Table of Contents

-

Opening remarks, Deputy Minister Forbes

4 minutes

Thank you, Mr. Chair, for the invitation to appear before the committee today to discuss the Auditor General’s report on the health and safety of agricultural temporary foreign workers in Canada during the COVID-19 pandemic.

Labour is a vital resource for Canadian farmers and food processors. Some 60 per cent of all those in the Temporary Foreign worker Program are employed in the agriculture and food sector.

In the early days of the pandemic, Agriculture and Agri- Food Canada launched two programs to provide financial support to employers to comply with the new federal health and safety measures for temporary foreign workers.

The Mandatory Isolation Support for Temporary Foreign Workers Program provided over $130 million to help farm employers, food processors and fish harvesters across Canada to cover costs of compliance with the isolation protocols under the Quarantine Act.

Employers faced a number of increased costs related to entry requirements of Temporary Foreign Workers, and the program helped them offset some of those costs — including wages and benefits, accommodations and transportation.

Due to high demand and ongoing border measures, we increased funding to the program twice.

And we added provisions for employers to cover hotel stays for workers who were unable to travel directly to their place of employment due to quarantine requirements.

The program successfully assisted employers as they brought foreign workers to Canada to enable agriculture and food production to continue.

The second program, the Emergency On-Farm Support Fund provided federal-provincial support of over $40 million to help more than 1,700 farm employers prevent and respond to the spread of COVID-19 within their workforce, including temporary foreign workers.

This investment helped to fund

- improvements to living quarters and work stations;

- PPE

- sanitary stations

- and other key measures

These upgrades helped to ensure farm employers were better ready to protect workers and reduce risk of transmission.

Last year, these programs helped to facilitate the arrival of a record number of temporary foreign workers to farms across Canada.

Looking ahead, Mr. Chair, we continue to work with ESDC and Immigration, Refugees and Citizenship Canada, on a number of improvements to the Temporary Foreign Worker Program.

The goal is to improve worker health and safety, and ease administrative burden for employers.

As the report reminds us -- temporary foreign workers are essential to Canada's agricultural sector, to our supply chain and to our food security.

Their skills and labour were key to the Canadian agriculture sector’s resilience during the COVID-19 pandemic.

We will continue to work together to strengthen our programs, protect the health and safety of workers, and keep our food supply chain strong.

Thank you, Mr. Chair.

-

AAFC media lines, 2021 Office of the Auditor General Report – Health and Safety of Agricultural Temporary Foreign Workers in Canada during the COVID-19 Pandemic

The issue

The Office of the Auditor General (OAG) will release a report entitled, “Health and Safety of Agricultural Temporary Foreign Workers in Canada During the COVID-19 Pandemic”. The report is focused on Employment and Social Development Canada (ESDC) and concludes that ESDC provided “little assurance” on the protection of temporary foreign workers (TFWs), and that there were “significant problems” with the inspections. It will also look at Agriculture and Agri-Food Canada’s (AAFC) management of programs providing direct employer support during the pandemic. The report notes that AAFC did not know whether employers met their terms and conditions because of the problems with the ESDC inspections. Although there are no recommendations for AAFC in the report, it is anticipated AAFC will receive media calls, in particular with ag-specific media, with ESDC garnering most of the media attention.

Key messages

General/COVID-19

- Protecting the health and well-being of all agri-food workers who are helping to support the Canadian food system has been a top priority since the beginning of the pandemic.

- Given chronic labour shortages in the agriculture and agri-food sector, temporary foreign workers (TFWs) have been, and will continue to be, a key source of labour, particularly in horticulture and processing.

- AAFC acted quickly to develop and deliver three programs over the course of the COVID-19 pandemic to urgently address these challenges and support the Canadian food system.

Program delivery

Emergency On-Farm Support Fund

- The Emergency On-Farm Support Fund (EOFSF) helped to ensure that farmers put measures in place to safeguard their employees and limit the spread of the virus on farms.

- The EOFSF provided non-repayable contributions to primary producers to implement measures to improve on-farm workplace health and safety in response to the COVID-19 pandemic.

Mandatory Isolation Support for Temporary Foreign Worker Program

- AAFC developed time-limited emergency programming to offset some of the incremental costs related to quarantine measures for employers of TFWs. This support was put in place to entice employers to continue to bring TFWs to Canada.

- The $142-million Mandatory Isolation Support for Temporary Foreign Worker Program (MISTFWP) was created as a temporary support for employers during the most acute COVID-19 crisis period.

- Though this program has now ended, the MISTFWP helped employers offset some of the incremental costs associated with the entry requirements imposed upon TFWs under the Quarantine Act.

- As additional costs could impact employers’ ability to keep hiring TFWs, the MISTFWP aimed to minimize the risk on the Canadian food supply chain.

The EOFSF and the MISTFWP were measures that targeted TFWs and were complemented by the Emergency Processing Fund:

- The Emergency Processing Fund (EPF) helped to ensure that farmers and food processors put measures in place to safeguard their employees and limit the spread of the virus.

- The EPF helped companies implement changes to ensure the health and safety of employees and their families during the COVID-19 pandemic.

- This program supported over 560 companies across Canada make changes to their facilities, including installing protective barriers, sanitation stations, and temperature screening as well as purchasing reusable personal protective equipment and making adjustments to production lines

Questions and answers

How did AAFC work with federal partners to ensure continued arrival, and health and safety, of TFWs throughout the COVID-19 pandemic?

The Government of Canada understands that agricultural workers, both domestic and foreign, are essential for the production of safe and reliable food in this country.

Employee safety is a shared responsibility between employers, the Canadian provinces and territories, and the Government of Canada. Agriculture and Agri-Food Canada works with federal, provincial and territorial partners to ensure that temporary foreign workers (TFWs) can continue to arrive and work safely in Canada, protecting both their health and the health of all Canadians.

AAFC developed time-limited emergency programming to offset some pandemic-related costs for employers of TFWs and to continue to entice foreign workers to come to Canada. The $142-million Mandatory Isolation Support for Temporary Foreign Worker Program (MISTFWP) helped employers offset some of the incremental costs associated with the entry requirements imposed upon TFWs under the Quarantine Act.

The program provided up to $1,500 per worker arriving between March 26, 2020 and up toJune 15, 2021, and up to $750 per worker for arrivals from June 16, 2021 to August 31, 2021 for eligible costs associated with the mandatory 14-day isolation period.

The program also provided up to $2,000 per worker arriving between March 21, 2021 and August 8, 2021 for eligible costs associated with the mandatory quarantine period at a government- authorized facility.

The program closed on August 31, 2021, and applications are no longer accepted.

In addition, $54.9 million has been proposed over three years, to Employment and Social Development Canada and Immigration, Refugees and Citizenship Canada, to increase inspections of employers and ensure temporary foreign workers have appropriate working conditions and wages.

We are encouraged that TFW arrivals for the 2021 season were very strong and ahead of previous years and pre-COVID trends.

How did AAFC determine eligibility under its TFW-related programs?

AAFC develops programs that outline eligible recipients and costs along with terms and conditions for each program that must be met.

While the Emergency On-Farm Support Fund (EOFSF) was delivered by AAFC in some jurisdictions, some provinces in other jurisdictions, and by a third-party delivery agenda in British Columbia.

Under all three scenarios, primary producers, as ultimate recipients, had to meet the terms and conditions of the program. These include observing and abiding by all applicable federal, provincial, territorial, and municipal government laws and regulations, including, those related to labour codes and standards as well as public health and safety.

Under the Mandatory Isolation Support for Temporary Foreign Workers Program (MISTFWP), eligible recipients were Canadian employers directly involved in the farming, fish harvesting, and food production and processing sectors who hired workers through the various streams of the Temporary Foreign Workers Program (TFWP) and/or the International Mobility Program (IMP) and whose workers were subject to the mandatory 14-day isolation period imposed under the Quarantine Act.

In order to be eligible under the MISTFWP, employers had to comply with the mandatory isolation protocols, any other public health order and the regulations of the TFWP and/or the IMP for the duration of the 14-day isolation period. Employers also had to comply with regulations concerning wages and other employment conditions of the program or stream they hired their TFWs through (e.g. Seasonal Agricultural Worker Program, Temporary Foreign Worker Program) during the mandatory 14-day isolation period.

The MISTFWP was delivered by AAFC in all provinces, except Prince Edward Island, where it was delivered by the Province. The same eligibility criteria had to be met in both program delivery instances.

What is the process of dispersing funds through TFW-related programs?

Eligible costs under the EOFSF include adjustments to on-farm operations to ensure worker safety, funding for disposable and non-disposable personal protective equipment that are incremental to normal operations, and other associated costs related to worker training and safety related to COVID-19 protocols.

Program funding was only disbursed to primary producers where written confirmation that all applicable measures of the Quarantine Act ( S.C. 2005, c. 20) were being adhered to, including but not limited to the mandatory 14-day isolation period for Temporary Foreign Workers; and a written plan documenting steps in place to limit the spread of the disease.

The Mandatory Isolation Support for Temporary Foreign Workers Program (MISTFWP), provided non- repayable contributions to help offset some of the incremental costs associated with the mandatory 14- day isolation period as well as costs associated with the 3-day hotel quarantine imposed under the Quarantine Act on temporary foreign workers upon entering into Canada.

Program funding was only disbursed to Canadian employers directly involved in the farming, fish harvesting, and food production and processing sectors who hired workers through the various streams of the Temporary Foreign Workers Program (TFWP) and/or the International Mobility Program (IMP) and whose workers were subject to the mandatory 14-day isolation period imposed under the Quarantine Act.

Prior to issuing contribution funding payments to recipients, program officials confirmed the employers had the proper approvals in place to hire the number of workers for which incremental costs were claimed and verified that none of the individual employers under the MISTFWP were found to be non- compliant under the regulations of the TFWP and/or the IMP for the duration of the 14-day isolation period.

Does AAFC have the ability to recover funds from employers who are found to have violated program terms and conditions?

Yes. In the small number of instances where an employer did not meet their duty to sufficiently protect their employees, AAFC has the ability to stop their payments, or to recover the funds they received.

How does AAFC measure the impact of its programs on the sector?

A survey of primary producers who received Emergency On-Farm Support Fund (EOFSF) funding was completed to look at the impact of the program on production; and, on the number of hours worked by employees. Survey results indicate that the majority of respondents maintained their levels of production after implementing EOFSF projects. While a majority of farms maintained the number of hours worked by employees, a significant number of respondents reported that they experienced an increase in number of hours worked by their employees after implementing EOFSF projects.

Under the Mandatory Isolation Support for Temporary Foreign Workers Program (MISTFWP), the primary objective was to ensure that Canadian farmers, fish harvesters, and food production and processing sectors continued to hire Temporary Foreign Workers (TFWs) despite the incremental costs being accrued due to COVID-19 isolation requirements. As such, key indicators measured under the program included the number of employers receiving funding by province/territory as well as the number of TFWs for which costs were claimed by province/territory. The captured data was benchmarked against similar pre-COVID hiring employer and TFW entry data. Preliminary review indicates that both the number of employers hiring workers and the number of workers that entered into Canada in 2020 and 2021 were similar to pre-COVID levels, indicating the program favorably impacted continued access to this labour supply while ultimately securing Canada's food system during the current COVID-19 pandemic.

The OAG noted that AAFC could not rely on ESDC's inspection results to identify instances in which employers may not be complying and thereby AAFC did not have the assurance that the employers it approved for funding met the conditions of these programs. How does AAFC respond?

AAFC is responsible for the management of the three COVID-19 support programs/funds that were made available to farm employers of TFWs. As part of their application process, employers are required to provide an up-front attestation of certain eligibility criteria, and asked to maintain relevant documentation for a period of six years that can be subject to auditing by AAFC. The results of ESDC inspections are therefore not an eligibility criteria for the programs, but ESDC does share non- compliance findings with AAFC to help inform corrective action or the rescinding of financial support.

Employers found to be non-compliant can be identified here: https://www.canada.ca/en/immigration-refugees-citizenship/services/work-canada/employers-non-compliant.html

The OAG reports that ESDC did not obtain information on the Emergency On-Farm Support Fund’s results to support accommodation safety for TFWs and that information collected instead focuses on farm productivity. How does AAFC respond?

AAFC is responsible for the management of the three COVID-19 support programs/funds that were made available to farm employers of TFWs, including any reporting of results. ESDC communication on the programs/funds focused on providing basic information on their objectives and eligibility criteria to employers and other stakeholders in order to support their uptake.

The Emergency On-Farm Support Fund (EOFSF) provided support to farmers for direct infrastructure improvements to living quarters and work stations, temporary or emergency housing (on or off-farm), as well as personal protective equipment (PPE), sanitary stations, and any other health and safety measures to safeguard the health and safety of Canadian and TFWs from COVID-19. The EOFSF was complemented by the Emergency Processing Fund that helped companies implement changes to safeguard the health and safety of workers and their families due to the impacts of COVID-19, and the Mandatory Isolation Support for TFWs Program that assisted Canadian employers with some of the incremental costs associated with the mandatory 14-day isolation period as well as costs associated with the 3-day hotel quarantine imposed under the Quarantine Act on TFWs upon entering into Canada.

AAFC has surveyed EOFSF recipients on their ability to maintain productivity and staffing levels, comparing pre and post EOFSF funding. These survey results indicated that the majority of respondents maintained their levels of production after implementing EOFSF projects, while a significant number of respondents reported that they experienced an increase in the number of hours worked by their employees after implementing EOFSF projects. Like all people in Canada, TFW employers and their workers are expected to follow the latest public health and safety requirements and/or guidance from the federal, provincial, territorial and local authorities. The Government has worked with employers, workers and various stakeholders to ensure that they are all aware of their obligations to comply with the public health requirements in the context of COVID-19, in order to help prevent the introduction and spread of the virus.

Temporary foreign workers are a key source of labour, particularly in agriculture and agri-food, and ensuring their reliable entry and safe working conditions is key to the continued food security of Canadians and Canada's broader economic recovery.

-

OAG Audit Health and Safety of Agricultural Temporary Foreign Workers in Canada during the COVID-19 Pandemic

December 1, 2021

About

In March 2020, at the start of the Quarantine Act due to the COVID-19 pandemic, when the largest volume of agricultural temporary foreign workers to support Canada's food security were due to arrive, an exemption order enabled them to enter Canada, subject to a 14 day quarantine and then testing/travel requirements. Federal funding was committed to help employers cover the costs.

Scope

Whether Employment and Social Development Canada (ESDC) and AAFC effectively managed the TFW program, including whether AAFC effectively managed the

- Mandatory Isolation Support for Temporary Foreign Workers Program (MISTFWP); and

- Emergency On-Farm Support Fund (EOFSF).

Finding

AAFC was unable to confirm recipient eligibility for program funding, due to problems with the ESDC inspections. AAFC could recover funds later; however, this will not be possible due to ESDC inspection backlogs. AAFC is implicated in the audit report for relying on these inspections to verify MISTFWP and EOFSF recipients. However, it is important to note that the MISTFWP objective was to entice Canadian employers to still hire temporary foreign workers who may have been deterred due to additional costs imposed under the Quarantine Act and help address a domestic food security issue.

Recommendations

The audit report contained six recommendations

- None are directed towards AAFC

- Six are directed towards ESDC

All ESDC recommendations have been accepted. AAFC is working with ESDC to complete assessments of program recipients' eligibility. AAFC is also working with ESDC to stop payment or recover funds, where applicable, on the most serious of circumstances (for example, employee wages not paid, sexual, physical, psychological, and/or financial abuse).

Conclusion

Because of ESDC's 2020 and 2021 inspections poor quality, AAFC did not have assurance that employers approved for funding under MISTFWP and EOFSF met program conditions aimed at supporting safe quarantine and other health and safety measures for temporary foreign workers.

Media

This report is likely to generate media attention. Media focus is expected to be on ESDC's lack of enforcement of standards related to housing and workers' safety. Questions directed at AAFC are likely to focus on the MISTFWP, and whether the Department had adequate information from EDSC to make funding decisions under the program, as noted in the audit. The Department developed responsive messaging, focusing on AAFC oversight and accountability with regards to the MISTFWP. The Department will ensure a coordinated approach with ESDC on responding to media requests.

-

Audit of Agriculture and Agri-Food Canada’s COVID-19 Programs Related to Temporary Foreign Workers

December 3, 2021

Anticipated question

How does Agriculture and Agri-Food Canada plan on responding to the findings in the Office of the Auditor General's report entitled, Health and Safety of Agricultural Temporary Foreign Workers in Canada During the COVID-19?

- Temporary foreign workers are an important part of Canada's agricultural sector.

- At the outset of the COVID-19 pandemic, Agriculture and Agri-Food Canada launched the Mandatory Isolation Support for Temporary Foreign Workers Program and the Emergency On-Farm Support Fund, to provide financial support to the sector as we implemented the new health and safety measures for temporary foreign workers.

- The importance of the skills and labor that temporary foreign workers bring, was a key part of the agriculture sector's resilience during the COVID-19 pandemic.

Responsive on employers that didn't follow the health and safety requirements

- Overall, the majority of agricultural employers did respect the health and safety requirements, while it is unfortunate that some employers chose to not meet their obligations, as the Auditor General's report highlights.

- In the small number of instances where an employer did not meet their duty to sufficiently protect their employees, Agriculture and Agri-Food Canada has the ability to stop their payments, or recover the funds they received.

Responsive on working with ESDC to ensure the health and safety of temporary foreign workers

- Inspections were done by Employment and Social Development Canada, and results as they related to AAFC programs were shared with the Department.

- AAFC continues to work with Employment and Social Development Canada to enhance systems and programs supporting TFWs. The health and safety of these workers is a priority.

Responsive on AAFC's programs

- The Mandatory Isolation Support for Temporary Foreign Workers Program ended on August 31, 2021. This was consistent with its purpose as a short-term emergency support for employers to help them offset the initial costs associated with public health requirements during the most acute COVID-19 crisis period.

- The Emergency On-Farm Support Fund provided support to primary producers to implement measures to improve on-farm workplace health and safety, by assisting them with some of the incremental costs for activities that improve the health and safety of all farm workers, domestic and temporary foreign workers.

-

Audit of Agriculture and Agri-Food Canada's Programs Related to Temporary Foreign Workers' Programs due to COVID-19

December 3, 2021

Background

Findings from the Office of the Auditor General’s report

The Office of the Auditor General's report entitled, “Health and Safety of Agricultural Temporary Foreign Workers in Canada During the COVID-19 Pandemic” mainly focused on inspections done by Employment and Social Development Canada (ESDC). Agriculture and Agri-Food Canada (AAFC) worked with ESDC when designing and launching programs to support TFWs ability to come and work safely in Canada during the COVID-19 Pandemic. Problems were found with ESDC’s compliance inspection regime, and AAFC is implicated in the audit report as selected COVID-19 support programs it managed, the Mandatory Isolation Support for Temporary Foreign Workers (MISTFWP) and the Emergency On-Farm Support Fund (EOFSF) both used the results of those inspections to verify that their recipients were not involved in non-compliance events.

AAFC will appear to have distributed funding to employers who did not obey regulations. However, it is important to note that the MISTFWP objective was to minimize the impacts of the COVID-19 pandemic on food security in Canada by enabling Canadian employers to continue to hire temporary foreign workers as they may have been deterred to do so due to the additional costs associated with the Quarantine Act. Initial results demonstrate that the program successfully encouraged domestic employers to keep hiring foreign workers while preventing the spread of the COVID-19 virus and protecting workers health. Subsequently, AAFC continues to work with ESDC regarding employers non-compliance events and retains the ability to stop payments or recover funds, where applicable, on the most serious of violations (for example, employee wages not paid, sexual, physical, psychological and/or financial abuse).

In addition, as part of their application process, employers are required to provide an up-front attestation of certain eligibility criteria, and asked to maintain relevant documentation for a period of seven years that can be subject to auditing by AAFC. As such, ESDC shared results from these inspections with AAFC to identify instances in which employers were involved in non-compliance events related to health and safety regulations, to help inform corrective action or the rescinding of financial support.

ESDC credited the Emergency On-Farm Support Fund (EOFSF) as having helped ensure employers were better prepared to receive TFWs and address the risks of virus transmission for the 2021 season, AAFC is implicated in the audit report for not obtaining information on the program's results to support this position. AAFC will appear to have not focused on the health and accommodation safety of TFWs, and instead focused on farm productivity.

It is important to note, farm productivity and maintaining staffing levels are considered a key indicator of how well the program supported the health and safety of workers in terms of their ability to continue to work throughout the pandemic. AAFC has surveyed EOFSF recipients on their ability to maintain productivity and staffing levels, comparing pre- and post-EOFSF funding. These survey results indicated that the majority of respondents maintained their levels of production after implementing EOFSF projects, while a significant number of respondents reported that they experienced an increase in the number of hours worked by their employees after implementing EOFSF projects.

Mandatory Isolation Support for Temporary Foreign Workers Program

On April 13, 2020, the Government of Canada announced $50 million for the Mandatory Isolation Support for Temporary Foreign Workers Program (MISTFWP) to help farmers, fish harvesters, and all food production and processing employers, put in place the measures necessary to follow the mandatory 14-day isolation period required of all workers arriving from abroad. In addition to the responsibility of paying the workers for the two weeks during which time they cannot work, many employers are also responsible for providing workers with transportation and accommodations, as well as access to food and basic supplies needed to meet all of the conditions imposed by public health authorities. The Fall Economic Statement committed to providing up to an additional $34.4 million to continue MISTFWP until March 31, 2021. The Program was further extended until April 21, 2021 which included eligible workers who arrived up until April 21, 2021 and covered eligible expenses until May 5, 2021.

On April 19, 2021, the Government of Canada released Budget 2021 which allowed the Program to be extended until August 31, 2021, with two streams:

- 14-Day Isolation Period Stream helped offset incremental costs associated with the mandatory 14-day isolation period as well as pre-entry testing requirements imposed under the Quarantine Act on temporary foreign workers upon entering Canada. The maximum funding amount under this stream was $1,500 per TFW for arrivals between January 1, 2021, and June 15, 2021, and for eligible activities taking place between January 1, 2021, and June 29, 2021, (i.e. employers with workers coming in on June 15th are eligible for the $1,500). As of June 16, 2021, the maximum funding amount was reduced to $750 per TFW for arrivals between June 16, 2021 and August 31, 2021 and for eligible activities taking place between June 16th, 2021, and September 14, 2021, (i.e. employers with workers coming in on August 31 are eligible for $750). As of November 26, 2021, 2954 projects were approved under the 14-Day Isolation Period Stream for $50.61 million in funding.

- 3-Day Hotel Quarantine Stream helped offset incremental costs specifically associated with the mandatory quarantine period at a government-authorized facility imposed under the Quarantine Act on temporary foreign workers upon entering Canada, when travel directly via private transportation from their point of entry to employer-provided accommodation for their mandatory 14-day isolation period could not be provided. The maximum funding amount under this stream was $2,000 per TFW for arrivals between March 21, 2021, and August 8, 2021, and for eligible activities taking place between March 21, 2021, and August 9, 2021. March 21, 2021, is the date the order came into effect for TFWs entering Canada and August 8, 2021 is the end date for this specific order. As of November 26, 2021, 151 projects were approved under the 3-Day Hotel Quarantine Stream for $2.19 million in funding.

The Emergency On-Farm Support Fund

AAFC's Emergency On-Farm Support Fund provided support to farmers for direct infrastructure improvements to living quarters and work stations, temporary or emergency housing (on or off-farm), as well as personal protective equipment (PPE), sanitary stations, work stations and any other health and safety measures to safeguard the health and safety of Canadian and temporary foreign workers from COVID-19.

Contributions under the AAFC-managed program were cost-shared 50:50 with the applicants up to $100,000. An additional 10 per cent was provided to women, youth, Indigenous Peoples, visible minorities, and persons with disabilities-owned farms (greater than 50% ownership) making the split 60:40. In Ontario, Quebec, Nova Scotia, and Prince Edward Island the province delivered the Fund, and in British Columbia, the B.C Investment Foundation (BCIAF), a third-party delivery agent delivered there.

As of March 31, 2021 (program end date), 1,645 applications were received by provincial and third- party delivery agents of the fund and 135 applications were received by AAFC for a total of 1,780 applications. Approximately $37.3 million in funding was requested from provincial and third-party delivery agents, and approximately $5.2 million was requested from AAFC (for a total of $42.2 million), of which $29.0 million was approved.

-

████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ████████████████████ ███████████████████████████████████████████████████████████

-

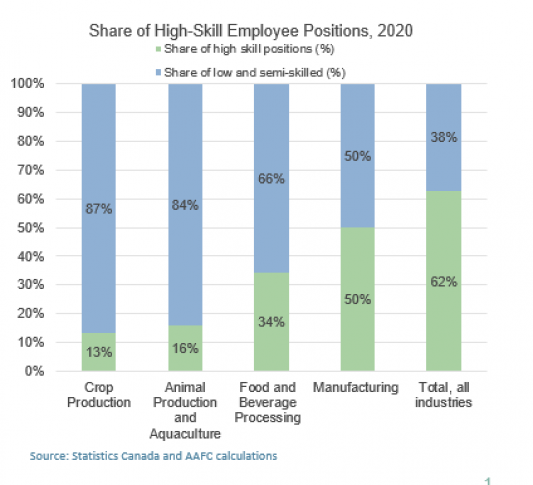

Positions are mostly low- and semi-skilled, low-wage and rural

Low- and semi-skilled jobs account for the majority of crop production (87%), animal production (84%), and food and beverage processing (66%) jobs.

On average, paid agriculture workers earn a wage rate below that of other industries, and food-processing wages are lower than the average wages in other manufacturing sectors.

The shares of rural employment in the primary-agriculture and food-processing industries were 72% and 19%, respectively, while the shares of rural employment in manufacturing and all other industries were 17% and 15%, respectively.

[Description of the above image]

A stacked column chart with x-axis labels corresponding to five sectors: crop production, animal production and aquaculture, food and beverage processing, manufacturing, and total all industries. The y-axis shows the percentage share of jobs ranging from zero percent to one hundred percent in ten percent intervals. The source of the data is Statistics Canada and Agriculture and Agri-Food Canada calculations.

Share of high-skill employee positions, 2020 Crop production Animal production and aquaculture Food and beverage processing Manufacturing Total, all industries High skill positions 13 16 34 50 62 Low and semiskilled positions 87 84 66 50 38 The stacked column chart shows that only 13% of jobs in crop production are classified as high skill positions, followed by 16% in animal production and aquaculture, 34% in food and beverage processing, 50% in manufacturing, and finally the highest share of 62% for total all industries. The opposite is true for the share of low and semi-skilled positions.

Job vacancy rate: The number of job vacancies expressed as a percentage of labour demand (vacancies/(payroll employees + vacancies)).

Source: Statistics Canada, Job Vacancy and Wage Survey

-

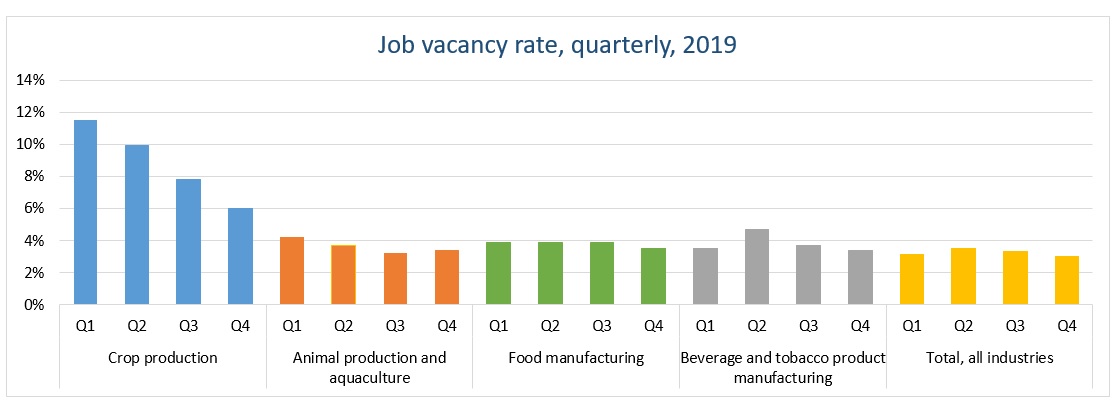

Vacancy rates are high, and some parts of the sector are constantly recruiting

The vacancy rate in the sector remains higher than in the economy as a whole, with chronic labour and skills shortages impacting many parts of the sector.

Job vacancy rates are highest in crop production – the absolute number of vacant positions typically remains stable through the year, but the number of payroll employees increases from Q1 to Q4, causing a declining vacancy rate.

A high proportion of agriculture and agri-food vacancies are considered to be “constantly recruiting” – particularly for industrial butchers and meat cutters, fish and seafood plant workers, and harvesting labourers.

Description of above image

A clustered column chart with x-axis labels broken into five sectors: crop production, animal production and aquaculture, food manufacturing, beverage and tobacco product manufacturing, and total all industries. Each sector along the x-axis is broken into four categories corresponding to Q1, Q2, Q3, and Q4. The y-axis shows the job vacancy rate as a percentage starting at zero and ending at fourteen, increasing by two percent intervals. The source of the data is Statistics Canada's Job Vacancy and Wage Survey.

Job vacancy rate, quarterly, 2019 Crop production Animal production and aquaculture Food manufacturing Beverage and tobacco product manufacturing Total, all industries Q1 12 4 4 4 3 Q2 10 4 4 5 4 Q3 8 3 4 4 3 Q4 6 3 4 3 3 The clustered column chart shows that job vacancy rates are significantly higher in crop production than in other industries, ranging from 6% to 13%. The job vacancy rate for all other sectors shown ranges between 3% and 5% in 2019. Crop production job vacancies show the most seasonal variation ranging from a high of 13% in the winter and decline to a low of 6% in the fall. Seasonal variability in all other sectors shown is fairly minor.

-

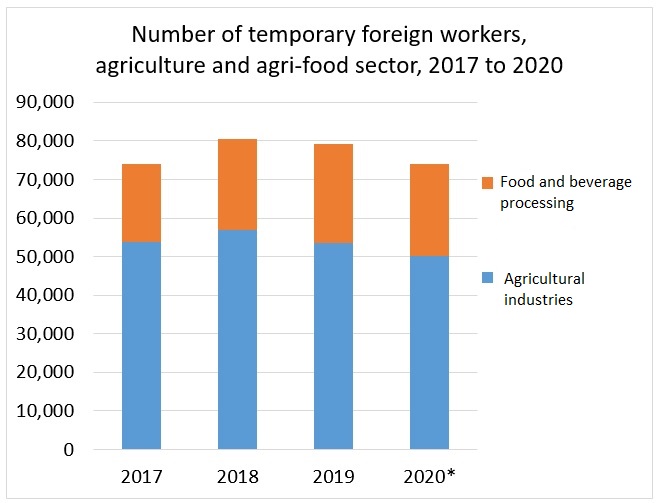

But temporary foreign workers continue to be a critical source of labour

70,000+ TFWs worked in the agriculture and agri-food sector annually from 2017 to 2020.

Ontario, Quebec and British Columbia account for the highest number of TFWs.

Most TFWs in the sector are hired in low-skilled/low-wage occupations, such as general farm workers, nursery and greenhouse workers, and fish plant workers.

Preliminary 2020 data indicate that:

- TFWs accounted for about 18% of the primary agriculture workforce and 8% of the food-and beverage- processing workforce.

- Top TFW employment industries included horticulture and meat processing.

Description of the above image

Number of temporary foreign workers, Agriculture and agri-food sector, 2017 to 2020

A stacked column chart with x-axis labels corresponding to the years 2017, 2018, 2019, and 2020. The 2020 x-axis category has an asterisk indicating this is preliminary data. The y-axis shows the number of temporary foreign workers in intervals of ten thousand from zero to ninety thousand. The source of the data used in the chart is Statistics Canada and Agriculture and Agri-Food Canada calculations.

Number of temporary foreign workers, Agriculture and agri-food sector, 2017 to 2020 2017 2018 2019 2020 Food and beverage processing 20,115 23,635 25,555 23,985 Agricultural industries 53,842 56,919 53,605 50,126 The stacked column chart shows that agricultural industries had more temporary foreign workers in each year than food and beverage processing. The total number of temporary foreign workers employed in both sectors declined from around 80,000 in 2018 to around 74,000 in 2020.

Note: 2020 data are preliminary

Source: Statistics Canada

-

Federal–provincial–territorial government response to COVID-19

Federal initiatives

- Economy-wide initiatives: Canadian Emergency Wage Subsidy, Canadian Emergency Response Benefit, Canadian Emergency Business Account, $3 billion in essential worker wage top-ups, etc.

- AAFC program support for employer costs related to the mandatory isolation period, as well as worker health and safety both on-farm and in processing facilities

- Public Health Agency of Canada guidance for health and safety guidance for employers

- ESDC/IRCC introduced temporary flexibilities into the TFW program and are exploring further options for program reforms and worker protections, including housing standards

- Dedicated federal task team to monitor agriculture temporary foreign worker arrivals throughout the season, as well as address emerging issues to facilitate safe entry into Canada

Provincial and territorial initiatives

- Program responses to help enhance health and safety on farms and in processing facilities, including purchase of PPE (British Columbia, Alberta, Manitoba, Ontario, Quebec, Prince Edward Island, New Brunswick, Nova Scotia, Newfoundland and Labrador) and address labour shortages (Ontario, Quebec, Yukon, Prince Edward Island)

- Job connector portals in British Columbia, Alberta, Ontario, Quebec, New Brunswick and Nova Scotia

- Linkages with Business Risk Management suite – Ontario with labour as an insurable peril for AgriInsurance

- Centralized, government-run isolation program for workers upon arrival - includes accommodation, meals and wrap-around services (British Columbia)

- Provincial inspections of on-farm health and safety measures prior to workers release to the respective farms (Quebec and others)

-

2020 Temporary Foreign Worker program flexibilities due to COVID-19

- Temporarily waived 2-week recruitment period for agriculture and agri-food employers

- Prioritized processing for agriculture and agri-food sector LMIAs and work permits

- Increased maximum duration of employment under LMIAs from 1 to 2 years, as part of the Agri-Food pilot

- Allowed TFWs in Canada on employer-specific work permits to temporarily begin working in a new job while their application is being processed

- Extended period to apply for the restoration of TFWs’ legal status beyond the 90-day timeframe

- Allowed visitors currently in Canada, with a valid job offer, to apply for an employer-specific work permit without having to leave Canada

- Allowed certain SAWP workers to continue working beyond their identified end date and extended certain SAWP workers’ work term beyond 8 months

- Streamlined visa issuance and facilitated biometrics capture at point of entry into Canada to facilitate entry

-

Examples of federal government Temporary Foreign Worker program changes, 2016 to 2021

Improving efficient access to temporary foreign workers

- Created a joint industry/government-led working group to help address administrative irritants (ESDC, 2018).

- Froze the cap at 20%, and implemented a temporary seasonal exemption to the cap for positions of up to 180 days (ESDC, 2016); implemented a change to the cap calculation (ESDC, 2019).

- Introduced an LMIA online pilot (ESDC, 2019).

- Expanded the National Commodities List, adding grains, oil seeds and maple syrup (ESDC, 2020).

- Announced a temporary increase of 10% to 20% in the maximum number of TFWs in low-wage positions in Quebec (ESDC, 2021).

Improving worker protections

- Piloted the Migrant Worker Support Network in British Columbia to provide better supports for migrant workers and to educate workers and employers on obligations and rights (ESDC, 2018); Budget 2021 confirmed funding for migrant worker organizations (ESDC).

- Strengthened program compliance regime, including risk-based and unannounced inspections (ESDC, 2018).

- Introduced open work permits for vulnerable workers, which allow workers with employer-specific work permits in situations of abuse to leave their employer and work for another (IRCC, 2019).

- Invested $35 million to improve health and safety on farms and in employee living quarters in order to prevent and respond to the spread of COVID-19 (AAFC, 2020).

- Introduced a job-matching platform to help match TFWs with employers who have already obtained or applied for an LMIA (ESDC, 2021).

- Budget 2021 announced $54.9 million over three years, for ESDC and IRCC, to increase inspections of employers and ensure TFWs have appropriate working conditions and wages.

Enhancing pathways to permanent residence options

- Added 2,000 additional National Occupational Classification (NOC) C spaces under the Provincial Nominee Program (IRCC, 2019).

- Launched the Agri-Food Pilot (IRCC, 2020).

- Increased the maximum duration of employment under LMIAs from 1 to 2 years for positions in meat processing, as part of IRCC's Agri-Food pilot (ESDC, 2020).

- Launched a temporary policy to grant permanent residence to up to 90,000 graduates and essential workers (including seasonal agricultural workers) (IRCC, 2021).

-

Temporary foreign workers: briefing note

March 18, 2022

Anticipated question

What is the Government doing to ensure the agriculture sector's reliable and timely access to, and safe stay of temporary foreign workers?

First response

- We will continue to work hard to support the safe and timely arrival and stay of temporary foreign workers and to improve the temporary foreign worker program.

- Thanks to remarkable cooperation between levels of government and the sector, the 2021 season saw the highest number of temporary foreign workers arrive to work in the agriculture and agri-food sector.

- A number of improvements to the program are being considered – to ease administrative burden as well as improve worker health and safety.

- As we develop an Agricultural Labour Strategy to address chronic labour shortages in farming and food processing, we will also work closely with industry to identify and address short- and longer-term issues facing employers.

Responsive on mandatory isolation support for temporary foreign workers

- As Canada’s international border measures ease, so do post- arrival public health requirements for Temporary Foreign Workers and the costs to employers associated with them.

- The Mandatory Isolation Support for Temporary Foreign Workers Program was a time limited emergency support for employers to help them offset the costs associated with public health requirements during the most acute COVID-19 crisis period.

Responsive on arrivals of temporary foreign workers

- Despite challenges caused by the COVID-19 pandemic, the 2021 season saw record arrivals of international workers in Canada.

- The 2022 season has begun smoothly, with most workers arriving fully vaccinated.

Responsive on easing border/PT measures

- As government restrictions are lifted, we remain committed to keeping international workers safe and healthy.

- The list of accepted COVID-19 vaccines for travelers entering Canada will continue to align with the World Health Organization Emergency Use Listing.

- Unvaccinated or partially vaccinated TFWs in the agriculture and food processing stream continue to be exempt from entry requirements. However, once they reach their final destination, vaccination will be required for any further domestic air or rail travel within Canada.

- Government is working closely with partners and provinces to ensure unvaccinated temporary foreign workers have the opportunity to be vaccinated against COVID-19.

Responsive on measures to boost protections for temporary foreign workers and address COVID-19 outbreaks on farms

- It is essential that every foreign worker find themselves in a working and living environment that ensures safety and human dignity.

- That is why, to build on actions taken in 2020 to support temporary foreign workers affected by COVID-19, Budget 2021 announced, starting in 2021-22:

- $49.5 million over three years, to support community-based organizations in providing migrant worker programs and services, through the new Migrant Worker Support Program.

- $54.9 mi llion over three years to increase employer inspections and ensure that temporary foreign workers have appropriate working conditions and wages.

- $6.3 million over three years to support faster processing and improved service delivery of open work permits for vulnerable workers.

- The Government has also proposed amendments to the Immigration and Refugee Protection Regulations that would enhance the protection of temporary foreign workers, and continues to work on developing standardized housing requirements to improve employer-provided accommodations, focusing on ensuring better living conditions for workers.

-

Temporary foreign workers: backgrounder

March 7, 2022

Background

Reliable access to workers through the Temporary Foreign Worker (TFW) Program is a key concern for some agriculture and processing employers. The TFW Program aims to assist employers in filling their temporary skills and labour requirements when qualified Canadians and permanent residents are not available. The TFW Program is jointly administered by Employment and Social Development Canada (ESDC) and Immigration, Refugees and Citizenship Canada (IRCC).

In 2020, TFWs accounted for about 18% of the primary agriculture workforce and 8% of the food and beverage manufacturing sector. TFWs are common in horticulture and meat and seafood processing in Ontario, British Columbia, and Quebec. Most TFWs in the sector are hired in low-skilled/low-wage occupations such as general farm workers, industrial butchers and fish plant workers.

In March 2020, the Government of Canada announced exemptions to the air travel restrictions, including seasonal agricultural workers, fish/seafood workers, caregivers and all other TFWs. Allowing foreign workers to enter Canada recognizes their vital importance to the Canadian economy, including food security for Canadians and the success of Canadian food producers.

Temporary foreign worker arrivals

The 2021 season exceeded pre-pandemic trends for both arrivals and work permit applications for TFWs in agriculture and processing. To date, arrivals for the 2022 season are tracking well with most arrivals fully vaccinated with World Health Organization approved vaccines. As in previous years, Mexico, Guatemala and Jamaica comprise the top three source countries for TFWs, with the majority of arrivals to Canada in Ontario, Quebec and British Columbia.

Temporary Foreign Worker Quarantine Requirements and Employer Compliance

Amendments to the Immigration and Refugee Protection Regulations came into force April 20, 2020, and compel employers of TFWs to meet additional requirements, including

- paying workers for any required initial quarantine/isolation period upon entry into Canada,

- not preventing a worker from meeting their requirements under orders made under the Quarantine Act and/or the Emergencies Act, as well as provincial/territorial public health laws related to COVID-19, and

- additional requirements for employers who provide accommodations to workers.

Employers are subject to inspection and those who do not comply with the requirements could be subject to penalties of up to $1 million and a ban from hiring TFWs, depending on the seriousness of the situation and number of workers affected.

Border measures, testing, and rules on international travel

Current status

TFWs in the agriculture and food-processing sector continue to be exempt and may enter Canada regardless of their vaccination status.

- As of April 1, 2022, fully vaccinated travellers, including TFWs, will no longer need to provide a pre-entry COVID-19 test result to enter Canada by air, land or water. Fully vaccinated travellers seeking to arrive in Canada before April 1, 2022, must still have a valid pre-entry test.

- All unvaccinated travellers must continue to provide proof of a negative COVID-19 test prior to scheduled travel, unless they have evidence of a positive COVID-19 test taken 11–180 days prior to arrival in Canada. Options include providing proof of a negative molecular PCR test, administered within 72 hours prior to their scheduled departure to Canada or arrival at the land border or marine port of entry to meet pre-entry requirement; or

- a COVID-19 Rapid Antigen Test result authorized by the country in which it was purchased and administered by a laboratory (the day prior to their scheduled flight or arrival at the land border or marine port of entry)

- As of February 28, all vaccinated travellers, including TFWs, may be selected for mandatory random testing on arrival, but will no longer be required to quarantine while awaiting results. However, should they receive a positive result, they must isolate for 10 days.

- Unvaccinated TFWs will continue to be required to test on arrival and on Day 8, and quarantine for 14 days.

- Effective February 28, 2022, additional Canadian airports that are designated by the Canada Border Services Agency to receive international passenger flights can welcome international flights, including for TFWs.

- Unvaccinated TFWs will continue to be allowed to board commercial transportation to depart Canada until August 31, 2022, provided they show proof of a valid COVID-19 test result at the time of boarding.

While isolation and quarantine rules may vary by province based on the directives of local public health experts, federal authorities recommend an isolation period of a minimum of 10 days from the onset of symptoms for a symptomatic case, or from the time of receiving a positive test for an asymptomatic case.

Penalties of up to $750,000 can be levied against any person who violates these orders. A person who causes a risk of imminent death or serious bodily harm to another person while willfully or recklessly contravening the Quarantine Act or associated regulations could be liable for a fine of up to $1,000,000 or to imprisonment of up to three years, or to both. Under the Immigration and Refugee Protection Regulations, workers who are found to have failed to adhere to an isolation order could be found inadmissible, issued a removal order and barred from coming back to Canada for one.

Mandatory Isolation Support for Temporary Foreign Workers Program

On April 13, 2020, the Government of Canada announced $50 million for the Mandatory Isolation Support for Temporary Foreign Workers Program (the Program) to help farmers, fish harvesters, and all food production and processing employers, put in place the measures necessary to follow the mandatory 14-day isolation period required of all workers arriving from abroad. In addition to the responsibility of paying the workers for the two weeks during which time they could not work, many employers were also responsible for providing workers with transportation and accommodations, as well as access to food and basic supplies needed to meet all of the conditions imposed by public health authorities. Additional funding was provided through the 2020 Fall Economic Statement, and the 2021 Federal Budget increasing the total investment to $142 million.

Budget 2021 allowed the Program to be extended until August 31, 2021, with two streams:- 14-Day Isolation Period Stream helped offset incremental costs associated with the mandatory 14-day isolation period as well as pre-entry testing requirements imposed under the Quarantine Act on temporary foreign workers upon entering Canada. The maximum funding amount under this stream was $1,500 per TFW for arrivals between January 1, 2021, and June 15, 2021, and for eligible activities taking place between January 1, 2021, and June 29, 2021 (i.e. employers with workers coming in on June 15th are eligible for the $1,500). As of June 16, 2021, the maximum funding amount was reduced to $750 per TFW for arrivals between June 16, 2021, and August 31, 2021, and for eligible activities taking place between June 16th, 2021, and September 14, 2021 (that is, employers with workers coming in on August 31 are eligible for $750).

- 3-Day Hotel Quarantine Stream helped offset incremental costs specifically associated with the mandatory quarantine period at a government-authorized facility imposed under the Quarantine Act on temporary foreign workers upon entering Canada, when travel directly via private transportation from their point of entry to employer-provided accommodation for their mandatory 14-day isolation period could not be provided. The maximum funding amount under this stream was $2,000 per TFW for arrivals between March 21, 2021, and August 8, 2021, and for eligible activities taking place between March 21, 2021, and August 9, 2021. March 21, 2021, is the date the order came into effect for TFWs entering Canada and August 8, 2021 is the end date for this specific order.

As of February 4, 2022, a total of 7,720 projects had been approved under the Program, representing over $132.55 million in federal funding.

The program closed at 6PM (EST) on August 31, 2021, and thus is no longer accepting applications. Every employer with an outstanding application has now been contacted by an AAFC official in order to address any outstanding information or documentation, and to confirm overall 2021 funding needs.

Employers with a previously submitted application that have not been contacted yet or who are still waiting on a contribution agreement should contact the Program directly by email at aafc.MISP- PAIO.aac@agr.gc.ca or by telephone through the contact center at 1-877-246-4682, to inquire about the status of their funding request.

There remains a high volume of claims for reimbursement submitted to the Program. Processing is underway, in the order that claims were received. Processing times may be slightly longer than the published service standard in some cases due to volume. It should be noted that delays are not indicative of any particular issue. If an issue does arise in a particular file, an AAFC official will contact the employer directly. If no issues are noted, claims will be processed as submitted and employers will receive a notification to that effect. It should also be noted that payments are issued by cheques via the mail system, which can cause delays between the approval of the claim and the reception of the payment.

Flexibility in the Temporary Foreign Worker Program

Labour Market Impact Assessments and work permits in key occupations related to agriculture and agri- food sectors have been prioritized for processing. The Government has also increased the maximum duration of employment under Labour Market Impact Assessments from 1 to 2 years, for workers in the low-wage stream of the TFW Program as part of a three-year pilot. This will improve flexibility and reduce the administrative burden for employers, including those in food processing. These measures are in addition to existing flexibilities within the SAWP within the TFW Program, including a process for the transfer of foreign workers between employers.

Measures to protect temporary foreign workers and address COVID-19 outbreaks on farms

On July 31, 2020, ESDC and AAFC announced immediate plans to strengthen the TFW Program and make further investments to safeguard the health and safety of Canadian and TFWs from COVID-19 by

- investing $7.4 million to increase supports to TFWs including $6.0 million for direct outreach to workers delivered through migrant worker support organizations;

- strengthening the employer inspections regime, particularly on farms, and making improvements to how tips and allegations of employer non-compliance are addressed (such as by initiating an inspection) through an investment of $16.2 million; and

- investing $35 million (through the Emergency On-Farm Support Fund) to improve health and safety on farms and in employee living quarters to prevent and respond to the spread of COVID-19.

The Emergency On-Farm Support Fund

AAFC's Emergency On-Farm Support Fund provided support to farmers for direct infrastructure improvements to living quarters and work stations, temporary or emergency housing (on or off-farm), as well as personal protective equipment (PPE), sanitary stations, work stations and any other health and safety measures to safeguard the health and safety of Canadian and temporary foreign workers from COVID-19.

Contributions under the AAFC-managed program were cost-shared 50:50 with the applicants up to $100,000. An additional 10% was provided to women, youth, Indigenous Peoples, visible minorities, and persons with disabilities-owned farms (greater than 50% ownership) making the split 60:40. In Ontario, Quebec, Nova Scotia, and Prince Edward Island the province delivered the Fund, and in British Columbia, the B.C. Investment Foundation (BCIAF), a third-party delivery agent delivered there.

As of March 31, 2021 (program end date), 1,645 applications were received by provincial and third-party delivery agents of the fund and 135 applications were received by AAFC for a total of 1,780 applications. Approximately $37.3 million in funding was requested from provincial and third-party delivery agents, and approximately $5.2 million was requested from AAFC (for a total of $42.2 million), of which $29.0 million was approved.

Budget 2021 enhancing the TFW program measures

The Government of Canada has committed to continuing to protect the most vulnerable and isolated workers, ensuring their health, safety, and quality of life are protected while working in Canada. Budget 2021 builds on actions taken in July 2020 to support TFWs affected by COVID-19, and announced:

- $49.5 million over three years, starting in 2021-22, to support community-based organizations in the provision of migrant worker-centric programs and services, such as on-arrival orientation services and assistance in emergency and at-risk situations, through the new Migrant Worker Support Program.

- $54.9 million over three years, starting in 2021-22, to increase inspections of employers and ensure TFWs workers have appropriate working conditions and wages.

- $6.3 million over three years, starting in 2021-22, to support faster processing and improved service delivery of open work permits for vulnerable workers, which helps migrant workers in situations of abuse find a new job.

Mandatory requirements for employer-provided accommodations for agricultural workers

The Government of Canada has committed to developing mandatory requirements to improve employer- provided accommodations for agricultural workers under the TFW Program, with a focus on ensuring better living conditions for workers.

As a first step, the Government has consulted with provinces and territories, employers, workers and foreign partner countries, on a proposal for these mandatory requirements for the TFW Program, and will work with those same partners to implement changes. The consultation process was open from October 27 to December 22, 2020. ESDC has indicated that no changes are planned for the 2021 growing season. Input received through this consultation will inform the Government's actions in the coming months, including continued collaboration with provinces, territories and program partners in advancing this important work.

On November 2, 2020, the Government of Canada launched a survey of TFW employers in the agricultural sector to better understand the variety of accommodations arrangements being provided by employers for TFWs while employed in Canada. The survey closed on December 9, 2020. Shortly thereafter, on December 2, 2021, ESDC released a What We Heard Report following consultations on the development of the national accommodation standard.

Proposed amendments to the Immigration and Refugee and Protection Regulations

On July 10, 2021, IRCC and ESDC published proposed amendments to the Immigration and Refugee Protection Regulations in the Canada Gazette to allow for an initial dialogue. The proposed amendments seek to

- improve worker protections

- address program integrity gaps, and

- make technical amendments to the regulations.

The consultation period ended on August 9, 2021. The final version of the proposed amendments will be published in the Canada Gazette Part II and amendments could come into force as early as 2022.

Liberal Party of Canada 2021 platform commitments

The Liberal Party of Canada's 2021 platform made commitments related to improving access to domestic and foreign labour in agriculture, including

- developing a sector-specific Agricultural Labour Strategy with employers and unions to address persistent labour shortages; and

- establishing a Trusted Employer system to streamline the application process for Canadian companies hiring TFWs to fill labour shortages that cannot be filled by Canadian workers.

Mandate letter

Priorities identified in Minister Bibeau’s mandate letter include

- development of a sector-specific strategy, with the support of the Minister of Employment, Workforce Development and Disability Inclusion, and in partnership with provinces and territories, employers, unions and workers, to address persistent and chronic labour shortages in farming and food processing;

- supporting the Minister of Employment, Workforce Development and Disability Inclusion to implement sector-based work permits and strengthen the inspection regime to ensure the health and safety of temporary foreign workers; and

- supporting the Minister of Immigration, Refugees and Citizenship to expand pathways to Permanent Residence for international students and temporary foreign workers through the Express Entry system.

-

Office of the Auditor General Report 13 – Health and safety of agricultural temporary foreign workers in Canada during the COVID-19 pandemic

March 24, 2022

Information on the Mandatory Isolation Support for Temporary Foreign Workers Program

The $142-million Mandatory Isolation Support for Temporary Foreign Workers Program (MISTFWP) was developed to serve as a time-limited emergency support for employers to help them offset the initial costs associated with public health requirements during the most acute COVID-19 crisis period.

The MISTFWP provided non-repayable contributions to help offset some of the incremental costs associated with the mandatory 14-day isolation period, as well as costs associated with the 3-day hotel quarantine imposed under the Quarantine Act on temporary foreign workers upon entering into Canada.

The program provided up to $1,500 per worker arriving between March 26, 2020 and up to June 15, 2021, and up to $750 per worker for arrivals from June 16, 2021 to August 31, 2021 for eligible costs associated with the mandatory 14-day isolation period.

The program also provided up to $2,000 per worker arriving between March 21, 2021 and August 8, 2021 for eligible costs associated with the mandatory quarantine period at a government-authorized facility.

The program closed on August 31, 2021, and applications are no longer accepted. As of February 4, 2022, a total of 7,720 projects were approved under the MISTFWP for $132.55 million in funding.

Program funding was available to Canadian employers in the farming, fish harvesting, and food production and processing sectors who hired workers through the various streams of the Temporary Foreign Workers Program (TFWP) and/or the International Mobility Program (IMP) and whose workers were subject to the mandatory 14-day isolation period imposed under the Quarantine Act.

Prior to issuing contribution funding payments to recipients, program officials confirmed the employers had the proper approvals in place to hire the number of workers for which incremental costs were claimed and verified that individual employers under the MISTFWP were found to be non-compliant under the regulations of the TFWP and/or the IMP for the duration of the 14-day isolation period.

As part of their application process, employers were required to provide an up-front attestation of certain eligibility criteria, and asked to maintain relevant documentation for a period of six years that can be subject to auditing by AAFC. The results of ESDC inspections are therefore not an eligibility criteria for the programs, but ESDC does share non-compliance findings with AAFC to help inform corrective action or the rescinding of financial support.

Detailed background

Mandatory Isolation Support for Temporary Foreign Workers Program

On April 13, 2020, the Government of Canada announced $50 million for the Mandatory Isolation Support for Temporary Foreign Workers Program (MISTFWP) to help farmers, fish harvesters, and all food production and processing employers, put in place the measures necessary to follow the mandatory 14-day isolation period required of all workers arriving from abroad. In addition to the responsibility of paying the workers for the two weeks during which time they cannot work, many employers are also responsible for providing workers with transportation and accommodations, as well as access to food and basic supplies needed to meet all of the conditions imposed by public health authorities. The Fall Economic Statement committed to providing up to an additional $34.4 million to continue MISTFWP until March 31, 2021. The Program was further extended until April 21, 2021 which included eligible workers who arrived up until April 21, 2021 and covered eligible expenses until May 5, 2021.

On April 19, 2021, the Government of Canada released Budget 2021 which allowed the Program to be extended until August 31, 2021, with two streams:

- 14-Day Isolation Period Stream helped offset incremental costs associated with the mandatory 14-day isolation period as well as pre-entry testing requirements imposed under the Quarantine Act on temporary foreign workers upon entering Canada. The maximum funding amount under this stream was $1,500 per TFW for arrivals between January 1, 2021, and June 15, 2021, and for eligible activities taking place between January 1, 2021, and June 29, 2021, (that is, employers with workers coming in on June 15th are eligible for the $1,500). As of June 16, 2021, the maximum funding amount was reduced to $750 per TFW for arrivals between June 16, 2021 and August 31, 2021 and for eligible activities taking place between June 16, 2021, and September 14, 2021, (that is, employers with workers coming in on August 31 are eligible for $750).

- 3-Day Hotel Quarantine Stream helped offset incremental costs specifically associated with the mandatory quarantine period at a government-authorized facility imposed under the Quarantine Act on temporary foreign workers upon entering Canada, when travel directly via private transportation from their point of entry to employer-provided accommodation for their mandatory 14-day isolation period could not be provided. The maximum funding amount under this stream was $2,000 per TFW for arrivals between March 21, 2021, and August 8, 2021, and for eligible activities taking place between March 21, 2021, and August 9, 2021. March 21, 2021, is the date the order came into effect for TFWs entering Canada and August 8, 2021 is the end date for this specific order.

The Emergency On-Farm Support Fund

AAFC’s Emergency On-Farm Support Fund (EOFSF) provided support to farmers for direct infrastructure improvements to living quarters and work stations, temporary or emergency housing (on or off-farm), as well as personal protective equipment (PPE), sanitary stations, work stations and any other health and safety measures to safeguard the health and safety of Canadian and temporary foreign workers from COVID-19.

Contributions under the AAFC-managed program were cost-shared 50:50 with the applicants up to $100,000. An additional 10 per cent was provided to women, youth, Indigenous Peoples, visible minorities, and persons with disabilities-owned farms (greater than 50% ownership) making the split 60:40. In Ontario, Quebec, Nova Scotia, and Prince Edward Island the province delivered the Fund, and in British Columbia, the B.C Investment Foundation (BCIAF), a third-party delivery agent delivered there.

As of March 31, 2021 (program end date), 1,645 applications were received by provincial and third-party delivery agents of the fund and 135 applications were received by AAFC for a total of 1,780 applications. Approximately $37.3 million in funding was requested from provincial and third-party delivery agents, and approximately $5.2 million was requested from AAFC (for a total of $42.2 million), of which $29.0 million was approved.

Farm productivity and maintaining staffing levels are considered a key indicator of how well the program supported the health and safety of workers in terms of their ability to continue to work throughout the pandemic. AAFC surveyed EOFSF recipients on their ability to maintain productivity and staffing levels, comparing pre- and post-EOFSF funding. These survey results indicated that the majority of respondents maintained their levels of production after implementing EOFSF projects, while a significant number of respondents reported that they experienced an increase in the number of hours worked by their employees after implementing EOFSF projects. Like all people in Canada, TFW employers and their workers are expected to follow the latest public health and safety requirements and/or guidance from the federal, provincial, territorial and local authorities. The Government has worked with employers, workers and various stakeholders to ensure that they are all aware of their obligations to comply with the public health requirements in the context of COVID-19, in order to help prevent the introduction and spread of the virus.

Temporary foreign workers are a key source of labour, particularly in agriculture and agri- food, and ensuring their reliable entry and safe working conditions is key to the continued food security of Canadians and Canada’s broader economic recovery.

-

COVID-19: Supporting the agricultural sector

Updated November 9, 2021

Anticipated question

Agricultural and agri-food businesses have been seriously affected by the COVID-19 pandemic. What will you do about this?

First reponse

- The work of the sector is critically important to the country, and we are supporting producers, processors and other agri-food businesses so that they can continue to provide for Canadians during this challenging time.

- We have taken unprecedented action to support farmers, ranchers, food businesses, and food processors across the value chain as well as provided support for vulnerable populations.

- Budget 2021 built on the Government’s commitment to support the sector through COVID-19 and laid out investments to help Canadian farmers and agri-food businesses, their families and their communities as we finish the fight against COVID-19.

Responsive on AAFC-led measures

- To date, we have unlocked $5 billion in additional FCC lending capacity and launched the $100 million Agriculture and Food Business Solutions Fund. We increased the Canadian Dairy Commission’s borrowing capacity by $200 million to support costs associated with the temporary storage of cheese and butter and avoid food waste.

- The Government responded to ensure our farmers continued to have access to labour and provided more than $142.3 million to help offset costs associated with mandatory COVID-19 quarantine measures and facilitate the timely and safe arrival of temporary foreign workers.

- We also launched a $125-million national AgriRecovery initiative to offset the extraordinary costs caused by supply chain disruptions and COVID-19. Producers continue to have access to the suite of business risk management programs.

- The Emergency Processing Fund helped companies implement changes to safeguard the health and safety of workers and to improve, automate, and modernize facilities to increase Canada’s food supply capacity.

- And for vulnerable Canadians, nearly $250 million has been provided to improve food security, and Budget 2021 announced another $140 million to help prevent hunger, strengthen food security in our communities, and provide nutritious food to more Canadians.

Responsive on economy-wide measures

- The Government also provided a number of other supports to help businesses and Canadians through the pandemic. such as wage and rent subsidies.

- For example, the Canada Emergency Business Account provided interest-free loans of up to $60,000 to help bridge businesses to the other side of the pandemic.

- The Government has proposed to extend the Canada Recovery Hiring Program and the Canada Emergency Wage Subsidy until May 2022 to continue helping businesses who have been hardest hit by the pandemic by offsetting a portion of the extra costs employers take on as they reopen, to ensure they can hire the workers they need so that the economy can fully recover.

-

Supporting the agricultural sector

November 9, 2021

Background

The COVID-19 health crisis has created significant disruption in the food supply chain and in consumer demand. Budget 2021 lays out significant investments in many areas to further support Canadians and Canadian businesses throughout the pandemic and into recovery.

The Government of Canada plays a critical role to support farmers and food processors to provide safe and secure supply of food to Canadians. Numerous concrete actions have already been taken.

To provide financing and expand lending options, the Government has:

- enabled Farm Credit Canada to provide an additional $5 billion in lending to producers, agribusinesses, and food processors;

- created a $100 million Agriculture and Food Business Solutions Fund designed to support viable enterprises dealing with significant business disruptions with financing provided to companies on an individual basis, up to a maximum of $10 million; and,

- expanded the Canadian Dairy Commission’s line of credit by $200 million to support costs associated with the temporary storage of cheese and butter to avoid food waste.

To support temporary foreign workers and employers who rely on them, the Government has:

- removed travel exemptions for temporary foreign workers, increased the maximum allowable employment duration for workers in the low-wage stream of the temporary foreign worker program from one to two years and waived the 2-week recruitment period for the next six months, a modification to the labour market impact assessment process;

- invested $50M under the Mandatory Isolation Support for Temporary Foreign Workers Program to help with the impacts of the COVID-19 pandemic on food supply in Canada by assisting the farming, fish harvesting, and food production and processing sectors with some of the incremental costs associated with the mandatory 14-day isolation period imposed under the Quarantine Act on temporary foreign workers upon entering Canada. The 2020 Fall Economic Statement provided an additional $34.4M to continue the Program until March 31, 2021. Budget 2021 extended the Program until August 31, 2021 - providing support of up to $1,500 per worker was provided until June 15, 2021 and $750 per worker until the wind down of the program on August 31, 2021 - and added an additional stream to include support for 3-day hotel quarantines of temporary foreign workers and further increased support. If workers were required to quarantine at a government approved facility, employers could receive up to $2,000 per worker for costs associated with mandatory isolation requirements. This made total program funding up to $142 million; and

- invested $35 million to improve health and safety on farms and in employee living quarters to prevent and respond to the spread of COVID-19.