Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

There is a growing demand observed, for natural and healthy ingredients. The main reasons for this change are the increased prevalence of diseases related to poor lifestyle habits (overweight, diabetes, chronic disease, etc.) and the resulting decrease in life expectancy. Consumer shifts toward healthy ingredients or nutraceuticals is in accordance with the principle of "prevention is better than cure".

Future food innovation will be driven by the need to find solutions to some of the big picture issues facing the industry. Food producers will have to meet the dual global challenge of feeding a growing and ageing population, while also responding to an escalating rate of diseases like obesity and type-2 diabetes.

COVID-19 has reinforced the importance of having a healthy immune system, and keeping healthy is extremely important to consumers during this time. A quarter of French consumers claim to be eating more fruit and vegetables, rising to 39% of 16 to 24s. Just over a third of United Kingdom (UK) consumers said that the outbreak has prompted them to add more nutrients that support the immune system to their diet. This rises to 54% of 16 to 24s (Mintel's Impact of COVID-19 on Food & Drink 2020 research, May 2020).

The health and wellness food sector remains as relevant as ever, despite broader economic concerns. Consumers are more than ever seeking healthier lifestyles, a well-balanced diet, and additional functionality and benefits from food and beverages even before the pandemic.

Heart health-positioned foods and beverages were valued at US$568.2 million in 2021 in Germany, but the last six years have seen growth (4.4% compound annual growth rate CAGR between 2016 and 2021.

In 2021, the UK was the biggest digestive health market in EU, with the retail sales at US$2.6 billion, growing at a CAGR of 2.9% between 2016 and 2021.

In 2021, the UK was the biggest weight management market in EU, with the retail sales at US$7.2 billion, growing at a CAGR of 3.6% between 2016 and 2021.

Introduction

There is a growing demand observed, for natural and healthy ingredients. The main reasons for this change are the increased prevalence of diseases related to poor lifestyle habits (overweight, diabetes, chronic disease, etc.) and the resulting decrease in life expectancy. Consumer shifts toward healthy ingredients or nutraceuticals is in accordance with the principle of "prevention is better than cure".

Consumer desires and interests can vary significantly across the globe, with age being one of the key determinants of nutritional and psychological needs. Young people1 will prioritize and buy products that will provide them with functionality. For example, products formulated to give a boost of energy after being eaten or drunk. Oppositely, Baby Boomers want products that help prevent or mitigate conditions that relate to aging.

The agri-food companies have responded to this new trend and have developed a growing variety of new products with instructions and pictures related to health: functional foods. It is not easy to understand the level of consumer knowledge about these foods and the motivations behind the decision to buy or not to buy a functional product compared to one with the same nutritional attributes. In terms of products (besides dietary supplements), the possibilities are wide-ranging: yoghurts, juices, smoothies, snack bars and other types of snacks, beverages, desserts and even baby food provide fertile ground for new product developments.

Future food innovation will be driven by the need to find solutions to some of the big picture issues facing the industry. Food producers will have to meet the dual global challenge of feeding a growing and ageing population, while also responding to an escalating rate of diseases like obesity and type-2 diabetes. Numerous attempts to curb the growing obesity epidemic have failed around the world. As a result, long-term solutions for calorie reduction via healthy lifestyle changes are becoming a necessity.

COVID-19 has reinforced the importance of having a healthy immune system, and keeping healthy is extremely important to consumers during this time. A quarter of French consumers claim to be eating more fruit and vegetables, rising to 39% of 16-24s. Just over a third of UK consumers said that the outbreak has prompted them to add more nutrients that support the immune system to their diet. This rises to 54% of 16-24s (Mintel's Impact of COVID-19 on Food & Drink 2020 research, May 2020).

This report does not attempt to cover the wide range of functional ingredients, variety of conditions or nutritional approaches, but it will provide an overview of the market and consumer trends with regards to functional/fortified products which specifically claim to support a metabolic health.

Overview of the sector

The health and wellness food sector remains as relevant as ever, despite broader economic concerns. Consumers are more than ever seeking healthier lifestyles, a well-balanced diet, and additional functionality and benefits from food and beverages even before the pandemic. Consumers demand health and wellness solutions of ever greater specificity, such as products that claim to be beneficial for their metabolic health.

Within the EU, the largest market for metabolic health products is the United Kingdom (UK) with the retail value sales at US$532.6 million for cardiovascular health, US$2.6 billion for digestive health and US$7.2 billion for weight management in 2021. Cardiovascular health grew at CAGR of 2.6% between 2016 and 2021. It is forecast to grow at a CAGR of 2.7% between 2021 and 2026.

The second largest market is Germany with the retail value sales at US$568.2 million for cardiovascular health, US$1.7 billion for digestive health and US$5.7 billion for weight management in 2021. Cardiovascular health grew at CAGR of 4.4% between 2016 and 2021. It is forecast to grow at a CAGR of 2.2% between 2021 and 2026.

| Top 6 markets | Category | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|---|

| France | Cardiovascular Health | 383.0 | 433.5 | 2.5 | 441.0 | 483.4 | 2.2 |

| Digestive Health | 1,481.0 | 1,678.0 | 2.5 | 1,734.2 | 2,086.4 | 4.5 | |

| Weight Management | 2,858.6 | 2,799.2 | −0.4 | 2,833.6 | 3,148.9 | 2.4 | |

| Germany | Cardiovascular Health | 457.4 | 568.2 | 4.4 | 577.5 | 632.1 | 2.2 |

| Digestive Health | 1,526.4 | 1,708.2 | 2.3 | 1,742.8 | 1,926.1 | 2.4 | |

| Weight Management | 4,925.6 | 5,775.0 | 3.2 | 5,851.8 | 6,353.8 | 1.9 | |

| Italy | Cardiovascular Health | 166.8 | 186.7 | 2.3 | 188.7 | 199.3 | 1.3 |

| Digestive Health | 1,271.0 | 1,622.0 | 5.0 | 1,685.0 | 2,028.8 | 4.6 | |

| Weight Management | 1,836.9 | 1,995.1 | 1.7 | 2,064.9 | 2,374.0 | 3.5 | |

| Spain | Cardiovascular Health | 243.2 | 261.2 | 1.4 | 251.7 | 271.3 | 0.8 |

| Digestive Health | 944.6 | 991.5 | 1.0 | 1,012.0 | 1,143.9 | 2.9 | |

| Weight Management | 2,205.1 | 2,560.5 | 3.0 | 2,650.0 | 3,023.1 | 3.4 | |

| United Kingdom | Cardiovascular Health | 467.7 | 532.6 | 2.6 | 542.2 | 608.0 | 2.7 |

| Digestive Health | 2,287.2 | 2,637.5 | 2.9 | 2,693.2 | 3,096.8 | 3.3 | |

| Weight Management | 6,072.0 | 7,242.6 | 3.6 | 7,482.3 | 8,782.5 | 3.9 | |

| Netherlands | Cardiovascular Health | 164.4 | 195.0 | 3.5 | 198.7 | 225.8 | 3.0 |

| Digestive Health | 1,538.6 | 1,812.9 | 3.3 | 1,872.9 | 2,236.5 | 4.3 | |

| Weight Management | 1,220.7 | 1,683.2 | 6.6 | 1,756.5 | 2,087.9 | 4.4 | |

|

Source: Euromonitor 2022 *CAGR: Compound Annual Growth Rate |

|||||||

Cardiovascular health

Heart disease remains one of the leading causes of death in the world. The aging of the population (baby boomers and seniors) will increase sales of nutritional supplements and products with features. Heart health-positioned foods and beverages were valued at US$568.2 million in 2021 in Germany, but the last six years have seen growth (4.4% CAGR) between 2016 and 2021. United Kingdom ranked 2nd, with packaged food valued at US$527.4 million and beverages valued at US$5.2 million in 2021. It grew at a CAGR of 2.6% for the total cardiovascular health between 2016 and 2021.

There are opportunities for cardiovascular health-positioned products, since it is widely recognised that a healthy diet is essential to keep under control some of the most important risk factors involved in the development of CVD, such as high cholesterol levels and high blood pressure, as well as overweight and obesity.

| Market | Category | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|---|

| Germany | Cardiovascular Health | 457.4 | 568.2 | 4.4 | 577.5 | 632.1 | 2.2 |

| CH - Beverages | N/C | N/C | |||||

| CH- Packaged Food | 457.4 | 568.2 | 4.4 | 577.5 | 632.1 | 2.2 | |

| United Kingdom | Cardiovascular Health | 467.7 | 532.6 | 2.6 | 542.2 | 608.0 | 2.7 |

| CH - Beverages | 4.6 | 5.2 | 2.5 | 5.3 | 5.9 | 2.6 | |

| CH - Packaged Food | 463.1 | 527.4 | 2.6 | 536.9 | 602.1 | 2.7 | |

| France | Cardiovascular Health | 383.0 | 433.5 | 2.5 | 441.0 | 483.4 | 2.2 |

| CH - Beverages | N/C | N/C | |||||

| CH - Packaged Food | 383.0 | 433.5 | 2.5 | 441.0 | 483.4 | 2.2 | |

| Spain | Cardiovascular Health | 243.2 | 261.2 | 1.4 | 251.7 | 271.3 | 0.8 |

| CH - Beverages | N/C | N/C | |||||

| CH - Packaged Food | 243.2 | 261.2 | 1.4 | 251.7 | 271.3 | 0.8 | |

| Netherlands | Cardiovascular Health | 164.4 | 195.0 | 3.5 | 198.7 | 225.8 | 3.0 |

| CH - Beverages | N/C | N/C | |||||

| CH - Packaged Food | 164.4 | 195.0 | 3.5 | 198.7 | 225.8 | 3.0 | |

| Italy | Cardiovascular Health | 166.8 | 186.7 | 2.3 | 188.7 | 199.3 | 1.3 |

| CH - Beverages | N/C | N/C | |||||

| CH - Packaged Food | 166.8 | 186.7 | 2.3 | 188.7 | 199.3 | 1.3 | |

|

Source: Euromonitor 2022 *CAGR: Compound Annual Growth Rate N/C Not Calculable |

|||||||

Example of products

Another approach for cardiovascular health-positioned foods is with heart healthy ingredients like omegas, plants sterols and complex carbohydrates. There is a clear movement towards artificially-fortified foods and beverages with these ingredients to naturally functional foods that contain heart health ingredients like nuts or almonds, which are perceived as healthier options by consumers

Banana & Cocoa Flavoured Baby Cereal

Source: Mintel, 2022

| Company | HiPP |

|---|---|

| Brand | HiPP Biologique Matins Gourmands |

| Category | Baby food |

| Sub-category | Baby cereals |

| Market | France |

| Store type | Mass merchandise / hypermarket |

| Date published | December 2021 |

| Launch type | New packaging |

| Price in local currency | €2.80 |

| Price in US dollars | 3.17 |

HiPP Biologique Matins Gourmands Céréales Banane Cacao (Banana & Cocoa Flavoured Baby Cereal) has been repackaged in a new pack. This product comprises wholegrain cereals, has been specially developed for baby needs, can be served for breakfast or dinner, and is rich in slow release and highly digestible carbohydrates. It also contains vitamin B1 that helps the development and functioning of the nervous system, is free from added sugars, preservatives, colourings and added flavourings, and is suitable for babies from eight months onwards. It retails in a 250 gram partly recyclable pack bearing the Climate Friendly, Organic Stefan Hipp. the AB - Agriculture Biologique and EU Organic logos as well as preparation instructions. The manufacturer is claimed to use renewable energy and to have a carbon neutral production

Clementine & Winter Berry Flavour Porridge

Source: Mintel, 2022

| Company | Sainsbury's |

|---|---|

| Brand | Sainsbury's |

| Category | Breakfast cereals |

| Sub-category | Hot cereals |

| Market | United Kingdom |

| Store type | Supermarket |

| Date published | November 2021 |

| Launch type | New variety / range extension |

| Price in local currency | £1.25 |

| Price in US dollars | 1.68 |

| Price in Euros | 1.47 |

Sainsbury's Clementine & Winter Berry Flavour Porridge is now available for the festive season 2021. It comprises rolled oat flakes with a clementine and winter berry flavour. The microwavable product contains at least 1 gram of oat beta-glucan from oats, which is said to help lower cholesterol levels to prevent risk of heart disease, is suitable for vegetarians, and retails in a recyclable 288 gram pack containing eight 36 gram individual sachets.

Product launch analysis - cardiovascular health

Cardiovascular health positioned beverages remains an underexploited area. Although there are numerous offerings marketed as high in antioxidants and/or with omega-3, drinks with a specific heart health positioning are scarce. While reduced fat and reduced salt products historically dominated heart health, consumers are starting to move to those products with more specific functional ingredients which, for example, lower cholesterol.

According to Mintel's Global New Products Database (2021), from 2017 to 2021, a total of 1,694 products claiming (on pack) to have "functional - cardiovascular properties"" were launched in UK, Germany, France, Italy Spain and Netherland. Out of these, 385 were new products, 599 were new variety, 491 were new packaging and 18 were new formation while 201 were relaunched.

| Launch type | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| New Variety / Range Extension | 150 | 147 | 98 | 97 | 107 | 599 |

| New Packaging | 122 | 104 | 88 | 78 | 99 | 491 |

| New Product | 88 | 84 | 66 | 92 | 55 | 385 |

| Relaunch | 47 | 33 | 31 | 48 | 42 | 201 |

| New Formulation | 6 | 3 | 6 | 3 | 0 | 18 |

| Total Sample | 413 | 371 | 289 | 318 | 303 | 1,694 |

| Source: Mintel 2022 | ||||||

The biggest number of launches from 2017 to 2021 occurred in the UK (734), followed by Spain (251), France (248), Italy (224), Germany (167) and Netherlands (70).

| Market | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| United Kingdom | 167 | 169 | 114 | 145 | 139 | 734 |

| Spain | 65 | 53 | 36 | 38 | 59 | 251 |

| France | 68 | 55 | 49 | 38 | 38 | 248 |

| Italy | 53 | 46 | 48 | 44 | 33 | 224 |

| Germany | 45 | 24 | 29 | 43 | 26 | 167 |

| Netherlands | 15 | 24 | 13 | 10 | 8 | 70 |

|

Total sample |

413 | 371 | 289 | 318 | 303 | 1,694 |

| Source: Mintel 2022 | ||||||

Between 2017 and 2021, there are 161 hot cereals that claim "functional - cardiovascular properties", followed by 159 cold cereal, 131 fish products,129 oils, 77 margarine & other blends, 75 juice, 59 prepared meals, 55 drinking yogurt and liquid cultured milk, 52 sweet biscuits and 52 nuts.

| Category | United Kingdom | Spain | France | Italy | Germany | Netherlands | Total sample |

|---|---|---|---|---|---|---|---|

| Hot Cereals | 124 | 11 | 5 | 0 | 15 | 6 | 161 |

| Cold Cereals | 63 | 24 | 26 | 9 | 25 | 12 | 159 |

| Fish Products | 92 | 8 | 9 | 20 | 2 | 0 | 131 |

| Oils | 16 | 6 | 40 | 37 | 19 | 11 | 129 |

| Margarine and Other Blends | 22 | 10 | 20 | 1 | 11 | 13 | 77 |

| Juice | 34 | 13 | 8 | 2 | 11 | 7 | 75 |

| Prepared Meals | 57 | 0 | 1 | 1 | 0 | 0 | 59 |

| Drinking Yogurt and Liquid Cultured Milk | 27 | 11 | 0 | 15 | 0 | 2 | 55 |

| Sweet Biscuits/Cookies | 2 | 28 | 2 | 18 | 0 | 2 | 52 |

| Nuts | 12 | 11 | 1 | 18 | 4 | 6 | 52 |

| Total sample | 734 | 251 | 248 | 224 | 167 | 70 | 1,694 |

| Mintel 2022 | |||||||

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| Hot Cereals | 49 | 27 | 22 | 30 | 33 | 161 |

| Cold Cereals | 49 | 38 | 25 | 21 | 26 | 159 |

| Fish Products | 29 | 25 | 13 | 28 | 36 | 131 |

| Oils | 23 | 21 | 35 | 19 | 31 | 129 |

| Margarine and Other Blends | 28 | 13 | 11 | 11 | 14 | 77 |

| Juice | 30 | 21 | 9 | 9 | 6 | 75 |

| Prepared Meals | 9 | 13 | 11 | 19 | 7 | 59 |

| Drinking Yogurt and Liquid Cultured Milk | 23 | 11 | 8 | 8 | 5 | 55 |

| Sweet Biscuits/Cookies | 11 | 13 | 5 | 5 | 18 | 52 |

| Nuts | 9 | 11 | 11 | 10 | 11 | 52 |

| Total sample | 413 | 371 | 289 | 318 | 303 | 1,694 |

| Mintel 2022 | ||||||

Digestive health

Digestive health products are likely to emerge as a major revenue contributor to the global healthcare sector in the coming years due to the growing prevalence of digestive diseases and rising awareness about the importance of maintaining a healthy gut flora. Rising awareness among consumers about the importance of digestive health is likely to remain the key driver for the digestive health products market.

The increasing availability of healthcare information on the Internet and the increasing emphasis of healthcare agencies on outreach programs to boost healthcare awareness among the population have helped the digestive health products market in developed countries.

In 2021, the UK was the biggest digestive health market in EU, with the retail sales at US$2.6 billion, growing at a CAGR of 2.9% between 2016 and 2021. It was followed by Netherland, with the retail value at US$1.8 billion, growing at a CAGR of 3.3% between 2016 and 2021.

| Market | Category | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|---|

| United Kingdom | Digestive Health | 2,287.2 | 2,637.5 | 2.9 | 2,693.2 | 3,096.8 | 3.3 |

| DH-Beverages | N/A | N/C | |||||

| DH-Packaged Food | 2,287.2 | 2,637.5 | 2.9 | 2,693.2 | 3,096.8 | 3.3 | |

| Netherlands | Digestive Health | 1,538.6 | 1,812.9 | 3.3 | 1,872.9 | 2,236.5 | 4.3 |

| DH - Beverages | N/C | N/C | |||||

| DH - Packaged Food | 1,538.6 | 1,812.9 | 3.3 | 1,872.9 | 2,236.5 | 4.3 | |

| Germany | Digestive Health | 1,526.4 | 1,708.2 | 2.3 | 1,742.8 | 1,926.1 | 2.4 |

| DH - Beverages | N/C | N/C | |||||

| DH - Packaged Food | 1,526.4 | 1,708.2 | 2.3 | 1,742.8 | 1,926.1 | 2.4 | |

| France | Digestive Health | 1,481.0 | 1,678.0 | 2.5 | 1,734.2 | 2,086.4 | 4.5 |

| DH - Beverages | 3.7 | 5.9 | 9.8 | 6.3 | 8.8 | 8.3 | |

| DH - Packaged Food | 1,477.3 | 1,672.1 | 2.5 | 1,727.8 | 2,077.5 | 4.4 | |

| Italy | Digestive Health | 1,271.0 | 1,622.0 | 5.0 | 1,685.0 | 2,028.8 | 4.6 |

| DH - Beverages | N/C | N/C | |||||

| DH - Packaged Food | 1,271.0 | 1,622.0 | 5.0 | 1,685.0 | 2,028.8 | 4.6 | |

| Spain | Digestive Health | 944.6 | 991.5 | 1.0 | 1,012.0 | 1,143.9 | 2.9 |

| DH - Beverages | 0.2 | 0.1 | −12.9 | 0.1 | 0.1 | 0.0 | |

| DH - Packaged Food | 944.4 | 991.3 | 1.0 | 1,011.9 | 1,143.8 | 2.9 | |

|

Source: Euromonitor 2022 *CAGR: Compound Annual Growth Rate N/A: Not applicable N/C: Not calculable |

|||||||

Example of products

The market for digestive health products has undergone massive changes over the past several years. In the past, metabolic products tended to focus solely on the benefits of digestive health. However, the market is changing and if they want to remain competitive they need to reinvent their formulas and add new ingredients. The same products now claim other competitive benefits such as: immune support health, women's health benefits, improved nutrient absorption, and even products that help brain and cardiovascular health. Since digestive health problems are more prevalent among older consumers, they account for the majority of sales.

InfuDigest Chamomile, Licorice and Mint Infusion

Source: Mintel, 2022

| Company | Jacobs Douwe Egberts |

|---|---|

| Brand | Hornimans |

| Category | Hot beverages |

| Sub-category | Tea |

| Market | Spain |

| Store type | Mass merchandise / hypermarket |

| Date published | October 2021 |

| Launch type | New packaging |

| Price in local currency | €2.09 |

| Price in US dollars | 2.42 |

Hornimans InfuDigest Infusión con Manzanilla, Regaliz y Menta (InfuDigest Chamomile, Licorice and Mint Infusion) has been repackaged. This product is described as a delicious blend with natural ingredients traditionally known to facilitate digestion, including: licorice, a root traditionally recognised as a natural remedy to improve the performance of the digestive system, adding a touch of unique flavor; chamomile, traditionally known for its digestive properties; and mint, an ideal freshness complement for after meals. It is suitable for microwaves, can be prepared in three to five minutes with hot water, and retails in a 30 gram pack containing 20 1.5 gram bags.

Classic Authentic Half Bread

Source: Mintel, 2022

| Company | Albert Heijn |

|---|---|

| Brand | AH Waldkorn |

| Category | Bakery |

| Sub-category | Bread and bread products |

| Market | Netherlands |

| Store type | Supermarket |

| Date published | December 2021 |

| Launch type | New product |

| Price in local currency | €1.09 |

| Price in US dollars | 1.23 |

AH Waldkorn The Original Classic Halfbrood (Classic Authentic Half Bread) is now available. This authentic multigrain bread is said to be rich in fibres and suitable for vegans. The fibres contribute to a healthy digestion system. The product retails in a pack containing 11 slices and features the Plastic Heroes and Vegan logos.

Product launch analysis - digestive health

According to Mintel's Global New Products Database (2022), from 2017 to 2021, a total of 1,446 products claiming (on pack) to have "functional - digestive properties"" were launched in UK, Germany, France, Italy Spain and Netherland. Out of these, 537 were new products, 480 were new variety, 301 were new packaging and 14 were new formation while 114 were relaunched.

| Launch type | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| New Product | 101 | 107 | 111 | 109 | 109 | 537 |

| New Variety / Range Extension | 88 | 87 | 128 | 88 | 89 | 480 |

| New Packaging | 66 | 64 | 51 | 54 | 66 | 301 |

| Relaunch | 9 | 21 | 28 | 34 | 22 | 114 |

| New Formulation | 1 | 3 | 6 | 1 | 3 | 14 |

| Total Sample | 265 | 282 | 324 | 286 | 289 | 1,446 |

| Source: Mintel 2022 | ||||||

The biggest number of launches from 2017 to 2021 occurred in the UK (423), followed by France (293), Italy (273), Spain (238), Germany (153) and Netherlands (66).

| Market | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| United Kingdom | 48 | 80 | 94 | 96 | 105 | 423 |

| France | 79 | 58 | 56 | 39 | 61 | 293 |

| Italy | 50 | 65 | 60 | 56 | 42 | 273 |

| Spain | 46 | 50 | 57 | 44 | 41 | 238 |

| Germany | 30 | 17 | 43 | 38 | 25 | 153 |

| Netherlands | 12 | 12 | 14 | 13 | 15 | 66 |

| Total Sample | 265 | 282 | 324 | 286 | 289 | 1,446 |

| Source: Mintel 2022 | ||||||

Between 2017 and 2021, there are 381 tea that claim "functional - digestive properties", followed by 107 spoonable yogurt, 89 cold cereals, 80 nutritional & meal replacement drinks, 58 drinking yogurt and liquid cultured milk, 57 water, 55 juice, 53 kombucha and other fermented drinks, 49 baby formula and 30 hot meals.

| Category | United Kingdom | France | Italy | Spain | Germany | Netherlands | Total sample |

|---|---|---|---|---|---|---|---|

| Tea | 37 | 119 | 73 | 79 | 54 | 19 | 381 |

| Spoonable Yogurt | 45 | 10 | 28 | 16 | 7 | 1 | 107 |

| Cold Cereals | 44 | 6 | 10 | 17 | 5 | 7 | 89 |

| Nutritional and Meal Replacement Drinks | 31 | 5 | 8 | 5 | 28 | 3 | 80 |

| Drinking Yogurt and Liquid Cultured Milk | 29 | 5 | 12 | 8 | 1 | 3 | 58 |

| Water | 0 | 20 | 36 | 1 | 0 | 0 | 57 |

| Juice | 6 | 17 | 10 | 15 | 4 | 3 | 55 |

| Kombucha and Other Fermented Drinks | 26 | 10 | 0 | 10 | 4 | 3 | 53 |

| Baby Formula (0-6 months) | 18 | 1 | 10 | 9 | 10 | 1 | 49 |

| Hot Cereals | 23 | 2 | 0 | 4 | 0 | 1 | 30 |

| Total Sample | 423 | 293 | 273 | 238 | 153 | 66 | 1,446 |

| Source: Mintel 2022 | |||||||

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| Tea | 87 | 84 | 74 | 73 | 63 | 381 |

| Spoonable Yogurt | 16 | 15 | 21 | 26 | 29 | 107 |

| Cold Cereals | 10 | 10 | 34 | 24 | 11 | 89 |

| Nutritional and Meal Replacement Drinks | 13 | 8 | 25 | 16 | 18 | 80 |

| Drinking Yogurt and Liquid Cultured Milk | 5 | 3 | 16 | 11 | 23 | 58 |

| Water | 16 | 14 | 16 | 6 | 5 | 57 |

| Juice | 15 | 14 | 10 | 8 | 8 | 55 |

| Kombucha and Other Fermented Drinks | 1 | 16 | 12 | 17 | 7 | 53 |

| Baby Formula (0-6 months) | 5 | 11 | 7 | 8 | 18 | 49 |

| Hot Cereals | 9 | 3 | 5 | 3 | 10 | 30 |

| Total Sample | 265 | 282 | 324 | 286 | 289 | 1,446 |

| Source: Mintel 2022 | ||||||

Weight management

Weight management related products are undergoing major modifications as consumers move towards healthier lifestyles and increasingly buying nutrient rich foods at the expense of low calorific food related products. Consumers are moving towards a more holistic and long-term weight management approach to improve their health.

In 2021, the UK was the biggest weight management market in EU, with the retail sales at US$7.2 billion, growing at a CAGR of 3.6% between 2016 and 2021. It was followed by Germany, with the retail value at US$5.8 billion, growing at a CAGR of 3.2% between 2016 and 2021. The biggest growth was Netherland's VM-beverages at a CAGR of 15.1% between 2016 and 2021.

| Market | Category | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|---|

| United Kingdom | Weight Management (WM) | 6,072.0 | 7,242.6 | 3.6 | 7,482.3 | 8,782.5 | 3.9 |

| WM - Beverages | 2,689.5 | 3,742.4 | 6.8 | 3,890.2 | 4,706.1 | 4.7 | |

| WM- Packaged Food | 3,382.5 | 3,500.2 | 0.7 | 3,592.1 | 4,076.4 | 3.1 | |

| Germany | Weight Management | 4,925.6 | 5,775.0 | 3.2 | 5,851.8 | 6,353.8 | 1.9 |

| WM - Beverages | 1,800.4 | 2,384.9 | 5.8 | 2,461.4 | 2,733.5 | 2.8 | |

| WM- Packaged Food | 3,125.2 | 3,390.1 | 1.6 | 3,390.3 | 3,620.4 | 1.3 | |

| France | Weight Management | 2,858.6 | 2,799.2 | −0.4 | 2,833.6 | 3,148.9 | 2.4 |

| WM - Beverages | 785.5 | 1,008.0 | 5.1 | 1,044.7 | 1,312.8 | 5.4 | |

| WM - Packaged Food | 2,073.1 | 1,791.2 | −2.9 | 1,788.9 | 1,836.0 | 0.5 | |

| Spain | Weight Management | 2,205.1 | 2,560.5 | 3.0 | 2,650.0 | 3,023.1 | 3.4 |

| WM - Beverages | 951.6 | 1,124.0 | 3.4 | 1,206.3 | 1,400.1 | 4.5 | |

| WM - Packaged Food | 1,253.5 | 1,436.5 | 2.8 | 1,443.7 | 1,623.0 | 2.5 | |

| Italy | Weight Management | 1,836.9 | 1,995.1 | 1.7 | 2,064.9 | 2,374.0 | 3.5 |

| WM - Beverages | 445.0 | 568.9 | 5.0 | 607.3 | 790.0 | 6.8 | |

| WM- Packaged Food | 1,391.8 | 1,426.2 | 0.5 | 1,457.6 | 1,584.0 | 2.1 | |

| Netherlands | Weight Management | 1,220.7 | 1,683.2 | 6.6 | 1,756.5 | 2,087.9 | 4.4 |

| WM - Beverages | 417.0 | 842.5 | 15.1 | 888.2 | 1,072.7 | 4.9 | |

| WM- Packaged Food | 803.7 | 840.6 | 0.9 | 868.3 | 1,015.2 | 3.8 | |

|

Source: Euromonitor 2022 *CAGR: Compound Annual Growth Rate |

|||||||

Example of products

Meal replacements are in high demand among young customers because they are perceived to offer more functional benefits and are a healthier source of nutrition than conventional foods. The Millennials are now the largest population group consuming this product, outnumbering the Baby Boomers. Millennials focus on organic food, exercise-friendly related products, and avoiding artificial sweeteners and highly processed foods. With limited incomes, they are likely to favor inexpensive and convenient diet plans and "wholesome" diet products.

Multi-Cereal Bars with Milk Chocolate

Source: Mintel, 2022

| Company | Biocentury |

|---|---|

| Brand | Bicentury Sarialis + |

| Category | Snacks |

| Sub-category | Snack / cereal / energy bars |

| Market | Spain |

| Store type | Mass merchandise / hypermarket |

| Date published | December 2021 |

| Launch type | New packaging |

| Price in local currency | €2.91 |

| Price in US dollars | 3.29 |

Bicentury Sarialis + Barritas Multicereales con Chocolate con Leche (Multi-Cereal Bars with Milk Chocolate) have been repackaged with a new look. These cereal bars are made with corn, rice and buckwheat, which provide a good source of nutrients. They are rich in fibre and contain 11 vitamins, including vitamins A, B1, B2, B3, B6, B9, B12, D, E, biotin and pantothenic acid. The product is said to make the consumer feel satisfied until the next meal and retails in an 88.2 gram pack with six 14.7 gram individually wrapped units.

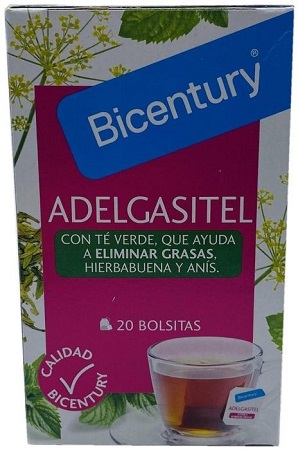

Adelgasitel Herbal, Peppermint and Anise Slimming Tea

Source: Mintel, 2022

| Company | Biocentury |

|---|---|

| Brand | Biocentury |

| Category | Hot beverages |

| Sub-category | Tea |

| Market | Spain |

| Store name | El Corte Inglés |

| Store type | Department store |

| Date published | December 2021 |

| Launch type | New packaging |

| Price in local currency | €3.05 |

| Price in US dollars | 3.45 |

Bicentury Adelgasitel Té Aromatizado con Hierbabuena (Adelgasitel Herbal, Peppermint and Anise Slimming Tea) has been repackaged in a 36 gram pack containing 20 tea bags, and featuring brewing instructions. The antioxidant product is claimed to naturally help reduce fat by supporting fat removal and oxidation. Furthermore, it helps to maintain cardiovascular health, and protects the skin against ultra-violet rays.

Gingerbread Flavour Meal Replacement

Source: Mintel, 2022

| Company | RSH Functional Food |

|---|---|

| Brand | GymQueen Slim Queen |

| Category | Nutritional drinks and other beverages |

| Sub-category | Nutritional and meal replacement drinks |

| Market | Germany |

| Store type | Internet / mail order |

| Date published | December 2021 |

| Launch type | New variety / range extension |

| Price in local currency | €14.99 |

| Price in US dollars | 16.96 |

GymQueen Slim Queen Mahlzeitersatz Lebkuchen (Gingerbread Flavour Meal Replacement) is for Christmas 2021. The product for a weight-controlled diet contains sweetener, is free from added sugar, and retails in a 420 gram pack bearing the Facebook and Instagram logos.

Product launch analysis - weight management

According to Mintel's (2022), from 2017 to 2021, a total of 1,368 products with the claim "functional - slimming properties" were launched in UK, Germany, France, Italy Spain and Netherland. Out of these, 519 were new products, 438 were new variety, 226 were new packaging and 44 were new formation while 141 were relaunched.

| Launch type | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| New Product | 102 | 158 | 75 | 100 | 84 | 519 |

| New Variety / Range Extension | 69 | 109 | 94 | 89 | 77 | 438 |

| New Packaging | 64 | 61 | 23 | 26 | 52 | 226 |

| Relaunch | 24 | 30 | 24 | 27 | 36 | 141 |

| New Formulation | 6 | 12 | 9 | 10 | 7 | 44 |

| Total Sample | 265 | 370 | 225 | 252 | 256 | 1,368 |

| Source: Mintel 2022 | ||||||

The biggest number of launches from 2017 to 2021 occurred in the UK (447), followed by Germany (371), France (204), Spain (190), Italy (110) and Netherlands (46).

| Market | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| United Kingdom | 95 | 127 | 73 | 80 | 72 | 447 |

| Germany | 66 | 93 | 74 | 85 | 53 | 371 |

| France | 31 | 83 | 24 | 22 | 44 | 204 |

| Spain | 26 | 29 | 33 | 32 | 70 | 190 |

| Italy | 39 | 27 | 13 | 17 | 14 | 110 |

| Netherlands | 8 | 11 | 8 | 16 | 3 | 46 |

| Total Sample | 265 | 370 | 225 | 252 | 256 | 1,368 |

| Source: Mintel 2022 | ||||||

Between 2017 and 2021, there are 583 nutritional & meal replacement drinks that claim "functional - slimming properties", followed by 188 snack/cereal/energy bars, 127 tea, 52 prepared meals, 36 dry soup, 33 cold cereals, 32 pasta, 25 hot cereals, 18 shelf-stable desserts and 18 sweet biscuits/cookies.

| Category | United Kingdom | France | Italy | Spain | Germany | Netherlands | Total sample |

|---|---|---|---|---|---|---|---|

| Nutritional and Meal Replacement Drinks | 183 | 245 | 59 | 52 | 33 | 11 | 583 |

| Snack / Cereal / Energy Bars | 67 | 19 | 30 | 45 | 20 | 7 | 188 |

| Tea | 10 | 17 | 47 | 27 | 15 | 11 | 127 |

| Prepared Meals | 47 | 5 | 0 | 0 | 0 | 0 | 52 |

| Dry Soup | 8 | 16 | 10 | 1 | 0 | 1 | 36 |

| Cold Cereals | 6 | 7 | 7 | 3 | 10 | 0 | 33 |

| Pasta | 7 | 7 | 6 | 9 | 2 | 1 | 32 |

| Hot Cereals | 11 | 7 | 0 | 5 | 0 | 2 | 25 |

| Shelf-Stable Desserts | 1 | 5 | 4 | 7 | 1 | 0 | 18 |

| Sweet Biscuits/Cookies | 2 | 0 | 5 | 4 | 4 | 3 | 18 |

| Total Sample | 447 | 371 | 204 | 190 | 110 | 46 | 1,368 |

| Source: Mintel 2022 | |||||||

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| Nutritional and Meal Replacement Drinks | 75 | 128 | 123 | 116 | 141 | 583 |

| Snack / Cereal / Energy Bars | 39 | 41 | 25 | 59 | 24 | 188 |

| Tea | 33 | 34 | 19 | 14 | 27 | 127 |

| Prepared Meals | 11 | 23 | 4 | 12 | 2 | 52 |

| Dry Soup | 6 | 10 | 8 | 7 | 5 | 36 |

| Cold Cereals | 10 | 16 | 4 | 1 | 2 | 33 |

| Pasta | 8 | 10 | 3 | 8 | 3 | 32 |

| Hot Cereals | 6 | 9 | 0 | 6 | 4 | 25 |

| Shelf-Stable Desserts | 1 | 4 | 5 | 3 | 5 | 18 |

| Sweet Biscuits/Cookies | 3 | 7 | 1 | 4 | 3 | 18 |

| Total Sample | 265 | 370 | 225 | 252 | 256 | 1,368 |

| Source: Mintel 2022 | ||||||

Key functional ingredients

The products positioned primarily as beneficial for metabolic health may contain one or several of the following ingredients, among others.

Prebiotics are 'non‐living' food ingredients that reach the large intestine unaffected by digestion, and 'feed' the good bacteria in our gut helping them to grow and flourish. This fermentation process nourishes the colonies with beneficial bacteria (including probiotic bacteria) and allows for a healthy bacteriological culture in our digestive system.

Probiotics are live beneficial bacteria that are naturally created by the process of fermentation. Probiotics help to maintain healthy levels of good bacteria in the intestines, they support our immune defences, are useful for anyone suffering from the uncomfortable symptoms of bloating, gas or flatulence and may assist in decreasing the duration of diarrhoea in kids. They are naturally found in cultured or fermented foods such as yoghurt, buttermilk, aged cheese, sauerkraut, sourdough bread, miso, tempeh, kombucha (a type of fermented tea) and can also be taken in supplement form.

Sterols contributes to lowering cholesterol levels and is widely used in food products, beverages, pharmaceuticals, cosmetics and as a food supplement in Europe.

Prebiotics and probiotics

Consumers have become increasingly interested in consuming probiotics to boost their gut health, driving interest in probiotic-containing functional beverages. Probiotics and prebiotic have become such a hot industry topic that the combination thereof is appearing in a growing array of products. Growing awareness of health is the prime driver of the market. The growing menace of conditions such as constipation, diarrhea, inflammatory bowel disease and others is the second most important driver of the market. The rise in risk factors such as growing intake of sugar and fat rich junk foods, sedentary lifestyles, and others are indirectly resulting in high demand for the prebiotics.

Prebiotics

Although consumers have embraced the concept of supplementing with healthy bacteria (probiotics), the word "prebiotic" is still largely unknown to consumers, and they often confuse it with probiotic. Prebiotic insiders insist that despite the sharp drop in sales, the category could take off in the next few years as more consumers begin embracing the health benefits of prebiotics.

Example of products

Quick Porridge+ Sleepytime Chamomile & Gentle Ginger

Source: Mintel, 2022

| Company | Troofoods |

|---|---|

| Brand | Troo |

| Category | Breakfast cereals |

| Sub-category | Hot cereals |

| Market | United Kingdom |

| Store type | Internet / mail order |

| Date published | December 2021 |

| Launch type | New variety / range extension |

| Price in local currency | £3.59 |

| Price in US dollars | 4.76 |

| Price in Euros | 4.21 |

Troo Quick Porridge+ Sleepytime Chamomile & Gentle Ginger contains 8 gram fibre and 6 gram chicory inulin prebiotic fibre per bowl, which is two times the fibre of standard porridge, and is said to provide gut healthy goodness, and naturally calming fragrance. The vegan, microwaveable product is low in sugar, is free from gluten, and retails in a 400 gram pack bearing social media references, and preparation instructions. The manufacturer claims to make a pledge right from the start to use eco-friendly packaging, with wood pulp, home compostable inner bag and 100% plant-based, recyclable cardboard.

Blueberry Flavoured Smoothie

Source: Mintel, 2022

| Company | Enervit |

|---|---|

| Brand | Enervit Protein |

| Category | Nutritional drinks and other beverages |

| Sub-category | Nutritional and meal replacement drinks |

| Market | Italy |

| Store name | Esselunga |

| Store type | Supermarket |

| Date published | September 2021 |

| Launch type | New variety / range extension |

| Price in local currency | €19.90 |

| Price in US dollars | 23.47 |

Enervit Protein Smoothie Mirtillo (Blueberry Flavoured Smoothie) is now available. The product is described as a 100% plant-based instant drink, based on soluble fibre and pea and rice proteins which contributes for the maintenance of muscle mass, contains blueberry and acerola vegetable extract, which contributes to the physiological antioxidant function, and contains sweetener. It is rich in protein, from pea and rice; in fibres, with prebiotic function; in vitamin C, with antioxidant function; and is free from added sugars and fats. The product retails in a 520 gram pack providing 13 smoothies and featuring preparation instructions.

Product launch analysis - prebiotics

The prebiotics have a greater association with foods such as baby food, pet food, dairy products, bakery products, weight loss products, etc. Thus a growth of these food segments has a linear growth effect on the market for prebiotics. In this report, there are 166 food and drinks for human consumption and 400 pet food.

According to Mintel's (2022), from 2017 to 2021, a total of 566 products with the claim "prebiotics" were launched in UK, Germany, France, Italy Spain and Netherland. Out of these, 220 were new products, 201 were new variety, 76 were new packaging and 15 were new formation while 54 were relaunched.

| Launch type | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| New Product | 49 | 42 | 46 | 40 | 43 | 220 |

| New Variety / Range Extension | 41 | 32 | 33 | 41 | 54 | 201 |

| New Packaging | 25 | 11 | 8 | 18 | 14 | 76 |

| Relaunch | 13 | 8 | 4 | 16 | 13 | 54 |

| New Formulation | 3 | 3 | 3 | 4 | 2 | 15 |

| Total Sample | 131 | 96 | 94 | 119 | 126 | 566 |

| Source: Mintel 2022 | ||||||

The biggest number of launches from 2017 to 2021 occurred in the UK (293), followed by Spain (93), Germany (60), France (52), Italy (41) and Netherlands (27).

| Market | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| United Kingdom | 56 | 56 | 47 | 70 | 64 | 293 |

| Spain | 23 | 15 | 22 | 17 | 16 | 93 |

| Germany | 22 | 6 | 8 | 12 | 12 | 60 |

| France | 15 | 13 | 9 | 6 | 9 | 52 |

| Italy | 8 | 3 | 4 | 12 | 14 | 41 |

| Netherlands | 7 | 3 | 4 | 2 | 11 | 27 |

| Total Sample | 131 | 96 | 94 | 119 | 126 | 566 |

| Source: Mintel 2022 | ||||||

Between 2017 and 2021, there are 150 dog food dry that claim "prebiotics", followed by 106 cat food dry, 65 dog food wet, 49 cat food wet, 24 cold cereals, 19 dog snacks and treats, 18 snack/cereal/energy bars, 17 cat snacks & treats, 16 nutritional & meal replacement drinks, and 15 baby formula (6-12 months)

| Sub-Category | United Kingdom | Spain | Germany | France | Italy | Netherlands | Total sample |

|---|---|---|---|---|---|---|---|

| Dog Food Dry | 66 | 21 | 25 | 15 | 18 | 5 | 150 |

| Cat Food Dry | 36 | 23 | 13 | 23 | 3 | 8 | 106 |

| Dog Food Wet | 48 | 11 | 4 | 0 | 0 | 2 | 65 |

| Cat Food Wet | 35 | 4 | 5 | 3 | 0 | 2 | 49 |

| Cold Cereals | 19 | 2 | 0 | 0 | 1 | 2 | 24 |

| Dog Snacks and Treats | 13 | 0 | 1 | 4 | 1 | 0 | 19 |

| Snack / Cereal / Energy Bars | 12 | 1 | 5 | 0 | 0 | 0 | 18 |

| Cat Snacks and Treats | 6 | 4 | 2 | 3 | 1 | 1 | 17 |

| Nutritional and Meal Replacement Drinks | 8 | 7 | 0 | 0 | 1 | 0 | 16 |

| Baby Formula (6-12 months) | 5 | 1 | 0 | 0 | 7 | 2 | 15 |

| Total Sample | 293 | 93 | 60 | 52 | 41 | 27 | 566 |

| Source: Mintel 2022 | |||||||

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| Dog Food Dry | 48 | 17 | 25 | 28 | 32 | 150 |

| Cat Food Dry | 29 | 24 | 10 | 23 | 20 | 106 |

| Dog Food Wet | 12 | 12 | 18 | 15 | 8 | 65 |

| Cat Food Wet | 10 | 15 | 7 | 5 | 12 | 49 |

| Cold Cereals | 0 | 1 | 5 | 13 | 5 | 24 |

| Dog Snacks and Treats | 11 | 2 | 2 | 1 | 3 | 19 |

| Snack / Cereal / Energy Bars | 0 | 2 | 2 | 3 | 11 | 18 |

| Cat Snacks and Treats | 5 | 1 | 3 | 6 | 2 | 17 |

| Nutritional and Meal Replacement Drinks | 0 | 1 | 0 | 4 | 11 | 16 |

| Baby Formula (6-12 months) | 6 | 2 | 2 | 3 | 2 | 15 |

| Total Sample | 131 | 96 | 94 | 119 | 126 | 566 |

| Source: Mintel 2022 | ||||||

Probiotics

Consumers are moving beyond digestive health and are beginning to seek probiotics for a variety of other health concerns including oral health and weight control making it one of today's most versatile ingredients for the industries. Consumers are using probiotics to target specific health concerns and are becoming more interested with the number and strain types of the bacteria. With that, companies have the opportunity to differentiate themselves by broadening their probiotic portfolio to appeal to a variety of specific health concerns.

In Europe, consumers have a positive attitude towards probiotic products. The UK dominates the probiotic products market followed by France and Spain, respectively. Europeans are aware of the health benefits of eating live bacteria, and they have also associated lactic acid bacteria with gut health.

Between 2016 and 2021, the fast growth market was the UK, at a CAGR of 3.1%. It is worth noting that France's FF milk formula grew even faster at a CAGR of 4.1% between 2016 and 2021. However France's probiotics by FF yoghurt decreased at a CAGR of −1.5% over the same period. Overall, France's probiotics had a slow growth at a CAGR of 0.2% between 2016 and 2021.

| Market | Category | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2016-2021 |

|---|---|---|---|---|---|---|---|---|

| United Kingdom | Probiotics | 984.4 | 1,005.2 | 1,014.3 | 1,020.5 | 1,117.6 | 1,146.8 | 3.1 |

| Probiotics by Product | 984.4 | 1,005.2 | 1,014.3 | 1,020.5 | 1,117.6 | 1,146.8 | 3.1 | |

| Probiotics by FF Yoghurt | 984.4 | 1,005.2 | 1,014.3 | 1,020.5 | 1,117.6 | 1,146.8 | 3.1 | |

| France | Probiotics | 658.6 | 641.9 | 663.3 | 664.2 | 669.3 | 663.7 | 0.2 |

| Probiotics by Product | 658.6 | 641.9 | 663.3 | 664.2 | 669.3 | 663.7 | 0.2 | |

| Probiotics by FF Yoghurt | 483.0 | 465.9 | 454.8 | 448.7 | 453.6 | 448.8 | −1.5 | |

| Probiotics by FF Milk Formula | 175.6 | 176.0 | 208.5 | 215.5 | 215.7 | 214.9 | 4.1 | |

| Spain | Probiotics | 634.2 | 617.1 | 596.6 | 579.5 | 593.9 | 611.7 | −0.7 |

| Probiotics by Product | 634.2 | 617.1 | 596.6 | 579.5 | 593.9 | 611.7 | −0.7 | |

| Probiotics by FF Yoghurt | 563.2 | 550.2 | 532.8 | 518.2 | 532.7 | 552.1 | −0.4 | |

| Probiotics by FF Milk Formula | 70.2 | 66.0 | 63.0 | 60.5 | 60.3 | 58.8 | −3.5 | |

| Probiotics by FF Powder Milk | 0.8 | 0.8 | 0.8 | 0.8 | 0.8 | 0.8 | 0.0 | |

| Italy | Probiotics | 507.3 | 504.8 | 499.2 | 500.0 | 513.5 | 545.4 | 1.5 |

| Probiotics by Product | 507.3 | 504.8 | 499.2 | 500.0 | 513.5 | 545.4 | 1.5 | |

| Probiotics by FF Yoghurt | 480.6 | 481.0 | 479.4 | 480.4 | 494.2 | 526.9 | 1.9 | |

| Probiotics by FF Milk Formula | 26.8 | 23.7 | 19.8 | 19.6 | 19.3 | 18.5 | −7.1 | |

| Germany | Probiotics | 465.3 | 459.7 | 455.8 | 455.4 | 461.5 | 462.8 | −0.1 |

| Probiotics by Product | 465.3 | 459.7 | 455.8 | 455.4 | 461.5 | 462.8 | −0.1 | |

| Probiotics by FF Yoghurt | 396.2 | 395.0 | 394.3 | 395.2 | 401.8 | 404.3 | 0.4 | |

| Probiotics by FF Milk Formula | 69.2 |

64.7 |

61.5 | 60.2 | 59.7 | 58.5 | −3.3 | |

| Netherlands | Probiotics | 64.6 | 59.8 | 55.2 | 53.4 | 55.0 | 56.4 | −2.7 |

| Probiotics by Product | 64.6 | 59.8 | 55.2 | 53.4 | 55.0 | 56.4 | −2.7 | |

| Probiotics by FF Yoghurt | 63.8 | 59.2 | 54.6 | 52.8 | 54.3 | 55.7 | −2.7 | |

| Probiotics by FF Milk Formula | 0.8 | 0.6 | 0.6 | 0.5 | 0.6 | 0.7 | −2.6 | |

|

Source: Euromonitor International, 2022 *CAGR: Compound annual growth |

||||||||

Example of products

Due to the presence of many international players investing in the probiotics market for product & application portfolio development the market will develop significantly in coming years. However standardized labeling, demand for efficient packaging, and low product shelf life are restraining the probiotics market industry growth.

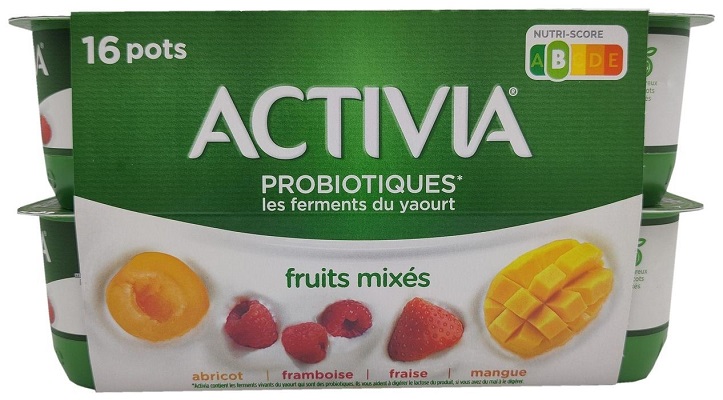

Mixed Fruit Yogurt Assortment with Probiotics

Source: Mintel, 2022

| Company | D.P.F.F. / DPFF |

|---|---|

| Brand | Activia Probiotiques |

| Category | Dairy |

| Sub-category | Spoonable Yogurt |

| Market | France |

| Store type | Internet / mail order |

| Date published | December 2021 |

| Launch type | New product |

| Price in local currency | €5.45 |

| Price in US dollars | 6.17 |

Activia Probitioques Fruits Mixés (Mixed Fruits Yogurt Assortment with Probiotics) is now available. The product comprises a unique blend of five ferments including Bifidus and contains natural yogurt probiotics that help digest lactose. It contains the following varieties: apricot, raspberry, strawberry and mango, and scores a B on the Nutri-Score. It retails in a partly recyclable 2 kilogram pack containing sixteen 125 gram units.

Blueberries, Currants and Pomegranate Flavoured Probiotic Drink

Source: Mintel, 2022

| Company | Coop |

|---|---|

| Brand | Coop Bene.Sì |

| Category | Dairy |

| Sub-category | Drinking yogurt and liquid cultured milk |

| Market | Italy |

| Store type | Mass merchandise / hypermarket |

| Date published | January 2021 |

| Launch type | New variety / range extension |

| Price in local currency | €2.29 |

| Price in US dollars | 2.81 |

Coop Bene.Sì Probiotico al Gusto di Mirtilli, Ribes e Melograno (Blueberries, Currants and Pomegranate Flavoured Probiotic Drink) is now available. The gluten-free product contains a drink made from 100% Italian partially skimmed milk fermented with Streptococcus thermophilus, Lactobacillus bulgaricus and at least 10 billion Lactobacillus paracasei probiotic ferments; and is added with vitamins B6 and D which help the normal functioning of the immune system and contribute to the reduction of tiredness and fatigue. The drinking yogurt contains only natural flavours and retails in a 600 gram pack containing six 100 gram units. The manufacturer states to produce without discrimination or labour exploitation.

Product launch analysis - probiotics

According to Mintel's Global New Products Database (2022), from 2017 to 2021, a total of 276 products claiming (on pack) to contain "probiotic", launched in UK, Germany, France, Italy Spain and Netherland. Out of these, 136 were new products, 72 were new variety, 37 were new packaging and 3 were new formation while 28 were relaunched.

In this report, there are 238 food and drinks for human consumption and 38 pet food

| Launch type | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| New Product | 11 | 26 | 50 | 22 | 27 | 136 |

| New Variety / Range Extension | 4 | 5 | 28 | 15 | 20 | 72 |

| New Packaging | 6 | 8 | 6 | 11 | 6 | 37 |

| Relaunch | 3 | 3 | 9 | 7 | 6 | 28 |

| New Formulation | 0 | 1 | 1 | 1 | 0 | 3 |

| Total Sample | 24 | 43 | 94 | 56 | 59 | 276 |

| Source: Mintel 2022 | ||||||

The biggest number of launches from 2017 to 2021 occurred in the UK (78), followed by Spain (66), Italy (56), France (48), Germany (19) and Netherlands (9).

| Market | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| United Kingdom | 12 | 7 | 26 | 18 | 15 | 78 |

| Spain | 3 | 12 | 23 | 11 | 17 | 66 |

| Italy | 1 | 12 | 22 | 13 | 8 | 56 |

| France | 5 | 5 | 21 | 7 | 10 | 48 |

| Germany | 2 | 5 | 2 | 3 | 7 | 19 |

| Netherlands | 1 | 2 | 0 | 4 | 2 | 9 |

| Total Sample | 24 | 43 | 94 | 56 | 59 | 276 |

| Source: Mintel 2022 | ||||||

Companies in the probiotics market primarily manufacture dairy-based probiotic products such as probiotic yoghurt and probiotic cultured drinks. The dairy-based probiotic products segment in the probiotic F&B market is responsible for the consistent growth of the latter in the overall probiotic products market. New product launches and developments in the probiotics market is the best development strategy adopted by the players to garner a large market share.

Emerging categories in food with probiotics include juice drinks, bakery, chocolate confectionery and savory spreads.

Between 2017 and 2021, there are 53 kombucha & other fermented drinks that claim "probiotic", followed by 42 drinking yogurt & liquid cultured milk, 40 spoonable yogurt, 40 nutritional & meal replacement drinks, 12 dog food dry, 12 pickled condiments, 10 cat food dry, 8 snack/cereal/energy bars, 7 dog snacks & treats and 6 cold cereals.

| Sub-Category | United Kingdom | Spain | Italy | France | Germany | Netherlands | Total sample |

|---|---|---|---|---|---|---|---|

| Kombucha and Other Fermented Drinks | 7 | 25 | 2 | 16 | 0 | 3 | 53 |

| Drinking Yogurt and Liquid Cultured Milk | 4 | 8 | 22 | 3 | 1 | 4 | 42 |

| Spoonable Yogurt | 2 | 13 | 18 | 7 | 0 | 0 | 40 |

| Nutritional and Meal Replacement Drinks | 7 | 10 | 9 | 10 | 4 | 0 | 40 |

| Dog Food Dry | 10 | 0 | 1 | 0 | 1 | 0 | 12 |

| Pickled Condiments | 5 | 0 | 0 | 6 | 1 | 0 | 12 |

| Cat Food Dry | 4 | 1 | 0 | 1 | 4 | 0 | 10 |

| Snack / Cereal / Energy Bars | 7 | 0 | 0 | 0 | 1 | 0 | 8 |

| Dog Snacks and Treats | 6 | 1 | 0 | 0 | 0 | 0 | 7 |

| Cold Cereals | 6 | 0 | 0 | 0 | 0 | 0 | 6 |

| Total Sample | 78 | 66 | 56 | 48 | 19 | 9 | 276 |

| Source: Mintel 2022 | |||||||

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| Kombucha and Other Fermented Drinks | 6 | 13 | 14 | 13 | 7 | 53 |

| Drinking Yogurt and Liquid Cultured Milk | 1 | 5 | 19 | 8 | 9 | 42 |

| Spoonable Yogurt | 1 | 4 | 15 | 12 | 8 | 40 |

| Nutritional and Meal Replacement Drinks | 0 | 6 | 15 | 7 | 12 | 40 |

| Dog Food Dry | 4 | 2 | 2 | 1 | 3 | 12 |

| Pickled Condiments | 0 | 2 | 6 | 2 | 2 | 12 |

| Cat Food Dry | 2 | 3 | 1 | 3 | 1 | 10 |

| Snack / Cereal / Energy Bars | 1 | 0 | 2 | 0 | 5 | 8 |

| Dog Snacks & Treats | 0 | 0 | 2 | 2 | 3 | 7 |

| Cold Cereals | 0 | 0 | 5 | 1 | 0 | 6 |

| Total Sample | 24 | 43 | 94 | 56 | 59 | 276 |

| Source: Mintel 2022 | ||||||

Sterols

Sterols represent a rapidly thriving industry, as the demand for dietary supplements, functional food products, and healthy food ingredients continues to increase predominantly to reduce the level of cholesterol in blood. Also increase in cardiovascular diseases are another reason for growth of the market.

While developed countries have the highest geriatric population profiles, developing economies have a substantially large chunk of the population moving to a geriatric population group. Since age remains a primary factor that fosters the susceptibility of acquiring chronic health conditions, an expanding elderly population is poised to continue the optimistic growth prospects for the sterols market over the forecast period.

Rules and regulations in some countries have led to an increase in the consumption of plant sterol in the last five years. For instance, as a plant sterols have been generally recognized as safe (GRAS) by FDA (Food and Drug Association), its addition in a limited amount in many food applications, such as milk, yoghurt, mayonnaise, vegetable oils, coffee, beverages, butter, chocolates, snacks, etc. in many well-developed and emerging countries, such as Germany, Finland etc.

Example of products

Reduce Cholesterol Light Margarine

Source: Mintel, 2022

| Company | Mercadona |

|---|---|

| Brand | Hacendado |

| Category | Dairy |

| Sub-category | Margarine and other blends |

| Market | Spain |

| Store type | Supermarket |

| Date published | February 2021 |

| Launch type | New packaging |

| Price in local currency | €1.80 |

| Price in US dollars | 2.18 |

Hacendado Reduce Colesterol Margarina Ligera (Reduce Cholesterol Light Margarine) is now available in a newly designed pack. This product contains free plant-sterols, which are said to reduce the blood cholesterol and diminish the risk of coronary heart disease, and retails in a 250 gram pack.

Red Fruits Flavoured Drinking Yogurt

Source: Mintel, 2022

| Company | Danone |

|---|---|

| Brand | Danone Danacol |

| Category | Dairy |

| Sub-category | Drinking yogurt and liquid cultured milk |

| Market | Italy |

| Store type | Supermarket |

| Date published | December 2020 |

| Launch type | New packaging |

| Price in local currency | 2.69 |

| Price in US dollars | 3.22 |

Danone Danacol Latte Fermentato con Preparazione di Frutta (Red Fruits Flavoured Drinking Yogurt) has been repackaged with new graphics. The sweetened product is said to reduce cholesterol thanks to 100% natural plant-based sterols, resulting in 10% less cholesterol from the third week. It is made from fermented milk, is free from gluten, added sugars and preservatives, and retails in a 400 gram pack containing four 100 gram units.

Product launch analysis - sterols

According to Mintel's Global New Products Database (2022), from 2017 to 2021, a total of 116 products claiming (on pack) to contain "sterols", launched in UK, Germany, France, Italy Spain and Netherland. Out of these, 6 were new products, 33 were new variety, and 61 were new packaging while 16 were relaunched.

| Launch type | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| New Packaging | 18 | 17 | 10 | 9 | 7 | 61 |

| New Variety / Range Extension | 10 | 9 | 6 | 3 | 5 | 33 |

| Relaunch | 6 | 3 | 3 | 4 | 0 | 16 |

| New Product | 3 | 2 | 0 | 1 | 0 | 6 |

| Total Sample | 37 | 31 | 19 | 17 | 12 | 116 |

| Source: Mintel 2022 | ||||||

The biggest number of launches from 2017 to 2021 occurred in the UK (66), followed by Italy (19), Spain (19), Netherlands (7), Germany (3) and France (2)

| Market | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| United Kingdom | 25 | 18 | 6 | 9 | 8 | 66 |

| Italy | 4 | 5 | 7 | 2 | 1 | 19 |

| Spain | 6 | 3 | 5 | 2 | 3 | 19 |

| Netherlands | 1 | 3 | 1 | 2 | 0 | 7 |

| Germany | 0 | 1 | 0 | 2 | 0 | 3 |

| France | 1 | 1 | 0 | 0 | 0 | 2 |

| Total Sample | 37 | 31 | 19 | 17 | 12 | 116 |

| Source: Mintel 2022 | ||||||

Between 2017 and 2021, there are 55 drinking yogurt & liquid cultured milk that claim "sterols", followed by 22 margarine & other blends, 10 spoonable yogurt, 9 oils, 5 snack/cereal/energy bars, 4 plant based drinks, 4 white milk, 2 nuts, 1 cold cereal, and 1 malt and other hot beverages.

| Category | United Kingdom | Italy | Spain | Netherlands | Germany | France | Total sample |

|---|---|---|---|---|---|---|---|

| Drinking Yogurt and Liquid Cultured Milk | 27 | 15 | 11 | 2 | 0 | 0 | 55 |

| Margarine and Other Blends | 14 | 0 | 3 | 2 | 2 | 1 | 22 |

| Spoonable Yogurt | 9 | 0 | 1 | 0 | 0 | 0 | 10 |

| Oils | 3 | 2 | 0 | 3 | 1 | 0 | 9 |

| Snack / Cereal / Energy Bars | 4 | 0 | 1 | 0 | 0 | 0 | 5 |

| Plant Based Drinks (Dairy Alternatives) | 4 | 0 | 0 | 0 | 0 | 0 | 4 |

| White Milk | 2 | 0 | 2 | 0 | 0 | 0 | 4 |

| Nuts | 0 | 2 | 0 | 0 | 0 | 0 | 2 |

| Cold Cereals | 1 | 0 | 0 | 0 | 0 | 0 | 1 |

| Malt & Other Hot Beverages | 0 | 0 | 1 | 0 | 0 | 0 | 1 |

| Total Sample | 66 | 19 | 19 | 7 | 3 | 2 | 116 |

| Source: Mintel 2022 | |||||||

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | Total sample |

|---|---|---|---|---|---|---|

| Drinking Yogurt and Liquid Cultured Milk | 23 | 11 | 8 | 8 | 5 | 55 |

| Margarine and Other Blends | 6 | 7 | 3 | 3 | 3 | 22 |

| Spoonable Yogurt | 3 | 3 | 3 | 1 | 0 | 10 |

| Oils | 1 | 3 | 2 | 2 | 1 | 9 |

| Snack / Cereal / Energy Bars | 0 | 3 | 0 | 2 | 0 | 5 |

| Plant Based Drinks (Dairy Alternatives) | 1 | 1 | 1 | 1 | 0 | 4 |

| White Milk | 1 | 1 | 0 | 0 | 2 | 4 |

| Nuts | 1 | 0 | 1 | 0 | 0 | 2 |

| Cold Cereals | 0 | 0 | 1 | 0 | 0 | 1 |

| Malt and Other Hot Beverages | 0 | 1 | 0 | 0 | 0 | 1 |

| Total Sample | 37 | 31 | 19 | 17 | 12 | 116 |

| Source: Mintel 2022 | ||||||

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

Resources

- Euromonitor International, 2022

- Mintel Global New Products Database, 2022

- Mintel: How COVID-19 Impacts Consumer Behaviour in Food & BPC, June 2020

- Euromonitor International, 2018. Health & wellness in Canada

- Euromonitor International, 2018. The world market for health and wellness packaged food

- Mintel, July 2018. Tap into the self-care market with food and drink

- World Health Organization (WHO). Mental Health: A State of Well-Being. 2011. Geneva, WHO

Health and Wellness Series – Metabolic health products and trends in the European Union (including the United Kingdom)

Global Analysis Report

Prepared by: Hongli Wang, Senior Market Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2023).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.