Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

China continues to dominate the global fish and seafood industry as the largest producer and consumer. The market is characterized by a growing preference for high-quality, value-added products driven by increasing per capita disposable income and changing dietary preferences. By 2032, per capita fish and seafood consumption in China is projected to expand by 14%, reflecting a shift towards healthier and more diverse food choices (OECD-FAO, 2023).

China's total fish and seafood imports increased at a compound annual growth rate (CAGR) of 6.0% from 2019 to 2023, reaching a total of US$23.2 billion in 2023. The regional analysis reveals significant contributions from costal regions like Shandong, Guangdong, Fujian, Shanghai, and Zhejiang, which collectively accounted for 68.0% of total imports in 2023. Among the top five importing regions, Zhejiang demonstrated the highest CAGR of 31.3% during the same period. Inland provinces like Yunnan, Guizhou, and Gansu showcased remarkable growth rates, albeit from lower bases.

China was Canada's 2nd largest export market for fish and seafood in 2023, to which Canada exported US$1.1 billion, accounting for 18.7% of Canada's global fish and seafood exports. Canada's fish and seafood exports to China expanded by a CAGR of 2.0% between 2019 and 2023. Canadian exports, particularly lobster, frozen cold-water shrimp, and crab, have seen significant growth in China due to their perceived quality and improved supply chain logistics.

Between 2019 and 2023, the total retail sales value of fish and seafood in China experienced notable growth, with total sales rising from US$ 71.5 billion to US$92.7 billion, reflecting a CAGR of 6.7%.

Between 2019 and 2023, the total foodservice sales of fish and seafood in China declined from 26.9 million tonnes to 25.0 million tonnes, with a CAGR of −1.8%. Looking ahead, total foodservice sales of fish and seafood are projected to recover, with an anticipated CAGR of 1.8% from 2023 to 2028, reaching 27.2 million tonnes.

The rise of e-commerce has significantly altered consumer purchasing behavior, with platforms like Douyin and Freshippo driving the growth of online seafood sales. This trend is expected to continue, especially among young urban consumers who value the convenience and time-saving benefits of online shopping.

Market trends

China is not only the world's largest producer of aquaculture and capture fisheries and exporter of fish for human consumption (OECD-FAO, 2023), but it also leads the world in fish and seafood consumption (USDA, 2024). As Chinese consumers' per capita disposable income and food consumption continue to grow steadily, there is a notable trend toward increased expenditure on high-quality, value-added fish and seafood products. This shift is indicative of evolving dietary preferences, with the per capita consumption of fish and seafood growing faster than that of meat, reflecting changing consumer priorities towards healthier and more diverse food choices. By 2032, China's per capita consumption of fish and meat is set to expand by 14% and 12% respectively (OECD-FAO, 2023).

| Category | 2019 | 2023 | CAGR* % 2019-2023 | 2024 | 2028 | CAGR* % 2023-2028 |

|---|---|---|---|---|---|---|

| Food | 739.1 | 925.6 | 5.8 | 954.0 | 1,232.8 | 5.9 |

| Meat | 208.0 | 260.4 | 5.8 | 268.5 | 346.9 | 5.9 |

| Fish and Seafood | 72.9 | 91.6 | 5.9 | 94.6 | 122.4 | 6.0 |

| Disposable Income | 6,114.9 | 8,038.7 | 7.1 | 8,379.0 | 11,008.9 | 6.5 |

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

||||||

In China, the fish and seafood market exhibits a broad spectrum of products, encompassing both freshwater and marine species, alongside processed and value-added options. While traditional choices like carp, tilapia, and shrimp maintain their popularity, there's a noticeable surge in demand for high-quality and imported selections such as salmon, lobster, and oysters, especially within urban demographics. Chinese consumers' increasing concerns about environmental pollution and food safety have led to a preference for imported seafood, deemed more nutritious and safer due to better water quality and stricter controls. While health benefits like high unsaturated fatty acids are important, taste remains crucial. On e-commerce platforms, positive reviews highlight the deliciousness and freshness of seafood, while negative reviews focus on safety issues (Daxue Consulting, 2023).

Regarding regional per capita fish and seafood consumption, coastal provinces generally surpass inland ones. In 2022, Zhejiang, Hainan, Fujian, Shanghai, and Guangdong rank in the top five nationwide, with per capita consumption ranging from 60.15 kilograms to 75.19 kilograms. In contrast, inland provinces such as Guizhou, Shaanxi, Shanxi, Xinjiang, Ningxia, Gansu, Qinghai, and Tibet all have per capita consumption levels below 10 kilograms. Within inland provinces, those along the Yangtze River tend to have higher consumption rates. Regions within the Yangtze River Basin like Chongqing, Hubei, Hunan, Anhui, and Jiangxi have per capita consumption levels above 35 kilograms, whereas other inland provinces have levels below 22 kilograms. Additionally, there is a discrepancy between southern and northern regions, with residents in the south consuming more seafood (44.19 kilograms per capita) compared to those in the north (17.90 kilograms per capita), divided by the Qinling-Huaihe boundary (Fisheries Development Strategy Research Center of Chinese Academy of Fishery Sciences,2023).

With the increase in disposable income, fish and seafood household consumption grew faster in rural areas than in urban areas from 2018 to 2022. As Chinese consumers living in third-tier (and below) cities and rural areas are expected to drive the next wave of consumption (Tan & Wang, 2020), high-end imported seafood products will find new opportunities for growth in China. Big e-commerce platforms and fresh supermarkets such as Pinduoduo, Alibaba, RT-MART and Yonghui Superstores are bringing an affordable middle-class lifestyle to rural residents through live streaming and aquatic counters, while the ever-improving cold chain logistics and community retail models such as fresh group buying and front-warehousing-to-home are making imported fish and seafood products fresher and more affordable (Wu, 2021).

| Category | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2018-2022 |

|---|---|---|---|---|---|---|

| Urban | 14.3 | 16.7 | 16.6 | 16.7 | 16.2 | 3.2 |

| Rural | 7.8 | 9.6 | 10.3 | 10.9 | 10.7 | 8.2 |

| National | 11.4 | 13.6 | 13.9 | 14.2 | 13.9 | 5.1 |

Source: China Statistical Yearbook, 2023 *CAGR: Compound Annual Growth Rate |

||||||

Due to the COVID-19 pandemic, there is a slight decrease in per capita fish and seafood consumption in foodservice sector, decreased from 18.9 kilograms in 2019 to 17.3 kilograms in 2023, with a CAGR of −2.2%. However, this trend is expected to reverse from 2023 to 2028, with consumption increasing at a CAGR of 1.7% to reach 18.8 kilograms by 2028.

Presently, seafood restaurants represent the predominant avenue for seafood consumption. Recent years have witnessed rapid growth in this sector, attributed to accelerated urbanization, rising living standards, and evolving consumption patterns. This trend signals a period of expansion for China's seafood restaurant industry, expected to persist with further income growth and logistical advancements. In 2019, the market size of China's seafood restaurant industry reached RMB 558.2 billion (about US$ 77.0 billion), marking an 18.4% year-on-year increase (Insight and Info, 2023). However, the industry experienced a downturn in 2020 due to the pandemic, with market size declining to RMB 463.3 billion (about US$ 63.9 billion), a 17% year-on-year decrease (Insight and Info, 2023). Projections indicate that by 2026, the market size is anticipated to reach approximately RMB1005.6 billion (about US$ 138.8 billion).

| Category | 2019 | 2023 | CAGR* % 2019-2023 | 2024 | 2028 | CAGR* % 2023-2028 |

|---|---|---|---|---|---|---|

| Fish and Seafood | 18.9 | 17.3 | −2.2 | 17.6 | 18.8 | 1.7 |

| Crustaceans | 2.0 | 2.0 | 0.0 | 2.1 | 2.4 | 3.7 |

| Fish | 11.5 | 10.1 | −3.2 | 10.2 | 10.8 | 1.3 |

| Molluscs and Cephalopods | 5.4 | 5.2 | −0.9 | 5.3 | 5.7 | 1.9 |

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

||||||

The rise of e-commerce has significantly boosted domestic seafood consumption in China, with popular items including fresh and frozen shrimp, ready-to-eat seafood, and fresh and frozen fish products. It is expected that COVID-19 and associated measures accelerated shifts in consumer purchasing behavior. This transition saw a move from traditional wet markets to e-commerce platforms for seafood purchases, initially driven by safety concerns but now favored for convenience. This shift is expected to persist, particularly among young, urban consumers with disposable income seeking the convenience and time-saving benefits of online seafood shopping (USDA, 2024).

Securing an affordable and sufficient supply of fish and seafood has been an indispensable pillar of China's food security strategy (Government of China, 2008; Han & Li, 2017; Ministry of Agriculture and Rural Affairs of China, 2017). The Chinese government emphasizes in the "14th Five-Year Plan" for National Fishery Development (2021-2025) that the proportion of high-quality fish and seafood products in the supply is relatively low, and there is insufficient development of prefabricated processed aquatic products that meet consumers' diverse demands. Therefore, the 14th Five-Year Plan will carry out innovation in the seed industry. Targeting the restricted access to core germplasm resources for introduced species such as South American white shrimp, salmon, and scallops, China will promote the introduction and exchange of important aquaculture germplasm resources and initiate the implementation of innovation in the introduction of aquaculture species. It will promote joint efforts in the commercial breeding of major aquaculture species and encourage the selection and breeding of high-quality, efficient, multi-resistant, and new aquaculture varieties suitable for different aquaculture models and environments (Ministry of Agriculture and Rural Affairs of China, 2021).

Trade overview

With imports of US$23.2 billion in 2023, China was the second largest fish and seafood importer in the world, after the US (US$27.1 billion). The growth trajectory of Chinese imports was steady, showcasing a CAGR of 3.6% from 2019 to 2023. This surge in imports solidified China's position, capturing a market share of 12.9% in 2023.

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 | Share % in 2023 |

|---|---|---|---|---|---|---|---|

| World | 162.1 | 150.1 | 174.0 | 192.8 | 180.7 | 2.8 | 100.0 |

| United States | 23.5 | 23.0 | 30.2 | 32.4 | 27.1 | 3.6 | 15.0 |

| China | 18.4 | 15.3 | 17.8 | 23.3 | 23.2 | 6.0 | 12.9 |

| Japan | 15.6 | 13.6 | 14.4 | 15.4 | 13.8 | −2.9 | 7.7 |

| Spain | 8.2 | 7.4 | 8.9 | 9.6 | 9.2 | 3.2 | 5.1 |

| Italy | 6.7 | 6.2 | 7.5 | 8.0 | 8.1 | 4.7 | 4.5 |

| France | 6.8 | 6.5 | 7.9 | 8.3 | 7.9 | 3.8 | 4.4 |

| Sweden | 5.3 | 5.1 | 5.6 | 6.2 | 6.5 | 5.4 | 3.6 |

| Germany | 6.0 | 6.1 | 6.1 | 6.7 | 6.4 | 1.6 | 3.5 |

| South Korea | 5.7 | 5.5 | 6.0 | 6.8 | 6.2 | 2.1 | 3.4 |

| Netherlands | 4.5 | 4.6 | 5.2 | 5.6 | 5.6 | 5.4 | 3.1 |

| Canada(16th ) | 3.3 | 3.0 | 3.7 | 4.0 | 3.4 | 1.1 | 1.9 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

Due to the COVID-19 related measures, the global exports of fish and seafood to China saw fluctuations from 2019 to 2023, ultimately reaching a peak of US$20.6 billion in 2023, with a CAGR of 3.4%. Ecuador emerged as the leading supplier in 2023, contributing US$3,956.5 million with a CAGR of 16.3%, followed by Russia at US$2,217.6 million with a 6.0% CAGR. South American countries like Peru and Chile, along with Asian nations such as India, Vietnam and Indonesia, also played significant roles. Canada ranked 7th among the leading suppliers of fish and seafood to China in 2023. Canada's share of exports to China grew at a CAGR of 2.0% from 2019 to 2023, and its market share was 5.2% in 2023.

Recognizing the potential in China's hotel, restaurant, and institutional (HRI) sector, seafood exporters are targeting high-end markets. Norway, known for its salmon, recently launched campaigns to promote farmed Atlantic cod, or "snow cod," to HRI buyers in major cities. To build a premium image, the cod were shipped chilled and displayed with sashimi-grade Norwegian salmon (USDA, 2024)

| 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 | Share % in 2023 | |

|---|---|---|---|---|---|---|---|

| World | 17,960.6 | 15,033.4 | 16,492.1 | 20,379.2 | 20,555.1 | 3.4 | 100.0 |

| Ecuador | 2,164.2 | 1,950.8 | 2,372.2 | 3,980.4 | 3,956.5 | 16.3 | 19.2 |

| Russia | 1,756.7 | 1,625.0 | 1,122.8 | 1,161.1 | 2,217.6 | 6.0 | 10.8 |

| India | 1,383.7 | 894.2 | 1,048.5 | 1,365.5 | 1,455.3 | 1.3 | 7.1 |

| Vietnam | 1,214.9 | 1,333.1 | 1,163.9 | 1,634.5 | 1,380.2 | 3.2 | 6.7 |

| Peru | 1,522.6 | 1,127.3 | 1,962.8 | 1,877.2 | 1,238.6 | −5.0 | 6.0 |

| Indonesia | 770.4 | 773.7 | 845.1 | 1,033.8 | 1,078.1 | 8.8 | 5.2 |

| Canada | 989.0 | 778.9 | 930.0 | 995.4 | 1,071.2 | 2.0 | 5.2 |

| United States | 926.1 | 788.8 | 884.6 | 1,051.0 | 1,052.2 | 3.2 | 5.1 |

| Norway | 589.7 | 410.4 | 579.6 | 753.0 | 808.4 | 8.2 | 3.9 |

| Chile | 538.1 | 425.7 | 371.0 | 581.0 | 755.6 | 8.9 | 3.7 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

China's fish and seafood imports increased at a CAGR of 6.0% from 2019 to 2023, reaching a total of US$23.2 billion in 2023. The regional analysis reveals significant contributions from costal regions like Shandong, Guangdong, Fujian, Shanghai, and Zhejiang, which collectively accounted for 68.0% of total imports in 2023. Among the top five importing regions, Zhejiang demonstrated the highest CAGR of 31.3% during the same period. Inland provinces like Yunnan, Guizhou, and Gansu showcased remarkable growth rates, albeit from lower bases.

Region |

2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 | Share % in 2023 |

|---|---|---|---|---|---|---|---|

| Total | 18,413.6 | 15,267.6 | 17,760.3 | 23,347.1 | 23,245.8 | 6.0 | 100.0 |

| Shandong | 3,455.8 | 2,783.7 | 3,139.3 | 4,595.3 | 4,343.4 | 5.9 | 18.7 |

| Guangdong | 2,461.8 | 2,224.4 | 2,735.1 | 3,562.8 | 3,464.1 | 8.9 | 14.9 |

| Fujian | 1,890.9 | 2,066.1 | 2,354.3 | 2,901.9 | 2,962.2 | 11.9 | 12.7 |

| Shanghai | 2,045.5 | 1,691.2 | 2,050.4 | 2,163.1 | 2,777.3 | 8.0 | 11.9 |

| Zhejiang | 761.2 | 739.9 | 1,288.6 | 2,147.7 | 2,262.6 | 31.3 | 9.7 |

| Liaoning | 2,308.9 | 1,862.7 | 1,495.1 | 1,717.6 | 1,906.5 | −4.7 | 8.2 |

| Beijing | 2,765.2 | 1,561.5 | 1,654.9 | 1,783.5 | 1,539.8 | −13.6 | 6.6 |

| Tianjin | 825.7 | 749.8 | 853.8 | 1,379.3 | 896.5 | 2.1 | 3.9 |

| Jilin | 279.2 | 219.8 | 629.5 | 677.3 | 586.2 | 20.4 | 2.5 |

| Hunan | 219.0 | 393.2 | 371.3 | 507.8 | 566.0 | 26.8 | 2.4 |

| Jiangsu | 307.7 | 210.6 | 252.5 | 366.8 | 376.3 | 5.2 | 1.6 |

| Guangxi | 132.0 | 195.1 | 202.5 | 364.5 | 270.6 | 19.7 | 1.2 |

| Yunnan | 33.5 | 33.5 | 52.6 | 124.5 | 174.8 | 51.1 | 0.8 |

| Sichuan | 84.9 | 91.6 | 139.5 | 136.6 | 172.8 | 19.5 | 0.7 |

| Hebei | 179.8 | 116.8 | 158.9 | 190.8 | 172.0 | −1.1 | 0.7 |

| Chongqing | 65.6 | 33.8 | 40.7 | 231.2 | 147.9 | 22.5 | 0.6 |

| Hubei | 65.9 | 35.9 | 42.6 | 66.7 | 111.9 | 14.2 | 0.5 |

| Xinjiang | 74.1 | 63.7 | 47.8 | 59.3 | 94.5 | 6.3 | 0.4 |

| Anhui | 143.0 | 89.3 | 126.6 | 122.4 | 84.1 | −12.4 | 0.4 |

| Henan | 42.7 | 32.6 | 50.0 | 62.5 | 74.7 | 15.0 | 0.3 |

| Jiangxi | 32.0 | 4.3 | 14.0 | 28.3 | 70.1 | 21.7 | 0.3 |

| Heilongjiang | 28.4 | 24.2 | 33.2 | 81.9 | 60.0 | 20.5 | 0.3 |

| Guizhou | 0.0 | 0.0 | 0.0 | 14.4 | 56.3 | 1,064.3 |

0.2 |

| Hainan | 47.2 | 27.4 | 24.6 | 47.9 | 43.1 | −2.2 | 0.2 |

| Shaanxi | 76.9 | 2.8 | 1.2 | 1.8 | 19.0 | −29.5 | 0.1 |

| Qinghai | 0.3 | 0.3 | 0.0 | 0.3 | 4.4 | 94.0 | 0.02 |

| Gansu | 0.2 | 9.7 | 0.8 | 4.0 | 3.2 | 100.6 | 0.01 |

| Shanxi | 0.3 | 1.0 | 0.3 | 6.2 | 3.0 | 84.2 | 0.01 |

| Ningxia | 13.1 | 1.0 | 0.0 | 0.3 | 1.7 | −40.2 | 0.01 |

| Nei Mongol | 72.2 | 1.1 | 0.2 | 0.6 | 1.0 | −65.5 | 0.00 |

| Xizang | 0.5 | 0.7 | 0.0 | 0.0 | 0.0 | N/C | 0.00 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate N/C: Not caculable |

|||||||

China's top 3 fish and seafood imports in 2023

The top ten fish and seafood products accounted for 68.0% of China's total fish and seafood imports in 2023. Ecuador, Peru, Russia, India, and Canada emerged as key suppliers, dominating various segments of the market.

Frozen shrimp

Frozen shrimp was China's largest fish and seafood import in 2023.China's imports of frozen shrimp experienced a CAGR of 7.8% during 2019-2023, reaching US$5.4 billion in 2023. Ecuador emerged as the largest supplier, with a substantial market share of 66.2% in 2023, followed by India and Thailand. While Ecuador maintained its dominance, India and Thailand also showed significant growth in their export of frozen shrimp to China.

The implementation of a free trade agreement between China and Ecuador in May 2023 is expected to boost Ecuadorian seafood exports, particularly shrimp, to China. The agreement provides preferential tariffs on over 95% of Ecuador's exports to China, including white shrimp, fish, and fish oil. Duties on these products, currently at 5 to 20 percent, will gradually be reduced to zero (USDA, 2024). The majority of China's imports from Ecuador consist of head-on, shell-on (HOSO) shrimp, which undergo processing to create value-added products intended for both domestic consumption and re-exportation (Mark Godfrey, 2024).

Fishmeal

Fishmeal was China's 2nd largest fish and seafood import in 2023. Fishmeal imports showed a CAGR of 10.2%, reaching US$2.9 billion in 2023. Peru, Vietnam, and Russia were the major suppliers, with Peru holding the largest market share of 26.1% in 2023. While Peru and Vietnam showed fluctuating trends, India exhibited the fastest growth in supplying fishmeal to China.

China's reliance on fishmeal and soybean imports stems from its protein scarcity. With Canada's domestic crushers increasing their canola usage, Canada's canola seed exports may decline, while canola meal exports rise. This shift positions China as the primary market for roughly three million additional tonnes of Canadian canola meal, driven by its expanding aquaculture industry, presenting a notable opportunity (Sean Pratt, 2024)

Live, fresh, or chilled crab

Live, fresh, or chilled crab was China's 3rd largest fish and seafood import in 2023. Imports of live, fresh, or chilled crab grew at a CAGR of 20.4%, reaching US$1.6 billion in 2023. Russia dominated the market with a substantial share of 60.0% in 2023, followed by Canada and Myanmar.

Russia retains its position as the leading exporter of live crab to China, primarily due to its proximity and consistent trade relationships. Russian shipments of crab to China surged in 2023, partly due to limited access to the U.S. and European markets (Chris Chase, 2024). Canada's greater market share is purportedly attributed to its increased price flexibility, offerings of hard-shelled products, and reliable supply (USDA, 2024).

| Product / supplier | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 | Share % in 2023 |

|---|---|---|---|---|---|---|---|

| Total fish and seafood imports | 18,413.6 | 15,267.6 | 17,760.3 | 23,347.1 | 23,245.8 | 6.0 | 100.0 |

| Frozen shrimp | 3,973.9 | 3,107.5 | 3,695.9 | 5,655.9 | 5,361.6 | 7.8 | 23.1 |

| Ecuador | 1,848.8 | 1,689.4 | 2,173.5 | 3,542.5 | 3,548.5 | 17.7 | 66.2 |

| India | 904.3 | 607.1 | 725.5 | 927.0 | 793.1 | −3.2 | 14.8 |

| Thailand | 254.8 | 165.5 | 206.1 | 241.5 | 262.6 | 0.8 | 4.9 |

| Argentina | 254.0 | 183.1 | 104.2 | 145.6 | 231.2 | −2.3 | 4.3 |

| Indonesia | 52.0 | 61.2 | 31.8 | 97.5 | 91.7 | 15.3 | 1.7 |

| Canada(24th) | 7.3 | 3.6 | 10.0 | 0.0 | 0.1 | −63.4 | 0.002 |

| Fishmeal | 1,974.7 | 1,965.3 | 2,745.4 | 2,989.6 | 2,914.4 | 10.2 | 12.5 |

| Peru | 1,141.3 | 905.8 | 1,547.1 | 1,513.3 | 762.0 | −9.6 | 26.1 |

| Vietnam | 132.7 | 150.6 | 206.1 | 287.2 | 425.0 | 33.8 | 14.6 |

| Russia | 97.4 | 119.4 | 156.9 | 196.0 | 250.6 | 26.7 | 8.6 |

| India | 6.3 | 0.2 | 9.1 | 85.8 | 223.1 | 144.4 | 7.7 |

| Chile | 97.2 | 170.8 | 125.4 | 163.6 | 222.4 | 23.0 | 7.6 |

| Crab, live, fresh or chilled | 779.0 | 803.1 | 1,231.8 | 1,299.7 | 1,635.9 | 20.4 | 7.0 |

| Russia | 310.6 | 411.0 | 644.9 | 710.4 | 980.8 | 33.3 | 60.0 |

| Canada | 109.8 | 86.6 | 102.4 | 116.3 | 173.0 | 12.0 | 10.6 |

| Myanmar | 5.6 | 8.8 | 59.8 | 87.4 | 84.5 | 97.0 | 5.2 |

| United States | 48.4 | 45.7 | 73.9 | 40.6 | 73.2 | 10.9 | 4.5 |

| Indonesia | 40.3 | 40.7 | 78.3 | 69.3 | 58.3 | 9.7 | 3.6 |

| Cuttle fish and squid, frozen | 861.3 | 662.8 | 989.2 | 893.2 | 1,173.0 | 8.0 | 5.0 |

| Indonesia | 224.8 | 194.5 | 261.4 | 300.6 | 355.7 | 12.2 | 30.3 |

| Peru | 141.5 | 53.5 | 127.2 | 31.7 | 229.9 | 12.9 | 19.6 |

| United States | 73.0 | 68.9 | 95.3 | 126.9 | 111.1 | 11.1 | 9.5 |

| Malaysia | 43.1 | 43.4 | 47.9 | 68.3 | 101.7 | 23.9 | 8.7 |

| Argentina | 68.9 | 74.9 | 60.2 | 59.4 | 56.9 | −4.7 | 4.9 |

| Fresh or chilled salmon | 686.4 | 326.3 | 586.4 | 736.8 | 1,059.5 | 11.5 | 4.6 |

| Norway | 235.4 | 137.3 | 267.2 | 366.7 | 538.8 | 23.0 | 50.8 |

| Chile | 244.7 | 71.0 | 68.1 | 102.4 | 222.7 | −2.3 | 21.0 |

| Australia | 51.9 | 65.5 | 132.0 | 155.3 | 163.5 | 33.2 | 15.4 |

| Faroe Islands | 116.8 | 40.8 | 63.6 | 85.5 | 62.9 | −14.3 | 5.9 |

| United Kingdom | 24.3 | 4.0 | 46.5 | 17.8 | 45.7 | 17.0 | 4.3 |

| Canada (8th) | 6.5 | 3.6 | 2.5 | 2.8 | 2.3 | −22.4 | 0.2 |

| Frozen fish | 881.7 | 825.0 | 679.3 | 969.6 | 998.9 | 3.2 | 4.3 |

| India | 201.0 | 140.7 | 101.6 | 212.2 | 286.0 | 9.2 | 28.6 |

| Indonesia | 164.1 | 213.9 | 169.7 | 146.4 | 149.9 | −2.2 | 15.0 |

| United States | 99.8 | 70.0 | 63.9 | 99.3 | 88.4 | −3.0 | 8.9 |

| Iran | 0.9 | 3.1 | 16.0 | 72.5 | 68.9 | 198.9 | 6.9 |

| Malaysia | 26.0 | 62.2 | 57.6 | 90.3 | 68.2 | 27.2 | 6.8 |

| Canada (25th) | 6.2 | 3.9 | 1.7 | 2.2 | 3.3 | −14.4 | 0.3 |

| lobster, live, fresh or chilled | 475.1 | 452.7 | 681.1 | 614.2 | 790.2 | 13.6 | 3.4 |

| Canada | 462.7 | 344.2 | 534.9 | 516.2 | 604.1 | 6.9 | 76.5 |

| United States | 9.3 | 105.1 | 141.8 | 96.1 | 182.5 | 110.7 | 23.1 |

| United Kingdom | 2.5 | 3.3 | 3.9 | 1.9 | 3.2 | 5.8 | 0.4 |

| Ireland | 0.4 | 0.1 | 0.2 | 0.0 | 0.3 | −8.7 | 0.03 |

| Netherlands | 0.0 | 0.1 | 0.0 | 0.0 | 0.1 | 58.0 | 0.02 |

| Frozen alaska pollack | 940.8 | 690.6 | 464.0 | 805.3 | 687.4 | −7.6 | 3.0 |

| Russia | 874.0 | 647.3 | 434.6 | 750.3 | 642.2 | −7.4 | 93.4 |

| United States | 49.5 | 33.1 | 19.6 | 37.3 | 35.7 | −7.9 | 5.2 |

| Japan | 9.1 | 7.0 | 8.5 | 15.9 | 7.6 | −4.4 | 1.1 |

| Canada | 1.7 | 3.0 | 1.3 | 1.6 | 1.9 | 2.1 | 0.3 |

| Vietnam | 0.1 | N/C | |||||

| Rock lobster | 941.4 | 897.3 | 621.7 | 892.3 | 629.2 | −9.6 | 2.7 |

| New Zealand | 197.5 | 207.6 | 247.5 | 240.5 | 251.1 | 6.2 | 39.9 |

| Mexico | 99.5 | 107.1 | 122.4 | 107.1 | 123.4 | 5.5 | 19.6 |

| United States | 27.6 | 34.5 | 64.5 | 74.5 | 97.3 | 37.1 | 15.5 |

| Portugal | 0.9 | 0.9 | 14.5 | 16.6 | 25.0 | 130.5 | 4.0 |

| Indonesia | 16.2 | 17.2 | 20.9 | 12.7 | 18.3 | 3.1 | 2.9 |

| Frozen cold-water shrimp | 303.5 | 260.0 | 260.6 | 542.6 | 551.5 | 16.1 | 2.4 |

| Canada | 139.4 | 100.4 | 100.5 | 203.4 | 211.7 | 11.0 | 38.4 |

| Greenland | 84.7 | 93.3 | 72.1 | 165.6 | 156.5 | 16.6 | 28.4 |

| Russia | 34.9 | 28.2 | 66.5 | 119.3 | 123.5 | 37.1 | 22.4 |

| Estonia | 12.3 | 6.1 | 5.1 | 19.1 | 22.6 | 16.4 | 4.1 |

| Denmark | 15.5 | 12.8 | 6.5 | 21.8 | 18.9 | 5.1 | 3.4 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate N/C: Not calculable |

|||||||

Among China's top 10 fast-growing fish and seafood imports and top suppliers, significant growth was observed in imports of pacific salmon fillets, with Norway leading as the primary supplier, followed by Chile. Shrimp and prawns also saw steady growth, with Chile emerging as the dominant supplier. Vietnam dominated the market for cuttlefish and squid, while Norway solely supplied trout. Snail imports surged, primarily sourced from Pakistan and France.

| Product/supplier | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 | Share % in 2023 |

|---|---|---|---|---|---|---|---|

| Fresh or chilled fillets of pacific salmon | 0.7 | 0.3 | 2.2 | 7.3 | 19.5 | 129.5 | |

| Norway | 0.4 | 0.0 | 2.0 | 7.2 | 15.1 | 156.1 | 77.5 |

| Chile | 0.1 | 0.2 | 0.0 | 0.0 | 4.3 | 146.9 | 22.1 |

| Shrimp and prawns, prepared/preserved | 0.1 | 0.3 | 0.6 | 1.0 | 2.4 | 107.6 | |

| Chile | 0.0 | 0.0 | 1.7 | N/C | 71.1 | ||

| Denmark | 0.2 | 0.3 | N/C | 14.5 | |||

| Greenland | 0.2 | 0.6 | 0.3 | N/C | 11.7 | ||

| Cuttle fish and squid, smoked/dried/salted | 2.6 | 25.1 | 33.4 | 64.1 | 47.3 | 106.4 | |

| Vietnam | 1.6 | 24.3 | 32.8 | 63.4 | 45.6 | 131.3 | 96.4 |

| Indonesia | 0.3 | 0.1 | 1.0 | 31.4 | 2.2 | ||

| Pakistan | 0.0 | 0.1 | 0.5 | 0.2 | 0.5 | 133.5 | |

| Fresh or chilled trout | 0.2 | 0.6 | 0.0 | 1.8 | 2.6 | 99.7 | |

| Norway | 0.2 | 0.6 | 0.0 | 1.8 | 2.6 | 99.7 | 100.0 |

| Snails, prepared or preserved | 0.2 | 0.2 | 0.4 | 0.4 | 3.2 | 92.4 | |

| Pakistan | 2.7 | N/C | 85.7 | ||||

| France | 0.1 | 0.1 | 0.2 | 0.2 | 0.3 | 27.5 | 9.5 |

| Fish heads, tails and maws, smoked/dried | 9.9 | 21.1 | 24.2 | 57.9 | 124.0 | 88.1 | |

| Vietnam | 1.5 | 17.7 | 22.3 | 48.5 | 76.0 | 165.1 | 61.3 |

| Tanzania | 27.1 | N/C | 21.9 | ||||

| Kenya | 4.4 | 9.6 | N/C | 7.7 | |||

| Frozen meat of tilapia | 0.7 | 1.8 | 1.0 | 3.7 | 8.0 | 84.1 | |

| Vietnam | 0.7 | 1.7 | 1.0 | 3.7 | 8.0 | 184.1 | 100.0 |

| Sea cucumbers, prepared/preserved | 14.8 | 24.1 | 62.6 | 113.7 | 142.5 | 76.0 | |

| Japan | 4.7 | 4.3 | 6.1 | 32.1 | 29.3 | 58.4 | 20.6 |

| South Korea | 1.9 | 7.1 | 23.6 | 18.5 | 22.1 | 83.9 | 15.5 |

| Mexico | 0.0 | 13.9 | 20.4 | N/C | 14.3 | ||

| Malaysia | 0.8 | 4.6 | 18.8 | N/C | 13.2 | ||

| Canada | 3.5 | 5.1 | 6.0 | 17.5 | 14.6 | 43.5 | 10.3 |

| Live eels | 18.6 | 27.3 | 56.3 | 165.1 | 178.8 | 76.0 | |

| Hong Kong | 13.5 | 25.5 | 53.3 | 163.0 | 176.1 | 89.9 | 98.5 |

| Myanmar | 0.1 | 0.1 | 1.4 | 0.8 | 2.1 | 125.1 | 1.1 |

| Thailand | 0.1 | 0.9 | 0.9 | 0.9 | 0.4 | 36.2 | 0.2 |

| Fish, salted or in brine | 0.7 | 1.7 | 0.5 | 2.9 | 6.0 | 70.6 | |

| Myanmar | 0.0 | 2.1 | 5.1 | 139.8 | 86.1 | ||

| Indonesia | 0.1 | 1.4 | 0.2 | 0.5 | 0.7 | 63.1 | 11.2 |

| Russia | 0.3 | 0.1 | 0.1 | 0.1 | 0.2 | −14.2 | 2.7 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate N/C: Not calculable |

|||||||

Canadian performance

China was Canada's 2nd largest export market for fish and seafood in 2023, to which Canada exported US$1.1 billion, accounting for 18.7% of Canada's global fish and seafood exports. Canada's fish and seafood exports to China expanded by a CAGR of 2.0% between 2019 and 2023. Canada has always been a net exporter of fish and seafood trade with China, recording a trade surplus of US$665.5 million in 2023.

| Export market | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 | Share % in 2023 |

|---|---|---|---|---|---|---|---|

| World | 5,732.2 | 4,933.6 | 7,228.8 | 6,587.7 | 5,732.6 | 0.002 | 100.0 |

| United States | 3,501.7 | 3,144.4 | 5,063.7 | 4,261.2 | 3,667.5 | 1.2 | 64.0 |

| China | 989.0 | 778.9 | 930.0 | 995.4 | 1,071.2 | 2.0 | 18.7 |

| Hong Kong | 189.2 | 101.2 | 138.7 | 131.5 | 143.4 | −6.7 | 2.5 |

| Japan | 215.3 | 164.4 | 204.5 | 194.7 | 140.2 | −10.2 | 2.4 |

| United Kingdom | 101.3 | 84.1 | 103.3 | 117.0 | 88.3 | −3.4 | 1.5 |

| France | 62.0 | 60.2 | 67.4 | 79.3 | 74.2 | 4.6 | 1.3 |

| South Korea | 91.9 | 79.4 | 103.5 | 112.0 | 70.0 | −6.6 | 1.2 |

| Belgium | 43.0 | 48.4 | 66.9 | 67.6 | 53.7 | 5.7 | 0.9 |

| Denmark | 69.3 | 49.1 | 55.8 | 48.9 | 43.5 | −11.0 | 0.8 |

| Netherlands | 38.1 | 38.6 | 55.2 | 68.2 | 41.2 | 2.0 | 0.7 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

The table below highlights significant regional variations in the growth and market share of Canadian fish and seafood imports into China. Shanghai led the regions with a significant CAGR of 13.8%, capturing 36.8% of the market share by 2023. Shandong, while showing minimal growth (0.8% CAGR), maintained a substantial market share of 17.4%. Zhejiang experienced the highest growth rate at 133.2%, increasing its market share to 13.0%. Guangdong also showed notable growth (8.7% CAGR) with a 10.5% market share. Conversely, regions like Beijing and Liaoning experienced declines with CAGRs of −14.7% and −10.9% respectively, although Beijing still held a 6.7% share. Other regions like Hunan, Jiangsu, and Fujian showed mixed growth rates and smaller market shares. Newer markets such as Henan, Chongqing, and Hainan showed promising growth, albeit from smaller bases.

| Region | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 | Share % in 2023 |

|---|---|---|---|---|---|---|---|

| Total | 1,136,042.3 | 839,007.2 | 1,086,927.7 | 1,236,340.6 | 1,358,456.9 | 4.6 | 100.0 |

| Shanghai | 297,995.2 | 260,421.3 | 458,621.5 | 407,126.2 | 500,426.6 | 13.8 | 36.8 |

| Shandong | 228,775.1 | 172,939.7 | 167,136.1 | 246,417.4 | 236,023.9 | 0.8 | 17.4 |

| Zhejiang | 5,988.3 | 12,916.9 | 18,146.5 | 74,967.8 | 177,128.3 | 133.2 | 13.0 |

| Guangdong | 102,704.6 | 68,793.8 | 117,961.6 | 171,415.6 | 143,152.8 | 8.7 | 10.5 |

| Beijing | 172,271.8 | 78,442.6 | 79,016.8 | 65,742.5 | 91,208.9 | −14.7 | 6.7 |

| Liaoning | 101,880.5 | 89,805.6 | 54,974.9 | 61,514.9 | 64,304.6 | −10.9 | 4.7 |

| Fujian | 34,234.7 | 15,139.9 | 25,937.6 | 22,517.6 | 39,381.3 | 3.6 | 2.9 |

| Hunan | 138,742.6 | 95,359.1 | 115,905.6 | 108,346.1 | 38,898.8 | −27.2 | 2.9 |

| Jiangsu | 14,266.3 | 11,135.1 | 25,154.0 | 43,638.2 | 26,992.7 | 17.3 | 2.0 |

| Tianjin | 22,198.6 | 14,260.7 | 6,639.9 | 16,574.6 | 13,796.5 | −11.2 | 1.0 |

| Henan | 3,804.4 | 6,019.9 | 12,631.9 | 11,812.7 | 10,260.1 | 28.2 | 0.8 |

| Chongqing | 522.9 | 250.1 | 423.9 | 1,540.8 | 5,531.1 | 80.3 | 0.4 |

| Sichuan | 1,051.1 | 648.6 | 624.1 | 335.2 | 4,966.7 | 47.4 | 0.4 |

| Hainan | 119.2 | 120.7 | 17.0 | 230.3 | 1,718.2 | 94.9 | 0.1 |

| Hebei | 409.5 | 302.4 | 457.1 | 134.3 | 1,073.6 | 27.3 | 0.1 |

| Jilin | 38.2 | 0.0 | 0.0 | 3,217.6 | 984.0 | 125.3 | 0.1 |

| Anhui | 5,078.9 | 11,508.2 | 2,058.3 | 284.7 | 790.0 | −37.2 | 0.1 |

| Hubei | 12.3 | 41.2 | 29.0 | 42.8 | 680.0 | 172.7 | 0.1 |

| Guizhou | 0.0 | 0.0 | 0.0 | 0.0 | 439.0 | N/C | 0.0 |

| Gansu | 0.0 | 0.0 | 0.0 | 0.0 | 398.0 | N/C | 0.0 |

| Jiangxi | 0.0 | 0.0 | 0.0 | 191.1 | 301.1 | N/C | 0.0 |

| Qinghai | 0.0 | 0.0 | 0.0 | 0.0 | 0.7 | N/C | 0.0 |

| Shaanxi | 679.4 | 0.0 | 0.0 | 0.0 | 0.0 | N/C | 0.0 |

| Heilongjiang | 0.0 | 28.8 | 1,192.0 | 281.9 | 0.0 | N/C | 0.0 |

| Nei Mongol | 5,268.7 | 0.0 | 0.0 | 0.0 | 0.0 | N/C | 0.0 |

| Shanxi | 0.0 | 872.5 | 0.0 | 8.3 | 0.0 | N/C | 0.0 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate N/C: Not calculable |

|||||||

Canada's top 3 fish and seafood exports in 2023

Lobster, live, fresh or chilled

Lobster, live, fresh or chilled were Canada's largest fish and seafood export to China, with a CAGR of 3.2%, amounting to US$390.5 million and accounting for 36.4% of the market share in 2023. Several factors contributed to this growth. Firstly, the increasing demand for premium seafood among China's expanding middle class has played a significant role. Chinese consumers perceive Canadian lobster as a high-quality delicacy, which has driven up consumption both in households and high-end restaurants. Additionally, the logistical improvements and efficient supply chain management between Canada and China have ensured a steady and timely supply of fresh lobster, enhancing their market availability and appeal. (Cliff White, 2024). Meanwhile, the U.S. lobster exports to China were severely impacted by tariffs in 2018 and 2019, nearly halting sales. Canada partially filled the gap with direct lobster flights from Nova Scotia (Leyland Cecco, 2019). Furthermore, global warming has led to a northward migration of American lobster, reducing lobster resources in the U.S., particularly in Maine, while increasing them along Canada's Atlantic coast (Trevor Hughes, 2023). Efforts from the Canadian lobster industry, along with support from federal and provincial governments, as well as exporters, have strengthened the Canadian lobster brand in China.

Frozen cold-water shrimp and prawns

Frozen cold-water shrimp and prawns was Canada's second-largest fish and seafood export to China in 2023, with a CAGR of 7.1%, reaching $179.9 million and holding 16.8% of the market share. According to the Canadian Association of Prawn Producers, although northwest China does not directly import Canadian cold-water shrimp (also named Arctic shrimp in the Chinese market), it is an important market for cold-water shrimp in China. Each year, a large volume of Canadian cold-water shrimp is exported to Qingdao, Dalian and other coastal ports and then reshipped to northeastern cities like Xi'an, Lanzhou, Xining and Urumqi, where they have become a favorite dish (Canadian Association of Prawn Producers, 2021). Canadian cold-water shrimp has taken root in the Chinese market, completing the localization process, paving the way for future expansion into secondary and tertiary markets, and serving more dining and group meal customers. Growth opportunities remain in various cold-water shrimp varieties in China (Canadian Association of Prawn Producers, 2023).

Crab, live, fresh, or chilled

Crab, live, fresh, or chilled was Canada's 3rd largest fish and seafood exports to China in 2023, with a CAGR of 6.8%, totaling US$154.7 million and representing 14.4% of the market. The Chinese market for Canadian snow crab is expanding due to rising consumer demand for high-quality proteins. Available in retail outlets like Costco and Hema, these products cater to various cooking methods and social gatherings. Additionally, the popularity of snow crab is growing on e-commerce and live streaming platforms such as Douyin and Taobao Live, where consumers enjoy detailed product information and enhanced shopping experiences. The product range has diversified beyond traditional offerings to include innovative, convenient options like hotpot platters (Sina, 2023).

| Product | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 | Market % share in 2023 |

|---|---|---|---|---|---|---|---|

| Fish and seafood total | 989.0 | 778.9 | 930.0 | 995.4 | 1,071.2 | 2.0 | 100.0 |

| Lobster, live, fresh or chilled | 344.9 | 278.7 | 384.8 | 354.2 | 390.5 | 3.2 | 36.4 |

| Frozen cold-water shrimp and prawns | 136.8 | 118.6 | 120.9 | 180.9 | 179.9 | 7.1 | 16.8 |

| Crab, live, fresh or chilled | 118.8 | 99.1 | 99.6 | 108.8 | 154.7 | 6.8 | 14.4 |

| Frozen clams | 59.6 | 43.2 | 61.1 | 55.2 | 73.7 | 5.5 | 6.9 |

| Frozen crab | 82.1 | 56.8 | 83.3 | 110.3 | 68.7 | −4.4 | 6.4 |

| Live, fresh or chilled, clams | 27.3 | 20.6 | 29.1 | 38.1 | 32.7 | 4.6 | 3.0 |

| Frozen lesser or greenland halibut | 27.4 | 12.5 | 32.0 | 24.4 | 25.5 | −1.7 | 2.4 |

| Frozen lobster | 37.0 | 23.8 | 19.9 | 27.1 | 24.4 | −9.9 | 2.3 |

| Frozen sea cucumbers | 9.9 | 7.3 | 17.8 | 20.6 | 19.9 | 19.1 | 1.9 |

| Frozen anchovies, Indian mackerels, seerfishes, etc | 22.8 | 31.6 | 21.4 | 3.3 | 9.2 | −20.2 | 0.9 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate |

|||||||

From 2019 to 2023, Canada's top fast-growing fish and seafood exports to China exhibited significant increases in value, with the most remarkable growth seen in frozen Alaska pollock, which surged from US$0.04 million to $1.74 million, marking a staggering CAGR of 160.0%. Cold-water shrimp and prawns (live, fresh, or chilled) also demonstrated strong growth with a CAGR of 48.4%, reaching US$0.52 million in 2023. Prepared or preserved sea cucumbers saw their export values rise to US$3.71 million, achieving a CAGR of 42.9%. Additionally, exports of fats and oils of fish, frozen pacific salmon fillets, and prepared or preserved lobster displayed robust CAGRs of 41.7%, 35.1%, and 32.5% respectively. Notably, the export value of frozen shrimp and prawns rose to $9.11 million, driven by a CAGR of 28.8%.

| Description | 2019 | 2020 | 2021 | 2022 | 2023 | CAGR* % 2019-2023 |

|---|---|---|---|---|---|---|

| Frozen alaska pollack | 0.04 | 0.13 | 0.52 | 1.09 | 1.74 | 160.0 |

| Cold-water shrimp and prawns, live, fresh or chilled | 0.11 | 0.11 | 0.20 | 0.04 | 0.52 | 48.4 |

| Sea cucumbers, prepared or preserved | 0.89 | 2.24 | 1.34 | 6.12 | 3.71 | 42.9 |

| Fats and oils of fish and their fractions | 0.49 | 0.46 | 1.68 | 0.60 | 1.96 | 41.7 |

| Frozen fillets of pacific salmon | 0.47 | 0.02 | 0.00 | 0.00 | 1.58 | 35.1 |

| Lobster, prepared or preserved | 2.47 | 2.35 | 0.65 | 4.01 | 7.61 | 32.5 |

| Frozen shrimp and prawns | 3.31 | 1.03 | 3.09 | 7.31 | 9.11 | 28.8 |

| Live, fresh or chilled, sea cucumbers | 0.23 | 0.25 | 0.06 | 0.00 | 0.52 | 22.5 |

| Frozen pacific salmon | 0.34 | 2.04 | 0.22 | 0.82 | 0.72 | 20.3 |

| Molluscs, smoked, dried, salted or in brine | 2.07 | 1.49 | 3.49 | 2.56 | 4.15 | 19.0 |

Source: Global Trade Tracker, 2024 *CAGR: Compound Annual Growth Rate |

||||||

Market size

With the lifting of China's "zero Covid" policies, consumers are returning to their regular lifestyles, reducing time spent at home and decreasing retail fish and seafood sales in 2023. Dining out is rebounding, benefiting foodservice volumes, although they remain below pre-pandemic levels. Despite this, total fish and seafood sales rose in 2023 after declines in 2020 and 2021, driven by the perception of these foods as high-protein and low-fat. Increased health awareness, boosted by the pandemic, is expected to continue, leading to a full recovery of fish and seafood volumes to pre-pandemic levels by 2026 (Euromonitor International, 2024).

Between 2019 and 2023, the total retail sales value of fish and seafood in China experienced notable growth, with total sales rising from US$ 71.5 billion to US$92.7 billion, reflecting a CAGR of 6.7%. Fresh fish and seafood led this growth, reaching US$89.8 billion in 2023 with a CAGR of 6.7%, and are forecasted to continue growing at a CAGR of 6.4% to US$122.7 billion by 2028. Crustaceans showed the highest growth rate from 2019 to 2023 at 10.3%, and are expected to grow at a slower CAGR of 5.4% from 2023 to 2028. Fish sales, which grew at a CAGR of 3.7% from 2019 to 2023, are projected to accelerate to a CAGR of 6.7% through 2028. Molluscs and cephalopods are expected to see their growth rate increase from 5.3% to 8.5% over the same periods. Processed seafood, including shelf-stable and frozen products, also displayed robust growth, with frozen processed seafood achieving a CAGR of 8.5% from 2019 to 2023 and projected to grow at 6.4% through 2028.

| Category | 2019 | 2023 | CAGR* % 2019-2023 | 2024 | 2028 | CAGR* % 2023-2028 |

|---|---|---|---|---|---|---|

| Fresh Fish and Seafood | 69,412.9 | 89,804.0 | 6.7 | 99,123.2 | 122,666.7 | 6.4 |

| Crustaceans | 26,578.8 | 39,319.2 | 10.3 | 42,809.6 | 51,025.7 | 5.4 |

| Fish | 30,649.7 | 35,502.2 | 3.7 | 39,714.0 | 49,142.2 | 6.7 |

| Molluscs and Cephalopods | 12,184.4 | 14,982.6 | 5.3 | 16,599.6 | 22,498.8 | 8.5 |

| Processed Seafood | 2,105.1 | 2,856.9 | 7.9 | 3,123.7 | 3,920.8 | 6.5 |

| Shelf Stable Seafood | 365.7 | 450.3 | 5.3 | 498.1 | 644.6 | 7.4 |

| Frozen Processed Seafood | 1,739.4 | 2,406.6 | 8.5 | 2,625.6 | 3,276.2 | 6.4 |

| Total | 71,518.0 | 92,660.9 | 6.7 | 102,246.9 | 126,587.5 | 6.4 |

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

||||||

Between 2019 and 2023, the total foodservice sales of fish and seafood in China declined from 26.9 million tonnes to 25.0 million tonnes, with a CAGR of −1.8%. The largest segment, fish, experienced a significant decrease, dropping from 16.1 million tonnes to 14.2 million tonnes (CAGR of −3.1%). Crustaceans and molluscs also saw slight declines, with CAGRs of −0.4% and −0.5%, respectively. However, processed seafood bucked the trend, growing from 404.7 thousand tonnes to 549.4 thousand tonnes, achieving a robust CAGR of 7.9%. Looking ahead, total foodservice sales of fish and seafood are projected to recover, with an anticipated CAGR of 1.8% from 2023 to 2028, reaching 27.2 million tonnes. Processed seafood is expected to continue its strong growth with CAGRs of 9.6%.

| Category | 2019 | 2023 | CAGR* % 2019-2023 | 2024 | 2028 | CAGR* % 2023-2028 |

|---|---|---|---|---|---|---|

| Fish and Seafood | 26,513.0 | 24,442.2 | −2.0 | 24,851.3 | 26,426.4 | 1.6 |

| Crustaceans | 2,852.6 | 2,811.4 | −0.4 | 2,919.4 | 3,364.4 | 3.7 |

| Fish | 16,132.9 | 14,246.7 | −3.1 | 14,391.9 | 15,092.0 | 1.2 |

| Molluscs and Cephalopods | 7,527.5 | 7,384.1 | −0.5 | 7,540.0 | 7,970.1 | 1.5 |

| Processed Seafood | 404.7 | 549.4 | 7.9 | 607.1 | 867.4 | 9.6 |

| Shelf Stable Seafood | 11.2 | 12.0 | 1.7 | 12.5 | 14.4 | 3.7 |

| Frozen Processed Seafood | 393.5 | 537.5 | 8.1 | 594.6 | 853.0 | 9.7 |

| Total | 26,917.7 | 24,991.6 | −1.8 | 25,458.4 | 27,293.8 | 1.8 |

Source: Euromonitor International, 2024 *CAGR: Compound Annual Growth Rate |

||||||

E-commerce's penetration of fresh food remains significantly higher than pre-pandemic levels, despite a slight decline in 2023 as consumers return to normal routines. The sector still shows strong growth potential, driven by social commerce platforms like Douyin and online grocery services such as Freshippo and Meituan Grocery. These platforms are crucial for future growth, with companies exploring new delivery methods to efficiently supply live seafood on demand. Understanding these trends, players are partnering with China's high-speed rail operator for on-demand live seafood delivery. This allows same-day delivery within provinces and 2-day cross-province shipping. The growing popularity of e-commerce and livestreaming will drive the future momentum of on-demand seafood delivery, enhancing accessibility and boosting sales (Euromonitor International, 2024).

Product launch analysis

Between 2019 and 2023, 1,050 new packaged fish and seafood products were launched in China. The majority of products were priced between US$0.37 and $8.36, with the most substantial launches in the $0.37 - $4.36 range, except in 2022 when the $4.37 - $8.36 range saw the highest number. Convenience was the most common product claim each year, especially in 2022. Non-imported products dominated the market, and only a few imported products were launched, with a notable absence in 2021 and 2022. Hema / Freshippo emerged as a significant brand, particularly in 2023. New variety/range extension was the most common launch type, with unflavoured/plain being the predominant flavor each year. Supermarkets were the leading store type for launches, though club stores saw increased activity in 2022 and 2023.

Hema / Freshippo, Alibaba's grocery chain, has launched the "Baoxian" series of aquatic products, designed to eliminate the earthy taste of freshwater fish using innovative breeding and cleaning technology. This off-flavour originates from the breeding environment and stress during breeding and transport. To address this, Hema has developed a patented system that controls water circulation and temperature in temporary tanks, allowing fish to adapt to lower temperatures and reduce off-flavours. This process, along with live bloodletting and plant-based deodorisation, removes 85% of the unwanted taste while preserving the fish's tender texture (Euromonitor International, 2024).

| Product attributes | Yearly launch count | ||||

|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Yearly product launches | 216 | 224 | 135 | 288 | 187 |

| Top five price groups in US dollars | |||||

| 0.37 - 4.36 | 91 | 95 | 60 | 72 | 62 |

| 4.37 - 8.36 | 55 | 58 | 40 | 92 | 56 |

| 8.37 - 12.36 | 35 | 28 | 17 | 52 | 40 |

| 12.37 - 16.36 | 17 | 21 | 9 | 34 | 14 |

| 16.37 - 22.00 | 15 | 17 | 7 | 24 | 12 |

| Top five claim categories | |||||

| Convenience | 44 | 56 | 35 | 86 | 48 |

| Positioning | 37 | 33 | 10 | 41 | 21 |

| Ethical & environmental | 24 | 42 | 10 | 25 | 10 |

| Natural | 15 | 12 | 3 | 9 | 5 |

| Plus | 4 | 14 | 6 | 13 | 7 |

| Imported status | |||||

| Not imported | 192 | 197 | 124 | 275 | 173 |

| Imported | 6 | 10 | 0 | 0 | 2 |

| Top five brands | |||||

| Hema / Freshippo | 0 | 0 | 4 | 8 | 18 |

| Difresco | 8 | 4 | 1 | 8 | 4 |

| Hai Tian Xia / Sea World / Huamer | 14 | 4 | 1 | 5 | 0 |

| Member's Mark | 1 | 4 | 2 | 9 | 5 |

| Hema / Freshippo Gong Fang / Kitchen | 0 | 0 | 0 | 13 | 8 |

| Top five launch types | |||||

| New Variety/Range Extension | 121 | 110 | 72 | 170 | 99 |

| New Product | 63 | 87 | 52 | 86 | 60 |

| New Packaging | 28 | 24 | 9 | 26 | 26 |

| New Formulation | 2 | 1 | 0 | 5 | 1 |

| Relaunch | 2 | 2 | 2 | 1 | 1 |

| Top five flavours (including blend) | |||||

| Unflavoured/Plain | 152 | 157 | 72 | 189 | 113 |

| Spice/Spicy | 11 | 9 | 10 | 14 | 9 |

| Hot | 6 | 16 | 1 | 4 | 0 |

| Garlic | 5 | 5 | 3 | 8 | 3 |

| Roasted/Toasted | 2 | 4 | 3 | 6 | 3 |

| Top store type | |||||

| Supermarket | 93 | 101 | 88 | 149 | 123 |

| Mass Merchandise/Hypermarket | 92 | 67 | 20 | 64 | 23 |

| Internet/Mail Order | 26 | 33 | 15 | 34 | 19 |

| Club Store | 0 | 6 | 0 | 19 | 18 |

| Department Store | 3 | 14 | 6 | 8 | 1 |

Source: Mintel 2024 |

|||||

Product launch examples

Flavourfully Steamed Scallop and Abalone Seafood Pot

Source: Mintel, 2024

| Company | Hua Xin Food |

|---|---|

| Brand | Zheng Yang |

| Store name | He Ma Xian Sheng |

| Store type | Supermarket |

| Date published | October 2023 |

| Launch type | New variety / range extension |

| Price in US dollars | 11.00 |

Zheng Yang Zheng Xiang Shan Bei Bao Yu Hai Xian Guo (Flavourfully Steamed Scallop and Abalone Seafood Pot) is now available, and retails in a 1 kilogram pack containing 800 grams of seafood platter, 150 grams of garlic flavoured sauce, and two 25 gram seasoning sauce sachets. - Selected nutritious combination of seafood - Great choice for lazy people as it does not require washing and cutting - Can be easily enjoyed - Meaty seafood and flavourful vegetables - Serving instructions

Big Sea Cucumber Fish Balls

Source: Mintel, 2024

| Company | Hema |

|---|---|

| Brand | Hema / Freshippo Zhen Xiu Hai Wei |

| Store name | He Ma Xian Sheng |

| Store type | Supermarket |

| Date published | September 2023 |

| Launch type | New variety / range extension |

| Price in US dollars | 2.74 |

Hema / Freshippo Zhen Xiu Hai Wei Da Ke Li Hai Shen Yu Wan (Big Sea Cucumber Fish Balls) are now available, and retail in a 120 gram pack containing four units. - Minced tender white fish mixed with sea cucumber pieces - Suitable for air fryers - Made with an ancient Taiwanese method - Soft and tender minced fish with chewy sea cucumber - Serving instructions - Logos and certifications: QR code

Frozen Cooked Canadian Lobster

Source: Mintel, 2024

| Company | Xian Wu Jie Food |

|---|---|

| Brand | Global Fishery |

| Store name | He Ma Xian Sheng |

| Store type | Supermarket |

| Date published | January 2019 |

| Launch type | New product |

| Price in US dollars | 11.28 |

Global Fishery Shu Dong Jia Na Da Long Xia (Frozen Cooked Canadian Lobster) is now available. The product retails in a 400 gram pack bearing a QR code.

Frozen Cooked Snow Crab Leg

Source: Mintel, 2024

| Company | Hua Xin Food |

|---|---|

| Brand | Zheng Yang |

| Store name | He Ma Xian Sheng |

| Store type | Supermarket |

| Date published | August 2023 |

| Launch type | New variety / range extension |

| Price in US dollars | 17.95 |

Zheng Yang Shu Dong Xue Xie Tui (Frozen Cooked Snow Crab Leg) is now available, and retails in a 300 gram pack. - Frozen cooked to lock in freshness - Cooking instructions

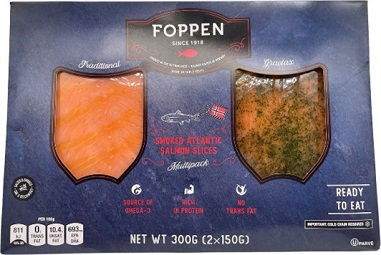

Smoked Atlantic Salmon Slices Multipack

Source: Mintel, 2024

| Company | Foppen |

|---|---|

| Brand | Foppen |

| Store name | Sam's Club |

| Store type | Club store |

| Date published | August 2023 |

| Launch type | New product |

| Price in US dollars | 11.94 |

Foppen Fu Peng Yan Xun Da Xi Yang San Wen Yu Pian (Smoked Atlantic Salmon Slices Multipack) is now available, and retail in a 300 gram pack containing two 150 gram units. - Smoked in the Netherlands - Salmon raised in Norway - Based on family recipe - With Traditional, and Gravlax varieties- Salted and smoked with oak and beechwood - Source of omega-3 - Rich in protein - No trans fat - Ready to eat - Made from fresh salmon- Carefully filleted - Cold smoked at 24-30 degree Celsius - Pre-sliced for convenience - Recipe suggestions - Freezable - Logos and certifications: QR code, Kosher

Salmon Belly

Source: Mintel, 2024

| Company | Ito Yokado |

|---|---|

| Brand | Ito Yokado Limit |

| Store name | Ito Yokado |

| Store type | Supermarket |

| Date published | December 2022 |

| Launch type | New variety / range extension |

| Price in US dollars | 14.08 |

Ito Yokado Limit Bing Xian San Wen Yu Yu Nan (Salmon Belly) is now available, and retails in a 180 gram pack containing 3 grams of Tianli wasabi sauce and 10 grams of Tianli seasoning juice. - Sliced from 100% Atlantic salmon - Sashimi grade salmon - 54% NRV of vitamin D and selenium - 1.95 gram of omega-3 per 100 gram

Wild Caught Greenlandic Prawns

Source: Mintel, 2024

| Company | Ze Pu Food |

|---|---|

| Brand | Royal Greenland |

| Store name | JD |

| Store type | Internet / mail order |

| Date published | January 2023 |

| Launch type | New variety / range extension |

| Price in US dollars | 14.76 |

Royal Greenland Ye Sheng Hai Bu Ge Ling Lan Bei Ji Xia (Wild Caught Greenlandic Prawns) are now available, and retail in a 1 kilogram pack. - Frozen at sea - Raw and shell-on - Cold water prawns are quickly frozen on board the catching vessel to ensure premium quality - Use the raw prawns directly after defrosting in sushi, sashimi or add them to hot dishes just before serving, and one will certainly impress their family and beloved ones - Since 1774 Royal Greenland has been dedicated to providing premium quality seafood - All products are caught in the crystal clear waters surrounding Greenland, and are packed and shipped from Europe - Logos and certifications: MSC (Marine Stewardship Council) - Certified Sustainable

Fish Maw

Source: Mintel, 2024

| Company | Haishanlai Food |

|---|---|

| Brand | Haishanlai |

| Store name | He Ma Xian Sheng |

| Store type | Supermarket |

| Date published | May 2021 |

| Launch type | New variety / range extension |

| Price in US dollars | 18.33 |

Haishanlai Yu Jiao (Fish Maw) is said to offer beauty benefits. This product can be used for making soup, stir-frying or as seasoning, and retails in a 93 gram pack featuring a QR code

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

For additional information on China Fisheries & Seafood Expo 2024, please contact:

Ben Berry, Deputy Director

Trade Show Strategy and Delivery

Agriculture and agri-food Canada

ben.berry@agr.gc.ca

Resources

- Canadian Association of Prawn Producers. 2023: 加拿大北极虾南下战略基本成型,全国10大区域布局接近收官! (Canada's Arctic shrimp strategy for going south has basically taken shape, and the layout of the country's 10 major regions is nearing completion!) (in Chinese only)

- Canadian Association of Prawn Producers. 2021: 北极虾"南下"趋势锐不可当,"南宋版图"等待您开疆拓土! (Arctic shrimp "south" trend is unstoppable, "Southern Song map" waiting for you to open up the territory!) (in Chinese only)

- Chris Chase, 2024: Russian shipments of crab to China spiked in 2023

- Cliff White, 2024: Lobster sales surpassed pre-pandemic levels in 2023

- Daxue Consulting, 2023: The seafood market in China amid Japan's import ban and Fukushima water release

- Euromonitor International, database 2024

- Euromonitor International 2023: Fish and Seafood in China

- Fisheries Development Strategy Research Center of Chinese Academy of Fishery Sciences,2023: Report on the Estimation and Analysis of Per Capita Consumption of Aquaculture Products Among Chinese Residents (2023) (中国居民水产品食用消费量 测算与分析报告(2023)) (in Chinese only)

- Global Trade Tracker, 2024

Government of China. 2008. 国家粮食安全中长期规划纲要(2008-2020年) National Food Security Medium and Long-Term Planning Outline [2008-2020] (in Chinese only) - Han, L. M., & Li, D. 2017. 蓝色粮仓":国家粮食安全的战略保障 (Blue Food System: Guarantee of China's Food Security) (in Chinese only)

Leyland Cecco, 2019: Trump's trade war with China creates unexpected winner: Canada's lobster industry - Insight and Info, 2023: 中国海鲜行业发展现状研究与投资前景预测报告 (2023-2029年) (Research on the Development Status of China's Seafood Industry and Investment Outlook Forecast Report: 2023-2029) (in Chinese only)

- Mintel Global New Products Database, 2024

- Ministry of Agriculture and Rural Affairs of China. 2021, "十四五"全国渔业发展规划 ("14th Five-Year Plan" for National Fishery Development) (in Chinese only)

- Mark Godfrey, 2024: China's shrimp market poised for change as free trade deal with Ecuador kicks in

- OECD-FAO, 2023: Agricultural Outlook 2023-2032

- Sean Pratt, 2024: Australian canola a 'thorn in our side'

- Sina 2023: 加拿大熟冻雪蟹热销中国高端零售商超 (Canadian cooked frozen snow crab are selling well at high-end Chinese retailers) (in Chinese only)

- Trevor Hughes, 2023: A 'whole way of life' at risk as warming waters change Maine's lobster fishing

- Tan & Wang, 2020, Can China's "Stall Economy" Save Its Stalled Economy?

- USDA, 2024: 2024 China Fishery Products Report

- USDA, 2024: China Imported Live Seafood Products Market Update

- Wu, L. 2021. 1年吃掉2.5万吨波龙,谁把高端海鲜端上了下沉市场的餐桌? (One year to eat 25,000 tons of Boston lobster, who put high-end seafood on the table of the sinking market?) (in Chinese only)

Sector Trend Analysis – Fish and seafood trends in China

Global Analysis Report

Prepared by: Zhi Duo Wang, Market Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2024).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.