For your convenience, this report is available in the following format: PDF (442 KB)

Overview

Despite a relatively short growing season, Canadian farmers produce a wide range of fruits, including apples, pears, stone fruits (peaches, nectarines, plums, prunes and cherries), grapes, blueberries, cranberries, strawberries, raspberries, saskatoons and haskaps. Southern Ontario and southwest British Columbia, which each benefit from about 180 frost-free days every year, produce much of the fruit grown in the country, while Quebec and the Maritimes also have significant fruit production, despite having only about 120 frost-free days per year. With farm cash receipts of over $1.3 billion, fruits accounted for 16.7% of total farm cash receiptsEndnote 1 for edibleEndnote 2 horticulture in Canada in 2023.

After reaching its second highest level in a decade in 2022, due mainly to record cranberry and lowbush blueberry production, the overall production volume for all fruits fell by 8% in 2023. Fruit production reached 887,191 metric tons in 2023, representing the third lowest level in a decade, led by declines in the production of cranberries (−28%), highbush blueberries (−14.4%), strawberries (−11.4%), lowbush blueberries (−7.5%) apples (−3.7%) and raspberries (−2.7%). In contrast, 2023 production volumes were higher for grapes (+15.3%), sweet cherries (+7.4%), pears (+5.2%), sour cherries (+3.8%) and peaches (+3.4%).

In 2022, a massive increase in cranberry and lowbush blueberry production in Quebec had propelled this province to the top fruit production rank accounting for 33.2% of the country's production volume, ahead of Ontario (27.1%), and British Columbia (26.3%). However, with year-over-year drops in fruit production of 21% in Quebec and 9.7% in BC in 2023, Ontario regained the top fruit production rank, accounting for 32.2% of the country's fruit crop, ahead of Quebec (28.6%) and BC (25.8%). These three provinces accounted collectively for 86.6% of Canada's total fruit production volume in 2023, while Nova Scotia (7.2%), New Brunswick (4.5%) and Prince Edward Island (1.4%) accounted together for a little over 13% of production, with small amounts of fruit produced in Newfoundland and Labrador and the prairie provinces.

British Columbia's fruit production reached a peak of 308,601 metric tons in 2018, and has since been dropping for five consecutive years as a result of extreme weather events. The most significant drop occurred in 2021, when overall production fell by 8.5%, with all fruit crops being affected to varying degrees by the unprecedented and persistent heat wave that the province experienced between June 25 and July 1, 2021. This was followed by a series of devastating winter floods in November 2021 affecting the southern, central and coastal regions of British Columbia and parts of neighbouring Washington State.

In 2023, difficult growing conditions in BC, such as untimely frost, drought and extreme heat, led to a year-over-year decrease of 9% in the province's overall fruit production volume, which reached its lowest level in over a decade. Grapes (−25%), blueberries (−15%) and apples (−14%) saw the most significant drops in crop volumes, making all 3 fruit crops the smallest crops in the last 10 years. In contrast, production volumes were up for sweet cherries (+7.6%), pears (+4.4%), cranberries (+1.8%) and raspberries (+1.3%), while strawberry production was almost unchanged.

In late December 2022, a freeze event swept across British Columbia's main winemaking regions as temperatures remained below −20°C for a sustained period, with temperatures reaching as low as −30°C in Kelowna, West Kelowna, and Shuswap/Tappen.Endnote 3 The province's Vinifera grape production fell by 25% in 2023, reaching 17,753 metric tons, its lowest level in over a decade. While there are currently no estimates of the extent of the long-term impacts, many in the grape and wine industry fear that some of the planted acreage may have suffered long-term damages, with the need to replace some of the acreage.

British Columbia, which accounts for 95% of the country's highbush blueberry production, had its smallest blueberry crop in over a decade, as the crop volume dropped for a fifth consecutive year to reach 56,523 metric tons in 2023, which was 15% smaller than the previous year. A number of factors contributed to the small crop, including a cool spring and unseasonably high temperatures during bloom, affecting pollination and contributing to poor fruit set and small fruit size, and a hot and dry summer. Berry sizing was quite variable this season, especially for the Duke variety, causing smaller berries than normal, which contributed to the low yield this year. While scorch virus is still an ongoing issue in blueberry fields, symptoms were less visible in 2023 than in the two previous seasons. Spotted Wing Drosophila (SWD) did not appear to be a serious issue in 2023, as very low levels of infested berries were found in the fields and in harvested berries, likely due to the hot and dry summer weather.Endnote 4

British Columbia, which is the second largest cranberry-producing province, had its second largest crop in the last 10 years, with an estimated crop volume of 47,905 metric tons. While this represents a mere 1.8% year-over-year increase, it is 9% above the 5-year average and represents almost 32% of Canada's cranberry production. The warm and dry weather improved pollination, leading to favourable growing conditions. Higher yields can also be attributed to some extent to the sector's transition to new varieties. Over the years, the BC Cranberry Marketing CommissionEndnote 5 has aligned its levy with the US, enabling it to amass significant financial reserves, which are used to fund many research projects on cranberries and the programs and services offered by the Commission. However, following the USDA's termination of the US Marketing Order on cranberries in October 2023 and the suspension of the US Cranberry Marketing Committee's authority to collect assessments, the BC Cranberry Marketing Commission has reassessed its levy strategy. In light of these developments, and given the province's large cranberry crop, for the 2023 crop, the BC Cranberry Marketing Commission decided to lower the BC levy to 5 cents (USD) per barrel (each barrel is equivalent to 100 pounds of cranberries), a change that it deems to be in the best interest of British Columbian growers.

British Columbia's apple crop continued to decline for the fourth consecutive year, making the 2023 crop the smallest crop in the last decade. The 2023 crop fell by 14.2% to 65,637 metric tons, mainly as a result of a 3% decline in acreage and weather events. Apple trees were impacted by the cold weather in December 2022, and the 2023 growing season in the Okanagan started about two weeks later than usual. Unusually high spring temperatures affected yields in some varieties, since at temperatures around 30°C many of the blooms just dried up and the fruit was not pollinated properly. Some orchards in the Keremeos area also suffered hail damage midway through the season.

Ontario's fruit production increased by 9% to reach 285,641 metric tons in 2023, its highest level in a decade, mainly as a result of a 35% surge in grape production. After experiencing a very challenging year in 2022, which saw Ontario's grape crop fall by 16% due to winter damage, Ontario's grape and wine industry, which accounts for the largest share of Canada's production, had a larger crop than anticipated earlier in the year. Wine grape production rose in 2023 by 36% to reach 82,188 metric tons, as a result of favourable weather conditions, particularly a warm September that helped grapes mature and ripen.

The 2023 apple crop was Ontario's largest apple crop in the last decade, reaching a volume of 166,153 metric tons. The industry's earlier estimate in July predicted a smaller crop than the previous year, but as summer progressed, timely rains and a warm September led to a larger crop. Some growers experienced frost and hail. New high-density plantings coming into production also contributed to higher yields. As in 2022, the Ontario apple industry was challenged with a shortage of bins and storage space to hold the apples. Grower returns for the 2023 crop have been declining for all varieties, particularly for Honeycrisp, due to the much larger crop in Washington State, which saw a 9% increase reaching a production volume of almost 2.8 million metric tons. The large apple crop in the US has led to much higher fresh apple holdings in storage than in previous years, leading to downward price pressures on apples imported from the US, which have had a negative impact on returns for apple growers not only in Ontario, but across the country.

Ontario, which grows most of Canada's tender fruits, reported increased volumes in peaches, nectarines, apricots and Bosc pears from the previous year, but reductions in plums.Endnote 6 The Ontario Tender Fruit Growers reported a 6% year-over-year decline in the province's Bartlett pear crop, which was the second largest crop in recent history, with the 2022 crop being the largest. Newer fire blight- tolerant crosses have been coming into production, which, with timely rains, are being credited for the increased sizing and production. Lower volumes of stone fruit imported from the US have led to higher pricing for imported fruit and higher returns for Ontario growers, while a large pear crop in Washington State has increased price pressures leading to necessary price adjustments later in the season for Ontario pears.

Quebec's fruit production volume declined by 21% to reach 253,771 metric tons in 2023, mainly as a result of a 40% drop in cranberry production and production declines in apples (−6%), strawberries (−12,5%), raspberries (−16.6%) and grapes (−9.5%). In stark contrast, the province's 2023 lowbush blueberry crop was up by 3.8%, reaching 45,406 metric tons, which represents Quebec's second largest lowbush-blueberry crop in the last 10 years. The increased production is primarily due to higher yields as a result of maturing blueberry fields and improved cultural practices. With a crop volume of 45,406 metric tons, which is 36% above the 5-year average, Quebec accounted for 42% of the country's total production and remained the top lowbush-blueberry-producing province.

Quebec, which is also the country's leading producer of cranberries, had its second smallest cranberry crop in 2023. While production fell by 40% to 92,925 metric tons in 2023, it still represents 61% of Canada's cranberry production. The 2023 season was characterized by a number of freezing nights during the spring, which caused damage to many fields, and a challenging summer with July being the rainiest month in the last 20 years. This combination of extreme weather events took its toll on cranberry plants, which also had to contend with new pests observed on most farms in Central Québec, a region that accounts for more than 80% of the province's cranberry production.

A late spring frost and a rainy summer also led to a decline in Quebec's apple crop, which fell by 6% to 96,704 metric tons, its lowest level in a decade. Initial industry estimates predicted a much smaller crop due to the spring frost, but a heat wave in September provided a much-needed growth spurt. The McIntosh variety, which accounts for the largest proportion (35%) of Quebec's apple mix, was down the most, while production volumes were higher for Gala, Ambrosia and Honeycrisp. Quebec's strawberry and raspberry production was also negatively affected by the spring frost and rainy summer, which led to the smallest crops in a decade for both berry crops. Strawberry production fell by 12.5% to 12,506 metric tons and raspberry production declined by 16.6% to 1,021 metric tons.

Fruit production in Atlantic Canada was down by 8.3% in 2023 reaching 117,240 metric tons, mostly as a result of a 14.4% drop in lowbush-blueberry production across the Maritimes and a severe freeze event that reduced the wine grape crop in Nova Scotia by 55%. Excessive moisture during the 2023 growing season, in addition to pollination issues and poor-quality harvest led to lower lowbush-blueberry yields and smaller crops in all Atlantic provinces. Production in New Brunswick, which accounts for 44% of the lowbush- blueberry crop in the Atlantic provinces, fell the most, by 17% to 27,242 metric tons, while production in Nova Scotia and Prince Edward Island fell respectively to 22,803 metric tons (−14%) and 11,574 metric tons (−8.7%). In early 2023, a polar vortex swept across Nova Scotia, affecting many horticultural crops, and particularly the province's wine grapes.

Canada is the second-largest commercial producer of blueberries in the world, behind only the United States, and the industry has a fully integrated production and processing supply chain using modern production practices and processing technologies. Canada produces and processes two types of blueberries: highbush (cultivated blueberries) and lowbush (wild blueberries). Lowbush blueberries are native to Eastern and Atlantic Canada with commercial production limited to Quebec, which accounted for 42.3% of the country's production in 2023, New Brunswick (25.4%), Nova Scotia (21.3%) and Prince Edward Island (10.8%), while British Columbia accounts for the bulk (95% in 2023) of Canada's highbush blueberry production. Over 98% of Canada's lowbush blueberry crop is processed or individually quick-frozen for sale to the retail market (for example, frozen consumer packs) and to the wholesale market where the fruit is used by food processors, hotels, restaurants, and institutions in a wide variety of processed food products. In contrast, only 50% to 60% of the highbush blueberry crop is destined for the frozen and processing markets, while 40% to 50% of the crop is sold fresh.

Canada is also the second largest producer of cranberries after the United States. Quebec and British Columbia together accounted for almost 93% of Canada's cranberry crop in 2023, while New Brunswick is the third largest cranberry-producing province and produced close to 5% of Canada's crop in 2023. Quebec is currently not only Canada's largest cranberry-producing province, accounting for 60% of the country's planted acreage, but also the largest producer of organic cranberries in the world.

After reaching an all-time high of $1.4 billion in 2022, Canada's fruit farm-gate value fell by 4.1% to $1.34 billion in 2023, mostly as a result of much smaller cranberry and blueberry crops and significantly lower prices for lowbush blueberries. Lowbush blueberry prices were lower at the beginning of the new 2023-24 marketing season, due to higher inventory levels of frozen blueberries both in the US and Canada. However, the smaller highbush and lowbush blueberry crops in North America in 2023 should help rebalance supply and demand, contributing to a recovery in prices as the season progresses.

Despite a 9% drop in its fruit production volume, with a fruit farm-gate value of over $457 million, British Columbia still accounted for the largest share of Canada's fruit farm-gate value (34%), followed by Ontario (30.6%), Quebec (23.8%), Nova Scotia (6.2%) and New Brunswick (2.9%). With a 2023 farm-gate value of over $293 million, which represents an all-time high, apples became the leading fruit crop in terms of value, ahead of blueberries ($291 million), grapes ($228 million), cranberries ($144 million), strawberries ($138 million) and sweet cherries ($98 million).

Given Canada's northern latitude and short growing season, the country is highly dependent on imports to satisfy the growing domestic demand for fruits throughout the year. While Canada accounts for less than 0.6% of global fruit exports, in 2023 Canada was the world's seventh largest fruit-importing country accounting for 3.8% of global fruit imports. As a result, Canada's fresh and frozen fruit trade deficit has been steadily growing, reaching an all-time high of almost $6.5 billion in 2023. Canada's fresh and frozen fruit exports have grown by 31.8% over the last five years to reach $1.1 billion in 2023, its second highest level, while the country's fresh and frozen fruit imports have increased by 19.2% during the same time to reach their highest level of almost $7.6 billion in 2023. The impressive growth in Canada's fruit exports over the last five years is mainly due to a surge in exports of strawberries (enjoying a five-fold increase), cranberries (up 67%), apples (up 63%) and blueberries (up 14%). With a little over $630 million in exports, blueberries continue to be Canada's top fruit export and accounted for 57% of the country's fruit export value in 2023, followed by cranberries (7.2%), sweet cherries (6.3%), apples (6%), strawberries (5%) and raspberries (1.3%). The U.S. remains Canada's top export destination absorbing 72% of Canadian fruit exports in 2023, while other major export markets include Japan (5.7%), China (3.5%), Germany (2.7%) and the Netherlands (1.6%).

1. Production

1.1. Number of fruit farmsEndnote 1 by province

| 2011 | 2016 | 2021 | 2021 % Share |

|

|---|---|---|---|---|

| Newfoundland and Labrador | 44 | 26 | 30 | 0.4% |

| Prince Edward Island | 173 | 175 | 148 | 2.1% |

| Nova Scotia | 971 | 890 | 619 | 8.7% |

| New Brunswick | 379 | 415 | 319 | 4.5% |

| Quebec | 1,414 | 1,495 | 1,470 | 20.7% |

| Ontario | 1,548 | 1,362 | 1,211 | 17.1% |

| Manitoba | 94 | 75 | 66 | 0.9% |

| Saskatchewan | 112 | 90 | 79 | 1.1% |

| Alberta | 151 | 137 | 123 | 1.7% |

| British Columbia | 3,367 | 3,180 | 3,036 | 42.8% |

| Canada | 8,253 | 7,845 | 7,101 | 100.0% |

|

Note:

Source: Statistics Canada. Table 32-10-0166-01 Farms classified by farm type, Census of Agriculture historical data |

||||

1.2. Total fruit areaEndnote 1 by commodity – hectares

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Lowbush blueberries | 65,159 | 65,341 | 68,625 | 68,577 | 63,155 | 48.9% |

| Apples | 17,230 | 17,885 | 18,147 | 17,846 | 17,748 | 13.7% |

| GrapesEndnote 2 | 12,521 | 13,302 | 13,826 | 13,334 | 12,545 | 9.7% |

| Highbush blueberries | 11,604 | 11,712 | 12,367 | 12,080 | 11,880 | 9.2% |

| Cranberries | 7,382 | 7,917 | 7,970 | 8,356 | 8,148 | 6.3% |

| Strawberries | 3,839 | 3,858 | 4,099 | 3,672 | 3,331 | 2.6% |

| Cherries, sweet | 2,128 | 2,464 | 2,953 | 2,980 | 3,017 | 2.3% |

| Peaches | 2,465 | 2,555 | 2,565 | 2,490 | 2,444 | 1.9% |

| Raspberries | 1,963 | 1,739 | 1,652 | 1,499 | 1,411 | 1.1% |

| Haskaps | 668 | 1,041 | 1,172 | 1,125 | 1,094 | 0.8% |

| Saskatoon berries | 956 | 1,066 | 1,080 | 1,081 | 1,083 | 0.8% |

| Pears | 832 | 819 | 871 | 863 | 859 | 0.7% |

| Cherries, sour | 926 | 859 | 791 | 780 | 781 | 0.6% |

| Plums and prunes | 608 | 627 | 600 | 587 | 592 | 0.5% |

| Nectarines | 309 | 303 | 309 | 314 | 314 | 0.2% |

| Currants | 125 | 142 | 167 | 157 | 145 | 0.1% |

| Apricots | 130 | 119 | 113 | 108 | 109 | 0.1% |

| Blackberries | 111 | x | 101 | 92 | 85 | 0.1% |

| Other fruits | 580 | 582 | 523 | 463 | 458 | 0.4% |

| Total fruitsEndnote 3 | 129,535 | 132,435 | 137,948 | 136,418 | 129,213 | 100.0% |

|

Notes:

x: Suppressed to meet the confidentiality requirements of the Statistics Act. Source: Statistics Canada. Table 32-10-0364-01 Estimates, production and farm gate value of fresh and processed fruits |

||||||

1.3. Total fruit areaEndnote 1 by province – hectares

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 239 | 306 | 337 | 310 | 320 | 0.2% |

| Prince Edward Island | 5,601 | 5,449 | 5,502 | 5,572 | 5,522 | 4.3% |

| Nova Scotia | 18,087 | 18,332 | 18,598 | 18,599 | 18,523 | 14.3% |

| New Brunswick | 16,432 | 16,965 | 17,090 | 17,216 | 12,070 | 9.3% |

| Quebec | 42,750 | 43,296 | 46,968 | 46,586 | 45,740 | 35.4% |

| Ontario | 19,468 | 19,416 | 19,684 | 19,202 | 18,934 | 14.7% |

| Manitoba | 211 | 210 | 220 | 201 | 186 | 0.1% |

| Saskatchewan | 641 | 696 | 659 | 615 | 604 | 0.5% |

| Alberta | 779 | 985 | 959 | 947 | 938 | 0.7% |

| British Columbia | 25,327 | 26,781 | 27,931 | 27,170 | 26,378 | 20.4% |

| CanadaEndnote 2 | 129,535 | 132,435 | 137,948 | 136,418 | 129,213 | 100.0% |

|

Notes:

Source: Statistics Canada. Table 32-10-0364-01 Estimates, production and farm gate value of fresh and processed fruits |

||||||

1.4. Fruit production volume by commodity – metric tons

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Apples | 382,771 | 390,999 | 351,565 | 382,456 | 368,476 | 41.5% |

| Cranberries | 156,846 | 161,143 | 156,575 | 210,288 | 151,316 | 17.1% |

| Lowbush blueberries | 87,950 | 75,088 | 73,773 | 115,986 | 107,233 | 12.1% |

| GrapesEndnote 1 | 121,511 | 104,709 | 104,203 | 90,177 | 104,016 | 11.7% |

| Highbush blueberries | 88,540 | 77,175 | 71,916 | 69,787 | 59,749 | 6.7% |

| Cherries, sweet | 22,079 | 19,355 | 16,404 | 20,816 | 22,350 | 2.5% |

| Strawberries | 27,270 | 24,134 | 24,615 | 25,022 | 22,181 | 2.5% |

| Peaches | 22,862 | 15,958 | 19,427 | 19,912 | 20,590 | 2.3% |

| Pears | 9,396 | 8,545 | 7,533 | 8,833 | 9,296 | 1.0% |

| Raspberries | 9,145 | 7,608 | 5,541 | 6,907 | 6,720 | 0.8% |

| Nectarines | 3,435 | 3,544 | 4,303 | 4,097 | 4,139 | 0.5% |

| Plums and prunes | 4,096 | 2,993 | 3,665 | 3,865 | 3,869 | 0.4% |

| Cherries, sour | 3,669 | 2,023 | 3,542 | 3,015 | 3,131 | 0.4% |

| Apricots | 917 | 747 | 801 | 729 | 696 | 0.1% |

| Saskatoon berries | 620 | 685 | 683 | 689 | 695 | 0.1% |

| Blackberries | 880 | 677 | 594 | 581 | 516 | 0.1% |

| Haskaps | 395 | 431 | 509 | 495 | 477 | 0.1% |

| Currants | 214 | 170 | 185 | 166 | 157 | 0.0% |

| Kiwis | .. | .. | 33 | 52 | 54 | 0.0% |

| Other fruits | 2,516 | 2,396 | 1,475 | 1,539 | 1,529 | 0.2% |

| Total fruits | 945,112 | 898,380 | 847,344 | 965,412 | 887,191 | 100.0% |

|

Notes:

..: Not available for a specific reference period. Source: Statistics Canada. Table 32-10-0364-01 Estimates, production and farm gate value of fresh and processed fruits |

||||||

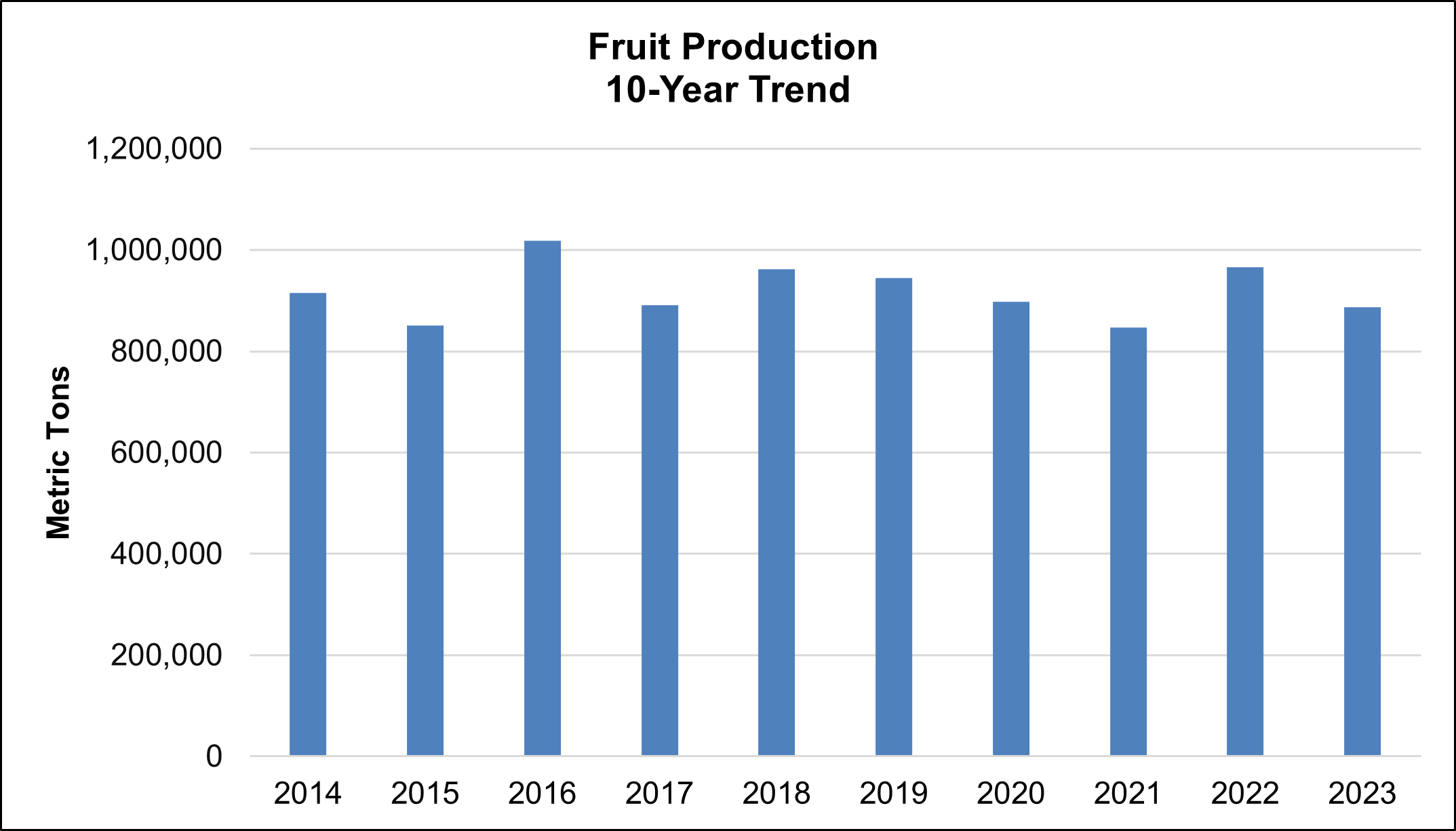

1.5. Total fruit production volume — 10-year trend

Source: Statistics Canada. Table 32-10-0364-01 Estimates, production and farm gate value of fresh and processed fruits

Description of above image

1.5. Total fruit production volume — 10-year trend

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Total fruits (metric tonnes) | 915,262 | 850,816 | 1,018,099 | 891,522 | 962,325 | 945,112 | 898,380 | 847,344 | 965,412 | 887,191 |

1.6. Fruit production volume by province — metric tons

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 313 | 473 | 978 | 980 | 1,024 | 0.1% |

| Prince Edward Island | 10,143 | 9,518 | 10,486 | 13,591 | 12,546 | 1.4% |

| Nova Scotia | 51,252 | 52,742 | 65,925 | 67,149 | 63,617 | 7.2% |

| New Brunswick | 40,567 | 25,941 | 39,176 | 46,043 | 40,052 | 4.5% |

| Quebec | 268,489 | 270,564 | 235,008 | 320,663 | 253,771 | 28.6% |

| Ontario | 271,731 | 254,476 | 235,277 | 261,895 | 285,641 | 32.2% |

| Manitoba | 468 | 345 | 274 | 281 | 269 | 0.0% |

| Saskatchewan | 549 | 564 | 496 | 496 | 488 | 0.1% |

| Alberta | 723 | 700 | 671 | 646 | 637 | 0.1% |

| British Columbia | 300,878 | 283,057 | 259,051 | 253,668 | 229,145 | 25.8% |

| Canada | 945,112 | 898,380 | 847,344 | 965,412 | 887,191 | 100.0% |

| Source: Statistics Canada. Table 32-10-0364-01 Estimates, production and farm gate value of fresh and processed fruits | ||||||

1.7. Fruit farm gate valueEndnote 1 by commodity – thousands of Canadian dollars

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Apples | $245,740 | $258,729 | $242,730 | $284,926 | $293,183 | 21.8% |

| GrapesEndnote 2 | $215,619 | $193,539 | $202,997 | $195,783 | $227,926 | 17.0% |

| Highbush blueberries | $182,130 | $163,732 | $176,739 | $180,489 | $169,309 | 12.6% |

| Cranberries | $133,409 | $152,912 | $137,011 | $184,772 | $144,202 | 10.7% |

| Strawberries | $130,436 | $126,975 | $128,380 | $140,756 | $137,661 | 10.3% |

| Lowbush blueberries | $122,305 | $127,878 | $133,773 | $180,847 | $121,559 | 9.1% |

| Cherries, sweet | $89,098 | $76,594 | $69,610 | $88,786 | $98,000 | 7.3% |

| Peaches | $42,726 | $32,081 | $44,475 | $49,694 | $53,842 | 4.0% |

| Raspberries | $32,128 | $28,174 | $25,995 | $32,426 | $32,710 | 2.4% |

| Pears | $10,714 | $10,063 | $11,489 | $14,336 | $15,558 | 1.2% |

| Nectarines | $7,322 | $7,950 | $12,727 | $12,584 | $13,125 | 1.0% |

| Plums and prunes | $8,940 | $6,817 | $10,070 | $10,866 | $11,189 | 0.8% |

| Cherries, sour | $4,282 | $2,257 | $6,231 | $5,693 | $5,994 | 0.4% |

| Haskaps | $2,321 | $2,691 | $3,322 | $3,749 | $3,710 | 0.3% |

| Blackberries | $4,609 | $3,737 | $3,348 | $3,496 | $3,144 | 0.2% |

| Saskatoon berries | $2,293 | $2,745 | $2,752 | $2,948 | $3,081 | 0.2% |

| Apricots | $1,745 | $1,402 | $2,318 | $2,228 | $2,272 | 0.2% |

| Currants | $874 | $704 | $937 | $910 | $889 | 0.1% |

| Kiwis | $0 | $0 | $115 | $166 | $173 | 0.0% |

| Other fruits | $3,890 | $5,136 | $4,360 | $4,611 | $5,181 | 0.4% |

| Total fruits | $1,240,582 | $1,204,114 | $1,219,378 | $1,400,064 | $1,342,708 | 100.0% |

|

Notes:

Source: Statistics Canada. Table 32-10-0364-01 Estimates, production and farm gate value of fresh and processed fruits |

||||||

1.8. Fruit farm gate valueEndnote 1 by province – thousands of Canadian dollars

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | $930 | $1,154 | $1,636 | $1,689 | $1,908 | 0.1% |

| Prince Edward Island | $12,705 | $15,820 | $19,243 | $28,808 | $24,345 | 1.8% |

| Nova Scotia | $60,378 | $66,942 | $92,068 | $100,177 | $82,718 | 6.2% |

| New Brunswick | $48,360 | $36,932 | $62,945 | $69,286 | $38,815 | 2.9% |

| Quebec | $312,736 | $339,911 | $283,595 | $375,562 | $319,205 | 23.8% |

| Ontario | $326,454 | $300,192 | $316,485 | $351,418 | $411,318 | 30.6% |

| Manitoba | $2,211 | $1,685 | $1,574 | $1,740 | $1,737 | 0.1% |

| Saskatchewan | $2,707 | $2,702 | $2,437 | $2,609 | $2,620 | 0.2% |

| Alberta | $3,355 | $3,196 | $2,722 | $2,857 | $3,005 | 0.2% |

| British Columbia | $470,747 | $435,580 | $436,672 | $465,917 | $457,038 | 34.0% |

| Canada | $1,240,582 | $1,204,114 | $1,219,378 | $1,400,064 | $1,342,708 | 100.0% |

|

Note:

Source: Statistics Canada. Table 32-10-0364-01 Estimates, production and farm gate value of fresh and processed fruits |

||||||

2. Trade

2.1. Canadian fruitEndnote 1 trade balance – by value (thousands of Canadian dollars)

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Exports | $843,012 | $879,520 | $906,466 | $1,123,030 | $1,111,268 |

| Imports | $6,362,608 | $6,650,450 | $6,856,760 | $7,271,204 | $7,582,848 |

| Trade Balance (Exports − Imports) |

−$5,519,596 | −$5,770,931 | −$5,950,294 | −$6,148,174 | −$6,471,580 |

|

Note:

Source: Statistics Canada. (CATSnet, March 2024) |

|||||

2.2. Exports

2.2.1. Fresh fruitEndnote 1 export value by commodity – thousands of Canadian dollars

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Lowbush blueberriesEndnote 2 | $294,821 | $314,238 | $303,938 | $366,738 | $323,423 | 29.1% |

| Highbush blueberriesEndnote 2 | $257,944 | $224,599 | $226,998 | $297,258 | $306,949 | 27.6% |

| Cranberries | $47,682 | $57,864 | $65,164 | $70,790 | $79,474 | 7.2% |

| Cherries, sweet | $67,608 | $72,628 | $79,402 | $130,010 | $69,710 | 6.3% |

| ApplesEndnote 3 | $41,088 | $42,318 | $50,368 | $51,264 | $67,039 | 6.0% |

| StrawberriesEndnote 2 | $11,451 | $11,523 | $14,478 | $34,658 | $55,241 | 5.0% |

| RaspberriesEndnote 2Endnote 4 | $9,068 | $12,881 | $16,774 | $23,546 | $14,054 | 1.3% |

| Guavas and mangoes | $291 | $29 | $631 | $1,129 | $1,411 | 0.1% |

| Melons, nesEndnote 5 | $71 | $45 | $163 | $111 | $1,153 | 0.1% |

| Almonds | $547 | $550 | $11,195 | $5,224 | $1,095 | 0.1% |

| Watermelons | $608 | $317 | $170 | $1,632 | $784 | 0.1% |

| GrapesEndnote 3 | $1,339 | $177 | $950 | $368 | $457 | 0.0% |

| Others | $110,750 | $142,531 | $136,236 | $140,304 | $190,489 | 17.1% |

| Total | $843,012 | $879,520 | $906,466 | $1,123,030 | $1,111,268 | 100.0% |

|

Notes:

Source: Statistics Canada. (CATSnet, March 2024) |

||||||

2.2.2. Fresh fruitEndnote 1 export volume by commodity – metric tons

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Lowbush blueberriesEndnote 2 | 103,263 | 94,516 | 72,296 | 76,951 | 71,372 | 20.3% |

| Highbush blueberriesEndnote 2 | 67,035 | 61,689 | 54,731 | 54,605 | 58,871 | 16.7% |

| ApplesEndnote 3 | 36,745 | 35,703 | 47,333 | 68,045 | 58,810 | 16.7% |

| Cranberries | 39,358 | 53,987 | 52,609 | 49,328 | 53,207 | 15.1% |

| StrawberriesEndnote 2 | 2,006 | 1,622 | 2,472 | 5,472 | 9,085 | 2.6% |

| Cherries, sweet | 8,207 | 6,851 | 9,691 | 12,159 | 8,124 | 2.3% |

| RaspberriesEndnote 2Endnote 4 | 3,663 | 4,556 | 2,491 | 3,154 | 2,319 | 0.7% |

| GrapesEndnote 3 | 2,650 | 214 | 1,259 | 410 | 573 | 0.2% |

| Watermelons | 1,373 | 753 | 373 | 2,035 | 462 | 0.1% |

| Melons, nesEndnote 5 | 103 | 63 | 152 | 387 | 396 | 0.1% |

| Guavas and mangoes | 153 | 3 | 37 | 73 | 261 | 0.1% |

| Almonds | 61 | 62 | 934 | 455 | 133 | 0.0% |

| Others | 53,928 | 63,206 | 57,026 | 57,403 | 88,015 | 25.0% |

| Total | 318,524 | 323,207 | 301,402 | 330,476 | 351,625 | 100.0% |

|

Notes:

Source: Statistics Canada. (CATSnet, March 2024) |

||||||

2.2.3. Canada's top fresh fruit export destinations – by value (thousands of Canadian dollars)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| United States | $546,084 | $571,378 | $612,502 | $789,989 | $799,791 | 72.0% |

| Japan | $41,665 | $47,055 | $56,878 | $67,137 | $63,453 | 5.7% |

| China | $53,504 | $45,014 | $43,141 | $39,494 | $39,002 | 3.5% |

| Germany | $48,112 | $48,468 | $40,955 | $44,736 | $29,757 | 2.7% |

| Netherlands | $20,854 | $27,095 | $15,961 | $23,473 | $23,489 | 2.1% |

| France | $13,887 | $15,491 | $13,201 | $24,895 | $18,057 | 1.6% |

| South Korea | $2,060 | $1,267 | $5,555 | $7,676 | $17,186 | 1.5% |

| Australia | $9,391 | $13,119 | $15,040 | $20,488 | $15,884 | 1.4% |

| Viet Nam | $9,053 | $10,659 | $11,687 | $23,278 | $14,500 | 1.3% |

| Poland | $20,563 | $19,945 | $11,738 | $11,047 | $12,429 | 1.1% |

| Belgium | $13,030 | $14,255 | $15,318 | $12,606 | $12,124 | 1.1% |

| United Kingdom | $10,536 | $5,871 | $8,144 | $10,023 | $10,259 | 0.9% |

| Italy | $2,586 | $3,334 | $3,302 | $2,500 | $9,901 | 0.9% |

| Switzerland | $8,628 | $6,876 | $6,426 | $3,195 | $5,473 | 0.5% |

| Austria | $1,476 | $1,770 | $2,859 | $2,243 | $4,381 | 0.4% |

| Others | $41,583 | $47,921 | $43,758 | $40,250 | $35,580 | 3.2% |

| Total | $843,012 | $879,520 | $906,466 | $1,123,030 | $1,111,268 | 100.0% |

| Source: Statistics Canada. (CATSnet, March 2024) | ||||||

2.2.4. Canada's top 10 fresh fruit export destinations – by volume (metric tons)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| United States | 209,438 | 220,009 | 205,625 | 213,933 | 238,072 | 67.7% |

| Viet Nam | 8,632 | 9,029 | 14,722 | 42,831 | 28,609 | 8.1% |

| Japan | 11,272 | 11,482 | 12,136 | 12,619 | 13,004 | 3.7% |

| China | 13,015 | 11,674 | 11,271 | 6,239 | 10,708 | 3.0% |

| Germany | 18,149 | 15,736 | 11,145 | 10,975 | 9,639 | 2.7% |

| Netherlands | 8,528 | 9,558 | 5,154 | 7,683 | 8,549 | 2.4% |

| Poland | 8,932 | 7,899 | 4,253 | 3,823 | 5,369 | 1.5% |

| United Kingdom | 4,182 | 2,237 | 3,774 | 5,021 | 4,812 | 1.4% |

| France | 4,950 | 4,746 | 3,176 | 5,608 | 4,488 | 1.3% |

| Belgium | 4,301 | 4,572 | 3,680 | 2,952 | 3,669 | 1.0% |

| Australia | 2,809 | 3,519 | 3,992 | 4,350 | 3,358 | 1.0% |

| South Korea | 883 | 453 | 1,397 | 1,260 | 3,048 | 0.9% |

| Italy | 935 | 1,098 | 662 | 488 | 2,235 | 0.6% |

| Austria | 849 | 798 | 755 | 812 | 1,601 | 0.5% |

| Switzerland | 3,012 | 1,907 | 1,509 | 819 | 1,502 | 0.4% |

| Others | 18,636 | 18,491 | 18,152 | 11,062 | 12,960 | 3.7% |

| Total | 318,524 | 323,207 | 301,402 | 330,476 | 351,625 | 100.0% |

| Source: Statistics Canada. (CATSnet, March 2024) | ||||||

2.2.5. Export destinations for Canada's top 5 fresh fruitEndnote 1 exports – by value (thousands of Canadian dollars)

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

|---|---|---|---|---|---|---|

| Lowbush blueberriesEndnote 2 | United States | $124,440 | $137,858 | $140,666 | $184,630 | $168,213 |

| Japan | $32,176 | $28,589 | $29,034 | $34,325 | $34,739 | |

| Germany | $42,471 | $42,630 | $34,052 | $38,134 | $22,315 | |

| France | $11,758 | $12,311 | $11,733 | $22,904 | $16,469 | |

| Netherlands | $12,588 | $21,250 | $11,354 | $14,437 | $12,960 | |

| Others | $71,389 | $71,599 | $77,099 | $72,308 | $68,726 | |

| Total | $294,821 | $314,238 | $303,938 | $366,738 | $323,423 | |

| Highbush blueberriesEndnote 2 | United States | $246,868 | $213,218 | $214,814 | $280,528 | $289,351 |

| Japan | $4,663 | $3,082 | $4,938 | $10,639 | $13,877 | |

| New Zealand | $2,027 | $3,653 | $2,430 | $1,047 | $1,317 | |

| China | $1,995 | $1,063 | $1,188 | $2,608 | $601 | |

| Australia | $266 | $289 | $710 | $328 | $336 | |

| Others | $2,126 | $3,296 | $2,919 | $2,108 | $1,467 | |

| Total | $257,944 | $224,599 | $226,998 | $297,258 | $306,949 | |

| Cranberries | United States | $45,239 | $56,742 | $63,454 | $68,757 | $79,314 |

| Netherlands | $180 | $371 | $693 | $1,433 | $81 | |

| Poland | $1,244 | $19 | $0 | $198 | $53 | |

| United Arab Emirates | $0 | $0 | $0 | $29 | $18 | |

| France | $27 | $31 | $172 | $200 | $8 | |

| Others | $991 | $701 | $847 | $174 | $1 | |

| Total | $47,682 | $57,864 | $65,164 | $70,790 | $79,474 | |

| Cherries, sweet | United States | $30,143 | $38,936 | $44,435 | $73,647 | $36,079 |

| China | $24,683 | $16,886 | $18,109 | $27,472 | $12,643 | |

| South Korea | $0 | $30 | $0 | $1,644 | $8,880 | |

| United Kingdom | $1,277 | $1,184 | $1,841 | $1,742 | $2,476 | |

| Viet Nam | $978 | $2,989 | $3,046 | $8,387 | $2,269 | |

| Others | $11,505 | $15,591 | $15,018 | $25,505 | $9,633 | |

| Total | $67,608 | $72,628 | $79,402 | $130,010 | $69,710 | |

| ApplesEndnote 3 | United States | $29,656 | $28,688 | $37,534 | $33,155 | $51,471 |

| Viet Nam | $6,429 | $6,887 | $6,763 | $14,213 | $10,344 | |

| Cuba | $2,472 | $870 | $1,549 | $572 | $1,917 | |

| Mexico | $541 | $627 | $573 | $459 | $753 | |

| Israel | $155 | $2,694 | $1,650 | $548 | $747 | |

| Others | $1,833 | $2,552 | $2,299 | $2,317 | $1,806 | |

| Total | $41,088 | $42,318 | $50,368 | $51,264 | $67,039 | |

|

Notes:

Source: Statistics Canada. (CATSnet, March 2024) |

||||||

2.2.6. Export destinations for Canada's top 5 fresh fruitEndnote 1 exports – by volume (metric tons)

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

|---|---|---|---|---|---|---|

| Lowbush blueberriesEndnote 2 | United States | 45,750 | 40,736 | 34,104 | 37,322 | 34,859 |

| Japan | 8,940 | 7,286 | 5,998 | 6,215 | 6,664 | |

| Germany | 15,708 | 13,439 | 8,055 | 8,441 | 5,657 | |

| France | 4,208 | 3,738 | 2,627 | 4,904 | 3,853 | |

| Netherlands | 4,401 | 6,916 | 3,095 | 4,353 | 3,728 | |

| Others | 24,256 | 22,400 | 18,417 | 15,716 | 16,611 | |

| Total | 103,263 | 94,516 | 72,296 | 76,951 | 71,372 | |

| Highbush blueberriesEndnote 2 | United States | 63,909 | 58,565 | 51,516 | 50,905 | 54,707 |

| Japan | 1,209 | 766 | 1,296 | 2,423 | 3,162 | |

| New Zealand | 611 | 1,108 | 606 | 243 | 374 | |

| China | 580 | 294 | 305 | 554 | 148 | |

| Croatia | 0 | 0 | 0 | 0 | 120 | |

| Others | 726 | 956 | 1,008 | 479 | 361 | |

| Total | 67,035 | 61,689 | 54,731 | 54,605 | 58,871 | |

| ApplesEndnote 3 | Viet Nam | 8,176 | 8,522 | 14,005 | 41,885 | 27,793 |

| United States | 20,234 | 18,342 | 22,674 | 19,910 | 22,830 | |

| United Kingdom | 636 | 360 | 1,433 | 2,250 | 1,680 | |

| Hong Kong | 410 | 133 | 212 | 758 | 1,364 | |

| Cuba | 5,916 | 892 | 1,547 | 606 | 1,291 | |

| Others | 1,374 | 7,455 | 7,461 | 2,636 | 3,852 | |

| Total | 36,745 | 35,703 | 47,333 | 68,045 | 58,810 | |

| Cranberries | United States | 38,160 | 53,549 | 51,985 | 48,578 | 53,132 |

| Netherlands | 57 | 75 | 257 | 312 | 46 | |

| Poland | 712 | 11 | 0 | 114 | 21 | |

| United Arab Emirates | 0 | 0 | 0 | 8 | 5 | |

| France | 9 | 23 | 70 | 43 | 2 | |

| Others | 420 | 329 | 297 | 273 | 1 | |

| Total | 39,358 | 53,987 | 52,609 | 49,328 | 53,207 | |

| StrawberriesEndnote 2 | United States | 1,796 | 1,524 | 2,469 | 5,458 | 9,083 |

| Saint Pierre and Miquelon | 3 | 1 | 1 | 1 | 2 | |

| France | 0 | 22 | 0 | 0 | 0 | |

| Others | 207 | 76 | 3 | 13 | 0 | |

| Total | 2,006 | 1,622 | 2,472 | 5,472 | 9,085 | |

|

Notes:

Source: Statistics Canada. (CATSnet, March 2024) |

||||||

2.3. Imports

2.3.1. Fresh fruitEndnote 1 import value by commodity – thousands of Canadian dollars

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| GrapesEndnote 2Endnote 3 | $662,805 | $686,286 | $669,079 | $727,386 | $827,232 | 10.9% |

| StrawberriesEndnote 4 | $516,914 | $570,239 | $643,440 | $667,233 | $703,147 | 9.3% |

| BananasEndnote 5 | $567,340 | $585,788 | $574,866 | $637,080 | $680,334 | 9.0% |

| Highbush blueberriesEndnote 4 | $349,306 | $364,146 | $423,256 | $473,959 | $481,834 | 6.4% |

| RaspberriesEndnote 4 | $350,506 | $379,868 | $406,304 | $456,729 | $432,392 | 5.7% |

| Mandarins, tangerines and clementines | $285,208 | $316,924 | $322,647 | $324,862 | $384,092 | 5.1% |

| Avocados | $315,480 | $315,013 | $315,504 | $351,558 | $327,557 | 4.3% |

| ApplesEndnote 3 | $296,276 | $268,760 | $272,866 | $336,737 | $301,380 | 4.0% |

| Oranges | $235,763 | $268,102 | $260,600 | $293,273 | $300,875 | 4.0% |

| Guavas and mangoes | $157,139 | $162,582 | $177,579 | $189,050 | $236,595 | 3.1% |

| Watermelons | $144,275 | $164,291 | $183,798 | $170,187 | $216,710 | 2.9% |

| Lemons and limes | $170,456 | $170,885 | $176,656 | $198,533 | $212,742 | 2.8% |

| Cherries, sweet | $166,131 | $199,371 | $194,842 | $167,288 | $179,399 | 2.4% |

| Almonds | $271,042 | $262,121 | $218,696 | $200,465 | $177,956 | 2.3% |

| Blackberries and mulberries | $121,916 | $137,473 | $145,777 | $157,525 | $157,966 | 2.1% |

| OthersEndnote 6 | $1,752,051 | $1,798,601 | $1,870,852 | $1,919,339 | $1,962,637 | 25.9% |

| Total | $6,362,608 | $6,650,450 | $6,856,760 | $7,271,204 | $7,582,848 | 100.0% |

|

Notes:

Source: Statistics Canada. (CATSnet, March 2024) |

||||||

2.3.2. Fresh fruitEndnote 1 import volume by commodity – metric tons

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| BananasEndnote 2 | 603,318 | 617,507 | 612,115 | 597,622 | 615,467 | 21.4% |

| Watermelons | 228,225 | 232,684 | 257,745 | 216,604 | 242,518 | 8.4% |

| GrapesEndnote 3Endnote 4 | 210,323 | 212,412 | 209,943 | 210,710 | 196,430 | 6.8% |

| Oranges | 185,851 | 195,968 | 188,172 | 182,730 | 178,606 | 6.2% |

| ApplesEndnote 3 | 206,264 | 200,040 | 198,070 | 205,209 | 170,171 | 5.9% |

| Mandarins, tangerines and clementines | 143,293 | 161,309 | 160,729 | 148,580 | 159,025 | 5.5% |

| StrawberriesEndnote 5 | 127,230 | 134,370 | 144,014 | 147,609 | 145,046 | 5.0% |

| Pineapples | 119,825 | 113,087 | 125,731 | 128,845 | 131,535 | 4.6% |

| Lemons and limes | 101,811 | 107,169 | 109,390 | 110,082 | 111,970 | 3.9% |

| Avocados | 94,956 | 106,680 | 109,578 | 98,512 | 110,301 | 3.8% |

| Cantaloupes and muskmelons | 93,146 | 80,077 | 72,505 | 74,101 | 81,564 | 2.8% |

| Guavas and mangoes | 71,230 | 77,404 | 80,544 | 76,140 | 80,435 | 2.8% |

| Highbush blueberriesEndnote 5 | 55,871 | 63,581 | 74,024 | 74,216 | 75,276 | 2.6% |

| Pears | 64,664 | 59,448 | 62,361 | 57,256 | 56,142 | 1.9% |

| Melons, nesEndnote 6 | 46,916 | 45,424 | 51,177 | 47,208 | 49,831 | 1.7% |

| OthersEndnote 7 | 504,375 | 500,198 | 534,467 | 476,374 | 477,834 | 16.6% |

| Total | 2,857,300 | 2,907,357 | 2,990,565 | 2,851,798 | 2,882,150 | 100.0% |

|

Notes:

Source: Statistics Canada. (CATSnet, March 2024) |

||||||

2.3.3. Top sources of Canada's fresh fruit imports – by value (thousands of Canadian dollars)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| United States | $2,564,829 | $2,767,241 | $2,760,789 | $2,825,695 | $2,845,958 | 37.5% |

| Mexico | $1,064,312 | $1,103,965 | $1,225,874 | $1,309,303 | $1,440,131 | 19.0% |

| Peru | $237,314 | $278,921 | $310,939 | $414,025 | $442,599 | 5.8% |

| Guatemala | $292,432 | $272,585 | $309,196 | $382,631 | $403,320 | 5.3% |

| Chile | $355,037 | $305,944 | $317,456 | $335,596 | $340,024 | 4.5% |

| South Africa | $203,636 | $230,579 | $239,916 | $270,520 | $269,258 | 3.6% |

| Costa Rica | $255,536 | $262,249 | $244,322 | $231,208 | $261,485 | 3.4% |

| Morocco | $124,724 | $139,300 | $151,678 | $179,655 | $194,533 | 2.6% |

| Viet Nam | $128,369 | $122,462 | $134,135 | $136,522 | $137,413 | 1.8% |

| Türkiye | $145,111 | $154,216 | $122,469 | $124,220 | $127,071 | 1.7% |

| Others | $991,306 | $1,012,989 | $1,039,988 | $1,061,830 | $1,121,057 | 14.8% |

| Total | $6,362,608 | $6,650,450 | $6,856,760 | $7,271,204 | $7,582,848 | 100.0% |

| Source: Statistics Canada. (CATSnet, March 2024) | ||||||

2.3.4. Top sources of Canada's fresh fruit imports – by volume (metric tons)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| United States | 989,304 | 1,008,643 | 1,018,318 | 919,666 | 921,875 | 32.0% |

| Mexico | 386,089 | 393,351 | 423,726 | 392,194 | 412,615 | 14.3% |

| Guatemala | 296,753 | 276,687 | 316,197 | 351,922 | 347,987 | 12.1% |

| Costa Rica | 267,078 | 274,287 | 250,501 | 215,295 | 236,732 | 8.2% |

| South Africa | 89,086 | 112,751 | 130,513 | 138,909 | 140,872 | 4.9% |

| Peru | 68,392 | 87,896 | 93,406 | 110,660 | 106,194 | 3.7% |

| Chile | 106,509 | 90,210 | 90,684 | 86,906 | 81,457 | 2.8% |

| Honduras | 82,530 | 72,808 | 59,916 | 79,436 | 76,390 | 2.7% |

| Morocco | 68,211 | 73,215 | 78,393 | 85,222 | 71,593 | 2.5% |

| Colombia | 59,097 | 72,671 | 85,715 | 69,826 | 70,906 | 2.5% |

| Others | 444,252 | 444,837 | 443,196 | 401,761 | 415,529 | 14.4% |

| Total | 2,857,300 | 2,907,357 | 2,990,565 | 2,851,798 | 2,882,150 | 100.0% |

| Source: Statistics Canada. (CATSnet, March 2024) | ||||||

2.3.5. Sources of Canada's top 5 fresh fruitEndnote 1 imports – by value (thousands Canadian dollars)

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

|---|---|---|---|---|---|---|

| GrapesEndnote 2Endnote 3 | United States | $281,720 | $293,866 | $285,658 | $300,173 | $308,102 |

| Peru | $65,546 | $78,624 | $97,698 | $132,205 | $191,600 | |

| Mexico | $66,758 | $73,424 | $64,057 | $65,471 | $104,586 | |

| Chile | $119,245 | $108,132 | $91,183 | $96,163 | $96,814 | |

| South Africa | $80,348 | $83,853 | $82,254 | $85,352 | $67,683 | |

| Others | $49,189 | $48,387 | $48,230 | $48,022 | $58,447 | |

| Total | $662,805 | $686,286 | $669,079 | $727,386 | $827,232 | |

| StrawberriesEndnote 4 | United States | $366,894 | $405,745 | $436,035 | $450,520 | $477,397 |

| Mexico | $104,178 | $103,498 | $134,312 | $140,710 | $158,775 | |

| Peru | $8,169 | $12,920 | $16,897 | $18,872 | $19,321 | |

| Chile | $17,737 | $23,747 | $19,762 | $18,536 | $15,715 | |

| Türkiye | $8,818 | $6,813 | $12,501 | $11,388 | $9,847 | |

| Others | $11,117 | $17,516 | $23,933 | $27,208 | $22,092 | |

| Total | $516,914 | $570,239 | $643,440 | $667,233 | $703,147 | |

| BananasEndnote 5 | Guatemala | $234,443 | $220,936 | $243,272 | $319,827 | $331,285 |

| Costa Rica | $118,814 | $131,827 | $103,072 | $80,514 | $98,109 | |

| Colombia | $56,458 | $67,593 | $78,326 | $72,112 | $74,398 | |

| Ecuador | $85,337 | $94,221 | $74,800 | $63,405 | $68,512 | |

| Honduras | $33,272 | $34,245 | $28,822 | $49,874 | $49,825 | |

| Others | $39,017 | $36,966 | $46,573 | $51,349 | $58,206 | |

| Total | $567,340 | $585,788 | $574,866 | $637,080 | $680,334 | |

| Highbush blueberriesEndnote 4 | United States | $148,438 | $166,983 | $167,525 | $174,101 | $192,352 |

| Peru | $80,118 | $83,450 | $103,575 | $153,148 | $130,848 | |

| Mexico | $36,276 | $49,109 | $83,179 | $82,355 | $105,327 | |

| Chile | $68,331 | $47,463 | $56,903 | $52,169 | $32,719 | |

| Morocco | $0 | $0 | $40 | $1,666 | $9,363 | |

| Others | $16,144 | $17,141 | $12,033 | $10,520 | $11,226 | |

| Total | $349,306 | $364,146 | $423,256 | $473,959 | $481,834 | |

| RaspberriesEndnote 4Endnote 6 | Mexico | $188,113 | $209,156 | $220,214 | $254,650 | $265,926 |

| United States | $130,412 | $128,559 | $138,910 | $149,327 | $124,923 | |

| Chile | $18,425 | $18,848 | $14,350 | $29,559 | $22,463 | |

| Serbia | $11,233 | $20,667 | $28,513 | $14,779 | $11,554 | |

| China | $731 | $1,146 | $2,116 | $4,604 | $4,640 | |

| Others | $1,592 | $1,493 | $2,203 | $3,810 | $2,885 | |

| Total | $350,506 | $379,868 | $406,304 | $456,729 | $432,392 | |

|

Notes:

Source: Statistics Canada. (CATSnet, March 2024) |

||||||

2.3.6. Sources of Canada's top 5 fresh fruitEndnote 1 imports – by volume (metric tons)

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

|---|---|---|---|---|---|---|

| BananasEndnote 2 | Guatemala | 246,490 | 228,420 | 258,922 | 298,975 | 293,740 |

| Costa Rica | 142,081 | 156,178 | 121,365 | 84,683 | 101,292 | |

| Colombia | 56,318 | 67,562 | 81,598 | 64,193 | 64,250 | |

| Ecuador | 82,577 | 88,956 | 70,874 | 52,036 | 53,837 | |

| Honduras | 40,462 | 42,217 | 34,696 | 51,537 | 52,598 | |

| Others | 35,390 | 34,174 | 44,659 | 46,198 | 49,750 | |

| Total | 603,318 | 617,507 | 612,115 | 597,622 | 615,467 | |

| Watermelons | United States | 138,771 | 157,207 | 165,968 | 144,051 | 166,138 |

| Mexico | 75,282 | 60,078 | 75,221 | 59,494 | 61,903 | |

| Guatemala | 5,189 | 9,266 | 10,663 | 7,775 | 9,855 | |

| Honduras | 7,285 | 3,756 | 3,178 | 3,342 | 2,507 | |

| Brazil | 714 | 1,512 | 2,022 | 1,396 | 1,629 | |

| Others | 983 | 864 | 693 | 546 | 485 | |

| Total | 228,225 | 232,684 | 257,745 | 216,604 | 242,518 | |

| GrapesEndnote 3Endnote 4 | United States | 101,893 | 98,231 | 94,633 | 87,536 | 71,945 |

| Peru | 16,384 | 20,386 | 24,935 | 30,865 | 38,276 | |

| Mexico | 24,665 | 24,622 | 20,525 | 20,200 | 24,883 | |

| Chile | 33,874 | 30,299 | 27,652 | 29,523 | 25,344 | |

| South Africa | 18,032 | 23,195 | 25,892 | 27,079 | 18,337 | |

| Others | 15,475 | 15,679 | 16,306 | 15,507 | 17,645 | |

| Total | 210,323 | 212,412 | 209,943 | 210,710 | 196,430 | |

| Oranges | United States | 96,443 | 109,065 | 97,660 | 74,744 | 89,327 |

| South Africa | 29,137 | 37,117 | 39,475 | 41,192 | 42,759 | |

| Spain | 35,210 | 24,064 | 21,740 | 37,671 | 15,884 | |

| Morocco | 11,973 | 9,272 | 12,202 | 18,048 | 12,426 | |

| Egypt | 1,038 | 1,712 | 2,596 | 852 | 7,629 | |

| Others | 12,049 | 14,739 | 14,498 | 10,223 | 10,582 | |

| Total | 185,851 | 195,968 | 188,172 | 182,730 | 178,606 | |

| ApplesEndnote 4 | United States | 159,623 | 167,578 | 161,962 | 172,102 | 136,264 |

| Chile | 23,464 | 13,441 | 16,970 | 13,790 | 12,846 | |

| New Zealand | 7,831 | 8,631 | 6,385 | 7,474 | 9,197 | |

| South Africa | 1,268 | 1,241 | 1,617 | 3,201 | 3,923 | |

| Italy | 8,930 | 3,064 | 4,277 | 2,225 | 2,865 | |

| Others | 5,148 | 6,084 | 6,859 | 6,417 | 5,075 | |

| Total | 206,264 | 200,040 | 198,070 | 205,209 | 170,171 | |

|

Notes:

Source: Statistics Canada. (CATSnet, March 2024) |

||||||

3. Consumption

3.1. Fresh fruits availableEndnote 1 for consumptionEndnote 2 in Canada – kg per person

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Bananas | 15.44 | 15.57 | 15.34 | 14.68 | 14.64 | 20.6% |

| Melons totalEndnote 3 | 9.99 | 9.63 | 10.14 | 8.90 | 9.50 | 13.4% |

| Apples | 9.75 | 9.92 | 8.67 | 7.74 | 8.35 | 11.7% |

| OrangesEndnote 4 | 8.49 | 9.11 | 8.85 | 8.25 | 8.17 | 11.5% |

| Grapes | 4.49 | 4.46 | 4.39 | 4.39 | 3.93 | 5.5% |

| Pineapples | 3.02 | 2.82 | 3.12 | 3.14 | 3.11 | 4.4% |

| Strawberries | 2.92 | 2.89 | 2.98 | 2.99 | 2.76 | 3.9% |

| Avocados | 2.37 | 2.63 | 2.69 | 2.37 | 2.58 | 3.6% |

| Cranberries | 3.07 | 2.74 | 2.60 | 3.95 | 2.33 | 3.3% |

| Lemons | 1.86 | 1.92 | 2.01 | 2.02 | 1.91 | 2.7% |

| Dates | 1.78 | 1.89 | 1.95 | 1.74 | 1.87 | 2.6% |

| Guavas and mangoes | 1.74 | 1.88 | 1.94 | 1.81 | 1.85 | 2.6% |

| Pears | 1.83 | 1.66 | 1.70 | 1.58 | 1.52 | 2.1% |

| Blueberries | 1.45 | 1.37 | 1.86 | 1.36 | 1.24 | 1.7% |

| Other fresh berries | 1.14 | 1.17 | 1.10 | 1.16 | 1.04 | 1.5% |

| Cherries | 0.97 | 0.88 | 0.89 | 0.59 | 0.98 | 1.4% |

| Peaches | 1.11 | 0.96 | 1.04 | 0.94 | 0.81 | 1.1% |

| Limes | 0.73 | 0.78 | 0.73 | 0.68 | 0.76 | 1.1% |

| Fruits not specified | 0.62 | 0.73 | 0.73 | 0.71 | 0.70 | 1.0% |

| Grapefruits | 0.87 | 0.98 | 0.90 | 0.79 | 0.70 | 1.0% |

| Kiwis | 0.45 | 0.52 | 0.61 | 0.62 | 0.52 | 0.7% |

| Figs | 0.38 | 0.46 | 0.47 | 0.54 | 0.48 | 0.7% |

| Papayas | 0.44 | 0.45 | 0.54 | 0.47 | 0.45 | 0.6% |

| Nectarines | 0.51 | 0.46 | 0.46 | 0.46 | 0.43 | 0.6% |

| Plums total | 0.51 | 0.51 | 0.53 | 0.49 | 0.41 | 0.6% |

| Apricots | 0.11 | 0.09 | 0.09 | 0.07 | 0.06 | 0.1% |

| Other citrus | 0.07 | 0.03 | 0.04 | 0.03 | 0.03 | 0.0% |

| Quinces | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.0% |

| Total | 76.12 | 76.52 | 76.38 | 72.48 | 71.14 | 100.0% |

|

Notes:

Source: Statistics Canada. Table 32-10-0054-01 Food available in Canada |

||||||

3.2. Fresh fruits availableEndnote 1 for consumption adjusted for lossesEndnote 2 in Canada – kg per person

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| Bananas | 7.58 | 7.64 | 7.53 | 7.21 | 7.19 | 21.6% |

| Apples | 5.67 | 5.77 | 5.04 | 4.50 | 4.86 | 14.6% |

| OrangesEndnote 3 | 3.38 | 3.63 | 3.52 | 3.29 | 3.25 | 9.8% |

| Melons totalEndnote 4 | 2.96 | 2.88 | 3.05 | 2.65 | 2.84 | 8.5% |

| Grapes | 2.64 | 2.62 | 2.58 | 2.58 | 2.31 | 6.9% |

| Cranberries | 1.95 | 1.73 | 1.65 | 2.50 | 1.48 | 4.4% |

| Strawberries | 1.53 | 1.52 | 1.56 | 1.57 | 1.45 | 4.4% |

| Dates | 1.13 | 1.20 | 1.24 | 1.11 | 1.19 | 3.6% |

| Avocados | 0.97 | 1.07 | 1.10 | 0.97 | 1.05 | 3.2% |

| Blueberries | 1.15 | 1.09 | 1.48 | 1.08 | 0.99 | 3.0% |

| Pears | 1.12 | 1.02 | 1.04 | 0.97 | 0.93 | 2.8% |

| Guavas and mangoes | 0.82 | 0.89 | 0.92 | 0.86 | 0.88 | 2.6% |

| Other berries | 0.78 | 0.80 | 0.75 | 0.79 | 0.71 | 2.1% |

| Pineapples | 0.66 | 0.61 | 0.68 | 0.68 | 0.68 | 2.0% |

| Lemons | 0.52 | 0.54 | 0.57 | 0.57 | 0.54 | 1.6% |

| Fruits not specified | 0.38 | 0.44 | 0.44 | 0.43 | 0.42 | 1.3% |

| Cherries | 0.39 | 0.35 | 0.35 | 0.24 | 0.39 | 1.2% |

| Peaches | 0.50 | 0.44 | 0.48 | 0.43 | 0.37 | 1.1% |

| Figs | 0.27 | 0.33 | 0.33 | 0.38 | 0.34 | 1.0% |

| Limes | 0.29 | 0.31 | 0.30 | 0.28 | 0.31 | 0.9% |

| Plums total | 0.30 | 0.27 | 0.27 | 0.27 | 0.25 | 0.8% |

| Grapefruits | 0.28 | 0.32 | 0.29 | 0.26 | 0.23 | 0.7% |

| Kiwis | 0.18 | 0.21 | 0.24 | 0.25 | 0.21 | 0.6% |

| Nectarines | 0.23 | 0.23 | 0.24 | 0.22 | 0.19 | 0.6% |

| Papayas | 0.14 | 0.14 | 0.16 | 0.14 | 0.14 | 0.4% |

| Apricots | 0.06 | 0.05 | 0.05 | 0.04 | 0.04 | 0.1% |

| Other citrus | 0.04 | 0.02 | 0.02 | 0.02 | 0.02 | 0.1% |

| Quinces | 0.00 | 0.01 | 0.00 | 0.01 | 0.01 | 0.0% |

| Total | 35.92 | 36.13 | 35.88 | 34.30 | 33.27 | 100.0% |

|

Notes:

Source: Statistics Canada. Table 32-10-0054-01 Food available in Canada |

||||||

4. World data

4.1. World production

4.1.1. World fruit productionEndnote 1 by commodity – by volume (metric tons)

| 2018 | 2019 | 2020 | 2021 | 2022 | 2022 % Share |

|

|---|---|---|---|---|---|---|

| Bananas | 117,204,598 | 117,339,974 | 126,737,998 | 132,082,174 | 135,112,326 | 14.5% |

| Watermelons | 101,014,640 | 100,798,759 | 100,977,006 | 102,171,351 | 99,957,595 | 10.7% |

| Apples | 85,839,728 | 87,462,289 | 90,603,540 | 93,924,721 | 95,835,965 | 10.3% |

| Oranges | 73,476,062 | 76,317,766 | 76,678,734 | 76,316,328 | 76,410,037 | 8.2% |

| Grapes | 80,096,667 | 77,054,569 | 76,828,209 | 76,750,674 | 74,942,573 | 8.0% |

| MangoesEndnote 2 | 54,583,093 | 56,461,411 | 56,365,595 | 57,061,367 | 59,151,823 | 6.3% |

| TangerinesEndnote 3 | 34,484,496 | 38,972,616 | 39,227,438 | 42,431,496 | 44,179,831 | 4.7% |

| Plantains and cooking bananas | 38,021,419 | 44,171,712 | 43,987,146 | 43,450,770 | 44,150,813 | 4.7% |

| Pineapples | 28,290,033 | 27,657,868 | 27,448,680 | 28,714,479 | 29,361,138 | 3.1% |

| Cantaloupes and other melons | 27,000,791 | 26,898,435 | 27,912,958 | 28,726,729 | 28,558,069 | 3.1% |

| Peaches and nectarines | 23,991,825 | 24,668,452 | 24,285,498 | 25,012,445 | 26,354,497 | 2.8% |

| Pears | 23,719,003 | 24,278,767 | 24,975,886 | 25,616,665 | 26,324,874 | 2.8% |

| Lemons and limes | 19,452,694 | 19,770,009 | 20,515,518 | 21,546,660 | 21,529,604 | 2.3% |

| Papayas | 13,789,846 | 14,234,313 | 14,219,152 | 14,086,181 | 13,822,328 | 1.5% |

| Plums and sloes | 12,534,505 | 12,231,648 | 12,225,434 | 12,209,265 | 12,391,467 | 1.3% |

| Grapefruit and pomelos | 9,040,561 | 9,491,035 | 9,560,290 | 9,701,956 | 9,761,755 | 1.0% |

| Dates | 8,767,836 | 9,216,541 | 9,470,322 | 9,867,985 | 9,747,570 | 1.0% |

| Strawberries | 8,562,053 | 9,054,130 | 8,939,022 | 9,361,657 | 9,569,865 | 1.0% |

| Avocados | 6,842,058 | 7,219,430 | 8,209,609 | 8,570,284 | 8,978,275 | 1.0% |

| Kiwi fruit | 4,239,653 | 4,304,832 | 4,435,780 | 4,439,663 | 4,539,471 | 0.5% |

| Persimmons | 4,247,432 | 4,246,551 | 4,224,405 | 4,344,027 | 4,436,475 | 0.5% |

| Apricots | 3,894,645 | 4,052,375 | 3,693,873 | 3,622,553 | 3,863,180 | 0.4% |

| Cherries, sweet | 2,560,162 | 2,633,041 | 2,618,306 | 2,757,363 | 2,765,427 | 0.3% |

| Cherries, sour | 1,581,622 | 1,408,563 | 1,482,455 | 1,519,935 | 1,593,025 | 0.2% |

| Cashew apples | 1,324,285 | 1,324,434 | 1,333,534 | 1,337,470 | 1,329,862 | 0.1% |

| Figs | 1,239,712 | 1,323,700 | 1,399,829 | 1,321,022 | 1,242,449 | 0.1% |

| Blueberries | 819,804 | 1,022,697 | 1,032,359 | 1,153,234 | 1,228,596 | 0.1% |

| Raspberries | 899,742 | 877,943 | 934,767 | 925,502 | 947,852 | 0.1% |

| Others | 82,938,813 | 84,119,535 | 85,047,747 | 83,610,182 | 84,917,808 | 9.1% |

| Total | 870,457,775 | 888,613,394 | 905,371,091 | 922,634,137 | 933,004,550 | 100.0% |

|

Notes:

Source: Food and Agriculture Organization (FAO) of the United Nations | © FAO Statistics Division 2024 |

||||||

4.1.2. World fruit productionEndnote 1 by country – by volume (metric tons)

| 2018 | 2019 | 2020 | 2021 | 2022 | 2022 % Share |

|

|---|---|---|---|---|---|---|

| China | 237,547,700 | 247,341,579 | 249,900,598 | 257,435,002 | 260,234,428 | 27.9% |

| India | 101,895,034 | 104,155,759 | 106,960,178 | 107,815,823 | 111,590,486 | 12.0% |

| Brazil | 41,200,378 | 41,557,945 | 41,185,568 | 41,288,367 | 41,667,465 | 4.5% |

| Türkiye | 23,604,491 | 23,320,686 | 24,264,733 | 25,109,708 | 25,682,848 | 2.8% |

| Indonesia | 20,175,728 | 20,989,923 | 22,895,083 | 23,518,712 | 24,790,335 | 2.7% |

| Mexico | 22,918,639 | 23,794,189 | 23,897,744 | 23,685,415 | 24,735,286 | 2.7% |

| United States | 24,375,293 | 25,493,501 | 23,887,258 | 22,832,558 | 21,346,636 | 2.3% |

| Italy | 17,756,035 | 17,253,730 | 17,827,510 | 17,194,020 | 18,121,550 | 1.9% |

| Nigeria | 11,936,849 | 11,997,250 | 14,471,853 | 16,306,369 | 16,931,810 | 1.8% |

| Philippines | 16,777,937 | 16,629,718 | 16,468,918 | 16,655,540 | 16,591,532 | 1.8% |

| Spain | 20,000,020 | 18,317,650 | 19,471,070 | 19,031,150 | 16,542,670 | 1.8% |

| Iran | 16,655,150 | 17,397,907 | 16,851,395 | 16,988,308 | 15,991,072 | 1.7% |

| Egypt | 14,923,503 | 14,357,417 | 14,843,618 | 14,248,537 | 14,289,480 | 1.5% |

| Viet Nam | 9,657,720 | 10,490,899 | 11,074,370 | 11,711,451 | 12,187,503 | 1.3% |

| Colombia | 9,530,329 | 10,834,378 | 10,525,973 | 11,533,928 | 11,636,846 | 1.2% |

| … | ||||||

| CanadaEndnote 2 | 998,731 | 985,929 | 934,873 | 889,609 | 998,856 | 0.1% |

| Total | 870,457,775 | 888,613,394 | 905,371,091 | 922,634,137 | 933,004,550 | 100.0% |

|

Notes:

Source: Food and Agriculture Organization (FAO) of the United Nations | © FAO Statistics Division 2024 |

||||||

4.1.3. World fruit productionEndnote 1 by commodity – by area (hectares)

| 2018 | 2019 | 2020 | 2021 | 2022 | 2022 % Share |

|

|---|---|---|---|---|---|---|

| Plantains and cooking bananas | 5,539,305 | 6,901,957 | 7,010,523 | 6,914,227 | 6,733,791 | 10.0% |

| Grapes | 6,875,427 | 6,909,209 | 6,918,654 | 6,881,766 | 6,730,181 | 10.0% |

| MangoesEndnote 2 | 5,540,813 | 5,700,995 | 5,853,737 | 5,941,878 | 6,009,725 | 8.9% |

| Bananas | 5,034,061 | 5,058,010 | 5,674,470 | 5,854,850 | 5,940,157 | 8.8% |

| Apples | 4,611,067 | 4,679,333 | 4,762,723 | 4,825,629 | 4,825,728 | 7.2% |

| Oranges | 3,855,678 | 3,946,378 | 3,971,164 | 3,979,467 | 3,976,571 | 5.9% |

| TangerinesEndnote 3 | 2,680,450 | 3,026,245 | 3,030,239 | 3,186,454 | 3,343,894 | 5.0% |

| Watermelons | 3,097,439 | 3,068,550 | 3,019,290 | 3,022,144 | 2,916,451 | 4.3% |

| Plums and sloes | 2,562,458 | 2,576,420 | 2,563,324 | 2,562,980 | 2,599,622 | 3.9% |

| Peaches and nectarines | 1,494,117 | 1,490,053 | 1,481,480 | 1,510,686 | 1,542,646 | 2.3% |

| Pears | 1,373,941 | 1,375,793 | 1,377,932 | 1,396,008 | 1,417,980 | 2.1% |

| Lemons and limes | 1,168,229 | 1,254,893 | 1,287,478 | 1,349,775 | 1,334,257 | 2.0% |

| Dates | 1,243,440 | 1,283,239 | 1,257,867 | 1,261,631 | 1,270,285 | 1.9% |

| Cantaloupes and other melons | 1,024,651 | 1,037,536 | 1,059,984 | 1,075,350 | 1,062,497 | 1.6% |

| Pineapples | 1,088,423 | 1,066,223 | 1,041,238 | 1,054,994 | 1,059,205 | 1.6% |

| Persimmons | 975,084 | 993,732 | 1,009,216 | 1,030,208 | 1,044,386 | 1.5% |

| Avocados | 728,907 | 752,315 | 812,832 | 840,253 | 884,039 | 1.3% |

| Apricots | 542,797 | 554,477 | 554,652 | 547,081 | 558,384 | 0.8% |

| Papayas | 462,653 | 469,488 | 482,702 | 482,696 | 503,255 | 0.7% |

| Cashew apples | 506,264 | 493,587 | 493,938 | 494,113 | 490,843 | 0.7% |

| Cherries, sweet | 414,947 | 441,335 | 443,730 | 446,382 | 454,413 | 0.7% |

| Strawberries | 396,085 | 401,901 | 384,925 | 394,051 | 397,605 | 0.6% |

| Grapefruit and pomelos | 385,250 | 371,621 | 376,002 | 381,698 | 393,705 | 0.6% |

| Figs | 290,310 | 286,712 | 294,020 | 296,298 | 296,754 | 0.4% |

| Kiwi fruit | 260,373 | 266,950 | 274,815 | 285,208 | 286,104 | 0.4% |

| Cherries, sour | 221,222 | 223,910 | 217,978 | 221,738 | 223,481 | 0.3% |

| Blueberries | 134,890 | 152,367 | 160,249 | 172,223 | 173,924 | 0.3% |

| Currants | 129,467 | 136,929 | 127,483 | 132,678 | 138,924 | 0.2% |

| Raspberries | 128,657 | 124,809 | 115,126 | 115,688 | 116,392 | 0.2% |

| Quinces | 76,384 | 74,921 | 76,652 | 76,459 | 75,535 | 0.1% |

| Cranberries | 23,559 | 23,346 | 24,258 | 23,409 | 23,898 | 0.0% |

| Others | 10,433,229 | 10,514,545 | 10,611,615 | 10,449,016 | 10,529,410 | 15.6% |

| Total | 63,416,674 | 65,782,037 | 66,898,345 | 67,343,215 | 67,486,767 | 100.0% |

|

Notes:

Source: Food and Agriculture Organization (FAO) of the United Nations | © FAO Statistics Division 2024 |

||||||

4.1.4. World fruit productionEndnote 1 by country – by area (hectares)

| 2018 | 2019 | 2020 | 2021 | 2022 | 2022 % Share |

|

|---|---|---|---|---|---|---|

| China | 14,903,310 | 15,366,692 | 15,303,102 | 15,600,933 | 15,697,408 | 23.3% |

| India | 6,929,284 | 7,062,326 | 7,195,937 | 7,372,041 | 7,468,888 | 11.1% |

| Uganda | 797,260 | 2,099,406 | 2,634,532 | 2,515,946 | 2,360,448 | 3.5% |

| Brazil | 2,287,604 | 2,290,040 | 2,303,261 | 2,294,005 | 2,317,010 | 3.4% |

| Nigeria | 1,939,290 | 1,934,895 | 1,914,965 | 1,969,495 | 1,989,835 | 2.9% |

| Mexico | 1,522,191 | 1,554,633 | 1,573,702 | 1,587,211 | 1,626,116 | 2.4% |

| Spain | 1,560,080 | 1,556,110 | 1,548,120 | 1,553,960 | 1,536,800 | 2.3% |

| Democratic Republic of Congo | 1,357,444 | 1,366,344 | 1,366,485 | 1,370,472 | 1,371,245 | 2.0% |

| Türkiye | 1,347,851 | 1,363,435 | 1,340,157 | 1,341,818 | 1,363,993 | 2.0% |

| Philippines | 1,325,490 | 1,319,359 | 1,323,161 | 1,322,465 | 1,312,045 | 1.9% |

| Italy | 1,095,281 | 1,113,420 | 1,131,370 | 1,126,240 | 1,128,730 | 1.7% |

| United States | 1,109,958 | 1,100,310 | 1,084,280 | 1,064,203 | 1,045,889 | 1.5% |

| Thailand | 987,578 | 977,905 | 929,057 | 959,795 | 979,331 | 1.5% |

| Iran | 1,133,909 | 1,125,567 | 1,051,701 | 995,771 | 961,115 | 1.4% |

| Indonesia | 789,449 | 823,913 | 898,964 | 891,704 | 933,137 | 1.4% |

| ... | ||||||

| CanadaEndnote 2 | 87,934 | 87,099 | 86,054 | 88,838 | 88,944 | 0.1% |

| Total | 63,416,674 | 65,782,037 | 66,898,345 | 67,343,215 | 67,486,767 | 100.0% |

|

Notes:

Source: Food and Agriculture Organization (FAO) of the United Nations | © FAO Statistics Division 2024 |

||||||

4.2. World trade

4.2.1. Top importers of fruitEndnote 1 worldwide – by value (thousands of Canadian dollars)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| United States | $25,950,458 | $26,135,963 | $27,867,200 | $31,282,909 | $32,687,541 | 16.2% |

| China | $15,487,121 | $16,142,132 | $19,789,763 | $21,523,837 | $25,164,451 | 12.5% |

| Germany | $14,914,245 | $16,928,229 | $16,367,998 | $15,635,581 | $17,074,631 | 8.4% |

| Netherlands | $11,678,238 | $12,939,487 | $12,826,303 | $12,893,248 | $13,913,473 | 6.9% |

| France | $7,663,007 | $8,439,897 | $8,590,666 | $8,265,390 | $9,103,716 | 4.5% |

| United Kingdom | $8,408,889 | $8,597,417 | $8,020,662 | $7,908,737 | $8,306,200 | 4.1% |

| Canada | $6,370,248 | $6,657,204 | $6,864,751 | $7,279,813 | $7,591,298 | 3.8% |

| Viet Nam | $4,412,977 | $3,734,414 | $5,870,198 | $5,857,986 | $6,686,522 | 3.3% |

| Spain | $4,645,980 | $5,014,427 | $5,021,698 | $5,246,553 | $6,011,156 | 3.0% |

| Italy | $5,066,954 | $5,292,296 | $5,062,877 | $4,827,240 | $5,735,862 | 2.8% |

| India | $4,082,822 | $4,261,487 | $4,580,661 | $5,739,305 | $5,450,186 | 2.7% |

| Japan | $4,603,058 | $4,750,115 | $4,450,657 | $4,233,534 | $4,204,951 | 2.1% |

| Belgium | $4,476,109 | $4,944,129 | $4,617,743 | $4,130,243 | $3,948,389 | 2.0% |

| Hong Kong | $6,070,577 | $5,431,971 | $6,042,702 | $4,937,630 | $3,866,659 | 1.9% |

| Poland | $2,732,646 | $3,106,848 | $3,238,022 | $3,254,943 | $3,696,613 | 1.8% |

| Others | $49,400,682 | $52,391,409 | $53,264,950 | $47,200,445 | $48,663,878 | 24.1% |

| Total | $175,964,011 | $184,767,425 | $192,476,851 | $190,217,394 | $202,105,526 | 100.0% |

|

Notes:

Source: Global Trade Tracker (March 2024) |

||||||

4.2.2. Top exporters of fruitEndnote 1 worldwide – by value (thousands of Canadian dollars)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2023 % Share |

|

|---|---|---|---|---|---|---|

| United States | $20,007,671 | $19,146,451 | $18,857,406 | $19,187,819 | $20,069,407 | 10.1% |

| Viet Nam | $6,469,669 | $6,415,029 | $6,636,098 | $5,835,394 | $16,121,317 | 8.1% |

| Spain | $13,451,131 | $14,625,521 | $15,050,675 | $13,521,171 | $14,565,614 | 7.3% |

| Netherlands | $10,738,952 | $12,285,475 | $12,224,668 | $11,550,838 | $13,422,081 | 6.7% |

| Mexico | $11,940,328 | $12,368,521 | $12,653,041 | $11,938,923 | $11,738,228 | 5.9% |

| Thailand | $4,973,355 | $5,648,290 | $7,694,475 | $7,336,570 | $9,294,630 | 4.7% |

| Chile | $7,672,608 | $7,771,251 | $8,153,518 | $11,146,982 | $8,974,254 | 4.5% |

| China | $8,248,184 | $9,393,118 | $7,961,579 | $7,188,784 | $8,015,971 | 4.0% |

| Peru | $4,583,462 | $5,228,830 | $6,024,428 | $6,365,621 | $7,655,718 | 3.8% |

| Türkiye | $6,084,103 | $6,448,371 | $6,737,141 | $6,468,071 | $7,252,622 | 3.6% |

| South Africa | $4,527,920 | $5,048,603 | $5,519,838 | $5,759,907 | $5,864,485 | 2.9% |

| Italy | $4,964,721 | $5,554,233 | $5,643,140 | $5,162,450 | $5,781,291 | 2.9% |

| Ecuador | $4,632,713 | $5,223,837 | $4,693,253 | $4,621,880 | $5,549,588 | 2.8% |

| Belgium | $3,622,554 | $3,695,388 | $3,642,210 | $3,639,299 | $3,839,474 | 1.9% |

| Iran | $3,204,267 | $4,741,877 | $4,104,634 | $2,836,712 | $3,509,210 | 1.8% |

| … | ||||||

| CanadaEndnote 2 | $913,866 | $963,809 | $995,396 | $1,231,208 | $1,194,479 | 0.6% |

| Total | $169,052,145 | $180,262,100 | $182,902,034 | $179,239,082 | $199,223,140 | 100.0% |

|

Notes:

Source: Global Trade Tracker (March 2024) |

||||||

5. Key Resources

FAOSTAT.

Global Trade Tracker.

Statistics Canada. Table 32-10-0166-01 Farms classified by farm type, Census of Agriculture historical data

Statistics Canada. Table 32-10-0364-01 Estimates, production and farm gate value of fresh and processed fruits.

Statistics Canada. Statistics Canada. Table 32-10-0054-01 Food available in Canada.

Statistics Canada. CATSNET.

Import and export data is based on the following Harmonized System Codes (H.S. Codes):

All import and export H.S. codes fall under Chapter 08 of the Custom Tariff.

- Fresh fruit for import

- 0801110000

- 0801190000

- 0801210000

- 0801220000

- 0801310000

- 0801320000

- 0802110000

- 0802120000

- 0802210000

- 0802220000

- 0802310000

- 0802320000

- 0802400010

- 0802400020

- 0802500010

- 0802500020

- 0802600000

- 0802900011

- 0802900012

- 0802900091

- 0802900092

- 0803000010

- 0803000011

- 0803000012

- 0803000020

- 0804100010

- 0804100020

- 0804200010

- 0804200020

- 0804300010

- 0804300011

- 0804300012

- 0804300020

- 0804400000

- 0804500010

- 0804500020

- 0805100011

- 0805100012

- 0805100013

- 0805100019

- 0805100020

- 0805200011

- 0805200019

- 0805200020

- 0805400000

- 0805400010

- 0805400020

- 0805500011

- 0805500012

- 0805500020

- 0805500021

- 0805500022

- 0805500030

- 0805900010

- 0805900020

- 0806101100

- 0806101900

- 0806109100

- 0806109110

- 0806109120

- 0806109900

- 0806200000

- 0807110000

- 0807110010

- 0807110020

- 0807190010

- 0807190020

- 0807190090

- 0807200000

- 0807200010

- 0807200020

- 0808101011

- 0808101012

- 0808101013

- 0808101014

- 0808101015

- 0808101016

- 0808101017

- 0808101019

- 0808101081

- 0808101082

- 0808101083

- 0808101084

- 0808101089

- 0808101091

- 0808101092

- 0808101093

- 0808101094

- 0808101095

- 0808101096

- 0808101097

- 0808101099

- 0808109000

- 0808201000

- 0808202900

- 0808202910

- 0808202920

- 0808203000

- 0809101000

- 0809109900

- 0809201000

- 0809202900

- 0809203900

- 0809203910

- 0809203920

- 0809209000

- 0809301000

- 0809302100

- 0809302900

- 0809302910

- 0809302920

- 0809303000

- 0809309000

- 0809401000

- 0809402900

- 0809403900

- 0809409000

- 0810101000

- 0810109100

- 0810109900

- 0810109910

- 0810109920

- 0810201100

- 0810201900

- 0810201910

- 0810201920

- 0810209000

- 0810300000

- 0810401010

- 0810401011

- 0810401012

- 0810401021

- 0810401022

- 0810401023

- 0810401090

- 0810409000

- 0810500000

- 0810600000

- 0810900010

- 0810900020

- 0810900090

- 0810901000

- 0810909010

- 0810909020

- 0810909090

- 0811101000

- 0811109000

- 0811200010

- 0811200090

- 0811901010

- 0811901090

- 0811902000

- 0811909011

- 0811909012

- 0811909013

- 0811909021

- 0811909029

- 0811909030

- 0811909091

- 0811909099

- 0812101000

- 0812109010

- 0812109090

- 0812901010

- 0812901020

- 0812902000

- 0812909000

- 0813100000

- 0813200000

- 0813300000

- 0813400010

- 0813400090

- 0813500010

- 0813500020

- 0813500030

- 0814000010

- 0814000090

- Fresh fruit for export:

- 08011100

- 08011900

- 08012100

- 08012200

- 08013100

- 08013200

- 08021100

- 08021200

- 08022100

- 08022200

- 08023100

- 08023200

- 08024000

- 08025000

- 08026000

- 08029000

- 08030000

- 08041000

- 08042000

- 08043000

- 08044000

- 08045000

- 08051000

- 08052000

- 08054000

- 08055000

- 08059000

- 08061000

- 08062000

- 08071100

- 08071900

- 08072000

- 08081010

- 08081090

- 08082000

- 08091000

- 08092000

- 08093000

- 08094000

- 08101000

- 08102010

- 08102020

- 08103000

- 08104011

- 08104012

- 08104090

- 08105000

- 08109000

- 08109010

- 08109090

- 08111000

- 08112000

- 08119011

- 08119012

- 08119090

- 08121000

- 08129000

- 08131000

- 08132000

- 08133000

- 08134000

- 08135000

- 08140000