Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

In 2021, Canada ranked the eighth largest exporter of dog and cat food in the world, and the largest exporter of dog and cat food to China. Meanwhile, China was the second largest importer from Canada.

In 2021, the global pet food market had a retail value of US$114.9 billion. China was ranked the second largest market in the world, reaching US$7.5 billion in 2021. That represents a 23.2% increase in the compound annual growth rate (CAGR) over the 2017-2021 period. Retail pet food sales in China are expected to grow to US$14.3 billion in 2026 at a CAGR of 15.3%.

Current value sales of cat food grew by 30.8% (CAGR, 2017 to 2021) to US$4.1 billion. Cat treats and mixers was the most dynamic category in 2021 with a CAGR of 62.4% during that period.

Retail sales of dog food reached US$3.4 billion in 2021, a CAGR of 16.6% from 2017 to 2021. Economy wet dog food had the best performance in 2021 with a CAGR of 23.4% from 2017 to 2021.

The top three players in the cat food sector (Mars Inc, Nestlé SA and Champion Petfoods LP) accounted for 14.4% of the market share in 2021, ahead of other competitors. The top three players in the dog food sector (Mars Inc, Huaxing Pet Food Co Ltd and Yantai China Pet Foods Co Ltd) had a market share of 15.1% in 2021.

The share of e-commerce in pet food is the highest among all distribution channels because many pet owners are young people who are familiar with online shopping. It is likely to continue to see share expansion.

From 2017 to 2021, 1,673 pet food products were launched in China. The number of yearly product launches declined by a CAGR of 9.1% from the larger launch of 386 pet products in 2017 to the lower and most recent launch of 263 pet products in 2021.

Trade overview

The world's top 10 dog and cat food importers in 2021 are all located in Western Europe and North America, with the exception of Japan. Canada was the fifth largest importer of dog and cat food, reaching US$1.1 billion in 2021. China was the 11th largest importer of dog and cat food, with sales of US$581.7 million in 2021.

| Geography | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 | Share % in 2021 |

|---|---|---|---|---|---|---|---|

| World | 12,834.5 | 14,122.5 | 15,007.4 | 17,586.1 | 20,440.5 | 12.3 | 100.0 |

| Germany | 1,348.3 | 1,465.2 | 1,514.7 | 1,684.4 | 1,969.9 | 9.9 | 9.6 |

| United States | 842.9 | 982.3 | 1,027.9 | 1,231.7 | 1,535.0 | 16.2 | 7.5 |

| Poland | 440.1 | 570.1 | 695.5 | 988.3 | 1,149.2 | 27.1 | 5.6 |

| United Kingdom | 845.1 | 878.8 | 927.3 | 1,006.1 | 1,122.7 | 7.4 | 5.5 |

| Canada | 668.1 | 683.1 | 799.9 | 898.2 | 1,064.1 | 12.3 | 5.2 |

| France | 683.3 | 701.4 | 719.9 | 902.0 | 1,053.1 | 11.4 | 5.2 |

| Italy | 612.1 | 630.5 | 677.4 | 705.0 | 847.8 | 8.5 | 4.1 |

| Netherlands | 536.5 | 637.9 | 610.7 | 699.2 | 776.8 | 9.7 | 3.8 |

| Belgium | 587.8 | 504.9 | 513.2 | 657.1 | 731.9 | 5.6 | 3.6 |

| Japan | 618.9 | 643.5 | 646.1 | 673.7 | 701.7 | 3.2 | 3.4 |

| China | 89.2 | 206.4 | 307.9 | 621.4 | 581.7 | 59.8 | 2.8 |

| Austria | 391.3 | 438.1 | 454.0 | 548.3 | 580.1 | 10.3 | 2.8 |

| Spain | 311.6 | 335.4 | 366.9 | 435.0 | 511.6 | 13.2 | 2.5 |

| Australia | 245.5 | 281.7 | 309.5 | 333.9 | 421.7 | 14.5 | 2.1 |

| Russia | 289.2 | 315.0 | 351.0 | 387.9 | 406.4 | 8.9 | 2.0 |

|

Source: Global Trade Tracker, 2022 *CAGR: compound annual growth rate HS Code: 230910 |

|||||||

In 2021, Canada ranked the eighth largest exporter of dog and cat food in the world, exporting US$840.2 million worth of dog and cat food, representing a 4.0% share of the total global exports of dog and cat food. Canada was also the largest exporter of dog and cat food to China in 2021, with a 38.5% market share. Meanwhile, China ranked the second largest importer from Canada, received 21.7% (US$182.0 million) of Canadian dog and cat food exports in 2021 with a 21.7% CAGR from 2017 to 2021.

| Geography | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 | Share % in 2021 |

|---|---|---|---|---|---|---|---|

| World | 102.1 | 168.2 | 257.0 | 459.5 | 472.2 | 46.6 | 100.0 |

| Canada | 8.2 | 33.3 | 84.5 | 172.5 | 182.0 | 116.8 | 38.5 |

| United States | 6.5 | 5.9 | 11.2 | 32.7 | 73.0 | 82.7 | 15.5 |

| New Zealand | 7.2 | 15.2 | 29.1 | 60.5 | 71.2 | 77.1 | 15.1 |

| Thailand | 24.7 | 49.3 | 49.7 | 55.9 | 56.5 | 23.0 | 12.0 |

| Hong Kong | 34.7 | 42.8 | 52.2 | 94.9 | 31.6 | −2.3 | 6.7 |

| Others | 20.7 | 21.8 | 30.3 | 43.1 | 58.0 | −2.3 | 12.3 |

|

Source: Global Trade Tracker, 2022 *CAGR: compound annual growth rate HS Code: 230910 |

|||||||

| Geography | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 | Share % in 2021 |

|---|---|---|---|---|---|---|---|

| World | 525.2 | 531.1 | 598.7 | 754.2 | 840.2 | 12.5 | 100.0 |

| United States | 228.1 | 244.8 | 248.5 | 293.4 | 333.7 | 10.0 | 39.7 |

| China | 8.2 | 33.3 | 84.5 | 172.5 | 182.0 | 116.8 | 21.7 |

| South Korea | 16.2 | 13.3 | 16.5 | 17.9 | 29.2 | 15.7 | 3.5 |

| Hong Kong | 22.7 | 14.4 | 12.4 | 29.2 | 21.8 | −0.9 | 2.6 |

| Japan | 23.5 | 23.7 | 17.2 | 16.7 | 21.5 | −2.3 | 2.6 |

| Russia | 40.4 | 35.0 | 40.1 | 32.3 | 20.3 | −15.8 | 2.4 |

| Spain | 12.0 | 10.2 | 13.8 | 14.2 | 19.3 | 12.6 | 2.3 |

| Netherlands | 9.2 | 8.2 | 12.6 | 12.6 | 18.9 | 19.5 | 2.2 |

| New Zealand | 14.9 | 15.6 | 15.9 | 16.1 | 16.3 | 2.1 | 1.9 |

| Taiwan | 10.6 | 13.4 | 14.6 | 14.5 | 14.8 | 8.7 | 1.8 |

|

Source: Global Trade Tracker, 2022 *CAGR: compound annual growth rate HS Code: 230910 |

|||||||

Pet food market overview

Immunity and digestion

The outbreak of the COVID-19 pandemic intensified consumer interest in products that promise to support immunity and enlightened many people about the link between gut flora and overall health. This heightened level of understanding about immunity and gut health influenced the way pet owners feel about the products they choose for their pets. According to Mintel's survey in 2020, 73% of pet owners in China look for pet foods that improve immunity, 59% for digestive support (Mintel, 2022).

Pet humanization

The continuing trend in Asia towards pet humanization, where pets are adored and regarded as companions, friends and members of the family, is driving interest in foods that can help to prevent lifestyle illnesses and diseases. (Mintel, 2021). The developing pet humanization trend is also leading to Chinese consumer health awareness starting to influence pet food too. Pet owners are showing a growing willingness to pay more for pet food if they perceive it will make their pet companion's life happier and more comfortable (Euromonitor International, 2021).

In 2021, the global pet food market had a retail value of US$114.9 billion. China was ranked the second largest market in the world, reaching US$7.5 billion in 2021, for an increase by a CAGR of 23.3% (2017-2021). Pet food retail sales in China are expected to grow to US$14.3 billion in 2026 at a CAGR of 15.3%.

| Geography | 2017 | 2021 | CAGR* % 2017-2021 | 2022 | 2026 | CAGR* % 2022-2026 |

|---|---|---|---|---|---|---|

| World | 87,761.0 | 114,942.0 | 7.0 | 123,637.8 | 165,424.7 | 7.6 |

| United States | 31,741.4 | 42,731.4 | 7.7 | 45,438.9 | 56,761.1 | 5.7 |

| China | 3,235.0 | 7,472.2 | 23.3 | 8,081.6 | 14,303.1 | 15.3 |

| Brazil | 5,161.7 | 5,645.8 | 2.3 | 6,890.9 | 12,154.3 | 15.2 |

| United Kingdom | 4,605.3 | 5,322.6 | 3.7 | 5,515.2 | 6,664.6 | 4.8 |

| Japan | 4,048.9 | 4,688.8 | 3.7 | 5,119.8 | 5,651.1 | 2.5 |

| Germany | 3,856.8 | 4,655.1 | 4.8 | 4,815.9 | 6,054.5 | 5.9 |

| France | 3,855.4 | 4,395.7 | 3.3 | 4,486.0 | 5,552.5 | 5.5 |

| Canada | 2,736.4 | 3,560.2 | 6.8 | 3,744.0 | 5,269.4 | 8.9 |

| Italy | 2,805.9 | 3,239.3 | 3.7 | 3,322.2 | 4,195.0 | 6.0 |

| Australia | 2,565.0 | 2,982.6 | 3.8 | 3,141.3 | 3,715.7 | 4.3 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Pet population and ownership

In China, the cat and dog populations increased by CAGRs of 8.9% and 2.9% respectively, from 2017 to 2021. There were 4.5% more cats than dogs in 2021. Dogs have been losing popularity in recent years and COVID-19 merely reinforced this, leading to negative growth of the dog population in 2020 and 2021 (Euromonitor International, 2021). The cat and dog populations will grow to 114.9 million and 95.9 million respectively in 2026.

| Category | 2017 | 2021 | CAGR* % 2017-2021 | 2022 | 2026 | CAGR* % 2022-2026 |

|---|---|---|---|---|---|---|

| Cats | 68,525.9 | 96,306.0 | 8.9 | 100,273.8 | 114,917.5 | 3.5 |

| Dogs | 82,204.2 | 92,162.5 | 2.9 | 92,651.9 | 95,883.2 | 0.9 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Retail sales by category in China

Cat food

Current value sales of cat food grew by 30.8% (CAGR, 2017 to 2021) to US$4.1 billion. Cat treats and mixers was the most dynamic category in 2021 with a CAGR of 62.4% from 2017 to 2021. Chinese customers spent US$2.7 billion on dry cat food and US$1.2 billion on wet cat food in 2021. They spent more money buying mid-priced dry cat food (US$1.7 billion in 2021) than premium dry cat food (US$839.9 million) and economy dry food (US$118.2 million). They also spent more money buying mid-priced wet cat food (US$878.6 million in 2021) than premium (US$290.4 million) and economy wet food (US$41.4 million).

High protein and genuine meat have become the main theme for cat food in China. The preference for high protein in human food has been transmitted to pet food, under the prevailing humanization trend. International brands like Orijen and Go have increased Chinese cat owners' awareness that cats need animal protein, genuine meat to sustain health. Therefore, products with a high animal protein content, either adopting genuine meat or mixed with meat powder for the sake of cost control, have been popular in China's cat food market (Euromonitor International, 2021).

Wet cat food and treats are expected to continue registering robust growth in the next five years (2022-2026) as cat owners want their cats to take in enough moisture to stay healthy and they also enjoy interacting with their cats by feeding them treats. In the future, wet cat food is likely to witness continuous upgrading, which means it is nutritious enough to replace dried cat food. Treats with specific functions that are closely linked to the well-being of cats, such as oral care and fur digestion, are also likely to gain popularity (Euromonitor International, 2021).

| Category | 2017 | 2021 | CAGR* % 2017-2021 | 2022 | 2026 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|

| Cat food | 1,393.2 | 4,076.4 | 30.8 | 4,688.3 | 9,663.7 | 19.8 |

| Cat treats and mixers | 30.6 | 213.0 | 62.4 | 239.3 | 387.3 | 12.8 |

| Dry cat food | 963.3 | 2,653.1 | 28.8 | 3,117.4 | 6,888.3 | 21.9 |

| Economy dry cat food | 43.1 | 118.2 | 28.7 | 134.3 | 261.1 | 18.1 |

| Mid-priced dry cat food | 650.5 | 1,695.0 | 27.1 | 1,936.0 | 4,199.9 | 21.4 |

| Premium dry cat food | 269.8 | 839.9 | 32.8 | 1,047.1 | 2,427.3 | 23.4 |

| Wet cat food | 399.2 | 1,210.4 | 32.0 | 1,331.6 | 2,388.1 | 15.7 |

| Economy wet cat food | 14.6 | 41.4 | 29.8 | 43.4 | 69.6 | 12.5 |

| Mid-priced wet cat food | 294.2 | 878.6 | 31.5 | 960.3 | 1,675.1 | 14.9 |

| Premium wet cat food | 90.5 | 290.4 | 33.8 | 327.9 | 643.4 | 18.4 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Dog food

Retail sales of dog food reached US$3.4 billion in 2021, with a CAGR of 16.6% from 2017 to 2021. Economy wet dog food had the best performance in 2021 with a CAGR of 23.4% from 2017 to 2021. Mid-priced food led sales in dry dog food (US$1.6 billion in 2021) with a 15.3% CAGR from 2017 to 2021. Mid-priced wet food led sales in wet dog food (US$86.4 million in 2021) with a 21.5% CAGR from 2017 to 2021.

Freeze-dried and air-dried kibble are likely to remain popular because they maintain rich nutrition and taste. In 2020, freeze-dried products demonstrated strong resilience against the epidemic and continued expanding digital shelf space, based on Euromonitor's Via tracking tool. Another technology that is also gaining popularity is air-drying, which is similar to freeze-drying in terms of maintaining flavour and nutrition. In future, the demand for these two technologies is likely to remain dynamic (Euromonitor International, 2021).

| Category | 2017 | 2021 | CAGR* % 2017-2021 | 2022 | 2026 | CAGR* % 2022-2026 |

|---|---|---|---|---|---|---|

| Dog food | 1,830.4 | 3,381.9 | 16.6 | 3,379.8 | 4,623.1 | 8.1 |

| Dog treats and mixers | 175.5 | 405.1 | 23.3 | 398.3 | 572.5 | 9.5 |

| Dry dog food | 1,604.1 | 2,864.6 | 15.6 | 2,870.9 | 3,911.0 | 8.0 |

| Economy dry dog food | 120.3 | 208.9 | 14.8 | 210.0 | 285.5 | 8.0 |

| Mid-priced dry dog food | 905.5 | 1,602.6 | 15.3 | 1,589.2 | 2,068.8 | 6.8 |

| Premium dry dog food | 578.4 | 1,053.1 | 16.2 | 1,071.7 | 1,556.7 | 9.8 |

| Wet dog food | 50.7 | 112.1 | 21.9 | 110.6 | 139.5 | 6.0 |

| Economy wet dog food | 4.1 | 9.5 | 23.4 | 9.5 | 12.3 | 6.7 |

| Mid-priced wet dog food | 39.6 | 86.4 | 21.5 | 85.0 | 106.4 | 5.8 |

| Premium wet dog food | 7.0 | 16.2 | 23.3 | 16.2 | 20.9 | 6.6 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Company shares

The top three players in the cat food sector (Mars Inc, Nestlé SA and Champion Petfoods LP) captured 14.4% market share in 2021, ahead of other competitors. However, Mars Inc had a negative CAGR of −4.5% from 2017 to 2021. Petcurean Pet Foods Ltd had the highest CAGR at 39.2% over the past five years.

Domestic cat food was considered low quality five years ago, but is now catching up, providing quality products. They are benchmarking international brands such as Orijen and Go, which offer high animal protein content but at lower prices and therefore offer high value for money. For example, domestic brand NetEase has launched dry cat food that has a similar ingredient list to Go and provides detailed information about recipes and raw material suppliers to guarantee the utmost transparency to consumers, while its unit price is only around 70% of Go. It is therefore widely recognized by local consumers and has the potential to be an important player in the mid-priced dry cat food market (Euromonitor International, 2021).

| Company Name | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|

| Mars Inc | 10.6 | 9.4 | 8.3 | 8.1 | 8.8 | −4.5 |

| Nestlé SA | 2.7 | 2.7 | 2.8 | 3.1 | 3.1 | 3.5 |

| Champion Petfoods LP | 0.8 | 2.1 | 2.3 | 2.3 | 2.5 | 33.0 |

| Rongxi Pet Food Co Ltd | 2.3 | 2.0 | 1.7 | 1.5 | 2.1 | −2.2 |

| Yantai China Pet Foods Co Ltd | 1.3 | 1.3 | 1.3 | 1.6 | 1.7 | 6.9 |

| Shanghai Bridge Petcare Co Ltd | 3.0 | 2.7 | 1.8 | 1.8 | 1.7 | −13.2 |

| Shanghai Enova Pet Products Co Ltd | 1.2 | 1.4 | 1.5 | 1.6 | 1.7 | 9.1 |

| Petcurean Pet Foods Ltd | 0.4 | 0.8 | 1.3 | 2.6 | 1.5 | 39.2 |

| Inaba Pet Food Co Ltd | 0.5 | 0.9 | 1.1 | 1.1 | 1.1 | 21.8 |

| Gambol Pet Group Co Ltd | 0.4 | 0.5 | 0.6 | 1.2 | 1.0 | 25.7 |

| Others | 76.8 | 76.2 | 77.3 | 75.1 | 74.8 | −0.7 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

The top three players in the dog food sector (Mars Inc, Huaxing Pet Food Co Ltd and Yantai China Pet Foods Co Ltd) had 15.1% market share in 2021, ahead of other competitors. However, Mars Inc had a negative CAGR of −11.2% from 2017 to 2021. Yantai China Pet Foods Co Ltd and Gambol Pet Group Co Ltd had the highest CAGR at 23.6% over the past five years.

Domestic players, such as Gambol Pet Food Group and Yantai China Pet Foods Co, transformed from original equipment manufacturers (OEMs) to dog food brand owners. Instead of being OEMs in China, the two companies dedicated themselves to becoming brand owners by promoting their own brands, Myfoodie and Wanpy, respectively. From 2017 to 2020, the two companies' sales almost tripled and they are aiming to become China's "pride in pet food" (Euromonitor International, 2021).

| Company Name | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|

| Mars Inc | 11.1 | 9.5 | 8.4 | 7.2 | 6.9 | −11.2 |

| Huaxing Pet Food Co Ltd | 2.5 | 2.9 | 3.0 | 3.8 | 5.4 | 21.2 |

| Yantai China Pet Foods Co Ltd | 1.2 | 1.4 | 1.7 | 2.2 | 2.8 | 23.6 |

| Shanghai Bridge Petcare Co Ltd | 8.3 | 6.1 | 3.3 | 2.8 | 2.6 | −25.2 |

| Nestlé SA | 3.2 | 2.9 | 2.4 | 2.3 | 2.5 | −6.0 |

| Shanghai Enova Pet Products Co Ltd | 1.1 | 1.4 | 1.7 | 2.0 | 2.5 | 22.8 |

| Navarch Pet's Material Co Ltd | 2.6 | 2.2 | 2.0 | 2.0 | 2.0 | −6.3 |

| Tianjin Canpo Hi Tech Development Co Ltd | 1.2 | 1.2 | 1.0 | 1.0 | 1.0 | −4.5 |

| Xuzhou Suchong Pet Product Co Ltd | 1.1 | 1.7 | 2.2 | 1.4 | 0.8 | −7.7 |

| Gambol Pet Group Co Ltd | 0.3 | 0.4 | 0.5 | 1.1 | 0.7 | 23.6 |

| Others | 67.4 | 70.3 | 73.8 | 74.2 | 72.8 | 1.9 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Brand shares

Royal Canin by Mars Inc is the top brand in cat food (5.9% share in 2021), followed by Orijen by Champion Petfoods LP (2.5% share) and Whiskas by Mars Inc (2.2% share). Orijen saw the biggest CAGR of 33.0% from 2016 to 2020.

| Brand | Company | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|---|

| Royal Canin | Mars Inc | 5.5 | 5.5 | 5.1 | 5.3 | 5.9 | 1.8 |

| Orijen | Champion Petfoods LP | 0.8 | 2.1 | 2.3 | 2.3 | 2.5 | 33.0 |

| Whiskas | Mars Inc | 4.2 | 3.1 | 2.5 | 2.3 | 2.2 | −14.9 |

| Wanpy | Yantai China Pet Foods Co Ltd | 1.3 | 1.3 | 1.3 | 1.6 | 1.7 | 6.9 |

| Fa Pure & Natural | Shanghai Enova Pet Products Co Ltd | 1.2 | 1.4 | 1.5 | 1.6 | 1.7 | 9.1 |

| Bridge | Shanghai Bridge Petcare Co Ltd | 2.8 | 2.5 | 1.7 | 1.7 | 1.6 | −13.1 |

| Petcurean Go! | Petcurean Pet Foods Ltd | 0.4 | 0.8 | 1.3 | 2.6 | 1.5 | 39.2 |

| Pro Plan | Nestlé SA | 0.5 | 0.7 | 0.9 | 1.2 | 1.3 | 27.0 |

| Ciao | Inaba Pet Food Co Ltd | 0.5 | 0.9 | 1.1 | 1.1 | 1.1 | 21.8 |

| Fancy Feast/Gourmet | Nestlé SA | 0.6 | 0.8 | 0.9 | 1.1 | 1.0 | 13.6 |

| Others | Others | 82.2 | 80.9 | 81.4 | 79.2 | 79.5 | −0.8 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||||||

Royal Canin by Mars Inc is also the leading brand in dog food (4.1% share in 2021), followed by Lilang by Huaxing Pet Food Co Ltd (2.9% share) and Wanpy by Yantai China Pet Foods Co Ltd (2.8% share). Leading domestic players occupy over half of the top 10 places in dog food and their shares increased in 2021. Their constant innovation, multi-brand strategies and constant public exposure are likely to foster their further expansion in the future (Euromonitor International, 2021).

| Brand name | Company name | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|---|

| Royal Canin | Mars Inc | 5.8 | 5.3 | 4.8 | 4.2 | 4.1 | −8.3 |

| Lilang | Huaxing Pet Food Co Ltd | 1.4 | 1.5 | 1.6 | 2.0 | 2.9 | 20.0 |

| Wanpy | Yantai China Pet Foods Co Ltd | 1.2 | 1.4 | 1.7 | 2.2 | 2.8 | 23.6 |

| Odin | Huaxing Pet Food Co Ltd | 1.1 | 1.3 | 1.4 | 1.8 | 2.5 | 22.8 |

| Fa Pure & Natural | Shanghai Enova Pet Products Co Ltd | 1.1 | 1.4 | 1.7 | 2.0 | 2.5 | 22.8 |

| Pedigree | Mars Inc | 3.2 | 2.6 | 2.3 | 2.1 | 2.2 | −8.9 |

| Navarch | Navarch Pet's Material Co Ltd | 2.6 | 2.2 | 2.0 | 2.0 | 2.0 | −6.3 |

| Bridge | Shanghai Bridge Petcare Co Ltd | 5.7 | 4.4 | 2.4 | 2.1 | 1.9 | −24.0 |

| Pro Plan | Nestlé SA | 1.6 | 1.5 | 1.4 | 1.6 | 1.9 | 4.4 |

| Crazydog | Xuzhou Suchong Pet Product Co Ltd | 1.1 | 1.7 | 2.2 | 1.4 | 0.8 | −7.7 |

| Others | Others | 75.2 | 76.7 | 78.5 | 78.6 | 76.4 | 0.4 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||||||

Distribution channels

E-commerce accounted for the majority of pet food retail sales in China (60.9% market share), while store-based retailing and non-retail channels accounted for the remainder in 2021. The market share of most distribution channels, whether categorized as store-based or non-store based retailing, increased at varying CAGRs between 2017 to 2021. And e-commerce increased by the largest CAGR (34.9%) in all channels, from a 42.5% market share recorded in 2017.

The share of e-commerce in pet food is the highest among all distribution channels because many pet owners are young people who are familiar with purchasing online. It is likely to continue to see share expansion.

| Outlet type | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|

| Store-based retailing | 1,573.2 | 1,874.5 | 2,001.8 | 2,083.1 | 2,212.0 | 8.9 |

| Grocery retailers | 355.4 | 408.8 | 420.1 | 364.3 | 354.9 | 0.0 |

| Modern grocery retailers | 352.9 | 406.3 | 417.6 | 362.1 | 352.8 | 0.0 |

| Hypermarkets | 258.9 | 302.7 | 313.5 | 276.2 | 271.4 | 1.2 |

| Supermarkets | 94.0 | 103.6 | 104.1 | 85.9 | 81.4 | −3.5 |

| Traditional grocery retailers | 2.5 | 2.5 | 2.5 | 2.3 | 2.1 | −4.3 |

| Non-grocery specialists | 1,217.8 | 1,465.7 | 1,581.7 | 1,718.7 | 1,857.1 | 11.1 |

| Pet shops | 1,171.4 | 1,408.0 | 1,530.4 | 1,689.2 | 1,835.0 | 11.9 |

| Other non-grocery specialists | 46.5 | 57.7 | 51.3 | 29.5 | 22.1 | −17.0 |

| Non-store retailing | 1,374.7 | 1,959.8 | 2,611.3 | 3,536.7 | 4,550.3 | 34.9 |

| E-commerce | 1,374.7 | 1,959.8 | 2,611.3 | 3,536.7 | 4,550.3 | 34.9 |

| Non-retail channels | 287.1 | 436.1 | 538.1 | 563.5 | 709.9 | 25.4 |

| Veterinary clinics | 287.1 | 436.1 | 538.1 | 563.5 | 709.9 | 25.4 |

| Total | 3,235.0 | 4,270.4 | 5,151.3 | 6,183.3 | 7,472.2 | 23.3 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Product launch analysis

From 2017 to 2021, a total of 1,673 pet food products were launched in China. The number of yearly product launches declined in growth by a CAGR of 9.1% from the larger launch of 386 pet products in 2017 to the lower and most recent launch of 263 pet products in 2021. Dog snacks & treats, cat snacks & treats, and cat food dry were the top categories of newly released pet food product launches while no additives/preservatives, other (functional pet) and functional pet - digestion were top claims associated with new pet food products released during the prescribed period.

| Product attributes | Yearly launch count | ||||

|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Yearly product launches | 386 | 321 | 329 | 338 | 263 |

| Top five categories | |||||

| Dog snacks and treats | 128 | 99 | 101 | 112 | 97 |

| Cat snacks and treats | 42 | 42 | 89 | 107 | 58 |

| Cat food dry | 46 | 66 | 58 | 58 | 63 |

| Dog food dry | 79 | 51 | 27 | 39 | 35 |

| Cat food wet | 63 | 34 | 37 | 14 | 7 |

| Top five claims | |||||

| No additives/preservatives | 157 | 117 | 113 | 120 | 111 |

| Other (functional pet) | 184 | 135 | 84 | 76 | 43 |

| Functional pet - digestion | 136 | 109 | 87 | 93 | 71 |

| Skin and coat (functional pet) | 178 | 116 | 70 | 76 | 44 |

| Vitamin/mineral fortified | 100 | 111 | 83 | 100 | 65 |

| Top five price groups (US dollars) | |||||

| 0.43 - 4.42 | 226 | 168 | 160 | 92 | 47 |

| 4.43 - 8.42 | 82 | 69 | 95 | 129 | 65 |

| 8.43 - 12.42 | 27 | 19 | 38 | 46 | 54 |

| 12.43 - 16.42 | 28 | 25 | 21 | 38 | 25 |

| 16.43 - 23.00 | 18 | 25 | 12 | 19 | 36 |

| Top five launch types | |||||

| New variety/range extension | 146 | 125 | 162 | 140 | 112 |

| New product | 155 | 131 | 122 | 137 | 127 |

| New packaging | 66 | 50 | 37 | 48 | 20 |

| Relaunch | 11 | 9 | 8 | 10 | 0 |

| New formulation | 8 | 6 | 0 | 3 | 4 |

| Top five flavours (including blend) | |||||

| Chicken | 54 | 47 | 50 | 42 | 46 |

| Unflavoured/plain | 70 | 54 | 40 | 31 | 17 |

| Beef | 44 | 31 | 34 | 22 | 17 |

| Tuna | 14 | 15 | 18 | 17 | 8 |

| Salmon | 8 | 7 | 21 | 15 | 11 |

| Top five ingredient preparations | |||||

| Powdered | 167 | 140 | 121 | 159 | 134 |

| Meal | 53 | 32 | 41 | 53 | 51 |

| Pulp | 41 | 39 | 50 | 47 | 39 |

| Frozen | 18 | 19 | 23 | 38 | 85 |

| Hydrolyzed | 29 | 34 | 43 | 29 | 26 |

| Source: Mintel, 2022 | |||||

Product examples

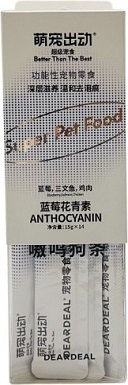

Blueberry, Salmon and Chicken Functional Dog Snack

Source: Mintel, 2022

| Company | Chong Ai Information Technology |

|---|---|

| Brand | Dear Deal Super Pet Food |

| Category | Pet food |

| Sub-category | Dog snacks and treats |

| Store name | Tmall |

| Store type | Internet / mail order |

| Date published | May 2022 |

| Launch type | New product |

| Price in local currency | CNY69.80 |

| Price in US dollars | 10.56 |

Dear Deal Super Pet Food Lan Mei San Wen Yu Ji Rou Gong Neng Xing Chong Wu Ling Shi (Blueberry, Salmon and Chicken Functional Dog Snack) features anthocyanins, which are said to provide deep nourishment and gently remove tear stains. The product is suitable for dogs at all stages, and retails in a pack containing 14 15 gram units, bearing a WeChat QR code.

Duck Strips

Source: Mintel, 2022

| Company | Lian Yi Biotechnology |

|---|---|

| Brand | Feng Kuang De Xiao Gou / Crazy Puppy / Crazy Dog |

| Category | Pet food |

| Sub-category | Dog snacks and treats |

| Market | China |

| Store name | Vanguard |

| Store type | Mass merchandise / hypermarket |

| Date published | July 2021 |

| Launch type | New packaging |

| Price in local currency | CNY15.90 |

| Price in US dollars | 2.45 |

Feng Kuang De Xiao Gou / Crazy Puppy / Crazy Dog Ya Rou Tiao (Duck Strips) have been repackaged. These pet treats are said to be specially designed to help with digestion and absorption, and are suitable for dogs at all stages of life. It is claimed that this product helps replenish nutrients and retails in a newly designed 100 gram pack bearing a Weibo QR code and a WeChat QR code.

Roasted Chicken Recipe Mini Treats for Dogs

Source: Mintel, 2022

| Company | CanAm Pet Treats |

|---|---|

| Distributor | Guang Rao Trading |

| Brand | Darford Zero/G |

| Category | Pet food |

| Sub-category | Dog snacks and treats |

| Market | China |

| Location of manufacture | Canada |

| Import status | Imported product |

| Store name | Tmall |

| Store type | Internet / mail order |

| Date published | May 2018 |

| Launch type | New variety / range extension |

| Price in local currency | CNY70.80 |

| Price in US dollars | 11.18 |

Darford Zero / G Zhi Chun Kao Ji Rou Mi Ni Hong Bei Ling Shi (Roasted Chicken Recipe Mini Treats for Dogs) are all-natural treats made in a government-inspected certified organic bakery with limited ingredients, chicken as the number 1 ingredient and quality protein. They are free from grains, gluten, potato, corn, soy, meals, by-products, artificial colours and flavours, preservatives, GMOs, added salt and chemicals. These oven-baked treats for any size dog are rich in protein, low glycemic and power packed with super foods including blueberries, cranberries, quinoa seeds, chia seeds and dried kelp. This product is available in a 170 gram recyclable pack.

Spongy Freeze-Dried Rabbit Recipe Complete Cat Food

Source: Mintel, 2022

| Company | Wu Wei Technology |

|---|---|

| Brand | Furrytail |

| Category | Pet food |

| Sub-category | Cat food dry |

| Store name | Tmall |

| Store type | Internet / mail order |

| Date published | May 2022 |

| Launch type | New variety / range extension |

| Price in local currency | CNY99.00 |

| Price in US dollars | 15.23 |

Furrytail Quan Jia Mao Liang Hai Mian Dong Gan Tu Tu Pei Fang (Spongy Freeze-Dried Rabbit Recipe Complete Cat Food) features big meat chunks made using freeze-dried raw bone and meat according to a patented 8:1:1 ratio, which includes 80% muscle tissues, 10% bone and meat, and 10% liver and organs. It also contains patented FTP-21 saccharomyces polypeptides, 3% fresh rabbit blood, and complete trace elements and vitamins. It is processed according to a freeze-drying technique at low temperature for 38 hours to make a sponge pore structure. The product is said to rehydrate in five seconds, contains zero gum, starch, appetizing stimulants and meat meal. It is described as crunchy and rich in meat aroma, and retails in a 138 gram pack. The cat food is claimed to be certified and recommended by the GB/T, fediaf, AAFCO, WSAVA, PennVet, Cornell University, habri, Cornell Feline Health Center, TICA, American Dairy Science Association, International Cat Care, American Society of Animal Science and ASPCA.

Daily Freeze-Dried Treats

Source: Mintel, 2022

| Company | Chong Ai Information Technology |

|---|---|

| Brand | Dear Deal |

| Category | Pet food |

| Sub-category | Cat snacks and treats |

| Store name | Tmall |

| Store type | Internet / mail order |

| Date published | September 2021 |

| Launch type | New product |

| Price in local currency | CNY118.00 |

| Price in US dollars | 18.31 |

Dear Deal Mei Ri Dong Gan Chong Wu Ling Shi (Daily Freeze-Dried Treats) are said to be made using human food-grade, high-quality ingredients and processed according to an aviation freeze-drying technology at −45°C to lock in 99% of nutrients. The product comprises the following ingredients: Luhe chicken, New Zealand beef, New Zealand venison, Russian salmon, South American white shrimp and Rushan oyster. The pet snack provides low-allergic protein and has less than 2% moisture. It is said to be highly absorbable, and regulate and relieve skin conditions. The product is suitable for dogs and cats, and retails in an 84 gram pack containing seven 12 gram sachets bearing a WeChat QR code and a QR code. The sachet is processed according to a separation packaging technique to divide freeze-dried powder and freeze-dried diced meat to retain freshness.

Grain-Free Food for Kittens

Source: Mintel, 2022

| Company | Petcurean Pet Nutrition |

|---|---|

| Distributor | Petcurean Pet Nutrition |

| Brand | Petcurean Now Fresh |

| Category | Pet food |

| Sub-category | Cat food dry |

| Market | China |

| Location of manufacture | Canada |

| Import status | Imported product |

| Store name | JD |

| Store type | Internet / mail order |

| Date published | June 2019 |

| Launch type | New product |

| Price in local currency | CNY12.00 |

| Price in US dollars | 1.74 |

Petcurean Now Fresh Wu Gu You Mao Liang (Grain-Free Food for Kittens) is made with coconut oil, and 100% fresh turkey, salmon and duck. It is formulated to meet the nutritional levels established by the AAFCO Cat Food Nutrient Profiles for Growth. It contains 0% rendered meats, by-product meals, gluten, wheat, corn and soy. The product is suitable for cats aged under 12 months old, and retails in a 100 gram pack featuring Facebook, Twitter and Instagram logos.

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

For additional information on Pet Fair Asia 2022, please contact:

Luka Luo, Trade Commissioner

Consulate General of Canada in Shanghai

Lujia.Luo@international.gc.ca

Resources

- Euromonitor International, 2022

- Euromonitor International, 2021. Cat Food in China

- Euromonitor International, 2021. Dog Food in China

- Global Trade Tracker, 2022

- Mintel: A year of innovation in pet food and products, 2022

- Mintel Global New Products Database, 2022

Sector Trend Analysis – Pet food in China

Global Analysis Report

Prepared by: Zhiduo Wang, Market Analyst

© Her Majesty the Queen in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2022).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright Her Majesty the Queen in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.