Note: This report includes forecasting data that is based on baseline historical data.

Executive summary

The United Kingdom (U.K) was the tenth largest global retail sales market for baked goods with values of US$10.6 billion (2.4% market share) in 2022, representing an increase in CAGR of 3.1% from US$9.1 billion in 2017. In the forecast period, the market is expected to increase in CAGR by 5.0% to achieve retail sales of US$13.6 billion by 2027.

In 2022, the U.K was the second largest global market for baked goods with imports valued at US$3.6 billion (7.8% market share), 1.1 billion kilograms, representing an increase in CAGR of 8.3% from US$2.4 billion (880.8 million kilograms) in 2017.

Canada was the U.K's ninth largest supplier of baked goods, representing a 1.3% market value share and providing US$45.9 million, 11.6 million kilograms in 2022, representing an increase in CAGR of 5.6% from US$35.0 million in 2017. Top baked goods imports from Canada in 2022 included bread, pastry, cakes and biscuits (HS code: 190590) valued at US$44.4 million (96.7% market share), 11.3 million kilograms.

Recently labour shortages, the energy crisis and the increasing costs of raw materials, in conjunction with the implementation of the HFSS (high fat, sugar, salt) regulation in October 2022, have led to strong price increases in baked goods in 2022. Growth in the baked goods category is expected to remain positive at 5.0%, as retail sales reach US$13.6 billion by 2027, despite the implementation of the HFSS regulation which is expected to challenge the immediate performance of baked goods, especially in 2023.

Bread was the largest category in the baked goods market with retail value sales of US$5.1 billion (47.9% market share) in 2022. The category grew at a measurable CAGR of 2.9% during the 2017-2022 period, increasing in retail sales from US$4.4 billion in 2017.

According to Mintel's Global New Products Database (GNPD), there were 9,323 new bakery products launched in the U.K from January 2017 to December 2022.

The predominant sub-categories of new bakery products released were cakes, pastries and sweet goods (3,079 products), sweet biscuits/cookies (2,268 products) and bread and bread products (1,660 products).

Global trade overview of bakery product imports

The global market for baked goods has experienced positive value growth with a moderate compound annual growth rate (CAGR) of 7.3% as imports have increased from US$32.7 billion, (11.2 billion kilograms) in 2017 to US$46.5 billion, (13.9 billion kilograms) in 2022. The United States (U.S) was the largest global market for baked goods in 2022 with imports valued at US$9.8 billion, (21.1% market share), 2.4 billion kilograms, representing a substantial increase in CAGR of 13.9% from US$5.1 billion in 2017, followed by the United Kingdom (U.K) with imports valued at US$3.6 billion (7.8% market share), 1.1 billion kilograms, and an increase in CAGR of 8.3% from US$2.4 billion (880.8 million kilograms) in 2017 and Germany, with import values of US$3.1 billion (6.7% market share), 1.0 billion kilograms, in 2022.

Canada in comparison, was the fifth largest global market for baked goods with import values of US$2.0 billion (4.4% market share), 509.9 million kilograms in 2022, representing a moderate increase in CAGR of 6.5% from imports of US$1.5 billion, (491.7 million kilograms) in 2017.

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 | Market share % in 2022 |

|---|---|---|---|---|---|---|---|---|

| World Total | 32,672.8 | 35,675.4 | 37,079.6 | 37,253.8 | 42,890.1 | 46,474.4 | 7.3 | 100.0 |

| United States | 5,120.2 | 5,722.6 | 6,172.5 | 6,445.4 | 7,808.5 | 9,828.8 | 13.9 | 21.1 |

| United Kingdom (2) | 2,421.5 | 2,612.2 | 2,747.8 | 2,766.0 | 2,787.4 | 3,608.2 | 8.3 | 7.8 |

| Germany | 2,294.6 | 2,473.0 | 2,556.0 | 2,710.8 | 3,068.0 | 3,115.4 | 6.3 | 6.7 |

| France | 2,260.7 | 2,365.2 | 2,377.9 | 2,357.0 | 2,668.5 | 2,688.3 | 3.5 | 5.8 |

| Canada (5) | 1,485.3 | 1,554.8 | 1,635.3 | 1,655.1 | 1,762.0 | 2,036.3 | 6.5 | 4.4 |

| Netherlands | 1,235.5 | 1,410.3 | 1,451.9 | 1,470.8 | 1,753.5 | 1,853.0 | 8.4 | 4.0 |

| Belgium | 1,147.6 | 1,228.2 | 1,191.8 | 1,139.6 | 1,476.4 | 1,555.9 | 6.3 | 3.3 |

| Italy | 950.0 | 993.4 | 960.7 | 932.2 | 1,053.6 | 1,118.6 | 3.3 | 2.4 |

| Spain | 746.9 | 845.9 | 874.0 | 777.5 | 925.4 | 999.0 | 6.0 | 2.1 |

| Australia | 637.5 | 698.9 | 762.9 | 779.5 | 890.9 | 996.2 | 9.3 | 2.1 |

|

Source: Global Trade Tracker, 2023 (accessed August 23, 2023) 1: Baked goods; HS code 1905 *CAGR: Compound Annual Growth Rate |

||||||||

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 | Market share % in 2022 |

|---|---|---|---|---|---|---|---|---|

| World Total | 11,211.6 | 11,985.2 | 12,549.9 | 13,431.6 | 13,582.8 | 13,991.2 | 4.5 | 100.0 |

| United States | 1,563.7 | 1,724.5 | 1,833.3 | 1,939.4 | 2,181.7 | 2,425.9 | 9.2 | 17.3 |

| United Kingdom (2) | 880.8 | 897.5 | 964.1 | 977.0 | 863.7 | 1,063.6 | 3.8 | 7.6 |

| Germany | 794.9 | 828.4 | 899.7 | 923.5 | 993.2 | 1,024.8 | 5.2 | 7.3 |

| France | 753.2 | 752.1 | 772.5 | 786.3 | 863.8 | 871.5 | 3.0 | 6.2 |

| Netherlands | 424.0 | 457.3 | 537.1 | 594.2 | 656.5 | 786.2 | 13.1 | 5.6 |

| Belgium | 439.6 | 456.9 | 441.7 | 397.5 | 518.7 | 556.3 | 4.8 | 4.0 |

| Canada (7) | 491.7 | 508.0 | 519.2 | 505.3 | 498.0 | 509.9 | 0.7 | 3.6 |

| Italy | 334.0 | 326.2 | 338.7 | 319.0 | 347.1 | 366.2 | 1.9 | 2.6 |

| Spain | 248.9 | 261.8 | 290.7 | 267.9 | 304.9 | 337.6 | 6.3 | 2.4 |

| Austria | 219.9 | 232.9 | 254.7 | 244.1 | 257.0 | 260.0 | 3.4 | 1.9 |

|

Source: Global Trade Tracker, 2023 1: Baked goods; HS code 1905 *CAGR: Compound Annual Growth Rate |

||||||||

United Kingdom trade overview of baked good imports

The U.K has a diverse supply network of baked goods products. In 2022, the top three suppliers of baked goods to the U.K were France with values of US$548.0 million (15.2% market share), 157.0 million kilograms, followed by Belgium with values of US$475.6 million (13.2% market share), 137.7 million kilograms and representing a measurable increase in CAGR of 12.0% from US$270.3 million in 2017, and Germany with values of US$460.7 million (12.8% market share), 133.5 million kilograms. Canada in comparison, was the U.K's ninth largest supplier of baked goods, representing a 1.3% market value share and providing US$45.9 million, 11.6 million kilograms in 2022, representing an increase in CAGR of 5.6% from US$35.0 million in 2017.

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 | Market share % in 2022 |

|---|---|---|---|---|---|---|---|---|

| World Total | 2,421.5 | 2,612.2 | 2,747.8 | 2,766.0 | 2,787.4 | 3,608.2 | 8.3 | 100.0 |

| France | 437.4 | 441.4 | 447.4 | 433.9 | 374.3 | 548.0 | 4.6 | 15.2 |

| Belgium | 270.3 | 297.5 | 255.1 | 284.4 | 393.6 | 475.6 | 12.0 | 13.2 |

| Germany | 405.7 | 421.7 | 436.2 | 412.8 | 351.0 | 460.7 | 2.6 | 12.8 |

| Ireland | 287.4 | 313.6 | 381.7 | 411.3 | 380.1 | 421.0 | 7.9 | 11.7 |

| Netherlands | 242.0 | 261.3 | 274.5 | 255.4 | 206.9 | 355.3 | 8.0 | 9.8 |

| Poland | 136.4 | 186.1 | 199.8 | 202.0 | 222.8 | 321.2 | 18.7 | 8.9 |

| Italy | 153.6 | 153.5 | 192.2 | 213.2 | 270.5 | 275.3 | 12.4 | 7.6 |

| Spain | 103.0 | 125.9 | 132.4 | 132.9 | 136.4 | 151.4 | 8.0 | 4.2 |

| Canada (9) | 35.0 | 42.6 | 40.9 | 44.9 | 48.1 | 45.9 | 5.6 | 1.3 |

| Luxembourg | 0.7 | 0.6 | 0.6 | 0.4 | 0.1 | 43.9 | 125.8 | 1.2 |

|

Source: Global Trade Tracker, 2023 *CAGR: Compound Annual Growth Rate |

||||||||

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 | Market share % in 2022 |

|---|---|---|---|---|---|---|---|---|

| World (Total) | 880.8 | 897.5 | 964.1 | 977.0 | 863.7 | 1,063.6 | 3.8 | 100.0 |

| Ireland | 143.6 | 146.3 | 158.3 | 175.3 | 143.7 | 164.0 | 2.7 | 15.4 |

| France | 152.2 | 145.4 | 154.8 | 159.3 | 123.6 | 157.0 | 0.6 | 14.8 |

| Belgium | 89.3 | 97.5 | 93.8 | 98.3 | 122.6 | 137.7 | 9.0 | 12.9 |

| Germany | 153.6 | 147.5 | 161.9 | 144.8 | 107.2 | 133.5 | −2.8 | 12.5 |

| Netherlands | 86.5 | 86.9 | 90.3 | 87.1 | 59.3 | 111.5 | 5.2 | 10.5 |

| Poland | 41.0 | 47.5 | 55.7 | 55.9 | 57.2 | 79.3 | 14.1 | 7.5 |

| Italy | 35.1 | 35.3 | 44.4 | 54.4 | 64.6 | 61.4 | 11.8 | 5.8 |

| Spain | 41.8 | 46.7 | 49.6 | 49.3 | 46.2 | 47.9 | 2.8 | 4.5 |

| Czech Republic | 21.9 | 16.5 | 24.5 | 19.3 | 17.9 | 14.7 | −7.7 | 1.4 |

| China | 10.7 | 10.8 | 12.2 | 10.3 | 12.4 | 13.7 | 5.1 | 1.3 |

| Canada (13) | 9.9 | 12.9 | 11.1 | 12.2 | 12.7 | 11.6 | 3.4 | 1.1 |

|

Source: Global Trade Tracker, 2023 *CAGR: Compound Annual Growth Rate |

||||||||

The U.K is a net importer of baked goods products. In 2022, the U.K's baked goods trade deficit was US$2.4 billion as imports were valued at US$3.6 billion while exports were valued at US$1.2 billion. Of the U.K's baked good imports, bread, pastry, cakes and biscuits (HS code: 190590) were the largest with values of US$2.6 billion (71.5% market share), 793.1 million kilograms, followed by sweet biscuits (HS code: 190531) with values of US$540.5 million (15.0% market share), 160.6 million kilograms and waffles and wafers (HS code: 190532) with values of US$420.4 million (11.7% market share), 93.5 million kilograms in 2022. Of note, Canada has attained measurable market representation in each of the U.K's baked goods imports (with the exception of crispbreads) particularly gingerbread imports, which Canada's supply represented 3.7% of the market share in 2022.

| HS Code | Description | Import value (US$M) | Import volume (million kilograms) | Top suppliers and market value share % | Canada's value share % | ||

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | |||||

| Baked goods total (HS code 1905) | 3,608.2 | 1,063.6 | France: 15.2 | Belgium: 13.2 | Germany: 12.8 | 1.3 | |

| 190590 | Bread, pastry, cakes and biscuits | 2,579.1 | 793.1 | France: 19.4 | Ireland: 15.6 | Belgium: 12.6 | 1.7 |

| 190531 | Sweet biscuits | 540.5 | 160.6 | Netherlands: 25.2 | Germany: 18.6 | Belgium: 18.5 | 0.1 |

| 190532 | Waffles and wafers | 420.4 | 93.5 | Poland: 40.8 | Germany: 11.4 | Belgium: 10.9 | 0.0 |

| 190540 | Rusks, toasted bread | 32.8 | 9.3 | Italy: 20.9 | France: 18.1 | Netherlands: 10.1 | 1.2 |

| 190520 | Gingerbread | 19.7 | 4.5 | Germany: 38.7 | Belgium: 25.7 | Denmark: 7.4 | 3.7 |

| 190510 | Crispbread | 15.7 | 2.4 | Thailand: 35.3 | Germany: 20.8 | Italy: 13.6 | |

| Source: Global Trade Tracker, 2023 | |||||||

Canada's performance

The United Kingdom's baked goods imports from Canada

The U.K was the second largest global market for baked goods products with imports valued at US$3.6 billion, 1.1 billion kilograms in 2022. Of these imports, Canada was the ninth largest supplier to the U.K (representing a 1.3% market share) with imports valued at US$45.9 million, 11.6 million kilograms in 2022. Top baked goods imports from Canada in 2022 included bread, pastry, cakes and biscuits (HS code: 190590) valued at US$44.4 million (96.7% market share), 11.3 million kilograms, gingerbread (HS code 190520) with values of US$0.7 million (1.6% market share), 0.2 million kilograms and rusks, toasted bread (HS code: 190540) with values of US$0.4 million (0.9% market share), 0.1 million kilograms, signifying Canada's position as a trusted and capable supplier of baked goods (products) to the U.K and the surrounding EU region.

| HS Code | Description | Import value (US$) | Import volume (kg) | Market value share % |

|---|---|---|---|---|

| Baked goods total (HS code 1905) | 45.9 | 11.6 | 100.0 | |

| 190590 | Bread, pastry, cakes and biscuits | 44.4 | 11.3 | 96.7 |

| 190520 | Gingerbread | 0.7 | 0.2 | 1.6 |

| 190540 | Rusks, toasted bread | 0.4 | 0.1 | 0.9 |

| 190531 | Sweet biscuits | 0.3 | 0.0 | 0.6 |

| 190532 | Waffles and wafers | 0.1 | 0.0 | 0.2 |

| Source: Global Trade Tracker, 2023 | ||||

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | CAGR* % 2017-2022 |

|---|---|---|---|---|---|---|---|

| United Kingdom imports from the World | 2,421.5 | 2,612.2 | 2,747.8 | 2,766.0 | 2,787.4 | 3,608.2 | 8.3 |

| United Kingdom imports from Canada | 35.0 | 42.6 | 40.9 | 44.9 | 48.1 | 45.9 | 5.6 |

| Supply gap | 2,386.5 | 2,569.6 | 2,706.9 | 2,721.0 | 2,739.3 | 3,562.3 | 8.3 |

|

Source: Global Trade Tracker, 2023 *CAGR: Compound Annual Growth Rate |

|||||||

Canada's export market

Canada, unlike the U.K, is a net exporter of baked goods products. In 2022, Canada enjoyed a baked goods product trade surplus of US$2.7 billion with imports of US$2.0 billion, and exports valued at US$4.7 billion (Canada was the second largest (after Germany) global exporter of baked goods).

Top baked goods products that Canada exported to global markets included bread, pastry, cakes and biscuits (HS code: 190590) with values of US$3.7 billion (71.0% market share), 712.6 million kilograms, sweet biscuits (HS code: 190531) with values of US$561.9 million (11.9% market share), 109.3 million kilograms and waffles and wafers (HS code: 190532) valued at US$533.3 million, 79.9 million kilograms in 2022.

The U.S was the largest market for Canadian baked goods product exports with values of US$4.5 billion (97.0% market share), 911.2 million kilograms, followed by the U.K with values of US$44.7 million (1.0% market share), 14.4 million kilograms and Mexico with values of US$34.7 million (0.8% market share), 4.0 million kilograms in 2022.

| Country | Export value (US$ millions) | Export volume (million kilograms) | Market value share % in 2022 |

|---|---|---|---|

| Global total | 4,656.2 | 947.2 | 100.0 |

| United States | 4,518.2 | 911.2 | 97.0 |

| United Kingdom (2) | 44.7 | 14.4 | 1.0 |

| Mexico | 34.7 | 4.0 | 0.8 |

| Australia | 12.1 | 3.0 | 0.3 |

| Japan | 7.5 | 2.2 | 0.2 |

| Korea | 3.6 | 1.3 | 0.1 |

| Ireland | 3.6 | 1.3 | 0.1 |

| Saudi Arabia | 3.1 | 0.6 | 0.1 |

| Philippines | 2.1 | 0.5 | 0.0 |

| Costa Rica | 2.0 | 1.3 | 0.0 |

| Source: Global Trade Tracker, 2023 | |||

The province of Ontario was predominant in supplying baked good products to the U.K, occupying a 91.7% market share, followed by Québec, representing a 7.0% market share in 2022. Bread, pastry, cakes and biscuits (HS code: 190590) was the largest baked goods product exported to the U.K with values of US$43.4 million (97% market share), 13.9 million kilograms in 2022.

| HS Code | Description | Export value (US$ M) | Export volume (million kilograms) | Top provincial suppliers and market value share % | ||

|---|---|---|---|---|---|---|

| Baked goods total (HS code 1905) | 44.7 | 14.4 | Ontario: 91.7 | Québec: 7.0 | British Columbia: 1.1 | |

| 190590 | bread, pastry, cakes, biscuits | 43.4 | 13.9 | Ontario: 92.2 | Québec: 6.9 | British Columbia: 0.9 |

| 190520 | gingerbread | 0.5 | 0.1 | Ontario: 100.0 | ||

| 190510 | crispbread | 0.4 | 0.2 | Ontario: 69.3 | Nova Scotia: 30.7 | |

| 190531 | sweet biscuits | 0.4 | 0.1 | Ontario: 58.1 | British Columbia: 21.7 | Québec: 19.2 |

| 190532 | waffles and wafers | 0.1 | 0.0 | Québec: 100.0 | ||

| 190540 | rusks, toasted bread | 0.0 | 0.0 | Ontario: 100.0 | ||

| Source: Global Trade Tracker, 2023 | ||||||

Retail markets

Global retail sales overview of bakery products (baked goods)

Global retail sales of baked goods have increased moderately in CAGR by 6.0% from US$328.5 billion in 2017 to US$439.9 billion in 2022 and are expected to increase at an additional CAGR of 6.5% as retail sales attain US$604.1 billion by 2027. The United States (U.S) was the largest global market for baked goods with retail sales of US$82.9 billion (18.8% market share), followed by China with values of US$38.1 billion (8.7% market share) and Brazil, with retail sales of US$24.9 billion (5.7% market share) in 2022.

The U.K was the tenth largest global retail sales market for baked goods with values of US$10.6 billion, representing a 2.4% market share in 2022. The U.K experienced an increase in CAGR of 3.1% as retail sales grew from US$9.1 billion in 2017 and are expected to further improve with an increase in CAGR of 5.0% in the forecast period as retail sales are anticipated to achieve US$13.6 billion by 2027. In comparison, Canada was the twelfth largest retail sales market for baked goods, accounting for a 1.7% retail sale market share with values of US$7.6 billion in 2022. Similarly, Canada is also expected to achieve positive growth, albeit at a lower rate of 2.5% in the forecast period as retail sales attain US$8.6 billion by 2027. Of note, Brazil is anticipated to experience the largest increase in CAGR (11.1%) in the forecast period as retail sales of baked goods reach US$42.3 billion by 2027.

| Geography | 2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Global total | 328,499.2 | 439,977.1 | 6.0 | 473,991.7 | 604,081.9 | 6.5 |

| United States | 64,714.1 | 82,933.7 | 5.1 | 86,641.3 | 97,740.0 | 3.3 |

| China | 28,380.8 | 38,095.8 | 6.1 | 41,265.3 | 53,975.9 | 7.2 |

| Brazil | 15,950.4 | 24,952.0 | 9.4 | 28,300.2 | 42,275.7 | 11.1 |

| Japan | 22,937.9 | 24,515.1 | 1.3 | 25,140.6 | 26,423.9 | 1.5 |

| Mexico | 15,423.1 | 23,801.0 | 9.1 | 25,555.0 | 32,831.3 | 6.6 |

| Italy | 18,254.6 | 21,837.2 | 3.6 | 22,983.2 | 26,080.9 | 3.6 |

| Germany | 16,940.0 | 18,765.8 | 2.1 | 19,405.8 | 20,876.3 | 2.2 |

| France | 14,993.6 | 17,150.6 | 2.7 | 17,943.3 | 20,359.6 | 3.5 |

| Russia | 7,994.0 | 10,754.9 | 6.1 | 11,947.4 | 16,246.7 | 8.6 |

| United Kingdom (10) | 9,121.9 | 10,623.3 | 3.1 | 11,267.7 | 13,556.0 | 5.0 |

| Canada (12) | 6,180.5 | 7,633.6 | 4.3 | 7,880.4 | 8,626.1 | 2.5 |

|

Source: Euromonitor International, 2023 1: Baked goods (as defined by Euromonitor International) - the aggregation of bread, pastries, dessert mixes, frozen baked goods and cakes. Note: Baked goods from in-store bakeries are classified under unpackaged/artisanal, not packaged/industrial. *CAGR: Compound Annual Growth Rate |

||||||

Retail sales overview of bakery products (baked goods) in the United Kingdom

Retail sales of baked goods in the U.K were valued at US$10.6 billion in 2022. During the 2017-2022 period, this market grew at a CAGR of 3.1% from US$9.1 billion in 2017 (−0.4% from 2019-2020 with the onset of the pandemic). Between 2020-2021, the market increased by 1.6%, and a further 9.0% from 2021 −2022 (as retail sales grew from US$9.7 billion in 2021), despite consumers spending less time at home as restrictions eased (Euromonitor International; Baked Goods in the U.K, November 2022). Recently however, labour shortages, the energy crisis and the increasing costs of raw materials, in conjunction with the implementation of the HFSS (high fat, sugar, salt) regulation in October 2022, (legislation which will affect price promotions, in-store product location, and online locations of foods high in fat, sugar and salt), have led to strong price increases in baked goods in 2022.

Inflation has since limited the consumers' disposable incomes and decreased demand for packaged leavened bread, cakes and pastries. However, despite recent inflationary pressure, overall baked goods were expected to remain more resilient compared to other staple foods in 2022, guided by the demand for unpackaged options and the high penetration of private and artisanal offerings which are competitively priced, have innovative flavourings and can be consumed on the go (Euromonitor International; Baked Goods in the U.K, November 2022).

The top baked goods categories in the U.K, in terms of retail value sales in 2022, were bread, with values of US$5.1 billion (47.9% market share) increasing at a CAGR of 2.9% from US$4.4 billion in 2017, followed by cakes valued at US$3.1 billion (29.6% market share), representing an increase in CAGR of 2.2% from US$2.8 billion in 2017 and pastries with values of US$1.2 billion (11.1% market share) and experiencing the greatest performance, increasing in CAGR by 5.8% from US$889.3 million in 2017.

Growth in the baked goods category is expected to remain positive at 5.0%, as retail sales reach US$13.6 billion by 2027, despite the implementation of the HFSS regulation which is expected to challenge the immediate performance of baked goods, especially in 2023, when the regulation is set to apply to the first, and full year of baked goods' sales. In addition, alongside its negative impact on impulse buying, the upcoming restrictions on advertising HFSS products in January 2024 are expected to create further barriers to the promotion of new products and is likely to hamper growth. Although the category is unlikely to be dominated by HFSS-compliant products over the forecast period, innovation is expected to continue focusing on healthier products through calorie reduction to address rising consumer demand with permissible indulgence. In addition, sustainability commitments for manufacturers and retailers will remain as concerns around climate change intensify (Euromonitor International; Baked Goods in the U.K, November 2022).

|

Category |

2017 | 2022 | CAGR* % 2017-2022 | 2023 | 2027 | CAGR* % 2022-2027 |

|---|---|---|---|---|---|---|

| Baked Goods (Total) | 9,121.9 | 10,623.3 | 3.1 | 11,267.7 | 13,556.0 | 5.0 |

| Bread | 4,406.7 | 5,090.5 | 2.9 | 5,403.1 | 6,160.4 | 3.9 |

| Cakes | 2,817.2 | 3,148.2 | 2.2 | 3,343.4 | 4,226.4 | 6.1 |

| Dessert Mixes | 130.9 | 171.8 | 5.6 | 183.8 | 222.6 | 5.3 |

| Frozen Baked Goods | 180.1 | 229.3 | 4.9 | 242.1 | 299.4 | 5.5 |

| Pastries | 889.3 | 1,180.2 | 5.8 | 1,249.4 | 1,587.7 | 6.1 |

| Dessert Pies and Tarts | 697.7 | 803.3 | 2.9 | 845.9 | 1,059.6 | 5.7 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

||||||

Competitive landscape

The U.K baked goods market remained a highly fragmented industry in 2022. The top five baked goods companies (Warburtons Ltd, Hovis Ltd, Premier Foods Plc, Associated British Foods Plc and Mondelez International Inc) represented a combined market share of 19.8% in 2022.

In terms of retail sales, Warburtons Ltd, (Brand name; Warburtons) was the largest baked goods company in the U.K with values of US$856.7 million (8.1% market share), while Hovis Ltd (Brand name; Hovis), the second largest baked goods company, attained US$544.7 million (5.1% market share) in 2022.

Private label companies in comparison, continue to show a moderate presence in the baked goods market in the U.K with retail sales of US$3.9 billion (36.4% market share) in 2022, increasing in CAGR by 5.3% from retail sales of US$2.9 billion in 2017, while artisanal companies attained retail sales of US$2.7 billion (25.0% market share) in 2022, representing an increase in CAGR of 1.7% from US$2.4 billion in 2017.

The recent application of the HFSS regulations in the baked goods sector has classified a majority of packaged cakes, pastries and sweetpies and tarts as high fat, sugar and salt (HFSS) with an accompanying nutritional score for each product. Euromonitor International reports that in order to address these classifications, brand manufacturers are investing in recipe adjustments and developing healthier variants to reduce the nutritional score of their products, such as limiting sugar, salt and fat, and increasing fibre content to compete with their artisanal unpackaged counterparts, who are exempt from these regulations (Euromonitor International; Baked Goods in the U.K, November 2022). For example, Premier Foods Group, the U.K's third largest baked good company, launched Deliciously Good featuring a range of non-HFSS cakes and pies made with real fruit, 30% less sugar and a higher fibre content (Euromonitor International; Baked Goods in the U.K, November 2022).

| Company | Retail sales (US$ millions) | Market share % |

|---|---|---|

| Total | 10,623.3 | 100.0 |

| Warburtons Ltd | 856.7 | 8.1 |

| Hovis Ltd | 544.7 | 5.1 |

| Premier Foods Plc | 314.7 | 3.0 |

| Associated British Foods Plc | 230.3 | 2.2 |

| Mondelez International Inc | 153.8 | 1.4 |

| Pladis Ltd | 94.5 | 0.9 |

| General Mills Inc | 86.9 | 0.8 |

| Grupo Bimbo SAB de CV | 73.4 | 0.7 |

| Frank Roberts & Sons Ltd | 69.9 | 0.7 |

| Lightbody Celebration Cakes Ltd | 64.0 | 0.6 |

| Private Label | 3,867.6 | 36.4 |

| Artisanal | 2,652.4 | 25.0 |

| Others | 1,203.5 | 11.3 |

| Source: Euromonitor International, 2023 | ||

Distribution channels

The majority of the U.K's baked goods market is distributed through grocery retailers versus non-grocery retailers. Grocery retailers (offline) distribution of baked goods accounted for a 98.4% market share in 2022, decreasing slightly from 98.6% held in 2017, while grocery retailing (online), e-commerce in particular, increased from US$391.9 million (4.3% market share) in 2017 to US$915.7 million (8.6% market share) in 2022. Further, within grocery retailers (offline), supermarkets and hypermarkets were the predominant distribution channels for baked goods representing US$2.5 billion and US$2.6 billion each, with market shares of 26.0% and 27.2% respectively, while convenience retailers and discounters occupied a 15.8% and 15.1% market share respectively, in 2022.

| Outlet Type | 2017 | 2022 | ||

|---|---|---|---|---|

| Actual | Share % | Actual | Share % | |

| Retail Channels Total | 9,121.9 | 100.0 | 10,623.3 | 100.0 |

| Retail Offline | 8,730.0 | 95.7 | 9,707.6 | 91.4 |

| Grocery Retailers | 8,608.1 | 98.6 | 9,556.3 | 98.4 |

| Convenience Retail | 1,234.5 | 14.3 | 1,505.9 | 15.8 |

| Convenience Stores | 1,033.6 | 83.7 | 1,312.9 | 87.2 |

| Forecourt Retailers | 200.8 | 16.3 | 193.0 | 12.8 |

| Supermarkets | 2,667.6 | 31.0 | 2,480.5 | 26.0 |

| Hypermarkets | 2,143.4 | 24.9 | 2,595.0 | 27.2 |

| Discounters | 1,170.8 | 13.6 | 1,446.1 | 15.1 |

| Warehouse Clubs | 6.4 | 0.1 | 8.0 | 0.1 |

| Food/drink/tobacco specialists | 729.9 | 8.5 | 802.4 | 8.4 |

| Small Local Grocers | 655.5 | 7.6 | 718.5 | 7.5 |

| Non-Grocery Retailers | 121.9 | 1.4 | 151.3 | 1.6 |

| General Merchandise Stores | 121.9 | 100.0 | 151.3 | 100.0 |

| Retail E-Commerce | 391.9 | 4.3 | 915.7 | 8.6 |

| Source: Euromonitor International, 2023 | ||||

Market segmentation

Bread

Bread was the largest category in the baked goods market with retail value sales of US$5.1 billion (47.9% market share) in 2022. The category grew at a measurable CAGR of 2.9% during the 2017-2022 period, increasing in retail sales from US$4.4 billion in 2017.

Leavened bread was the largest bread segment with retail value sales of US$4.6 billion (90.2% of bread market share) in 2022. Of the leavened bread segment, packaged leavened bread increased in CAGR by 3.0% from US$3.0 billion in 2017 to US$3.5 billion in 2022, while unpackaged leavened bread achieved the best performance, increasing in growth by 13.5% as retail sales increased from US$927.1 million in 2021 to US$1.1 billion in 2022. Flat bread in comparison, grew by 6.0% from US$371.0 million in 2017 to US$497.1 million in 2022. Of the flat breads, packaged flat bread experienced an increase of 6.2% from retail sales of US$356.3 million in 2017 to US$481.2 million in 2022, while unpackaged flat bread experienced the greatest performance, expanding by 12.8% from US14.1 million in 2021 to US$15.9 million in 2022.

The bread market is forecast to remain positive with a CAGR of 3.9% as retail sales are anticipated to reach US$6.2 billion by 2027. Flat bread is anticipated to achieve greater growth (5.9%) in relation to leavened bread growth of 3.7% in the forecast period, as more consumers choose the perceived healthier option of flat breads (Euromonitor International; Baked Goods in the U.K, November 2022). Relatedly, packaged leavened bread is expected to continue to improve the nutritional value of their products and strengthen their brands' value amongst those consumers able to afford premium offerings (Euromonitor International; Baked Goods in the U.K, November 2022). In the bread (flat and unleavened) market competitive landscape, Waburtons Ltd (Brand names: Warburtons) led sales with a market share of 16.3%, followed by Hovis Ltd. (Brand names: Hovis and Mothers Pride) with a market share of 10.6% and Associated British Foods Plc (Brand names: Kingmill, Allinson, Bürgen and Sunblest) with a market share of 4.1% in 2022. In comparison, private label and artisanal companies represent a significant presence in the U.K bread market, attaining market shares of 30.0% and 21.0% respectively, in 2022.

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Bread | 4,406.7 | 4,507.6 | 4,598.0 | 4,652.5 | 4,662.9 | 5,090.5 |

| Flat Bread | 371.0 | 394.7 | 415.4 | 444.1 | 447.5 | 497.1 |

| Packaged Flat Bread | 356.3 | 379.5 | 399.6 | 430.8 | 433.4 | 481.2 |

| Unpackaged Flat Bread | 14.7 | 15.2 | 15.7 | 13.3 | 14.1 | 15.9 |

| Leavened Bread | 4,035.7 | 4,112.9 | 4,182.6 | 4,208.4 | 4,215.3 | 4,593.3 |

| Packaged Leavened Bread | 3,049.8 | 3,093.5 | 3,130.6 | 3,331.0 | 3,288.3 | 3,541.3 |

| Unpackaged Leavened Bread | 986.0 | 1,019.4 | 1,052.0 | 877.4 | 927.1 | 1,052.1 |

| Source: Euromonitor International, 2023 | ||||||

| Category | Annual growth % 2021-2022 | CAGR* % 2017-2022 | Total growth % 2017-2022 |

|---|---|---|---|

| Bread | 9.2 | 2.9 | 15.5 |

| Flat Bread | 11.1 | 6.0 | 34.0 |

| Packaged Flat Bread | 11.0 | 6.2 | 35.1 |

| Unpackaged Flat Bread | 12.8 | 1.6 | 8.2 |

| Leavened Bread | 9.0 | 2.6 | 13.8 |

| Packaged Leavened Bread | 7.7 | 3.0 | 16.1 |

| Unpackaged Leavened Bread | 13.5 | 1.3 | 6.7 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

| Company | Retail Sales (US$ millions) | Market share % |

|---|---|---|

| Total | 5,090.5 | 100.0 |

| Waburtons Ltd | 830.4 | 16.3 |

| Hovis Ltd. | 540.4 | 10.6 |

| Associated British Foods Plc | 207.7 | 4.1 |

| Private Label | 1,528.6 | 30.0 |

| Artisanal | 1,068.0 | 21.0 |

| Others | 479.3 | 9.4 |

| Source: Euromonitor International, 2023 | ||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| Bread | 5,403.1 | 5,613.4 | 5,811.7 | 5,987.2 | 6,160.4 |

| Flat Bread | 537.6 | 569.8 | 601.7 | 631.4 | 661.2 |

| Packaged Flat Bread | 520.1 | 551.0 | 581.5 | 610.1 | 638.8 |

| Unpackaged Flat Bread | 17.5 | 18.8 | 20.1 | 21.3 | 22.5 |

| Leavened Bread | 4,865.4 | 5,043.6 | 5,210.0 | 5,355.7 | 5,499.1 |

| Packaged Leavened Bread | 3,695.9 | 3,779.5 | 3,855.4 | 3,914.8 | 3,972.7 |

| Unpackaged Leavened Bread | 1,169.5 | 1,264.1 | 1,354.6 | 1,440.9 | 1,526.4 |

| Source: Euromonitor International, 2023 | |||||

| Category | Annual growth % 2022-2023 | CAGR* % 2022-2027 | Total growth % 2022-2027 |

|---|---|---|---|

| Bread | 6.1 | 3.9 | 21.0 |

| Flat Bread | 8.1 | 5.9 | 33.0 |

| Packaged Flat Bread | 8.1 | 5.8 | 32.8 |

| Unpackaged Flat Bread | 10.1 | 7.2 | 41.5 |

| Leavened Bread | 5.9 | 3.7 | 19.7 |

| Packaged Leavened Bread | 4.4 | 2.3 | 12.2 |

| Unpackaged Leavened Bread | 11.2 | 7.7 | 45.1 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

Cakes

Cakes were the second largest category in the U.K baked goods market with retail value sales of US$3.1 billion (29.6% market share) in 2022. The category grew at a CAGR of 2.2% during the 2017-2022 period, increasing in retail sales from US$2.8 billion in 2017.

Packaged cakes were the largest cake segment with retail value sales of US$1.9 billion (59.4% of cake market share) in 2022, increasing in CAGR by 2.9% from US$1.6 billion in 2017. Of note, unpackaged cakes experienced a decline in growth of 15.7% with the emergence of the pandemic (2019-2020) and the accompanying lockdowns (home seclusion) and restrictions (foodservice and non-essential retail closures) as celebratory occasions and gatherings were limited, however as restrictions eased, the segment recovered, and experienced the best performance from 2021 to 2022, expanding 12.8% as retail sales increased from US$1.1 billion to US$1.3 billion from 2021 to 2022.

The cake market is forecast to remain positive with a greater increase in CAGR of 6.1% as retail sales are anticipated to reach US$4.2 billion by 2027. In the cake market competitive landscape, Premier Foods Plc (Brand names: Mr. Kipling and Lyons Cakes) led sales with a market share of 6.6%, followed by Mondelez International Inc (Brand names: Cadbury and Cadbury Dairy Milk) with a market share of 4.9% and Pladis Ltd (Brand names: Galaxy, Jaffa Cakes, McVitie's and Penguin) with a market share of 3.0% in 2022. In comparison, private label and artisanal companies represent a significant presence in the U.K cake market, attaining market shares of 28.1% and 40.6% respectively, in 2022.

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Cakes | 2,817.2 | 2,878.2 | 2,989.7 | 2,803.4 | 2,875.6 | 3,148.2 |

| Packaged Cakes | 1,625.1 | 1,654.8 | 1,726.0 | 1,738.1 | 1,743.8 | 1,871.2 |

| Unpackaged Cakes | 1,192.1 | 1,223.4 | 1,263.8 | 1,065.3 | 1,131.8 | 1,276.9 |

| Source: Euromonitor International, 2023 | ||||||

| Category | Annual growth % 2021-2022 | CAGR* % 2017-2022 | Total growth % 2017-2022 |

|---|---|---|---|

| Cakes | 9.5 | 2.2 | 11.7 |

| Packaged Cakes | 7.3 | 2.9 | 15.1 |

| Unpackaged Cakes | 12.8 | 1.4 | 7.1 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

| Company | Retail sales (US$ millions) | Market share % |

|---|---|---|

| Total | 3,148.2 | 100.0 |

| Premier Foods Plc | 208.5 | 6.6 |

| Mondelez International Inc | 152.8 | 4.9 |

| Pladis Ltd | 94.5 | 3.0 |

| Private Label | 883.6 | 28.1 |

| Artisanal | 1,276.9 | 40.6 |

| Others | 367.6 | 11.7 |

| Source: Euromonitor International, 2023 | ||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| Cakes | 3,343.4 | 3,552.1 | 3,771.9 | 3,992.8 | 4,226.4 |

| Packaged Cakes | 1,943.7 | 2,049.4 | 2,166.7 | 2,287.9 | 2,415.8 |

| Unpackaged Cakes | 1,399.7 | 1,502.6 | 1,605.2 | 1,704.9 | 1,810.6 |

| Source: Euromonitor International, 2023 | |||||

| Category | Annual growth % 2022-2023 | CAGR* % 2022-2027 | Total growth % 2022-2027 |

|---|---|---|---|

| Cakes | 6.2 | 6.1 | 34.2 |

| Packaged Cakes | 3.9 | 5.2 | 29.1 |

| Unpackaged Cakes | 9.6 | 7.2 | 41.8 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

Pastries

Pastries were the third largest category in the U.K baked goods market with retail value sales of US$1.2 billion (11.1% market share) in 2022. The category grew at a moderate CAGR of 5.8% during the 2017 at 2022 period, increasing in retail sales from US$889.3 million in 2017.

Packaged pastries were the largest segment with retail value sales of US$872.8 million (74.0% of pastries market share) in 2022, increasing in CAGR by 6.1% from US$648.7 million in 2017. Similar to unpackaged cakes, unpackaged pastries also experienced a decline in growth of 5.2% with the emergence of the pandemic, however as restrictions eased, the segment recovered, expanding 10.4% as retail sales increased from US$278.5 million in 2021 to US$307.5 million in 2022 (+5.9% from 2020 at 2021).

The pastry market is forecast to increase in CAGR by 6.1% as retail sales are anticipated to reach US$1.6 billion by 2027. In the pastry market competitive landscape, Warburtons Ltd (Brand name: Warburtons) led sales with a market share of 2.2%, followed by Associated British Foods Plc (Brand name: Kingsmill) with a market share of 1.9% and Hovis Ltd (Brand name: Hovis) with a market share of 0.4% in 2022. In comparison, private label and artisanal companies represent a significant presence in the U.K pastry market, attaining market shares of 55.9% and 26.1% respectively, in 2022.

|

Category |

2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Pastries | 889.3 | 940.0 | 996.6 | 1,044.8 | 1,094.0 | 1,180.2 |

| Packaged Pastries | 648.7 | 681.8 | 719.3 | 781.8 | 815.5 | 872.8 |

| Unpackaged Pastries | 240.6 | 258.2 | 277.4 | 262.9 | 278.5 | 307.5 |

| Source: Euromonitor International, 2023 | ||||||

| Category | Annual growth % 2021-2022 | CAGR* % 2017-2022 | Total growth % 2017-2022 |

|---|---|---|---|

| Pastries | 7.9 | 5.8 | 32.7 |

| Packaged Pastries | 7.0 | 6.1 | 34.5 |

| Unpackaged Pastries | 10.4 | 5.0 | 27.8 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

| Company | Retail sales (US$ millions) | Market share % |

|---|---|---|

| Total | 1,180.2 | 100.0 |

| Warburtons Ltd | 26.3 | 2.2 |

| Associated British Foods Plc | 22.6 | 1.9 |

| Hovis Ltd | 4.3 | 0.4 |

| Private Label | 659.6 | 55.9 |

| Artisanal | 307.5 | 26.1 |

| Others | 157.3 | 13.3 |

| Source: Euromonitor International, 2023 | ||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| Pastries | 1,249.4 | 1,326.2 | 1,409.9 | 1,496.1 | 1,587.7 |

| Packaged Pastries | 912.6 | 962.5 | 1,017.7 | 1,074.4 | 1,134.6 |

| Unpackaged Pastries | 336.8 | 363.7 | 392.3 | 421.7 | 453.0 |

| Source: Euromonitor International, 2023 | |||||

| Category | Annual growth % 2022-2023 | CAGR* % 2022-2027 | Total growth % 2022-2027 |

|---|---|---|---|

| Pastries | 5.9 | 6.1 | 34.5 |

| Packaged Pastries | 4.6 | 5.4 | 30.0 |

| Unpackaged Pastries | 9.5 | 8.1 | 47.3 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

Dessert pies and tarts

The dessert pies and tarts category attained retail value sales of US$803.3 million (7.6% market share of baked goods) in 2022. The category grew at a measurable CAGR of 2.9% during the 2017-2022 period, increasing in retail sales from US$697.7 million in 2017. Sweet pies and tarts were the largest segment with retail value sales of US$455.7 million (56.7% of dessert pies and tarts market share) in 2022, increasing in CAGR by 3.0% from US$392.4 million in 2017 (+9.1% from US$417.6 million in 2021.

The dessert pies and tarts market is forecast to remain positive with a CAGR of 5.7% as retail sales increase to US$1.1 billion by 2027. In the dessert pies and tarts market competitive landscape, Premier Foods Plc (Brand name: Mr. Kipling) led sales with a market share of 7.8%, followed by Nomad Foods Ltd (Brand name: Aunt Bessie's) with a market share of 1.8% and Oetker-Gruppe (Brand name: Coppenrath & Wiese) with a market share of 1.1% in 2022. In comparison, private labels represented a significant presence in the U.K dessert pies and tarts market, attaining a market share of 79.3% in 2022.

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Dessert Pies and Tarts | 697.7 | 693.7 | 712.7 | 730.2 | 739.0 | 803.3 |

| Sweet Pies and Tarts | 392.4 | 384.4 | 394.4 | 408.1 | 417.6 | 455.7 |

| Frozen Cakes, Sweet Pies and Tarts | 305.3 | 309.3 | 318.3 | 322.1 | 321.4 | 347.7 |

| Source: Euromonitor International, 2023 | ||||||

| Category | Annual growth % 2021-2022 | CAGR* % 2017-2022 | Total growth % 2017-2022 |

|---|---|---|---|

| Dessert Pies and Tarts | 8.7 | 2.9 | 15.1 |

| Sweet Pies and Tarts | 9.1 | 3.0 | 16.1 |

| Frozen Cakes, Sweet Pies and Tarts | 8.2 | 2.6 | 13.9 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

| Company | Retail sales (US$ millions) | Market share % |

|---|---|---|

| Total | 803.3 | 100.0 |

| Premier Foods Plc | 62.9 | 7.8 |

| Nomad Foods Ltd | 14.6 | 1.8 |

| Oetker-Gruppe | 9.1 | 1.1 |

| Private Label | 636.7 | 79.3 |

| Others | 72.7 | 9.1 |

| Source: Euromonitor International, 2023 | ||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| Dessert Pies and Tarts | 845.9 | 891.2 | 942.7 | 996.2 | 1,059.6 |

| Sweet Pies and Tarts | 482.3 | 509.2 | 540.1 | 572.3 | 612.8 |

| Frozen Cakes, Sweet Pies and Tarts | 363.6 | 382.1 | 402.6 | 423.8 | 446.8 |

| Source: Euromonitor International, 2023 | |||||

| Category | Annual growth % 2022-2023 | CAGR* % 2022-2027 | Total growth % 2022-2027 |

|---|---|---|---|

| Dessert Pies and Tarts | 5.3 | 5.7 | 31.9 |

| Sweet Pies and Tarts | 5.8 | 6.1 | 34.5 |

| Frozen Cakes, Sweet Pies and Tarts | 4.6 | 5.1 | 28.5 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

Frozen baked goods and dessert mixes

Frozen baked goods and dessert mixes attained retail value sales of US$229.3 million (2.2% market share of baked goods) and US$171.8 million (1.6% market share of baked goods) respectively, in 2022. Dessert mixes increased in CAGR by 5.6% from US$130.9 million in 2017, while frozen baked goods was the greater performing category between 2021-2022, achieving growth of 7.8% from US$212.8 million in 2021.

In the forecast period, both frozen baked goods and dessert mixes will achieve positive growth, increasing to US$299.4 million and US$222.6 million respectively, by 2027. In the frozen baked goods competitive landscape, General Mills Inc (Brand name: Jus-Rol) led sales with a market share of 8.9% in 2022. In comparison, private labels represented a substantial presence in the U.K frozen baked goods market, attaining a market share of 52.6% in 2022. In the dessert mixes competitive landscape, Premier Foods Plc

(Brand names: Angel Delight, Bird's and Rowntree's) led sales with a market share of 25.3%, followed by General Mills Inc (Brand names: Betty Crocker and Jus-Rol) with a market share of 24.7% and Kerry Group Plc (Brand name: Green's) with a market share of 9.7% in 2022. In comparison, private labels represented a measurable presence in the U.K dessert mixes market, attaining a market share of 22.5% in 2022.

| Category | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Frozen Baked Goods | 180.1 | 187.3 | 193.9 | 209.0 | 212.8 | 229.3 |

| Dessert Mixes | 130.9 | 137.7 | 144.3 | 156.1 | 160.5 | 171.8 |

| Source: Euromonitor International, 2023 | ||||||

| Category | Annual growth % 2021-2022 | CAGR* % 2017-2022 | Total growth % 2017-2022 |

|---|---|---|---|

| Frozen Baked Goods | 7.8 | 4.9 | 27.3 |

| Dessert Mixes | 7.0 | 5.6 | 31.2 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

| Company | Retail sales (US$ millions) | Market share % |

|---|---|---|

| Total | 229.3 | 100.0 |

| General Mills Inc | 20.5 | 8.9 |

| Private Label | 120.7 | 52.6 |

| Others | 88.1 | 38.4 |

| Source: Euromonitor International, 2023 | ||

| Company | Retail sales (US$ millions) | Market share % |

|---|---|---|

| Total | 171.8 | 100.0 |

| Premier Foods Plc | 43.4 | 25.3 |

| General Mills Inc | 42.5 | 24.7 |

| Kerry Group Plc | 16.6 | 9.7 |

| Private Label | 38.6 | 22.5 |

| Others | 27.8 | 16.2 |

| Source: Euromonitor International, 2023 | ||

| Category | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| Frozen Baked Goods | 242.1 | 254.2 | 268.3 | 283.3 | 299.4 |

| Dessert Mixes | 183.8 | 193.7 | 203.2 | 212.9 | 222.6 |

| Source: Euromonitor International, 2023 | |||||

| Category | Annual growth % 2022-2023 | CAGR* % 2022-2027 | Total growth %2022-2027 |

|---|---|---|---|

| Frozen Baked Goods | 5.6 | 5.5 | 30.6 |

| Dessert Mixes | 7.0 | 5.3 | 29.6 |

|

Source: Euromonitor International, 2023 *CAGR: Compound Annual Growth Rate |

|||

New product launch analysis

According to Mintel, European launches of cakes and sweet baked goods with premium packaging claims remains niche yet remain a focus of innovation as consumers look for everyday luxuries and affordable treats (47.0% of adults in the U.K see premium cakes and sweet baked goods as an affordable luxury, and this peaks among parents with young kids). Innovation also focuses on smaller-sized (mini or bite-sized) formats as more consumers look for cakes in varying sizes that can suit a variety of consumption choices (Mintel; A year of innovation in cakes, pastries and sweet goods, 2023). Consumers are also looking for cookies and crackers with healthier ingredients such as nuts, grains, fruit and vegetables and a reduction in the use of palm oil (31.% of cracker consumers in the U.K would like to see palm-oi-free crackers), (Mintel; A year of innovation in biscuits, cookies and crackers, 2023).

According to Mintel's Global New Products Database (GNPD), there were 9,323 new bakery products launched in the U.K from January 2017 to December 2022. The number of yearly product launches has decreased in growth by a CAGR of 3.8% from a launch of 1,752 bakery products in 2017 to its most recent launch of 1,444 bakery products in 2022. Of note, new launches of bakery products experienced the only increase in growth rate (19.7%) from 2020 to 2021 as product launches increased from 1,346 to 1,611 products.

The predominant sub-categories of new bakery products released were cakes, pastries and sweet goods (3,079 products), sweet biscuits/cookies (2,268 products) and bread and bread products (1,660 products). The most popular product claim was vegetarian (6,419 products), followed by ethical - environmentally friendly packaging (4,922 products) and ethical - recycling with (4,793 products). The companies with the highest number of new product launches were Asda with (857 products), followed by Sainsbury's (738 products) and Tesco (734 products). Just under one half (47.8%) of the product launches were new variety/range extension (4,461 products), whereas 27.1% were new packaging products (2,531 products). The top five packaging types included flexible packaging (6,883 products), carton (855 products), clam-pack (330 products), tub (288 products) and flexible stand-up pouch (234 products). Top flavours were unflavoured/plain (2,032 products), chocolate (857 products) and milk chocolate (252 products).

| Product attributes | Number of new products by year | Total | |||||

|---|---|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | ||

| Yearly product launches | 1,752 | 1,670 | 1,500 | 1,346 | 1,611 | 1,444 | 9,323 |

| Top 5 sub-categories | |||||||

| Cakes, pastries and sweet goods | 549 | 536 | 476 | 457 | 508 | 553 | 3,079 |

| Sweet biscuits/cookies | 416 | 376 | 328 | 330 | 445 | 373 | 2,268 |

| Bread and bread products | 346 | 352 | 284 | 266 | 232 | 180 | 1,660 |

| Baking ingredients and mixes | 262 | 286 | 271 | 198 | 313 | 254 | 1,584 |

| Savoury biscuits/crackers | 179 | 120 | 141 | 95 | 113 | 84 | 732 |

| Top 10 claims | |||||||

| Vegetarian | 1,272 | 1,171 | 1,023 | 898 | 1,065 | 990 | 6,419 |

| Ethical - environmentally friendly package | 693 | 721 | 685 | 725 | 1,038 | 1,060 | 4,922 |

| Ethical - recycling | 679 | 711 | 666 | 705 | 1,006 | 1,026 | 4,793 |

| No additives/preservatives | 558 | 400 | 410 | 326 | 372 | 306 | 2,372 |

| Free from added/artificial colourings | 486 | 326 | 364 | 276 | 323 | 254 | 2,029 |

| Free from added/artificial flavourings | 433 | 283 | 329 | 252 | 310 | 252 | 1,859 |

| Social media | 292 | 322 | 302 | 207 | 238 | 170 | 1,531 |

| Low/no/reduced allergen | 290 | 286 | 264 | 204 | 238 | 179 | 1,461 |

| Vegan/no animal ingredients | 164 | 184 | 249 | 234 | 309 | 256 | 1,396 |

| Seasonal | 169 | 221 | 189 | 163 | 325 | 312 | 1,379 |

| Top 10 companies | |||||||

| Asda | 237 | 110 | 145 | 104 | 130 | 131 | 857 |

| Sainsbury's | 67 | 94 | 74 | 153 | 133 | 217 | 738 |

| Tesco | 158 | 216 | 102 | 78 | 79 | 101 | 734 |

| Marks & Spencer | 81 | 71 | 31 | 80 | 106 | 163 | 532 |

| Aldi | 52 | 60 | 71 | 53 | 107 | 91 | 434 |

| Morrisons | 69 | 64 | 66 | 70 | 77 | 71 | 417 |

| Waitrose | 77 | 41 | 53 | 71 | 79 | 37 | 358 |

| Lidl | 45 | 37 | 38 | 19 | 47 | 50 | 236 |

| Premier Foods | 50 | 67 | 37 | 31 | 35 | 16 | 236 |

| Mondelez | 31 | 45 | 38 | 24 | 33 | 16 | 187 |

| Top product launches | |||||||

| New variety/range extension | 867 | 783 | 710 | 586 | 827 | 688 | 4,461 |

| New packaging | 437 | 477 | 411 | 403 | 400 | 403 | 2,531 |

| New product | 230 | 238 | 242 | 187 | 215 | 173 | 1,285 |

| Relaunch | 181 | 144 | 121 | 160 | 154 | 162 | 922 |

| New formulation | 37 | 28 | 16 | 10 | 15 | 18 | 124 |

| Top 5 flavours (including blend) unordered | |||||||

| Unflavoured/plain | 434 | 411 | 335 | 305 | 305 | 242 | 2,032 |

| Chocolate | 161 | 162 | 151 | 108 | 144 | 131 | 857 |

| Chocolate (milk) | 56 | 43 | 34 | 29 | 47 | 43 | 252 |

| Lemon | 21 | 20 | 22 | 30 | 27 | 30 | 150 |

| Vanilla/vanilla bourbon/vanilla Madagascar | 20 | 29 | 25 | 21 | 29 | 25 | 149 |

| Top 5 ingredients | |||||||

| Wheat flour (food) | 1,247 | 1,134 | 981 | 984 | 1,176 | 1,061 | 6,583 |

| White sugar (food) | 1,174 | 1,129 | 985 | 917 | 1,206 | 1,118 | 6,529 |

| Salt (food) | 1,231 | 1,162 | 980 | 935 | 1,153 | 1,014 | 6,475 |

| Emulsifiers | 932 | 888 | 806 | 732 | 917 | 890 | 5,165 |

| Iron (food) | 852 | 795 | 695 | 704 | 828 | 802 | 4,676 |

| Top 5 package types | |||||||

| Flexible | 1,317 | 1,237 | 1,100 | 1,006 | 1,186 | 1,037 | 6,883 |

| Carton | 154 | 178 | 150 | 135 | 112 | 126 | 855 |

| Clam-pack | 52 | 51 | 52 | 60 | 44 | 71 | 330 |

| Tub | 59 | 46 | 41 | 31 | 62 | 49 | 288 |

| Flexible stand-up pouch | 53 | 36 | 42 | 30 | 38 | 35 | 234 |

| Total pack size | |||||||

| 200.00 grams | 93 | 106 | 90 | 93 | 100 | 99 | 581 |

| 150.00 grams | 88 | 76 | 74 | 52 | 92 | 61 | 443 |

| 100.00 grams | 72 | 79 | 64 | 61 | 54 | 56 | 386 |

| 400.00 grams | 60 | 63 | 51 | 58 | 83 | 47 | 362 |

| 250.00 grams | 60 | 50 | 36 | 51 | 39 | 57 | 293 |

| Source: Mintel Global New Product Database (GNPD), 2023 | |||||||

| Sub-category | Number of products | Average price per product (in US$) |

|---|---|---|

| Cakes, Pastries & Sweet Goods | 3,079 | 3.67 |

| Sweet Biscuits/Cookies | 2,268 | 3.32 |

| Bread & Bread Products | 1,660 | 2.05 |

| Baking Ingredients & Mixes | 1,584 | 3.15 |

| Savoury Biscuits/Crackers | 732 | 2.62 |

| Source: Mintel Global New Product Database (GNPD), 2023 | ||

Examples of new product launches

Organic Petit Fours Mince Pies

Source: Mintel, 2023

| Company | Highgrove Enterprises |

|---|---|

| Brand | Highgrove |

| Category | Bakery |

| Sub-category | Cakes, pastries and sweet goods |

| Market | United Kingdom |

| Location of manufacture | United Kingdom |

| Import status | Not imported |

| Store type | Internet / mail order |

| Date published | December 2022 |

| Launch type | New product |

| Price in US dollars | 12.20 |

Highgrove Organic Petit Fours Mince Pies are now available for 2022 Christmas, and retail in a 210 gram pack. The finest organic products inspired by the Royal Gardens Highgrove, the private residence of HRH the Prince of Wales - Suitable for vegetarians - Part of the Prince's Foundation - Recyclable pack - Logos and certifications: OF&G Organic, EU Organic

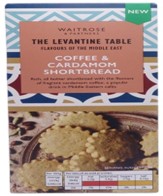

Coffee & Cardamom Shortbread

Source: Mintel, 2023

| Company | Waitrose |

|---|---|

| Brand | Waitrose & Partners The Levantine Table |

| Category | Bakery |

| Sub-category | Sweet biscuits / cookies |

| Market | United Kingdom |

| Store type | Internet / mail order |

| Date published | July 2021 |

| Launch type | New product |

| Price in US dollars | 3.06 |

Waitrose & Partners The Levantine Table Coffee & Cardamom Shortbread is suitable for vegetarians. The product is described as rich, all butter shortbread with the flavours of fragrant cardamom coffee, a popular drink in Middle Eastern cafés. It retails in a partly recyclable 145 gram pack.

Thick Sliced Toastie Bread

Source: Mintel, 2023

| Company | Warburtons |

|---|---|

| Brand | Warburtons Gluten Free |

| Category | Bakery |

| Sub-category | Bread and bread products |

| Market | United Kingdom |

| Store type | Supermarket |

| Date published | September 2020 |

| Launch type | New variety / range extension |

| Price in US dollars | 2.46 |

Warburtons Gluten Free Thick Sliced Toastie Bread is free from gluten, milk and wheat This vegetarian white bread is high in calcium and provides a source of fibre. It is halal and kosher certified, is suitable for home freezing and retails in a 400 gram recyclable pack featuring Facebook, Instagram, Pinterest, Twitter and YouTube logos.

Natural Madagascan Vanilla Extract

Source: Mintel, 2023

| Company | Dr. Oetker |

|---|---|

| Brand | Dr. Oetker |

| Category | Bakery |

| Sub-category | Baking ingredients and mixes |

| Market | United Kingdom |

| Store type | Internet / mail order |

| Date published | December 2019 |

| Launch type | New variety / range extension |

| Price in US dollars | 5.12 |

Dr. Oetker Natural Madagascan Vanilla Extract is said to be made from real Madagascan vanilla bean pods, which are renowned for delivering the best all round vanilla flavour. Vanilla is claimed to enhance the creamy and sweet flavours in cakes, desserts and icings. The vegan product retails in a 95 millilitre recyclable pack featuring Facebook, Twitter and Instagram.

Sour Cream & Chive Flavour Salted Savoury Snack Biscuits

Source: Mintel, 2023

| Company | Mondelez |

|---|---|

| Brand | Tuc |

| Category | Bakery |

| Sub-category | Savoury biscuits / crackers |

| Market | United Kingdom |

| Store type | Mass merchandise / hypermarket |

| Date published | December 2017 |

| Launch type | New variety / range extension |

| Price in US dollars | 1.34 |

Tuc Sour Cream & Chive Flavour Salted Savoury Snack Biscuits are now available. The product retails in a 120 gram pack, containing about 21 5.2 gram units.

Opportunities for Canada

The U.K was the tenth largest global retail sales market for baked goods with values of US$10.6 billion, representing a 2.4% market share in 2022. The U.K experienced an increase in CAGR of 3.1% as retail sales grew from US$9.1 billion in 2017 and are expected to further improve with an increase in CAGR of 5.0% in the forecast period as retail sales are anticipated to achieve US$13.6 billion by 2027.

The U.K is a net importer of baked goods products. In 2022, the U.K's baked goods trade deficit was US$2.4 billion as imports were valued at US$3.6 billion while exports were valued at US$1.2 billion. In 2022, the U.K was the second largest global import market for baked goods (7.8% market share) after the United States, with imports valued at US$3.6 billion (7.8% market share), 1.1 billion kilograms, representing an increase in CAGR of 8.3% from US$2.4 billion (880.8 million kilograms) in 2017. Of the U.K's 2022 baked good imports, Canada was the U.K's ninth largest supplier, representing a 1.3% market value share, providing US$45.9 million, 11.6 million kilograms in 2022.

Top baked goods imports from Canada in 2022 included bread, pastry, cakes and biscuits (HS code: 190590) valued at US$44.4 million (96.7% market share), 11.3 million kilograms, gingerbread (HS code 190520) with values of US$0.7 million (1.6% market share), 0.2 million kilograms and rusks, toasted bread (HS code: 190540) with values of US$0.4 million (0.9% market share), 0.1 million kilograms, signifying Canada's position as a trusted and capable supplier of baked goods (products) to the U.K and the surrounding EU region.

Canada's broad (and growing) trade network provides Canadian companies preferred access to diverse markets all over the world. Information on Canada's free trade agreements (FTA) may be found at Global Affairs Canada, Trade and investment agreements.

The Canada-United Kingdom Trade Continuity Agreement (Canada-UK TCA) came into force on April 1, 2021, and provides continuity, predictability, and stability for trade between Canada and the United Kingdom (UK). (Trade Agreements; Canada-UK Trade Continuity Agreement). The Canada-UK Trade Continuity Agreement (Canada-UK TCA) replicates the main benefits of the Canada-EU Comprehensive Economic Trade Agreement (CETA) to ensure continuity in Canada's trade with the UK following the UK's departure from the EU (Canada-UK Trade Continuity Agreement explained).

The Canada-UK TCA provides Canadian exporters with continued preferential access to the UK market and includes the elimination of 98% of tariffs on Canadian exports to the UK (carried over from CETA) on entry into force, and the elimination of an additional 1% of tariffs on Canadian exports to the UK by January 1, 2024, when the TCA is fully implemented–which will bring the elimination of tariffs on Canadian exports to 99% (Canada-UK Trade Continuity Agreement explained).

Given the expected and continued growth in the baked goods product market in the U.K, Canadian producers have the opportunity to expand their exports of baked goods, including value-added products to the U.K market. That said, it is important for Canadian suppliers to work closely with their importing partners and Trade Commissioners to understand and ensure that the U.K's import requirements for their specific products are met.

For more information

The Canadian Trade Commissioner Service:

International Trade Commissioners can provide Canadian industry with on-the-ground expertise regarding market potential, current conditions and local business contacts, and are an excellent point of contact for export advice.

More agri-food market intelligence:

International agri-food market intelligence

Discover global agriculture and food opportunities, the complete library of Global Analysis reports, market trends and forecasts, and information on Canada's free trade agreements.

Agri-food market intelligence service

Canadian agri-food and seafood businesses can take advantage of a customized service of reports and analysis, and join our email subscription service to have the latest reports delivered directly to their inbox.

More on Canada's agriculture and agri-food sectors:

Canada's agriculture sectors

Information on the agriculture industry by sector. Data on international markets. Initiatives to support awareness of the industry in Canada. How the department engages with the industry.

For information on the upcoming trade show Anuga, please contact:

Ben Berry, Deputy Director

Trade Show Strategy and Delivery

Agriculture and agri-food Canada

ben.berry@agr.gc.ca

Resources

- Euromonitor International, 2023

- Country Report; Baked Goods in the U.K, November 2022

- Global Affairs Canada; Trade and investment agreements, (About the) Canada-UK Trade Continuity Agreement

- Global Trade Tracker, 2023

- Mintel Global New Products Database, 2023

- Mintel; year of innovation in cakes, pastries and sweet goods, Walji, Amrin. June 20, 2023

- Mintel; A year of innovation in biscuits, cookies and crackers. Kaczorowski, Mikolaj. March, 2023

Sector Trend Analysis – Bakery products in the United Kingdom

Global Analysis Report

Prepared by: Laurie Bernardi, International Market Research Analyst

© His Majesty the King in Right of Canada, represented by the Minister of Agriculture and Agri-Food (2023).

Photo credits

All photographs reproduced in this publication are used by permission of the rights holders.

All images, unless otherwise noted, are copyright His Majesty the King in Right of Canada.

To join our distribution list or to suggest additional report topics or markets, please contact:

Agriculture and Agri-Food Canada, Global Analysis1341 Baseline Rd, Tower 5, 3rd floor

Ottawa ON K1A 0C5

Canada

Email: aafc.mas-sam.aac@agr.gc.ca

The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada (AAFC) assumes no liability for any actions taken based on the information contained herein.

Reproduction or redistribution of this document, in whole or in part, must include acknowledgement of agriculture and agri-food Canada as the owner of the copyright in the document, through a reference citing AAFC, the title of the document and the year. Where the reproduction or redistribution includes data from this document, it must also include an acknowledgement of the specific data source(s), as noted in this document.

Agriculture and Agri-Food Canada provides this document and other report services to agriculture and food industry clients free of charge.