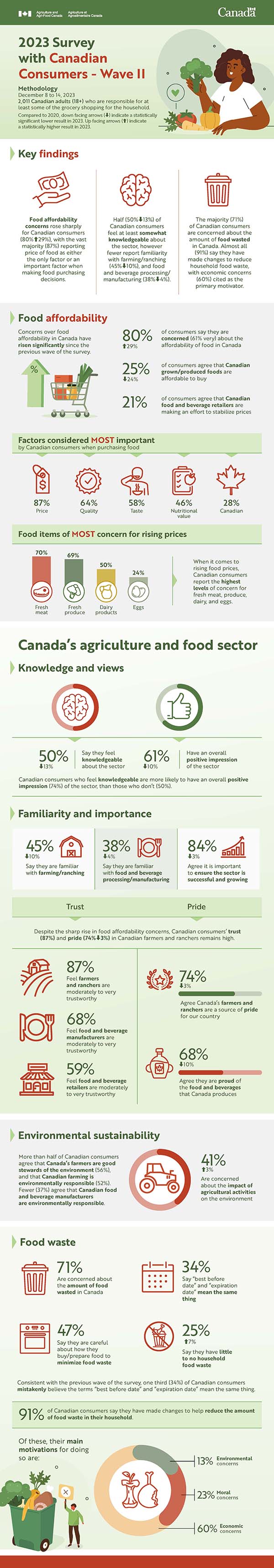

This 2023 research explores Canadian consumer attitudes, behaviours, impressions, and knowledge as it relates to Canada’s agriculture and food sector. Specifically, affordability, purchasing preferences, household food waste, environmental sustainability, and public trust.

Methodology

The research was comprised of an online survey of 2,011 Canadian adults (18+) who are responsible for at least some of the grocery shopping for the household. The survey was conducted from December 8-14, 2023 in English and French.

Key findings

- Food affordability concerns rose sharply for Canadian consumers (80%, up 29%), with the vast majority (87%) reporting price of food as either the only factor or an important factor when making food purchasing decisions.

- Half (50%, down 13%) of Canadian consumers feel at least somewhat knowledgeable about the sector, however fewer report familiarity with farming/ranching (45%, down 10%), and food and beverage processing/manufacturing (38%, down 4%).

- The majority (71%) of Canadian consumers are concerned about the amount of food wasted in Canada. Almost all (91%) say they have made changes to reduce household food waste, with economic concerns (60%) cited as the primary motivator.

Food affordability

Concerns over food affordability in Canada have risen significantly since the previous wave of the survey.

- 80% (up 29%) of consumers say they are concerned (61% very) about the affordability of food in Canada

- 25% (down 24%) of consumers agree that Canadian grown/produced foods are affordable to buy

- 21% of consumers agree that Canadian food and beverage retailers are making an effort to stabilize prices

Factors considered most important by Canadian consumers when purchasing food

- 87% Price

- 64% Quality

- 58% Taste

- 46% Nutritional value

- 28% Canadian

Food items of most concern for rising prices

- 70% Fresh meat

- 69% Fresh produce

- 50% Dairy products

- 24% Eggs

When it comes to rising food prices, Canadian consumers report the highest levels of concern for fresh meat, produce, dairy, and eggs.

Canada’s agriculture and food sector

Knowledge and Views

- 50% (down 13%) say they feel knowledgeable about the sector

- 61% (down 10%) have an overall positive impression of the sector

Canadian consumers who feel knowledgeable are more likely to have an overall positive impression (74%) of the sector, than those who don't (50%).

Familiarity and importance

- 45% (down 10%) say they are familiar with farming/ranching

- 38% (down 4%) say they are familiar with food and beverage processing/manufacturing

- 84% (down 3%) agree it is important to ensure the sector is successful and growing

Trust and pride

Despite the sharp rise in food affordability concerns, Canadian consumers' trust (87%) and pride (74%, down 3%) in Canadian farmers and ranchers remains high.

- 87% feel farmers and ranchers are moderately to very trustworthy

- 68% feel food and beverage manufacturers are moderately to very trustworthy

- 59% feel food and beverage retailers are moderately to very trustworthy

- 74% (down 3%) agree Canada's farmers and ranchers are a source of pride for our country

- 68% (down 10%) agree they are proud of the food and beverages that Canada produces

Environmental sustainability

More than half of Canadian consumers agree that Canada's farmers are good stewards of the environment (56%), and that Canadian farming is environmentally responsible (52%). Fewer (37%) agree that Canadian food and beverage manufacturers are environmentally responsible.

- 41% (up 3%) are concerned about the impact of agricultural activities on the environment

Food waste

- 71% are concerned about the amount of food wasted in Canada

- 47% say they are careful about how they buy/prepare food to minimize food waste

- 34% say "best before date" and "expiration date" mean the same thing

- 25% (up 7%) say they have little to no household food waste

Consistent with the previous wave of the survey, one third (34%) of Canadian consumers mistakenly believe the terms "best before date" and "expiration date" mean the same thing.

91% of Canadian consumers say they have made changes to help reduce the amount of food waste in their household.

- Of these, their main motivations for doing so are:

- 13% environmental concerns

- 23% moral concerns

- 60% economic concerns

Additional information

AAFC Canadian Consumers Survey – Wave II (2023): quantitative research report