Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

Retail sales of plant-based food are still negligible in Mexico. However, the market this is expected to change over the forecast period as more products become available (Euromonitor International,2022). Growing health concerns on obesity and diabetes might also encourage Mexican consumers to shift from meat to plant-based food.

In 2022, market size for plant-based protein ingredients (non-animal derived proteins) in Mexico was weighed at 96.6 thousand tonnes. From 2017 to 2022, sales of plant-based protein ingredients recorded a compound annual growth rate (CAGR) of 5.4%. During the 2022-2027 period, sales of plant-based protein ingredients is forecast to record a CAGR of 3.9%, reaching 117.1 thousand tonnes in 2026.

In Mexican food market, plant-based protein ingredients are most used in pet food products. In 2022, 88.5 tonnes of plant-based protein ingredients were used in pet food (80.2 tonnes used in dog food). During the 2022-2027 period, demand of plant-based protein ingredients in pet food is forecast to record a CAGR of 0.2%, reaching 89.6 tonnes in 2026.

In 2021, Mexico was the 22nd largest importer of plant-based protein ingredients in the world. The country recorded total imports valued at US$792.8 million in 2021, which increased at a CAGR of 2.1% from 2017. In 2021, Canada was Mexico's 13th largest plant-based protein ingredients in 2021, representing 0.5% market share or US$ 3.9 million. Among plant-based protein ingredients that Mexico imported from Canada, wheat gluten saw the highest growth at a CAGR of 710.3% from 2017 to 2021.

According to data from Mintel, 138 plant-based food products were launched in Mexico between 2017 and 2021. Snacks, bakery, and Processed fish, meat & egg products were top categories of newly released plant-based food launches while social media, kosher, and no additives/preservatives were top claims associated with plant-based food released during the prescribed period. PepsiCo, Kellogg, and Haribo were the three companies with the most launches in the past five years.

Market overview

As patent activity in plant-based food and drink continues to grow around the world, innovators are actively developing more sophisticated meat substitutes, be it through ever more complex meat-like products, or increasing realism in appearance, texture, or cooking experience (Mintel, 2021). Despite recent reports about declining sales driven primarily by some companies' unrealistic forecasts, plant-based trend continues to grow in retail sales and in foodservice (Euromonitor International,2022).

Motivated by consumers' increasing health, sustainability/environmental and animal welfare concerns, plant-based eating, consumption of alternative proteins, and the move away from animal-derived food products are continuing to grow in the markets like Mexico. According to Euromonitor International, while the number of vegan or vegetarian consumers is small worldwide, the number who are trying to limit their animal product consumption is much more significant for meat that has now reached 22.5% globally.

The demand for plant-based food products is increasing in Mexico (USDA, 2022). The ongoing Covid-19 pandemic has encouraged Mexican consumers to focus their diet on healthier options. Surveys conducted by Euromonitor International found that 67% of respondents (versus a global average of 56%) reported looking for health ingredients in food and drink, 30% of respondents said they were trying to reduce their meat consumption, and 90% of the respondents indicated they would like to intake plant-based proteins more often (Euromonitor International, Ministerie van Landbouw, Natuur en Voedselkwaliteit, 2022).

Retail sales of plant-based food are still negligible in Mexico. However, the market this is expected to change over the forecast period as more products become available (Euromonitor International,2022). Growing health concerns on obesity and diabetes might also encourage Mexican consumers to shift from meat towards plant-based food.

Market size

In 2022, market size of plant-based protein ingredients (non-animal derived proteins) in Mexico was valued at 96.6 thousand tonnes. From 2017 to 2022, sales of plant-based protein ingredients recorded a CAGR of 5.4%. During the 2022-2027 period, sales of plant-based protein ingredients is forecast to record a CAGR of 3.9%, reaching 117.1 thousand tonnes in 2026.

| Category | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Non-animal derived proteins[1] | 74,235.9 | 96,577.9 | 5.4 | 100,528.5 | 117,083.5 | 3.9 |

| Gluten | 45,147.7 | 58,928.2 | 5.5 | 61,239.0 | 70,815.8 | 3.7 |

| Soy protein concentrate | 26,868.0 | 34,803.9 | 5.3 | 36,307.3 | 42,710.4 | 4.2 |

| Soy protein isolate | 2,138.5 | 2,708.8 | 4.8 | 2,834.5 | 3,363.9 | 4.4 |

| Pea protein | 29.3 | 78.0 | 21.6 | 87.6 | 128.1 | 10.4 |

| Vegetable proteins | 52.3 | 59.0 | 2.4 | 60.0 | 65.4 | 2.1 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate 1: Non-animal derived proteins - aggregation of specific proteins tracked by Euromonitor International which are wholly derived from sources which are not animal based in any way. Please note that this category is not all inclusive as non-animal derived proteins may be used in the more ambiguous categories 'Hydrolysed Keratins,' 'Protein Hydrolysates' and 'Other Proteins,' as in these cases it is not always conclusively clear whether a protein is animal derived or not. Typically, these proteins come from plant, pulse or cereal sources |

||||||

In Mexican food market, plant-based protein ingredients are most used in pet food products. In 2022, 88.5 tonnes of plant-based protein ingredients were used in pet food (80.2 tonnes used in dog food). During the 2022-2027 period, demand of plant-based protein ingredients in pet food is forecast to record a CAGR of 0.2%, reaching 89.6 tonnes in 2026.

| Category | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Pet food | 86.3 | 88.5 | 0.5 | 88.8 | 89.6 | 0.2 |

| Cat food | 7.9 | 8.3 | 1.0 | 8.3 | 8.4 | 0.2 |

| Dog food | 78.4 | 80.2 | 0.5 | 80.5 | 81.2 | 0.2 |

| Packaged food | 13.7 | 11.5 | −3.4 | 11.1 | 10.3 | −2.2 |

| Snacks | 0.3 | 0.2 | −7.8 | 0.2 | 0.2 | 0.0 |

| Savoury snacks | 0.2 | 0.2 | 0.0 | 0.2 | 0.2 | 0.0 |

| Sweet biscuits, snack bars and fruit snacks | 0.1 | 0.0 | −100.0 | 0.0 | 0.0 | N/C |

| Dairy products and alternatives | 1.2 | 1.2 | 0.0 | 1.3 | 1.3 | 1.6 |

| Baby food | 0.9 | 0.9 | 0.0 | 1.0 | 1.0 | 2.1 |

| Dairy | 0.3 | 0.3 | 0.0 | 0.3 | 0.3 | 0.0 |

| Cooking ingredients and meals | 0.2 | 0.2 | 0.0 | 0.2 | 0.1 | −12.9 |

| Ready meals | 0.2 | 0.2 | 0.0 | 0.2 | 0.1 | −12.9 |

| Staple foods | 12.0 | 9.9 | −3.8 | 9.5 | 8.7 | −2.6 |

| Baked goods | 8.3 | 6.4 | −5.1 | 6.0 | 5.2 | −4.1 |

| Breakfast cereals | 0.1 | 0.1 | 0.0 | 0.1 | 0.1 | 0.0 |

| Processed meat, seafood and alternatives to meat | 3.3 | 3.1 | −1.2 | 3.1 | 3.1 | 0.0 |

| Rice, pasta and noodles | 0.3 | 0.3 | 0.0 | 0.3 | 0.3 | 0.0 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate N/C: Not calculable |

||||||

Trade overview

In 2021, Mexico was the 22nd largest importer of plant-based protein ingredients in the world. The country recorded total imports valued at US$792.8 million in 2021, which increased at a CAGR of 2.1% from 2017. In 2021, Canada was Mexico's 13th largest plant-based protein ingredients in 2021, representing 0.5% market share or US$ 3.9 million. Among plant-based protein ingredients that Mexico imported from Canada, wheat gluten saw the highest growth at a CAGR of 710.3% from 2017 to 2021.

| HS Code | Description | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|---|

| Total | 728.2 | 762.2 | 758.7 | 718.4 | 792.8 | 2.1 | |

| 210690[a] | Food preparations, not specified elsewhere | 613.6 | 639.8 | 631.2 | 596.0 | 690.9 | 3.0 |

| 210610 | Protein concentrates and textured protein substances | 70.1 | 78.1 | 75.4 | 77.3 | 84.5 | 4.8 |

| 110900 | Wheat gluten | 8.4 | 8.6 | 12.3 | 9.7 | 16.5 | 18.2 |

| 110610 | Flour, meal and powder of peas, beans, lentils and the other dried leguminous vegetables of heading 0713 | 0.1 | 0.1 | 0.2 | 0.1 | 0.8 | 74.1 |

| 35040006 | Isolated soy protein | 35.9 | 35.7 | 39.6 | 35.3 | 0.2 | −73.2 |

|

Source: Global trade tracker, 2022 *CAGR: Compound Annual Growth Rate 1: All plant-based meat products are classified under HS 210690, that is, burgers, patties, sausages |

|||||||

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|

| World | 728.2 | 762.2 | 758.7 | 718.4 | 792.8 | 2.2 |

| United States | 574.3 | 589.1 | 580.0 | 493.5 | 561.9 | −0.5 |

| Uruguay | 34.9 | 36.6 | 37.8 | 32.8 | 37.2 | 1.6 |

| Guatemala | 0.8 | 0.3 | 6.0 | 47.1 | 30.2 | 148.9 |

| China | 22.0 | 28.0 | 31.0 | 32.1 | 22.5 | 0.5 |

| Spain | 9.6 | 12.7 | 10.7 | 15.8 | 19.5 | 19.4 |

| Netherlands | 15.6 | 13.3 | 13.4 | 15.2 | 18.4 | 4.1 |

| Germany | 9.3 | 9.2 | 10.9 | 10.5 | 12.2 | 7.0 |

| Italy | 7.8 | 12.3 | 11.7 | 8.3 | 11.3 | 9.8 |

| Belgium | 5.4 | 5.1 | 5.0 | 6.1 | 7.0 | 6.8 |

| France | 8.2 | 8.4 | 5.7 | 5.5 | 5.1 | −10.9 |

| Canada (13th) | 3.8 | 3.8 | 3.5 | 2.5 | 3.9 | 0.8 |

|

Source: Global trade tracker, 2022 *CAGR: Compound Annual Growth Rate |

||||||

| HS Code | Description | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2017-2021 |

|---|---|---|---|---|---|---|---|

| Total | 3,799,537 | 3,754,201 | 3,548,402 | 2,526,941 | 3,928,944 | 0.8 | |

| 210690[a] | Food preparations, not specified elsewhere | 3,664,624 | 3,645,090 | 3,271,737 | 2,450,923 | 2,992,784 | −4.9 |

| 210610 | Protein concentrates and textured protein substances | 130,191 | 99,375 | 84,427 | 8,346 | 612,449 | 47.3 |

| 110900 | Wheat gluten, whether or not dried | 75 | 920 | 61 | 312 | 323,400 | 710.3 |

| 110610 | Flour, meal and powder of peas, beans, lentils and the other dried leguminous vegetables of heading 0713 | 3,441 | 8,816 | 192,177 | 67,360 | 311 | −45.2 |

| 35040006 | Isolated soy protein | 1,206 | 0 | 0 | 0 | 0 | N/C |

|

Source: Global trade tracker, 2022 *CAGR: Compound Annual Growth Rate 1: all plant-based meat products are classified under HS 210690, that is, burgers, patties, sausages N/C: Not calculable |

|||||||

New product launches

According to data from Mintel, 138 plant-based food products were launched in Mexico between 2017 and 2021. Snacks, bakery, and Processed fish, meat & egg products were top categories of newly released plant-based food launches while social media, kosher, and no additives/preservatives were top claims associated with plant-based food released during the prescribed period. PepsiCo, Kellogg, and Haribo were the three companies with the most launches in the past five years.

| Product attributes | Yearly launch count | ||||

|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Yearly product launches | 34 | 43 | 32 | 19 | 10 |

| Top five categories | |||||

| Snacks | 11 | 22 | 7 | 3 | 3 |

| Bakery | 7 | 6 | 3 | 2 | 0 |

| Processed fish, meat and egg products | 4 | 4 | 4 | 3 | 0 |

| Sauces and seasonings | 0 | 1 | 9 | 4 | 1 |

| Sugar and gum confectionery | 1 | 0 | 3 | 2 | 5 |

| Top five claims | |||||

| Social media | 14 | 22 | 8 | 6 | 1 |

| Kosher | 10 | 13 | 5 | 4 | 2 |

| No additives/preservatives | 8 | 7 | 2 | 2 | 4 |

| Microwaveable | 5 | 7 | 5 | 2 | 0 |

| Low/no/reduced allergen | 1 | 9 | 2 | 4 | 2 |

| Top five price groups (US dollars) | |||||

| 0.38 - 3.37 | 17 | 29 | 15 | 14 | 8 |

| 3.38 - 6.37 | 12 | 9 | 10 | 4 | 2 |

| 6.38 - 9.37 | 4 | 1 | 5 | 1 | 0 |

| 9.38 - 12.37 | 1 | 1 | 0 | 0 | 0 |

| 12.38 - 19.00 | 0 | 0 | 0 | 0 | 0 |

| Top three launch types | |||||

| New variety/range extension | 19 | 15 | 16 | 7 | 2 |

| New product | 5 | 17 | 8 | 6 | 0 |

| New packaging | 7 | 10 | 8 | 6 | 5 |

| Top five flavours (including blend) | |||||

| Unflavoured/plain | 3 | 3 | 2 | 1 | 0 |

| Fruit | 0 | 1 | 2 | 2 | 3 |

| Spice/spicy | 0 | 1 | 0 | 1 | 2 |

| Chocolate | 1 | 2 | 0 | 1 | 0 |

| Corn/sweetcorn | 1 | 0 | 1 | 0 | 0 |

| Top five companies | |||||

| PepsiCo | 8 | 6 | 1 | 1 | 0 |

| Kellogg | 1 | 2 | 3 | 2 | 0 |

| Haribo | 0 | 0 | 0 | 1 | 4 |

| Bimbo | 2 | 1 | 1 | 0 | 0 |

| Campbell's | 3 | 0 | 1 | 0 | 0 |

| Source: Mintel Global New Products Database, 2022 | |||||

Examples of new products

Vanilla Lucuma Flavored Organic Plant Protein + Superfoods

Source: Mintel, 2022

| Company | Luchi Organics |

|---|---|

| Distributor | Docacie |

| Brand | Sprout Living Epic Protein |

| Category | Nutritional drinks and other beverages |

| Location of manufacture | United States |

| Import status | Imported product |

| Store name | Farmacia San Pablo |

| Store type | Drug store / pharmacy |

| Date published | September 2022 |

| Launch type | Relaunch |

| Price in US dollars | 41.72 |

Sprout Living Epic Protein Proteína Vegetal en Polvo Sabor Vainilla Lúcuma (Vanilla Lucuma Flavored Organic Plant Protein + Superfoods) has been relaunched, previously under Sprout Living Epic, and retails in a 455 gram pack.

- Real taste, real texture, from real ingredients

- Creamy and aromatic with hints of spice from a whole food blend of real vanilla, ginger, baobab, lucuma and more

- 19 grammes plant protein

- Free from GMO, gluten, gums, flavors, additives, grain, soy

- Made fresh and 3rd-party tested in the United States

- The manufacturer believes in pure, plant-based nutrition developed in kitchens, not in labs

- Using the finest organic ingredients and thoughtful formulations, they proudly make premium products that work and taste great, nothing weird or artificial

- Reflective mix of complete, organic plant-based proteins and exotic super foods rich of nutrients

- With bursts of creamy vanilla flavour and a spicy touch

- Smooth and delicious protein powder for a healthy lifestyle

- Organic, vegan, kosher

- Naturally gluten free

- Highest quality ingredients

- Produced in a cGMP certified facility that follows strict sanitary and regulatory procedures

- Environmentally-friendly pouch made with post-consumer recycled material as part of the manufacturer's commitment to sustainability

- Logos and certifications: USDA Organic, Certified Vegan Vegan.org, QAI, Kosher Check, Vegan Action

Gluten Free Meatless Pepperoni Style Pizza

Source: Mintel, 2022

| Company | Daiya Foods |

|---|---|

| Category | Meals and meal centers |

| Location of manufacture | Canada |

| Import status | Imported product |

| Store name | Soriana |

| Store type | Mass merchandise / hypermarket |

| Date published | April 2022 |

| Launch type | New formulation |

| Price in US dollars | 11.99 |

Daiya Pizza Sin Gluten de Peperoni Vegetariano (Gluten Free Meatless Pepperoni Style Pizza) has been reformulated with and a new and improved recipe featuring premium cutting board cheeze shreds. This plant based product is made with gourmet ingredients, and is free from GMOs, dairy, gluten and soy. This vegan pizza is a good source of fiber, and contains saturated fat and sodium excess according to the Mexican Health Secretary. It retails in a recyclable 16.7 ounce pack featuring baking instructions.

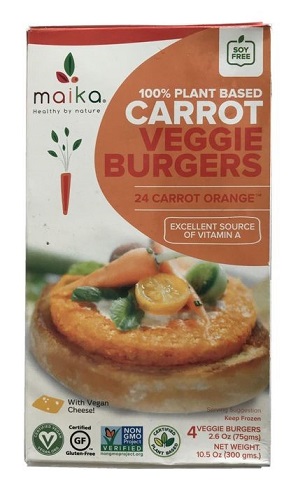

24 Carrot Orange Veggie Burgers

Source: Mintel, 2022

| Company | Maika Foods |

|---|---|

| Importer | Tiendas Soriana |

| Brand | Maika |

| Category | Processed fish, meat and egg products |

| Market | Mexico |

| Location of manufacture | United States |

| Store name | Mega |

| Store type | Supermarket |

| Date published | October 2019 |

| Launch type | New packaging |

| Price in US dollars | 4.45 |

Maika Hamburguesa Vegana de Zanahoria (24 Carrot Orange Veggie Burgers) have been repackaged with an updated design. The 100% plant based product is made with real veggies and vegan cheese, is an excellent source of vitamin A, and is free from soy and GMO. It is certified vegan and retails in a 300 gram pack containing four 75 gram units and featuring cooking instructions, as well as Facebook, Instagram, Pinterest and Twitter logos. The manufacturer claims to be a young plant based food company dedicated to producing premium sustainable products made with a social and environmental.

Plant Based No Chicken Seitan Tenders

Source: Mintel, 2022

| Company | Grupo Agroindustrial Andel Sapi |

|---|---|

| Brand | Plant Squad |

| Category | Processed fish, meat and egg products |

| Store name | La Comer |

| Store type | Supermarket |

| Date published | September 2019 |

| Launch type | New product |

| Price in US dollars | 6.70 |

Plant Squad Tenders de Seitán con Salsa Búfalo (Plant Based No Chicken Seitan Tenders) is now available. The vegan product is described as fajitas with buffalo sauce, is a source of vitamin B12 and iron, and features 45 gram protein per pack. It is said to be ready in minutes, can be heated in the microwave, and retails in a 360 gram pack featuring cooking instructions.

Plant Based Seitan Barbecue Ribs

Source: Mintel, 2022

| Company | Grupo Agroindustrial Andel Sapi |

|---|---|

| Brand | Plant Squad |

| Category | Processed fish, meat and egg products |

| Store name | La Comer |

| Store type | Supermarket |

| Date published | September 2019 |

| Launch type | New product |

| Price in US dollars | 6.70 |

Plant Squad Costillas Vegetarianas de Seitán con Salsa Barbecue (Plant Based Seitan Barbecue Ribs) are now available. The vegan product is a source of vitamin B12 and iron and features 45 gram protein per pack. It is said to be ready in minutes, can be heated in the microwave, and retails in a 360 gram pack featuring cooking instructions.

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

Resources

- Euromonitor International, 2022

- Euromonitor International, October 2022, Megatrends in Mexico

- Euromonitor International, October 2022, Consumer Lifestyles in Mexico

- Euromonitor International, June 2021, Plant-based Eating and Alternative Proteins

- Euromonitor International, January 2022, Processed Meat, Seafood and Alternatives to Meat in Mexico

- Euromonitor International, January 2022, Free from in Mexico

- Euromonitor International, March 2022, The Evolution of Plant Based: Eating and Beyond

- Ministerie van Landbouw, Natuur en Voedselkwaliteit, January 2022, Demand for plant-based proteins rises in Mexico

- Mintel Global New Products Database, 2022

- Mintel, October 2021, Patent insights: plant protein ingredients

- Mintel, September 2021, A year of innovation in meat substitutes and eggs, 2021

- United States Department of Agriculture, July 2022, Mexico: Retail Foods

Sector Trend Analysis – Plant-based food trends in Mexico

Global Analysis Report

Prepared by: Zhiduo Wang, Market Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2023).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.