Note: This report includes forecasting data that is based on baseline historical data.

Mustard flour and seed ingredient market snapshot

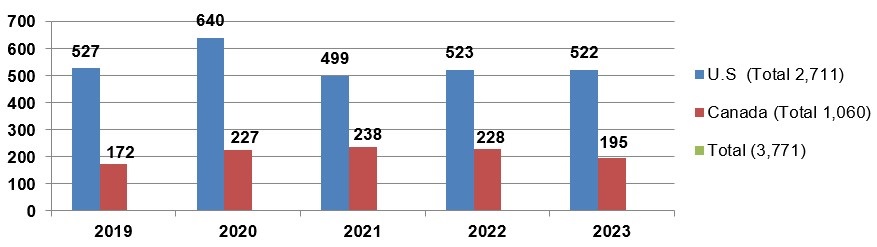

According to Mintel's Global New Products Database (GNPD), there were 3,771 new launches of products containing mustard flour and seeds, in the North American market (Canada and the United States), between January 2019 to December 2023 (440 new products launched year-to-date, January to June 2024).

Of the 3,771 new mustard flour and seed products released in Canada and the United States (US) markets between January 2019 and December 2023, all products (100.0% market share) launched were in the food category. In terms of new product category launches per market, the US released 2,711 food products, while Canada released 1.060 food products.

The predominant categories of new mustard flour and mustard seeds (mustard flour and seeds) containing food products released in the Canadian market during the review period were sauces and seasonings (615 products), processed fish, meat and egg products (173 products), meals and meal centers with 149 products, snacks (60 products), and savoury spreads (25 products), representing a combined market share of 96.4%.

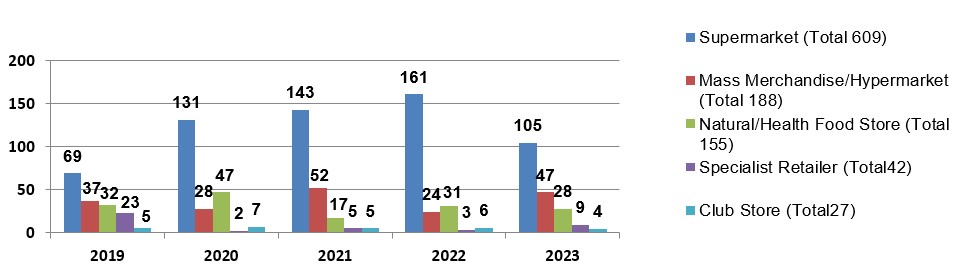

In the Canadian retail and e-commerce packaged food market, new launched products containing mustard flour and seeds were distributed primarily through supermarkets (609 products), followed by mass merchandise/hypermarket (188 products) and natural/health food stores with (155 products), representing a combined market share of 89.8% during the 2019 to 2023 period.

Packaged food retail sales in Canada were valued at Can$77.4 billion in 2023, increasing 6.5% in CAGR from Can$60.2 billion in 2019, and are expected to increase an additional 4.4% in CAGR to reach retail sales of Can$91.9 billion by 2027.

The predominant categories of new mustard flour and mustard seeds (mustard flour and seeds) containing food products released in the US market during the review period were sauces and seasonings (1,245 products), followed by meals and meal centers (652 products), processed fish, meat and egg products (336 products), snacks (232 products) and savoury spreads (72 products), representing a combined market share of 93.6%.

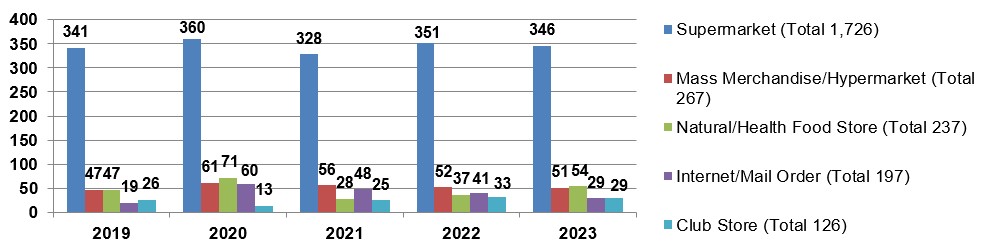

In the US retail and e-commerce packaged food market, new launched products containing mustard flour and seeds were distributed primarily through supermarkets (1,726 products), followed by mass merchandise/hypermarket (267 products) and natural/health food stores with (237 products), representing a combined market share of 82.3% during the 2019 to 2023 period.

Packaged food retail sales in the US were valued at US$580.0 billion in 2023, increasing 8.6% in CAGR from US$416.6 billion in 2019, and are expected to increase an additional 4.8% in CAGR to reach US$700.4 billion by 2027.

New products containing mustard flour and seeds in Canada and the United States

According to Mintel's Global New Products Database (GNPD), there were 3,771 new launches of products containing mustard flour and seeds, in the North American market (Canada and the United States (U.S), between January 2019 to December 2023 (440 new products launched year-to-date, January-June 2024).

The US launched the majority of the new products (2,711) representing a 71.9% market share, while Canada in comparison, launched a total of 1,060 products (28.1% market share) between 2019 to 2023.

Description of above image

| Market | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| United States | 527 | 640 | 499 | 523 | 522 |

| Canada | 172 | 227 | 238 | 228 | 195 |

Total products: 3,771

Source: Mintel Global New Product Database (GNPD), 2024

Of the 3,771 new mustard flour and seed products released in Canada and the US markets between January 2019 and December 2023, all products (100.0% market share) launched were in the food category.

In terms of new product category launches per market, the US released 2,711 food products, while Canada released 1.060 food products.

| Market | Product category | Number of products |

|---|---|---|

| Total | 3,771 | |

| United States | Food | 2,711 |

| Drink | 0 | |

| Canada | Food | 1,060 |

| Drink | 0 | |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||

The mustard flour and seed market in Canada

According to Mintel's Global New Products Database (GNPD), there were a total of 1,060 new food products containing mustard flour (as an ingredient) and mustard seeds (as an ingredient-and all children) launched in Canada between January 2019 to December 2023. The number of new food product launches has increased 3.2% in compound annual growth rate (CAGR) from 172 products released in 2019 to 195 products released in 2023. There have been 128 new mustard flour and mustard seed containing food products launched year-to-date, January-June 2024.

The predominant categories of new mustard flour and mustard seeds (mustard flour and seeds) containing food products released in the Canadian market during the review period were sauces and seasonings (615 products), processed fish, meat and egg products (173 products), meals and meal centers with 149 products, snacks (60 products), and savoury spreads (25 products), representing a combined market share of 96.4%. Of interest, the majority of food product categories experienced declines in new product launches during the review period, with the exception of the sauces and seasonings category, which increased 11.7% in CAGR from 79 products in 2019 to 123 products released in 2023, and the fruit and vegetable category which increased 36.8% in CAGR from 2 to 7 products released during the same period.

| Product category | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 172 | 227 | 238 | 228 | 195 | 1,060 |

| Sauces and seasonings | 79 | 131 | 145 | 137 | 123 | 615 |

| Processed fish, meat and egg products | 37 | 31 | 42 | 36 | 27 | 173 |

| Meals and meal centers | 25 | 40 | 34 | 29 | 21 | 149 |

| Snacks | 18 | 9 | 8 | 16 | 9 | 60 |

| Savoury spreads | 6 | 11 | 0 | 5 | 3 | 25 |

| Fruit and vegetables | 2 | 1 | 5 | 0 | 7 | 15 |

| Side dishes | 4 | 1 | 3 | 0 | 0 | 8 |

| Soup | 0 | 1 | 0 | 4 | 3 | 8 |

| Dairy | 1 | 1 | 0 | 1 | 1 | 4 |

| Bakery | 0 | 1 | 1 | 0 | 1 | 3 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

Top flavours of mustard flour and seed-containing food products noted were unflavoured/plain (124 products), mustard (61 products), barbecue/barbacoa (53 products), mustard (Dijon/French) with 37 products and Caesar (25 products) representing a combined market share of 28.3% between January 2019 to December 2023. Of the top five flavours, mustard, barbecue/barbacoa and mustard (Dijon/French) experienced the only increases in CAGR (17.0%, 25.7% and 13.6% respectively) during the review period.

In 2023, the top ten flavours of mustard flour and seed-containing food products released in Canada were unflavoured/plain (18 products), mustard (15 products), barbecue/BBQ/Barbacoa and mustard (Dijon/French) (10 products) respectively, smoke and honey and mustard (5 products) respectively, pepperoni, Caesar and dill (3 products) respectively and coleslaw (2 products).

| Flavours | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 172 | 227 | 238 | 228 | 195 | 1,060 |

| Unflavoured / plain | 26 | 30 | 25 | 25 | 18 | 124 |

| Mustard | 8 | 12 | 16 | 10 | 15 | 61 |

| Barbecue / BBQ / Barbacoa | 4 | 10 | 13 | 16 | 10 | 53 |

| Mustard (Dijon / French) | 6 | 7 | 7 | 7 | 10 | 37 |

| Caesar | 5 | 5 | 5 | 7 | 3 | 25 |

| Honey and mustard | 3 | 6 | 4 | 3 | 5 | 21 |

| Smoke | 2 | 5 | 5 | 4 | 5 | 21 |

| Spice / spicy | 3 | 4 | 2 | 5 | 0 | 14 |

| Honey and mustard (Dijon / French) | 3 | 2 | 2 | 4 | 2 | 13 |

| Dill | 2 | 3 | 3 | 0 | 3 | 11 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

During the review period, the most popular food product claims in recent mustard flour and seed- containing launches were no additives/preservatives (319 products), low/no/reduced allergen (306 products), gluten free with (292 products), kosher with 258 products and free from added/artificial flavourings (229) products).

Primary food products with no additives / preservatives food claims included mainly sauces and seasonings (163 products), processed fish, meat and egg products (55 products), meal and meal centers (51 products), snacks (23 products) and savoury spreads (10 products). Low / no / reduced allergen claims were identified mainly within sauces and seasonings (201 products), processed fish, meat and egg products (53 products), and snacks (23 products), while gluten freeclaims were predominantly found within the sauces and seasonings category (194 products), processed fish, meat and egg products (50 products) and snacks category (23 products).

| Claims | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 172 | 227 | 238 | 228 | 195 | 1,060 |

| No additives / preservatives | 42 | 64 | 61 | 96 | 56 | 319 |

| Low / no / reduced allergen | 49 | 65 | 49 | 73 | 70 | 306 |

| Gluten free | 48 | 59 | 45 | 70 | 70 | 292 |

| Kosher | 46 | 49 | 44 | 64 | 55 | 258 |

| Free from added / artificial flavourings | 24 | 46 | 45 | 72 | 42 | 229 |

| Free from added / artificial colourings | 23 | 47 | 43 | 69 | 37 | 219 |

| Social media | 13 | 30 | 27 | 46 | 26 | 142 |

| Ethical - environmentally friendly package | 26 | 43 | 29 | 28 | 16 | 142 |

| Ease of use | 22 | 24 | 24 | 32 | 31 | 133 |

| Ethical recycling | 27 | 33 | 26 | 26 | 15 | 127 |

|

Source: Mintel Global New Product Database (GNPD), 2024 1: products may report more than one claim. |

||||||

Primary mustard flour and seed ingredients launched as new food products in Canada during the review period were mustard seeds (909 products), followed by mustard flour (160 products), yellow mustard seed (33 products), black mustard seed (6 products) and mustard seed extract (2 products). Of interest, of the top five mustard flour and seed ingredients launched as new food products, mustard seeds as an ingredient have increased 8.7% in CAGR from 128 new products in 2019 to 179 new products released in 2023, while mustard flour as an ingredient has declined 30.4% in CAGR from 47 to 11 new products released during the same period.

Of the top products containing mustard flour and mustard seeds as an ingredient during the review period, new products containing mustard seed ingredients were launched primarily in the sauces and seasonings (table sauces / seasonings / dressings and vinegar), processed fish, meat and egg products (meat / poultry / fish products), and the meals and meal center (salads / prepared meals / pizzas / meal kits) categories.

New products launched containing mustard flour as an ingredient were also released mainly within the sauces and seasonings (table sauces / mayonnaise / dressings and vinegars/ cooking sauces), meals and meal centers (salads/ prepared meals / pastry dishes) and the processed fish, meat and egg product (meat / poultry / fish products) categories.

Yellow mustard seed as an ingredient was released primarily within the sauces and seasonings (seasonings / table sauces), meals and meal centers (meal kits / sandwich wraps) and the snacks (wheat and other grain-based snacks / snack mixes / hors d'oeuvres / canapes) categories, during the review period.

| Ingredients | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 172 | 227 | 238 | 228 | 195 | 1,060 |

| Mustard Seeds | 128 | 188 | 214 | 200 | 179 | 909 |

| Mustard Flour | 47 | 39 | 28 | 35 | 11 | 160 |

| Yellow Mustard Seed | 7 | 11 | 6 | 3 | 6 | 33 |

| Black Mustard Seed | 3 | 1 | 1 | 0 | 1 | 6 |

| Mustard Seed Extract | 0 | 0 | 0 | 1 | 1 | 2 |

| White Mustard Seed | 0 | 1 | 0 | 0 | 0 | 1 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

The companies with the highest number of new mustard flour and seed-containing (food) product launches in the review period were Loblaws (Top Brands; PC President's Choice and No Name) with 64 products, followed by Sobeys (Top Brand; Compliments and Panache) with 56 products, Walmart (Top Brand; Great Value ) with 38 products, Save-on-Foods (Top Brand; Western Family, Only Goodness and Save On Foods Kitchen) with 29 products and Metro Brands (Top Brand; Irristibles, Selection and Irristibles Organics) with 24 products, representing a combined market share of 20.0% during the review period.

In terms of top company category launches during the review period, Loblaws released 33 new products within the sauces and seasoning category and 12 new products within the processed fish, meat and egg products category, and the meals and meal centers category (11 products), while Sobeys also released new products primarily within the sauces and seasoning, processed fish, meat and egg products and the meals and meal centers category categories with 28 and 13 products respectively. Walmart in comparison, released most of their products (23) in sauces and seasonings category. Save-on-Foods released a majority of their new product launches within sauces and seasonings (11 products) and processed fish, meat and egg products category (14 products) and Metro Brands also released products in sauces and seasonings (18 products) and the processed fish, meat and egg products category (4 products).

Of interest, Loblaws new product launches declined by 14.5% in CAGR from 15 products in 2019 to 8 products in 2023, while Metro Brands in contrast, experienced an increase of 25.7% in CAGR as their new products released grew from 2 to 5 products during the same period. All top companies, except for Earth Island and Amora Maille, released new products in 2023.

In 2023, the top ten companies releasing new mustard flour and seed-containing (food) products in Canada were Loblaws (8 products), Euro-Excellence, Olds Products, Walmart and Save-on-Foods with (6 products) respectively, and Chosen Foods, Kozlik's, Metro Brands, B&G Foods and Taylor Fresh Foods with (5 products) respectively.

| Companies | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 172 | 227 | 238 | 228 | 195 | 1,060 |

| Loblaws | 15 | 15 | 11 | 15 | 8 | 64 |

| Sobeys | 0 | 23 | 26 | 4 | 3 | 56 |

| Walmart | 9 | 12 | 9 | 2 | 6 | 38 |

| Save-on-Foods | 0 | 6 | 11 | 6 | 6 | 29 |

| Metro Brands | 2 | 1 | 7 | 9 | 5 | 24 |

| McCormick | 2 | 2 | 7 | 8 | 3 | 22 |

| M&M Food Market | 9 | 2 | 5 | 3 | 2 | 21 |

| Earth Island | 11 | 0 | 0 | 6 | 0 | 17 |

| Grimm's Fine Foods | 1 | 0 | 7 | 6 | 3 | 17 |

| Amora Maille | 6 | 2 | 4 | 4 | 0 | 16 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

During the review period, 397 products (37.5% market share) were launched as new variety/range extensions, whereas 362 products (34.2% market share) were released as new packaging. Of note, new food product launch types experienced the greatest performance, increasing in CAGR by 18.9% from 27 products in 2019 to 54 products in 2023.

Relatedly, top food packaging types launched during the review period were bottle (282 products), jar (279 products), flexible (161 products), skin pack (81 products) and trays (70 products), representing a combined 82.4% market share.

| Launch type | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 172 | 227 | 238 | 228 | 195 | 1,060 |

| New variety/range extension | 86 | 82 | 98 | 70 | 61 | 397 |

| New packaging | 47 | 73 | 80 | 93 | 69 | 362 |

| New product | 27 | 52 | 40 | 50 | 54 | 223 |

| Relaunch | 12 | 19 | 19 | 15 | 9 | 74 |

| New formulation | 0 | 1 | 1 | 0 | 2 | 4 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

In the Canadian retail and e-commerce packaged food market, new launched products containing mustard flour and seeds were distributed primarily through supermarkets (609 products), followed by mass merchandise/hypermarket (188 products) and natural/health food stores with (155 products), representing a combined market share of 89.8% during the 2019 to 2023 period. E-commerce (internet/mail order) in contrast, was responsible for distributing eight products in 2020 (0.8% market share), during the same review period.

Of the top distribution channels, products distributed through supermarkets increased in CAGR by 11.1% from sixty-nine products in 2019 to 105 products in 2023 (161 products distributed in 2022), while specialist retailers in contrast, declined in CAGR by 20.9% as product distribution decreased from 23 to 9 products during the same period.

Description of above image

| Distribution channel | 2019 | 2020 | 2021 | 2022 | 2023 | Total |

|---|---|---|---|---|---|---|

| Supermarket | 69 | 131 | 143 | 161 | 105 | 609 |

| Mass merchandise / hypermarket | 37 | 28 | 52 | 24 | 47 | 188 |

| Natural / health food store | 32 | 47 | 17 | 31 | 28 | 155 |

| Specialist retailer | 23 | 2 | 5 | 3 | 9 | 42 |

| Club store | 5 | 7 | 5 | 6 | 4 | 27 |

Source: Mintel Global New Product Database (GNPD), 2024

Retail market sales of packaged food categories in Canada

Between 2019 and 2023, there were 1.060 new food product launches containing mustard flour and seed (as an ingredient) in Canada, as searched in Mintel (Global New Product Database-GNPD, 2024). Of these 1,060 products, 937 products (88.3% market share) were launched within the sauces and seasonings, processed fish, meat and egg products, and meals and meal centers food categories. Similar subcategories (source; Euromonitor International, 2024) that align with Mintel GNPD food category product launches, represent a combined market share of 28.9% of the total packaged food retail market in Canada, valued at Can$77.4 billion in 2023. In the forecast period, the combined market share of these similar sub-categories is expected to represent 29.4% of the total packaged food retail market (US$91.9 billion by 2027).

Packaged food retail sales in Canada were valued at Can$77.4 billion in 2023, increasing 6.5% in CAGR from Can$60.2 billion in 2019, and are expected to increase an additional 4.4% in CAGR to reach retail sales of Can$91.9 billion by 2027. In terms of similar food subcategories, the meals and soups sub-category attained retail value sales of Can$9.1 billion in 2023, increasing 7.6% in CAGR from Can$6.8 billion in 2019, while the sauces, dips and condiments sub-category attained values of Can$4.7 billion, representing 5.8% in CAGR from Can$3.7 billion in 2019. The processed meat, seafood and alternatives to meat sub-category, reached Can$8.5 billion in 2023, increasing 5.4% in CAGR from Can$6.9 billion in 2019.

Growth in all the food subcategories is expected to remain positive, albeit at lower rates, in the forecast period, as meals and soups, are anticipated to experience the greatest performance, increasing 6.7% in CAGR to reach Can$11.9 billion by 2027.

| Sub-category | 2019 | 2023 | CAGR* % 2019-2023 | 2024 | 2027 | CAGR* % 2023-2027 |

|---|---|---|---|---|---|---|

| Packaged food total | 60,244.6 | 77,444.0 | 6.5 | 80,701.4 | 91,964.4 | 4.4 |

| Meals and Soups | 6,825.9 | 9,147.9 | 7.6 | 9,631.4 | 11,859.0 | 6.7 |

| Sauces, Dips and Condiments | 3,743.8 | 4,686.9 | 5.8 | 4,902.4 | 5,613.5 | 4.6 |

| Processed Meat, Seafood and Alternatives to Meat | 6,907.9 | 8,516.2 | 5.4 | 8,709.2 | 9,548.4 | 2.9 |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

||||||

Examples of new products in Canada

Classic Dijon Canadian Mustard

Source: Mintel Global New Products Database, 2024

| Company | Kozlik's |

|---|---|

| Brand | Kozlik's |

| Category | Sauces and seasonings |

| Sub-category | Table sauces |

| Market | Canada |

| Store type | Natural / health food store |

| Date published | October 2023 |

| Launch type | New packaging |

| Price in local currency | Can$6.49 |

Ingredients (on pack): Mustard seed, white wine vinegar, water, spices, garlic puree, sea salt, natural flavour

Fish Cakes

Source: Mintel Global New Products Database, 2024

| Company | M&M Food Market |

|---|---|

| Category | Processed fish, meat and egg products |

| Sub-category | Fish Products |

| Market | Canada |

| Location of manufacture | United Kingdom |

| Import status | Imported product |

| Store type | Specialist retailer |

| Date published | May 2022 |

| Launch type | New variety / range extension |

| Price in local currency | Can$9.99 |

Ingredients (on pack): Potatoes, salmon, bechamel sauce (water, modified milk ingredients, palm oil, butter, salt, soy lecithin, modified corn starch, yeast extract, sugars (maltodextrin, sugar), onion powder, carrot powder, tomato powder, herb, sunflower oil), smoked coloured cod (cod, salt, turmeric, annatto), cheddar cheese, haddock, potato flakes, naturally smoked cod (cod, salt), savoy cabbage, rapeseed oil, leeks, horseradish sauce (horseradish, rapeseed oil, vinegar, water, sugar, cream, dried whole egg, salt, xanthan gum, mustard flour), wholegrain mustard (water, mustard seed, vinegar, salt, spices), smoked salmon (salmon, salt), shallots, binder (modified corn starch, tapioca starch, xanthan gum, rapeseed oil)

Chili-Lime Crunch Chopped Salad Kit

Source: Mintel Global New Products Database, 2024

| Company | Curation Foods |

|---|---|

| Brand | Eat Smart Flavours of The World |

| Category | Meals and meal centers |

| Sub-category | Salads |

| Market | Canada |

| Location of manufacture | United States |

| Import status | Imported product |

| Store type | Supermarket |

| Date published | September 2021 |

| Launch type | New packaging |

| Price in local currency | Can$5.49 |

Ingredients (on pack): Vegetables (romaine lettuce, red cabbage, cabbage, kale, carrots), lime cumin ranch dressing (canola oil, water, buttermilk powder, concentrated lime juice, liquid yolk, dried onion, sugar, salt, dried garlic, white vinegar, spices, cultured skim milk powder, skim milk powder, cumin, xanthan gum, mustard flour, rosemary extract), seasoned chili-lime tortilla strips (stone ground yellow corn, stone ground white corn, corn oil, sunflower oil, chili lime seasoning (whey, salt, natural sour cream flavouring (sour cream (cream, non-fat milk, cultures), citric acid), maltodextrin, lime juice, spices, tartaric acid, citric acid, paprika, extractives of paprika, lactic acid)), freeze dried corn, shredded Monterey jack cheese (milk, bacterial culture, salt, microbial enzyme, powdered cellulose), salt.

The mustard flour and seed market in the United States

According to Mintel's Global New Products Database (GNPD), there were a total of 2,711 new food products containing mustard flour (as an ingredient) and mustard seeds (as an ingredient-and all children) launched in the U.S between January 2019 to December 2023. The number of new food product launches has decreased slightly (0.2%) in CAGR from 527 products released in 2019 to 522 products released in 2023. There have been 312 new mustard flour and mustard sees containing food products launched year-to-date, January-June 2024.

The predominant categories of new mustard flour and mustard seeds (mustard flour and seeds) containing food products released in the US market during the review period were sauces and seasonings (1,245 products), followed by meals and meal centers (652 products), processed fish, meat and egg products (336 products), snacks (232 products) and savoury spreads (72 products), representing a combined market share of 93.6%. Of the main food categories launching new products, the sauces and seasonings category increased 4.7% in CAGR from 193 products in 2019 to 232 products released in 2023, while meal and meal centers declined in CAGR by 6.1% from 167 to 130 products during the same period.

| Product category | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 527 | 640 | 499 | 523 | 522 | 2,711 |

| Sauces and seasonings | 193 | 318 | 233 | 269 | 232 | 1,245 |

| Meals and meal centers | 167 | 154 | 111 | 90 | 130 | 652 |

| Processed fish, meat and egg products | 74 | 58 | 65 | 75 | 64 | 336 |

| Snacks | 53 | 46 | 45 | 35 | 53 | 232 |

| Savoury spreads | 6 | 21 | 12 | 23 | 10 | 72 |

| Side dishes | 17 | 14 | 9 | 10 | 10 | 60 |

| Soup | 8 | 13 | 9 | 7 | 7 | 45 |

| Fruit and vegetables | 5 | 12 | 9 | 7 | 11 | 44 |

| Dairy | 1 | 1 | 4 | 2 | 3 | 11 |

| Bakery | 2 | 2 | 1 | 3 | 2 | 10 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

Top flavours of mustard flour and seed-containing food products noted were unflavoured/plain (203 products), barbecue/BBQ/barbacoa (80 products), mustard (75 products), Caesar (67 products), and honey and mustard (46 products), representing a combined market share of 17.4.3% between January 2019 to December 2023. Of the top five flavours, only mustard and honey and mustard experienced increases in CAGR of 13.6% and 21.3% respectively, during the review period. Of the top ten flavours, Chicken flavoured products also increased in CAGR (18.9%), as the number of products released grew from 3 to 6 products during the same period.

Top flavours launched in 2023 include unflavoured/plain (44 products), mustard (20 products), Caesar (15 products), honey and mustard (13 products), barbecue/BBQ/Barbacoa (11 products), salmon, Ranch/ranch sauce and mustard (Dijon/French) with (10 products) respectively, and cocktail sauce and chicken with (6 products), respectively.

| Flavours | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 527 | 640 | 499 | 523 | 522 | 2,711 |

| Unflavoured / plain | 42 | 33 | 46 | 38 | 44 | 203 |

| Barbecue / BBQ / Barbacoa | 12 | 22 | 17 | 18 | 11 | 80 |

| Mustard | 12 | 10 | 14 | 19 | 20 | 75 |

| Caesar | 17 | 15 | 9 | 11 | 15 | 67 |

| Honey and mustard | 6 | 7 | 9 | 11 | 13 | 46 |

| Mustard (Dijon / French) | 7 | 14 | 6 | 8 | 10 | 45 |

| Ranch / ranch sauce | 6 | 9 | 9 | 5 | 10 | 39 |

| Smoke | 4 | 8 | 10 | 9 | 5 | 36 |

| Chicken | 3 | 6 | 6 | 8 | 6 | 29 |

| Barbecue / BBQ / Barbacoa and Horney | 4 | 3 | 6 | 4 | 4 | 21 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

During the review period, the most popular food product claims in recent mustard flour and seed- containing launches were low/no/reduced allergen (916 products), followed by gluten free with (875 products), no additives/preservatives (743 products), kosher (698 products) and gmo free (461) products).

Primary food product categories withlow/no/reduced allergen food claims included mainly sauces and seasonings (588 products), processed fish, meat and egg products (103 products), meal and meal centers (64 products), snacks (91 products), savoury spreads (25 products), soup (15 products) and side dishes (13 products). Gluten free claims were identified mainly within sauces and seasonings (574 products), processed fish, meat and egg products (99 products), meal and meal centers (53 products), snacks (23 products), savoury spreads (22 products), soup (15 products) and side dishes (12 products, while no additives/preservatives claims were predominantly found within the sauces and seasonings category (387 products), meal and meal centers (165 products), processed fish, meat and egg products (88 products), snacks (53 products), savoury spreads (18 products) and side dishes (17 products).

| Claims | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 527 | 640 | 499 | 523 | 522 | 2,711 |

| Low / no / reduced allergen | 170 | 212 | 169 | 209 | 156 | 916 |

| Gluten free | 163 | 203 | 160 | 210 | 148 | 875 |

| No additives / preservatives | 128 | 204 | 121 | 138 | 152 | 743 |

| Kosher | 134 | 153 | 126 | 140 | 145 | 698 |

| GMO free | 76 | 124 | 95 | 88 | 78 | 461 |

| Ease of use | 109 | 99 | 79 | 84 | 79 | 450 |

| Social media | 78 | 84 | 66 | 87 | 86 | 401 |

| Free from added / artificial preservatives | 80 | 110 | 60 | 67 | 81 | 398 |

| Free from added / artificial flavourings | 60 | 95 | 64 | 85 | 78 | 382 |

| Microwaveable | 77 | 86 | 74 | 66 | 69 | 372 |

|

Source: Mintel Global New Product Database (GNPD), 2024 1: products may report more than one claim |

||||||

Primary mustard flour and seed ingredients launched as new food products in the US during the review period were mustard seeds (2,303 products), followed by mustard flour (494 products), yellow mustard seed (107 products), black mustard seed (37 products) and white mustard seed (14 products). All top five mustard flour and seed ingredients, with the exception of mustard seeds which remained stable, decreased in product launches during the review period, with white mustard seed ingredient products experiencing the largest decline in CAGR (29.3%) from 4 products launched in 2019 to 1 product in 2023.

Of the top products containing mustard flour and mustard seeds as an ingredient during the review period, new products containing mustard seed ingredients were launched primarily in the sauces and seasonings (table sauces/ dressings and vinegar/ seasonings/ pickled condiments/ cooking sauces), meals and meal centers (salads/ prepared meals/ sandwiches and wraps/ meal kits/ pizzas), processed fish, meat and egg products (meat/ poultry/ fish products/ meat substitutes), and the snacks (hors d'oeuvres and canapes/ meat snacks/ snack mixes/ potato snacks/ wheat and other grain-based snacks) categories.

New products launched containing mustard flour as an ingredient were also released mainly within the sauces and seasonings (table sauces/ dressings and vinegars/ mayonnaise/ cooking sauces/ seasonings), meals and meal centers (salads/ sandwiches and wraps/ prepared meals/ meal kits) and the processed fish, meat and egg product (fish/ poultry/ meat products/ meat substitutes) categories.

Yellow mustard seed as an ingredient was released primarily within the sauces and seasonings (table sauces/ seasonings/ cooking sauces/ dressing and vinegar), processed fish, meat and egg products (fish/ poultry/ meat products), snacks (hors d'oeuvres/canapes/ wheat and other grain-based snacks/ potato snacks/ vegetable snacks/ bean-based snacks), and the meals and meal centers (sandwich wraps/ prepared meals/ meal kits/ salads), during the review period.

| Ingredients | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 527 | 640 | 499 | 523 | 522 | 2,711 |

| Mustard Seeds | 452 | 545 | 427 | 427 | 452 | 2,303 |

| Mustard Flour | 104 | 118 | 78 | 106 | 88 | 494 |

| Yellow Mustard Seed | 21 | 30 | 20 | 23 | 13 | 107 |

| Black Mustard Seed | 9 | 9 | 9 | 7 | 3 | 37 |

| White Mustard Seed | 4 | 3 | 4 | 2 | 1 | 14 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

The companies with the highest number of new mustard flour and seed-containing (food) product launches in the review period were Aldi (Top Brands; Park Street Deli, Specially Selected, Fremont; Fish Market, Little Salad Bar) with 113 products, followed by Kroger (Top Brands; Private Selection, Kroger, Simple Truth Organic, Simple Truth Free From Plant Based,) with 104 products, Giant Eagle (Top Brands; Giant Eagle, Market District, Great to go from Market District) with 91 products, Kraft Heinz Foods (Top Brands; Kraft and Heinz) with 68 products and Target (Top Brand; Good & Gather) with 66 products, representing a combined market share of 16.3% during the review period.

In terms of top company category launches during the review period, Aldi released primarily within the sauces and seasoning category (36 products), meal and meal centers (27 products), processed fish, meat and egg products (21 products) and savoury spreads (7 products), while Kroger also released new products within the sauces and seasoning (62 products) and meal and meal centers and processed fish, meat and egg products categories with (15 products) respectively. Giant Eagle in comparison, released most of their products (48) in meal and meal centers and (31 products) in the sauces and seasonings, and (5 products) in the processed fish, meat and egg products category. Kraft Heinz Foods released primarily within sauces and seasonings (43 products), snacks (11 products) and meal and meal centers (8 products) and Target, released new products primarily in meal and meal centers (28 products), sauces and seasonings with (22 products), processed fish, meat and egg products (6 products), and snacks category (5 products).

Of interest, four of the top five companies' new product launches declined during the review period, with Kroger experiencing the largest decline in CAGR (21.7%) from 32 in 2019 to 12 products in 2023, while Target in contrast, experienced a positive increase in CAGR of 13.6% as their new products released grew from 6 to 10 products during the same period.

In 2023, top companies releasing new mustard flour and seed-containing (food) products in the US were Giant Eagle (21 products), Aldi (18 products), Kraft Heinz Foods (17 products), Publix and Trader Joe's (13 products) respectively, Kroger, Tops Markets and Taylor Fresh foods with (12 products) respectively, Target (10 products) and Lucerne Foods with (9 products).

| Companies | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 527 | 640 | 499 | 523 | 522 | 2,711 |

| Aldi | 33 | 25 | 28 | 9 | 18 | 113 |

| Kroger | 32 | 22 | 35 | 3 | 12 | 104 |

| Giant Eagle | 31 | 12 | 10 | 17 | 21 | 91 |

| Kraft Heinz Foods | 23 | 17 | 3 | 8 | 17 | 68 |

| Target | 6 | 20 | 20 | 10 | 10 | 66 |

| H-E-B | 23 | 20 | 9 | 7 | 7 | 66 |

| Wegmans Food Market | 8 | 17 | 12 | 15 | 4 | 56 |

| Trader Joe's | 12 | 9 | 13 | 6 | 13 | 53 |

| Whole Foods Market | 12 | 15 | 7 | 7 | 9 | 50 |

| Walmart | 15 | 7 | 4 | 11 | 4 | 41 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

During the review period, 1,343 products (49.5% market share) were launched as new variety/range extensions, whereas 665 products (24.5% market share) were released as new packaging. Of note, new packaging product launch types experienced the only positive increase in CAGR (4.9%) as their number of products grew from 123 products in 2019 to 149 products in 2023.

Relatedly, top food packaging types launched during the review period were bottle (744 products), flexible (414 products), jar (395 products), tray (298 products) and tub (286 products), representing a combined 78.8% market share.

| Launch type | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food category | 527 | 640 | 499 | 523 | 522 | 2,711 |

| New variety/range extension | 260 | 334 | 259 | 247 | 243 | 1,343 |

| New packaging | 123 | 127 | 125 | 141 | 149 | 665 |

| New product | 107 | 133 | 99 | 105 | 102 | 546 |

| Relaunch | 31 | 46 | 15 | 30 | 27 | 149 |

| New formulation | 6 | 0 | 1 | 0 | 1 | 8 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

In the US retail and e-commerce packaged food market, new launched products containing mustard flour and seeds were distributed primarily through supermarkets (1,726 products), followed by mass merchandise/hypermarket (267 products) and natural/health food stores with (237 products), representing a combined market share of 82.3% during the 2019 to 2023 period. E-commerce (internet/mail order) in contrast, was responsible for distributing 197 products (7.3% market share), during the same review period.

Of the top distribution channels, products distributed through e-commerce (internet/mail order), experienced the greatest performance, increasing 11.2% in CAGR from 19 products in 2019 to 29 products in 2023. Natural/health food stores also increased 3.5% in CAGR as the channel's product distribution grew from 47 to 54 products during the same period.

Description of above image

| Distribution channel | 2019 | 2020 | 2021 | 2022 | 2023 | Total |

|---|---|---|---|---|---|---|

| Supermarket | 341 | 360 | 328 | 351 | 346 | 1,726 |

| Mass merchandise / hypermarket | 47 | 61 | 56 | 52 | 51 | 267 |

| Natural / health food store | 47 | 71 | 28 | 37 | 54 | 237 |

| Internet / mail order | 19 | 60 | 48 | 41 | 29 | 197 |

| Club store | 26 | 13 | 25 | 33 | 29 | 126 |

Source: Mintel Global New Product Database (GNPD), 2024

Retail market sales of packaged food categories in the United States

Between 2019 and 2023, there were 2,711 new food product launches containing mustard flour and seed (as an ingredient) in the US, as searched in Mintel (Global New Product Database-GNPD, 2024). Of these 2,711 products, 2,233 products (82.4% market share) were launched within the sauces and seasonings, meals and meal centers and processed fish, meat and egg product food categories. Similar subcategories (source; Euromonitor International, 2024) that align with Mintel GNPD food category product launches, represent a combined market share of 26.4% of the total packaged food retail market (US$580.0 billion in 2023). In the forecast period, the combined market share of these similar sub-categories is expected to represent 25.1% of the total packaged food retail market (US$700.4 billion by 2027).

Packaged food retail sales in the US were valued at US$580.0 billion in 2023, increasing 8.6% in CAGR from US$416.6 billion in 2019, and are expected to increase an additional 4.8% in CAGR to reach US$700.4 billion by 2027. In terms of similar food subcategories, the meals and soups sub-category attained retail value sales of US$63.3 billion in 2023, increasing 9.1% in CAGR from US$44.7 billion in 2019, while the sauces, dips and condiments sub-category attained values of US$34.3 billion, representing 6.3% in CAGR from US$26.8 billion in 2019. The processed meat, seafood and alternatives to meat sub-category, reached US$55.4 billion in 2023, increasing 10.1% in CAGR from US$37.7 billion in 2019.

Growth in all the food sub-categories is expected to remain positive, albeit at lower rates, in the forecast period, as sauces, dips and condiments, are anticipated to experience the greatest performance, increasing 4.5% in CAGR to reach US$40.9 billion by 2027.

| Category | 2019 | 2023 | CAGR* % 2019-2023 | 2024 | 2027 | CAGR* % 2023-2027 |

|---|---|---|---|---|---|---|

| Packaged food total | 416,622.4 | 580,046.6 | 8.6 | 614,250.1 | 700,433.6 | 4.8 |

| Meals and Soups | 44,742.6 | 63,297.6 | 9.1 | 64,918.5 | 72,240.0 | 3.4 |

| Sauces, Dips and Condiments | 26,831.4 | 34,265.5 | 6.3 | 35,611.7 | 40,938.9 | 4.5 |

| Processed Meat, Seafood and Alternatives to Meat | 37,666.7 | 55,394.5 | 10.1 | 57,978.0 | 62,955.7 | 3.3 |

|

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

||||||

Examples of new products in the United States

Miso Caesar Dressing + Sauce

Source: Mintel Global New Products Database, 2024

| Company | Defined Brand |

|---|---|

| Brand | SideDish |

| Category | Sauces and seasonings |

| Sub-category | Dressings and vinegar |

| Market | United States |

| Store type | Internet / mail order |

| Date published | December 2023 |

| Launch type | New product |

| Price in local currency | US$9.29 |

Ingredients (on pack): water, avocado oil, chickpea miso paste (organic handmade rice koji, organic whole chickpeas, sun-dried sea salt, Blue Ridge Mountain well water, koji spores), apple cider vinegar, coconut aminos (coconut blossom nectar, sea salt, water), dijon mustard (organic distilled vinegar, water, organic mustard seed, sea salt, organic spices), lemon juice concentrate, honey, nutritional yeast, garlic powder, salt, spices, konjac, cayenne pepper

Scallop & Champagne Gratin

Source: Mintel Global New Products Database, 2024

| Company | Aldi |

|---|---|

| Brand | Specially Selected |

| Category | Meals and meal centers |

| Sub-category | Prepared meals |

| Market | United States |

| Location of Manufacture | United Kingdom |

| Import Status | Imported product |

| Store type | Supermarket |

| Date published | May 2022 |

| Launch type | New variety / range extension |

| Price in local currency | US$5.49 |

Ingredients (on pack): sauce (heavy cream, whole milk, water, cheddar cheese (cheddar cheese (whole milk, salt, starter culture, rennet), potato starch), white wine, cornstarch, champagne, lemon juice, parmigiano reggiano cheese (whole milk, salt, starter culture, calf rennet), fish stock (fish stock powder, salt, maltodextrin, yeast extract, onion powder, celeriac, canola oil, leek, carrot powder, white pepper, bay leaves), dijon mustard (water, mustard flour, distilled vinegar, salt)), scallops (Zygochlamys patagonica), breadcrumb (enriched wheat flour (wheat flour, calcium carbonate, iron, niacin, thiamin), yeast, salt), chives, canola oil

Pimento Cheese Dip

Source: Mintel Global New Products Database, 2024

| Company | Trader Joe's |

|---|---|

| Brand | Trader Joe's |

| Category | Savoury spreads |

| Sub-category | Dips |

| Market | United States |

| Store type | Supermarket |

| Date published | August 2021 |

| Launch type | New packaging |

| Price in local currency | US$3.99 |

Ingredients (on pack): cheddar cheese (cultured pasteurized milk, salt, microbial enzyme, annatto extract (for color), potato starch, powdered cellulose), cream cheese (pasteurized cream, skim milk, salt, guar gum, cheese culture, locust bean gum, xanthan gum), mayonnaise (expeller pressed canola oil, water, egg yolk, white wine vinegar, salt, lemon juice concentrate, mustard flour), water, pimento pepper (pimento, water, citric acid (to preserve)), white wine vinegar, yellow onion, sea salt, granulated onion, black pepper, garlic powder, cayenne pepper

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

Resources

- Euromonitor International, 2024

- Mintel Global New Products Database, 2024

Customized Report Service – Product Launch Analysis – Mustard flour and seeds in packaged food products – Canada and the United States markets

Global Analysis Report

Prepared by: Erin-Ann Chauvin, Senior Market Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2024).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.