Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

According to Euromonitor International, the United States (U.S) is set to remain the largest global consumer market in the forecast period (2021-2040).

The oilseed industry is a strong and important element to the U.S. economy. In the U.S, soybeans are the dominant oilseed accounting for about 90% of the U.S oilseed production.

The U.S was the third largest global market for cooking oils with imports valued at US$8.9 billion (8.4% market share), 5.5 billion kg in 2021. Of these imports, Canada was the largest supplier (representing a 34.8% market share) with imports valued at US$3.1 billion, 2.1 billion kg in 2021. The top supplying Canadian provinces to the U.S market were Saskatchewan, Manitoba and Alberta occupying market shares of 49.0%, 20.2% and 15.6% respectively in 2021.

The United States (U.S) was the fifth largest global retail sales market for cooking oils with values of US$3.9 billion, representing a 3.8% market share in 2021. The U.S experienced an increase in CAGR of 1.9% as retail sales grew from US$3.6 billion in 2016 and are expected to further improve with an increase in CAGR of 4.0% in the forecast period as retail sales are anticipated to achieve US$4.8 billion by 2026

The top three cooking oil categories in the U.S, in terms of retail value sales in 2021, were olive oil with values of US$1.5 billion (37.7% market share), followed by soy oil valued at US$1.2 billion (29.6% market share), and rapeseed oil with values of US$527.3 million (13.4% market share).

ConAgra Brands Inc (Brand name; Pam and Wesson) was the largest cooking oil company in the U.S with retail sales of US$392.3 million (10.0% market share) in 2021.

According to Mintel's Global New Products Database (GNPD), there were 1,219 new cooking oil products launched in the U.S between January 2016 and December 2021.

United States market and consumer overview

According to Euromonitor International, the U.S is set to remain the largest global consumer market in the forecast period, benefiting from a large population, a high concentration of affluent consumers and a positive economic outlook. By 2030, the U.S is projected to retain its position and rank first out of 84 countries as noted in Euromonitor's Wealth Index. Millennials, as the highest income earners by 2040, will dictate the consumption trends, pursuing simplicity, sustainability and brand-driven purchases while consumers aged 65+, will be prevalent in the top-income band (those with an annual gross income over USD250,001).

In 2021, the U.S (US$53,587.1) ranked second to Switzerland (US$55,574.0) in per capita disposable income levels globally, accommodating a large and affluent consumer base. California will remain the largest consumer market accounting for 13.2% of total consumer expenditure by 2040 as urbanization, a large and growing population, high cost of living, and concentration of high-tech and services sectors are projected to drive consumer market growth in the region. In comparison, private spending in Idaho is set for the fastest growth due to an influx of population from other regions, lower corporate and individual income taxes and a strong labour demand have led to new market opportunities in the region.

The US economy benefits from significant stimulus packages prompted by the pandemic, in addition to a decisive monetary policy, advances in technology, a robust retail sector as well as strong oil and gas prices at the end of 2021/first half of 2022. According to the Euromonitor Lifestyles survey in 2021, 48% of respondents in the US say they believe they will be better off financially in the future. Nevertheless, consumer confidence remains below pre-pandemic levels in 2021-2022, reflecting the high inflation impact on the domestic market. Further, social progress in the US are set to devolve over the forecast period, leading to an expanding gap in income distribution throughout the population.

In 2021, the total population in the U.S was 331.9 million, with females occupying 50.5% of the population, while the median age was 38.8, and 82.7% of the population resided in urban areas. By 2040, the U.S population is expected to reach 359 million and remain the third largest country globally (India and China are the larger populated countries). Females are still expected to occupy 50.5% of the population and the median age will be 42.4 years while urbanization will increase to 85.9%.

The single person household (most commonly a female, aged 60+) is dominant in the U.S (due mainly to the ageing population and the tendency to postpone marriage until later in life) and is expected to account for 29.0% of all households by 2040. Disposable income per household (US$138,956 in 2021) is set to witness moderate growth as the unemployment rate will remain the major determinant, while couples with children (representing 17.1% of households by 2040) will become the largest spenders. Household digital penetration is high, with 84.0% of households possessing a laptop in comparison to 79.9% who own a tablet in 2021.

Production (cooking oils)

The oilseed industry is a strong and important element to the U.S. economy. Oilseeds are highly versatile crops and are grown on more than 90 million acres. Oilseed and oilseed product exports not only strengthen the U.S's balance of trade, but also provide cost-effective solutions to the nutritional and industrial needs of a rapidly increasing world population (NOPA, October 2015).

Soybean oil is the world's most widely produced and widely consumed vegetable oil. In the U.S, soybeans are the dominant oilseed accounting for about 90% of the U.S oilseed production. After harvest and throughout the year, soybeans are shipped directly from storage elevators by truck, rail, or barge to processing facilities that crush nearly 45% of the nation's soybean production, with the balance exported as whole beans or carried over to the next year. The extracted crude soybean oil is refined, bleached, and deodorized, resulting in clear and odorless soybean oil, suitable for edible and non-edible uses (NOPA, October 2015).

In 2017, more than 90 million acres of soybeans were planted and in 2018, soybean acreage exceeded corn acreage for the first time since 1983. In 2019 however, soybean acreage declined to 76.1 million. For 2022/23, the soybean acreage is 88.3 million acres, representing a 1.0% increase from 2021/22 according to the USDA's Acreage report (USDA; Soybeans and Oil Crops, July 2022).

More than 81 percent of U.S.soybean acreage in 2020 was concentrated in the upper Midwest. The top soybean producing States in 2020 were Illinois, Iowa, and Minnesota, accounting for 35.2 percent of total U.S. production (USDA; Soybeans and Oil Crops, July 2022).

High in polyunsaturates and relatively low in cost, soybean oil has emerged as the leading vegetable oil in the U.S. food economy. In recent years, soybean oil production has responded quickly to increased demand, becoming the U.S's number one choice of vegetable oil.

Soybean oil was the largest processed crop in the U.S with a production of 11.3 million tonnes in 2019, representing an increase in CAGR of 4.0% from 10.0 million tonnes processed in 2016. Maize (corn) oil is the second largest processed crop with 1.8 million tonnes in 2019, increasing by the larger CAGR of 4.9% from 1.5 million tonnes in 2016, while rapeseed oil experienced the largest decline in CAGR (5.1%) as volume decreased from 951,000 tonnes in 2016 to 813,000 tonnes in 2019.

| Crops (tonnes) | 2016 | 2017 | 2018 | 2019 | CAGR* % 2016-2019 |

|---|---|---|---|---|---|

| Oil[1], soybean | 10,024,000.0 | 10,380,000.0 | 10,884,000.0 | 11,290,000.0 | 4.0 |

| Oil[1], maize | 1,537,200.0 | 1,687,800.0 | 1,707,600.0 | 1,774,200.0 | 4.9 |

| Oil[1], rapeseed | 951,000.0 | 757,000.0 | 717,000.0 | 813,000.0 | −5.1 |

| Oil, cottonseed | 246,000.0 | 263,000.0 | 225,000.0 | 218,000.0 | −3.9 |

| Oil[1], sunflower | 210,000.0 | 200,000.0 | 211,000.0 | 187,000.0 | −3.8 |

|

Source: FAOSTAT Agricultural Production, 2022 *CAGR: Compound Annual Growth Rate 1: Crops also produced in Canada |

|||||

Maize (corn) was the largest crop produced in the U.S with 360.3 million tonnes recorded in 2020, representing a decline in CAGR of 3.3% from 412.3 million tonnes produced in 2016. Soybeans were the second largest crop with production of 112.5 million tonnes in 2020, also declining in CAGR by 1.0% from 116.9 million tonnes in 2016. Rapeseed was the only crop that experienced an increase in CAGR of 2.9% as crop production grew from 1.4 million tonnes in 2016 to 1.6 million tonnes in 2020.

| Crops (tonnes) | 2016 | 2017 | 2018 | 2019 | 2020 | CAGR* % 2016-2020 |

|---|---|---|---|---|---|---|

| Maize[1] | 412,262,180.0 | 371,096,030.0 | 364,262,150.0 | 345,962,110.0 | 360,251,560.0 | −3.3 |

| Soybeans[1] | 116,931,500.0 | 120,064,970.0 | 120,514,490.0 | 96,667,090.0 | 112,549,240.0 | −1.0 |

| Seed, cotton | 10,083,328.0 | 12,000,000.0 | 11,132,694.0 | 12,819,060.0 | 9,737,277.0 | −0.9 |

| Maize, green[1] | 3,294,760.0 | 3,431,310.0 | 3,332,080.0 | 3,198,818.0 | 3,196,405.0 | −0.8 |

| Rapeseed[1] | 1,405,370.0 | 1,394,190.0 | 1,643,670.0 | 1,552,800.0 | 1,576,170.0 | 2.9 |

|

Source: FAOSTAT Agricultural Production, 2022 *CAGR: Compound Annual Growth Rate 1: Crops also produced in Canada |

||||||

Global trade overview of cooking oils

The global market for cooking oils has experienced positive growth with a moderate CAGR of 9.4% as imports have increased from US$67.5 billion in 2016 to US$105.7 billion in 2021. India was the largest global market for cooking oils in 2021 with imports valued at US$17.3 billion, (16.3% market share) representing a CAGR of 10.5% from US$10.5 billion in 2016, followed by China with imports valued at US$13.4 billion (12.7% market share) and the largest increase in CAGR of 16.5% from US$6.2 billion in 2016 and the United States (U.S), with import values of US$8.9 billion (8.4% market share) in 2021.

The U.S was the third largest global market for cooking oils and experienced a CAGR of 8.9% as imports increased from US$5.8 billion in 2016. Canada in comparison, was the thirty-first largest global market for cooking oils with values of US$0.8 billion (0.7% market share) in 2021 , representing an increase in CAGR of 6.1% from imports valued at US$0.6 billion in 2016.

| Country | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR* % 2016-2021 | Market share (%) in 2021 |

|---|---|---|---|---|---|---|---|---|

| Global Total | 67.5 | 75.2 | 72.1 | 67.4 | 75.5 | 105.7 | 9.4 | 100.0 |

| India | 10.5 | 11.8 | 10.1 | 9.7 | 10.5 | 17.3 | 10.5 | 16.3 |

| China | 6.2 | 7.2 | 7.3 | 8.7 | 9.9 | 13.4 | 16.5 | 12.7 |

| United States | 5.8 | 6.5 | 6.3 | 5.7 | 6.0 | 8.9 | 8.9 | 8.4 |

| Netherlands | 3.9 | 4.5 | 4.2 | 3.9 | 4.4 | 5.9 | 8.8 | 5.6 |

| Italy | 3.8 | 4.2 | 3.9 | 3.6 | 3.7 | 4.6 | 4.0 | 4.4 |

| Spain | 2.2 | 2.9 | 2.8 | 2.3 | 2.8 | 3.6 | 10.4 | 3.4 |

| Pakistan | 1.9 | 1.9 | 2.1 | 1.9 | 2.2 | 3.5 | 13.5 | 3.3 |

| Germany | 3.0 | 3.0 | 2.6 | 2.4 | 2.6 | 3.5 | 2.7 | 3.3 |

| Belgium | 1.4 | 1.6 | 1.6 | 1.5 | 1.9 | 2.6 | 12.9 | 2.5 |

| Malaysia | 1.1 | 1.3 | 1.3 | 1.2 | 1.5 | 2.4 | 16.4 | 2.3 |

| Canada (31) | 0.6 | 0.6 | 0.6 | 0.6 | 0.7 | 0.8 | 6.1 | 0.7 |

|

Source: Global Trade Tracker, 2022 1: For the purpose of this report, '"cooking oil'" is defined by HS codes 1507 to 1515, inclusively. *CAGR: Compound Annual Growth Rate |

||||||||

United States trade overview of cooking oils

The U.S imported US$8.9 billion, 5.5 billion kilograms of cooking oils from global markets in 2021. The top three suppliers of cooking oils to the U.S was Canada with a 34.8% market share equivalent to US$3.1 billion, 2.1 billion kilograms, followed by Indonesia with a 23.4% market share, equal to US$2.1 billion, 1.8 billion kilograms, and Italy, representing a 6.5% market share with US$0.6 billion, 0.1 billion kilograms in 2021.

Top imported cooking oils to the U.S in 2021 were rape, colza or mustard oil and its fractions (HS code: 1514) valued at US$2.9 billion, 2.0 billion kilograms, followed by palm oil and its fractions (HS code: 1511) valued at US$1.8 billion, 1.7 billion kilograms and olive oil and its fractions (HS code: 1509) with values of US$1.5 billion, 0.4 billion kilograms.

| HS code | Description | Import value (US$B) | Import volume (billion kilograms) | Top suppliers and market value share (%) | Canada % share | ||

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | |||||

| Cooking oils total | 8.9 | 5.5 | Canada 34.8 | Indonesia: 23.4 | Italy: 6.5 | 34.8 | |

| 1514 | Rape, colza or mustard oil and its fractions | 2.9 | 2.0 | Canada: 98.1 | Australia: 0.9 | Turkey: 0.4 | 98.1 |

| 1511 | Palm oil and its fractions | 1.8 | 1.7 | Indonesia: 81.4 | Malaysia: 15.2 | Colombia: 1.0 | 0.0 |

| 1509 | Olive oil and its fractions | 1.5 | 0.4 | Italy: 35.5 | Spain: 26.7 | Tunisia: 15.6 | 0.0 |

| 1513 | Palm kernel oil | 1.4 | 0.8 | Indonesia: 45.7 | Philippines: 40.0 | Malaysia: 8.4 | 0.1 |

| 1515 | Fixed vegetable fats and oils, incl.jojoba oil | 0.8 | 0.2 | Mexico: 23.3 | India: 20.8 | Spain: 11.0 | 6.3 |

| 1512 | Sunflower, safflower seed oil | 0.3 | 0.2 | Ukraine: 32.0 | France: 16.8 | Mexico: 12.6 | 0.6 |

| 1507 | Soybean oil and its fractions | 0.2 | 0.2 | Canada: 95.5 | Mexico: 3.4 | Turkey: 0.3 | 95.5 |

| 1508 | Groundnut oil and its fractions | 0.1 | 0.0 | Argentina: 71.0 | Nicaragua: 10.4 | Brazil: 8.7 | |

| 1510 | Other oils and their fractions | 0.0 | 0.0 | Spain: 58.3 | Italy: 19.3 | Turkey: 8.2 | 0.1 |

| Source: Global Trade Tracker, 2022 | |||||||

Canada's performance

United States imports from Canada

The U.S was the third largest global market for cooking oils with imports valued at US$8.9 billion, 5.5 billion kilograms in 2021. Of these imports, Canada was the largest supplier (representing a 34.8% market share) with imports valued at US$3.1 billion, 2.1 billion kilograms in 2021. Top cooking oil imports from Canada were rape, colza or mustard oil and its fractions, (HS code: 1514) valued at US$2.8 billion, 1.9 billion kilograms, (91.9% market share), followed by soybean oil and its fractions (HS code: 1507) with values of US$199.2 million, 142.4 million kilograms (6.5% market share) and fixed vegetable fats and oils, incl.jojoba oil (HS code: 1515) valued at US$48.6 million, 30.4 million kilograms (1.6% market share) in 2021.

| HS Code | Description | Import value (US$M) | Import volume (million kilograms) | Market share (%) |

|---|---|---|---|---|

| Cooking Oil Total | 3,085.4 | 2,109.0 | 100.0 | |

| 1514 | Rape, colza or mustard oil and its fractions | 2,834.8 | 1,935.6 | 91.9 |

| 1507 | Soybean oil and its fractions | 199.2 | 142.4 | 6.5 |

| 1515 | Fixed vegetable fats and oils, incl.jojoba oil | 48.6 | 30.4 | 1.6 |

| 1512 | Sunflower, safflower seed oil | 1.6 | 0.3 | 0.1 |

| 1513 | Palm kernel oil | 0.7 | 0.1 | 0.0 |

| 1511 | Palm oil and its fractions | 0.3 | 0.2 | 0.0 |

| 1509 | Olive oil and its fractions | 0.2 | 0.0 | 0.0 |

| 1510 | Other oils and their fractions | 0.0 | 0.0 | 0.0 |

| Source: Global Trade Tracker, 2022 | ||||

Canada's export market

In 2021, Canada exported US$4.5 billion, 3.3 billion kilograms of cooking oils to global markets. The U.S was the largest export market for Canadian cooking oils (69.0% market share) valued at US$3.1 billion, 2.1 billion kilograms, followed by China (17.7% market share) with values of US$799.9 million, 774.2 million kilograms and Mexico (5.6% market share) valued at US$250.5 million, 165.5 million kilograms in 2021.

| Country | Export value (US$ M) | Export volume (million kilograms) | Market share (%) in 2021 |

|---|---|---|---|

| Global Total | 4,517.0 | 3,333.4 | 100.0 |

| United States | 3,117.1 | 2,108.9 | 69.0 |

| China | 799.9 | 774.2 | 17.7 |

| Mexico | 250.5 | 165.5 | 5.6 |

| Korea | 167.2 | 143.2 | 3.7 |

| Chile | 107.8 | 83.0 | 2.4 |

| Japan | 18.8 | 12.4 | 0.4 |

| Hong Kong | 12.0 | 12.5 | 0.3 |

| United Arab Emirates | 9.5 | 8.6 | 0.2 |

| Taiwan | 9.4 | 8.2 | 0.2 |

| Colombia | 6.0 | 4.3 | 0.1 |

| Source: Global Trade Tracker, 2022 | |||

The U.S was the largest export market for Canadian cooking oils in 2021. The top supplying Canadian provinces to the U.S market were Saskatchewan, Manitoba and Alberta occupying market shares of 49.0%, 20.2% and 15.6% respectively in 2021. Top cooking oil exports from Canada to the U.S were rape, colza or mustard oil and its fractions (HS code: 1514) with values of US$2.9 billion, 1.9 billion kilograms, followed by soybean oil and its fractions (HS: 1507) valued at US$199.3 million, 142.4 million kilograms, and fixed vegetable fats and oils, incl.jojoba oil (HS code: 1515) with values of US$49.2 million, 30.4 million kilograms in 2021.

| HS code | Description | Export value (US$M) | Export volume (million kilograms) | Top provincial suppliers and market value share | ||

|---|---|---|---|---|---|---|

| Cooking Oils total | 3,117.1 | 2,108.9 | Saskatchewan: 49.0 | Manitoba: 20.2 | Alberta: 15.6 | |

| 1514 | Rape, colza or mustard oil and its fractions | 2,865.8 | 1,935.5 | Saskatchewan: 53.1 | Manitoba: 21.7 | Alberta: 16.9 |

| 1507 | Soybean oil and its fractions | 199.3 | 142.4 | Ontario: 73.1 | Québec: 25.9 | Manitoba: 0.7 |

| 1515 | Fixed vegetable fats and oils, incl.jojoba oil | 49.2 | 30.4 | Ontario: 64.2 | Saskatchewan: 11.1 | Manitoba: 9.9 |

| 1512 | Sunflower, safflower seed oil | 1.6 | 0.3 | Alberta: 66.4 | Ontario: 30.3 | Québec: 3.2 |

| 1513 | Palm kernel oil | 0.7 | 0.1 | British Colombia: 43.3 | Ontario: 24.0 | Saskatchewan: 17.7 |

| 1511 | Palm oil and its fractions | 0.3 | 0.2 | Ontario: 100.0 | ||

| 1509 | Olive oil and its fractions | 0.2 | 0.0 | Ontario: 89.5 | Québec: 5.9 | British Columbia: 4.6 |

| 1510 | Other oils and their fractions | 0.0 | 0.0 | Ontario: 100.0 | ||

| Source: Global Trade Tracker, 2022 | ||||||

Retail markets

Global retail sales of cooking oils

Global retail sales of cooking oils have increased moderately in CAGR by 8.5% from US$69.5 billion in 2016 to US$104.7 billion in 2021 and are expected to increase at an additional CAGR of 8.5% as retail sales attain US$157.5 billion by 2026. India was the largest global market for cooking oils with retail sales of US$22.1 billion (21.1% market share), followed by China with values of US$15.7 billion (15.0% market share) and Brazil, with retail sales of US$4.6 billion (4.4% market share) in 2021.

The United States (U.S) was the fifth largest global retail sales market for cooking oils with values of US$3.9 billion, representing a 3.8% market share in 2021. The U.S experienced an increase in CAGR of 1.9% as retail sales grew from US$3.6 billion in 2016 and are expected to further improve with an increase in CAGR of 4.0% in the forecast period as retail sales are anticipated to achieve US$4.8 billion by 2026. In comparison, Canada was the forty-seventh largest retail sales market for cooking oils, accounting for a 0.4% retail sale market share with values of US$469.9 million in 2021. Similarly, Canada is also expected to achieve positive growth with an increase in CAGR of 5.1% in the forecast period as retail sales attain US$603.3 million by 2026.

| Geography | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|

| World | 69,510.1 | 104,722.3 | 8.5 | 113,091.7 | 157,513.8 | 8.5 |

| India | 10,656.4 | 22,089.9 | 15.7 | 25,467.9 | 43,112.6 | 14.3 |

| China | 14,059.2 | 15,717.0 | 2.3 | 16,373.9 | 19,044.7 | 3.9 |

| Brazil | 1,972.7 | 4,555.5 | 18.2 | 4,944.5 | 7,144.3 | 9.4 |

| Turkey | 1,440.0 | 4,060.5 | 23.0 | 4,401.6 | 6,452.2 | 9.7 |

| United States (5) | 3,588.2 | 3,942.7 | 1.9 | 4,161.0 | 4,802.9 | 4.0 |

| Italy | 2,575.1 | 2,441.9 | −1.1 | 2,501.9 | 2,831.3 | 3.0 |

| Indonesia | 1,428.8 | 2,396.8 | 10.9 | 2,613.4 | 4,214.3 | 11.9 |

| Bangladesh | 1,137.2 | 2,316.2 | 15.3 | 2,185.6 | 2,727.3 | 3.3 |

| Spain | 2,211.5 | 2,292.2 | 0.7 | 2,383.2 | 2,830.5 | 4.3 |

| Russia | 1,839.7 | 2,290.4 | 4.5 | 2,409.3 | 2,922.3 | 5.0 |

| Canada (47) | 360.6 | 469.9 | 5.4 | 498.9 | 603.3 | 5.1 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

||||||

United States retail sales of cooking oil

The cooking oil market in the U.S was valued at US$3.9 billion in 2021. During the 2016-2021 period, this market grew at a CAGR of 1.9% from US$3.6 billion in 2016, with exceptionally higher growth between 2019-2020 at 21.2% with the onset of the pandemic. The U.S total cooking oil market did contract 12.0% between 2020 and 2021 due to the initial decline in foodservice demand (pandemic imposed foodservice restrictions/closures) and later, by the easing of home seclusion, as less meals were prepared at home - Euromonitor International 2021), as retail sales decreased from US$4.5 billion in 2020. The overall cooking oil market is forecast to recover and expand by 5.5%, attaining US$4.2 billion by 2022, as a large number of U.S employees with new hybrid schedules are expected to spend more time at home, improving cooking oil consumption. In addition, recent trade disputes between the U.S and the European Union (EU) which included a tariff rate of 25% imposed on Spanish olive oil imports, have been eliminated, encouraging the extent to which Spanish producers can reconcile their market share loss to competitors. (Euromonitor International 2021).

The U.S consumer's perception and growing appreciation for healthy fats as a key component to an overall healthy lifestyle, should prove beneficial to most cooking oils. Olive oil in particular, is best known as a source of healthy fats while in contrast, rapeseed oil is recognized as the most naturally low in saturated fat (Euromonitor International 2021).

The top three cooking oil categories in the U.S, in terms of retail value sales in 2021, were olive oil with values of US$1.5 billion (37.7% market share) increasing at a CAGR of 2.5% from US$1.3 billion in 2016 , followed by soy oil valued at US$1.2 billion (29.6% market share), representing an increase in CAGR of 1.9% from US$1.1 billion in 2016 and rapeseed oil with values of US$527.3 million (13.4% market share) and increasing in CAGR by 0.2% from US$521.1 million in 2016.

Growth in the cooking oil category is expected to be strongly positive with a larger CAGR of 4.0% as retail sales reach US$4.8 billion by 2026. Relatedly, all cooking oil categories are expected to attain larger CAGR's in the forecast period. Olive oil in particular, is expected to increase in CAGR by 4.7% achieving US$1.9 billion by 2026, while corn oil is also expected to perform well attaining an increase in CAGR of 4.2% with values of US$559.0 million by 2026. Of note, Euromonitor International reports that cooking oil retail sale growth may be limited due to supply chain shortages. Truck driver shortages evident in 2021, for example, led to some regional spikes in olive oil prices while the effects of climate change, wildfires in California in particular, present long-term supply pressures that may affect production and supply levels.

| Category | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| Cooking Oils (total) | 3,588.2 | 3,630.5 | 3,664.3 | 3,697.1 | 4,482.0 | 3,942.7 |

| Olive Oil | 1,311.8 | 1,344.9 | 1,385.0 | 1,416.1 | 1,733.1 | 1,487.8 |

| Corn Oil | 405.6 | 414.1 | 416.9 | 419.1 | 512.5 | 455.0 |

| Rapeseed Oil | 521.1 | 514.8 | 506.8 | 501.2 | 618.8 | 527.3 |

| Soy Oil | 1,063.3 | 1,068.7 | 1,070.3 | 1,074.3 | 1,267.9 | 1,166.7 |

| Other Edible Oil[1] | 286.3 | 288.0 | 285.3 | 286.4 | 349.6 | 305.9 |

|

Source: Euromonitor International, 2022 1: Other edible oil includes vegetable and seed oil such as coconut oil, grapeseed oil, groundnut oil, sesame oil and walnut oil, as well as blended oils which contain less than 50% of any single type of oils broken down into the researched oil categories. |

||||||

| Category | Annual growth % 2021-2022 | CAGR* % 2016-2021 | Total growth % 2016-2021 |

|---|---|---|---|

| Cooking Oils (total) | −12.0 | 1.9 | 9.9 |

| Olive Oil | −14.2 | 2.5 | 13.4 |

| Corn Oil | −11.2 | 2.3 | 12.2 |

| Rapeseed Oil | −14.8 | 0.2 | 1.2 |

| Soy Oil | −8.0 | 1.9 | 9.7 |

| Other Edible Oil | −12.5 | 1.3 | 6.8 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

| Category | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|

| Cooking Oils (total) | 4,161.0 | 4,336.8 | 4,498.4 | 4,652.1 | 4,802.9 |

| Olive Oil | 1,588.4 | 1,663.9 | 1,734.9 | 1,802.6 | 1,869.6 |

| Corn Oil | 480.6 | 502.4 | 522.5 | 541.2 | 559.0 |

| Rapeseed Oil | 556.0 | 579.7 | 600.4 | 619.0 | 636.2 |

| Soy Oil | 1,211.8 | 1,260.7 | 1,305.5 | 1,348.7 | 1,391.5 |

| Other Edible Oil | 324.2 | 330.0 | 335.1 | 340.5 | 346.5 |

| Source: Euromonitor International, 2022 | |||||

| Category | Annual growth % 2021-2022 | CAGR* % 2021-2026 | Total growth % 2021-2026 |

|---|---|---|---|

| Cooking Oils (total) | 5.5 | 4.0 | 21.8 |

| Olive Oil | 6.8 | 4.7 | 25.7 |

| Corn Oil | 5.6 | 4.2 | 22.9 |

| Rapeseed Oil | 5.4 | 3.8 | 20.7 |

| Soy Oil | 3.9 | 3.6 | 19.3 |

| Other Edible Oil | 6.0 | 2.5 | 13.3 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

Competitive landscape

The U.S cooking oil market remained a fragmented industry throughout 2016 to 2021. ConAgra Brands Inc (Brand name; Pam and Wesson) was the largest cooking oil company in the U.S with retail sales of US$392.3 million (10.0% market share), while Deoleo SA (Brand name; Bertolli), the second largest cooking oil company, attained US$305.2 million (7.7% market share) in 2021. Private label cooking oil companies continue to show a strong presence in the cooking oils market with retail sales of US$1.3 billion (31.8% market share) in 2021, increasing their total market share slightly since 2016.

Of interest, recent legislative debate regarding the labelling/mislabelling of an olive's origin required 'California' labelled olive oils to be 100% of California origin. Euromonitor International notes that as a result of these debates, a compromise was reached, allowing brands continued use of the term "California" even with blended oils, as long as the percentage of California olives used in the final product is clearly identified on the packaging. It is anticipated that some smaller producers of 'single-origin' products will use this particular identifier to promote their Californian sourced brand to distinguish themselves from their 'blended origin' competition to enhance product sales.

| Company | Retail sales (US$ millions) | Market share (%) |

|---|---|---|

| Total | 3,942.7 | 100.0 |

| ConAgra Brands Inc | 392.3 | 10.0 |

| Deoleo SA | 305.2 | 7.7 |

| B & G Foods Inc | 234.0 | 5.9 |

| Associated British Foods Plc | 222.2 | 5.6 |

| Bright Food (Group) Co Ltd | 159.0 | 4.0 |

| California Olive Ranch Inc | 145.3 | 3.7 |

| Pompeian Inc | 137.4 | 3.5 |

| Industria Alimentare Colavita SpA | 52.0 | 1.3 |

| Private Label | 1,254.7 | 31.8 |

| Others | 1,040.5 | 26.4 |

| Source: Euromonitor International, 2022 | ||

Retail distribution channels; cooking oil product sector (off-trade)

The majority of the U.S's cooking oil market is distributed through store-based retailing versus non-store retailing. Store-based retailing for cooking oils accounted for a 92.4% market share in 2021, declining from 98.1% held in 2016, while non-store retailing, e-commerce in particular, increased its market share representation to 7.6% in 2021, growing from 1.9% held in 2016. Further, within store-based retailing, hypermarkets and supermarkets were the predominant distribution channels for cooking oils representing market shares of 39.3% and 37.4% respectively, in 2021.

| Outlet Type | 2016 | 2021 | ||

|---|---|---|---|---|

| Actual | Share % | Actual | Share % | |

| Total | 3,588.2 | 100.0 | 3,942.7 | 100.0 |

| Store-Based Retailing | 3,519.5 | 98.1 | 3,644.3 | 92.4 |

| Grocery Retailers | 3,325.9 | 92.7 | 3,436.0 | 87.1 |

| Modern Grocery Retailers | 3,109.9 | 86.7 | 3,222.4 | 81.7 |

| Convenience Stores | 55.2 | 1.5 | 53.0 | 1.3 |

| Discounters | 134.5 | 3.7 | 146.1 | 3.7 |

| Hypermarkets | 1,375.3 | 38.3 | 1,549.8 | 39.3 |

| Supermarkets | 1,545.0 | 43.1 | 1,473.5 | 37.4 |

| Traditional Grocery Retailers | 215.9 | 6.0 | 213.7 | 5.4 |

| Independent Small Grocers | 215.9 | 6.0 | 213.7 | 5.4 |

| Non-Grocery Specialists | 2.5 | 0.1 | 3.1 | 0.1 |

| Health and Beauty Specialist Retailers | 2.5 | 0.1 | 3.1 | 0.1 |

| Mixed Retailers | 191.1 | 5.3 | 205.3 | 5.2 |

| Non-Store Retailing | 68.7 | 1.9 | 298.4 | 7.6 |

| E-Commerce | 68.7 | 1.9 | 298.4 | 7.6 |

| Source: Euromonitor International, 2022 | ||||

New product launch analysis

The pandemic changed how consumers approach their health, shifting emphasis from reactive 'quick-fixes' to a more holistic and long-term approach to building one's health and wellness. For many, making dietary changes has helped them to feel more in control and protected against potential ill health. In fact, 41% of U.S consumers agree that changes in their diets and eating habits have helped them feel more in control of their health, (Mintel, July 2022).

Improving one's health, in addition to ethics and personal preferences, has encouraged the prevalence of specialist diets (i.e., veganism, paleo and keto) as consumers increasingly expect grocery staples to accommodate their dietary choice. In addition, consumer interest in new and unfamiliar flavours in retail food and drink products has also increased, however; flavour innovation in butter, spreads and oils remains limited. Mintel notes that 81% of launches of butter, spreads and oils from April 2020 to March 2021 in North America, were unflavoured/plain Further, most launches of butter, spreads and oils remain unflavoured as consumers mainly expect a neutral flavour from these ingredient-style foods. Of interest, most flavours are found in oils, illustrating their use as a dressing or marinade. In North America, garlic and chili as a flavour continue to emerge, while more exotic flavours like miso and mandarin are also launching within the oils market. (Mintel, July 2022).

Ingredient watch - A new fat alternative ingredient is emerging in the U.S market as a means to reduce fat and calories in food and beverages.Esterified propoxylated glycerols (EPG) or modified plant-based oils, are fat-like substances that have been modified to limit digestion. EPGs are not metabolized by the body delivering 0.7kcal per gram in comparison to 9kcal per gram equated with traditional, digestible fats. EPG has yet to be approved by the European Food Safety Authority (EFSA) however, it is anticipated by some European sugar-free ice cream and snack parent companies, that EFSA will give approval for the ingredient within the next two to three years. Relatedly, although studies have found that EPG does not have any gastrointestinal side effects, and people can safely consume up to 150g of EPG per day, consumers may be wary of the safety and digestive tolerance of fat alternative ingredients (Mintel, April 2021).

According to Mintel's Global New Products Database (GNPD), there were 1,219 new cooking oil products launched in the U.S between January 2016 and December 2021. The number of yearly product launches has increased slightly in growth by a CAGR of 0.2% from the larger launch of 200 cooking oil products in 2016 to its most recent launch of 202 cooking oil products in 2021. Of note, new product launches of cooking oils experienced the largest increase in growth rate (19.8%) from 2019 to 2020 as product launches increased from 197 to 236 products, and contracted in growth by a further 14.4% to 202 products released in 2021.

Spectrum Culinary, Signature Select and Pompeian, were top brands of newly released cooking oil product launches while kosher (814 products), GMO free (426 products) and organic (346 products) were top claims associated with new products released during the prescribed period. Top price groupings for cooking oils in US dollars were $0.99 to $4.98, followed by $4.99 to $8.98 and $8.99 to $12.98.

Bottle (881 products), aerosol (195 products) and jar (73 products) were the predominant package types released, while new packaging (426 products), new variety/range extension (400 products) and new product (317 products) launch types were the leading product attributes of new products released between January 2016 and December 2021.

Unflavoured/plain, garlic and butter were top flavours (including blends), while extra virgin olive oil, coconut oil and low erucic acid rapeseed oil were top ingredients identified during this period.

| Product attributes | Yearly launch counts | Total | |||||

|---|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | ||

| Yearly product launches | 200 | 182 | 202 | 197 | 236 | 202 | 1,219 |

| Top brands | |||||||

| Spectrum Culinary | 0 | 2 | 22 | 8 | 4 | 2 | 38 |

| Signature Select | 0 | 2 | 9 | 3 | 3 | 2 | 19 |

| Pompeian | 5 | 2 | 3 | 2 | 1 | 6 | 19 |

| Bertolli | 1 | 2 | 5 | 3 | 5 | 2 | 18 |

| Pam | 2 | 7 | 2 | 2 | 2 | 3 | 18 |

| Top claims | |||||||

| Kosher | 113 | 108 | 163 | 120 | 172 | 138 | 814 |

| GMO free | 58 | 58 | 84 | 70 | 84 | 72 | 426 |

| Organic | 48 | 61 | 57 | 53 | 71 | 56 | 346 |

| Low/no/reduced allergen | 37 | 42 | 38 | 44 | 35 | 41 | 237 |

| Gluten free | 36 | 42 | 37 | 40 | 29 | 39 | 223 |

| Top price groupings (US$) | |||||||

| 0.99 - 4.98 | 35 | 52 | 82 | 47 | 67 | 51 | 334 |

| 4.99 - 8.98 | 57 | 46 | 64 | 56 | 55 | 54 | 332 |

| 8.99 - 12.98 | 52 | 40 | 28 | 40 | 41 | 39 | 240 |

| 12.99 - 16.98 | 25 | 25 | 17 | 28 | 27 | 28 | 150 |

| 16.99 - 24.00 | 19 | 11 | 10 | 19 | 24 | 18 | 101 |

| Imported status | |||||||

| Not imported | 24 | 11 | 22 | 29 | 10 | 10 | 106 |

| Imported | 94 | 73 | 72 | 73 | 119 | 101 | 532 |

| Top packaged types | |||||||

| Bottle | 148 | 130 | 135 | 146 | 172 | 150 | 881 |

| Aerosol | 16 | 30 | 52 | 33 | 31 | 33 | 195 |

| Jar | 16 | 14 | 10 | 7 | 17 | 9 | 73 |

| Can | 13 | 4 | 2 | 3 | 14 | 10 | 46 |

| Tub | 3 | 1 | 0 | 2 | 0 | 0 | 6 |

| Top launch types | |||||||

| New packaging | 65 | 58 | 79 | 64 | 88 | 72 | 426 |

| New variety/range extension | 67 | 57 | 69 | 68 | 60 | 79 | 400 |

| New product | 59 | 52 | 30 | 60 | 75 | 41 | 317 |

| Relaunch | 6 | 15 | 23 | 5 | 13 | 10 | 72 |

| New formulation | 3 | 0 | 1 | 0 | 0 | 0 | 4 |

| Top flavours (including blend) | |||||||

| Unflavoured/plain | 153 | 163 | 184 | 132 | 208 | 163 | 1,003 |

| Garlic | 4 | 2 | 1 | 9 | 3 | 5 | 24 |

| Butter | 4 | 3 | 5 | 5 | 1 | 2 | 20 |

| Roasted/toasted | 5 | 0 | 0 | 4 | 4 | 4 | 17 |

| Chili/chili pepper | 0 | 2 | 2 | 2 | 2 | 4 | 12 |

| Top ingredients | |||||||

| Extra virgin olive oil | 81 | 74 | 65 | 86 | 94 | 102 | 502 |

| Coconut oil | 36 | 22 | 26 | 15 | 28 | 16 | 143 |

| Low erucic acid rapeseed oil | 9 | 15 | 34 | 24 | 19 | 12 | 113 |

| Soy lethicin | 9 | 17 | 39 | 14 | 14 | 13 | 106 |

| Avocado oil | 11 | 9 | 13 | 14 | 26 | 12 | 85 |

| Source: Mintel GNPD, 2022 | |||||||

Examples of new products

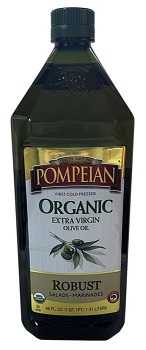

Robust Organic Extra Virgin Olive Oil

Source: Mintel GNPD, 2022

| Company | Pompeian |

|---|---|

| Brand | Pompeian |

| Category | Sauces and seasonings |

| Sub-category | Oils |

| Market | United States |

| Store type | Internet / mail order |

| Date published | December 2021 |

| Launch type | New packaging |

| Price in US dollars | 13.27 |

Pompeian Robust Organic Extra Virgin Olive Oil has been repackaged in a newly updated, recyclable 48 fluid ounce pack bearing the USDA Organic and Non GMO Project Verified logos. The farmer-owned, QAI certified product is said to be expertly crafted and made from first cold-pressed olives, is ideal for salads and marinades, is high in monounsaturated fats, is kosher certified, and is free from GMOs and gluten.

White Truffle Infused Oil

Source: Mintel GNPD, 2022

| Company | La Tourangelle |

|---|---|

| Brand | La Tourangelle |

| Category | Sauces and seasonings |

| Sub-category | Oils |

| Market | United States |

| Store type | Internet / mail order |

| Date published | September 2020 |

| Launch type | New packaging |

| Price in US dollars | 21.12 |

La Tourangelle White Truffle Infused Oil has been repackaged. This kosher certified product is described as an expeller-pressed artisan sunflower oil infused with natural white truffle flavoring, made using traditional French techniques, and features complex notes of woods, earth and fruit that are characteristic of the Italian white alba truffle, perfect as a finishing drizzle. It is free from sodium and gluten, is suitable for vegans, and retails in a newly designed 8.45 fluid ounce BPA-free and recyclable pack.

Non-Hydrogenated Coconut Oil

Source: Mintel GNPD, 2022

| Company | ConAgra Brands |

|---|---|

| Brand | Pam |

| Category | Sauces and seasonings |

| Sub-category | Oils |

| Market | United States |

| Store type | Mass merchandise / hypermarket |

| Date published | December 2019 |

| Launch type | New packaging |

| Price in US dollars | 3.69 |

Pam Non-Hydrogenated Coconut Oil has been repackaged and is available in a redesigned 5 ounce recyclable pack featuring the Smartlabel logo and a QR code. This kosher certified non-stick coconut oil is said to have a subtle taste that works well with almost any dish, and is perfect for roasting or baking. It can be sprayed directly on food to help lock in food and texture, and is free from calories, soy and GMO.

Non Stick Vegetable Oil Cooking Spray

Source: Mintel GNPD, 2022

| Company | Kroger |

|---|---|

| Brand | Kroger |

| Category | Sauces and seasonings |

| Sub-category | Oils |

| Market | United States |

| Import status | Not imported |

| Store type | Supermarket |

| Date published | July 2017 |

| Launch type | Relaunch |

| Price in US dollars | 2.29 |

Kroger Non Stick Vegetable Oil Cooking Spray has been relaunched with a new and improved spray nozzle and a propellant-free formulation. This product is free from gluten, is suitable for vegans, and retails in a 6 ounce pack providing 680 servings.

Sunflower Oil & Avocado Oil

Source: Mintel GNPD, 2022

| Company | Iberia Foods |

|---|---|

| Brand | Iberia |

| Category | Sauces and seasonings |

| Sub-category | Oils |

| Market | United States |

| Import status | Imported product |

| Store type | Mass merchandise / hypermarket |

| Date published | December 2016 |

| Launch type | New variety / range extension |

| Price in US dollars | 5.96 |

Iberia Sunflower Oil & Avocado Oil is a Mediterranean blend that is said to be ideal for seasoning, frying and baking. This product retails in a 51 fluid ounce bottle.

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

For additional information on the American Food and Beverage Show, please contact:

Cecile Landgrebe

Trade Commissioner

Consulate General of Canada

Government of Canada

cecile.landgrebe@international.gc.ca

Resources

- Euromonitor International:

- Country Report. Edible Oils in the U.S, December 2021.

- Country Report. Households: The U.S, July 2022.

- Country Report. Income and Expenditure: The U.S, July 2022

- Country Report. The USA in 2040: The Future Demographic, September 2020

- Global Trade Tracker, 2022

- Mintel Global New Products Database, 2022

- Mintel, A year of innovation in butter, spreads and oils, July 4, 2022.

- Mintel, Ingredient watch: modified plant-based oil, April 27, 2021.

- National Oilseed Processors Association (NOPA), Unlocking the power of the seed, October 2015

- USDA; Soybeans and Oil Crops, Oil Crops Sector at a Glance, July 2022.

Sector Trend Analysis – Cooking oil trends in the United States

Global Analysis Report

Prepared by: Laurie Bernardi, International Market Research Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2022).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.