Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

In 2021, Japan imported a total value of US$1.0 billion (267,200 metric tonnes) from the world in cocoa and cocoa preparations. Top import markets were Malaysia at a value market share of 15.9%, followed by Singapore (15.6%), and Ghana (10.3%). Leading imported ingredients from Japan were chocolate and other cocoa preparations in blocks, slabs or bars (excluding cocoa powder and filled) at a combined total of US$482.1 million, followed by cocoa beans (whole or broken, raw or roasted) at US$118 million, and cocoa butter, fat and oil (US$116.4 million).

Canada was Japan's 24th largest import market at a value of US$4.5 million in 2021. Over the last 5-years (2017-2021), Japan reports importing only various Canadian cocoa and cocoa preparation types in blocks, slabs or bars. During this time period, trade between Canada decreased by a compound annual growth rate (CAGR) of −2.4%, while Japan's imports from the world registered a CAGR of 0.5%.

In 2021, Japan registered total retail sales of US$6.9 billion among chocolate confectionery (74%) or chocolate coated biscuit snack (26%) food products. Chocolate pouches and bags was the most dynamic category since 2020 with a value growth of 1.5%, followed by chocolate tablets (+0.2%), whereby all other chocolate confectionery categories registered declines. Chocolate confectionery in general has experienced a shift to larger or multi-pack economy sizes in wake of the pandemic, while single portion and smaller pack sales declined - most popular with office workers.

The average unit price of chocolate confectionery in Japan was set to decline by 4% in current value terms in 2021. Top companies included the Meiji Holdings Company, the Lotte Group and Pladis Ltd. Popular brands from these manufacturers were Meiji, Ghana, Godiva and Kit Kat (Nestlé SA).

In 2021, store-based modern/traditional grocery retailers represented the largest distribution value share at a total of 40.7%, followed closely by mixed retailers (40.1%), non-grocery specialty stores (9.8%), and non-store retailers (9.4%) - such as e-commerce (6.6%) & homeshopping sales (2.7%).

Trade of cocoa and cocoa preparations

In 2021, Japan imported from the world a total value of US$1.0 billion (267,200 metric tonnes) of cocoa and cocoa preparations (including cocoa beans, cocoa butter, fat and oil, unsweetened or sweetened cocoa powder, cocoa pastes, cocoa shells/husks/skins and other waste, and Chocolate and other preparations). The largest import markets for cocoa products were Malaysia (US$163.7 million), Singapore (US$160.7 million), and Ghana (US$105.8 million). Canada was Japan's 24th largest import market at a value of US$4.5 million in 2021.

| Import description | Volume (Metric tonnes) | Value (US$ millions) | Top import markets and value share % | ||

|---|---|---|---|---|---|

| 1 | 2 | 3 | |||

| Total - global imports (Chapter 18) | 267,200 | 1,032.3 | Malaysia: 15.9 | Singapore: 15.6 | Ghana: 10.3 |

| 180620 - Chocolate and other cocoa food preparations, in blocks, slabs or bars weighing > 2 kilograms or in liquid, paste, powder, granular or other bulk form, in packings of a content > 2 kilograms (excluding cocoa powder) | 112,196 | 274.7 | Singapore: 50.9 | Australia: 9.3 | Belgium: 9.2 |

| 180632 - Chocolate and other cocoa preparations, in blocks, slabs or bars of <= 2 kilograms (excluding filled) | 16,993 | 207.4 | Italy: 34.6 | Belgium: 20.9 | France: 9.8 |

| 180100 - Cocoa beans, whole or broken, raw or roasted | 37,820 | 118.0 | Ghana: 73.0 | Ecuador: 11.0 | Venezuela: 6.8 |

| 180400 - Cocoa butter, fat and oil | 23,843 | 116.4 | Malaysia: 62.9 | Indonesia: 21.5 | Singapore: 6.2 |

| 180690 - Chocolate and other cocoa preparations, in packings <= 2 kilograms (excluding in blocks, slabs or bars and cocoa powder) | 10,923 | 90.2 | United States: 21.6 | France: 16.2 | Belgium: 14.6 |

| 180631 - Chocolate and other cocoa preparations, in blocks, slabs or bars of <= 2 kilograms, filled | 9,541 | 74.2 | Belgium: 17.6 | China: 13.3 | France: 10.3 |

| 180500 - Cocoa powder, unsweetened | 20,885 | 72.7 | Malaysia: 41.1 | Netherlands: 40.6 | Singapore: 5.4 |

| 180310 - Cocoa paste (excluding defatted) | 14,624 | 58.3 | Netherlands: 54.5 | Malaysia: 9.4 | France: 8.6 |

| 180610 - Cocoa powder, sweetened | 20,375 | 20.3 | Malaysia: 38.9 | Ghana: 27.5 | Ecuador: 10.4 |

| 180320 - Cocoa paste, wholly or partly defatted | 0 | 0.07 | France: 100.0 | ||

| 180200 - Cocoa shells, husks, skins and other cocoa waste | 0 | 0.003 | Mexico: 100.0 | ||

|

Source: Global Trade Tracker, 2022 |

|||||

In 2021, Canada supplied to Japan a total value of Can$3.6 million (480.9.9 thousand tonnes) in cocoa and cocoa preparations, which represents a compound annual growth rate (CAGR) decline of −9.0% over the last 5 years (2017-2021) - equivalent to a decline of −24.5% over 2020. Top Canadian imports from Japan were chocolate & cocoa preparations in packages <=2 kilograms (excluding in blocks, slabs or bars and cocoa powder) at Can$2.7 million (HS:180690), followed by chocolate & cocoa preparations in blocks, slabs or bars weighing >2 kilograms (in liquid, paste, powder or other bulk format) at Can$842.8 million (HS:180620), and similar cocoa preparations in blocks, slabs, bars <= 2 kilograms (excluding filled) at a total of Can$77.8 million (HS:180632) in 2021.

| Export description | 2017 | 2018 | 2019 | 2020 | 2021 | *CAGR % 2017-2021 |

|---|---|---|---|---|---|---|

| Total - exports to Japan | 5,266.4 | 3,697.3 | 5,317.8 | 4,787.6 | 3,613.8 | −9.0 |

| 180690 - Chocolate and other cocoa preparations, in packings <= 2 kilograms (excluding in blocks, slabs or bars and cocoa powder) | 5,009.2 | 3,488.9 | 4,742.0 | 3,716.6 | 2,668.2 | −9.0 |

| 180620 - Chocolate and other cocoa food preparations, in blocks, slabs or bars weighing > 2 kilograms or in liquid, paste, powder, granular or other bulk form, in packings of a content > 2 kilograms (excluding cocoa powder) | 58.4 | 38.7 | 4.5 | 781,435 | 842.8 | −14.6 |

| 180632 - Chocolate and other cocoa preparations, in blocks, slabs or bars of <= 2 kilograms (excluding filled) | 26.5 | 1.8 | 505.5 | 289.6 | 77.8 | 94.9 |

| 180631 - Chocolate and other cocoa preparations, in blocks, slabs or bars of <= 2 kilograms, filled | 172.3 | 162.1 | 65.8 | 0.0 | 25.0 | 30.8 |

| 180610 - Cocoa powder, sweetened | 0.0 | 5.8 | 0.0 | 0.0 | 0.0 | −38.3 |

| Source: Global Trade Tracker, 2022 | ||||||

Retail sales of chocolate confectionery and snack products

In 2021, Japan registered total retail sales of US$6.9 billion in the chocolate or chocolate snack sector, which included almost 74% from the chocolate confectionery category and 26% among chocolate coated biscuit food products. The chocolate confectionery category declined by −6.9% in current value terms and by −3.1% in retail volume terms over last year, to reach US$5.1 billion (158.8 thousand tonnes) in 2021. While chocolate coated biscuits declined by −4.5% in current value terms and by −2.2% in retail volume terms over the same period, to reach US$1.8 billion (79.7 thousand tonnes) in 2021. During this period, chocolate pouches and bags was the most dynamic category with a value growth of 1.5%, followed by chocolate tablets (+0.2%). All other chocolate confectionery categories registered declines over the 2021/2020 period with boxed assortment (−20.4%) and seasonal chocolate (−12.8%) experiencing the largest declines in value terms. Over the forecast period (2022-2026), chocolate confectionery (incl. chocolate coated biscuits) is projected to see a CAGR of 2%, to reach US$7.5 billion in 2026.

In Japan, chocolate confectionery in general has experienced a shift to larger pack or multi-pack economy sizes in wake of the pandemic. In 2020, single portion and smaller packs most popular with office workers saw a larger decline in sales due to the decline in impulse purchases, as people switched to home working arrangements and spent less time outside. In response to the shift towards larger pack sizes manufacturers are focusing on adding value to their ranges in order to maintain their profit margins. Albeit, the average unit price of chocolate confectionery is set to decline by 4% in 2021.Footnote 1

Another challenge in chocolate confectionery since COVID-19 has been the declining demand for gifting. With St Valentine's Day traditionally being an important part of Japan's culture the decline in gifting on this day hurt sales in this category in 2021. Since the impact of COVID-19 was not felt until after this highly marketed day in 2020, the sale of boxed assortments in Japan centred on the month of February benefitted from the strong demand seen around this seasonal event. However, gifting chocolate sales in 2021 (also popular during other seasonal events) did significantly impact the boxed assortments category due to increased home seclusion and fewer in-person communications.Footnote 1

| Category | 2017 | 2021 | CAGR* (%) 2017-2021 | 2022 | 2026 | CAGR* (%) 2022-2026 |

|---|---|---|---|---|---|---|

| Chocolate confectionery | 5,700.5 | 5,114.6 | −2.7 | 5,222.0 | 5,681.3 | 2.1 |

| Chocolate pouches and bags | 1,757.1 | 1,605.8 | −2.2 | 1,636.5 | 1,760.1 | 1.8 |

| Tablets | 1,182.8 | 1,157.1 | −0.5 | 1,179.4 | 1,277.8 | 2.0 |

| Boxed assortments | 1,388.4 | 1,092.4 | −5.8 | 1,137.8 | 1,322.6 | 3.8 |

| Seasonal chocolate | 930.2 | 832.1 | −2.7 | 844.0 | 898.5 | 1.6 |

| Countlines | 337.9 | 311.8 | −2.0 | 308.3 | 300.9 | −0.6 |

| Chocolate with toys | 83.7 | 94.9 | 3.2 | 95.6 | 100.1 | 1.2 |

| Other chocolate confectionery | 20.3 | 20.4 | 0.1 | 20.5 | 21.4 | 1.1 |

| Chocolate coated biscuits | 1,734.2 | 1,806.4 | 1.0 | 1,791.8 | 1,790.6 | −0.02 |

| Total - chocolate confectionery and chocolate coated biscuits | 7,434.7 | 6,921.0 | −1.8 | 7,013.8 | 7,471.9 | 1.6 |

|

Source: Euromonitor Intelligence, 2022 *CAGR: Compound Annual Growth Rate |

||||||

| Category | 2017 | 2021 | CAGR* (%) 2017-2021 | 2022 | 2026 | CAGR* (%) 2022-2026 |

|---|---|---|---|---|---|---|

| Chocolate confectionery | 171.3 | 158.8 | −1.9 | 160.7 | 166.3 | 0.9 |

| Chocolate pouches and bags | 63.9 | 59.2 | −1.9 | 59.9 | 61.7 | 0.7 |

| Tablets | 51.5 | 50.1 | −0.7 | 50.5 | 52.0 | 0.7 |

| Seasonal chocolate | 23.8 | 21.4 | −2.6 | 21.8 | 22.9 | 1.2 |

| Countlines | 13.7 | 12.9 | −1.5 | 12.9 | 13.1 | 0.4 |

| Boxed assortments | 16.0 | 12.7 | −5.6 | 13.0 | 14.1 | 2.1 |

| Chocolate with toys | 1.1 | 1.2 | 2.2 | 1.2 | 1.2 | 0.0 |

| Other chocolate confectionery | 1.3 | 1.3 | 0.0 | 1.3 | 1.3 | 0.0 |

| Chocolate coated biscuits | 72.0 | 79.7 | 2.6 | 80.4 | 82.7 | 0.7 |

| Total - chocolate confectionery and chocolate coated biscuits | 414.6 | 397.3 | −1.1 | 401.7 | 415.3 | 0.8 |

|

Source: Euromonitor Intelligence, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Competitive landscape

In 2021, leading retail companies (and top brands) in the chocolate confectionery category in Japan included the Meiji Holdings Company (Meiji, Chocolate Kouka, Galbo) at 10% value share, the Lotte Group (Ghana, Mary's, Crunky) at 9%, and Pladis Ltd. (Godiva) at 5%. Private label chocolate food products with it's great value for money held a 3% market value share.

Leading companies (and top brands) in the chocolate coated biscuits category in Japan included Ezaki Glico Co. Ltd. (Pocky, Friend Bakery) at 29% value share, the Meiji Holdings Company (Takenoko No Sato, Kinoko No Yama, Fran) at 19%, and the Bourbon Corporation (Alfort) at 6.5% in 2021.

In 2020, Meiiji's chocolate brand (Galbo) suffered from a drop in sales within its most popular small packaging products due to home seclusion, as the brand's products are commonly consumed away from the home. Meanwhile, the company enjoyed stronger growth for its products which come in large packs such as some of its tablets and chocolate pouches and bags. Meiji continues to promote the preventative health benefits of cacao in its products that focuses on its prebiotic attributes and more on its low sugar content that uses oligofructose to give it sweetness, called Oligo Smart.

Lotte continues to offer various chocolate products that delivers a premium image for its Ghana brand, as well as expanding its customer base for its Rummy & Bacchus brands that contain alcohol in 2021. Lotte's, Mary brand in Japan is also a leader with its affordable premium price positioning that's been around over 70 years. Lotte likes to create premium versions of its existing brands, along with innovating in terms of creating healthier brands with probiotic and prebiotic attributes with a revised price reduction that appeals to a wider consumer base with its concept of being both a dessert and a supplement with medicinal benefits.Footnote 1

| Category | Company | Brand(s) | Market share (%) |

|---|---|---|---|

| Chocolate confectionery | Meiji Holdings Co. Ltd. | Meiji, Chocolate Kouka, Galbo | 10.0 |

| Lotte Group | Ghana, Mary's, Crunky, Lotte, Zero | 9.0 | |

| Pladis Ltd. | Godiva | 4.6 | |

| Nestlé SA | Kit Kat, Crunch | 3.6 | |

| Fuyiya Co. Ltd. | Look, Fujiya | 3.5 | |

| Private labels | Private label | 2.6 | |

| Others | Others | 54.3 | |

| Total market share - top five companies | 30.7 | ||

| Chocolate coated biscuits | Ezaki Glico Co. Ltd. | Pocky, Friend Bakery | 29.3 |

| Meiji Holdings Co. Ltd. | Takenoko No Sato, Kinoko No Yama, Fran | 19.1 | |

| Bourbon Corp. | Alfort | 6.5 | |

| Ito Biscuits Co. Ltd. | Mr Ito | 0.8 | |

| Pladis Ltd. | McVitie's | 0.4 | |

| Others | Others | 43.7 | |

| Total market share - top five companies | 100.0 | ||

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

Retail distribution channels of chocolate confectionery sector (off-trade)

In 2021, store-based grocery retailers represented the largest distribution value share at a total of 40.7%, followed by mixed retailers (40.1%), non-grocery specialty stores (9.8%), and non-store retailers such as e-commerce and homeshopping sales (9.4%). In Japan, there were little notable shifts in value market growth amongst all distribution channels over the year, as a result of the pandemic. The largest percentage point changes were from within the supermarkets and e-commerce retailing outlets (+0.5 p.p) in 2021.

| Outlet type | Market share % in 2021 |

|---|---|

| Store-based retailing - grand total: | 90.6 |

| Total - grocery retailers | 40.7 |

| Sub-total - modern grocery retailers | 33.2 |

| Supermarkets | 19.4 |

| Convenience stores | 13.8 |

| Sub-total - traditional grocery retailers | 7.5 |

| Food/drink/tobacco specialists | 3.8 |

| Independent small grocers | 1.0 |

| Other traditional grocery retailers | 2.7 |

| Total - non-grocery health and beauty specialist retailers | 9.8 |

| Total - mixed retailers | 40.1 |

| Non-store retailing - grand total: | 9.4 |

| E-commerce | 6.7 |

| Homeshopping | 2.7 |

| Total - distribution channels | 100.0 |

| Source: Euromonitor International, 2022 | |

Product launch and trend analysis

Global trends in chocolate brands include the improvement of their ethical certification credentials, ensuring sustainable cocoa production made with ethical qualities and commitment to people and the environment ie; illegal deforestation, decreased child labour (Tony's Chocolonely % slave-free chocolate), helping small farmers (fairtrade) etc.Footnote 2

Europe, Russia and Turkey are forecast to record the strongest value growth. European consumers want to see innovation in chocolate brands that are more exciting and take a bold approach to introducing new flavours. Quality taste (78% in UK) is the key driver to satisfy chocolate indulgence with hazelnut remaining as the most popular flavour and aromatic citrus oil flavours like orange chocolate are seeing an increase in launch activity. Brands continue to explore alcohol-flavoured chocolates, especially with gin and tonic or craft beer flavourings.Footnote 2

In the Asia-Pacific (APAC) region, Australia has the highest per capita consumption of chocolate and growth in low-consumption markets are expected in Vietnam and Indonesia. Chinese and Asian consumers enjoy unconventional, rich-textured, sensual, gooey chocolate flavours to treat themselves that offer a unique/memorable experience in taste and smell (ie; Philippines - Risa Bacon Chili Chocolate with applewood bacon, Japan - Fujiya Loo Muscat flavoured Blue Jewel Chocolate coloured with butterfly pea powder etc).Footnote 2

In Japan over the years, Nestlé combined matcha green tea with nuts and berries for a luxury KitKat chocolate product with a slightly different form and an unusual flavor and an innovative textural experience (October 2017).Footnote 3 The Bourbon company, also has introduced new innovative chocolate products like a thin slice of chocolate ganache that can be versatile in other recipes for a quick and easy snack - used as a spread on toast or dessert, as brioche or in pastry applications etc.Footnote 4

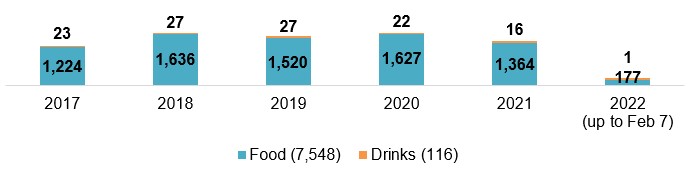

Mintel indicated that there were 7,664 chocolate food (98.5%) and drink (1.5%) products launched (including new variety/range extension, packaging, formulation or relaunched) in Japan between the period of January 2017 and February 7th, 2022.

Description of above image

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 (up to February 7) | Total | |

|---|---|---|---|---|---|---|---|

| Food | 1,224 | 1,636 | 1,520 | 1,627 | 1,364 | 177 | 7,548 |

| Drinks | 23 | 27 | 27 | 22 | 16 | 1 | 116 |

Source: Mintel, 2022

Out of a total of 7,664 new chocolate food and drink products launched in Japan between January 2017 and February 7th 2022, these products contained cocoa ingredient types (may overlap) as followed: cocoa butter (9,552), cocoa fat (3,483), cocoa liquor (3,600), cocoa powder (2,464), cocoa and cocoa products (812), cocoa beans (410), cocoa or other fillings/cream pastes (1,026), cocoa nibs (58), white chocolate (3,591), chocolate/milk chocolate (3,603/7,356), dark chocolate (236), chocolate chips (739), and semi-sweet chocolate (26).

According to Mintel, top parent companies launching chocolate food & beverage products in Japan over the last 5-year period were Yamazaki Baking (1,140), Lotte (747), Fujiya (621), Bourbon (616), Morinaga & Company (588), and Meiji (552). Top chocolate food brands included Seven & i Premium (203), Ministop Café (188), Nestlé Kit Kat Mini (139), Bourbon (133), and Fujiya Country Ma'am (128). Top chocolate drink brands included Starbucks/Origami Personal Drip Coffee/Starbucks by Nespresso & Premium Mixes (25), Coffee Tanbo (13), Mt. Rainier Caffé Latte (10), Meiji Savas Whey Protein 100 (+for women)/Athlete Weight Down (7), Glico (5), and Kirin Gogo No Kocha (4). New chocolate brands launched in the Japanese market include YBC Nago Me Time Spice & Chocolate (apple & cinnamon chocolate coated biscuit), Patisserie Terrace (chocolate Ganache & Tiramisu parfait), Ministop Café Fun! Fan! Sweets (chocolate cake), and Tokyo Meiraku (chocolate banana drink).

The fastest growing flavours in chocolate products in Japan were eclair (+400%), crème brulé/Catalan cream (+300%), sea salt (+300%), pistachio (+250%), raspberry (+200%), and Muscat grape (+200%)

[Q1-2020/Q1-2022]. New ingredients included orange oil, gingerbread, grapeseed oil, Kirsch, pear cider, Sorbitan Esters of fatty acids, Bergamot extract, vegetable juice concentrates, coconut pulp, and mango Compote. Top growing claims at +100% were event merchandising, functional - weight and muscle gain, and low/no/reduced calorie, followed by added calcium (+75%), and ethical - toxins free (+69%). While declining claims (−100%) included low/no/reduced saturated fat, innovative ingredient, functional - skin, nails & hair, novel, and organic.

In Japan, bakery products was the largest food and drink category with 3,242 new product launches (42.3%), followed by the chocolate confectionery category 2,460 new products (32.1%), and the desserts and ice cream category at 1,373 (17.9%) over the 5-year period. Top growing categories included chocolate confectionery (+107.3%), dairy (+100%), hot beverages (+100%), desserts and ice cream (+53.2%), snacks (+22.2%), and bakery (+20.5%); while declining categories included breakfast cereals (−50%) between Q1-2021 and Q1-2022.

| Category | Top 50 brands launched (product item count) | Number of products |

|---|---|---|

| Bakery | Famima Bakery/Café & Sweets (183), Bourbon/Alfort (135), Fujiya - Country Ma'am/Look (132), Glico Pocky (107), Pasco (103), Seven & i - Premium (134), Ministop Café (96), Daiichi Pan (82), Châteraisé (77), Monteur Fresh Dessert (75), Uchi Café - Sweets (67), Mujirushi Ryohin (49), FamilyMart - Collection (46), Kobeya (43), Morinaga - Dars (41), Yamazaki (38), Fujipan (34), Natural Lawson (31), Ropia - Totteoki No Sweets (25), Domremy (24), TopValu (20), Lotte - Ghana/Crunky (16), Meiji (9) | 3,242 |

| Chocolate confectionery | Meiji - The Chocolate/Meltykiss/Galbo/Almond (218), Nestlé Kit Kat Mini/Chocolatory (183), Morinaga - Choco Ball/Koeda /Dars (153), Lotte - Ghana/Crunky (116), Fujiya - Look (80), TopValu (53), Bourbon (46), Lindt (45), FamilyMart - Collection (43), Fujiya - Country Ma'am (41), Seven & i - Premium (40), Mujirushi Ryohin (37), Natural - Lawson (21), Châteraisé (6), Uchi Café - Sweets (1), Ropia Totteoki No Sweets (1) | 2,460 |

| desserts and ice cream | Morinaga - Choco Ball/Koeda/Dars/Pino/Parm (115), Ministop Café (88), Seven & i - Premium (73), Ropia Totteoki No Sweets (54), Lotte - Ghana/Choco Pie/Crunky (45), Domremy (42), Glico Giant Cone (41), Famima Sweets (21), Uchi Café - Sweets (25), FamilyMart - Collection (14), Meiji - Almond (13), Monteur Fresh Dessert (12), Fujiya - Country Ma'am/Look (7), Châteraisé (4), TopValu (4), Lawson (4), Bourbon (1), Mujirushi Ryohin (1) | 1,373 |

| Snacks | Nissin Cisco Choco Flakes (35), Bourbon (8), TopValu (6), FamilyMart Collection (6), Seven & i Premium (5), Mujirushi Ryohin (4), Morinaga Choco Ball (4), Châteraisé (3) | 224 |

| Dairy | Uchi Café - Sweets (7), Morinaga (5), Ministop Café (1), Lotte Ghana (1), Fujiya Look (1), FamilyMart (1), Natural Lawson (1) | 88 |

| Breakfast cereals | TopValu (2) | 76 |

| Sugar & gum | Fujiya (9), Morinaga (2), Seven & i Premium (1), Mujirushi Ryohin (1),

FamilyMart Collection (1), Lawson (1) |

64 |

| Hot beverages | TopValu (1), FamilyMart Collection (1) | 51 |

| Ready-to-drink (RTDs) | Ministop Café (3), Seven & i Premium (1), TopValu (1) | 44 |

| Nutritional drinks and other beverages | Brands not in top 100 list | 17 |

| Total sample size | 7,664 | |

| Source: Mintel, 2021 | ||

Product examples

Heart-Shaped Amaou Strawberry Chocolate

Source: Mintel, 2022

| Company | Fujiya |

|---|---|

| Brand | Fujiya Peko |

| Sub-category | Chocolate confectionery |

| Market | Japan |

| Related ingredients | Cocoa fat, cocoa butter, whole milk powder |

| Store name/type | Okashi no Machioka, convenience store |

| Launch type | New variety / range extension |

| Date published | February 2022 |

| Price in US dollars | 0.89 |

This product retails in a 23 gram pack. Launched on December 14, 2021, with a recommended retail price of 108 yen.

Milk Chocolate Potato Chips with Rich Milk

Source: Mintel, 2022

| Company | Bourbon |

|---|---|

| Brand | Bourbon Jaga Choco Grande |

| Sub-category | Chocolate confectionery, non-individually wrapped chocolate pieces |

| Market | Japan |

| Related ingredients | Cocoa fat, cocoa butter, whole milk powder |

| Store name/type | Family Mart, convenience store |

| Launch type | Relaunch |

| Date published | February 2022 |

| Price in US dollars | 1.68 |

Described as sweet and salty, the potato chips are coated with 1.5 times as much white chocolate as the Bourbon Jaga Choco range varieties. This product retails in a 50 gram pack. Launched on January 18, 2022 with an recommended retail price of 195 yen.

Chocolate Cake

Source: Mintel, 2022

| Company | Ministop |

|---|---|

| Manufacturer | Ropia |

| Brand | Ministop Café Fun! Fan! Sweets |

| Sub-category | Bakery, cakes, pastries and sweet goods |

| Market | Japan |

| Related ingredients | Chocolate products, chocolate, cocoa powder |

| Store name/type | Ministop, convenience store |

| Launch type | New product |

| Date published | February 2022 |

| Price in US dollars | 2.46 |

This product is made with Belgian chocolate and fresh cream from Hokkaido. The product retails in a single-unit pack. Launched on January 7, 2022, with an recommended retail price of 280 yen.

Eclair Bread

Source: Mintel, 2022

| Company | Kobeya Baking |

|---|---|

| Brand | Kobeya Pan De Sweets |

| Sub-category | Cakes, pastries and sweet goods |

| Market | Japan |

| Related ingredients | Chocolate |

| Store name/type | Peacock stores, supermarket |

| Launch type | New product |

| Date published | February 2022 |

| Price in US dollars | 1.20 |

This Eclair Bread is coated with pastry dough and chocolate, and filled with custard. The product retails in a single-unit pack. Launched in January 2022, recommended retail price not available.

Apple Brandy Chocolate

Source: Mintel, 2022

| Company | Lotte |

|---|---|

| Brand | Lotte Apple Brandy Chocolate |

| Sub-category | Chocolate confectionery, seasonal chocolate |

| Market | Japan |

| Related ingredients | Cocoa liquor, cocoa fat, cocoa butter |

| Store name/type | Ito Yokado, supermarket |

| Launch type | New product |

| Date published | December 2021 |

| Price in US dollars | 1.50 |

This Apple Brandy Chocolate product is now a limited edition and seasonal variety for winter 2021. The chocolate is filled with diced apples and chocolate ganache. The product retails in a pack with easy-to-eat three 2.6 gram packets. Launched on November 16, 2021, open-priced.

Milk Chocolate Flavour Protein Powder

Source: Mintel, 2022

| Company | Meiji |

|---|---|

| Brand | Meiji Savas for Woman Whey Protein 100 |

| Sub-category | Nutritional and meal replacement drinks |

| Market | Manufactured in Japan, not imported |

| Related ingredients | Cocoa powder |

| Store name/type | Yodobashi Online, internet / mail order |

| Launch type | New product |

| Date published | November 2021 |

| Price in US dollars | 0.37 |

This product can be used for body making to support the ideal body along with exercise, and contains ten vitamins, calcium, iron, magnesium and added dietary fibre. It has an amino acid score of 100, is said to be immediately soluble and easy to drink, and can simply be mixed in a glass instead of a shaker. It can be taken as a supplement at breakfast, after exercise, during a break, or one hour before bed. The product retails in a 294 gram pack containing a spoon. Launched in October, 2021 with an recommended retail price of 2,322 yen.

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

For additional information on the upcoming FoodEx Japan 2022 Trade Show, please contact:

Ben Berry, Deputy Director

Trade Show Strategy and Delivery

Agriculture and agri-food Canada

ben.berry@agr.gc.ca

Resources

- Euromonitor International. July 2021. Country Report: Chocolate Confectionery in Japan

- Euromonitor International, 2022. Data statistics (2017-2026)

- Global Trade Tracker, 2022

- Mintel. A year of innovation in chocolate confectionery, 2021

- Mintel Global New Products Database, 2022

- Mintel. March 2018. Nestlé KitKat Everyday Luxury Chocolate

Sector Trend Analysis – Chocolate confectionery in Japan

Global Analysis Report

Prepared by: Erin-Ann Chauvin, Senior Market Analyst

© Her Majesty the Queen in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2022).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright Her Majesty the Queen in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.