Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

In 2023, global imports of unroasted malt ingredients (HS:110710) totaled US$4.8 billion (6,567.2 thousand tonnes) and imports of germ of cereals (HS:110430) reached US$186.8 million (323.3 thousand tonnes). Top import markets for unroasted malt over the year included Brazil, Mexico, Japan, United States (US), and Vietnam; while top markets of germ of cereals were Turkey, Italy, Belgium, United States, and Romania in 2023.

Off/on-trade volume sales of malt totaled 26.2 million tonnes across the world with off-trade (retail) sales accounting for 80.3% and the remainder 19.7% in on-trade (foodservice) sales in 2023. The regions that had the highest volume sales of malt were Asia Pacific (within top 10: incl. China, Vietnam, Japan), followed by Latin America (Brazil, Mexico), and Western Europe (Germany, United Kingdom, Spain). In 2023, volume sales of malt extract totaled 286.2 thousand tonnes across the world - 80.1% in retail and 19.9% in foodservice sales in 2023. Top global markets for volume sales of malt extract over the year were India, US, Nigeria, Brazil and the UK with Canada ranking as the 20th largest market.

99.6% of all malt ingredients found within alcoholic drinks goes into beer products. Global consumption of malt products was equivalent to 3.3 tonnes per '000 people in 2023. In 2022, global sales of beer totaled US$711.6 billion (200.0 billion litres) consisting of off-trade retail sales of US$324.6 billion (133.3 billion litres) and in on-trade or foodservice sales at US$387.0 billion (66.8 billion litres) - based on retailer selling prices (RSP). These totals consisted of dark beer (incl. Ale, Sorghum, Weissbier/Weizen/wheat Beer) at a value of US$63.9 billion (market share: 9.0%), Lager beer (incl. domestic and imported standard, flavoured/mixed Lager) at US$610.6 billion (85.8%), Stout beer at US$16.2 billion (2.3%), and non/low alcohol beer at US$20.8 billion (2.9%). In 2023, leading global markets with the highest volume off/on-trade sales in the beer sector were China (US$103.1 billion) at 43.1 billion litres (market share: 21.5%), the United States (US$114.2 billion) at 22.5 billion litres (11.3%), Brazil (US$56.2 billion) at 15.1 billion litres (7.5%), Mexico (US$32.4 billion) at 9.7 billion litres (4.9%), and Germany (US$31.8 billion) at 9.2 billion litres (4.6%). Canada was the 10th largest market at US$13.3 billion at a volume share of 1.1% (2.3 billion litres) in 2022.

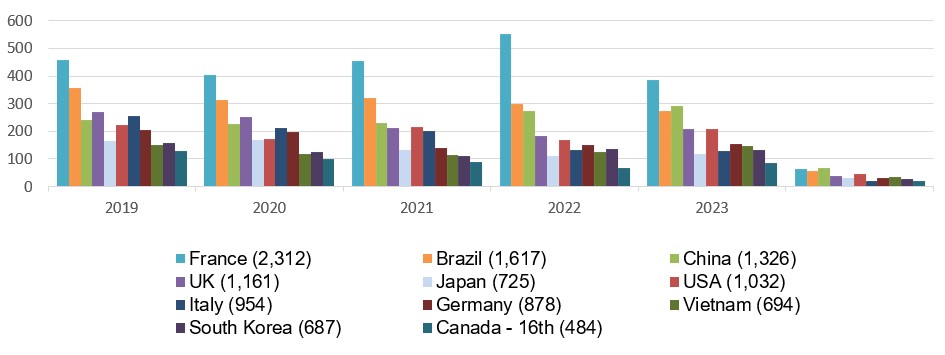

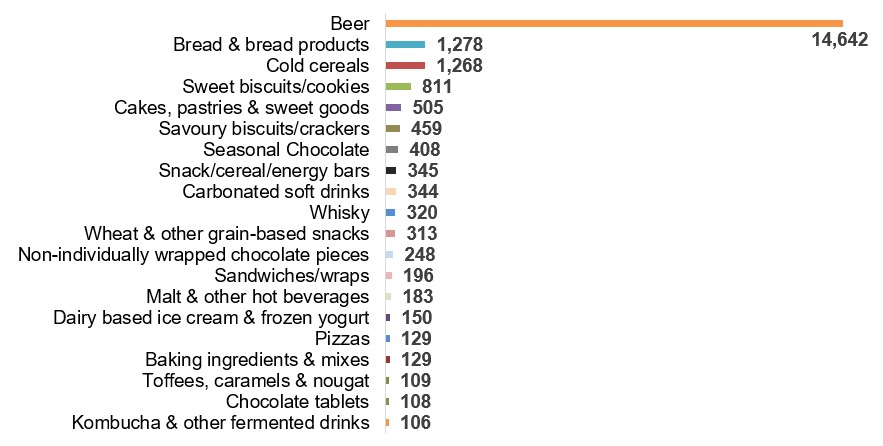

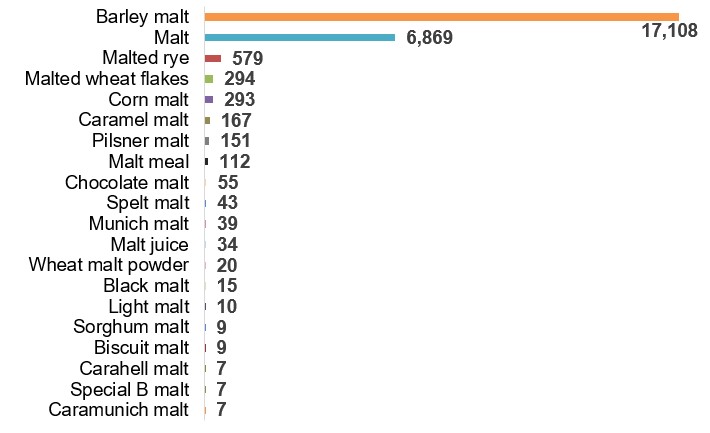

According to Mintel, there were 24,751 new food, drink, health, and petfood products containing malt ingredients (excl. malt extract) launched globally across grocery retailer outlets (incl. new variety/range extension, packaging, formulation or relaunched) between the period of January 2019 and March 27, 2024. Top global sub-categories for these product launches were beer (59.2%), bread and bread products (5.2%), cold cereals (5.1%), sweet biscuits/cookies (3.3%), and cakes, pastries and sweet goods (2%). In Mintel's report, innovation in these sectors are mainly pivoting around new packaging and limited edition flavours, while low/no alcohol options are gaining share of launch activity. In the Europe, Middle Eastern and Africa (EMEA) region, canned formats are taking a growing share in beer and cider launches, whereby brands are increasingly experimenting with new exciting flavour infusions much like in the Asia Pacific (APAC) region. Limited edition launches and flagging up social media claims are also, trends driving consumer engagement in the APAC. Meanwhile, flavoured beer launches have declined in the Americas region, although consumer interest remains - especially in low and no alcohol beers (A Year of Innovation in beer and cider, 2024).

Trade overview

Malt

In 2023, global imports of malt, excluding roasted (HS:110710) reached a total of US$4.8 billion (6,567.2 thousand tonnes). This total import value has been increasing at a compound annual growth rate (CAGR) of 5.6%, between 2019 and 2023. Smaller malt ingredients in the unroasted malt category that have registered the highest growth between the review period include malted barley grains (including 97.6% brewery barley) at a CAGR of 187.7%, along with malted oats or rye, not roasted growing at a CAGR of 66.6%. During this time period, the imports experiencing a decline were for unroasted malted sorghum or millet at a CAGR of −54.4% and unroasted malt for use in brewing (−34.1%).

The top global importers of unroasted malt were Brazil at a market value share of 19.4%, Mexico (9.4%), Japan (7.8%), the United States (US) (6.2%), and Vietnam (5.2%), with Canada (ranking 47th in value terms) importing US$12.3 million (0.3%) in 2023. The largest malt (excluding roasted) categories were malt (excluding wheat and flour) at a total of US$1.2 billion in 2023 (CAGR: 10.6%), wheat malt (excluding flour) at US$999.4 million (+12.5%), and malt flour from wheat, rye, meslin or triticale at US$82.4 million (+5.8%).

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - global imports | 3,847.4 | 3,351.4 | 4,081.1 | 4,671.6 | 4,780.2 | 5.6 |

| 1. Brazil | 580.9 | 578.5 | 765.0 | 815.9 | 928.2 | 12.4 |

| 2. Mexico | 335.3 | 268.8 | 383.4 | 416.2 | 448.8 | 7.6 |

| 3. Japan | 272.7 | 237.4 | 210.2 | 273.8 | 370.7 | 8.0 |

| 4. United States | 287.6 | 247.2 | 284.0 | 273.7 | 294.1 | 0.6 |

| 5. Vietnam | 194.0 | 155.2 | 125.5 | 265.5 | 249.6 | 6.5 |

| 6. Belgium | 163.9 | 132.0 | 221.2 | 210.1 | 214.7 | 7.0 |

| 7. Thailand | 113.4 | 107.6 | 105.1 | 132.1 | 198.3 | 15.0 |

| 8. Netherlands | 106.4 | 96.6 | 121.6 | 132.9 | 160.8 | 10.9 |

| 9. Poland | 87.8 | 94.3 | 110.6 | 117.2 | 152.6 | 14.8 |

| 10. Italy | 71.3 | 58.9 | 83.4 | 80.8 | 141.8 | 18.8 |

| Subtotal - top 10 importers | 2,213.2 | 1,976.5 | 2,410.1 | 2,718.3 | 3,159.5 | 9.3 |

| Canada (47th) | 13.7 | 16.1 | 16.3 | 16.3 | 12.3 | −2.8 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - global imports | 7,255.1 | 6,582.0 | 7,520.3 | 7,399.5 | 6,567.2 | −2.5 |

| 1. Brazil | 1,086.3 | 1,139.5 | 1,418.7 | 1,272.3 | 1,293.3 | 4.5 |

| 2. Mexico | 602.2 | 462.8 | 640.4 | 605.5 | 586.5 | −0.7 |

| 3. Japan | 485.0 | 424.0 | 375.2 | 450.3 | 461.6 | −1.2 |

| 4. Belgium | 435.5 | 336.3 | 490.0 | 447.9 | 412.0 | −1.4 |

| 5. Vietnam | 408.4 | 339.6 | 270.0 | 480.6 | 362.5 | −2.9 |

| 6. United States | 419.6 | 363.1 | 410.3 | 354.4 | 361.2 | −3.7 |

| 7. Thailand | 237.1 | 227.8 | 232.8 | 215.3 | 266.3 | 2.9 |

| 8. Netherlands | 282.5 | 261.5 | 310.5 | 299.1 | 264.2 | −1.7 |

| 9. Poland | 204.2 | 224.3 | 266.1 | 234.6 | 215.4 | 1.3 |

| 11. Germany | 222.4 | 193.6 | 177.8 | 190.1 | 197.1 | −3.0 |

| Subtotal - top 10 importers | 4,383.2 | 3,972.6 | 4,591.9 | 4,550.1 | 4,420.2 | 0.2 |

| Italy (11th) | 147.8 | 131.1 | 178.4 | 160.8 | 195.1 | 7.2 |

| Canada (17th) | 18.5 | 79.1 | 23.8 | 56.1 | 77.1 | 42.9 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - malt, not roasted (HS[1]:110710) | 3,847.4 | 3,351.4 | 4,081.1 | 4,671.6 | 4,780.2 | 5.6 |

| Malt (excluding roasted, wheat and flour) | 769.4 | 678.5 | 817.1 | 914.7 | 1,151.5 | 10.6 |

| Wheat malt, not roasted (excluding flour) | 623.2 | 615.3 | 821.0 | 867.0 | 999.4 | 12.5 |

| Malt flour from wheat, rye, meslin or triticale (excluding roasted) | 65.8 | 64.2 | 82.7 | 60.6 | 82.4 | 5.8 |

| Malted barley grains, not roasted (including brewery barley[2]) | 0.432 | 0.777 | 0.326 | 27.4 | 29.6 | 187.7 |

| Malted oats or rye, not roasted | 1.1 | 0.697 | 7.9 | 1.7 | 8.4 | 66.6 |

| Malt for use in brewing, not roasted | 2.3 | 1.6 | 0.935 | 0.737 | 0.436 | −34.1 |

| Malted sorghum or millet, not roasted | 2.4 | 0.483 | 0.023 | 0.003 | 0.103 | −54.4 |

| Other - malt, not roasted | 2,171.2 | 1,822.7 | 2,138.0 | 2,571.9 | 2,507.1 | 3.7 |

| Total - roasted malt (HS:110720) | 341.1 | 274.1 | 295.4 | 306.3 | 327.6 | −1.0 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate 1 - HS codes used in malt definition (excluding roasted): Malt (excluding roasted, wheat and flour) - 11071099; Wheat malt (excluding flour) - 11071010, 1107019, 110710100000; Malt flour - 1107101000, 11071011, 11071091, 11071091000, 11071020000; Malted barley grains (including brewery barley) - 1107100010, 1107100090, 1107101010, 1107102010, 110710200000; Malted oats or rye - 1107100010, 1107100090, 1107101010, 1107102010, 110710200000; Malt for use in brewing - 1107100001; Malted sorghum or millet - 11071020, 11071025; 11071030, 11071050, 110710500000 2: Malted barley grains, not roasted - Total in 2023, includes 97.6% of brewery barley |

||||||

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - malt, not roasted (HS[1]:110710) | 7,255.1 | 6,582.0 | 7,520.2 | 7,399.5 | 6,567.1 | −2.5 |

| Malt (excluding roasted, wheat and flour) | 1,841.3 | 1,639.9 | 1,869.6 | 1,869.9 | 1,770.1 | −1.0 |

| Wheat malt, not roasted (excluding flour) | 1,167.9 | 1,215.2 | 1,529.0 | 1,366.2 | 1,390.0 | 4.4 |

| Malt flour from wheat, rye, meslin or triticale (excluding roasted) | 132.3 | 143.3 | 161.7 | 105.8 | 107.8 | −5.0 |

| Malted barley grains, not roasted (including brewery barley[2]) | 0.600 | 1.3 | 0.516 | 34.0 | 33.5 | 173.3 |

| Malted oats or rye, not roasted | 1.5 | 0.690 | 17.7 | 2.1 | 11.5 | 65.6 |

| Malt for use in brewing, not roasted | 3.9 | 2.6 | 1.3 | 0.484 | 0.342 | −45.7 |

| Malted sorghum or millet, not roasted | 3.8 | 0.919 | 0.037 | 0.010 | 0.180 | −53.3 |

| Other - malt, not roasted | 3,723.4 | 3,251.9 | 3,549.9 | 3,679.9 | 3,252.8 | −3.3 |

| Total - roasted malt (HS:110720) | 559.2 | 490.5 | 465.6 | 425.2 | 421.0 | −6.9 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate 1 - HS codes used in malt definition (excluding roasted): Malt (excluding roasted, wheat and flour) - 11071099; Wheat malt (excluding flour) - 11071010, 1107019, 110710100000; Malt flour - 1107101000, 11071011, 11071091, 11071091000, 11071020000; Malted barley grains (including brewery barley) - 1107100010, 1107100090, 1107101010, 1107102010, 110710200000; Malted oats or rye - 1107100010, 1107100090, 1107101010, 1107102010, 110710200000; Malt for use in brewing - 1107100001; Malted sorghum or millet - 11071020, 11071025; 11071030, 11071050, 110710500000 2: Malted barley grains, not roasted - Total in 2023, includes 97.6% of brewery barley |

||||||

Canada's trade performance - malt

In 2023, Canada's imports from the world of unroasted malt (HS:110710) totaled Can$16.5 million (77.1 thousand tonnes) and roasted malt (HS:110720) at Can$6.4 million (4.2 thousand tonnes). Total import values for roasted malt has been increasing by a CAGR of 1.8%, while unroasted malt has declined by 2.4% between 2019 and 2023.

In terms of export performance, Canada exported to the world a total of Can$571.6 million (574.6 thousand tonnes) growing at a CAGR of 6.3% in value (2019-2023), with zero exports of roasted malt in 2023 - down from Can$850 thousand in 2022. In 2023, Canada's top export markets for unroasted malt included the United States at a value of Can$307.2 million (market share: 53.7%), Japan at Can$130.5 million (22.8%), Mexico at Can$88.4 million (15.5%), South Korea at Can$22.7 million (4.0%), and Peru at Can$8.6 million (1.5%). Other smaller markets showing high growth over the review period for importing Canadian unroasted malt, including Peru at a CAGR of 158.9% were Côte d'Ivoire (+86.7%), Guatemala (+74%), Burkina Faso (+69.8%), and Angola (+12.9%).

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - malt, not roasted (HS:110710) | 18.2 | 21.6 | 20.4 | 21.2 | 16.5 | −2.4 |

| 1107101100 - Malt, not roasted, whole, within access commitment | 14.6 | 16.1 | 15.4 | 13.9 | 12.0 | −4.7 |

| 1107101200 - Malt, not roasted, whole, over access commitment | 3.2 | 5.2 | 4.6 | 6.8 | 4.0 | 6.2 |

| 1107109200 - Malt, not roasted, other than whole, over access commitment | 0.188 | 0.115 | 0.241 | 0.277 | 0.259 | 8.4 |

| 1107109100 - Malt, not roasted, other than whole, within access commitment | 0.266 | 0.188 | 0.151 | 0.207 | 0.208 | −5.9 |

| Total - roasted malt (HS:110720) | 6.0 | 5.0 | 5.6 | 5.4 | 6.4 | 1.8 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - malt, not roasted (HS:110710) | 18.4 | 79.1 | 23.8 | 56.1 | 77.1 | 42.9 |

| 1107101100 - Malt, not roasted, whole, within access commitment | 3.7 | 60.9 | 4.7 | 43.1 | 67.4 | 106.0 |

| 1107101200 - Malt, not roasted, whole, over access commitment | 14.0 | 17.7 | 18.6 | 12.2 | 9.0 | −10.5 |

| 1107109200 - Malt, not roasted, other than whole, over access commitment | 0.202 | 0.098 | 0.211 | 0.332 | 0.327 | 12.8 |

| 1107109100 - Malt, not roasted, other than whole, within access commitment | 0.540 | 0.415 | 0.272 | 0.467 | 0.313 | −12.7 |

| Total - roasted malt (HS:110720) | 5.1 | 29.4 | 7.8 | 5.2 | 4.2 | −4.7 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - exports of malt, roasted | 0.006 | 0.0 | 0.023 | 0.850 | 0.0 | −100.0 |

| Total - exports of malt, excluding roasted | 448.0 | 396.6 | 392.2 | 451.9 | 571.6 | 6.3 |

| 1. United States | 260.7 | 231.5 | 235.8 | 255.6 | 307.2 | 4.2 |

| 2. Japan | 100.1 | 81.5 | 63.7 | 88.6 | 130.5 | 6.9 |

| 3. Mexico | 58.1 | 55.1 | 58.6 | 79.3 | 88.4 | 11.0 |

| 4. South Korea | 10.3 | 10.6 | 13.2 | 6.5 | 22.7 | 22.0 |

| 5. Peru | 0.0 | 0.496 | 0.221 | 3.1 | 8.6 | 158.9 |

| 6. Angola | 0.0 | 0.0 | 0.0 | 3.5 | 4.0 | 12.9 |

| 7. Colombia | 3.8 | 6.5 | 4.9 | 10.7 | 4.0 | 0.7 |

| 8. Burkina Faso | 0.0 | 0.0 | 0.0 | 1.4 | 2.3 | 69.8 |

| 9. Guatemala | 0.0 | 0.437 | 0.786 | 1.1 | 2.3 | 74.0 |

| 10. Côte d'Ivoire | 0.0 | 0.0 | 0.0 | 0.780 | 1.5 | 86.7 |

| Subtotal - top 10 countries | 433.1 | 386.1 | 377.2 | 450.5 | 571.5 | 7.2 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - exports of malt, roasted (kilograms) | 12,617 | 670 | 9,979 | 678,646 | 0.0 | −100 |

| Total - exports of malt, excluding roasted | 588,795 | 515,129 | 543,804 | 517,453 | 574,624 | −0.6 |

| 1. United States | 316,121 | 277,426 | 304,831 | 276,108 | 302,107 | −1.1 |

| 2. Japan | 142,192 | 114,688 | 95,452 | 111,925 | 128,614 | −2.5 |

| 3. Mexico | 88,591 | 81,659 | 91,550 | 93,542 | 88,453 | 0.0 |

| 4. South Korea | 15,802 | 17,251 | 21,481 | 7,277 | 24,636 | 11.7 |

| 5. Peru | 0.0 | 609 | 313 | 3,017 | 11,850 | 169.0 |

| 6. Angola | 0.0 | 0.0 | 0.0 | 4,861 | 5,487 | 12.9 |

| 7. Colombia | 5,370 | 9,021 | 7,964 | 14,642 | 4,923 | −2.1 |

| 8. Burkina Faso | 0.0 | 0.0 | 0.0 | 1,906 | 3,236 | 69.8 |

| 9. Guatemala | 0.0 | 547 | 1,046 | 1,431 | 3,168 | 79.6 |

| 10. Côte d'Ivoire | 0.0 | 0.0 | 0.0 | 1,046 | 2,010 | 92.2 |

| Subtotal - top 10 countries | 588,795 | 515,129 | 543,804 | 517,453 | 574,624 | −0.6 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

Germ of cereals (whole, rolled, flaked, ground)

In 2023, global imports of germ of cereals (HS:110430) reached a total of US$186.8 million (323.3 thousand tonnes). This total import value has been increasing at a CAGR of 9.1%, while the total import volume has decreased by 3.9% between 2019 and 2023. Germ of cereals ingredients that have grown the most between the review period include cereal grains otherwise worked, excluding rice of heading 10.06 (HS: 11043000/00 - ie; hulled, rolled, flaked, pearled, sliced or kibbled) at a CAGR of 23.5%, along with the smaller market for germ of cereals for the production of brewing malt or beer, whole, squashed, flaked or ground (HS: 11043091, 11043099) growing at a CAGR of 106.9%.

The top global importers of germ of cereals were Turkey at a market share of 22.8%, Italy (15.5%), Belgium (13.2%), the US (11.6%), and Romania (7.6%), with Canada (11th largest value market) importing US$3.0 million (1.6%) in 2023. The largest germ of cereals categories over the last year, were cereal germ, whole, rolled, flaked or ground (excluding wheat)) at US$142.3 million (CAGR: 7.7%), cereal grains otherwise worked at US$29.8 million (+23.5%), and germ of cereals, whole/rolled/flaked or ground used as breakfast at US$9.1 million (+5.3%).

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - global imports | 131.9 | 151.8 | 226.7 | 279.9 | 186.8 | 9.1 |

| 1. Turkey | 28.6 | 39.6 | 74.0 | 93.0 | 42.6 | 10.5 |

| 2. Italy | 22.0 | 27.3 | 38.6 | 46.1 | 29.0 | 7.2 |

| 3. Belgium | 28.0 | 32.1 | 42.8 | 36.9 | 24.8 | −2.9 |

| 4. United States | 10.5 | 11.9 | 18.6 | 26.6 | 21.6 | 19.6 |

| 5. Romania | 0.207 | 0.211 | 2.3 | 7.6 | 14.2 | 187.6 |

| 6. Hungary | 5.8 | 4.9 | 8.0 | 10.5 | 9.4 | 13.0 |

| 7. Germany | 5.3 | 5.3 | 7.6 | 15.8 | 7.2 | 7.6 |

| 8. Nigeria | 0.051 | 1.2 | 0.186 | 5.9 | 6.4 | 385.9 |

| 9. Netherlands | 2.8 | 3.3 | 5.1 | 5.5 | 5.7 | 19.5 |

| 10. France | 4.7 | 4.2 | 5.2 | 4.3 | 5.1 | 1.9 |

| Subtotal - top 10 importers | 107.9 | 130.1 | 202.5 | 252.1 | 166.0 | 11.4 |

| Canada (11th) | 3.3 | 2.8 | 2.9 | 3.9 | 3.0 | −2.1 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - global imports | 379.3 | 380.7 | 424.1 | 434.6 | 323.3 | −3.9 |

| 1. Turkey | 78.4 | 97.3 | 127.3 | 134.7 | 74.4 | −1.3 |

| 2. Italy | 70.3 | 77.2 | 79.9 | 81.4 | 57.7 | −4.8 |

| 3. Belgium | 87.5 | 88.4 | 87.3 | 69.1 | 56.0 | −10.6 |

| 4. United States | 35.9 | 27.8 | 30.9 | 33.2 | 30.3 | −4.2 |

| 5. Romania | 0.642 | 0.293 | 4.3 | 11.6 | 24.7 | 149.1 |

| 6. Hungary | 18.1 | 12.5 | 15.3 | 16.9 | 16.1 | −2.8 |

| 7. Germany | 8.1 | 8.6 | 12.2 | 21.5 | 10.6 | 7.0 |

| 8. Canada | 16.7 | 13.1 | 10.3 | 13.7 | 9.2 | −13.9 |

| 9. Netherlands | 6.4 | 7.7 | 9.7 | 8.6 | 8.0 | 5.7 |

| 10. France | 10.8 | 9.0 | 10.4 | 7.6 | 6.9 | −10.6 |

| Subtotal - top 10 importers | 332.9 | 341.8 | 387.5 | 398.3 | 293.9 | −3.1 |

| Nigeria (12th) | 0.038 | 1.2 | 0.180 | 2.8 | 3.2 | 204.0 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - germ of cereals[1] | 131.9 | 151.8 | 226.7 | 279.9 | 186.8 | 9.1 |

| Cereal germ, whole, rolled, flaked or ground (excluding wheat) | 105.6 | 122.7 | 190.8 | 227.3 | 142.3 | 7.7 |

| Cereal grains otherwise worked (that is, hulled, rolled, flaked, pearled, sliced or kibbled), excluding rice of heading 10.06; and germ of cereals | 12.8 | 15.2 | 21.3 | 34.6 | 29.8 | 23.5 |

| Germ of cereals, whole, rolled, flaked or ground used as breakfast for human consumption | 7.4 | 7.5 | 8.0 | 8.8 | 9.1 | 5.3 |

| Wheat germ for human consumption, whole, rolled, flaked or ground (including rye, meslin or triticale seeds) | 1.8 | 1.9 | 1.5 | 1.5 | 1.8 | 0.8 |

| Cereal or wheat germs for animal feed | 0.551 | 0.644 | 0.452 | 0.364 | 0.519 | −1.5 |

| Germ of cereals, whole, rolled, flaked or ground | 0.378 | 0.498 | 0.610 | 0.808 | 0.317 | −4.3 |

| Germ of cereals for the production of brewing malt or beer, whole, squashed, flaked or ground | 0.00010 | 0.00101 | 0.00105 | 0.00260 | 0.00183 | 106.9 |

| Other - germs of cereals, nes, whole, rolled, flaked or ground (often for the production of oils or fats for edible purposes) | 3.0 | 2.6 | 3.6 | 5.9 | 3.0 | −0.1 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate 1 - Codes used in germ of cereals definition under HS 110430: Cereal germ (excluding wheat) - 11043090, 11043092; Cereal grains otherwise worked - 11043000/00; Germ of cereals used as breakfast for consumption - 11043010; Wheat germ - 11043089, 1104300010, 1104301000/0, 1104301100, 110401200; Cereal germs for animal feed - 11043001, 11043070, 11043081, 11043093; Germ of cereals, whole/rolled/flaked or ground - 11043009, 110430000/00/0, 11043000007, 1104300020; germ for use in brewing malt or beer - 11043091, 11043099; Other germs of oils or fats - 11043012, 11043021, 11043039, 1104300090, 1104309000/0 |

||||||

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - germ of cereals[1] | 379.3 | 380.7 | 424.1 | 434.6 | 323.3 | −3.9 |

| Cereal germ, whole, rolled, flaked or ground (excluding wheat) | 308.9 | 318.7 | 363.5 | 365.5 | 264.4 | −3.8 |

| Cereal grains otherwise worked (ie; hulled, rolled, flaked, pearled, sliced or kibbled), excluding rice of heading 10.06; and germ of cereals | 37.1 | 32.1 | 34.5 | 37.8 | 34.9 | −1.5 |

| Germ of cereals, whole, rolled, flaked or ground used as breakfast for human consumption | 12. | 11.3 | 10.2 | 10.8 | 10.6 | −3.0 |

| Wheat germ for human consumption, whole, rolled, flaked or ground (including rye, meslin or triticale seeds) | 1.5 | 1.7 | 1.2 | 1.0 | 0.917 | −11.8 |

| Cereal or wheat germs for animal feed | 1.1 | 1.2 | 0.848 | 0.621 | 0.853 | −6.9 |

| Germ of cereals, whole, rolled, flaked or ground | 0.221 | .201 | 0.203 | 0.201 | 0.144 | −10.2 |

| Germ of cereals for the production of brewing malt or beer, whole, squashed, flaked or ground | 0.027 | 1.4 | .133 | 1.011 | 0.047 | 14.9 |

| Other - germs of cereals, nes, whole, rolled, flaked or ground (often for the production of oils or fats for edible purposes) | 18.2 | 15.1 | 13.2 | 18.3 | 11.5 | −10.9 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate 1 - Codes used in germ of cereals definition under HS 110430: Cereal germ (excluding wheat) - 11043090, 11043092; Cereal grains otherwise worked - 11043000/00; Germ of cereals used as breakfast for consumption - 11043010; Wheat germ - 11043089, 1104300010, 1104301000/0, 1104301100, 110401200; Cereal germs for animal feed - 11043001, 11043070, 11043081, 11043093; Germ of cereals, whole/rolled/flaked or ground - 11043009, 110430000/00/0, 11043000007, 1104300020; germ for use in brewing malt or beer - 11043091, 11043099; Other germs of oils or fats - 11043012, 11043021, 11043039, 1104300090, 1104309000/0 |

||||||

Canada's trade performance - germ of cereals

In 2023, Canada's imports from the world of germ of cereals, whole, rolled, flaked (HS:110430) totaled Can$4.0 million (9.2 thousand tonnes). This total import value for germ of cereals has been decreasing by a CAGR value of 1.7% between 2019 and 2023. Over the review period, other germ of cereals, nowhere else specified (n.e.s.) have declined the most in value at a CAGR of −7.8%, while wheat germ (both over/within access commitment) have been increasing by 6.3% and 3.3%, respectively.

Basically, all of Canada's exports for germ of cereals in 2023 were to the United States at a total of Can$28.8 million (30.1 thousand tonnes) growing at a value CAGR of 20.3% (2019-2023). A small amount of germ of cereals were exported to France over last year, while other small export markets over the previous 5-yr period have been Trinidad and Tobago, Qatar, and China.

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - Germ of cereals, whole, rolled, flaked | 4.3 | 3.7 | 3.6 | 5.0 | 4.0 | −1.7 |

| 1104309000 - Germs of cereals, nowhere else specified | 2.6 | 1.8 | 2.0 | 3.3 | 1.9 | −7.8 |

| 1104301200 - Wheat germ, over access commitment | 1.3 | 1.6 | 1.4 | 1.4 | 1.7 | 6.3 |

| 1104301100 - Wheat germ, within access commitment | 0.418 | 0.277 | 0.245 | 0.321 | 0.477 | 3.3 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - Germ of cereals, whole, rolled, flaked | 16.7 | 13.1 | 10.3 | 13.7 | 9.2 | −13.9 |

| 1104309000 - Germs of cereals, nowhere else specified | 15.7 | 11.9 | 9.2 | 12.9 | 8.4 | −14.5 |

| 1104301200 - Wheat germ, over access commitment | 0.798 | 1.0 | 0.938 | 0.713 | 0.678 | −4.0 |

| 1104301100 - Wheat germ, within access commitment | 0.247 | 0.152 | 0.185 | 0.165 | 0.164 | −9.7 |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - Exports of germ of cereals | 13,770.4 | 15,450.5 | 23,057.5 | 34,172.6 | 28,842.6 | 20.3 |

| 1. United States | 13,768.1 | 15,443.4 | 23,055.8 | 34,172.0 | 28,842.3 | 20.3 |

| 2. France | 0.144 | 0.478 | 0.479 | 0.648 | 0.330 | 23.0 |

| 3. Trinidad and Tobago | 0.0 | 3.2 | 1.3 | 0.0 | 0.0 | −100.0 |

| 4. Qatar | 0.0 | 3.4 | 0.0 | 0.0 | 0.0 | |

| 5. China | 2.2 | 0.0 | 0.0 | 0.0 | 0.0 | |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Total - Exports of germ of cereals | 35,695.5 | 27,480.9 | 30,762.6 | 32,956.3 | 30,062.4 | −4.2 |

| 1. United States | 35,691.4 | 27,468.0 | 30,759.9 | 32,955.1 | 30,061.8 | −4.2 |

| 2. France | 0.261 | 0.868 | 0.869 | 1.2 | 0.601 | 23.2 |

| 3. Trinidad and Tobago | 0.0 | 5.8 | 1.8 | 0.0 | 0.0 | −100.0 |

| 4. Qatar | 0.0 | 6.3 | 0.0 | 0.0 | 0.0 | |

| 5. China | 3.9 | 0.0 | 0.0 | 0.0 | 0.0 | |

|

Source: Global trade tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

Retail sales and market sizes

Global view - malt and malt extract

In 2023, volume sales of malt totaled 26.2 million tonnes across the world with off-trade retail sales accounting for 80.3% (21.1 million tonnes) and the remainder 19.7% (5.2 million tonnes) in on-trade (foodservice) sales based on retailer selling price (RSP). Total on-trade volume sales have suffered the most over the pandemic declining by a CAGR of 0.5% (2018-2023), while off-trade sales have historically increased by a CAGR of 1.5%; with both sectors expected to grow almost equally by an overall CAGR of 2.6% over the forecast period between 2023 and 2028.

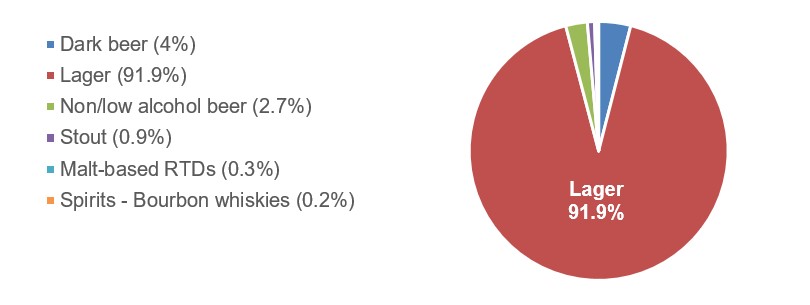

99.6% of all malt ingredients found within alcoholic drinks goes into beer products. Lager (91.9%) contains the highest volume of malt as an ingredient, followed by dark beer (4.0%), non/low alcohol beer (2.7%), Stout (0.9%), malt-based RTDs (0.3%), and bourbon or other US Whisky (0.2%). Global consumption of malt products was equivalent to 3.3 tonnes per '000 people in 2023. The Czech Republic was the largest consumer of malt products at 18 tonnes (per '000 people), followed by Germany (14.9 tonnes), Austria (14.1 tonnes), Croatia (12.7 tonnes), and Poland (11.7 tonnes); The US (9.2 tonnes) and Canada (7.3 tonnes) were the 23rd and 39th largest consumers of malt products, respectively in 2023.

Description of above image

- Dark beer: 4%

- Lager: 91.9%

- Non/low alcohol beer: 2.7%

- Stout: 0.9%

- Malt-based ready-to-drinks: 0.3%

- Spirits - Bourbon whiskies: 0.2%

| Region | 2018 | 2023 | CAGR* % 2018-2023 | 2024 | 2028 | CAGR* % 2023-2028 | |

|---|---|---|---|---|---|---|---|

| World (Total) | Off-trade | 19,557.1 | 21,073.8 | 1.5 | 21,672.4 | 24,024.2 | 2.7 |

| On-trade | 5,283.1 | 5,159.4 | −0.5 | 5,415.8 | 5,789.2 | 2.3 | |

| Total | 24,840.1 | 26,233.2 | 1.1 | 27,088.2 | 29,813.4 | 2.6 | |

| Asia Pacific | Off-trade | 6,819.6 | 7,305.6 | 1.4 | 7,631.3 | 8,467.6 | 3.0 |

| On-trade | 1,926.4 | 1,787.2 | −1.5 | 1,918.1 | 2,286.7 | 5.1 | |

| Total | 8,745.9 | 9,092.8 | 0.8 | 9,549.4 | 10,754.3 | 3.4 | |

| Australasia | Off-trade | 181.6 | 196.9 | 1.6 | 200.9 | 214.4 | 1.7 |

| On-trade | 51.5 | 46.1 | −2.2 | 47.7 | 52.9 | 2.8 | |

| Total | 233.1 | 242.9 | 0.8 | 248.6 | 267.3 | 1.9 | |

| Eastern Europe | Off-trade | 2,467.3 | 2,468.7 | 0.0 | 2,497.6 | 2,618.0 | 1.2 |

| On-trade | 348.9 | 302.6 | −2.8 | 315.8 | 359.9 | 3.5 | |

| Total | 2,816.3 | 2,771.3 | −0.3 | 2,813.4 | 2,977.9 | 1.4 | |

| Latin America | Off-trade | 3,190.9 | 3,993.2 | 4.6 | 4,151.2 | 5,146.2 | 5.2 |

| On-trade | 852.7 | 980.5 | 2.8 | 1,027.5 | 806.5 | −3.8 | |

| Total | 4,043.5 | 4,973.7 | 4.2 | 5,178.8 | 5,952.6 | 3.7 | |

| Middle Eastern and Africa | Off-trade | 1,221.0 | 1,433.9 | 3.3 | 1,501.1 | 1,803.5 | 4.7 |

| On-trade | 364.5 | 398.0 | 1.8 | 416.9 | 499.1 | 4.6 | |

| Total | 1,585.5 | 1,832.0 | 2.9 | 1,918.0 | 2,302.6 | 4.7 | |

| North America | Off-trade | 2,566.7 | 2,516.3 | −0.4 | 2,523.7 | 2,568.2 | 0.4 |

| On-trade | 918.5 | 857.3 | −1.4 | 872.6 | 904.9 | 1.1 | |

| Total | 3,485.2 | 3,373.6 | −0.6 | 3,396.3 | 3,473.2 | 0.6 | |

| Western Europe | Off-trade | 3,110.1 | 3,159.2 | 0.3 | 3,166.6 | 3,206.4 | 0.3 |

| On-trade | 820.6 | 787.7 | −0.8 | 817.2 | 879.1 | 2.2 | |

| Total | 3,930.6 | 3,947.0 | 0.1 | 3,983.7 | 4,085.6 | 0.7 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

The top regions with the highest volume sales of malt were Asia Pacific at a total of 9.1 million tonnes in 2023 (within top 10: including China, Vietnam, Japan); followed by Latin America at 5.0 million tonnes (Brazil, Mexico), Western Europe at 3.9 million tonnes (Germany, United Kingdom, Spain), North America at 3.4 million tonnes (91.5% from the United States), and Eastern Europe at 2.8 million tonnes (Russia). Volume sales of malt totalled 1.8 million tonnes in the Middle Eastern and Africa (MENA) region and the Australasia region totalled volume sales of 242.9 thousand tonnes in 2023. Canada was the 19th largest market for sales of malt over the year at a total off/on-trade volume of 287.2 thousand tonnes.

| Region | 2018 | 2023 | CAGR* % 2018-2023 | 2024 | 2028 | CAGR* % 2023-2028 | |

|---|---|---|---|---|---|---|---|

| World - malt | Off-trade | 19,557.1 | 21,073.8 | 1.5 | 21,672.4 | 24,024.2 | 2.7 |

| On-trade | 5,283.1 | 5,159.4 | −0.5 | 5,415.8 | 5,789.2 | 2.3 | |

| Total | 24,840.1 | 26,233.2 | 1.1 | 27,088.2 | 29,813.4 | 2.6 | |

| 1. China | Off-trade | 4,524.3 | 4,680.1 | 0.7 | 4,859.2 | 5,093.0 | 1.7 |

| On-trade | 1,246.1 | 1,149.8 | −1.6 | 1,217.5 | 1,345.5 | 3.2 | |

| Total | 5,770.4 | 5,829.9 | 0.2 | 6,076.7 | 6,438.5 | 2.0 | |

| 2. United States | Off-trade | 2,334.9 | 2,298.6 | −0.3 | 2,308.6 | 2,355.5 | 0.5 |

| On-trade | 840.1 | 787.8 | −1.3 | 801.1 | 828.5 | 1.0 | |

| Total | 3,175.0 | 3,086.4 | −0.6 | 3,109.7 | 3,184.1 | 0.6 | |

| 3. Brazil | Off-trade | 1,149.0 | 1,530.5 | 5.9 | 1,589.7 | 2,198.1 | 7.5 |

| On-trade | 406.9 | 485.5 | 3.6 | 503.5 | 187.7 | −17.3 | |

| Total | 1,556.0 | 2,015.9 | 5.3 | 2,093.2 | 2,385.8 | 3.4 | |

| 4. Mexico | Off-trade | 836.6 | 1,023.3 | 4.1 | 1,064.6 | 1,217.2 | 3.5 |

| On-trade | 221.5 | 246.1 | 2.1 | 258.6 | 297.0 | 3.8 | |

| Total | 1,058.1 | 1,269.4 | 3.7 | 1,323.2 | 1,514.2 | 3.6 | |

| 5. Germany | Off-trade | 1,063.8 | 1,014.3 | −0.9 | 1,006.5 | 976.0 | −0.8 |

| On-trade | 264.7 | 243.4 | −1.7 | 246.8 | 247.8 | 0.4 | |

| Total | 1,328.6 | 1,257.8 | −1.1 | 1,253.4 | 1,223.8 | −0.5 | |

| 6. Russia | Off-trade | 933.7 | 1,022.6 | 1.8 | 1,027.9 | 1,054.8 | 0.6 |

| On-trade | 101.8 | 94.8 | −1.4 | 97.0 | 103.4 | 1.8 | |

| Total | 1,035.5 | 1,117.4 | 1.5 | 1,124.9 | 1,158.2 | 0.7 | |

| 7. Vietnam | Off-trade | 374.0 | 533.0 | 7.3 | 586.7 | 810.5 | 8.7 |

| On-trade | 168.5 | 162.4 | −0.7 | 186.6 | 285.8 | 12.0 | |

| Total | 542.4 | 695.4 | 5.1 | 773.3 | 1,096.3 | 9.5 | |

| 8. United Kingdom | Off-trade | 476.7 | 484.0 | 0.3 | 481.7 | 491.6 | 0.3 |

| On-trade | 132.5 | 119.4 | −2.1 | 123.8 | 133.5 | 2.3 | |

| Total | 609.3 | 603.4 | −0.2 | 605.5 | 625.0 | 0.7 | |

| 9. Japan | Off-trade | 586.3 | 514.6 | −2.6 | 504.4 | 458.0 | −2.3 |

| On-trade | 111.1 | 75.1 | −7.5 | 76.8 | 75.9 | 0.2 | |

| Total | 697.4 | 589.7 | −3.3 | 581.2 | 533.9 | −2.0 | |

| 10. Spain | Off-trade | 384.4 | 403.6 | 1.0 | 405.8 | 432.3 | 1.4 |

| On-trade | 113.4 | 117.7 | 0.7 | 124.3 | 145.3 | 4.3 | |

| Total | 497.8 | 521.4 | 0.9 | 530.0 | 577.6 | 2.1 | |

| Sub-total (top 10 markets) | Off-trade | 12,663.7 | 13,504.6 | 1.3 | 13,835.1 | 15,087.0 | 2.2 |

| On-trade | 3,606.6 | 3,482.0 | −0.7 | 3,636.0 | 3,650.4 | 0.9 | |

| Total | 16,270.5 | 16,986.7 | 0.9 | 17,471.1 | 18,737.4 | 2.0 | |

| Canada (19th) | Off-trade | 231.8 | 217.7 | −1.2 | 215.1 | 212.7 | −0.5 |

| On-trade | 78.4 | 69.5 | −2.4 | 71.5 | 76.4 | 1.9 | |

| Total | 310.2 | 287.2 | −1.5 | 286.6 | 289.1 | 0.1 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

In 2023, volume sales of malt extract totaled 286.2 thousand tonnes across the world with off-trade retail sales accounting for 80.1% (229.3 thousand tonnes) and the remainder 19.9% (56.9 thousand tonnes) in on-trade foodservice sales. The regions in order of the highest volume sales of malt extract were Asia Pacific (132.5 thousand tonnes), MENA (36.3 thousand tonnes), followed by North America (33.8 thousand tonnes), Latin America (33.2 thousand tonnes), Western Europe (32.8 thousand tonnes), Eastern Europe (12.3 thousand tonnes), and Australasia (5.2 thousand tonnes) in 2023. Top global markets for volume sales of malt extract over the year were India, the US, Nigeria, Brazil and the United Kingdom (UK). Canada ranked as the 20th largest market at volume sales of 3.3 thousand tonnes in 2023.

| Region | 2018 | 2023 | CAGR* % 2018-2023 | 2024 | 2028 | CAGR* % 2023-2028 | |

|---|---|---|---|---|---|---|---|

| World - malt extract | Off-trade | 204,491.1 | 229,313.4 | 2.3 | 234,788.8 | 262,007.8 | 2.7 |

| On-trade | 57,647.2 | 56,888.5 | −0.3 | 59,476.3 | 65,958.0 | 3.0 | |

| Total | 262,138.4 | 286,201.9 | 1.8 | 294,265.1 | 327,965.8 | 2.8 | |

| 1. India | Off-trade | 42,796.9 | 54,574.5 | 5.0 | 56,968.3 | 66,387.2 | 4.0 |

| On-trade | 11,954.0 | 12,140.5 | 0.3 | 12,991.5 | 16,387.8 | 6.2 | |

| Total | 54,750.9 | 66,715.0 | 4.0 | 69,959.8 | 82,775.1 | 4.4 | |

| 2. United States | Off-trade | 22,443.4 | 22,704.1 | 0.2 | 22,993.3 | 24,321.9 | 1.4 |

| On-trade | 8,075.2 | 7,781.7 | −0.7 | 7,978.4 | 8,555.0 | 1.9 | |

| Total | 30,518.6 | 30,485.8 | 0.0 | 30,971.7 | 32,876.9 | 1.5 | |

| 3. Nigeria | Off-trade | 9,717.8 | 11,980.7 | 4.3 | 12,718.4 | 16,410.7 | 6.5 |

| On-trade | 2,990.1 | 3,607.4 | 3.8 | 3,873.1 | 5,178.4 | 7.5 | |

| Total | 12,707.9 | 15,588.0 | 4.2 | 16,591.5 | 21,589.1 | 6.7 | |

| 4. Brazil | Off-trade | 9,708.7 | 11,245.5 | 3.0 | 11,657.2 | 16,218.3 | 7.6 |

| On-trade | 3,438.5 | 3,567.0 | 0.7 | 3,692.0 | 1,385.0 | −17.2 | |

| Total | 13,147.1 | 14,812.5 | 2.4 | 15,349.1 | 17,603.3 | 3.5 | |

| 5. United Kingdom | Off-trade | 8,649.4 | 8,768.2 | 0.3 | 8,616.4 | 8,405.1 | −0.8 |

| On-trade | 2,404.4 | 2,162.7 | −2.1 | 2,214.1 | 2,281.9 | 1.1 | |

| Total | 11,053.8 | 10,930.9 | −0.2 | 10,830.5 | 10,687.0 | −0.5 | |

| 6. China | Off-trade | 7,609.8 | 8,209.9 | 1.5 | 8,299.5 | 8,644.2 | 1.0 |

| On-trade | 2,095.9 | 2,016.9 | −0.8 | 2,079.4 | 2,283.8 | 2.5 | |

| Total | 9,705.7 | 10,226.8 | 1.1 | 10,378.9 | 10,928.0 | 1.3 | |

| 7. Malaysia | Off-trade | 6,292.6 | 6,593.2 | 0.9 | 6,729.5 | 7,613.1 | 2.9 |

| On-trade | 2,711.5 | 2,314.0 | −3.1 | 2,449.6 | 2,866.9 | 4.4 | |

| Total | 9,004.1 | 8,907.2 | −0.2 | 9,179.1 | 10,480.0 | 3.3 | |

| 8. Japan | Off-trade | 6,706.6 | 7,398.0 | 2.0 | 7,317.6 | 7,184.5 | −0.6 |

| On-trade | 1,271.0 | 1,079.6 | −3.2 | 1,113.9 | 1,190.6 | 2.0 | |

| Total | 7,977.6 | 8,477.6 | 1.2 | 8,431.6 | 8,375.1 | −0.2 | |

| 9. Indonesia | Off-trade | 5,875.0 | 6,661.5 | 2.5 | 6,832.6 | 7,503.1 | 2.4 |

| On-trade | 1,244.3 | 1,477.5 | 3.5 | 1,522.8 | 1,760.5 | 3.6 | |

| Total | 7,119.3 | 8,139.0 | 2.7 | 8,355.4 | 9,263.5 | 2.6 | |

| 10. Russia | Off-trade | 7,486.0 | 6,727.4 | −2.1 | 6,882.4 | 7,362.8 | 1.8 |

| On-trade | 816.1 | 623.9 | −5.2 | 649.4 | 721.8 | 3.0 | |

| Total | 8,302.1 | 7,351.2 | −2.4 | 7,531.8 | 8,084.6 | 1.9 | |

| Sub-total (top 10 markets) | Off-trade | 127,286.2 | 144,863.0 | 2.6 | 149,015.2 | 170,050.9 | 3.3 |

| On-trade | 37,001.0 | 36,771.2 | −0.1 | 38,564.2 | 42,611.7 | 3.0 | |

| Total | 164,287.1 | 181,634.0 | 2.0 | 187,579.4 | 212,662.6 | 3.2 | |

| Canada (20th) | Off-trade | 2,620.8 | 2,536.8 | −0.6 | 2,450.4 | 2,207.9 | −2.7 |

| On-trade | 886.0 | 809.6 | −1.8 | 814.9 | 792.8 | −0.4 | |

| Total | 3,506.9 | 3,346.4 | −0.9 | 3,265.3 | 3,000.8 | −2.2 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

Global view - beer

In 2022, global sales of beer (including dark beer, lager, stout, non/low alcohol) totaled US$711.6 billion (200.0 billion litres) consisting of off-trade retail sales at US$324.6 billion (133.3 billion litres) and on-trade or foodservice sales at US$387.0 billion (66.8 billion litres) based on retailer selling prices (RSP). Total retail value sales of beer in the world have been growing by a CAGR of 6.5% (2017 to 2022), while foodservice sales have historically increased by approximately half this rate at a CAGR of 3.1%. However, the foodservice sector is expected to recover from the impact of the pandemic, where both off/on-trade sectors are forecast to grow by a CAGR of 8.6% and 10.6%, respectively (2022 to 2027).

The United States was the largest consumer of beer beverages in terms of off/on-trade value at a total of US$114.2 billion (22,518.3 million litres) in 2022. Anheuser-Busch InBev NV was the leading American player with a total volume share of 41% in 2022. Total value growth in off/on-trade beer sales in the US turned to a decline of −15.4% starting in 2020, reaching US$88.7 million from US$104.9 billion in 2019; which returned to higher sales in 2022, registering a total value sales growth of 2.0% (2017 to 2022) - set to slightly improve by a CAGR of 4.2% over the forecast period (2022 to 2027) to reach sales of US$140.3 billion (22.9 billion litres) in 2027. Non/low alcohol beer was the best performing category in 2022, with total volume sales increasing by 12% to reach 271 million litres. In the last five years, non-alcoholic beer in the US has shown growth unmatched by any other beer category, holding a place of its own in the sector aided by technological improvements and aggressive marketing efforts with the introduction of award-winning new products that is often trailblazing over its alcoholic counterparts. Coupled with a growing consumer desire for health and mindfulness, the non-alcoholic beer category is believed to continue to grow aggressively in a short period of time. The Boston Beer Company made recent headway with a hazy and hop-forward offering, while Athletic Brewing is unique with no comparable peers in the craft non-alcoholic beer space.Footnote 1

China was the 2nd largest consumer of beer beverages with a total off/on-trade value of US$103.1 billion (43,104.9 million litres) in 2022. Stout was the best performing category in 2022, with total volume sales still decreasing by 1% to reach 376 million litres. China Resources Beer (Holdings) Company Ltd. was the leading player with a total volume sales share of 25% in 2022. Total value sales first decreased by 5.1% in 2020 down to US$91.5 billion from US$96.5 billion in 2019, yet has historically grown by a CAGR of 3.9% (2017 to 2022) and is set to grow by a CAGR of 9.6% over the forecast period (2022 to 2027) to reach US$163.0 billion by 2027. Historically, off-trade retail sales in China grew by a CAGR of 6.5%, while on-trade foodservice sales grew by a CAGR of 2.6%. Albeit, foodservice volumes - which accounted for half of total beer volumes in China in 2021 - declined at a double-digit rate in 2022 due to lockdowns as a result of the wide spread of the second wave of the Omicron variant of COVID-19. Meanwhile, with a hotter summer season than usual and the stress and anxiety from spending more time at home, the demand for alcoholic beer drinks increased with boosted volume sales being in the retail channel. The expansion of the online-to-offline (O2O) commerce channel, was a business strategy that also drew in more sales in retail convenience stores, supermarkets, etc. Nevertheless, the rise in off-trade sales was not enough to completely offset the on-trade decline, which led to a total volume decline in 2022 by 3% to 43 billion litres.Footnote 2

Brazil was the 3rd largest consumer of beer beverages with a total off/on-trade value of US$56.2 billion (15,098.5 million litres) in 2022. Non/low alcohol beer was the best performing category in 2022, with total volume sales rising by 38% to reach 394 million litres. Cia Brasileira de Bebidas was the leading Brazilian player in 2022, with a total volume share of 62%. Total volume sales of beer rose by 5% in 2022 to 15.1 billion litres, which is set to increase at a CAGR of 3.6% over the forecast period to reach 18 billion litres. Total value sales of beer continued to show resilience and achieve total growth in 2020 to US$35.7 billion, historically growing by a CAGR of 15.9% (2017 to 2022), which is set to grow by a CAGR of 14% over the forecast period (2022 to 2027) to reach US$108.2 billion by 2027. The quick return of socialization and ongoing events, played a significant role in sustaining growth momentum, especially with continued consumption in the on-trade sector. However, despite the positive trend, the category now faces a potential threat due to the impact of inflation and rising living costs exerting added pressure on consumers' wallets, particularly amongst the middle-classes. Beer is likely to retain its position as the top Brazilian consumers choice amongst alcoholic drinks, yet the disposable income share dedicated to beer is expected to decline. Simultaneously, companies are strategizing by increasingly investing in premium categories to possibly strengthen their bottom lines.Footnote 3

| Category | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| Beer[1] (Total) | Off-trade | 236,876.6 | 324,616.7 | 6.5 | 359,550.3 | 491,491.7 | 8.6 |

| On-trade | 332,757.8 | 386,957.4 | 3.1 | 446,615.1 | 640,376.6 | 10.6 | |

| Total | 569,634.4 | 711,574.1 | 4.6 | 806,165.4 | 1,131,868.4 | 9.7 | |

| Dark beer | Off-trade | 17,748.7 | 23,873.5 | 6.1 | 25,336.4 | 32,783.1 | 6.5 |

| On-trade | 33,924.0 | 40,041.8 | 3.4 | 46,725.5 | 68,954.7 | 11.5 | |

| Total | 51,672.7 | 63,915.4 | 4.3 | 72,061.9 | 101,737.8 | 9.7 | |

| - Ale | Off-trade | 11,229.6 | 15,255.6 | 6.3 | 16,230.2 | 19,239.3 | 4.7 |

| On-trade | 21,647.5 | 23,833.4 | 1.9 | 26,984.4 | 30,997.5 | 5.4 | |

| Total | 32,877.1 | 39,089.0 | 3.5 | 43,214.6 | 50,236.8 | 5.1 | |

| - Sorghum | Off-trade | 1,300.1 | 1,333.6 | 0.5 | 1,358.6 | 1,648.0 | 4.3 |

| On-trade | 461.9 | 596.2 | 5.2 | 644.5 | 874.3 | 8.0 | |

| Total | 1,762.0 | 1,929.8 | 1.8 | 2,003.1 | 2,522.3 | 5.5 | |

| - Weissbier/Weizen/wheat beer | Off-trade | 5,219.0 | 7,284.3 | 6.9 | 7,747.6 | 11,895.7 | 10.3 |

| On-trade | 11,814.6 | 15,612.3 | 5.7 | 19,096.6 | 37,082.9 | 18.9 | |

| Total | 17,033.6 | 22,896.6 | 6.1 | 26,844.2 | 48,978.7 | 16.4 | |

| Lager | Off-trade | 209,970.0 | 285,747.5 | 6.4 | 316,981.5 | 431,309.0 | 8.6 |

| On-trade | 282,060.5 | 324,873.0 | 2.9 | 374,621.3 | 534,204.9 | 10.5 | |

| Total | 492,030.4 | 610,620.5 | 4.4 | 691,602.8 | 965,513.9 | 9.6 | |

| - Flavoured/mixed lager | Off-trade | 5,181.8 | 8,067.7 | 9.3 | 9,056.5 | 12,037.9 | 8.3 |

| On-trade | 4,405.2 | 5,195.1 | 3.4 | 5,694.2 | 7,309.3 | 7.1 | |

| Total | 9,587.0 | 13,262.8 | 6.7 | 14,750.7 | 19,347.2 | 7.8 | |

| - Domestic Lager | Off-trade | 177,530.3 | 240,237.8 | 6.2 | 266,799.0 | 364,293.6 | 8.7 |

| On-trade | 240,192.1 | 277,169.1 | 2.9 | 319,970.9 | 457,747.0 | 10.6 | |

| Total | 417,722.4 | 517,406.9 | 4.4 | 586,769.8 | 822,040.6 | 9.7 | |

| - Imported Lager | Off-trade | 27,257.8 | 37,442.0 | 6.6 | 41,126.0 | 54,977.5 | 8.0 |

| On-trade | 37,463.2 | 42,508.8 | 2.6 | 48,956.2 | 69,148.6 | 10.2 | |

| Total | 64,721.0 | 79,950.8 | 4.3 | 90,082.3 | 124,126.2 | 9.2 | |

| Non/low alcohol beer | Off-trade | 6,259.2 | 11,077.2 | 12.1 | 12,951.6 | 21,413.4 | 14.1 |

| On-trade | 7,738.0 | 9,768.3 | 4.8 | 11,286.0 | 16,952.6 | 11.7 | |

| Total | 13,997.2 | 20,845.5 | 8.3 | 24,237.6 | 38,366.0 | 13.0 | |

| Stout | Off-trade | 2,898.7 | 3,918.5 | 6.2 | 4,280.7 | 5,986.3 | 8.8 |

| On-trade | 9,035.4 | 12,274.3 | 6.3 | 13,982.3 | 20,264.4 | 10.5 | |

| Total | 11,934.1 | 16,192.8 | 6.3 | 18,263.1 | 26,250.6 | 10.1 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate 1: Sales value - Retailer selling price (RSP) |

|||||||

In terms of Canada's performance, the country was the 10th largest consumer of beer beverages in terms of total off/on-trade value sales US$13.3 billion (17th largest market - volume: 2,253.9 million litres) in 2022. The most dynamic growth and the best performing category in 2022 has been in non/low alcohol beer, with total volume Canadian sales growing by 21% to 46 million litres. Labatt Brewing Company Ltd. was the leading player in 2022, with a total volume share of 41%. Total volume sales of beer fell by 1% in 2022 to 2.3 billion litres, which is set to continue to fall at a CAGR of 0.03% over the forecast period to remain around 2.3 billion litres. Total value sales first decreased by 10.1% in 2020 down to US$12.4 billion from US$13.8 billion in 2019, and has historically declined by a CAGR of 0.3% (2017 to 2022) and is set to grow by a CAGR of 3.2% over the forecast period (2022 to 2027) to reach US$15.5 billion by 2027. Beer continues to lose market share to other types of alcoholic drinks, most notably ready-to-drink (RTDs) and spirits. The young population of the country is gradually moving away from beer to more innovative and exciting product offerings. Increasing health consciousness is driving the non-alcoholic beer category, which discourages alcohol consumption amongst consumers. Non-alcohol beer is gaining shelf space in grocery retailers and convenience stores, however, due to its small market size, it has not contributed overall to the growth of the beer market.Footnote 4

| Category | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| Beer[1] (Total) | Off-trade | 122,041.8 | 133,275.3 | 1.8 | 136,460.2 | 148,975.2 | 2.3 |

| On-trade | 72,585.2 | 66,765.1 | −1.7 | 71,111.0 | 81,557.4 | 4.1 | |

| Total | 194,627.0 | 200,040.4 | 0.6 | 207,571.2 | 230,532.6 | 2.9 | |

| Dark beer | Off-trade | 5,667.8 | 6,169.3 | 1.7 | 6,171.3 | 6,739.7 | 1.8 |

| On-trade | 3,657.7 | 3,562.3 | −0.5 | 3,815.9 | 4,706.5 | 5.7 | |

| Total | 9,325.5 | 9,731.6 | 0.9 | 9,987.3 | 11,446.2 | 3.3 | |

| - Ale | Off-trade | 2,728.7 | 3,233.2 | 3.5 | 3,255.5 | 3,479.3 | 1.5 |

| On-trade | 2,073.8 | 1,866.2 | −2.1 | 1,981.3 | 2,108.1 | 2.5 | |

| Total | 4,802.6 | 5,099.4 | 1.2 | 5,236.8 | 5,587.4 | 1.8 | |

| - Sorghum | Off-trade | 1,280.7 | 1,099.6 | −3.0 | 1,091.9 | 1,114.5 | 0.3 |

| On-trade | 443.0 | 423.8 | −0.9 | 425.8 | 454.4 | 1.4 | |

| Total | 1,723.7 | 1,523.4 | −2.4 | 1,517.6 | 1,568.9 | 0.6 | |

| - Weissbier/Weizen/wheat beer | Off-trade | 1,658.4 | 1,836.5 | 2.1 | 1,824.0 | 2,145.8 | 3.2 |

| On-trade | 1,140.8 | 1,272.2 | 2.2 | 1,408.8 | 2,144.1 | 11.0 | |

| Total | 2,799.2 | 3,108.7 | 2.1 | 3,232.8 | 4,289.9 | 6.7 | |

| Lager | Off-trade | 111,866.5 | 121,606.1 | 1.7 | 124,510.7 | 134,911.2 | 2.1 |

| On-trade | 65,937.6 | 60,062.5 | −1.8 | 63,934.4 | 72,638.0 | 3.9 | |

| Total | 177,804.1 | 181,668.6 | 0.4 | 188,445.1 | 207,549.2 | 2.7 | |

| - Flavoured/mixed lager | Off-trade | 2,291.9 | 3,250.9 | 7.2 | 3,392.2 | 3,923.6 | 3.8 |

| On-trade | 652.3 | 689.5 | 1.1 | 708.0 | 816.1 | 3.4 | |

| Total | 2,944.2 | 3,940.4 | 6.0 | 4,100.2 | 4,739.7 | 3.8 | |

| - Domestic Lager | Off-trade | 102,096.7 | 109,758.7 | 1.5 | 112,336.4 | 121,049.5 | 2.0 |

| On-trade | 62,113.5 | 56,276.0 | −2.0 | 59,924.0 | 67,880.7 | 3.8 | |

| Total | 164,210.2 | 166,034.7 | 0.2 | 172,260.4 | 188,930.2 | 2.6 | |

| - Imported Lager | Off-trade | 7,477.9 | 8,596.5 | 2.8 | 8,782.1 | 9,938.1 | 2.9 |

| On-trade | 3,171.7 | 3,097.0 | −0.5 | 3,302.4 | 3,941.2 | 4.9 | |

| Total | 10,649.7 | 11,693.5 | 1.9 | 12,084.5 | 13,879.3 | 3.5 | |

| Non/low alcohol beer | Off-trade | 3,754.3 | 4,633.8 | 4.3 | 4,890.1 | 6,280.6 | 6.3 |

| On-trade | 1,845.2 | 1,869.9 | 0.3 | 1,998.4 | 2,491.2 | 5.9 | |

| Total | 5,599.5 | 6,503.6 | 3.0 | 6,888.4 | 8,771.8 | 6.2 | |

| Stout | Off-trade | 753.2 | 866.1 | 2.8 | 888.1 | 1,043.6 | 3.8 |

| On-trade | 1,144.8 | 1,270.5 | 2.1 | 1,362.3 | 1,721.7 | 6.3 | |

| Total | 1,898.0 | 2,136.6 | 2.4 | 2,250.4 | 2,765.4 | 5.3 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate 1: Sales value - Retailer selling price (RSP) |

|||||||

| Region | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| World - Beer | Off-trade | 236,876.6 | 324,616.7 | 6.5 | 359,550.3 | 491,491.7 | 8.6 |

| On-trade | 332,757.8 | 386,957.4 | 3.1 | 446,615.1 | 640,376.6 | 10.6 | |

| Total | 569,634.4 | 711,574.1 | 4.6 | 806,165.4 | 1,131,868.4 | 9.7 | |

| 1. United States | Off-trade | 48,959.8 | 55,792.5 | 2.6 | 58,603.4 | 66,159.3 | 3.5 |

| On-trade | 54,651.3 | 58,362.1 | 1.3 | 64,818.3 | 74,122.1 | 4.9 | |

| Total | 103,611.1 | 114,154.6 | 2.0 | 123,421.7 | 140,281.3 | 4.2 | |

| 2. China | Off-trade | 28,204.2 | 38,648.9 | 6.5 | 42,979.1 | 53,934.8 | 6.9 |

| On-trade | 56,827.7 | 64,468.3 | 2.6 | 75,347.1 | 109,074.4 | 11.1 | |

| Total | 85,031.9 | 103,117.3 | 3.9 | 118,326.2 | 163,009.2 | 9.6 | |

| 3. Brazil | Off-trade | 6,549.0 | 16,504.9 | 20.3 | 20,053.9 | 35,835.4 | 16.8 |

| On-trade | 20,281.6 | 39,666.4 | 14.4 | 45,770.4 | 72,371.8 | 12.8 | |

| Total | 26,830.6 | 56,171.4 | 15.9 | 65,824.3 | 108,207.2 | 14.0 | |

| 4. Mexico | Off-trade | 10,408.6 | 18,025.8 | 11.6 | 20,018.8 | 27,208.1 | 8.6 |

| On-trade | 9,723.6 | 14,382.3 | 8.1 | 16,329.7 | 22,125.5 | 9.0 | |

| Total | 20,132.2 | 32,408.0 | 10.0 | 36,348.5 | 49,333.6 | 8.8 | |

| 5. Germany | Off-trade | 8,056.4 | 8,978.5 | 2.2 | 9,494.4 | 10,267.4 | 2.7 |

| On-trade | 22,133.8 | 22,814.4 | 0.6 | 24,669.8 | 26,730.7 | 3.2 | |

| Total | 30,190.2 | 31,792.9 | 1.0 | 34,164.2 | 36,998.1 | 3.1 | |

| 6. United Kingdom | Off-trade | 8,552.8 | 11,792.8 | 6.6 | 12,646.0 | 14,379.9 | 4.0 |

| On-trade | 17,432.3 | 18,558.0 | 1.3 | 20,674.9 | 24,409.7 | 5.6 | |

| Total | 25,985.2 | 30,350.8 | 3.2 | 33,320.9 | 38,789.6 | 5.0 | |

| 7. Japan | Off-trade | 16,359.1 | 16,248.9 | −0.1 | 16,836.2 | 16,012.9 | −0.3 |

| On-trade | 14,503.6 | 8,068.0 | −11.1 | 9,501.5 | 9,743.2 | 3.8 | |

| Total | 30,862.7 | 24,316.9 | −4.7 | 26,337.7 | 25,756.1 | 1.2 | |

| 8. Russia | Off-trade | 9,618.0 | 14,409.1 | 8.4 | 15,759.6 | 20,095.6 | 6.9 |

| On-trade | 4,188.8 | 5,159.1 | 4.3 | 5,603.7 | 7,248.9 | 7.0 | |

| Total | 13,806.8 | 19,568.2 | 7.2 | 21,363.3 | 27,344.5 | 6.9 | |

| 9. Spain | Off-trade | 2,253.6 | 2,628.7 | 3.1 | 2,855.4 | 3,278.4 | 4.5 |

| On-trade | 12,949.1 | 14,056.8 | 1.7 | 15,517.4 | 19,300.5 | 6.5 | |

| Total | 15,202.8 | 16,685.5 | 1.9 | 18,372.8 | 22,578.9 | 6.2 | |

| 10. Canada | Off-trade | 7,642.8 | 8,088.2 | 1.1 | 8,240.1 | 8,716.3 | 1.5 |

| On-trade | 5,861.5 | 5,194.6 | −2.4 | 5,685.2 | 6,812.3 | 5.6 | |

| Total | 13,504.4 | 13,282.8 | −0.3 | 13,925.3 | 15,528.5 | 3.2 | |

| Sub-total (top 10 markets) | Off-trade | 146,604.3 | 191,118.3 | 5.4 | 207,486.9 | 255,888.1 | 6.0 |

| On-trade | 218,553.3 | 250,730.0 | 2.8 | 283,918.0 | 371,939.1 | 8.2 | |

| Total | 365,157.9 | 441,848.4 | 3.9 | 491,404.9 | 627,827.0 | 7.3 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

| Region | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| World - Beer | Off-trade | 122,041.8 | 133,275.3 | 1.8 | 136,460.2 | 148,975.2 | 2.3 |

| On-trade | 72,585.2 | 66,765.1 | −1.7 | 71,111.0 | 81,557.4 | 4.1 | |

| Total | 194,627.0 | 200,040.4 | 0.6 | 207,571.2 | 230,532.6 | 2.9 | |

| 1. China | Off-trade | 22,027.7 | 23,533.9 | 1.3 | 24,788.6 | 26,848.9 | 2.7 |

| On-trade | 23,378.4 | 19,571.0 | −3.5 | 21,045.4 | 23,050.3 | 3.3 | |

| Total | 45,406.1 | 43,104.9 | −1.0 | 45,834.1 | 49,899.2 | 3.0 | |

| 2. United States | Off-trade | 17,613.4 | 16,826.3 | −0.9 | 16,611.3 | 16,795.8 | 0.0 |

| On-trade | 6,302.6 | 5,692.0 | −2.0 | 5,919.7 | 6,147.0 | 1.5 | |

| Total | 23,916.0 | 22,518.3 | −1.2 | 22,531.0 | 22,942.8 | 0.4 | |

| 3. Brazil | Off-trade | 4,678.6 | 6,372.0 | 6.4 | 6,706.0 | 8,085.4 | 4.9 |

| On-trade | 7,706.4 | 8,726.5 | 2.5 | 9,040.0 | 9,954.1 | 2.7 | |

| Total | 12,385.0 | 15,098.5 | 4.0 | 15,746.0 | 18,039.5 | 3.6 | |

| 4. Mexico | Off-trade | 6,139.3 | 7,925.7 | 5.2 | 8,267.0 | 9,543.8 | 3.8 |

| On-trade | 1,738.3 | 1,786.3 | 0.5 | 1,908.9 | 2,218.1 | 4.4 | |

| Total | 7,877.6 | 9,712.0 | 4.3 | 10,175.9 | 11,761.9 | 3.9 | |

| 5. Germany | Off-trade | 6,167.7 | 6,149.6 | −0.1 | 6,082.0 | 5,938.8 | −0.7 |

| On-trade | 3,227.7 | 3,027.1 | −1.3 | 3,061.1 | 3,020.6 | 0.0 | |

| Total | 9,395.4 | 9,176.7 | −0.5 | 9,143.1 | 8,959.4 | −0.5 | |

| 6. Russia | Off-trade | 6,542.8 | 7,433.8 | 2.6 | 7,450.0 | 7,673.4 | 0.6 |

| On-trade | 829.1 | 737.8 | −2.3 | 737.9 | 754.8 |

0.5 |

|

| Total | 7,371.9 | 8,171.6 | 2.1 | 8,187.9 | 8,428.1 | 0.6 | |

| 7. Japan | Off-trade | 4,604.8 | 4,261.4 | −1.5 | 4,043.4 | 3,674.5 | −2.9 |

| On-trade | 1,122.1 | 592.8 | −12.0 | 676.3 | 690.2 | 3.1 | |

| Total | 5,726.9 | 4,854.2 | −3.3 | 4,719.7 | 4,364.8 | −2.1 | |

| 8. United Kingdom | Off-trade | 2,234.9 | 2,517.5 | 2.4 | 2,491.9 | 2,507.5 | −0.1 |

| On-trade | 2,250.1 | 1,901.1 | −3.3 | 1,943.5 | 2,047.9 | 1.5 | |

| Total | 4,485.0 | 4,418.7 | −0.3 | 4,435.5 | 4,555.3 | 0.6 | |

| 9. Spain | Off-trade | 1,562.4 | 1,668.8 | 1.3 | 1,675.5 | 1,710.9 | 0.5 |

| On-trade | 2,188.6 | 2,218.9 | 0.3 | 2,297.4 | 2,592.6 | 3.2 | |

| Total | 3,751.0 | 3,887.7 | 0.7 | 3,972.9 | 4,303.4 | 2.1 | |

| 10. Canada | Off-trade | 1,905.6 | 1,853.8 | −0.5 | 1,823.1 | 1,771.5 | −0.9 |

| On-trade | 490.9 | 400.0 | −4.0 | 423.6 | 479.6 | 3.7 | |

| Total | 2,396.5 | 2,253.9 | −1.2 | 2,246.7 | 2,251.0 | −0.03 | |

| Sub-total (top 10 markets) | Off-trade | 73,477.2 | 78,542.8 | 1.3 | 79,938.8 | 84,550.5 | 1.5 |

| On-trade | 49,234.2 | 44,653.5 | −1.9 | 47,053.8 | 50,955.2 | 2.7 | |

| Total | 122,711.4 | 123,196.5 | 0.1 | 126,992.8 | 135,505.4 | 1.9 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

Dark beer

In 2022, total off/on-trade sales of dark beer (including Ale, Sorghum, Weissbier/Weizen/Wheat Beer) was US$63.9 billion (9.7 billion litres), which consisted of US$23.9 billion (6.2 billion litres) in off-trade retail sales and US$40.0 billion (3.6 billion litres) in on-trade foodservice sales. Retail sales of dark beer grew the most at a CAGR of 6.1% compared to foodservice sales at a CAGR of 3.4% between 2017 and 2022. However, on-trade sales are forecast to turn around with a CAGR of 11.5% versus stable off-trade (6.5%) sales between 2022 and 2027.

The largest regions with the most total off/on-trade value sales of dark beer were Western Europe (US$23.2 billion), North America (US$22.7 billion), and Asia Pacific (US$9.9 billion) in 2022. Top regions with the highest total historical value growth (2017 to 2022) of dark beer were Asia Pacific (CAGR: 16.2%), followed by Latin America (13.5%), and Eastern Europe (12.8%).

Off-trade sales of dark beer brought in the most value over on-trade sales within the following regions: Australasia (off-trade share: 67.4%), Eastern Europe (73.8%), and MENA (63.2%) in 2022. Alternatively, the Asia Pacific (72.1%), Latin America (59.5%), North America (64.4%), and Western Europe (66.2%) regions registered higher sales within the on-trade sector of dark beer in 2022.

| Region | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| World (Total) | Off-trade | 17,748.7 | 23,873.5 | 6.1 | 25,336.4 | 32,783.1 | 6.5 |

| On-trade | 33,924.0 | 40,041.8 | 3.4 | 46,725.5 | 68,954.7 | 11.5 | |

| Total | 51,672.7 | 63,915.4 | 4.3 | 72,061.9 | 101,737.8 | 9.7 | |

| Asia Pacific | Off-trade | 1,051.6 | 2,775.6 | 21.4 | 3,118.9 | 5,783.6 | 15.8 |

| On-trade | 3,629.7 | 7,161.1 | 14.6 | 9,832.6 | 25,947.8 | 29.4 | |

| Total | 4,681.3 | 9,936.7 | 16.2 | 12,951.5 | 31,731.4 | 26.1 | |

| Australasia | Off-trade | 917.3 | 1,447.3 | 9.5 | 1,612.5 | 2,188.1 | 8.6 |

| On-trade | 591.7 | 699.9 | 3.4 | 795.3 | 1,129.2 | 10.0 | |

| Total | 1,509.0 | 2,147.3 | 7.3 | 2,407.8 | 3,317.3 | 9.1 | |

| Eastern Europe | Off-trade | 891.9 | 1,696.9 | 13.7 | 1,890.3 | 2,511.0 | 8.2 |

| On-trade | 368.5 | 603.7 | 10.4 | 707.0 | 1,017.6 | 11.0 | |

| Total | 1,260.4 | 2,300.6 | 12.8 | 2,597.3 | 3,528.6 | 8.9 | |

| Latin America | Off-trade | 194.6 | 477.7 | 19.7 | 578.7 | 1,616.7 | 27.6 |

| On-trade | 432.8 | 702.0 | 10.2 | 839.5 | 1,501.7 | 16.4 | |

| Total | 627.5 | 1,179.7 | 13.5 | 1,418.1 | 3,118.4 | 21.5 | |

| Middle Eastern and Africa (MENA) | Off-trade | 1,406.0 | 1,528.8 | 1.7 | 1,582.4 | 1,992.3 | 5.4 |

| On-trade | 685.4 | 891.4 | 5.4 | 993.0 | 1,446.3 | 10.2 | |

| Total | 2,091.4 | 2,420.2 | 3.0 | 2,575.5 | 3,438.6 | 7.3 | |

| North America | Off-trade | 7,311.0 | 8,094.8 | 2.1 | 8,251.0 | 9,159.7 | 2.5 |

| On-trade | 13,869.3 | 14,634.9 | 1.1 | 16,660.7 | 18,040.0 | 4.3 | |

| Total | 21,180.2 | 22,729.6 | 1.4 | 24,911.7 | 27,199.7 | 3.7 | |

| Western Europe | Off-trade | 5,976.3 | 7,852.4 | 5.6 | 8,302.6 | 9,531.7 | 4.0 |

| On-trade | 14,346.7 | 15,348.9 | 1.4 | 16,897.4 | 19,872.2 | 5.3 | |

| Total | 20,323.0 | 23,201.3 | 2.7 | 25,200.0 | 29,403.8 | 4.9 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

| Region | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| World (Total) | Off-trade | 5,667.8 | 6,169.3 | 1.7 | 6,171.3 | 6,739.7 | 1.8 |

| On-trade | 3,657.7 | 3,562.3 | −0.5 | 3,815.9 | 4,706.5 | 5.7 | |

| Total | 9,325.5 | 9,731.6 | 0.9 | 9,987.3 | 11,446.2 | 3.3 | |

| Asia Pacific | Off-trade | 168.5 | 394.6 | 18.6 | 444.8 | 757.8 | 13.9 |

| On-trade | 265.5 | 481.0 | 12.6 | 598.4 | 1,308.4 | 22.2 | |

| Total | 434.0 | 875.6 | 15.1 | 1,043.2 | 2,066.2 | 18.7 | |

| Australasia | Off-trade | 156.9 | 223.6 | 7.3 | 233.0 | 279.6 | 4.6 |

| On-trade | 58.9 | 60.6 | 0.6 | 64.7 | 82.7 | 6.4 | |

| Total | 215.8 | 284.1 | 5.7 | 297.7 | 362.4 | 5.0 | |

| Eastern Europe | Off-trade | 370.0 | 530.3 | 7.5 | 523.4 | 563.9 | 1.2 |

| On-trade | 59.2 | 72.5 | 4.1 | 76.5 | 94.2 | 5.4 | |

| Total | 429.2 | 602.7 | 7.0 | 599.9 | 658.2 | 1.8 | |

| Latin America | Off-trade | 46.8 | 99.7 | 16.3 | 103.1 | 129.0 | 5.3 |

| On-trade | 40.6 | 57.2 | 7.1 | 61.8 | 74.4 | 5.4 | |

| Total | 87.5 | 156.9 | 12.4 | 164.9 | 203.4 | 5.3 | |

| Middle Eastern and Africa | Off-trade | 1,308.1 | 1,143.7 | −2.7 | 1,140.9 | 1,189.9 | 0.8 |

| On-trade | 484.2 | 468.3 | −0.7 | 475.6 | 527.9 | 2.4 | |

| Total | 1,792.3 | 1,612.0 | −2.1 | 1,616.5 | 1,717.8 | 1.3 | |

| North America | Off-trade | 1,643.1 | 1,661.8 | 0.2 | 1,626.8 | 1,668.8 | 0.1 |

| On-trade | 1,088.2 | 970.5 | −2.3 | 1,062.8 | 1,093.2 | 2.4 | |

| Total | 2,731.3 | 2,632.3 | −0.7 | 2,689.7 | 2,762.0 | 1.0 | |

| Western Europe | Off-trade | 1,974.3 | 2,115.6 | 1.4 | 2,099.3 | 2,150.6 | 0.3 |

| On-trade | 1,661.1 | 1,452.2 | −2.7 | 1,476.2 | 1,525.6 | 1.0 | |

| Total | 3,635.4 | 3,567.9 | −0.4 | 3,575.4 | 3,676.2 | 0.6 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

In 2022, leading dark beer global markets registering the highest total on/off-trade sales were the United States at US$20.0 billion (2.3 billion litres), China at US$7.5 billion (600.1 million litres), the United Kingdom at US$6.2 billion (933.2 million litres), Germany at US$5.4 billion (1.3 billion litres), and the France at US$3.3 billion (566 million litres). Canada was the 6th largest market in terms of value sales of dark beer at US$2.7 billion (291.1 million litres) in 2022.

Within the top 10 markets in 2022, those countries with larger off-trade dark beer sales over on-trade sales were France (off-trade share: 60.4%), Canada (51.1%), and Russia (82.2%). Alternatively, the US (on-trade share: 66.5%), China (78.1%), the UK (61.9%), Germany (77.2%), Netherlands (78.6%), Belgium (72.8%), and Italy (85.5%) were regions that registered higher sales within the on-trade sector of dark beer in 2022.

| Region | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| World - dark beer | Off-trade | 17,748.7 | 23,873.5 | 6.1 | 25,336.4 | 32,783.1 | 6.5 |

| On-trade | 33,924.0 | 40,041.8 | 3.4 | 46,725.5 | 68,954.7 | 11.5 | |

| Total | 51,672.7 | 63,915.4 | 4.3 | 72,061.9 | 101,737.8 | 9.7 | |

| 1. United States | Off-trade | 6,152.4 | 6,700.9 | 1.7 | 6,795.1 | 7,485.8 | 2.2 |

| On-trade | 12,497.9 | 13,322.4 | 1.3 | 15,270.0 | 16,559.8 | 4.4 | |

| Total | 18,650.3 | 20,023.3 | 1.4 | 22,065.1 | 24,045.6 | 3.7 | |

| 2. China | Off-trade | 572.5 | 1,634.1 | 23.3 | 1,877.2 | 4,180.0 | 20.7 |

| On-trade | 2,381.2 | 5,831.1 | 19.6 | 8,231.7 | 23,765.0 | 32.4 | |

| Total | 2,953.7 | 7,465.2 | 20.4 | 10,108.9 | 27,944.9 | 30.2 | |

| 3. United Kingdom | Off-trade | 1,895.8 | 2,365.4 | 4.5 | 2,544.6 | 2,867.8 | 3.9 |

| On-trade | 3,737.6 | 3,842.9 | 0.6 | 4,269.6 | 4,961.9 | 5.2 | |

| Total | 5,633.4 | 6,208.4 | 2.0 | 6,814.1 | 7,829.7 | 4.7 | |

| 4. Germany | Off-trade | 1,309.5 | 1,235.8 | −1.2 | 1,293.1 | 1,346.1 | 1.7 |

| On-trade | 4,390.4 | 4,186.5 | −0.9 | 4,520.7 | 4,891.2 | 3.2 | |

| Total | 5,699.9 | 5,422.2 | −1.0 | 5,813.8 | 6,237.2 | 2.8 | |

| 5. France | Off-trade | 1,288.2 | 2,018.3 | 9.4 | 2,110.0 | 2,463.7 | 4.1 |

| On-trade | 1,321.0 | 1,323.2 | 0.0 | 1,461.9 | 1,924.7 | 7.8 | |

| Total | 2,609.2 | 3,341.5 | 5.1 | 3,571.9 | 4,388.4 | 5.6 | |

| 6. Canada | Off-trade | 1,158.5 | 1,393.9 | 3.8 | 1,455.9 | 1,674.0 | 3.7 |

| On-trade | 1,371.4 | 1,312.4 | −0.9 | 1,390.7 | 1,480.2 | 2.4 | |

| Total | 2,529.9 | 2,706.3 | 1.4 | 2,846.6 | 3,154.2 | 3.1 | |

| 7. Netherlands | Off-trade | 263.3 | 461.4 | 11.9 | 483.6 | 573.0 | 4.4 |

| On-trade | 1,118.5 | 1,698.9 | 8.7 | 1,873.0 | 2,193.1 | 5.2 | |

| Total | 1,381.8 | 2,160.3 | 9.3 | 2,356.6 | 2,766.1 | 5.1 | |

| 8. Belgium | Off-trade | 440.3 | 535.7 | 4.0 | 549.0 | 689.2 | 5.2 |

| On-trade | 1,313.7 | 1,432.1 | 1.7 | 1,534.1 | 1,737.5 | 3.9 | |

| Total | 1,754.0 | 1,967.9 | 2.3 | 2,083.1 | 2,426.6 | 4.3 | |

| 9. Italy | Off-trade | 166.5 | 214.4 | 5.2 | 236.5 | 275.2 | 5.1 |

| On-trade | 1,073.8 | 1,264.8 | 3.3 | 1,408.7 | 1,781.7 | 7.1 | |

| Total | 1,240.3 | 1,479.2 | 3.6 | 1,645.2 | 2,057.0 | 6.8 | |

| 10. Russia | Off-trade | 557.2 | 1,069.7 | 13.9 | 1,120.0 | 1,376.7 | 5.2 |

| On-trade | 149.4 | 231.1 | 9.1 | 247.3 | 305.4 | 5.7 | |

| Total | 706.6 | 1,300.8 | 13.0 | 1,367.3 | 1,682.1 | 5.3 | |

| Sub-total (top 10 markets) | Off-trade | 13,804.2 | 17,629.6 | 5.0 | 18,465.0 | 22,931.5 | 5.4 |

| On-trade | 29,354.9 | 34,445.4 | 3.3 | 40,207.7 | 59,600.5 | 11.6 | |

| Total | 43,159.1 | 52,075.1 | 3.8 | 58,672.6 | 82,531.8 | 9.6 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

| Region | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| World - dark beer | Off-trade | 5,667.8 | 6,169.3 | 1.7 | 6,171.3 | 6,739.7 | 1.8 |

| On-trade | 3,657.7 | 3,562.3 | −0.5 | 3,815.9 | 4,706.5 | 5.7 | |

| Total | 9,325.5 | 9,731.6 | 0.9 | 9,987.3 | 11,446.2 | 3.3 | |

| 1. United States | Off-trade | 1,443.7 | 1,452.1 | 0.1 | 1,415.9 | 1,442.6 | −0.1 |

| On-trade | 992.3 | 889.1 | −2.2 | 979.7 | 1,010.8 | 2.6 | |

| Total | 2,435.9 | 2,341.2 | −0.8 | 2,395.6 | 2,453.4 | 0.9 | |

| 2. Germany | Off-trade | 818.1 | 706.4 | −2.9 | 693.1 | 661.8 | −1.3 |

| On-trade | 668.8 | 568.1 | −3.2 | 573.4 | 562.3 | −0.2 | |

| Total | 1,486.8 | 1,274.5 | −3.0 | 1,266.5 | 1,224.1 | −0.8 | |

| 3. United Kingdom | Off-trade | 455.8 | 482.9 | 1.2 | 481.0 | 483.8 | 0.0 |

| On-trade | 560.2 | 450.3 | −4.3 | 457.7 | 469.2 | 0.8 | |

| Total | 1,016.0 | 933.2 | −1.7 | 938.7 | 953.0 | 0.4 | |

| 4. China | Off-trade | 76.6 | 200.8 | 21.3 | 249.3 | 546.9 | 22.2 |

| On-trade | 184.7 | 399.3 | 16.7 | 505.5 | 1,198.3 | 24.6 | |

| Total | 261.3 | 600.1 | 18.1 | 754.8 | 1,745.2 | 23.8 | |

| 5. France | Off-trade | 362.1 | 503.6 | 6.8 | 509.0 | 554.8 | 2.0 |

| On-trade | 73.3 | 62.5 | −3.1 | 65.0 | 75.4 | 3.8 | |

| Total | 435.3 | 566.0 | 5.4 | 574.0 | 630.1 | 2.2 | |

| 6. Russia | Off-trade | 210.1 | 317.4 | 8.6 | 300.7 | 297.7 | −1.3 |

| On-trade | 19.9 | 22.6 | 2.6 | 22.1 | 22.0 | −0.5 | |

| Total | 230.0 | 339.9 | 8.1 | 322.7 | 319.6 | −1.2 | |

| 7. Canada | Off-trade | 199.5 | 209.7 | 1.0 | 210.9 | 226.2 | 1.5 |

| On-trade | 95.9 | 81.5 | −3.2 | 83.1 | 82.4 | 0.2 | |

| Total | 295.4 | 291.1 | −0.3 | 294.0 | 308.6 | 1.2 | |

| 8. Belgium | Off-trade | 125.6 | 131.4 | 0.9 | 125.8 | 135.8 | 0.7 |

| On-trade | 122.3 | 118.7 | −0.6 | 119.6 | 123.1 | 0.7 | |

| Total | 247.9 | 250.1 | 0.2 | 245.4 | 258.9 | 0.7 | |

| 9. Netherlands | Off-trade | 81.0 | 115.3 | 7.3 | 113.0 | 120.3 | 0.9 |

| On-trade | 79.7 | 99.4 | 4.5 | 98.2 | 109.6 | 2.0 | |

| Total | 160.7 | 214.7 | 6.0 | 211.2 | 229.9 | 1.4 | |

| 10. Italy | Off-trade | 33.7 | 38.3 | 2.6 | 39.3 | 42.0 | 1.9 |

| On-trade | 50.8 | 50.8 | 0.0 | 52.4 | 60.8 | 3.7 | |

| Total | 84.5 | 89.1 | 1.1 | 91.7 | 102.8 | 2.9 | |

| Sub-total (top 10 markets) | Off-trade | 3,806.2 | 4,157.9 | 1.8 | 4,138.0 | 4,511.9 | 1.6 |

| On-trade | 2,828.0 | 2,743.2 | −0.6 | 2,957.2 | 3,713.9 | 6.4 | |

| Total | 6,653.8 | 6,899.9 | 0.7 | 7,094.6 | 8,225.6 | 3.6 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

Competitive landscape - dark beer

In 2022, the leading global companies in the dark beer category were Anheuser-Busch InBev NV (top brands: Hoegaarden, Leffe, Franziskaner, Labatt) at a global market value share of 13.4% (US$8.6 billion), Molson Coors Brewing Co. (top brands: Blue Moon, Red's, Leinenkugel, Worthington) at 6.6% (US$4.2 billion), and Heineken NV (top brands: John Smith's, Lagunitas, Newcastle Brown Ale, Affligem) at 5.0% (US$3.2 billion). Private labels of dark beer throughout the world registered a market value share of 0.2% (US$129.0 million) in 2022.

| Market | Company | Top brand(s) | Retail sales (US$M) | Market share % in 2022 |

|---|---|---|---|---|

| United States | Molson Coors Brewing Co. | Blue Moon, Redd's, Leinenkugel | 2,880.3 | 14.4 |

| New Belgium Brewing Co. | Voodoo Ranger, Fat Tire Amber Ale | 1,219.2 | 6.1 | |

| Sierra Nevada Brewing Co. | Hazy Little Thing, Sierra Nevada | 1,012.9 | 5.1 | |

| Total - Dark beer in the United States | 20,023.3 | 100.0 | ||

| China | Anheuser-Busch InBev NV | Hoegaarden, Franziskaner | 1,319.3 | 17.7 |

| Carlsberg A/S | Kronenbourg | 829.9 | 11.1 | |

| Beijing Yanjing Brewery Co Ltd. | Yanjing | 90.3 | 1.2 | |

| Total - Dark beer in China | 7,465.2 | 100.0 | ||

| United Kingdom | Anheuser-Busch InBev NV | Hoegaarden, Boddingtons, Bass, Whitbread | 942.1 | 15.2 |

| Molson Coors Brewing Co. | Worthington, Doom Bar, Stone's, Blue Moon, Caffrey's, Hancock's HB, Toby | 758.0 | 12.2 | |

| Heineken NV | John Smith's, Newcastle Brown Ale, Deuchars IPA | 743.3 | 12.0 | |

| Private label | Private label | 89.3 | 1.4 | |

| Total - Dark beer in the United Kingdom | 6,208.4 | 100.0 | ||

| Germany | Paulaner Brauerei GmbH & Co KG | Paulaner, Hacker Pschorr, Kapuziner, Thurn & Taxis Weissbier, AuerBräu, Fürstenberg, Hoepfner Schmucker | 985.9 | 18.2 |

| Oetker-Gruppe | Schöfferhofer, Dom/Sion/Gilden/ Küppers Kölsch, Schlösser Alt | 555.8 | 10.2 | |

| Anheuser-Busch InBev NV | Franziskaner, Diebels | 465.7 | 8.6 | |

| Private label | Private label | 23.1 | 0.4 | |

| Total - Dark beer in Germany | 5,422.2 | 100.0 | ||

| France | Anheuser-Busch InBev NV | Leffe, Hoegaarden, Triple Karmeliet, Victoria, Kwak | 1,541.0 | 46.1 |

| Carlsberg A/S | Grimbergen, 1664 Blanc | 779.5 | 23.3 | |

| Heineken NV | Affligem, Pelforth, Mort Subite, Edelweiss, Adelscott | 347.2 | 10.4 | |

| Total - Dark beer in France | 3,341.5 | 100.0 | ||

| Canada | Anheuser-Busch InBev NV | Labatt, Alexander Keith's, Shock Top | 857.0 | 31.7 |

| Molson Coors Brewing Co. | Molson (Export), Granville Island, Gastown Ale | 579.2 | 21.4 | |

| Sapporo Holdings Ltd. | Okanagan, Sleeman | 337.3 | 12.5 | |

| Total - Dark beer in Canada | 2,706.3 | 100.0 | ||

| Netherlands | Anheuser-Busch InBev NV | Hertog Jan, Leffe, Hoegaarden, Franziskaner | 708.1 | 32.8 |

| Asahi Group Holdings Ltd | Grolsch | 257.9 | 11.9 | |

| Heineken NV | Brand, Affligen, Wieckse Witte, Heineken | 236.2 | 10.9 | |

| Total - Dark beer in the Netherlands | 2,160.3 | 100.0 | ||

| Belgium | Anheuser-Busch InBev NV | Leffe, Hoegaarden, Belle-Vue, Tripel Karmeliet, Vieux Temps, Kwak, Ginder Ale | 657.0 | 33.4 |

| Duvel Moortgat NV | Chouffe, Duvel, Liefmans, Maredsous, De Koninck | 225.7 | 11.5 | |

| Heineken NV | Grimbergen, Mort Subite, Ciney, Judas, Affligem | 176.3 | 9.0 | |

| Private label | Private label | 10.0 | 0.5 | |

| Total - Dark beer in Belgium | 1,967.9 | 100.0 | ||

| Italy | Anheuser-Busch InBev NV | Leffe, Hoegaarden | 357.6 | 24.2 |

| Heineken NV | Moretti, McFarland, Mort Subite, Edelweiss | 252.7 | 17.1 | |

| Paulaner Brauerei GmbH & Co KG | Paulaner | 161.2 | 10.9 | |

| Total - Dark beer in Italy | 1,479.2 | 100.0 | ||

| Russia | Anheuser-Busch InBev NV | Hoegaarden, Leffe, Franziskaner, Chernigivske, | 337.0 | 25.9 |

| Oasis Group | Hamovniki Bavarskoye, 5 Okean, Mokhnaty Shmel | 90.5 | 7.0 | |

| Carlsberg A/S | Baltika, Grimbergen, Old Bobby Ale | 76.2 | 5.9 | |

| Total - Dark beer in Russia | 1,300.8 | 100.0 | ||

| Source: Euromonitor International, 2024 | ||||

Lager

In 2022, total sales of Lager beer (including premium/mid-priced/economy domestic and imported standard Lager, flavoured/mixed Lager) was US$610.6 billion (181.7 billion litres), which consisted of US$285.7 billion (121.6 billion litres) in off-trade retail sales and US$324.9 billion (60.1 billion litres) in on-trade sales. Both off-trade and on-trade sales increased by 6.4% and 2.9%, respectively between 2017 and 2022. Although on-trade sales of Lager beer suffered during the pandemic lockdown periods, the foodservice sector is forecast to turn around with a CAGR of 10.5% versus retail off-trade (8.6%) between 2022 and 2027.

The largest regions with the most total value of off/on-trade sales of Lager beer were Asia Pacific (US$171.6 billion), Latin America (US$124.6 billion), Western Europe (US$113.5 billion), and North America (US$100.5 billion) in 2022. Top regions with the highest total historical growth (2017 to 2022) of Lager beer were Latin America (CAGR:11.8%) and MENA (9.8%). Australasia and Asia Pacific regions suffered the most during the COVID-19 period within the foodservice sector, registering negative on-trade sales growths of −3.4% and −0.8% respectively.

Off-trade sales of Lager beer brought in the most value over on-trade sales within the following regions: Australasia (off-trade share: 73.7%), Eastern Europe (67.5%), and North America (53.8%) in 2022. Alternatively, the Asia Pacific (52%), Latin America (57.8%), MENA (54.2%), and Western Europe (65%) regions registered higher sales within the on-trade sector of Lager beer in 2022.

| Region | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| World (Total) | Off-trade | 209,970.0 | 285,747.5 | 6.4 | 316,981.5 | 431,309.0 | 8.6 |

| On-trade | 282,060.5 | 324,873.0 | 2.9 | 374,621.3 | 534,204.9 | 10.5 | |

| Total | 492,030.4 | 610,620.5 | 4.4 | 691,602.8 | 965,513.9 | 9.6 | |

| Asia Pacific | Off-trade | 64,084.2 | 82,401.9 | 5.2 | 91,128.8 | 115,276.8 | 6.9 |

| On-trade | 92,899.2 | 89,224.3 | −0.8 | 105,508.7 | 144,007.9 | 10.0 | |

| Total | 156,983.4 | 171,626.3 | 1.8 | 196,637.5 | 259,284.7 | 8.6 | |

| Australasia | Off-trade | 5,025.1 | 5,872.9 | 3.2 | 6,282.8 | 7,060.7 | 3.8 |

| On-trade | 2,486.9 | 2,094.5 | −3.4 | 2,443.8 | 3,438.5 | 10.4 | |

| Total | 7,512.1 | 7,967.4 | 1.2 | 8,726.6 | 10,499.2 | 5.7 | |

| Eastern Europe | Off-trade | 20,083.1 | 27,225.3 | 6.3 | 30,550.8 | 38,581.4 | 7.2 |

| On-trade | 11,572.4 | 13,098.0 | 2.5 | 15,139.1 | 21,113.6 | 10.0 | |

| Total | 31,655.5 | 40,323.3 | 5.0 | 45,689.9 | 59,695.1 | 8.2 | |

| Latin America | Off-trade | 28,787.9 | 52,579.2 | 12.8 | 62,390.8 | 114,415.5 | 16.8 |

| On-trade | 42,599.2 | 72,028.4 | 11.1 | 85,537.9 | 152,124.8 | 16.1 | |

| Total | 71,387.1 | 124,607.7 | 11.8 | 147,928.7 | 266,540.3 | 16.4 | |

| Middle Eastern and Africa | Off-trade | 13,547.7 | 23,839.6 | 12.0 | 26,359.2 | 38,523.5 | 10.1 |

| On-trade | 19,142.8 | 28,217.9 | 8.1 | 32,449.3 | 53,255.6 | 13.5 | |

| Total | 32,690.6 | 52,057.5 | 9.8 | 58,808.5 | 91,779.1 | 12.0 | |

| North America | Off-trade | 48,161.0 | 54,077.5 | 2.3 | 56,688.0 | 62,969.0 | 3.1 |

| On-trade | 44,539.3 | 46,436.7 | 0.8 | 51,125.6 | 59,822.0 | 5.2 | |

| Total | 92,700.3 | 100,514.3 | 1.6 | 107,813.6 | 122,791.0 | 4.1 | |

| Western Europe | Off-trade | 30,280.9 | 39,751.0 | 5.6 | 43,581.1 | 54,482.0 | 6.5 |

| On-trade | 68,820.7 | 73,773.1 | 1.4 | 82,416.9 | 100,442.5 | 6.4 | |

| Total | 99,101.6 | 113,524.1 | 2.8 | 125,998.0 | 154,924.5 | 6.4 | |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

| Region | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 | |

|---|---|---|---|---|---|---|---|

| World (Total) | Off-trade | 111,866.5 | 121,606.1 | 1.7 | 124,510.7 | 134,911.2 | 2.1 |

| On-trade | 65,937.6 | 60,062.5 | −1.8 | 63,934.4 | 72,638.0 | 3.9 | |

| Total | 177,804.1 | 181,668.6 | 0.4 | 188,445.1 | 207,549.2 | 2.7 | |

| Asia Pacific | Off-trade | 36,820.9 | 40,347.7 | 1.8 | 42,276.9 | 47,524.9 | 3.3 |

| On-trade | 30,280.8 | 24,716.5 | −4.0 | 27,054.9 | 31,105.8 | 4.7 | |

| Total | 67,101.7 | 65,064.2 | −0.6 | 69,331.8 | 78,630.7 | 3.9 | |

| Australasia | Off-trade | 1,069.7 | 1,083.1 | 0.2 | 1,077.2 | 1,051.7 | −0.6 |

| On-trade | 339.2 | 255.4 | −5.5 | 274.3 | 328.0 | 5.1 | |

| Total | 1,408.9 | 1,338.5 | −1.0 | 1,351.5 | 1,379.7 | 0.6 | |

| Eastern Europe | Off-trade | 16,319.9 | 16,248.3 | −0.1 | 16,369.3 | 16,850.9 | 0.7 |

| On-trade | 3,333.5 | 2,695.8 | −4.2 | 2,828.3 | 3,296.1 | 4.1 | |

| Total | 19,653.3 | 18,944.1 | −0.7 | 19,197.6 | 20,147.0 | 1.2 | |

| Latin America | Off-trade | 18,331.0 | 22,983.9 | 4.6 | 23,757.1 | 26,875.4 | 3.2 |

| On-trade | 12,048.5 | 13,182.6 | 1.8 | 13,843.7 | 15,713.4 | 3.6 | |

| Total | 30,379.4 | 36,166.5 | 3.5 | 37,600.8 | 42,588.8 | 3.3 | |

| Middle Eastern and Africa | Off-trade | 7,633.2 | 9,352.9 | 4.1 | 9,736.6 | 11,338.6 | 3.9 |

| On-trade | 5,833.9 | 6,364.4 | 1.8 | 6,718.1 | 8,303.3 | 5.5 | |

| Total | 13,467.2 | 15,717.3 | 3.1 | 16,454.7 | 19,641.9 | 4.6 | |

| North America | Off-trade | 17,581.3 | 16,639.2 | −1.1 | 16,410.1 | 16,375.8 | −0.3 |

| On-trade | 5,530.1 | 4,949.1 | −2.2 | 5,093.1 | 5,329.5 | 1.5 | |

| Total | 23,111.4 | 21,588.3 | −1.4 | 21,503.3 | 21,705.3 | 0.1 | |