Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

South Korea's population at 51.8 million in 2021 has increased by a compound annual growth rate (CAGR) of 0.2% over the last decade (2011-2021), and is expected to slightly decline by −0.04% over the forecast period (2022-2032). The country's urban population increased by 0.2% and is looking to remain relatively stable in the next 10 years, reaching a total of 42.2 million (81.4%) of the country's total population in 2021.

The top 10 largest South Korean urban cities accounted for just over half of the population. Seoul is the biggest city with 10.2 million people, followed by Busan and Incheon with 3.4 million and 2.9 million respectively, in 2021.

South Korea was the 13th largest global importer of processed or packaged agri-food and seafood products (US$21.3 billion) in 2021. Last year, Canada was South Korea's ninth-largest supplier (US$678.2 million), representing an export compound annual growth rate (CAGR) of 11.9% (2017-2021).

In 2021, retail sales of packaged food in South Korea totaled US$35.3 billion. Top packaged food categories for sales value included rice, pasta and noodles, dairy, and processed meat, seafood and alternatives to meat. Premium ready meals and convenient, easy to cook foods have become a growing demand within packaged food categories in South Korea during the pandemic.

E-commerce platforms played a vital role in supporting retailers during lockdown periods, which held a high retailer market share of 21.0% amongst all distribution channels in 2021. Based on the previously, well-built infrastructure of e-commerce home delivery services in South Korea, consumers have shown strong confidence in online shopping and is expected to continue even after the pandemic.

COVID-19 country impact

South Korean authorities avoided lockdowns and instead pursued a strategy of early and aggressive mass testing, isolating infected persons and tracking their movements to carry out contact-tracing. Within two weeks of its first case, the country was producing more than 100,000 test kits per day and it had tested over 600,000 people by early May.

The Korean government introduced strict social distancing measures on 23 February, which were in place until 5 May in 2020. Stores were not forced to close, although in-person sales decreased as consumers were reluctant to visit them. The COVID-19 outbreak occurred during the student's winter break, but return was delayed beyond their expected return date on 2 March, and online schooling began on 6 April - until normal in-person school operations resumed from 13 May to everyone back from 20 May. As virus numbers resurged again in August, and then again in November, restrictions have been regularly imposed and augmented accordingly.Footnote 1

Consumer profile

In 2021, South Korea's population reached 51.8 million and is expected to relatively remain stable over the next decade, decreasing by a CAGR of −0.04% between 2022 and 2032. South Korea's urban population accounted for 81% with the remainder 29% of the population residing in rural regions.

Seoul has the largest urban population at 10.2 million people (24%), followed by Busan (8%), Incheon (7%), Daegu (6%), and Daejeon (4%). Out of the most populated 10 urban regions, all cities have historically registered slight increases in its population, at the exception of Busan that decreased by a CAGR of −0.1% (2011-2021). Albeit, Incheon is the only city expected to slightly increase in the forecast period (2022-2032).

| Rank | Cities | Population ('000) |

|---|---|---|

| Total - rural population | 9,626.7 | |

| Total - urban population | 42,194.9 | |

| 1 | Seoul | 10,152.3 |

| 2 | Busan | 3,426.8 |

| 3 | Incheon | 2,940.2 |

| 4 | Daegu | 2,520.5 |

| 5 | Daejeon | 1,631.2 |

| 6 | Gwangju | 1,604.1 |

| 7 | Ulsan | 1,165.5 |

| 8 | Suwon | 1,162.1 |

| 9 | Changwon | 1,110.8 |

| 10 | Seongnam | 1,029.2 |

| Subtotal - urban population (top 10) | 26,742.7 | |

| Total - South Korean population | 51,821.6 | |

| Source: Euromonitor International, 2022 | ||

In 2021, out of approximately 21 million households, South Korea's average household size was 2.5 persons with an average of 0.4 children per household. Single persons represent the largest demographic by 31%, followed by couples with children (29%), couples without children (18%), single-parent families (9%), and other blended families (13%). Home owners accounted for 58% of the population and 37% were renters in 2021. The median age of population was 44.3 in South Korea.

In South Korea, the average gross income of population (aged 15+) was US$29,835.6 with an annual median disposable income per household of US$40,854.2 in 2021. The South Korean average gross income was the lowest at US$15,628.8 of population (aged 15-19) and on average peaked at US$32,995.6 of population (aged 45-49). Furthermore, middle class South Koreans (Social Class C) bringing in a salary between (100-150%) of the average gross income (up to US$44.8k) accounted for 23% of the population, while 36% (Social Class D) making between (50-100% average income), and 23% (Social Class E) making less than 50% of average salary per year (<US$14,917.8). On the upper end, 11% (Social Class B) salary fell between (150-200% average income) and 8% of the population (Social Class A) made over 200% of average salary per year (>US$59,671.2).

Imports

South Korea was the 13th largest importer for value-added processed packaged food and seafood products at a total value of US$21.3 billion and a global market share of 2.4% in 2021. South Korea is a net importer of processed agri-food and seafood products with 2021 exports to the world at US$5.5 billion, representing a trade deficit of (US$15.8 billion).

South Korea's processed agri-food and seafood imports increased at a CAGR of 8.6% between 2017 and 2021. The top five imported commodities in 2021 at a total of US$7.2 billion (33.6%) were food preparations, nowhere else specified (n.e.s.) (10.2%), frozen pork, excluding bone in (7.4%), frozen beef, boneless (6.2%), fresh or chilled beef, boneless (6.0%), and animal feed (3.8%). Key supplier countries were the United States, China, Australia, Brazil, and Indonesia.

In 2021, Canada was South Korea's 6th largest supplier of total processed agri-food and seafood products at a value of US$678.2 million and a country market share of 3.2%; representing an increasing 5-year CAGR in Canadian imports of 11.9% (2017-2021). Top Canadian exports to South Korea at a total of US$476.2 million (70.2%) were canola oil, low erucic acid (29.1%), food preparations, n.e.s. (14.6%), frozen pork, excluding bone in (11.8%), fresh or chilled pork, excluding bone in (8.8%), and frozen lobsters, with(out) shell (5.9%) in 2021. Last year, Canada registered a processed agri-food and seafood trade surplus of Can$536.5 million with South Korea (as reported by Canada).

Retail sales – packaged food

In 2021, retail sales of packaged food products in South Korea totalled US$35.3 billion. Top categories with the highest sales included rice, pasta and noodles (US$5.3 billion), dairy (US$5.1 billion), and processed meat, seafood and substitute products (US$4.0 billion). Albeit, categories that registered the highest 5-year growth (2017-2021) fell under the cooking ingredients and meals segment (CAGR: 10.8%) such as the soup category (24.8%), ready meals (15.1%), and sauces, dressings and condiments (7.3%). While declining categories during this period were confectionery (−2.0%), baby food (−1.4%), and sweet spreads (−0.1%).

Between 2017 and 2021, packaged food registered a CAGR of 3.5% with total sales within the sector recording its strongest current value growth in 2020 as Korean consumers stayed and cooked meals more frequently from within the home. While cooking and eating meals at home has increased, soup (+34.6%) and high quality and good tasting ready-meals (+22.0%) registered the largest spikes in value growth since the outbreak of COVID-19 (2020/2019). As adults and children spent more time in the home due to increased telework and school closures, distribution and sales of snack foods have shifted from the foodservice to the retailing channel. Confectionery and the ice cream and frozen desserts categories suffered the most over this period.Footnote 1

| Category | 2017 | 2021 | CAGR* % 2017-2021 | 2022 | 2026 | CAGR* % 2022-2026 |

|---|---|---|---|---|---|---|

| Total - packaged foods | 27,265.6 | 31,320.2 | 3.5 | 32,374.7 | 35,276.9 | 2.2 |

| Staple foods | 12,054.7 | 13,255.4 | 2.4 | 13,534.5 | 14,577.3 | 1.9 |

| Rice, pasta and noodles | 4,983.0 | 5,325.7 | 1.7 | 5,377.7 | 5,557.6 | 0.8 |

| Processed meat, seafood and alternatives | 3,358.8 | 3,986.8 | 4.4 | 4,157.3 | 4,484.3 | 1.9 |

| Baked goods | 3,383.0 | 3,526.6 | 1.0 | 3,565.2 | 4,088.8 | 3.5 |

| Breakfast cereals | 228.9 | 295.4 | 6.6 | 308.5 | 322.0 | 1.1 |

| Processed fruit and vegetables | 101.1 | 120.9 | 4.6 | 125.8 | 124.5 | −0.3 |

| Snacks | 6,005.8 | 6,355.3 | 1.4 | 6,578.0 | 6,904.3 | 1.2 |

| Savoury snacks | 1,903.6 | 2,118.1 | 2.7 | 2,191.7 | 2,224.1 | 0.4 |

| Ice cream and frozen desserts | 1,598.7 | 1,637.3 | 0.6 | 1,700.4 | 1,713.5 | 0.2 |

| Confectionery | 1,495.3 | 1,381.0 | −2.0 | 1,420.3 | 1,621.5 | 3.4 |

| Sweet biscuits, snack bars and fruit snacks | 1,008.3 | 1,218.9 | 4.9 | 1,265.6 | 1,345.2 | 1.5 |

| Cooking ingredients and meals | 4,053.3 | 6,098.1 | 10.8 | 6,461.1 | 7,394.4 | 3.4 |

| Ready meals | 1,558.3 | 2,733.3 | 15.1 | 2,969.0 | 3,747.6 | 6.0 |

| Sauces, dressings and condiments | 1,481.8 | 1,967.3 | 7.3 | 2,005.2 | 2,068.3 | 0.8 |

| Soup | 244.3 | 591.9 | 24.8 | 653.2 | 730.4 | 2.8 |

| Edible oils | 440.2 | 478.7 | 2.1 | 498.3 | 508.2 | 0.5 |

| Sweet spreads | 328.7 | 326.8 | −0.1 | 335.4 | 339.8 | 0.3 |

| Dairy products and alternatives | 5,151.8 | 5,611.4 | 2.2 | 5,801.1 | 6,400.9 | 2.5 |

| Dairy | 4,624.2 | 5,111.8 | 2.5 | 5,290.7 | 5,829.9 | 2.5 |

| Baby food | 527.7 | 499.5 | −1.4 | 510.5 | 571.0 | 2.8 |

|

Source: Euromonitor, 2022 *CAGR: Compound Annual Growth Rate |

||||||

In 2021, leading retail companies (and top brands) in the packaged food category in South Korea included the CJ Corporation (Bibigo, Hatban, CJ)) at 9.6% value share, the Lotte Group (Lotte, Pepero, Kokalcorn) at 7.0%, and the Nong Shim Company Ltd. (Chapagetti, Saewookang, Yukgejang Big Bowl) at 4.9%. Private labelled brands accounted for 5.5% of sales in 2021.

| Company | Top brand(s) | Retail sales value (US$ million) | Market share (%) |

|---|---|---|---|

| Total - market share | 31,320.2 | 100.0 | |

| CJ Corporation | Bibigo, Hatban, CJ, Beksul, Gourmet, Haechandle, Healthier Ham, Dashida | 2,982.7 | 9.6 |

| Lotte Group | Lotte, Pepero, Kokalcorn, World Cone, Ghana, Crunky, Goo Goo, Margaret | 2,172.3 | 7.0 |

| Nong Shim Company Ltd. | Chapagetti, Saewookang, Yukgejang Big Bowl, Ansung tang myun, Neoguri | 1,525.4 | 4.9 |

| Ottogi Foods Company Ltd. | Jin Ramyun, Ottogi Bab, Yetnal Dangmyun, Jin Jjamppong, Ppushuh Ppushuh | 1,394.2 | 24.5 |

| Dongwon Group | Dongwon Mandu, Richam, Sowanamu, Slice Cheese, Simya Sikdang | 1,251.8 | 4.0 |

| Seoul Dairy Cooperative | Seoul, Biyott, Enfant, Milk Lab, Duo Ahn, Mokjang Yoghurt, Jiayo Jiayo | 1,300.0 | 3.6 |

| Crown Confectionery Company Ltd. | Crown, Homerun Ball, Gohyang Mandu, Mat Dongsan, Honey Butter Chips, Oh Yes, Hime | 1,049.7 | 3.4 |

| Binggrae Company Ltd. | Together, Ssamanco, Melona, Bibibig, Bravo Cone, Nougat Bar, Pangttoa, Dr Capsule | 965.0 | 3.1 |

| National Agricultural Cooperative Federation | Nonghyub | 900.9 | 2.9 |

| Maeil Dairies Company Ltd. | Sangha, Maeil Absolute, Enyo, Calcium Soy Milk, Banana is white, Gut and Wit, Kefir | 807.8 | 2.6 |

| Private label | Private label | 1,715.7 | 5.5 |

| Others | Others | 7,330.6 | 23.5 |

| Subtotal - top ten companies | 14,182.8 | 45.5 | |

| Source: Euromonitor, 2022 | |||

Rice, pasta and noodles

In 2021, staple foods totalling US$13.3 billion continued to see small retail value growth (0.9%), following an already strong performance growth (5.2%) in 2020. As South Koreans continued with at-home food preparation and consumption, demand of staple foods boosted sales in this segment in both offline and online channels (some sales moving away from the foodservice channel). Furthermore, as people faced a new set of pressures while juggling work and meal planning at home, the demand for convenient staple foods increased during the pandemic. As a result, convenient forms of bread, breakfast cereals, processed meat, seafood and meat alternatives, processed fruit and vegetables, and rice, pasta and noodles performed better over standard products in 2021.

The premiumisation trend is expected to come to the forefront in staple foods over the forecast period. If a staple food offers additional value, South Korean's are willing to pay higher prices when prioritizing over a purchasing decision. Premium concepts that the majority of domestic players tend to focus on in this segment are taste by adding premium or locally-produced ingredients, improving processing technology, and by meeting "value consumption" trends amidst the demand for plant-based diets, or adding "clean labelling" claims in certification such as animal welfare or antibiotic-free products.Footnote 2

In South Korea, rice, pasta and noodles was the largest packaged food category (US$5.3 billion) with retail value sales falling annually by −1.2% in 2021. Pasta was its best performing sub-category in value growth (11.4%), followed by rice (4.0%), plain noodles (2.2%), and chilled noodles (1.2%). Meanwhile, the overall contraction in the category resulted only from plummeting sales of instant noodle pouches and cups that registered a negative growth of −8.0% in 2021. This downturn in both types of instant noodles, is most likely only due to factors such as stockpiling and the fading effect in consumer popularity, whereby domestic and export sales spiked in 2020, after a signature noodle dish (a mixture of Chapaghetti, instant black bean noodles, and spicy Korean Neoguri udon-like noodles)Footnote 3 was advertised in the Oscar-winning film "Parasite".

All rice, pasta and noodles are expected to show continued growth, except for dried pasta (−4.7%) - that similarly spiked over the pandemic with the introduction of exotic flavours contributing to its popularity - and rice (−0.9%), more for raw rice products over convenient instant rice brands.Footnote 4

| Category | 2017 | 2021 | CAGR* (%) 2017-2021 | 2022 | 2026 | CAGR* (%) 2022-2026 |

|---|---|---|---|---|---|---|

| Total - rice, pasta and noodles | 4,983.0 | 5,325.7 | 1.7 | 5,377.7 | 5,557.6 | 0.8 |

| Rice | 2,802.5 | 2,989.3 | 1.6 | 3,079.9 | 2,970.1 | −0.9 |

| Noodles | 2,165.0 | 2,314.0 | 1.7 | 2,274.5 | 2,568.2 | 3.1 |

| Subtotal - instant noodles | 2,010.8 | 2,146.0 | 1.6 | 2,102.5 | 2,398.1 | 3.3 |

| Instant noodle pouches | 1,284.2 | 1,417.6 | 2.5 | 1,372.8 | 1,556.8 | 3.3 |

| Instant noodle cups | 726.6 | 728.3 | 0.1 | 729.7 | 841.3 | 3.6 |

| Plain noodles | 145.3 | 159.9 | 2.4 | 163.6 | 161.5 | −0.3 |

| Chilled noodles | 8.9 | 8.2 | −2.0 | 8.4 | 8.5 | 0.3 |

| Dried pasta | 15.5 | 22.4 | 9.6 | 23.4 | 19.3 | −4.7 |

|

Source: Euromonitor, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Competitive landscape - rice, pasta and noodles

In 2021, leading retail companies (and brand) per rice, pasta and noodle category in South Korea included National Agricultural Cooperative Federation (rice: Nonghyup) at a value of US$911 million (30.5%), Pastificio Fabianelli SpA (pasta: Fresco) at US$12 million (53.4%), and Nong Shim Company Ltd. (noodle: Shin Ramyun) at US$390.2 (16.9%). Private labelled rice, pasta and noodle brands accounted for US$270.6 million (5.1%) of sales in 2021.

Key players in the instant noodles category are trying to create a variety of innovative products that reflect new consumption trends and appeal to more experimental, younger consumers, who are creating new recipes by combining different food products and actively sharing them on their social media platforms. This has led to leading companies like Nong Shim that now offer a limited-edition that mixed Chapagetti with Neoguri (Chapaguri); and Ottogi that recently released Kaguri that adds curry powder to Neoguri, also launching Yeollla Jjamppong - a combination of two instant noodle brands (Yeol Ramyun with Jin Jjamppong) to offer more spiciness. Nevertheless, consumers are also increasingly looking for more health value or premiumisation in instant noodles.

In the instant rice category, the proportion of brown rice, black rice and multi-grain rice, compared with white rice, has been growing in line with the overall healthy eating trend in South Korea. Furthermore, CH Cheiljedang developed a brand called Hatban Sotban that adds nutrition through adding other raw ingredients such as mushrooms, lotus root, chestnuts, sweet potatoes, radishes, cinnamon and/or pumpkin seeds. However, South Koreans, especially female consumers, are trying to reduce the intake of carbohydrates and are interested in alternative formats over rice and plain noodles. Konjac is a starchy root vegetable adopted as a rice alternative that cuts calories, while tofu noodles released by Pulmuone have also gained traction as a healthier alternative to plain noodles.Footnote 4

| Company | Brand(s) | Retail sales value (US$ million) | Market share (%) |

|---|---|---|---|

| Subtotal - top five companies | 2,955.9 | 55.5 | |

| National Agricultural Cooperative Federation | Nonghyup | 911.0 | 17.1 |

| Nong Shim Company Ltd. | Shin Ramyun, Chapagetti, Ansung Tang Myun, Neoguri, Kimchi Cup, Doong Ji Authentic Korean Cold Noodle, ZZawang, Mat Jjamppong | 801.2 | 15.2 |

| CJ Corporation | Hatban, Cheil Jemyunso | 530.5 | 9.9 |

| Ottogi Foods Company Ltd. | Jin Ramyun, Ottogo Bab, Yetnal Dangmuyun, Jin Jjamppong, Ottogi | 523.1 | 9.8 |

| Paldo Company Ltd. | Paldo, Kko Kko Myun | 190.1 | 3.5 |

| Private label | Private label | 270.6 | 5.1 |

| Others | Others | 1,718.8 | 32.3 |

| Total - market share | 5,325.7 | 100.0 | |

| Source: Euromonitor, 2022 | |||

Dairy products

Retail sales

In 2021, dairy products was the 2nd largest packaged food segment at a total retail sales value of US$5.1 billion in South Korea. Triggered by home-cooking, home-baking, and home-café trends, dairy value sales increased by 2.8% over the 2020/2021 period with hard cheese registering the highest growth (24.7%), followed by butter (17.8%), and yoghurt (2.6%) products. Alternatively, other chilled dairy desserts (−18.9%), powder drinking milk (−13.0%), and coffee whiteners (−6.5%) did not benefit in value sales during the pandemic. Moreover, milk formula (−4.7%) has been sinking into stagnation due to the falling birth rate in South Korea, which was exacerbated by COVID-19.Footnote 5

| Category | 2017 | 2021 | CAGR* (%) 2017-2021 | 2022 | 2026 | CAGR* (%) 2022-2026 |

|---|---|---|---|---|---|---|

| Total - dairy | 4,624.2 | 5,111.8 | 2.5 | 5,290.7 | 5,829.9 | 2.5 |

| Drinking milk products | 2,619.9 | 2,899.4 | 2.6 | 2,991.3 | 3,285.2 | 2.4 |

| Yoghurt and sour milk products | 1,627.5 | 1,753.6 | 1.9 | 1,820.9 | 2,029.2 | 2.7 |

| Cheese | 302.3 | 368.2 | 5.1 | 384.2 | 411.6 | 1.7 |

| Milk baby formula | 387.0 | 286.8 | −7.2 | 281.9 | 290.6 | 0.8 |

| Butter and spreads | 24.0 | 38.1 | 12.2 | 40.4 | 43.7 | 2.0 |

| Other dairy[1] | 50.5 | 52.6 | 1.0 | 53.9 | 60.2 | 2.8 |

|

Source: Euromonitor, 2022 *CAGR: Compound Annual Growth Rate 1: Other dairy includes other chilled and shelf stable desserts, chilled snacks, coffee whiteners, condensed/evaporated milk, cream, and fromage frais and quark |

||||||

Competitive landscape - Dairy products

In 2021, leading retail companies (and top brands) in the dairy category in South Korea included Seoul Dairy Cooperative (all dairy: Seoul, Enfant, Milk Lab) at US$1.1 billion (21.2%), Yakult Hongsha Company Ltd. (yogurt and sour milk: Will, Yakult, Kupffer's) at US$732.6 million (14.3%), and Maeil Dairies Company Ltd. (all dairy: Maeil, Sangha, Enyo) at US$668.6 million (12.9%). Private label dairy products totalled US$173.5 million (11.8%).

Encouraged by the pandemic, the importance of self-medication, maintaining or boosting health has become one of the key concerns for many South Koreans. Functional/fortified products are gaining traction with a broad range of product options available in an increasing number of food and drink categories, whereby added protein is the main actively adopted nutrient claim included across dairy products and alternatives.

Maeil Dairies has particularly diversified its value-added protein offerings in the drinking milk category within its chocolate milk, soy milk and almond-based milk alternative varieties. The yoghurt industry are attempting to offer additional health benefits using different functional ingredients such as fish collagen, lutein, vitamin D and calcium. Korea Yakult is said to be seeking official certification from the Ministry of Food and Drug Safety in terms of ensuring proven functionality in its dairy products.Footnote 5

| Company | Brand(s) | Retail sales value (US$ million) | Market share (%) |

|---|---|---|---|

| Subtotal - top five companies | 3,269.2 | 63.6 | |

| Seoul Dairy Cooperative | Seoul, Enfant, Milk Lab, Duo Ahn, Mokjang Yoghurt, Jiayo Jiayo | 1,086.1 | 21.2 |

| Yakult Hongsha Company Ltd. | Will, Yakult, Kupffer's, MPRO3, Super 100, Metchnikoff | 732.6 | 14.3 |

| Maeil Dairies Company Ltd. | Maeil, Sangha, Enyo, Calcium Soy Milk, Banana is White, Gut & Wit, Kefir | 668.6 | 12.9 |

| Namyang Dairy Products Co. Ltd. | Delicious GT, Bulgaris, E-5, De Vinch, Namyang, Einstein, Wee Ssen | 422.8 | 8.3 |

| Dongwon Group | Denmark, Sowanamu, Slice Cheese, Munning | 359.1 | 6.9 |

| Private label | Private label | 173.5 | 3.4 |

| Others | Others | 605.7 | 11.8 |

| Total - market share | 5,111.8 | 100.0 | |

| Source: Euromonitor, 2022 | |||

Processed meat, seafood and alternatives

In 2021, processed meat, seafood and meat alternative products in South Korea accounted for the 3rd largest packaged food segment at a total retail sales value of US$4.0 billion. Over the pandemic, all meat and meat alternatives registered boosted growth in this segment - frozen meat and seafood substitutes having the highest growth of 34.6% (2021/2020) - where total sales are set to slow down from a fixed CAGR of 4.4% (2017-2021) to 1.9% between 2022 and 2026.

Trends like at home drinking and the unprecedented sharp rise in outdoor camping have facilitated the increased consumption and sales of some processed meat, seafood and meat alternative products during the social distancing and travel restriction periods in 2020. Frozen or processed sausage-type products and customized cubes of chicken (released by the Harim company) for grilling on barbeques, along with fried chicken, shrimp, octopus (Jjukumi) or dried Pollack (Hwangtae) products have gained traction over the pandemic with consumers wanting to enjoy restaurant or pub-quality snacks, while cooking outside or in the home.

Although, sales in processed poultry products (US$376.5 million) was the lowest in value terms in 2021, chicken has been identified as the healthier choice both as a source for protein and for building muscle with less fat content compared to red meat (US$1.8 billion) and seafood (US$1.2 million) categories. Chilled processed poultry (57.8%) and frozen processed poultry (13.7%) registered the highest annual growth within the processed meat and seafood sub-segments (2021/2020). Meeting this increasing demand, hundreds of chicken breast brands have popped up in South Korea over the past few years, whereby mounting competition amongst these companies for flavourful and non-conventional product types have led to a wider variety of diverse options in the meat and alternative sector as well. Traditional dishes largely popular only around national holidays are experiencing dampened sales in festive meat foods, by having diverse choices in frozen processed meat, seafood and alternatives to meat options.Footnote 6

| Category | 2017 | 2021 | CAGR* (%) 2017-2021 | 2022 | 2026 | CAGR* (%) 2022-2026 |

|---|---|---|---|---|---|---|

| Total - meat, seafood and alternatives | 3,358.8 | 3,986.8 | 4.4 | 4,157.3 | 4,484.3 | 1.9 |

| Processed meat | 1,727.0 | 2,194.9 | 6.2 | 2,313.0 | 2,586.9 | 2.8 |

| Chilled processed meat | 873.0 | 1,031.9 | 4.3 | 1,090.7 | 1,184.8 | 2.1 |

| Frozen processed meat | 374.5 | 581.7 | 11.6 | 624.5 | 733.6 | 4.1 |

| Shelf stable meat | 479.6 | 581.3 | 4.9 | 597.8 | 668.5 | 2.8 |

| Processed seafood | 1,173.8 | 1,249.9 | 1.6 | 1,284.2 | 1,357.1 | 1.4 |

| Shelf stable seafood | 657.0 | 674.0 | 0.6 | 691.7 | 759.2 | 2.4 |

| Chilled processed seafood | 422.1 | 465.1 | 2.5 | 479.2 | 479.9 | 0.04 |

| Frozen processed seafood | 94.7 | 110.9 | 4.0 | 113.3 | 118.0 | 1.0 |

| Tofu and derivatives | 450.8 | 528.0 | 4.0 | 542.9 | 514.4 | −1.3 |

| Frozen meat and seafood substitutes | 7.1 | 14.0 | 18.5 | 17.2 | 25.9 | 10.8 |

|

Source: Euromonitor, 2022 *CAGR: Compound Annual Growth Rate |

||||||

Competitive landscape - processed meat, seafood and meat alternatives

In 2021, leading retail companies (and brands) in the meat, seafood and meat alternatives category in South Korea included the CJ Cheiljedang Corporation (CJ, Gourmet, Healthier Ham) at US$703.9 million (17.5%), the Dong Wong Group (Dongwon, Richam, Simja Sikdang) at US$652.0 million (16.3%), and the Sajo Industrial Company Ltd. (Daerim, Sajo, Oyang) at US$316.7 million (8.0%). Private label (0.1%) meat, seafood and meat alternative products held a total market value of US$53.7 million (1.3%) in 2021.

The health and wellness trend will drive growth in the shelf stable processed red meat category, whereby products that reduce the content of unhealthy ingredients, such as sodium, sugar and fat are important to gain a broader consumer attention over the forecast period. Canned ham in shelf-stable processed meat is a popular product consumed in South Korea - notably the Spam brand (Hormel Foods Corp.) held as the 4th largest company in the meat sector. However, since canned ham has had a long unhealthy image, leading players like CJ Cheiljedang and Dongwon F&B are trying to alter its image by reducing its product's sodium and fat content.

The idea of plant-based eating is also, gaining traction in South Korea, whereby the number of Koreans who follow vegetarian diets regularly (incl. flexitarians) has rose dramatically with the number growing by 70% in just three years - estimated as being 2.5 million in 2021. In particular, tofu has a long history in South Korea, as one of the ingredients widely used in traditional meals. However, its presence was becoming weaker in the market due to the consumer shift to ready meals and fewer Koreans cooking from scratch. While some local players were struggling with the growing demand for meat analogues, the leader in tofu and derivative products (Pulmuone) now offers plant-based types in various forms like tofu noodles, tofu bars and tofu-based chicken tenders.Footnote 6

| Company | Brand(s) | Retail sales value (US$ million) | Market share (%) |

|---|---|---|---|

| Subtotal - top five companies | 1,672.6 | 41.8 | |

| CJ Cheiljedang Corporation | CJ, Gourmet, Healthier Ham, Beksul, Max Bong, Samho Fish Cake, Bibigo, The Healthier Fish Cake | 703.9 | 17.5 |

| Dongwon Group | Dongwon, Richam, Simja Sikdang, Soon Chicken Breast | 652.0 | 16.3 |

| Sajo Industrial Company Ltd. | Daerim, Sajo, Oyang | 316.7 | 8.0 |

| Hormel Foods Corporation | Spam | 297.6 | 7.5 |

| Pulmuone Company Ltd. | Pulmuone | 223.7 | 5.6 |

| Private label | Private label | 53.7 | 1.3 |

| Others | Others | 1,028.3 | 25.8 |

| Total - market share | 3,986.8 | 100.0 | |

| Source: Euromonitor, 2022 | |||

Distribution channels – packaged food

In 2021, store-based retailing distribution totalled a market share of 77.5% consisting of modern (59.7%) and traditional (13.4%) grocery retailers, mixed retailers (4.2%), and non-grocery health and beauty specialists (0.2%). The most popular grocery retailer outlet types were hyper/supermarkets, convenience stores and independent small grocers.

Non-store e-commerce retailing holds a high 21.0% market share amongst all retail distribution channels in South Korea in 2021. Due to convenience and habit, South Koreans are likely to continue to shop online even after the pandemic ends, and consequently no downturn is expected for this channel over the forecast period. In response to consumers' home seclusion, manufacturers have developed "e-commerce only" products. Companies with exclusive e-commerce distribution products include Shinsegae Food, which has introduced a milk and honey frozen dessert - expanding away from its dessert cafés channelling that have been struggling due to reduced-capacity restrictions during football games, where its foodservice outlets are highly situated - within the home baking and home dessert markets.

The leading e-commerce player SSG.COM has also chose to cease distribution via store-based channels to launch its (online only) SSG Fresh brand of fresh food, bakery products and dinner meal kit mixes with overnight delivery services. Based on the well-built infrastructure of e-commerce home delivery services in South Korea, consumers have shown strong confidence in online plaforms to deliver essential household items, even amongst the (often hesitant) older generation. This continual strong performance of e-commerce (19.1%) within the packaged food sector, has seen the channel's value share surpass that of popular convenience store outlets (13.2%) for the first time in 2020 and has continued as such into 2021.Footnote 1

| Outlet type | Retail sales value (US$ million) | Market share (%) |

|---|---|---|

| Store-based retailing - grand total: | 24,140.4 | 77.5 |

| Total - grocery retailers | 22,782.6 | 73.1 |

| Subtotal - modern grocery retailers | 18,612.1 | 59.7 |

| Hypermarkets | 8,433.5 | 27.1 |

| Supermarkets | 5,817.2 | 18.7 |

| Convenience stores | 4,192.6 | 13.4 |

| Discounters | 123.1 | 0.4 |

| Forecourt retailers | 45.7 | 0.1 |

| Subtotal - traditional grocery retailers | 4,170.5 | 13.4 |

| Independent small grocers | 2,411.5 | 7.7 |

| Food/drink/tobacco specialists | 1,450.1 | 4.7 |

| Other grocery retailers | 308.9 | 1.0 |

| Total - non-grocery specialists | 53.6 | 0.2 |

| Health and beauty specialist retailers | 47.0 | 0.2 |

| Other foods of non-grocery specialists | 6.6 | 0.02 |

| Total - mixed retailers | 1,304.2 | 4.2 |

| Non-store retailing - grand total: | 7,033.5 | 22.5 |

| E-commerce | 6,551.2 | 21.0 |

| Direct selling | 451.9 | 1.4 |

| Homeshopping | 24.3 | 0.1 |

| Vending | 6.1 | 0.02 |

| Total - distribution channels | 31,173.9 | 100.0 |

| Source: Euromonitor, 2022 | ||

Product launch and trend analysis

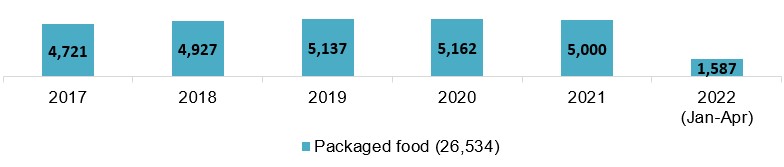

Mintel indicated that there were 26,534 packaged food products launched (including new variety/range extension, packaging, formulation or relaunched) in South Korea between the period of January 2017 and April 28th, 2022.

Top parent companies launching the most new package food products in South Korea from Q2-2021 to Q2-2022 were Lotte (265), Shinsegae (223), CJ Group (155), Dongwon (134), Homeplus (114), and Daesang (105). New packaged food brands launched recently for the first time within the last six months in the South Korean market (2022) include Daesang Chungjungone Home:ings (home-made Kimchi Tofu dumplings), 7-Select Snack King (Choco egg cookie), Let'see (green apple flavour Konjac jelly), and Fitcook Gyechokchok (garlic flavoured chicken breast).

Description of above image

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 (January to April) | Total | |

|---|---|---|---|---|---|---|---|

| Packaged food | 4,721 | 4,927 | 5,137 | 5,162 | 5,000 | 1,587 | 26,534 |

Source: Mintel, 2022

In South Korea, the fastest growing flavours in these packaged food products were seaweed (+950%), mint (+600%), chilli/chilli pepper - Cheongyang (+400%), oat (+400%), mala sauce (+400%), and Chinese (+400%) [Q2-2020/Q2-2022]. New or popular ingredients included Mafaldine pasta, Geotrichum, frillice lettuce, caramel, L-serine, apple mint, Ocal olive, artificial Schisandra Chenensis flavour, wheat grit, and instant rice.

Leading claims used on these packaged food products within the last three months were related to premium, quick and convenient trends such as microwaveable (17.9%), ease of use (15.2%), environmental friendly package (11.4%), premium (11.0%), convenient packaging (7.2%), on-the-go (2.3%). Other health and functional claims on packaging included no additives/preservatives (8.6%), wholegrain (3.8%), high added protein (3.2%), organic (3.0%), low/no/reduced allergen (2.5%), vitamins/minerals plus (2.3%), gluten free (2.0%), vegan/no animal ingredients (1.6%), low/no/reduced fat (1.6%), probiotic (1.5%). Amongst these products, top growing claims included vegetarian (+500%), functional - bone health (+200%), antioxidant (+200%), low/no/reduced cholesterol )+125%), and prebiotic (+100%); while declining claims at −100% included seniors (aged 55+), low/no/reduced glycemic, novel, low/no/reduced carb, and breath-freshening [Q1-2021 vs. Q1-2022].

In the South Korean market, processed fish, meat and egg products was the largest packaged food category with 4,583 (17.3%) new product launches, followed by snacks at 4,059 (15.3%), and meals and meals centers at 3,360 (12.7%) products over the approximately 5.4-year period. Growing categories included fruit and vegetables (+53.9%), soup (+39.5%), meal and meal centers (+20.1%), snacks (+7.1%), desserts and ice cream (+4.4%), dairy (+4.1%), and sauces and seasonings (+1.0%); while top declining categories included side dishes (−37.2%), bakery (−4.9%), and processed fish, meat and egg products (−3.5%) [Q1-2021 vs Q1-2022].

| Top Categories | Top 50 brands (product item count) | Number of products |

|---|---|---|

| Processed fish, meat and egg products | Chorocmaeul (100), Hansalim (98), Yorihada (81), Dongwon (68), Johncook Deli Meats (66), Gomgom (59), No Brand (54), Peacock (54), Homeplus Signature (46), Orga (45) | 4,583 |

| Snacks | Only Price (73), No Brand (72), Homeplus Signature (38), Orga (37), You Us GS Retail (36), Pulmuone (35), Yougaone (35), Peacock (31), Yorihada (26), Hansalim (26) | 4,059 |

| Meals and meal centers | Pulmuone - Saenggadeuk (163), Yorihada (120), Ottogi (115), Samyang (64), Peacock (58), Nonshim (52), Mychef (50), Fresheasy (49), Homeplus Signature (40), Gomgom (31) | 3,360 |

| Sauces and seasonings | Yorihad (87), Ottogi (57), Homeplus Signature (56), No Brand (45), Peacock (44), Chorocmaeul (49), Beksul (38), Pulmuone (36), Hansalim (31), Choice L (30), Fontana (27) | 2,958 |

| Bakery | Paris Baguette (201), Samlip (191), Lotte (52), Peacock (48), No Brand (47), Homeplus Signature (36), Beksul (33), Chorocmaeul (24), Hansalim (18), Only Price (18), Gomgom (16) | 2,863 |

| Dairy | Seoul Milk (47), Binggrae (29), Only Price (24), Peacock (20), Homeplus Signature (20), No Brand (19), Sangha Farm (15), Choice L (11), Chorocmaeul (9), Kirkland Signature (9) | 2,162 |

| Desserts and ice cream | Häagen-Dazs (46), Lotte (28), Peacock Mamolo (15), Paris Baguette (14), Haitai (13), No Brand (11), Only Price (10), Chorocmaeul (7), Homeplus Signature (6), Ottogi (6), Emart (6) | 1,288 |

| Fruit and vegetables | Homeplus Signature (17), Chorocmaeul (17), Hansalim (17), Gomgom (15), Pulmuone (13), Orga (13), Lotte (6), No Brand (5), You Us GS Retail (5), Choice L (5), Dongwon (5), Jongga (5) | 943 |

| Soup | Ottogi (41), CJ CheilJedang Bibigo/Gourmet (25), Peacock (22), Homeplus Signature (14), Shinsegae Food Olbaan Kitchen (13), Pulmuone (12), Hansalim (12), Fontana (10), Orga (10) | 803 |

| Side dishes | Peacock (19), Chorocmaeul (16), Hansalim (15), Only Price (12), Pulmuone - Saaenggadeuk (16), No Brand (10), Homeplus Signature (8), Yorihada (6), Orga (6), Oasis (4), Sempio (1) | 799 |

| Total sample size | 26,534 | |

| Source: Mintel, 2022 | ||

Product examples

Korean Spicy Flavoured Barbecue Pork Ribs

Source: Mintel, 2022

| Company | Emart |

|---|---|

| Manufacturer | K & C Food |

| Brand | Private label (Peacock Gosuui Matjip) |

| Sub-category | Processed fish, meat and egg products |

| Market | South Korea |

| Related claims | Microwaveable, ease of use |

| Store name / type | SSG.COM, internet / mail order |

| Launch type | New product |

| Date published | April 2022 |

| Price in US dollars | 9.55 |

The microwaveable product also can be cooked easily in an air-fryer, contains 67.25% pork rib and 30% Korean spicy sauce, and retails in a 500 gram pack.

Dandan Noodles

Source: Mintel, 2022

| Company | Farm&Dle |

|---|---|

| Brand | Barunshik Barunjungshik |

| Sub-category | Meals and meal kit centers / noodles |

| Country | South Korea |

| Related claims | Premium, cobranded, ease of use |

| Store name / type | coupang.com, internet / mail order |

| Launch type | New product |

| Date published | April 2022 |

| Price in US dollars | 4.80 |

This product is said to be handmade with a special recipe to offer a nutty and spicy Chinese noodles. This easy-to-cook premium product features fresh noodles, dandan sauce, chilli oil, Ottogi sesame oil and chilli flakes. It can be prepared in six minutes retails in a 311 gram pack providing one portion.

Anchovy Large-Eyed Herring Soup Stock Bags

Source: Mintel, 2022

| Company | Nonghyup 100, private label (branded) |

|---|---|

| Manufacturer | Haesim |

| Sub-category | Sauces and seasonings / stocks |

| Market | South Korea |

| Related claims | Ethical environmentally friendly, convenient packaging |

| Store name / type | Lotte Mart, supermarket |

| Launch type | New product |

| Date published | April 2022 |

| Price in US dollars | 6.50 |

This soup stock bag product is comprised of 50% domestic dried anchovy, 20% domestic dried large-eyed herring, shiitake mushroom, kelp and shrimp, and helps in the preparation of a deep rich seafood soup base. This product retails in a 150 gram resealable pack containing 15 10 gram eco-friendly tea bags, which are made from corn starch. Also, available in crab seafood and achovy kelp soup stock bag flavours.

100% Pure Maple Spread

Source: Mintel, 2022

| Company / manufacturer | Les Industries Bernard & Fils |

|---|---|

| Brand | Bernard, private label (branded) |

| Sub-category | Sweet spreads / syrups |

| Country | Manufactured in Canada, importer – Aha |

| Store name / type | Lotte Mart, supermarket |

| Launch type | New product |

| Date published | February 2022 |

| Price in US dollars | 10.66 |

This kosher certified product is made with 100% pure maple syrup, and retails in a 160 gram jar.

Sweet Potato Straight Fries

Source: Mintel, 2022

| Company / manufacturer | Kraft Heinz Foods |

|---|---|

| Brand | Kraft Heinz, Ore-Ida |

| Sub-category | Side dishes / potato products |

| Country | Manufactured in Canada |

| Store name / type | homeplus.co.kr, internet / mail order |

| Launch type | New product |

| Date published | October 2021 |

| Price in US dollars | 5.91 |

This product is described as crispy and delicious French fried sweet potatoes made with the manufacturer's best recipe yet crafted by kids for kids, and recommended to be enjoyed with Heinz Tomato Ketchup. The kosher certified product is gluten free, and retails in a 538 gram pack.

Pecan & Almond Clusters

Source: Mintel, 2022

| Company / manufacturer | Inno Foods |

|---|---|

| Brand | Inno Foods |

| Sub-category | Snacks / cereal / energy bars, snacks |

| Country | Manufactured in Canada, importer Costco |

| Store name / type | Costco, club store |

| Launch type | New product |

| Date published | December 2021 |

| Price in US dollars | 12.20 |

This product is claimed to be a delicious snack, which also contains coconut and pumpkin seeds. This gluten-free product is said to be the perfect complement to salads, yogurt, cereal or can just be eaten straight out of the bag. It contains no artificial colours or flavours and retails in a 500 gram pack.

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

For additional information on the SFH – Seoul Food & Hotel 2022 trade show, please contact:

Ben Berry, Deputy Director

Trade Show Strategy and Delivery

Agriculture and agri-food Canada

ben.berry@agr.gc.ca

Resources

- Euromonitor International database, 2022

- Euromonitor International. December 2021. Country Report: Dairy Products and Alternatives in South Korea

- Euromonitor International. December 2020. Country Report: Packaged Food in South Korea

- Euromonitor International. December 2021. Country Report: Processed Meat, Seafood and Alternatives To Meat in South Korea

- Euromonitor International. December 2021. Country Report: Rice, Pasta and Noodles in South Korea

- Euromonitor International. December 2021. Country Report: Staple Foods in South Korea

- Global Trade Tracker, 2022

- Mintel Global New Products Database, 2022

- Yonhap. 25 April, 2022. The Korean Herald: Instant noodle exports jump 20% in March

Sector Trend Analysis – Packaged food trends in South Korea

Global Analysis Report

Prepared by: Erin-Ann Chauvin, Senior Market Analyst

© Her Majesty the Queen in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2022).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright Her Majesty the Queen in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.