Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

Key health and wellness (HW) trends across the world include keeping bellies and wallets full with satiating, nutritious food and drink; arming consumers with the know-how they need to adapt their meal plans using new alternative ingredients; giving overwhelmed consumers the freedom to indulge, to treat themselves and to help them optimize their mental performance at work, home and play; also, invigorating consumers with new experiences that helps them thrive in extreme environmental conditions by invoking food and drink more as a source of optimism, innovation and connection (Mintel: Global food & drink Trends, 2023).

In Mexico, the new labelling regulation (NOM051) introduced on packaging for food and drink products that have high levels in sugar, salt and fats content, which came into effect towards the end of 2020, has served to bolster consumer concerns and resulted in a continuation of HW trends in 2021. Lower and middle-income Mexicans continued to prioritize fortified foods & beverages in the interest of receiving maximum value from economy brands in the face of continued economic stress brought on by the pandemic (Euromonitor: Health & Wellness in Mexico, 2022).

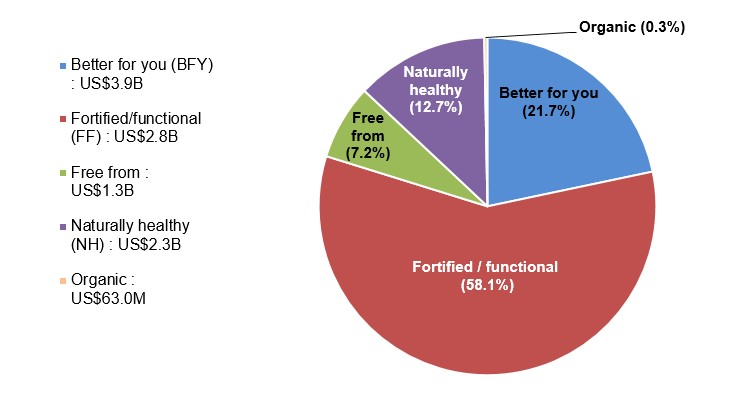

In 2021, retail sales of the Mexican HW sector totaled US$18.1 billion. Of this total, 64% accounted for HW retail food sales at US$11.6 billion with the remainder 36% in HW retail beverage products at US$6.5 billion. The HW category with the highest retail sales value was for fortified/functional (FF) food and drink products at US$10.5 billion, followed by better for you (BFY) at US$3.9 billion and naturally healthy (NH) at US$2.3 billion in 2021. Free from food products and organic food and drink products are becoming more popular amongst Mexicans with registered sales and a compound annual growth rate (CAGR) between 2016 and 2021 of US$1.3 billion (13.1%) and US$63 billion (12.0%), respectively.

According to a Mintel Global survey consisting of 1,000 responses (2022), 59% of Mexicans indicated that they look to consume more nutritious food/drink products packed with vitamins and minerals. Although, competitive pricing is a key consideration when introducing high premium quality products to the market, consumers are looking for 'value-added' products that deliver in forms beyond low cost.

2023 – Global and Mexican food and drink trends

Consumers across the world are looking for reassurance as they continue to be challenged to adapt, with feelings of insecurity and uncertainty surrounded around increasing fluctuations in cost-of-living finances, such as food and drink products. Manufacturers are also, facing these same challenges and are trying to adjust alongside the anxious, value-conscious consumer by continuing to diversify and innovate their brand offerings that offer measurable tangible benefits from what they invest in terms of quality, premium, convenient and budget-friendly products. Consumers are looking for 'value-added' products that go beyond affordable, low prices, where they want satiating, yet nutritious food and drink, while also having the freedom to indulge in new experiences, including the choice between versatile options that help optimize one's health and well-being throughout all life occasions.Footnote 1

To better connect with overwhelmed, fatigued consumers, on-pack product communication should be streamlined to focus on a few specific key health claim benefits in order to remain as a more trustworthy brand. Amongst, the countries with the highest inflation in mid-2022 (including Brazil, Canada, Italy, South Korea), key health claims such as immune support, healthy heart or digestive health benefits and the usage of natural health-boosting ingredients over fortified ones are factors that are often more important than low price offerings. In a Mintel Global Consumer survey, 59% of Mexicans (over 1,000 users) indicated that they look to consume more nutritious food/drink products packed with vitamins and minerals over seeking more affordable options (23%).Footnote 1

'Better-for-us' will become the new 'better-for-you' for ethical consumers that expect that health products considered for 'luxury' should not be restricted to those with high disposable incomes. Food insecurities and exposed inequalities across global and local food systems have only heightened during the pandemic, forcing a shift toward community-led solutions - and moving away from power monopolies that have driven food systems in the past. Manufacturers are forced to address sustainable issues beyond storage and processing factors; to also, protect the factors that impact the nutritional value of food from farm to table by devoting resources to improve soil health, growing conditions (water stewardship, CO2 levels, pollution), crop genetics, post-harvest nutrient degradation and climate change - to name a few.Footnote 1

Consumers are still cooking at home frequently, but more recently, rising food costs due to inflation, export/food supply issues and the looming threat of a global recession have put more pressure on consumers' abilities to obtain, prepare and maximize their groceries. Brands will need to help consumers become more flexible in the kitchen, both to optimize the usage of alternative, cheaper ingredients and to find new ways to cook with them. Brands have the opportunity to help consumers gain confidence and put them in control when practicing flexibility, by arming them with the 'know how' guidance and support, while offering versatile ways to incorporate new ingredients and transforming traditional recipes in new ways. Now more important than it was pre-pandemic, brands can enhance the experience of at-home consumption, by building food and drink into self-care regimens, and transforming the experience from a guilty pleasure to a necessary coping mechanism - whereby lower than global average, 22% of 1,000 Mexican respondents indicated that they like to relieve stress by eating comforting foods and 27% like to pamper themselves (that is, taking relaxing baths/showers, in-home facials).Footnote 1

Health and wellness sector – market overview

Overall, the HW Mexican sector reached a retail sales value of US$18.1 billion in 2021, which has increased at a CAGR of 6.5% (2016-2021) and a forecast CAGR of 6.4% (2021-2026). A total of 64% were HW packaged food products at a sales value of US$11.6 billion, with the FF category representing the highest market share at 66.3%, followed by BFY (11.7%), free from (11.3%), NH (10.5%) and organic (0.3%) in 2021.

The remainder 36% of HW non-alcoholic beverages reached sales of US$6.5 billion, which are thriving the most from within the FF (43.6%), BFY (39.4%), NH (16.7%), and organic ( 0.3%) related drink categories in 2021.

| Category | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|

| Total - Health and wellness food and drink by type | 13,231.6 | 18,093.4 | 6.5 | 19,246.3 | 24,688.4 | 6.4 |

| Better for you (BFY) | 2,877.3 | 3,918.7 | 6.4 | 4,164.0 | 5,351.5 | 6.4 |

| Fortified / functional (FF) | 8,004.5 | 10,509.2 | 5.6 | 11,115.2 | 13,795.1 | 5.6 |

| Free from | 705.9 | 1,303.9 | 13.1 | 1,421.6 | 2,074.4 | 9.7 |

| Naturally healthy (NH) | 1,608.3 | 2,298.7 | 7.4 | 2,475.0 | 3,361.0 | 7.9 |

| Organic | 35.7 | 63.0 | 12.0 | 70.6 | 106.5 | 11.1 |

|

Source: Euromonitor, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Description of above image

| Value (US$ million) | Market share (%) | |

|---|---|---|

| Better for you (BFY) | 3,918.7 | 21.7 |

| Fortified / functional (FF) | 10,509.2 | 58.1 |

| Free from | 1,303.9 | 7.2 |

| Naturally healthy (NH) | 2,298.7 | 12.7 |

| Organic | 63.0 | 0.3 |

Source: Euromonitor, 2022

Health and wellness packaged food products

| Category | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|

| Total - Health and wellness packaged food by type | 8,298.5 | 11,573.9 | 6.9 | 12,315.9 | 15,752.8 | 6.4 |

| Better for you (BFY) | 881.0 | 1,349.0 | 8.9 | 1,439.8 | 1,894.2 | 7.0 |

| Fortified / functional (FF) | 5,857.7 | 7,668.7 | 5.5 | 8,096.3 | 9,892.1 | 5.2 |

| Free from | 705.9 | 1,303.9 | 13.1 | 1,421.6 | 2,074.4 | 9.7 |

| Naturally healthy (NH) | 833.0 | 1,212.1 | 7.8 | 1,312.4 | 1,820.6 | 8.5 |

| Organic | 20.9 | 40.2 | 14.0 | 45.8 | 71.5 | 12.2 |

|

Source: Euromonitor, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Health and wellness beverages products

Non-alcoholic HW beverages fall under both hot drink (coffee, tea, other) and soft drink categories such carbonates, energy/sport drinks, fruit or vegetable juices or powders concentrations, functional drinks, iced/ready-to-drink (RTD) coffee or tea drinks, enhanced/flavored bottled water combinations, and Asian specialty drinks.

| Category | 2016 | 2021 | CAGR* % 2016-2021 | 2022 | 2026 | CAGR* % 2021-2026 |

|---|---|---|---|---|---|---|

| Total - Health and wellness beverages by type | 4,933.2 | 6,519.5 | 5.7 | 6,930.3 | 8,935.7 | 6.5 |

| Better for you (BFY) | 1,996.3 | 2,569.7 | 5.2 | 2,724.2 | 3,457.3 | 6.1 |

| Fortified / functional (FF) | 2,146.9 | 2,840.5 | 5.8 | 3,018.8 | 3,903.0 | 6.6 |

| Naturally healthy (NH) | 775.3 | 1,086.5 | 7.0 | 1,162.5 | 1,540.4 | 7.2 |

| Organic | 14.7 | 22.8 | 9.2 | 24.8 | 35.0 | 8.9 |

|

Source: Euromonitor, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Competitive analysis – Health and wellness packaged food and beverages

In 2021, Coca Cola with a Mexican market share of 10.5% and Nestlé SA (9%) were set to see share growth in the HW space as they tapped into a great consumer demand for reduced-calorie and naturally healthy products. Coca-Cola leads in HW beverages with its Coca-Cola Sin Azúcar (Zero Sugar) continuing to make strong gains during the year, which is a brand targeted by the company to provide healthier options and actively tries to redirect consumers from regular Coca-Cola (whose price is also elevated by added taxes). Meanwhile, the Mexican multinational, Grupo Bimbo with a market share of 13.7% in 2021, leads in the HW packaged food segment with its national coverage, well-positioned brands, and efficient distribution network.Footnote 2

"Back to local" is an important trend, which is increasing in visibility and gaining some traction in Mexico. Many coffee brands are looking to promote organic products to support the local coffee industry. During the year, the rationalization strategy implemented in 2020 by many companies has been replaced by products launched with consumers' willingness-to-pay in mind. Motivation for the move towards new product development was further strengthened by the implementation of the new labelling regulation - requiring companies to place black octagonal seals on products that contain excess of sugar, calories, sodium, or fat.Footnote 2

| Company | Brand(s) | Retail sales (US$ million) | Market share in 2021 |

|---|---|---|---|

| Grupo Bimbo SAB de CV | Bimbo, Marinela, Tía Rosa, Barcel, Lara, Milpa Real, Wonder | 2,482.7 | 13.7 |

| The Coca-Cola Company | Diet Coke, Powerade, Coca-Cola Zero Sugar, Ciel, Glacéau VitaminWater, Santa Clara, Del Valle, Ades, Sprite Zero | 1,908.2 | 10.5 |

| Nestlé SA | Nido, Nan, Sveltesse, Santa Maria, Nescafé, Gerber, Nesquik, Carnation, Nature's Heart, Chamyto, Chiquitin, S Pellegrino | 1,631.8 | 9.0 |

| PepsiCo Inc. | Gamesa, Gatorade, Lay's, Quaker, Diet Pepsi, Mafer, Be-Light, H2OH!, Maizoro, Diet 7-Up | 1,223.5 | 6.8 |

| Mondelez International Inc. | Trident/Dirol, Tang, Clorets, Halls, Clight | 1,040.7 | 5.8 |

| Private label | Private label | 148.4 | 0.8 |

| Others | Others | 2,205.6 | 12.2 |

| Total - market share | 21,161.5 | 100.0 | |

| Source: Euromonitor, 2022 | |||

Better for you – packaged food and beverage category

To qualify for inclusion in the BFY product category, the 'less healthy' element of foodstuff needs to have been actively removed or substituted during the processing stage. Products most likely to be included in this BFY positioning/marketing claim will be those which are low-fat or low-sugar versions of standard products (that is, reduced fat mayonnaise/cheese/milk or reduced sugar confectionery etc). NH drinks contain categories of packaged/flavored/enhanced water, fruit powders, juices and nectars.

Market sizes: Better for you

In Mexico, better for you (BFY) packaged food (US$1.3 billion) and drink (US$2.6 billion) products reached a retail sales value of US$3.9 billion in 2021. The BFY - reduced fat in the food category had the largest sales (mostly dairy) at US$749.8 million, followed by BFY - reduced salt (butter and spreads) at US$403.7 million, and BFY - reduced/no sugar products at US$195.5 million (mostly confectionery) in 2021. BFY sub-categories with the highest CAGRs (2016-2021) were reduced fat sauces, dressings and condiments (12.2%) and ice cream (11.4%), along with reduced sugar yogurt (21%) and spreads, excluding honey (11.5%).

| Category | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| Total - Better for you food and drink by type | 2,877.3 | 3,073.8 | 3,283.9 | 3,494.2 | 3,743.2 | 3,918.7 |

| Better for you - packaged food | 881.0 | 981.8 | 1,055.7 | 1,137.3 | 1,301.4 | 1,349.0 |

| Better for you - reduced fat | 484.7 | 528.5 | 575.6 | 621.6 | 708.6 | 749.8 |

| Dairy | 372.3 | 400.8 | 431.9 | 462.8 | 531.9 | 550.8 |

| Ice cream | 8.9 | 9.3 | 10.4 | 11.2 | 13.3 | 15.3 |

| Sauces, dressings and condiments | 103.5 | 118.5 | 133.3 | 147.5 | 163.5 | 183.7 |

| Better for you - reduced salt (butter and spreads) | 256.2 | 287.6 | 303.5 | 328.7 | 412.3 | 403.7 |

| Better for you - reduced/no sugar | 140.0 | 165.6 | 176.7 | 187.0 | 180.5 | 195.5 |

| Confectionery (including sugar-free gum) | 106.7 | 112.9 | 119.1 | 126.1 | 115.3 | 125.8 |

| Spreads (excluding honey) | 5.0 | 5.7 | 6.3 | 6.9 | 7.6 | 8.6 |

| Sweet biscuits | 11.5 | 12.6 | 13.9 | 14.9 | 16.2 | 17.3 |

| Yoghurt | 16.9 | 34.5 | 37.3 | 39.1 | 41.3 | 43.8 |

| Better for you - beverages | 1,996.3 | 2,092.0 | 2,228.2 | 2,357.0 | 2,441.8 | 2,569.7 |

| Better for you - reduced caffeine | 147.4 | 157.5 | 164.3 | 166.2 | 170.3 | 172.9 |

| Better for you - reduced sugar | 1,848.9 | 1,934.4 | 2,063.8 | 2,190.7 | 2,271.5 | 2,396.8 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2021/2020 | CAGR* % 2016-2021 | Total growth % 2016-2021 |

|---|---|---|---|

| Total - Better for you food and drink by type | 4.7 | 6.4 | 36.2 |

| Better for you - packaged food | 3.7 | 8.9 | 53.1 |

| Better for you - reduced fat | 5.8 | 9.1 | 54.7 |

| Dairy | 3.6 | 8.1 | 47.9 |

| Ice cream | 15.0 | 11.4 | 71.9 |

| Sauces, dressings and condiments | 12.4 | 12.2 | 77.5 |

| Better for you - reduced/no salt (butter and spreads) | −2.1 | 9.5 | 57.6 |

| Better for you - reduced sugar | 8.3 | 6.9 | 39.6 |

| Confectionery (including sugar-free gum) | 9.1 | 3.3 | 17.9 |

| Spreads (excluding honey) | 13.2 | 11.5 | 72.0 |

| Sweet biscuits | 6.8 | 8.5 | 50.4 |

| Yoghurt | 6.1 | 21.0 | 159.2 |

| Better for you - beverages | 5.2 | 5.2 | 28.7 |

| Better for you - reduced caffeine | 1.5 | 3.2 | 17.3 |

| Better for you - reduced sugar | 5.5 | 5.3 | 29.6 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

| Category | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Total - Better for you food and drink by type | 3,918.7 | 4,164.0 | 4,426.6 | 4,710.9 | 5,017.8 | 5,351.5 |

| Better for you - packaged food | 1,349.0 | 1,439.8 | 1,540.7 | 1,648.7 | 1,765.8 | 1,894.2 |

| Better for you - reduced fat | 749.8 | 801.9 | 859.4 | 921.0 | 988.5 | 1,062.9 |

| Dairy | 550.8 | 581.8 | 617.3 | 655.9 | 698.6 | 746.8 |

| Ice cream | 15.3 | 16.5 | 17.9 | 19.3 | 21.0 | 22.8 |

| Sauces, dressings and condiments | 183.7 | 203.6 | 224.3 | 245.8 | 268.9 | 293.3 |

| Better for you - reduced salt (butter and spreads) | 403.7 | 425.2 | 451.3 | 480.2 | 511.6 | 546.2 |

| Better for you - reduced/no sugar | 195.5 | 212.7 | 230.0 | 247.4 | 265.7 | 285.1 |

| Confectionery (including sugar-free gum) | 125.8 | 137.7 | 149.8 | 162.0 | 174.8 | 188.6 |

| Spreads (excluding honey) | 8.6 | 9.6 | 10.7 | 11.8 | 12.9 | 14.2 |

| Sweet biscuits | 17.3 | 18.8 | 20.2 | 21.7 | 23.1 | 24.7 |

| Yoghurt | 43.8 | 46.6 | 49.3 | 52.0 | 54.8 | 57.6 |

| Better for you - beverages | 2,569.7 | 2,724.2 | 2,886.0 | 3,062.3 | 3,252.0 | 3,457.3 |

| Better for you - reduced caffeine | 172.9 | 178.9 | 185.4 | 191.8 | 198.5 | 205.1 |

| Better for you - reduced sugar | 2,396.8 | 2,545.3 | 2,700.6 | 2,870.5 | 3,053.5 | 3,252.1 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2022/2021 | CAGR* % 2021-2026 | Total growth % 2021-2026 |

|---|---|---|---|

| Total - Better for you food and drink by type | 6.3 | 6.4 | 36.6 |

| Better for you - packaged food | 6.7 | 7.0 | 40.4 |

| Better for you - reduced fat | 6.9 | 7.2 | 41.8 |

| Dairy | 5.6 | 6.3 | 35.6 |

| Ice cream | 7.8 | 8.3 | 49.0 |

| Sauces, dressings and condiments | 10.8 | 9.8 | 59.7 |

| Better for you - reduced salt (butter and spreads) | 5.3 | 6.2 | 35.3 |

| Better for you - reduced/no sugar | 8.8 | 7.8 | 45.8 |

| Confectionery (including sugar-free gum) | 9.5 | 8.4 | 49.9 |

| Spreads (excluding honey) | 11.6 | 10.5 | 65.1 |

| Sweet biscuits | 8.7 | 7.4 | 42.8 |

| Yoghurt | 6.4 | 5.6 | 31.5 |

| Better for you - beverages | 6.0 | 6.1 | 34.5 |

| Better for you - reduced caffeine | 3.5 | 3.5 | 18.6 |

| Better for you - reduced sugar | 6.2 | 6.3 | 35.7 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

Competitive landscape – better for you

Leading packaged food companies in Mexico and top brands in the BFY category in 2021, include Nestlé SA (Sveltesse, Carnation) at a market share of 18.4% (US$248.4 million), Cremería Americana SA de CV (Gloria, La Abuelita) at 12.4% (US$166.7 million), and Ganaderos Productores de Leche Pura SA de CV (Alpura) at 10.2% (US$137.9 million).

The Coca-Cola company (top brands: Coke, Ciel, Sprite) dominates within the BFY beverage category at a market share of 45.5% (US$1.2 billion), followed by Le Groupe Danone (Levité) at 24.3% (US$623.8 million), and PepsiCo Inc. (Pepsi Max, Be-Light, H2OH!, 7Up) at 9.7% (US$249.8 million) in 2021.

| Category | Company | Brand(s) | Retail sales (US$ million) | Market share in 2021 |

|---|---|---|---|---|

| Better for you - packaged food | Nestlé SA | Sveltesse, Carnation | 248.4 | 18.4 |

| Cremería Americana SA de CV | Gloria, La Abuelita | 166.7 | 12.4 | |

| Ganaderos Productores de Leche Pura SA de CV | Alpura | 137.9 | 10.2 | |

| Sigma Alimentos SA de CV | Noche Buena, Eugenia | 124.1 | 9.2 | |

| Unifoods SA de CV | Chipilo, Breyers, Holanda | 102.5 | 7.6 | |

| Others | Others | 194.6 | 14.4 | |

| Total - market share | 1,349.0 | 100.0 | ||

| Better for you - beverages | The Coca-Cola Co. | Coke, Ciel, Sprite, Fuze Tea, Fresca, Lift | 1,170.2 | 45.5 |

| Groupe Danone | Levité | 623.8 | 24.3 | |

| PepsiCo Inc. | Pepsi (Max), Be-Light, H2OH!, 7-Up | 249.8 | 9.7 | |

| Nestlé SA | Nescafé, Taster's Choice, Nestea | 125.8 | 4.9 | |

| Mondelez International Inc. | Tang, Clight | 114.4 | 4.5 | |

| Private label | Private label | 12.1 | 0.5 | |

| Others | Others | 205.3 | 8.0 | |

| Total - market share | 2,569.7 | 100.0 | ||

| Source: Euromonitor, 2022 | ||||

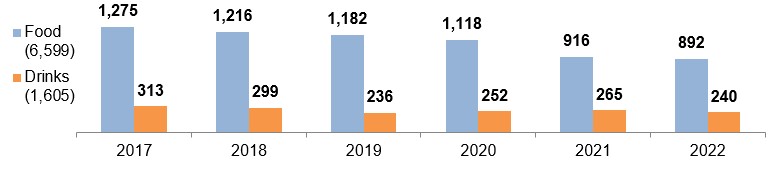

Product launch analysis – better for you

According to Mintel, there were approximately 6,599 new BFY food products launched (including new variety/range extension, packaging, formulation or relaunched) within Mexico between January 2017 and December 2022. These minus food products contained claims such as low/no/reduced (saturated or trans) fat; low/no/reduced calories, cholesterol, sodium, carbs, glycemic; no added sugar or sugar free; diet/light and not pasteurized. During this same period there were 1,605 minus 'BFY' related drink products launched in the Mexican market.

Description of above image

| Product | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Food (6,599) | 1,275 | 1,216 | 1,182 | 1,118 | 916 | 892 |

| Drinks (1,605) | 313 | 299 | 236 | 252 | 265 | 240 |

Source: Mintel, 2022

Total item count: 8,204

Top sub-categories (brands) within the BFY food category with new product launches in Mexico (2017 to 2022) were sweet biscuits/cookies (Sweetwell), white milk (Lala Deslactosada/Lala 100), corn-based snacks (Doritos Nacho), potato snacks (Sabritas) and flavoured milk (Lala Yomi/Lala 100).

| Top 10 - Better for you sub-category | Top 50 brands launched (product item count) | Number of products in sub-category |

|---|---|---|

| Sweet biscuits / cookies | Sweetwell (20), Don't Worry (18), D'Meals (10), H-E-B Select Ingredients, Okko Super Foods (5), (6), Great Value (3), Granvita (3), I Am(aranth) (2), Sanissimo (1) | 411 |

| White milk | Lala - Deslactosada/100 (61), Alpura (26), Sello Rojo (24), Santa Clara (17), Valley Foods (8), Kirkland Signature (6), Great Value (4), Selecto Brand (3), H-E-B Select Ingredients (2), Member's Mark (2), 7-Select (2), Lyncott (2) | 312 |

| Corn-based snacks | Doritos Nacho (17), Nopalia (15), I Am(aranth) (5), Sanissimo (4), Nutrisa (4), H-E-B Select Ingredients (2), Hill Country Fare (1), Member's Mark (1), Yema & Co (1) | 287 |

| Potato snacks | Sabritas (55), Ruffles (18), 7-Select (14), Selecto Brand (8), H-E-B Select Ingredients (6), Great Value (3), Yema & Co (1), I Am(aranth) (1) | 254 |

| Flavoured milk | Lala Yomi/100 (41), Alpura Vaquitas (35), Santa Clara (30), Hershey's (29), Great Value (13), Sello Rojo (8), Alpura (3), Valley Foods (2), 7-Select (2) | 252 |

| Bread & bread products | Sanissimo (7), Nopalia (4), Great Value (3), Yema & Co (2), Valley Foods (1) | 239 |

| Snack / cereal / energy bars | Kellogg's Special K (15), Sweetwell (6), Don't Worry (6), Kirkland Signature (4), Okko Super Foods (4), Yema & Co. (2), Granvita (1), I Am(aranth) (1) | 239 |

| Plant based drinks (dairy alternatives) | Silk (28), AdeS (27), Nature's Heart (17), Kirkland Signature (5), Member's Mark (5), Great Value (4), Valley Foods (4), H-E-B (4), Granvita (3) | 217 |

| Cold cereals | Kellogg's Special K (18), Granvita (13), H-E-B Select Ingredients (1), Nature's Heart (1), I Am(aranth) (1), Nutrisa (1) | 192 |

| Spoonable yogurt | Chobani (26), H-E-B Select Ingredients (12), Santa Clara (7), Alpura (4), Lyncott (4), Kirkland Signature (2), Lala (1) | 181 |

| Total sample size | 6,599 | |

| Source: Mintel, 2022 | ||

Between January 2017 and December 2022, among a sample size of 1,605 new products, top brands launched within the BFY non-alcoholic drink category were Coca-Cola (Sin Azúcar/Light), Tang, Bonafont Kids, V8 Splash and Great Value.

Description of above image

- Coca-Cola (carbonated soft drink): 79

- Tang (beverage mix): 56

- Bonafont Kids (fruit flavor still drink): 30

- V8 Splash (Juice): 21

- Great Value (fruit/drink mix/water): 17

- Be Light (flavored water): 13

- Nestlé Aguitas (flavored water): 12

- 7UP (carbonated soft drink): 12

- Buho (carbonated soft drink): 11

- Ciel Exprim (flavored water): 11

Source: Mintel, 2022

Total item count: 1,605

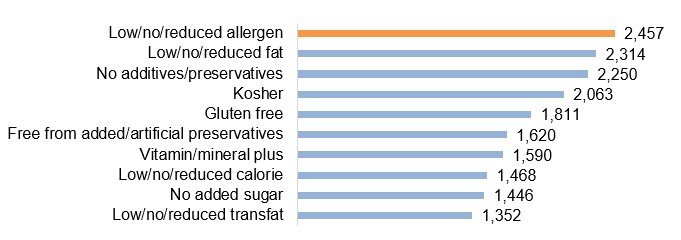

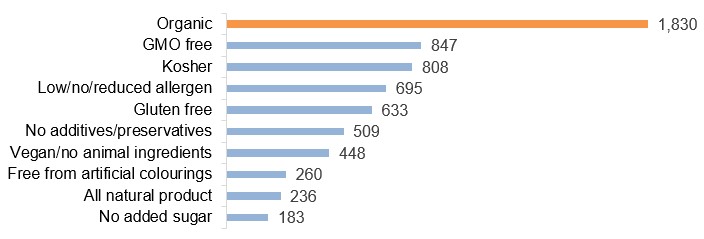

Popular claims associated with BFY food and beverage new product launches over the last six-year period were low/no/reduced allergen or fat, free from or no additives/artificial preservatives, Kosher, gluten free, vitamin/mineral plus, low/no/reduced calorie, no added sugar, and low/no/reduced transfat.

Description of above image

- Low/no/reduced transfat: 1,352

- No added sugar: 1,446

- Low/no/reduced calorie: 1,468

- Vitamin/mineral plus: 1,590

- Free from added/artificial preservatives: 1,620

- Gluten free: 1,811

- Kosher: 2,063

- No additives/preservatives: 2,250

- Low/no/reduced fat: 2,314

- Low/no/reduced allergen: 2,457

Source: Mintel, 2022

Total item count: 8,204

Product examples – better for you

Strawberry Pie Donuts

Source: Mintel, 2022

| Company | Yadira Rivera Zapata |

|---|---|

| Brand | Keto Fitness |

| Sub-category | Bakery, cake, pastries and sweet goods |

| Country | Manufactured in Mexico, not imported |

| Related claims | Low / no / reduced calorie, fat or allergens, diabetic, gluten free, high/added protein |

| Store type | Mass merchandise / hypermarket, Mexico City 03310 |

| Launch type | New product |

| Date published | December 2022 |

| Price in US dollars | 7.45 |

This product retails in a 120 gram pack containing two units. Contains excess amounts of saturated fat, and contains sweeteners according to the Mexican Health Secretariat. High in proteins. Baked artisan donut filled with cream cheese and natural strawberry jam. With added protein and monk fruit sweetener. Healthy snack with 11.7 grams of proteins - 4.7 gram of net carbs. Reduced total fat and calories comparing to similar products. Suitable for controlled diabetics and non-coeliac gluten intolerance.

Adobo Hot Flavored Potato Chips

Source: Mintel, 2022

| Company | Operadora de Ciudad Juárez |

|---|---|

| Brand | S-Mart (private label) |

| Sub-category | Snacks, potato snacks |

| Country | Manufactured in Canada, market Mexico |

| Related claims | Gluten free, low / no / reduced transfat and Allergens |

| Store type | Supermarket |

| Launch type | New product |

| Date published | September 2022 |

| Price in US dollars | 1.61 |

This new product retails in a 141.75 gram pack. It is high in calories and sodium, according to the Secretariat of Health for Mexico- Naturally gluten-free - 0% trans fats. Also, available in cheddar and sour cream, sour cream and onion, and classic or wavy original flavoured potato chips.

Rainbow Unicorn Flavored Energy Drink

Source: Mintel, 2022

| Company | Bang Energy |

|---|---|

| Brand | Bang |

| Sub-category | Sports and energy drink, energy drinks |

| Country | Manufactured in United States, market Mexico |

| Related claims | No additives / preservatives, low / no / reduced calorie and carb, antioxidant, functional – brain and nervous system / energy, sugar free, free from added / artificial colourings |

| Store type / location | Specialist retailer Mexico City 03600 |

| Launch type | New product |

| Date published | December 2022 |

| Price in US dollars | 3.36 |

This new product retails in a 473 millilitres pack. Contains super creatine - Ultra CoQ10- EAA amino acids, natural flavors and stable aqueous amide-protected bioactive creatine species. Powers one up- by the makers of the legendary Redline Energy products. Potent brain and body fuel, with super creatine, caffeine. Zero carbohydrates, sugar, calories and artificial colors.

Fortified / functional – packaged food and beverage categories

When identifying FF products, focus is on products to which health ingredients or/and nutrients have been added, as well as, brands that are positioned to deliver certain functionality. To be included here the enhancement has to be highlighted in the label or hold a health/nutritional claim. FF food and beverages provide health benefits beyond their nutritional value and/or the level of added ingredients wouldn't normally be found in that product and merits inclusion only when the product was actively fortified/enhanced during production. For example healthy products such as 100% fruit/vegetable juices are only added under FF, if additional health ingredients have been added like calcium, omega-3 etc.

Market sizes – fortified / functional

In Mexico, FF packaged food (US$7.7 billion) & drink (US$2.8 billion) products reached a retail sales value of US$10.5 billion in 2021. The largest sales occurred in the FF soft drink category at US$2.6 billion, followed by FF dairy at US$2.3 billion, and FF bread at US$1.6 billion in 2021.

All FF food and drink products registered moderate growth between 2016 and 2021. Categories with the highest CAGRs (between 6-7%) during this period were FF sport drinks, FF bread, FF sweet biscuits, FF snack bars, and FF dairy. FF energy drinks (10%), FF sports drinks (7.9%), and FF milk baby formula (7.9%) are expected to grow the most between the forecast period (2021-2026).

| Category | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| Total - fortified / functional food and drink by type | 8,004.5 | 8,602.8 | 9,130.5 | 9,582.7 | 10,063.4 | 10,509.2 |

| Fortified / functional - packaged food | 5,857.7 | 6,283.2 | 6,660.2 | 6,957.6 | 7,368.7 | 7,668.7 |

| Breakfast cereals | 629.6 | 666.7 | 709.9 | 741.8 | 795.3 | 827.0 |

| Bread | 1,215.0 | 1,306.9 | 1,390.3 | 1,447.6 | 1,627.9 | 1,633.0 |

| Confectionery | 549.5 | 593.0 | 634.4 | 664.7 | 589.7 | 636.1 |

| Dairy | 1,803.5 | 1,920.8 | 2,019.2 | 2,100.6 | 2,240.1 | 2,340.2 |

| Milk baby formula | 650.3 | 694.7 | 731.2 | 763.7 | 795.9 | 841.9 |

| Prepared baby food | 74.1 | 81.0 | 86.8 | 92.1 | 96.8 | 103.1 |

| Sweet biscuits | 699.5 | 760.5 | 809.7 | 854.0 | 917.1 | 966.6 |

| Snack bars | 236.0 | 259.5 | 278.5 | 293.2 | 305.9 | 320.8 |

| Fortified / functional - beverages | 2,146.9 | 2,319.5 | 2,470.3 | 2,625.2 | 2,694.7 | 2,840.5 |

| Hot drinks | 231.9 | 242.5 | 234.7 | 242.6 | 250.9 | 264.6 |

| Fortified / functional - soft drinks | 1,915.0 | 2,077.0 | 2,235.6 | 2,382.6 | 2,443.8 | 2,575.9 |

| Energy drinks | 432.3 | 444.7 | 503.0 | 547.9 | 524.5 | 546.8 |

| Sports drinks | 437.2 | 488.3 | 529.8 | 566.6 | 550.4 | 613.0 |

| Other soft drinks | 1,045.5 | 1,144.0 | 1,202.9 | 1,268.2 | 1,368.9 | 1,416.1 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2021/2020 | CAGR* % 2016-2021 | Total growth % 2016-2021 |

|---|---|---|---|

| Total - fortified / functional food and drink by type | 4.4 | 5.6 | 31.3 |

| Fortified / functional - packaged food | 4.1 | 5.5 | 30.9 |

| Breakfast cereals | 5.8 | 5.3 | 29.5 |

| Bread | 6.5 | 6.8 | 39.1 |

| Confectionery | 4.0 | 5.6 | 31.4 |

| Dairy | 0.3 | 6.1 | 34.4 |

| Milk baby formula | 7.9 | 3.0 | 15.8 |

| Prepared baby food | 4.5 | 5.3 | 29.8 |

| Sweet biscuits | 5.4 | 6.7 | 38.2 |

| Snack bars | 4.9 | 6.3 | 35.9 |

| Fortified / functional - beverages | 5.4 | 5.8 | 32.3 |

| Hot drinks | 5.5 | 2.7 | 14.1 |

| Fortified / functional - soft drinks | 5.4 | 6.1 | 34.5 |

| Energy drinks | 4.3 | 4.8 | 26.5 |

| Sports drinks | 11.4 | 7.0 | 40.2 |

| Other soft drinks | 3.4 | 6.3 | 35.4 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

| Category | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Total - fortified / functional food and drink by type | 10,509.2 | 11,115.2 | 11,722.9 | 12,360.6 | 13,052.7 | 13,795.1 |

| Fortified / functional - packaged food | 7,668.7 | 8,096.3 | 8,505.9 | 8,928.5 | 9,393.5 | 9,892.1 |

| Breakfast cereals | 841.9 | 890.4 | 938.4 | 988.2 | 1,041.7 | 1,099.1 |

| Bread | 103.1 | 109.8 | 116.6 | 123.9 | 131.6 | 140.0 |

| Confectionery | 827.0 | 846.5 | 867.5 | 895.7 | 933.8 | 979.8 |

| Dairy | 1,633.0 | 1,721.8 | 1,811.0 | 1,904.6 | 2,004.7 | 2,115.2 |

| Milk baby formula | 636.1 | 694.6 | 752.0 | 810.5 | 869.0 | 931.2 |

| Prepared baby food | 2,340.2 | 2,461.1 | 2,563.3 | 2,662.7 | 2,779.7 | 2,898.7 |

| Sweet biscuits | 966.6 | 1,032.2 | 1,097.1 | 1,161.9 | 1,228.9 | 1,298.4 |

| Snack bars | 320.8 | 339.9 | 360.0 | 381.1 | 404.1 | 429.6 |

| Fortified / functional - beverages | 2,840.5 | 3,018.8 | 3,217.0 | 3,432.0 | 3,659.2 | 3,903.0 |

| Hot drinks | 264.6 | 262.7 | 267.5 | 272.7 | 277.7 | 283.0 |

| Fortified / functional - soft drinks | 2,575.9 | 2,756.2 | 2,949.5 | 3,159.4 | 3,381.5 | 3,620.0 |

| Energy drinks | 546.8 | 595.1 | 655.2 | 728.2 | 802.2 | 880.2 |

| Sports drinks | 613.0 | 670.0 | 724.3 | 777.3 | 834.3 | 895.5 |

| Other soft drinks | 1,416.1 | 1,491.0 | 1,570.1 | 1,653.8 | 1,745.0 | 1,844.3 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2022/2021 | CAGR* % 2021-2026 | Total growth % 2021-2026 |

|---|---|---|---|

| Total - fortified / functional food and drink by type | 5.8 | 5.6 | 31.3 |

| Fortified / functional - packaged food | 5.6 | 5.2 | 29.0 |

| Breakfast cereals | 5.8 | 5.5 | 30.5 |

| Bread | 6.5 | 6.3 | 35.8 |

| Confectionery | 2.4 | 3.4 | 18.5 |

| Dairy | 5.4 | 5.3 | 29.5 |

| Milk baby formula | 9.2 | 7.9 | 46.4 |

| Prepared baby food | 5.2 | 4.4 | 23.9 |

| Sweet biscuits | 6.8 | 6.1 | 34.3 |

| Snack bars | 6.0 | 6.0 | 33.9 |

| Fortified / functional - beverages | 6.3 | 6.6 | 37.4 |

| Hot drinks | −0.7 | 1.4 | 7.0 |

| Fortified / functional - soft drinks | 7.0 | 7.0 | 40.5 |

| Energy drinks | 8.8 | 10.0 | 61.0 |

| Sports drinks | 9.3 | 7.9 | 46.1 |

| Other soft drinks | 5.3 | 5.4 | 30.2 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

Competitive landscape – fortified / functional

Leading packaged food companies in Mexico and top brands in the FF category in 2021, include Grupo Bimbo SAB de CV (Bimbo, Marinela, Tía Rosa) at a market share of 30.3% (US$2.3 billion), Nestlé SA (Nido, Nan, Gerber) at 10.7% (US$820.8 million), and The Kellogg Company (Zucaritas, Choco Krispies, Corn Flakes) at 8.8% (US$676.9 million). Private labels accounted for a sales share of 0.9% (US$71.5 million) in 2021.

In 2021, leading FF beverage companies (top brands) in Mexico included The Coca-Cola company (Powerade, Burn, Ciel) at a 15.5% market share (US$441.1 million), followed by Grupo Nutresa SA (Zuko) at 10.8% (US$307.5 million), and Modelez International Inc. (Tang, Clight) at 10.7% (US$303.9 million).

| Category | Company | Top brand(s) | Retail sales (US$ million) | Market share in 2021 |

|---|---|---|---|---|

| Fortified / functional - packaged food | Grupo Bimbo SAB de CV | Bimbo, Marinela, Tía Rosa, Milpa Real | 2,325.0 | 30.3 |

| Nestlé SA | Nido, Nan, Gerber, Chamyto, Chiquitin | 820.8 | 10.7 | |

| Kellogg Company | Zucaritas, Choco Krispies, Corn Flakes | 676.9 | 8.8 | |

| Mondelez International Inc. | Trident/Dirol, Clorets, Halls | 597.3 | 7.8 | |

| Grupo Lala SAB de CV | Lala, Nutri Leche, Mi Leche | 392.8 | 5.1 | |

| Private label | Private label | 71.5 | 0.9 | |

| Others | Others | 642.8 | 8.4 | |

| Total - market share | 7,668.7 | 100.0 | ||

| Fortified / functional - beverages | The Coca-Cola Company | Powerade, Burn, Ciel, Gladiator | 441.1 | 15.5 |

| Grupo Nutresa SA | Zuko | 307.5 | 10.8 | |

| Mondelez International Inc. | Tang, Clight | 303.9 | 10.7 | |

| PepsiCo Inc. | Gatorade, Propel | 233.0 | 8.2 | |

| Sociedad Cooperativa Trabajadores de Pascual SCL | Boing | 216.9 | 7.6 | |

| Others | Others | 235.3 | 8.3 | |

| Total - market share | 2,840.5 | 100.0 | ||

| Source: Euromonitor, 2022 | ||||

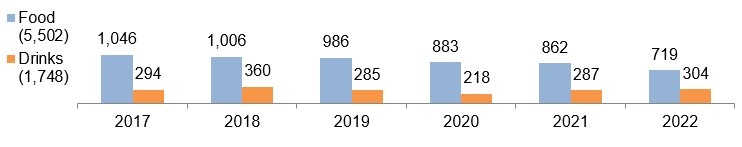

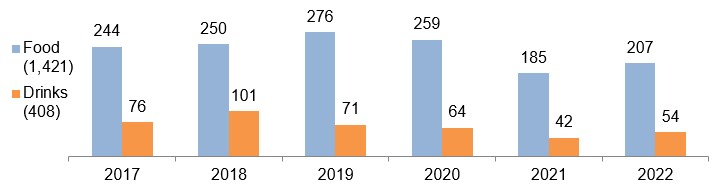

Product launch analysis – fortified / functional

According to Mintel, there were approximately 5,502 new fortified / functional food products launched (including new variety/range extension, packaging, formulation or relaunched) within Mexico between January 2017 and December 2022. These products contained either fortified (food plus) claims (added calcium, high/added fiber or protein, stanols/sterols, vitamin/mineral fortified) or functional claims (antioxidant, functional: bone health, brain & nervous system, cardiovascular, digestive, energy, eye health, immune system, other; slimming, stress and sleep, weight and muscle gain, high satiety, prebiotic, probiotic).

During this same period there were 1,748 fortified / functional related drink products launched in the Mexican market.

Description of above image

| Product | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Food (5,502) | 1,046 | 1,006 | 986 | 883 | 862 | 719 |

| Drinks (1,748) | 294 | 360 | 285 | 218 | 287 | 304 |

Source: Mintel, 2022

Total item count: 7,250

According to new product launches in Mexico (2017 to 2022), top sub-categories (brands) within the FF food category were cold cereals (Kellogg's - Zucaritas/Choco Krispis), white milk (Lala), snack/cereal/ energy bars (Berry Nuts), sweet cookies & biscuits (Garmesa Marias) and pasta (La Moderna).

| Top 10 - fortified / functional sub-category | Top 50 brands launched (product item count) | Number of products in sub-category |

|---|---|---|

| Cold cereals | Kellogg's - Zucaritas (30)/Choco Krispis (30)/Special K (20)/Fruit Loops (15)/All- Bran (9), Great Value (16), Nestlé - Cheerios (18)/Nesquik (14), Quaker (6), Valley Foods (4), H-E-B Select Ingredients (2), Aurrera (1), Okko Super Foods (1) | 586 |

| White milk | Lala (47) - Deslactosada (27)/100 (20), Alpura (27), Sello Rojo (27), Santa Clara (25), Nutri (19), Alpura Clásica (17), Great Value (13), Kirkland Signature (7), Aurrera (6), Valley Foods (10), Hill Country Fare (2), Nestlé Carnation Clavel (2), H-E-B Select Ingredients (2), Chedraui (2) | 507 |

| Snack/cereal/energy bars | Berry Nuts (18), Kellogg's - Special K (12)/All-Bran (5)/Fruit Loops (4)/Choco Krispis (1), Okko Super Foods (4), Quaker (3), Kirkland Signature (3), Great Value (2), Valley Foods (1) | 400 |

| Sweet cookies and biscuits | Gamesa Marias (19), Quaker (5), Mister Gourmet (2), Okko Super Foods (2), Kellogg's - Zucaritas (2)/Choco Krispis (1)/Fruit Loops (1), La Moderna (1), Great Value (1) | 310 |

| Pasta | La Moderna (76), Kellogg's - Choco Krispis (33), Yemina (32), S-Mart (17), Aurrera (15), H-E-B Select Ingredients (10), Chedraui (9), Valley Foods (2) | 308 |

| Flavored milk | Santa Clara (30), Great Value (13), Nestlé Nesquik (9), Sello Rojo (8), Kellogg's - All-Bran (5), Lala 100 (3), Alpura (3), Aurrera (2), Danonino (2), Valley Foods (2), Chedraui (1), Kirkland Signature (1) | 283 |

| Plant based drinks | AdeS (41), Silk (24), Nature's Heart (16), Valley Foods (4), Kirkland Signature (4), Great Value (3) | 227 |

| Liquid yogurt/cultured milk | Danone Danonino (20), Santa Clara (16), Hill Country Fare (10), Sello Rojo (2), Lala 100 (2), Chobani (1) | 193 |

| Fruit snacks | Mister Gourmet (6), Okko Super Foods (5), Great Value (3), | 159 |

| Bread and bread products | Bimbo (20), Nopalia (4), Hill Country Fare (3), H-E-B Select Ingredients (2), Great Value (1) | 157 |

| Total sample size | 5,502 | |

| Source: Mintel, 2022 | ||

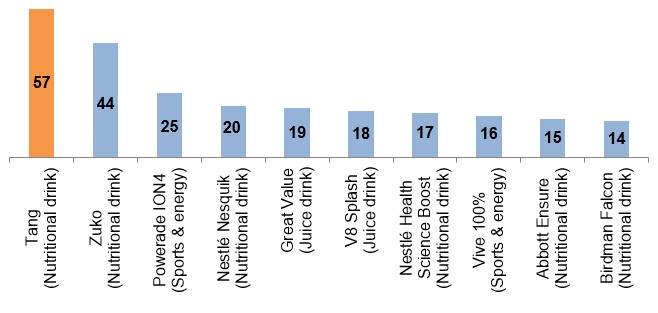

Between January 2017 and December 2022, among a sample size of 1,748 new products, top brands launched within the FF non-alcoholic drink category were Tang (Sin Azúcar/Light), Zuko, Powerade ION4, Nestlé Nesquick, and Great Value.

Description of above image

- Tang (Nutritional drink): 57

- Zuko (Nutritional drink): 44

- Powerade ION4 (Sports and energy: 25

- Nestlé Nesquik (Nutritional drink): 20

- Great Value (Juice drink): 19

- V8 Splash (Juice drink): 18

- Nestlé Health Science Boost (Nutritional drink): 17

- Vive 100% (Sports and energy): 16

- Abbott Ensure (Nutritional drink): 15

- Birdman Falcon (Nutritional drink): 14

Source: Mintel, 2022

Total item count: 1,748

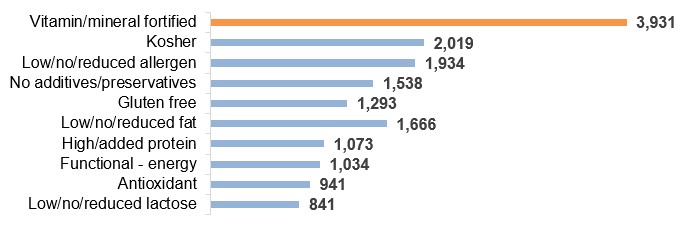

Popular claims associated with FF food and beverage new product launches over the last six-year period were vitamin/mineral fortified, Kosher, low/no/reduced allergen/fat/lactose, no additives/preservatives, gluten free, high/added protein, functional - energy, and antioxidant.

Description of above image

- Vitamin/mineral fortified: 3,931

- Kosher: 2,019

- Low/no/reduced allergen: 1,934

- No additives/preservatives: 1,538

- Gluten free: 1,293

- Low/no/reduced fat: 1,666

- High/added protein: 1,073

- Functional - energy: 1,034

- Antioxidant: 941

- Low/no/reduced lactose: 841

Source: Mintel, 2022

Total item count: 7,250

Product examples – fortified / functional

Cheddar & Mozza Style Blend

Source: Mintel, 2022

| Company / brand | Daiya Foods |

|---|---|

| Importer | Tiendas Soriana |

| Sub-category | Dairy, processed cheese |

| Country | Manufactured in Canada, market Mexico |

| Related claims | Added calcium, Kosher, vitamin/mineral fortified, Halal, gluten free, low/no/reduced allergen, vegan/no animal ingredients, GMO and dairy free, plant based |

| Store name / type | Mega Soriana, mass merchandise/hypermarket, Mexico City 01090 |

| Launch type | New variety / range extension |

| Date published | November 2022 |

| Price in US dollars | 7.12 |

This product is now available, and retails in a 200 gram pack. Deliciously dairy-free. Cutting board collection shreds, made with chickpea. Free from soy, gluten, GMO and peanuts. Good source of calcium. Plant based. Contains excess amounts of saturated fats and sodium, according to the Secretariat of Health of Mexico. Resealable pouch and is a freezable, Vegan product. Logos and certifications: Certified plant based, certified gluten free, non-GMO; Project verified: Halal, Kosher.

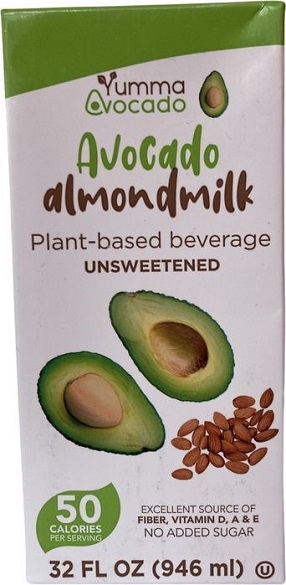

Avocado Almond Milk

Source: Mintel, 2022

| Company / brand | Yumma Foods/Yumma Avocado |

|---|---|

| Importer | Distribuidora Yaxche |

| Sub-category | Dairy, plant based drinks (dairy alternatives) |

| Country | Manufactured in Canada, market Mexico |

| Related claims | High/added fibre, vegetarian, premium, vitamin/ Mineral fortified, gluten free, low/no/reduced allergen, dairy free, no added sugar, plant based |

| Store name / type | La Comer, supermarket, Mexico City 03900 |

| Launch type | New product |

| Date published | June 2022 |

| Price in US dollars | 4.96 |

This unsweetened plant-based beverage is made with premium Hass avocados, is an excellent source of fibre, and vitamins D, A and E, and contains 50 calories per serving. It is kosher-certified, vegetarian and free from added sugar, dairy, gluten and soy. This product retails in a recyclable 946 millilitre pack, bearing the FSC Mix logo.

Free from – packaged food and beverage categories

The free from category includes product claims such as free from gluten, lactose, allergens, dairy and free from meat. This excludes foods which are certified 'free' of a specific product, when this is based on use of sterilised equipment.

Market sizes – Free from

The free from market has became more popular in Mexico, which grew at a CAGR of 13.1% (2016-2021) with a packaged food retail sales value of US$1.3 billion in 2021. The largest category in the free from food sector was within the free from lactose category with sales at US$845.5 million, consisting of sub-categories such as 'free from lactose - dairy' (US$735.8 million) and the 'free from lactose - baby food' (US$109.6 million).

There were no free from drink products reported in Euromonitor within the Mexican market. The free from allergens - HA milk formula category had the highest historical growth at a CAGR of 16.2% (2016-2021) and is expected to continue to grow the most at a CAGR of 11.5% (2021-2026).

| Category | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| Total - 'free from' packaged food by type | 705.9 | 821.1 | 939.4 | 1,060.6 | 1,227.6 | 1,303.9 |

| Free from allergens - HA milk formula | 84.7 | 102.0 | 119.8 | 138.7 | 158.1 | 179.8 |

| Free from dairy - milk | 148.6 | 169.5 | 189.7 | 211.6 | 244.8 | 278.6 |

| Free from lactose | 472.5 | 549.5 | 629.8 | 710.3 | 824.6 | 845.5 |

| Baby food | 72.2 | 80.5 | 87.7 | 94.9 | 101.7 | 109.6 |

| Dairy | 400.4 | 469.0 | 542.1 | 615.4 | 723.0 | 735.8 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2021/2020 | CAGR* % 2016-2021 | Total growth % 2016-2021 |

|---|---|---|---|

| Total - 'free from' packaged food by type | 6.2 | 13.1 | 84.7 |

| Free from allergens - HA milk formula | 13.7 | 16.2 | 112.3 |

| Free from dairy - milk | 13.8 | 13.4 | 87.5 |

| Free from lactose | 2.5 | 12.3 | 78.9 |

| Baby food | 7.8 | 8.7 | 51.8 |

| Dairy | 1.8 | 12.9 | 83.8 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

| Category | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Total - 'free from' packaged food by type | 1,303.9 | 1,421.6 | 1,559.0 | 1,711.1 | 1,883.0 | 2,074.4 |

| Free from allergens - HA milk formula | 179.8 | 203.4 | 228.0 | 253.8 | 281.4 | 310.5 |

| Free from dairy - milk | 278.6 | 313.1 | 348.9 | 387.4 | 429.7 | 476.7 |

| Free from lactose | 845.5 | 905.1 | 982.1 | 1,069.9 | 1,172.0 | 1,287.1 |

| Baby food | 109.6 | 118.6 | 128.0 | 138.3 | 149.5 | 162.1 |

| Dairy | 735.8 | 786.5 | 854.1 | 931.6 | 1,022.5 | 1,125.0 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2022/2021 | CAGR* % 2021-2026 | Total growth % 2021-2026 |

|---|---|---|---|

| Total - 'free from' packaged food by type | 9.0 | 9.7 | 59.1 |

| Free from allergens - HA milk formula | 13.1 | 11.5 | 72.7 |

| Free from dairy - milk | 12.4 | 11.3 | 71.1 |

| Free from lactose | 7.0 | 8.8 | 52.2 |

| Baby food | 8.2 | 8.1 | 47.9 |

| Dairy | 6.9 | 8.9 | 52.9 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

Competitive landscape – free from

Leading packaged food companies (top brands) in Mexico in the 'free from' category in 2021, include Grupo Lala SAB de CV (Lala, Vita Lala, Borden) at a market share of 19.7% (US$257.0 million), Ganaderos Productores de Leche Pura SA de CV (Alpura) at 17.2% (US$224.3 million), and Nestlé SA (Nido, Nan, Nestlé) at 12.4% (US$162.0 million).

| Company | Brand(s) | Retail sales (US$ million) | Market share in 2021 |

|---|---|---|---|

| Grupo Lala SAB de CV | Lala, Vita Lala, Borden, Boulder | 257.0 | 19.7 |

| Ganaderos Productores de Leche Pura SA de CV | Alpura | 224.3 | 17.2 |

| Nestlé SA | Nido, Nan, Nestlé, Nursoy, SMA | 162.0 | 12.4 |

| The Coca-Cola Company | Ades, Santa Clara, Del Valle | 107.6 | 8.3 |

| Groupe Danone | Silk, Aptamil | 94.0 | 7.2 |

| Others | Others | 290.2 | 22.3 |

| Total - market share | 1,303.9 | 100.0 | |

| Source: Euromonitor, 2022 | |||

Product launch analysis – free from

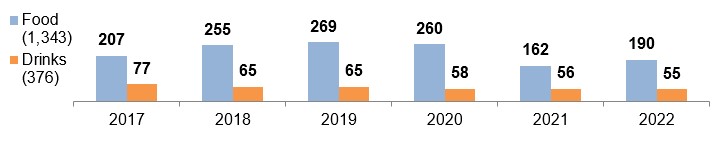

According to Mintel, there were approximately 1,343 new free from food products launched (including new variety/range extension, packaging, formulation or relaunched), within Mexico between January 2017 and December 2022. These products contained free from ingredient claims such as caffeine, dairy, hormone or palm oil free. During this same period, there were 376 free from drink products launched.

Description of above image

| Product | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Food (1,343) | 207 | 255 | 269 | 260 | 162 | 190 |

| Drinks (376) | 77 | 65 | 65 | 58 | 56 | 55 |

Source: Mintel, 2022

Total item count: 1,719

According to new product launches in Mexico (2017 to 2022), top sub-categories (brands) within the free from food category were poultry products (Pilgrim's), white milk (Lala - Deslactosada/Light/100/Orgánica), sweet biscuits/cookies (Sweetwell), snack/cereal/energy bars (Nature's Bakery) and plant based drinks or dairy alternatives (Nature's Heart).

| Top 10 - free from sub-category | Top 50 brands launched (product item count) | Number of products in sub-category |

|---|---|---|

| Poultry products | Pilgrim's (52), Tyson (52), Bachoco (22) - Prácticos (7), Del Día Empanizados (7), Aires de Campo (6), Lala Plenia (5), Verdes Motivos (4), H-E-B Select Ingredients (2) | 237 |

| White milk | Lala (33) - Deslactosada (27) / Light (12) / 100 (10) / Orgánica (5), Kirkland Signature (4), Aires de Campo (4), Valley Foods (4), H-E-B Select Ingredients (2) | 120 |

| Sweet biscuits/ cookies | Sweetwell (18), Lenny & Larry's The Complete Cookie (10), Gaveti (5), AngelFood2 (5), I Am(aranth) (2), H-E-B Select Ingredients (2) | 109 |

| Snack/cereal/energy bars | Nature's Bakery (8), Pal's (6), Sweetwell (5), Clean & Tasty Oh Joy! (5), Smart Bites (2) | 80 |

| Plant based drinks (dairy alternatives) | Nature's Heart (6), Califia Farms (10), H-E-B - Organics (8), Valley Foods (4), Silk (4), Kirkland Signature (3) | 78 |

| Spoonable yogurt | Chobani (24), H-E-B Select Ingredients (12) / H-E-B Organics (6) | 57 |

| Meat products | Verdes Motivos (7), Green Farmers (6), Frontière (6), Verdes Motivos Cortes Básicos & Finos (6), Kirkland Signature (2), Aires de Campo (1) | 42 |

| Eggs and egg products | Seleccionado de Allende (7), Aires de Campo (3), H-E-B (2) | 36 |

| Baking ingredients and mixes | Morama (9), Cooggies (6), H-E-B Organics (3) Aires de Campo (1) | 35 |

| Dairy based ice cream and frozen yogurt | H-E-B Select Ingredients (15), Crystal Creamery (8), Kirkland Signature (2) | 34 |

| Total sample size | 1,343 | |

| Source: Mintel, 2022 | ||

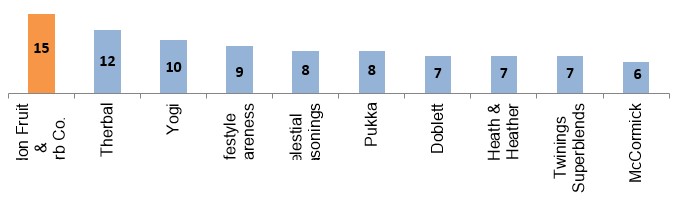

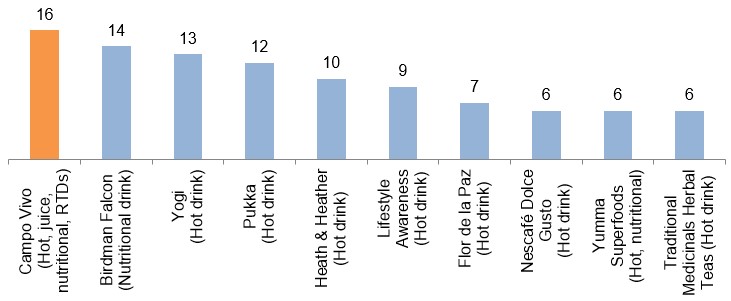

Between January 2017 and December 2022, among a sample size of 376 new free from hot beverage products, top brands launched within the free from non-alcoholic drink category were The London Fruit & Herb Company, Therbal, Yogi, Lifestyle Awareness, and Celestial Seasonings.

Description of above image

- London Fruit and Herb Co.: 15

- Therbal: 12

- Yogi: 10

- Lifestyle Awareness: 9

- Celestial Seasonings: 8

- Pukka: 8

- Doblett: 7

- Heath and Heather: 7

- Twinings Superblends: 7

- McCormick: 6

Source: Mintel, 2022

Total item count: 376

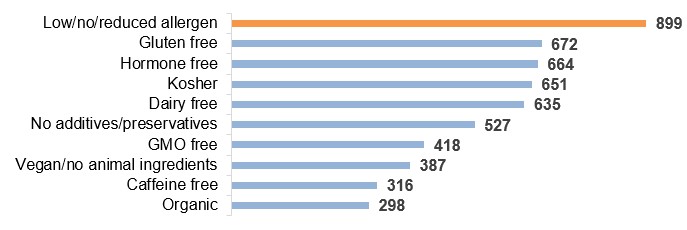

Popular claims associated with 'food minus' food & beverage new product launches over the last six-year period were low/no/reduced allergen, gluten free, hormone free, Kosher, dairy free, no additives/ preservatives, GMO free, vegan/no animal ingredients, caffeine free, and organic.

Description of above image

- Low/no/reduced allergen: 899

- Gluten free: 672

- Hormone free: 664

- Kosher: 651

- Dairy free: 635

- No additives/preservatives: 527

- GMO free: 418

- Vegan/no animal ingredients: 387

- Caffeine free: 316

- Organic: 298

Source: Mintel, 2022

Total item count: 1,719

Product examples – free from

Gluten Free Meatless Pepperoni Style Pizza

Source: Mintel, 2022

| Company | Daiya Foods |

|---|---|

| Brand | Daiya |

| Sub-category | Meals and meal centers, pizzas |

| Country | Manufactured in Canada, market Mexico |

| Related claims | High / added fibre, Premium, gluten free, low / no / reduced allergen, vegan / no animal ingredients, GMO free, dairy free, plant based |

| Store name / type | Soriana, mass merchandise/hypermarket, Puebla 72020 |

| Launch type | New formulation |

| Date published | April 2022 |

| Price in US dollars | 11.99 |

This product has been reformulated with and a new and improved recipe featuring premium cutting board cheeze shreds. This plant based product is made with gourmet ingredients, and is free from GMOs, dairy, gluten and soy. This vegan pizza is a good source of fiber, and contains saturated fat and sodium excess according to the Mexican Health Secretary. It retails in a recyclable 16.7 ounce pack featuring baking instructions.

Double Chocolate Quinoa Cookies

Source: Mintel, 2022

| Company / importer | Cie 2 Ameriks/Tiendas Soriana |

|---|---|

| Brand | GoGo Quinoa |

| Sub-category | Bakery, sweet biscuits/cookies |

| Country | Manufactured in Canada, market Mexico |

| Related claims | High / added fibre, Kosher, gluten free low / no / reduced allergen, high / added protein, GMO free, dairy free, plant based |

| Store name / type | Soriana Mega, supermarket, Mexico City 03730 |

| Launch type | New packaging |

| Date published | August 2021 |

| Price in US dollars | 8.91 |

This product has been repackaged with an updated design. These plant-based cookies, according to the Secretariat of Health for Mexico, are high in calories, sugars and saturated fats. They have been made using 70% cocoa, and comprise of natural ingredients, including: royal quinoa flour, which has been harvested in the Bolivian highlands; chia seeds, which are rich in protein and fiber; and kiwicha, a small crunchy seed with a full-bodied nuttiness. These cookies are free from eggs, milk, corn, soy, nuts and peanuts, have been kosher certified and made using RSPO certified palm oil. They retail in a recyclable 165 gram pack, itself made from 100% recycled fibres and features the Certified Gluten-Free and Non GMO Project Verified logos. The pack also features a plastic-free and compostable overwrap in accordance with the manufacturer's aim to reduce plastic consumption by 2021. Also, available in chocolate chip variety.

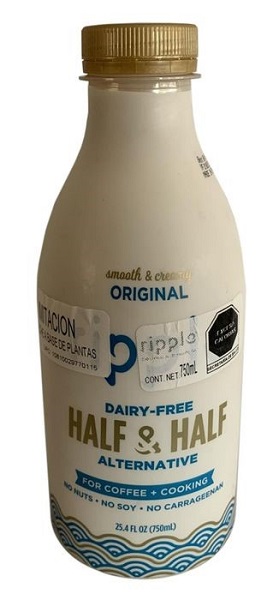

Dairy-Free Half & Half Alternative

Source: Mintel, 2022

| Company / importer | Ripple Foods/RD Amerimex |

|---|---|

| Brand | Ripple |

| Sub-category | Dairy, creamers |

| Country | Manufactured in Canada, market Mexico |

| Related claims | Low / no / reduced: cholesterol, allergen, lactose, and saturated fat, Kosher, gluten free, vegan / no animal ingredients, GMO free, dairy free, plant based |

| Store name / type | Soriana Mega, supermarket, Mexico City 03730 |

| Launch type | New variety / range extension |

| Date published | March 2022 |

| Price in US dollars | 6.16 |

The original, plant-based product is said to be smooth and creamy, and contains no nuts, GMO, gluten, lactose, soy or carrageenan, saturated fat or cholesterol. It can be used for coffee or cooking, is claimed to be nutritious and delicious, and is made with 100% vegan pea protein. This kosher-certified product retails in a recyclable 750 millilitre pack, bearing the Certified B Corporation logo, and an excess of calories warning by the Mexican Health Secretariat.

Naturally healthy – packaged food and beverage categories

The NH category includes food and beverages on the basis of naturally containing a substance that improves health and wellbeing beyond the product's pure calorific value and are usually a healthier alternative within a certain sector/subsector. Examples include high fibre food (wholegrain/wholemeal/ brown) soy products, sour milk drinks, nuts, seeds and trail mixes, honey, fruit & nut bars, and olive oil; along with NH beverages such as 100% fruit/vegetable juice, superfruit juice, natural mineral/spring water, RTD green tea etc. Noting that NH food and beverages that are additionally fortified fall into the FF category.

Market sizes: naturally healthy

In Mexico, NH packaged food (US$1.2 billion) and NH drink (US$1.1 billion) products reached a retail sales value of US$2.3 billion in 2021. The largest sales occurred in the NH soft drink category such as bottled water and fruit/vegetable juices at US$975.5 million, followed by staples like NH nuts, seeds & trail mixes at US$558.1 million, NH - high fibre breakfast cereals at US$190.7 million, NH olive oil at US$137.7 million, and NH honey at US$127.1 million in 2021.

The NH segment benefited from the ongoing shift towards a more holistic and preventative approach to health & wellness, which is highly related with rising consumer concerns about the long-term consumption of artificial additives and an interest in natural ingredients.Footnote 2 All NH food and drink products registered moderate growth between 2016 and 2021 at a total CAGR of 7.4%. Categories with the highest growth during this period were NH rice (11.4%), NH - high fibre pasta (9.5%), NH hot tea drinks (9.3%), NH fruit snacks (9%), and NH honey (9%). NH cereal bars (12.9%), NH olive oil (9.4%), and NH rice (9.2%) products are expected to grow the most over the forecast period (2021-2026).

| Category | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| Total - Naturally healthy food and drink by type | 1,608.3 | 1,777.4 | 1,915.0 | 2,053.1 | 2,186.8 | 2,298.7 |

| Naturally healthy - packaged food | 833.0 | 926.2 | 1,003.8 | 1,077.8 | 1,148.8 | 1,212.1 |

| Cereal bars | 61.9 | 68.9 | 74.6 | 81.5 | 80.9 | 82.8 |

| Fruit snacks | 24.4 | 27.5 | 30.6 | 33.3 | 35.3 | 37.6 |

| Honey | 82.6 | 96.8 | 102.4 | 110.2 | 121.4 | 127.1 |

| Nuts, seeds and trail mixes | 378.2 | 423.3 | 463.9 | 500.9 | 529.5 | 558.1 |

| Olive oil | 92.1 | 102.0 | 109.2 | 115.1 | 126.8 | 137.7 |

| Rice | 4.2 | 4.7 | 5.4 | 5.9 | 6.5 | 7.2 |

| Naturally healthy - high fibre packaged food | 189.6 | 202.9 | 217.8 | 230.9 | 248.3 | 261.6 |

| Breakfast cereals | 135.9 | 147.1 | 158.0 | 168.0 | 181.5 | 190.7 |

| Pasta | 9.7 | 10.8 | 11.9 | 12.7 | 14.0 | 15.3 |

| Sweet biscuits | 44.0 | 45.0 | 48.0 | 50.2 | 52.8 | 55.5 |

| Naturally healthy - beverages | 775.3 | 851.2 | 911.2 | 975.3 | 1,038.0 | 1,086.5 |

| Naturally healthy - hot drinks | 77.8 | 84.0 | 91.4 | 95.6 | 104.0 | 111.1 |

| Tea | 46.5 | 50.6 | 55.8 | 59.2 | 66.7 | 72.4 |

| Other hot drinks | 31.4 | 33.4 | 35.6 | 36.4 | 37.3 | 38.7 |

| Naturally healthy - soft drinks | 697.4 | 767.3 | 819.8 | 879.6 | 934.0 | 975.5 |

| Bottled water | 312.7 | 339.8 | 364.5 | 388.2 | 416.8 | 425.5 |

| Fruit/vegetable juice | 384.7 | 427.5 | 455.3 | 491.4 | 517.2 | 549.9 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2021/2020 | CAGR* % 2016-2021 | Total growth % 2016-2021 |

|---|---|---|---|

| Total - Naturally healthy food and drink by type | 5.1 | 7.4 | 42.9 |

| Naturally healthy - packaged food | 5.5 | 7.8 | 45.5 |

| Cereal bars | 2.3 | 6.0 | 33.8 |

| Fruit snacks | 6.5 | 9.0 | 54.1 |

| Honey | 4.7 | 9.0 | 53.9 |

| Nuts, seeds and trail mixes | 5.4 | 8.1 | 47.6 |

| Olive oil | 8.6 | 8.4 | 49.5 |

| Rice | 10.8 | 11.4 | 71.4 |

| Naturally healthy - high fibre packaged food | 5.4 | 6.6 | 38.0 |

| Breakfast cereals | 5.1 | 7.0 | 40.3 |

| Pasta | 9.3 | 9.5 | 57.7 |

| Sweet biscuits | 5.1 | 4.8 | 26.1 |

| Naturally healthy - beverages | 4.7 | 7.0 | 40.1 |

| Naturally healthy - hot drinks | 6.8 | 7.4 | 42.8 |

| Tea | 8.5 | 9.3 | 55.7 |

| Other hot drinks | 3.8 | 4.3 | 23.2 |

| Naturally healthy - soft drinks | 4.4 | 6.9 | 39.9 |

| Bottled water | 2.1 | 6.4 | 36.1 |

| Fruit/vegetable juice | 6.3 | 7.4 | 42.9 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

| Category | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Total - Naturally healthy food and drink by type | 2,298.7 | 2,475.0 | 2,667.8 | 2,877.7 | 3,108.8 | 3,361.0 |

| Naturally healthy - packaged food | 1,212.1 | 1,312.4 | 1,422.6 | 1,542.5 | 1,675.3 | 1,820.6 |

| Cereal bars | 82.8 | 93.8 | 106.4 | 120.3 | 135.5 | 151.8 |

| Fruit snacks | 37.6 | 41.3 | 45.0 | 48.6 | 52.7 | 57.3 |

| Honey | 127.1 | 134.2 | 143.3 | 154.1 | 166.6 | 180.5 |

| Nuts, seeds and trail mixes | 558.1 | 607.8 | 661.1 | 718.1 | 780.7 | 848.9 |

| Olive oil | 137.7 | 150.3 | 164.3 | 179.7 | 196.9 | 216.0 |

| Rice | 7.2 | 8.0 | 8.7 | 9.5 | 10.3 | 11.2 |

| Naturally healthy - high fibre packaged food | 261.6 | 277.1 | 293.8 | 312.2 | 332.5 | 354.9 |

| Breakfast cereals | 190.7 | 200.9 | 212.2 | 224.6 | 238.4 | 253.5 |

| Pasta | 15.3 | 16.7 | 18.2 | 19.8 | 21.6 | 23.7 |

| Sweet biscuits | 55.5 | 59.4 | 63.4 | 67.8 | 72.5 | 77.8 |

| Naturally healthy - beverages | 1,086.5 | 1,162.5 | 1,245.2 | 1,335.2 | 1,433.5 | 1,540.4 |

| Naturally healthy - hot drinks | 111.1 | 118.9 | 127.8 | 137.2 | 147.4 | 158.6 |

| Tea | 72.4 | 77.5 | 83.8 | 90.6 | 98.1 | 106.7 |

| Other hot drinks | 38.7 | 41.4 | 44.0 | 46.6 | 49.3 | 51.9 |

| Naturally healthy - soft drinks | 975.5 | 1,043.6 | 1,117.4 | 1,198.0 | 1,286.1 | 1,381.8 |

| Bottled water | 425.5 | 453.6 | 483.1 | 514.2 | 546.5 | 580.2 |

| Fruit/vegetable juice | 549.9 | 590.0 | 634.4 | 683.8 | 739.7 | 801.6 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2022/2021 | CAGR* % 2021-2026 | Total growth % 2021-2026 |

|---|---|---|---|

| Total - NH food and drink by type | 7.7 | 7.9 | 46.2 |

| Naturally healthy - packaged food | 8.3 | 8.5 | 50.2 |

| Cereal bars | 13.3 | 12.9 | 83.3 |

| Fruit snacks | 9.8 | 8.8 | 52.4 |

| Honey | 5.6 | 7.3 | 42.0 |

| Nuts, seeds and trail mixes | 8.9 | 8.7 | 52.1 |

| Olive oil | 9.2 | 9.4 | 56.9 |

| Rice | 11.1 | 9.2 | 55.6 |

| Naturally healthy - high fibre packaged food | 5.9 | 6.3 | 35.7 |

| Breakfast cereals | 5.3 | 5.9 | 32.9 |

| Pasta | 9.2 | 9.1 | 54.9 |

| Sweet biscuits | 7.0 | 7.0 | 40.2 |

| Naturally healthy - beverages | 7.0 | 7.2 | 41.8 |

| Naturally healthy - hot drinks | 7.0 | 7.4 | 42.8 |

| Tea | 7.0 | 8.1 | 47.4 |

| Other hot drinks | 7.0 | 6.0 | 34.1 |

| Naturally healthy - soft drinks | 7.0 | 7.2 | 41.7 |

| Bottled water | 6.6 | 6.4 | 36.4 |

| Fruit/vegetable juice | 7.3 | 7.8 | 45.8 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

Competitive landscape – naturally healthy

Leading packaged food companies (top brands) in Mexico in the NH category in 2021, include PepsiCo Inc. (Lay's, Barras - Quaker, Mafer) at a market share of 33.1% (US$401.0 million), Grupo Bimbo SAB de CV (Barcel, Hot Nuts) at 12.6% (US$153.0 million), and Deoleo SA (Carbonell, Carapelli, Arroz SOS) at 4% (US$48.1 million). Private labels accounted for a sales share of 15.9% (US$192.7 million) in sales value in 2021.

In 2021, leading NH beverage companies (top brands) in Mexico included Nestlé SA (Santa María, S Pellegrino) at a 16.8% market share (US$182.1 million), followed by Grupo Jumex SA de CV (Jumex, Bida) at 15.1% (US$164.0 million), and Keurig Dr Pepper Inc. (Peñafiel, Aguafiel) at 12.7% (US$138.5 million). Private label NH beverages represented 0.3% (US$3.3 million) in sales in Mexico over the year.

| Category | Company | Top brand(s) | Retail sales (US$ million) | Market share in 2021 |

|---|---|---|---|---|

| Natually healthy - packaged food | PepsiCo Inc. | Lay's, Barras - Quaker, Mafer, Sunchips | 401.0 | 33.1 |

| Grupo Bimbo SAB de CV | Barcel, Hot Nuts | 153.0 | 12.6 | |

| Deoleo SA | Carbonell, Carapelli, Arroz SOS | 48.1 | 4.0 | |

| General Mills Inc. | Nature Valley, Fiber One | 34.5 | 2.8 | |

| Grupo Industrial Vida SA de CV | Granvita, Cashitas, Granola Muesli | 31.4 | 2.6 | |

| Others | Others | 56.3 | 4.6 | |

| Private label | Private label | 192.7 | 15.9 | |

| Total - market share | 1,212.1 | 100.0 | ||

| Natually healthy -beverages | Nestlé SA | Santa María, S Pellegrino | 182.1 | 16.8 |

| Grupo Jumex SA de CV | Jumex, Bida | 164.0 | 15.1 | |

| Keurig Dr Pepper Inc. | Peñafiel, Aguafiel | 138.5 | 12.7 | |

| The Coca-Cola Company | Del Valle | 92.5 | 8.5 | |

| Groupe Danone | Evian | 82.8 | 7.6 | |

| Private label | Private label | 3.3 | 0.3 | |

| Others | Others | 218.9 | 20.1 | |

| Total - market share | 1,086.5 | 100.0 | ||

| Source: Euromonitor, 2022 | ||||

Product launch analysis – naturally healthy

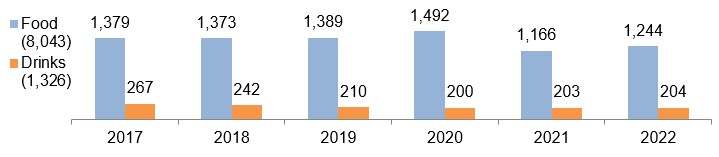

According to Mintel, there were approximately 8,043 new natural food products launched (including new variety/range extension, packaging, formulation or relaunched), within Mexico between January 2017 and December 2022. These claims were either an 'all natural', GMO free, no artificial additives (colourings, flavourings) and preservatives, organic or wholegrain products.

During this same period there were 1,326 naturally healthy related drink products launched.

Description of above image

| Product | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Food (8,043) | 1,379 | 1,373 | 1,389 | 1,492 | 1,166 | 1,244 |

| Drinks (1,326) | 267 | 242 | 210 | 200 | 203 | 204 |

Source: Mintel, 2022

Total item count: 9,369

According to new product launches in Mexico (2017 to 2022), top sub-categories (brands) within the NH food category were cold cereals (Nestlé Cheerios), both sweet biscuits/cookies and snack/cereal/energy bars (Quaker), vegetables (La Costeña), and seasonings (Esquina González).

| Top 10 - Naturally healthy sub-category | Top 50 brands launched (product item count) | Number of products in sub-category |

|---|---|---|

| Cold cereals | Nestlé Cheerios (18), Granvita (14), Bob's Red Mill (9), Eat Natural Lima Limón (9), Tía Ofilia (8), Quaker (6), H-E-B Select Ingredients (2), Aires de Campo (2), Valley Foods (2), Yema & Co. (1), I Am(aranth) (1) | 473 |

| Sweet biscuit/cookies | Quaker (15), Don't Worry (11), H-E-B (5) - Select Ingredients (3)/Organics (1), Okko Super Foods (4), I Am(aranth) (3), Kirkland Signature (2), Great Value (2), Granvita (2), Yema & Co. (1) | 405 |

| Snack/cereal/energy bars | Quaker (8), Kirkland Signature (7), Eat Natural Lima Limón (7), Okko SuperFoods (6), Don't Worry (6), Bob's Red Mill (5), Granvita (4), Valley foods (3), Great Value (2), Yema & Co. (2), Aires de Campo (1), I Am(aranth) (1) | 365 |

| Vegetables | La Costeña (19), La Huerta (18), Herdez (16), Del Monte (13), Great Value (11), Global Premier (8), Isadora (5), Kirkland Signature (4), Member's Mark (4), La Sierra (4), Valley Foods (3), Eat Natural Lima Limón (3), Chata (1), Yema & Co. (1) | 295 |

| Seasonings | Esquina González (28), Intalmesa (11), H-E-B - Select Ingredients (4)/Organics (1), Valley Foods (4), Yema & Co. (3), Knorr (1), Member's Mark (1), Aires de Camp (1) | 289 |

| Baking Ingredients | Morama (12), Bob's red Mill (11), Tía Ofilia (6), Granvita (5), H-E-B - Organics (5)/Select Ingredients (1), Aires de Campo (2), Yema & Co. (2), Esquina González (2), Okko Super Foods (2), Intalmesa (2), Great Value (1), Quaker (1) | 276 |

| Bread and bread products | Nopalia (4), H-E-B Select Ingredients (2), Great Value (2), Yema & Co. (2), Valley Foods (2), Member's Mark (1) | 249 |

| Fruit snacks | Nochiola (9), H-E-B Organics (5), Okko Super Foods (4), Intalmesa (2), Kirkland Signature (1), Member's Mark (1), Yema & Co. (1), Valley Foods (1) | 247 |

| Meat products | Chata (27), Kirkland Signature (5), H-E-B (6) - Select Ingredients (1), Aires de Campo (1), Herdez (1) | 228 |

| Fish products | Marina Azul (25), Atún Dolores (21), Member's Mark (11), Herdez (5), Kirkland Signature (4), Great Value (2), Chata (1) Valley Foods (1) | 212 |

| Total sample size | 8,043 | |

| Source: Mintel, 2022 | ||

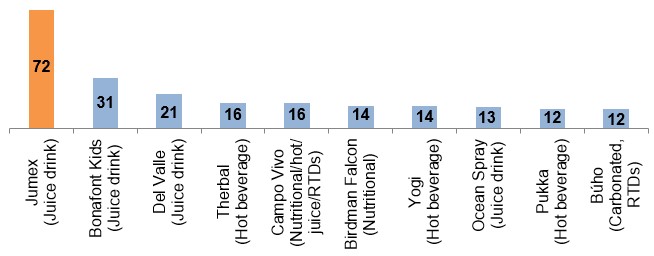

Between January 2017 and December 2022, among a sample size of 1,326 new products, top brands launched within the NH drink category were Jumex, Bonafont Kids, Del Valle, Therbal, and Campo Vivo.

Description of above image

- Jumex (Juice drink): 72

- Bonafont Kids (Juice drink): 31

- Del Valle (Juice drink): 21

- Therbal (Hot beverage): 16

- Campo Vivo (Nutritional /hot / juice / ready-to-drink): 16

- Birdman Falcon (Nutritional): 14

- Yogi (Hot beverage): 14

- Ocean Spray (Juice drink): 13

- Pukka (Hot beverage): 12

- Búho (Carbonated, RTDs): 12

Source: Mintel, 2022

Total item count: 1,326

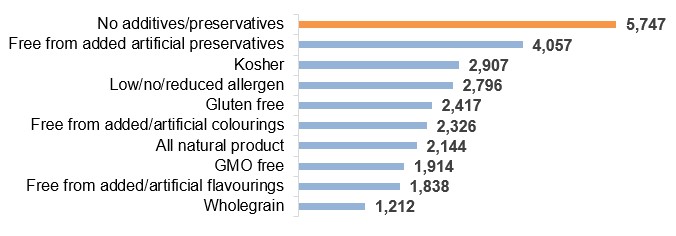

Popular claims associated with NH food & beverage new product launches over the last six-year period were no additives/preservatives, free from added artificial preservatives/colourings/flavourings, Kosher, low/no/reduced allergen, gluten free, all natural product, GMO free, and wholegrain.

Description of above image

- No additives/preservatives: 5,747

- Free from added artificial preservatives: 4,057

- Kosher: 2,907

- Low/no/reduced allergen: 2,796

- Gluten free: 2,417

- Free from added/artificial colourings: 2,326

- All natural product: 2,144

- GMO free: 1,914

- Free from added/artificial flavourings: 1,838

- Wholegrain: 1,212

Source: Mintel, 2022

Total item count: 9,369

Product examples – naturally healthy

Tzatziki and Dill Dip

Source: Mintel, 2022

| Company / importer | Skotidakis Goat Farm/Primex |

|---|---|

| Brand | Skotidakis |

| Sub-category | Savoury spreads, dips |

| Country | Manufactured in Canada, market Mexico |

| Related claims | All natural product, Kosher |

| Store name / type | Costco, club store, Mexico City 01180 |

| Launch type | New packaging |

| Date published | January 2022 |

| Price in US dollars | 7.51 |

This product has been repackaged with an updated design. This kosher certified product is described both a dip and dressing and, according to the Secretariat of Health for Mexico, is high in saturated fats. It has been made using all natural ingredients and retails in a 681 gram pack.

Total Oat

Source: Mintel, 2022

| Company | Tiendas Tres B |

|---|---|

| Brand | Quick (private label) |

| Sub-category | Breakfast cereals, hot cereals |

| Country | Manufactured in Canada, market Mexico |

| Related claims | All natural product, wholegrain |

| Store name / type | Tiendas 3B, mass merchandise / hypermarket, Mexico City 03020 |

| Launch type | New packaging |

| Date published | February 2022 |

| Price in US dollars | 0.58 |

This product has been repackaged and now retails in a newly designed 400 gram pack featuring preparation instructions. The product is a source of fiber, is described as 100% natural wholegrain oat flakes, and contains no seals or legends, according to the Secretariat of Health of Mexico.

Blueberry Herbal Tea

Source: Mintel, 2022

| Company / importer | Trans-Herb/Fertre |

|---|---|

| Brand | La Cour Tisane |

| Sub-category | Hot beverages, tea |

| Country | Manufactured in Canada, market Mexico |

| Related claims | All natural product, Kosher, toxins free |

| Store name / type | City Market, supermarket, Cuernavaca 62290 |

| Launch type | New variety / range extension |

| Date published | October 2022 |

| Price in US dollars | 4.43 |

This product retails in a 34 gram pack containing 20 1.7 gram units within freshness sealed tea bags. 100% natural herbal tea. Non-chlorine bleached white filter paper. Can be enjoyed hot or iced. Pack bearing usage directions. Logos and certifications: Kosher.

Organic – packaged food and beverage categories

Organic products are often associated with 'free-from' or 'all natural' attribute claims, including fat-free/extra lean or salt/sodium-free or 'no added' ingredients that are known to be considered as being unhealthy. Beverages within the organic category only include juice types that usually consist of all natural ingredients. Opportunity exists in Mexico to develop claims such as organic, and interest in natural products is high across all sectors, making it an important consideration for new product development.

Market sizes – Organic

As consumers have become increasingly concerned about the production processes, as well as more aware about the presence of artificial chemicals in products, the organic market has become more trusted in Mexico growing at a CAGR of 12% (2016-2021), registering organic packaged food (US$40.2 million) and drink (US$22.8 million) combined retail sales value of US$63.0 million in 2021. With the demand for organic products also supported by rising environmental consciousness, organic products looked set to see notable growth in coffee, juices, and baby food in 2021.Footnote 2

The largest category in the organic sector was within the hot drink - organic coffee category with sales at US$19.6 million, followed by organic spreads (US$16.1 million) and organic ready meals (US$6.9 million).

Between 2016 and 2021, the highest growing organic categories were dairy (24.1%), baby food (19.3%), sauces, dressings and condiments (14.9%), and ready meals (13.3%). Categories forecast (2021-2026) to grow the most are organic dairy (17.6%), organic baby food (12.5%), and organic rice, pasta & noodles (12.5%) products.

| Category | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| Total - organic food and drink by type | 35.7 | 40.6 | 45.7 | 50.2 | 55.9 | 63.0 |

| Organic packaged food | 20.9 | 24.1 | 27.3 | 30.5 | 34.8 | 40.2 |

| Baby food | 1.9 | 2.6 | 3.1 | 3.6 | 4.1 | 4.6 |

| Dairy | 1.9 | 2.1 | 2.5 | 3.3 | 4.3 | 5.6 |

| Edible oil | 0.8 | 0.9 | 1.0 | 1.1 | 1.2 | 1.3 |

| Ready meals | 3.7 | 4.3 | 4.8 | 5.4 | 6.1 | 6.9 |

| Rice, pasta and noodles | 0.3 | 0.3 | 0.4 | 0.4 | 0.5 | 0.5 |

| Sauces, dressings and condiments | 2.6 | 3.1 | 3.6 | 4.0 | 4.5 | 5.2 |

| Spreads | 9.7 | 10.7 | 11.8 | 12.7 | 14.1 | 16.1 |

| Organic beverages | 14.7 | 16.6 | 18.4 | 19.6 | 21.1 | 22.8 |

| Hot drinks - coffee | 12.9 | 14.4 | 16.1 | 17.0 | 18.2 | 19.6 |

| Soft drinks - fruit/vegetable juice | 1.9 | 2.2 | 2.4 | 2.7 | 2.9 | 3.2 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2021/2020 | CAGR* % 2016-2021 | Total growth % 2016-2021 |

|---|---|---|---|

| Total - organic food and drink by type | 12.7 | 12.0 | 76.5 |

| Organic packaged food | 15.5 | 14.0 | 92.3 |

| Baby food | 12.2 | 19.3 | 142.1 |

| Dairy | 30.2 | 24.1 | 194.7 |

| Edible oil | 8.3 | 10.2 | 62.5 |

| Ready meals | 13.1 | 13.3 | 86.5 |

| Rice, pasta and noodles | 0.0 | 10.8 | 66.7 |

| Sauces, dressings and condiments | 15.6 | 14.9 | 100.0 |

| Spreads | 14.2 | 10.7 | 66.0 |

| Organic beverages | 8.1 | 9.2 | 55.1 |

| Hot drinks - coffee | 7.7 | 8.7 | 51.9 |

| Soft drinks - fruit/vegetable juice | 10.3 | 11.0 | 68.4 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

| Category | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|

| Total - organic food and drink by type | 63.0 | 70.6 | 78.9 | 87.6 | 96.7 | 106.5 |

| Organic packaged food | 40.2 | 45.8 | 51.9 | 58.1 | 64.6 | 71.5 |

| Baby food | 4.6 | 5.1 | 5.8 | 6.5 | 7.4 | 8.3 |

| Dairy | 5.6 | 7.0 | 8.4 | 9.8 | 11.1 | 12.6 |

| Edible oil | 1.3 | 1.4 | 1.6 | 1.7 | 1.8 | 2.0 |

| Ready meals | 6.9 | 7.7 | 8.6 | 9.5 | 10.5 | 11.5 |

| Rice, pasta and noodles | 0.5 | 0.6 | 0.7 | 0.7 | 0.8 | 0.9 |

| Sauces, dressings and condiments | 5.2 | 5.8 | 6.4 | 7.1 | 7.8 | 8.6 |

| Spreads | 16.1 | 18.1 | 20.5 | 22.8 | 25.2 | 27.6 |

| Organic beverages | 22.8 | 24.8 | 27.0 | 29.4 | 32.1 | 35.0 |

| Hot drinks - coffee | 19.6 | 21.2 | 23.0 | 25.0 | 27.1 | 29.4 |

| Soft drinks - fruit/vegetable juice | 3.2 | 3.6 | 4.0 | 4.4 | 5.0 | 5.6 |

| Source: Euromonitor International, 2022 | ||||||

| Category | Annual growth % 2022/2021 | CAGR* % 2021-2026 | Total growth % 2021-2026 |

|---|---|---|---|

| Total - organic food and drink by type | 12.1 | 11.1 | 69.0 |

| Organic packaged food | 13.9 | 12.2 | 77.9 |

| Baby food | 10.9 | 12.5 | 80.4 |

| Dairy | 25.0 | 17.6 | 125.0 |

| Edible oil | 7.7 | 9.0 | 53.8 |

| Ready meals | 11.6 | 10.8 | 66.7 |

| Rice, pasta and noodles | 20.0 | 12.5 | 80.0 |

| Sauces, dressings and condiments | 11.5 | 10.6 | 65.4 |

| Spreads | 12.4 | 11.4 | 71.4 |

| Organic beverages | 8.8 | 8.9 | 53.5 |

| Hot drinks - coffee | 8.2 | 8.4 | 50.0 |

| Soft drinks - fruit/vegetable juice | 12.5 | 11.8 | 75.0 |

|

Source: Euromonitor International, 2022 *CAGR: Compound Annual Growth Rate |

|||

Competitive landscape – organic

Leading organic packaged food companies (brand) in Mexico 2021, include Grupo Herdez SAB de CV (Aires de Campo) at a market share of 28.8% (US$11.6 million), Grupo Industrial Cuadritos Biotek, SA de CV (Bové) at 9.4% (US$3.8 million), and Nestlé SA (Gerber) at 8.7% (US$3.5 million). Private labels accounted for a sales share of 5.6% (US$2.3 million) in sales value in 2021.

Leading organic beverage companies (top brands) in Mexico included Grupo Herdez SAB de CV (Aires de Campo, Blasón) at a market share of 24.5% (US$5.6 million), followed by Santa Cruz Natural Inc. (Santa Cruz) at 4.5% (US$1.0 million), and Nestlé SA (Taster's Choice) at 0.7% (US$0.2 million) in 2021. Private label organic beverages held a market share of 9.3% (US$2.1 million) in sales in Mexico over the year.

| Category | Company | Brand(s) | Retail sales (US$ million) | Market share in 2021 |

|---|---|---|---|---|

| Organic - packaged food | Grupo Herdez SAB de CV | Aires de Campo | 11.6 | 28.8 |

| Grupo Industrial Cuadritos Biotek, SA de CV | Bové | 3.8 | 9.4 | |

| Nestlé SA | Gerber | 3.5 | 8.7 | |

| Lancaster Colony Corporation | Marzetti | 1.9 | 4.6 | |

| Grupo Lala SAB de CV | Lala | 1.6 | 4.1 | |

| Private label | Private label | 2.3 | 5.6 | |

| Others | Others | 13.0 | 32.3 | |

| Total - market share | 40.2 | 100.0 | ||