Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

The per capita consumption of beer, wine and spirits in India is relatively low, at just over 2 litres per person in 2022. There are sharp demographic and regional divides: men are much more likely to consume alcohol than women, and Northwestern India has much lower consumption rates than Southern and Northeastern India.

Spirits and beer are the most popular alcoholic beverage categories in India. Wine is comparatively marginal, with an average consumption of 2.6 litres per 100 people in 2022.

Across the board, alcohol on-sales decreased during the pandemic, while off-sales increased. Beer, wine and spirits all experienced positive growth over the 2017 to 2022 period, and these trends were driven entirely by off-sales, with on-sales categorically declining over the same period.

The Indian market is shifting towards premium and craft products, and this is opening up new market opportunities. Domestic craft gin, brandy and rum products are increasingly being launched in the Indian market, catering to consumers looking for premium cocktail ingredients.

Canada has a relatively low amount of bilateral trade with India for beer, wine and spirits. Canada's main export to India is grain alcohol, while spirits and liqueurs form the bulk of Indian exports to Canada. The value of bilateral trade is increasing, with the value of Canadian imports increasing by 20.8% compound annual growth rate (CAGR) from 2018 to 2023 and the value of exports to Canada increasing by 8.1% CAGR over the same period.

Overview

Alcohol sales in India took a significant hit due to the COVID-19 pandemic, but have since recovered to pre-pandemic numbers. The Indian alcohol market is dominated by spirits and beer, while wine is very marginal, but is growing quickly. Apple and pear ciders are not significant in the Indian market.

Consumption of alcoholic beverages was affected by the COVID-19 pandemic, primarily due to reductions in on-trade sales (that is, restaurants, hotels and bars). Off-trade sales were steady during the pandemic, and as such off-sales for beer, wine and spirits all posted positive sales growth from 2017 to 2022. Spirits were the most insulated product category, because spirits are favoured for off-sale consumption relative to wine and beer.

Alcohol use in India is highly dependent on demographic characteristics. Men are much more likely to consume alcohol than women. Alcohol users tend to be older and lower-income. Members of certain religious groups are more likely to consume alcohol than others due to cultural and religious norms.

Climate can drive alcoholic beverage sales: an early, hot summer in 2022 was credited with boosting beer sales, which were 30.5% higher in 2022 than in 2021.

India is a federal country where states have high levels of legal autonomy. India's 36 states and union territories each have their own taxation structures and legal drinking agesFootnote 1. Drinking ages range from as low as 18 years in states such as Goa, Rajasthan and Himchal Pradesh to as high as 25 years in Punjab, Haryana and Maharashtra. In most (25) of India's states and territories, the legal drinking age is 21. States can set their own tax rates. Some have raised taxes and prices in response to higher inflation, while others have been reluctant to do so. Companies rely on their well-developed local distribution networks, and some international companies have divested their businesses to local partners. For example, MolsonCoors has sold its beer business in India to Inbrew.

Tastes are evolving in India. Whiskey is still the dominant spirit category in India, but gin is increasingly popular, and the number of domestic premium Indian gin brands is increasing. Gin is benefitting from the increased popularity of cocktails and mixology, and perceptions have shifted from negative to positive. The coastal state of Goa, which is an important tourist destination, is the hub of India's craft gin industryFootnote 1.

Market characteristics

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| Alcoholic beverages | 5,145.2 | 5,454.6 | 5,779.2 | 4,167.8 | 5,179.2 | 6,211.8 | 3.8 |

| Beer | 2,366.2 | 2,495.7 | 2,689.4 | 1,633.0 | 2,136.9 | 2,789.3 | 3.3 |

| Ready-to-drink (RTDs) | 36.4 | 40.6 | 45.5 | 38.1 | 41.0 | 46.0 | 4.8 |

| Spirits | 2,715.1 | 2,886.8 | 3,008.7 | 2,465.6 | 2,966.7 | 3,338.9 | 4.2 |

| Wine | 27.5 | 31.5 | 35.7 | 31.1 | 34.5 | 37.5 | 6.4 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

|||||||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 | CAGR* % 2023-2027 |

|---|---|---|---|---|---|---|

| Alcoholic beverages | 6,607.9 | 7,025.5 | 7,467.2 | 7,933.0 | 8,422.8 | 6.3 |

| Beer | 2,982.7 | 3,185.7 | 3,399.4 | 3,624.7 | 3,862.5 | 6.7 |

| Ready-to-drink (RTDs) | 51.8 | 58.3 | 65.7 | 74.1 | 83.5 | 12.7 |

| Spirits | 3,531.8 | 3,734.9 | 3,949.9 | 4,175.6 | 4,410.8 | 5.7 |

| Wine | 41.6 | 46.6 | 52.2 | 58.6 | 65.9 | 11.9 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

||||||

Alcoholic beverage sales in India fell significantly during the pandemic, driven by a large drop in beer and spirits sales in 2020. Beer sales did not recover until 2022, while spirits sales recovered by the end of 2021.

Besides cider, which does not have any significant sales in India, wine is the least popular alcoholic beverage in India. Wine grew at a steady pace from 2017 to 2022, with 6.4% CAGR over this period, the highest among all categories. Sales dipped slightly during the pandemic, but have since recovered.

RTDs have the highest forecast growth rate over the 2022 to 2027 period, followed by wine. Beer is forecast to continue its recovery and will thus close the gap with spirits.

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| Off-trade volume | 78.4 | 78.7 | 79.0 | 84.1 | 84.8 | 84.0 | 5.3 |

| On-trade volume | 21.6 | 21.3 | 21.0 | 15.9 | 15.2 | 16.0 | −2.2 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

|||||||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 | CAGR* % 2023-2027 |

|---|---|---|---|---|---|---|

| Off-trade volume | 83.7 | 83.4 | 83.1 | 82.8 | 82.6 | 5.9 |

| On-trade volume | 16.3 | 16.6 | 16.9 | 17.2 | 17.4 | 8.1 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

||||||

On-trade fell during the pandemic, registering an overall decline of −2.2% CAGR from 2017 to 2022. Recovery in 2022 was only partial. The growth of alcohol sales over the 2017 to 2022 period was entirely driven by off-trade volume.

On-trade volume is forecast to grow at a faster rate than off-trade volume through 2027, at 8.1% CAGR for on-trade compared to 5.9% CAGR for off-trade. Nonetheless, on-trade volume will not close the gap with off-trade volume.

In general, alcohol sales in India are low on a per capita basis: beer consumption amounted to just over 2 litres per person in 2022, which is one-tenth the average rate in the Asia-Pacific region. Consumers tend to be younger, with older customers looking to reduce their alcohol intakeFootnote 1. Women in India are much less likely to consume alcohol than men, and consumption varies significantly by religion and region. Balasubramani et al. (2021) ran a country-wide epidemiological survey of India in 2015-2016. The authors found that 29.2% of Indian men consume alcohol, compared to only 1.2% of women. The highest rates of alcohol consumption are found in southern and northeastern India, where just over 40% of men consume alcohol. Northeastern India is also the region where women are most likely to consume alcohol, at 6.9%. In southern India, only 1.8% of women consume alcohol, slightly above the national average. Consumption is lowest in western India, where 17% of men and a mere 0.3% of women consume alcoholFootnote 2.

Alcohol consumption for both men and women is highest among Christians, at 42.8% and 4.8% for men and women, respectively. Due to religious prohibitions, Muslims have the lowest level of alcohol consumption, at 11.3% for men and 0.1% for women. Among the majority Hindu population, 31.6% of men and 1.3% of women consumed alcoholFootnote 2.

Alcohol consumption is decreasing in income and education level for both men and women. There is no significant urban/rural split in terms of alcohol consumption. Tobacco users tend to be more likely to use alcohol, and this is true for both men and womenFootnote 2.

| Company name | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Heineken NV | 0.2 | 0.2 | 0.2 | 0.1 | 22.3 | 24.3 |

| Diageo Plc | 17.9 | 17.2 | 16.4 | 19.2 | 17.2 | 10.6 |

| Pernod Ricard Groupe | 8.0 | 8.8 | 9.1 | 10.4 | 9.8 | 9.0 |

| Anheuser-Busch InBev NV | 9.8 | 9.8 | 9.6 | 8.2 | 8.4 | 8.7 |

| Carlsberg A/S | 7.0 | 7.8 | 7.5 | 6.3 | 6.7 | 7.5 |

| Inbrew Beverages Pvt Ltd | 5.4 | |||||

| Allied Blenders & Distillers Pvt Ltd | 4.5 | 6.0 | 5.0 | 5.4 | 4.8 | 4.5 |

| Radico Khaitan Ltd | 3.1 | 3.2 | 3.3 | 4.2 | 3.8 | 3.6 |

| Mohan Meakin Ltd | 2.6 | 2.6 | 2.7 | 3.3 | 3.2 | 3.0 |

| John Distilleries Pvt Ltd | 2.6 | 2.7 | 2.9 | 3.3 | 2.8 | 2.4 |

| Others | 44.3 | 41.7 | 43.3 | 39.6 | 21.0 | 21.0 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Source: Euromonitor International Limited 2024, all rights reserved | ||||||

| Brand name (company name) | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Kingfisher (Heineken NV)[1] | 19.7 | 20.7 | 21.7 | 18.2 | 19.5 | 21.2 |

| McDowell's (Diageo Plc) | 9.0 | 8.8 | 8.4 | 9.5 | 8.8 | 7.9 |

| Tuborg (Carlsberg A/S) | 6.0 | 6.6 | 6.3 | 5.7 | 6.0 | 6.5 |

| Royal Stag (Pernod Ricard Groupe) | 3.3 | 3.6 | 3.4 | 4.0 | 3.9 | 3.9 |

| Officer's Choice (Allied Blenders & Distillers) | 4.4 | 5.7 | 4.6 | 4.7 | 4.2 | 3.7 |

| Imperial (Pernod Ricard Groupe) | 3.3 | 3.7 | 4.1 | 4.6 | 4.2 | 3.5 |

| Haywards (Anheuser-Busch InBev NV) | 3.8 | 3.7 | 3.5 | 3.2 | 3.3 | 3.4 |

| Knock Out (Anheuser-Busch InBev NV) | 3.9 | 3.9 | 3.9 | 3.3 | 3.3 | 3.4 |

| Budweiser (Anheuser-Busch InBev NV) | 1.5 | 1.8 | 1.9 | 1.6 | 1.7 | 1.8 |

| Original Choice (John Distilleries Pvt Ltd) | 2.0 | 1.9 | 1.9 | 2.2 | 1.8 | 1.6 |

| Others | 43.1 | 39.6 | 40.3 | 43.0 | 43.3 | 43.1 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

|

Source: Euromonitor International Limited 2024, all rights reserved 1: Kingfisher was distributed by UB Group prior to 2021 |

||||||

Heineken became a major player in the Indian market in 2021 through its acquisition of the Kingfisher beer brand. Many of the most popular spirits brands in India are whiskies.

Wine in India

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| Wine | 27.5 | 31.5 | 35.7 | 31.1 | 34.5 | 37.5 | 6.4 |

| Red Wine | 13.5 | 14.8 | 16.1 | 13.7 | 15.0 | 16.1 | 3.5 |

| White Wine | 3.6 | 3.9 | 4.4 | 3.4 | 3.6 | 4.1 | 2.6 |

| Sparkling Wine | 0.9 | 1.0 | 1.2 | 1.0 | 1.1 | 1.2 | 6.7 |

| Fortified Wine & Vermouth | 9.6 | 11.6 | 13.9 | 13.0 | 14.8 | 16.1 | 11.0 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

|||||||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 | CAGR* % 2023-2027 |

|---|---|---|---|---|---|---|

| Wine | 41.6 | 46.6 | 52.2 | 58.6 | 65.9 | 11.9 |

| Red Wine | 17.7 | 19.6 | 21.6 | 23.9 | 26.4 | 10.4 |

| White Wine | 4.5 | 5.1 | 5.7 | 6.4 | 7.1 | 12.0 |

| Sparkling Wine | 1.4 | 1.7 | 2.0 | 2.3 | 2.7 | 16.8 |

| Fortified Wine & Vermouth | 18.0 | 20.2 | 22.9 | 26.1 | 29.7 | 13.0 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

||||||

Wine sales in India are low but increasing, driven primarily by fortified wine and vermouth. Red and white wine sales dipped during the pandemic, but have since recovered to pre-pandemic levels. Red wine is significantly more popular than white wine, and this gap will be maintained through 2027. Rosé wine, saké and non-alcoholic wine are not popular in India.

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| Off-trade volume | 68.9 | 69.4 | 69.7 | 78.5 | 81.7 | 80.7 | 9.8 |

| On-trade volume | 31.1 | 30.6 | 30.3 | 21.5 | 18.3 | 19.3 | −3.3 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

|||||||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Off-trade volume | 80.4 | 80.0 | 79.7 | 79.4 | 79.0 | 11.5 |

| On-trade volume | 19.6 | 20.0 | 20.3 | 20.6 | 21.0 | 13.8 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

||||||

Due to the pandemic, on-trade wine sales dipped by one-third from 2019 to 2020, and continued to fall through 2021. Slight recovery started in 2022, but the gap between off-trade and on-trade volumes will persist through 2027.

| Company name | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Samant Soma Wines Ltd | 31.0 | 33.9 | 34.3 | 34.2 | 33.5 | 34.2 |

| Grover Zampa Pvt Ltd | 9.5 | 8.6 | 8.4 | 7.9 | 7.7 | 7.6 |

| John Distilleries Pvt Ltd | 6.2 | 6.8 | 6.3 | 7.6 | 7.4 | 7.4 |

| Diageo Plc | 5.9 | 5.7 | 5.9 | 6.0 | 06.1 | 6.0 |

| Tonia Liquor Industries GOA | 4.4 | 4.8 | 5.0 | 5.3 | 05.2 | 5.2 |

| Pernod Ricard Groupe | 3.2 | 3.0 | 2.9 | 2.7 | 02.3 | 2.3 |

| Sankalp Winery Pvt Ltd | 2.4 | 2.2 | 2.1 | 2.0 | 01.9 | 1.9 |

| Vinbros & Co Ltd | 1.4 | 1.2 | 1.2 | 1.3 | 01.3 | 1.3 |

| LVMH Moët Hennessy Louis Vuitton SA | 0.7 | 0.7 | 0.7 | 0.5 | 0.4 | 0.5 |

| Heritage Grape Winery Pvt Ltd | 4.0 | |||||

| Others | 31.5 | 33.1 | 33.2 | 32.3 | 34.0 | 33.7 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Source: Euromonitor International Limited 2024, all rights reserved | ||||||

| Brand name (company name) | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Port Wine 1000 (Samant Soma) | 6.9 | 7.2 | 7.2 | 7.7 | 7.8 | 7.8 |

| Grover Vineyards (Grover Zampa) | 9.5 | 8.6 | 8.4 | 7.9 | 7.7 | 7.6 |

| Goanas (John Distilleries) | 6.2 | 6.8 | 6.3 | 7.6 | 7.4 | 7.4 |

| Heritage (Samant Soma)[1] | 4.0 | 4.2 | 4.4 | 4.7 | 4.8 | 4.9 |

| Golconda (Diageo) | 4.4 | 4.3 | 4.5 | 4.8 | 4.9 | 4.8 |

| Vinsura Vineyards (Sankalp Winery) | 2.4 | 2.2 | 2.1 | 2.0 | 1.9 | 1.9 |

| Sula Brut (Samant Soma) | 1.3 | 1.3 | 1.4 | 1.4 | 1.5 | 1.5 |

| Dom Sanchos (Tonia Liquor) | 1.2 | 1.4 | 1.4 | 1.5 | 1.5 | 1.5 |

| Crystal Red Ruby Wine (Tonia Liquor) | 1.1 | 1.2 | 1.2 | 1.3 | 1.3 | 1.3 |

| Globus Fortified Port Wine (Vinbros & Co.) | 1.4 | 1.2 | 1.2 | 1.3 | 1.3 | 1.3 |

| Others | 61.6 | 61.6 | 61.9 | 59.8 | 59.9 | 60.0 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

|

Source: Euromonitor International Limited 2024, all rights reserved 1: Distributed by Heritage Grape Winery in 2017 |

||||||

There were a total of nine wine companies with notable market shares in India in 2022. The most important player, Samant Soma Wines, accounts for 34.2% of total sales by volume. A total of 33.7% of wine shares by volume were outside the top nine in 2022.

In terms of brands, the wine market is relatively more segmented, with brands outside of the top 10 accounting for 60% of sales in 2022 by volume. Samant Soma's company market share is the reason why it accounts for three of the brands in the top 10.

Beer in India

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| Beer (lager) | 2,366.2 | 2,495.7 | 2,689.4 | 1,633.0 | 2,136.9 | 2,789.3 | 3.3 |

| Premium lager | 1,883.2 | 1,985.8 | 2,135.8 | 1,291.6 | 1,710.7 | 2,235.7 | 3.5 |

| Mid-priced lager | 483.1 | 510.0 | 553.6 | 341.4 | 426.2 | 553.6 | 2.8 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

|||||||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Beer (lager) | 2,982.7 | 3,185.7 | 3,399.4 | 3,624.7 | 3,862.5 | 6.7 |

| Premium lager | 2,385.0 | 2,541.6 | 2,706.8 | 2,881.1 | 3,064.8 | 6.5 |

| Mid-priced lager | 597.7 | 644.1 | 692.5 | 743.6 | 797.7 | 7.6 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

||||||

Dark beer, stouts and non-alcoholic beer are not sold in significant quantities in India. Only lagers saw significant sales. Most sales were in the premium market tier. Mid-priced lagers represented about one fifth of the market in 2022. Economy lagers are not sold in India.

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| Off-trade volume | 77.9 | 78.0 | 78.7 | 83.9 | 83.8 | 83.2 | 4.7 |

| On-trade volume | 22.1 | 22.0 | 21.3 | 16.1 | 16.2 | 16.8 | −2.2 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

|||||||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Off-trade volume | 82.9 | 82.6 | 82.3 | 82.0 | 81.6 | 6.3 |

| On-trade volume | 17.1 | 17.4 | 17.7 | 18.0 | 18.4 | 8.7 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

||||||

As is the case for wine and spirits, the pandemic impacted beer sales in restaurants. Off-trade volumes increased by 4.7% CAGR from 2017 to 2022, while on-trade volumes decreased by −2.2% CAGR.

| Company name | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Heineken NV | 0.4 | 0.4 | 0.4 | 0.4 | 54.1 | 54.2 |

| Anheuser-Busch InBev NV | 21.2 | 21.5 | 20.6 | 20.9 | 20.4 | 19.4 |

| Carlsberg A/S | 15.2 | 17.1 | 16.0 | 16.1 | 16.3 | 16.6 |

| Som Distilleries & Breweries Ltd | 2.2 | 2.4 | 2.5 | 2.1 | 2.1 | 3.6 |

| Mohan Meakin Ltd | 3.3 | 3.3 | 3.2 | 4.3 | 3.4 | 2.6 |

| Inbrew Beverages Pvt Ltd | 1.4 | |||||

| B9 Beverages Pvt Ltd | 0.1 | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 |

| Asahi Group Holdings Ltd | 0.3 | 0.3 | 0.2 | |||

| Mount Shivalik Industries Ltd | 2.1 | 1.9 | 1.7 | 1.7 | 1.5 | |

| Molson Coors Brewing Co | 0.2 | 0.2 | 0.2 | 0.2 | 0.1 | |

| Others | 55.3 | 53.0 | 55.1 | 53.7 | 1.5 | 1.7 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Source: Euromonitor International Limited 2024, all rights reserved | ||||||

| Brand name (company name) | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Kingfisher (Heineken NV)[1] | 42.9 | 45.2 | 46.7 | 46.4 | 47.2 | 47.3 |

| Tuborg (Carlsberg A/S) | 13.0 | 14.4 | 13.5 | 14.5 | 14.6 | 14.5 |

| Haywards (Anheuser-Busch) | 8.4 | 8.0 | 7.6 | 8.1 | 8.1 | 7.7 |

| Knock Out (Anheuser-Busch) | 8.5 | 8.5 | 8.5 | 8.5 | 8.1 | 7.5 |

| Budweiser (Anheuser-Busch) | 3.3 | 4.0 | 4.2 | 4.1 | 4.1 | 4.1 |

| UB Export (Heineken NV)[1] | 2.6 | 2.6 | 2.5 | 2.4 | 2.3 | 2.2 |

| Carlsberg (Carlsberg A/S) | 2.1 | 2.7 | 2.5 | 1.6 | 1.7 | 2.1 |

| Power (Som Distilleries & Breweries) | 0.7 | 0.8 | 0.8 | 0.7 | 0.8 | 1.8 |

| Golden Eagle (Mohan Meakin) | 1.9 | 1.8 | 1.8 | 2.4 | 1.9 | 1.5 |

| Thunderbolt (Inbrew Beverages)[2] | 2.1 | 1.9 | 1.7 | 1.7 | 1.5 | 1.3 |

| Others | 42.9 | 42.3 | 42.1 | 43.5 | 43.1 | 43.3 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

|

Source: Euromonitor International Limited 2024, all rights reserved 1: Manufactured by UB Group prior to 2021 2: Manufactured by Mount Shivalik Industries prior to 2022 |

||||||

The Indian beer market is consolidated, but it is not becoming noticeably more consolidated. Rather, Heineken NV acquired UB Group's entire market share when it took majority ownership of UB Group in 2021Footnote 3. As such, Kingfisher is now considered a Heineken brand, as is UB Export. Kingfisher is the most popular beer brand in India, representing 47.3% of the market in 2022.

Spirits in India

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| Spirits | 2,715.1 | 2,886.8 | 3,008.7 | 2,465.6 | 2,966.7 | 3,338.9 | 4.2 |

| Brandy and Cognac | 554.1 | 570.1 | 585.0 | 467.3 | 619.4 | 687.6 | 4.4 |

| Liqueurs | 0.1 | 0.2 | 0.3 | 0.2 | 0.4 | 0.9 | 47.9 |

| Rum | 384.4 | 387.9 | 392.1 | 299.6 | 338.1 | 402.2 | 0.9 |

| Whiskies | 1,680.4 | 1,828.6 | 1,927.3 | 1,613.6 | 1,918.6 | 2,137.2 | 4.9 |

| White Spirits | 96.1 | 100.1 | 104.1 | 84.9 | 90.2 | 111.2 | 3.0 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

|||||||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Spirits | 3,531.8 | 3,734.9 | 3,949.9 | 4,175.6 | 4,410.8 | 5.7 |

| Brandy and Cognac | 717.3 | 747.6 | 778.1 | 809.3 | 840.8 | 4.1 |

| Liqueurs | 1.5 | 2.2 | 3.1 | 4.0 | 4.8 | 41.2 |

| Rum | 436.9 | 472.6 | 509.3 | 546.8 | 584.7 | 7.8 |

| Whiskies | 2,255.4 | 2,381.8 | 2,518.2 | 2,663.7 | 2,818.0 | 5.7 |

| White Spirits | 120.7 | 130.7 | 141.1 | 151.8 | 162.5 | 7.9 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

||||||

Whiskies are the most popular spirits in India, representing 64.0% of the market in 2022. Liqueurs are not particularly popular, but have grown very quickly over the 2017 to 2022 period, with 47.9% CAGR over the period. The forecast is positive, at 41.2% CAGR through 2027. Liqueur sales are expected to reach 4.8 million litres in 2027.

Brandy, rum and white spirits (that is, vodka and gin) are all more popular than wine in India. All three categories were negatively impacted by the pandemic, but sales have since recovered to pre-pandemic levels. Through 2027, rum and white spirits sales are expected to outpace the overall spirits sector, with forecast growth of 7.8% and 7.9% CAGR, respectively.

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| Off-trade volume | 79.0 | 79.4 | 79.6 | 84.3 | 85.5 | 84.7 | 5.7 |

| On-trade volume | 21.0 | 20.6 | 20.4 | 15.7 | 14.5 | 15.3 | −2.2 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

|||||||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Off-trade volume | 84.4 | 84.1 | 83.9 | 83.6 | 83.5 | 5.4 |

| On-trade volume | 15.6 | 15.9 | 16.1 | 16.4 | 16.5 | 7.3 |

|

Source: Euromonitor International Limited 2024, all rights reserved *CAGR: Compound Annual Growth Rate |

||||||

On-trade fell during the pandemic, as was the case for wine and beer. Recovery is expected through 2027, but the gap between off-trade and on-trade will remain substantial.

| Company name | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Diageo Plc | 33.8 | 32.5 | 31.5 | 32.4 | 29.9 | 19.7 |

| Pernod Ricard Groupe | 15.2 | 16.7 | 17.3 | 17.5 | 17.0 | 16.8 |

| Inbrew Beverages Pvt Ltd | 8.9 | |||||

| Allied Blenders & Distillers Pvt Ltd | 8.4 | 11.4 | 9.6 | 9.1 | 8.4 | 8.3 |

| Radico Khaitan Ltd | 5.8 | 6.0 | 6.2 | 7.1 | 6.6 | 6.7 |

| John Distilleries Pvt Ltd | 4.9 | 5.1 | 5.5 | 5.4 | 4.7 | 4.4 |

| Mohan Meakin Ltd | 2.1 | 2.1 | 2.3 | 2.8 | 3.2 | 3.4 |

| Tilaknagar Industries Ltd | 2.0 | 2.1 | 2.0 | 2.4 | 2.4 | 2.8 |

| Jagatjit Industries Ltd | 3.3 | 2.7 | 2.3 | 2.4 | 2.0 | 1.8 |

| Amrut Distilleries Pvt Ltd | 1.2 | 1.2 | 1.2 | 1.1 | 1.0 | 1.1 |

| Others | 23.3 | 20.2 | 22.1 | 19.8 | 24.8 | 26.1 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Source: Euromonitor International Limited 2024, all rights reserved | ||||||

| Brand name (company name) | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| McDowell's (Diageo Plc) | 17.1 | 16.6 | 16.2 | 16.1 | 15.4 | 14.7 |

| Royal Stag (Pernod Ricard Groupe) | 6.2 | 6.7 | 6.6 | 6.8 | 6.8 | 7.3 |

| Officer's Choice (Allied Blenders & Distillers) | 8.4 | 10.8 | 8.8 | 8.0 | 7.3 | 6.9 |

| Imperial (Pernod Ricard Groupe) | 6.3 | 7.1 | 7.9 | 7.8 | 7.3 | 6.5 |

| Haywards (Inbrew Beverages)[1] | 2.8 | 2.9 | 2.9 | 3.5 | 3.6 | 3.0 |

| Original Choice (John Distilleries Pvt) | 3.7 | 3.5 | 3.6 | 3.7 | 3.2 | 3.0 |

| Old Monk (Mohan Meakin) | 1.1 | 1.2 | 1.4 | 1.9 | 2.4 | 2.7 |

| Blenders Pride (Pernod Ricard Groupe) | 2.1 | 2.3 | 2.3 | 2.4 | 2.4 | 2.5 |

| 8PM (Radico Khaitan) | 2.4 | 2.4 | 2.6 | 3.1 | 2.7 | 2.3 |

| Mansion House (Tilaknagar Industries) |

1.4 |

1.5 | 1.4 | 1.6 | 1.7 | 2.0 |

| Others | 48.5 | 45.0 | 46.3 | 45.1 | 47.2 | 49.1 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

|

Source: Euromonitor International Limited 2024, all rights reserved 1: Distributed by Diageo prior to 2022. |

||||||

Seven of the ten most popular spirits brands in India are whiskies. Most are Indian whiskies and the remainder are Scotches. Old Monk is a domestic rum brand, while Mansion House is a domestic French-style brandy. McDowell's, the most popular spirits brand in India overall, is used to market whiskey, brandy and rum.

Analysis of imports and exports

India is a net importer of spirits, with a trade deficit of CAD$ 1.1 billion in 2023. Imports have grown faster than exports, with 15.7% CAGR for imports from 2018 to 2023 and 4.4% CAGR for exports over the same period. India's leading imports are spirits and liqueurs, wine and grain alcohol. India's leading exports are spirits and liqueurs, grain alcohol and beer.

Canada has a trade surplus with India for beer, wine and spirits, although the total amount of bilateral trade between the two countries is very small, being worth less than CAD$ 2 million in 2023. India's principal import from Canada is grain alcohol, which accounted for 92.7% of the total value of imports from Canada. Spirits and liquor were India's main export to Canada, accounting for 82.8% of the total value of exports in 2023. The remainder of exports in 2023 were beer.

| HS-04 Code | Description | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2018-2023 |

|---|---|---|---|---|---|---|---|---|

| Total | 809,386.3 | 929,683.0 | 725,360.1 | 802,966.6 | 1,076,229.2 | 1,679,758.8 | 15.7 | |

| 2203 | Beer | 16,363.6 | 15,209.6 | 7,873.4 | 6,469.8 | 8,266.8 | 15,488.0 | −1.1 |

| 2204 | Wine | 35,378.7 | 28,776.3 | 17,635.3 | 29,484.3 | 43,393.4 | 587,556.7 | 75.4 |

| 2205 | Vermouth/fortified wine | 169.7 | 86.2 | 111.4 | 231.3 | 624.9 | 201.7 | 3.5 |

| 2206 | Cider, mead, saké | 39.6 | 65.4 | 101.1 | 80.4 | 251.7 | 394.1 | 58.3 |

| 2207 | Grain alcohol | 347,022.5 | 420,249.6 | 412,125.5 | 396,461.6 | 312,076.3 | 305,039.8 | −2.6 |

| 2208 | Spirits and liqueurs | 410,412.2 | 465,295.9 | 287,513.4 | 370,239.2 | 711,616.2 | 771,078.5 | 13.4 |

|

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate Note: all import and export numbers are as reported by European Union countries |

||||||||

| HS-04 Code | Description | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2018-2023 |

|---|---|---|---|---|---|---|---|---|

| Total | 396.3 | 259.9 | 496.8 | 495.1 | 579.2 | 1,017.9 | 20.8 | |

| 2203 | Beer | |||||||

| 2204 | Wine | 0.1 | ||||||

| 2205 | Vermouth/fortified wine | |||||||

| 2206 | Cider, mead, saké | |||||||

| 2207 | Grain alcohol | 375.0 | 259.9 | 494.8 | 357.4 | 460.0 | 944.0 | 20.3 |

| 2208 | Spirits and liqueurs | 21.2 | 2.0 | 137.7 | 119.2 | 73.8 | 28.4 | |

|

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate Note: all import and export numbers are as reported by European Union countries |

||||||||

| HS-04 Code | Description | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2018-2023 |

|---|---|---|---|---|---|---|---|---|

| Total | 402,391.0 | 331,341.4 | 412,907.0 | 359,875.5 | 428,727.9 | 498,799.1 | 4.4 | |

| 2203 | Beer | 54,599.7 | 52,901.4 | 37,187.5 | 50,478.6 | 58,139.9 | 48,513.8 | −2.3 |

| 2204 | Wine | 11,539.8 | 11,357.9 | 6,383.5 | 5,389.1 | 6,716.3 | 4,044.6 | −18.9 |

| 2205 | Vermouth/fortified wine | 8.2 | 12.4 | 73.9 | 7.7 | 27.2 | 35.1 | |

| 2206 | Cider, mead, saké | 57.9 | 7.1 | 17.1 | 37.8 | 17.8 | 122.2 | 16.1 |

| 2207 | Grain alcohol | 117,114.1 | 49,451.7 | 144,115.6 | 82,708.8 | 128,512.1 | 157,241.7 | 6.1 |

| 2208 | Spirits and liqueurs | 219,079.5 | 217,615.2 | 225,190.7 | 221,187.3 | 235,334.3 | 288,849.7 | 5.7 |

|

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate Note: all import and export numbers are as reported by European Union countries |

||||||||

| HS-04 Code | Description | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2018-2023 |

|---|---|---|---|---|---|---|---|---|

| Total | 494.6 | 254.3 | 183.4 | 309.6 | 626.3 | 730.1 | 8.1 | |

| 2203 | Beer | 39.5 | 27.6 | 14.2 | 13.2 | 45.3 | 125.5 | 26.0 |

| 2204 | Wine | 32.8 | −100 | |||||

| 2205 | Vermouth/fortified wine | |||||||

| 2206 | Cider, mead, saké | |||||||

| 2207 | Grain alcohol | |||||||

| 2208 | Spirits and liqueurs | 422.3 | 226.7 | 169.2 | 296.4 | 580.9 | 604.6 | 7.4 |

|

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate Note: all import and export numbers are as reported by European Union countries |

||||||||

New product launches

According to data from the Mintel Global New Products Database, 783 new or repackaged alcoholic beverage products were launched in India from 2019 to 2023. Whiskey launches accounted for 34.2% of launches over this period, and beer accounted for 23.9% of the total.

Many of the new alcoholic bevegrage products launched in India over the last five years could be classified as high-end: a quarter (27.3%) of all products launched in 2023 were priced as US $24.80 or more. Most (53.2%) of the launches in 2023 were for new products. There were only two relaunches in 2023, and no new formulations.

| Product attributes | Yearly launch count | ||||

|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Yearly product launches | 147 | 124 | 122 | 155 | 235 |

| Top ten categories | |||||

| Whisky | 51 | 53 | 41 | 60 | 63 |

| Beer | 46 | 44 | 38 | 36 | 23 |

| Flavoured Alcoholic Beverages | 8 | 4 | 2 | 16 | 36 |

| Vodka | 11 | 10 | 15 | 13 | 12 |

| Gin | 3 | 1 | 4 | 3 | 47 |

| Brandy | 9 | 10 | 11 | 8 | 4 |

| Dark Rum | 6 | 0 | 5 | 4 | 11 |

| Liqueur | 7 | 0 | 1 | 4 | 13 |

| Fortified & Other Wines | 3 | 0 | 3 | 1 | 8 |

| White Rum | 2 | 1 | 2 | 6 | 4 |

| Top five claims | |||||

| Vegetarian | 45 | 40 | 35 | 27 | 47 |

| Premium | 49 | 37 | 37 | 30 | 36 |

| Environmentally Friendly Package | 16 | 10 | 6 | 18 | 24 |

| Ethical - Recycling | 16 | 10 | 6 | 13 | 23 |

| Limited Edition | 14 | 9 | 9 | 13 | 13 |

| Launches by price group (US dollars) | |||||

| 0.80 - 8.79 | 84 | 61 | 52 | 70 | 83 |

| 8.80 - 16.79 | 21 | 37 | 28 | 31 | 27 |

| 16.80 - 24.79 | 18 | 16 | 26 | 20 | 60 |

| 24.80 - 32.79 | 15 | 5 | 10 | 18 | 28 |

| 32.80 - 43.00 | 9 | 5 | 6 | 16 | 36 |

| Launches by launch type | |||||

| New Product | 59 | 36 | 51 | 62 | 125 |

| New Packaging | 67 | 65 | 50 | 60 | 49 |

| New Variety/Range Extension | 20 | 21 | 17 | 29 | 59 |

| Relaunch | 1 | 2 | 3 | 4 | 2 |

| New Formulation | 0 | 0 | 1 | 0 | 0 |

| Top five companies | |||||

| United Spirits | 8 | 17 | 8 | 12 | 10 |

| B9 Beverages | 3 | 1 | 3 | 13 | 13 |

| Bacardi | 5 | 6 | 1 | 10 | 11 |

| Pernod Ricard | 3 | 9 | 4 | 2 | 8 |

| Anheuser-Busch Inbev | 4 | 6 | 0 | 2 | 6 |

| Source: Mintel Global New Products Database, 2024, all rights reserved | |||||

Vegetarian claims were extremely common. This is a feature of Indian food product packaging standards, where a vegetarian green dot will be automatically added to conformant products.

Examples of new product launches

Japanese Whiskey

| Company | Indospirit Beverages |

|---|---|

| Brand | Enso |

| Sub-category | Whisky |

| Location of manufacture | Japan |

| Store name | Bottom's UP |

| Store type | Department store |

| Store address | Old Goa 403402 |

| Date published | February 2024 |

| Launch type | New product |

| Price in US dollars | 38.49 |

Enso Japanese Whiskey is now available, and retails in a 750 millilitre pack. Distilled and matured in Japan's Koshu mountain distillery. Logos and certifications: FSSAI

Rum

| Company | Piccadily Agro Industries |

|---|---|

| Brand | Camikara |

| Sub-category | Dark rum |

| Import status | Not imported |

| Store name | D.G Mart |

| Store type | Department store |

| Store address | Old Goa 403402 |

| Date published | January 2024 |

| Launch type | New product |

| Price in US dollars | 21.72 |

Camikara Rum is now available, and retails in a 750 millilitre bottle. Cask aged three years. First Indian pure cane juice rum. Logos and certifications: FSSAI

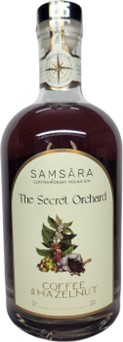

Coffee & Hazelnut Contemporary Indian Gin

| Company | Naveen Distillery |

|---|---|

| Brand | Samsara The Secret Orchard |

| Category | Alcoholic Beverages |

| Sub-category | Gin |

| Market | India |

| Store name | Bottom's UP |

| Store type | Department store |

| Store address | Old Goa 403402 |

| Date published | December 2023 |

| Launch type | New variety / range extension |

| Price in US dollars | 24.02 |

Samsara The Secret Orchard Coffee & Hazelnut Contemporary Indian Gin is now available, and retails in a 750 millilitre bottle. Logos and certifications: FSSAI, Vegetarian green dot

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

Resources

- Euromonitor International, Passport statistics, 2024

- Global Trade Tracker, 2024

- Mintel Global New Products Database, 2024

- Euromonitor International, Alcoholic Drinks in India – Analysis, October 2023

- Sahu, Ram Prasad and Dev Chatterjee. Heineken buys Mallya's 15% stake to take control of United Breweries. June 24, 2021. Business Standard, Mumbai.

- Balasubramani, Karuppusamy and Winnie Paulson, Savitha Chellappan, Ramakrishnan Ramachandran, Sujit Kumar Behera and Praveen Balabaskaran Nina. Epidemiology, Hot Spots, and Sociodemographic Risk Factors of Alcohol Consumption in Indian Men and Women: Analysis of National Family Health Survey-4 (2015-16), a Nationally Representative Cross-Sectional Study. August 27, 2021. Frointiers in Public Health.

Sector Trend Analysis – Beer, wine and spirits in India

Global Analysis Report

Prepared by: Alexandre Holm Perrault, Market Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2024).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.