Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

The plant-based food sector accounted for retail value sales of US$23.3 billion globally in 2021 and are expected to maintain its rapid growth momentum in the coming years (Euromonitor International,2022). Motivated by consumers' increasing health, sustainability/environmental and animal welfare concerns, plant-based eating, consumption of alternative proteins, and the move away from animal-derived food products are continuing to grow in the markets like Hong Kong.

In 2021, retail sales of plant-based (free from meat) food products in Hong Kong were valued at US$36.0 million. From 2017 to 2021, sales of plant-based food recorded a compound annual growth rate (CAGR) of 7.7%. As the COVID-19 uncertainty is set to remain at large, retail sales of plant-based meals will continue to experience positive growth over the next five years. During the 2022-2026 period, sales of plant-based food is forecast to record a CAGR of 8.0%, reaching US$46.5 million in 2026.

In 2021, the top five plant-based food companies in Hong Kong accounted for 31.1% of the market. Vegefarm Corp, Tenin Food Co Ltd and Fu Kuei Hsiang Co Ltd were the top three companies in 2021. Vegefarm Corp saw the largest growth (12.5%) in retail sales, from US$2.0 million in 2017 to US$3.2 million in 2021.

According to data from Mintel, 72 plant-based food products were launched in Hong Kong between 2017 and 2021. Dairy, snacks, and side dishes were top categories of newly released plant-based food launches while plant based, low/no/reduced allergen, and vegan/no animal ingredients were top claims associated with plant-based food released during the prescribed period. Earthly Treats, Jung Nung Bees Threads, and Alpro were the three companies with the most launches in the past five years.

Market overview

As patent activity in plant-based food and drink continues to grow around the world, innovators are actively developing more sophisticated meat substitutes, be it through ever more complex meat-like products, or increasing realism in appearance, texture, or cooking experience (Mintel, 2021). Despite recent reports about declining sales driven primarily by some companies' unrealistic forecasts, plant-based trend continues to grow in retail sales and in foodservice (Euromonitor International,2022).

Hong Kong is the first overseas market where Beyond Meat and Impossible Foods launched their products. Also available in the market is a plant-based pork alternative called Omnipork (USDA 2020). Motivated by consumers' increasing health, sustainability/environmental and animal welfare concerns, plant-based eating, consumption of alternative proteins, and the move away from animal-derived food products are continuing to grow in the markets like Hong Kong. (Euromonitor International, 2022).

The ongoing COVID-19 pandemic has encouraged Hong Kong consumers to focus their diet on healthier options. Euromonitor International indicates that although there are few vegetarians or vegans (4% of millennials) in Hong Kong, plant-based food has experienced growing demand as people move away from eating meat to what they perceive to be healthier and more sustainable food options (Euromonitor International, 2022).

In 2021, retail sales of plant-based (free from meat) food products in Hong Kong were valued at US$31.1 million. From 2016 to 2021, sales of plant-based food recorded a CAGR of 11.1%. During the 2021-2026 period, sales of plant-based food is forecast to record a CAGR of 9.4%, reaching US$48.7 million in 2026. Hong Kong consumers are choosing flexible plant-based diets, supported by initiatives such as "Green Monday", and the associated sensory enjoyment for the sake of helping their health, animals and the earth. Various plant-based food products have benefited from this trend. (Euromonitor International, 2022).

| Category | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|

| Free from meat | 18.4 | 31.1 | 11.1 | 34.4 | 48.7 | 9.4 |

| Free from meat tofu and derivatives | 16.6 | 24.7 | 8.3 | 26.7 | 32.9 | 5.9 |

| Free from meat meat and seafood substitutes | 1.8 | 6.3 | 28.5 | 7.7 | 15.9 | 20.3 |

| Free from meat chilled meat and seafood substitutes | ||||||

| Free from meat frozen meat and seafood substitutes | 1.8 | 6.3 | 28.5 | 7.7 | 15.9 | 20.3 |

| Free from meat soy-based frozen meat and seafood substitutes | ||||||

| Free from meat other frozen meat and seafood substitutes | 1.8 | 6.3 | 28.5 | 7.7 | 15.9 | 20.3 |

| Free From Meat Shelf meat and seafood substitutes | ||||||

| Free from meat ready meals | ||||||

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate Free from meat: this category includes plant-based products that are positioned as a replacement of meat-based variants. It includes products where meat has been substituted by soy, tofu, quorn (mycoprotein), non-soybeans (that is, black bean burgers), wheat gluten, etc. Note: Euromonitor's Retailing research took place before the invasion of Ukraine. As such, the impact of the war in Ukraine and sanctions on Russia are not factored into our forecast data and analysis. The repercussions of the crisis and implications at a wider regional/global level. |

||||||

Competitive landscape

In 2021, the top three plant-based food companies in Hong Kong accounted for 70.4% of the market. Nestlé SA, Vitasoy International Holdings Ltd and Green Monday Holdings were the top three companies in 2021. Beyond Meat saw the largest growth (18.9%) in retail sales, from US$0.4 million in 2017 to US$0.8 million in 2021.

| Company Name | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|

| Total | 20.4 | 22.0 | 23.9 | 30.5 | 31.1 | 11.1 |

| Nestlé SA | 9.8 | 10.5 | 11.4 | 13.7 | 13.2 | 7.7 |

| Vitasoy International Holdings Ltd | 5.0 | 5.3 | 5.6 | 6.5 | 6.3 | 5.9 |

| Green Monday Holdings | 0.1 | 0.3 | 1.6 | 2.3 | ||

| ConAgra Brands Inc | 0.7 | 0.7 | 0.9 | 1.0 | ||

| Beyond Meat Inc | 0.4 | 0.5 | 0.5 | 0.7 | 0.8 | 18.9 |

| Impossible Foods Inc | 0.1 | 0.4 | ||||

| Pinnacle Foods Inc | 0.6 | |||||

| Others | 4.5 | 4.9 | 5.3 | 6.9 | 6.9 | 11.3 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

| Company Name | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|

| Nestlé SA | 48.4 | 47.9 | 47.8 | 44.9 | 42.5 | −3.2 |

| Vitasoy International Holdings Ltd | 24.7 | 24.1 | 23.4 | 21.4 | 20.4 | −4.7 |

| Green Monday Holdings | 0.7 | 1.3 | 5.1 | 7.5 | ||

| ConAgra Brands Inc | 3.0 | 3.1 | 3.0 | 3.3 | ||

| Beyond Meat Inc | 2.1 | 2.2 | 2.2 | 2.4 | 2.7 | 6.5 |

| Impossible Foods Inc | 0.4 | 1.3 | ||||

| Pinnacle Foods Inc | 2.9 | |||||

| Others | 21.9 | 22.1 | 22.1 | 22.7 | 22.3 | 0.5 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

New product launches in Hong Kong

According to data from Mintel, 88 plant-based food products were launched in Hong Kong between 2017 and 2021. Snacks dairy and processed fish, meat & egg products were top categories of newly released plant-based food launches while plant based, low/no/reduced allergen, and GMO free were top claims associated with plant-based food released during the prescribed period. DJ&A, Beyond Meat and Plant A Foods were the three companies with the most launches in the past five years.

| Product attributes | Yearly launch count | ||||

|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Yearly product launches | 4 | 14 | 15 | 30 | 25 |

| Top five categories | |||||

| Snacks | 0 | 3 | 7 | 4 | 11 |

| Dairy | 2 | 2 | 3 | 13 | 5 |

| Processed fish, meat and egg products | 0 | 6 | 0 | 7 | 3 |

| Breakfast cereals | 2 | 1 | 2 | 0 | 2 |

| Meals and meal centers | 0 | 1 | 0 | 4 | 0 |

| Top five claims | |||||

| Plant based | 4 | 14 | 15 | 30 | 25 |

| Low/no/reduced allergen | 2 | 12 | 10 | 17 | 9 |

| GMO free | 0 | 10 | 8 | 15 | 16 |

| Vegan/no animal ingredients | 0 | 8 | 6 | 27 | 6 |

| No additives/preservatives | 2 | 2 | 8 | 15 | 15 |

| Top five price groups (USD) | |||||

| 5.02 - 9.01 | 0 | 11 | 5 | 12 | 9 |

| 1.02 - 5.01 | 4 | 0 | 5 | 9 | 14 |

| 9.02 - 13.01 | 0 | 3 | 0 | 7 | 1 |

| 13.02 - 17.01 | 0 | 0 | 0 | 2 | 0 |

| 17.02 - 24.00 | 0 | 0 | 0 | 0 | 0 |

| Top five launch types | |||||

| New product | 4 | 10 | 12 | 14 | 12 |

| New variety/range extension | 0 | 3 | 0 | 13 | 7 |

| New packaging | 0 | 0 | 3 | 0 | 4 |

| Relaunch | 0 | 0 | 0 | 3 | 1 |

| New formulation | 0 | 1 | 0 | 0 | 1 |

| Top five flavours (including blend) | |||||

| Unflavoured/plain | 2 | 8 | 5 | 17 | 8 |

| Pork | 0 | 0 | 0 | 2 | 0 |

| Brazil nut and date and amaranth | 0 | 1 | 1 | 0 | 0 |

| Almond | 1 | 0 | 0 | 1 | 0 |

| Walnut and fig and amaranth | 0 | 1 | 1 | 0 | 0 |

| Top five companies | |||||

| DJ&A | 0 | 0 | 0 | 0 | 8 |

| Beyond Meat | 0 | 4 | 0 | 2 | 1 |

| Plant A Foods | 0 | 0 | 0 | 6 | 0 |

| Kuranda Wholefoods | 0 | 2 | 2 | 0 | 0 |

| Agripicks | 0 | 0 | 3 | 0 | 0 |

| Source: Mintel Global New Products Database, 2022 | |||||

Examples of new products

Shiitake, Nameko & Oyster Mixed Mushroom Crisps

Source: Mintel, 2022

| Company | DJ&A |

|---|---|

| Brand | DJ&A |

| Category | Snacks |

| Location of manufacture | Australia |

| Store name | Circle K |

| Store type | Convenience store |

| Date published | November 2021 |

| Launch type | New variety / range extension |

| Price in local currency | HKD18.50 |

| Price in US dollars | 2.37 |

DJ&A Shiitake, Nameko & Oyster Mixed Mushroom Crisps are described as an all natural, ready-to-eat snack that is lightly seasoned and vacuum cooked using a lower temperature to preserve the natural mushroom goodness and delicious taste. This plant based snack is claimed to be made from about 84 gram of fresh mushrooms, making the snack naturally nutrient dense. It is free from genetically modified vegetables, added MSG, artificial colours, flavours or preservatives, and is said to be a good source of dietary fibre. The halal and kosher certified product retails in a 30 gram pack.

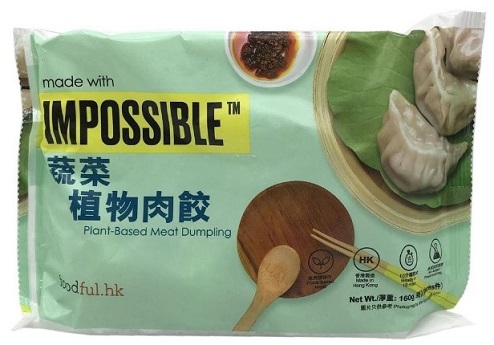

Vegetable and Plant-Based Meat Dumpling

Source: Mintel, 2022

| Company | Lightmax International |

|---|---|

| Brand | Foodful.hk Made with Impossible |

| Category | Snacks |

| Store name | Fusion |

| Store type | Supermarket |

| Date published | July 2021 |

| Launch type | New packaging |

| Price in local currency | HKD35.00 |

| Price in US dollars | 4.51 |

Foodful.hk Made with Impossible Vegetable and Plant-Based Meat Dumpling is now available. The product is made with USA Impossible plant-based meat, and added with shredded cabbage, which is said to detoxify the body. It contains no added preservatives, is ready in ten minutes, and retails in a 160 gram pack containing four pieces and bearing a QR code.

Plant-Based Beefy Crumbles

Source: Mintel, 2022

| Company | Beyond Meat |

|---|---|

| Brand | Beyond Meat Beyond Beef |

| Category | Processed fish, meat and egg products |

| Store name | HKTV Mall |

| Store type | Internet / mail order |

| Date published | February 2021 |

| Launch type | Relaunch |

| Price in local currency | HKD63.90 |

| Price in US dollars | 8.24 |

Beyond Meat Beyond Beef Plant-Based Beefy Crumbles have been relaunched with a new formulation, now with 14 gram of plant protein per serving, and in a redesigned 283 gram pack bearing Non-GMO Project Verified, Facebook, Twitter, Instagram, Pinterest and YouTube logos and recommended cooking instructions. This kosher and vegan certified tender product contains no soy or gluten and is claimed to offer health, sustainability and animal welfare as the benefits of plant protein.

Impossible Beef

Source: Mintel, 2022

| Company | Impossible Foods |

|---|---|

| Brand | Impossible |

| Category | Processed fish, meat and egg products |

| Store name | Fusio |

| Store type | Supermarket |

| Date published | December 2020 |

| Launch type | New product |

| Price in local currency | HKD89.90 |

| Price in US dollars | 11.60 |

Impossible Beef is now available. This 100% animal free product can be cooked like ground beef in burgers, meatballs, tacos, and dumplings, contains 19 gram protein and 8 gram saturated fat per serving, and is free from gluten and cholesterol. It is kosher and halal certified, is made from plants and retails in a 340 gram pack.

Plant-Based Meat Strips

Source: Mintel, 2022

| Company | Plant A Foods |

|---|---|

| Brand | OmniPork |

| Category | Processed fish, meat and egg products |

| Market | Hong Kong, China |

| Store name | Apita |

| Store type | Supermarket |

| Date published | November 2020 |

| Launch type | New variety / range extension |

| Price in local currency | HKD42.00 |

| Price in US dollars | 5.42 |

OmniPork Plant-Based Meat Strips are low in calories, fat and saturated fat, with 48% lower calories and 76% lower total fat content compared to raw pork shoulder. This all-purpose plant-based meat is high protein, potassium, calcium and iron, and provides dietary fibre. The vegan and cruelty-free product is Buddhist friendly, contains no cholesterol, added hormones, added antibiotics or GMO, and is retailed in a 150 gram pack featuring cooking instructions and bearing the Facebook, Instagram and Green Monday logos, as well as a QR code.

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

Resources

- Euromonitor International, June 2022, Consumer Lifestyles in Hong Kong, China

- Euromonitor International, March 2022, The Evolution of Plant Based: Eating and Beyond

- Euromonitor International, June 2021, Plant-based Eating and Alternative Proteins

- Mintel Global New Products Database, 2022

- Mintel, October 2021, Patent insights: plant protein ingredients

- Mintel, September 2021, A year of innovation in meat substitutes and eggs, 2021

- United States Department of Agriculture (USDA), June 2020, Plant-based Meats in Hong Kong

Sector Trend Analysis – Plant-based food trends in Hong Kong

Global Analysis Report

Prepared by: Zhiduo Wang, Market Analyst

© Her Majesty the Queen in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2022).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright Her Majesty the Queen in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.