum of $400,000 per year (that is, $300,000 interest bearing) and $400,000 at any given time (it is possible for a producer to have more than one loan at the same time). AAFC pays the interest on the first $100,000 of each advance made to producers. The administrators are responsible for obtaining security from producers on these loans.

The value of each APP advance is calculated based on the value of the producer’s agricultural product, or the maximum amount that could be received from an AAFC Business Risk Management program (that is, AgriStability or AgriInsurance). Producers who receive advances enter into an agreement with their APP administrator to repay the advance upon sale of the commodity, or the term of the loan, which varies depending on the production period associated with the commodity (12 to 24 months). Producers are required to repay their loans in a timely manner (within 30 days of sale) and provide proof of sale (within 60 days) to demonstrate that the advance was issued for short-term cash flow and marketing purposes. Eligible producers must own and be responsible for marketing the agricultural product and be willing to use the value of the commodity as security, or future payments from AgriStability or AgriInsurance as security for products that have not yet been harvested.

While APP administrators have primary responsibility for collecting on defaulted advances, if they have completed the collection process outlined in their Advance Guarantee Agreement without success, they can request AAFC to honour the guarantee, that is, to pay the bank the outstanding debt. Default-related costs associated with honouring guarantees primarily include principal payments, default-related interest costs, and legal fees. AAFC attempts to collect all debt owed after honouring their guarantees with financial institutions, including outstanding interest. APP debt recovery activities are conducted by AAFC’s Corporate Management Branch (CMB), and are, therefore, outside of the mandate of the APP and the scope of this evaluation.

Price Pooling Program

The PPP facilitates the marketing of agricultural products under cooperative plans by guaranteeing a minimum average price of products sold by marketing agencies. This enables marketing agencies to secure financing and to issue initial delivery payments to their members. The government guarantee protects agencies against unanticipated declines in the market price of their products that exceed 35 per cent. Target clients are marketing agencies of agricultural products defined under the AMPA.

Similar to the APP, the PPP is managed by the Business Risk Management Programs Directorate, Programs Branch of AAFC. AAFC enters into agreements with cooperative marketing agencies to provide a price guarantee for products sold under a cooperative plan. Three cooperative marketing agencies are currently involved in the delivery of the PPP. The agreement between AAFC and the cooperative marketing agencies covers the initial delivery payment made to producers, as well as eligible costs incurred to market the product. The guarantee is set at a percentage (currently 65%) of the expected average wholesale price of the product and triggers only when there is a dramatic drop in the market which results in a price that is less than the guarantee. The price guarantee can be used by cooperative marketing agencies as security to obtain a loan from a financial institution and to make an initial payment to producers for products delivered.

The price guarantee agreement covers the production of an agricultural product for one production year. Once the entire agricultural product is sold under the pool, the actual average wholesale price received by the marketing agency is determined. If the calculated value is less than the eligible initial payment plus eligible costs (65%), the program allows for a payment for the shortfall by the federal government. No claim has been made against the program since the enactment of the AMPA in 1997. If the calculated value is greater, the surplus is retained by the pool for future use or is distributed by the marketing agency to the producers according to the grade, variety and type of the products delivered to the pool.

Government Purchase Program

The GPP is designed to provide the Minister of AAFC with the authority to buy or sell agricultural products. Under the program, the Minister can sell or deliver agricultural products to a government or government agency of any country; buy, sell or import agricultural products; and store, transport or process agricultural products or make contracts for the storage, transportation and processing of agricultural products. This authority is reserved for extreme situations where intervention in the market could contribute to greater market stability. Since the enactment of the AMPA in 1997, the Minister has not used the authority granted under the GPP.

3.3 Program resources

As indicated in Table 3.1, AMPA programs budgeted resources totalled $98.1 million in 2013-14 and $69.7 million in 2014-15. Human resources totalled approximately 34 full-time equivalents in 2013-14. The vast majority of the financial and human resources attributed to the AMPA programs are allocated to the APP. It is estimated that one half resource is attributed to PPP. As the GPP has been inactive, no human or financial resources have been allocated to the program.

| Funding | 2013-14 ($) | 2014-15 ($) |

|---|---|---|

| Salary | 2,437,885 | 2,534,452 |

| Non-Pay Operating | 1,672,962 | 1,259,160 |

| Vote 10 Statutory Funding | 94,000,000 | 65,900,000 |

| Total | 98,110,847 | 69,693,612 |

| Source: AAFC Program Performance Measurement and Risk Management Strategy, 2015 | ||

4.0 Evaluation findings

4.1 Relevance

4.1.1 Continued need for the programs

The evaluation found that there continues to be a need for producers to have guaranteed access to low cost, short-term loans to support cash flow and marketing. Producers who are not able to acquire adequate alternative private financing benefit significantly from such support. Producers who are able to acquire alternative loans benefit from the difference in the interest rate between APP loans and private loans. As bank prime interest rates are low and commodity prices are high, the benefit to these producers is currently small. However, if and when interest rates rise or commodity prices decline, the benefits would increase.

Interviewees noted that the interest-free component of APP is important as it helps to entice producers to participate in the program, increasing the program’s ability to leverage private financing at low rates. As APP loans do not target producers based on the need for increased cash flow, it is likely that the APP provides benefits to some producers who are not experiencing cash flow difficulties, but who may otherwise wish to obtain the benefits of APP loans. Demand for the APP is significant among Canadian producers, although participation rates have declined by approximately a third since 2008-09. There is also low demand for services offering price guarantees to facilitate delivery payments to members of cooperative marketing agencies (that is, PPP).

Producers' need for cash-flow

Farming is a capital-intensive industry requiring a large initial financial commitment each production period. The timing for this financial commitment does not always align with when farmers have available capital from the sale of their commodity. Farmers, therefore, often need to carry debt for much of the year.

Cash flow is essential for producers to meet input and other production costs, enhance their marketing flexibility and respond to short-term economic conditions and emergencies. Insufficient liquidity can limit producers’ ability to purchase inputs and necessitate the use of high interest input financing. Low cash flow can also limit producers’ marketing flexibility by forcing them to market their product when prices are depressed.

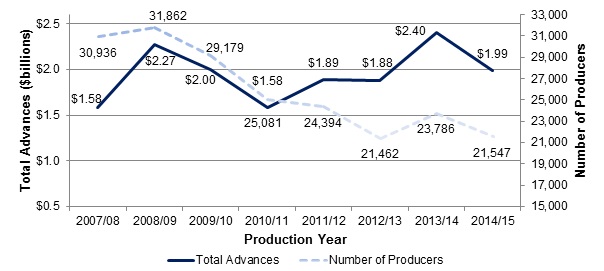

In circumstances where there are more significant risks or emergencies, inadequate cash flow can force producers to reduce or close operations. As an illustration, a significant backlog in railway shipments of grain in 2013 prevented producers from delivering their grain to the elevators and marketing their product.Footnote 7 With approximately $20 billion worth of crops in storage, producers faced unanticipated cash flow problems.Footnote 8 As a result, APP participation rates increased substantially as producers sought short-term financing to cover operating costs until they were able to sell their product (see Figure 3). A study commissioned by Saskatchewan Barley Development Commission for submission to the Canada Transportation Act Review Panel in 2014 estimated that the backlog cost farmers up to $3.1 billion in lost revenue due to the fact that they were not able to sell their product when they intended.Footnote 9

The consensus among APP administrators surveyed is that APP advances are extremely important to producers because these advances enables them to improve their cash flow, avoid high fees and interest rates associated with input loans, reduce borrowing costs by paying down an operating loan or line of credit, and delay marketing of their product until prices improve. Similar feedback was obtained from a survey of producers that received APP advances in 2013. Producers stated that they most frequently used the APP advance to (in order of frequency mentioned) improve cash flow, pay for inputs, delay marketing of their product to increase the price and improve their operations’ financial viability.

The need for guaranteed access to low cost loans

The need for guaranteed access to low cost loans is significant among producers who would otherwise not qualify for alternative financing from commercial lenders. These producers typically do not have enough security or income to obtain alternative loans from the private sector. If these producers were not able to secure working capital financing, they would be significantly disadvantaged as described in the previous section. The guaranteed access to APP loans ensures that any producer in Canada is able to benefit from access to short-term loans.

Producers who are not able to access alternative loans also benefit from the more favourable terms associated with both the interest-free and interest bearing portion of the APP loan. For example, producers have to repay their APP advance only once they sell their commodity, whereas a private short-term loan often requires that a producer begin paying the principle immediately. APP loans also use the producers’ commodity as collateral, freeing up their assets to use as collateral for other loans. Producers also benefit from the interest-free terms on the first $100,000 of the APP loan and the lower interest rate on the interest-bearing loan.

The producer survey results indicated that a total of 31 percent of producers either believed that they would not be able to acquire an alternative loan (13%), or if they could acquire a loan, the terms would be worse than their APP loan (18%). An additional 43 percent stated that they either did not know if they would be able to acquire an alternative loan (24%), or if they could acquire a loan, whether or not the terms would be better or worse than their APP loan (19%).

Those producers who indicated that they would not qualify for an alternative loan or line of credit reported that, without the APP, they would be forced to market their product early in order to have sufficient cash flow, reduce their input costs, or retire or cease operation of their business. The evaluation evidence indicates that these percentages would likely change if the economic conditions facing producers changed, particularly in the event of a rise in interest rates. For example, if interest rates were to increase, it is likely that more producers would have a difficult time accessing alternative private sector financing.

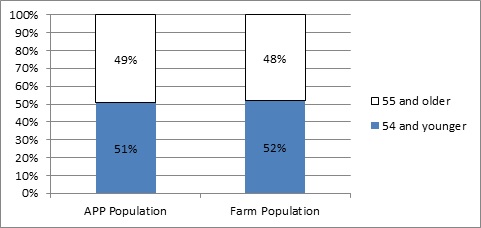

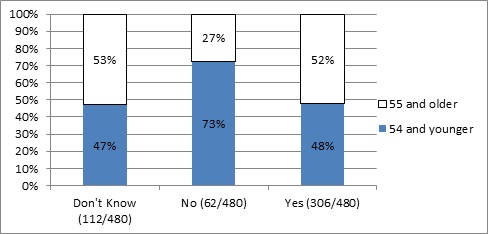

The evaluation found that APP participants overall match the farm population in terms of age (see Figure 1). However, producers who do not have access to alterative loans are younger (73% who are 54 and younger) than producers who do have access to alternative loans (48% who are 54 and younger) (see Figure 2). This suggests that guaranteed access to loans particularly benefits younger producers.

Description of above image

Figure 1 compares the distributions of APP producers by age cohort to that of the general farm population. 49% of APP producers were 55 and older, compared to 48% of the general farm population.

Data on APP population is derived from the 2015 survey of producers who received APP advances in 2013; data on farm population is derived from Statistics Canada Census of Agriculture 2011.

Description of above image

Figure 2 compares the age of APP producers by their ability to access private financing outside of APP for the same amount. For the 306 out of 480 respondents who believed that they could obtain a loan outside of the APP for the same amount as their last APP advance, 52% were 55 and older and 48% were 54 and younger. For 62 out of 480 who believed that they would not obtain a loan, 27% were 55 and older and 73% were 54 and younger.

Data is derived from the 2015 survey of producers who received APP advances in 2013. Question: If the APP did not exist and you would have had to obtain a loan outside of the APP for the same amount as your last APP advance, do you believe that you would have qualified for a loan? (n=480)

The benefit of guaranteed access to short-term loans is currently small for producers who are able to access alternative financing as interest rates are low and commodity prices are high. If those producers require increased cash flow, they are able to access private sector financing of equivalent quantity and terms. Producer survey results indicated that 24 percent of producers expected that they would qualify for alternate financing with either the same (21%) or better (3%) terms as their APP loan. However, almost of all these producers believed that the interest rate on the private loan would be considerably higher than the interest rate charged on the interest-bearing portion of their APP advance. With interest rates at historic lowsFootnote 10 and commodity prices high, the direct savings to producers in terms of the difference in interest payments from the APP and what they would pay privately is currently small. Producers are currently able to borrow from the private sector at below historic average interest rates. According to cost-benefit analysis conducted for this evaluation, on average each producer gained $5,152 in 2013 through savings related to the terms of their APP loan (both interest-free and interest-bearing loans)Footnote 11. Of this amount, producers gained $3,964 through savings related to the interest-free portion of the APP loan and $1,188 through the interest-bearing loan.Footnote 12

Although the benefit of the interest-free component of APP loans is currently small, program management noted that the interest-free loan is important as it helps to entice producers to participate in the program. The interest-free portion attracts many producers who would otherwise not participate. High participation rates then allow the program to leverage significant amounts of private money, injecting approximately $2 billion in the sector each year. If the interest-free loan was removed, the amount of private sector financing leveraged by the program may be significantly reduced, which could then also increase the overall cost of borrowing.

The evidence from program documents and key informant interviews also suggest that APP can be used as a tool for injecting liquidity into struggling industries, thereby reducing the pressure for costly ad hoc measures. Further, it is possible that if the interest-free loan is eliminated, the number of producers would decrease such that there could also be a loss of some administrators, impacting the overall program efficiency. There may also not be an appetite from the Canadian agriculture sector to see benefits like the interest-free removed since there have been significant reductions to AAFC's Business Risk Management programming under the Growing Forward 2 policy framework.

However, it could also be argued that the support provided through the APP's interest-free portion covers normal risk considered to be part of everyday business operation. This is especially true when interest rates are very low, commodity prices are high and when farm asset levels have considerably outgrown farm debt for most sectors.Footnote 13 The Organisation for Economic Co-operation and Development (OECD) stated in its 2011 review of risk management in agriculture in Canada that, "…the Canadian set of policies does not leave a clear layer of "normal" risk out of the government responsibility and, therefore, it reduces the responsibility of farmers for their management of normal farming risk."

Finally, APP loans do not target producers based on the need for increased cash flow. APP loans are available to any farmer who produces and markets an APP approved commodity, regardless of their need for cash flow assistance. It is possible that a producer who is not experiencing cash flow difficulties will take advantage of the favourable terms associated with the APP, particularly the interest-free component. However, as noted above, higher participation rates allow the program to leverage a greater amount of private capital and inject it into the agriculture sector without having to use costly ad hoc measures.

Demand for Advance Payments Program

There continues to be strong uptake of the APP as the amount of loan per producer has been increasing over the last seven years. An average of $2 billion in advances has been provided to approximately 26,000 producers annually across Canada during the past seven years. Data from the most recent Census of Agriculture (2011) suggests that approximately 18.9 percent of all Canadian producers participated in the APP in 2011.Footnote 14

The 2002 APP evaluation reported that an average of 38,000 producers participated in the APP annually during the three year period from 1998 to 2001.Footnote 15 As highlighted in Figure 3, the number of producers receiving APP advances has declined considerably since 2008-09. The total number of producers receiving regular APP advances has decreased from 31,862 in 2008-09 to 21,547 in 2014-15, which is a decline of 32 percent overall or an average of 4.6 percent per year. As a comparison, the overall farm population decreased by 10 percent between 2006 and 2011Footnote 16, which is an average of 1.7 percent each year.

Description of above image

Figure 3 illustrates the value of total APP regular advances and the number of producers from production year 2007/08 to 2014/15.

- The value of total advances was:

- $1.58 billion in 2007/08

- $2.27 billion in 2008/09

- $2 billion in 2009/10

- $1.58 billion in 2010/11

- $1.89 billion in 2011/12

- $1.88 billion in 2012/13

- $2.40 billion in 2013/14 and

- $1.99 billion in 2014/15

- The number of producers was:

- 30,936 in 2007/08

- 31,862 in 2008/09

- 29,179 in 2009/10

- 25,081 in 2010/11

- 24,394 in 2011/12

- 21,462 in 2012/13

- 23,786 in 2013/14 and

- 21,547 in 2014/15

Note: Figure does not include the $454 million in APP emergency advances paid to livestock producers in 2008-09

Source: Business Risk Management One-Pagers, E - April 10, 2014 APP

Over the last five years, the average APP advance amount increased by 48 percent from $68,740 in 2009-10 to $101,700 in 2013-14. The main factors that have contributed to the increase in average APP advance amount are the increase in the size of farms in Canada, greater use of the program by livestock producers (which typically obtain a higher APP advance than other commodity groups) and an increase in the maximum limits for cash advances in 2007 (that is, increase in interest-free maximum cash advance from $50,000 to $100,000 and an increase in maximum loan from $250,000 to $400,000).

The total value of APP advances peaked at $2.7 billion in 2008-09 due to the issuance of $454 million in APP emergency advances to assist producers during the market crash for cattle and hog producers. Rising input costs, declining export demand from the US, falling prices, a high-value Canadian dollar and loss of processing capacity resulted in beef and pork prices previously unseen since the Great Depression and many producers were at risk of losing their operations. In response to this crisis, $142 million in emergency APP advances were issued to 1,503 cattle producers and $312 million to 1,812 hog producers through the APP's Severe Economic Hardship provisionFootnote 17

These producers then received a stay of defaultFootnote 18 and thus, the loans did not have to be repaid until 2012 for cattle producers and 2013 for hog producers. The 2011 APP legislative review provided several explanations for the decline in producer participation in 2009 and 2010: reduced seeded acreage in 2010 by 14.5 percent compared to 2009 due to a number of floods in Western Canada; high commodity prices, which encouraged producers to sell their products at harvest; and some cattle and hog producers may not have applied to the program in 2009 or 2010, as they received a stay of default for their 2008 advances.

According to the key informants interviewed for this evaluation, the key factors contributing to the decline in the number of participating producers are high commodity prices and low interest rates, ranging from prime business rate of 3 percent in 2009 to 2.70 percent in 2015Footnote 19. The lower interest rates reduce the demand for APP advances because the interest-free component of the APP loans is less valuable. With low interest rates more producers are also able to source alternate cash flow financing at competitive interest rates. With high commodity prices, coupled with good weather conditions, some producers are able to better manage cash flow pressures by selling their production at harvest.

Several key informants indicated that the number of producers participating in the APP may increase if prime lending interest rates rise in the future. Interviewees also suggested that recent legislative changes may also increase participation rates. For example, a producer is now able to apply to a single administrator for all of their commodities, whereas in the past the same producer had to apply to multiple administrators who were only allowed to provide advances on specific commodities. The legislative changes also reduce the administrative burden on producers.Footnote 20

Increased promotion of the APP could also potentially increase the number of producers participating in the program. Of the producers who responded to the evaluation survey who never have used APP, 40 percent (56 producers) were previously unaware of the APP’s existence prior to completing the survey. Now that they have learned of the program, 38 percent intend to obtain an APP loan going forward and 56 percent are considering it. This sample of producers is too small to accurately assess the potential to increase program participation resulting from increased awareness. However, the survey findings and the consensus of the APP administrators surveyed suggest that greater awareness and promotion of the program may contribute to increased uptake of the APP in the future.

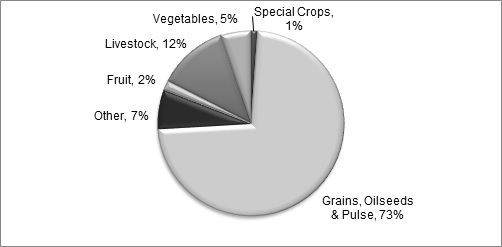

As highlighted in Figure 4, demand for APP advances was highest among grain, oilseed and pulse producers, reflecting the original design and intent of the program (that is, products that could be stored if necessary to obtain higher prices).Footnote 21

Description of above image

Figure 4 shows the proportion of APP advances by major commodity for the period of 2008-09 to 2013-14.

The APP advances for this period were:

- 73% for Grains, Oilseeds and Pulse

- 12% for Livestock

- 5% for Vegetables

- 2% for Fruit

- 1% for Special crops and

- 7% for Other major commodities

Source: Summary of 7-Year Average Default Rate Update, Dec 31, 2014.

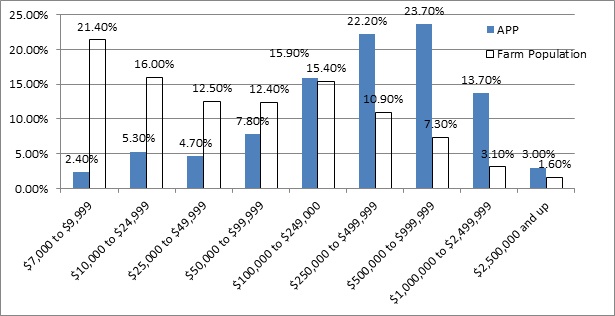

Finally, the APP generally is used by medium to larger farms (see Figure 5). This is partially due to the fact that with APP, the more value a producer holds in his/her commodities, the higher the amount of the APP loan that they are able to acquire. For example, for a producer to take advantage of the full $100,000 interest-free loan, he/she must have $200,000 worth of commodity as collateral.

Description of above image

Figure 5 compares the Gross Farm Revenue of APP producers to the general farm population. In 2013:

- 2.4% of APP producers had gross farm revenue of $ 7,000 to $9,999, compared to 21.4% of the general farm population.

- 5.3% of APP producers had a gross farm revenue of $10,000 to $24,999 compared to 16% of the general farm population.

- 4.7% of APP producers had a gross farm revenue of $25,000 to $49,999 compared to 12.5% of the general farm population.

- 4.7% of APP producers had a gross farm revenue of $25,000 to $49,999 compared to 12.5% of the general farm population.

- 7.8% of APP producers had a gross farm revenue of $50,000 to $99,999 compared to 12.40% of the general farm population.

- 15.9% of APP producers had a gross farm revenue of %100,000 to $249,999 compared to 15.4% of the general farm population.

- 22.2% of APP producers had a gross farm revenue of $250,000 to $499,999 compared to 10.9% of the general farm population.

- 23.7% of APP producers had a gross farm revenue of $500,000 to $999,999 compared to 7.3% of the general farm population.

- 13.7% of APP producers had a gross farm revenue of $1,000,000 to $2,499,999 compared to 3.1% of the general farm population.

- 3.00% of APP producers had a gross farm revenue of $2,500,00 0 and up compared to 1.6% of the general farm population.

*Gross farm revenues for the APP population are derived from the survey of 2013 producers; gross farm revenues for the total population are derived from Statistics Canada Census of Agriculture 2011 Table 004-0233 as the program data does not track farm size.

Continued need for Price Pooling Program

The evaluation found that there is low demand for services offering price guarantees to facilitate delivery payments to members of cooperative marketing agencies. The total number of cooperative marketing agencies that have utilized PPP price guarantees has declined from five to three over the last five years. While the remaining three agencies had a total of 1,453 members in 2013-14, the PPP administrators interviewed indicated that only about 1,200 producers participated in price pools guaranteed by the PPP.

Two cooperative marketing agencies who ceased participating in the PPP have since become APP administrators and now provide APP advances to their members in place of delivery payments. These agencies reported that the APP is better suited to their needs for the following reasons:

- APP advances reduce the risk to the agency and the amount of debt they are forced to carry.

- The APP enables all members to access short-term advances regardless of whether they participate in a given price pool. Many cooperative marketing agencies stated that they are experiencing a declining demand for price pooling among their members and are now acting on behalf of their members as a federation or producer association.

A few AAFC representatives suggested that the PPP is particularly important in assisting emerging marketing cooperatives become established and provide initial payments to their members. They explained that if commodity prices and market conditions were to change and collective marketing strategies were to regain popularity among producers, demand for the PPP could potentially increase.

Continued need for the Government Purchase Program

The evaluation found that there is a continued need for the GPP to provide the Minister with the legal authority to intervene in the purchase or sale of agricultural products. Although the program has not been activated since the AMPA was introduced in 1997, all AAFC representatives familiar with the program explained that the GPP is an important tool available to the Minister in the case of a catastrophe (for example,, extremely unusual market conditions where, by intervening in the market, the Minister would be able to influence some degree of market stability). AAFC representatives also stated that, although there has never been a need to trigger the program recently, the GPP should continue to be available because of the susceptibility of the agriculture sector to external risks and the importance of the sector to Canadians. This is supported by the findings of the literature review, which indicate that the legal authority to intervene in emergency situations is common among governments of developed economies.

4.1.2 Alignment with federal priorities and departmental strategic outcomes

Alignment with federal priorities

The AMPA programs align with federal priorities. The APP and PPP are enacted in federal legislation through the AMPA, one of several pieces of legislation directed specifically at enhancing farm competitiveness in Canada. The objectives of the APP and PPP strongly align with federal priorities for economic growth and competitiveness by supporting increased marketing flexibility and improved cash flow. This helps Canadian producers to obtain higher returns and be more financially competitive. AAFC representatives rated the APP and PPP as being aligned with the priorities of the federal government (an average rating of 4 out of 5)Footnote 22. Interviewees emphasized that the APP and PPP are aligned with the government's priority to ensure the competitiveness and adaptability of the agricultural sector.

Program documents demonstrate that the APP supports specific priorities identified in Budget 2013. As a part of AAFC's Business Risk Management suite of programs, APP supports Budget 2013's reference to the Growing Forward 2 agriculture policy framework, which delivers an effective suite of Business Risk Management programs to provide assistance to farmers in cases of severe market volatility and disasters.

Alignment with Agriculture and Agri-Food Canada strategic outcomes

The AMPA programs align with departmental strategic outcomes. AAFC’s mandate is to bring about a sustainable, competitive, and innovative agricultural sector in which risks are appropriately managed. The objectives of the AMPA programs align with AAFC's Strategic Outcome 2: "A competitive and market-oriented agriculture, agri-food and agri-based products sector that proactively manages risk". As part of AAFC's suite of Business Risk Management programs, the APP and PPP support the objective to provide producers with effective tools to manage business risks that are largely beyond their control, such as drought, flooding, low prices, and increased input costs, and remain competitive within the agricultural sector, thereby helping them to stabilize their farm income. The APP and PPP support Strategic Outcome 2 by providing producers with adequate cash flow so that producers have the flexibility to take advantage of markets when prices are high.

AAFC representatives reported that the APP and PPP are well aligned with the priorities and strategic objectives of the department (an average rating of 4.3 out of 5Footnote 23). The programs were said to help ensure Canadian producers remain competitive in the domestic and global economy by providing them with the tools they need to make good marketing decisions and manage cash flow effectively, to promote growth and development in the sector, and to be aligned with the department's Business Risk Management priorities.

4.1.3 Alignment with federal roles and responsibilities

Governed by federal law under the AMPA, the APP and PPP play an important federal role in equalizing opportunities for producers across Canada to have guaranteed access to low cost, short-term loans.

Program documents show that the APP is available to a wide variety of Canadian producer organizations and producers regardless of province. The comparative analyses indicate that the APP provides consistency in the types of loan guarantee programs available across Canada, as there is wide variation in the programs available to producers at the provincial level. As demand for the APP cash advances fluctuates across provinces and in response to changes in commodity prices, market conditions and external emergencies, a national program allows for greater consistency and stability across Canada.

Similarly, the PPP provides marketing agencies and producers in all provinces and territories an equal opportunity to participate in price pooling and cooperative strategies to reduce price risk. As demand for the PPP is low with only three agencies currently participating in the program, it is unlikely the provinces would be able to justify a provincially managed program with as few as one or two participating agencies.

4.1.4 Duplication and complementarity with other government programs and private sector financing

AMPA programs do not duplicate or overlap with other federal or provincial programs. The APP and PPP short-term advances complement other federal or provincial programs that offer longer-term financing intended for capital investment and non-guaranteed working capital financing that require realizable assets for security. The APP and PPP also complement the financing provided by the private sector by reducing risk for commercial lenders and supplementing the short-term private financing available to producers.

Findings from the comparative analysis indicate that the APP differs from loans offered through the Canadian Agricultural Loans Act (CALA) Program and Farm Credit Canada (FCC) because CALA and FCC loans are primarily long-term loans and are intended for investment in real property and assets rather than short-term working capital loans to improve cash flow and marketing. While some FCC financing options (for example, lines of credit, input financing) are used for short-term cash flow purposes, FCC does not provide a loan guarantee and usually requires security in the form of realizable assets such as farm equipment, land or property. APP advances, on the other hand, use Business Risk Management programs and the commodity on which the advance is taken as security, thus allowing producers to use their real assets as security for other investments.

Program documents and interviews with AAFC representatives indicate that the APP and PPP complement the objectives of Growing Forward 2 Business Risk Management programs by helping producers manage risk through access to short-term loans. Although the APP and AgriRecovery can both be used for emergencies such as flooding, almost all AAFC representatives stated there is no duplication or overlap between the programs. AgriRecovery is intended to respond to disaster events and the recovery of extraordinary cost resulting from the disaster.

According to AAFC representatives, the use of APP loans is appropriate in emergency situations where cash flow is an appropriate tool to respond to the crisis and administrators adhere to the appropriate measures of risk in order to avoid high default rates. However, the APP is not an ideal tool to assist sectors undergoing long-term structural adjustment, such as was the case for 2008-09 emergency.

Most AAFC representatives stated that the design of the APP is complementary to Growing Forward 2 Business Risk Management programs in its use of AgriStability and AgriInsurance payments as security. Producers can use the future payments from these programs as a guarantee to repay the APP principal. If their crop fails or there is a disaster and they are not able to repay their advance, the payment they receive from the other Business Risk Management programs would be used to repay the APP advance.Footnote 24

Evidence from the comparative analysis and interviews with AAFC representatives demonstrate that the APP and PPP complement provincial programs by filling gaps to ensure the availability of short-term loans to producers of a wide variety of commodity groups across Canada. The literature indicates that agricultural loans backed by provincial government guarantees exist in most provinces; however, eligibility by commodity group and type of loan expenditures varies widely. For example, programs such as the Alberta Farm Loan Program, the Manitoba Operating Credit Guarantees for Agriculture and the Ontario Commodity Loan Program guarantee loans to producers of all commodity groups for a range of eligible expenses. However, programs such as the British Columbia Feeder Associations Loan Guarantee Program, the Saskatchewan Livestock Loan Guarantee and New Brunswick’s Livestock Incentive Loan Program provide guaranteed loans only for the purchase of livestock. The APP focuses specifically on short-term loans for cash flow and marketing purposes, whereas many provincial programs provide funding for the purchase of fixed assets. There are no programs similar to the PPP offered by provincial governments.

The comparative analysis and key informant interviews demonstrate that the APP and PPP use private sector financing to provide alternative financing options for producers. As mentioned previously, APP administrators obtain financing for APP loans through private financial institutions, on a competitive basis. The APP advances differ from the financing provided by commercial lenders as many commercial loans are for capital investments rather than operating expenses and typically offer longer repayment periods and different repayment terms. The short-term working capital loans and lines of credit offered by the private sector command a considerably higher interest rate than APP advances and require security in the form of both assets and the commodity itself. The fact that many producers obtain loans and lines of credit from commercial lenders in addition to APP advances suggests that the advances do not replace the need for other financing products available from commercial lenders. The PPP provides a price guarantee that enables cooperative marketing agencies to obtain loans from financial institutions, and thus the PPP also complements the financing provided by the private sector.

4.2 Performance – effectiveness

The following section assesses the performance of the APP and PPP in terms of the extent to which the programs effectively meet their intended outcomes and demonstrate efficiency and economy.

4.2.1 Achievement of expected outputs and outcomes

Overall, the APP and PPP have largely achieved their intended outputs and outcomes.

4.2.1.1 Outputs

The evaluation found that the APP and PPP have successfully achieved their intended outputs. As highlighted in Table 4.1, the APP has exceeded its intended targets by ensuring that more than 440 agricultural products are eligible for cash advances under the program in the last five years. The fact that the program target was exceeded by such a significant degree suggests that the target may no longer be relevant and thus should be reviewed.

The PPP has met its target of signing three Price Guarantee Agreements with cooperative marketing agencies. As indicated in the following table, the number of cooperative marketing agencies participating in the PPP has declined from five to three over the last five years. Other output indicators and targets outlined in the Program Performance Measurement and Risk Management Strategy do not support an assessment of the intended outputs, but rather are service standards.Footnote 25

| Program output | Indicator | Target | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 |

|---|---|---|---|---|---|---|---|

| Cash advances are available to eligible producers | Number of products that are eligible for advances | 440 | 475 | 552 | 643 | 689 | 750 |

| Source: AAFC APP Administrative Data, Agreement Lender Information. | |||||||

| Program output | Indicator | Target | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 |

|---|---|---|---|---|---|---|---|

| Government guarantee protects agencies against unanticipated declines in the market price | Number of marketing agencies that have signed price guarantee agreements | 3 | 5 | 5 | 3 | 3 | 3 |

| Source: AAFC APP Administrative Data, Agreement Lender Information. | |||||||

4.2.1.2 Immediate outcomes

The APP has achieved its intended immediate outcome of enabling APP administrators to secure financing at preferential interest rates, but has not met its performance target of issuing cash advances to 28,000 eligible producers in the last five years (Table 4.2).

| Immediate outcome | Indicator | Target | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 |

|---|---|---|---|---|---|---|---|

| Administrators can secure financing at preferential interest rate | Below prime borrowing rate | Prime < −.25 |

Prime < −.25 |

Prime < −.25 |

Prime < −.25 |

Prime < −.25 |

Prime < −.25 |

| Cash advances issued to eligible producers | Number of producers receiving APP advances per production period | 28,000 | 25,081 | 24,394 | 21,462 | 23,786 | 21,547 |

| Immediate outcome | Indicator | Target | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 |

|---|---|---|---|---|---|---|---|

| Marketing agencies can secure financing to make initial delivery payments to producers | Initial delivery payments made to members | n/a | $20.3 million | $28.4 million | $26.1 million | $36.9 million | n/a |

| Source: AAFC APP Administrative Data, Agreement Lender Information n/a = not available |

|||||||

There is a requirement in each Advance Guarantee Agreement that prevents lenders from charging administrators interest rates greater than prime minus 0.25. Further, program data shows that in 2013, 72 percent of the APP administrators were able to use the APP guarantee to secure financing at the bank prime rate minus 0.25 while the remaining 28 percent of administrators were able to secure financing at prime minus 1. Consequently, the APP met its performance target of prime minus 0.25.

Approximately two-thirds of APP administrators (63%) stated they would not be able to secure loans from commercial lenders without the Advance Guarantee Agreement, while a minority (16%) who thought they could secure financing suggested that they would have to pay a higher interest rate and that the terms of the loan would not be as favorable. The lenders interviewed stated that the guarantee is an important component of the Advance Guarantee Agreement. They indicated that they would be unwilling to participate without it because many APP administrators lack significant realizable assets to offer as security for the loan.

While the APP has issued cash advances to a large number of eligible producers, the program has not met its performance target of issuing advances to 28,000 producers in the last five years. The total number of producers receiving regular APP advances has declined from 31,862 in 2008-09 to 21,547 in 2014-15 (Figure 3). As indicated previously, some key factors contributing to the decline in the number of producers participating in the APP are high commodity prices and low interest rates.Footnote 26 Several key informants and APP administrators indicated that greater awareness and promotion of the program, improvements resulting from the recent legislative changes, and higher interest rates are factors which may contribute to increased uptake of the APP in the future.

The PPP has achieved its immediate outcome of enabling marketing agencies to secure financing to make initial delivery payments to producers. This guaranteed financing was used to make initial delivery payments of $36.9 million to producers by the three cooperative marketing agencies participating in the PPP in 2013-14. The PPP administrators explained that, in the absence of the PPP price guarantee, they would be unable to secure financing from commercial lenders to issue delivery payments.

4.2.1.3 Intermediate outcomes

Advance Payments Program intermediate outcomes

The evaluation found that the APP achieved its intended outcomes of providing producers with low cost capital to reduce short-term financial pressures and enhance marketing flexibility, though not all performance targets were met.

Reducing short-term financial pressures

As indicated in Table 4.3, the APP has achieved, or has come very close to achieving, its performance target of providing $2 billion in APP advances in four of the last five years. The total value of APP cash advances peaked in 2008-09 with the provision of $2.7 billion in regular and emergency cash advances. Since then, the value of APP cash advances declined to $1.6 billion in 2010-11 and then increased to $2.4 billion in 2013-14 and $2 billion in 2014-15.

| Intermediate outcome | Indicator | Target | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 |

|---|---|---|---|---|---|---|---|

| Producers can access low cost capital | Dollar value of APP advances issued per production period | $2 billion | $1.6 billion | $1.9 billion | $1.9 billion | $2.4 billion | $2 billion |

| Enhanced marketing flexibility during the agreement period | Repayment of loans through proceeds of sales[1] | 90% | 92% | 91% | 87% | 91% | 79% |

|

[1] This data excludes payments that are received from BRM program as a result of a loss suffered by producers that was beyond their control (for example, production insurance payments and AgriStability). If these payments were included to indicate who is not providing proof of sale, the numbers in the table would exceed the target. Source: AAFC APP Administrative Data, Agreement Lender Information |

|||||||

The APP has enabled producers to access low cost capital because the interest costs that producers must pay on the APP advance are lower than that incurred for alternative financing options. Program documents show that in 2013-14, APP administrators commonly charged producers interest at the bank prime rate for the interest-bearing portion of their advance while higher interest rates were charged for loans in default and advance repayments without proof of sale (Table 4.4).

Number of Advance Payments Program administrators (N=43)

| Interest Rate | Administrators who charged interest bearing loan rates (#) |

Administrators who charged interest bearing loan rates (%) |

Administrators who charged default rates[1] (#) |

Administrators who charged default rates[1] (%) |

Administrators who

charged repayment without proof of sale rates (#) |

Administrators who

charged repayment without proof of sale rates (%) |

|---|---|---|---|---|---|---|

| Prime −1 | 2 | 4.8 | 0 | 0 | 0 | 0 |

| Prime | 39 | 92.9 | 4 | 9.3 | 5 | 11.6 |

| Prime +1 | 0 | 0 | 5 | 11.6 | 5 | 11.6 |

| Prime +2 | 0 | 0 | 14 | 32.6 | 13 | 30.2 |

| Prime +3 | 0 | 0 | 20 | 46.5 | 20 | 46.5 |

| BA +0 | 1 | 2.3 | 0 | 0 | 0 | 0 |

| Total | 42 | 100% | 43 | 100% | 43 | 100% |

|

[1] It should be noted that, as of 2014-15, the retroactive default penalty has been capped at prime +1. Source: Producer Rates by Administrator, 2013-14 Note: BA is shortform for Bankers' Acceptance Only references administrators who gave interest bearing loans. | ||||||

According to the 2013 producer survey results, presented in Section 4.1.1 and Figure 2, a total of 13 percent of producers surveyed believed that they would not be able to acquire an alternative loan, while another 24 percent were uncertain. The impact of this survey finding when extrapolated to the total producer population that received APP advances in 2013 is that, in the absence of the APP in 2013, it is estimated that 3,092 producers would not have qualified for alternate financing, leading to a shortfall in financing of approximately $315 millionFootnote 27. Further, another 4,282 (24%) of producers may or may not have qualified for alternative financing, leading to an additional shortfall of approximately $435 million, if none of these producers could have obtained alternate financing.

Of those 178 producers who stated that they would qualify for alternate financing in the absence of the APP, 75 percent stated that they would rely on an operating loan or line of credit or a short-term loan offered by a bank, credit union or caisse populaire. Twenty percent stated that they would rely on financing available from input suppliers. The majority (59%) stated that the interest rate of the alternative financing would be greater than the APP advance. More than three-quarters of producers (79%) suggested the rates would be one percent to five percent greater and 18 percent reported that it could be as much as six percent to 10 percent higher than their last APP advance. While many producers (33%) were unsure what rates they would be offered in the absence of the APP, only a very small minority (8%) believed the rate would be the same or lower than what is currently offered by their administrator.Footnote 28

Overall, surveyed producers believed that they would likely be charged an interest rate of a weighted average of 3.5% higher than the interest rate charged on their interest-bearing APP advance which was typically at the prime rate (that is, 3% in 2013-14). By extrapolating these results to all APP participants, it is estimated that, for the 2013-14 production period, producers saved approximately $121.5 million in interest costs on the interest-free and interest-bearing portions of the APP advances compared to the interest costs that would have been incurred with alternate financing. The interest cost savings works out to an average of approximately $5,152 per producer. In addition to the cost savings achieved from the preferential interest rate on the APP advance, the APP advance helped some producers obtain a better rate on their operating loan (4%) or line of credit (2%) and reduced the limit on their operating loan (8%) or line of credit (14%).

Both AAFC staff and APP administrators reported that APP advances have significantly helped producers address short-term financial pressures (average ratings of 4 and 4.1 out of 5, respectively)Footnote 29. AAFC representatives and APP administrators indicated that the design and value of the advances are well-suited to medium sized producers who require financial assistance to bridge the gap from planting to marketing. Several respondents explained that, historically, APP advances have proven particularly helpful in short-term emergencies such as the grain transportation crisis in 2013 as previously stated.

According to the producers surveyed, almost all producers who received advances in 2013 reported that the APP advance significantly (73%) or somewhat (21%) helped them address short-term financial pressures. These producers stated that the APP advance helped them by: (in order of frequency mentioned)

- providing cash flow assistance during production when capital was needed most;

- saving interest costs;

- enabling them to pay for input costs early in the season and take advantage of rebates and promotions;

- allowing them to delay marketing until commodity prices increase; and

- supporting operating costs (for example, fuel, repairs and land rental payments).

Enhancing marketing flexibility

As indicated in Table 4.3, the APP has achieved its performance target of having 90 percent of loans repaid through proceeds of sales for three of the five years. According to program management, APP was slightly below the target for two years due to the transition of western grain and oil producers that used Canadian Wheat Board to the Canadian Canola Growers Association and the 2012-13 grain transportation crisis in western Canada.Footnote 30 The performance indicator of "repayment of loans through proceeds of sales" is not an appropriate indicator to measure the intermediate outcome of "Enhanced marketing flexibility during the agreement period" since the producers can repay their loans without proof of sale.

The enhanced cash flow provided by APP advances allowed producers to market their storable commodities when prices were highest which may or may not involve a delay of sale. The evaluation found that the increased marketing flexibility achieved as a result of the APP had a significant impact on producers of storable commodities who benefited from the ability to delay marketing their commodities. The APP advance had a minimal impact in terms of increased marketing flexibility on products that are perishable because they have to be sold at harvest, or on products that are produced on contract as they have to be sold at a particular time.