Note: This report includes forecasting data that is based on baseline historical data.

Market snapshot

In 2022, a total of US$588.8 million of solid maple sugar and maple syrup products were imported from the world registering a compound annual growth rate (CAGR) of 11.3% since 2018. The Netherlands ranked as the 2nd largest import market for maple products at a value of US$48.0 million (27.0 thousand tonnes), while Canada ranked as the 8th largest market (US$13.2 million, 2.9 thousand tonnes) in 2022.

The Netherlands top suppliers for maple products in 2022, were Germany (US$21.4 million, 13.6 thousand tonnes), Canada (US$20.2 million, 2.8 thousand tonnes) and Belgium (US$4.4 million, 10.0 thousand tonnes). Imports from Canada has been growing by a CAGR of 49.6%, increasing from US$6.0 million in 2019 to US$20.2 million in 2022 (zero imports in 2018).

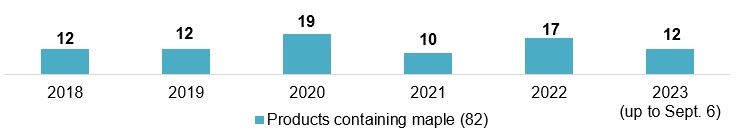

Mintel's Global New Products Database (GNPD) indicated that there were 82 new maple food (74) and drink (8) products launched (including new variety/range extension, packaging, or relaunched) throughout the Netherlands grocery markets between January 2018 and September 6, 2023. Four Canadian maple products (4.9%) were found on the market shelves within the Netherlands grocery stores, which accounted for Canada being the 4th largest location of manufacture.

With maple syrup being the main ingredients found in these products, often used as a sweetener, leading parent companies launching new maple products (n=22) across the Netherlands (Q3-2022 and Q3-2023) were Gimsel (3), Lazy Vegan (3), Nestlé (2), Biovegan (1), BMB Brands (1), and Brown-Forman (1). The top 10 brands during this period were Gimsel, BMB Brands, I Just Love Breakfast, Lazy Vegan Ready Meal, Raaka Chocolate, Natural Bamboo, Jan, TerraSana, Pulsin, Benriach, and Bamboo.

More recently over the period of Q3-2022 and Q3-2023, usages for maple syrup as an ingredient has been diversified and can be found in popular food categories such as bakery, sauces & seasonings, snacks, and breakfast cereals. While declining categories during this period include meals and meal centers, sweet spreads, and hot beverages. The most important claims that were always included on all maple product packaging within the last three months were ethical - sustainable (habitat/resources), vegan/no animal ingredients, ethical - environmentally friendly product, and organic.

Global trade overview of maple products

The global import market for solid maple sugar and maple syrup (HS:170220) registered a total CAGR increase of 11.3% increasing from US$383.8 million in 2018 to US$588.8 million in 2022. The United States (market share: 49.8%) was the largest global importer of these maple products valued at US$293 million, (44.6 thousand tonnes), followed by the Netherlands (8.2%) with imports valued at US$48 million (27.0 thousand tonnes) and Germany (5.3%) with an import value of US$31.4 million (4.2 thousand tonnes) in 2022.

Canada in comparison, was the 8th largest market for imports of maple products accounting for 2.2% of the total world market share in 2022 at a value of US$13.2 million (2.9 thousand tonnes).

| Country | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2018-2022 | Market share % in 2022 |

|---|---|---|---|---|---|---|---|

| Total - world imports | 383.8 | 398.3 | 467.7 | 565.7 | 588.8 | 11.3 | 100.0 |

| 1. United States | 193.3 | 201.0 | 226.8 | 278.0 | 293.0 | 11.0 | 49.8 |

| 2. Netherlands | 15.1 | 8.7 | 16.5 | 20.3 | 48.0 | 33.5 | 8.2 |

| 3. Germany | 28.4 | 28.3 | 32.8 | 40.4 | 31.4 | 2.6 | 5.3 |

| 4. France | 12.6 | 17.7 | 19.9 | 24.9 | 29.2 | 23.4 | 5.0 |

| 5. United Kingdom | 19.2 | 22.4 | 27.8 | 30.8 | 28.8 | 10.7 | 4.9 |

| 6. Japan | 21.1 | 21.7 | 21.4 | 29.6 | 27.2 | 6.5 | 4.6 |

| 7. Australia | 15.4 | 16.6 | 20.4 | 20.4 | 21.8 | 9.0 | 3.7 |

| 8. Canada | 11.4 | 11.0 | 11.3 | 8.9 | 13.2 | 3.7 | 2.2 |

| 9. Denmark | 6.5 | 6.4 | 7.8 | 9.0 | 8.9 | 7.9 | 1.5 |

| 10. South Korea | 4.7 | 4.0 | 6.8 | 9.5 | 8.7 | 16.6 | 1.5 |

| Subtotal - top 10 | 327.8 | 337.9 | 391.5 | 472.0 | 510.3 | 11.7 | 86.7 |

|

Source: Global Trade Tracker, 2023 1: HS 170220 *CAGR: Compound Annual Growth Rate |

|||||||

| Country | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2018-2022 | Market share % in 2022 |

|---|---|---|---|---|---|---|---|

| Total - world imports | 61,028 | 68,562 | 77,736 | 90,080 | 110,901 | 11.3 | 100.0 |

| 1. United States | 30,229 | 32,126 | 36,990 | 44,503 | 44,555 | 11.0 | 40.2 |

| 2. Netherlands | 2,107 | 1,155 | 2,288 | 2,566 | 26,989 | 33.5 | 24.3 |

| 3. United Kingdom | 4,402 | 4,447 | 4,667 | 4,705 | 4,300 | 10.7 | 3.9 |

| 4. Germany | 3,732 | 4,052 | 4,538 | 5,417 | 4,158 | 2.6 | 3.7 |

| 5. France | 1,776 | 2,563 | 2,608 | 3,123 | 3,703 | 23.4 | 3.3 |

| 6. Japan | 2,469 | 2,588 | 2,577 | 3,333 | 3,023 | 6.5 | 2.7 |

| 7. Canada | 2,506 | 2,594 | 2,624 | 1,895 | 2,907 | 3.7 | 2.6 |

| 8. Australia | 2,509 | 2,493 | 2,826 | 2,840 | 2,832 | 9.0 | 2.6 |

| 9. Ghana | 445 | 987 | 833 | 1,164 | 2,311 | 59.0 | 2.1 |

| 10. Italy | 531 | 744 | 1,619 | 2,482 | 1,879 | 15.3 | 1.7 |

| Subtotal - top 10 | 50,706 | 53,749 | 61,570 | 72,028 | 96,657 | 17.5 | 87.2 |

|

Source: Global Trade Tracker, 2023 1: HS 170220 *CAGR: Compound Annual Growth Rate |

|||||||

Imports of maple products in the Netherlands

The top three suppliers of solid maple sugar and maple syrup products to the Netherlands were Germany (US$21.4 million, 13.6 thousand tonnes), Canada (US$20.2 million, 2.8 thousand tonnes) and Belgium (US$4.4 million, 9.9 thousand tonnes) in 2022. Amongst the top 5 markets, Belgium registered the largest growth increase (2018 to 2022) at a CAGR of 124.3%, followed by Germany (+111%), France (+79.2%), and Canada (+49.6%). Alternatively, Spain and Denmark were the only leading import markets from the Netherlands that registered a negative CAGR of 21.7% and 5.6%, respectively in 2022.

| Country | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2018-2022 | Market share % in 2022 |

|---|---|---|---|---|---|---|---|

| Total - world imports | 15.1 | 8.7 | 16.5 | 20.3 | 48.0 | 33.5 | 100.0 |

| 1. Germany | 1.1 | 0.684 | 0.794 | 0.845 | 21.4 | 111.0 | 44.6 |

| 2. Canada | 0.0 | 6.0 | 12.5 | 13.6 | 20.2 | 49.6 | 42.0 |

| 3. Belgium | 0.173 | 0.072 | 0.764 | 2.8 | 4.4 | 124.3 | 9.1 |

| 4. France | 0.093 | 0.562 | 0.727 | 0.735 | 1.0 | 79.2 | 2.0 |

| 5. Denmark | 0.885 | 1.0 | 1.2 | 1.3 | 0.703 | −5.6 | 1.5 |

| 6. United States | 0.0 | 0.082 | 0.140 | 0.130 | 0.092 | 4.0 | 0.2 |

| 7. Greece | 0.002 | 275.0 | 173.0 | 382.0 | 0.033 | 111.0 | 0.1 |

| 8. Poland | 0.003 | 0.002 | 0.008 | 0.169 | 0.025 | 73.5 | 0.05 |

| 9. Spain | 0.048 | 0.0 | 0.009 | 0.0 | 0.018 | −21.7 | 0.04 |

| 10. Italy | 0.007 | 0.029 | 0.107 | 0.033 | 0.018 | 26.8 | 0.04 |

| Subtotal - top 10 | 2.3 | 8.5 | 16.3 | 19.5 | 47.9 | 113.8 | 99.6 |

|

Source: Global Trade Tracker, 2023 1: HS 170220 *CAGR: Compound Annual Growth Rate |

|||||||

| Country | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2018-2022 | Market share % in 2022 |

|---|---|---|---|---|---|---|---|

| Total - world imports | 2,106.7 | 1,154.6 | 2,288.4 | 2,566.5 | 26,988.6 | 89.2 | 100.0 |

| 1. Germany | 128.6 | 75.6 | 81.6 | 86.0 | 13,618.7 | 220.8 | 50.5 |

| 2. Belgium | 28.7 | 8.1 | 76.9 | 263.5 | 9,895.1 | 331.0 | 36.7 |

| 3. Canada | 0.0 | 860.9 | 1,841.2 | 1,913.7 | 2,755.8 | 47.4 | 10.2 |

| 4. Denmark | 86.0 | 109.4 | 121.3 | 94.7 | 439.5 | 50.3 | 1.6 |

| 5. France | 6.3 | 42.5 | 67.8 | 75.1 | 225.5 | 144.4 | 0.8 |

| 6. United States | 0.0 | 18.2 | 41.4 | 38.6 | 15.4 | −5.4 | 0.1 |

| 7. Greece | 0.115 | 0.020 | 0.016 | 0.036 | 8.1 | 189.3 | 0.03 |

| 8. Portugal | 0.011 | 0.006 | 0.068 | 0.054 | 6.2 | 387.3 | 0.02 |

| 9. Poland | 0.209 | 0.148 | 0.717 | 11.8 | 2.6 | 87.0 | 0.01 |

| 10. United Kingdom | 9.4 | 12.2 | 5.1 | 29.1 | 2.2 | −30.1 | 0.01 |

| Subtotal - top 10 | 259.3 | 1,127.0 | 2,236.1 | 2,512.7 | 26,969.1 | 219.3 | 99.9 |

|

Source: Global Trade Tracker, 2023 1: HS 170220 *CAGR: Compound Annual Growth Rate |

|||||||

Product launch and trend analysis

New product launch analysis

Mintel's (GNPD) indicated that there were 82 new maple food (74) and drink (8) products launched throughout the Netherlands grocery stores (including new variety/range extension, packaging, or relaunched) between January 2018 and September 6, 2023.

Maple syrup, along with raw sugar and low-GI malt syrup are often used in products as a sweetener, instead of refined sugar.Footnote 1 Amongst these maple products, a total of 54 products (65.9%) contained maple syrup according to the ingredient list upon its packaging label.

Description of above image

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 (up to September 6) | |

|---|---|---|---|---|---|---|

| Products containing maple (82) | 12 | 12 | 19 | 10 | 17 | 12 |

Top locations of manufacture for these 82 new maple food and drink products found in the grocery stores in the Netherlands making up a total market share of 30.5% were the United Kingdom, United States, Belgium, Canada and France. Canada represented the 4th largest market that manufactured four (4.9%) of the maple products found in the Netherlands. These Canadian products were maple syrup brands manufactured by companies such as Cofradex (Vertmont Organic, Vermont), De Smaakspecialist (Bio Today), and Bergfood (Maple Gold).

Leading parent companies launching food and drink products (22) containing maple as an ingredient in the Netherlands between Q3-2022 and Q3-2023 were Gimsel (3), Lazy Vegan (3), Nestlé (2), Biovegan (1), BMB Brands (1), and Brown-Forman (1). New brands appearing for the first time launched in the Netherlands market within the last 6 months, include Biovegan (My Blondies maple-walnut baking mix), Abbot Kinney's (Coco frost strawberry cookie crumble coconut-based ice cream), Lazy Vegan Meal for 1 (pasta al pesto) and Nojo (orange sauce).

Top categories for maple products in the Netherlands with a 0.0% change (between Q3-2022 and Q3-2023) were bakery, sauces & seasonings, snacks, and breakfast cereals. While declining categories during this period by −100% included meals & meal centers, sweet spreads, and hot beverages. New ingredients appearing in these maple products within the last 12 months included strawberry sauce or purée, maltose syrup, coconut cream, fibres, potassium tartrates, millet flour, psyllium seed husks, coconut flour, and linseed protein. The fastest declining flavours in these products by −100% were maple/maple syrup, banana, dark/black chocolate, salt (sea/fleur de sel) between Q3-2021 and Q3-2023.

Claims and claim combinations used 100% of the time in the last three months for these maple product launches included ethical - sustainable (habitat/resources), vegan/no animal ingredients, environmentally friendly product, and organic. Other popular claims used 50% of the time during this period were social media, environmental friendly package, ethical - charity, plant based, carbon neutral, low/no/reduced allergen, gluten free, and all natural product. Top growing claims between Q2-2022 and Q2-2023 was ethical - sustainable (habitat/resources) (+200%), while declining claims by −100% were high/added fibre, no added sugar, microwaveable, ethical - animal, and ethical - recycling (−50%).

| Product attributes | Yearly launch counts | ||||||

|---|---|---|---|---|---|---|---|

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Total | |

| Yearly product launches | 12 | 12 | 19 | 10 | 17 | 12 | 82 |

| New launch types | |||||||

| New product | 7 | 8 | 7 | 7 | 4 | 2 | 35 |

| New variety / range extension | 5 | 3 | 8 | 2 | 8 | 7 | 33 |

| New packaging | 0 | 1 | 3 | 1 | 3 | 2 | 10 |

| Relaunch | 0 | 0 | 1 | 0 | 2 | 1 | 4 |

| Top five sub-categories | |||||||

| Syrups | 2 | 4 | 1 | 3 | 3 | 3 | 16 |

| Cold cereals | 1 | 4 | 6 | 0 | 2 | 2 | 15 |

| Cakes, pastries and sweet goods | 2 | 1 | 4 | 2 | 3 | 1 | 13 |

| Snack / cereal / energy bars | 3 | 2 | 1 | 0 | 1 | 0 | 7 |

| Whisky | 0 | 0 | 0 | 3 | 2 | 0 | 5 |

| Top five parent companies (brands) | |||||||

| Gimsel | 1 | 1 | 1 | 0 | 2 | 1 | 6 |

| BMB Brands | 0 | 3 | 1 | 0 | 1 | 1 | 6 |

| I Just Love Breakfast | 0 | 0 | 4 | 0 | 0 | 1 | 5 |

| Lazy Vegan (Ready Meal) | 0 | 0 | 1 | 0 | 2 | 1 | 4 |

| Raaka Chocolate | 0 | 0 | 3 | 1 | 0 | 0 | 4 |

| Top ten brands (other than above noted company/brands) | |||||||

| Natural Bamboo | 0 | 3 | 1 | 0 | 0 | 0 | 4 |

| Jan | 0 | 0 | 2 | 0 | 1 | 0 | 3 |

| TerraSana | 0 | 2 | 0 | 1 | 0 | 0 | 3 |

| Pulsin | 2 | 0 | 1 | 0 | 0 | 0 | 3 |

| Benriach | 0 | 0 | 0 | 2 | 0 | 0 | 2 |

| Bamboo | 0 | 0 | 0 | 0 | 1 | 1 | 2 |

| Top five related claims | |||||||

| Vegan / no animal ingredients | 3 | 7 | 11 | 6 | 5 | 7 | 39 |

| Organic | 4 | 6 | 11 | 3 | 5 | 7 | 36 |

| Low / no / reduced allergen | 4 | 5 | 11 | 3 | 4 | 4 | 31 |

| Gluten free | 4 | 1 | 6 | 3 | 4 | 3 | 21 |

| Ethical - sustainable (habitat/resources) | 0 | 1 | 5 | 0 | 4 | 6 | 16 |

| Top five flavour component | |||||||

| Maple / maple (syrup) | 6 | 5 | 2 | 3 | 4 | 4 | 24 |

| Unflavoured/plain | 0 | 2 | 1 | 4 | 3 | 2 | 12 |

| Pecan | 2 | 2 | 1 | 0 | 0 | 2 | 7 |

| Caramel / caramelised | 0 | 1 | 0 | 1 | 2 | 1 | 5 |

| Salt (sea) / fleur de sel | 0 | 2 | 1 | 0 | 1 | 0 | 4 |

| Import status (if reported) | |||||||

| Imported | 1 | 3 | 10 | 6 | 3 | 4 | 27 |

| Not imported (Jan - American Style Pancakes) | 0 | 0 | 1 | 0 | 0 | 0 | 1 |

| Top location of manufacture | |||||||

| United Kingdom | 1 | 0 | 1 | 3 | 2 | 1 | 8 |

| United States | 0 | 1 | 4 | 2 | 0 | 0 | 7 |

| Belgium | 0 | 0 | 4 | 0 | 0 | 1 | 5 |

| Canada | 0 | 0 | 0 | 1 | 1 | 2 | 4 |

| Netherlands | 0 | 0 | 1 | 0 | 0 | 0 | 1 |

| Source: Mintel; Global New Product Database, 2023 | |||||||

Product examples

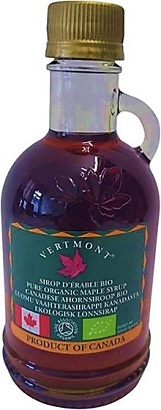

Pure Organic Canadian Maple Syrup

Source: Mintel, 2023

| Company | Cofradex |

|---|---|

| Brand | Vertmont |

| Sub-category | Sweet spreads, syrups |

| Market | Netherlands |

| Store name / type | Ekoplaza, natural / health food store Rotterdam 3021, GN |

| Claims | Organic |

| Launch type | New packaging |

| Date published | February 2023 |

| Price in US dollars | 6.79 |

This 100% pure Canadian maple syrup has been repackaged, and retails in a newly updated 330 gram pack. Logos and certifications: Soil Association Organic, EU Organic

Organic Oven-Baked Nuts & Seeds Mix

Source: Mintel, 2023

| Company | Meesters van de Halm |

|---|---|

| Brand | Meesters van de Halm |

| Sub-category | Snacks, nuts |

| Market | Netherlands |

| Related claims / ingredients | Organic, vegan/no animal ingredients, maple syrup |

| Store name / type | Vitaminstore, natural / health food Rotterdam 3011, JA |

| Launch type | New product |

| Date published | May 2023 |

| Price in US dollars | 6.17 |

Retails in a 400 gram pack. Sourced from as nearby as possible. Produced with green electricity and the manufacturer tries to be as circular as possible. 100% organic which ensures more biodiversity and a more beautiful landscape. To package the product as sustainably as possible, a bio based pack is used. Mainly from Dutch soil, grown in an environmentally friendly way. Logos and certifications: EU Organic, Vegan Society Approved Vegan Trademark.

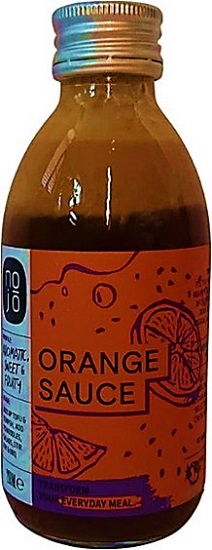

Orange Sauce

Source: Mintel, 2023

| Company | Guilt Free Enterprises |

|---|---|

| Distributor | VR Import |

| Brand | Nojo |

| Sub-category | Table sauces and seasonings |

| Market | Netherlands, imported from the United Kingdom |

| Related claims / ingredients | No additives / preservatives, gluten free, low / no allergen, ethical, vegan / no animal ingredients; maple syrup |

| Store name / type | crisp.nl, internet / mail order |

| Launch type | New product |

| Date published | April 2023 |

| Price in US dollars | 5.68 |

Retails in a 200 millilitre pack. Profile: aromatic, sweet and fruity. Jazz up tofu and tempeh, add to noodles, salads, stir fry and BBQ to transform everyday meals. Add to rice bowls, beans and salads or a can of chickpeas. Free from GMOs, additives, artificial flavours, gluten and refined sugar. Vegan - the manufacturer is a B-Corporation certified company creating products with a sustainable ethos at its heart.

Triple Decker Vegan Salted Nut Caramel Protein Bar

Source: Mintel, 2023

| Company | Tribe |

|---|---|

| Brand | Tribe |

| Sub-category | Snack / cereal / energy bars |

| Market | Netherlands, imported from the United Kingdom |

| Related claims / ingredients | Gluten free, low / no / reduced allergen, ethical – human, high / added protein, vegan / no animal ingredients; maple syrup, inulin, coconut palm sugar |

| Store name / type | hollandandbarrett.nl, internet / mail order |

| Launch type | New product |

| Date published | August 2022 |

| Price in US dollars | 1.83 |

This product with peanuts contains 8 grams of protein, is free from gluten, and retails in a 43 gram pack. According to the manufacturer, the mission of the company is to end modern slavery.

My Blondies Maple-Walnut Baking Mix

Source: Mintel, 2023

| Company | Biovegan |

|---|---|

| Brand | Biovegan |

| Sub-category | Bakery, baking ingredients and mixes |

| Market | Netherlands |

| Related claims / ingredients | Organic, gluten free, low / no / allergen, ethical – environmentally friendly product / packaging / charity / sustainable (habitat / resources), vegan / no animal ingredients, carbon neutral; maple sugar |

| Store name / type | Ekoplaza, Natural / health food store Rotterdam 3021, GN |

| Launch type | New variety / range extension |

| Date published | July 2023 |

| Price in US dollars | 4.59 |

Retails in a 400 gram pack. Organic baking mix with 7.1% walnuts and 3.3% maple syrup. Only selected ingredients which bring the purity and authenticity of nature to the home. Naturally vegan and organic. Free from gluten. Compensates all previously unavoidable CO2 emissions, which arise in the production of the product, by supporting a range of different climate protection projects and tracking how much CO2 is used with an ID number and tracking URL. Logos and certifications: Vegan V-Label seal from the European Vegetarian Union, EU Organic, Certified Gluten Free, CO2 Compensated Product.

Holiday Blend Whole Bean Coffee

Source: Mintel, 2023

| Company | Nestlé |

|---|---|

| Brand | Starbucks |

| Sub-category | Hot beverages, coffee |

| Market | Netherlands |

| Related claims / ingredients | Ethical – environmentally friendly / human / sustainable (habitat / resources); maple syrup |

| Store name / type | ah.nl, internet / mail order |

| Launch type | New packaging |

| Date published | January 2023 |

| Price in US dollars | 4.13 |

This limited edition product has been repackaged for holidays 2022, and retails in a newly designed 190 gram pack. Herbal and sweet maple notes, medium roast, 100% arabica. Earthy Indonesian beans, roasted to bring out their full flavour. Logos and certifications: Starbucks + Conservation International.

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

Resources

- Global Trade Tracker, 2023

- Mintel Global New Products Database (GNPD), 2023

Customized Report Service – Maple products in the Netherlands

Global Analysis Report

Prepared by: Erin-Ann Chauvin, Senior Market Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2023).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.