Note: This report includes forecasting data that is based on baseline historical data.

Pea starch ingredient market snapshot

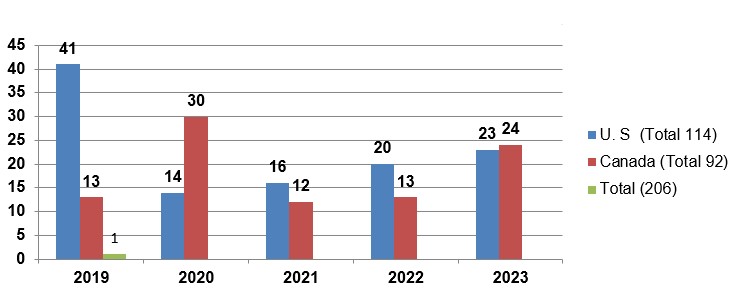

According to Mintel's Global New Products Database (GNPD), there were 206 new launches of products containing pea starch, in the North American market (Canada and the United States), between January 2019 to December 2023 (18 new products launched year-to-date, January-June 2024).

Of the 206 new pea starch products released between January 2019 and December 2023, 167 of the products (81.1% market share) were categorized as food products versus 39 new products (18.9% market share) in the drink category. In terms of new product category launches per market, the United States released 104 food and 10 drink products, while Canada released 63 food and 29 drink products.

The predominant categories of new pea starch food products released in the Canadian market were snacks, bakery and dairy with (11 products respectively), and processed fish, meat and egg products and meals and meal centers with (10 products respectively), representing a combined market share of 84.1% during the 2019 to 2023 period.

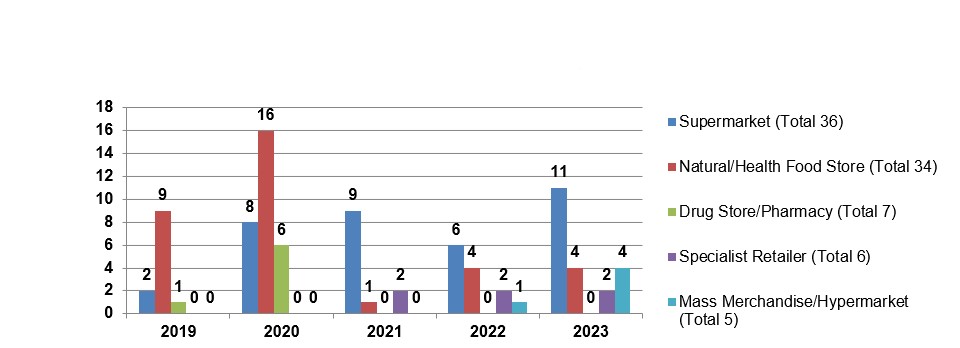

In the Canadian retail and e-commerce packaged food and drink market, new launched products containing pea starch were distributed primarily through supermarkets (36 products), followed by natural/health food stores with (34 products), drug store/pharmacies (7 products), representing a combined market share of 83.7% during the 2019 to 2023 period.

Volume sales of pea protein ingredients in the Canadian packaged food market were valued at 2,442.9 tonnes in 2023, increasing 7.7% annually from 1,817.3 tonnes in 2019, and are expected to remain positive in the forecast period, increasing 2.7% annually to reach volume sales of 2,714.0 tonnes by 2027.

The predominant categories of new pea starch food products released in the U.S market were snacks (29 products), followed by meals and meal centers (23 products), bakery (15 products), processed fish, meat and egg products (9 products) and dairy (8 products), representing a combined market share of 80.8% during the 2019 to 2023 period.

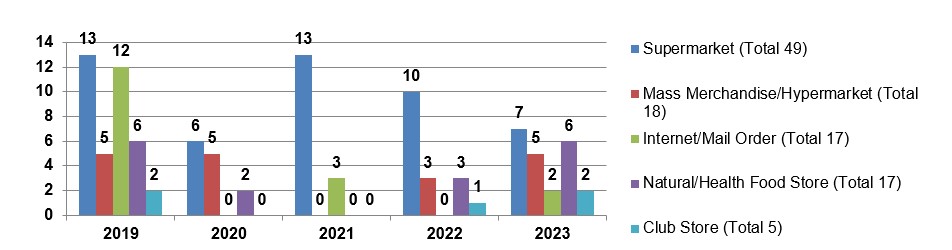

In the United States retail and e-commerce packaged food and drink market, new launched products containing pea starch were distributed primarily through supermarkets (49 products), followed by mass merchandise/hypermarket with (18 products) and internet/mail order (17 products), representing a combined market share of 73.7% during the 2019 to 2023 period.

Volume sales of pea protein ingredients in the United States packaged food market were valued at 25,171.1 tonnes in 2023, increasing 6.2% in compound annual growth rate (CAGR) from 19,808.6 tonnes in 2019, and are expected to remain positive in the forecast period, increasing 3.3% in CAGR to reach volume sales of 28,651.5 tonnes by 2027.

New products containing pea starch in Canada and the United States

According to Mintel's Global New Products Database (GNPD), there were 206 new launches of products containing pea starch, in the North American market (Canada and the United States (U.S)), between January 2019 to December 2023 (18 new products launched year-to-date, January-June 2024).

The United States launched the majority of the new products (114) representing a 55.3% market share, while Canada in comparison, launched a total of 92 products (44.7% market share) between 2019 to 2023.

Description of above image

| Market | 2019 | 2020 | 2021 | 2022 | 2023 | Total |

|---|---|---|---|---|---|---|

| United States | 41 | 14 | 16 | 20 | 23 | 114 |

| Canada | 13 | 30 | 12 | 13 | 24 | 92 |

Total: 260

Source: Mintel Global New Product Database (GNPD), 2024

Of the 206 new pea starch products released between January 2019 and December 2023, 167 of the products (81.1% market share) were categorized as food products versus 39 new products (18.9% market share) in the drink category. In terms of new product category launches per market, the United States released 104 food and 10 drink products, while Canada released 63 food and 29 drink products.

| Market | Product category | Number of products |

|---|---|---|

| Total | 206 | |

| United States | Food | 104 |

| Drink | 10 | |

| Canada | Food | 63 |

| Drink | 29 | |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||

The pea starch market in Canada

According to Mintel's Global New Products Database (GNPD), there were a total of 92 new food and drink products containing pea starch (as an ingredient-and all children) launched in Canada between January 2019 to December 2023. The number of new food and beverage product launches has increased 16.6% in compound annual growth rate (CAGR) from 13 products released in 2019 to 24 products released in 2023. There have been 7 new pea starch containing food and drink products launched year-to-date, January-June 2024. Of the 92 new food and drink products released between 2019 to 2023, 63 products (68.5% market share) were food products, while 29 products (31.5% market share) were drink products.

New food products (containing pea starch) launched has increased in CAGR by 11.5% from 11 products released in 2019 to 17 products released in 2023. In comparison, new drink products launched also increased in CAGR by 36.8% from 2 to 7 products released during the same period.

The predominant categories of new pea starch food products released in the Canadian market were snacks, bakery and dairy with (11 products respectively), and processed fish, meat and egg products and meals and meal centers with (10 products respectively), representing a combined market share of 84.1% during the 2019 to 2023 period. In 2023, top food categories were processed fish, meat and egg products (5 products), sugar & gum confectionery and meals and meal centers (4 products) respectively, dairy (3 products) and side dishes (1 product). Of interest, the processed fish, meat and egg products category experienced the greatest increase in CAGR (49.5%) from 1 product in 2019 to 5 products released in 2023.

In the drink category, nutritional drinks and other beverages released a total of 29 products during the review period, with most of the launches released in 2020 and 2023 (15 products and 7 products respectively).

| Product category | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 13 | 30 | 12 | 13 | 24 | 92 |

| Food category | 11 | 15 | 9 | 11 | 17 | 63 |

| Snacks | 0 | 4 | 3 | 4 | 0 | 11 |

| Bakery | 5 | 4 | 1 | 1 | 0 | 11 |

| Dairy | 5 | 2 | 0 | 1 | 3 | 11 |

| Processed fish, meat and egg products | 1 | 2 | 0 | 2 | 5 | 10 |

| meals and meal centers | 0 | 3 | 2 | 1 | 4 | 10 |

| Drink category | 2 | 15 | 3 | 2 | 7 | 29 |

| Nutritional drinks and other beverages | 2 | 15 | 3 | 2 | 7 | 29 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

Top flavours of pea starch-containing food products noted were unflavoured/plain (20 products), and strawberry and cherry with 3 products respectively, representing a combined market share of 41.3% between January 2019 to December 2023. In 2023, top food flavours released were unflavoured/plain (7 products), cherry and strawberry (3 products) respectively, blueberry (2 products) and blackcurrant/cassis (1 product). Of interest, strawberry, cherry and blueberry flavours appeared in food product launches in 2023 only. Of the drink category product releases, vanilla/vanilla bourbon/vanilla (Madagascar) with 6 products, berry (5 products) and chocolate with (4 products) were identified as main flavours, representing a combined market share of 51.7% during the same period.

| Flavours | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 13 | 30 | 12 | 13 | 24 | 92 |

| Food category | 11 | 15 | 9 | 11 | 17 | 63 |

| Unflavoured/plain | 7 | 4 | 1 | 1 | 7 | 20 |

| Strawberry | 0 | 0 | 0 | 0 | 3 | 3 |

| Cherry | 0 | 0 | 0 | 0 | 3 | 3 |

| Chocolate | 1 | 1 | 1 | 0 | 0 | 3 |

| Blueberry | 0 | 0 | 0 | 0 | 2 | 2 |

| Drink category | 2 | 15 | 3 | 2 | 7 | 29 |

| Vanilla/vanilla bourbon/vanilla Madagascar | 1 | 0 | 0 | 0 | 5 | 6 |

| Berry | 0 | 3 | 0 | 1 | 1 | 5 |

| Chocolate | 0 | 2 | 0 | 1 | 1 | 4 |

| Tropical | 0 | 2 | 0 | 0 | 0 | 2 |

| Unflavoured/plain | 0 | 1 | 1 | 0 | 0 | 2 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

During the review period, the most popular food product claims in recent pea starch containing launches were low / no / reduced allergen (43 products), followed by gluten free with (40 products) and GMO free with (33 products). Likewise top drink claims were also GMO free, low / no / reduced allergen and gluten free claims with (27 products, respectively). In 2023, top food claims were plant based (9 products), vegan/no animal ingredients (7 products), low / no / reduced allergen (6 products), gluten free and palm oil free (5 products) respectively. Of the top claims, only vegan/no animal ingredients experienced positive growth, increasing 8.8% in CAGR as the number of products released with this claim grew from 5 products in 2019 to 7 products in 2023.

Primary food products with low / no / reduced allergen food claims included snacks (8 products), bakery and dairy (11 products) respectively, processed fish, meat and egg products (3 products), meal and meal centers (5 products), sugar and gum confectionery (3 products), and sauces and seasonings (2 products). Gluten free claims were identified in snacks (8 products), bakery and dairy (11 products) respectively, processed fish, meat and egg products (3 products), meal and meal centers (5 products), and sauces and seasonings (2 products). GMO free claims were identified in snacks (8 products), bakery (10 products), dairy (7 products), processed fish, meat and egg products (5 products), meal and meal centers (2 products), and side dishes (1 product).

In the drink (nutritional drink and other beverages) category, GMO free, low / no / reduced allergen and gluten free claims were identified in 27 products, respectively. All top drink claims experienced positive growth during the review period, as the number of products reporting each claim grew 36.8% in CAGR, from 2 products in 2019 to 7 products in 2023, with the exception of social media, which grew 10.7% in CAGR from 2 to 3 products during the same period.

| Claims | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 13 | 30 | 12 | 13 | 24 | 92 |

| Food category | 11 | 15 | 9 | 11 | 17 | 63 |

| low / no / reduced allergen | 11 | 14 | 3 | 9 | 6 | 43 |

| Gluten free | 11 | 14 | 1 | 9 | 5 | 40 |

| GMO free | 10 | 12 | 1 | 8 | 2 | 33 |

| Vegan/no animal ingredients | 5 | 8 | 2 | 5 | 7 | 27 |

| Dairy based | 10 | 8 | 1 | 2 | 3 | 24 |

| Drink category | 2 | 15 | 3 | 2 | 7 | 29 |

| GMO Free | 2 | 15 | 1 | 2 | 7 | 27 |

| low / no / reduced allergen | 2 | 15 | 1 | 2 | 7 | 27 |

| Gluten free | 2 | 15 | 1 | 2 | 7 | 27 |

| Vegan/no animal ingredients | 2 | 14 | 1 | 2 | 7 | 26 |

| Social media | 2 | 15 | 3 | 2 | 3 | 25 |

|

Source: Mintel Global New Product Database (GNPD), 2024 1: products may report more than one claim. |

||||||

The companies with the highest number of new pea starch-containing (food) product launches in the review period were Kinnikinnick Foods (Top Brands; Kinnikinnick, Kinnikinnick Kinni Kritters, Kinnikinnick S'moreables and Kinnikinnick KinniTOOS) with 10 products, followed by Vegeat Foods (Top Brand; Vegeat) with 5 products, and ANS Performance (Top Brand; ANS Performance KetoWow) with 4 products, representing a combined market share of 30.2% during the review perod.

During the review period, Kinnikinnick Foods released 10 new pea starch products within the bakery category, while Vegeat Foods released (4 products) in the processed fish, meat and egg products category, and (1 product) in the meals and meal centers category. ANS Performance in comparison, released (4 products) in 2022 only, within the snack category. Of note, all top food companies during the 2019 to 2023 review period, did not release any new pea starch containing products in 2023, however all companies recently released products in 2022, with the exception of Earth Island, which last released new products in 2019. In 2023, top companies that did release new food product lauches in Canada were Katjes Fassin and Laiterie Chalifoux with (3 products) respectively, Farm Boy and Earth Grown Foods with (2 products) respectively, and Azuma Foods with (1 product).

Top drink companies launching pea starch-containing products during the review period were Sequel Natural (Top Brands; Vega One, Vega, Vega Protein & Greens, Vega Organic Protein & Greens) with 19 products, Sequel Naturals (Top Brands; Vega, and Vega Protein and Greens) with 3 products and Body Plus (Top Brands; IronVegan Athlete's Gainer and Iron Vegan Athlete's Gainer) with 3 product launches, representing a combined market share of 86.2% during the review period.

All top drink companies released new products containing pea starch within the nutritional drinks and other beverages category within the review period. Of note, all top drink companies in the review period launched new products in 2023, (Active Greens Group and Body Plus releasing new products in 2023 only), with the exception of Redcon 1, which released 2 new products in 2021 only.

| Companies | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 13 | 30 | 12 | 13 | 24 | 92 |

| Food category | 11 | 15 | 9 | 11 | 17 | 63 |

| Kinnikinnick Foods | 5 | 4 | 0 | 1 | 0 | 10 |

| Vegeat Foods | 1 | 2 | 1 | 1 | 0 | 5 |

| ANS Performance | 0 | 0 | 0 | 4 | 0 | 4 |

| Earth Island | 4 | 0 | 0 | 0 | 0 | 4 |

| Daiya Foods | 1 | 2 | 0 | 1 | 0 | 4 |

| Drink category | 2 | 15 | 3 | 2 | 7 | 29 |

| Sequel Natural | 2 | 15 | 1 | 0 | 1 | 19 |

| Sequel Naturals | 0 | 0 | 0 | 2 | 1 | 3 |

| Body Plus | 0 | 0 | 0 | 0 | 3 | 3 |

| Redcon 1 | 0 | 0 | 2 | 0 | 0 | 2 |

| Active Greens Group | 0 | 0 | 0 | 0 | 1 | 1 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

During the review period, 26 products (41.3% market share) were launched as new products, followed by 18 products released as new variety/range extensions (28.6% market share), and 13 products released as new packaging (20.6% market share) in the food category. Of note, new food product launch types experienced the greatest performance, increasing in CAGR by 93.4% from 1 product in 2019 to 14 products in 2023. In the drink category, 14 products released (48.3% market share) were categoried as relaunches and the remaining launches were new variety/range extension (6 products), new packaging and new products with (5 and 4 products respectively) during the prescribed period.

Relatedly, top food packaging types launched during the review period were flexible (37 products), flexible stand-up pouches (9 products), tray (5 products), cartons (4 products) and skinpacks (3 products), representing a 92.1% market share, while main drink package types launched were jars (24 products), flexible stand-up pouch (4 products) and flexible sachet (1 products) during the same period.

| Launch type | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 13 | 30 | 12 | 13 | 24 | 92 |

| Food category | 11 | 15 | 9 | 11 | 17 | 63 |

| New product | 1 | 2 | 4 | 5 | 14 | 26 |

| New variety/range extension | 6 | 2 | 4 | 4 | 2 | 18 |

| New packaging | 2 | 7 | 1 | 2 | 1 | 13 |

| Relaunch | 2 | 4 | 0 | 0 | 0 | 6 |

| Drink category | 2 | 15 | 3 | 2 | 7 | 29 |

| Relaunch | 0 | 8 | 1 | 2 | 3 | 14 |

| New variety/range extension | 1 | 2 | 0 | 0 | 3 | 6 |

| New packaging | 0 | 5 | 0 | 0 | 0 | 5 |

| New product | 1 | 0 | 2 | 0 | 1 | 4 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

In the Canadian retail and e-commerce packaged food and drink market, new launched products containing pea starch were distributed primarily through supermarkets (36 products), followed by natural/health food stores with (34 products), drug store/pharmacies (7 products), representing a combined market share of 83.7% during the 2019 to 2023 period. E-commerce (internet/mail order) in comparison, was responsible for distributing (2 products in 2023), during the same period.

Of the top distribution channels, products distributed through supermarkets increased in CAGR by 53.1% from 2 products in 2019 to 11 products in 2023.

Description of above image

| Distribution channel | 2019 | 2020 | 2021 | 2022 | 2023 | Total |

|---|---|---|---|---|---|---|

| Supermarket | 2 | 8 | 9 | 6 | 11 | 39 |

| Natural / health food store | 9 | 16 | 1 | 4 | 4 | 34 |

| Drug store / pharmacy | 1 | 6 | 0 | 0 | 0 | 7 |

| Specialist retailer | 0 | 0 | 2 | 2 | 2 | 6 |

| Mass merchandise / hypermarket | 0 | 0 | 0 | 1 | 4 | 5 |

Source: Mintel Global New Product Database (GNPD), 2024

Ingredient volume sales

Volume sales of pea protein ingredients in the Canadian packaged food market were valued at 2,442.9 tonnes in 2023, increasing 7.7% annually from 1,817.3 tonnes in 2019. Pea protein ingredient volume sales in packaged food is expected to remain positive in the forecast period, increasing 2.7% annually to reach volume sales of 2,714.0 tonnes by 2027.

Of the volume sales of pea protein ingredients in the packaged food market in Canada, the dairy products and alternatives category yielded the largest volume sales with 1,278.3 tonnes (52.3% market share), followed by the staple foods category, with volume sales of 755.4 tonnes (30.9% market share), and the snacks category, with volume sales of 403.0 tonnes (16.5% market share) in 2023.

In the dairy products and alternatives category, the other plant-based milk segement represented the largest volume sales of pea protein ingredients with 939.7 tonnes (38.5% maket share) in 2023, and experienced the greatest performance, increasing 10.3% in CAGR from volume sales of 634.4 tonnes in 2019. In the staple foods category, the meat and seafood substitutes segment experienced the largest increase in CAGR (28.6%), as volume sales grew from 78.4 tonnes in 2019 to 214.3 tonnes in 2023.

In the forecast period, the majority of categories and segments of packaged food ingredient volmes are expected to increase in growth, albeit at lower rates, with the exception of packaged leavened bread, which is anticipated to decrease 1.4% in CAGR in pea protein volume sales, from 478.8 tonnes in 2023 to 452.4 tonnes by 2027.

| Category | 2019 | 2023 | CAGR* % 2019-2023 | 2024 | 2027 | CAGR* % 2023-2027 |

|---|---|---|---|---|---|---|

| Packaged Food | 1,817.3 | 2,442.9 | 7.7 | 2,515.5 | 2,714.0 | 2.7 |

| Snacks | 391.3 | 403.0 | 0.7 | 415.1 | 445.5 | 2.5 |

| Ice Cream | 93.4 | 111.4 | 4.5 | 117.2 | 132.8 | 4.5 |

| Snack Bars | 297.9 | 291.6 | −0.5 | 297.9 | 312.7 | 1.8 |

| Dairy Products and Alternatives | 918.7 | 1,278.3 | 8.6 | 1,322.6 | 1,446.7 | 3.1 |

| Cheese | 153.4 | 168.5 | 2.4 | 172.3 | 182.2 | 2.0 |

| Yoghurt | 129.8 | 168.2 | 6.7 | 171.2 | 178.8 | 1.5 |

| Other Plant-based Milk | 634.4 | 939.7 | 10.3 | 976.9 | 1,083.2 | 3.6 |

| Staple Foods | 501.1 | 755.4 | 10.8 | 771.6 | 815.3 | 1.9 |

| Packaged Leavened Bread | 370.9 | 478.8 | 6.6 | 470.3 | 452.4 | −1.4 |

| Meat and Seafood Substitutes | 78.4 | 214.3 | 28.6 | 236.8 | 292.6 | 8.1 |

|

Source: Euromonitor International, 2024 1: protein derived from pea sources, including but not limited to isolates and concentrates. 2: Ingredient volume sales represents end-product sales through retail and foodservice channels to consumers and is the total aggregation of all the individual ingredients used in the manufacture of products that are tracked in Packaged Food. *CAGR: Compound Annual Growth Rate Ingredient data as of July 2023 |

||||||

Examples of new products

Chicken-Free Hot 'N Spicy Breaded Strips & Fries

Source: Mintel Global New Product Database (GNPD), 2024

| Company | Earth Grown Foods |

|---|---|

| Brand | Plant-It |

| Category | Processed fish, meat and egg products |

| Sub-category | Meat substitutes |

| Market | Canada |

| Location of manufacture | Ireland |

| Import status | Imported product |

| Store type | Supermarket |

| Date published | November 2023 |

| Launch type | New product |

| Price in local currency | Can$7.99 |

Ingredients (on pack): fries (potatoes, sunflower oil, modified potato starch, rice flour, potato starch, salt, sodium acid pyrophosphate, sodium bicarbonate, xanthan gum, turmeric, sugars (dextrose)), strips filling (water, pea starch, canola oil, soy protein, wheat gluten, calcium carbonate, natural flavour, methylcellulose, wheat starch, sunflower oil, salt, sugar, yeast extract, pea protein isolate), strips coating (enriched flour, seasoning (sugar, spices, corn starch, garlic powder, onion powder, salt, yeast extract powder, herbs, natural flavour), salt, sugars (dextrose), yeast, wheat starch, spices, potato starch, garlic powder, wheat gluten, onion powder, rice flour, canola oil), browned in canola oil, vegetables (sliced onions, red bell pepper strips, green bell pepper strips), seasoning (sugar, spices, corn starch, garlic powder, onion powder, yeast extract powder, herbs, natural flavour), sunflower oil

Lemon Strawberry Cheesecake Snack Bar

Source: Mintel Global New Product Database (GNPD), 2024

| Company | ANS Performance |

|---|---|

| Brand | ANS Performance |

| Category | Snacks |

| Sub-category | Snack / Cereal / Energy Bars |

| Market | Canada |

| Location of manufacture | Canada |

| Import status | Not imported |

| Store type | Supermarket |

| Date published | September 2022 |

| Launch type | New product |

| Price in local currency | Can$2.99 |

Ingredients (on pack): fats blend (cocoa butter, sunflower seed butter, MCTs, coconut oil powder, organic coconut oil), white chocolate flavoured coating (fractionated palm kernel oil, whey protein isolate, inulin, erythritol, natural flavours, sunflower lecithin, salt, stevia extract), chicory root fibre, strawberry layer (fructooligosaccharides, water, glycerine, erythritol, strawberries, corn starch, apple powder, fractionated palm kernel oil, citric acid, pectin, natural flavour, sunflower lecithin, sodium citrate, salt, colour (carrot juice, blackcurrant juice)), milk protein isolate, soluble corn fibre, natural flavours, pea crisps (pea protein isolate, pea starch, rice flour, calcium carbonate), milk protein concentrate, dehydrated coconut, guar gum, sunflower lecithin, citric acid, stevia leaf extract, mixed tocopherols

Berry Flavoured Drink Mix

Source: Mintel Global New Product Database (GNPD), 2024

| Company | Sequel Natural |

|---|---|

| Brand | Vega Protein & Greens |

| Category | Nutritional drinks and other beverages |

| Sub-category | Nutritional and meal replacement drinks |

| Market | Canada |

| Store type | Natural / health food store |

| Date published | November 2020 |

| Launch type | New packaging |

| Price in local currency | Can$36.99 |

Ingredients (on pack): pea protein, spinach powder, beet root powder, brown rice protein, pea starch, organic kale powder, stevia leaf extract, xanthan gum, papain powder, sacha inchi powder, organic alfalfa grass powder, broccoli powder, natural flavours

The pea starch market in the United States

According to Mintel's Global New Products Database (GNPD), there were a total of 114 new food and drink products containing pea starch (as an ingredient-and all children) launched in the United States between January 2019 to December 2023. The number of new food and beverage product launches has declined 13.5% in CAGR from 41 products released in 2019 to 23 products released in 2023. There have been 11 new pea starch containing food and drink products launched year-to-date, January-June 2024. Of the 201 new food and drink products released between 2019 to 2023, 104 products (91.2% market share) were food products, while 10 products (8.8% market share) were drink products.

New food products (containing pea starch) launched has decreased in CAGR by 12.0% from 35 products released in 2019 to 21 products released in 2023, while new drink products launched have also decreased in CAGR by 24.0% from 6 to 2 products released during the same period.

The predominant categories of new pea starch food products released in the U.S market were snacks (29 products), followed by meals and meal centers (23 products), bakery (15 products), processed fish, meat and egg products (9 products) and dairy (8 products), representing a combined market share of 80.8% during the 2019 to 2023 period. In the drink category, nurtritional drinks and other beverages released a total of 10 products during the review period.

| Product category | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 41 | 14 | 16 | 20 | 23 | 114 |

| Food category | 35 | 14 | 14 | 20 | 21 | 104 |

| Snacks | 17 | 6 | 1 | 3 | 2 | 29 |

| meals and meal centers | 8 | 4 | 1 | 1 | 9 | 23 |

| Bakery | 3 | 2 | 1 | 6 | 3 | 15 |

| Processed fish, meat and egg products | 1 | 0 | 1 | 5 | 2 | 9 |

| Dairy | 2 | 0 | 2 | 2 | 2 | 8 |

| Drink category | 6 | 0 | 2 | 0 | 2 | 10 |

| Nutritional drinks and other beverages | 6 | 0 | 2 | 0 | 2 | 10 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

Top flavours of pea starch-containing food products noted were unflavoured/plain (27 products), chocolate and vanilla/vanilla bourbon/vanilla Madagascar (3 products) respectively, and chocolate (dark/black) and brownie and cookie and cream (2 products) respectively, representing a combined market share of 35.6% between January 2019 to December 2023. In 2023, other top food flavours noted (other than those top flavours launched during the review period) were cheese and pizza, and meat, sugar, avocado and gherkin/pickled cucumber, three/four mixed cheeses, crab and spice/spicey, cereal and milk (with 1 product released) respectively, in 2023.

Of the drink category product releases, vanilla/vanilla bourbon/vanilla (Madagascar) (5 products), and berry and chocolate (2 products respectively) were identified as main flavours, representing a combined market share of 90.0% held between 2019 to 2023. In terms of recent (2023) launches, vanilla/vanilla bourbon/vanilla (Madagascar) was the only flavour launched (2 products), whereas berry, chocolate and caramel flavours launched in 2019 only.

| Flavours | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 41 | 14 | 16 | 20 | 23 | 114 |

| Food category | 35 | 14 | 14 | 20 | 21 | 104 |

| Unflavoured / plain | 7 | 1 | 6 | 11 | 2 | 27 |

| Chocolate | 0 | 0 | 0 | 2 | 1 | 3 |

| Vanilla / vanilla bourbon / vanilla Madagascar | 1 | 0 | 1 | 0 | 1 | 3 |

| Chocolate (dark/black) and brownie | 0 | 0 | 0 | 1 | 1 | 2 |

| Cookies and cream | 2 | 0 | 0 | 0 | 0 | 2 |

| Drink category | 6 | 0 | 2 | 0 | 2 | 10 |

| Vanilla / vanilla bourbon / vanilla Madagascar | 1 | 0 | 2 | 0 | 2 | 5 |

| Berry | 2 | 0 | 0 | 0 | 0 | 2 |

| Chocolate | 2 | 0 | 0 | 0 | 0 | 2 |

| Caramel (salted) | 1 | 0 | 0 | 0 | 0 | 1 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

During the review period, the most popular food product claims in recent pea starch containing launches in the United States market were low / no / reduced allergen (66 products), followed by gluten free with (60 products) and GMO free with (50 products). In comparison, top drink claims were GMO free, plant based and low / no / reduced allergen with (10 products) respectively, during the same period.

Of the top three food claims, low / no / reduced allergen included products within the following categories: snacks (24 products), processed fish, meat and egg products (3 products), meal and meal centers (8 products), bakery (14 products) and dairy (8 products). Gluten free claims were identified in the snacks category (24 products), processed fish, meat and egg products (2 products), meal and meal centers (6 products), bakery (14 products) and dairy (7 products). GMO free claims were identified in the snack category (19 products), meal and meal centers (5 products), bakery (8 products), processed fish, meat and egg products (5 products) and dairy (6 products).

In the drink (nutritional drink and other beverages) category, the top three claims, gmo free, plant based and low / no / reduced allergen claims were identified in 10 products, respectively, between 2019 to 2023.

| Claims | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 41 | 14 | 16 | 20 | 23 | 114 |

| Food category | 35 | 14 | 14 | 20 | 21 | 104 |

| low / no / reduced allergen | 27 | 9 | 6 | 12 | 12 | 66 |

| Gluten free | 25 | 9 | 6 | 10 | 10 | 60 |

| GMO free | 17 | 5 | 5 | 10 | 13 | 50 |

| Kosher | 21 | 3 | 3 | 11 | 10 | 48 |

| Vegan / no animal ingredients | 15 | 5 | 6 | 12 | 10 | 46 |

| Drink category | 6 | 0 | 2 | 0 | 2 | 10 |

| GMO free | 6 | 0 | 2 | 0 | 2 | 10 |

| Plant based | 6 | 0 | 2 | 0 | 2 | 10 |

| low / no / reduced allergen | 6 | 0 | 2 | 0 | 2 | 10 |

| Gluten free | 6 | 0 | 2 | 0 | 2 | 10 |

| No additives / preservatives | 6 | 0 | 2 | 0 | 0 | 8 |

|

Source: Mintel Global New Product Database (GNPD), 2024 1: products may report more than one claim |

||||||

The companies with the highest number of new pea starch-containing (food) product launches in the review period were Kroger (Top Brands; Simple Truth Free From Plant Based and Private Selection ) with 7 products, followed by One Brands (Top Brands; One Plant and One) and Good Karma Foods (Top Brand; Good Karma) with 5 products respectively, representing a combined market share of 16.3% during the review period.

Kroger has released new pea starch products primarily within the meals and meal centers and dairy category, while One Brands released new products within the snacks (snack/cereal/energy bars) category and Good Karma Foods in comparison, released all new products within the diary (plant based drinks) category. Of the top food companies, Good Karma Foods was the only company to release (2) new products containing pea starch in 2023, while Vintage Italia released 5 products in 2019 only. In 2023, top food companies releasing pea starch containing products were Rana Meal Solutions (4 products), Renewal Mill (3 products) and Konscious Food, Good Karma Foods and KLB Enterprises with (2 products), respectively.

During the review period, top drink companies launching products within the nutritional drinks and other beverages category were Sequel Natural (Top Brands; Vega and Vega Protein & Grains) with 6 products released in 2019, and Kate Farms (Top Brand Name; Kate Farms) with 4 product launches.

| Companies | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 41 | 14 | 16 | 20 | 23 | 114 |

| Food category | 35 | 14 | 14 | 20 | 21 | 104 |

| Kroger | 3 | 0 | 3 | 1 | 0 | 7 |

| One Brands | 0 | 4 | 0 | 1 | 0 | 5 |

| Good Karma Foods | 2 | 0 | 1 | 0 | 2 | 5 |

| Vintage Italia | 5 | 0 | 0 | 0 | 0 | 5 |

| Aldi | 3 | 1 | 0 | 0 | 0 | 4 |

| Drink category | 6 | 0 | 2 | 0 | 2 | 10 |

| Sequel Natural | 6 | 0 | 0 | 0 | 0 | 6 |

| Kate Farms | 0 | 0 | 2 | 0 | 2 | 4 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

In recent food launches, 48 products (46.2% market share) were launched as new variety/range extensions, followed by 28 products which were launched as new products (26.9% market share), and 16 products were released as new packaging (15.4% market share) between January 2019 to December 2023.

Of the products released in the drink category, 7 products released were new packaging and the remaining 3 products were released as variety/range extensions products.

Relatedly, top food packaging types launched during the review period were flexible (54 products), carton (15 products), flexible stand-up pouches (13 products), tray (10 products), and tub (4 products) representing a combined market share of 92.3%, while main drink package types launched were cartons (4 products), jars and flexible stand-up pouches (3 products respectively) during the same period.

| Launch Type | Yearly launch counts | Total | ||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Total food and beverage | 41 | 14 | 16 | 20 | 23 | 114 |

| Food category | 35 | 14 | 14 | 20 | 21 | 104 |

| New variety / range extension | 20 | 6 | 7 | 8 | 7 | 48 |

| New product | 6 | 4 | 4 | 6 | 8 | 28 |

| New packaging | 2 | 3 | 3 | 2 | 6 | 16 |

| Relaunch | 7 | 1 | 0 | 3 | 0 | 11 |

| New formulation | 0 | 0 | 0 | 1 | 0 | 1 |

| Drink category | 6 | 0 | 2 | 0 | 2 | 10 |

| New packaging | 5 | 0 | 0 | 0 | 2 | 7 |

| New variety/range extension | 1 | 0 | 2 | 0 | 0 | 3 |

| Source: Mintel Global New Product Database (GNPD), 2024 | ||||||

In the United States retail and e-commerce packaged food and drink market, new launched products containing pea starch were distributed primarily through supermarkets (49 products), followed by mass merchandise/hypermarket with (18 products) and internet/mail order (17 products), representing a combined market share of 73.7% during the 2019 to 2023 period. Of note, e-commerce (internet/mail order) experienced the largest decline in CAGR (36.1%) during the review period, as products distributed through this channel declined from 12 in 2019 to 2 products in 2023.

Description of above image

| Distribution channel | 2019 | 2020 | 2021 | 2022 | 2023 | Total |

|---|---|---|---|---|---|---|

| Supermarket | 13 | 6 | 13 | 10 | 7 | 49 |

| Mass merchandise / hypermarket | 5 | 5 | 0 | 3 | 5 | 18 |

| Internet / mail order | 12 | 0 | 3 | 0 | 2 | 17 |

| Natural / health food store | 6 | 2 | 0 | 3 | 6 | 17 |

| Club store | 2 | 0 | 0 | 1 | 2 | 5 |

Source: Mintel Global New Product Database (GNPD), 2024

Ingredient volume sales

Volume sales of pea protein ingredients in the United States packaged food market were valued at 25,171.1 tonnes in 2023, increasing 6.2% in CAGR from 19,808.6 tonnes in 2019. Pea protein ingredient volume sales in packaged food is expected to remain positive in the forecast period, increasing 3.3% in CAGR to reach volume sales of 28,651.5 tonnes by 2027.

Of the volume sales of pea protein ingredients in the packaged food market in the United States market, the dairy products and alternatives category yielded the largest volume sales with 14,490.4 tonnes (57.6% market share), followed by the snacks category, with volume sales of 6,020.8 tonnes (23.9% market share), and the staple foods category, with volume sales of 4,596.9 tonnes (18.3% market share) in 2023.

In the dairy products and alternatives category, the other plant-based milk segment represented the largest volume sales of pea protein ingredients with 11,587.8 tonnes (46.0% market share) in 2023, and experienced the greatest performance, increasing 10.1% in CAGR from volume sales of 7,891.8 tonnes in 2019. In the snacks category, the ice cream segment experienced the largest increase in CAGR (5.3%), as volume sales grew from 1,282.8 tonnes in 2019 to 1,578.4 tonnes in 2023. In the staple foods category, the meat and seafood substitutes segment experienced the largest increase in CAGR (18.1%) as volume sales increased from 530.6 tonnes in 2019 to 1,033.2 tonnes in 2023.

In the forecast period, all categories of packaged food ingredient volume sales are expected to increase in growth, albeit at lower rates, with the snack bars, other plant-based milk and meat and seafood substitutes segments anticipated to experience the greatest increases in CAGR (4.9%, 3.7% and 5.3% respectively) by 2027.

| Categorization type | 2019 | 2023 | CAGR* % 2019-2023 | 2024 | 2027 | CAGR* % 2023-2027 |

|---|---|---|---|---|---|---|

| Packaged Food | 19,808.6 | 25,171.1 | 6.2 | 26,087.4 | 28,651.5 | 3.3 |

| Snacks | 5,929.8 | 6,020.8 | 0.4 | 6,349.9 | 7,168.1 | 4.5 |

| Ice Cream | 1,282.8 | 1,578.4 | 5.3 | 1,653.9 | 1,793.6 | 3.2 |

| Snack Bars | 4,647.0 | 4,442.4 | −1.1 | 4,696.0 | 5,374.5 | 4.9 |

| Dairy Products and Alternatives | 10,388.9 | 14,490.4 | 8.7 | 15,017.1 | 16,492.4 | 3.3 |

| Cheese | 1,272.8 | 1,364.1 | 1.7 | 1,402.4 | 1,487.0 | 2.2 |

| Yoghurt | 1,216.7 | 1,527.8 | 5.9 | 1,541.3 | 1,593.5 | 1.1 |

| Other Plant-based Milk | 7,891.8 | 11,587.8 | 10.1 | 12,062.2 | 13,399.1 | 3.7 |

| Staple Foods | 3,424.6 | 4,596.9 | 7.6 | 4,656.4 | 4,924.0 | 1.7 |

| Packaged Flat Bread | 643.2 | 720.2 | 2.9 | 741.3 | 789.2 | 2.3 |

| Packaged Leavened Bread | 2,206.5 | 2,801.2 | 6.1 | 2,757.9 | 2,822.2 | 0.2 |

| Meat and Seafood Substitutes | 530.6 | 1,033.2 | 18.1 | 1,114.2 | 1,268.1 | 5.3 |

|

Source: Euromonitor International, 2024 1: protein derived from pea sources, including but not limited to isolates and concentrates. 2: Ingredient volume sales represents end-product sales through retail and foodservice channels to consumers and is the total aggregation of all the individual ingredients used in the manufacture of products that are tracked in Packaged Food. *CAGR: Compound Annual Growth Rate Ingredient data as of July 2023 |

||||||

Examples of new products

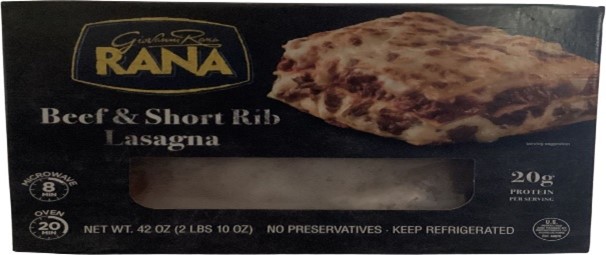

Beef & Short Rib Lasagna

Source: Mintel Global New Product Database (GNPD), 2024

| Company | Rana Meal Solutions |

|---|---|

| Brand | Giovanni Rana |

| Category | Meals and meal centers |

| Sub-category | Prepared meals |

| Market | United States |

| Store type | Club store |

| Date published | November 2023 |

| Launch type | New packaging |

| Price in local currency | US$15.99 |

Ingredients (on pack): meat sauce (beef, tomato puree (tomatoes), water, tomato paste, onions, carrots, 2% or less of (red wine, beef stock base (yeast extract, beef stock, salt, water, natural flavor, organic potato starch, lactic acid, carrot puree, onion powder, celery juice concentrate), natural flavors, garlic, salt, spices, modified food starch)), cheese sauce (ricotta cheese (whey, whole milk, cream, vinegar), mozzarella cheese (pasteurized cultured milk, salt, enzymes), heavy cream (cream, milk), parmesan cheese (pasteurized cultured part-skimmed milk, salt, enzymes)), 2% or less of (whey, salt, natural flavors, garlic, spices, black pepper, vegetable fiber and starch (pea fiber, potato fiber, corn fiber, pea starch, potato starch, corn starch), corn starch, potato fiber), tomato sauce (tomato puree (tomatoes), water, onions, 2% or less of (garlic, salt, natural flavors, modified food starch, spices, black pepper), pasta (durum wheat flour, eggs, water), cooked seasoned shredded beef short rib (beef, water, salt, rice starch, vinegar, yeast extract, sodium bicarbonate), mozzarella cheese

Non-Dairy Mozzarella Style Shreds

Source: Mintel Global New Product Database (GNPD), 2024

| Company | Kroger |

|---|---|

| Brand | Simple Truth Free From Plant Based |

| Category | Dairy |

| Sub-category | Processed cheese |

| Market | United States |

| Store type | Supermarket |

| Date published | February 2021 |

| Launch type | New product |

| Price in local currency | US$3.50 |

Ingredients (on pack): water, modified food starch, coconut oil, peas starch, natural flavor, salt, fava bean protein, turmeric extract (color), annatto extract (color)

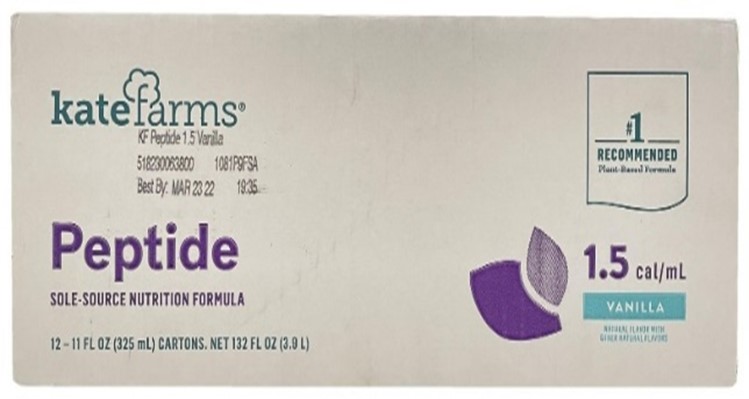

Peptide Vanilla 1.5 cal/ml Sole-Source Nutrition Formula

Source: Mintel Global New Product Database (GNPD), 2024

| Company | Kate Farms |

|---|---|

| Brand | Kate Farms |

| Category | Nutritional drinks and other beverages |

| Sub-category | Nutritional and meal replacement drinks |

| Market | United States |

| Location of manufacture | United States |

| Import status | Not imported |

| Store type | Internet / mail order |

| Date published | November 2021 |

| Launch type | New variety / range extension |

| Price in local currency | US$120.00 |

Ingredients (on pack): purified water, organic hydrolyzed pea protein, organic brown rice syrup solids, organic agave syrup, organic high linoleic sunflower oil, organic MCT oil, vitamin and mineral blend (potassium citrate, magnesium chloride, choline bitartrate, tricalcium phosphate, sodium chloride, sodium ascorbate, L-cysteine, L-carnitine, sodium molybdate, taurine, DL-alpha-tocopheryl acetate, beta carotene, ferric pyrophosphate, niacinamide, vitamin A palmitate, zinc oxide, copper sulfate, manganese sulfate, sodium selenite, chromium picolinate, tripotassium phosphate, calcium pantothenate, biotin, folic acid, pyridoxine hydrochloride, phytonadione, potassium iodide, thiamine hydrochloride, riboflavin, cyanocobalamin (vitamin B12), cholecalciferol (vitamin D3)), organic vanilla flavor (natural flavors, organic vanilla extract), organic flaxseed oil, organic agave inulin, organic pea starch, organic sunflower lecithin, organic locust bean gum, organic rosemary extract, organic Spectra phytonutrient blend (contains extracts and concentrates (contains organic broccoli extract, organic broccoli concentrate, organic Coffeeberry extract, organic Coffeeberry concentrate, organic green tea extract, organic green tea concentrate, organic turmeric extract, organic turmeric concentrate, organic kale extract, organic kale concentrate, organic broccoli sprout extract, organic broccoli sprout concentrate, organic acai extract, organic acai concentrate, organic cinnamon extract, organic cinnamon concentrate, organic garlic extract, organic garlic concentrate, organic tomato extract, organic tomato concentrate, organic blueberry extract, organic blueberry concentrate, organic carrot extract, organic carrot concentrate, organic beet extract, organic beet concentrate, organic raspberry extract, organic raspberry concentrate, organic spinach extract, organic spinach concentrate, organic tart cherry extract, organic tart cherry concentrate, organic blackberry extract, organic blackberry concentrate))

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

Resources

- Euromonitor International, Ingredients, 2024

- Mintel Global New Products Database, 2024

Customized Report Service – Product Launch Analysis – Pea starch ingredients in packaged food and beverage products – Canada and the United States markets

Global Analysis Report

Prepared by: Laurie Bernardi, International Market Research Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2024).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.