For your convenience, this report is available in the following format:

PDF (1,452 KB)

November 2019

Introduction

Canada is recognized worldwide as a leading producer, processor and exporter of high-quality seed for a wide range of crops. It is a diverse sector that contributes billions to the Canadian economy and provides jobs for thousands. It is an innovation-focused industry that utilizes complex technologies with millions invested annually in seed research and development.

This report is an overview of the seed industry in Canada, providing a clear picture of how it is structured and its impact on the Canadian economy.

Canada's seed sector:

- Plays a critical role in the agri-food value chain

- Drives agricultural innovation

- Contributes billions to the Canadian economy

- Encompasses diverse crops and businesses; and

- Fuels a strong export market

Critical role in agri-food value

Seed is the critical first link in the agri-food value chain. It's the starting point for growing crops that produce food, feed and other bioproducts for both domestic and export markets.

Driver of agricultural innovation

- The industry utilizes complex technologies to produce seed that farmers plant to achieve increased productivity and market opportunities.

- Canada is known for its adoption of leading-edge technologies, including biotechnology, genomics and other plant breeding advances.

- Private sector invested about $171 million in plant breeding, research and varietal development in 2017.

- In addition to the private sector, there is also a significant public investment in seed research at the Federal, Provincial and University level.

Significant contributor to the Canadian economy

- Total economic impact (direct and indirect) of the seed industry in Canada is estimated at over $6 billion annually.

- The implied employment effect of the seed industry is 63,622 jobs and $2.26 billion in wages and salaries.

Diverse sector with numerous crops and various businesses

- Canada's fertile soil and various climatic zones enable seed producers to grow more than 50 different crops.

- The sector encompasses many types of businesses, including: plant breeding and research, seed growers, seed conditioners and seed testing labs as well as seed distributors, brokers and exporters.

- The sector involves business of all sizes – from small farmer seed growers and independent seed companies to large multinationals.

Strong export market and trade relationships

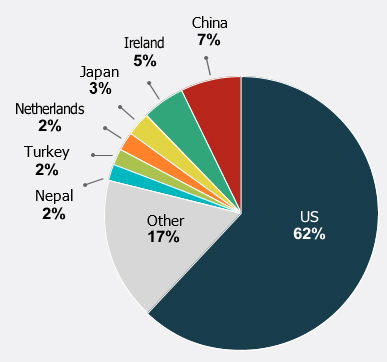

- 2017/2018, Canadian seed exports went to over 100 different countries and were valued at approximately $646 million. The Top 5 importing nations were United States (US) ($403 million), China ($47 million), Ireland ($31 million), Japan ($19 million) and Turkey ($13 million).

- Canadian seed companies and plant breeders are involved in many aspects of the international seed trade such as germplasm exchange, global research and development programs, contract production for export, and marketing new varieties imported into Canada.

Critical role in agri-food value chain

Seed: the starting point of all agri-food output

The Canadian seed industry is the critical first link in the agri-food value chain. Seed is the starting point for growing crops that produce food, feed and bioproducts such as feedstock for biofuels. Much of the innovation for increased productivity and market opportunities for farmers is delivered by seed.

Description of the image above.

...

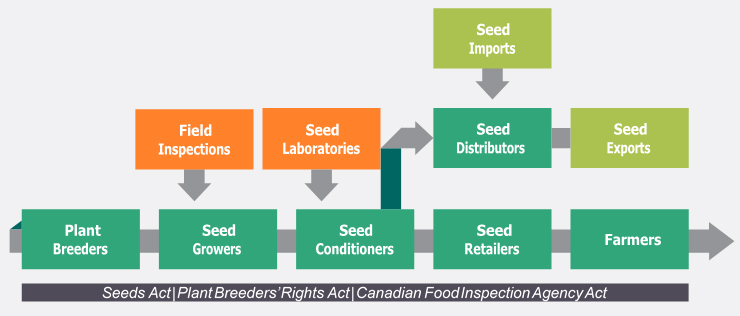

Structure of Canada's Seed Sector

The seed value chain can be described by five basic links: plant breeders; seed growers; seed conditioners; seed distributors and retailers; and farmers (seed end users). In the case of seed exports, seed conditioners and distributors ship seed to end users around the world.

Description of the image above.

...

Driver of agricultural innovation

Sophisticated seed technology advances industry

The seed sector is continuously evolving. Due to its unique position as a starting point for the agri-food value chain, it is an industry that embraces innovation and technological advancement to produce new plant varieties with desirable attributes, such as higher yield potential, greater disease resistance, improved grain quality and more. Innovation carried in seed can also help the agriculture sector meet consumer demands for improved nutrition, appearance and processing characteristics as well as help reduce agriculture's environmental footprint.

Canada is known for its development and adoption of leading-edge technologies. This includes biotechnology, genomics, molecular breeding and other plant breeding innovations. The Canadian seed industry has invested a large amount of resources in developing new seed products, ideas, patents and techniques that create value up the chain by increasing yield, quality and consistency. This allows Canada to enjoy a unique brand position in domestic and international markets.

Investment in research and development

Canada is at the forefront in research and development initiatives.

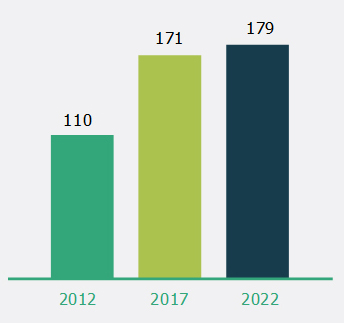

- Private sector invested about $171 million in plant breeding, research and varietal development in 2017.

- Canadian Seed Trade Association (CSTA) members expect research and development investment to increase to about $179 million in 2022. (Public investment in research is not included in these estimates).

Description of figure 1.

Private sector research investment forecast in $ million (year): 110 (2021), 171 (2017), 179 (2022)

In 2017, private companies invested almost $171 million in plant breeding, research and variety development in Canada. That is almost 6% of their combined domestic sales and it represents an increase of more than 56% from 2012. The forecast is that private investment will increase by another $8 million by 2022. (Figure 1)

Private company investment in crop research and development in Canada has been largely focused on canola, corn and soybeans in recent years. However, these investments have broadened to include cereals and pulses. By continuously improving plant genetics, Canadian seed researchers and producers are able to meet the growing demand for food, feed and bioproducts. The industry also contributes to the health of Canadians through seed technology that results in more nutritious crops that are safe and meet the functionality requirements of consumers.

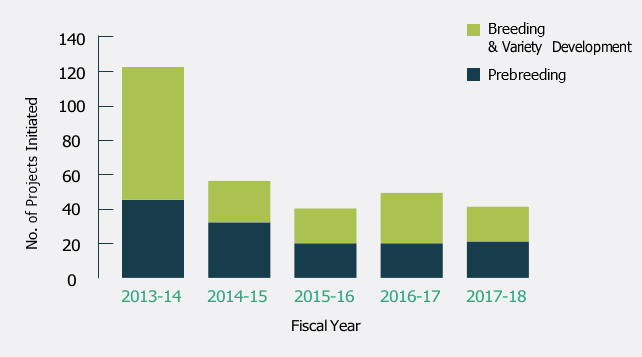

Between 2013 and 2018, Agriculture and Agri-Food Canada (AAFC) has been involved in over 300 projects that provide direct benefit to the seed sector (Figure 2). These pre-breeding, breeding and variety development based projects represent a significant investment partnership between government and industry, and are further supplemented by AAFC's work on broader agronomic and agri-environ- mental resiliency areas. The higher number of projects in 2013-14 reflects those that were initiated under Growing Forward 2 Programs. Projects touch on a wide range of crops, including wheat, coarse grains, pulses, oilseeds and specialty crops.

Description of figure 2.

...

Significant contributor to the Canadian economy

Economic impactFootnote 1

The Canadian seed sector is a significant contributor to the Canadian economy, with $3.5 billion in seed sales to Canadian farmers and to overseas customers in 2017/2018. In addition to providing advanced genetics for commercial farm operations, the seed sector generates over $6 billion in annual economic activity in Canada, and provides employment in many value added sectors of the economy.

These seed sales are an integral input into the $33 billion in annual crop production sold by farmers into markets, as well as the crops used as home-grown feed and forages on livestock operations.

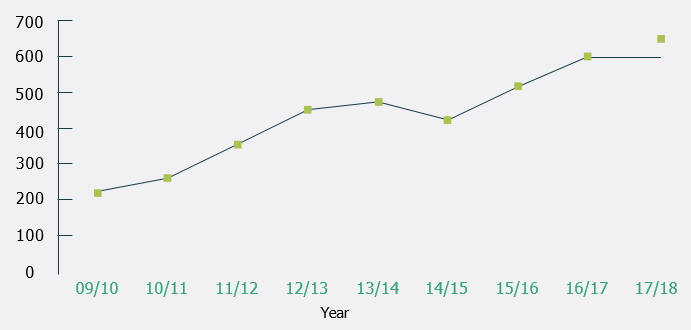

In 2017/2018, Canadian seed exports were valued at approximately $646 million, nearly triple the $220 million in sales in 2009/2010. In addition, Canadian seed imports were valued at $609 million in 2017/2018.

Employment

The Canadian seed industry employs Canadians working in various segments of the industry, including plant breeding and research, seed production, seed processing and production services, and seed sales and marketing.

There are more than 1150 people employed in the research departments of Canada's private sector seed companies as scientists, technicians, and support and summer staff. At least another 1,000 are employed in seed sales, production and processing roles.Footnote 2

The implied employment effects of the seed sector based on the Statistics Canada multiplier is 63,622 jobs and $2.26 billion in wages and salaries.

Seed revenue

The Canadian seed market size and value is rapidly growing. Canadian farmers spent $2.8 billion on commercial seed for planting in 2018, which is up 63% from 2010. This impressive increase is evidence of the importance of the seed sector as a basis for grain, oilseed, pulses and forage production, but also contributes significant revenue as a standalone industry.

Canadian Seed Sector by the numbers:

- $6 billion = Annual economic impact (direct and indirect) of Canada's seed sector

- $2.8 billion = Seed sales to Canadian farmers in 2018

- $33 billion = Crop production and home-grown feed/forages

- $646 million = Seed exports in 2017/2018

- $609 million = Seed imports in 2017/2018

- 63,622 jobs = Implied employment effects of seed sector

- $171 million = Private sector investment in plant breeding, research and varietal development in 2017

- $179 million = Forecasted private sector research and varietal development in 2022

Diverse sector with numerous crops and various businesses

Diverse and numerous Canadian crops

Canada's unique geography, which includes several different climatic zones and millions of acres of fertile soil, enables producers to grow diverse and numerous crops.

- Approximately 50 principal crops are grown for seed in Canada, including: forages and turf, grains and oilseeds, pulses and more.

- The number of registered seed varieties increased from 106 in 1978 to 4,418 in 2018 (excluding cancelled varieties).

| Class | Category | Crop type |

|---|---|---|

| Forages | Legumes |

|

| Grasses |

|

|

| Turf |

|

|

| Grains | Cereals |

|

| Oilseeds |

|

|

| Pulses |

|

|

| Vegetable |

|

|

| Other |

|

Seed growers

There were 1.33 million pedigreed seed acres in Canada produced by 3,487 seed growers in 2018. Consolidation and increase in average farm size has decreased the number of seed farms from a high of 5,723 in 1982. The average size of farms producing seed increased to 381 acres in 2018 from 127 acres in 1978.

Forage seed farms, some of which are included in the number of pedigree seed growers above, number approximately 1,800 in Canada. In addition, there are approximately 400 hybrid seed corn growers and 370 potato seed growers in Canada. There are also a small number of vegetable seed producers in Canada.

Seed conditioners

Canada's seed processing and conditioning segment includes nearly 1,000 Registered Seed Establishments (RSE). This includes 575 Approved Conditioners (AC) and 887 Bulk Storage Facilities (BSF). (Note: some ACs are also BSFs.) Many are small and medium-sized integrated operations that produce the pedigreed seed that they process. There is also a subset of larger firms that function in several areas of the seed value chain such as research, marketing and distribution in addition to seed processing/conditioning.

National seed organizations

The primary national seed organizations are the Canadian Seed Trade Association (CSTA) and the Canadian Seed Growers' Association (CSGA). The industry is also supported by the Canadian Seed Institute (CSI), the Commercial Seed Analysts Association of Canada (CSAAC) and the Canadian Plant Technology Agency (CPTA).

The CSTA represents more than 130 seed companies and a broad cross-section of Canadian businesses that develop, produce, sell, and export seed. Membership ranges from those who market garden seeds to large western grain handlers, and from small family-run businesses to multinational seed companies.

CSGA, which represents about 3,500 seed growers, provides leadership as the Canadian organization designated in the federal Seeds Act and Seeds Regulations to certify pedigreed seed crops for all agricul- tural crop kinds in Canada (except potatoes). Each year the CSGA certifies more than 18,000 fields and plots of at least 2,000 varieties of nearly 50 different species, grown on the 1.33 million pedigreed seed acres. This is one of the world's largest acreage of certified seed crops.

The CSI delivers accreditation and monitoring programs for the Canadian seed industry. Recognized by the Canadian Food Inspection Agency (CFIA), CSI has been given the mandate to be the single point of contact for all seed establishments, seed laboratories, operators and graders seeking registration, licensing or accreditation. Currently, CSI monitors approximately 575 ACs, 887 BSFs, Canadian seed establishments, authorized importers and 32 accredited seed testing laboratories.

CSAAC is a group of more than 100 individuals who have an interest in the seed testing industry. The organization enables Commercial Seed Analysts to keep abreast of changes and improvements in seed analysis, and maintains the highest proficiency and professional standards among its members.

CPTA supports intellectual property protection by monitoring the seed marketplace for infringements and enforcing the rights of plant breeders. CPTA also engages in proactive education to ensure compliance with modern plant breeders rights legislation. The organization has approximately 25 members, ranging from small plant breeding to large life science companies.

Acts and regulations

Canada's seed regulations, quality and purity standards and intellectual property protection help to enhance the industry's competitiveness. Here are the key pieces of legislation and regulation:

- Seeds Act and Seeds Regulations help to ensure that seeds sold in, imported into and exported from Canada meet established standards for quality and are labelled so that they are properly represented in the marketplace, and are registered prior to sale in Canada. The Seeds Act encompasses several seed regulations such as variety registration, seed certification, plants with novel traits as well as grade tables and Weed Seeds Order.

- Plant Breeders' Rights (PBR) are a form of intellectual property rights by which the developers of new plant varieties can protect their innovation in the same way an inventor protects a new invention with a patent. Canada's Plant Breeders' Rights (PBR) Act provides plant breeders with an opportunity to exercise control over their innovation in the marketplace, and through the collection of royalties recover their investment in research and development. A holder of PBR, or their licensee, can seek compensation through the civil court system if an infringement of their right occurs in the marketplace. Canada's PBR Act conforms to the 1991 Act of the International Convention for the Protection of New Plant Varieties (UPOV). The mission of UPOV is to provide and promote an effective system of plant variety protection, with the aim of encouraging the development of new varieties of plants, for the benefit of society.

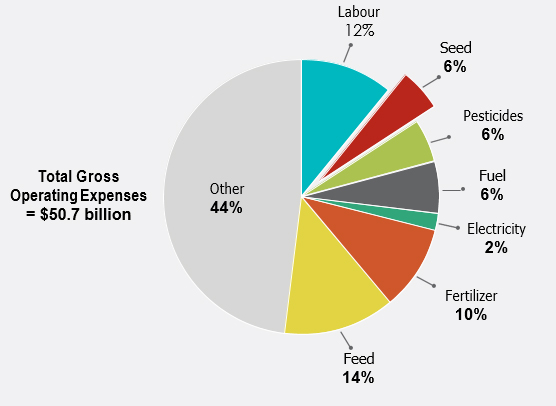

Seed as an input

According to Statistics Canada, total gross operating expenses for Canadian farms in 2018 were $50.7 billion, of which commercial seed accounts for $2.8 billion or 6%. Approximately 190,000 farms reported seed expenses with an average of about $14,700 per farm. (Figure 3)

Description of figure 3.

...

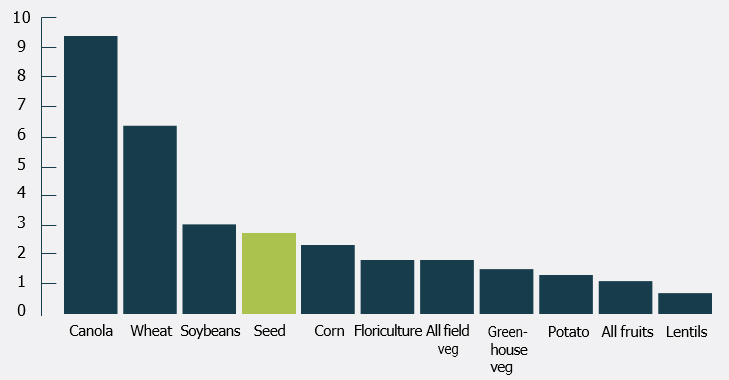

Comparing the seed industry's contribution to the overall value of Canadian agriculture (not accounting for the downstream production), the industry's value is ranked amongst the highest in terms of farm cash receipts. Seed accounted for approximately 5% of agricultural farm cash receipts in 2017 valued at approximately $2.6 billion dollars. Seed farm cash receipts was surpassed by only three crops: canola, wheat and soybeans.

Description of figure 4.

...

Strong export market and trade relationships

International seed trade

In addition to its strong contribution to the domestic economy, Canadian seed attracts significant demand internationally. Canadian seed companies and plant breeders are involved in many aspects of the international seed trade, including:

- Variety and germplasm exchange agreements;

- Multi-national Research & Development efforts;

- Contractual agreements for production of seed for export and import;

- Marketing new varieties imported into Canada; and

- Marketing new varieties abroad.

Trade balance

Canada is active in the world seed market and benefiting from increases in seed trade. In 2017/2018, seed accounted for approximately $609 million in imports and $646 million in exports making Canada a net exporter of seed, with a trade surplus of approximately $37 million.

Exports

Seed exports have increased markedly since 2009/2010, consistent with increases in crop prices. In 2017/2018, Canadian seed exports were valued at approximately $646 million, a 213% rise in eight years. Commodities that account for the majority of seed export sales are: corn, soybeans, peas and forage/ turf grasses. (Figure 5)

Description of figure 5.

...

The largest importers of Canadian seed are the US (62%), China (7%), Ireland (5%), Japan (3%), Turkey (2%), the Netherlands (2%) and Nepal (2%). Together, these countries accounted for approximately 83% of total Canadian seed exports in 2017/2018. Canada exports seed to over 100 countries worldwide, 63 countries buy seed worth over $100,000; 34 countries over $1 million and seven countries over $10 million.

Description of figure 6.

...

Conclusion

In summary, Canada's seed sector is a diverse and dynamic industry that:

- Is the critical first step in the agri-food value chain;

- Drives agricultural innovation;

- Contributes billions to the Canadian economy;

- Encompasses diverse crops and businesses; and

- Fuels a strong export market.

References

- Canadian Food Inspection Agency Canadian Seed Growers' Association Canadian Seed Institute

- Canadian Seed Trade Association

- Commercial Seed Analysts Association of Canada

- Economic Impact Assessment and Risk Analysis – JRG Consulting Group and SJT Solutions

- Economic Profile of the Canadian Seed Sector – Seed Producer Summary and Seed Processor Summary, George Morris Centre, 2014.

- Statistics Canada