Executive summary

Purpose

The Office of Audit and Evaluation of Agriculture and Agri-Food Canada (AAFC) conducted an evaluation of the Canadian Agricultural Loans Act (CALA) Program to assess relevance, design, delivery, efficiency and effectiveness.

Scope and methodology

The CALA Program’s activities from 2018-19 to 2022-23 were evaluated using multiple lines of evidence: a review of program documents, literature and media; analysis of Program and secondary data; and interviews with internal and external stakeholders.

Background

The CALA Program is a federal loan guarantee program legislated under the authority of the Canadian Agricultural Loans Act. By guaranteeing repayment to lenders of up to 95% of the net loss of a registered, eligible loan, the CALA Program aims to support the renewal of the agricultural sector and improve the affordability of agriculture credit. Between 2018-19 and 2022-23, the Program registered 3,561 new loans at a value of over $322 million. The net cost of the Program during this period was $1,964,306.

Findings

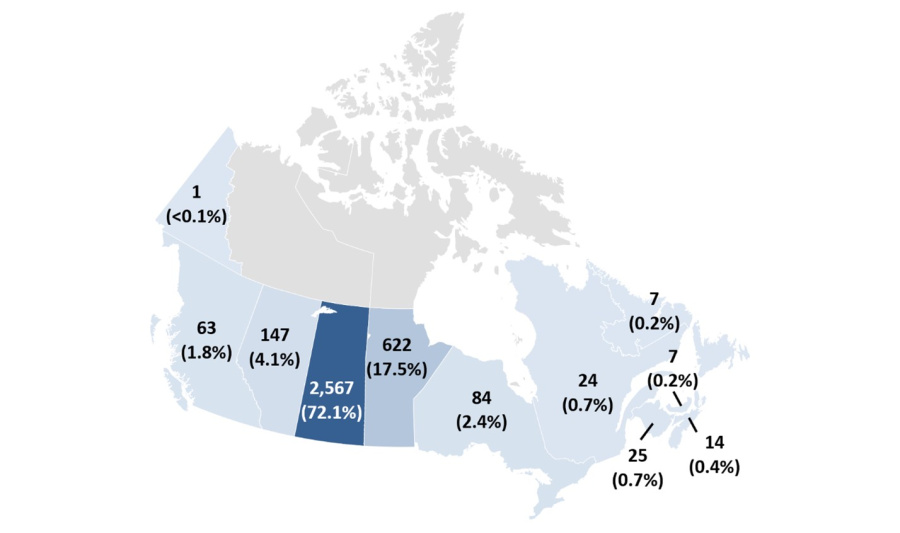

- The CALA Program filled a gap in access to affordable credit for beginning farmers and underrepresented groups. It was also relevant to credit unions who issued 89.4% of loans nationally and to lenders in Saskatchewan who issued 72.1% of all CALA loans.

- The Program was generally not needed by established farmers and agricultural co-operatives.

- Low loan limits diminished the utility and uptake of CALA loans for farmers due to increasing farm capital values. The number and size of CALA loans declined for both beginning and existing farmers.

- The CALA Program’s design is efficient because it leverages existing financial infrastructure. However, the Program has operated in a deficit in recent years due to declining uptake.

- Increasing the loan limits to respond to increased costs faced by farmers and improving outreach activities to lenders could result in increased uptake of the Program.

- The CALA Program provided access to affordable credit to farmers and co-operatives.

- Access to capital was not a limiting factor for most producers; however, the CALA Program did not directly contribute to this outcome.

- The Performance Information Profile is outdated and should better reflect program theory.

Conclusion

Given the abundance of credit available over the reference period, favorable economic conditions for the agricultural sector, and current design limitations such as loan limits that were reported to be insufficient, the CALA Program is no longer relevant for the majority of its client base. The Program was found to meet its immediate outcome, providing access to credit; however, declining participation rates and low awareness of the Program suggests it not a significant contributor to its intermediate and ultimate outcomes. Further, data availability and integrity challenges limited the evaluation’s ability to assess the CALA Program’s adherence to program guidelines and achievement of outcomes.

Recommendations

Recommendation 1: The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Strategic Policy Branch, review and propose changes to the CALA Program parameters to ensure its relevancy.

Recommendation 2: The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Public Affairs Branch, should work to increase the awareness of the CALA Program among lenders.

Recommendation 3: The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Corporate Management Branch, should update the performance information profile and ensure administrative data is consistently collected.

Management response and action plan

Management agrees with the evaluation recommendations and has developed an action plan to address them by March, 2025. For further details see Annex D.

Introduction

The Office of Audit and Evaluation conducted an evaluation of the Canadian Agricultural Loans Act (CALA) Program as part of the 2022-23 to 2026-27 Integrated Audit and Evaluation Plan. The evaluation complies with the Treasury Board of Canada’s Policy on Results and fulfils the requirements of the Financial Administration Act. Findings from this evaluation are intended to inform current and future program and policy decisions.

Scope and methodology

The evaluation assessed the relevance, design, delivery, efficiency and effectiveness of the Canadian Agricultural Loans Act (CALA) Program from 2018-19 to 2022-23. The evaluation used multiple lines of evidence including a review of program documents, literature and media; analysis of administrative and secondary data; and key informant interviews. See Annex A for the detailed methodology.

The CALA Program’s activities were most recently evaluated through the evaluations of the CALA Program in 2019 and 2014.

Program profile

Overview

The federal government has offered agricultural loan guarantees to private sector loans since 1945 through the Farm Improvement Loans Act (1945 to 1987) and the Farm Improvement and Marketing Cooperatives Loan Act (1987 to 2009). Following national consultations in 2006 and a legislative change in 2009, the Canadian Agricultural Loans Act (CALA) replaced the Farm Improvement and Marketing Cooperatives Loan Act.

The CALA Program is intended to support the agricultural sector by increasing the availability of private sector loans to farmers and agricultural co-operatives. BeginningFootnote 1 and existing farmers can use CALA loans to establish, improve and develop farms, while agricultural co-operatives can use these loans to process, distribute or market the products of farming. The Program guarantees repayment of 95% of the net loss on a registered loan.

CALA loans are delivered by eligible private sector financial institutions (lenders), such as chartered banks, credit unions, caisse populaires, Alberta Treasury Branches and any other organizations designated by the Minister of Agriculture and Agri-Food. CALA loans to farmers can only be issued for eligible purposes (see Annex B) up to:

- $500,000 for the purchase of land and the construction or improvement of buildings;

- $350,000 for all other purposes, including consolidation/refinancing and inter‑generational farm transfers;

- A maximum aggregate loan limit of $500,000 for any one farm operation; and

- A maximum aggregate loan limit of $3 million for agricultural co-operatives, with the Minister’s approval.

CALA loans are issued to existing farmers with a 20% minimum down payment, and to beginning farmers with a 10% minimum down payment. The interest rates are capped at the lender’s prime rate plus one% for a floating rate, or the lender’s residential mortgage rate, for a comparable term, plus one% for a fixed rate.

CALA loans are subject to a registration fee and an administrative fee, both paid by the borrower. The registration fee is equal to 0.85% of the loan value and is paid to the CALA Program. The administrative fee is variable and paid to the lender, with a maximum of 0.25% for loans up to $250,000, and 0.1% for loans above $250,000.

Governance

Agriculture and Agri-Food Canada’s Financial Guarantee Programs Division within Programs Branch is responsible for oversight of the Program and assessing loss claims. The Division develops tools, policies and guidelines required to help ensure the Program is delivered according to legislative and regulatory parameters. Loss claims are assessed by Agriculture and Agri-Food Canada (AAFC) based on whether the loan met the criteria outlined by CALA and its regulations and whether the lender followed their regular lending practices when reviewing a loan application and assessing the risks associated with the loan. A payment is only made to lenders for eligible losses incurred on a defaulted registered CALA loan after the lender has collected their security and then submitted a claim for the loss.

The CALA Program shares online portal infrastructure with Innovation, Science and Economic Development Canada’s Canada Small Business Financing Program. This secure portal is used by lenders to register new loans and make claims for payment with the Program.

Resources

From 2018-19 to 2022-23, the cost to deliver the CALA Program was $3,161,730, averaging $632,346 per year. The Program spent $1,675,459 in payments to lenders for defaults. However, the Program also collected $2,739,433 in revenues from loan registrations and recovered $133,450 from borrowers who defaulted on loans. In total, the Program cost $1,964,306 to deliver. AAFC employed between 3 and 4 full-time equivalents during this time (see Table 1).

| 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | Five-year total | |

|---|---|---|---|---|---|---|

|

Program delivery costs ($) |

591,267 |

667,706 |

514,600 |

688,118 |

700,040 |

3,161,730 |

|

Program default costs ($) |

4,779 |

787,712 |

1,229,428 |

113,471 |

−459,931 |

1,675,459 |

|

Recoveries ($) |

−56,187 |

−1,156 |

−75,793 |

−314 |

0 |

-133,450 |

|

Revenues ($) |

−765,546 |

−621,932 |

−580,314 |

−435,205 |

−336,436 |

-2,739,433 |

|

Total program costs ($) |

-225,687 |

832,330 |

1,087,921 |

366,070 |

-96,327 |

1,964,306 |

|

Full-time equivalents |

3 |

4 |

3 |

4 |

4 |

- |

|

Source: Program financial data |

||||||

Intended outcomes

The following immediate, intermediate and ultimate outcomes were examined as part of this evaluation:

- Immediate outcome: Lenders are aware of the availability of the CALA Program and are determining eligibility and borrower risk and issuing loans through the Program.

- Intermediate outcome: Producers and agricultural co-operatives have access to affordable capital to make investments in their operations.

- Ultimate outcome: Access to capital is not a limiting factor for producers and agricultural co-operatives to invest in their operations.

For the full CALA Program logic model, see Annex C.

Relevance

Gaps addressed by the CALA Program

The CALA Program was generally not needed by established farmers and agricultural co-operatives, but filled a gap for beginning farmers and underrepresented groups who face barriers accessing affordable credit.

Beginning farmers face barriers to agricultural credit due to lack of starting capital, limited historical yield and income information and rising input and capital costs. Without starting capital to make a down payment, beginning farmers may not obtain the low interest rates offered to larger and more established operations. Their lack of production history creates challenges in predicting yields and income, which may prevent them from leveraging high commodity prices. Finally, high input and capital costs make it difficult for beginning farmers to afford to invest in their operations.

This leaves a gap in accessible, affordable credit for beginning farmers despite the favourable agricultural credit landscape for most farmers during the evaluation period. The CALA Program partly addressed this gap by providing lower down payment requirements and competitive interest rates, which are intended to make obtaining and repaying the loan more affordable.

There are additional barriers which impede beginning farmers from accessing affordable credit that the CALA Program did not address. Beginning farmers may be inexperienced in producing the documentation required for a loan application, or they may struggle to provide historical farming results, which may make the applicants ineligible for a loan. Given that the Program does not reduce the risk assessment that lenders are required to conduct before approving a loan, the Program does not address this barrier to credit.

Underrepresented farming groups such as women and Indigenous farmers, as well as farmers in innovative commodity sectors also faced barriers to credit that the CALA Program partially addressed. A review of literature found that women entrepreneurs, including farmers, may receive less capital funding and face higher rejection rates for financing than their male counterparts. This may lead to women pursuing smaller operations that require less capital and generate lower profits. Indigenous farmers on First Nations reserves are not eligible for CALA loans because Section 89(1) of the Indian Act prevents on-reserve property from being utilized as security for loans. Farmers in innovative commodity sectors often present a higher risk to lenders as their commodities are less understood by lenders. These farming groups may benefit from the competitive terms offered through CALA loans to improve and expand their operations but as with beginning farmers, may not receive a CALA loan if their risk profile is too high to meet lender’s standard lending practices.

The CALA Program was found to be relevant for Saskatchewan lenders in particular as it serves to support the Saskatchewan Farm Security Act. This Act limits lenders’ options for collecting on agricultural securities in cases of defaulted loans. CALA loans allow lenders to manage the financial risks associated with agricultural loans by guaranteeing repayment in cases of default.

The CALA Program was generally not needed by established farmers and agricultural co-operatives. The evaluation did not identify any gaps in commercial agricultural credit for these groups due to favorable conditions, such as low interest rates, Footnote 2 high commodity prices, low levels of debt and high asset levels. The prime lending rate in Canada was low (around three%) between 2009 and 2023, which promoted easier and more affordable access to credit for farmers. Additionally, commodity prices during the evaluation period were generally high, increasing cash flow to farmers. This increase in revenue improved farmers’ ability to repay loans and qualify for credit. Finally, these groups were able to use their low levels of debt and their existing capital assets as leverage for new loans to improve or expand their operations.

Overlap with other loan programs

Lenders who use the CALA Program use it in a complementary fashion to their product offering. However, the risk of non-productive overlap was identified amongst federal and provincial crown corporations.

The evaluation defines 'overlap' as a degree of similarity between programs and 'duplication' as replicating other programming. Key criteria used to assess evidence of overlap and duplication included maximum loan amounts, down payment options, eligible applicants, eligible purposes and maximum interest rates. Thirty-four loan offerings from federal and provincial crown corporations and governments were reviewed to inform the evaluation.

Chartered banks and credit unions

The evaluation found that CALA loans overlapped with loans from chartered banks and credit unions in a complementary way, since these institutions could offer CALA loans in addition to their existing credit products, at their discretion. Neither chartered banks nor credit unions described the CALA Program as duplicative of or competing with their products; rather, these institutions described the CALA Program as complementing their existing products for farmers.

The CALA Program was available to farmers in all provinces and territories, either through chartered banks operating nationally, or through credit unions and caisse populaires operating locally. Chartered banks and credit unions play an important role in farm credit, combined they held approximately half of the agricultural outstanding debt in Canada from 2018 to 2022.

Federal and provincial crown corporations

There is a risk of non-productive overlap identified between the CALA Program and federal and provincial crown corporations that offered lending products to farmers. Federal and provincial crown corporations are not registered lenders under the CALA Program, and as such, cannot offer CALA loans.Footnote 3 Federal and provincial agencies are also important providers of farm credit. Combined, they held approximately one-third of the agricultural outstanding debt in Canada from 2018 to 2022.

Farm Credit Canada (FCC) offered loans that funded similar eligible products to farmers as the CALA Program, such as buildings, farm equipment, livestock, and farm transition loans. FCC also provided targeted programs for young farmers. There were variations between FCC products for amounts required for down payments and payment terms. There was a risk for non-productive overlap due to 2 federal entities providing loans to similar recipients for similar products. However, the evaluation was unable to conclude that the offerings were fully duplicative because the FCC had larger loan limits and its interest rates offered to farmers were based on FCC’s overall assessment of their risk profile. Finally, participation in one loan program did not exclude farmers from obtaining loans from other sources; as such, farmers could have multiple loans from multiple sources.

Four provincial crown corporations offered loans for most of the same eligible purposes as the CALA Program.Footnote 4 While not every loan program stated all of the same terms as the CALA Program (such as repayment terms or maximum interest rates), most loans had higher maximum loan amounts and lower down payment requirements than the CALA Program. Crown corporations also offered additional incentives for young farmers (mostly defined by the age of 40 years or below) such as lower interest rates, rebates or grants that could be applied to the loan, lower equity requirements, and flexible repayment terms.

Provincial governments

Outside of provincial crown corporations, most provincial governments offered loans to farmers with varying degree of overlap with the CALA Program. Some provinces offered loans for livestock or farmland purchases only, whereas others included several eligible products, such as real property and/or asset purchases. Two provincial governments (Saskatchewan and Newfoundland and Labrador) did not offer any loans to farmers.

Alignment with government responsibilities

The CALA Program is aligned with the departmental core responsibility of addressing sector risk.

The Program is legislated under the Canadian Agricultural Loans Act and was found to align with departmental responsibilities outlined in Agriculture and Agri-Food Canada’s annual Departmental Plan. The Program contributes to the departmental core responsibility of addressing sector risk by functioning as one of the tools available to farmers to mitigate the financial impact of risk beyond the farmer’s control that threaten the viability of their operations. CALA does this by offering preferential loan terms such as longer repayment periods and maximum interest rates, which are intended to make the loans more affordable to farmers and co-operatives by reducing the financial burden of loans on a farmer’s monthly cash flows.

Program design and delivery

Beneficial design and delivery elements

The 95% loan guarantee offered through the Program was the most beneficial design element of the Program, especially for credit unions and Saskatchewan lenders.

Credit unions stated that the Canadian Agricultural Loans Act (CALA) Program was highly important to them, noting that the loan guarantee was beneficial to their lending practices. Depending on the provincial regulations, credit unions are required to hold between 75 and 100% of an agricultural loan’s total book value in reserve. However, if an agricultural loan is guaranteed by the government, credit unions are not required to hold any capital for that loan. This allows credit unions to expand their lending portfolios and compete with larger lenders. Credit unions registered 89.4% of CALA loans during the evaluation period (see Table 2).

| Lender | Percentage of registered loans (%) | Percentage of dollars loaned (%) |

|---|---|---|

|

Credit unions |

89.4 |

73.9 |

|

Chartered banks |

9.5 |

22.9 |

|

Alberta Treasury Branches |

0.7 |

2.1 |

|

Caisse populaires |

0.5 |

1.1 |

Source: Program administrative data

Saskatchewan lenders also benefited from the Program’s 95% guarantee as it allows them to manage the financial risks associated with agricultural loans, noting that the Saskatchewan Farm Security Act limits the use of agricultural securities for loans in the Province. In the evaluation period, 72.1% of all CALA loans were registered in Saskatchewan (see Figure 1).

Figure 1: Number of CALA registered loans by province, 2018-19 to 2022-23

Source: Program administrative data

Description of the above image

Map of Canada showing each province and territory’s number of registered CALA loans, as well as each province and territory’s percentage of the total registered CALA loans, 2018-19 to 2022-23.

| Province/Territory | Number of loans | Percentage |

|---|---|---|

|

Yukon |

1 |

Less than 0.1 |

|

British Columbia |

63 |

1.8 |

|

Alberta |

147 |

4.1 |

|

Saskatchewan |

2,567 |

72.1 |

|

Manitoba |

622 |

17.5 |

|

Ontario |

84 |

2.4 |

|

Quebec |

24 |

0.7 |

|

New Brunswick |

25 |

0.7 |

|

Newfoundland and Labrador |

7 |

0.2 |

|

Prince Edward Island |

7 |

0.2 |

|

Nova Scotia |

14 |

0.4 |

The CALA Program’s maximum interest rate, amortization periods for loan categories, and lower down payment requirements for beginning farmers were also identified as favorable design elements for registered lenders. Interviewees suggested that while the Program’s uptake was low during the evaluation period, the Act being in force was still important as the Program functioned as a price leader in the credit market. CALA’s low maximum interest rate enabled farmers to negotiate more favourable and affordable rates when compared to typical commercial loan offerings.

Design and delivery concerns

Low loan limits diminished the utility and uptake of CALA loans due to increasing farm capital values. There are opportunities to increase the loan limits and outreach activities to lenders.

The CALA Program’s parameters were last updated in 2009 when CALA replaced the Farm Improvement and Marketing Cooperatives Loan Act. The updates were intended to increase the Program’s relevance for farmers and agricultural co-operatives. For example, the maximum aggregate loan limit was increased from $250,000 to the current limits of $500,000. Agricultural co-operatives could include those with majority farmer membership rather than only those with 100% farmer membership. Finally, beginning farmers were identified as a needs group and were provided with the lower down payment option. Other design elements such as the maximum interest rate and amortization period were unchanged.

Land and construction or improvement of buildings

Evaluation evidence pointed to the loan limit maximum of $500,000 for the purchase of land and the construction or improvement of buildings as being too low to meet farmers’ needs. In particular, the loan limit has not kept up with either the average price per acre or the average value of land and buildings on owned farms (see Table 3). The price of land nearly tripled from $1,681 per acre in 2011 to $4,899 per acre in 2021, reducing the number of acres that can be bought using a CALA loan from 300 acres to 102 acres. As a result, only 14% of CALA loans were used for land purchases, while less than four% were used for improvement or development or building purposes.

| 2011 | 2016 | 2021 | 2011 to 2021 change (%) | 2016 to 2021 change (%) | |

|---|---|---|---|---|---|

|

National average price per acre ($)Footnote 1 |

1,681 |

3,544 |

4,899 |

191 |

38 |

|

National average value of land and buildings ($/farm)Footnote 1 |

1,342,301 |

2,211,276 |

3,180,124 |

137 |

44 |

|

CALA loan limit for real property ($)Footnote 1 |

500,000 |

500,000 |

500,000 |

0 |

0 |

Lenders unanimously stated that the CALA Program’s $500,000 loan limit for real property restricted their use of the Program and that they would be more likely to register a CALA loan if the loan limits were increased. Lenders suggested that the loan limit for real property should be increased to at least $1 million to meet current needs, and even higher to meet future needs. This is consistent with previous consultations with lenders. The 2019 evaluation of the CALA Program found that 70% of surveyed lenders reported that the maximum loan amount of $500,000 for real property was not sufficient to meet the needs of farmers.

Implements and equipment

The loan limit maximum of $350,000 for other loan purposes, such as implements and equipment, was also too low to meet farmers’ needs, as it was no longer sufficient to cover the value of all on-farm machinery and equipment by 2021. For example, in 2022-23, a beginning grain farmer in Saskatchewan may need to pay between $497,900 and $664,700 for a new four‑wheel drive tractor. Between 2016 and 2021, the value of all on-farm machinery and equipment increased by 32% (see Table 4). A 2022 lender survey conducted by Agriculture and Agri-Food Canada found that 77% of lenders reported that the loan limits for all other purposes were too low and suggested that the loan limit for purposes other than real property be increased to at least $750,000.Footnote 5

| 2011 | 2016 | 2021 | 2011 to 2021 change (%) | 2016 to 2021 change (%) | |

|---|---|---|---|---|---|

|

National average value of on-farm machinery and equipment ($/farm)Footnote 1 |

201,438 |

278,405 |

367,088 |

82 |

32 |

|

CALA loan limit for all other purposes, including intergenerational transfers ($)Footnote 2 |

350,000 |

350,000 |

350,000 |

0 |

0 |

Intergenerational loans

The loan limit maximum of $350,000 to purchase shares for intergenerational farm transfers did not meet farmers’ needs, as the loan limit for intergenerational loans was too low and as such, no CALA loans were issued for this purpose in the evaluation period. Intergenerational loan conditions were intended to accommodate a variety of business structures so any farmer had the flexibility to organize their business and family affairs as they saw fit and still benefit from a loan guarantee. However, a CALA loan limit of $350,000 would only cover 9% of the 2021 total farm capital value that might be included in an intergenerational loan (see Table 5).

| 2011 | 2016 | 2021 | 2011 to 2021 change (%) | 2016 to 2021 change (%) | |

|---|---|---|---|---|---|

|

National average value of total farm capital ($/farm)Footnote 1 |

1,607,695 |

2,634,035 |

3,638,498 |

126 |

38 |

|

CALA loan limit for intergenerational transfers ($)Footnote 1 |

350,000 |

350,000 |

350,000 |

0 |

0 |

Options for increasing loan limits

The need to increase CALA’s loan limits is not new, as the 2019 evaluation recommended the CALA Program’s parameters be revised to ensure the availability of private sector loans to support farm productivity, competitiveness and sustainability. Changes to the Program’s design could set the loan limits to a new static number, which would require fixing new amounts as per paragraphs 4(3) and 6(3) of the Act. Another option is that the Program limits could be linked to inflation or farm input indexes, reducing the need for regular updates required through a regulatory change.

Outreach to lenders

Over the reference period, there was minimal training and outreach activities to lenders by the CALA Program due to the Program’s need to address other priorities (such as clearing a backlog of claims by lenders) and restrictions on staff activities (such as COVID-19 restrictions and other staffing issues). Some lenders stated that future outreach should occur after the CALA Program is updated to better reflect the needs of the agricultural sector, such as increased loan limits.

Performance

Performance measurement

The Performance Information Profile is outdated and should better reflect program theory. Inconsistent data collection limited the ability to fully assess the Program’s intermediate and ultimate outcomes.

Performance information profile

A review of the Canadian Agricultural Loans Act (CALA) Program’s performance information profile found it did not accurately reflect the Program’s current delivery model. As such, the logic model for the intermediate and ultimate outcomes, as well the performance measurement framework, require updating. For example, the evaluation found that the number of CALA loans registered is not an indicator of the affordability of capital to make investments for producers and agricultural co-operatives (intermediate outcome), nor does the percentage of CALA loan defaults reflect that access to capital is a limiting factor for investment (ultimate outcome). Further, 3 of the 4 ultimate outcome indicators were not collected, requiring the use of secondary data sources to assess the Program’s contribution to the achievement of the outcome.

Data integrity

The CALA Program’s administrative data is self-reported by authorized lenders who are responsible for uploading the data into a joint online registration system shared with Innovation, Science and Economic Development Canada. A review of administrative data determined that there were inconsistencies in the data reported by lenders, such as the name of the loan recipient, their classification (individual or co-operative) and the loan interest rates varied across lenders. These issues impacted the ability to assess the success of the Program to meet its intermediate and ultimate outcome and the Program’s ability to verify that lenders were following the Program’s guidelines.

Additionally, there are no loan recipient unique identifiers used by the CALA Program. This prevented detection of repeat program use by borrowers and the ability to determine if the program maximum loan amounts were exceeded. The CALA Program did not request or collect disaggregated demographic data from CALA loan recipients, such as whether they identified as Indigenous, persons with disabilities, visible minorities, women or youth. The Program collected data on whether CALA loan recipients were beginning and existing farmers. As such, the only relevant type of analysis using program data that could be conducted is the differences between beginning and existing farmers.

Efficiency

The CALA Program by design, benefits from leveraging a well-established banking industry to efficiently deliver the Program, however, due to declining use, it has moved from being cost neutral to operating in a deficit.

The CALA Program’s use of existing financial infrastructure efficiently leverages lender expertise and resources in program delivery. By integrating the Program’s review and registration process into a lender’s regular lending practice, lenders are responsible for fulfilling the loan’s requirements and performing the necessary assessments of risk and eligibility. For loan defaults, the lenders are responsible for attempts to collect on the security before requesting support from the Program. As a result, Agriculture and Agri-Food Canada (AAFC) maintained a low number (three to four) of full-time equivalents to administer the Program.

Service standards

The CALA Program generally met its service standards over the evaluation period. Almost all loans were registered in fifteen days, and almost all emails and telephone calls were responded to by the end of the next business day.Footnote 6 The CALA Program registered the vast majority of its loans (92.6%) within 1 day through the online portal. The remainder of the loans (7.8%) were registered and processed manually by the Program, either by either mail or fax.

Program delivery costs

During the current evaluation period (2018-19 to 2022-23), the Program operated in a deficit, with a net operation cost of $1,964,306 and an average cost per loan of $887.88. In comparison, during the previous evaluation period (2013-14 to 2017-18), the Program operated in a surplus of $285,385 and an average delivery cost per loan of $435.02 (see Table 6). The increase in delivery costs was due to declining uptake of the Program and the subsequent decline in revenue from the registration fees. The cost per registered loan in the evaluation period was comparable to that of the Canada Small Business Financing Program from 2013-14 to 2017-18, which was estimated to be over $900 per loan.

| 2013-14 to 2017-18 | 2018-19 to 2022-23 | |

|---|---|---|

|

Number of loans registered |

7,193 |

3,561 |

|

Program delivery costs ($) |

3,129,082 |

3,161,730 |

|

Average cost per loan ($) |

435.02 |

887.88 |

|

Source: Program administrative data |

||

Considerations for cost neutrality

The CALA Program could return to cost neutrality by increasing the loan limit. The evaluation estimated that if the loan limit for real property purposes were to be increased to $1.5 million and the registration fees were to remain at their current levels, then an additional 33 registered loans at the new maximum value would lead to cost neutrality. Lenders stated that the registration fees charged by the Program were appropriate and should not be increased.

Lender awareness and usage

Financial institution awareness of the CALA Program was low and the number of lenders registering CALA loans declined.

The evaluation found that lender awareness of the CALA Program was low. In general, interviewees stated that lenders were not aware of the Program and lenders themselves described several factors that negatively impacted their awareness. For example, it was difficult to locate information on the Program’s website and there was a reported lack of training from AAFC about the CALA Program in the last 5 years. Finally, lenders reported that staff turnover within their institutions resulted in the loss of institutional knowledge of the Program.

Low lender awareness is not a new issue for the CALA Program. The 2014 evaluation recommended that AAFC review its awareness efforts, and if necessary, work to increase the awareness of CALA among lenders and farmers.

Lenders who were aware of the CALA Program reported the following factors that facilitated their awareness: farmers proactively asking them about a CALA loan, lender experience in providing CALA loans and internal lender training modules on the CALA Program.

In assessing the immediate outcome, the evaluation found the number of lenders participating in the CALA Program decreased over the evaluation period, dropping from 173 branches among 45 lenders in 2018-19 to 116 branches among 37 lenders in 2022-23. Further, just over half of participating lenders (54.3%) registered loans in only 1 of the 5 years.

Access to affordable capital

The CALA Program provided access to affordable credit to farmers and agricultural co-operatives; however, the number and size of CALA loans declined for both beginning and existing farmers.

The CALA Program provided access to affordable capital to farmers and agricultural co-operatives through the lenders that provided CALA loans. It is not possible to compare the affordability of CALA loans to capital available through non-CALA loans, as the terms and conditions of other loan offerings are unknown.

Participation rates

The number and size of CALA loans for beginning and existing farmers declined over the evaluation period. From 2018-19 to 2022-23, the Program guaranteed 3,561 loans valued at $322.9 million, falling short of almost all targets (see Table 7).

| Performance indicators | Five-year targetFootnote 1 | Five-year total | Ratio achieved (%) | Target met |

|---|---|---|---|---|

|

Number of loans to existing farmers |

5,936 |

2,678 |

45.1 |

Unmet |

|

Number of loans to beginning farmers |

1,257 |

883 |

70.2 |

Unmet |

|

Number of loans to Co-operativesFootnote 2 |

4 |

1 |

25.0 |

Unmet |

|

Total number of loans for CALA |

11,015 |

3,561 |

49.5 |

Unmet |

|

Dollar value of loans for existing farmers ($) |

353,636,913 |

191,542,792 |

54.2 |

Unmet |

|

Dollar value of loans to beginning farmers ($) |

138,906,668 |

131,315,026 |

94.5 |

Met |

|

Total dollar value of loans ($) |

640,000,000 |

322,857,817 |

65.5 |

Unmet |

|

Total default (claims) rate (%) |

1 |

0.52 |

0.52 |

Met |

|

Source: Program administrative data |

||||

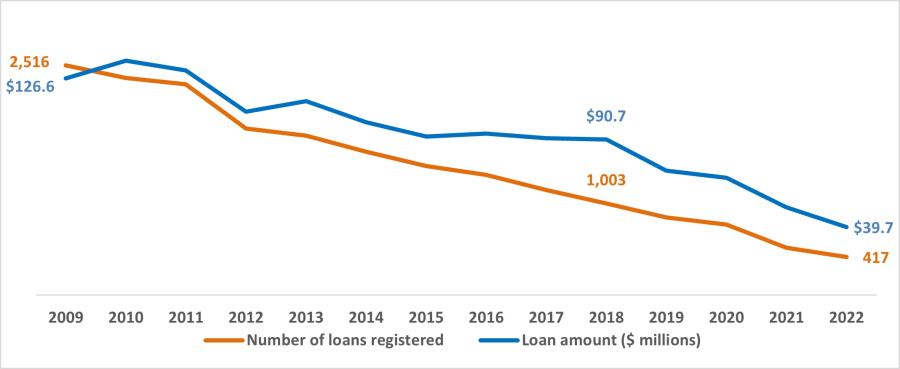

Program uptake declined over the evaluation period, with 1,003 loans registered in 2018-19 and 417 loans registered in 2022-23. Total loan values issued per year also declined from $90.7 million in 2018‑19 to $39.7 million in 2022-23 (see Figure 2). Since 2009, Program participation has declined by about 160 loans per year. If these trends were to continue after the evaluation period, it is expected that there would be no new CALA loans registered in 2025-26.

Figure 2: Number and value of CALA loans registered by fiscal year, 2009-10 to 2022-23

Source: Program administrative data

Description of the above image

| Fiscal year | Number of loans | Loan amount ($) |

|---|---|---|

|

2009-10 |

2,516 |

126,583,045 |

|

2010-11 |

2,378 |

136,829,542 |

|

2011-12 |

2,308 |

131,025,234 |

|

2012-13 |

1,822 |

106,957,558 |

|

2013-14 |

1,746 |

113,172,038 |

|

2014-15 |

1,569 |

100,804,298 |

|

2015-16 |

1,412 |

92,662,958 |

|

2016-17 |

1,316 |

94,397,156 |

|

2017-18 |

1,150 |

91,507,132 |

|

2018-19 |

1,003 |

90,719,774 |

|

2019-20 |

853 |

72,696,569 |

|

2020-21 |

771 |

68,517,484 |

|

2021-22 |

517 |

51,268,203 |

|

2022-23 |

417 |

39,655,788 |

Proportion of loans for beginning farmers

Beginning farmers and existing farmers used CALA loans for different purposes. Beginning farmers typically took out loans for land, whereas existing farmers obtained loans for implements and equipment. On average, loans to beginning farmers were, twice the size as those to existing farmers ($148,715 vs. $71,525). Over time, beginning farmers took a larger proportion of CALA loans. While they comprised only 24.8% of program participants, they accounted for over 40% of the value of all loans.

COVID-19’s impact on program participation

Agricultural credit was readily available during the COVID-19 pandemic. The federal government provided Farm Credit Canada with a $500-million capital contribution which increased the crown corporation’s lending capacity by $5 billion. Additionally, AAFC’s Business Risk Management programming, such as AgriStability and the Advance Payments Program, made delivery adjustments to support farmers affected by market disruptions and other challenges caused by the COVID-19 pandemic. Interviewees reported that the support and relief programs increased the amount of funding available to farmers and may have further reduced the need for CALA loans. The Program’s declining participation rates could not be attributed to the pandemic as it continued the long-term trend in decreased participation.

Access to capital was not a limiting factor

Access to capital was not a limiting factor for farmers due to the robust credit market in Canada. The Program did not directly contribute to this outcome.

The CALA Program is identified within AAFC’s Departmental Results Framework as 1 of 8 programming areas contributing to the core responsibility of ensuring the Agricultural sector is financially resilient. The Program is intended to contribute to this outcome by ensuring that access to credit is not a limiting factor for on-farm investment. However, CALA’s contribution to credit affordability was found to be limited by low program participation and the growing role of financial institutions in agricultural credit, including Farm Credit Canada, as well as credit being more affordable as low interest rates reduced expenses and high commodity prices increased revenues.

CALA’s contribution to the affordability of credit is measured through 2 indicators: CALA’s share of farm debt, and the default risk of CALA loans. During the evaluation period, twenty claims were submitted by lenders to the Program for defaulted loans, with a value equal to 0.52% of the loans registered over the evaluation period, higher than the default rate from the previous evaluation period (0.28%) and lower than the default rate of the Canada Small Business Financing Program.

The CALA Program was found to increase the revenue and profitability of Saskatchewan farms for the majority of the participants, when compared to a group of non-participants with similar business characteristics. Participation in the CALA Program was found to improve the profitability of both unincorporated and incorporated farms. The effect is larger for the latter, which tend to be larger in size.

Access to capital was not a limiting factor for farmers and agricultural co-operatives to invest in their operations. From 2018 to 2022, agricultural debt levels in Canada increased by $32 billion and debt levels for every major holder of Canadian farm debt increased as well (see Annex E). The estimated outstanding debt guaranteed by CALA declined in total dollar amount and percentage of total outstanding farm debt in Canada. CALA guaranteed an estimated 0.26% of 2022 outstanding farm debt in Canada, demonstrating that the CALA Program was not a significant contributor to this outcome.

Conclusions and recommendations

The evaluation found that the Canadian Agricultural Loans Act (CALA) Program was most relevant for beginning farmers and underrepresented farmer groups who face barriers to accessing affordable credit. The Program partly addressed these barriers by offering lower down payment requirements and affordable interest rates There were key benefits to the Program that contributed to its utility in the agricultural credit market. The loan guarantee was key to lenders in Saskatchewan who issued 72.1% of all CALA loans. The CALA Program complemented commercial agricultural credit offerings from chartered banks and credit unions, but there was a risk of non-productive overlap with credit offerings from federal and provincial crown corporation lending programs.

The Program’s design is efficient because it leverages existing financial infrastructure. However, the Program operated in a deficit in recent years as uptake declined. Increasing loan limits and incentivizing increased registrations could bring the Program back to cost neutrality. The Program’s loan limits were found to be insufficient for farmers and participation rates continued to decline during the evaluation period. If the current trend continues, the CALA Program risks having no loans registered by 2025-26.

Farmers, agricultural co-operatives and lenders had low awareness and declining participation in the Program. The Program did not conduct outreach or training activities with lenders to increase lender awareness and uptake. Given the key role that lenders play in facilitating uptake of the Program, investing in their awareness to increase uptake is needed.

The Program’s performance information profile did not reflect CALA’s current delivery model. Data integrity challenges limited the evaluation’s ability to assess the Program’s adherence to CALA guidelines and the achievement of outcomes using program administrative data.

While the Program was available to all farmers and agricultural co-operatives, it was not a leading driver of the ultimate outcome of farmers having access to credit to invest in their operations, which is being led by financial institutions such as chartered banks, Farm Credit Canada and credit unions. A long-term solution that addresses the declining relevance, uptake and impact of the CALA Program is needed.

Recommendations

Recommendation 1: The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Strategic Policy Branch, review and propose changes to the CALA program parameters to ensure its relevancy.

Recommendation 2: The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Public Affairs Branch, should work to increase the awareness of the CALA Program among lenders.

Recommendation 3: The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Corporate Management Branch, should update the performance information profile and ensure administrative data is consistently collected.

Management response and action plan

Management from the Programs Branch, in consultation with Strategic Policy Branch and Corporate Management Branch are supportive of this evaluation as well as the recommendations and have outlined an action plan to address them by March 2025. Please see Annex D.

Annex A: Evaluation methodologies

Document, file and literature review

To assess program relevance, design and delivery, efficiency and effectiveness, the evaluation reviewed internal program documents and files. With support from the Canadian Agriculture Library, the evaluation also examined select literature to support the assessment of relevance.

Key informant interviews

Interviews were conducted with internal and external stakeholders to assess program relevance, design and delivery, efficiency and effectiveness. The evaluation involved interviews with 18 stakeholders, including Agriculture and Agri-Food Canada (AAFC) staff (5), financial institutions (7), industry associations (4), an external expert (1) and a program recipient (1).

Analysis of administrative and secondary data

The evaluation analysed administrative program data for participating financial institutions and program recipients between 2018-19 and 2022-23. The evaluation supplemented the primary data analysis with data from Statistics Canada, as well as lender and producer surveys conducted by MNP. Secondary and administrative data was used to assess the Program’s relevance, design and delivery, efficiency and effectiveness.

AAFC’s Research and Analysis Directorate assisted in the evaluation by conducting an economic impact analysis of program participation using Statistics Canada’s Linked File Environment. The analysis examined the economic impact of program participation between the Canadian Agricultural Loans Act (CALA) Program’s participants and non-CALA Program participants investing in their operations. The causal analysis was conducted for Saskatchewan, as the vast majority of the participants are located in this province.

Methodological limitations

Methodological limitations were considered while interpreting the data (see Table 8):

| Limitation | Mitigation strategy | Impact on evaluation |

|---|---|---|

|

Response bias: Key informants who participated in the evaluation may have a vested interest in the continuation of the CALA Program. |

Interviews with participants from 5 different stakeholder groups generated a variety of perspectives. Data was synthesized within and across stakeholder groups, and triangulated with other lines of evidence where possible to eliminate potential bias. |

Low |

|

Lack of producer contact information: A survey of producers to determine their level of satisfaction with the Program was not possible. |

The evaluation relied on other lines of evidence, including key informant interviews with stakeholders and analysis of administrative and secondary data, to inform the extent to which receiving CALA loans met producer needs and Program outcomes. |

Medium |

|

Challenge in identification of control group: The control group must consist of farms that are similar to the CALA Program’s participants in every way including loan amounts. However, loan amounts are only known for CALA Program participants. |

Liability levels are used as a proxy for total loan amounts, allowing for appropriate matching of the participants and the non-participants. |

Low |

Annex B: List of eligible purposes under CALA

Eligible purposes

The following are eligible purposes under the Canadian Agricultural Loans Act.

Real property purposes

- Purchase of land

- Construction, repair or alteration of, or additions to, any building or structure on a farm

- Purchase, movement to and installing on a farm of complete or partially complete structures and, where necessary, the completion of the installed structures

Other loan purposes

- Purchase, installation, alteration, major overhaul, or major repair to/of

- tools, implements, apparatus and machines of any kind not usually affixed to real or immovable property

- machinery and apparatus for the generation or distribution of electricity, whether or not affixed to real or immovable property

- Purchase of breeding livestock which will provide a long-term improvement to a farm operation including: horses and other equines

- cattle, sheep, goats and other ruminants

- swine, poultry, bees and fur-bearing animals

- any other prescribed animal

- Erection or construction of fencing or works for drainage

- Clearing, breaking, irrigating and reclaiming of land

- Conservation of soil, prevention of soil erosion by the planting of trees and shelter belts

- Repair or overhaul of fencing where the cost is $2,000 or more

- Purchase and the planting of trees for syrup production and the purchase and planting of fruit trees, Christmas trees, and ginseng, where the cost is $2,000 or more

- Construction of a road or driveway on a farm

- Land transfer tax, survey, appraisal and legal costs relating to the purchase of additional land

- Purchase of shares for inter-generational farm transfers

- Consolidation/refinancing of loans

Ineligible purposes

- Improvements to the family dwelling

- Quota purchases of any kind

- Operating loans and loans for the purchase of short term feeder livestock

- Consolidation of a lender's ordinary loans

Annex C: Logic model

Activities

- Lender reviews applicant eligibility and loan risk and decides to issue a Canadian Agricultural Loans Act (CALA) loan, CALA receives, reviews and registers loans for the government guarantee; receive, review and approve revision of loan terms; receive, review and process defaults; receive, review and process claims for loss; raise program awareness; develop/maintain program guidelines; and review loan applications by co-operatives.

Outputs

- Loan registrations; program guidance, advice and eligibility rulings; honour guarantee to the financial institutions; and program training and info sessions.

Immediate outcomes

- Lenders are aware of the availability of the CALA Program and are determining eligibility and borrower risk, and issuing loans through the Program.

Intermediate outcomes

- Producers and agricultural co-operatives have access to affordable capital to make investments in their operations.

Ultimate outcomes

- Access to capital is not a limiting factor for producers and agricultural co-operatives to invest in their operations.

Annex D: Management response and action plan

Recommendation 1

The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Strategic Policy Branch, review and propose changes to the Canadian Agricultural Loans Act (CALA) Program parameters to ensure its relevancy. Agreed.

1.1 Partner with the Strategic Policy Branch to review and analyze the findings of the recent CALA reports (for example, the Evaluation Report and the Report to Parliament) to propose legislative and regulatory changes to improve CALA, including to increase its relevancy as well as increase program uptake among traditionally underrepresented producers (for example, beginning farmers, women and Indigenous producers).

Target date

November 2024

Responsible leads

Assistant Deputy Minister, Programs Branch; Assistant Deputy Minister, Strategic Policy Branch

Recommendation 2

The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Public Affairs Branch, should work to increase the awareness of the CALA Program among lenders. Agreed.

2.1 Collaborate with Public Affairs Branch to develop new marketing products (for example, decks, infographics, other relevant products) targeting lenders and identify and leverage new channels, platforms and/or lender networks to increase awareness of CALA amongst lenders. Develop new marketing products and identify channels to target producers to increase awareness of CALA amongst producers, including underrepresented producers (for example, beginning farmers, women, and Indigenous producers).

Target date

October 2024

Responsible leads

Assistant Deputy Minister, Programs Branch; Assistant Deputy Minister, Public Affairs Branch

2.2 Design, promote and deliver training workshops targeting lenders that is supported by a communications plan.

Target date

September 2024

Responsible leads

Assistant Deputy Minister, Programs Branch; Assistant Deputy Minister, Public Affairs Branch

2.3 Collaborate with Public Affairs Branch to update the program website, as needed, to better support lenders and increase program awareness among them.

Target date

March 2025

Responsible leads

Assistant Deputy Minister, Programs Branch; Assistant Deputy Minister, Public Affairs Branch

Recommendation 3

The Assistant Deputy Minister, Programs Branch, in consultation with the Assistant Deputy Minister, Corporate Management Branch, should update the performance information profile and ensure administrative data is consistently collected. Agreed.

3.1 Consult with relevant centres of expertise, review and amend the program performance information profile to ensure that it aligns with the program theory and its delivery model.

Target date

October 2024

Responsible leads

Assistant Deputy Minister, Programs Branch; Assistant Deputy Minister, Corporate Management Branch

3.2 Update program forms and the program system to ensure that the appropriate data is collected so that meaningful analysis can be completed of the program’s performance against its immediate, intermediate and ultimate outcomes in alignment with its Performance Information Profile.

Target date

January 2024

Responsible leads

Assistant Deputy Minister, Programs Branch

3.3 Design and develop new or amend current performance indicators to measure program performance and make updates to the program system and its reporting module to enable this activity.

Target date

March 2025

Responsible leads

Assistant Deputy Minister, Programs Branch; Assistant Deputy Minister, Corporate Management Branch

Annex E: Farm debt by financial institution, 2018 and 2022

| Financial institution | Amount of debt, 2018 ($) | Percentage of debt, 2018 (%) | Amount of debt, 2022 ($) | Percentage of debt, 2022 (%) | Change in debt, 2018 to 2022 (%) |

|---|---|---|---|---|---|

|

Advance payment programs |

1,966,076 |

1.8 |

2,677,476 |

1.9 |

36.2 |

|

Chartered banks |

36,955,500 |

34.6 |

49,650,975 |

35.8 |

34.4 |

|

Credit unions |

17,238,327 |

16.2 |

21,572,816 |

15.5 |

24.6 |

|

Federal government agenciesFootnote 1 |

31,147,681 |

29.2 |

40,806,090 |

29.4 |

31.0 |

|

Insurance companies and other lenders |

1,556,339 |

1.5 |

2,874,629 |

2.1 |

84.1 |

|

Private individuals and supply companies |

10,889,437 |

10.2 |

13,330,278 |

9.6 |

21.3 |

|

Provincial government agencies |

6,954,463 |

6.5 |

7,947,464 |

5.7 |

14.3 |

|

Total debt |

106,707,823 |

- |

138,859,727 |

- |

29.9 |

|

Source Statistics Canada. Table 32-10-0051-01 Farm Debt Outstanding, classified by lender (times 1,000) |

|||||