1) Introduction

Canadian food and beverage exporters are well positioned to explore Mexico as a viable option to expand their international market presence. With a young population interested in trying new things and a growing focus on innovation, health, quality and sustainability, business development opportunities are growing. As well, the two countries share a positive and long-standing trade relationship, an active interest in aligning standards and regulation and offer relative ease of transportation. The value of Canada being seen as trustworthy and friendly, with a stable business environment and high quality products can't be overestimated.

This Guide will be particularly useful to Canadian small and medium-sized food and beverage companies who have an export-ready product, have done the research needed to determine that Mexico is a viable export market and are now interested in understanding the essential steps required for market entry. This guide will remain online with links and other references regularly updated to provide current information. Readers are also encouraged to refer to Agriculture and AgriFood Canada's Market Intelligence for Mexico and Global Affairs Canada Doing Business in Mexico for detailed trade statistics, market profiles and opportunity analysis. Unless otherwise indicated, statistics are provided by Global Analysis at Agriculture and Agri-Food Canada (AAFC).

A Market Readiness Checklist can be found in the Annex as a quick reference tool to assist with the development of market entry strategies. AAFC Regional Offices, and provincial agriculture or trade development offices are available to assist with market readiness guidance and support. Export-ready companies are encouraged to reach out to the Trade Commissioner Service to discuss market entry approaches.

2) Overview

a. Socio-Economic Profile

Mexico is officially named the United Mexican States and is the 14th largest country in the world. There are 32 states, six of which border the United States (Tamaulipas, Nuevo León, Coahuila, Chihuahua, Sonora, and Baja California) and four bordering on Guatemala and Belize to the south (Chiapas, Tabasco, Campeche y Quintana Roo).

Mexico is the 16th largest economy in the world and although suffering declines through the COVID-19 pandemic, has rebounded with a 4.7% annual growth rate in 2021 to reach Can$1.7 million equaling the levels of 2019. Individual states recording the highest revenues included Mexico City, the State of Mexico, Nuevo León, Jalisco, Veracruz, Guanajuato, Baja California, Coahuila.

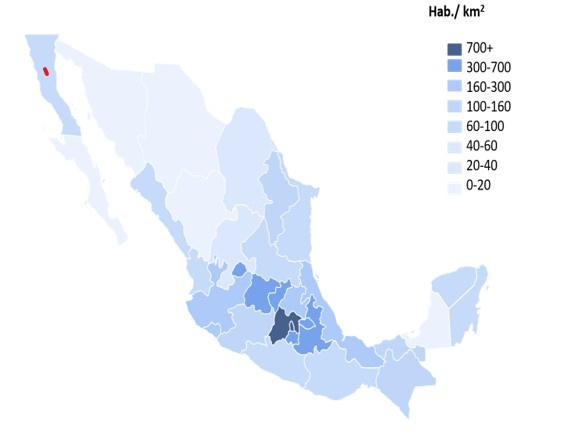

Description of above image

The Mexican population tends to be concentrated in the central region of the country, including the State of Mexico which surrounds the metropolitan area of Mexico City, the heart of the country’s political and financial activity. The most populous cities include Tijuana, Iztapalapa, León, Puebla, Ecatepec Morelos, Juárez, Zapopan, Guadalajara, and Monterrey.

As shown in the map, the population tends to be concentrated in the central region of the country, including the State of Mexico which surrounds the metropolitan area of Mexico City, the heart of the country's political and financial activity. The most populous cities include Tijuana, Iztapalapa, León, Puebla, Ecatepec Morelos, Juárez, Zapopan, Guadalajara, and Monterrey.

The 2020 census from the National Institute of Statistics and Geography (INEGI (in Spanish only)), confirmed a young Mexican population, with over 43.8% of its 126 million people being under 25 years of age with an average age of 29 years. Also noteworthy is the relative equal balance between men (49%) and women (51%).

From an economic perspective, Mexico is a country of great contrasts and complexities in regional, sectoral and social development which tend to influence access to health, education and welfare. According to the 2020 study by the INEGI “Quantifying the rising middle class in Mexico (in Spanish only) (PDF)” there are:

- 02 million people considered upper class: earn more than Can$5,400 monthly

- 20 million people considered middle class: earn from Can$1,610 CAD up to Can$5,399 monthly*

- 53 million considered lower class: earn from Can$796 CAD up to Can$1,609 CAD monthly

*The middle-class segment is quite broad and touches both ends of the classification, so it is advisable to consider that range when analyzing that particular income segment.

The most recent estimates from the National Health and Nutrition Survey (ENSANUT, 2018 (in Spanish only) (PDF) Footnote 1) reinforce the impact of this reality. Of the 33 million households in Mexico, 22.6 percent (7 million households) face moderate and severe food insecurity and 32.9% (10 million households) face mild food insecurity Footnote 2. In terms of location, rural households show a higher percentage of food insecurity, with only 30.4% of total households being food secure, while urban households are close to 50%. Of note, the average household size in Mexico is 3.6 people per family.

According to a recent food consumption report (in Spanish only) (PDF) (November 2021), the average household in Mexico spends about 25% of its income on food, reflecting the joy that Mexicans find in eating. By November 2022, Mexican consumers were paying on average over 12% more for food and beverage products than one year before. In 2022, food inflation began to stabilize, going from a high of 1.44% in June to 0.28% in November. Source: World Bank

Given income realities, Mexico remains a price-sensitive market, with food consumption or preferences aligning to social class. Generally, the food and beverage consumer is divided into two segments:

- High-end consumers: high and middle socioeconomic levels willing to pay for premium quality products (usually imported).

- Regular consumers: middle and lower socio-economic levels principally buying based on the price.

b. Food consumption and preferences

A combination of food culture, availability, and pricing has resulted in Mexico having the highest obesity rate in the world, affecting more than 75% of adults and 35.6% of children. In fact, Mexico leads the world in the consumption of sugar-added soft-drink beverages as well as favouring industrialised juices, sweetened non-dairy products, sweet snacks, desserts and cereals.

A significant contributing factor is that Mexico has the highest sales of ultra-processed food in Latin America and is the fourth largest consumer of these products worldwide with 23.1% of the population's dietary energy coming from these products. Processed Footnote 3 and ultra-processed foods are in most cases significantly cheaper than less processed food and easier to prepare which has contributed to their sales growth of 34.5% in recent years.

Consumption of safe and nutritious food and its association with chronic disease is monitored by the National Health and Nutrition Survey (ENSANUT). Foods and beverages are classified according to their nutritional characteristics in relation to chronic diseases and risk of overweight and obesity. They recommend daily consumption of vegetables, fruits, legumes, unprocessed meats, water, eggs and dairy products while discouraging processed and ultra-processed foods, sweetened non-dairy beverages and snacks, as well as sweets and desserts.

The government has been trying to address the obesity issues in a number of ways. Since 2014, there has been a Special Tax on Products and Services that aims to penalize "junk food". As well, a series of advertising campaigns for children about eating healthier and exercising were recently launched. A challenge has been providing education about the long term costs of being overweight or obese in an accessible way to lower income consumers. New product labelling is also a recent action and is covered in detail later in this guide.

More facts about Mexican processed food consumption:

- Mexico has the highest consumption per capita rate of processed foods in the world.

- Processed food consumption in Mexico is around 19 billion tons annually.

- Tortillas and bread are the most consumed foods with anticipated continued sales growth.

- More than 50% of processed food in Mexico comes from agricultural products such as potatoes or vegetables. If bakery and other wheat products are included, the percentage would increase slightly.

- 70% of the consumption of added sugars in Mexico comes from sugary drinks (soft drinks, dairy, juices and nectars canned, packaged or bottled).

- Food with health labelling has increased their sales around 85%

3) Introduction to the Food and Beverage Market

a. Food and Beverage Sector in Mexico

According to the National Statistical Directory of Economics Units (DENUE (in Spanish only)), the food industry currently has registered 217,320 companies, with a concentration in the State of Mexico (28,657), Oaxaca (22,298), and Puebla (19,639).

The food and beverage market in Mexico represents 4% of the GDP reaching Can$136.9 billion in 2022. INEGI reported in 2020, the production of processed foods represented 25.9% percent of the value of manufacturing industries GDP and 4.1% of total GDP, with bakery goods and tortillas among the leading products followed by meat and dairy processes.

The sector employs 1.96 million people (49.9% female) with an average monthly salary of Can$326. The average age is 39 years old with 11.1% of workers being directly linked to the food industry. Thirty-one percent of the workforce is in production of tortilla, bread, bakery, other cereals, and meals; 5.64% in sugar-based products, chocolate, confectionery and tobacco; 4.18% in meat, fish and derivatives; 2.58% in dairy products; and 1.16% in fruits and vegetables-based products.

b. Free Trade Agreements

Mexico has a network of 14 Free Trade Agreements (FTA's) with more than 50 different countries, 30 Agreements for the Promotion and Reciprocal Protection of Investments (APPRIs) with 31 countries or administrative regions and 9 agreements of limited scope (Economic Complementation Agreements and Partial Scope Agreements) within the framework of the Latin American Integration Association (ALADI). This makes Mexico a country with a high range of foreign trade and an open market. One of the first FTAs signed by Mexico was the North American Free Trade Agreement (NAFTA), now called Canada-United States-Mexico Agreement (CUSMA), which came into force in 2020. Details can be found on the Canada-United States-Mexico Agreement (CUSMA) page. Canada-Mexico trade is also influenced by the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The advantages of this Free-Trade Agreement for processed foods and beverages for Canadian companies as compared to CUSMA are considered minimal. For more information: CPTPP and Canada's agriculture and agri-food sector.

c. Competitive Environment

Who are Canada's Key Competitors

As taken from AAFC statistics, Mexico's main suppliers (TOP 10 with 82.96% of market share) in the processed food and beverage sector (2017-2022) are:

- United States (65.20%)

- Canada (5.02%)

- China (2.68%)

- Chile (2.42%)

- Spain (2.36%)

- Guatemala (1.35%)

- Brazil (1.21%)

- United Kingdom (1.10%)

- France (0.87%)

- Italy (0.75%)

The other Mexican suppliers hold a market share of 17.04%. Taking into consideration that Mexico is the 8th largest producer of processed food in the world, it is important to note that the Mexican processed food industry also enters into the scope of competition since the industry receives about 90% of its supplies locally and 10% from foreign suppliers. Domestically produced products have certain competitive advantages, such as better understanding of the local industry and its needs. (USDA, 2021)

Top imports from the United States included fresh and chilled hams (9.57%), milk and cream in solid form (6.47%), oil cake and other solid residues (6.19%), fresh or chilled bovine meat (5.06%) and fresh or chilled cuts (4.15%).

The most important imports from Canada are fresh and chilled hams (18.56%), colza oil (12.18%), fresh or chilled bovine meat (9.60%), prepared or preserved potatoes (6.92%), and waffles and wafers (5.38%). As can be seen, some products are similar to those from the United States, such as fresh and chilled hams and fresh bovine meat, which makes the competition for these products very strong.

Trends towards high-end, healthy and organic products in Mexico have elevated the opportunities for food and beverage companies. Categories more closely related to retail ready include: food preparations for sauces and prepared sauces corresponding to tariff chapter 21; glucose and fructose in solid form and syrup corresponding to tariff chapter 17; bread, pastry and cakes corresponding to tariff chapter 19; and sausages and similar products corresponding to tariff chapter 16.

What is giving them the advantage?

United States: The United States is the leading supplier of food and beverages to Mexico. In addition to the logistical advantages associated with geography, U.S. products have a good reputation in the Mexican market for consistent quality and a stable supply.

American culture, as shown through television commercials, programs, cartoons and movies, has influenced consumption and lifestyles in Mexico to the point of being considered normal or sometimes even goals to be achieved. The large Mexican presence in the United States from immigration also contributes to the cultural exchange.

A further advantage of the United States is the number of American franchises, which has led to their products becoming part of the Mexican structure and way of life. According to the Mexican Association of Franchises, 14% of the franchises in Mexico are foreign with 50% of these from the USA, with more than 2250 sales points. Food service examples include Shake Shack, Texas Ribs, Chillis, among others.

Chile: The FTA's that exists between Mexico and Chile is bilateral, which often makes trade more efficient and attentive to the specific needs of only two countries, compared with CUSMA, which is made up of three countries. A category that is well known from Chile in Mexico is preserved food and oils.

China: China's great advantage over many countries is its prices. Since China offers some of the lowest global labour rates, the few cents reduction in per unit cost can add to profit margins, which is a benefit in price-conscious Mexico. Some categories that are well known from China in Mexico are spices, instant soups and sauces.

Spain: Over time important companies from Spain have been established in Mexico and vice versa, leading to increased interest and consumption building based in this high degree of familiarity. Some categories that are well known from Spain are cured hams, spices, cookies, oils, olives, tomato sauces, cheese and processed fruits.

Domestic Industry: Mexican producers have two competitive advantages: they have a better understanding of the local industry and needs; and Government campaigns and advertising (“Back to local”) to promote local consumption and thus support Mexican companies.

Key Players in Mexico

In 2022, according to Mexico's National Association of Retailers and Department Stores (ANTAD), the Mexican retail sector comprised 3,284 supermarkets, 2,507 department stores and 41,103 specialised stores, contributing to 3.2% national GDP and 15.6% commerce GDP. The Mexican food industry is highly competitive, with a few companies controlling the market based on their national infrastructure and presence in the Mexican mindset.

In 2021, the key food and beverage players in the Mexican market in order of highest sales value were Bimbo, Coca-Cola (FEMSA), Sigma, Gruma, PepsiCo, Lala, Bachoco Industries, Nestle, SuKarne, Pilgrim's Pride Mexico and Grupo Herdez (Statista, 2021 (in Spanish only)). Other key players include Unilever (Netherlands), General Mills (EE.UU.), Mondelez (EE.UU.), Danone (France), Mars (EE.UU.), Kellogg's (EE.UU.), among others.

Meanwhile, the main competing brands were: La Costeña, Clemente Jacques, Del Monte, Hellmann's, Smucker's, French's, La Moderna, Dolores, Tuny, Jumex, Del Valle, Campbell's V8, Ades, Vita Real, Karo, Nescafé and Valentina.

d. Market Trends

Health

Achieving a healthy lifestyle is now a main goal for many Mexican customers however health and wellness continues to be a niche market, most often limited to higher income consumers. The fact that many of these premium products are not yet being manufactured in Mexico, makes this an attractive segment for imports.

The health and wellness sector in Mexico reached a retail sales value of Can$23.9 billion in 2021, which has increased at a CAGR of 6.5% (2016-2021) and a forecast CAGR of 6.4% (2021-2026). (Euromonitor International, 2022).

- BFY (Better for you): Contained claims such as low/no/reduced (saturated or trans) fat; low/no/reduced calories, cholesterol, sodium, carbs, glycemic, no added sugar or sugar free; diet/light and not pasteurised.

- FF (Fortified/functional): Contained either fortified (food plus) claims (added calcium, high/added fibre or protein, stanols/sterols, vitamin/mineral fortified) or functional, claims (antioxidant, functional: bone health, brain and nervous system, cardiovascular, digestive, energy, eye-health, immune system, other, slimming, stress, sleep, weight and muscle gain, high satiety, probiotic).

- Free From: Contained free from ingredient claims such as caffeine, dairy, hormone or palm oil free.

- NH (Naturally Healthy): Claims were either and “all natural”, Non genetically modified organism (GMO free), no artificial additives (colourings, flavourings) and preservatives, organic or whole grain products.

- Organic: Name given to vegetable, animal or derived products that are grown or raised with natural substances without the use of pesticides or artificial fertilisers, among other chemicals. (Ministry of Agriculture and Rural Development - SADER (in Spanish only)).

| Food (64%) | Beverages (36%) |

|---|---|

| FF (66.3%) | FF (43.6%) |

| BFY (11.7%) | BFY (39.4%) |

| NH (10.5%) | NH (16.7%) |

| ORGANIC (0.3%) | ORGANIC (0.3%) |

| FREE FROM (11.3%) | FREE FROM (0%) |

| Source: Euromonitor International | |

| Food (64%) | Beverages (36%) |

|---|---|

| 5,502 | 1,748 |

| 6,599 | 1,605 |

| 8,043 | 1,326 |

| 1,421 | 408 |

| 1,343 | 376 |

| Source: Mintel | |

Innovative and Sustainable

Trends are evolving around innovation based on consumer interest in nutrition, new product formats and functional attributes targeting specific aspects of health both for ingredient categories as well as retail-ready products. Innovation can align closely with sustainability as demonstrated by a growing interest in biodegradable packaging options. The consumption of insects is an interesting alternative source of protein. Of interest, for centuries, insects have been part of Mexican gastronomy as a protein source. Currently, various products made from crickets are being commercialised in the Mexican market such as snacks, flours, and protein powder.

Clean Label

Along with the rising interest, there is a growing focus on a clean labeling trend. In accordance with Market Data Forecast, Mexico is one of the countries in Latin America where the clean label ingredients market is most segmented. According to data from Innova Market Insights, “No additives/preservatives” is the top clean label claim in Mexico and has shown a 19 percent increase. GMO free, gluten free, lactose free, vegan products and natural claims are the most consumed and demanded within the trend.

Gourmet, Quality

Gourmet food products pull together the need for high-quality foods that respond to demand for health and wellness, sustainability and its traceability, but also speak to increasing interest in authenticity in different products and experiences. This has impacted the country's cuisine. Mexican gastronomy plays an important role within the culture; therefore, it continually evolves, combining typical Mexican dishes with gourmet ingredients to create exotic dishes and high-end presentations.

The most popular gourmet products produced in Mexico are chilli peppers, liquors, chocolates, insects, and oils. According to Food Tech (in Spanish only) review, the best selling gourmet products are cheeses, hams and sausages, beverages and liquors, fish and seafood, oil and vinegar, desserts, exotic products, etc.

The profile (in Spanish only) (PDF) of the gourmet consumer, according to AC Nielsen, in Mexico is between 25 and 65 years old, with a high level of education, above average economic level and is likely to be well-informed about new trends in food and nutrition.

COVID-19 Pandemic Trends Adopted by Consumers

Convenience: Ready-to-eat and ready-to-drink products that meet consumer needs for immediacy, variety and quality with new formats and formulations. Convenience is also ready-to-prepare such as products that come already chopped, sliced or in individual pieces are easy to consume, or speed up mealtime preparation. Brands have found this new market niche and are responding.

The Omnichannel Consumer: This consumer wants to find and purchase their favourite products when they need them and in the channel of their choice. Accessibility and availability is fundamental for Mexicans and although loyal to brands, they will substitute them if they can’t find them. Manufacturers and retailers require strong collaboration to have the required stock and comply with the new policy “Zero shortage of merchandise”.

#ConsumeLocal (“Back to local”): This campaign was created to encourage the purchase of products and services from local suppliers and move away from large chains and transnational companies. This, besides being a trend of social support, has helped to strengthen the local economy, which has also made the movement stronger, attracting companies such as Uber Eats, Rappi and American Express.

The biggest limiting factor to increase sales of healthy food is price, so most of those consumers in the lower income bracket remain focused on price, rather than quality, health, and innovation.

4) Operating in the Mexican Food and Beverage Market

a. How to do business in Mexico

Business Culture

Since Mexico is a high-context culture, business is based on personal relationships, loyalty, face-to-face interactions, and status consciousness. Canadian companies wanting to do business in Mexico should be prepared to invest the time needed to establish relationships and gain the trust of the counterparty.

In-person meetings are preferred for the first contact. A third-party introduction can be helpful, as Mexicans prefer to work with someone they know or have a prior reference. If not possible, communications through telephone conversations rather than email or WhatsApp are recommended. This is evolving with both “millenials” and “Gen Z” who are more open to text. Of note, WhatsApp is the social network with the highest percentage of users in Mexico, even for business purposes.

The decision-making process remains almost exclusively with a company's senior executives and should not be unduly rushed. Mexican business contacts are also flexible with the amount of time it takes to make important decisions since they tend to take some time before making a decision.

Structure

According to ANTAD, 57.8% of Mexican consumers prefer to purchase their products through the traditional retail channels, with 14.3% through supermarkets, 12.9% through specialised stores and 11.5% through department stores. There are 46,894 retail stores in Mexico: 88% are specialised stores, 7% are supermarkets and 5% department stores.

Retail

The retail trade of food and beverage in Mexico is divided into 3 channels:

- Modern

- Traditional

- E-commerce

The modern channel refers to supermarkets with large sales value, technology for inventory management, and transport infrastructure. Additionally, this channel also offers consumers consistency, quality, and a wide variety of products.

The chains within the channel adapt their stores based on the socioeconomic segments to which the customer belongs. It's classified into two groups:

- Warehouses, supermarkets, hypermarkets, mega-markets (WSHM)

- Discount and express stores (DES).

The first group is focused on middle and high-income customers, meanwhile, the second group with a smaller variety of products, is focused on lower-income customers.

Among WSHM stores, Walmart is the chain with the most stores in the country (87% of market share according to the Food and Beverage Modern Channel Research of Competence (in Spanish only) (PDF) by COFECE (in Spanish only)), followed by Soriana, Chedraui, Costco, Merza, Casa Ley, Super del Norte. Similarly, Walmart has more facilities within the DES group, followed by Tiendas 3B, Tiendas Neto, and Dunosusa.

- Walmart is present in all 32 Mexican states with 6 different formats: Walmart Supercenter, Bodega Aurrera, Mi Bodega Aurrera, Bodega Aurrera Express, Walmart Express and Sam's Club.

- Soriana in 32 states with 4 formats: Hiper, Super Mercado, Express and Mega.

- Chedraui in 25 states, mainly in the south of the country with 4 formats: Chedraui, Super Chedraui, Selecto and Almacenes.

- La Comer in 11 states with 4 formats: La Comer, Fresko, Citymarket and Sumesa.

- Casa Ley in 10 states, mainly in the north, with 5 different formats: Ley Autoservicio, Super Ley Express Fresh, Super Ley Express, Super Ley and Ley Mayoreo.

- Tiendas 3B in 12 states with more than 1,350 stores and expanding its coverage thanks to e-commerce through Mercado Libre.

- Tiendas 3B boosted sales during the COVID-19 pandemic with Mercado Libre. It achieved strong growth because of its small regional base, but has surprised recently with orders from cities where they do not have coverage, such as Tijuana.

As outlined by ANTAD, 95.8% of supermarkets are located in urban areas such as the State of Mexico, Nuevo León, Mexico City, Yucatán and Jalisco. The States of Tlaxcala, Zacatecas, Nayarit and Colima has less than 50 each. Baja California, Colima, Mexico City and Morelos Campeche, Quintana Roo, Sinaloa, Chiapas and Yucatán have few or no supermarkets in rural areas.

The traditional channel refers to small grocery stores (Abarrotes in Spanish), specific sector stores (butcher and poultry stores), as well as flea and street markets. Generally, traditional channel stores have limited stock, due to their small size and are known as family businesses (Mom & Pop stores). They are supplied both by the central food supply (Central de Abastos) markets, and wholesale stores, as well as by large companies that deliver products directly to the store (i.e., packaged bread, dairy, sodas, beer, and snacks).

The traditional channel offers some advantages to consumers, such as proximity, which is a relevant decision factor for households without a car, or whose income only allows them to shop daily. Despite the expansion of modern and online channels, the traditional channel remains the main destination for household spending of Mexicans in food and beverages.

E-commerce in Mexico began in the 90's, where the most famous subdomain was and still is -com.mx. Increasingly, shoppers are choosing to buy online, due to the convenience and ease of purchase. According to the Mexican Association of Online Sales (AMVO (in Spanish only)) over 216 million transactions were recorded on e-commerce sites in the first quarter of 2022, which was 9% more than reported as of the same period in 2021 and 82% more than in the first quarter of 2020. E-commerce at the retail level now represents 11.3% of total retail sales according to AMVO data and puts Mexico in the top five countries with the highest growth in e-commerce.

Mexican consumers, particularly women, have continued their interest with the digital channel, post pandemic. The use of online options as a source of information before deciding to buy continues to grow, meaning that the physical store continues to have an essential role, whether as showroom or as a final purchase channel.

Multiple categories have positioned themselves within the online shopping preference. Food delivery, fashion and electronics continue to lead the list of the most preferred categories in the digital channel of the Mexican consumers. However, the offline experience, the prevalence of cash as a method of payment, and the lack of confidence in online payments are some obstacles that limit the growth of this channel. E-commerce platforms are responding with benefits such as discounts and free shipping which are steadily motivating and convincing more consumers to choose digital stores over physical ones.

E-Commerce Considerations for Food and Beverage

ANVO reports that food and beverage sales reached Can$28.5 billion in 2022, 27% more than in 2021 with the highest sales with Rappi, Mercado Libre, Cornershop, and Uber Eats. In fact, five e-commerce operators in Mexico account for 52% of the market in terms of sales value, according to Euromonitor International. These are: Mercado Libre with (15.4%) of the share, followed by Amazon (13.2%), Walmart (9.6%), Liverpool (7.0%) and Coppel (6.8%).

The online segments with a larger penetration and acceptance in the Mexican market are: supermarket sites with a physical presence (88% penetration rate), using the Brick & Click system such as Walmart, Fresko, Chedraui and La Comer; delivery platforms (78%); followed by 100% online supermarkets like Justo and Amazon (72%). Some market opportunities are emerging for social networks (42%) and pharmacies (40%) to sell Food and Beverage s through their platforms.

Other chains of the modern channel that have an e-commerce infrastructure include HEB and Soriana. Some of the platforms that have been more popular, in relation to trends (organic, healthy, gourmet) mentioned above are: The Green Corner (in Spanish only), Yema (in Spanish only), Estado Natural (in Spanish only), Orgánicos en Línea (in Spanish only), Ecobutik (in Spanish only), Greenery (in Spanish only) and Patio Orgánico (in Spanish only).

According to AMVO (in Spanish only), 56% of Mexican consumers stated that they have bought food online and 47% bought beverages on-line, mainly purchased in grocery stores at least once a month.

Regarding food delivery, 37% of Mexicans purchase food through digital platforms. Among the most used are: Rappi (18%), MercadoLibre (15%), Cornershop (12%) and UberEats (10%).

The demographic profile of the Mexican online shopper for Food and Beverage s is:

- Belongs to the high and upper-middle socioeconomic level.

- Between 25 and 44 years old.

- Uses phone more than other devices.

- Prefers to use debit card when paying.

In terms of online prices, during the last quarter of 2021 and the first quarter of 2022, the average online prices of foods and beverages increased, yet was still 5% below inflation rates. Players with 100% online presence have been more affected by fluctuations, while price clubs and supermarkets with physical stores showed a more stable trend. To note that, the desired option is the omnichannel approach being used by customers to buy through multiple digital and physical stores, based on pricing.

Wholesale

The wholesale food sector in Mexico is made up of companies, traders, and distributors that purchase, store, and sell bulk. These companies, typically referred to as wholesalers, buy directly from producers to further supply to retailers, food service companies, or other channels. It is also common for wholesalers to manufacture and then commercialise their products.

The latest data provided by the Agrifood and Fisheries Information Service (SIAP (in Spanish only)) on the presence of the central supply centres in Mexico establishes that Mexico's food supply infrastructure consists of 89 wholesale outlets, 64 of which are central supply centres and 25 wholesale markets.

The biggest and most important wholesale market is known as “Central de Abastos” (Food Supply Centre) located in Iztapalapa, Mexico City. It is the world's largest wholesale market, covering 3.27 km2 of land area, and handling over 30,000 tonnes of merchandise each day. 35% of all food consumed in Mexico is sold through the Central de Abastos.

Among the most important companies in the wholesale sector are:

- Zorro Abarrotero: 113 stores in 15 states.

- Grupo Merza: 237 self-service stores and 24 wholesale distribution centres in 30 states.

- Scorpion: 46 stores in 6 states.

- Puma Abarrotero: 36 stores in 8 states.

All the above mentioned companies belong to ANAM (in Spanish only) (Mexican Wholesalers Grocers Association). It represents 87% of the grocery wholesalers in Mexico and is composed of 134 companies with approximately 3,500 self-service stores whose total sales (considering wholesale and retail) closed at Can$10,773.00 per year.

In addition, the association also executes the most important wholesale events in the country, described below in the marketing section with more details in Annex: Calendar of trade events.

Other key players in the wholesale sector are warehouse clubs, with lower prices than wholesale clubs. The warehouses clubs with the strongest presence in Mexico are:

- Sam's Club: 162 stores in Mexico nationwide (in all 32 Mexican states).

- Costco: 41 stores in Mexico within 20 states.

- City Club: 34 stores in Mexico, located in 17 states.

Foodservice

Distribution in the foodservice industry is commonly made through 2 areas:

- The HoReCa channel (hotel, restaurant and catering), encompasses the majority of the food service industry. The best way for Canadian suppliers to participate in this channel is through Mexican distributors specialized in these activities. There are some events specialized in this channel, please review the calendar of key trade events in this guide and consider visiting those shows.

- COMPRANET (in Spanish only). The Mexican government platform for distributors to register and to become government suppliers through tenders, and in some cases, particularly huge projects, at times, competition is open for foreign companies. Some of the government customers could be National System of Integral Family Development (DIF (in Spanish only)), the military SEDENA or Immigration Authorities INM (in Spanish only). If interested, it is advised to monitor tenders and work with local partners to assist.

b. Choosing a Market Entry Strategy

Distributors

When partnering with a distributor in Mexico, it is essential that they are registered with the government (Ministry of Economy) and have the required permits and licences to operate legally. Authorised distributors receive a Federal Taxpayers Registry number, (RFC) as identification. They are also required to fulfill standards of food safety and health regulations.

A distributor must obtain products from approved suppliers, in order to ensure that the products are of good quality and safe for consumers. They are also responsible for delivering products to retailers or customers.

In some cases, distributors may also be responsible for promoting the products and providing customer service. And if it applies, they are responsible for collecting the corresponding sales taxes.

It is advisable to partner with a distributor if you do not have a strong knowledge of market presence, to connect products within the relevant distribution channels. The percentage granted or added by them may vary according to the agreement on the product, but generally does not exceed 30%.

Identifying and Assessing Agents and Distributors

In Mexico, the best way to identify potential distributors is through networking. Therefore, it is highly recommended to:

- Meet companies through introductions by a professional matchmaker, government related office or expert in the industry.

- Visit the market in order to have a people-first approach and assess options prior to making a decision.

- Expositions, forums, and conferences. (See Annex: Calendar of trade events)

- Events of associations, chambers, and business entities.

- Food and Beverage trade missions

- Search directories of expos and Food and Beverage industry associations.

- Talk to other international exporters for references to quality agents.

The Chambers of Commerce are a good way to find agents, since they can facilitate networking with those entrepreneurs, owners of small, medium or large businesses within the sector in order to increase their productivity. In Mexico, usually these chambers have contacts within the government which means that funding and permits are more accessible.

In terms of the private sector, international consulting firms with a presence in both countries can also be helpful to find agents that are useful according to the sector. For detail on key buyers, importers and/or distributors please contact the TCS in Mexico: mexico.commerce@international.gc.ca.

Agent and Distributor Agreements

It is highly recommended that any international exporter closing a deal with an agent or distributor, hires a Mexican commercial lawyer to ensure there are no unfavourable terms and conditions to the exporter as well as to guarantee that the agreement is subject to the national and international laws that Mexico has ratified. The most important points to include in any standard agent/distributor agreement are:

- The date on which the agreement begins to take effect.

- The relationship between the importer and their legal representative and the nature of the agreement.

- Duration of the agreement and any provision for extending the agreement in the future.

- Cancellation provisions.

- Territory, where it takes place.

- Products.

- Commission fee to the agent/distributor.

- The frequency of payment, the bank account and the currency in which the payment would be made.

- Services to be completed by the agent/distributor.

- The mechanism by which disputes will be resolved.

- Indicate any applicable intellectual property clauses.

- How to deal with third parties in case they are added to the agreement.

- Non-Disclosure Agreement (NDA) section or agreement, to ensure that confidential information is not shared.

- Provisions allowing/preventing the agent/distributor from dealing with a potential competitor of the exporter.

- Include appropriate penalties incurred if any of the above is not met or is broken.

Infrastructure for transportation and warehousing

According to INEGI data in 2020, Mexico has a territorial extension of 1,960,189 km2, with an extensive connectivity infrastructure system, strategically distributed throughout the country, enabling the transportation of goods by land, sea, rail and air.

According to the National Network Road (RNC) (in Spanish only), Mexico's 788,323 km of roads is one of the most extensive in the world and it is the main mode of transportation for the movement of merchandise. The main land trade routes (highways) are: Mexico-Queretaro, Mexico-Puebla, México-Toluca and the Mexico-Tuxpan, as they connect the country's main cities and ports.

In terms of maritime transportation, the Ministry of the Navy (in Spanish only) (PDF), lists 50 shipping agencies in Mexico that provide services through 83 shipping lines. Out of these, 74 provide ocean international service, 19 provide cabotage service and 10 provide mixed service (ocean and cabotage). The main international ports in Mexico are: Lázaro Cardenas (Michoacán), Altamira (Tamaulipas), Manzanillo (Colima), Ensenada (Baja California) and Veracruz (Veracruz).

Regarding railway infrastructure, the Ministry of Infrastructure, Communications and Transportation (SICT) created a transportation map which can be consulted in order to check the most important existing railroad routes in Mexico. The product groups that are most transported by railway in Mexico are industrial, agricultural, mineral, petroleum and inorganic products. Additionally, to strengthen the existing trade agreements between the United States, Canada and Mexico, a railroad project called the “TMEC Corridor (in Spanish only)” is being created to connect these three countries through the construction of new ports and railroads to facilitate the movement of merchandise. It is expected to be completed by 2035.

Concerning air transportation, it is considered the least used in Mexico for cargo because it is seen as more exclusive. It tends to be used when speed is needed, such as emergencies or when a product has to access an area located in a very particular geographical position and difficult to reach. The busiest airports for cargo and passenger traffic are: Mexico City International Airport (AICM), Guadalajara, Monterrey, Querétaro and Cancún. However, the Comisión Nacional de Mejora Regulatoria (CONAMER) issued a decree to close AICM to cargo flights and move them to the new terminal Felipe Ángeles International Airport (known as AIFA) by the second quarter of 2023. Air cargo operations will continue in the other mentioned airports.

Regardless of the mode of transport used, it is highly recommended to have insurance, since damage, theft and loss within the foreign trade are variables that can happen at any time.

Protection of intellectual property rights

Internationally, Mexico is a member of the World Intellectual Property Organization (WIPO) and the World Trade Organization (WTO) and so respects the principles established by these organisations in terms of patents. This generally means that the first person to submit the patent application is the one who obtains it. Within CUSMA, the FTA between Canada, the U.S. and Mexico, Chapter 20 deals with intellectual property and establishes minimum standards for protection and enforcement of IP rights across North America.

Under the CUSMA framework, it is established that countries are required to have ratified the following agreements: Patent Cooperation Treaty, Berne Copyright Convention, Paris Convention, WCT and WPPT, meaning that Mexico accepts the jurisdiction of these international treaties and their statements about providing patent and trademark protection for foreign applications.

In the domestic arena, the Mexican Institute of Industrial Property (IMPI (in Spanish only)) is a decentralised public body with legal personality and authority to administer the industrial property system in Mexico. It covers issues related to the registration of trademarks and patents in the country, as well as the resolutions to the infringements that are committed. The administration of IP registration and protection is divided among several other government agencies, including IMPI, COFEPRIS and the Ministry of Economy.

In order to facilitate and expedite the trademark or patent registration process, IMPI created a complete collection of guides (in Spanish only) for interested parties, in which users can find step-by-step procedures, as well as some tools to carry out administrative formalities at IMPI. It is important to select the right class (in Spanish only) for your product or service in order to avoid a rejection from the authority.

The process of registering a trademark could take 6 to 8 months, if there is not any requirement from the IMPI, the cost for the application is about Can$215. After 3 years a company or person gets the register, the owner should send a proof of use to confirm and maintain the register.

c. Marketing

Online and Digital Media

According to the Federal Institute of Telecommunications (IFT) 2022 Statistical Yearbook (in Spanish only) (PDF), most of the online purchases in 2020 were made through: suppliers web page (64%), E-mail (34%), intermediary web pages (25%), social media (21%), or others (11%). It's important to note that respondents were able to select more than one option in the survey.

In a recent research from Statista (in Spanish only) in 2022 Mexico, 64.8% of the population prefers call communication, however, 88.4% of millennials and generation Z use more text messages. In fact, Whatsapp has the highest percentage of users in Mexico, with 92.2% of social media users, spending an average of 20 hours per month through this channel. It's popular for quick, informal communication, and has even become the communication channel through which multiple companies send not only promotional messages but also provide service attention for airlines, department stores, among others.

In terms of email providers, the main platforms used in Mexico are Gmail and Outlook. Zoom gained hundreds of millions of users during the COVID-19 pandemic because it offered an easy-to-use video platform, many events take place in this platform.

To create a successful digital marketing strategy for the Mexican market, it is important to take into consideration the following chart outlining the use of social media applications.

| Rank | Social Network | Percentage |

|---|---|---|

| 1 | 92.9% | |

| 2 | 92.2% | |

| 3 | Facebook messenger | 80.3% |

| 4 | 79.4% | |

| 5 | Tik Tok | 73.6% |

| 6 | 53.7% | |

| 7 | Telegram | 44.5% |

| 8 | 42.3% | |

| 9 | Snapchat | 29.3% |

| 10 | 20.9% | |

| Source: Statista 2022 | ||

Traditional Media

Based on the report “Study Total Media Value 2022” (in Spanish only) (PDF), marketing in traditional media is mostly made through Television (Free-to-air and pay-tv), radio, out of Home (OOH), and print.

Television remains the most important channel for advertising, with Mexico being one of the leading countries in terms of the percentage of advertising investment (33%): divided in 2021 into 76% free-to-air and 24% to pay-tv. The most important television groups in Mexico are Televisa and Grupo Azteca. The most famous channels are “Canal de las Estrellas and Canal 5” belonging to Televisa and “Azteca 7 and Azteca 1” belonging to Grupo Azteca.

Radio has experienced a downward trend diminishing its investment by 69% from 2017 to 2021, attributed to the growth of new digital platforms and new formats in the industry, such as podcasts. Despite the decline of the radio industry, the most listened to stations in Mexico are: “W Radio, Los 40 principales, IMAGEN, Radio Fórmula, iHeartRadio, Stereo Joya and Universal Stereo.”

OOH was impacted by the COVID-19 pandemic due to confinement of the population and the decrease in audience mobility. With the reopening and economic reactivation in 2021, there was a significant recovery in advertising investment, however it has not rebounded to 2018 levels. The official document within Mexico City that regulates outdoor advertising is the Exterior Publicity Law (LPECDMX) (in Spanish only) (PDF), which dictates the content, installation, distribution, maintenance, permanence and removal of advertising media in public space or on any other property visible from the outside.

Print media has moved from traditional formats to digital platforms, however both newspapers and magazines are available, even if advertising has dropped off. The most relevant newspapers in the country are: “Reforma, El Universal, El Financiero, Excelsior and El Economista”. The magazines most read are: “Nexos, Expansión, Quien, TVNotas, Caras, TvNovelas, Hola and InStyle”. Some of the most relevant magazines inside the food and beverage industry are: The Food Tech, Alimentaria Integral, Gastro Nómadas and Revista Industria Alimentaria. It is important to mention that all of the newspaper and magazine companies mentioned above have a digital platform, some of these require subscription and some others are free access.

Advertising regulations

The Federal Commission for Protection Against Sanitary Risks (COFEPRIS) regulates health facilities, advertising activities, and the manufacturing, import or export of health products. The institution protects the population against health risks (in Spanish only) from exposure to messages that promote a risky product and inappropriate use or consumption, mainly in vulnerable populations and a health service linked to risky practices.

COFEPRIS relies on the General Health Law on Advertising (in Spanish only) (PDF) to establish the marketing guidelines, in which food and non-alcoholic beverages are also included. Particularly, article 22 states that the advertising of food, food supplements and non-alcoholic beverages, shall not:

- Induce or promote unhealthy eating habits.

- Claim that the product alone meets the nutritional requirements of human beings.

- Attribute to industrialised foods a nutritional value superior or different from the one they have.

- Make comparisons to the detriment of the properties of natural foods.

- Express or suggest, through real or fictitious characters, that the ingestion of these products provides people with extraordinary characteristics or abilities.

- Directly or indirectly be associated with the consumption of alcoholic beverages or tobacco.

- Claim properties that cannot be proven, or that the products are useful to prevent, alleviate, treat or cure a disease, physiological state.

As mentioned above, Mexico is facing severe childhood obesity issues, therefore, the law and its advertising guidelines for children under 12 years old is different. In Mexico, the Code of Self-Regulation of Food and Beverage Advertising (in Spanish only) (PDF), (PABI Code), came into force on January 1, 2009, as a precautionary measure of the food industry to avoid state regulation of food and beverage advertising. It is under the supervision of the Council for Self-Regulation and Advertising Ethics (CONAR (in Spanish only) (PDF)).

Initially, the PABI (in Spanish only) (PDF) Code was signed by 17 food and beverage companies, but now there are 34, including large multinationals such as Coca-Cola, Pepsico, Kellogg's, Danone, Nestlé, Jumex, and Bimbo. The main objective is to promote the responsible creation and broadcasting of food and non-alcoholic beverage advertisements aimed at children. The code establishes the guidelines and verification mechanisms within the framework of private sector self-regulation, as a tool to encourage proper and healthy nutrition, as well as a regular practice of physical activity, thus contributing to the prevention of overweight and obesity.

The code has thirty articles which establish the general criteria that advertising should have. For example:

- Article 1. - Be indicative, educational and promote positive social values.

- Article 4. - Shall not contain any representation of violence or aggression.

- Article 12. - Be precise about the attributes, without attributing nutritional values, superior or different to those it possesses.

- Article 15. - Not incite the overconsumption.

- Article 19. - Shall present minors with a healthy physical figure.

5) Regulatory and Market Access Environment

a. Regulatory Bodies

Ministry of Economy (SE (in Spanish only))

Responsible for designing and conducting the country's policies in foreign trade, domestic, supply, and price policies. Mexican standards are promoted by this Ministry. Additionally, it is involved in the labelling regulations, as well as in the tariff rate quotas.

Ministry of Health (SSA (in Spanish only))

Government Body in charge of the national health policy and other aspects of health services, including regulating drugs and medical devices.

Ministry of Agriculture and Rural Development (SADER (in Spanish only))

Regulates, manages, and promotes agri-food health, safety, and quality activities, reducing the inherent risks in agriculture, livestock, aquaculture, and fisheries, for the benefit of producers, consumers, and industry.

National Service for Agri-Food Health, Safety, and Quality (SENASICA (in Spanish only))

Protects agricultural, aquaculture and livestock resources from pests and diseases of quarantine and economic importance. It is also involved in the zoo-sanitary, phytosanitary and fish health import requirements.

The Federal Commission for Protection Against Sanitary Risks (COFEPRIS (in Spanish only))

Protects the population against health risks caused by the use and consumption of goods and services, health supplies, as well as exposure to environmental and labour issues. COFEPRIS also regulates health facilities, advertising activities, and the manufacturing, import or export of health products.

National Customs Agency (ANAM (in Spanish only))

Strengthens national security and the customs system to ensure efficient export and import services, as well as to harmonise customs processes.

b. Key Regulations

Food Safety and certifications requirements

In Mexico, many processed food products are not subject to specific sanitary import requirements, but there are some exceptions such as:

- Fish, seafood, dairy products and nutritional supplements, which would require a sanitary import permit from COFEPRIS.

- All meat products require compliance of SENASICA requirements.

Federal Inspection Type (TIF (in Spanish only))

The certification is given to establishments that have adequate facilities and comply with the hygiene and safety standards for companies dedicated to the slaughter, processing and cold storage of meat in Mexico.

Organic Products

It guarantees that the production was carried out free of chemical products and under 100% natural processes. “The recent Canada-Mexico Organic Equivalency Arrangement came into effect on February 15, 2023. It allows products certified under the Canada Organic Regime or the Mexican organic system to be sold and labelled as organic in both countries.” SENASICA and The Canadian Food Inspection Agency (CFIA) are the bodies regulating the equivalency.

Since the organic seal equivalency convenience will be evaluated for one year, it is included in the process to obtain the Mexican organic certification.

Process for certifying organic products (in Spanish only) (PDF) in Mexico:

- Practices must be reviewed and implemented in compliance with the Mexican Organic Products Law / Ley de productos orgánicos (LPO)

- Contact a SENASICA-approved Organic Certification Body (OCO).

- The certification of production processes may be carried out directly by the Secretariat, or through certification bodies authorised (in Spanish only) (PDF) by the Secretariat.

- Organic inspection by authorities in which compliance with the regulations will be verified.

- The organic certification is issued.

International Regulations

ISO 22000: Food Safety Management System:

Demonstrates that a business involved in food products, whether as a manufacturer, supplier, or retailer, has an effective food safety management system in place to meet the requirements of regulators, partners, and consumers.

Hazard Analysis and Critical Control Point (HACCP):

System that provides a framework for monitoring the total food system, from harvesting to consumption, to reduce the risk of foodborne illness. The system is designed to identify and control potential problems before they occur. This is an import requirement for Mexico.

Other certifications that are not mandatory and depend on the market to be commercialised are: Halal, Kosher, No GMO, and Primus GFS.

Some stamps are important to keep in mind since there is a diversity of religions in Mexico. According to INEGI (in Spanish only) (PDF) 2020 the 4 main religious groups are: Catholics (97,864,218 people), Christians (14,095,307 people), Jews (58,876 people) and Muslims (7,982 people).

Labelling and packaging requirements

The Public agencies that advise on product labelling:

- Ministry of Economy

- Ministry of Health through COFEPRIS

- Federal Consumer Protection Agency

The Mexican regulatory framework for food is based on:

- General Health Law

- Regulation of Sanitary Control of Products and Services.

- Official Mexican Standard NOM-251-SSA1-2009 (in Spanish only), Hygienic practices for the processing of food, beverages or food supplements. Those are technical, mandatory standards issued by the competent agencies and are valid for 5 years.

Official Mexican Standards specific to the product being processed, for example:

- Official Mexican Standard NOM-194-SSA1-2004 (in Spanish only), applicable to establishments dedicated to the slaughter and dressing of animals for supply, storage, transport and sale.

- Official Mexican Standard NOM-213-SSA1-2002 (in Spanish only), applicable to processed meat products.

- Official Mexican Standard NOM-243-SSA1-2010 (in Spanish only), applicable to milk, milk formula, combined milk products and milk derivatives.

- Official Mexican Standard NOM-242-SSA1-2009 (in Spanish only), applicable to fresh, refrigerated, frozen and processed fishery products.

- Official Mexican Standard NOM-201-SSA1-2002 (in Spanish only), applicable to packaged and bulk water and ice for human consumption.

- Official Mexican Standard NOM-051-SCFI/SSA1-2010 (in Spanish only) (PDF), applicable for labeling for pre-packaged food and non-alcoholic beverages.

NOM-051 guarantees that marketed products comply with the commercial information that must be displayed on their label or packaging, in order to guarantee effective consumer protection. It does not apply to bulk products and products that have been packaged at the point of sale. The Ministry of Health standard establishes the commercial and sanitary information that these products must contain. It applies to all foreign and domestic products that are being commercialised in Mexico.

General Labelling mandatory requirement under NOM-051-SCFI/SSA1-2010 (in Spanish only) (PDF):

- Product Name/Product Description

- List of Ingredients

- Net Content/Drained Mass

- Companies Name and address (where the company tax number is registered)

- Country of origin

- Batch Number

- Expiration Date:

- The day and month for products with a maximum duration of three months

- The month and year for products with a duration of more than three months

- Nutritional Information

- Nutrient Content Statement

- Exporter's name and address

- Importer's name, address, and the RFC

- Manufacturer and Importer's Information

Considerations:

- The original label in English may remain on the package if an additional one in Spanish is affixed. Spanish content must be in a font size equal to or larger than those used for other languages.

- Products Sold in Multiple Packages: The information in NOM-051 indicates the data's location on the outer package, except for the batch number and the expiration date, displaying it on each package. Individual packages must include the statement "Not Labelled for Individual Sale."

- The labelling of certified organic products must include the organic certificate number, the identification number of the issuing Organic Certification Body, as well as stating that the product is free of genetically modified organisms, in accordance with the respective Mexican official standards and other applicable regulations.

On October 1, 2020, the NOM M-051-SCFI/SSA1-2010 (in Spanish only) (PDF) about food labelling regulations (in Spanish only) (PDF) came into force with the aim of warning the final consumer about the content of critical nutrients and ingredients that represent a health risk when consumed in excess.

Updates on the food and beverage labelling:

- Microjunk: small-size packages shall also bear warnings. It will be a single octagon with a number of stamps assigned to it.

- Sweeteners and caffeine: packaging in Mexico will also warn about the presence of these components and the recommendation that they should be avoided by children.

- Cartoons and cartoon characters: to attract children's attention will be prohibited.

The new labelling (in Spanish only) consists of 5 octagon-shaped warning seals, which clearly and simply indicate when a product contains excess nutrients and critical ingredients such as: calories, saturated fat, trans fat, sugar, and sodium, as well as 2 precautionary statements on caffeine and sweetener content, not recommended in children consumption. These seals are required to be included in front-of-package (FOP).

Description of above image

A series of five, separate, black octagonal seals in Spanish, with text noting "Excess calories", "Excess sodium", "Excess trans fats", "Excess sugars", and "Excess saturated fats". Underneath each octagon is the text "Secretaría de Salud", which is the Mexican Secretary of Health.

When the regulations are not met, PROFECO or COFEPRIS through verification visits will determine the corresponding administrative sanctions in accordance with the provisions of the Law of Metrology and Standardization (LFMN (in Spanish only) (PDF)). These could be a fine; temporary or definitive closure, which may be partial or total; arrest for up to thirty-six hours; suspension or revocation of the authorization, approval or registration as appropriate. In case of recidivism, the fine imposed for the previous infraction will be doubled without the total amount in each case exceeding twice the maximum amount set forth in Article 112A of the LFMN.

In order to monitor compliance with a NOM, the Consumer Protection Agency (PROFECO (in Spanish only) (PDF)) is responsible for conducting on-site inspections, verifying that manufacturers, importers or marketers of prepackaged food and non-alcoholic beverages marketed within Mexican territory comply with the commercial and sanitary information that must be included on the labelling or packaging, including the name or denomination of the food or non-alcoholic beverage.

Impact on current FTAs on Canadian food and beverage exporters

Under the terms of the current FTA's, preferential tariff treatment is granted to specified products and quantities. These provisions constitute a trade mechanism known as a “Tariff Preference Level” (TPL). The preferential rate of duty under this agreement TPL mechanism is the rate that would apply to the goods if they meet the country of origin requirements under the applicable agreement.

Within the current CUSMA framework, most Canadian agri-food products have duty-free access to Mexico, except for the following: eggs, poultry, dairy products and sugar. However, under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), some Canadian products that do not have preferential access under CUSMA, can be exported to Mexico duty free or with preferential duty under country-specific permanent tariff rate quotas established by Mexico. These products are:

- milk powder

- evaporated and condensed milk

- butter

- cheese

- dairy-based preparations

The Canada-Mexico Partnership (CMP) is a key mechanism for bilateral cooperation. It was established to support a dialogue between Canadian provinces and Mexican states to seek new trade and investment opportunities for the sector, therefore the importance of being aware of relevant updates on the subject.

6) Customs, Logistics, and Finance

a. Custom Process

The authorised custom broker plays an important role in the Mexican custom process, since they can carry out any business (exports or imports) into Mexico. According to ANAM there are 50 customs offices (in Spanish only), the main for land are Nuevo Laredo-Tamaulipas, Ciudad Juárez-Chihuahua, Tijuana-Baja California, for air are Mexico City, Guadalajara and Monterrey.

Mexican importers and exporters can also dispatch their goods through an authorised legal representative who meets certain technical requirements and who has a certain degree of experience. (International Trade Administration, 2022)

Only registered importers (in Spanish only) in Mexico in the “Padrón de Importadores” (registered in the Official Register of Importers) are allowed to import foreign goods. Given this, Canadian exporters should ensure that any companies they are dealing with in Mexico, meet this requirement.

b. Documentation

All import documents in Mexico should be submitted by a licensed Mexican customs broker. When preparing documents for submission to an importer, it is very important that those documents are error-free, since any inconsistencies in the documents may cause delays at the border, fines or even confiscation of the product.

The standard documents for exporting to Mexico are:

- Customs Declaration Form (Pedimento de Importación)

- Commercial Invoice

- Bill of lading / airway bill

- Packing list

- Documents that support compliance with the non-tariff regulations, if applicable

- Certificate of origin. The documents that prove the origin of the goods to apply the preferential duties.

- Compensatory rights, quotas, and or marks of the country of origin

- Weight or volume certificate issued by certified companies approved by the Government through the Tax Administration Service (SAT (in Spanish only)) in case of bulky imported goods via shipping.

Take into account that the documents may differ depending on the product.

c. Shipping Samples

The import requirements for food samples are typically similar to those for commercial sale, Including the followings:

- The unit value of the item must not exceed the equivalent in national currency of a dollar.

- The product must be marked, broken, punctured or treated in a manner that disqualifies them from sale or any use other than as samples.

- Food product samples are exempt from labelling requirements. Individual sample packages should contain the word “SAMPLE” on the package.

- Imported under the HS code 9806.00.01.

- Confirm shipping as not all service providers, such as DHL, can ship samples to Mexico

Documents:

- The commercial invoice should indicate no commercial value.

- Letter indicating the intended use of the product.

- Sanitary Permit.

d. Tariffs and taxes

As above noted, CUSMA regulatory framework establishes Tariff Preferences for specified products and quantities. Therefore, Canadian products can be exported to Mexico duty-free or with a preferential duty under country-specific permanent tariff rate quotas established by Mexico.

The government of Canada developed the Canada Tariff Finder platform where information about tariffs for specific products and countries where Canada has Free Trade Agreements can be found.

The Mexican tariff rates can be consulted in the General Import and Export Tax Law (LIGIE (in Spanish only) (PDF)). To further review, the Mexican government has created two mechanisms for obtaining tariff information: Tariffs and General Import and Export Taxes (TIGIE (in Spanish only)) and the Internet Tariff Information System (SIAVI 5.0 (in Spanish only)).

Mexico's Harmonized System is composed of 10 digits and are broken down into: Chapters (first 2 digits), Headings (first 4 digits), Subheadings (6 digits), Mexican HS Code (8 digits) and “trade identification numbers/TIN – in Número de Identificación Comercial/NICO,” (10 digits).

Moreover, according to the Federal Income Law, imports are subject to a customs procedure tax (DTA CDN$ 24.35). It varies in regard to the import regime of the goods and in some cases, it is calculated based on the value of the imports.

The most common tax inside Mexico is the Value Added Tax 16% applicable in central states in Mexico and a tax of 8% in south and north borders.

- North states that 8% of tax applies: Baja California, Sonora, Chihuahua, Coahuila, Nuevo León and Tamaulipas.

- South states that 8% of tax applies: Quintana Roo, Campeche, Chiapas and Tabasco.

In order to reduce the consumption of sugary foods and beverages, the Special Tax on Production and Services (IEPS) was approved. This establishes that products with sugar content greater than 15% will be taxed at a rate of 8%, while a product with a sugar content lower than 15% will be taxed at a rate of 5%.

e. Financing

The Trade Commissioner Service of Canada (TCS) has a generalized step-by-step guide to export, which contains a chapter on export financing, showing Canada's trade programs and what financial products/services are available to assist Canadian companies in international markets, including small and medium sized companies

Within the most commonly used export financing are the following:

- Factoring: technique in which a financial intermediary buys a company's receivables and advances cash to its business.

- Forfaiting: A method that allows exporters to obtain cash by selling their foreign receivables in the future with a discount to a finance company or bank.

- Lines of Credit: A loan that a bank or other financial institution provides to the customer, which has a maximum given amount of credit available and has to be repaid with an interest rate.

f. Insurance

Export Development Canada (EDC) offers insurance, guarantees and lending services to Canadian exporters and their international buyers.

The most common types of insurance for exporters are:

- Export credit insurance: protects against non-payment or in the event of receiving less than the agreed amount from the buyer.

- Shipping Insurance: insurance policy that responds in case the goods are damaged, endangered or stolen during transport.

- Exchange rate insurance: covers the possible depreciations that the currency-related product may suffer.

g. Risk Mitigation and due diligence

The evaluation of potential partners and buyers is essential for the successful management of risks in international trade. Careful investigation of a potential trading partner or establishment before signing any agreement or contract is highly recommended. To carry out due diligence, exporters should have access to resources (official documents) that offer insight into the company being evaluated.

Unlike Canada, it is not common to join a corporate credit bureau. Some Mexican companies that have international relations or large businesses abroad do so, however it is not the majority, so this type of document would not be part of dealing with due diligence in Mexico.

In Mexico, a reliable profile should provide assurance that the company is registered with the SAT and therefore has an RFC number. This number serves to validate the existence of the company, that it is registered with the government and is authorised to perform official procedures and documents needed to make commercial transactions. With this registration, it is possible to request the company to attach its tax compliance obligations obtained from article 32-D (in Spanish only) (PDF) of the Federal Fiscal Code, to demonstrate the company has no debts, or arrears, and has the appropriate tax documents.

Part of the due diligence process behind a good contract is knowledge of the public deed that provides the legal representative of the company as well as all the details of the agreement or contract, such as the parties, the conditions, the rights involved, forms of payment, among others. Another aspect that contributes to mitigating risks is to use factoring. This payment method is the most popular one, since it offers companies a relatively inexpensive and flexible form of short-term financing.

It is also highly recommended to use insurances such as the mentioned above. Especially in economic terms, exchange rate insurance can prevent any type of fluctuation, appreciation or depreciation by establishing a fixed exchange rate. It is also important to know that although Mexico recognizes and accepts different world currencies, the most common when making international transactions is U.S. dollars.

7) Summary Checklist

After all the analysis contained in previous pages on the important issues to consider, it may be helpful to summarize the main steps needed to support a successful product introduction to the Mexican market.

- Identify the Mexican tariff code of your product to verify if it has an import duty and the non-tariff restriction to enter, as well as FTA's facilities.

- Unless selling direct to a retailer, establish contact with a local distiributor and/or importer to work as a local agent and facilitate import requirements.

- Establish contact with a Mexican label verification unit or importer to understand the labelling requirements and modify your product/packaging based on the NOM-051 with the information in Spanish, and with the corresponding seals based on the nutritional values approved by COFEPRIS, to identify if it has excess sodium, sugar, fat, etc.

- Develop your export price based on the profit margin for your client in three levels, distributor (15% to 30%), supermarket chain (30% to 60%), and end customer remembering that in Mexico, the discount on the proposal is well appreciated. Keep taxes in mind, such as the VAT 16% (8% in the North and South border regions) and the IEPS tax that goes from 5% to 8% depending on the percentage of sugar contained in the product.

- Select the strategy for market promotion within a new market, it can be an exploratory trade mission with a small group of companies supported by government programmes. This strategy can be very useful as a market survey and making first contacts. Participating in a trade show like ANTAD could bring you closer to potential distributors and promote your company.

- Determine the type of channel (Retail, HORECA or other) to which your product is directed based on financial and production capacity, transport and distribution logistics, as well as the presentation of your product. Understand what the buyers from that channel are looking for, review your competitors and their offer. Identify your market niche and product's strengths.

- Prioritize states to start your market penetration strategy taking into account the states with the largest urban population, greater concentration of wealth and largest supermarkets and other stores with the ideal product categories for your products (imported, gourmet, organic, etc.)

- Choose the promotional event in which you will be participating in the following years depending on your budget, the geographical area in which you would like to penetrate, whether or not you already have a local partner, to generate brand presence, but, above all, confidence of the Mexican client.

- Map potential customers and buyers, which you can find through a trade mission, trade show, consultant or via the internet through specialized directories and start developing a first approach strategy: mailing campaign, phone call, etc.

- Contact associations and develop a specific proposal to them, and include elements that will increase their membership, such as discounts for members where a percentage is shared with the association, also consider including conferences in the association's events. It is advisable to participate with the association in expos, to promote your products.

- It is not advisable to start with distributors who are testing the market for the first time. Analyze customers with whom you can start selling your products. Dedicate time to develop the relationships. Create a follow-up program and visit Mexico for some meetings and take advantage of the good image of Canadian products.

- Contact a customs broker who specializes in your product and the customs office where your shipment will arrive.

- You may support and protect your foreign trade operations with factoring and make sure to ask your client or partner for their legal incorporation documents, legal power of attorney of their legal representative, proof of tax validation and their positive opinion before the Tax Authorities (SAT) to ensure the maximum legality of the company.

- Follow the guidelines of the guide for advertising products that are aimed at children under 12 years of age. Advertising on the sales floor is always more effective than on social networks, when you do not have the budget to do it on radio or television.

Finally, visit the market, businesses are mainly based on personal relationships with your potential customers and trade partners, so be prepared to invest time in establishing relationships and gaining the trust of the counterparty.

8) Annex

a. Additional information sources in Mexico

Government:

- Mexico's Ministry of Agriculture and Rural Development (SADER) (in Spanish only)

- National Department of Health, Food Safety and Food Quality (SENASICA) (in Spanish only)

- Federal Commission for the Protection against Sanitary Risks (COFEPRIS) (in Spanish only)

- Chamber of Commerce of Canada in Mexico (CANCHAM) (in Spanish only)

Associations:

- National Association of Food Manufacturers for Animal Consumption (ANFACA) (in Spanish only)

- National Association of Importers & Exporters of the Republic of Mexico (ANIERM) (in Spanish only)

- National Association of Industrial Oil & Edible Butters (ANIAME) (in Spanish only)

- National Association of Supermarkets and Department Stores (ANTAD) (in Spanish only)

- National Chamber of the Canned Food Industry (CANAINCA) (in Spanish only)

- National Association of Wholesale Grocers (ANAM) (in Spanish only)

- Mexican Association for Research in Natural Products (AMIPRONAT) (in Spanish only)

- Mexican Association of the Coffee Production Chain (AMECAFE) (in Spanish only)

- National Chamber of the Sugar and Alcohol Industry (CNIAA) (in Spanish only)

- National Chamber of the Bakery Industry (CANAINPA) (in Spanish only)

- National Chamber of the Restaurant & Seasoned Food Industry (CANIRAC) (in Spanish only)

- National Chamber of the Wheat Industry (CANIMOLT) (in Spanish only)

- National Union of Poultry (UNA) (in Spanish only)

- Mexican Meat Council (CoMeCarne) (in Spanish only)

b. Information Sources in Canada