Abbreviations

- AAFC: Agriculture and Agri-Food Canada

- FDMS: Farm Debt Mediation Service

- FTE: Full-time equivalent

- OAE: Office of Audit and Evaluation

Executive summary

Purpose

To provide an evaluation of the Farm Debt Mediation Service (FDMS or the Program) with regard to its relevance, efficiency and effectiveness.

Scope and methodology

The Office of Audit and Evaluation planned to conduct an evaluation of the FDMS as part of the 2021-22 OAE Plan. In the interim, the Program engaged a consultant to undertake an evaluation-like review as part of the 2021 Parliamentary Review of the FDMS. Thus, rather than conduct a full evaluation, the OAE conducted a review to validate the work of the consultant, conduct any additional analyses and deliver its own summary evaluation report. This evaluation report is intended to inform current and future program and policy decisions.

Background

The FDMS is a federal service administered through Agriculture and Agri-Food Canada (AAFC) and is rooted in the Farm Debt Mediation Act (the Act). The FDMS offers financial counselling to farmers having difficulty meeting their financial obligations and offers mediation to help them and their creditor(s) arrive at a mutually acceptable solution. To be eligible for the FDMS, a producer must farm commercially and be insolvent (that is, unable to make their payments on time, have ceased making payments or have debts exceeding the value of their property, if sold).

Key findings

- Sustained financial risk in the sector contributes to ongoing relevance of debt mediation services.

- Some alternatives to the FDMS are provided by financial institutions, law firms, Licensed Insolvency Trustees and the Province of Saskatchewan.

- Usage of the FDMS has declined over time and represents a very small proportion of farms.

- The FDMS helps to provide farmers with time to develop a recovery plan and improved understanding of their financial situations.

- Longer term outcomes of the Program are uncertain due to limitations with the performance measurement information collected.

- The Program meets the needs of various types of farms and farmers.

Conclusion

The evaluation found that with the ongoing financial uncertainty faced by some farmers, the need for debt mediation services continues. When a farmer is facing insolvency they can consider the FDMS or another service available from the private sector or the provincial government if the creditor is foreclosing on farmland located in Saskatchewan. Over the last 10 years, FDMS uptake has been declining, possibly due to the financial strength of the sector and increasing producer incomes.

The evaluation found that the FDMS provides services that help farmers manage financial difficulties in the short term. However, there is insufficient information available on the longer term outcomes to assess the ultimate effectiveness of the Program.

Recommendations

Recommendation 1: The Assistant Deputy Minister, Programs Branch, should assess whether the Farm Debt Mediation Service is still relevant, and whether it addresses and is responsive to a demonstrable need.

Recommendation 2: The Assistant Deputy Minister, Programs Branch, should develop performance metrics to adequately assess the impact of the Farm Debt Mediation Service.

Management response

Management agrees with the evaluation recommendations and has developed an action plan to address them by April 2024.

1.0 Introduction

The Office of Audit and Evaluation planned to conduct an evaluation of the FDMS as part of the 2021-22 OAE Plan. In the interim, the Program engaged a consultant to undertake an evaluation-like review as part of the 2021 Parliamentary Review of the FDMS. Thus, rather than conduct a full evaluation, the OAE conducted a review to validate the work of the consultant, conduct any additional analyses and deliver its own summary evaluation report. This evaluation report is intended to inform current and future program and policy decisions.

2.0 Scope and methodology

This evaluation used the 2021 review as the key source of information and assessed the relevance, performance, efficiency and effectiveness of the FDMS from 2016-17 to 2020-21, supplementing with additional document review, evidence and analyses as needed.

The evaluation assessed and validated the multiple lines of evidence used by the consultant in its review, including: a document and data review, a survey of farmers, a survey of stakeholders (including experts, creditors and mediators) and interviews with farmers, creditors, financial experts, mediators and Program officers.

For the detailed evaluation methodology, see Annex A.

3.0 Program profile

3.1 Overview of FDMS

The Farm Debt Mediation Service is a federal service administered through AAFC as per the Farm Debt Mediation Act (the Act). The Act received Royal Assent in 1997 and was last amended in 2016. Every 5 years, the Act requires that AAFC review the operations of the Act and the FDMS to provide a report to Parliament.

The FDMS offers financial counselling to farmers having difficulty meeting their financial obligations and offers mediation to help them and their creditor(s) arrive at a mutually acceptable solution. For the purpose of the FDMS, ‘farmers’ can include individuals, corporations, partnerships, co-operatives or other associations engaged in farming for commercial purposes. The FDMS is free, voluntary, confidential and divided into 2 streams.

The first stream, section 5(1)(a), is available to farmers when they have been informed by a secured creditor that they intend to start or have started the process of collecting on debt. If farmers apply under this first stream, they are entitled to financial counselling, a financial review and mediation. To allow time for that to occur, they also receive a stay of proceedings, which temporarily suspends recovery and seizure of assets by all creditors for 30 calendar days (which can be extended in 30-day increments to a maximum of 120 calendar days). Applicants and creditors can appeal the decision of the administrator relating to the eligibility of the application, extensions and termination of the stay of proceedings.

The second stream, section 5(1)(b), is available to farmers who are struggling financially but have not yet been served with a notice of intent or other recovery action from their creditors. This stream provides farmers with financial counselling, a financial review and mediation, but not a stay of proceedings.

To be eligible for the FDMS, a producer must farm commercially and be insolvent (that is, unable to make their payments on time, have ceased making payments or have debts exceeding the value of their property, if sold). Additionally, farmers are only eligible for either stream if they have not applied for that stream within the past 2 years.

Upon receipt of an application, an FDMS program officer screens the documentation to confirm it is complete and then assigns qualified financial consultant as well as a mediator to work with the farmer throughout the mediation process. Mediators and consultants are contracted by AAFC on a case by case basis, through a call up process from an established roster. The financial expert and mediator are assigned by the FDMS, but farmers are able, to hire their own financial consultant (subject to approval by the FDMS) to prepare the financial plan. The financial consultant meets with the farmer, conducts a site visit to inspect the assets, then prepares a detailed financial statement for the farm and assists the farmer in developing a recovery plan to be presented to creditors during the mediation. There is no cost to the farmer for these services. The mediation process must be completed within 120 days.

Once the financial statement and recovery plan are developed, the mediator hosts a meeting at a neutral location (or virtually) between the farmer and creditor(s) with the financial consultant also present. During the mediation session, the mediator remains neutral and works to ensure a fair and unbiased mediation process. The mediator has no decision-making power, and is there to assist the participants to reach their own mutually acceptable settlement, communicate effectively and explore and clarify options for settlement. If the parties agree upon a solution, the mediator draws-up an agreement, ensures it is signed by all parties and provides each participant with the signed copy.

3.2 Resources

During the evaluation period, the gross operating costs of the FDMS were just over $13 million. A significant proportion of these costs, over 40% in each year, was spent on personnel costs.

| Year | FTEs1 | Personnel2 ($) | Other operating3 ($) | Gross operating ($) |

|---|---|---|---|---|

| 2016-17 | 14 | 1,065,593 | 1,434,411 | 2,500,004 |

| 2017-18 | 15 | 1,268,201 | 1,384,762 | 2,652,963 |

| 2018-19 | 14 | 1,104,382 | 1,585,300 | 2,689,682 |

| 2019-20 | 14 | 1,228,737 | 1,845,879 | 3,074,616 |

| 2020-21 | 13 | 1,130,406 | 1,337,813 | 2,468,219 |

| Total | n/a | 5,797,318 | 7,588,165 | 13,385,483 |

Notes

- FDMS staff may also support 3 other programs as required: Career Focus Program, Green Jobs and Youth Employment Strategy.

- Salary and allowances for employees.

- Includes consultant costs, as well as any indirect program costs.

Source: AAFC program data

3.3 Intended outcomes

The following immediate, intermediate and ultimate outcomes are established for the FDMS:

Immediate outcomes:

- Farmers’ assets are temporarily protected.

- Farmers have a greater understanding of their financial situation.

- Creditors have a greater understanding of the clients’ financial situation.

Intermediate outcomes:

- Farmers are implementing activities to reduce debt and/or increase revenue.

- Creditors are suspending collection actions.

- Increased agreement between insolvent farmers and their creditors on financial recovery measures.

- Farmers are advancing their personal and business goals.

Ultimate outcome:

- The agricultural sector is financially resilient.

The full FDMS Performance Information Profile, which outlines these outcomes, is included in Annex B.

4.0 Relevance

This section validates and summarizes the review findings on the relevance of FDMS; specifically, whether there is a continued need for the FDMS, the extent to which the FDMS meets that need and Program alignment with departmental and government roles, responsibilities and priorities.

4.1 Need for debt mediation services

While the agriculture sector remains strong with increasing farm cash receipts and farm assets over the course of the evaluation period, farmers continue to face a variety of ongoing risks such as unpredictable weather (including increasing extreme weather events), unstable commodity pricing, increasing cost of land and rising debt levels.

The financial uncertainty linked to these risks can negatively affect farm income and thus the ability to meet debt obligations. In these situations, farmers may need financial counsel to return to a solvent position. Farm debt has increased over the evaluation period, and has increased at a faster rate than farm assets. Similarly, farm financial riskFootnote 1 has been increasing since 2013. In 2015 two-thirds (66.5%) of farms were low risk and one-sixth (12.9%) of farms were high risk. In 2019 just over half (53.3%) of farms were at low financial risk and one-fifth (19.9%) of farms were high risk.

There have been, however, very few farm bankruptcies over the evaluation period, never increasing above 0.02%. The rate of bankruptcy for farms is consistently lower than the rate of bankruptcy in the overall Canadian economy.

| Year | Number of farms1 | Number of farm bankruptcies | Rate of bankruptcy in agriculture sector (per thousand) |

Rate of bankruptcy all sectors (per thousand) |

|---|---|---|---|---|

| 2016 | 193,492 | 28 | 0.14 | 0.7 |

| 2017 | 192,768 | 25 | 0.13 | 0.7 |

| 2018 | 192,045 | 23 | 0.12 | 0.7 |

| 2019 | 191,321 | 19 | 0.10 | 0.7 |

| 2020 | 190,598 | 23 | 0.12 | 0.5 |

Note

- Estimated linearly from the Census of Agriculture data (2011, 2016 and 2021)

There are alternative services a farmer can turn to when facing financial difficulty. A small number of financial institutions provide debt mediation services that are similar to the FDMS, though it is unknown whether more would be offered in the absence of the FDMS. Law firms and Licensed Insolvency Trustees exist across Canada that offer services for a fee for businesses (including agricultural businesses) that are in debt.Footnote 2 These services include debt restructuring, preparation of proposals to creditors and debt re-negotiation. However, they can only provide the option of a stay of proceedings when formal proceedings under the Bankruptcy and Insolvency Act or other Federal Legislation are initiated.

There is a provincial program offered to farmers owning farmland in Saskatchewan, under the Saskatchewan Farm Security Act. Creditors intending to foreclose on farmland must notify both the farmer and the Farm Land Security Board, which initiates a process of financial review, mediation and reporting of up to 150 days.

During the evaluation period (2016 to 2021), farmers in financial difficulty in Manitoba had the right to free consultation and mediation services under the Manitoba Family Farm Protection Act. These services were provided by the Manitoba Farm Industry Board over a period of 90 days. These provincial protections only applied to cases involving farmland and required court approval for foreclosure (based in part on a mediation report produced by the Board). Manitoba’s mediation services were eliminated in 2021 due to low usage, their overlap with the FDMS and a concern that the service couldn’t adapt to the current complexity of farm financial needs. The evaluation noted that FDMS documentation did not refer to similar provincial programming, with the reverse also true; provincial programming did not mention FDMS.

The FDMS staff does not formally consider whether a farmer might be eligible for another program during the intake of applications. A financial expert, familiar with provincial policies and programs related to farm debt is sent to each applicant to provide advice to the farmer. The expert may recommend bankruptcy when preparing a recovery plan. However, there may be farmers accessing the FDMS who could receive services elsewhere. For example, some files from Saskatchewan (n=109) and Manitoba (n=65) were mediated by the FDMS over the evaluation period, which may have been eligible for support from their respective provincial programs. The ability of a farmer to access a private program is also not formally assessed.

4.2 Alignment with federal priorities and departmental strategic outcomes

The FDMS helps to support AAFC’s mission to “provide leadership in the growth and development of a competitive, innovative and sustainable Canadian agriculture and agri-food sector”. More specifically, FDMS somewhat strengthens the sector by helping to keep a small number of potentially successful farms in business by restructuring and returning them to viability, as only 9% of all FDMS files resulted in farmers planning to exit the industry (that is, stop farming) and less than 1% resulted in the farmer pursuing bankruptcy.

5.0 Performance

This section summarizes findings on the performance of the FDMS, including results, effectiveness and efficiency.

5.1 Program usage

Over the evaluation period, the number of applications remained relatively stable, with between 230 and 312 applications submitted annually. There was consistently higher uptake of stream 5(1)(a), which includes a stay of proceedings: between 148 and 185 applications annually, compared to between 82 and 127 applications annually for stream 5(1)(b). Across both streams, the largest fluctuation happened entering the final year of the review, where applications fell by 13% from 312 the previous year to 230.

Of the 1,384 applications received during the evaluation period, 73% (1,016) resulted in a mediation meeting. The number of files that resulted in mediation year over year was relatively stable during the five-year evaluation period (varying from 199 in 2016-17 to 170 in 2020-21).

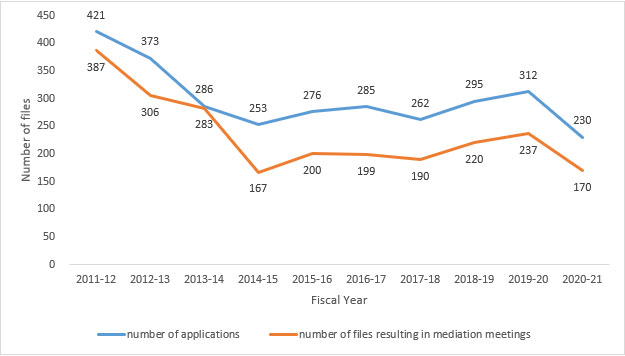

Figure 1 FDMS usage rate, 2011-12 through 2020-21

Source: FDMS service data

Description of the above image

Figure 1 FDMS usage rate, 2011-12 through 2020-21

Figure 1 presents the number of applications submitted to the FDMS, and the number of these files resulting in mediation meetings annually between 2011-12 through 2020-21. There was a general decrease in both the number of applications received and the number of files resulting in mediation.

| 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Number of applications | 421 | 373 | 286 | 253 | 276 | 285 | 262 | 295 | 312 | 230 |

| Number of files resulting in mediation meetings | 387 | 306 | 283 | 16 | 200 | 199 | 190 | 220 | 237 | 170 |

While there is a relative stability in FDMS usage over the last 5 years, there was a substantial decrease in files, to less than half, over the 10-year period from 387 in 2011-12 to 170 in 2020-21 (dipping as low as 167 in 2014-15). This extends a decreasing trend noted in the previous evaluation.

Similarly, the proportion of farms using FDMS is very low and is decreasing. Farms in the east were more likely to participate in the program, notably for both animal- and crop-producing sectors. Between 2015-16 and 2020-21 Animal Production farms in the east would access FDMS nearly 3.5 times more often than those in the west, and east Crop production farms’ access was typically 1.3 times that of the west. Overall, less than 0.2% of producers have accessed the Farm Debt Mediation Service between 2015-16 and 2020-21.

| 2015-2016 | 2016-2017 | 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | Overall | |

|---|---|---|---|---|---|---|---|

| East — animal production | 0.23 | 0.33 | 0.24 | 0.37 | 0.38 | 0.22 | 0.34 |

| East —crop production | 0.23 | 0.23 | 0.23 | 0.17 | 0.18 | 0.14 | 0.24 |

| West — animal production | 0.08 | 0.07 | 0.08 | 0.09 | 0.09 | 0.10 | 0.10 |

| West — crop production | 0.16 | 0.14 | 0.15 | 0.19 | 0.21 | 0.14 | 0.18 |

| Total | 0.17 | 0.18 | 0.17 | 0.19 | 0.21 | 0.15 | 0.18 |

5.2 Results and satisfaction

Farmers and creditors generally see benefit from the FDMS. The stay of proceedings available to farmers under FDMS gives farmers time to develop a recovery plan for outstanding debt and address issues on their farms (such as technical issues related to machinery, utilities and production). Farmers benefit from the consultation with a financial expert, which helps farmers improve their understanding of their financial situation and develop a better basis for their businesses.

The understanding that farmers and creditors were able to reach also helped to improve the financial viability of their farms going forward, as well as to implement activities to reduce debt and increase revenue. In some cases, the FDMS, not unlike other credit counselling and debt mediation services, helped farmers to remain in business and to improve their overall financial situation.

The FDMS helps farmers and creditors to reach agreements and solutions. For files where a mediation was held, 79% resulted in an agreement (representing 58% of all FDMS applications). When an agreement was reached, it was most common for farmers to restructure debt, sell assets or dispose of some assets as part of the approved recovery plan.

The performance indicators for the Program (as specified in the Performance Information Profile, included in Annex B) make it difficult to link the impact of the FDMS to longer term outcomes. For example, the only ultimate outcome of the Program, that the agricultural sector is financially resilient, could, given the low participation rate of the service, be very weakly linked to FDMS. The source of information for this ultimate outcome (the Farm Financial Survey) could not provide information about the contribution of the Program to this broader outcome.

There is no systematic follow-up with farmers who have used the service. Follow-up was undertaken through interviews and surveys at the time of the legislative review, with results reported only in aggregate. As such, there remains uncertainty about some outcomes of the Program, for example, the contribution of the FDMS to a diminished likelihood of financial default in the future is not clear; as is the extent to which agreements reached through the FDMS process are implemented.

One unintended outcome of the Program is assisting creditors to recover more than they may otherwise be able to and giving them a better understanding of their clients’ situations. This understanding helps to establish more realistic plans for debt repayment. However, creditors’ willingness to participate in the service is likely associated with the degree to which they recover their debt.

5.3 Efficiency and effectiveness

Efficiency

The FDMS is expected to meet the following service standards for 80% of all FDMS files:

- Applicants will receive a response to general inquiries before the end of the next business day;

- Applicants will be notified of whether the application was accepted by the end of the next business day;

- All necessary documents will be sent to creditors and farmers 7 business days prior to the mediation meeting; and

- The mediation meeting with be scheduled within 70 calendar days of accepting the application.

Reports from the past 3 years show that the FDMS has consistently exceeded the service standards.

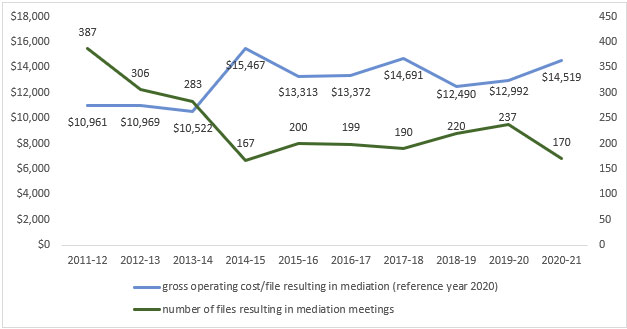

The cost per file mediated and applications received for the Program is generally increasing,Footnote3 reaching $14,519 or $10,731, respectively, in 2020-21. While the cost has fluctuated over the assessment period, it has generally been increasing as the number of files mediated and applications received has gone down. This continues the increasing cost trend noted in the last FDMS evaluation.

Figure 2 Cost per file mediated by FDMS, 2011-12 to 2020-21, ($)

Source: FDMS service data and OAE calculations

Description of the above image

Figure 2 Cost per file mediated by FDMS, 2011-12 to 2020-21, ($)

Figure 2 presents the relationship between the cost per file mediated by the FDMS, and the number of files resulting in mediation meetings annually between 2011-12 through 2020-21. There was a general decrease in the number of files resulting in mediation meetings, and a general increase in the cost of files mediated (represented by the ratio of gross operating cost in 2020 dollars and the number of files resulting in mediation).

| 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Gross operating cost/files resulting in mediation (reference year 2020) | 10,961 | 10,969 | 10,522 | 15,467 | 13,313 | 13,372 | 14,691 | 12,490 | 12,992 | 14,519 |

| Number of files resulting in mediation meetings | 387 | 306 | 283 | 167 | 200 | 199 | 190 | 220 | 237 | 170 |

Effectiveness

The FDMS offers services that can be accessed by different types of farms and farmers across the country. Similarly, based on available data, there is minimal difference (if any) in outcomes for farms and farmers with different characteristics, for example, farm size and commodity type.

The Program can adapt to the changing context that producers operate in. For example, the Program was able implement the use of videoconferencing services to continue to provide services during the COVID-19 pandemic. The Program can adapt to changes to the agricultural sector over time, such as increased equipment requirements.

6.0 Conclusions and recommendations

The evaluation found that with the ongoing financial uncertainty faced by some farmers, the need for debt mediation services continues. When a farmer is facing insolvency they can consider the FDMS or another service available from the private sector or the provincial government if the creditor is foreclosing on farmland located in Saskatchewan. FDMS is the federal offering of this service. Over the last 10 years, FDMS uptake has been declining, possibly due to the financial strength of the sector and increasing producer incomes.

The evaluation found that the FDMS provides services that help farmers manage financial difficulties in the short term. However, there is insufficient information available on the longer term outcomes to assess the ultimate effectiveness of the Program.

Recommendations

Recommendation 1: The Assistant Deputy Minister, Programs Branch, should assess whether the Farm Debt Mediation Service is still relevant, and whether it addresses and is responsive to a demonstrable need.

Recommendation 2: The Assistant Deputy Minister, Programs Branch, should develop performance metrics to adequately assess the impact of the Farm Debt Mediation Service.

Management response

Management for Programs Branch is supportive of the recommendations and has developed an action plan to address them by April 2024. This plan involves undertaking a study to better understand alternatives available to farmers and developing a one-year follow-up survey with farmers who have accessed the FDMS. For further details on the management response action plan, please see Annex C.

Annex A: Evaluation methodology

For the purpose of this report, key documentation prepared as part of the parliamentary review were reviewed and analyzed.

As part of the parliamentary review, several lines of evidence were undertaken:

Document and file review

To examine program relevance, effectiveness and efficiency, the evaluation reviewed internal program documents and files. Additional information available through Statistics Canada along with publicly available reports and materials that examine the financial situation of farmers (such as government reports and acts) were also reviewed to help clarify economic and sector trends driving the need for the FDMS.

Key informant interviews

Interviews were conducted with internal and external stakeholders to assess program relevance, design and delivery, efficiency and effectiveness. The review involved 30 interviews, including FDMS program officers (3), financial consultants and mediators (10), creditors (9) and farmers (8).

Surveys of farmers and creditors

Two surveys were conducted to collect further insights from creditors and farmers on the relevance, effectiveness and efficiency of the program. The farmer survey had a response rate of just under 21% (210 of 1,006 invited), and the creditor survey had a response rate of just under 3% (162 of 5,580 invited).

Methodological limitations

The following methodological limitations were considered in interpreting the data:

| Limitation | Mitigation strategy | Impact on evaluation |

|---|---|---|

| Response bias – key informant interviews: Farmers with negative experiences were more likely to participate in interviews | Interviews with participants from different stakeholder groups generated a variety of perspectives. Data was synthesized within and across stakeholder groups, and triangulated with other lines of evidence where possible to eliminate potential bias. | Low |

| Response rate – creditor survey: The creditor survey had a low response rate | Creditors that did respond represent a range of experiences, from across regions. Data was synthesized within and across stakeholder groups, and triangulated with other lines of evidence where possible to eliminate potential bias. | Low |

| Data limitation: Lack of data disaggregated by identity factors | The FDMS collects very limited demographic data on producers accessing the service. As such, in order to undertake GBA Plus for the program, only anecdotal information, as well as cross-analyzed survey data were used. | Medium |

| High level nature of the study: The evaluation work did not include case studies or a similar methodology to allow for an in depth understanding of the impact of the FDMS on farmers | An understanding of the high level impacts on farmers generally was developed through triangulation of the data collected. This was sufficient to respond to the questions and indicators set out for this evaluation. | Low |

Annex B: Performance Information Profile

Immediate outcome

| Program output and/or expected outcome | Farmers’ assets are temporarily protected | Farmers have a greater understanding of their financial situation | Creditors have a greater understanding of the clients’ financial situation |

|---|---|---|---|

| Indicator name | Percentage of total completed applications under section 5(1)(a) | Percentage of total applications that are completed | Percentage of completed applications that result in a signed agreement |

| Methodology | Explanation/rationale: The indicator demonstrates the percentage of farmers whose applications resulted in temporarily protecting their assets. Formula/calculation: The percentage of completed applications that include the required paperwork to temporarily protect a farmer’s assets. Measurement strategy: Data will be collected through AAFC internal data. |

Explanation/rationale: It is assumed that if a farmer does not withdraw from the process and completes participation in FDMS they will have increased their understanding of their financial situation. Formula/calculation: The calculation is developed by using past program statistics. During the 5-year period between 2010/2011 and 2014/2015 there were 1494 total FDMS applications. Of these 1156 or 77% were completed. Measurement strategy: Data will be collected through AAFC internal data. |

Explanation/rationale: It is assumed that if an agreement is reached between a farmer and their creditor(s) that the creditor has a greater understanding of the clients’ financial situation. Formula/calculation: The calculation is developed by using past program statistics. During the 5-year period between 2010/2011 and 2014/2015 there were 1156 completed FDMS applications. Of these 863 or 75% resulted in a signed agreement. Measurement strategy: Data will be collected through AAFC internal data. |

| Data type | Percentage | Percentage | Percentage |

| Data source | FDMS database | FDMS database | FDMS database |

| Data owner | Business Development and Competitiveness Directorate | Business Development and Competitiveness Directorate | Business Development and Competitiveness Directorate |

| Data collection frequency | Ongoing | Ongoing | Ongoing |

| Target (%) | 57 | 77 | 75 |

| Date to achieve target | March 31, 2018 | March 31, 2018 | March 31, 2018 |

| Baseline (%) | 57 | 77 (based on a 5 year average) | 75 (based on a 5 year average) |

| Thresholds | N/A | N/A | N/A |

| Reference | N/A | N/A | N/A |

Intermediate outcome

| Program output and/or expected outcome | Farmers are implementing activities to reduce debt and/or increase revenue | Creditors are suspending their collection actions | Increased agreement between insolvent farmers and their creditors on financial recovery measures | Farmers are advancing their personal and business goals | |

|---|---|---|---|---|---|

| Indicator name | Percentage of farmers implementing terms of their signed agreement | Percentage of creditors who have suspended collection action while the farmer implements the terms of their signed agreement | Percentage of completed applications that result in a signed agreement between farmers and creditors | Percentage of farmers with an improved financial situation | Percentage of farmers with reduced risk and credit problems |

| Methodology | Explanation/rationale: This indicator demonstrates that farmers are implementing activities to reduce debt and/or increase revenue by actively fulfilling the terms of their signed agreement with creditors. Formula/calculation: The calculation is developed by using past survey statistics. Farmers were surveyed for the 2008 FDMS review. Of those farmers surveyed 90% reported that their mediated arrangement was “to a great extent” implemented or on track to being implemented. Furthermore, of creditors interviewed for the 2008 FDMS review, 77% reported that the mediated arrangement was “to a great extent” implemented and additional 18% reported that it was “to some extent” implemented (that is, 95%) Measurement strategy: Data can be collected through interviews and or surveys of farmers who participated in FDMS in the past. This data can be collected during the review of the FDMS in 2020 as required by the Farm Debt Mediation Act (FDMA). |

Explanation/rationale: This indicator demonstrates the percentage of creditors that are suspending their collection actions as a result of farmer’s implementing the terms of their signed agreements obtained through the FDMS. Formula/calculation: The calculation is developed by using past survey statistics. Creditors were surveyed for the 2008 FDMS review. Of those surveyed 77% reported that the mediated arrangement was to a “great extent” implemented. It is assumed that these creditors would have suspended collection actions while the terms of their agreement were carried out. Measurement strategy: Data can be collected through interviews and or surveys of creditors who participated in FDMS. This data can be collected during the review of the FDMS in 2020 as required by the FDMA. |

Explanation/rationale: A number of factors affect farmers’ control over the financial viability of their business. The agricultural sector is cyclical and the need for farm debt mediation services fluctuates based on the economic conditions that the sector faces. As such, there is a strong and continuing need for a program that provides financial and mediation services to farmers who find themselves in financial difficulties and gives farmers and their creditor(s) the opportunity to work together to come to a mutually acceptable agreement on debt obligation. This measure is an useful barometer to understand whether the program responds to the above need. Formula/calculation: Total number of completed applications that result in a signed agreement / Total number of applications Measurement strategy: Data is collected through the Farm Debt Mediation Service database. Baseline: 75% (based on a 5-year average) During the five-year period between 2010/2011 and 2014/2015 there were 1156 completed Farm Debt Mediation Service applications. Of these, 863 or 75% resulted in a signed agreement. Since the percentage of agreements signed can fluctuate from year to year and may be due to factors outside of the control of Farm Debt Mediation Service, this indicator will be based on a rolling five-year average and will be reported on an annual basis. Notes/definitions: It is assumed that if an agreement is reached between a farmer and their creditor(s) that the creditor has a greater understanding of the clients’ financial situation. |

Explanation/rationale: It is assumed that if farmers are reporting an improved financial situation that they are advancing their personal and business goals. Formula/calculation: The calculation is developed by using past program statistics. Of farmers surveyed for the 2008 FDMS review 76% reported that participation in FDMS improved their situation. Measurement strategy: Data can be collected through interviews and or surveys of farmers who participated in FDMS in the past. This data can be collected during the review of the FDMS in 2020 as required by the FDMA. |

Explanation/rationale: This indicator demonstrates that through reporting reduced risk and credit problems, farmers are able to advance their personal and business goals. Formula/calculation: The calculation is developed by using past survey statistics. All of the farmers surveyed for the 2008 FDMS review reported that participation in FDMS resulted in reduced risk and credit problems. Measurement strategy: Data can be collected through interviews and or surveys of farmers who participated in FDMS in the past. This data can be collected during the review of the FDMS in 2020 as required by the FDMA. |

| Data type | Percentage | Percentage | Percentage | Percentage | Percentage |

| Data source | FDMS review for Report to Parliament (RTP) interviews and/or survey

|

FDMS review for RTP interviews and/or survey | FDMS database | FDMS review for RTP interviews and/or survey | FDMS review for RTP interviews and/or survey |

| Data owner | Business Development and Competitiveness Directorate | Business Development and Competitiveness Directorate | Business Development and Competitiveness Directorate | Business Development and Competitiveness Directorate | Business Development and Competitiveness Directorate |

| Data collection frequency | Every 5 years | Every 5 years | Ongoing | Every 5 years | Every 5 years |

| Target (%) | 95 | 77 | At least 60 | 78 | 100 |

| Date to achieve target | March 31, 2020 | March 31, 2020 | March 2020 | March 31, 2020 | March 31, 2020 |

| Baseline (%) | 90 | TBD – First survey will establish a baseline | 75%(based on a 5 year average) | 76 | 100 |

| Thresholds | N/A | N/A | ≥60% | N/A | N/A |

| Reference | N/A | N/A | INFOBASE | N/A | N/A |

Ultimate outcome

| Program output and/or expected outcome | The agricultural sector is financially resilient |

|---|---|

| Indicator name | Percentage of financially healthy farms |

| Methodology | Explanation/rationale: Farm financial vulnerability is influenced by numerous factors including both the income generated as well as the stock of assets and debt. No one financial indicator can tell a complete story of a farm’s financial vulnerability and the overall financial risk a farm is facing. The financial vulnerability level is estimated by a simultaneous assessment of income and balance sheet information. This composite measure covers the major aspects of a farm’s financial health at the farm level. This measure will be a useful barometer of the sector’s overall financial health as it will provide signals when farm finances are increasingly vulnerable to shocks as well as when farms are becoming more resilient financially. Formula/calculation: Free Cash Flow = Farm Revenues – Farm Expenses – Debt Servicing Costs + Off-Farm Income Equity ratio = (Value of Farm Asset – Farm Debt)/Value of Farm Asset*100 Financially healthy farm families have either: An equity ratio > 50% and free cash flow > twice the low income threshold (that is, level of family income below which a family will likely devote the majority of its income to the basic necessities — food, shelter, clothing etc.); or An equity ratio > 75% and free cash flow > the low income threshold. Definition(s): Free Cash Flow: represents available cash to farm families after paying farm business expenses, including servicing farm debt. It is based on family income from both farm and off-farm sources. The lowest cash flow category is set according to the Low Income threshold for a family of 4 living in a rural area. Equity Ratio: represents the value of farm assets less farm debt, expressed as a percentage. Low Income threshold: represents the level of family income below which a family will likely devote the majority of its income on the basic necessities (food, shelter, clothing etc.) than the average family. Note: Farms with high free cash flow and high equity are estimated to be in a healthy financial position while those with low free cash and flow and low equity levels are estimated to be financially vulnerable. |

| Data type | Percentage |

| Data source | Farm Financial Survey |

| Data owner | Research and Analysis Directorate |

| Data collection frequency | Every 2 years |

| Target (%) | At least 90% of farms are financially healthy |

| Date to achieve target | December 31, 2019 |

| Baseline (%) | An average of 91% of farms were financially healthy between 2003 and 2015 |

| Thresholds | N/A |

| Reference | Infobase |

Annex C: Management response action plan

| Recommendation | Management Response and Action Plan (MRAP) | Target date | Responsible leads |

|---|---|---|---|

| 1. The Assistant Deputy Minister, Programs Branch, should assess whether the Farm Debt Mediation Service is still relevant, and whether it addresses and is responsive to a demonstrable need. | Agreed. The 2021 Report to Parliament confirmed that the FDMS is a valuable, unique and necessary service; however, Programs Branch officials will undertake a study to confirm the economic elements of the FDMS. Specifically, the study will confirm currently available services to producers facing challenging, financial circumstances, with a focus on the cost-benefits to producers via private and/or public providers. | March 31, 2024 |

ADM, Programs Branch DG, Business Development and Competitiveness Directorate |

| 2. The Assistant Deputy Minister, Programs Branch, should develop performance metrics to adequately assess the impact of the Farm Debt Mediation Service. | Agreed. Programs Branch officials will complement existing performance metrics with the implementation of a one-year follow-up survey to FDMS participants. The results of the survey will be used to inform AAFC of the outcome of the mediation 12 months later. In addition, the Performance Information Profile (PIP) will be updated to include new performance indicators that are more directly linked to FDMS’ outcomes. | June 30, 2023 | ADM, Programs Branch

DG, Business Development and Competitiveness Directorate |

Notes

- 1

-

Farm financial risk is a composite score of the current ratio (ratio of current assets to current liabilities), the debt coverage ratio (ability to cover current debts with revenues) and the debt to equity ratio.

- 2

-

Based on information reviewed, the cost of these services is unknown.

- 3

-

These costs include indirect costs, such as corporate services, over which the Program has limited control.