Market overview

Smallest e-commerce market size for packaged food and beverages, as Mexican consumers appreciate the social aspect of grocery shopping in physical stores.

Mexico is only market where e-commerce share in packaged food and beverage has not reached 1% of total category sales.

Processed Fruit and Vegetables is the largest Canadian import category by Mexico.

E-commerce channel size registers tremendous growth, albeit rising from a very small base in 2015.

Note: Many consumers in Mexico were more resistant to the transition to e-commerce for a range of factors. These included concerns with security centered around safety of payment information on online portals and distrust regarding home delivery, which has translated to the popularity of click-and-collect options. Additionally, from a cultural standpoint, going to the grocery store multiple times a week is often seen as an important part of one's social life in Mexico, and it is difficult to replace that experience with an app or website.

| Metric | Value | Rank (of 10) |

|---|---|---|

| Total Packaged Food and Beverage Market in 2020 | Can$132.4 billion | 8th |

| E-commerce Channel Size of Total Packaged Food and Beverage in 2020 | Can$ 1.1 billion | 10th |

| E-commerce Channel Share of Total Packaged Food and Beverage in 2020 | 0.8% | 10th |

| Size of Canadian Packaged Food and Beverage Imports in 2019 | Can$458 million | 5th |

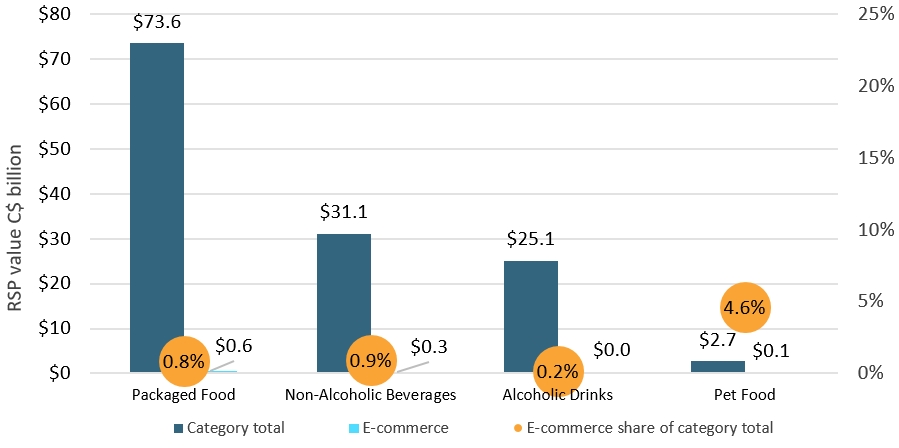

Description of above image

| Category | Category total | E-commerce | E-commerce share of category total |

|---|---|---|---|

| Packaged Food | $73.6 | $0.6 | 0.8% |

| Non-Alcoholic Beverages | $31.1 | $0.3 | 0.9% |

| Alcoholic Drinks | $25.1 | $0.0 | 0.2% |

| Pet Food | $2.7 | $0.1 | 4.6% |

Source: Euromonitor International

Leading import and e-commerce product categories

| Product Category | Imports from Canada (2019, Can$ million) | Historic CAGR* (2014-2019) |

|---|---|---|

| Processed Fruit and Vegetables | $129.4 | 21.8% |

| Ready Meals | $103.4 | 13.6% |

| Savoury Snacks | $82.1 | 14.0% |

| Chocolate and Confectionary | $44.7 | 5.5% |

| Processed Meat and Seafood | $42.6 | 13.7% |

| *CAGR: Compound Annual Growth Rate | ||

| Product Category | E-commerce Channel Sales (2020, Can$ million) | Share of E-commerce of all distribution (2020) | Historic E-commerce CAGR* (2015-2020) |

|---|---|---|---|

| Pet Food | $124.2 | 4.6% | 44.9% |

| Sauces, Dressings and Condiments | $124.0 | 2.8% | 34.9% |

| Carbonates | $120.4 | 0.9% | 26.0% |

| Dairy | $111.6 | 0.7% | 47.5% |

| Processed Meat and Seafood | $75.4 | 1.6% | 40.7% |

| *CAGR: Compound Annual Growth Rate | |||

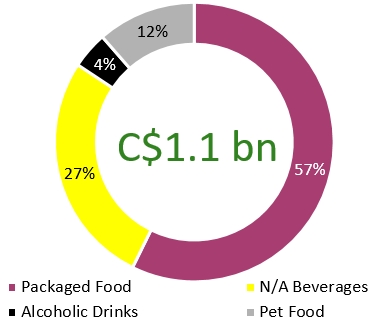

Industry split of packaged food and beverage e-commerce channel sales in Mexico (2020)

Description of above image

| Category | Packaged food and beverage e-commerce channel sales in Mexico |

|---|---|

| Packaged Food | 57% |

| Non-Alcoholic Beverages | 27% |

| Alcoholic Drinks | 4% |

| Pet Food | 12% |

| Total | Can$1.1 billion |

Larger format Carbonates/Bottled Water were sold via e-commerce in 2020 as Mexicans sought to stockpile amid times of limited mobility.

| Product Category | Value of Canadian imports by France (Can$ million) | E-commerce channel sales Can$ million | E-commerce channel share (%) of all distribution channels in 2020 |

|---|---|---|---|

| Beer | 0.4 | 37.8 | 0.8% |

| Spirits | 2.2 | 4.0 | 0.4% |

| Carbonates and Bottled Water | 5.0 | 120.0 | 0.9% |

| Hot Drinks | 1.0 | 18.9 | 0.7% |

| Confectionary | 44.7 | 81.0 | 2.8% |

| Pet Food | 17.0 | 124.2 | 4.6% |

| Processed Meat and Seafood | 42.6 | 75.4 | 1.6% |

| Processed Fruits and Vegetables | 129.4 | 47.1 | 3.3% |

| Ready Meals/ Food Preparations | 103.4 | 6.6 | 1.0% |

| Snack Foods | 82.1 | 17.3 | 0.3% |

| Dairy | 15.5 | 111.6 | 0.7% |

|

Source: Euromonitor International (e-commerce channel sales) and UN Comtrade (Canadian import data) |

|||

Sector snapshot

Packaged food

Packaged food was a strong beneficiary of the boost in e-commerce due to COVID-19. While independent grocery retailers (35.7% channel share) remained the leading channel in 2020, e-commerce was the channel to see the greatest uplift in growth, doubling in size vs. 2019 to reach Can$621 million in 2020.

As a consequence of COVID-19 stay-at-home regulations, sales of packaged food increased for those foods deemed essential such as bread, beans, tinned foods and rice, with consumers stockpiling goods with a long shelf life.

Non-alcoholic beverages

Third party retailers with their own e-commerce platforms and digital apps such as Rappi were success stories that drove growth in soft drinks e-commerce in Mexico in 2020. At the same time, major players leveraged their bulk water distribution networks to make home deliveries of other products, including carbonates and milk. Ordering channels became more diverse as a response, and also included phone orders and WhatsApp messages directly to the delivery staff.

Alcoholic drinks

General stockpiling of alcohol at the start of the pandemic expanded to online ordering so that producers of alcoholic beverages, alcoholic drinks specialist stores, and grocery retailers all saw their e-commerce sales of alcohol spike.

Sales through last mile delivery services, such as Rappi, also increased dramatically. However, e-commerce for alcoholic drinks remains incredibly low at less than Can$50 million in channel sales in 2020, only larger than countries such as India and South Korea that completely prohibit the sale of alcohol online.

Pet food

Pet food is the only industry where e-commerce channel share exceeds 1% in 2020, but the 4.6% share ranks 10th among the 10 countries under review. E-commerce continues to grow steadily in Mexico as retailers such as Amazon create more trust in online sales among consumers who appreciate the convenience of e-commerce.

In general, online consumers are more tech-savvy and better educated, thus boosting premium pet food demand, particularly as pure e-commerce retailers tend to offer a wide product range.

Industry dynamics and opportunities

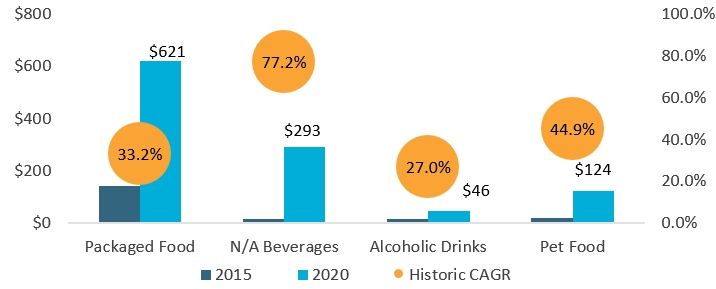

E-commerce size and growth

Description of above image

| Market | 2015 | 2020 | Historic CAGR* |

|---|---|---|---|

| Packaged Food | $141 | $621 | 33.2% |

| Non-Alcoholic Beverages | $16 | $293 | 77.2% |

| Alcoholic Drinks | $17 | $46 | 27.0% |

| Pet Food | $19 | $124 | 44.9% |

| *CAGR: Compound Annual Growth Rate | |||

Source: Euromonitor International

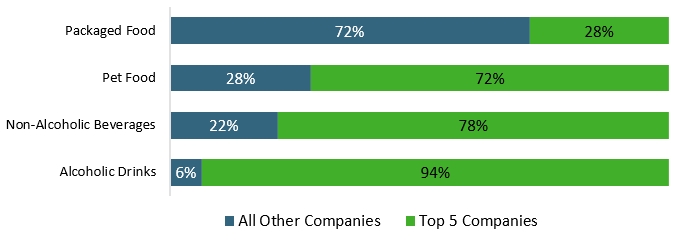

Competitive environment

Description of above image

| Category | All Other Companies | Top 5 Companies |

|---|---|---|

| Packaged Food | 72% | 28% |

| Pet Food | 28% | 72% |

| Non-Alcoholic Beverages | 22% | 78% |

| Alcoholic Drinks | 6% | 94% |

Source: Euromonitor International

Key e-commerce websites

| Rank (SKUs[1] on Via) | Packaged Food | Non-Alcoholic Beverages | Alcoholic Drinks | Pet Food |

|---|---|---|---|---|

| 1 | Chedraui (7.3 thousand SKUs) | Amazon (2.1 thousand) | Amazon (1.7 thousand) | Maskota (10.6 thousand) |

| 2 | La Comer en Tu Casa (6.9 thousand) | Chedraui (1.6 thousand) | Chedraui (1.5 thousand) | Amazon (9.6 thousand) |

| 3 | Walmart (6.3 thousand) | La Comer en Tu Casa (1.5 thousand) | La Comer en Tu Casa (1.0 thousand) | Mercado Libre (1.6 thousand) |

| 4 | H-E-B (4.7 thousand) | Walmart (1.3 thousand) | El Palacio de Hierro (0.9 thousand) | Walmart (0.3 thousand) |

| 5 | Amazon (4.5 thousand) | Superama (0.8 thousand) | Linio (0.8 thousand) | La Comer en Tu Casa (0.3 thousand) |

|

1: SKU data comes from Euromonitor International's proprietary Via data extraction tool, and was extracted in March 2021 |

||||

Key highlights for Canadian producers

Packaged food

A new labelling regulation that came into force in October 2020 requires the use of black seals to clearly identify products high in sugar, calories, sodium or fat, and this is expected to increase consumer focus on health.

Non-alcoholic beverages

Bottled water, juice and concentrates saw a strong performance during the pandemic, while RTD tea and coffee sales declined due to their higher price points and unessential status.

Alcoholic drinks

Extremely consolidated market with AB InBev and Heineken accounting for 90%+ share; approximately the same value of maple syrup as distilled spirits was exported from Canada to Mexico in 2019 (Can$2.1 million).

Pet food

Maskota offers more SKUs for pet food than Amazon. Additionally, new pure play pet care websites such as Petsy and Petngo are emerging as well.