Agriculture and Agri-Food Canada (AAFC) has summarized current trends and emerging opportunities for innovation available to the food processing industry. The information in this report will be of value to industry in the development of business plans for pursuing new products, processes and technologies over the next five years.

Methodology

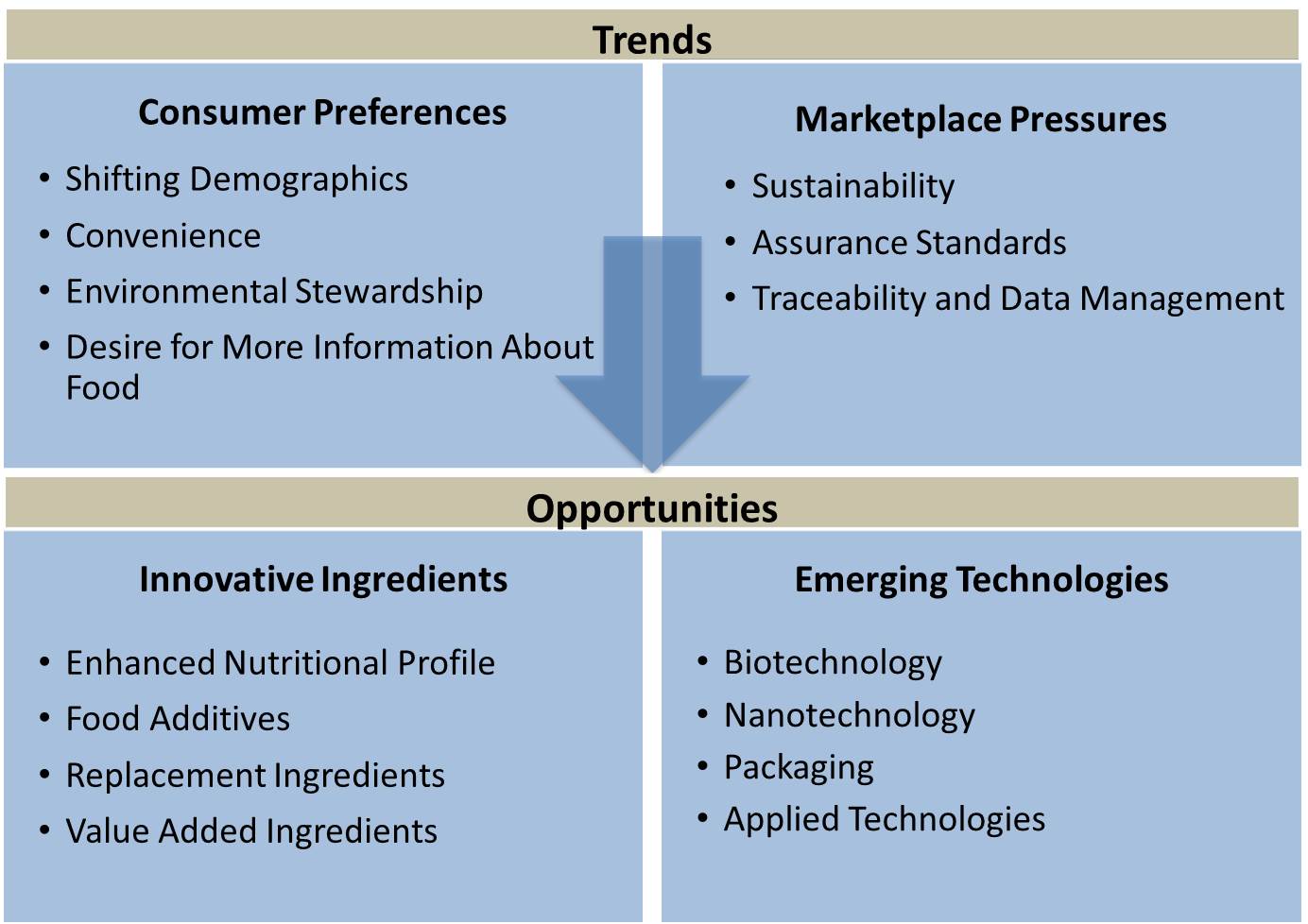

Food processing trends and emerging opportunities were identified by first conducting an environmental scan of industry reports and then cross-referencing the findings with information gathered at recent conferences (see Information Sources). Recurring themes were identified and then categorized as either being a "Trend" or an "Opportunity" that is important to the food processing environment in Canada. As illustrated in Figure 1, current day "Trends" were broken down into two groups: Consumer Preferences, and Marketplace Pressures. Identified "Opportunities" that are likely to appear in the marketplace within the next five years were broken down into Innovative Ingredients, or Emerging Technologies. The final phase of this exercise involved consulting key informants such as AAFC researchers and industry stakeholders to validate the findings.

Figure 1. Trends and Opportunities for the Food Processing Industry

Diagram illustrating two groups of food processing trends that drive two groups of food processing opportunities:

- Trends:

- Consumer Preferences: shifting demographics, convenience, environmental stewardship, and desire for more information about food

- Marketplace Pressures: sustainability, assurance standards, traceability and data management

- Opportunities:

- Innovative Ingredients opportunities: enhanced nutritional profile, food additives, replacement ingredients, and value added ingredients

- Emerging Technologies opportunities: biotechnology, nanotechnology, packaging, and applied technology

Trend: Consumer Preferences

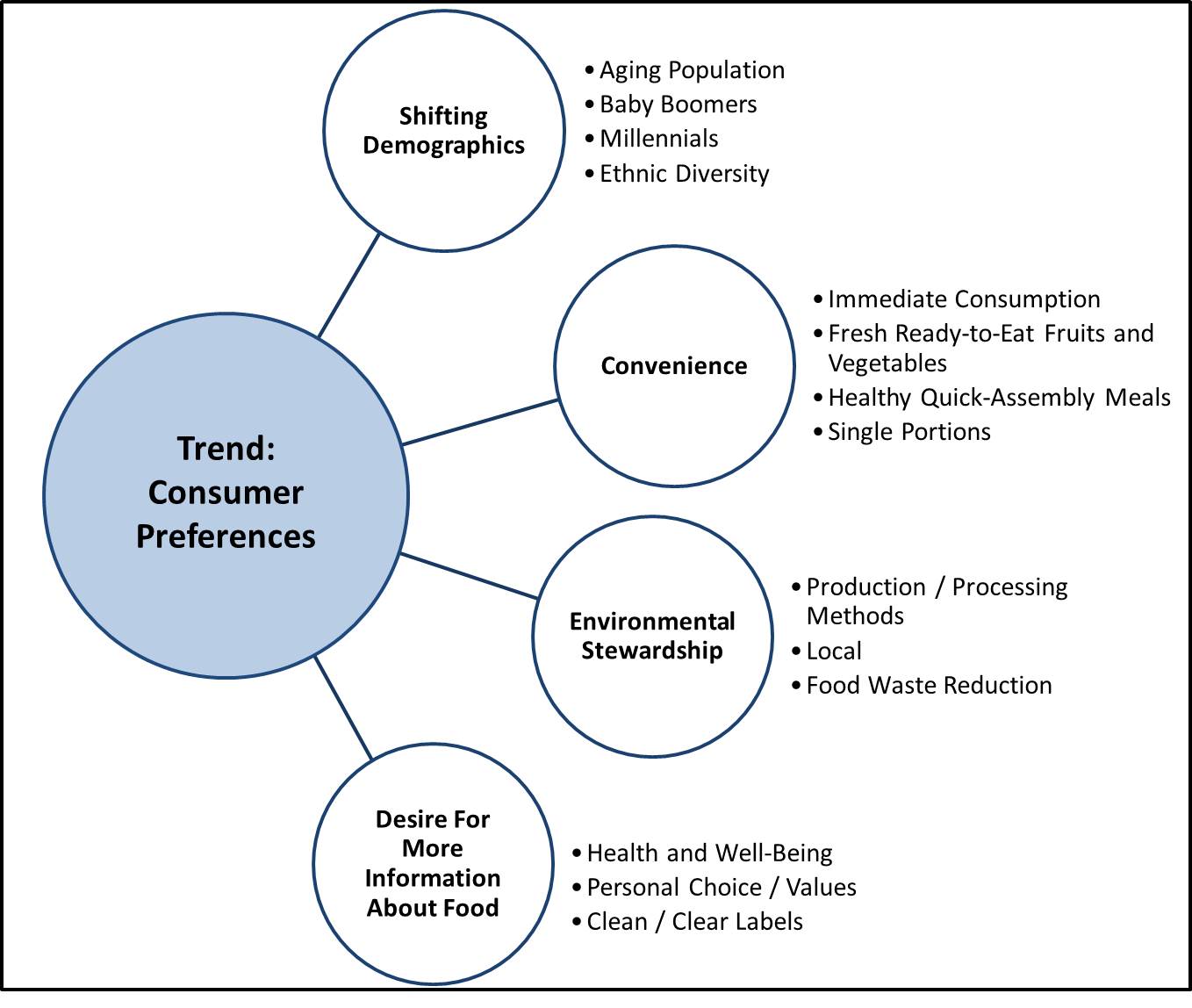

Price and taste have long been the most important decision factors for the majority of consumers when choosing food (Mintel 2015). However, there are some notable factors driving consumer preferences that can influence new product development and product acceptance: shifting demographics, convenience, environmental stewardship, and desire for more information about food (Figure 2).

Shifting demographics, precipitated by aging Baby Boomers, the growing purchasing power of Millennials, and increased ethnic diversity, are contributing to changing food preferences. These factors are influencing trends toward food products with enhanced nutrition, ethical food choices (such as animal welfare and fair trade), environmentally sustainable diets, as well as new taste profiles and flavour combinations.

Consumers want foods that are quick or ready for immediate consumption, but also fresh and nutritious, such as bag salads, and single portion prepared fruits and vegetables – as well as foods that can replace certain meals, such as breakfast bars.

Figure 2. Consumer Preferences

Diagram showing four driving factors of the Consumer Preferences trend:

- Shifting Demographics: aging population, baby boomers, millennials, ethnic diversity

- Convenience: immediate consumption, fresh ready-to-eat fruits and vegetables, healthy quick-assembly meals, single portions

- Environmental Stewardship: production/processing methods, local, food waste reduction

- Desire for more information about food: health and well-being, personal choice/values, clean/clear labels

Millennials tend to seek out information and are increasingly focused on environmental stewardship. These consumers are concerned about the impacts of agricultural and processing practices on the environment (for example, pesticide use, transportation, excessive packaging, and food waste). These concerns have led to the rising popularity of choices that are perceived to be environmentally friendly (such as organic, grass-fed, carbon footprint, and biodegradable or recyclable packaging), and the push to buy local (for example, the 100-Mile Diet). There has also been an increased interest in initiatives that aim to reduce food waste, such as "ugly" food markets and mobile applications for donating foods that are nearing expiration.

There is an increased desire for information about food, including the production practices used as well as the food’s contents. In addition to nutritional composition, consumers want to know how foods will enhance their performance or improve their health. They are looking for recognizable nutrition information that will help them make better choices for their personal health at point of purchase, including:

- Nutrition labels that are easy to understand (to find what they want – including vitamins, minerals, fibre, protein; and avoid what they do not want – such as allergens, sodium, gluten, trans-fats, added sugars, chemical additives and preservatives);

- Health claims that are linked to health outcomes such as bone or cardiovascular health, and lower cholesterol; and

- Front of pack symbols for easy selection (for example, whole grain, vegetarian, nutrition rating systems, and symbols).

Consumers also want more information in order to ensure that their buying habits align with their personal values (such as animal welfare, vegetarian, halal, kosher, and fair trade). The "clean label" approach, which focuses on fewer and more natural ingredients and includes claims such as no additives, no preservatives, and no artificial flavours or colours, has evolved into "clear label" positioning which embraces the concept of transparency. Information demands will vary depending on the nature of the product; addressing consumer concerns goes beyond the label and includes providing expanded information on company websites and social media.

Increased use of social media platforms may be supporting the formation of consumer groups that share information pertaining to food and contributing to social license, which is defined as "the ongoing level of acceptance, approval and trust of consumers regarding how food is produced" (Canadian Federation of Agriculture 2015). These groups are driving niche markets for environmental and personal choice attributes, beyond regulatory requirements.

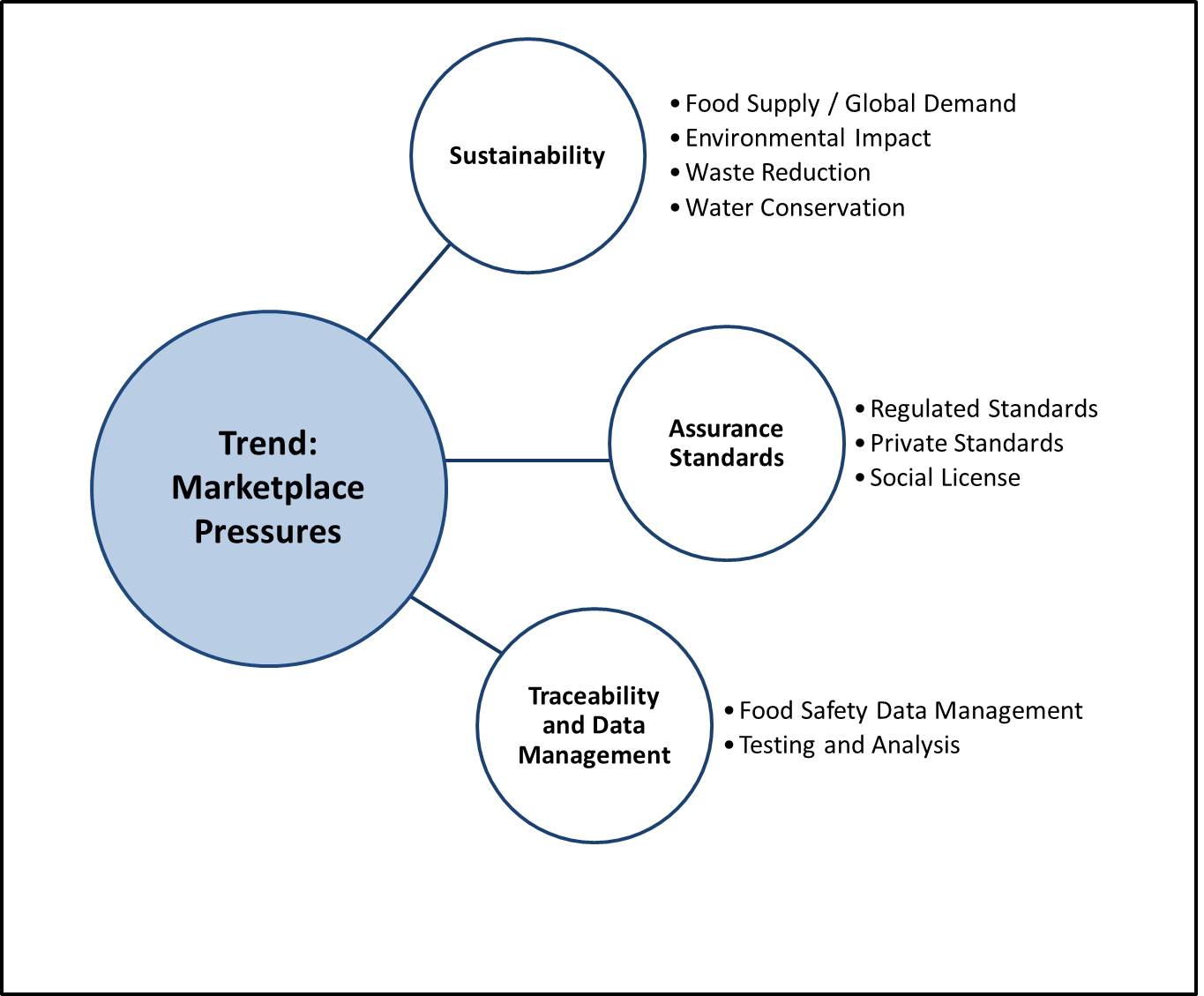

Trend: Marketplace Pressures

According to the United Nations Department of Economic and Social Affairs, the global population is expected to reach 9.7 billion by the year 2050 (United Nations Department of Economic and Social Affairs 2015). As the population grows, industry is challenged to produce more food to meet the growing demand (Figure 3). Addressing food security is further complicated by the desire to improve sustainability. Industry is under pressure to produce more food under diverse conditions, but use the least amount of resources possible and minimize its impact on the environment; this includes waste reduction and recycling.

Regulated food standards, which define the permitted ingredients or compositional requirements for specific foods, were initially put in place to prevent product adulteration and consumer fraud. However, these standardized foods are no longer keeping pace with product innovation, nor accommodating consumer interest in more food choices. The result has been a proliferation of national and international third-party assurance systems that address various product attributes, including:

- Consumer values (such as halal, kosher, vegetarian, organic, fair trade, and non-GMO);

- Environmental standards (such as FairWild Standard, Forest Stewardship Council Standards, Marine Stewardship Council Standards, and The Carbon Trust Standard); and

- Animal welfare (such as free range, cage-free, and international "Dolphin Safe" standards).

The increasing prevalence of these third-party verification systems is being driven, in part, by consumer desire to align food choices with personal values. Consumers want additional standards that enable them to choose products with the desired environmental and personal choice attributes. The food processing industry is under increased public scrutiny, resulting in a need to build public trust and maintain social license by aligning corporate behaviour and products with consumer values.

Canada’s reputation for having a high quality food supply depends on a superior food safety system, with enhanced traceability and data management, and increasing audit requirements. More refined testing capabilities are influencing requirements for analysis and data generation, such as thresholds for detecting low level presence of allergens or contaminants.

Figure 3. Marketplace Pressures

Diagram showing three driving factors of the Marketplace Pressures trend:

- Sustainability: food supply/global demand, environmental impact, waste reduction, water conservation

- Assurance Standards: regulated standards, private standards, social license

- Traceability and Data Management: food safety data management, testing and analysis

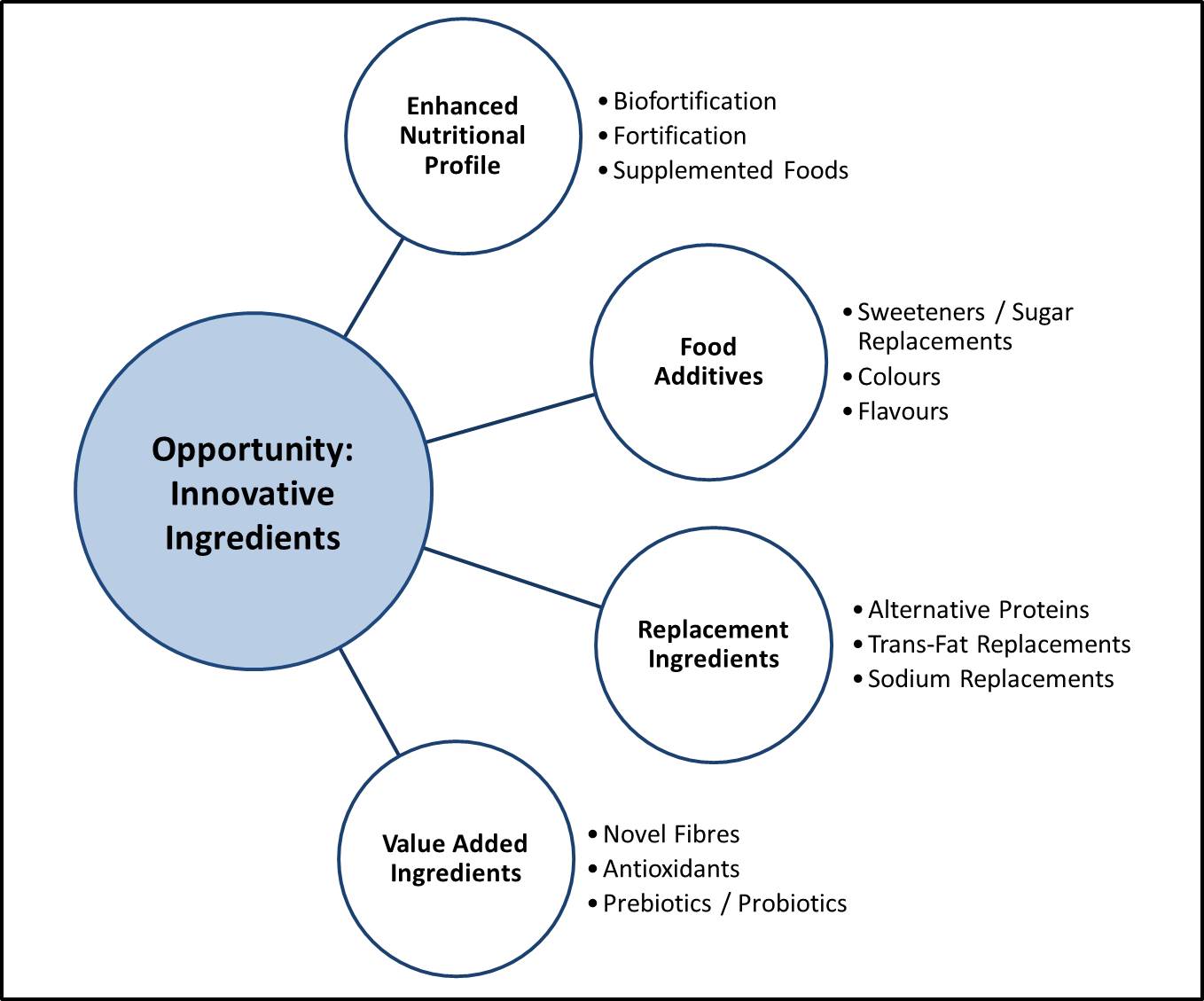

Opportunity: Innovative Ingredients

Innovative ingredients will help meet consumer and marketplace pressures (Figure 4). The population’s health concerns are a major contributing factor driving the development of food ingredients with enhanced nutrition, which have the ability to shift a product’s profile and attract new market segments. Three approaches are:

- Biofortification: The process of increasing the nutritional value of plants or animals through conventional selective breeding, genetic engineering, or adjusting animal feed (for example, omega 3 eggs, and mushrooms grown using pulsed UV light to boost the vitamin D content).

- Fortification: The mandatory addition of vitamins and minerals to select staple foods, to restore nutrients lost in processing or to address a public health requirement with minimal risk to health (for example, the addition of vitamin D to fluid milk to prevent childhood rickets and folic acid to white flour for proper fetal development of the brain and spinal cord).

- Supplemented foods: Products that are represented as foods that have added substances, such as vitamins, minerals, amino acids, herbals or bioactives, with the intent of providing a health benefit that is not a specific public health requirement. This is voluntarily added by manufacturers to capture a niche market (for example, energy drinks with caffeine, water with added vitamins, and foods that contain herbal ingredients).

Figure 4. Innovative Ingredients

Diagram showing four driving factors of the opportunities with Innovative Ingredients:

- Enhanced Nutritional Profile: biofortification, fortification, supplemented foods

- Food Additives: sweeteners/sugar replacements, colours, flavours

- Replacement Ingredients: alternative proteins, trans-fat replacements, sodium replacements

- Value Added Ingredients: novel fibres, antioxidants, prebiotics/probiotics

There are also opportunities for processors in the category of food additives. The demand is growing for sugar replacements, non-caloric sweeteners and natural alternative sweeteners such as honey, maple syrup, stevia, tagatose (naturally occurring in dairy products), and trehalose (found naturally, for example in mushrooms, shrimp and foods produced using baker's and brewer's yeast). Note that Canada regulates sweeteners and sugar replacements as food additives.

As consumers seek to avoid certain colouring additives, there is also interest in finding new natural sources of colour. Exotic flavours are another example of food additives that are in growing demand, as a more diverse ethnic population and an increase in travel are inspiring experimentation in the kitchen and the demand for new flavours.

Replacement ingredients that address consumer health and sustainability concerns are gaining momentum in the marketplace. For example, plant-based and alternative protein sources such as algae and insects are gaining interest. Other trending replacement ingredients include alternatives to trans-fat, such as high oleic oils from new varieties of canola and soybean, and sodium replacements, such as sugar fermentation products, yeast products, hydrolyzed vegetable proteins, and spices.

Value added ingredients are also in high demand in order to provide consumers with the specific health benefits that they desire. Among the most popular are novel fibres (such as extracted beta-glucan, cellulose, and gums), omega 3-6-9 fatty acids (from fish, hemp, flax, almonds, quinoa, or cashews), antioxidants (such as microencapsulated grape seed extract), and probiotics/prebiotics (such as inulin from Jerusalem artichoke).

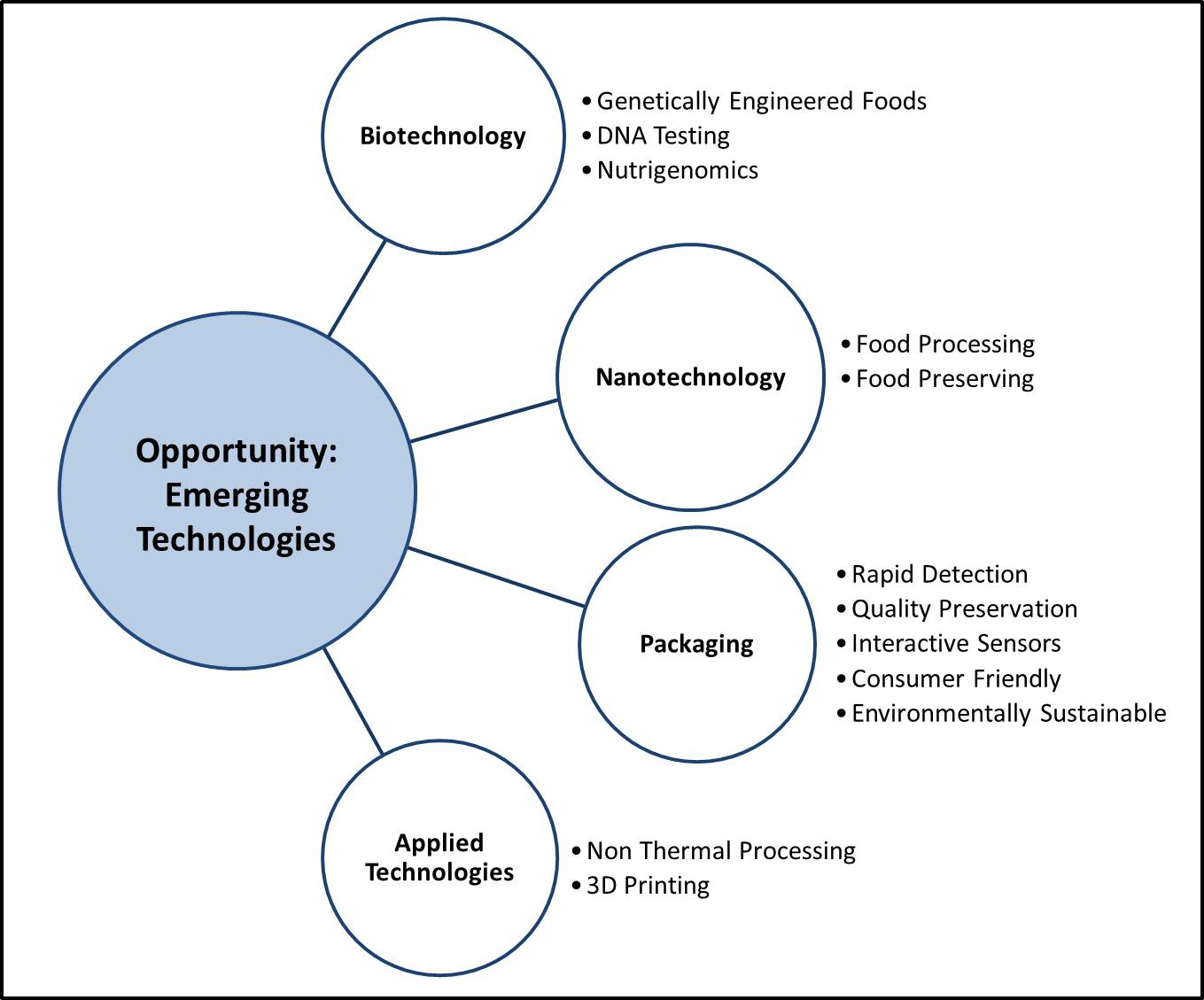

Opportunity: Emerging Technologies

Emerging technologies include opportunities that arise from new knowledge as well as from the innovative application of existing knowledge to the food processing industry (Figure 5).

These technologies can present unique challenges for regulators as the products can span multiple sectors and applications, and the potential risks and benefits may vary with different uses. Additionally, the rapid development of emerging technologies requires regulatory systems to respond quickly to ensure effective oversight and to facilitate their entry into the marketplace.

Biotechnology provides a wide range of tools that can be applied to food, yet consumer acceptance wavers depending on the application. It can be used to enhance nutrition and food safety, and help expand the food supply by adapting to different environments and using fewer resources, such as water or pesticides (Food and Agricultural Organization of the United Nations 2004). Biotechnology includes genetically engineered foods (foods derived from an organism that has had some of its heritable traits changed; such as Golden Rice, which is high in vitamin A, and Arctic Apples, which do not brown when cut). DNA testing can be used to assess the safety, quality and integrity of the food chain by identifying any allergenic material or microbes that cause food-borne diseases, and detecting adulteration (for example, horsemeat sold as beef). Nutrigenomics, which examines how genetic profiles interact with different foods and dietary patterns, can lower the risk of developing diet-related chronic diseases, such as type 2 diabetes, heart disease and cancer (Mead 2007).

There are also many opportunities for the food processing industry to use nanotechnology, the manipulation of matter at a very small scale. By working at this scale, scientists are developing a range of applications in the food sector. For example:

- Food processing: Nanocapsules can be used to improve the bioavailability of bioactive substances to enhance nutrition, or to infuse plant-based steroids to replace cholesterol. Additionally, nanoparticles can selectively bind and remove chemicals or pathogens from food, and nanoemulsions can be used for better availability and dispersion of nutrients.

- Food preservation: Antibodies attached to fluorescent nanoparticles can be used to detect chemicals or foodborne pathogens. Biodegradable nanosensors can be used for temperature, moisture and time monitoring. Nanoclays and nanofilms can be used as barrier materials to prevent spoilage and prevent oxygen absorption.

Consistent with the move toward environmental stewardship, sustainability, desire for more information about food, and enhanced food safety, is the interest in new technologies to enhance packaging. Technological advancements applied to packaging include:

- Rapid detection: Digital temperature monitoring labels can provide data on temperature fluctuations of perishable products during distribution and storage to avoid spoilage. Microchips in labels can also be used to indicate when food has spoiled.

- Quality preservation: Ethylene strips use a mixture of high-tech minerals and clay to absorb ethylene gas, delaying ripening and preventing waste. Radio frequency identification can also be used for quality preservation; for example, using a smart phone in the grocery store to find out what farm a particular lettuce came from, the date the produce arrived in the grocery store, and what temperatures the lettuce was exposed to during transit.

- Interactive sensors: Electronic food labels can be used to lower the price of a product as it nears its sell-by or best before date.

- Consumer friendly: Consumers want single portion packaging for convenience and to avoid waste. They also want packaging that is easy to open, has improved readability, and is re-sealable.

- Environmentally sustainable: Consumers are looking for packaging that is less harmful to the environment, such as packaging made from biodegradable plastics, and edible films.

Figure 5. Emerging Technologies

Diagram showing four driving factors of the opportunities with Emerging Technologies:

- Biotechnology: genetically engineered foods, DNA testing, nutrigenomics

- Nanotechnology: food processing, food preserving

- Packaging: rapid detection, quality preservation, interactive sensors, consumer friendly, environmentally sustainable

- Applied Technologies: non thermal processing, 3D printing

The food processing sector is also finding new applications for technologies that were initially designed for other purposes. For example, 3D printing provides an opportunity to develop niche markets by enabling manufacturers to customize food products in single or small batches at reasonable cost, such as foods that have a personalized appearance or composition. In addition, 3D printing can also play a role in customizing parts for the equipment used in food processing, such as unique molds for baked goods (IFT 2015). Non-thermal processing is changing the way foods are preserved by using lower temperatures than thermal pasteurization. As a result, flavours and essential nutrients undergo minimal or no changes. Non-thermal processing includes technologies that can be used either alone or in combination, such as irradiation, high pressure processing, ultrasound, light pulses, and oscillating magnetic fields.

Summary

The themes identified in this report are based on an environmental scan of food industry reports, websites and conference agendas. Their relevance to the food processing sector has been validated through discussions with AAFC researchers and key food industry stakeholders. These trends and opportunities provide insights to help inform plans for developing new products or applying new processes and technologies to the food processing sector. Further research and analysis is required to adapt each theme to specific situations and to identify the regulatory requirements before bringing a new product to the marketplace.

Key Messages:

- Shifting demographics are creating a consumer population that is less homogeneous, resulting in more niche markets and an opportunity for customized products.

- Consumer interest in health, sustainability and social responsibility are driving a demand for more information on what is in food and how it is produced, creating an opportunity for products addressing a range of "personal choice" attributes.

- Adding or substituting ingredients can shift the product profile and provide opportunities to attract new market segments.

- Advancing technologies provide food manufacturers with enhanced food processing methods and new ways to interact with consumers using innovative packaging.

Information Sources

The following information sources were reviewed to identify potential trends and emerging opportunities in food processing.

Print Publications

- AAFC Foresight Report: Emerging Food Products, Technologies and Processes: Insights for Regulators (June 2012)

- Agri-Innovators Committee Report to the Minister of Agriculture and Agri-Food Canada (2014) (internal report)

- Canadian Agri-food Policy Institute Reports

- Differentiate to Compete: The Consumer Perspective (May 2014)

- Talent, Skills and People: Enabling Innovation in Food Processing (May 2014)

- Innovation and Off-Grade Food (Due to Imperfections): Drivers and Deterrents (May 2014)

- Ipsos Reid’s 2014 research on consumer food and beverage trends

- Food Technology publications, 2014-2015

Web Content, 2014-2015

- National Geographic Future of Food Series

- International Food Information Council Foundation

- Center for Science in the Public Interest

Conference Programs

- Institute of Food Technologists July 2014 and July 2015 Conferences

- International Union of Food Science and Technology (IUFoST) August 2014 Convention

- Conference Board of Canada 2015 Canadian Food Summit

References

- Food and Agriculture Organization of the United Nations (FAO), The State of Food and Agriculture, 2003-04, Agricultural Biotechnology: Meeting the Needs of the Poor? Raney, T. (ed.). FAO Agriculture Series No. 35. (Rome: FAO, 2004)

- Mead, N., 2007. Nutrigenomics: The Genome-Food Interface, Environ Health Perspectives 115 (12): A582-A589.

- Mintel. "Facts, Trust and Transparency: Navigating Consumer Desires in the Era of Too Much Information" scientific session. Institute of Food Technologists. Chicago, July 12, 2015.

- United Nations, Department of Economic and Social Affairs, Population Division, World Population Prospects: The 2015 Revision, Key Findings and Advance Tables (New York: United Nations, 2015), p.1.

Alternative Format

Emerging Food Innovation: Trends and Opportunities (PDF Version, 930 KB)